Financial Accounting Homework Assignment: Client Account Analysis

VerifiedAdded on 2023/01/06

|22

|3990

|32

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial accounting homework assignment, focusing on the preparation of financial statements and analysis of client accounts. The assignment covers various aspects of financial accounting, including the recording of financial transactions in journals and ledgers, as well as the creation of key financial statements like income statements, balance sheets, and cash flow statements. The solution demonstrates the application of accounting principles, such as accrual accounting and double-entry bookkeeping, through detailed examples and calculations. The assignment also includes an analysis of different stakeholders, both internal and external, and their impact on a business. Furthermore, it provides practical examples of accounting for sole traders, including journal entries, ledger accounts, and the preparation of financial statements for various clients. The solution covers topics such as sales, purchases, expenses, and payments, providing a clear understanding of the accounting process. The assignment also includes references to relevant accounting standards and principles, ensuring a strong foundation in financial accounting practices.

Financial Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

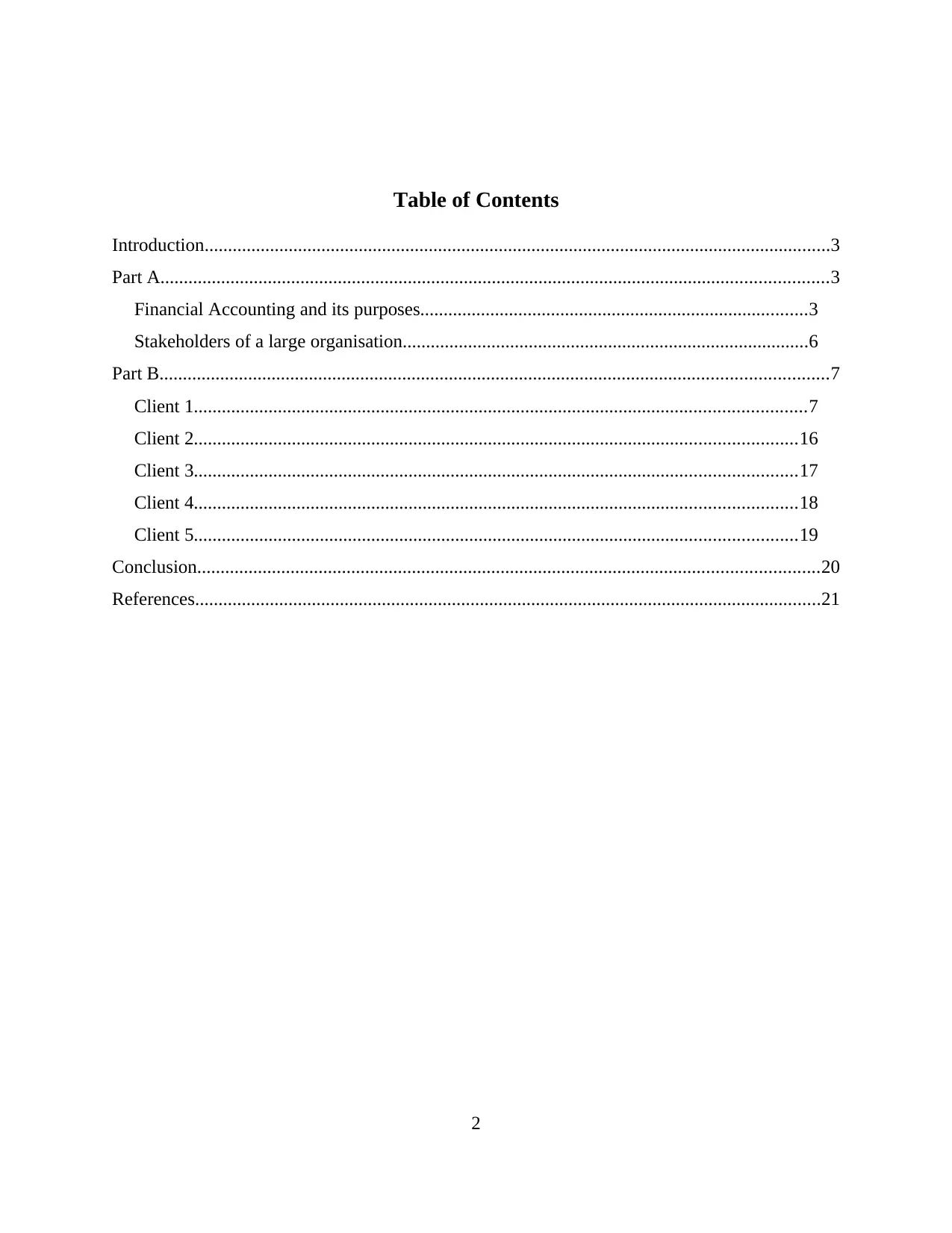

Table of Contents

Introduction......................................................................................................................................3

Part A...............................................................................................................................................3

Financial Accounting and its purposes...................................................................................3

Stakeholders of a large organisation.......................................................................................6

Part B...............................................................................................................................................7

Client 1...................................................................................................................................7

Client 2.................................................................................................................................16

Client 3.................................................................................................................................17

Client 4.................................................................................................................................18

Client 5.................................................................................................................................19

Conclusion.....................................................................................................................................20

References......................................................................................................................................21

2

Introduction......................................................................................................................................3

Part A...............................................................................................................................................3

Financial Accounting and its purposes...................................................................................3

Stakeholders of a large organisation.......................................................................................6

Part B...............................................................................................................................................7

Client 1...................................................................................................................................7

Client 2.................................................................................................................................16

Client 3.................................................................................................................................17

Client 4.................................................................................................................................18

Client 5.................................................................................................................................19

Conclusion.....................................................................................................................................20

References......................................................................................................................................21

2

Introduction

Financial accounting is related to the preparation and presentation of financial

information of a company's business performance. Purpose of financial accounting is financial

reporting (Birkenmaier Oliver and Huang, 2020). These reports reflects position and

performance of business to all its stakeholders. Stakeholders are parties that are interested in

affairs of the business. They can be internal or external for an organisation. They decide on their

course with company based on the financial reports. These reports include final accounts such as

income statement, balance sheet, cash flow statement, etc. Final accounts are drawn out of

recording financial transactions in books of accounts such as journal, ledgers, special subsidiary

books of accounts, trial balance, etc.

Part A

Financial Accounting and its purposes

Financial Accounting

Financial accounting is a branch of accounting that is concerned with recording,

summarising, analysing and presentation of financial transactions of a business. Transactions are

presented in financial statements such as income statement, Balance Sheet and cash flow

statement. All organisation have two kinds of stakeholders – internal and external. Internal

stakeholder includes owners, investors and employees of organisation while external

stakeholders include creditors, customers, government, etc. Financial accounting aims at

providing information to both external and internal stakeholder while management accounting is

concerned with only internal stakeholders (Flower and Ebbers, 2018).

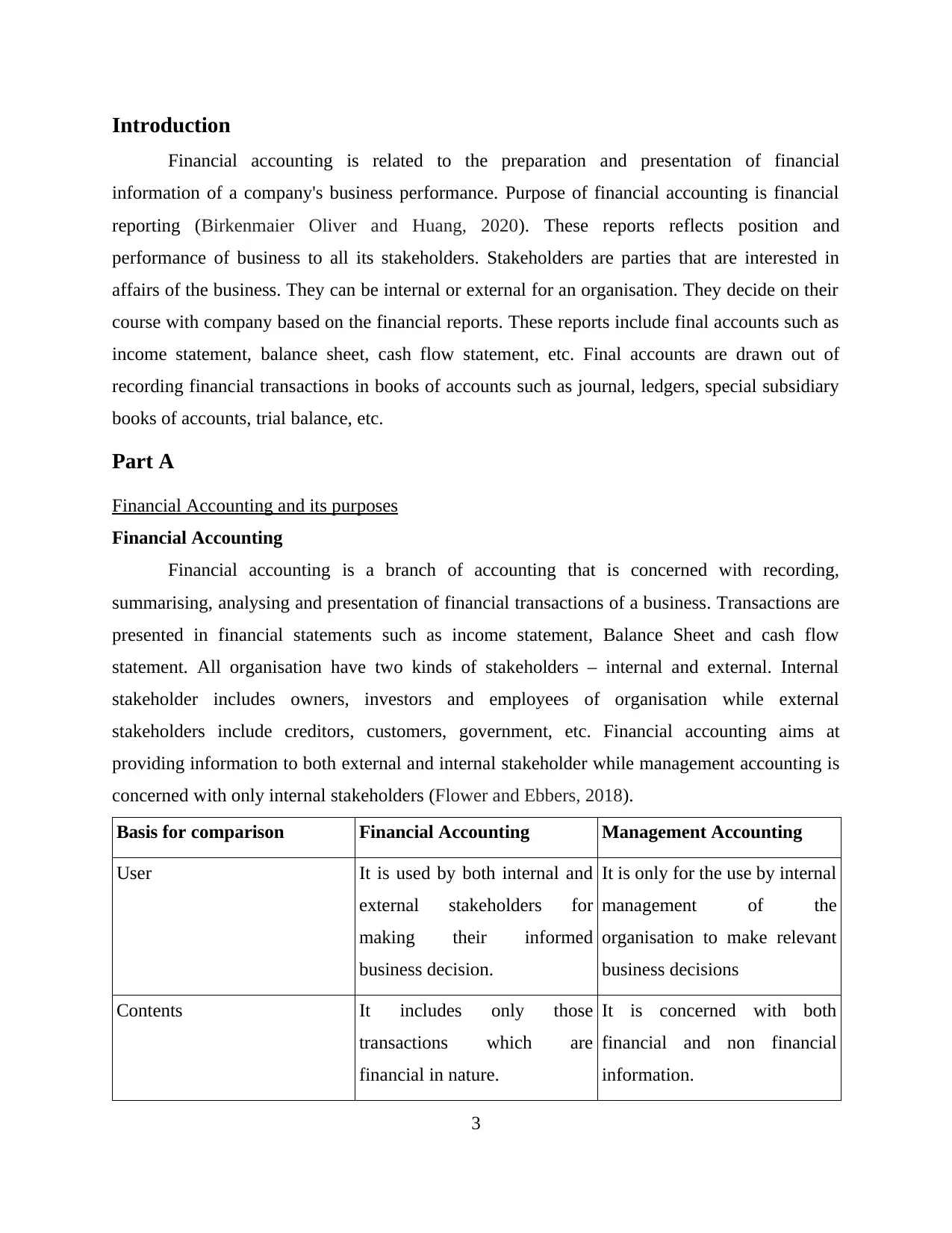

Basis for comparison Financial Accounting Management Accounting

User It is used by both internal and

external stakeholders for

making their informed

business decision.

It is only for the use by internal

management of the

organisation to make relevant

business decisions

Contents It includes only those

transactions which are

financial in nature.

It is concerned with both

financial and non financial

information.

3

Financial accounting is related to the preparation and presentation of financial

information of a company's business performance. Purpose of financial accounting is financial

reporting (Birkenmaier Oliver and Huang, 2020). These reports reflects position and

performance of business to all its stakeholders. Stakeholders are parties that are interested in

affairs of the business. They can be internal or external for an organisation. They decide on their

course with company based on the financial reports. These reports include final accounts such as

income statement, balance sheet, cash flow statement, etc. Final accounts are drawn out of

recording financial transactions in books of accounts such as journal, ledgers, special subsidiary

books of accounts, trial balance, etc.

Part A

Financial Accounting and its purposes

Financial Accounting

Financial accounting is a branch of accounting that is concerned with recording,

summarising, analysing and presentation of financial transactions of a business. Transactions are

presented in financial statements such as income statement, Balance Sheet and cash flow

statement. All organisation have two kinds of stakeholders – internal and external. Internal

stakeholder includes owners, investors and employees of organisation while external

stakeholders include creditors, customers, government, etc. Financial accounting aims at

providing information to both external and internal stakeholder while management accounting is

concerned with only internal stakeholders (Flower and Ebbers, 2018).

Basis for comparison Financial Accounting Management Accounting

User It is used by both internal and

external stakeholders for

making their informed

business decision.

It is only for the use by internal

management of the

organisation to make relevant

business decisions

Contents It includes only those

transactions which are

financial in nature.

It is concerned with both

financial and non financial

information.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Regulation It is subjected to multiple laws,

rules and regulations by

different authorities and are

prepared accordingly.

It it out of all legal purviews

and is prepared according to

management directions.

Purpose of financial accounting

Purpose of financial accounting is to prepare and present proper general purpose financial

statements (Foster, 2015). It helps management knowing whether company is incurring

profits or losses, what are the major sources of expenses, position of assets, investments

and liabilities, etc. Managerial accounting then takes over. Management analyses the

information extracted.

Financial statements provide necessary information to all stakeholders. This information

aids stakeholders in making their decisions regarding their association with company. For

example - it helps shareholders in deciding whether they should continue with their

investment in the company or withdraw it. Financial statements help management in

taking decisions regarding business operations and financial well being of the company.

Financial statements have quantified data. These statements serve as a base for

comparison between different products, departments, organisations and markets in

quantitative terms.

In order to maintain uniformity in all accounts of all business organisations, financial

accounting is performed according to some general standards, rules and guidelines. International

Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP)

have been prescribed that has to be followed by organisations all over.

Financial accounts are prepared on double entry book keeping system. It says that each

transaction affects at least two accounts and thus, for every debit in an account, there is

simultaneous and equal credit in some another account (Galariotis, Rong and Spyrou, 2015).

There are two different ways of recording financial transactions – Cash and accrual basis. Under

cash basis, incomes and expenses are only recorded as and when cash is received or paid

respectively. Under accrual basis, revenue and expenses are recognised as and when they

become due, irrespective of cash treatment being met or not.

4

rules and regulations by

different authorities and are

prepared accordingly.

It it out of all legal purviews

and is prepared according to

management directions.

Purpose of financial accounting

Purpose of financial accounting is to prepare and present proper general purpose financial

statements (Foster, 2015). It helps management knowing whether company is incurring

profits or losses, what are the major sources of expenses, position of assets, investments

and liabilities, etc. Managerial accounting then takes over. Management analyses the

information extracted.

Financial statements provide necessary information to all stakeholders. This information

aids stakeholders in making their decisions regarding their association with company. For

example - it helps shareholders in deciding whether they should continue with their

investment in the company or withdraw it. Financial statements help management in

taking decisions regarding business operations and financial well being of the company.

Financial statements have quantified data. These statements serve as a base for

comparison between different products, departments, organisations and markets in

quantitative terms.

In order to maintain uniformity in all accounts of all business organisations, financial

accounting is performed according to some general standards, rules and guidelines. International

Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP)

have been prescribed that has to be followed by organisations all over.

Financial accounts are prepared on double entry book keeping system. It says that each

transaction affects at least two accounts and thus, for every debit in an account, there is

simultaneous and equal credit in some another account (Galariotis, Rong and Spyrou, 2015).

There are two different ways of recording financial transactions – Cash and accrual basis. Under

cash basis, incomes and expenses are only recorded as and when cash is received or paid

respectively. Under accrual basis, revenue and expenses are recognised as and when they

become due, irrespective of cash treatment being met or not.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial accounts follows some underlying principles, assumptions and conventions.

Principles such as historical cost concept, matching principle, revenue recognition principle, full

disclosure principle, etc. are to be followed. Businesses are expected to follow assumptions such

as going concern assumption, separate entity assumption, fixed time period assumption, money

measurement assumption, etc. (Kemp and Morgan, 2019) Some conventions such as conventions

of materiality, cost benefit, conservatism, etc. are also followed. Necessary financial statements

that are required to be prepared on the above basis are as follows:

Income Statement – It is also known as profit and loss statement. It is a period statement

as it is prepared for a specified period of time. In it, all revenues, gains, expenses and losses of

business are recorded and then profit or loss is determined at the period end. Surplus of revenue

over expenses are called profit. Companies are required to used accrual basis of accounting to

record financial transactions. Accordingly, revenues and expenses are recorded as and when they

occur, regardless of when payment occurs.

Balance Sheet - It is a position statement as it shows the position of business assets and

liabilities at a specified point of time. Balance Sheet is prepared on the basis of fundamental

equation:

Assets = Liabilities + Shareholders' Equity.

Balance Sheet is divided in two sides – one is called assets side and other is called

liabilities side. Assets side shows all current and non-current assets and investments. Liabilities

side show shareholders' equity information as well as information about current and non-current

liabilities.

Cash Flow Statement – It is a financial statement that records all inflows and outflows

of cash and cash equivalents of a company in a specific period of time. It is divided into three

parts – cash flow from operating activities, investing activities and financing activities. Cash

flow from operations includes inflow and outflow from all operational business activities. Cash

flow from investment records gains and losses out of business investments (Reinsdorf and et.al.,

2017). Final section of cash flow from financing activities provides an account of cash usage in

and out because of debt and equity. Sum of all three segments is called net cash flow from

business activities. It acts like a bridge between income statement and balance sheet of business.

These three above statements help management and investors' determine the financial

performance and position of company as a whole.

5

Principles such as historical cost concept, matching principle, revenue recognition principle, full

disclosure principle, etc. are to be followed. Businesses are expected to follow assumptions such

as going concern assumption, separate entity assumption, fixed time period assumption, money

measurement assumption, etc. (Kemp and Morgan, 2019) Some conventions such as conventions

of materiality, cost benefit, conservatism, etc. are also followed. Necessary financial statements

that are required to be prepared on the above basis are as follows:

Income Statement – It is also known as profit and loss statement. It is a period statement

as it is prepared for a specified period of time. In it, all revenues, gains, expenses and losses of

business are recorded and then profit or loss is determined at the period end. Surplus of revenue

over expenses are called profit. Companies are required to used accrual basis of accounting to

record financial transactions. Accordingly, revenues and expenses are recorded as and when they

occur, regardless of when payment occurs.

Balance Sheet - It is a position statement as it shows the position of business assets and

liabilities at a specified point of time. Balance Sheet is prepared on the basis of fundamental

equation:

Assets = Liabilities + Shareholders' Equity.

Balance Sheet is divided in two sides – one is called assets side and other is called

liabilities side. Assets side shows all current and non-current assets and investments. Liabilities

side show shareholders' equity information as well as information about current and non-current

liabilities.

Cash Flow Statement – It is a financial statement that records all inflows and outflows

of cash and cash equivalents of a company in a specific period of time. It is divided into three

parts – cash flow from operating activities, investing activities and financing activities. Cash

flow from operations includes inflow and outflow from all operational business activities. Cash

flow from investment records gains and losses out of business investments (Reinsdorf and et.al.,

2017). Final section of cash flow from financing activities provides an account of cash usage in

and out because of debt and equity. Sum of all three segments is called net cash flow from

business activities. It acts like a bridge between income statement and balance sheet of business.

These three above statements help management and investors' determine the financial

performance and position of company as a whole.

5

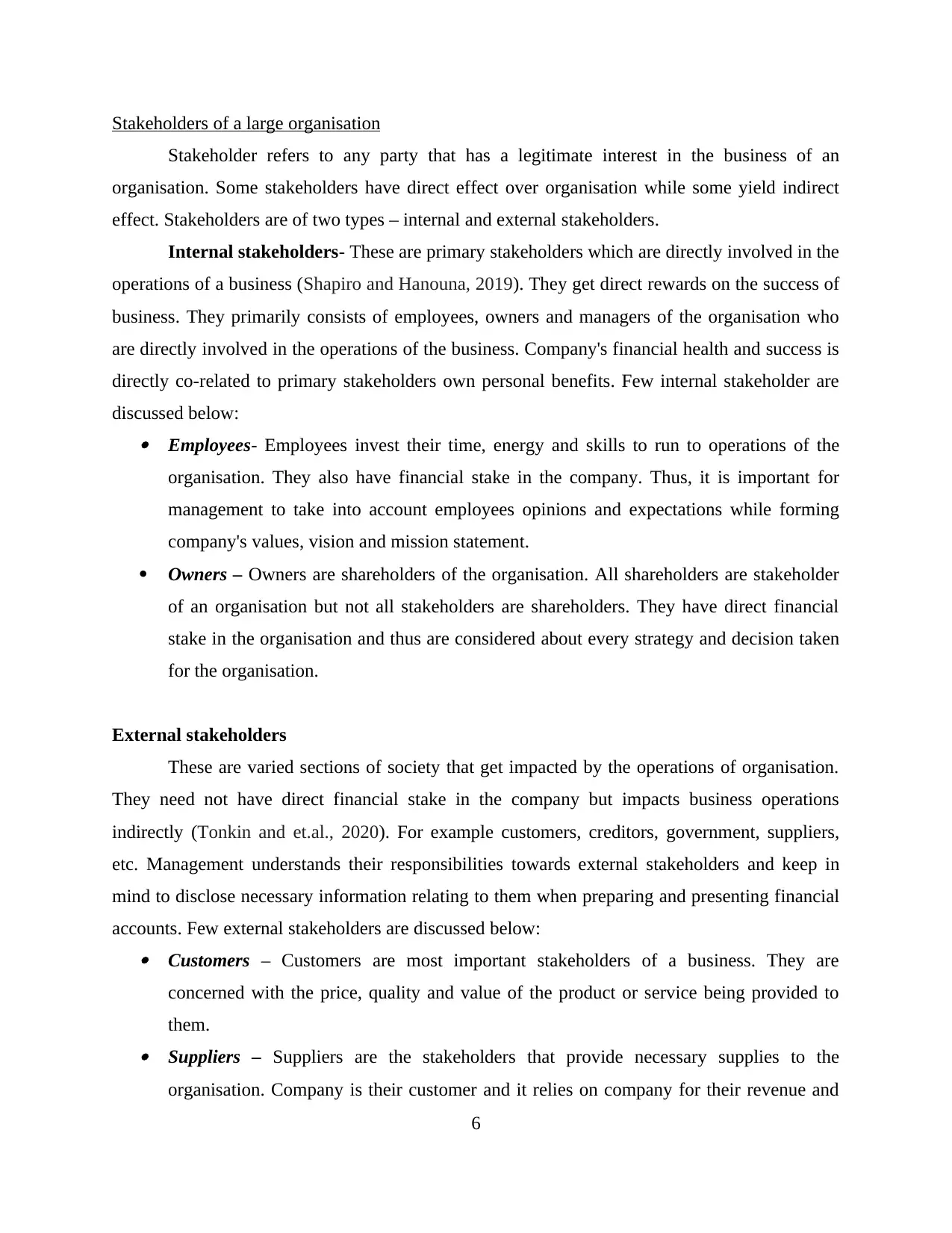

Stakeholders of a large organisation

Stakeholder refers to any party that has a legitimate interest in the business of an

organisation. Some stakeholders have direct effect over organisation while some yield indirect

effect. Stakeholders are of two types – internal and external stakeholders.

Internal stakeholders- These are primary stakeholders which are directly involved in the

operations of a business (Shapiro and Hanouna, 2019). They get direct rewards on the success of

business. They primarily consists of employees, owners and managers of the organisation who

are directly involved in the operations of the business. Company's financial health and success is

directly co-related to primary stakeholders own personal benefits. Few internal stakeholder are

discussed below: Employees- Employees invest their time, energy and skills to run to operations of the

organisation. They also have financial stake in the company. Thus, it is important for

management to take into account employees opinions and expectations while forming

company's values, vision and mission statement.

Owners – Owners are shareholders of the organisation. All shareholders are stakeholder

of an organisation but not all stakeholders are shareholders. They have direct financial

stake in the organisation and thus are considered about every strategy and decision taken

for the organisation.

External stakeholders

These are varied sections of society that get impacted by the operations of organisation.

They need not have direct financial stake in the company but impacts business operations

indirectly (Tonkin and et.al., 2020). For example customers, creditors, government, suppliers,

etc. Management understands their responsibilities towards external stakeholders and keep in

mind to disclose necessary information relating to them when preparing and presenting financial

accounts. Few external stakeholders are discussed below: Customers – Customers are most important stakeholders of a business. They are

concerned with the price, quality and value of the product or service being provided to

them. Suppliers – Suppliers are the stakeholders that provide necessary supplies to the

organisation. Company is their customer and it relies on company for their revenue and

6

Stakeholder refers to any party that has a legitimate interest in the business of an

organisation. Some stakeholders have direct effect over organisation while some yield indirect

effect. Stakeholders are of two types – internal and external stakeholders.

Internal stakeholders- These are primary stakeholders which are directly involved in the

operations of a business (Shapiro and Hanouna, 2019). They get direct rewards on the success of

business. They primarily consists of employees, owners and managers of the organisation who

are directly involved in the operations of the business. Company's financial health and success is

directly co-related to primary stakeholders own personal benefits. Few internal stakeholder are

discussed below: Employees- Employees invest their time, energy and skills to run to operations of the

organisation. They also have financial stake in the company. Thus, it is important for

management to take into account employees opinions and expectations while forming

company's values, vision and mission statement.

Owners – Owners are shareholders of the organisation. All shareholders are stakeholder

of an organisation but not all stakeholders are shareholders. They have direct financial

stake in the organisation and thus are considered about every strategy and decision taken

for the organisation.

External stakeholders

These are varied sections of society that get impacted by the operations of organisation.

They need not have direct financial stake in the company but impacts business operations

indirectly (Tonkin and et.al., 2020). For example customers, creditors, government, suppliers,

etc. Management understands their responsibilities towards external stakeholders and keep in

mind to disclose necessary information relating to them when preparing and presenting financial

accounts. Few external stakeholders are discussed below: Customers – Customers are most important stakeholders of a business. They are

concerned with the price, quality and value of the product or service being provided to

them. Suppliers – Suppliers are the stakeholders that provide necessary supplies to the

organisation. Company is their customer and it relies on company for their revenue and

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

income. That's why they are interested in knowing about the financial health of the

company.

Government – Corporate tax form a good source of revenue for government. Also, it

provides employment to numerous people and employees working in it pay income tax to

government. Company also pays other indirect taxes and contributes in Gross Domestic

Product of country (Tunç and et.al., 2020). Larger and more sound the company is, more

is its contribution to the country. Thus, government keeps close observations on financial

performance of businesses.

Society – Companies derive its resources from society and in return, provides them

employment, economic development, healthcare and safety, etc. Company's entry and

exit from a society impacts its directly and indirectly. That's why society is always

looking for performance of the company.

Part B

Client 1

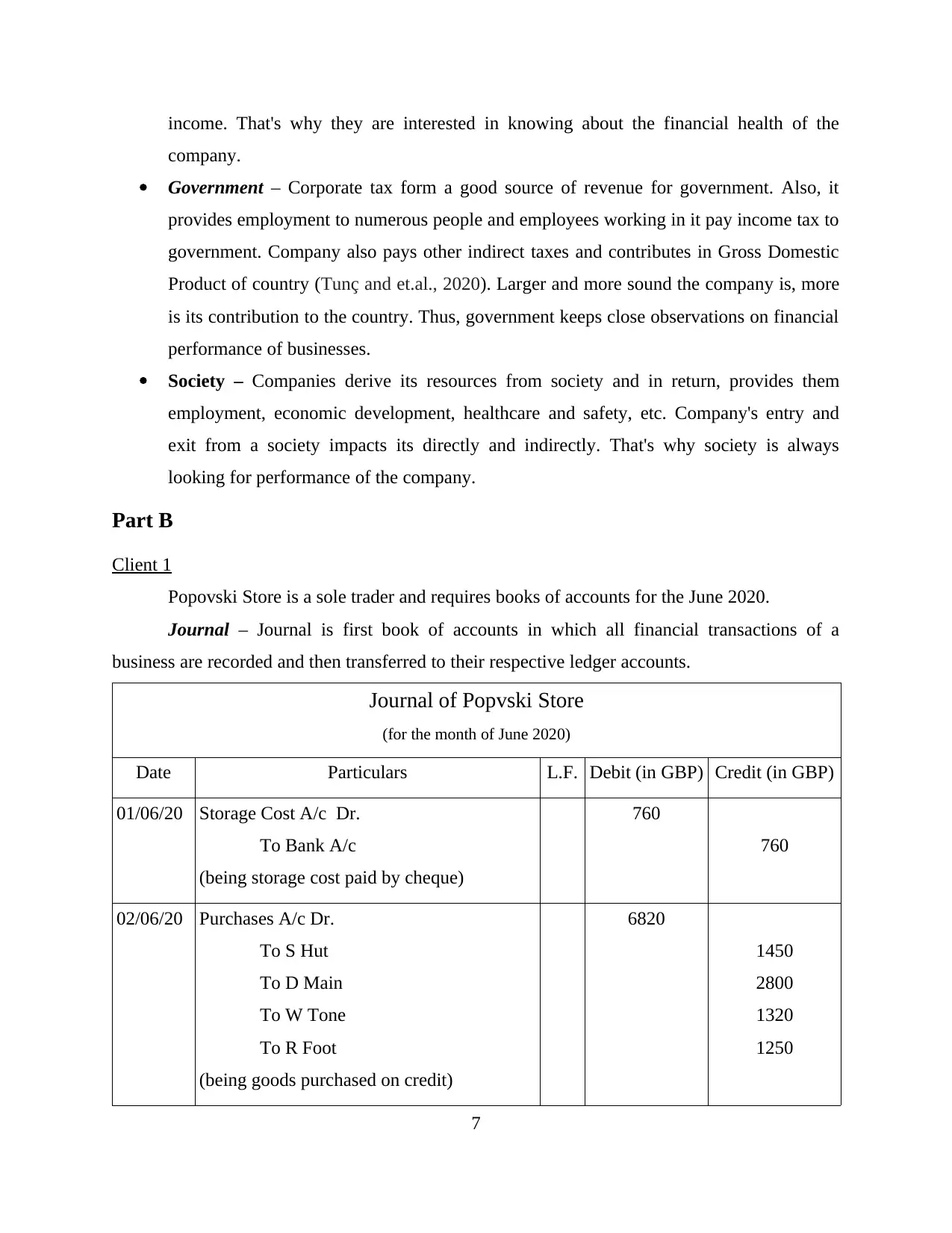

Popovski Store is a sole trader and requires books of accounts for the June 2020.

Journal – Journal is first book of accounts in which all financial transactions of a

business are recorded and then transferred to their respective ledger accounts.

Journal of Popvski Store

(for the month of June 2020)

Date Particulars L.F. Debit (in GBP) Credit (in GBP)

01/06/20 Storage Cost A/c Dr.

To Bank A/c

(being storage cost paid by cheque)

760

760

02/06/20 Purchases A/c Dr.

To S Hut

To D Main

To W Tone

To R Foot

(being goods purchased on credit)

6820

1450

2800

1320

1250

7

company.

Government – Corporate tax form a good source of revenue for government. Also, it

provides employment to numerous people and employees working in it pay income tax to

government. Company also pays other indirect taxes and contributes in Gross Domestic

Product of country (Tunç and et.al., 2020). Larger and more sound the company is, more

is its contribution to the country. Thus, government keeps close observations on financial

performance of businesses.

Society – Companies derive its resources from society and in return, provides them

employment, economic development, healthcare and safety, etc. Company's entry and

exit from a society impacts its directly and indirectly. That's why society is always

looking for performance of the company.

Part B

Client 1

Popovski Store is a sole trader and requires books of accounts for the June 2020.

Journal – Journal is first book of accounts in which all financial transactions of a

business are recorded and then transferred to their respective ledger accounts.

Journal of Popvski Store

(for the month of June 2020)

Date Particulars L.F. Debit (in GBP) Credit (in GBP)

01/06/20 Storage Cost A/c Dr.

To Bank A/c

(being storage cost paid by cheque)

760

760

02/06/20 Purchases A/c Dr.

To S Hut

To D Main

To W Tone

To R Foot

(being goods purchased on credit)

6820

1450

2800

1320

1250

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

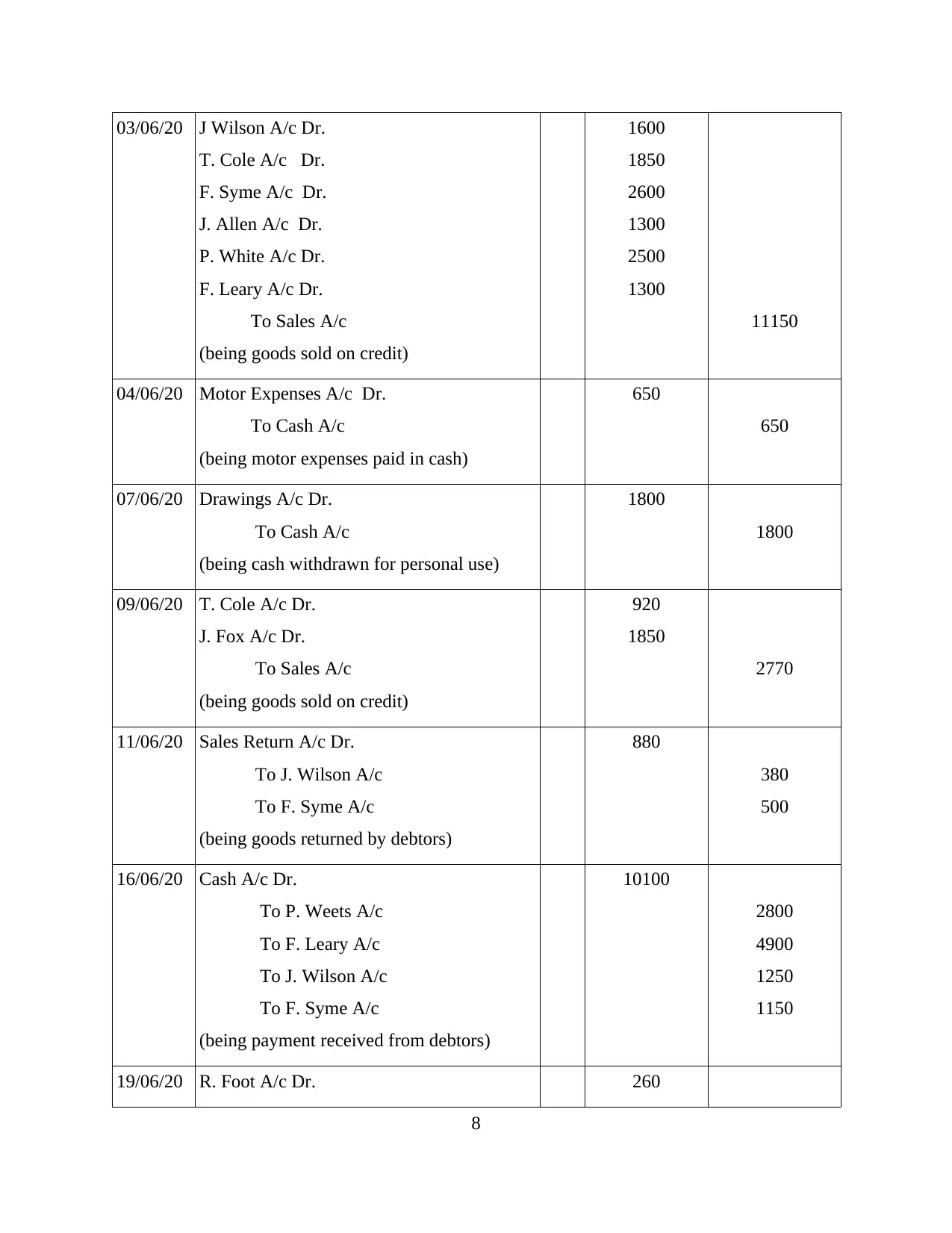

03/06/20 J Wilson A/c Dr.

T. Cole A/c Dr.

F. Syme A/c Dr.

J. Allen A/c Dr.

P. White A/c Dr.

F. Leary A/c Dr.

To Sales A/c

(being goods sold on credit)

1600

1850

2600

1300

2500

1300

11150

04/06/20 Motor Expenses A/c Dr.

To Cash A/c

(being motor expenses paid in cash)

650

650

07/06/20 Drawings A/c Dr.

To Cash A/c

(being cash withdrawn for personal use)

1800

1800

09/06/20 T. Cole A/c Dr.

J. Fox A/c Dr.

To Sales A/c

(being goods sold on credit)

920

1850

2770

11/06/20 Sales Return A/c Dr.

To J. Wilson A/c

To F. Syme A/c

(being goods returned by debtors)

880

380

500

16/06/20 Cash A/c Dr.

To P. Weets A/c

To F. Leary A/c

To J. Wilson A/c

To F. Syme A/c

(being payment received from debtors)

10100

2800

4900

1250

1150

19/06/20 R. Foot A/c Dr. 260

8

T. Cole A/c Dr.

F. Syme A/c Dr.

J. Allen A/c Dr.

P. White A/c Dr.

F. Leary A/c Dr.

To Sales A/c

(being goods sold on credit)

1600

1850

2600

1300

2500

1300

11150

04/06/20 Motor Expenses A/c Dr.

To Cash A/c

(being motor expenses paid in cash)

650

650

07/06/20 Drawings A/c Dr.

To Cash A/c

(being cash withdrawn for personal use)

1800

1800

09/06/20 T. Cole A/c Dr.

J. Fox A/c Dr.

To Sales A/c

(being goods sold on credit)

920

1850

2770

11/06/20 Sales Return A/c Dr.

To J. Wilson A/c

To F. Syme A/c

(being goods returned by debtors)

880

380

500

16/06/20 Cash A/c Dr.

To P. Weets A/c

To F. Leary A/c

To J. Wilson A/c

To F. Syme A/c

(being payment received from debtors)

10100

2800

4900

1250

1150

19/06/20 R. Foot A/c Dr. 260

8

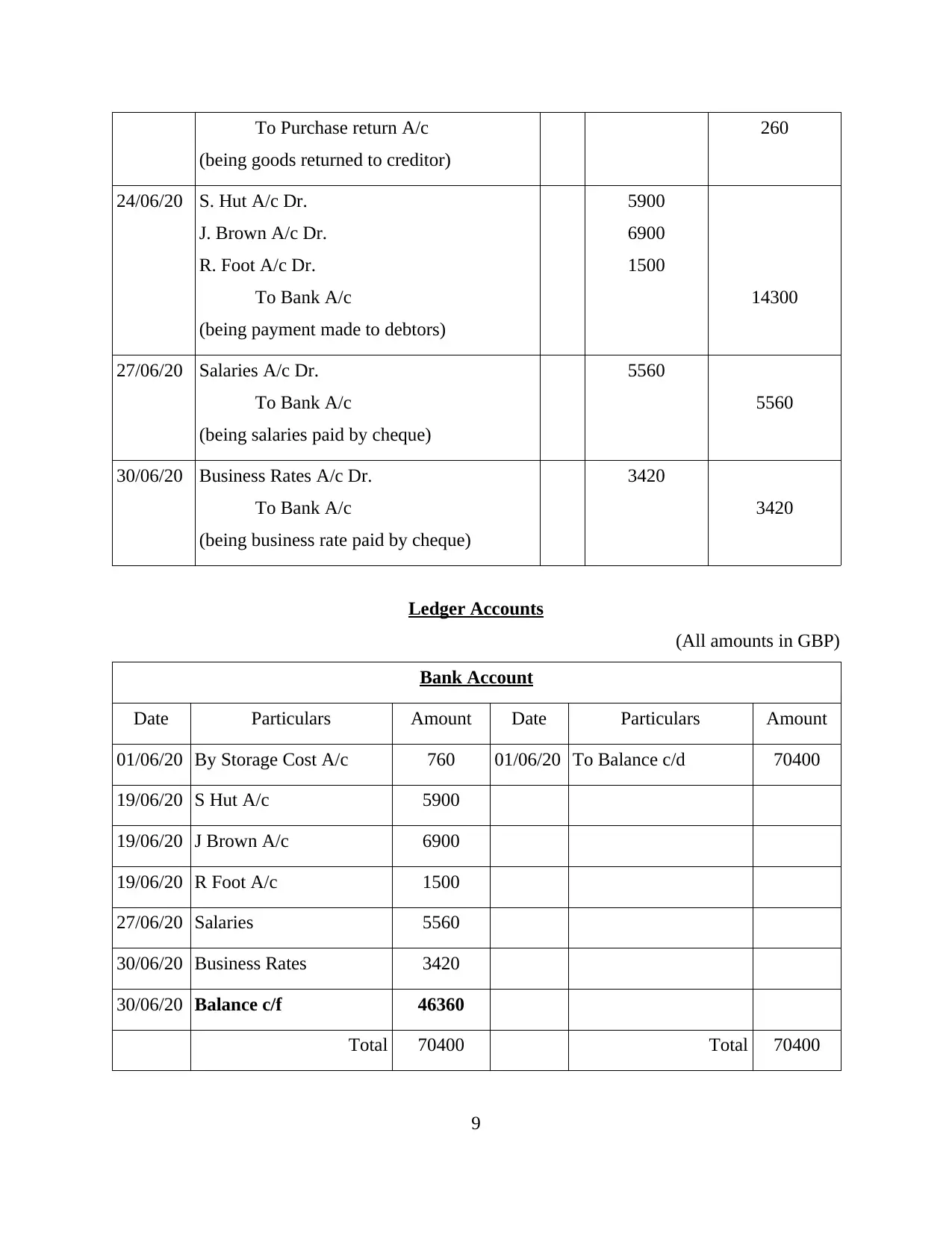

To Purchase return A/c

(being goods returned to creditor)

260

24/06/20 S. Hut A/c Dr.

J. Brown A/c Dr.

R. Foot A/c Dr.

To Bank A/c

(being payment made to debtors)

5900

6900

1500

14300

27/06/20 Salaries A/c Dr.

To Bank A/c

(being salaries paid by cheque)

5560

5560

30/06/20 Business Rates A/c Dr.

To Bank A/c

(being business rate paid by cheque)

3420

3420

Ledger Accounts

(All amounts in GBP)

Bank Account

Date Particulars Amount Date Particulars Amount

01/06/20 By Storage Cost A/c 760 01/06/20 To Balance c/d 70400

19/06/20 S Hut A/c 5900

19/06/20 J Brown A/c 6900

19/06/20 R Foot A/c 1500

27/06/20 Salaries 5560

30/06/20 Business Rates 3420

30/06/20 Balance c/f 46360

Total 70400 Total 70400

9

(being goods returned to creditor)

260

24/06/20 S. Hut A/c Dr.

J. Brown A/c Dr.

R. Foot A/c Dr.

To Bank A/c

(being payment made to debtors)

5900

6900

1500

14300

27/06/20 Salaries A/c Dr.

To Bank A/c

(being salaries paid by cheque)

5560

5560

30/06/20 Business Rates A/c Dr.

To Bank A/c

(being business rate paid by cheque)

3420

3420

Ledger Accounts

(All amounts in GBP)

Bank Account

Date Particulars Amount Date Particulars Amount

01/06/20 By Storage Cost A/c 760 01/06/20 To Balance c/d 70400

19/06/20 S Hut A/c 5900

19/06/20 J Brown A/c 6900

19/06/20 R Foot A/c 1500

27/06/20 Salaries 5560

30/06/20 Business Rates 3420

30/06/20 Balance c/f 46360

Total 70400 Total 70400

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

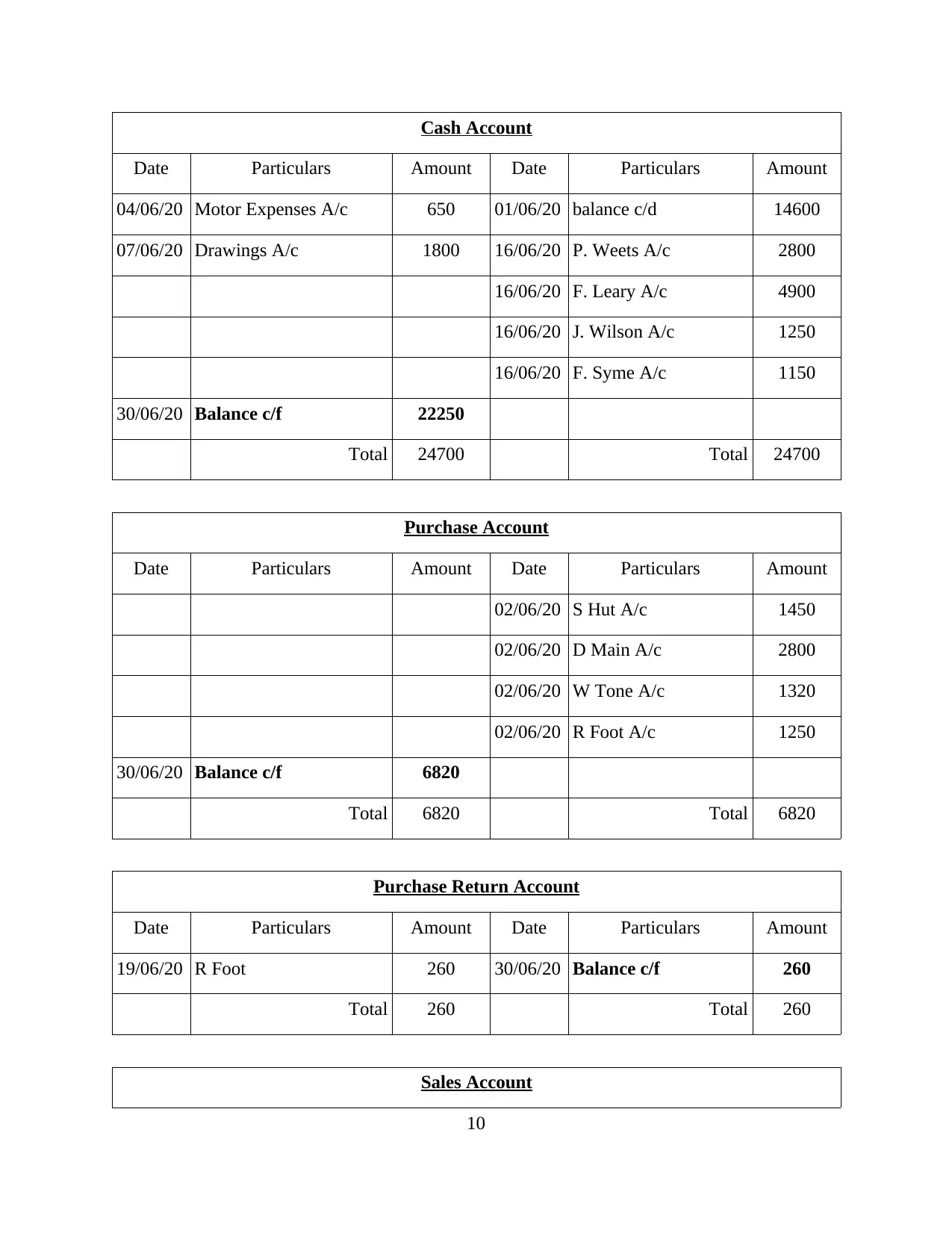

Cash Account

Date Particulars Amount Date Particulars Amount

04/06/20 Motor Expenses A/c 650 01/06/20 balance c/d 14600

07/06/20 Drawings A/c 1800 16/06/20 P. Weets A/c 2800

16/06/20 F. Leary A/c 4900

16/06/20 J. Wilson A/c 1250

16/06/20 F. Syme A/c 1150

30/06/20 Balance c/f 22250

Total 24700 Total 24700

Purchase Account

Date Particulars Amount Date Particulars Amount

02/06/20 S Hut A/c 1450

02/06/20 D Main A/c 2800

02/06/20 W Tone A/c 1320

02/06/20 R Foot A/c 1250

30/06/20 Balance c/f 6820

Total 6820 Total 6820

Purchase Return Account

Date Particulars Amount Date Particulars Amount

19/06/20 R Foot 260 30/06/20 Balance c/f 260

Total 260 Total 260

Sales Account

10

Date Particulars Amount Date Particulars Amount

04/06/20 Motor Expenses A/c 650 01/06/20 balance c/d 14600

07/06/20 Drawings A/c 1800 16/06/20 P. Weets A/c 2800

16/06/20 F. Leary A/c 4900

16/06/20 J. Wilson A/c 1250

16/06/20 F. Syme A/c 1150

30/06/20 Balance c/f 22250

Total 24700 Total 24700

Purchase Account

Date Particulars Amount Date Particulars Amount

02/06/20 S Hut A/c 1450

02/06/20 D Main A/c 2800

02/06/20 W Tone A/c 1320

02/06/20 R Foot A/c 1250

30/06/20 Balance c/f 6820

Total 6820 Total 6820

Purchase Return Account

Date Particulars Amount Date Particulars Amount

19/06/20 R Foot 260 30/06/20 Balance c/f 260

Total 260 Total 260

Sales Account

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

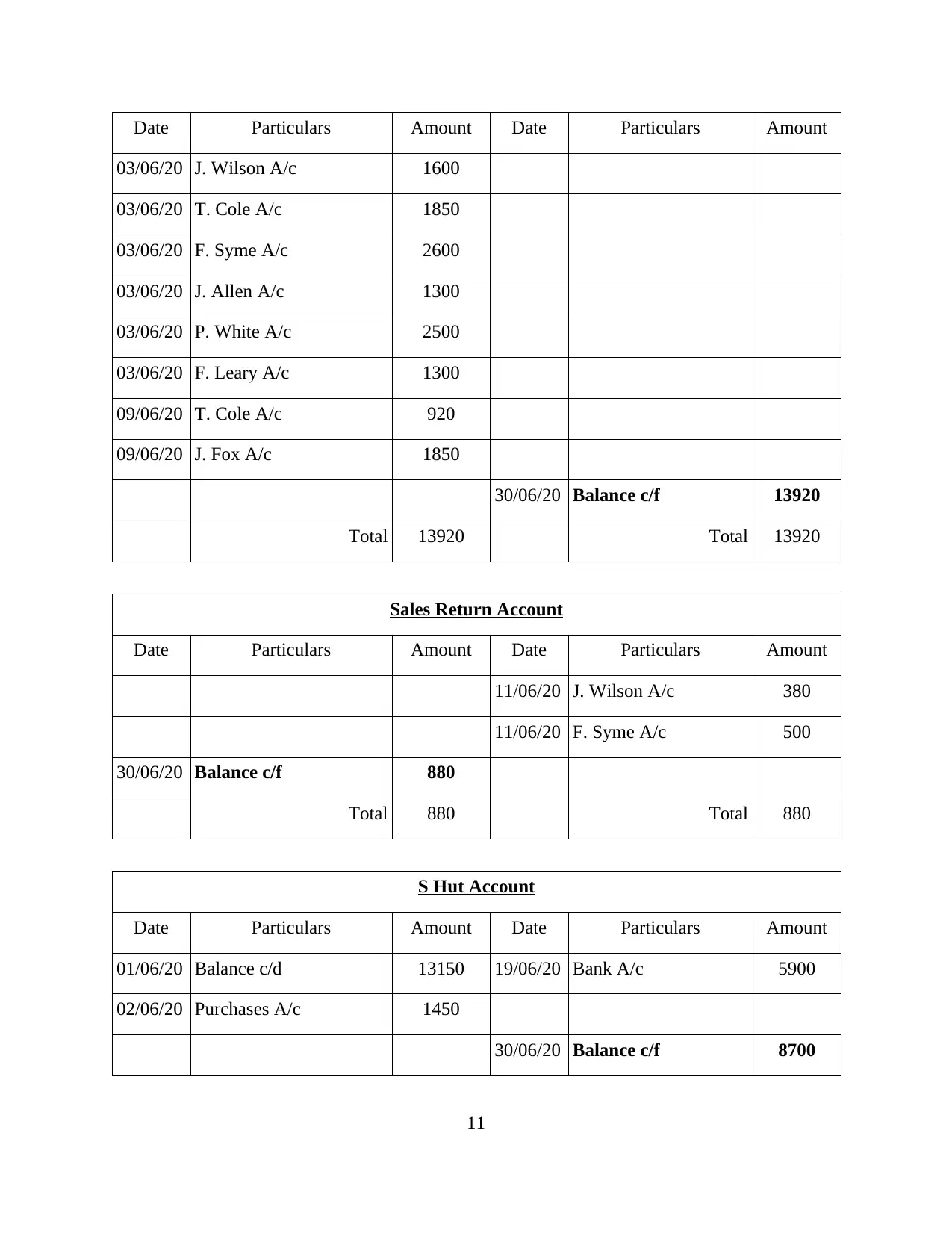

Date Particulars Amount Date Particulars Amount

03/06/20 J. Wilson A/c 1600

03/06/20 T. Cole A/c 1850

03/06/20 F. Syme A/c 2600

03/06/20 J. Allen A/c 1300

03/06/20 P. White A/c 2500

03/06/20 F. Leary A/c 1300

09/06/20 T. Cole A/c 920

09/06/20 J. Fox A/c 1850

30/06/20 Balance c/f 13920

Total 13920 Total 13920

Sales Return Account

Date Particulars Amount Date Particulars Amount

11/06/20 J. Wilson A/c 380

11/06/20 F. Syme A/c 500

30/06/20 Balance c/f 880

Total 880 Total 880

S Hut Account

Date Particulars Amount Date Particulars Amount

01/06/20 Balance c/d 13150 19/06/20 Bank A/c 5900

02/06/20 Purchases A/c 1450

30/06/20 Balance c/f 8700

11

03/06/20 J. Wilson A/c 1600

03/06/20 T. Cole A/c 1850

03/06/20 F. Syme A/c 2600

03/06/20 J. Allen A/c 1300

03/06/20 P. White A/c 2500

03/06/20 F. Leary A/c 1300

09/06/20 T. Cole A/c 920

09/06/20 J. Fox A/c 1850

30/06/20 Balance c/f 13920

Total 13920 Total 13920

Sales Return Account

Date Particulars Amount Date Particulars Amount

11/06/20 J. Wilson A/c 380

11/06/20 F. Syme A/c 500

30/06/20 Balance c/f 880

Total 880 Total 880

S Hut Account

Date Particulars Amount Date Particulars Amount

01/06/20 Balance c/d 13150 19/06/20 Bank A/c 5900

02/06/20 Purchases A/c 1450

30/06/20 Balance c/f 8700

11

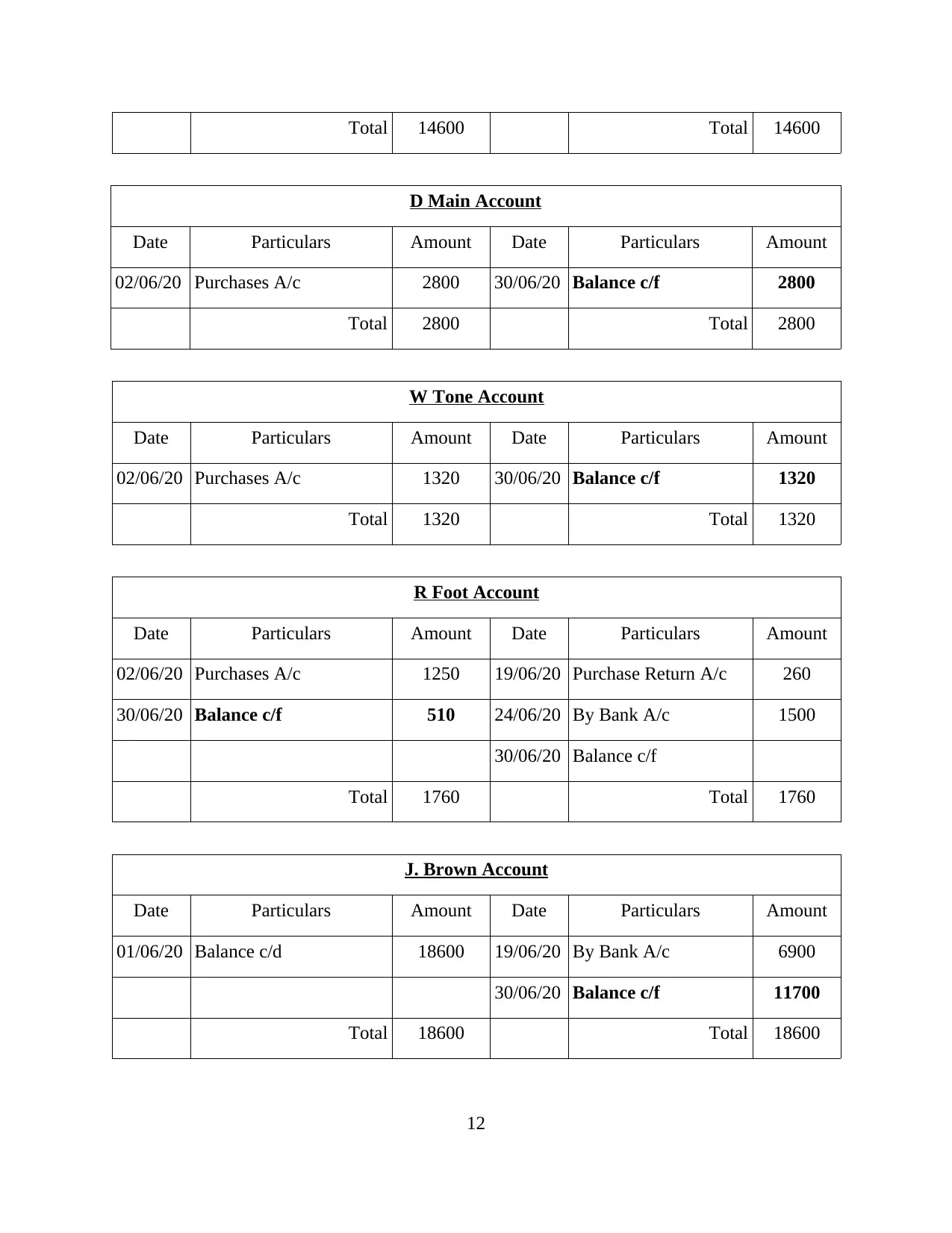

Total 14600 Total 14600

D Main Account

Date Particulars Amount Date Particulars Amount

02/06/20 Purchases A/c 2800 30/06/20 Balance c/f 2800

Total 2800 Total 2800

W Tone Account

Date Particulars Amount Date Particulars Amount

02/06/20 Purchases A/c 1320 30/06/20 Balance c/f 1320

Total 1320 Total 1320

R Foot Account

Date Particulars Amount Date Particulars Amount

02/06/20 Purchases A/c 1250 19/06/20 Purchase Return A/c 260

30/06/20 Balance c/f 510 24/06/20 By Bank A/c 1500

30/06/20 Balance c/f

Total 1760 Total 1760

J. Brown Account

Date Particulars Amount Date Particulars Amount

01/06/20 Balance c/d 18600 19/06/20 By Bank A/c 6900

30/06/20 Balance c/f 11700

Total 18600 Total 18600

12

D Main Account

Date Particulars Amount Date Particulars Amount

02/06/20 Purchases A/c 2800 30/06/20 Balance c/f 2800

Total 2800 Total 2800

W Tone Account

Date Particulars Amount Date Particulars Amount

02/06/20 Purchases A/c 1320 30/06/20 Balance c/f 1320

Total 1320 Total 1320

R Foot Account

Date Particulars Amount Date Particulars Amount

02/06/20 Purchases A/c 1250 19/06/20 Purchase Return A/c 260

30/06/20 Balance c/f 510 24/06/20 By Bank A/c 1500

30/06/20 Balance c/f

Total 1760 Total 1760

J. Brown Account

Date Particulars Amount Date Particulars Amount

01/06/20 Balance c/d 18600 19/06/20 By Bank A/c 6900

30/06/20 Balance c/f 11700

Total 18600 Total 18600

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.