Financial Accounting Principles Report: A Detailed Analysis

VerifiedAdded on 2021/01/01

|27

|6417

|341

Report

AI Summary

This report provides a comprehensive overview of financial accounting principles, covering various aspects such as the meaning of financial accounting, associated regulations, accounting principles and conventions, and the concept of consistency and materiality. It delves into journal entries, double-entry bookkeeping, trial balances, and the formulation of financial statements. The report analyzes sales and purchase transactions, profit and loss statements, and the bank reconciliation process. It includes examples and case studies, such as the preparation and balancing of books for a company, and discusses suspense accounts and control accounts. The report also covers accounting conventions and concepts like money measurement and conservatism, offering a detailed analysis of the practical application of accounting principles in business operations. The report is aimed at providing a comprehensive understanding of accounting principles and their practical application within a business context.

Financial Accounting

Principles

Principles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

Business Report...............................................................................................................................1

(a): Meaning of financial accounting.....................................................................................1

(b): Regulation associated with financial accounting.............................................................2

(c): Accounting principles and regulations.............................................................................3

(d): Accounting convention and concept of consistency and materiality...............................4

CLIENT 1: Journal Entries..............................................................................................................5

P1: Detail data regarding double entry bookkeeping.............................................................5

P2: Concept of trail balance and their balancing regulations...............................................14

M1: Analyse sales and purchase transactions to compile a trail balance.............................15

D1: Recording of transaction accurately into the trail balance............................................15

CLIENT 2......................................................................................................................................15

P3: (a): Development of final account and associated trail balances...................................15

CLIENT 3......................................................................................................................................16

P4: Formulation of financial statements and large number of examples.............................16

M2: Analysis of profit and losses statement and other financial account............................19

D2: Application of accurate calculation for the final account..............................................19

CLINET 4......................................................................................................................................19

P5: Bank reconciliation process...........................................................................................19

M3: Apply reconciliation process........................................................................................20

D3: Formulation of BRS......................................................................................................20

CLIENT 5......................................................................................................................................21

P6: Prepare and balance the books of Henderson................................................................21

D4: Produce various accounts that have been use for reconcile the statements...................22

CLINET 6......................................................................................................................................23

Suspense account and reconcile control accounts................................................................23

M4: Understanding of various types of accounts.................................................................23

CONCLUSION..............................................................................................................................24

REFERENCES..............................................................................................................................25

INTRODUCTION...........................................................................................................................1

Business Report...............................................................................................................................1

(a): Meaning of financial accounting.....................................................................................1

(b): Regulation associated with financial accounting.............................................................2

(c): Accounting principles and regulations.............................................................................3

(d): Accounting convention and concept of consistency and materiality...............................4

CLIENT 1: Journal Entries..............................................................................................................5

P1: Detail data regarding double entry bookkeeping.............................................................5

P2: Concept of trail balance and their balancing regulations...............................................14

M1: Analyse sales and purchase transactions to compile a trail balance.............................15

D1: Recording of transaction accurately into the trail balance............................................15

CLIENT 2......................................................................................................................................15

P3: (a): Development of final account and associated trail balances...................................15

CLIENT 3......................................................................................................................................16

P4: Formulation of financial statements and large number of examples.............................16

M2: Analysis of profit and losses statement and other financial account............................19

D2: Application of accurate calculation for the final account..............................................19

CLINET 4......................................................................................................................................19

P5: Bank reconciliation process...........................................................................................19

M3: Apply reconciliation process........................................................................................20

D3: Formulation of BRS......................................................................................................20

CLIENT 5......................................................................................................................................21

P6: Prepare and balance the books of Henderson................................................................21

D4: Produce various accounts that have been use for reconcile the statements...................22

CLINET 6......................................................................................................................................23

Suspense account and reconcile control accounts................................................................23

M4: Understanding of various types of accounts.................................................................23

CONCLUSION..............................................................................................................................24

REFERENCES..............................................................................................................................25

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is considering as one of the crucial aspects for an organisation. It is uses for the

purpose of making effective planning and allocating future aims and objectives within an

accounting period of time. It is known as of the vital field of accounting those are concerned with

the summary, analysing and reporting financial transaction in pertaining to all business

transaction those are discussed during the period of time. This project report is all about various

crucial aspects those are associated with accounting principles.

All necessary financial statements those are prepared by the company can be analyse by

using appropriate tools and techniques. This consist of formulation of financial records that are

available for public consumptions. Overall this report guides an organisation to attain more

reliable outcome in case all statements are providing sufficient amount of gain in coming period

of time. Analysis of bank reconciliation is done effectively in order to determine total cash

balance of the company (Scott, 2015).

Business Report

(a): Meaning of financial accounting

Financial accounting is one of the special branch of accounting which track of overall

financial transactions that are done within an organisation. It is used to be based on certain

guidelines, transactions that are recorded, summarise and present in preparation of financial

statements. With this all relevant data associated with the financial condition and position of the

company easily be analyse in effective manner. This information is then after use by different

investors and stakeholder those are connected with the company in order to make relevant

decision regarding, whether to make invest in future projects of a company. The financial

statements also aid overall supplies in deciding, whether sufficient amount of raw material is

being provided by the company through judging their overall condition in effective manner. This

financial report is done with use of certain goals that are based on overall profitability of an

organisation (Agoglia, Doupnik and Tsakumis, 2011). The various companies select various

accounting systems that are prepared by using standard bodies such as IFRS etc. Financial

accounting that is being done in order to keep in views that standards and their duties of

managers to be shown in financial statements of the company. Some crucial statements are

discussed underneath:

1

Finance is considering as one of the crucial aspects for an organisation. It is uses for the

purpose of making effective planning and allocating future aims and objectives within an

accounting period of time. It is known as of the vital field of accounting those are concerned with

the summary, analysing and reporting financial transaction in pertaining to all business

transaction those are discussed during the period of time. This project report is all about various

crucial aspects those are associated with accounting principles.

All necessary financial statements those are prepared by the company can be analyse by

using appropriate tools and techniques. This consist of formulation of financial records that are

available for public consumptions. Overall this report guides an organisation to attain more

reliable outcome in case all statements are providing sufficient amount of gain in coming period

of time. Analysis of bank reconciliation is done effectively in order to determine total cash

balance of the company (Scott, 2015).

Business Report

(a): Meaning of financial accounting

Financial accounting is one of the special branch of accounting which track of overall

financial transactions that are done within an organisation. It is used to be based on certain

guidelines, transactions that are recorded, summarise and present in preparation of financial

statements. With this all relevant data associated with the financial condition and position of the

company easily be analyse in effective manner. This information is then after use by different

investors and stakeholder those are connected with the company in order to make relevant

decision regarding, whether to make invest in future projects of a company. The financial

statements also aid overall supplies in deciding, whether sufficient amount of raw material is

being provided by the company through judging their overall condition in effective manner. This

financial report is done with use of certain goals that are based on overall profitability of an

organisation (Agoglia, Doupnik and Tsakumis, 2011). The various companies select various

accounting systems that are prepared by using standard bodies such as IFRS etc. Financial

accounting that is being done in order to keep in views that standards and their duties of

managers to be shown in financial statements of the company. Some crucial statements are

discussed underneath:

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Income statements: According this accounting reports a company’s financial

performances during a particular period of time. It has been assessing by using a summary of

business activities that are incurs their earning and expenses from various activities such as

operating and non-profit aspects. It assists companies in evaluating, whether the company is

making earning, profit and losses. The transactions related to operating gains, gross and net profit

are determining in overall profit and loss statements of the company.

Balance sheet: This seems to be one of the crucial statements of the company which used

to provide specific information about all detail aspects of assets and debt a company is having

with them. By using this statements, financial position and stability in respect to other company’s

positions are taken into account (Zeff, 2016). Financial organisation and other stakeholder

determine their financial statements for providing sufficient loans and investing in the

companies.

Cash flow statements: This seems to be one of the crucial statements which will be used

to determine inflows and outflows from various activities of an organisation that are collected

from various operating activities, investing and financing activities. This statements enable

managers to detect the overall fluctuations of cash during accounting period of time.

Changes in statement of equity: It is known as more similar statements of alteration of

all necessary changes in partner’s equity for a various taxpayer’s equity for a government

financial reports. It records all necessary changes that are done in capital balance of an

organisation over a given period of time.

(b): Regulation associated with financial accounting

Financial accounting standards is concern with private, non-profit organisation those are

setting bodies. Their role is to establish and make modification in GAAP as per the interest of

public. Regulators used to apply those two effective system for managing and controlling about

operators report their financial outcomes during an accounting period of time. There are no any

current legal needs that a companies used to report on extent to which their activities are

harmony with essential demand or sustainability development. Current reporting and practices

are having only more connection with overall sustainability of an organisation. However, UK

system reports on progresses towards attempts to incorporate overall needs of sustainability into

the economic overall life of reports (Horngren and et. al., 2012). The financial data users are very

wide and diversified range as per the financial accounting. Because of such modification the data

2

performances during a particular period of time. It has been assessing by using a summary of

business activities that are incurs their earning and expenses from various activities such as

operating and non-profit aspects. It assists companies in evaluating, whether the company is

making earning, profit and losses. The transactions related to operating gains, gross and net profit

are determining in overall profit and loss statements of the company.

Balance sheet: This seems to be one of the crucial statements of the company which used

to provide specific information about all detail aspects of assets and debt a company is having

with them. By using this statements, financial position and stability in respect to other company’s

positions are taken into account (Zeff, 2016). Financial organisation and other stakeholder

determine their financial statements for providing sufficient loans and investing in the

companies.

Cash flow statements: This seems to be one of the crucial statements which will be used

to determine inflows and outflows from various activities of an organisation that are collected

from various operating activities, investing and financing activities. This statements enable

managers to detect the overall fluctuations of cash during accounting period of time.

Changes in statement of equity: It is known as more similar statements of alteration of

all necessary changes in partner’s equity for a various taxpayer’s equity for a government

financial reports. It records all necessary changes that are done in capital balance of an

organisation over a given period of time.

(b): Regulation associated with financial accounting

Financial accounting standards is concern with private, non-profit organisation those are

setting bodies. Their role is to establish and make modification in GAAP as per the interest of

public. Regulators used to apply those two effective system for managing and controlling about

operators report their financial outcomes during an accounting period of time. There are no any

current legal needs that a companies used to report on extent to which their activities are

harmony with essential demand or sustainability development. Current reporting and practices

are having only more connection with overall sustainability of an organisation. However, UK

system reports on progresses towards attempts to incorporate overall needs of sustainability into

the economic overall life of reports (Horngren and et. al., 2012). The financial data users are very

wide and diversified range as per the financial accounting. Because of such modification the data

2

needed to every individual is required for plenty of ways. To maintain all rules and regulations,

various regulatory bodies are created by following IASB etc. The ASB is another important

accounting norm which are used by the company during formulation of financial reports. These

standard used to provide accounting regulation that can assist managers and accountant in

formulating financial records through using financial data of the company

(c): Accounting principles and regulations

In every business organisation, it is based on various common rules and regulations that

are being adopted or proposed by using certain guidelines those are needed to be taken during

formulation of appropriate statements. There are various rules and concepts that are govern

appropriate accounting. It consists of major three rules that basic accounting principles and

regulations, the detailed rules and policies those are being issued by FASB and their predecessor

the accounting principles board. It every industry distributes their financial statements to public,

it is needed to implement GAAP principles during formulation of various statements. Further, in

case company overall stock is publicly traded and required financial records be audited by a

skilled accountant (Warren and Jones, 2018). Below mentioned various accounting principles

and guidelines together are discussed effectively. Some of them are:

Cost principles: As per as accountant is concern, they used to consider cost as those

amount which is spent during an items were originally obtained. For this particular

reason, the total value indicates on financial statements those are referred to be recorded

on historical cost basis. Hence, an assets amount does not reflect the total amount of

income a company which will be receive if it is sell the asset at current period of time.

Full disclosure principles: there are certain information which is to be made by

investors through using financial statements that data would be disclosure within

prepared statements. It is related with basic accounting aspects that taken as for attaining

more suitable results in coming period of time. It is requirements that are related with

publicly traded companies those are releasing and provide free exchange of facts that are

relevant to their continuing business operations.

Going concern principles: This types of accounting aspects assumes that a company will

continues to exist for longer period of time in order to attain their aims and objectives

into the allotted time frame. In case accountant believe that, the condition of company is

3

various regulatory bodies are created by following IASB etc. The ASB is another important

accounting norm which are used by the company during formulation of financial reports. These

standard used to provide accounting regulation that can assist managers and accountant in

formulating financial records through using financial data of the company

(c): Accounting principles and regulations

In every business organisation, it is based on various common rules and regulations that

are being adopted or proposed by using certain guidelines those are needed to be taken during

formulation of appropriate statements. There are various rules and concepts that are govern

appropriate accounting. It consists of major three rules that basic accounting principles and

regulations, the detailed rules and policies those are being issued by FASB and their predecessor

the accounting principles board. It every industry distributes their financial statements to public,

it is needed to implement GAAP principles during formulation of various statements. Further, in

case company overall stock is publicly traded and required financial records be audited by a

skilled accountant (Warren and Jones, 2018). Below mentioned various accounting principles

and guidelines together are discussed effectively. Some of them are:

Cost principles: As per as accountant is concern, they used to consider cost as those

amount which is spent during an items were originally obtained. For this particular

reason, the total value indicates on financial statements those are referred to be recorded

on historical cost basis. Hence, an assets amount does not reflect the total amount of

income a company which will be receive if it is sell the asset at current period of time.

Full disclosure principles: there are certain information which is to be made by

investors through using financial statements that data would be disclosure within

prepared statements. It is related with basic accounting aspects that taken as for attaining

more suitable results in coming period of time. It is requirements that are related with

publicly traded companies those are releasing and provide free exchange of facts that are

relevant to their continuing business operations.

Going concern principles: This types of accounting aspects assumes that a company will

continues to exist for longer period of time in order to attain their aims and objectives

into the allotted time frame. In case accountant believe that, the condition of company is

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

not so effective then the accounting books of that particular companies accounting books

are closed for next coming time.

Matching principles: This accounting principles need for companies to make use of

accrual basis of data. This particular principle need that all expenses to be matched with

total earnings of the company. It cannot be measure the future economic benefits of all

things like advertisement the accountant charges (Henderson and et. al., 2015).

Regulations and rules:

There are certain accounting rules which will be consider for effective recording of

financial transactions those are done within an accounting period of time. Some of them are

mentioned underneath:

Personal account: It is known as one of the effective account which is being used by an

individual for that persons that are own requirements. The accounting rules says that

debit the receivers and credit all amount to givers. Some crucial examples, capital and

drawings.

Real account: Such kind of account is related with nature of assets those are used by an

organisation. As per this rules, debit what comes in and credit all values those are goes

out during the period of business operations.

Nominal account: This seems to be utmost important financial transactions that are done

at the time of every financial period. The rules provide information about debits all

expenses and losses and credit all incomes and profit.

(d): Accounting convention and concept of consistency and materiality

It is known as common aspects of accounting that are used for the recording of a business

transactions. It is helpful in those situations which is not having any kind set guidelines in

accounting standards that are govern during period of time. There are various effective types of

accounting conventions that are held responsible for betterment the growth and gainfulness for

an organisation. Some of them are:

Consistency: It would be required to select most appropriate accounting tools and

techniques that are made for the adjustments on regular basis. Alteration can only be done in

which new methods it adopted by the company (May, 2013). There are certain examples that are

being consider for examine overall strength and financial position of the company.

4

are closed for next coming time.

Matching principles: This accounting principles need for companies to make use of

accrual basis of data. This particular principle need that all expenses to be matched with

total earnings of the company. It cannot be measure the future economic benefits of all

things like advertisement the accountant charges (Henderson and et. al., 2015).

Regulations and rules:

There are certain accounting rules which will be consider for effective recording of

financial transactions those are done within an accounting period of time. Some of them are

mentioned underneath:

Personal account: It is known as one of the effective account which is being used by an

individual for that persons that are own requirements. The accounting rules says that

debit the receivers and credit all amount to givers. Some crucial examples, capital and

drawings.

Real account: Such kind of account is related with nature of assets those are used by an

organisation. As per this rules, debit what comes in and credit all values those are goes

out during the period of business operations.

Nominal account: This seems to be utmost important financial transactions that are done

at the time of every financial period. The rules provide information about debits all

expenses and losses and credit all incomes and profit.

(d): Accounting convention and concept of consistency and materiality

It is known as common aspects of accounting that are used for the recording of a business

transactions. It is helpful in those situations which is not having any kind set guidelines in

accounting standards that are govern during period of time. There are various effective types of

accounting conventions that are held responsible for betterment the growth and gainfulness for

an organisation. Some of them are:

Consistency: It would be required to select most appropriate accounting tools and

techniques that are made for the adjustments on regular basis. Alteration can only be done in

which new methods it adopted by the company (May, 2013). There are certain examples that are

being consider for examine overall strength and financial position of the company.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Materiality: This seems to be one of the effective accounting conventions which are

consider for making influenced the economic decision of users. This concept is universally

attainable that all material aspects are to be disclosed by the company. This would be applied

through the applied auditors in planning and evaluation the audit and in analysing effect for

determining misstatements on report of the statements.

Concepts:

There are various concepts that being followed by the accountant within an accounting

period of time. Some of them are discussed underneath:

Money measurement: It refers as money measurement concepts that used to guide

business only for the purpose of recording accounting transactions if it can be mentioned

in respect to overall capital. In case products are cannot be recorded as accounting

transactions because they cannot be able to state in respect to money.

Conservatism: This conservatism concept is basically related with that concepts in more

common aspect for recognizing expenses and debts that are possible in uncertainty

regarding various results that are attain during the period of time. In accounting, the

convention of conservatism is associated with the policy of anticipating best possible

losses during the future of aims (Mulford and Comiskey, 2011).

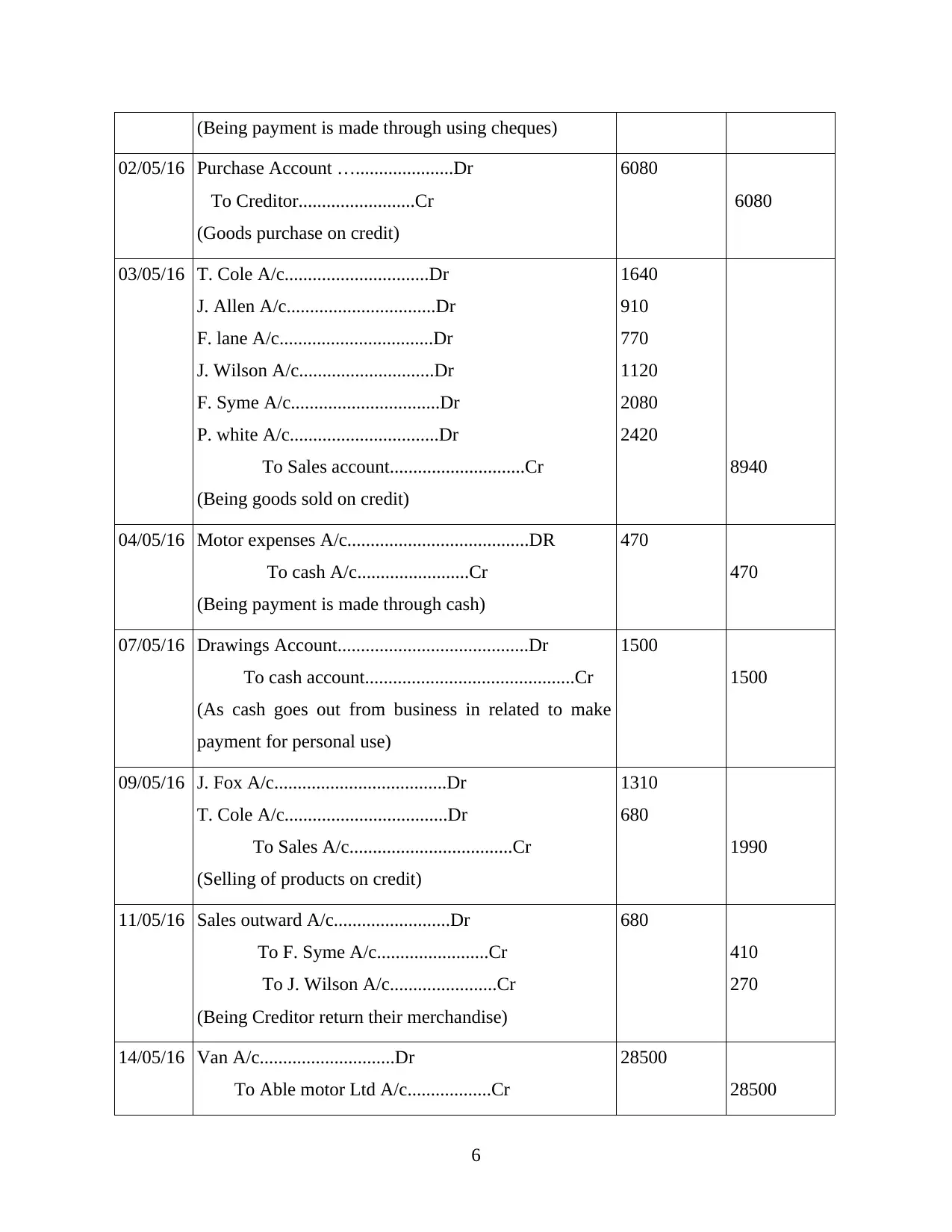

CLIENT 1: Journal Entries

P1: Detail data regarding double entry bookkeeping

In accounting terms double entry system of accounting means that every business data. It

means that every transaction will be associated with at least two account effects. If company

used to borrow money from the banks, they overall asset increase total liability as net payables is

increased effectively. A fundamental aspect for underlying effect in day to day bookkeeping and

accounting detail aspects those are related with financial transaction has opposite effects in at

least two various account. Every transaction need to satisfy below equation:

Asset= Liabilities + Equity

Date Particular Debit

(Amount)

Credit

(Amount)

01/05/16 Store expenditure A/c............... Dr

To Bank A/c......................CR

400

400

5

consider for making influenced the economic decision of users. This concept is universally

attainable that all material aspects are to be disclosed by the company. This would be applied

through the applied auditors in planning and evaluation the audit and in analysing effect for

determining misstatements on report of the statements.

Concepts:

There are various concepts that being followed by the accountant within an accounting

period of time. Some of them are discussed underneath:

Money measurement: It refers as money measurement concepts that used to guide

business only for the purpose of recording accounting transactions if it can be mentioned

in respect to overall capital. In case products are cannot be recorded as accounting

transactions because they cannot be able to state in respect to money.

Conservatism: This conservatism concept is basically related with that concepts in more

common aspect for recognizing expenses and debts that are possible in uncertainty

regarding various results that are attain during the period of time. In accounting, the

convention of conservatism is associated with the policy of anticipating best possible

losses during the future of aims (Mulford and Comiskey, 2011).

CLIENT 1: Journal Entries

P1: Detail data regarding double entry bookkeeping

In accounting terms double entry system of accounting means that every business data. It

means that every transaction will be associated with at least two account effects. If company

used to borrow money from the banks, they overall asset increase total liability as net payables is

increased effectively. A fundamental aspect for underlying effect in day to day bookkeeping and

accounting detail aspects those are related with financial transaction has opposite effects in at

least two various account. Every transaction need to satisfy below equation:

Asset= Liabilities + Equity

Date Particular Debit

(Amount)

Credit

(Amount)

01/05/16 Store expenditure A/c............... Dr

To Bank A/c......................CR

400

400

5

(Being payment is made through using cheques)

02/05/16 Purchase Account ….....................Dr

To Creditor.........................Cr

(Goods purchase on credit)

6080

6080

03/05/16 T. Cole A/c...............................Dr

J. Allen A/c................................Dr

F. lane A/c.................................Dr

J. Wilson A/c.............................Dr

F. Syme A/c................................Dr

P. white A/c................................Dr

To Sales account.............................Cr

(Being goods sold on credit)

1640

910

770

1120

2080

2420

8940

04/05/16 Motor expenses A/c.......................................DR

To cash A/c........................Cr

(Being payment is made through cash)

470

470

07/05/16 Drawings Account.........................................Dr

To cash account.............................................Cr

(As cash goes out from business in related to make

payment for personal use)

1500

1500

09/05/16 J. Fox A/c.....................................Dr

T. Cole A/c...................................Dr

To Sales A/c...................................Cr

(Selling of products on credit)

1310

680

1990

11/05/16 Sales outward A/c.........................Dr

To F. Syme A/c........................Cr

To J. Wilson A/c.......................Cr

(Being Creditor return their merchandise)

680

410

270

14/05/16 Van A/c.............................Dr

To Able motor Ltd A/c..................Cr

28500

28500

6

02/05/16 Purchase Account ….....................Dr

To Creditor.........................Cr

(Goods purchase on credit)

6080

6080

03/05/16 T. Cole A/c...............................Dr

J. Allen A/c................................Dr

F. lane A/c.................................Dr

J. Wilson A/c.............................Dr

F. Syme A/c................................Dr

P. white A/c................................Dr

To Sales account.............................Cr

(Being goods sold on credit)

1640

910

770

1120

2080

2420

8940

04/05/16 Motor expenses A/c.......................................DR

To cash A/c........................Cr

(Being payment is made through cash)

470

470

07/05/16 Drawings Account.........................................Dr

To cash account.............................................Cr

(As cash goes out from business in related to make

payment for personal use)

1500

1500

09/05/16 J. Fox A/c.....................................Dr

T. Cole A/c...................................Dr

To Sales A/c...................................Cr

(Selling of products on credit)

1310

680

1990

11/05/16 Sales outward A/c.........................Dr

To F. Syme A/c........................Cr

To J. Wilson A/c.......................Cr

(Being Creditor return their merchandise)

680

410

270

14/05/16 Van A/c.............................Dr

To Able motor Ltd A/c..................Cr

28500

28500

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

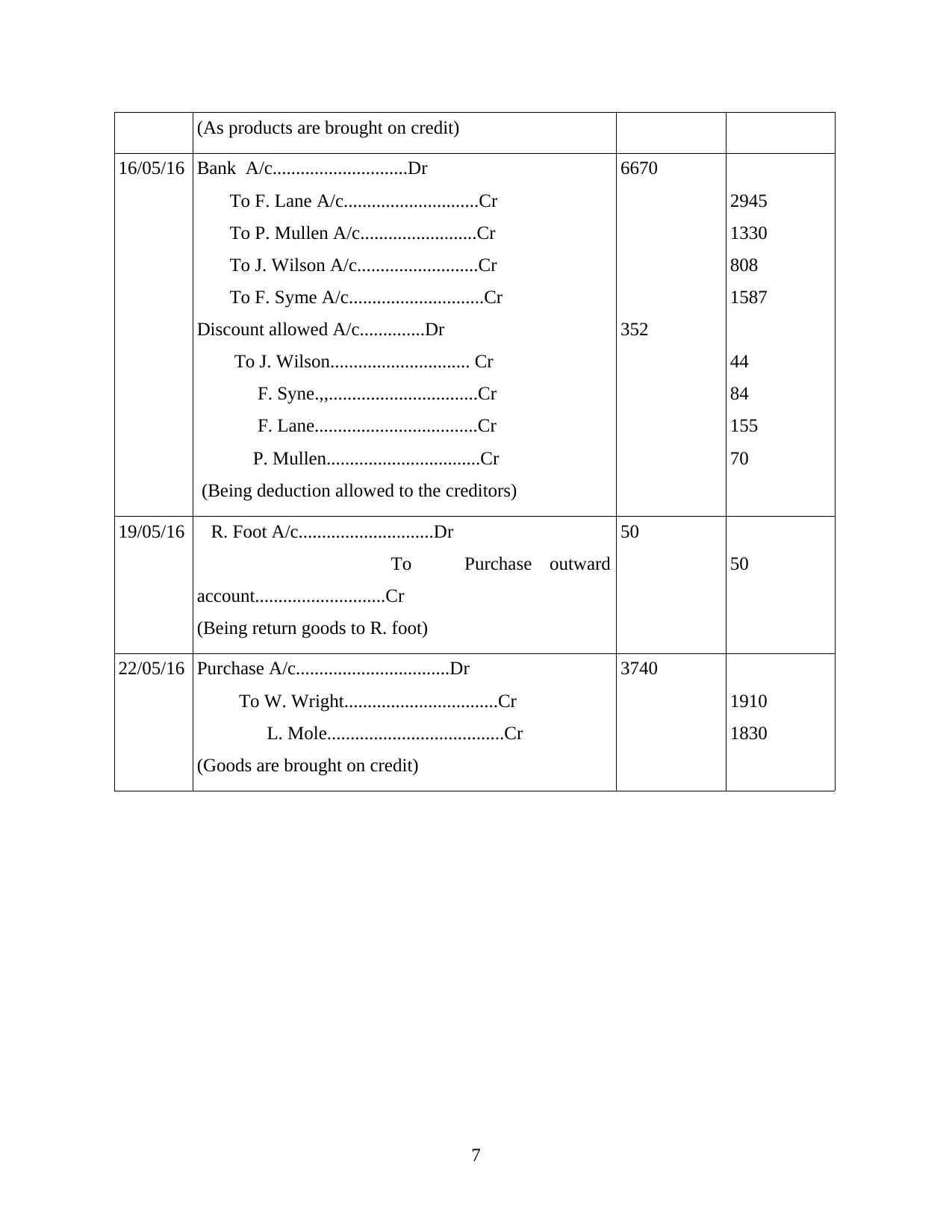

(As products are brought on credit)

16/05/16 Bank A/c.............................Dr

To F. Lane A/c.............................Cr

To P. Mullen A/c.........................Cr

To J. Wilson A/c..........................Cr

To F. Syme A/c.............................Cr

Discount allowed A/c..............Dr

To J. Wilson.............................. Cr

F. Syne.,,................................Cr

F. Lane...................................Cr

P. Mullen.................................Cr

(Being deduction allowed to the creditors)

6670

352

2945

1330

808

1587

44

84

155

70

19/05/16 R. Foot A/c.............................Dr

To Purchase outward

account............................Cr

(Being return goods to R. foot)

50

50

22/05/16 Purchase A/c.................................Dr

To W. Wright.................................Cr

L. Mole......................................Cr

(Goods are brought on credit)

3740

1910

1830

7

16/05/16 Bank A/c.............................Dr

To F. Lane A/c.............................Cr

To P. Mullen A/c.........................Cr

To J. Wilson A/c..........................Cr

To F. Syme A/c.............................Cr

Discount allowed A/c..............Dr

To J. Wilson.............................. Cr

F. Syne.,,................................Cr

F. Lane...................................Cr

P. Mullen.................................Cr

(Being deduction allowed to the creditors)

6670

352

2945

1330

808

1587

44

84

155

70

19/05/16 R. Foot A/c.............................Dr

To Purchase outward

account............................Cr

(Being return goods to R. foot)

50

50

22/05/16 Purchase A/c.................................Dr

To W. Wright.................................Cr

L. Mole......................................Cr

(Goods are brought on credit)

3740

1910

1830

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

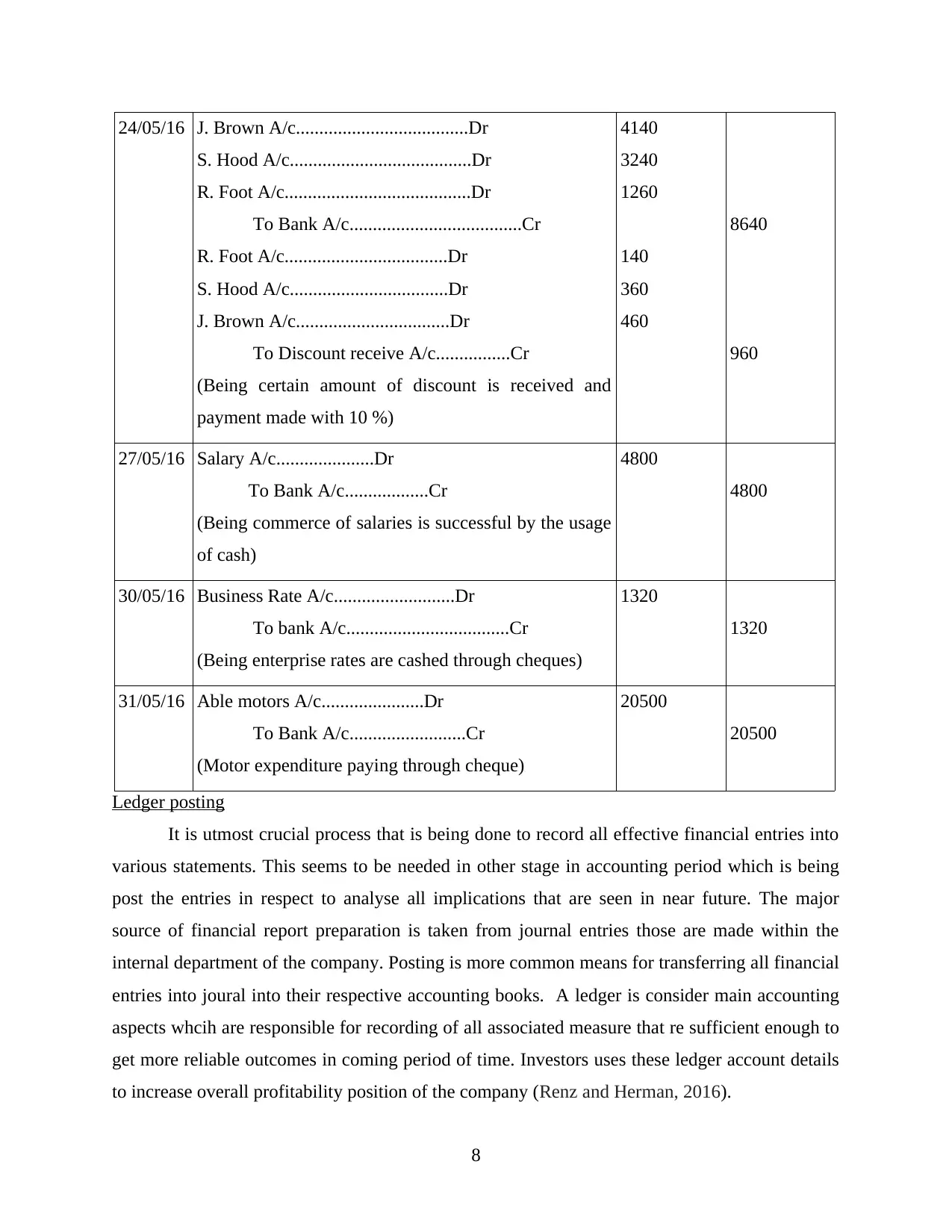

24/05/16 J. Brown A/c.....................................Dr

S. Hood A/c.......................................Dr

R. Foot A/c........................................Dr

To Bank A/c.....................................Cr

R. Foot A/c...................................Dr

S. Hood A/c..................................Dr

J. Brown A/c.................................Dr

To Discount receive A/c................Cr

(Being certain amount of discount is received and

payment made with 10 %)

4140

3240

1260

140

360

460

8640

960

27/05/16 Salary A/c.....................Dr

To Bank A/c..................Cr

(Being commerce of salaries is successful by the usage

of cash)

4800

4800

30/05/16 Business Rate A/c..........................Dr

To bank A/c...................................Cr

(Being enterprise rates are cashed through cheques)

1320

1320

31/05/16 Able motors A/c......................Dr

To Bank A/c.........................Cr

(Motor expenditure paying through cheque)

20500

20500

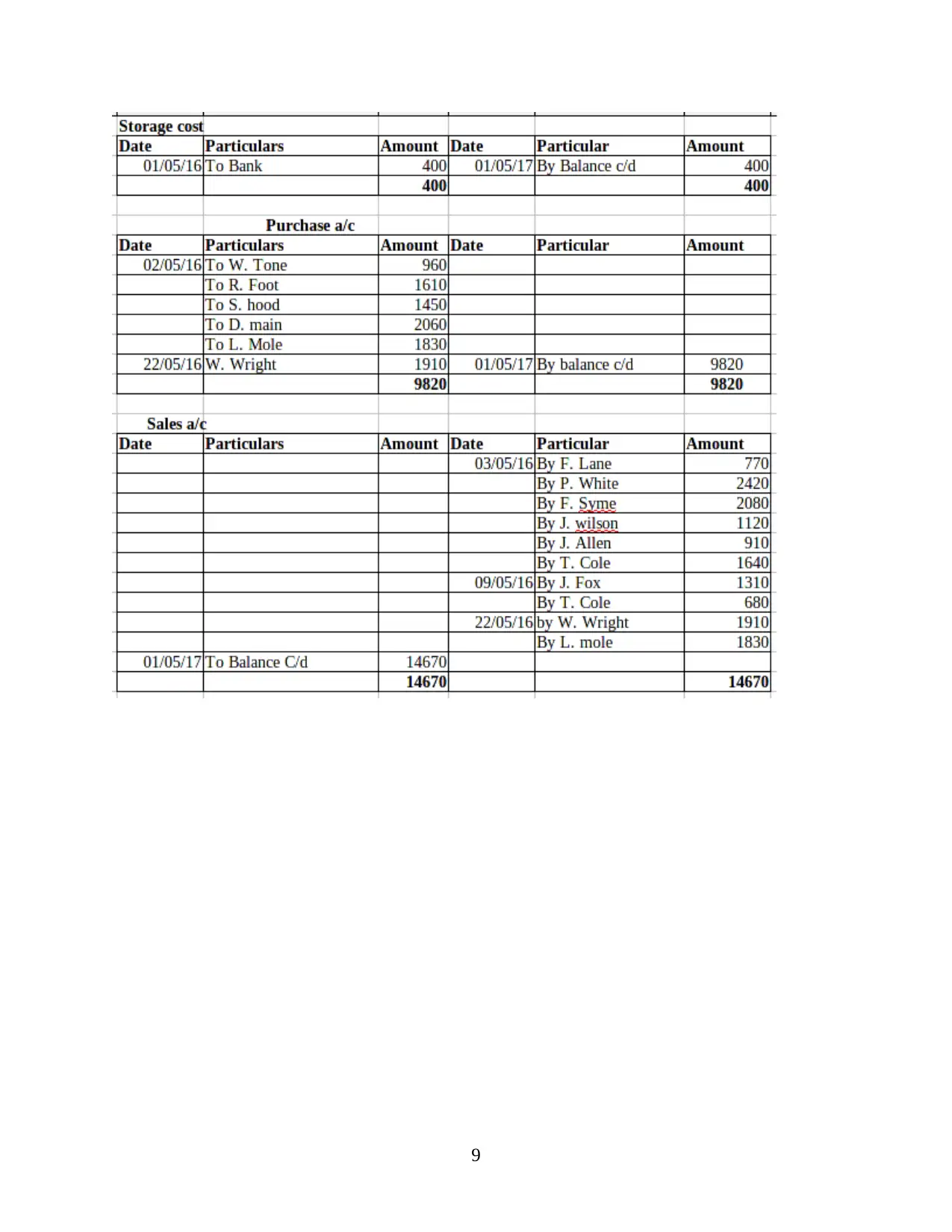

Ledger posting

It is utmost crucial process that is being done to record all effective financial entries into

various statements. This seems to be needed in other stage in accounting period which is being

post the entries in respect to analyse all implications that are seen in near future. The major

source of financial report preparation is taken from journal entries those are made within the

internal department of the company. Posting is more common means for transferring all financial

entries into joural into their respective accounting books. A ledger is consider main accounting

aspects whcih are responsible for recording of all associated measure that re sufficient enough to

get more reliable outcomes in coming period of time. Investors uses these ledger account details

to increase overall profitability position of the company (Renz and Herman, 2016).

8

S. Hood A/c.......................................Dr

R. Foot A/c........................................Dr

To Bank A/c.....................................Cr

R. Foot A/c...................................Dr

S. Hood A/c..................................Dr

J. Brown A/c.................................Dr

To Discount receive A/c................Cr

(Being certain amount of discount is received and

payment made with 10 %)

4140

3240

1260

140

360

460

8640

960

27/05/16 Salary A/c.....................Dr

To Bank A/c..................Cr

(Being commerce of salaries is successful by the usage

of cash)

4800

4800

30/05/16 Business Rate A/c..........................Dr

To bank A/c...................................Cr

(Being enterprise rates are cashed through cheques)

1320

1320

31/05/16 Able motors A/c......................Dr

To Bank A/c.........................Cr

(Motor expenditure paying through cheque)

20500

20500

Ledger posting

It is utmost crucial process that is being done to record all effective financial entries into

various statements. This seems to be needed in other stage in accounting period which is being

post the entries in respect to analyse all implications that are seen in near future. The major

source of financial report preparation is taken from journal entries those are made within the

internal department of the company. Posting is more common means for transferring all financial

entries into joural into their respective accounting books. A ledger is consider main accounting

aspects whcih are responsible for recording of all associated measure that re sufficient enough to

get more reliable outcomes in coming period of time. Investors uses these ledger account details

to increase overall profitability position of the company (Renz and Herman, 2016).

8

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.