Financial Accounting 1 Report: Users, Framework, and Analysis

VerifiedAdded on 2019/12/04

|18

|5378

|74

Report

AI Summary

This report on financial accounting provides a comprehensive overview of the subject, focusing on the needs of various users of financial statements, the influence of legal and regulatory frameworks, and the application of accounting principles. The report analyzes the requirements of stakeholders such as managers, employees, owners, investors, financial institutions, suppliers, and the government, highlighting their specific information needs. It explores the impact of the Companies Act 2006 and International Accounting Standards on financial reporting, emphasizing the importance of accurate and audited financial statements. The report also assesses the implications of legal and regulatory frameworks on users, demonstrating how adherence to these standards enhances the transparency and reliability of financial information. Furthermore, the report delves into the preparation of financial statements, including adjustments, incomplete records, and consolidated balance sheets, while also covering financial ratio analysis to assess the performance and position of a company. The report uses EL Ltd as a case study to illustrate the practical application of these concepts, providing a clear understanding of how financial accounting principles are applied in a real-world business context. The report concludes with a discussion on how different types of business organizations apply these principles.

Financial Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ...............................................................................................................................3

TASK 1.................................................................................................................................................3

1.1 Describing the different users of financial statements along with their needs..........................3

1.2 Stating the extent to which legal and regulatory framework affects the financial statements...4

1.3 Assessing the implications of legal and regulatory framework for users..................................4

1.4 Explaining the ways through which different laws and legislation deal with the accounting

and reporting standards ...................................................................................................................5

3.1 Summarizing the ways through which information needs of the different users vary..............5

3.2 Fundamental principles which are used by the different types of business organization while

preparing the financial statements...................................................................................................6

TASK 2.................................................................................................................................................6

2.1 Preparing financial statements for the variety of business by making appropriate adjustments

.........................................................................................................................................................6

Adjustments.....................................................................................................................................7

2.2 Preparing financial statements from incomplete records ..........................................................9

2.3 Framing consolidated balance sheet and P&L a/c...................................................................11

TASK 3...............................................................................................................................................14

4.1 Calculating financial ratios to assess he performance and position of ABC Ltd.....................14

4.2 Interpreting accounting ratios by making suitable comparisons.............................................15

CONCLUSION..................................................................................................................................16

References..........................................................................................................................................17

2

INTRODUCTION ...............................................................................................................................3

TASK 1.................................................................................................................................................3

1.1 Describing the different users of financial statements along with their needs..........................3

1.2 Stating the extent to which legal and regulatory framework affects the financial statements...4

1.3 Assessing the implications of legal and regulatory framework for users..................................4

1.4 Explaining the ways through which different laws and legislation deal with the accounting

and reporting standards ...................................................................................................................5

3.1 Summarizing the ways through which information needs of the different users vary..............5

3.2 Fundamental principles which are used by the different types of business organization while

preparing the financial statements...................................................................................................6

TASK 2.................................................................................................................................................6

2.1 Preparing financial statements for the variety of business by making appropriate adjustments

.........................................................................................................................................................6

Adjustments.....................................................................................................................................7

2.2 Preparing financial statements from incomplete records ..........................................................9

2.3 Framing consolidated balance sheet and P&L a/c...................................................................11

TASK 3...............................................................................................................................................14

4.1 Calculating financial ratios to assess he performance and position of ABC Ltd.....................14

4.2 Interpreting accounting ratios by making suitable comparisons.............................................15

CONCLUSION..................................................................................................................................16

References..........................................................................................................................................17

2

INTRODUCTION

Financial accounting may be defined as a field of accounting which serves information

regarding all the monetary transactions made by the firm during the accounting year. In this,

personnel prepare financial statements and present it to the general public at large. There are several

stakeholders who have keen interest in the financial statements which are prepared t6he

organization (Edwards, 2013). Thus, by preparing and presenting the financial statements to the

general public company is able to build faith in the mind of investors. The present report is based on

EL Ltd who provides all type of domestic electrical work to homes and business in London. This

report will describe the information need of all the users of financial; statements. Besides this, it

also depicts the legal and regulatory framework which business organization needs to adopt while

preparing the annual accounts. Further, it will also develop understanding about the financial

statements which are prepared by the different types of business organization.

TASK 1

1.1 Describing the different users of financial statements along with their needs

There are mainly seven users of the financial statements who have different information

need are enumerated below:

Managers: They are the one who manage all the financial and business activities of firm.

Thus, manager of EL Ltd undertakes all the the financial statements in order to frame the

competent financial strategies and policies for the future.

Employees: Human resources of EL Ltd. make assessment of profit and loss a/c. This

statement provides information to the employees about the stability and profitability aspect

of the business organization. Thus, high profit develops confidence among the employees

about their jobs (Mulford and Comiskey, 2011). By taking into account this fact employees

are able to discuss the salary and other aspects with the employer.

Owner: Business entity of EL Ltd make use of financial assessment to evaluate their

profitability and performance in against to their competitors. It also helps company in

identifying the extent to which business unit has attained its mission and goals.

Investors or shareholders: In order to assess the financial health and performance of EL

shareholders conduct ratio analysis by making use of the financial statements (7 Users of

finnacial statements, 2016).

Financial institutions: Bank and other lending institutions make use of balance sheet which

helps them in identifying the financial capacity of the firm. Through this, bank can decide

3

Financial accounting may be defined as a field of accounting which serves information

regarding all the monetary transactions made by the firm during the accounting year. In this,

personnel prepare financial statements and present it to the general public at large. There are several

stakeholders who have keen interest in the financial statements which are prepared t6he

organization (Edwards, 2013). Thus, by preparing and presenting the financial statements to the

general public company is able to build faith in the mind of investors. The present report is based on

EL Ltd who provides all type of domestic electrical work to homes and business in London. This

report will describe the information need of all the users of financial; statements. Besides this, it

also depicts the legal and regulatory framework which business organization needs to adopt while

preparing the annual accounts. Further, it will also develop understanding about the financial

statements which are prepared by the different types of business organization.

TASK 1

1.1 Describing the different users of financial statements along with their needs

There are mainly seven users of the financial statements who have different information

need are enumerated below:

Managers: They are the one who manage all the financial and business activities of firm.

Thus, manager of EL Ltd undertakes all the the financial statements in order to frame the

competent financial strategies and policies for the future.

Employees: Human resources of EL Ltd. make assessment of profit and loss a/c. This

statement provides information to the employees about the stability and profitability aspect

of the business organization. Thus, high profit develops confidence among the employees

about their jobs (Mulford and Comiskey, 2011). By taking into account this fact employees

are able to discuss the salary and other aspects with the employer.

Owner: Business entity of EL Ltd make use of financial assessment to evaluate their

profitability and performance in against to their competitors. It also helps company in

identifying the extent to which business unit has attained its mission and goals.

Investors or shareholders: In order to assess the financial health and performance of EL

shareholders conduct ratio analysis by making use of the financial statements (7 Users of

finnacial statements, 2016).

Financial institutions: Bank and other lending institutions make use of balance sheet which

helps them in identifying the financial capacity of the firm. Through this, bank can decide

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

that they need to issue new loan to EL or not.

Suppliers: In order to determine that the amount which is owing to EL will be paid on time

suppliers make use of financial statements.

Government: To make verification of tax amount government authority undertakes income

statement (Agoglia, Doupnik and Tsakumis, 2011). Through this, governing authority can

determine the amount which EL Ltd needs to pay to the government.

1.2 Stating the extent to which legal and regulatory framework affects the financial statements

According to the Company Act 2006 all the business organization including EL Ltd needs

to prepare and present the financial statement to the general public at large. Company requires to

undertake all the rules and regulations which are mentioned in the International Accounting

Standards. Thus, EL Ltd is obliged to give appropriate and detailed information top the stakeholders

about the revenue, profit, assets and liabilities. Through this, company is able to develop trust in the

mind of stakeholders.

Further, according to the laws and legislation company also requires to present the audited

financial statements. Usually, audited statement have high level of accuracy as compared to others.

In this, audit team maker verification of the each and every financial transactions in against to

vouchers. EL Ltd needs to follow Generally Accepted Accounting Principles during the preparation

of financial statements. According to this, business organization needs to follow common

accounting principles and conventions while recording, summarizing and presenting the business

transactions of the firm (Bamber, Jiang and Wang, 2010). Through this, EL Ltd can compare its

financial statements from other business entities. Through this, manager of the firm is able to

prepare the competent strategie4s and policies which aid in the growth and success of EL Ltd.

1.3 Assessing the implications of legal and regulatory framework for users

Legal and regulatory framework places positive influence on the users of financial

statements. When organization prepares financial statements according to the laws and legislations

or IAS then they are able to present the fair and realistic view of the monetary performance. In this,

manager is able to prepare suitable strategic framework for the upcoming years by taking into

account the current profitability and performance. Further, according to the International

Accounting Standard 16, EL needs to record all the benefits which are highly associated with the

human resources of firm. Through this, they can take appropriate decision about their career.

Besides this, as per the laws and legislation EL Ltd requires to conduct annual general

meeting and disseminate the information through annual report. Thus, such report and meeting

satisfy the information need of investors to the large extent. In addition to this, IAS 7 provides

4

Suppliers: In order to determine that the amount which is owing to EL will be paid on time

suppliers make use of financial statements.

Government: To make verification of tax amount government authority undertakes income

statement (Agoglia, Doupnik and Tsakumis, 2011). Through this, governing authority can

determine the amount which EL Ltd needs to pay to the government.

1.2 Stating the extent to which legal and regulatory framework affects the financial statements

According to the Company Act 2006 all the business organization including EL Ltd needs

to prepare and present the financial statement to the general public at large. Company requires to

undertake all the rules and regulations which are mentioned in the International Accounting

Standards. Thus, EL Ltd is obliged to give appropriate and detailed information top the stakeholders

about the revenue, profit, assets and liabilities. Through this, company is able to develop trust in the

mind of stakeholders.

Further, according to the laws and legislation company also requires to present the audited

financial statements. Usually, audited statement have high level of accuracy as compared to others.

In this, audit team maker verification of the each and every financial transactions in against to

vouchers. EL Ltd needs to follow Generally Accepted Accounting Principles during the preparation

of financial statements. According to this, business organization needs to follow common

accounting principles and conventions while recording, summarizing and presenting the business

transactions of the firm (Bamber, Jiang and Wang, 2010). Through this, EL Ltd can compare its

financial statements from other business entities. Through this, manager of the firm is able to

prepare the competent strategie4s and policies which aid in the growth and success of EL Ltd.

1.3 Assessing the implications of legal and regulatory framework for users

Legal and regulatory framework places positive influence on the users of financial

statements. When organization prepares financial statements according to the laws and legislations

or IAS then they are able to present the fair and realistic view of the monetary performance. In this,

manager is able to prepare suitable strategic framework for the upcoming years by taking into

account the current profitability and performance. Further, according to the International

Accounting Standard 16, EL needs to record all the benefits which are highly associated with the

human resources of firm. Through this, they can take appropriate decision about their career.

Besides this, as per the laws and legislation EL Ltd requires to conduct annual general

meeting and disseminate the information through annual report. Thus, such report and meeting

satisfy the information need of investors to the large extent. In addition to this, IAS 7 provides

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

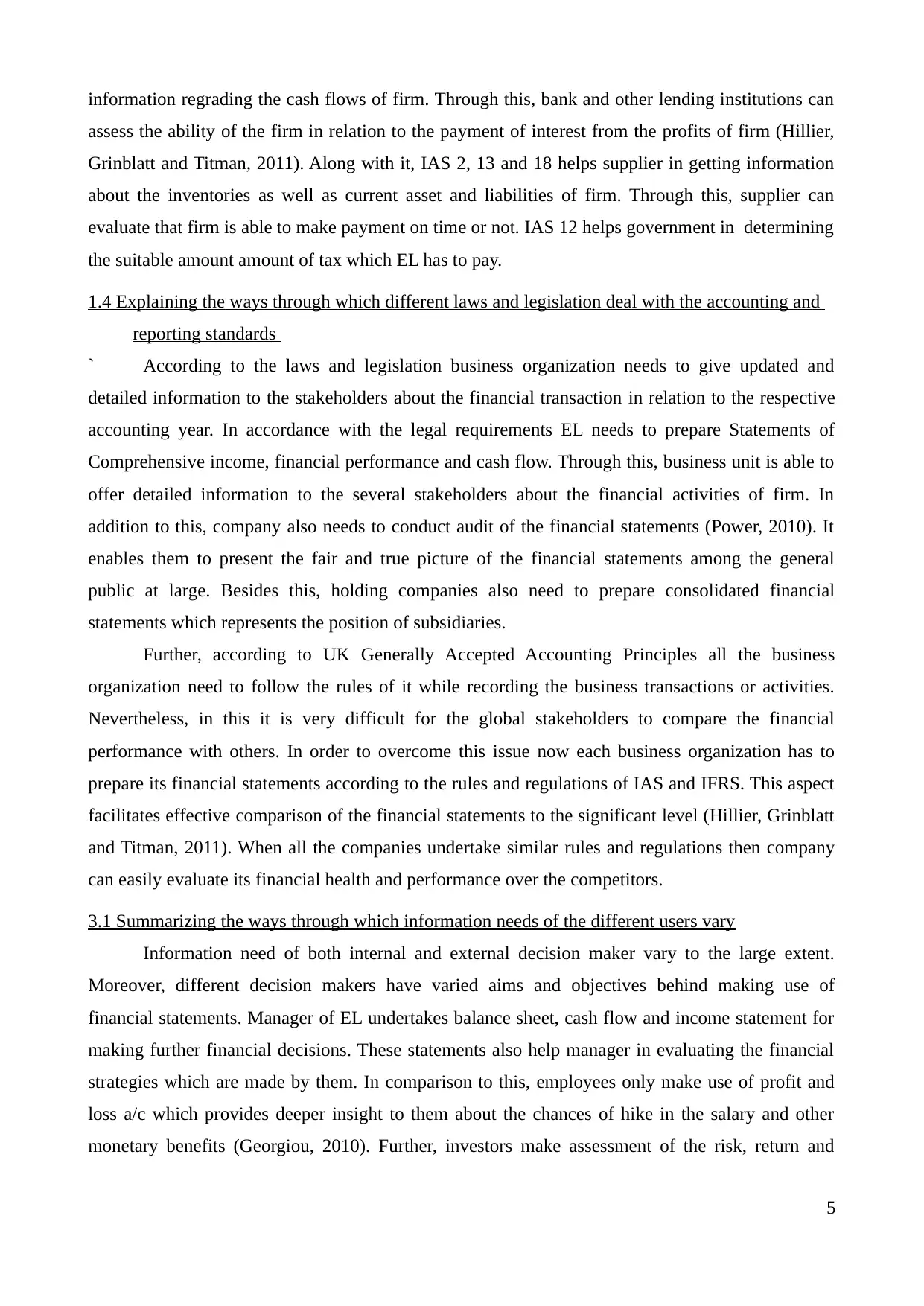

information regrading the cash flows of firm. Through this, bank and other lending institutions can

assess the ability of the firm in relation to the payment of interest from the profits of firm (Hillier,

Grinblatt and Titman, 2011). Along with it, IAS 2, 13 and 18 helps supplier in getting information

about the inventories as well as current asset and liabilities of firm. Through this, supplier can

evaluate that firm is able to make payment on time or not. IAS 12 helps government in determining

the suitable amount amount of tax which EL has to pay.

1.4 Explaining the ways through which different laws and legislation deal with the accounting and

reporting standards

` According to the laws and legislation business organization needs to give updated and

detailed information to the stakeholders about the financial transaction in relation to the respective

accounting year. In accordance with the legal requirements EL needs to prepare Statements of

Comprehensive income, financial performance and cash flow. Through this, business unit is able to

offer detailed information to the several stakeholders about the financial activities of firm. In

addition to this, company also needs to conduct audit of the financial statements (Power, 2010). It

enables them to present the fair and true picture of the financial statements among the general

public at large. Besides this, holding companies also need to prepare consolidated financial

statements which represents the position of subsidiaries.

Further, according to UK Generally Accepted Accounting Principles all the business

organization need to follow the rules of it while recording the business transactions or activities.

Nevertheless, in this it is very difficult for the global stakeholders to compare the financial

performance with others. In order to overcome this issue now each business organization has to

prepare its financial statements according to the rules and regulations of IAS and IFRS. This aspect

facilitates effective comparison of the financial statements to the significant level (Hillier, Grinblatt

and Titman, 2011). When all the companies undertake similar rules and regulations then company

can easily evaluate its financial health and performance over the competitors.

3.1 Summarizing the ways through which information needs of the different users vary

Information need of both internal and external decision maker vary to the large extent.

Moreover, different decision makers have varied aims and objectives behind making use of

financial statements. Manager of EL undertakes balance sheet, cash flow and income statement for

making further financial decisions. These statements also help manager in evaluating the financial

strategies which are made by them. In comparison to this, employees only make use of profit and

loss a/c which provides deeper insight to them about the chances of hike in the salary and other

monetary benefits (Georgiou, 2010). Further, investors make assessment of the risk, return and

5

assess the ability of the firm in relation to the payment of interest from the profits of firm (Hillier,

Grinblatt and Titman, 2011). Along with it, IAS 2, 13 and 18 helps supplier in getting information

about the inventories as well as current asset and liabilities of firm. Through this, supplier can

evaluate that firm is able to make payment on time or not. IAS 12 helps government in determining

the suitable amount amount of tax which EL has to pay.

1.4 Explaining the ways through which different laws and legislation deal with the accounting and

reporting standards

` According to the laws and legislation business organization needs to give updated and

detailed information to the stakeholders about the financial transaction in relation to the respective

accounting year. In accordance with the legal requirements EL needs to prepare Statements of

Comprehensive income, financial performance and cash flow. Through this, business unit is able to

offer detailed information to the several stakeholders about the financial activities of firm. In

addition to this, company also needs to conduct audit of the financial statements (Power, 2010). It

enables them to present the fair and true picture of the financial statements among the general

public at large. Besides this, holding companies also need to prepare consolidated financial

statements which represents the position of subsidiaries.

Further, according to UK Generally Accepted Accounting Principles all the business

organization need to follow the rules of it while recording the business transactions or activities.

Nevertheless, in this it is very difficult for the global stakeholders to compare the financial

performance with others. In order to overcome this issue now each business organization has to

prepare its financial statements according to the rules and regulations of IAS and IFRS. This aspect

facilitates effective comparison of the financial statements to the significant level (Hillier, Grinblatt

and Titman, 2011). When all the companies undertake similar rules and regulations then company

can easily evaluate its financial health and performance over the competitors.

3.1 Summarizing the ways through which information needs of the different users vary

Information need of both internal and external decision maker vary to the large extent.

Moreover, different decision makers have varied aims and objectives behind making use of

financial statements. Manager of EL undertakes balance sheet, cash flow and income statement for

making further financial decisions. These statements also help manager in evaluating the financial

strategies which are made by them. In comparison to this, employees only make use of profit and

loss a/c which provides deeper insight to them about the chances of hike in the salary and other

monetary benefits (Georgiou, 2010). Further, investors make assessment of the risk, return and

5

other financial aspects through ratio analysis. Through this, shareholders are able to make suitable

investment decision to the great extent. On the contrary to it, lenders make evaluation of the balance

sheet which helps ion determining that EL is abler to repay the loan within the suitable time frame

or not. Along with it, supplier undertakes cash flow statement which helps them in identifying the

extent to which business unit is able to make payment on time (Karande and Chakraborty, 2012).

Whereas owners of EL undertake all the financial statement for setting the goals and objectives for

the upcoming year.

3.2 Fundamental principles which are used by the different types of business organization while

preparing the financial statements

Each business organization has to follow accounting concepts and principles while drafting

the financial statements. Business unit to follow dual aspect concept which entails that each

transaction must be recorded in the two different account. In this, for every debit there must be a

credit with the similar amount. In dual concept assets are equal to the liabilities and shareholders

equity. According to the accrual concept business entity needs to record income or expenses in the

year in which they are accrued rather than received (Drivelos and Georgiou, 2012). In addition to

this, company also needs to follow accounting period concept. This aspect places emphasis on the

fact that financial statements pertaining to the specific financial year.

Further, business organization also needs to adopt cost concept which entails that business

organization need to record the asset on its real cost rather than market price. Through this,

company is able to present the suitable information about the assets. In addition to this, company

also needs to follow the going principle. According to this business organization requires to follow

the same principles in each year. Through this, company can make assessment of its growth by

making comparison of the current performance with the future (Georgiou, 2010).

Along wit it, manager of the firm needs to record business activities sin the financial

statements which are supported with the monetary values. Thus, all types of business organization

namely sole trader, public and private as well as partnership firm must follow the above mentioned

accounting principles and concept (Cui and Ryan, 2011). Through this, business organization is able

to prepare the financial statement in an appropriate manner. Besides this, EL Ltd also requires to

follow IAS which furnishes the format and rules according to which company needs to prepare its

financial statements. Thus, keeping this fact in mind business unit is able to present the clear view

of the activities which are performed by it during the accounting year.

6

investment decision to the great extent. On the contrary to it, lenders make evaluation of the balance

sheet which helps ion determining that EL is abler to repay the loan within the suitable time frame

or not. Along with it, supplier undertakes cash flow statement which helps them in identifying the

extent to which business unit is able to make payment on time (Karande and Chakraborty, 2012).

Whereas owners of EL undertake all the financial statement for setting the goals and objectives for

the upcoming year.

3.2 Fundamental principles which are used by the different types of business organization while

preparing the financial statements

Each business organization has to follow accounting concepts and principles while drafting

the financial statements. Business unit to follow dual aspect concept which entails that each

transaction must be recorded in the two different account. In this, for every debit there must be a

credit with the similar amount. In dual concept assets are equal to the liabilities and shareholders

equity. According to the accrual concept business entity needs to record income or expenses in the

year in which they are accrued rather than received (Drivelos and Georgiou, 2012). In addition to

this, company also needs to follow accounting period concept. This aspect places emphasis on the

fact that financial statements pertaining to the specific financial year.

Further, business organization also needs to adopt cost concept which entails that business

organization need to record the asset on its real cost rather than market price. Through this,

company is able to present the suitable information about the assets. In addition to this, company

also needs to follow the going principle. According to this business organization requires to follow

the same principles in each year. Through this, company can make assessment of its growth by

making comparison of the current performance with the future (Georgiou, 2010).

Along wit it, manager of the firm needs to record business activities sin the financial

statements which are supported with the monetary values. Thus, all types of business organization

namely sole trader, public and private as well as partnership firm must follow the above mentioned

accounting principles and concept (Cui and Ryan, 2011). Through this, business organization is able

to prepare the financial statement in an appropriate manner. Besides this, EL Ltd also requires to

follow IAS which furnishes the format and rules according to which company needs to prepare its

financial statements. Thus, keeping this fact in mind business unit is able to present the clear view

of the activities which are performed by it during the accounting year.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

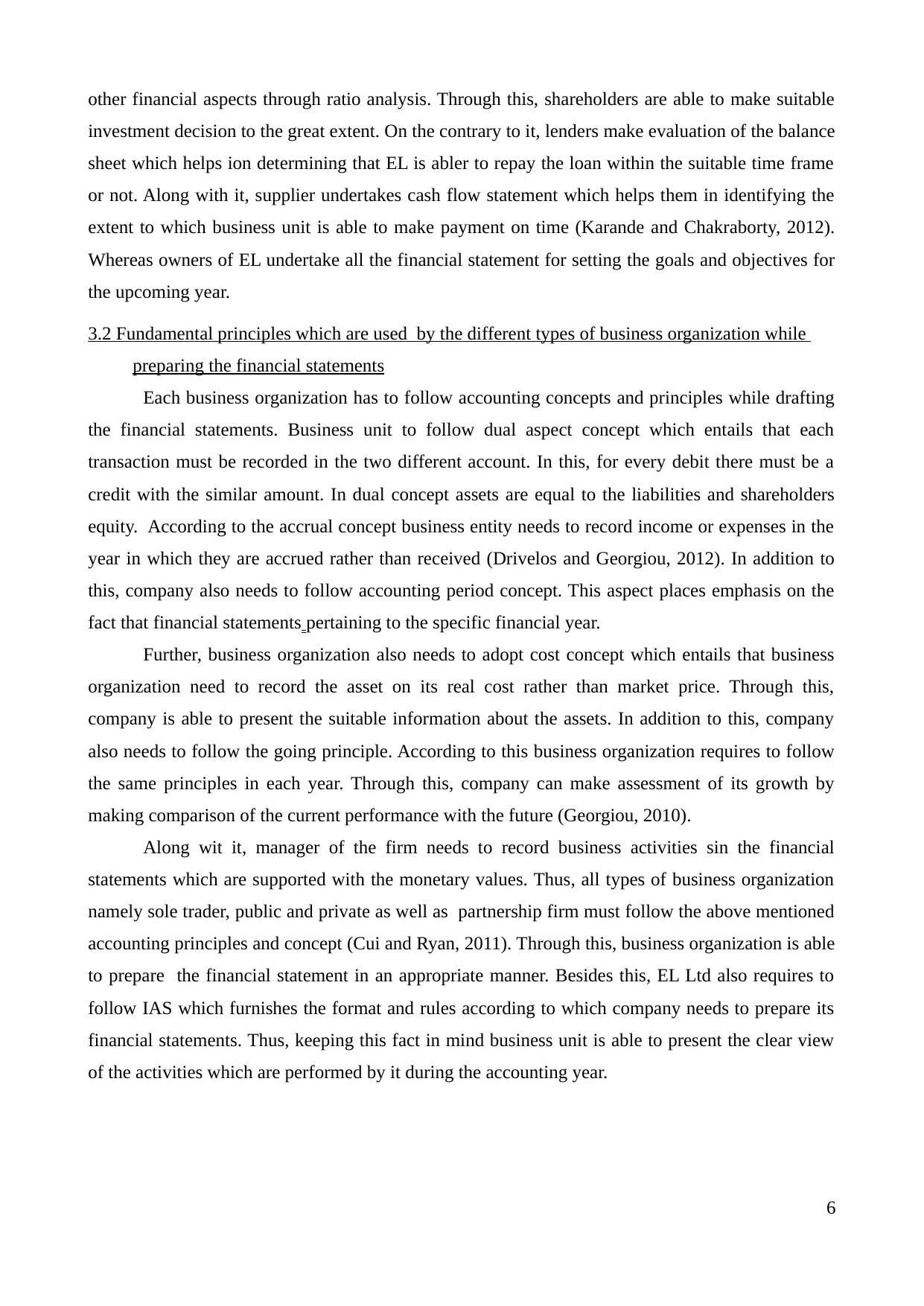

Income statement of sole trader as well as public and private limited firm is same. Usually, sole

traders make both the statement according to their convenience and willingness. Hence, standard

format which is adopted by both the firms are as follows:

Income statement

Particulars Amount Particulars Amount

To, opening stock 40000 By, Sales revenue 210000

To, Purchase 140000 By, closing stock 60000

To, wages a/c 10000

To gross profit 80000

270000 270000

To office expenses 10000 By gross profit 80000

To Selling and

distribution expenses 18000

By interest received

a/c 10000

To miscellaneous

expenses 12000

To Net profit 50000

80000 80000

Balance Sheet

Liabilities Amount Assets Amount

Shareholders equity

100000 150000 Current assets

add: net profit 50000 Cash / bank 175000

Debtors 15000

Current liabilities

Creditors 35000 Fixed assets

bank overdraft 15000

7

traders make both the statement according to their convenience and willingness. Hence, standard

format which is adopted by both the firms are as follows:

Income statement

Particulars Amount Particulars Amount

To, opening stock 40000 By, Sales revenue 210000

To, Purchase 140000 By, closing stock 60000

To, wages a/c 10000

To gross profit 80000

270000 270000

To office expenses 10000 By gross profit 80000

To Selling and

distribution expenses 18000

By interest received

a/c 10000

To miscellaneous

expenses 12000

To Net profit 50000

80000 80000

Balance Sheet

Liabilities Amount Assets Amount

Shareholders equity

100000 150000 Current assets

add: net profit 50000 Cash / bank 175000

Debtors 15000

Current liabilities

Creditors 35000 Fixed assets

bank overdraft 15000

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

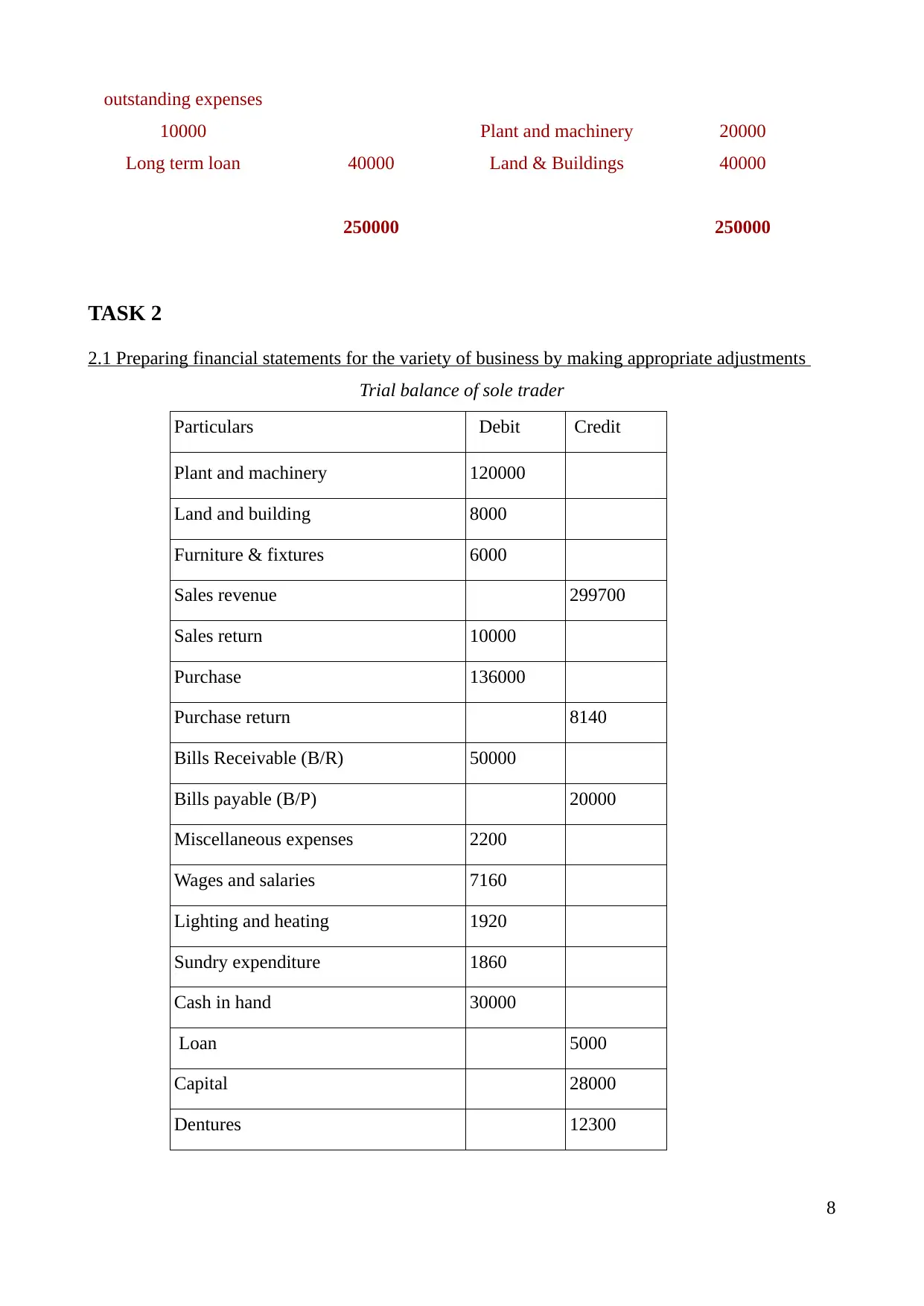

outstanding expenses

10000 Plant and machinery 20000

Long term loan 40000 Land & Buildings 40000

250000 250000

TASK 2

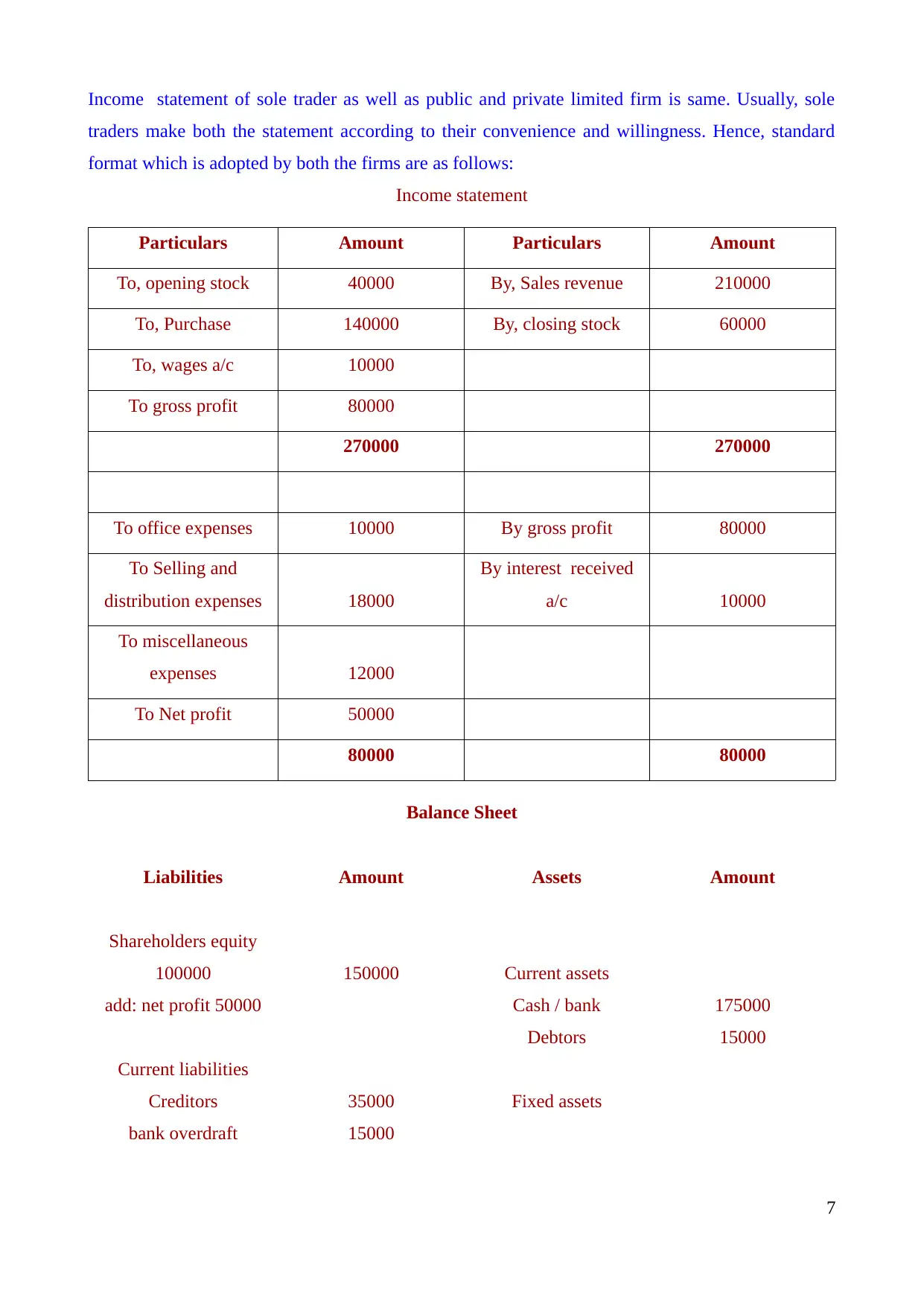

2.1 Preparing financial statements for the variety of business by making appropriate adjustments

Trial balance of sole trader

Particulars Debit Credit

Plant and machinery 120000

Land and building 8000

Furniture & fixtures 6000

Sales revenue 299700

Sales return 10000

Purchase 136000

Purchase return 8140

Bills Receivable (B/R) 50000

Bills payable (B/P) 20000

Miscellaneous expenses 2200

Wages and salaries 7160

Lighting and heating 1920

Sundry expenditure 1860

Cash in hand 30000

Loan 5000

Capital 28000

Dentures 12300

8

10000 Plant and machinery 20000

Long term loan 40000 Land & Buildings 40000

250000 250000

TASK 2

2.1 Preparing financial statements for the variety of business by making appropriate adjustments

Trial balance of sole trader

Particulars Debit Credit

Plant and machinery 120000

Land and building 8000

Furniture & fixtures 6000

Sales revenue 299700

Sales return 10000

Purchase 136000

Purchase return 8140

Bills Receivable (B/R) 50000

Bills payable (B/P) 20000

Miscellaneous expenses 2200

Wages and salaries 7160

Lighting and heating 1920

Sundry expenditure 1860

Cash in hand 30000

Loan 5000

Capital 28000

Dentures 12300

8

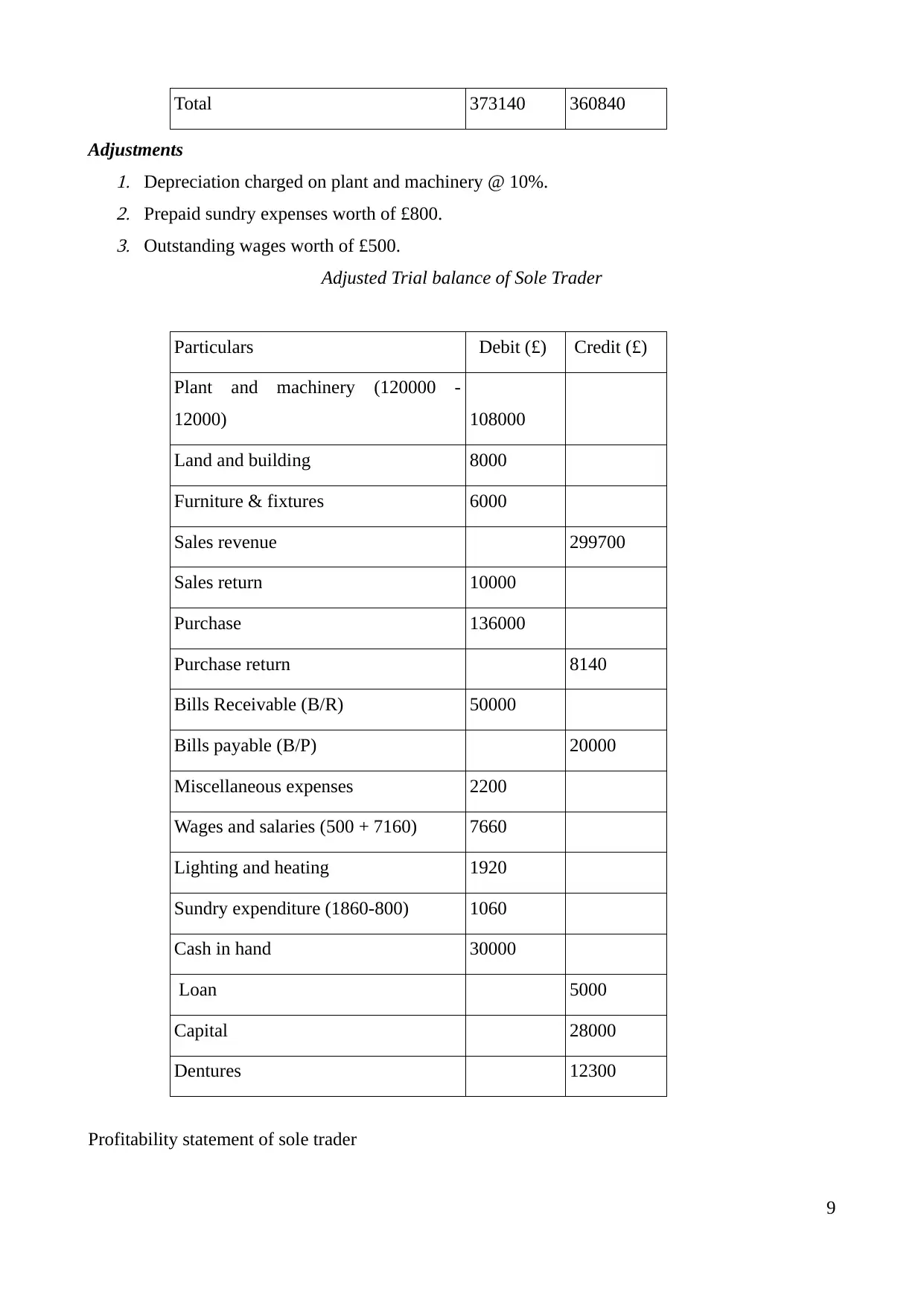

Total 373140 360840

Adjustments1. Depreciation charged on plant and machinery @ 10%.2. Prepaid sundry expenses worth of £800.3. Outstanding wages worth of £500.

Adjusted Trial balance of Sole Trader

Particulars Debit (£) Credit (£)

Plant and machinery (120000 -

12000) 108000

Land and building 8000

Furniture & fixtures 6000

Sales revenue 299700

Sales return 10000

Purchase 136000

Purchase return 8140

Bills Receivable (B/R) 50000

Bills payable (B/P) 20000

Miscellaneous expenses 2200

Wages and salaries (500 + 7160) 7660

Lighting and heating 1920

Sundry expenditure (1860-800) 1060

Cash in hand 30000

Loan 5000

Capital 28000

Dentures 12300

Profitability statement of sole trader

9

Adjustments1. Depreciation charged on plant and machinery @ 10%.2. Prepaid sundry expenses worth of £800.3. Outstanding wages worth of £500.

Adjusted Trial balance of Sole Trader

Particulars Debit (£) Credit (£)

Plant and machinery (120000 -

12000) 108000

Land and building 8000

Furniture & fixtures 6000

Sales revenue 299700

Sales return 10000

Purchase 136000

Purchase return 8140

Bills Receivable (B/R) 50000

Bills payable (B/P) 20000

Miscellaneous expenses 2200

Wages and salaries (500 + 7160) 7660

Lighting and heating 1920

Sundry expenditure (1860-800) 1060

Cash in hand 30000

Loan 5000

Capital 28000

Dentures 12300

Profitability statement of sole trader

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

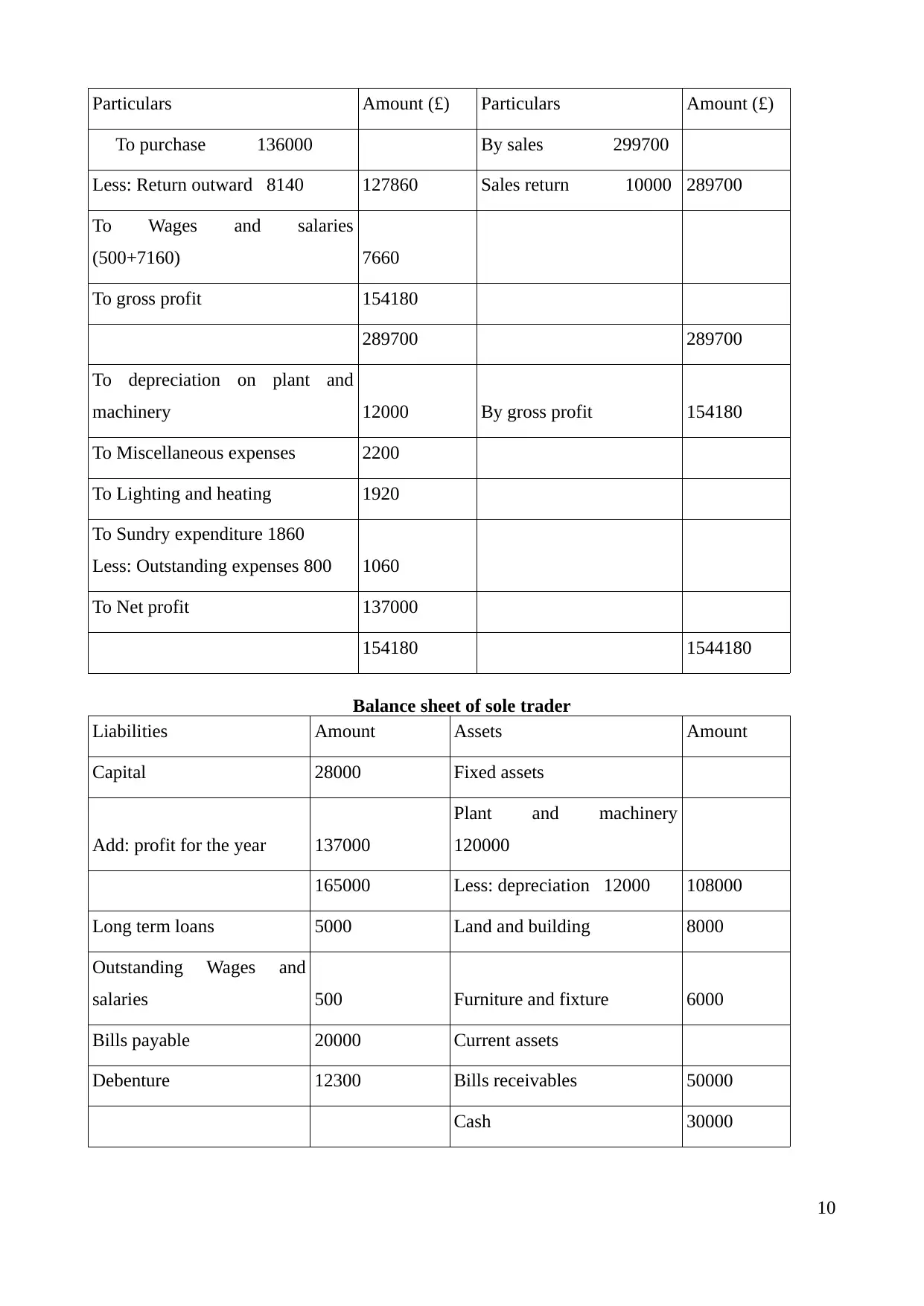

Particulars Amount (£) Particulars Amount (£)

To purchase 136000 By sales 299700

Less: Return outward 8140 127860 Sales return 10000 289700

To Wages and salaries

(500+7160) 7660

To gross profit 154180

289700 289700

To depreciation on plant and

machinery 12000 By gross profit 154180

To Miscellaneous expenses 2200

To Lighting and heating 1920

To Sundry expenditure 1860

Less: Outstanding expenses 800 1060

To Net profit 137000

154180 1544180

Balance sheet of sole trader

Liabilities Amount Assets Amount

Capital 28000 Fixed assets

Add: profit for the year 137000

Plant and machinery

120000

165000 Less: depreciation 12000 108000

Long term loans 5000 Land and building 8000

Outstanding Wages and

salaries 500 Furniture and fixture 6000

Bills payable 20000 Current assets

Debenture 12300 Bills receivables 50000

Cash 30000

10

To purchase 136000 By sales 299700

Less: Return outward 8140 127860 Sales return 10000 289700

To Wages and salaries

(500+7160) 7660

To gross profit 154180

289700 289700

To depreciation on plant and

machinery 12000 By gross profit 154180

To Miscellaneous expenses 2200

To Lighting and heating 1920

To Sundry expenditure 1860

Less: Outstanding expenses 800 1060

To Net profit 137000

154180 1544180

Balance sheet of sole trader

Liabilities Amount Assets Amount

Capital 28000 Fixed assets

Add: profit for the year 137000

Plant and machinery

120000

165000 Less: depreciation 12000 108000

Long term loans 5000 Land and building 8000

Outstanding Wages and

salaries 500 Furniture and fixture 6000

Bills payable 20000 Current assets

Debenture 12300 Bills receivables 50000

Cash 30000

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Prepaid sundry expenses 800

202800 202800

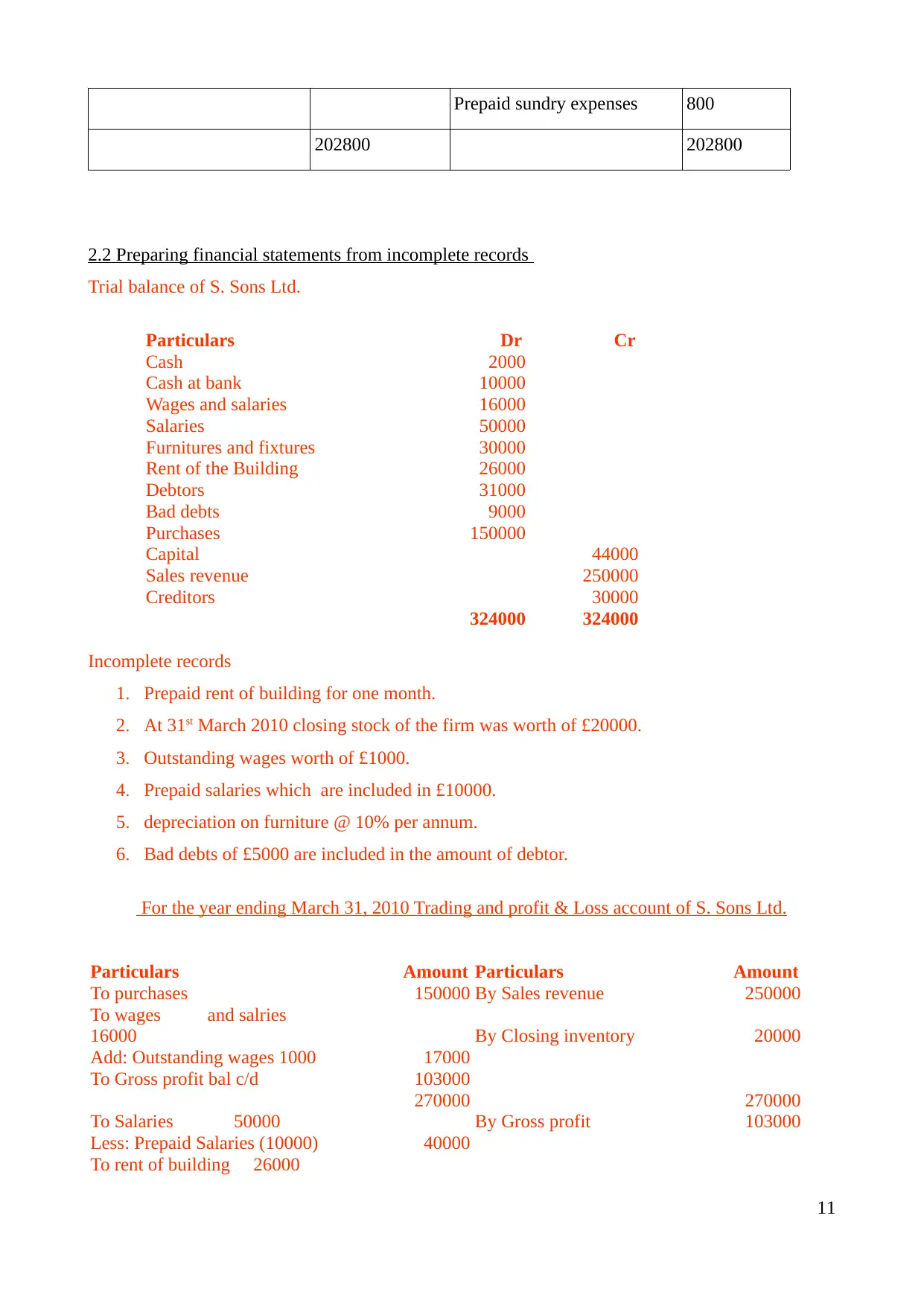

2.2 Preparing financial statements from incomplete records

Trial balance of S. Sons Ltd.

Particulars Dr Cr

Cash 2000

Cash at bank 10000

Wages and salaries 16000

Salaries 50000

Furnitures and fixtures 30000

Rent of the Building 26000

Debtors 31000

Bad debts 9000

Purchases 150000

Capital 44000

Sales revenue 250000

Creditors 30000

324000 324000

Incomplete records

1. Prepaid rent of building for one month.

2. At 31st March 2010 closing stock of the firm was worth of £20000.

3. Outstanding wages worth of £1000.

4. Prepaid salaries which are included in £10000.

5. depreciation on furniture @ 10% per annum.

6. Bad debts of £5000 are included in the amount of debtor.

For the year ending March 31, 2010 Trading and profit & Loss account of S. Sons Ltd.

Particulars Amount Particulars Amount

To purchases 150000 By Sales revenue 250000

To wages and salries

16000 By Closing inventory 20000

Add: Outstanding wages 1000 17000

To Gross profit bal c/d 103000

270000 270000

To Salaries 50000 By Gross profit 103000

Less: Prepaid Salaries (10000) 40000

To rent of building 26000

11

202800 202800

2.2 Preparing financial statements from incomplete records

Trial balance of S. Sons Ltd.

Particulars Dr Cr

Cash 2000

Cash at bank 10000

Wages and salaries 16000

Salaries 50000

Furnitures and fixtures 30000

Rent of the Building 26000

Debtors 31000

Bad debts 9000

Purchases 150000

Capital 44000

Sales revenue 250000

Creditors 30000

324000 324000

Incomplete records

1. Prepaid rent of building for one month.

2. At 31st March 2010 closing stock of the firm was worth of £20000.

3. Outstanding wages worth of £1000.

4. Prepaid salaries which are included in £10000.

5. depreciation on furniture @ 10% per annum.

6. Bad debts of £5000 are included in the amount of debtor.

For the year ending March 31, 2010 Trading and profit & Loss account of S. Sons Ltd.

Particulars Amount Particulars Amount

To purchases 150000 By Sales revenue 250000

To wages and salries

16000 By Closing inventory 20000

Add: Outstanding wages 1000 17000

To Gross profit bal c/d 103000

270000 270000

To Salaries 50000 By Gross profit 103000

Less: Prepaid Salaries (10000) 40000

To rent of building 26000

11

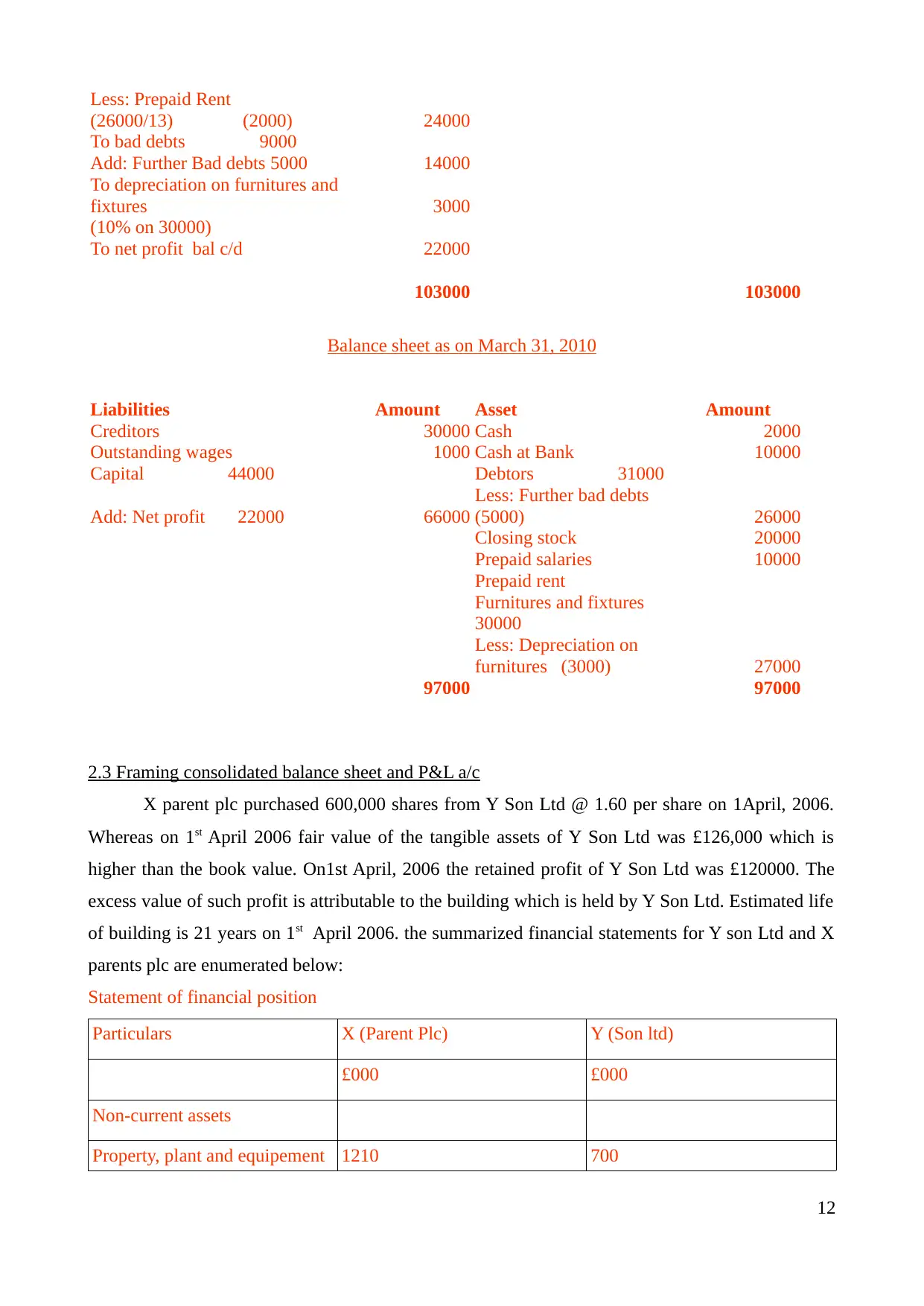

Less: Prepaid Rent

(26000/13) (2000) 24000

To bad debts 9000

Add: Further Bad debts 5000 14000

To depreciation on furnitures and

fixtures 3000

(10% on 30000)

To net profit bal c/d 22000

103000 103000

Balance sheet as on March 31, 2010

Liabilities Amount Asset Amount

Creditors 30000 Cash 2000

Outstanding wages 1000 Cash at Bank 10000

Capital 44000 Debtors 31000

Add: Net profit 22000 66000

Less: Further bad debts

(5000) 26000

Closing stock 20000

Prepaid salaries 10000

Prepaid rent

Furnitures and fixtures

30000

Less: Depreciation on

furnitures (3000) 27000

97000 97000

2.3 Framing consolidated balance sheet and P&L a/c

X parent plc purchased 600,000 shares from Y Son Ltd @ 1.60 per share on 1April, 2006.

Whereas on 1st April 2006 fair value of the tangible assets of Y Son Ltd was £126,000 which is

higher than the book value. On1st April, 2006 the retained profit of Y Son Ltd was £120000. The

excess value of such profit is attributable to the building which is held by Y Son Ltd. Estimated life

of building is 21 years on 1st April 2006. the summarized financial statements for Y son Ltd and X

parents plc are enumerated below:

Statement of financial position

Particulars X (Parent Plc) Y (Son ltd)

£000 £000

Non-current assets

Property, plant and equipement 1210 700

12

(26000/13) (2000) 24000

To bad debts 9000

Add: Further Bad debts 5000 14000

To depreciation on furnitures and

fixtures 3000

(10% on 30000)

To net profit bal c/d 22000

103000 103000

Balance sheet as on March 31, 2010

Liabilities Amount Asset Amount

Creditors 30000 Cash 2000

Outstanding wages 1000 Cash at Bank 10000

Capital 44000 Debtors 31000

Add: Net profit 22000 66000

Less: Further bad debts

(5000) 26000

Closing stock 20000

Prepaid salaries 10000

Prepaid rent

Furnitures and fixtures

30000

Less: Depreciation on

furnitures (3000) 27000

97000 97000

2.3 Framing consolidated balance sheet and P&L a/c

X parent plc purchased 600,000 shares from Y Son Ltd @ 1.60 per share on 1April, 2006.

Whereas on 1st April 2006 fair value of the tangible assets of Y Son Ltd was £126,000 which is

higher than the book value. On1st April, 2006 the retained profit of Y Son Ltd was £120000. The

excess value of such profit is attributable to the building which is held by Y Son Ltd. Estimated life

of building is 21 years on 1st April 2006. the summarized financial statements for Y son Ltd and X

parents plc are enumerated below:

Statement of financial position

Particulars X (Parent Plc) Y (Son ltd)

£000 £000

Non-current assets

Property, plant and equipement 1210 700

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.