Financial Accounting Report: Transactions, Statements, and Principles

VerifiedAdded on 2022/11/29

|17

|4359

|251

Report

AI Summary

This report delves into the core principles of financial accounting, providing a comprehensive overview of business transactions, including single and double-entry bookkeeping, and the importance of trial balances. It differentiates between financial statements and reports, emphasizing the role of income statements, trading accounts, and cash flow statements in assessing a company's financial performance. The report also covers bank reconciliation, control accounts, and suspense accounts, along with illustrative journal entries. Furthermore, it explores fundamental accounting principles such as conservatism, consistency, cost, going concern, and matching principles, providing a well-rounded understanding of financial accounting concepts. The report also includes examples of income statements, balance sheets, and trading accounts to illustrate the application of these concepts.

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................3

Task 1...............................................................................................................................................3

1.Types of business transaction including single entry double entry bookkeeping and trial

balance.........................................................................................................................................3

2 Transactions..............................................................................................................................4

3. Difference between financial statement and financial report...................................................6

4. Fundamental principles of accounting.....................................................................................6

5. Income statement.....................................................................................................................7

6. Trading account........................................................................................................................9

7. Cash flow statement...............................................................................................................11

Scenario 2.......................................................................................................................................12

Bank reconciliation....................................................................................................................12

Requirement of reconciliation....................................................................................................12

Control accounts........................................................................................................................12

Role of control account in financial management......................................................................13

Suspense account.......................................................................................................................13

Reason for drafting suspense account........................................................................................13

4. Cash account..........................................................................................................................13

5. a. Journal entries....................................................................................................................14

Conclusion.....................................................................................................................................15

References......................................................................................................................................16

Introduction......................................................................................................................................3

Task 1...............................................................................................................................................3

1.Types of business transaction including single entry double entry bookkeeping and trial

balance.........................................................................................................................................3

2 Transactions..............................................................................................................................4

3. Difference between financial statement and financial report...................................................6

4. Fundamental principles of accounting.....................................................................................6

5. Income statement.....................................................................................................................7

6. Trading account........................................................................................................................9

7. Cash flow statement...............................................................................................................11

Scenario 2.......................................................................................................................................12

Bank reconciliation....................................................................................................................12

Requirement of reconciliation....................................................................................................12

Control accounts........................................................................................................................12

Role of control account in financial management......................................................................13

Suspense account.......................................................................................................................13

Reason for drafting suspense account........................................................................................13

4. Cash account..........................................................................................................................13

5. a. Journal entries....................................................................................................................14

Conclusion.....................................................................................................................................15

References......................................................................................................................................16

Introduction

This entire report is based on financial accounting. Financial accounting refers to the process of

summarising analysing and reporting all the transactions of Business and its operations for a

given time duration (Abdusalomova 2019). All these transactions are analysed in financial

statements like balance sheet profit and loss account trading account cash flow statement and

income statement which helps the company to know operating performance of the business. This

report includes various types of business transactions with States about single entry and double

entry bookkeeping. Apart from this various differences between financial statement and financial

report is also elaborated in this report. This report focuses on providing principles of financial

accounting and bank reconciliation for companies. This report also talks about various suspense

account and general entries as well.

Task 1

1.Types of business transaction including single entry double entry bookkeeping and trial balance

The entire organisation with that it is a small medium or large they have to maintain business

transactions. Following are the important transactions of the business such as

Purchase of goods

Goods are very important part of any organisation because with the help of goods which are high

in quality organisation can increase their profitability and sales. So purchasing of goods can be

done and two categories first are cash and another is credit. Cash purchase is read in the business

because most of the business does not prefer to buy goods with the help of cash. The main

purchase goods in instruments and from other ways on the other hand credit purchase is very

difficult for the business therefore did not frequently credit purchase.

Purchasing of services

Services also play a critical role in the business services include different type of advertisement

printing cost equipment repairing raising Finance salary and wages etc (Akiyama, 2020). These

are the common services which business needs to invest and have to purchase the same.

Single entry bookkeeping

This is one of the simplest and normal methods of bookkeeping with many organisation follows.

This method of bookkeeping is based on cash method in which incoming and outgoing of the

This entire report is based on financial accounting. Financial accounting refers to the process of

summarising analysing and reporting all the transactions of Business and its operations for a

given time duration (Abdusalomova 2019). All these transactions are analysed in financial

statements like balance sheet profit and loss account trading account cash flow statement and

income statement which helps the company to know operating performance of the business. This

report includes various types of business transactions with States about single entry and double

entry bookkeeping. Apart from this various differences between financial statement and financial

report is also elaborated in this report. This report focuses on providing principles of financial

accounting and bank reconciliation for companies. This report also talks about various suspense

account and general entries as well.

Task 1

1.Types of business transaction including single entry double entry bookkeeping and trial balance

The entire organisation with that it is a small medium or large they have to maintain business

transactions. Following are the important transactions of the business such as

Purchase of goods

Goods are very important part of any organisation because with the help of goods which are high

in quality organisation can increase their profitability and sales. So purchasing of goods can be

done and two categories first are cash and another is credit. Cash purchase is read in the business

because most of the business does not prefer to buy goods with the help of cash. The main

purchase goods in instruments and from other ways on the other hand credit purchase is very

difficult for the business therefore did not frequently credit purchase.

Purchasing of services

Services also play a critical role in the business services include different type of advertisement

printing cost equipment repairing raising Finance salary and wages etc (Akiyama, 2020). These

are the common services which business needs to invest and have to purchase the same.

Single entry bookkeeping

This is one of the simplest and normal methods of bookkeeping with many organisation follows.

This method of bookkeeping is based on cash method in which incoming and outgoing of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

cash so that company can know how much they are they are earning and how much they are

spending.

Double entry bookkeeping

This is one of the methods to record all the transactions of business it doesn't matter that the

transaction is small or big but it is important to record. Is the name suggest double entry

bookkeeping in this two accounts entries are recorded when is debit side and other is. As per this

method amount which is being placed on the debit side should match to the credit side then the

entry will known as correct.

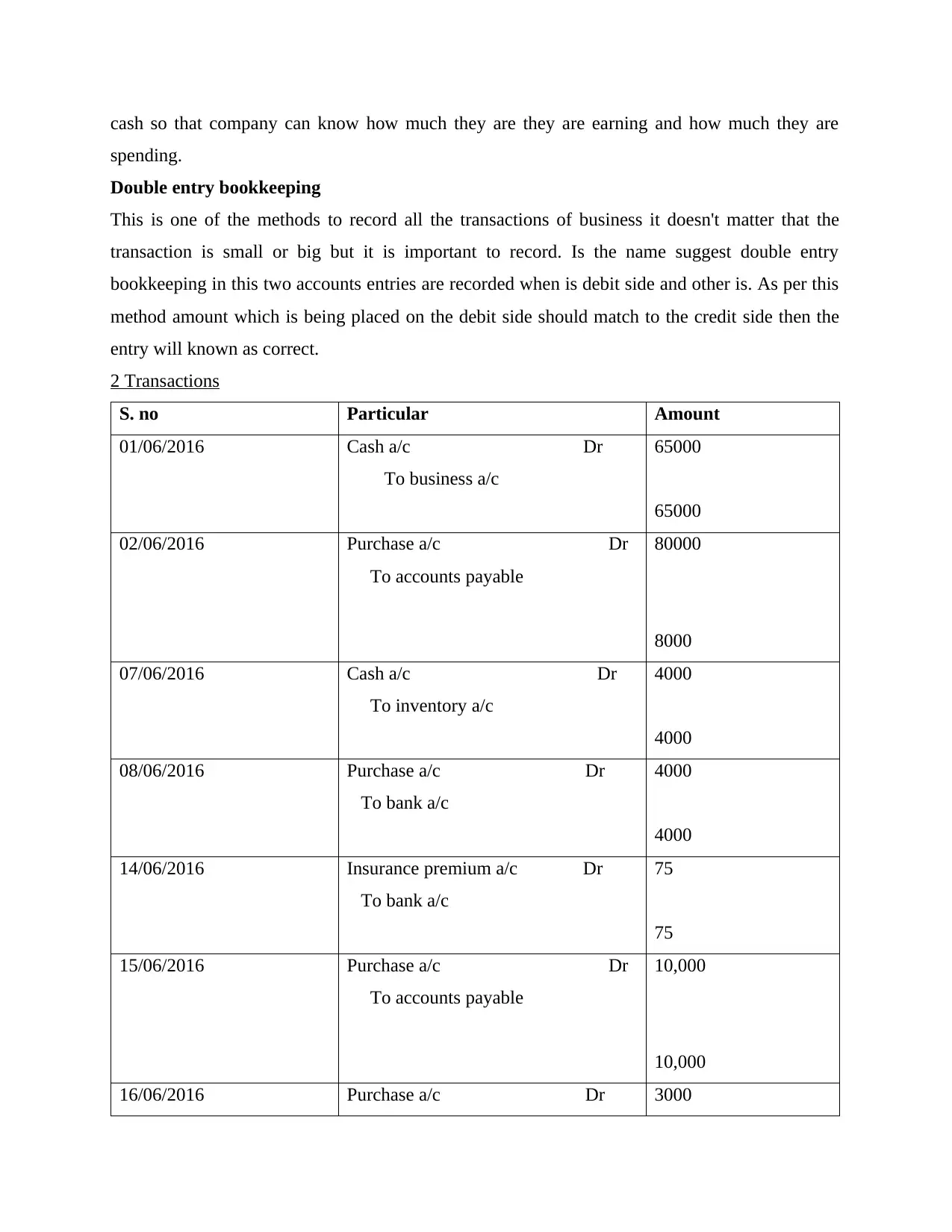

2 Transactions

S. no Particular Amount

01/06/2016 Cash a/c Dr

To business a/c

65000

65000

02/06/2016 Purchase a/c Dr

To accounts payable

80000

8000

07/06/2016 Cash a/c Dr

To inventory a/c

4000

4000

08/06/2016 Purchase a/c Dr

To bank a/c

4000

4000

14/06/2016 Insurance premium a/c Dr

To bank a/c

75

75

15/06/2016 Purchase a/c Dr

To accounts payable

10,000

10,000

16/06/2016 Purchase a/c Dr 3000

spending.

Double entry bookkeeping

This is one of the methods to record all the transactions of business it doesn't matter that the

transaction is small or big but it is important to record. Is the name suggest double entry

bookkeeping in this two accounts entries are recorded when is debit side and other is. As per this

method amount which is being placed on the debit side should match to the credit side then the

entry will known as correct.

2 Transactions

S. no Particular Amount

01/06/2016 Cash a/c Dr

To business a/c

65000

65000

02/06/2016 Purchase a/c Dr

To accounts payable

80000

8000

07/06/2016 Cash a/c Dr

To inventory a/c

4000

4000

08/06/2016 Purchase a/c Dr

To bank a/c

4000

4000

14/06/2016 Insurance premium a/c Dr

To bank a/c

75

75

15/06/2016 Purchase a/c Dr

To accounts payable

10,000

10,000

16/06/2016 Purchase a/c Dr 3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

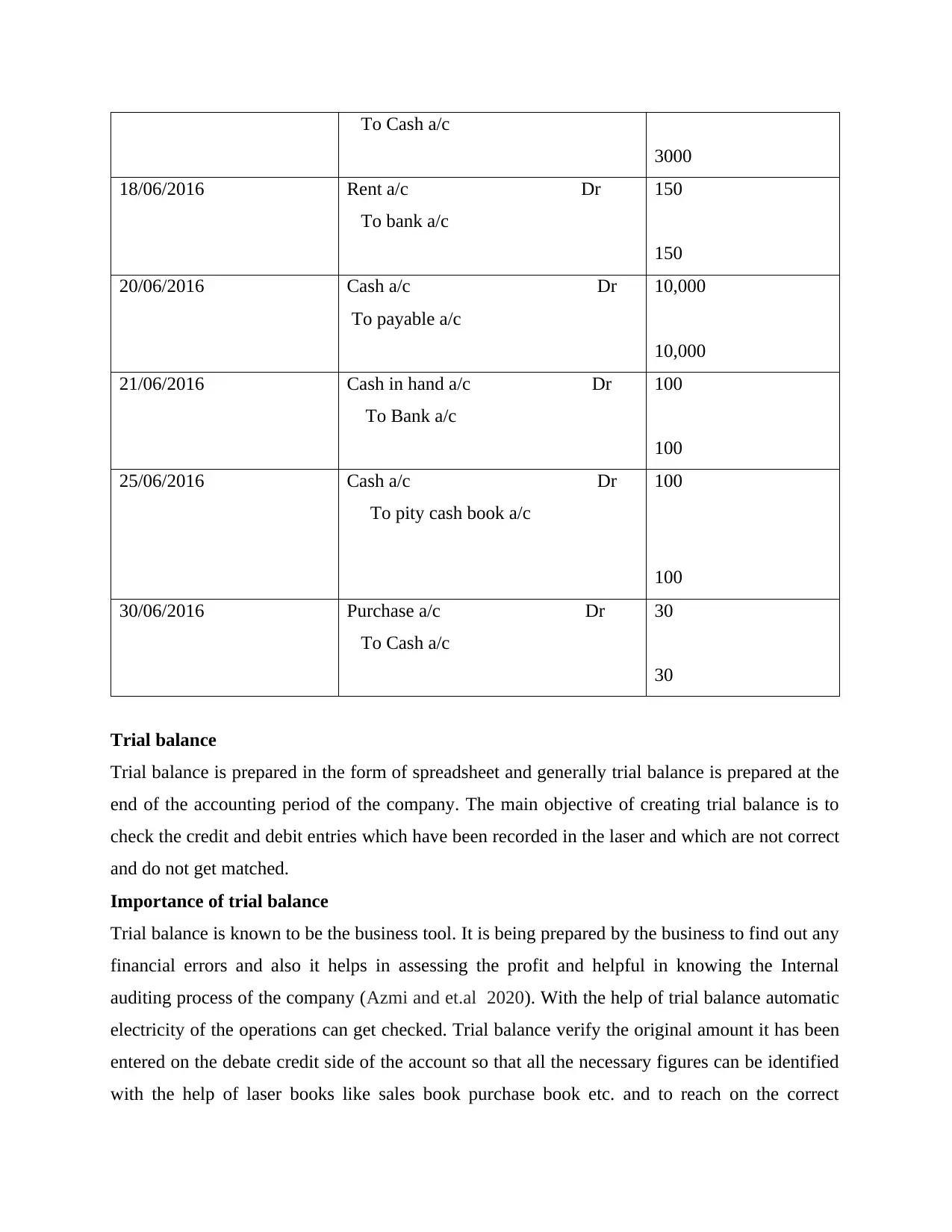

To Cash a/c

3000

18/06/2016 Rent a/c Dr

To bank a/c

150

150

20/06/2016 Cash a/c Dr

To payable a/c

10,000

10,000

21/06/2016 Cash in hand a/c Dr

To Bank a/c

100

100

25/06/2016 Cash a/c Dr

To pity cash book a/c

100

100

30/06/2016 Purchase a/c Dr

To Cash a/c

30

30

Trial balance

Trial balance is prepared in the form of spreadsheet and generally trial balance is prepared at the

end of the accounting period of the company. The main objective of creating trial balance is to

check the credit and debit entries which have been recorded in the laser and which are not correct

and do not get matched.

Importance of trial balance

Trial balance is known to be the business tool. It is being prepared by the business to find out any

financial errors and also it helps in assessing the profit and helpful in knowing the Internal

auditing process of the company (Azmi and et.al 2020). With the help of trial balance automatic

electricity of the operations can get checked. Trial balance verify the original amount it has been

entered on the debate credit side of the account so that all the necessary figures can be identified

with the help of laser books like sales book purchase book etc. and to reach on the correct

3000

18/06/2016 Rent a/c Dr

To bank a/c

150

150

20/06/2016 Cash a/c Dr

To payable a/c

10,000

10,000

21/06/2016 Cash in hand a/c Dr

To Bank a/c

100

100

25/06/2016 Cash a/c Dr

To pity cash book a/c

100

100

30/06/2016 Purchase a/c Dr

To Cash a/c

30

30

Trial balance

Trial balance is prepared in the form of spreadsheet and generally trial balance is prepared at the

end of the accounting period of the company. The main objective of creating trial balance is to

check the credit and debit entries which have been recorded in the laser and which are not correct

and do not get matched.

Importance of trial balance

Trial balance is known to be the business tool. It is being prepared by the business to find out any

financial errors and also it helps in assessing the profit and helpful in knowing the Internal

auditing process of the company (Azmi and et.al 2020). With the help of trial balance automatic

electricity of the operations can get checked. Trial balance verify the original amount it has been

entered on the debate credit side of the account so that all the necessary figures can be identified

with the help of laser books like sales book purchase book etc. and to reach on the correct

measurement. Trial balance is used to divide the accuracy about special accounting book. Trial

balance helps the company to prepare the financial statement. It also helps the company to

compare balance from the previous year so that we can know are they getting any kind of profit

or they are still facing loss. So that they can improve the financial position.

3. Difference between financial statement and financial report

Financial statements

The main objective of financial statement is to provide financial position in all the information

which is related to the finance such as cash flows operations etc. So that after seeing and

analysing all the financial information’s investors and Company get guidance and also they can

take their desirable action whether they want to invest in the company or not. Financial

statements include various cash flows income statement and balance sheet. Income statement is

helpful in knowing the capacity and ability of the business it shows that how a business is

generating profit and it also advise the company to increase the sales and revenues and also this

should decrease the expenses. Financial statement it includes balance sheet because it provides

accurate status of the business for the given accounting period. Balance sheet is prepared by

liquidity and debt position of the company. Apart from this, it also includes assets of the

company to provide accurate result to the company whether they have sufficient assets or not to

repay the debts and obligations.

Financial report

Financial report includes all the important financial information which is be distributed by the

company to the public (Bebbington and et.al 2017). Especially financially borders helpful for the

shareholders to know the position of the company and they can know how much they don’t live

in android on their investment. Financial records should be accurate so it provides correct result

to the company and the investors so that after analysing the financial report Company can make

decisions about the allocation of resources and funds. If the financial report is quick and accurate

then it provides good results to the company. As it helps the company for correct reporting

solution and helps in improvising the productivity. Financial report is necessary for the taxation.

4. Fundamental principles of accounting

There are various rules and regulations available in the accounts which the company has to

follow while recording any financial transaction. As the entire company and business works on

various fundamental principles of accounting then only they may get success. Accounting

balance helps the company to prepare the financial statement. It also helps the company to

compare balance from the previous year so that we can know are they getting any kind of profit

or they are still facing loss. So that they can improve the financial position.

3. Difference between financial statement and financial report

Financial statements

The main objective of financial statement is to provide financial position in all the information

which is related to the finance such as cash flows operations etc. So that after seeing and

analysing all the financial information’s investors and Company get guidance and also they can

take their desirable action whether they want to invest in the company or not. Financial

statements include various cash flows income statement and balance sheet. Income statement is

helpful in knowing the capacity and ability of the business it shows that how a business is

generating profit and it also advise the company to increase the sales and revenues and also this

should decrease the expenses. Financial statement it includes balance sheet because it provides

accurate status of the business for the given accounting period. Balance sheet is prepared by

liquidity and debt position of the company. Apart from this, it also includes assets of the

company to provide accurate result to the company whether they have sufficient assets or not to

repay the debts and obligations.

Financial report

Financial report includes all the important financial information which is be distributed by the

company to the public (Bebbington and et.al 2017). Especially financially borders helpful for the

shareholders to know the position of the company and they can know how much they don’t live

in android on their investment. Financial records should be accurate so it provides correct result

to the company and the investors so that after analysing the financial report Company can make

decisions about the allocation of resources and funds. If the financial report is quick and accurate

then it provides good results to the company. As it helps the company for correct reporting

solution and helps in improvising the productivity. Financial report is necessary for the taxation.

4. Fundamental principles of accounting

There are various rules and regulations available in the accounts which the company has to

follow while recording any financial transaction. As the entire company and business works on

various fundamental principles of accounting then only they may get success. Accounting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

principle states about general rules and regulations which the company and business has to

follow.

Conservatism principle

This principal speaks about such situation and which two acceptable solutions are present in front

of the company and they should go for save solution which provides favourable outcome. This

principle will safeguard the company of business for further losses and they should prepare for

future games as well.

Consistency principle

The consistency principle speaks about one decision if the company decided to adopt one

accounting method or any of the principle then it should stick on that principle on tea and follow

all the rules and regulations which has been mentioned and that principal so that company will

gain profit throughout the year.

Cost principle

Company and business should record all the Assets and liabilities on their original cost especially

on those cost in which they have bought and sold the assets (Delatorre and et.al 2017). As the

real value of Assets and liabilities can change with the passage of time but it will not reflect for

reporting.

Going Concern principle

This principle assumes that business will domain throughout its life and will continuously exist

and operates in the future as well.

Matching principle

In this principal each and every recorded transaction should made with each other whether they

are related to expenses or any income.

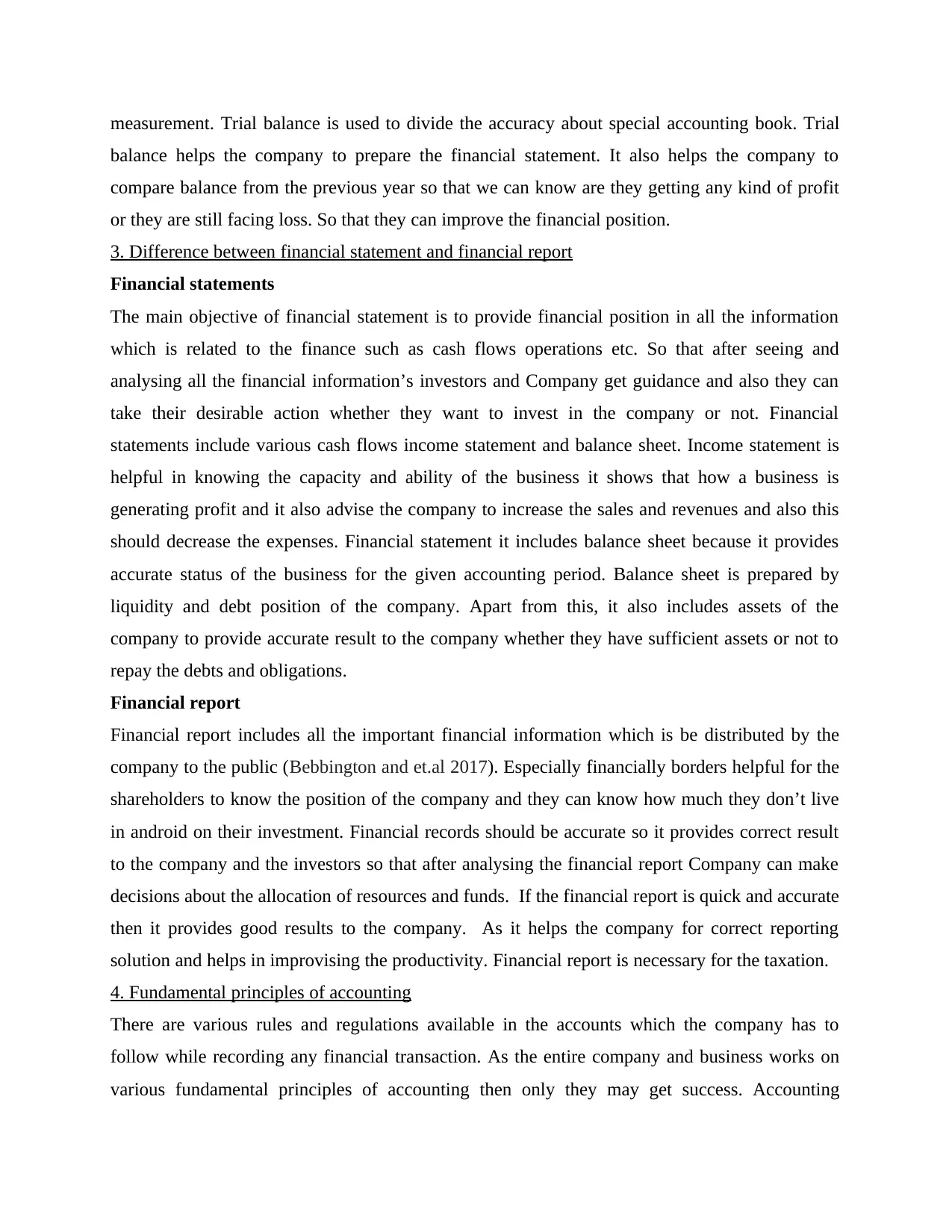

5. Income statement

Particulars Amount Amount

Sales 900,000

Cost of sales 7,00,000

Gross profit 200,000

Expenses :

Advertising 10,000

follow.

Conservatism principle

This principal speaks about such situation and which two acceptable solutions are present in front

of the company and they should go for save solution which provides favourable outcome. This

principle will safeguard the company of business for further losses and they should prepare for

future games as well.

Consistency principle

The consistency principle speaks about one decision if the company decided to adopt one

accounting method or any of the principle then it should stick on that principle on tea and follow

all the rules and regulations which has been mentioned and that principal so that company will

gain profit throughout the year.

Cost principle

Company and business should record all the Assets and liabilities on their original cost especially

on those cost in which they have bought and sold the assets (Delatorre and et.al 2017). As the

real value of Assets and liabilities can change with the passage of time but it will not reflect for

reporting.

Going Concern principle

This principle assumes that business will domain throughout its life and will continuously exist

and operates in the future as well.

Matching principle

In this principal each and every recorded transaction should made with each other whether they

are related to expenses or any income.

5. Income statement

Particulars Amount Amount

Sales 900,000

Cost of sales 7,00,000

Gross profit 200,000

Expenses :

Advertising 10,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Salaries 50,000

Electricity 10,000

Telephone 9,000

General expenses 1200

Total expenses 80200

Net profit 119800

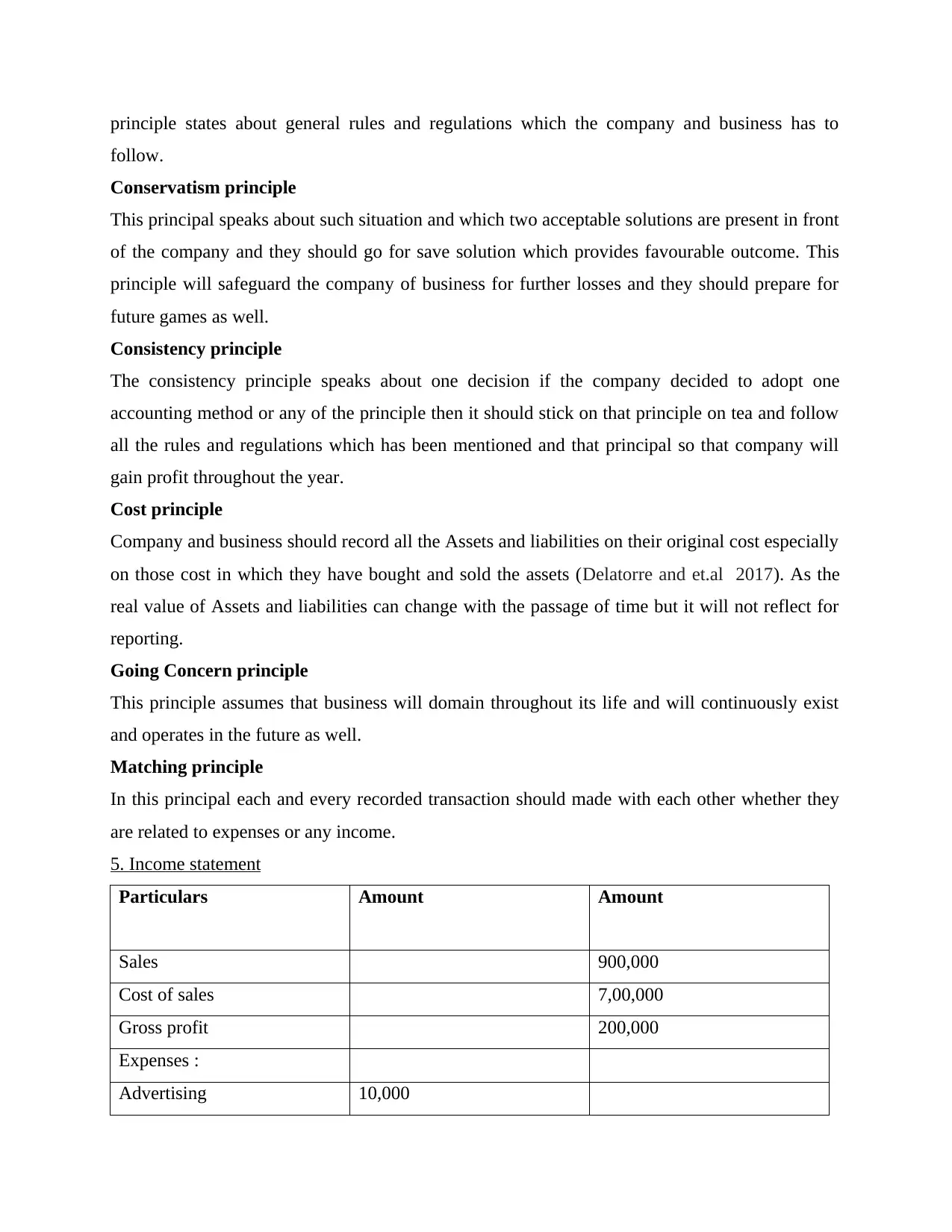

Balance sheet

Particulars Amount

Capital 354200

Current liabilities

Payables 80000

Bank overdraft 20000

Total liabilities 454200

Current asset

Receivables 1100000

Fixed assets

Land and building 400,000

Plant and machinery 30,000

Total 5,40,000

Income statement is one of the three important financial statements of any company. Income

statement one of the important financial statement which provides all the details about the

financial performance of the company for an accounting period. It provides all the information

which are related to the revenue and expenses of the company but the key focus of the income

statement is to produce more revenue for the company so that the company did not have to face

any kind of loss in the given time period (Delatorre and et.al 2018). Total revenue of the

company include operating and non operating revenue after deducting all the total expenses so

that company can know the exact and accurate profit after deducting the expenses so that they

Electricity 10,000

Telephone 9,000

General expenses 1200

Total expenses 80200

Net profit 119800

Balance sheet

Particulars Amount

Capital 354200

Current liabilities

Payables 80000

Bank overdraft 20000

Total liabilities 454200

Current asset

Receivables 1100000

Fixed assets

Land and building 400,000

Plant and machinery 30,000

Total 5,40,000

Income statement is one of the three important financial statements of any company. Income

statement one of the important financial statement which provides all the details about the

financial performance of the company for an accounting period. It provides all the information

which are related to the revenue and expenses of the company but the key focus of the income

statement is to produce more revenue for the company so that the company did not have to face

any kind of loss in the given time period (Delatorre and et.al 2018). Total revenue of the

company include operating and non operating revenue after deducting all the total expenses so

that company can know the exact and accurate profit after deducting the expenses so that they

may know the exact profit for the accounting period. Income statement is known as the core

financial statements of the business and company because with the help of income statement

company can create various Strategies and policies for the future. Company can also make

forecast and budgeting on the basis of income statement. Income statement also States about

various cost expenses net profit gross profit and different selling and administrative expenses

apart from this it also talks about Texas which has been levied on the company.

Financial position

Financial position States about where is assets liabilities and capital of the company and the

business for the accounting period. All the Assets of the company used to manufacture various

goods and services so that company can fulfil the market demand easily. Assets are also

categorised into two parts one is fixed assets and other its current assets. Fixed assets are those

assets which remain fixed for the entire life and I do not get converted into cash for more than a

year. Examples of fixed assets are vehicle computers various plants and machineries etc. Current

assets also include those assets which can get converted within cash in a year. Apart from this

liability also included in the financial position. Liabilities also get divided into two categories one

as current liabilities and other is long term liabilities. Current liabilities include creditors bills

payable etc. On the other hand noncurrent liabilities include all the long-term loans and

obligations of the company.

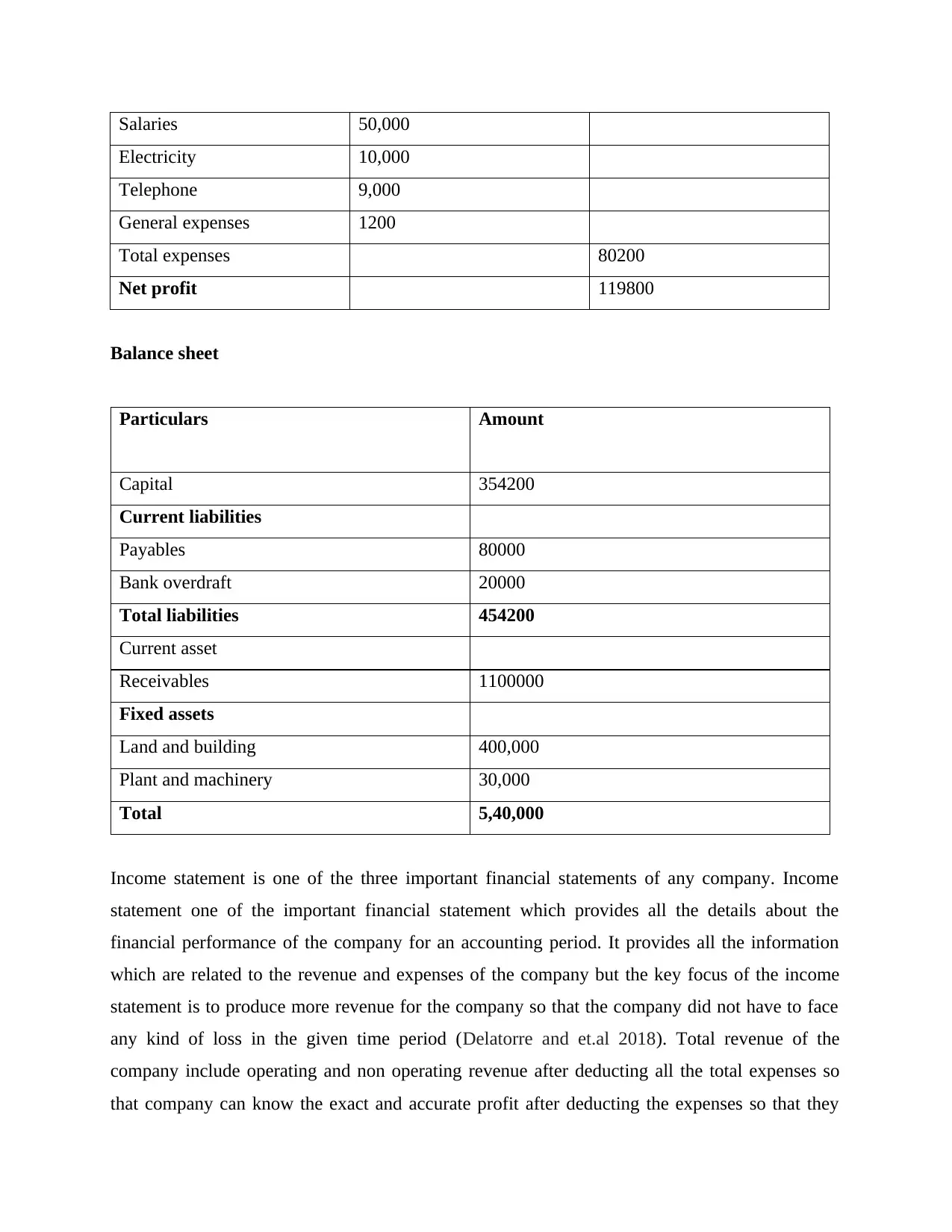

6. Trading account

Balance sheet

Particulars Amount

Capital 120800

Current liabilities 5150

Drawing 80000

Creditors 3900

Loan 1,00,000

Total liabilities 309850

Current asset

Debtors 12500

financial statements of the business and company because with the help of income statement

company can create various Strategies and policies for the future. Company can also make

forecast and budgeting on the basis of income statement. Income statement also States about

various cost expenses net profit gross profit and different selling and administrative expenses

apart from this it also talks about Texas which has been levied on the company.

Financial position

Financial position States about where is assets liabilities and capital of the company and the

business for the accounting period. All the Assets of the company used to manufacture various

goods and services so that company can fulfil the market demand easily. Assets are also

categorised into two parts one is fixed assets and other its current assets. Fixed assets are those

assets which remain fixed for the entire life and I do not get converted into cash for more than a

year. Examples of fixed assets are vehicle computers various plants and machineries etc. Current

assets also include those assets which can get converted within cash in a year. Apart from this

liability also included in the financial position. Liabilities also get divided into two categories one

as current liabilities and other is long term liabilities. Current liabilities include creditors bills

payable etc. On the other hand noncurrent liabilities include all the long-term loans and

obligations of the company.

6. Trading account

Balance sheet

Particulars Amount

Capital 120800

Current liabilities 5150

Drawing 80000

Creditors 3900

Loan 1,00,000

Total liabilities 309850

Current asset

Debtors 12500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

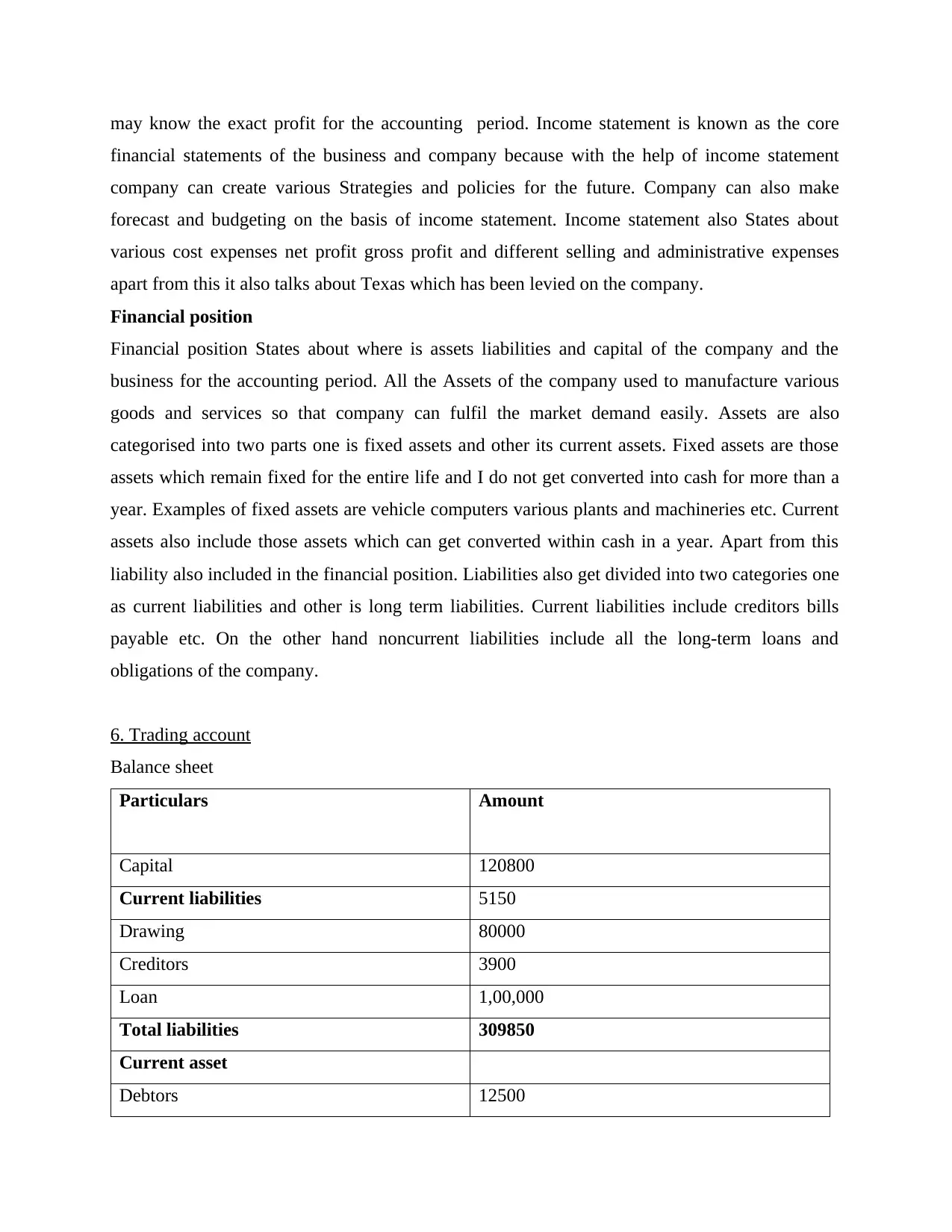

Stocks 10500

Total 23000

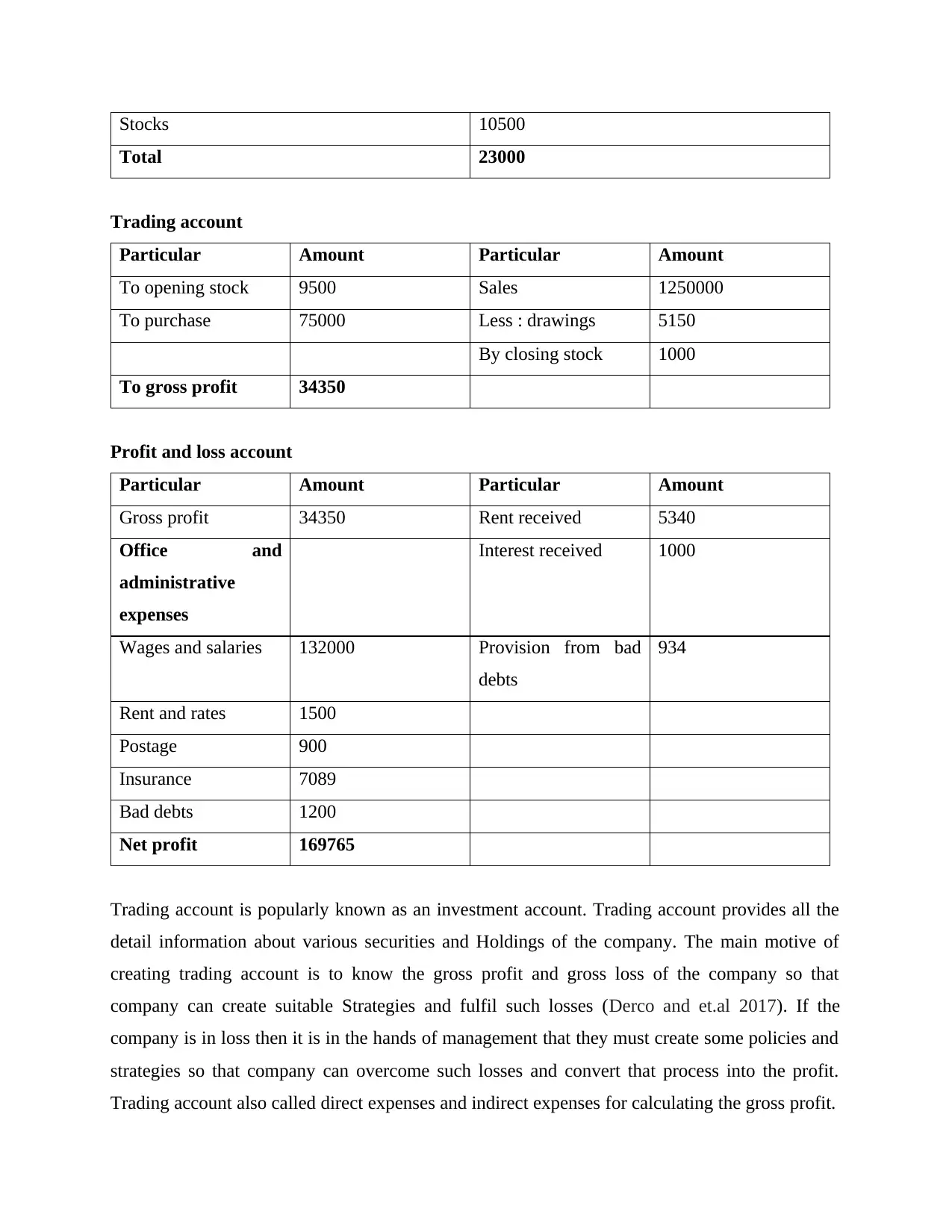

Trading account

Particular Amount Particular Amount

To opening stock 9500 Sales 1250000

To purchase 75000 Less : drawings 5150

By closing stock 1000

To gross profit 34350

Profit and loss account

Particular Amount Particular Amount

Gross profit 34350 Rent received 5340

Office and

administrative

expenses

Interest received 1000

Wages and salaries 132000 Provision from bad

debts

934

Rent and rates 1500

Postage 900

Insurance 7089

Bad debts 1200

Net profit 169765

Trading account is popularly known as an investment account. Trading account provides all the

detail information about various securities and Holdings of the company. The main motive of

creating trading account is to know the gross profit and gross loss of the company so that

company can create suitable Strategies and fulfil such losses (Derco and et.al 2017). If the

company is in loss then it is in the hands of management that they must create some policies and

strategies so that company can overcome such losses and convert that process into the profit.

Trading account also called direct expenses and indirect expenses for calculating the gross profit.

Total 23000

Trading account

Particular Amount Particular Amount

To opening stock 9500 Sales 1250000

To purchase 75000 Less : drawings 5150

By closing stock 1000

To gross profit 34350

Profit and loss account

Particular Amount Particular Amount

Gross profit 34350 Rent received 5340

Office and

administrative

expenses

Interest received 1000

Wages and salaries 132000 Provision from bad

debts

934

Rent and rates 1500

Postage 900

Insurance 7089

Bad debts 1200

Net profit 169765

Trading account is popularly known as an investment account. Trading account provides all the

detail information about various securities and Holdings of the company. The main motive of

creating trading account is to know the gross profit and gross loss of the company so that

company can create suitable Strategies and fulfil such losses (Derco and et.al 2017). If the

company is in loss then it is in the hands of management that they must create some policies and

strategies so that company can overcome such losses and convert that process into the profit.

Trading account also called direct expenses and indirect expenses for calculating the gross profit.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

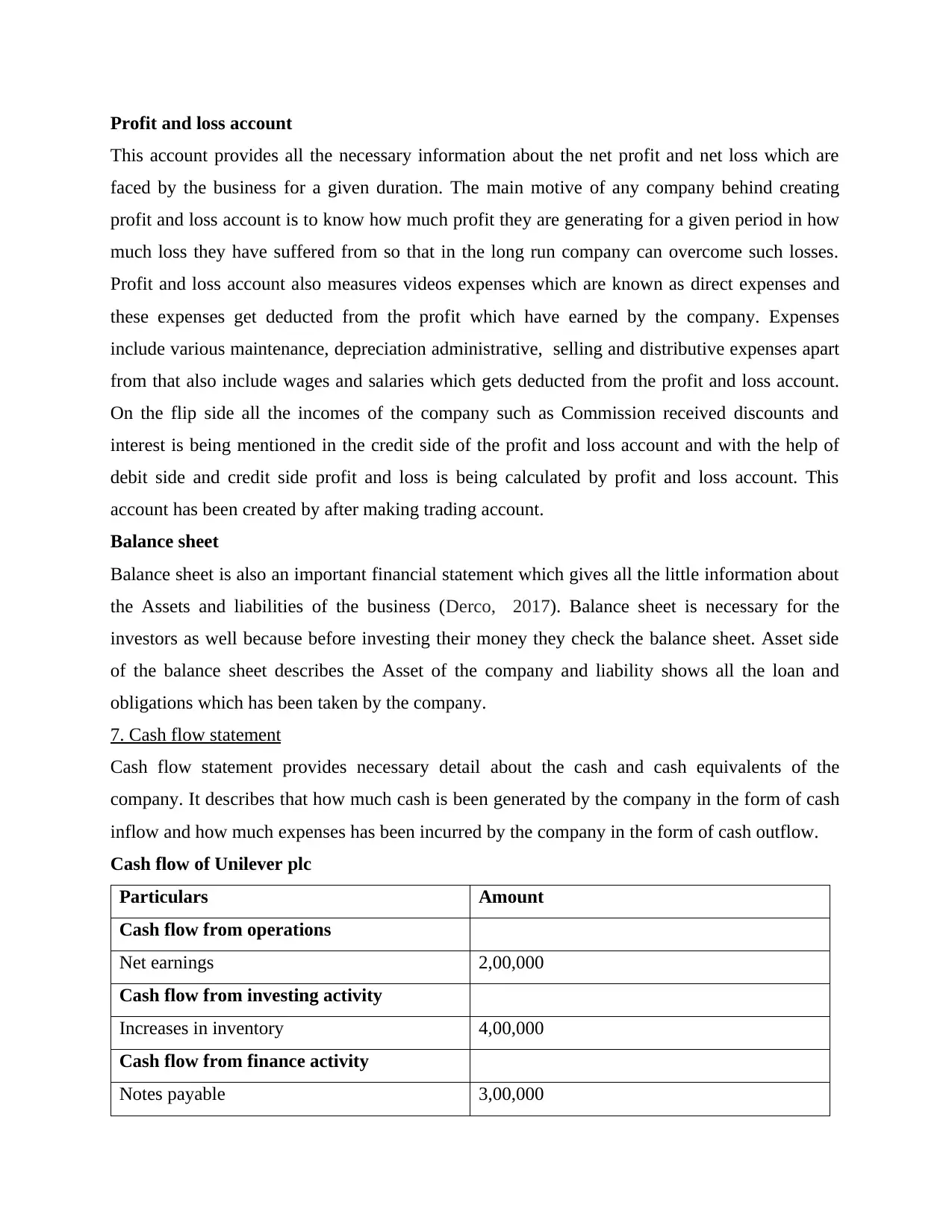

Profit and loss account

This account provides all the necessary information about the net profit and net loss which are

faced by the business for a given duration. The main motive of any company behind creating

profit and loss account is to know how much profit they are generating for a given period in how

much loss they have suffered from so that in the long run company can overcome such losses.

Profit and loss account also measures videos expenses which are known as direct expenses and

these expenses get deducted from the profit which have earned by the company. Expenses

include various maintenance, depreciation administrative, selling and distributive expenses apart

from that also include wages and salaries which gets deducted from the profit and loss account.

On the flip side all the incomes of the company such as Commission received discounts and

interest is being mentioned in the credit side of the profit and loss account and with the help of

debit side and credit side profit and loss is being calculated by profit and loss account. This

account has been created by after making trading account.

Balance sheet

Balance sheet is also an important financial statement which gives all the little information about

the Assets and liabilities of the business (Derco, 2017). Balance sheet is necessary for the

investors as well because before investing their money they check the balance sheet. Asset side

of the balance sheet describes the Asset of the company and liability shows all the loan and

obligations which has been taken by the company.

7. Cash flow statement

Cash flow statement provides necessary detail about the cash and cash equivalents of the

company. It describes that how much cash is been generated by the company in the form of cash

inflow and how much expenses has been incurred by the company in the form of cash outflow.

Cash flow of Unilever plc

Particulars Amount

Cash flow from operations

Net earnings 2,00,000

Cash flow from investing activity

Increases in inventory 4,00,000

Cash flow from finance activity

Notes payable 3,00,000

This account provides all the necessary information about the net profit and net loss which are

faced by the business for a given duration. The main motive of any company behind creating

profit and loss account is to know how much profit they are generating for a given period in how

much loss they have suffered from so that in the long run company can overcome such losses.

Profit and loss account also measures videos expenses which are known as direct expenses and

these expenses get deducted from the profit which have earned by the company. Expenses

include various maintenance, depreciation administrative, selling and distributive expenses apart

from that also include wages and salaries which gets deducted from the profit and loss account.

On the flip side all the incomes of the company such as Commission received discounts and

interest is being mentioned in the credit side of the profit and loss account and with the help of

debit side and credit side profit and loss is being calculated by profit and loss account. This

account has been created by after making trading account.

Balance sheet

Balance sheet is also an important financial statement which gives all the little information about

the Assets and liabilities of the business (Derco, 2017). Balance sheet is necessary for the

investors as well because before investing their money they check the balance sheet. Asset side

of the balance sheet describes the Asset of the company and liability shows all the loan and

obligations which has been taken by the company.

7. Cash flow statement

Cash flow statement provides necessary detail about the cash and cash equivalents of the

company. It describes that how much cash is been generated by the company in the form of cash

inflow and how much expenses has been incurred by the company in the form of cash outflow.

Cash flow of Unilever plc

Particulars Amount

Cash flow from operations

Net earnings 2,00,000

Cash flow from investing activity

Increases in inventory 4,00,000

Cash flow from finance activity

Notes payable 3,00,000

Cash flow for the year ended 2020 9,00,000

Scenario 2

Bank reconciliation

Bank reconciliation provides free cancellation of various accounts by matching internal records

and transactions to the available balance of the month which is being produced by the bank

statement. Each and every transaction of the company is being verified and managed individually

by the bank passbook so that all the apps can easily identified by the management of the

company. The entire process of bank reconciliation and categorised into two forms when it can

be formal and another in informal (Li and et.al 2020). Few companies go for the reconciliation

on daily basis as they can know how much expenses and income their generating on daily basis

so that they can overcome the loses. Along with this many companies go for quarterly and annual

bank reconciliation because it becomes easy and simpler for the company to reconcile their

revenue and expenses with the bank passbook so that they can make certain policies and

overcome such losses. Differences between the passbook and the statement of company can be

normal to find because some differences come due to changes in the timing and especially from

the time gap.

Requirement of reconciliation

Bank reconciliation is one of the necessary part of any company because with the help of bank

reconciliation company can know all the fruits and misrepresentation of the facts and figures.

Along with this bank reconciliation also provides detailed information to any duplication and

descriptions his having found in the company with the help of cross checking with bank

Statement Company can overcome the facts and figures. Bank reconciliation also States about

the cheque which has been issued by the company so by matching bank statement any

discrepancies which has been present in the clearance of cheque is being seen by the bank

reconciliation. Reconciliation is the procedure of matching internal and external records so that

gets can be identified by the company.

Control accounts

Control account provides summary of all the accounts which is mentioned in Ledger. This

control account provides in-depth information about different transactions which have been

installed in subsidiary ledger account of the company (Putra, 2019). The main motive of creating

Scenario 2

Bank reconciliation

Bank reconciliation provides free cancellation of various accounts by matching internal records

and transactions to the available balance of the month which is being produced by the bank

statement. Each and every transaction of the company is being verified and managed individually

by the bank passbook so that all the apps can easily identified by the management of the

company. The entire process of bank reconciliation and categorised into two forms when it can

be formal and another in informal (Li and et.al 2020). Few companies go for the reconciliation

on daily basis as they can know how much expenses and income their generating on daily basis

so that they can overcome the loses. Along with this many companies go for quarterly and annual

bank reconciliation because it becomes easy and simpler for the company to reconcile their

revenue and expenses with the bank passbook so that they can make certain policies and

overcome such losses. Differences between the passbook and the statement of company can be

normal to find because some differences come due to changes in the timing and especially from

the time gap.

Requirement of reconciliation

Bank reconciliation is one of the necessary part of any company because with the help of bank

reconciliation company can know all the fruits and misrepresentation of the facts and figures.

Along with this bank reconciliation also provides detailed information to any duplication and

descriptions his having found in the company with the help of cross checking with bank

Statement Company can overcome the facts and figures. Bank reconciliation also States about

the cheque which has been issued by the company so by matching bank statement any

discrepancies which has been present in the clearance of cheque is being seen by the bank

reconciliation. Reconciliation is the procedure of matching internal and external records so that

gets can be identified by the company.

Control accounts

Control account provides summary of all the accounts which is mentioned in Ledger. This

control account provides in-depth information about different transactions which have been

installed in subsidiary ledger account of the company (Putra, 2019). The main motive of creating

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.