Financial Analysis and Management Accounting Report for Nero Limited

VerifiedAdded on 2020/06/04

|19

|4781

|59

Report

AI Summary

This report provides a detailed analysis of management accounting principles and their application within the context of a software company, Nero Ltd. It begins by defining management accounting and its necessity, exploring different accounting systems like price optimization, inventory management, and cost accounting. The report then examines various methods used for management accounting reporting, including target costing, sales reports, and budget reports. A significant portion is dedicated to calculating costs and preparing income statements using marginal and absorption costing, comparing their methodologies and providing illustrative examples. Furthermore, the report delves into the advantages and disadvantages of planning tools for budgetary control and explores how management accounting systems can be utilized to address financial problems. Through these analyses, the report offers insights into effective financial management and decision-making within a business environment.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

P1 Management accounting and necessity of different types of system.....................................1

P2 Methods used for management accounting reporting............................................................3

P3 Calculation of cost and prepare income statement using marginal and absorption costing. .4

M1...............................................................................................................................................7

D1................................................................................................................................................7

M2...............................................................................................................................................8

D2................................................................................................................................................8

PART B............................................................................................................................................8

P4 Advantages and disadvantages of planning tools for budgetary control...............................8

P5 Usage of management accounting system to respond to financial problems......................10

M3.............................................................................................................................................11

D3..............................................................................................................................................11

M4.............................................................................................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

P1 Management accounting and necessity of different types of system.....................................1

P2 Methods used for management accounting reporting............................................................3

P3 Calculation of cost and prepare income statement using marginal and absorption costing. .4

M1...............................................................................................................................................7

D1................................................................................................................................................7

M2...............................................................................................................................................8

D2................................................................................................................................................8

PART B............................................................................................................................................8

P4 Advantages and disadvantages of planning tools for budgetary control...............................8

P5 Usage of management accounting system to respond to financial problems......................10

M3.............................................................................................................................................11

D3..............................................................................................................................................11

M4.............................................................................................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................12

INTRODUCTION

Management accounting is a profession which deals with financial terms and

helps managers in decision making process by providing accurate information. In fact all

the monetary terms and theories comes under this category which is used by

organization while estimating their future cost (Abrahamsson, Englund and Gerdin,

2011). Basically this field is responsible for managing capital of a company as well as

trying to reduce loss. Nero limited is a software company in UK having number of

branches due to which they require proper management of their budgetary system to

run their business smoothly. This assignment is segregated into two equal weight-age

for describing the necessary elements of finance for example various types of

accounting system, methods of calculating cost etc. Furthermore, it also highlighted

benefits and drawbacks of tools which is used by organization while planning process

for controlling the budget of an organization. Lastly, report also shows usage of

management accounting system in resolving various financial issues.

PART A

P1 Management accounting and necessity of different types of system

Accounts are associated with the collection of data, recording it to the books of

accounts and summarised in order to make a proper financial statements for a

company. All those informations are controlled and managed through applying effective

planning, controlling techniques. This assist the businesses entity to make more

sustainable and reliable for the coming time (Albu and Albu, 2012). Management

accounting provided business a base to plan the set objectives in more proper manner.

It mainly associated with controlling cost which are incurred during production process

of products. Some of the important techniques are lean accounting, traditional costing

and transfer pricing.

The accounting and managements are inter-connected with each other in order

to take effective decisions regarding the growth and stability of the company's

performances. For any company its financial positions are the main aspect to make

investment. It would present a complete images of a company the whether they are able

to meet out its short and long term goals. In NERO, Ltd company, they are dealing in

1

Management accounting is a profession which deals with financial terms and

helps managers in decision making process by providing accurate information. In fact all

the monetary terms and theories comes under this category which is used by

organization while estimating their future cost (Abrahamsson, Englund and Gerdin,

2011). Basically this field is responsible for managing capital of a company as well as

trying to reduce loss. Nero limited is a software company in UK having number of

branches due to which they require proper management of their budgetary system to

run their business smoothly. This assignment is segregated into two equal weight-age

for describing the necessary elements of finance for example various types of

accounting system, methods of calculating cost etc. Furthermore, it also highlighted

benefits and drawbacks of tools which is used by organization while planning process

for controlling the budget of an organization. Lastly, report also shows usage of

management accounting system in resolving various financial issues.

PART A

P1 Management accounting and necessity of different types of system

Accounts are associated with the collection of data, recording it to the books of

accounts and summarised in order to make a proper financial statements for a

company. All those informations are controlled and managed through applying effective

planning, controlling techniques. This assist the businesses entity to make more

sustainable and reliable for the coming time (Albu and Albu, 2012). Management

accounting provided business a base to plan the set objectives in more proper manner.

It mainly associated with controlling cost which are incurred during production process

of products. Some of the important techniques are lean accounting, traditional costing

and transfer pricing.

The accounting and managements are inter-connected with each other in order

to take effective decisions regarding the growth and stability of the company's

performances. For any company its financial positions are the main aspect to make

investment. It would present a complete images of a company the whether they are able

to meet out its short and long term goals. In NERO, Ltd company, they are dealing in

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

various electronic items such as mobile phones, internet and other board band facilities.

They required a perfect accounting system to manage and control their financial data.

So that they business would continued into the right direction in which they wants to

operate. The main reason company's wants a perfect system is to get a perfect results

and on time (Becker, Ulrich and Staffel, 2011). So that their necessary planning can be

implemented in order to expand their business. A appropriate planning can always

originated through a well organised accounting system. It is done so in order to achieve

group goals as well as organisation goals. While, implementation of right techniques

and updated technology the company financial transactions are recorded and managed

properly. Some to the accounting systems are: Price optimisation system: It is considered to be an important accounting

system which is used in the NERO, Ltd company to control its operational

activities. It is related with the concepts that price is the most sensitive aspect for

the customers, which are decided by the company according to the capacity of

customers interest (Bennett, Schaltegger and Zvezdov, 2011). The company

need to analyse that whether customers are comfortable for the price which are

set for the product and services are fulfil the need of them. The reaction of the

customers towards various product prices are analysed through this system. Inventory management system: In this system, the management of stocks

available with the company are analysed and controlled. The managers and

concern departments are work according to the proper utilisation of company's

resources so that effective results can be achieved. There are various tools

which are used in order to do control inventories. Such as EOQ and ABC

analysis. Cost accounting system: It is necessary to evaluate those costs which are

used under the production process by the organisation. This is mainly emphasis

not only related with the costs but to manage the expenses (CallahanStetz and

Brooks, 2011). There are some costing techniques which can be helpful in order

to control the costs. Such as normal, standard and actual costing.

Job costing system:- According to this process there are numerous of job

which are essential to be performed in an organization. Therefore it is essential

2

They required a perfect accounting system to manage and control their financial data.

So that they business would continued into the right direction in which they wants to

operate. The main reason company's wants a perfect system is to get a perfect results

and on time (Becker, Ulrich and Staffel, 2011). So that their necessary planning can be

implemented in order to expand their business. A appropriate planning can always

originated through a well organised accounting system. It is done so in order to achieve

group goals as well as organisation goals. While, implementation of right techniques

and updated technology the company financial transactions are recorded and managed

properly. Some to the accounting systems are: Price optimisation system: It is considered to be an important accounting

system which is used in the NERO, Ltd company to control its operational

activities. It is related with the concepts that price is the most sensitive aspect for

the customers, which are decided by the company according to the capacity of

customers interest (Bennett, Schaltegger and Zvezdov, 2011). The company

need to analyse that whether customers are comfortable for the price which are

set for the product and services are fulfil the need of them. The reaction of the

customers towards various product prices are analysed through this system. Inventory management system: In this system, the management of stocks

available with the company are analysed and controlled. The managers and

concern departments are work according to the proper utilisation of company's

resources so that effective results can be achieved. There are various tools

which are used in order to do control inventories. Such as EOQ and ABC

analysis. Cost accounting system: It is necessary to evaluate those costs which are

used under the production process by the organisation. This is mainly emphasis

not only related with the costs but to manage the expenses (CallahanStetz and

Brooks, 2011). There are some costing techniques which can be helpful in order

to control the costs. Such as normal, standard and actual costing.

Job costing system:- According to this process there are numerous of job

which are essential to be performed in an organization. Therefore it is essential

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

for managers of accounting system is to estimate cost of particular job before

assigning job to any employees.

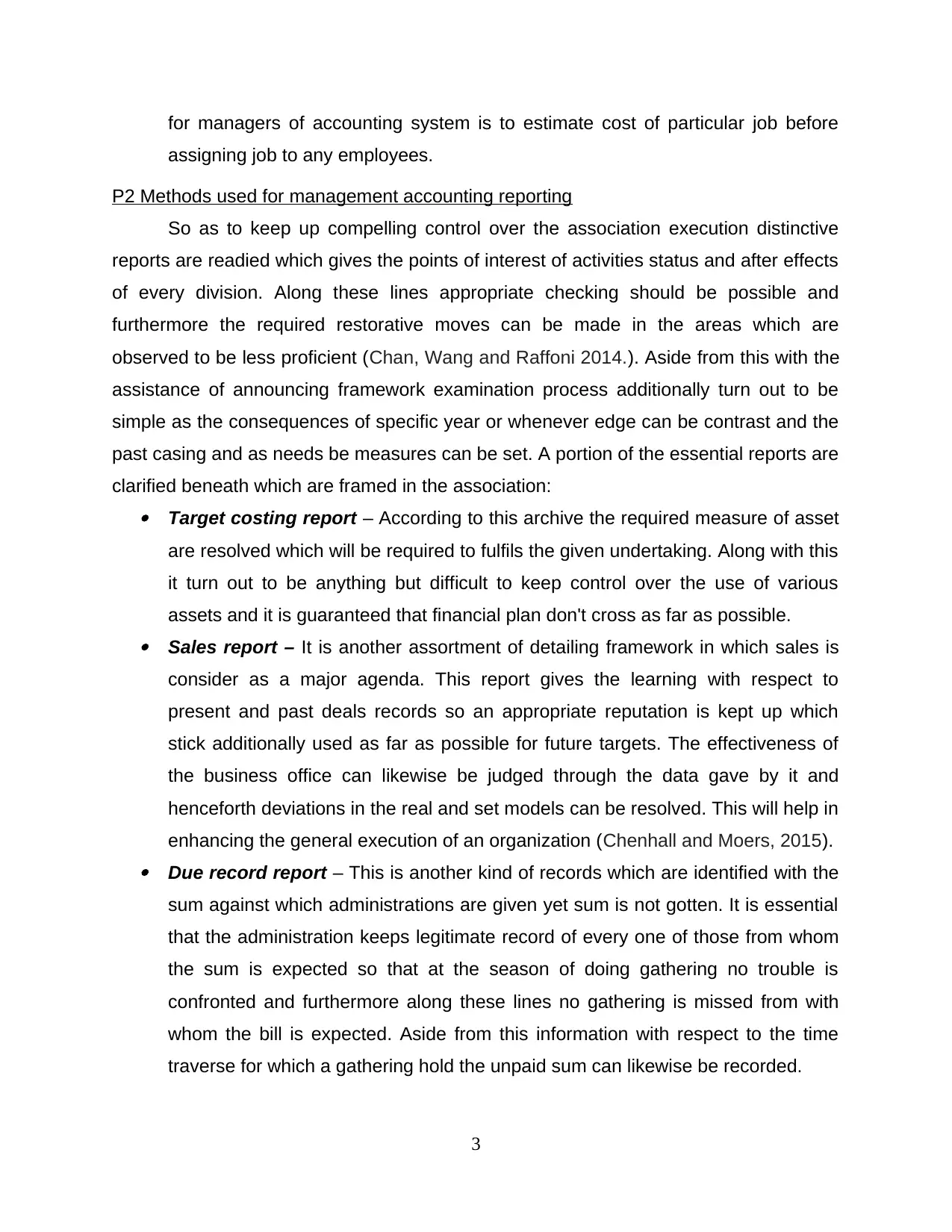

P2 Methods used for management accounting reporting

So as to keep up compelling control over the association execution distinctive

reports are readied which gives the points of interest of activities status and after effects

of every division. Along these lines appropriate checking should be possible and

furthermore the required restorative moves can be made in the areas which are

observed to be less proficient (Chan, Wang and Raffoni 2014.). Aside from this with the

assistance of announcing framework examination process additionally turn out to be

simple as the consequences of specific year or whenever edge can be contrast and the

past casing and as needs be measures can be set. A portion of the essential reports are

clarified beneath which are framed in the association: Target costing report – According to this archive the required measure of asset

are resolved which will be required to fulfils the given undertaking. Along with this

it turn out to be anything but difficult to keep control over the use of various

assets and it is guaranteed that financial plan don't cross as far as possible. Sales report – It is another assortment of detailing framework in which sales is

consider as a major agenda. This report gives the learning with respect to

present and past deals records so an appropriate reputation is kept up which

stick additionally used as far as possible for future targets. The effectiveness of

the business office can likewise be judged through the data gave by it and

henceforth deviations in the real and set models can be resolved. This will help in

enhancing the general execution of an organization (Chenhall and Moers, 2015). Due record report – This is another kind of records which are identified with the

sum against which administrations are given yet sum is not gotten. It is essential

that the administration keeps legitimate record of every one of those from whom

the sum is expected so that at the season of doing gathering no trouble is

confronted and furthermore along these lines no gathering is missed from with

whom the bill is expected. Aside from this information with respect to the time

traverse for which a gathering hold the unpaid sum can likewise be recorded.

3

assigning job to any employees.

P2 Methods used for management accounting reporting

So as to keep up compelling control over the association execution distinctive

reports are readied which gives the points of interest of activities status and after effects

of every division. Along these lines appropriate checking should be possible and

furthermore the required restorative moves can be made in the areas which are

observed to be less proficient (Chan, Wang and Raffoni 2014.). Aside from this with the

assistance of announcing framework examination process additionally turn out to be

simple as the consequences of specific year or whenever edge can be contrast and the

past casing and as needs be measures can be set. A portion of the essential reports are

clarified beneath which are framed in the association: Target costing report – According to this archive the required measure of asset

are resolved which will be required to fulfils the given undertaking. Along with this

it turn out to be anything but difficult to keep control over the use of various

assets and it is guaranteed that financial plan don't cross as far as possible. Sales report – It is another assortment of detailing framework in which sales is

consider as a major agenda. This report gives the learning with respect to

present and past deals records so an appropriate reputation is kept up which

stick additionally used as far as possible for future targets. The effectiveness of

the business office can likewise be judged through the data gave by it and

henceforth deviations in the real and set models can be resolved. This will help in

enhancing the general execution of an organization (Chenhall and Moers, 2015). Due record report – This is another kind of records which are identified with the

sum against which administrations are given yet sum is not gotten. It is essential

that the administration keeps legitimate record of every one of those from whom

the sum is expected so that at the season of doing gathering no trouble is

confronted and furthermore along these lines no gathering is missed from with

whom the bill is expected. Aside from this information with respect to the time

traverse for which a gathering hold the unpaid sum can likewise be recorded.

3

Budget report – It is another document which is identified with setting limits for

unmistakable division. This aides in controlling the money inflow and surge as so

as to make progress the most essential instrument is that the assets of an

undertaking are utilized to their greatest farthest point. Spending causes in giving

guidelines to the diverse offices so they figure out how to complete the

undertaking with the gave assets which additionally helps in accomplishing

competitive advantage (Cullen, and et. al., 2013).

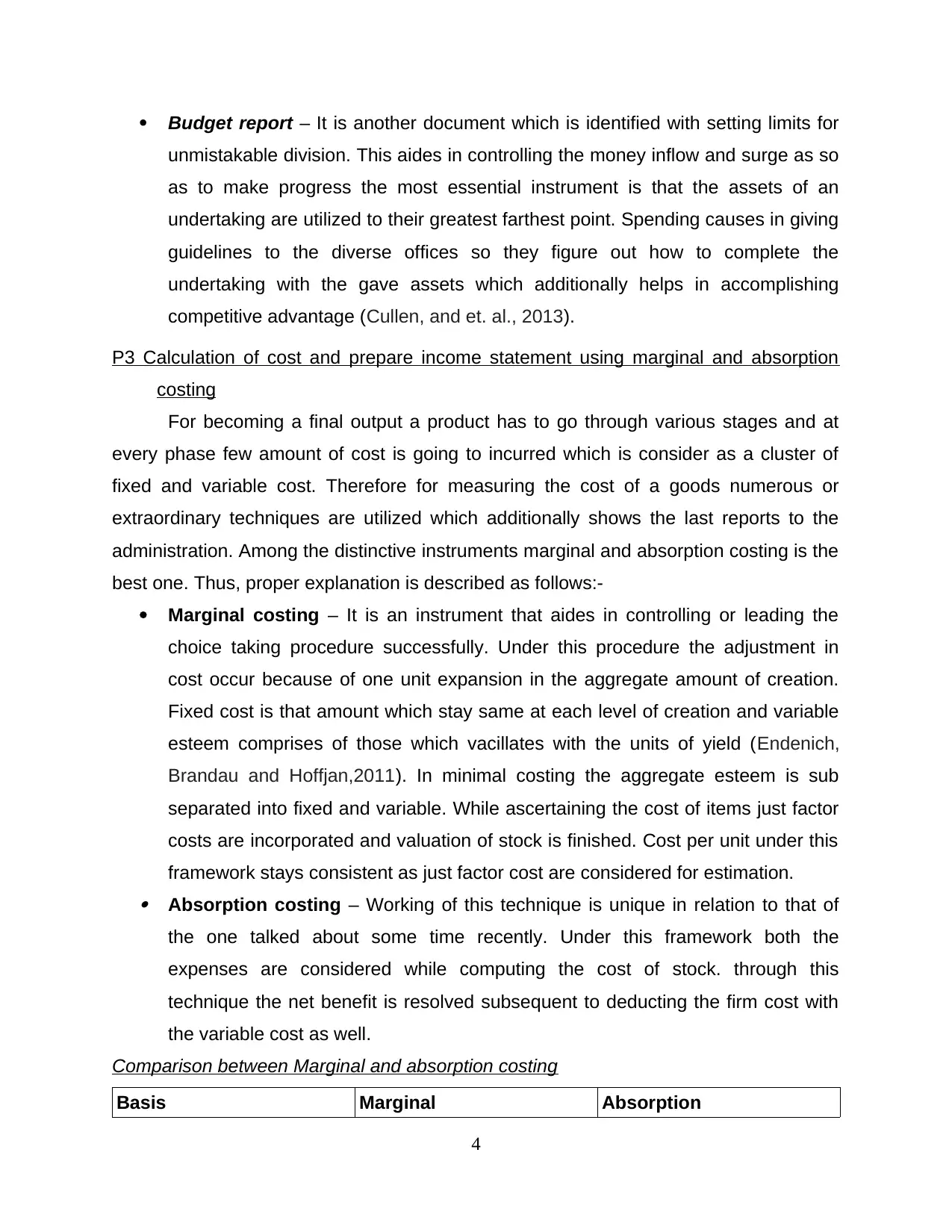

P3 Calculation of cost and prepare income statement using marginal and absorption

costing

For becoming a final output a product has to go through various stages and at

every phase few amount of cost is going to incurred which is consider as a cluster of

fixed and variable cost. Therefore for measuring the cost of a goods numerous or

extraordinary techniques are utilized which additionally shows the last reports to the

administration. Among the distinctive instruments marginal and absorption costing is the

best one. Thus, proper explanation is described as follows:-

Marginal costing – It is an instrument that aides in controlling or leading the

choice taking procedure successfully. Under this procedure the adjustment in

cost occur because of one unit expansion in the aggregate amount of creation.

Fixed cost is that amount which stay same at each level of creation and variable

esteem comprises of those which vacillates with the units of yield (Endenich,

Brandau and Hoffjan,2011). In minimal costing the aggregate esteem is sub

separated into fixed and variable. While ascertaining the cost of items just factor

costs are incorporated and valuation of stock is finished. Cost per unit under this

framework stays consistent as just factor cost are considered for estimation. Absorption costing – Working of this technique is unique in relation to that of

the one talked about some time recently. Under this framework both the

expenses are considered while computing the cost of stock. through this

technique the net benefit is resolved subsequent to deducting the firm cost with

the variable cost as well.

Comparison between Marginal and absorption costing

Basis Marginal Absorption

4

unmistakable division. This aides in controlling the money inflow and surge as so

as to make progress the most essential instrument is that the assets of an

undertaking are utilized to their greatest farthest point. Spending causes in giving

guidelines to the diverse offices so they figure out how to complete the

undertaking with the gave assets which additionally helps in accomplishing

competitive advantage (Cullen, and et. al., 2013).

P3 Calculation of cost and prepare income statement using marginal and absorption

costing

For becoming a final output a product has to go through various stages and at

every phase few amount of cost is going to incurred which is consider as a cluster of

fixed and variable cost. Therefore for measuring the cost of a goods numerous or

extraordinary techniques are utilized which additionally shows the last reports to the

administration. Among the distinctive instruments marginal and absorption costing is the

best one. Thus, proper explanation is described as follows:-

Marginal costing – It is an instrument that aides in controlling or leading the

choice taking procedure successfully. Under this procedure the adjustment in

cost occur because of one unit expansion in the aggregate amount of creation.

Fixed cost is that amount which stay same at each level of creation and variable

esteem comprises of those which vacillates with the units of yield (Endenich,

Brandau and Hoffjan,2011). In minimal costing the aggregate esteem is sub

separated into fixed and variable. While ascertaining the cost of items just factor

costs are incorporated and valuation of stock is finished. Cost per unit under this

framework stays consistent as just factor cost are considered for estimation. Absorption costing – Working of this technique is unique in relation to that of

the one talked about some time recently. Under this framework both the

expenses are considered while computing the cost of stock. through this

technique the net benefit is resolved subsequent to deducting the firm cost with

the variable cost as well.

Comparison between Marginal and absorption costing

Basis Marginal Absorption

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Meaning Technique which guides an

organization during decision

making process.

Supports in doing allocation

of overall cost.

Cost Recognition Uncertain is consider as the

worth of product and fixed is

taken as the cost of period.

At the time of calculating

costing of product fixed and

variable both the cost are

taken into care for acquiring

accurate consequences.

Highlights Share per factor Net Profits per component.

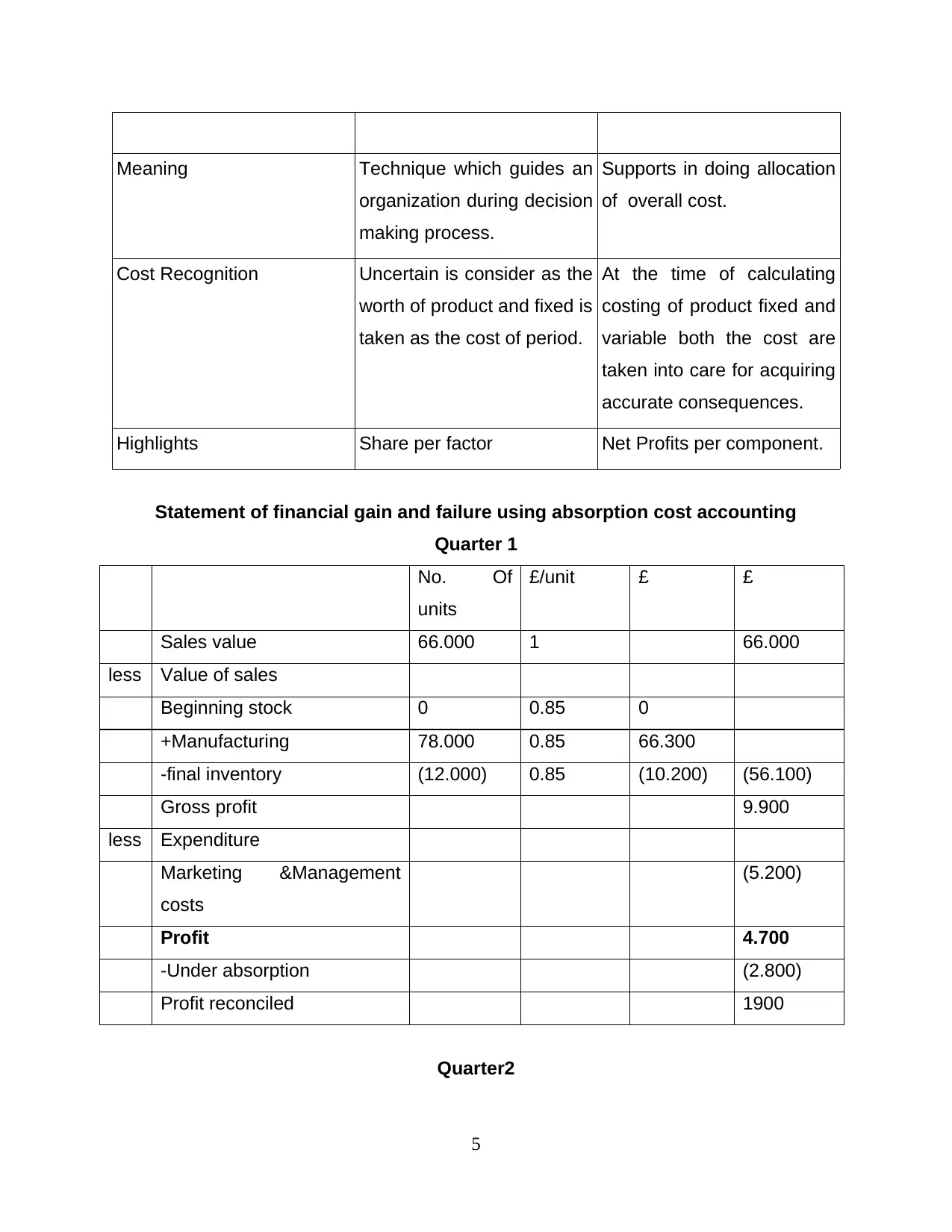

Statement of financial gain and failure using absorption cost accounting

Quarter 1

No. Of

units

£/unit £ £

Sales value 66.000 1 66.000

less Value of sales

Beginning stock 0 0.85 0

+Manufacturing 78.000 0.85 66.300

-final inventory (12.000) 0.85 (10.200) (56.100)

Gross profit 9.900

less Expenditure

Marketing &Management

costs

(5.200)

Profit 4.700

-Under absorption (2.800)

Profit reconciled 1900

Quarter2

5

organization during decision

making process.

Supports in doing allocation

of overall cost.

Cost Recognition Uncertain is consider as the

worth of product and fixed is

taken as the cost of period.

At the time of calculating

costing of product fixed and

variable both the cost are

taken into care for acquiring

accurate consequences.

Highlights Share per factor Net Profits per component.

Statement of financial gain and failure using absorption cost accounting

Quarter 1

No. Of

units

£/unit £ £

Sales value 66.000 1 66.000

less Value of sales

Beginning stock 0 0.85 0

+Manufacturing 78.000 0.85 66.300

-final inventory (12.000) 0.85 (10.200) (56.100)

Gross profit 9.900

less Expenditure

Marketing &Management

costs

(5.200)

Profit 4.700

-Under absorption (2.800)

Profit reconciled 1900

Quarter2

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

No. Of

units

£/unit £ £

Sales value 74.000 1 74.000

less Cost of sales

Opening inventory 12.000 0.85 10.200

+Production 66.000 0.85 56.100

66.300

-closing inventory (4.000) 0.85 (3.400) (62.900)

Gross profit 11.100

less Expenses

Selling &Administration costs (5.200)

Profit 5900

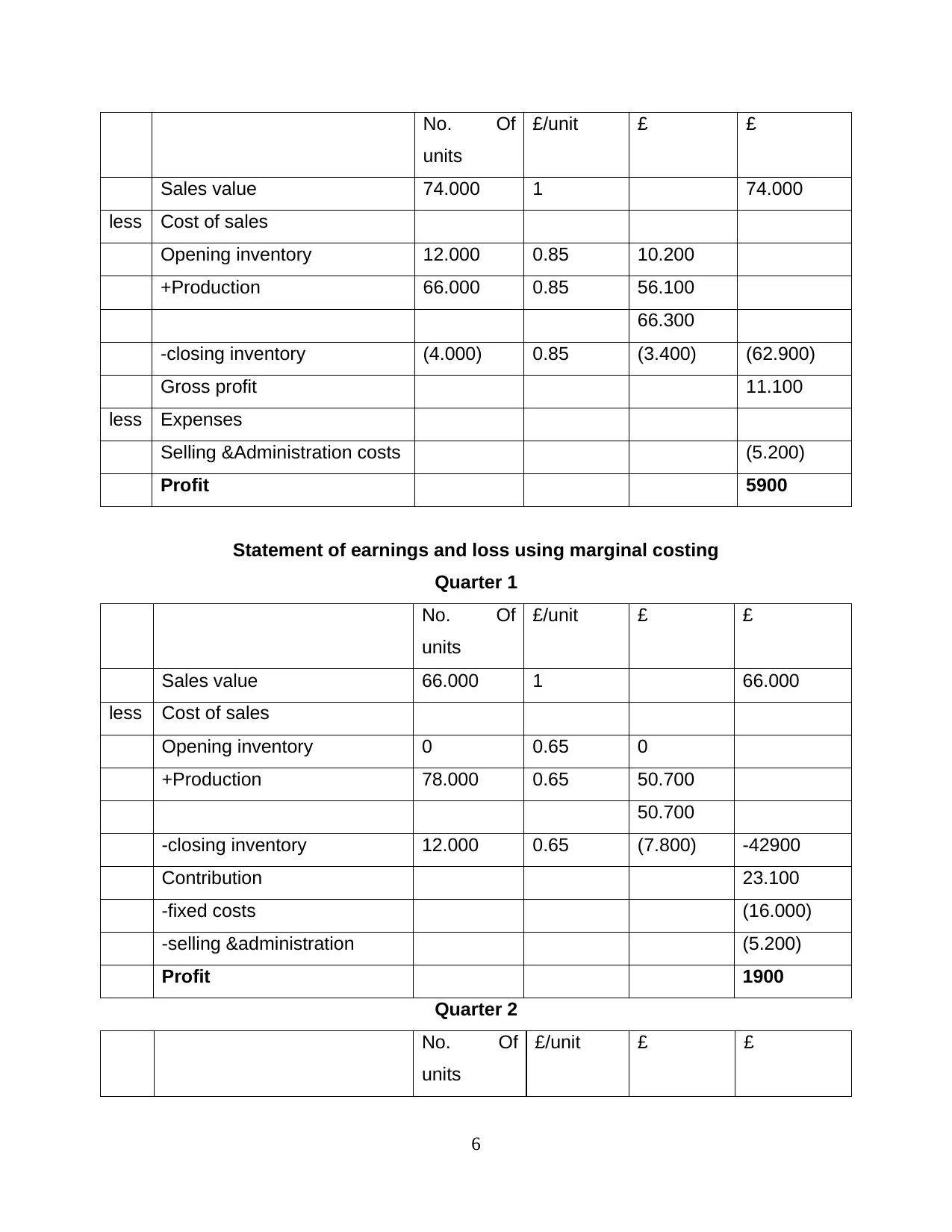

Statement of earnings and loss using marginal costing

Quarter 1

No. Of

units

£/unit £ £

Sales value 66.000 1 66.000

less Cost of sales

Opening inventory 0 0.65 0

+Production 78.000 0.65 50.700

50.700

-closing inventory 12.000 0.65 (7.800) -42900

Contribution 23.100

-fixed costs (16.000)

-selling &administration (5.200)

Profit 1900

Quarter 2

No. Of

units

£/unit £ £

6

units

£/unit £ £

Sales value 74.000 1 74.000

less Cost of sales

Opening inventory 12.000 0.85 10.200

+Production 66.000 0.85 56.100

66.300

-closing inventory (4.000) 0.85 (3.400) (62.900)

Gross profit 11.100

less Expenses

Selling &Administration costs (5.200)

Profit 5900

Statement of earnings and loss using marginal costing

Quarter 1

No. Of

units

£/unit £ £

Sales value 66.000 1 66.000

less Cost of sales

Opening inventory 0 0.65 0

+Production 78.000 0.65 50.700

50.700

-closing inventory 12.000 0.65 (7.800) -42900

Contribution 23.100

-fixed costs (16.000)

-selling &administration (5.200)

Profit 1900

Quarter 2

No. Of

units

£/unit £ £

6

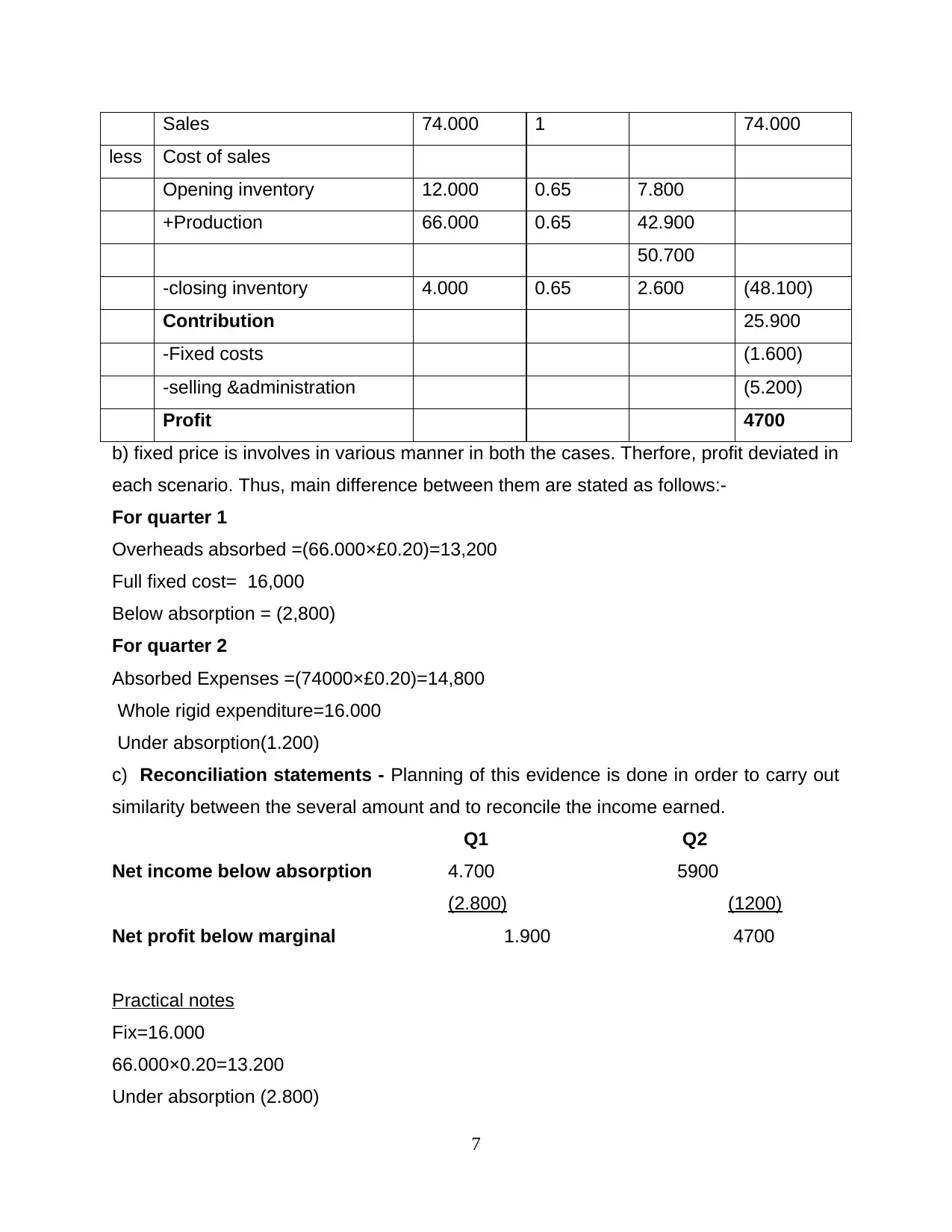

Sales 74.000 1 74.000

less Cost of sales

Opening inventory 12.000 0.65 7.800

+Production 66.000 0.65 42.900

50.700

-closing inventory 4.000 0.65 2.600 (48.100)

Contribution 25.900

-Fixed costs (1.600)

-selling &administration (5.200)

Profit 4700

b) fixed price is involves in various manner in both the cases. Therfore, profit deviated in

each scenario. Thus, main difference between them are stated as follows:-

For quarter 1

Overheads absorbed =(66.000×£0.20)=13,200

Full fixed cost= 16,000

Below absorption = (2,800)

For quarter 2

Absorbed Expenses =(74000×£0.20)=14,800

Whole rigid expenditure=16.000

Under absorption(1.200)

c) Reconciliation statements - Planning of this evidence is done in order to carry out

similarity between the several amount and to reconcile the income earned.

Q1 Q2

Net income below absorption 4.700 5900

(2.800) (1200)

Net profit below marginal 1.900 4700

Practical notes

Fix=16.000

66.000×0.20=13.200

Under absorption (2.800)

7

less Cost of sales

Opening inventory 12.000 0.65 7.800

+Production 66.000 0.65 42.900

50.700

-closing inventory 4.000 0.65 2.600 (48.100)

Contribution 25.900

-Fixed costs (1.600)

-selling &administration (5.200)

Profit 4700

b) fixed price is involves in various manner in both the cases. Therfore, profit deviated in

each scenario. Thus, main difference between them are stated as follows:-

For quarter 1

Overheads absorbed =(66.000×£0.20)=13,200

Full fixed cost= 16,000

Below absorption = (2,800)

For quarter 2

Absorbed Expenses =(74000×£0.20)=14,800

Whole rigid expenditure=16.000

Under absorption(1.200)

c) Reconciliation statements - Planning of this evidence is done in order to carry out

similarity between the several amount and to reconcile the income earned.

Q1 Q2

Net income below absorption 4.700 5900

(2.800) (1200)

Net profit below marginal 1.900 4700

Practical notes

Fix=16.000

66.000×0.20=13.200

Under absorption (2.800)

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

74.000×0.20=14.800

Fix=16.000

Under absorption =1.200

M1

Nero limited is a software company in which various system is going to used and

these systems are very helpful and appropriate in providing accurate information for

employees so that they can enhance their performance by implementing various

improvement sessions. Therefore they need to analyse actual cost of a product so that

they can meet the demand by utilising all the resources in a proper manner. Apart from

this it also maximizes with the use of effective policies.

D1

According to Hammad, (2010) targets which are set by an organization must be

attained by providing necessary benefits to entire association which for fulfilling the

demand of customers as well as employees. Therefore, to fulfils this assignment is

going to use accurate data and information which is available in an enterprise or which

is required in processing time. On the other hand as per Jusoh, and Yen Nee Oon,

(2010) management accounting system and reporting both are fully integrated within

process of a company due to its beneficiary and usage in budgetary planning.

M2

Management accounting methods are used by organization to identify their

hidden issues and problems which affect success of a Nero limited. Basically, main

motive of a financial tools is to help managers at the time of decision making process by

showing all the relevant facts and figures which plays a very eminent role in making

accounting report.

D2

Financial reports are designed and prepared for using during decision making

process so that proper estimation as well as future forecast may take place. Basically

financial statements shows accurate data or information which helps entire association

in resolving difficult circumstances and supports at the time of planning process.

8

Fix=16.000

Under absorption =1.200

M1

Nero limited is a software company in which various system is going to used and

these systems are very helpful and appropriate in providing accurate information for

employees so that they can enhance their performance by implementing various

improvement sessions. Therefore they need to analyse actual cost of a product so that

they can meet the demand by utilising all the resources in a proper manner. Apart from

this it also maximizes with the use of effective policies.

D1

According to Hammad, (2010) targets which are set by an organization must be

attained by providing necessary benefits to entire association which for fulfilling the

demand of customers as well as employees. Therefore, to fulfils this assignment is

going to use accurate data and information which is available in an enterprise or which

is required in processing time. On the other hand as per Jusoh, and Yen Nee Oon,

(2010) management accounting system and reporting both are fully integrated within

process of a company due to its beneficiary and usage in budgetary planning.

M2

Management accounting methods are used by organization to identify their

hidden issues and problems which affect success of a Nero limited. Basically, main

motive of a financial tools is to help managers at the time of decision making process by

showing all the relevant facts and figures which plays a very eminent role in making

accounting report.

D2

Financial reports are designed and prepared for using during decision making

process so that proper estimation as well as future forecast may take place. Basically

financial statements shows accurate data or information which helps entire association

in resolving difficult circumstances and supports at the time of planning process.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART B

P4 Advantages and disadvantages of planning tools for budgetary control

Money is the most pivotal asset off any undertaking thus it is fundamental that

the same is used in a way that greatest returns are accomplished from the same. For a

similar reason utilization of budgetary systems is done as through that over all control

can be continued the practices and inflow/outpouring of back can be checked (Kihn,

2010). Through this procedure limits are set for every office so they can deal with their

exercises inside the gave subsidizes and figure out how to act according to the

accessibility of assets. Budgetary plans are set up after investigating the need of each

task and contrasting the same and the past records as along these lines the proper

guidelines can be advanced against the worry office. According to the nature, Nero

limited prepares different plans and strategies as per demand of an organization and

distribute the cost in different types of budgets which are given below:-

Master budget

Cash budget

Sales budget

Zero budget

Operating financial plan

Statics estimates

Cash flow forecast report

Every single budget have its own benefits and drawbacks because business

condition is dynamic in nature and budgetary plans are set up on the premise of

expectations which can is hard to be right absolutely. Given beneath is the detail

description of distinctive favourable circumstances and weaknesses of the budgetary

control method (Klychova and et. al., 2015).

Positives Encourage control - With the assistance of this strategy successful control can

be drilled over the different elements of an organization as through this

framework limits are set against each capacity. Along these lines the entire office

work in a way that it has just the accessible measure of asset to use and thus

utilize it to its most extreme possibility (Lukka and Vinnari, 2014).

9

P4 Advantages and disadvantages of planning tools for budgetary control

Money is the most pivotal asset off any undertaking thus it is fundamental that

the same is used in a way that greatest returns are accomplished from the same. For a

similar reason utilization of budgetary systems is done as through that over all control

can be continued the practices and inflow/outpouring of back can be checked (Kihn,

2010). Through this procedure limits are set for every office so they can deal with their

exercises inside the gave subsidizes and figure out how to act according to the

accessibility of assets. Budgetary plans are set up after investigating the need of each

task and contrasting the same and the past records as along these lines the proper

guidelines can be advanced against the worry office. According to the nature, Nero

limited prepares different plans and strategies as per demand of an organization and

distribute the cost in different types of budgets which are given below:-

Master budget

Cash budget

Sales budget

Zero budget

Operating financial plan

Statics estimates

Cash flow forecast report

Every single budget have its own benefits and drawbacks because business

condition is dynamic in nature and budgetary plans are set up on the premise of

expectations which can is hard to be right absolutely. Given beneath is the detail

description of distinctive favourable circumstances and weaknesses of the budgetary

control method (Klychova and et. al., 2015).

Positives Encourage control - With the assistance of this strategy successful control can

be drilled over the different elements of an organization as through this

framework limits are set against each capacity. Along these lines the entire office

work in a way that it has just the accessible measure of asset to use and thus

utilize it to its most extreme possibility (Lukka and Vinnari, 2014).

9

Incorporates effectiveness – When staff members of Nero limited have to

perform their assigned task and activities by following limitation and rules of an

organization and after that if work is not accomplished in a given time period then

higher authority of a company have the right to ask question. Thus it is essential

for employees of Nero limited to work with more prominent effectiveness to stay

free from any negative cross examination. Strengthen communication – At the season of preparing budget, connection

between higher authority and related department office is taking place which

additionally enhances the correspondence level. It is a positive move as while

speaking with each other a superior connection is set at the work put which is a

positive sign for organizations development (Nakajima, 2010). Increase worker morale – When the best specialist is responsible to formulating

budgetary plan then they interface with their subordinates which shows that each

and every individual gets a sentiment belongingness within organization. They

get themselves worth and henceforth feel spurred and as needs be give their

execution.

Weaknesses/Negatives Time taking movement – Budget have different constructive outcomes on an

associations but it also have a few impediments as well. For example to attaining

a set goals and objectives it will take maximum time. Therefore, lots of duration is

squandered if there should arise an occurrence of spending disappointment. High esteem technique – keeping in mind the end goal to detail a viable

spending administration needs to guarantee that correct individual with

satisfactory information is delegated (Salehi, Rostami and Mogadam, 2010). To

get such individual great cost must be paid which makes it a costly procedure

cost of which is added to a definitive result of the organization and subsequently

the esteem increments. Complex Operation – As different capacities are performed at the workstation

due to which it is hard to decide every last viewpoint which should be considered

while defining specific financial limit.

10

perform their assigned task and activities by following limitation and rules of an

organization and after that if work is not accomplished in a given time period then

higher authority of a company have the right to ask question. Thus it is essential

for employees of Nero limited to work with more prominent effectiveness to stay

free from any negative cross examination. Strengthen communication – At the season of preparing budget, connection

between higher authority and related department office is taking place which

additionally enhances the correspondence level. It is a positive move as while

speaking with each other a superior connection is set at the work put which is a

positive sign for organizations development (Nakajima, 2010). Increase worker morale – When the best specialist is responsible to formulating

budgetary plan then they interface with their subordinates which shows that each

and every individual gets a sentiment belongingness within organization. They

get themselves worth and henceforth feel spurred and as needs be give their

execution.

Weaknesses/Negatives Time taking movement – Budget have different constructive outcomes on an

associations but it also have a few impediments as well. For example to attaining

a set goals and objectives it will take maximum time. Therefore, lots of duration is

squandered if there should arise an occurrence of spending disappointment. High esteem technique – keeping in mind the end goal to detail a viable

spending administration needs to guarantee that correct individual with

satisfactory information is delegated (Salehi, Rostami and Mogadam, 2010). To

get such individual great cost must be paid which makes it a costly procedure

cost of which is added to a definitive result of the organization and subsequently

the esteem increments. Complex Operation – As different capacities are performed at the workstation

due to which it is hard to decide every last viewpoint which should be considered

while defining specific financial limit.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.