Financial Accounting Principles Report: Client Analysis and Report

VerifiedAdded on 2020/12/24

|21

|4547

|232

Report

AI Summary

This comprehensive report on financial accounting principles begins with an introduction to financial accounting, defining its role and outlining relevant regulations and accounting rules. It delves into key concepts like consistency and material disclosure, followed by an analysis of practical applications through various client scenarios. The report covers topics such as double-entry bookkeeping, profit and loss statements, financial position statements, bank reconciliation, control accounts, and suspense accounts. It explores the importance of financial statements and the role of accounting in maintaining financial ethicalness and consistency. The report also examines the rules and regulations set by IASB, and accounting principles like matching, historical cost, and revenue recognition. The report concludes with a discussion of consistency and material disclosure. This report is a detailed guide to understanding the core principles and practical applications of financial accounting.

FINANCIAL ACCOUNTING

PRINCIPLES

PRINCIPLES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

BUSINESS REORT........................................................................................................................1

1. Defining financial accounting.................................................................................................1

2. Regulations related to financial accounting............................................................................2

3. Accounting rules and principles..............................................................................................4

4. The conventions and concepts relating to consistency and material disclosure.....................5

CLIENT 1........................................................................................................................................6

CLIENT 2........................................................................................................................................9

a) Profit and loss statement ........................................................................................................9

b) Financial position statement.................................................................................................10

CLIENT 3......................................................................................................................................11

a) Profit and loss of Raintree Ltd..............................................................................................11

b) Financial position statement of Raintree Ltd........................................................................11

c) Accounting concepts.............................................................................................................12

d) Purpose of depreciation in formulating accounting statements............................................12

CLIENT 4......................................................................................................................................13

a) Bank reconciliation Statement..............................................................................................13

b) cash book..............................................................................................................................14

CLIENT 5......................................................................................................................................15

a) Sales ledger control account and purchase ledger control account.......................................15

b) Importance of control account..............................................................................................15

CLIENT 6......................................................................................................................................16

a) Suspense account and main features.....................................................................................16

b) Trial balance (£)....................................................................................................................16

(c) Reconcile suspense account.................................................................................................16

d) Difference between clearing accounts and suspense accounts.............................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................1

BUSINESS REORT........................................................................................................................1

1. Defining financial accounting.................................................................................................1

2. Regulations related to financial accounting............................................................................2

3. Accounting rules and principles..............................................................................................4

4. The conventions and concepts relating to consistency and material disclosure.....................5

CLIENT 1........................................................................................................................................6

CLIENT 2........................................................................................................................................9

a) Profit and loss statement ........................................................................................................9

b) Financial position statement.................................................................................................10

CLIENT 3......................................................................................................................................11

a) Profit and loss of Raintree Ltd..............................................................................................11

b) Financial position statement of Raintree Ltd........................................................................11

c) Accounting concepts.............................................................................................................12

d) Purpose of depreciation in formulating accounting statements............................................12

CLIENT 4......................................................................................................................................13

a) Bank reconciliation Statement..............................................................................................13

b) cash book..............................................................................................................................14

CLIENT 5......................................................................................................................................15

a) Sales ledger control account and purchase ledger control account.......................................15

b) Importance of control account..............................................................................................15

CLIENT 6......................................................................................................................................16

a) Suspense account and main features.....................................................................................16

b) Trial balance (£)....................................................................................................................16

(c) Reconcile suspense account.................................................................................................16

d) Difference between clearing accounts and suspense accounts.............................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Accounting and management are the key requirement of business and organisations.

There are type of strategies and plans are made in terms of maintaining financial ethicalness and

consistency. Accounting principles and concepts frame the structure of keeping records and

details in organised manner. Financial accounting rules, legislations and standards assist

managers and accountants to operate the business and functions according to rules and

legislations (Edwards, 2013).

There is a business report prepared which defines the meaning of financial accounting,

regulations related to financial accounting. There are rules and principles defined subject to

maintain financial ethicalness and discipline are defined in this context. Conventions and

consistency which remain related to consistency and material disclosure are also defined in this

context. Practical evaluation done subject to book-keeping system, trial balance, accounting

rules, retaining of transactions and information in books of accounts elaborated in this context.

Analysis of financial information by using various data are reconciled and operated in financial

accounting.

BUSINESS REORT

1. Defining financial accounting

Financial accounting

Financial management and accounting is one of the important branch of management

accounting which assist managers and accountants to keep financial records and information in

systematic manner. There are guidelines, legislations and rules made subject to financial

accounting. These rules are followed by organisations to present financial reports and publish

relevant information for stockholders, shareholders and owners of organisation. Mainly financial

accounting is used to maintain the financial records and information in effective manner and

present these reports to managers and stakeholders of organisation. These statements are mainly

associated with external and internal environment of business (Hatfield, 2014).

Financial accounting is also considered as a language of organisation which

communicates the organisational aim and objectives in financial terms and provides an

information related to economic and financial information for outside parties as shareholders and

creditors. Financial accountants and chartered are hired by the business to maintain and analyse

1

Accounting and management are the key requirement of business and organisations.

There are type of strategies and plans are made in terms of maintaining financial ethicalness and

consistency. Accounting principles and concepts frame the structure of keeping records and

details in organised manner. Financial accounting rules, legislations and standards assist

managers and accountants to operate the business and functions according to rules and

legislations (Edwards, 2013).

There is a business report prepared which defines the meaning of financial accounting,

regulations related to financial accounting. There are rules and principles defined subject to

maintain financial ethicalness and discipline are defined in this context. Conventions and

consistency which remain related to consistency and material disclosure are also defined in this

context. Practical evaluation done subject to book-keeping system, trial balance, accounting

rules, retaining of transactions and information in books of accounts elaborated in this context.

Analysis of financial information by using various data are reconciled and operated in financial

accounting.

BUSINESS REORT

1. Defining financial accounting

Financial accounting

Financial management and accounting is one of the important branch of management

accounting which assist managers and accountants to keep financial records and information in

systematic manner. There are guidelines, legislations and rules made subject to financial

accounting. These rules are followed by organisations to present financial reports and publish

relevant information for stockholders, shareholders and owners of organisation. Mainly financial

accounting is used to maintain the financial records and information in effective manner and

present these reports to managers and stakeholders of organisation. These statements are mainly

associated with external and internal environment of business (Hatfield, 2014).

Financial accounting is also considered as a language of organisation which

communicates the organisational aim and objectives in financial terms and provides an

information related to economic and financial information for outside parties as shareholders and

creditors. Financial accountants and chartered are hired by the business to maintain and analyse

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the essential aspect in terms of business and operations. There are type of financial statements

are prepared by organisations which present the information related to financial performance and

analyse the financial health of business.

Cash flow statement: this is the statement which present the information related to

consumption of cash during the year. This statement mainly contains the information of

utilization of cash in in various activities such as cash flow from operating activities, cash flow

from investing activities and cash flow from financing activities. Overall cash inflows and

outflows information are presented in this statements. With the help of this statements managers

and accountants be able to make strategies and plans for arrangement of cash (Songini, Gnan and

Malmi, 2013).

Income and expenditure statement: this is the statement which defines the profitability

of organisation. This statement covers all the revenue expenditure and income to evaluate the

profit and loss for the year. All the expenses are recorded in the debit side of statement and all

the income and revenues are recorded in credit side. Excess over expenditure is considered as a

profit and excess over income indicates loss. Evaluation of income statement helps mangers and

accountants to make profit strategies and plans.

Financial position statement: this statement mainly associated with identifying the total

assets and liabilities of organisation. This statement present the clear picture of financial position

of organisation to stakeholders, investors, financiers and directors. Current assets, fixed assets,

current liabilities, share capital (Equity and preference), non current and current liabilities are the

elements which are considered in this statement. To generate financial help and funds, there are

strategies and plans are prepared by mangers of association.

Change in equity statement: this statement mainly associated with analysing the

variations in equity and share capital of organisation. There is a statement prepared which

contains equity share capital, shares issued during the year, sum of reserves and surplus,

securities premiums and profit. With the help of this statement managers be able to identify the

difference and variations done during the year subject to equity (Zeff, van der Wel and

Camfferman, 2016).

2. Regulations related to financial accounting

Rules, regulation and legislations helps to maintain and control the accounting records in

more effective and efficient manner. To get accurate information and results managers and

2

are prepared by organisations which present the information related to financial performance and

analyse the financial health of business.

Cash flow statement: this is the statement which present the information related to

consumption of cash during the year. This statement mainly contains the information of

utilization of cash in in various activities such as cash flow from operating activities, cash flow

from investing activities and cash flow from financing activities. Overall cash inflows and

outflows information are presented in this statements. With the help of this statements managers

and accountants be able to make strategies and plans for arrangement of cash (Songini, Gnan and

Malmi, 2013).

Income and expenditure statement: this is the statement which defines the profitability

of organisation. This statement covers all the revenue expenditure and income to evaluate the

profit and loss for the year. All the expenses are recorded in the debit side of statement and all

the income and revenues are recorded in credit side. Excess over expenditure is considered as a

profit and excess over income indicates loss. Evaluation of income statement helps mangers and

accountants to make profit strategies and plans.

Financial position statement: this statement mainly associated with identifying the total

assets and liabilities of organisation. This statement present the clear picture of financial position

of organisation to stakeholders, investors, financiers and directors. Current assets, fixed assets,

current liabilities, share capital (Equity and preference), non current and current liabilities are the

elements which are considered in this statement. To generate financial help and funds, there are

strategies and plans are prepared by mangers of association.

Change in equity statement: this statement mainly associated with analysing the

variations in equity and share capital of organisation. There is a statement prepared which

contains equity share capital, shares issued during the year, sum of reserves and surplus,

securities premiums and profit. With the help of this statement managers be able to identify the

difference and variations done during the year subject to equity (Zeff, van der Wel and

Camfferman, 2016).

2. Regulations related to financial accounting

Rules, regulation and legislations helps to maintain and control the accounting records in

more effective and efficient manner. To get accurate information and results managers and

2

accountants adopt financial rules and legislations. By adhering financial rules and regulations

organisation be able to maintain its financial information and details in systematic way. Financial

accounting is a process which starts form gathering information, collecting financial data and

keeping the records for making financial plans and strategies. It is very important for the

business to present the financial information accurately and as per the legal structure.

IASB (International Accounting Standards Board)

IASB was formed in April 2001 which is one of the independent accounting standard

board produces rules and regulations related to financial accounting. There is a committee

operates the IASB and keep align with making financial plans and strategies for better

management and operations. There are two main bodies as the trustees and the IASB works upon

financial accounting standards. Financial reporting standards and Standard Advisory council

works together to produce financial rules and regulations.

FRS

Financial Reporting standards and the quality management are the essential aspect in

terms of making the financial rules and regulations for better evaluation and management of

finance department. FRS 1 mainly associated with handling cash flows, operating activities,

taxation treatment, return on investments and producing finance, acquisition and disposals,

equity dividends and management are considered in this context (Aletkin, 2014).

FRS 3 provides rules and regulations related to present the financial performance in terms

of profit and loss of organisation. Financial performance of organisation is evaluated on the basis

of following components under FRS 3;

Outcomes of regular operations containing acquisition

Outcomes subject to discontinued operations

Revenues and losses on the sale or termination of an operation, costs of a fundamental

reorganisation or reconstructing, profitability and losses on the disposal of non current

assets

Records of extraordinary items and transactions.

There are also some financial reporting standards made which are adopted by organisations

which are as follows

FRS 10 which is related to treatment of goodwill and intangible assets.

3

organisation be able to maintain its financial information and details in systematic way. Financial

accounting is a process which starts form gathering information, collecting financial data and

keeping the records for making financial plans and strategies. It is very important for the

business to present the financial information accurately and as per the legal structure.

IASB (International Accounting Standards Board)

IASB was formed in April 2001 which is one of the independent accounting standard

board produces rules and regulations related to financial accounting. There is a committee

operates the IASB and keep align with making financial plans and strategies for better

management and operations. There are two main bodies as the trustees and the IASB works upon

financial accounting standards. Financial reporting standards and Standard Advisory council

works together to produce financial rules and regulations.

FRS

Financial Reporting standards and the quality management are the essential aspect in

terms of making the financial rules and regulations for better evaluation and management of

finance department. FRS 1 mainly associated with handling cash flows, operating activities,

taxation treatment, return on investments and producing finance, acquisition and disposals,

equity dividends and management are considered in this context (Aletkin, 2014).

FRS 3 provides rules and regulations related to present the financial performance in terms

of profit and loss of organisation. Financial performance of organisation is evaluated on the basis

of following components under FRS 3;

Outcomes of regular operations containing acquisition

Outcomes subject to discontinued operations

Revenues and losses on the sale or termination of an operation, costs of a fundamental

reorganisation or reconstructing, profitability and losses on the disposal of non current

assets

Records of extraordinary items and transactions.

There are also some financial reporting standards made which are adopted by organisations

which are as follows

FRS 10 which is related to treatment of goodwill and intangible assets.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FRS 15 this is the principle which provides rule related to tangible fixed assets with exception of

investment properties. SSAP 19 also followed under this standard as accounting for investment

properties. Main objective of FRS is to define the tangible fixed assets which are counted at

consistent basis (Ennew, Waite and Waite, 2013).

FRS 18 standard defines the policies and standards subject to disclosure of accounting policies.

Main objective of this standard is to assure managers and accountants for material information in

more effective and efficient manner. This FRS is also interrelated with SSAP 2 which is related

to 'disclosure of accounting policies' which are published under accounting periods. This

contains following essential elements such as relevance, reliability, comparability,

understandability.

3. Accounting rules and principles

Rules of accounting

Credit what goes out and debit what comes in: The given guideline applies on the

genuine records of the organization which its arrangements with. These are the advantages of the

organization and in this way they have a charge adjust in the books of record. The genuine

records of organization incorporates records, for example, plant and gear, Building, Land and so

forth (Boone, Linthicum and Poe, 2013).

Debit all expenses and losses, credit all the revenues and gains: This manage of

bookkeeping applies on all the ostensible records that the organization manages. The capital that

the organization have is an obligation for it and in this manner it has credit adjust.

Credit the giver and debit the receiver: The individual records of organization are the

genuine individuals who manages the business and these records can likewise additionally be

legitimate body. According to this control of bookkeeping, it applies on all the individual records

that are managing the business either immediate or in a roundabout way (Colasse and Durand,

2014).

Accounting principles:

Matching principle: This rule suggests that the incomes that are happened in a money

related year ought to be coordinated with the cost that is caused in delivering that income.

Historical Cost principle: According to this rule of bookkeeping, It is required by the

bookkeepers that they record the advantage bought by the organization at the value which is paid

4

investment properties. SSAP 19 also followed under this standard as accounting for investment

properties. Main objective of FRS is to define the tangible fixed assets which are counted at

consistent basis (Ennew, Waite and Waite, 2013).

FRS 18 standard defines the policies and standards subject to disclosure of accounting policies.

Main objective of this standard is to assure managers and accountants for material information in

more effective and efficient manner. This FRS is also interrelated with SSAP 2 which is related

to 'disclosure of accounting policies' which are published under accounting periods. This

contains following essential elements such as relevance, reliability, comparability,

understandability.

3. Accounting rules and principles

Rules of accounting

Credit what goes out and debit what comes in: The given guideline applies on the

genuine records of the organization which its arrangements with. These are the advantages of the

organization and in this way they have a charge adjust in the books of record. The genuine

records of organization incorporates records, for example, plant and gear, Building, Land and so

forth (Boone, Linthicum and Poe, 2013).

Debit all expenses and losses, credit all the revenues and gains: This manage of

bookkeeping applies on all the ostensible records that the organization manages. The capital that

the organization have is an obligation for it and in this manner it has credit adjust.

Credit the giver and debit the receiver: The individual records of organization are the

genuine individuals who manages the business and these records can likewise additionally be

legitimate body. According to this control of bookkeeping, it applies on all the individual records

that are managing the business either immediate or in a roundabout way (Colasse and Durand,

2014).

Accounting principles:

Matching principle: This rule suggests that the incomes that are happened in a money

related year ought to be coordinated with the cost that is caused in delivering that income.

Historical Cost principle: According to this rule of bookkeeping, It is required by the

bookkeepers that they record the advantage bought by the organization at the value which is paid

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

by the organization to obtain the benefit and this cost is considered as the premise of

bookkeeping at the season of the buy and furthermore in the resulting Financial years.

Revenue recognition Principle: The standard of income acknowledgement is principally

worried about chronicle the incomes of business in the salary articulation of the company (Di

Pietr, AyArt and Ronen, 2014).

4. The conventions and concepts relating to consistency and material disclosure

Material Disclosure: This progression is taken by the bookkeepers so money related

proclamations of the organization are not loaded with consistently subtle elements and exchanges

that are not critical to be recorded. According to this tradition of bookkeeping , it infers that the

bookkeepers of organization need to record and mull over just those exchanges which are

applicable and have noteworthy direction and all the unimportant things must be overlooked. It

ought to likewise be noticed that a thing which is material for one concern can be Irrelevant or

insignificant for another worry. Yet at the same time this procedure is entangled on the grounds

that their no such particular recipe with respect to which exchanges are applicable and which are

not, this is simply an issue of decisions that will be taken by the bookkeeper who is setting up the

records. And furthermore, a thing material in one monetary year may get superfluous in next

bookkeeping year.

Consistency convention: According to this tradition of bookkeeping, it suggests that

bookkeeping hones which are relevant or embraced in current year ought to be appropriate in the

organization for the specific time frames and ought not be changed for specific periods. This

tradition just infers that associations need to stay steady when they embrace any rule of

representing different periods (Drexler, Fischer and Schoar, 2014). At the point when the

organization's have settled approaches, it additionally turn out to be simple and straightforward

for the partners to utilize the money related articulations as against when the organizations

change the strategies consistently. This is on account of when the organization's stay consistent

for a more extended span it implies that organization's tasks are fruitful and they don't require

any adjustments in the arrangements. For example if the organization esteems the stock at the

market cost or cost whichever is less, at that point it ought to take after this standard for different

periods. So also, if some organization deteriorates the settled resources of the organization

utilizing straight line technique for devaluation, at that point the organization should utilize that

specific strategy for deteriorating every one of the benefits.

5

bookkeeping at the season of the buy and furthermore in the resulting Financial years.

Revenue recognition Principle: The standard of income acknowledgement is principally

worried about chronicle the incomes of business in the salary articulation of the company (Di

Pietr, AyArt and Ronen, 2014).

4. The conventions and concepts relating to consistency and material disclosure

Material Disclosure: This progression is taken by the bookkeepers so money related

proclamations of the organization are not loaded with consistently subtle elements and exchanges

that are not critical to be recorded. According to this tradition of bookkeeping , it infers that the

bookkeepers of organization need to record and mull over just those exchanges which are

applicable and have noteworthy direction and all the unimportant things must be overlooked. It

ought to likewise be noticed that a thing which is material for one concern can be Irrelevant or

insignificant for another worry. Yet at the same time this procedure is entangled on the grounds

that their no such particular recipe with respect to which exchanges are applicable and which are

not, this is simply an issue of decisions that will be taken by the bookkeeper who is setting up the

records. And furthermore, a thing material in one monetary year may get superfluous in next

bookkeeping year.

Consistency convention: According to this tradition of bookkeeping, it suggests that

bookkeeping hones which are relevant or embraced in current year ought to be appropriate in the

organization for the specific time frames and ought not be changed for specific periods. This

tradition just infers that associations need to stay steady when they embrace any rule of

representing different periods (Drexler, Fischer and Schoar, 2014). At the point when the

organization's have settled approaches, it additionally turn out to be simple and straightforward

for the partners to utilize the money related articulations as against when the organizations

change the strategies consistently. This is on account of when the organization's stay consistent

for a more extended span it implies that organization's tasks are fruitful and they don't require

any adjustments in the arrangements. For example if the organization esteems the stock at the

market cost or cost whichever is less, at that point it ought to take after this standard for different

periods. So also, if some organization deteriorates the settled resources of the organization

utilizing straight line technique for devaluation, at that point the organization should utilize that

specific strategy for deteriorating every one of the benefits.

5

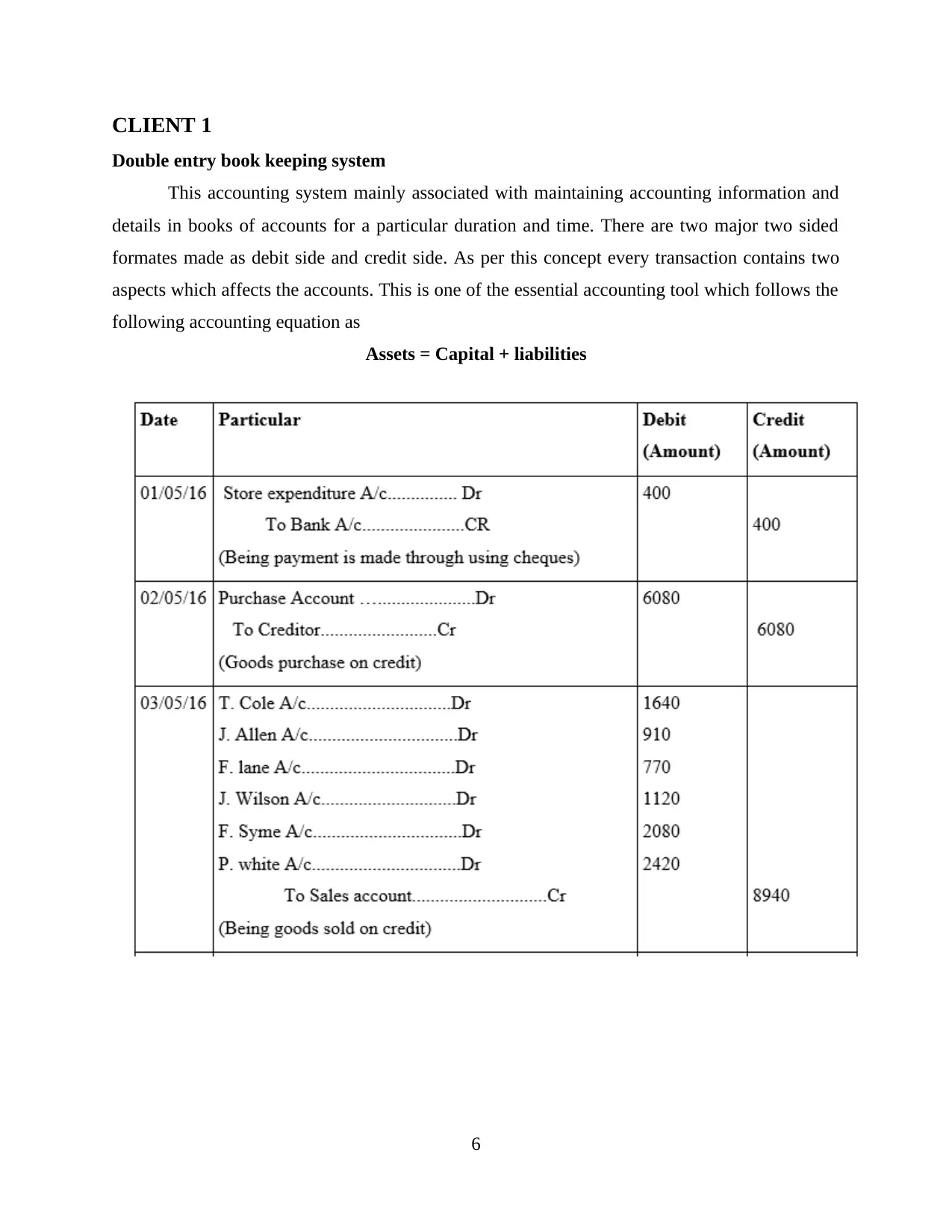

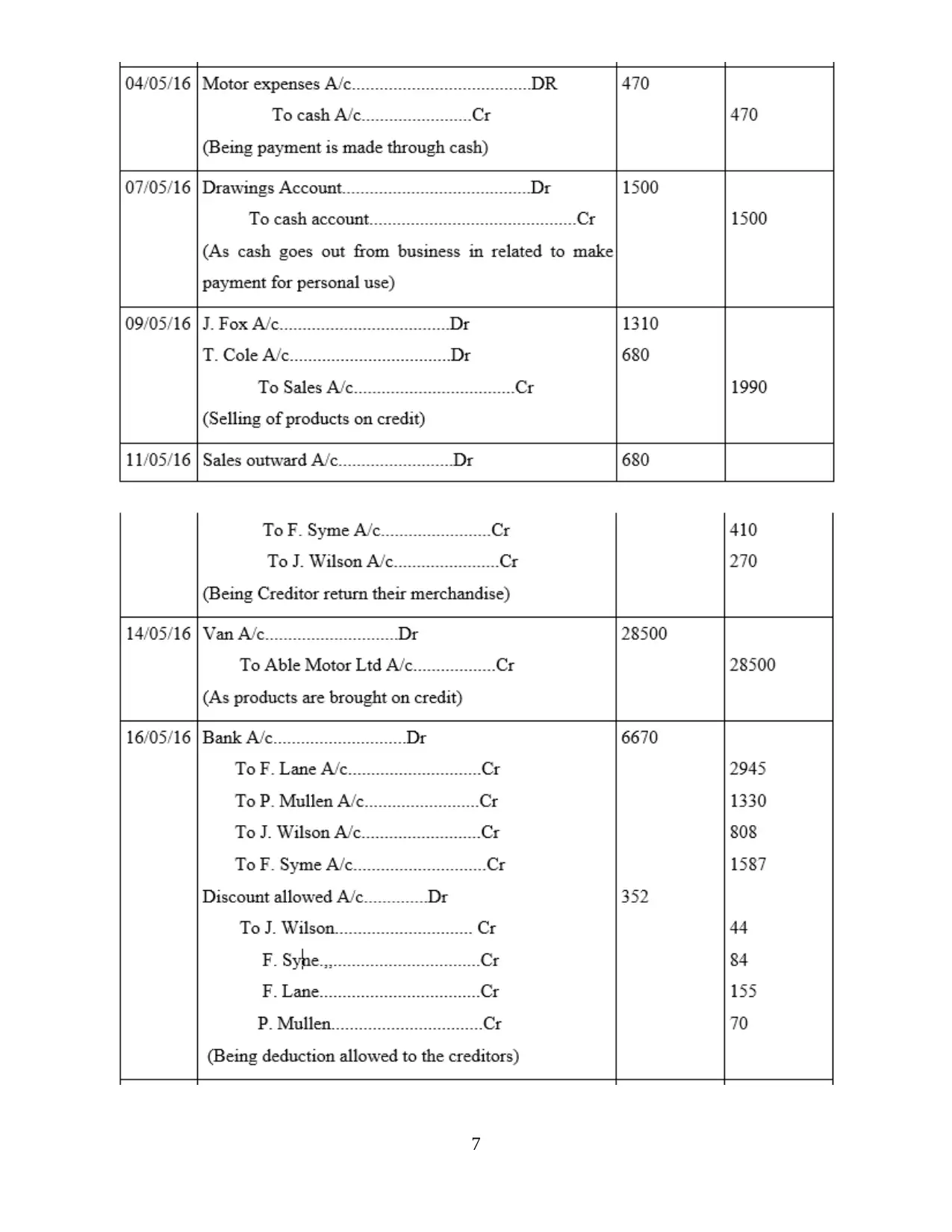

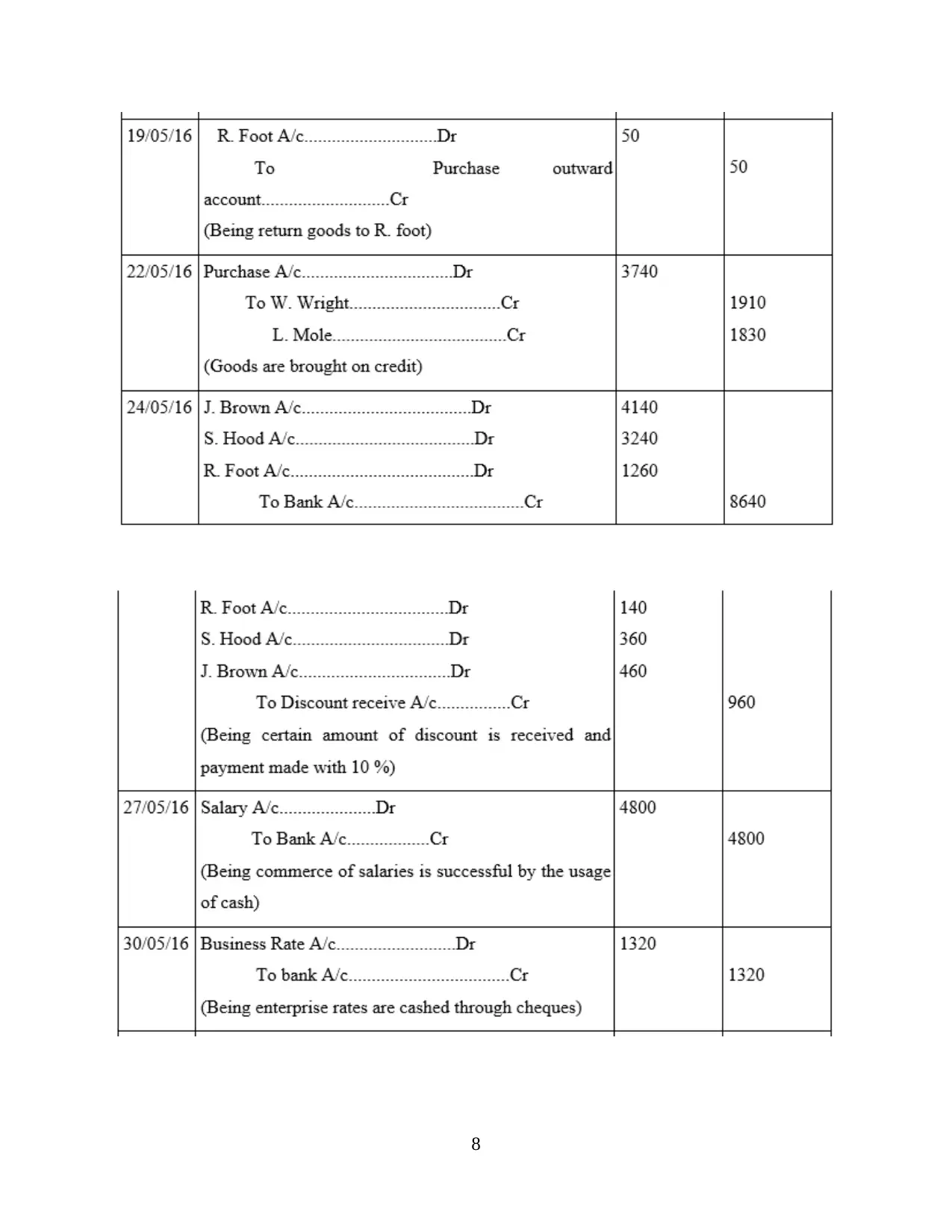

CLIENT 1

Double entry book keeping system

This accounting system mainly associated with maintaining accounting information and

details in books of accounts for a particular duration and time. There are two major two sided

formates made as debit side and credit side. As per this concept every transaction contains two

aspects which affects the accounts. This is one of the essential accounting tool which follows the

following accounting equation as

Assets = Capital + liabilities

6

Double entry book keeping system

This accounting system mainly associated with maintaining accounting information and

details in books of accounts for a particular duration and time. There are two major two sided

formates made as debit side and credit side. As per this concept every transaction contains two

aspects which affects the accounts. This is one of the essential accounting tool which follows the

following accounting equation as

Assets = Capital + liabilities

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

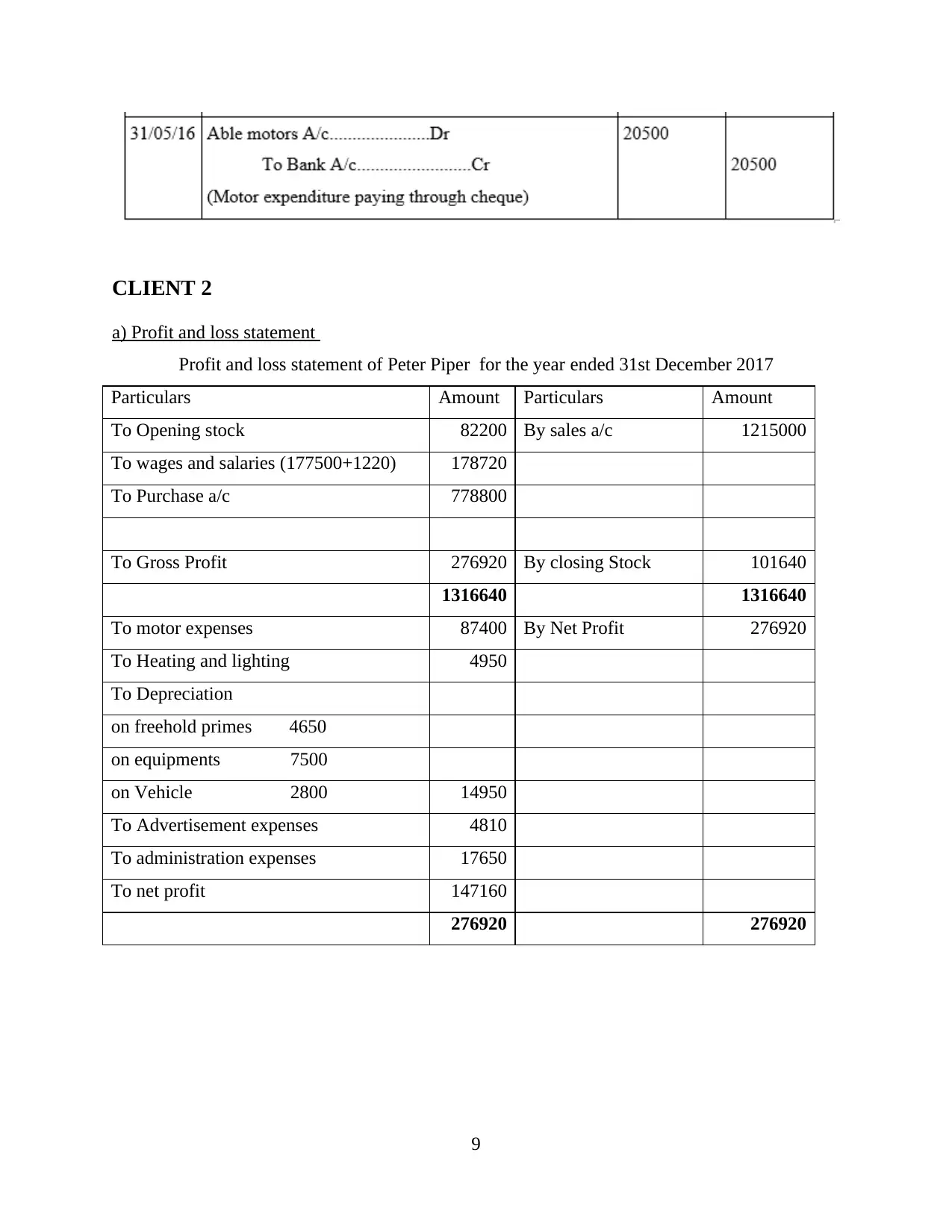

CLIENT 2

a) Profit and loss statement

Profit and loss statement of Peter Piper for the year ended 31st December 2017

Particulars Amount Particulars Amount

To Opening stock 82200 By sales a/c 1215000

To wages and salaries (177500+1220) 178720

To Purchase a/c 778800

To Gross Profit 276920 By closing Stock 101640

1316640 1316640

To motor expenses 87400 By Net Profit 276920

To Heating and lighting 4950

To Depreciation

on freehold primes 4650

on equipments 7500

on Vehicle 2800 14950

To Advertisement expenses 4810

To administration expenses 17650

To net profit 147160

276920 276920

9

a) Profit and loss statement

Profit and loss statement of Peter Piper for the year ended 31st December 2017

Particulars Amount Particulars Amount

To Opening stock 82200 By sales a/c 1215000

To wages and salaries (177500+1220) 178720

To Purchase a/c 778800

To Gross Profit 276920 By closing Stock 101640

1316640 1316640

To motor expenses 87400 By Net Profit 276920

To Heating and lighting 4950

To Depreciation

on freehold primes 4650

on equipments 7500

on Vehicle 2800 14950

To Advertisement expenses 4810

To administration expenses 17650

To net profit 147160

276920 276920

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.