Financial Accounting Principles Report: Stakeholders and Statements

VerifiedAdded on 2020/12/24

|24

|6171

|483

Report

AI Summary

This report provides a comprehensive overview of financial accounting principles, focusing on UK GAAP and its application. It begins with an introduction to financial accounting, outlining its purposes and the importance of financial reporting. The report then explores internal and external stakeholders and their interests. Key elements such as journal entries, ledgers, and trial balances are examined through case studies. Further sections delve into profit and loss accounts, balance sheets, and accounting concepts like consistency and prudence. Depreciation methods, including straight-line and written-down value, are explained, followed by a comparison of financial statements prepared by sole traders and limited companies. The report also covers bank reconciliation statements, control accounts, and suspense accounts. Detailed examples and calculations, including journal entries and balance sheets, are provided throughout, making it a valuable resource for students studying financial accounting.

Financial Accounting

Principles

Principles

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

BUSINESS REPORT......................................................................................................................4

1.Financial Accounting and its purposes:...................................................................................4

2. Internal and external stakeholders:..........................................................................................5

CLIENT 1........................................................................................................................................7

(a) Journal Entry in the books of Alexandra Study:...................................................................7

(b). Ledgers:................................................................................................................................7

(c). Trail Balance in the books of Alexandra Study:...................................................................7

CLIENT 2........................................................................................................................................8

(a) Profit and loss account of Munteanu Limited........................................................................8

(b) Balance Sheet of Munteanu Limited.....................................................................................8

(c) Accounting Concepts: Consistency and Prudence:...............................................................9

(d) Purpose of Depreciation and its Methods::...........................................................................9

(e) Evaluation of difference between financial statements prepared by sole traders and limited

companies :................................................................................................................................10

CLIENT 3......................................................................................................................................10

1. Purpose of preparation of Bank Reconciliation Statement:..................................................10

2 . Areas where bank records vary from personal records........................................................10

3. Imprest:.................................................................................................................................11

4. Bank-reconciliation statements of Burcu Ltd, for September 2018:.....................................11

CLIENT 4......................................................................................................................................11

(a) Sales Ledger Control and Purchase Ledger Control Account:............................................11

(b) Control account...................................................................................................................12

Client 5...........................................................................................................................................13

(a) Suspense account and its features:.......................................................................................13

INTRODUCTION...........................................................................................................................4

BUSINESS REPORT......................................................................................................................4

1.Financial Accounting and its purposes:...................................................................................4

2. Internal and external stakeholders:..........................................................................................5

CLIENT 1........................................................................................................................................7

(a) Journal Entry in the books of Alexandra Study:...................................................................7

(b). Ledgers:................................................................................................................................7

(c). Trail Balance in the books of Alexandra Study:...................................................................7

CLIENT 2........................................................................................................................................8

(a) Profit and loss account of Munteanu Limited........................................................................8

(b) Balance Sheet of Munteanu Limited.....................................................................................8

(c) Accounting Concepts: Consistency and Prudence:...............................................................9

(d) Purpose of Depreciation and its Methods::...........................................................................9

(e) Evaluation of difference between financial statements prepared by sole traders and limited

companies :................................................................................................................................10

CLIENT 3......................................................................................................................................10

1. Purpose of preparation of Bank Reconciliation Statement:..................................................10

2 . Areas where bank records vary from personal records........................................................10

3. Imprest:.................................................................................................................................11

4. Bank-reconciliation statements of Burcu Ltd, for September 2018:.....................................11

CLIENT 4......................................................................................................................................11

(a) Sales Ledger Control and Purchase Ledger Control Account:............................................11

(b) Control account...................................................................................................................12

Client 5...........................................................................................................................................13

(a) Suspense account and its features:.......................................................................................13

(b) Preparation of Trail Balance:...............................................................................................13

(c) Journal entries in order to show necessary corrections for eliminating suspense account

balance:.....................................................................................................................................13

CONCLUSION .............................................................................................................................14

REFERENCES .............................................................................................................................16

APPENDIX....................................................................................................................................17

(c) Journal entries in order to show necessary corrections for eliminating suspense account

balance:.....................................................................................................................................13

CONCLUSION .............................................................................................................................14

REFERENCES .............................................................................................................................16

APPENDIX....................................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial accounting principles refers to various guidelines and rules which are necessary

for business organisation in order to report its financial data. Financial accounting process

includes recording of financial transactions, posing them in different ledgers, summarizing,

preparation of financial position statements and reporting of financial performance to various

stakeholders. These all activities involved in financial accounting process are governed by

financial accounting principles (Edwards, J. R., 2013). In UK common set of accounting

principles is UK GAAP(Generally Accepted Accounting Principles). Financial accounting

provides groundwork for decision making functions of business organisation. This report

exhibits financial accounting and its purposes, internal and external stakeholders, importance of

control accounts and main purpose of preparation of bank reconciliation statement.

BUSINESS REPORT

1.Financial Accounting and its purposes:

Financial accounting is unique field of accounting that includes a systematic process of

recording, classifying, summarizing and reporting of financial transaction resulting from various

functions of business organisation during a particular period. These financial transaction are

classified systematically in order to prepare final accounts such as balance sheet, profit and loss

account, profit and loss account or income statement, cash flow statements, change in equity

statement and other relevant statements, that are used by business organisations to assess actual

financial performance and position (Fourie, 2015). Reporting under financial reporting process

assist business organisations to present true picture about financial performance and position

before shareholders, government, employees, landers and creditors etc. In financial accounting

accounts are prepared by entities as per accounting principles, assumptions and different

guidelines, It is governed and administrated by intentional and local guidelines and standards.

Purpose of financial accounting: Following points are describing key purpose of financial

accounting, as follows:

Main purpose of financial accounting is reporting of actual position and performance to

internal and external users of financial data and information.

Activities in financial reporting is framed in a systematic way to provide smoothness in

accounting operations.

Financial accounting principles refers to various guidelines and rules which are necessary

for business organisation in order to report its financial data. Financial accounting process

includes recording of financial transactions, posing them in different ledgers, summarizing,

preparation of financial position statements and reporting of financial performance to various

stakeholders. These all activities involved in financial accounting process are governed by

financial accounting principles (Edwards, J. R., 2013). In UK common set of accounting

principles is UK GAAP(Generally Accepted Accounting Principles). Financial accounting

provides groundwork for decision making functions of business organisation. This report

exhibits financial accounting and its purposes, internal and external stakeholders, importance of

control accounts and main purpose of preparation of bank reconciliation statement.

BUSINESS REPORT

1.Financial Accounting and its purposes:

Financial accounting is unique field of accounting that includes a systematic process of

recording, classifying, summarizing and reporting of financial transaction resulting from various

functions of business organisation during a particular period. These financial transaction are

classified systematically in order to prepare final accounts such as balance sheet, profit and loss

account, profit and loss account or income statement, cash flow statements, change in equity

statement and other relevant statements, that are used by business organisations to assess actual

financial performance and position (Fourie, 2015). Reporting under financial reporting process

assist business organisations to present true picture about financial performance and position

before shareholders, government, employees, landers and creditors etc. In financial accounting

accounts are prepared by entities as per accounting principles, assumptions and different

guidelines, It is governed and administrated by intentional and local guidelines and standards.

Purpose of financial accounting: Following points are describing key purpose of financial

accounting, as follows:

Main purpose of financial accounting is reporting of actual position and performance to

internal and external users of financial data and information.

Activities in financial reporting is framed in a systematic way to provide smoothness in

accounting operations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial accounting ensures compliance of rules and regulation relating to relevant

statute.

Activities involved in Financial accounting, acts in conformity of various assumptions,

accounting policies, concepts, principles and other significant fundamentals.

Strategy formulating and implementation processes in business organisations are purely

depends upon results of financial accounting.

It provides a decision making framework for investors, shareholders, owners, lenders and

creditors, governing body etc.

It provides an assurance that accounting policies and procedures adopted by business

organisation are uniformly followed.

2. Internal and external stakeholders:

Stakeholders refers to individuals, persons, body of individuals or organization that has

substantial interest or concern in an business organization. Stakeholders are highly influenced by

actions of organization, goals or objectives and policies adopted by business organisation.

Stakeholders are classified by their nature and concern in two parts: Internal stakeholders and

external stakeholders. Large scale organisations have direct or indirect influences of different

stakeholder (Hale, 2012). Key stakeholders in business organisation are shareholders, creditors,

government directors, employees, owners, suppliers, unions, and the community. Internal

stakeholders are those individuals, persons, group or organisation who can influence or are

influenced by an business organisation such as directors, owners, employees and management.

External stakeholders incudes individuals, persons,groups, body of individuals or organizations

outside of business organisation like customers, suppliers, creditors, government or regulatory

body, society etc.

Major Internal Stakeholders and their interest in large business organisation: Following are

the major internal stakeholders of a large business organisation:

1. Employees: Employees are prime internal stakeholders because employees have

monetary interests in form of salary, bonus and incentive in the organization. Employees

in an entity play a major role in formulation of strategy and other vital operations of

organisation. A large business organization considers employee opinions, their concerns,

and values in formulating of strategy, objectives, mission and any long term visions of

business organisation.

statute.

Activities involved in Financial accounting, acts in conformity of various assumptions,

accounting policies, concepts, principles and other significant fundamentals.

Strategy formulating and implementation processes in business organisations are purely

depends upon results of financial accounting.

It provides a decision making framework for investors, shareholders, owners, lenders and

creditors, governing body etc.

It provides an assurance that accounting policies and procedures adopted by business

organisation are uniformly followed.

2. Internal and external stakeholders:

Stakeholders refers to individuals, persons, body of individuals or organization that has

substantial interest or concern in an business organization. Stakeholders are highly influenced by

actions of organization, goals or objectives and policies adopted by business organisation.

Stakeholders are classified by their nature and concern in two parts: Internal stakeholders and

external stakeholders. Large scale organisations have direct or indirect influences of different

stakeholder (Hale, 2012). Key stakeholders in business organisation are shareholders, creditors,

government directors, employees, owners, suppliers, unions, and the community. Internal

stakeholders are those individuals, persons, group or organisation who can influence or are

influenced by an business organisation such as directors, owners, employees and management.

External stakeholders incudes individuals, persons,groups, body of individuals or organizations

outside of business organisation like customers, suppliers, creditors, government or regulatory

body, society etc.

Major Internal Stakeholders and their interest in large business organisation: Following are

the major internal stakeholders of a large business organisation:

1. Employees: Employees are prime internal stakeholders because employees have

monetary interests in form of salary, bonus and incentive in the organization. Employees

in an entity play a major role in formulation of strategy and other vital operations of

organisation. A large business organization considers employee opinions, their concerns,

and values in formulating of strategy, objectives, mission and any long term visions of

business organisation.

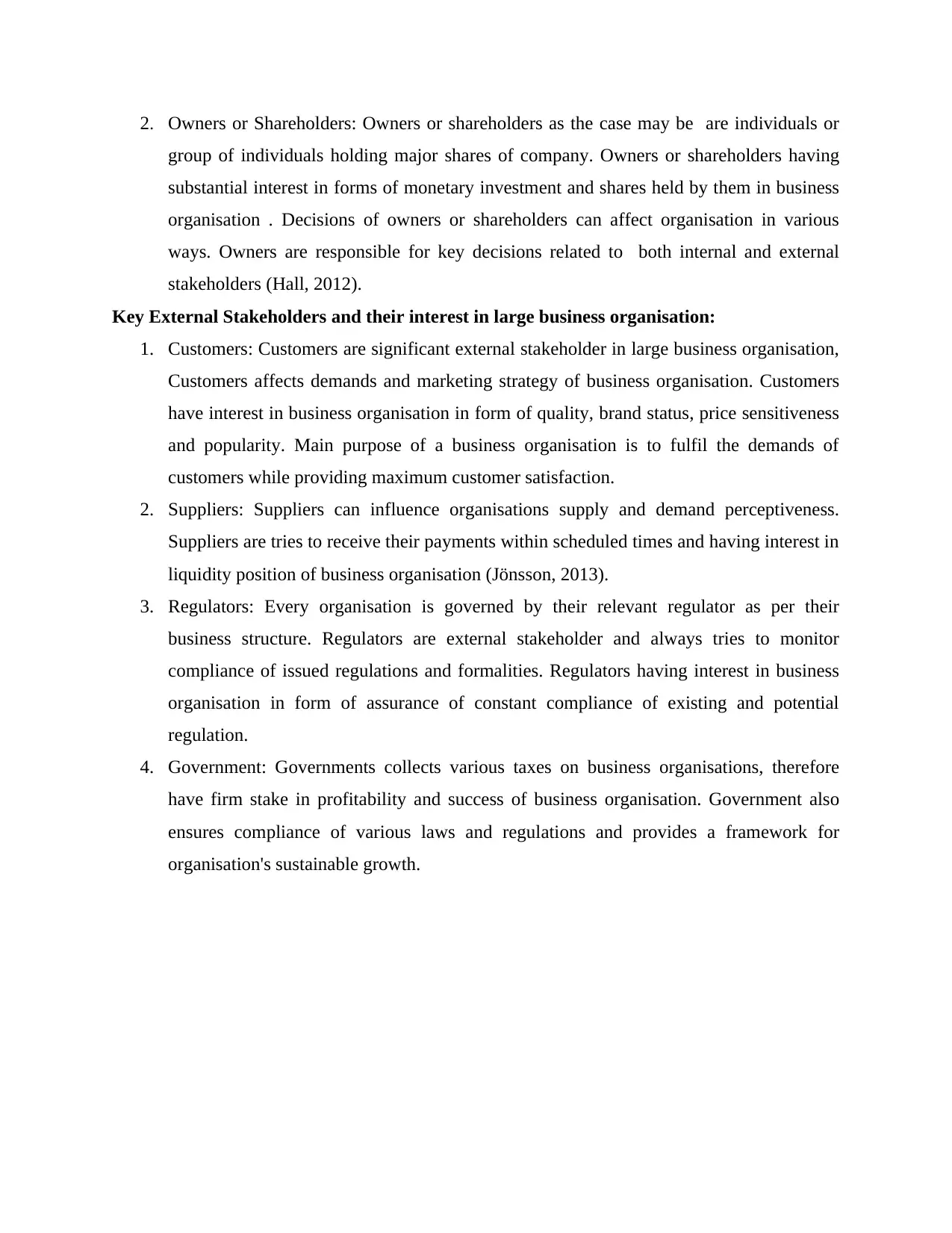

2. Owners or Shareholders: Owners or shareholders as the case may be are individuals or

group of individuals holding major shares of company. Owners or shareholders having

substantial interest in forms of monetary investment and shares held by them in business

organisation . Decisions of owners or shareholders can affect organisation in various

ways. Owners are responsible for key decisions related to both internal and external

stakeholders (Hall, 2012).

Key External Stakeholders and their interest in large business organisation:

1. Customers: Customers are significant external stakeholder in large business organisation,

Customers affects demands and marketing strategy of business organisation. Customers

have interest in business organisation in form of quality, brand status, price sensitiveness

and popularity. Main purpose of a business organisation is to fulfil the demands of

customers while providing maximum customer satisfaction.

2. Suppliers: Suppliers can influence organisations supply and demand perceptiveness.

Suppliers are tries to receive their payments within scheduled times and having interest in

liquidity position of business organisation (Jönsson, 2013).

3. Regulators: Every organisation is governed by their relevant regulator as per their

business structure. Regulators are external stakeholder and always tries to monitor

compliance of issued regulations and formalities. Regulators having interest in business

organisation in form of assurance of constant compliance of existing and potential

regulation.

4. Government: Governments collects various taxes on business organisations, therefore

have firm stake in profitability and success of business organisation. Government also

ensures compliance of various laws and regulations and provides a framework for

organisation's sustainable growth.

group of individuals holding major shares of company. Owners or shareholders having

substantial interest in forms of monetary investment and shares held by them in business

organisation . Decisions of owners or shareholders can affect organisation in various

ways. Owners are responsible for key decisions related to both internal and external

stakeholders (Hall, 2012).

Key External Stakeholders and their interest in large business organisation:

1. Customers: Customers are significant external stakeholder in large business organisation,

Customers affects demands and marketing strategy of business organisation. Customers

have interest in business organisation in form of quality, brand status, price sensitiveness

and popularity. Main purpose of a business organisation is to fulfil the demands of

customers while providing maximum customer satisfaction.

2. Suppliers: Suppliers can influence organisations supply and demand perceptiveness.

Suppliers are tries to receive their payments within scheduled times and having interest in

liquidity position of business organisation (Jönsson, 2013).

3. Regulators: Every organisation is governed by their relevant regulator as per their

business structure. Regulators are external stakeholder and always tries to monitor

compliance of issued regulations and formalities. Regulators having interest in business

organisation in form of assurance of constant compliance of existing and potential

regulation.

4. Government: Governments collects various taxes on business organisations, therefore

have firm stake in profitability and success of business organisation. Government also

ensures compliance of various laws and regulations and provides a framework for

organisation's sustainable growth.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

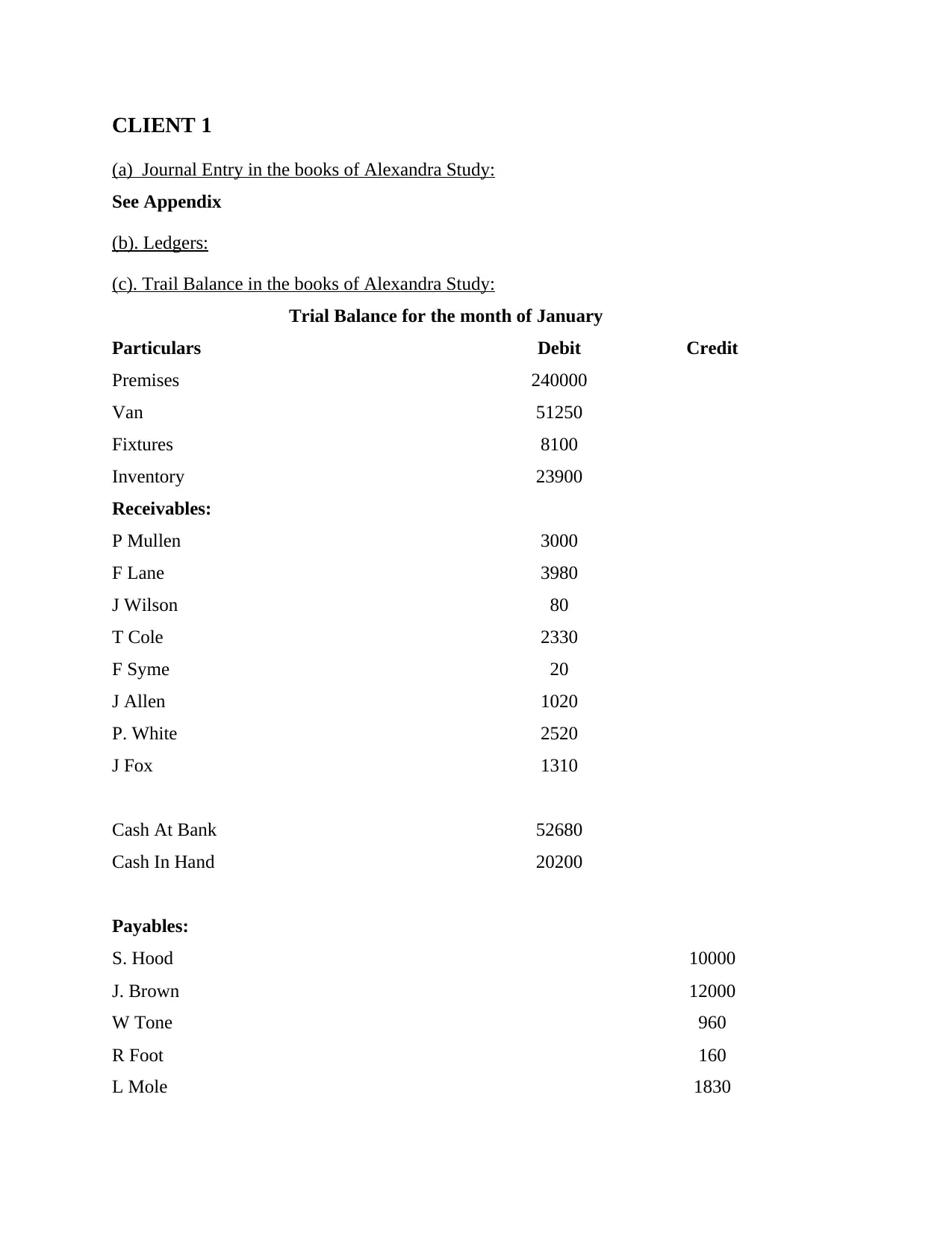

CLIENT 1

(a) Journal Entry in the books of Alexandra Study:

See Appendix

(b). Ledgers:

(c). Trail Balance in the books of Alexandra Study:

Trial Balance for the month of January

Particulars Debit Credit

Premises 240000

Van 51250

Fixtures 8100

Inventory 23900

Receivables:

P Mullen 3000

F Lane 3980

J Wilson 80

T Cole 2330

F Syme 20

J Allen 1020

P. White 2520

J Fox 1310

Cash At Bank 52680

Cash In Hand 20200

Payables:

S. Hood 10000

J. Brown 12000

W Tone 960

R Foot 160

L Mole 1830

(a) Journal Entry in the books of Alexandra Study:

See Appendix

(b). Ledgers:

(c). Trail Balance in the books of Alexandra Study:

Trial Balance for the month of January

Particulars Debit Credit

Premises 240000

Van 51250

Fixtures 8100

Inventory 23900

Receivables:

P Mullen 3000

F Lane 3980

J Wilson 80

T Cole 2330

F Syme 20

J Allen 1020

P. White 2520

J Fox 1310

Cash At Bank 52680

Cash In Hand 20200

Payables:

S. Hood 10000

J. Brown 12000

W Tone 960

R Foot 160

L Mole 1830

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

W. Wright 1910

D Main 2060

Storage Cost 450

Purchase 9820

Sales 11460

Motor Expenses 470

Sales Return 680

Purchase Return 50

Salaries 4800

Business Rates 1320

Capital 387500

Total 427930 427930

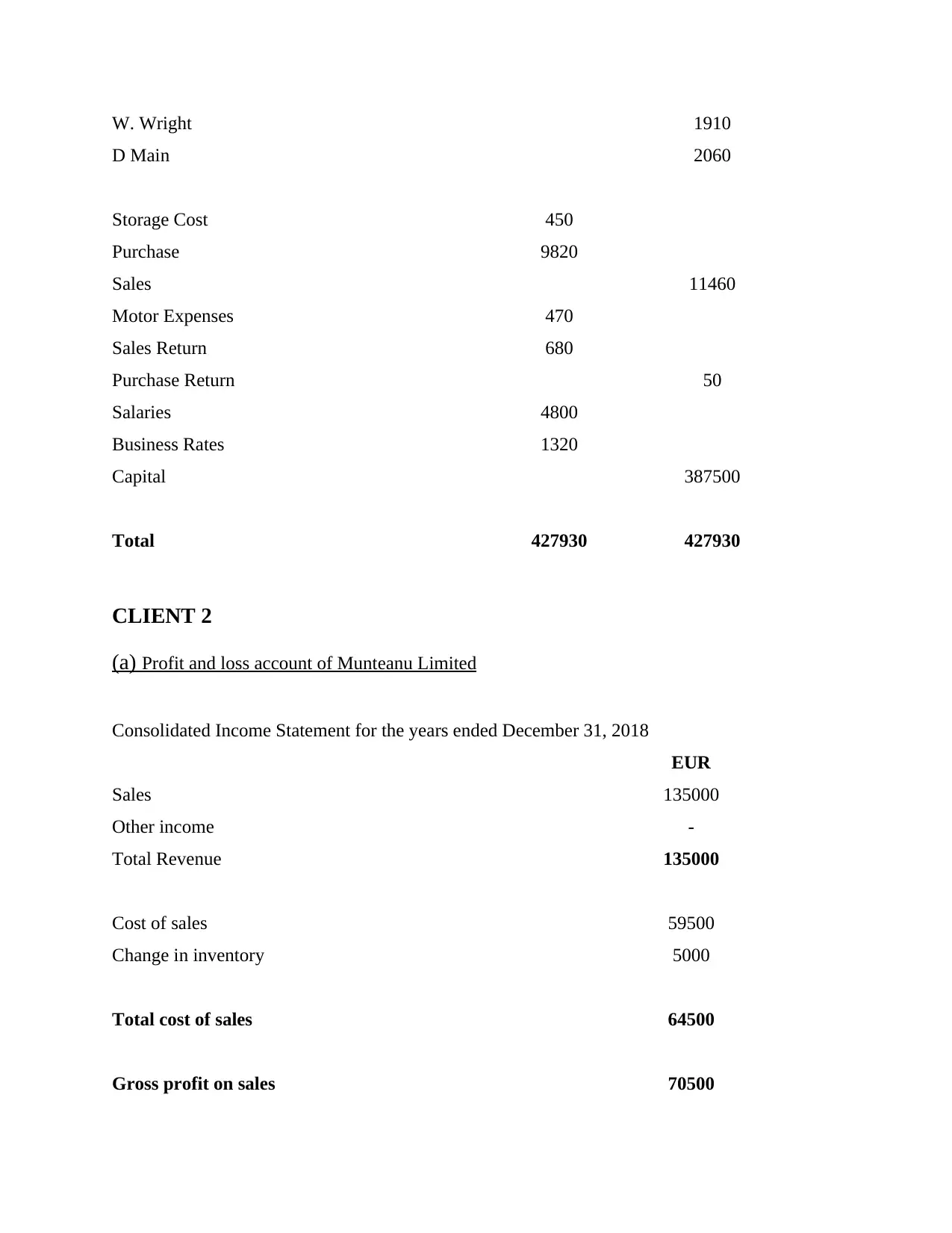

CLIENT 2

(a) Profit and loss account of Munteanu Limited

Consolidated Income Statement for the years ended December 31, 2018

EUR

Sales 135000

Other income -

Total Revenue 135000

Cost of sales 59500

Change in inventory 5000

Total cost of sales 64500

Gross profit on sales 70500

D Main 2060

Storage Cost 450

Purchase 9820

Sales 11460

Motor Expenses 470

Sales Return 680

Purchase Return 50

Salaries 4800

Business Rates 1320

Capital 387500

Total 427930 427930

CLIENT 2

(a) Profit and loss account of Munteanu Limited

Consolidated Income Statement for the years ended December 31, 2018

EUR

Sales 135000

Other income -

Total Revenue 135000

Cost of sales 59500

Change in inventory 5000

Total cost of sales 64500

Gross profit on sales 70500

Distribution cost 32000

Administrative costs 32000

Depreciation 3400

Finance cost 1500

Income before income taxes 1600

-

Income before income taxes 1600

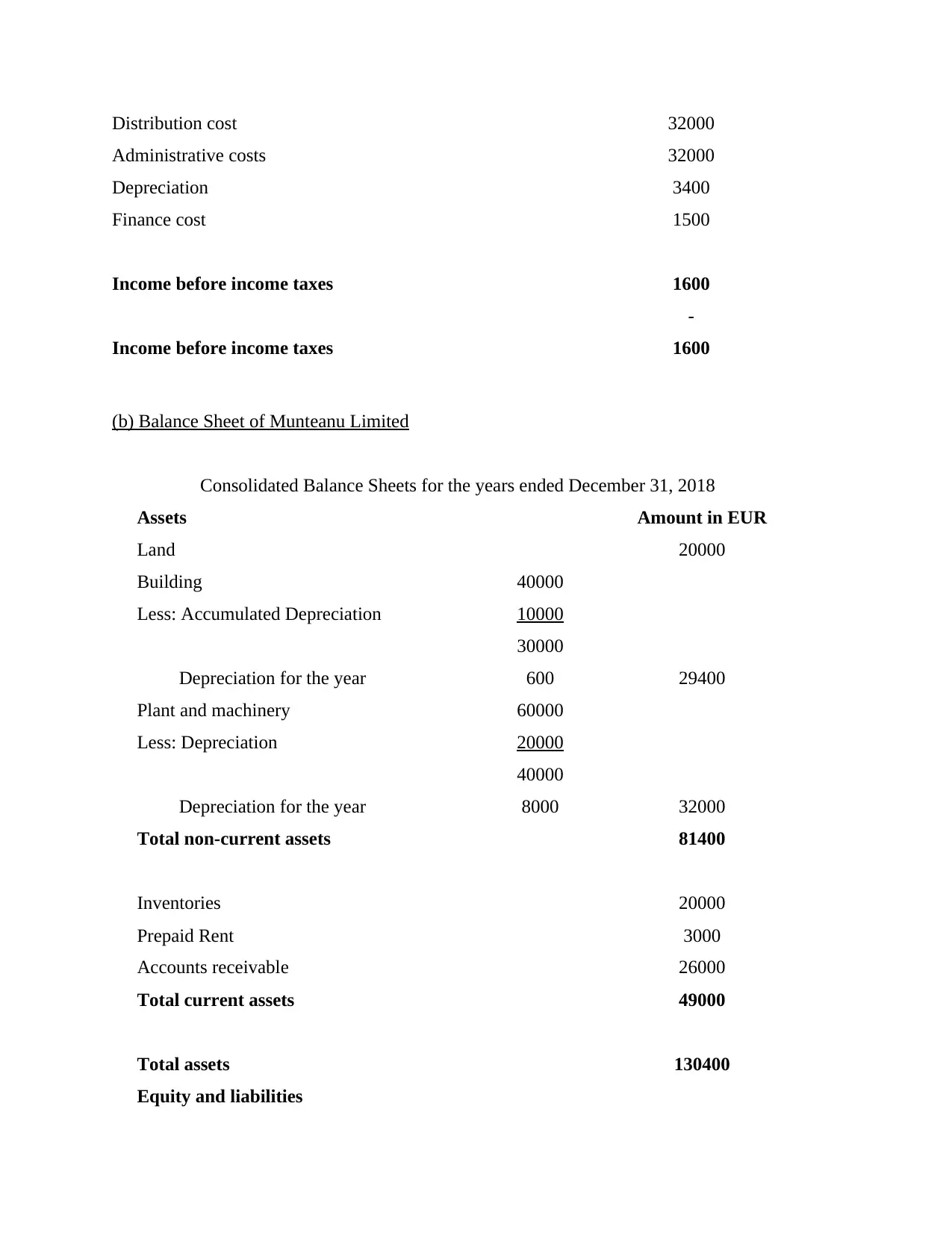

(b) Balance Sheet of Munteanu Limited

Consolidated Balance Sheets for the years ended December 31, 2018

Assets Amount in EUR

Land 20000

Building 40000

Less: Accumulated Depreciation 10000

30000

Depreciation for the year 600 29400

Plant and machinery 60000

Less: Depreciation 20000

40000

Depreciation for the year 8000 32000

Total non-current assets 81400

Inventories 20000

Prepaid Rent 3000

Accounts receivable 26000

Total current assets 49000

Total assets 130400

Equity and liabilities

Administrative costs 32000

Depreciation 3400

Finance cost 1500

Income before income taxes 1600

-

Income before income taxes 1600

(b) Balance Sheet of Munteanu Limited

Consolidated Balance Sheets for the years ended December 31, 2018

Assets Amount in EUR

Land 20000

Building 40000

Less: Accumulated Depreciation 10000

30000

Depreciation for the year 600 29400

Plant and machinery 60000

Less: Depreciation 20000

40000

Depreciation for the year 8000 32000

Total non-current assets 81400

Inventories 20000

Prepaid Rent 3000

Accounts receivable 26000

Total current assets 49000

Total assets 130400

Equity and liabilities

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

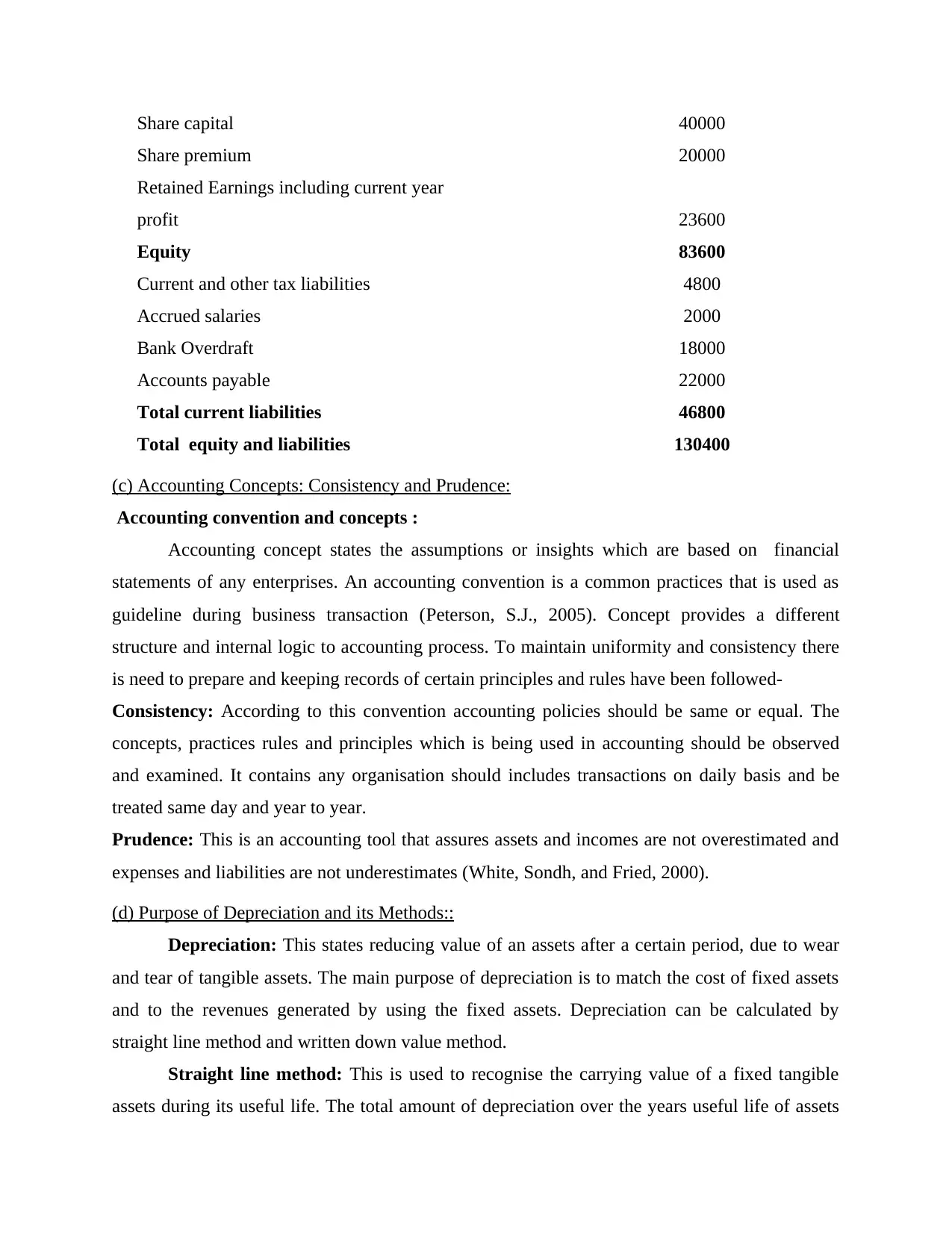

Share capital 40000

Share premium 20000

Retained Earnings including current year

profit 23600

Equity 83600

Current and other tax liabilities 4800

Accrued salaries 2000

Bank Overdraft 18000

Accounts payable 22000

Total current liabilities 46800

Total equity and liabilities 130400

(c) Accounting Concepts: Consistency and Prudence:

Accounting convention and concepts :

Accounting concept states the assumptions or insights which are based on financial

statements of any enterprises. An accounting convention is a common practices that is used as

guideline during business transaction (Peterson, S.J., 2005). Concept provides a different

structure and internal logic to accounting process. To maintain uniformity and consistency there

is need to prepare and keeping records of certain principles and rules have been followed-

Consistency: According to this convention accounting policies should be same or equal. The

concepts, practices rules and principles which is being used in accounting should be observed

and examined. It contains any organisation should includes transactions on daily basis and be

treated same day and year to year.

Prudence: This is an accounting tool that assures assets and incomes are not overestimated and

expenses and liabilities are not underestimates (White, Sondh, and Fried, 2000).

(d) Purpose of Depreciation and its Methods::

Depreciation: This states reducing value of an assets after a certain period, due to wear

and tear of tangible assets. The main purpose of depreciation is to match the cost of fixed assets

and to the revenues generated by using the fixed assets. Depreciation can be calculated by

straight line method and written down value method.

Straight line method: This is used to recognise the carrying value of a fixed tangible

assets during its useful life. The total amount of depreciation over the years useful life of assets

Share premium 20000

Retained Earnings including current year

profit 23600

Equity 83600

Current and other tax liabilities 4800

Accrued salaries 2000

Bank Overdraft 18000

Accounts payable 22000

Total current liabilities 46800

Total equity and liabilities 130400

(c) Accounting Concepts: Consistency and Prudence:

Accounting convention and concepts :

Accounting concept states the assumptions or insights which are based on financial

statements of any enterprises. An accounting convention is a common practices that is used as

guideline during business transaction (Peterson, S.J., 2005). Concept provides a different

structure and internal logic to accounting process. To maintain uniformity and consistency there

is need to prepare and keeping records of certain principles and rules have been followed-

Consistency: According to this convention accounting policies should be same or equal. The

concepts, practices rules and principles which is being used in accounting should be observed

and examined. It contains any organisation should includes transactions on daily basis and be

treated same day and year to year.

Prudence: This is an accounting tool that assures assets and incomes are not overestimated and

expenses and liabilities are not underestimates (White, Sondh, and Fried, 2000).

(d) Purpose of Depreciation and its Methods::

Depreciation: This states reducing value of an assets after a certain period, due to wear

and tear of tangible assets. The main purpose of depreciation is to match the cost of fixed assets

and to the revenues generated by using the fixed assets. Depreciation can be calculated by

straight line method and written down value method.

Straight line method: This is used to recognise the carrying value of a fixed tangible

assets during its useful life. The total amount of depreciation over the years useful life of assets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

would be less out of the full amount of assets any assumed salvage value (Khan and Mayes,

2009).

Written down value method: This is an accounting reducing method that reduces the

value of an assets by a fixed percentage every year. Its values are reduced year to year and helps

to define the minimum value foe which it would be sold.

(e) Evaluation of difference between financial statements prepared by sole traders and limited

companies :

Financial statements are the final reports of any organisation that includes financial

activities and position of a business, entity or other person. It also contains a balance sheet or

statement records of a company's assets, owner's equity and liabilities at a given time.

For sole trader: financial statements are maintained by the sole proprietor or trader at small size

of company. It includes financial position of a sole trader that is shown by the holding amount of

assets and the amount of owner's capital. In this type of business audit is not compulsory.

For limited company: These are prepared by the wider size of company which is controlled by

the government or other stakeholders. There is internal and external audit is needed by the

organisation that helps to provide tax benefits (Saunders, Cornett and McGraw, 2006).

CLIENT 3

1. Purpose of preparation of Bank Reconciliation Statement:

Bank reconciliation statement is prepared by business organisation to reconcile the

balance of bank account as prepared in cash book with amount shown in bank statements. Bank-

reconciliation statements may be prepared on monthly, quarterly or annually however

organisation should prepare bank-reconciliation statements on monthly basis in order to avoid

any complexity or inconsistency in accounts (Libby, Bloomfield and Nelson, 2002).

2 . Areas where bank records vary from personal records

Difference between bank balance as per cash book and bank balance in bank statements

arises due to bank charges charged by banks, direct deposit of any amount by any party, cheque

issued but not presented and due to other charges charged by bank without ant further

information.

2009).

Written down value method: This is an accounting reducing method that reduces the

value of an assets by a fixed percentage every year. Its values are reduced year to year and helps

to define the minimum value foe which it would be sold.

(e) Evaluation of difference between financial statements prepared by sole traders and limited

companies :

Financial statements are the final reports of any organisation that includes financial

activities and position of a business, entity or other person. It also contains a balance sheet or

statement records of a company's assets, owner's equity and liabilities at a given time.

For sole trader: financial statements are maintained by the sole proprietor or trader at small size

of company. It includes financial position of a sole trader that is shown by the holding amount of

assets and the amount of owner's capital. In this type of business audit is not compulsory.

For limited company: These are prepared by the wider size of company which is controlled by

the government or other stakeholders. There is internal and external audit is needed by the

organisation that helps to provide tax benefits (Saunders, Cornett and McGraw, 2006).

CLIENT 3

1. Purpose of preparation of Bank Reconciliation Statement:

Bank reconciliation statement is prepared by business organisation to reconcile the

balance of bank account as prepared in cash book with amount shown in bank statements. Bank-

reconciliation statements may be prepared on monthly, quarterly or annually however

organisation should prepare bank-reconciliation statements on monthly basis in order to avoid

any complexity or inconsistency in accounts (Libby, Bloomfield and Nelson, 2002).

2 . Areas where bank records vary from personal records

Difference between bank balance as per cash book and bank balance in bank statements

arises due to bank charges charged by banks, direct deposit of any amount by any party, cheque

issued but not presented and due to other charges charged by bank without ant further

information.

3. Imprest:

Imprest is type of financial accounting system and most popular imprest system is petty

cash system. Under imprest system of petty cash a fixed amount is reserved by organisation to

meet their day to day expenses.

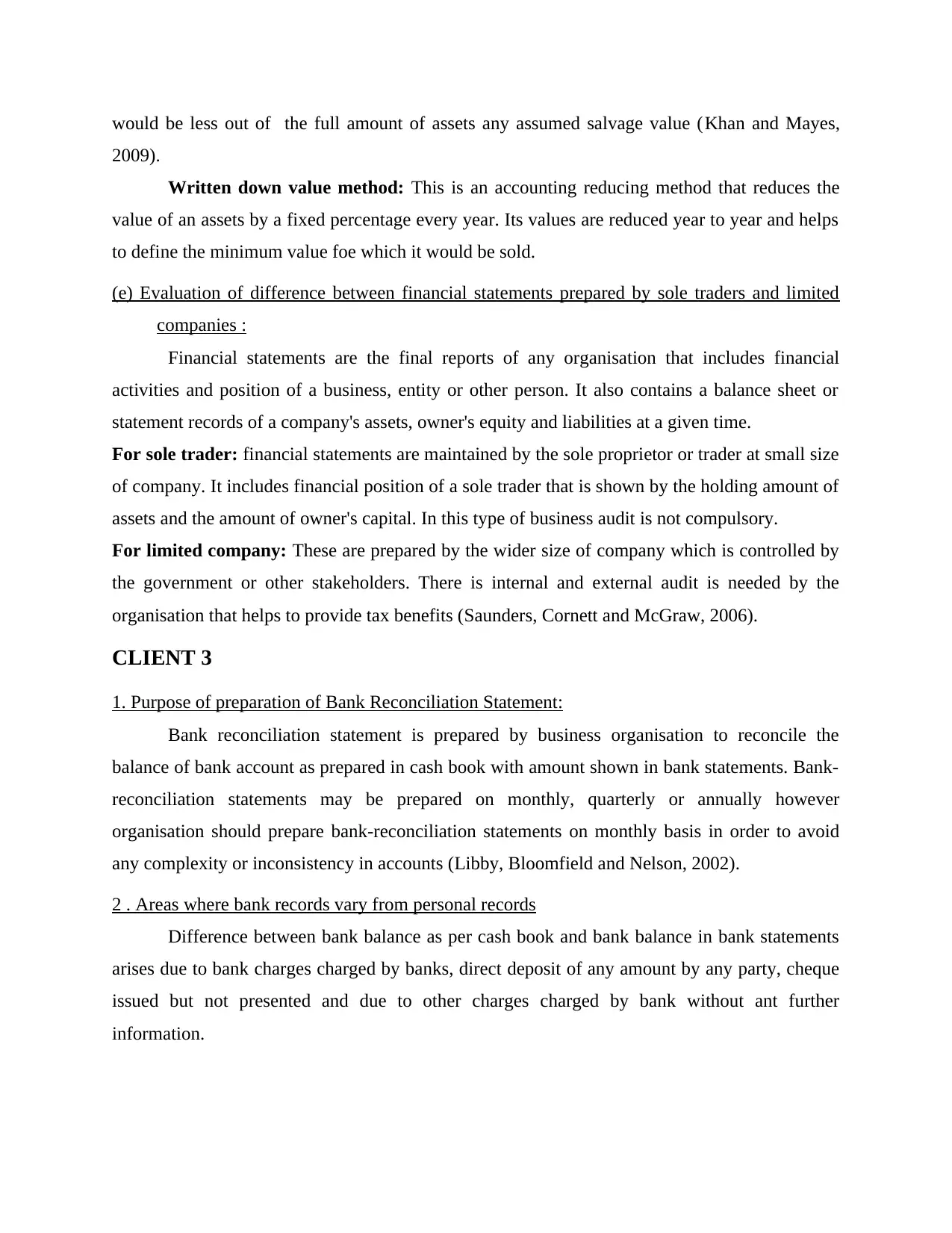

4. Bank-reconciliation statements of Burcu Ltd, for September 2018:

Bank reconciliation statement

Particulars Amount

Bank Balance as per pass book 398

Add: Items having effects of higher balance in cash book

Bank charges not recorded in cash book 36

Adjustment for direct debit rates 105

Less: Items having effects of lower balance in cash book

Payments to:

C David 122

S Leeming 116

C Lyons 87

Bank balance as per cash book 214

CLIENT 4

In the books of Henderson for January, 2018

(a) Sales Ledger Control and Purchase Ledger Control Account:

i) Purchase Ledger Control A/c

Purchase Ledger Control A/c

Particulars Amount Particulars Amount

Imprest is type of financial accounting system and most popular imprest system is petty

cash system. Under imprest system of petty cash a fixed amount is reserved by organisation to

meet their day to day expenses.

4. Bank-reconciliation statements of Burcu Ltd, for September 2018:

Bank reconciliation statement

Particulars Amount

Bank Balance as per pass book 398

Add: Items having effects of higher balance in cash book

Bank charges not recorded in cash book 36

Adjustment for direct debit rates 105

Less: Items having effects of lower balance in cash book

Payments to:

C David 122

S Leeming 116

C Lyons 87

Bank balance as per cash book 214

CLIENT 4

In the books of Henderson for January, 2018

(a) Sales Ledger Control and Purchase Ledger Control Account:

i) Purchase Ledger Control A/c

Purchase Ledger Control A/c

Particulars Amount Particulars Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.