Financial Accounting Report: Financial Statement Analysis and Users

VerifiedAdded on 2020/01/06

|23

|5057

|163

Report

AI Summary

This report delves into the realm of financial accounting, focusing on the analysis and reporting of financial transactions for EL Ltd., a company providing electrical services. It examines the diverse needs of various financial statement users, including managers, employees, owners, investors, lenders, suppliers, and government agencies, and how they utilize financial information for decision-making. The report explores the legal and regulatory influences on financial statements, such as the Companies Act 2006, UK GAAP, and International Accounting Standards (IAS/IFRS), and their implications for users. It covers the preparation of financial statements from both complete and incomplete records, including the preparation of a consolidated balance sheet and profit and loss account. Additionally, it includes the calculation of accounting ratios for assessing performance and the incorporation and interpretation of financial performance through comparative analysis. The report aims to provide a comprehensive understanding of financial accounting principles and practices.

FINANCIAL

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction .....................................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Different users of financial statements and their needs.........................................................3

1.2, 1.3 Legal and regulatory influences on financial statements and assessing the implications

for users........................................................................................................................................5

1.4 Ways in which different laws/ regulation are dealt with by accounting and reporting

standards......................................................................................................................................7

3.1 Varied information needs of different users group................................................................8

3.2 Fundamental principles towards preparation of financial statements of different types of

firms and preparing financial statements for EL Ltd...................................................................8

TASK 2..........................................................................................................................................11

2.1 Preparation of financial statements from trial balance with necessary adjustments............11

2.2 Preparation of financial statements from incomplete records..............................................16

2.3 Preparation of consolidated balance sheet and profit and loss account ..............................18

TASK 3..........................................................................................................................................20

4.1 Calculating accounting ratios for assessing performance and position of ABC Ltd...........20

4.2 Incorporation and interpretation of financial performance by means of comparative

analysis.......................................................................................................................................21

CONCLUSION .............................................................................................................................22

REFERENCES .............................................................................................................................23

2

Introduction .....................................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Different users of financial statements and their needs.........................................................3

1.2, 1.3 Legal and regulatory influences on financial statements and assessing the implications

for users........................................................................................................................................5

1.4 Ways in which different laws/ regulation are dealt with by accounting and reporting

standards......................................................................................................................................7

3.1 Varied information needs of different users group................................................................8

3.2 Fundamental principles towards preparation of financial statements of different types of

firms and preparing financial statements for EL Ltd...................................................................8

TASK 2..........................................................................................................................................11

2.1 Preparation of financial statements from trial balance with necessary adjustments............11

2.2 Preparation of financial statements from incomplete records..............................................16

2.3 Preparation of consolidated balance sheet and profit and loss account ..............................18

TASK 3..........................................................................................................................................20

4.1 Calculating accounting ratios for assessing performance and position of ABC Ltd...........20

4.2 Incorporation and interpretation of financial performance by means of comparative

analysis.......................................................................................................................................21

CONCLUSION .............................................................................................................................22

REFERENCES .............................................................................................................................23

2

INTRODUCTION

Financial accounting is regarded as the area of accounting that is concerned with the

summary, analysis as well as reporting of financial transactions that pertain to a particular

organization. This includes preparing financial statements that are available for public

consumption. Stockholders, suppliers, bank, employees as well as government agencies are the

individuals who possess interest in gaining information for the purpose of decision making.

Financial accountancy is being governed by both the local as well as international standards of

accounting. It is being used for the preparation of accounting information for the individuals

outside the firm or the one who are not engaged in running day-day activities of the firm (Delen,

Kuzey and Uyar, 2013). Every business needs to make preparation of essential accounts for the

determination of organizational performance. The role of financial accounting is very crucial as

it keeps a track on the financial transaction of business by making use of accounting principles,

guidelines as well as regulations. Thus, it is regarded as the procedure of recording, classifying

as well as summarizing the financial transaction through preparation of financial accounts and

interpretation of their performance.

The present study entails to gain insight to the importance of financial accounts that

includes profitability statement as well as balance sheet. Such is to make assessment of financial

position of the organization. Further, the report covers various kinds of internal and external

users who need unique information from the business accounts for the development of effective

decision by analyzing it. It also covers preparation of financial statements from complete or

incomplete records. The report includes presentation of monetary information in accepted

formations for publication. Lastly, it contains interpretation of financial statements.

TASK 1

1.1 Different users of financial statements and their needs

In accordance with the scenario, EL Ltd. is the firm that has been established since 10

years and offers different kinds of domestic electrical work to households and firms in London.

They are conducting different electrical work by the means of NICEIC-accredited electricians as

well as team of experienced personnel. The firm is providing support to home as well as business

customer’s need in an effective manner through its division that includes EL-home as well as

3

Financial accounting is regarded as the area of accounting that is concerned with the

summary, analysis as well as reporting of financial transactions that pertain to a particular

organization. This includes preparing financial statements that are available for public

consumption. Stockholders, suppliers, bank, employees as well as government agencies are the

individuals who possess interest in gaining information for the purpose of decision making.

Financial accountancy is being governed by both the local as well as international standards of

accounting. It is being used for the preparation of accounting information for the individuals

outside the firm or the one who are not engaged in running day-day activities of the firm (Delen,

Kuzey and Uyar, 2013). Every business needs to make preparation of essential accounts for the

determination of organizational performance. The role of financial accounting is very crucial as

it keeps a track on the financial transaction of business by making use of accounting principles,

guidelines as well as regulations. Thus, it is regarded as the procedure of recording, classifying

as well as summarizing the financial transaction through preparation of financial accounts and

interpretation of their performance.

The present study entails to gain insight to the importance of financial accounts that

includes profitability statement as well as balance sheet. Such is to make assessment of financial

position of the organization. Further, the report covers various kinds of internal and external

users who need unique information from the business accounts for the development of effective

decision by analyzing it. It also covers preparation of financial statements from complete or

incomplete records. The report includes presentation of monetary information in accepted

formations for publication. Lastly, it contains interpretation of financial statements.

TASK 1

1.1 Different users of financial statements and their needs

In accordance with the scenario, EL Ltd. is the firm that has been established since 10

years and offers different kinds of domestic electrical work to households and firms in London.

They are conducting different electrical work by the means of NICEIC-accredited electricians as

well as team of experienced personnel. The firm is providing support to home as well as business

customer’s need in an effective manner through its division that includes EL-home as well as

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

EL-business. There are different users of financial accounting who possess different information

needs. Such have been enumerated in the manner stated as under: Manager: They possess responsibility towards managing the entire functioning of EL.

Thus, they require information with respect to profitability, efficiency, solvency, ability

to generate cash as well as liquidity position of the firm. Employees: They are engaged in offering services to the clients and need information

with respect to profitability position of organization (Fraser and Ormiston, 2015). This is

due to the reason that their higher monetary salary can be satisfied by possessing higher

margin of profits. Owners: They require information regarding performance of EL as they have an objective

that relates with maximizing revenues, profitability as well as financial strength. They

possess intention to build stronger position in order to compete in an effective manner

and attain sustainable growth. Investors: They are engaged in making evaluation of profit margin, solvency, ability to

generate cash as well as shareholders earning in form of dividend (Hu, 2013). This is to

analyze risk and return which are attached with funds that are being invested as well as

take decision regarding strategic investment. Lenders: They need information about profits, financial risk, debt burden capacity of EL,

cash inflow ability as well as potential to make payment of long term debts in an effective

manner and on time. In turn, lenders will be able to make selection of organization that is

performing in an effective manner. Further, it acts as an aid in taking better decision

regarding lending. Suppliers: They offer credit facility to EL and thus, they need information regarding the

cash management strategy as well as credit worthiness by the means of liquidity position.

It acts as an aid in making determination of ability of EL towards satisfying their short

term obligations with greater effectiveness (Scott, 2014).

Government: Regulatory authority of UK makes determination of information relating to

profitability by the means of profit and loss account. This is to make determination of tax

obligation of EL that is required to be paid. Further, in situation of default, penalties will

be charged for the individual who is liable.

4

needs. Such have been enumerated in the manner stated as under: Manager: They possess responsibility towards managing the entire functioning of EL.

Thus, they require information with respect to profitability, efficiency, solvency, ability

to generate cash as well as liquidity position of the firm. Employees: They are engaged in offering services to the clients and need information

with respect to profitability position of organization (Fraser and Ormiston, 2015). This is

due to the reason that their higher monetary salary can be satisfied by possessing higher

margin of profits. Owners: They require information regarding performance of EL as they have an objective

that relates with maximizing revenues, profitability as well as financial strength. They

possess intention to build stronger position in order to compete in an effective manner

and attain sustainable growth. Investors: They are engaged in making evaluation of profit margin, solvency, ability to

generate cash as well as shareholders earning in form of dividend (Hu, 2013). This is to

analyze risk and return which are attached with funds that are being invested as well as

take decision regarding strategic investment. Lenders: They need information about profits, financial risk, debt burden capacity of EL,

cash inflow ability as well as potential to make payment of long term debts in an effective

manner and on time. In turn, lenders will be able to make selection of organization that is

performing in an effective manner. Further, it acts as an aid in taking better decision

regarding lending. Suppliers: They offer credit facility to EL and thus, they need information regarding the

cash management strategy as well as credit worthiness by the means of liquidity position.

It acts as an aid in making determination of ability of EL towards satisfying their short

term obligations with greater effectiveness (Scott, 2014).

Government: Regulatory authority of UK makes determination of information relating to

profitability by the means of profit and loss account. This is to make determination of tax

obligation of EL that is required to be paid. Further, in situation of default, penalties will

be charged for the individual who is liable.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.2, 1.3 Legal and regulatory influences on financial statements and assessing the implications

for users

There is presence of several legal as well as regulatory influences on the financial

statements. Such have been enumerated in the manner as under: Companies Act 2006: The particular act is comprised of several provisions for the

preparation of financial report of EL firm. In accordance with the legislation, it becomes

essential for EL to keep updated as well as detailed records relating with the historical

affairs. Such has obligation on EL that is regarding summarizing all the transactions like

revenue, expenses, liabilities and assets in the financial statements. It has been exhibited

by CA, 2006 that EL needs to make preparation of profit and loss account as well as

balance sheet in an accurate manner (Xia, Fei and Liu, 2015). Moreover, auditing is

compulsory as it represents true and fair profitability and financial position of EL's

accounts. Along with this, there is duty of manager to give approval to such statements

by their sign as it is the director’s obligation. UK Generally Accepted Accounting Principles (GAAP): UK GAAP is regarded as the

guidelines and principles that needs to be kept in mind by EL's while making draft of

essential accounts. This is categorized into accounting rules, regulations, conventions as

well standards that needs to be complied with EL for recording, classifying as well as

summarizing the affairs of business. This is for the sake of reporting each and every

transaction of the organization's accounts and demonstrate true and fair position. International Accounting Standards: The role of IAS is effective in recording transaction

by different firms through application of single set out accounting standards at

international level. Since the time, 41 IAS is required to be issued by IASC for recording

several business transactions within the financial statements.

International financial reporting standards: These are regarded as the global standards

that harmonizes the practices of accounting across the globe. By issuing IFRS all the

international firms are complying with particular set of reporting standards with IFRS. In

the present era of globalization transactions at international level are increasing to a

greater extent. Thus it becomes difficult for the investors to gain insight to all the national

accounting standards. Therefore IFRS makes elimination of such needs through

5

for users

There is presence of several legal as well as regulatory influences on the financial

statements. Such have been enumerated in the manner as under: Companies Act 2006: The particular act is comprised of several provisions for the

preparation of financial report of EL firm. In accordance with the legislation, it becomes

essential for EL to keep updated as well as detailed records relating with the historical

affairs. Such has obligation on EL that is regarding summarizing all the transactions like

revenue, expenses, liabilities and assets in the financial statements. It has been exhibited

by CA, 2006 that EL needs to make preparation of profit and loss account as well as

balance sheet in an accurate manner (Xia, Fei and Liu, 2015). Moreover, auditing is

compulsory as it represents true and fair profitability and financial position of EL's

accounts. Along with this, there is duty of manager to give approval to such statements

by their sign as it is the director’s obligation. UK Generally Accepted Accounting Principles (GAAP): UK GAAP is regarded as the

guidelines and principles that needs to be kept in mind by EL's while making draft of

essential accounts. This is categorized into accounting rules, regulations, conventions as

well standards that needs to be complied with EL for recording, classifying as well as

summarizing the affairs of business. This is for the sake of reporting each and every

transaction of the organization's accounts and demonstrate true and fair position. International Accounting Standards: The role of IAS is effective in recording transaction

by different firms through application of single set out accounting standards at

international level. Since the time, 41 IAS is required to be issued by IASC for recording

several business transactions within the financial statements.

International financial reporting standards: These are regarded as the global standards

that harmonizes the practices of accounting across the globe. By issuing IFRS all the

international firms are complying with particular set of reporting standards with IFRS. In

the present era of globalization transactions at international level are increasing to a

greater extent. Thus it becomes difficult for the investors to gain insight to all the national

accounting standards. Therefore IFRS makes elimination of such needs through

5

application global as well as higher qualitative standards for the entire firms. This

majorly assist in increasing consistency, comparability and reliability of financial

standards.

Based upon the legal and regulatory requirements discussed above it can be stated that

such assist in representing true and fair profitability as well as financial performance. As such the

different users who are making use of financial information can ensure better decision making. Managers: Within EL manager makes formulation of policies, rules and regulations for

managing business functions for enhancing growth and development. They make analysis

of the financial statements and takes decision for improving the performance of future.

Thus misleading or incorrect information can lead to taking harmful decision and vice

versa. In accordance with legislation EL would record all the revenues as well as

expenses by following several standards and regulation in order to gain knowledge

regarding reliable and accurate amount of profitability (Overton, 2007). Further they

make analysis of the financial strengths by collecting information from SOFP, balance

sheet that is being developed by complying with global standards. It assist the manager in

making collection of prominent information in order to take suitable decisions. For

example, IAS for recognizing financial cost, depreciation, income tax, PPE, current

liabilities, intangible assets that would assist in demonstrating valid data. Employees: Standards for gathering income and expenses acts as an aid in representation

of true profitability thus they can demand for higher salary. In addition to this other

objectives like job security, bonus, incentives and appraisal can also be satisfied. In

relation to international standards as per IAS 16, EL has to make recording of all the

personnel benefits in the statements of financials. Investors: In accordance with the legislation preparation of all the statements as well as

auditing obligations acts as an aid in offering authentic information. Further it assist in

satisfying their need for information. They can make assessment of the accurate

information that relates with profitability, solvency, ability to generate cash as well as

investors return for analyzing relationship between risk and return and take suitable

decisions. IFRS assist the investors in making comparison of organizational performance

at international level and gain their interest in the foreign investment. In addition to this

6

majorly assist in increasing consistency, comparability and reliability of financial

standards.

Based upon the legal and regulatory requirements discussed above it can be stated that

such assist in representing true and fair profitability as well as financial performance. As such the

different users who are making use of financial information can ensure better decision making. Managers: Within EL manager makes formulation of policies, rules and regulations for

managing business functions for enhancing growth and development. They make analysis

of the financial statements and takes decision for improving the performance of future.

Thus misleading or incorrect information can lead to taking harmful decision and vice

versa. In accordance with legislation EL would record all the revenues as well as

expenses by following several standards and regulation in order to gain knowledge

regarding reliable and accurate amount of profitability (Overton, 2007). Further they

make analysis of the financial strengths by collecting information from SOFP, balance

sheet that is being developed by complying with global standards. It assist the manager in

making collection of prominent information in order to take suitable decisions. For

example, IAS for recognizing financial cost, depreciation, income tax, PPE, current

liabilities, intangible assets that would assist in demonstrating valid data. Employees: Standards for gathering income and expenses acts as an aid in representation

of true profitability thus they can demand for higher salary. In addition to this other

objectives like job security, bonus, incentives and appraisal can also be satisfied. In

relation to international standards as per IAS 16, EL has to make recording of all the

personnel benefits in the statements of financials. Investors: In accordance with the legislation preparation of all the statements as well as

auditing obligations acts as an aid in offering authentic information. Further it assist in

satisfying their need for information. They can make assessment of the accurate

information that relates with profitability, solvency, ability to generate cash as well as

investors return for analyzing relationship between risk and return and take suitable

decisions. IFRS assist the investors in making comparison of organizational performance

at international level and gain their interest in the foreign investment. In addition to this

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CA, 2006 has developed provisions for carrying out Annual General Meeting once in

every year and offer greater information regarding generation of rights to the investors. Lenders: They makes analysis of capacity of debt burden by means of determination of

financial risk. Thus they collection information regarding the current debt and equity

level (Pratt, 2010). Further IAS 7 for SOCF plays imperative role for the lenders as they

make determination of cash earning capacity. In addition to this they make assessment of

interest bearing capacity for determining the extent of interest that EL would pay out of

its profit. Therefore accurate information would facilitate the lenders in taking better

decision regarding lending. Suppliers: They make assessment of liquidity position through evaluation of CA and CL.

IAS 2, IAS 13 and IAS 18 is applied for recording stock, CA as well as CL. It assists the

suppliers in evaluating credit worthiness of EL and taking decisions regarding the firm

that would be more suitable and can make payment of credit on time.

Government: The issuance of IAS 12 has been done with respect to income taxes. Further

it imposes legal obligations in order to reflect correct amount of tax liability within their

statement of profitability (Schulze, 2007). Through evaluation of true profitability,

regulatory authority can make computation of firm's tax obligations and impose penalties

in situation of default.

1.4 Ways in which different laws/ regulation are dealt with by accounting and reporting

standards

In accordance with the analysis carried out above it has been gained that in UK, CA 2006

has imposed essential needs for keeping detail as well as updated records relating with historical

trading functions. As per such it is the legal obligations to make preparation of SOCI, SOFP as

well as SOCF. On the other hand auditing facilitates towards testing the fairness of

organizational position which is reported by financial statements. Further holding company has

to make preparation of consolidated statement of financials by taking into account subsidiaries

position.

UK GAAP are the devised national standards that needs to be complied with by all the

UK based firms while recording their business affairs within the accounts. However after

globalization, cross currency transactions has been enhanced in rapid manner. Thus it has

7

every year and offer greater information regarding generation of rights to the investors. Lenders: They makes analysis of capacity of debt burden by means of determination of

financial risk. Thus they collection information regarding the current debt and equity

level (Pratt, 2010). Further IAS 7 for SOCF plays imperative role for the lenders as they

make determination of cash earning capacity. In addition to this they make assessment of

interest bearing capacity for determining the extent of interest that EL would pay out of

its profit. Therefore accurate information would facilitate the lenders in taking better

decision regarding lending. Suppliers: They make assessment of liquidity position through evaluation of CA and CL.

IAS 2, IAS 13 and IAS 18 is applied for recording stock, CA as well as CL. It assists the

suppliers in evaluating credit worthiness of EL and taking decisions regarding the firm

that would be more suitable and can make payment of credit on time.

Government: The issuance of IAS 12 has been done with respect to income taxes. Further

it imposes legal obligations in order to reflect correct amount of tax liability within their

statement of profitability (Schulze, 2007). Through evaluation of true profitability,

regulatory authority can make computation of firm's tax obligations and impose penalties

in situation of default.

1.4 Ways in which different laws/ regulation are dealt with by accounting and reporting

standards

In accordance with the analysis carried out above it has been gained that in UK, CA 2006

has imposed essential needs for keeping detail as well as updated records relating with historical

trading functions. As per such it is the legal obligations to make preparation of SOCI, SOFP as

well as SOCF. On the other hand auditing facilitates towards testing the fairness of

organizational position which is reported by financial statements. Further holding company has

to make preparation of consolidated statement of financials by taking into account subsidiaries

position.

UK GAAP are the devised national standards that needs to be complied with by all the

UK based firms while recording their business affairs within the accounts. However after

globalization, cross currency transactions has been enhanced in rapid manner. Thus it has

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

become complex for the equity investors to make determination and comparison of various

organizational performance (Edwards, 2013). Thus after issuing IAS and IFRS, all the firms are

complying with similar standards as well as principles f or drafting their financial statements.

IFRS effectively offers greater support for enhancing compatibility so that investors can

understand organization's performance in an effective manner and can take suitable decisions

regarding investment.

3.1 Varied information needs of different users group

Several stakeholders need various information from the financial statements in order to

carry out the process of decision making. Group of investors is comprised of both existing and

potential investors who possess the intention to make investment in the business funds in the

future course of time. Therefore they make evaluation of profit margin, ability of generating cash

as well as investors return in relation to appreciation in capital as well as dividend. Growing firm

that offers return on continuous basis to the investors are able to persuade greater number of

investors to the firm. While lenders makes determination of profit, cash inflows, debt bearing

ability, financial risk and solvency position in order to examine that weather the organization

would be able to make payment of interest obligations on time along with repayment of capital

on maturity (Georgiou, 2010). Therefore they lends the firm wherein the funds are secured.

Suppliers makes evaluation of strategies of working capital management in order to gain insight

to credit worthiness. The business that possess adequate of cash funds would be able to take

credit facility with favorable terms. In contrast to this authority of taxation determines profit in

order to compute tax liability as well as make its comparison with tax payment in order to

impose penalties as well as other types of law suits.

On the other hand, managers, personnel as well as owners possess interest in gaining

higher returns. The focus of management and owner is on making evaluation of profitability and

entire financial strength. Essential policy as well as suitable decisions can be taken for enhancing

the potential performance within the financial year.

3.2 Fundamental principles towards preparation of financial statements of different types of

firms and preparing financial statements for EL Ltd.

In accordance with accrual concept, all the types of firms would make recognition of

revenues as well as expenses while making receipts and payments without taking into account

8

organizational performance (Edwards, 2013). Thus after issuing IAS and IFRS, all the firms are

complying with similar standards as well as principles f or drafting their financial statements.

IFRS effectively offers greater support for enhancing compatibility so that investors can

understand organization's performance in an effective manner and can take suitable decisions

regarding investment.

3.1 Varied information needs of different users group

Several stakeholders need various information from the financial statements in order to

carry out the process of decision making. Group of investors is comprised of both existing and

potential investors who possess the intention to make investment in the business funds in the

future course of time. Therefore they make evaluation of profit margin, ability of generating cash

as well as investors return in relation to appreciation in capital as well as dividend. Growing firm

that offers return on continuous basis to the investors are able to persuade greater number of

investors to the firm. While lenders makes determination of profit, cash inflows, debt bearing

ability, financial risk and solvency position in order to examine that weather the organization

would be able to make payment of interest obligations on time along with repayment of capital

on maturity (Georgiou, 2010). Therefore they lends the firm wherein the funds are secured.

Suppliers makes evaluation of strategies of working capital management in order to gain insight

to credit worthiness. The business that possess adequate of cash funds would be able to take

credit facility with favorable terms. In contrast to this authority of taxation determines profit in

order to compute tax liability as well as make its comparison with tax payment in order to

impose penalties as well as other types of law suits.

On the other hand, managers, personnel as well as owners possess interest in gaining

higher returns. The focus of management and owner is on making evaluation of profitability and

entire financial strength. Essential policy as well as suitable decisions can be taken for enhancing

the potential performance within the financial year.

3.2 Fundamental principles towards preparation of financial statements of different types of

firms and preparing financial statements for EL Ltd.

In accordance with accrual concept, all the types of firms would make recognition of

revenues as well as expenses while making receipts and payments without taking into account

8

their cash impacts. It has been assumed by going concern concept that firm would run for longer

duration of time. The concept of business entity demonstrates that owner of firm is separate from

his organization (Introduction to Accounting, 2010). Thus any withdrawal made by the owner

would be considered as drawing. The principal of materiality reflects that all the information

needs to be recorded. On the other hand the money measurement concept reflects that

transactions that are quantitative in nature that can be measured in monetary terms would be

reported. The principle of consistency demonstrate that principle of accounting would be

complied with for preparation of financial statements for varied period. However duality

principle demonstrate that each transactions would be recorded under both credit and debit side

that is referred to as double entry system.

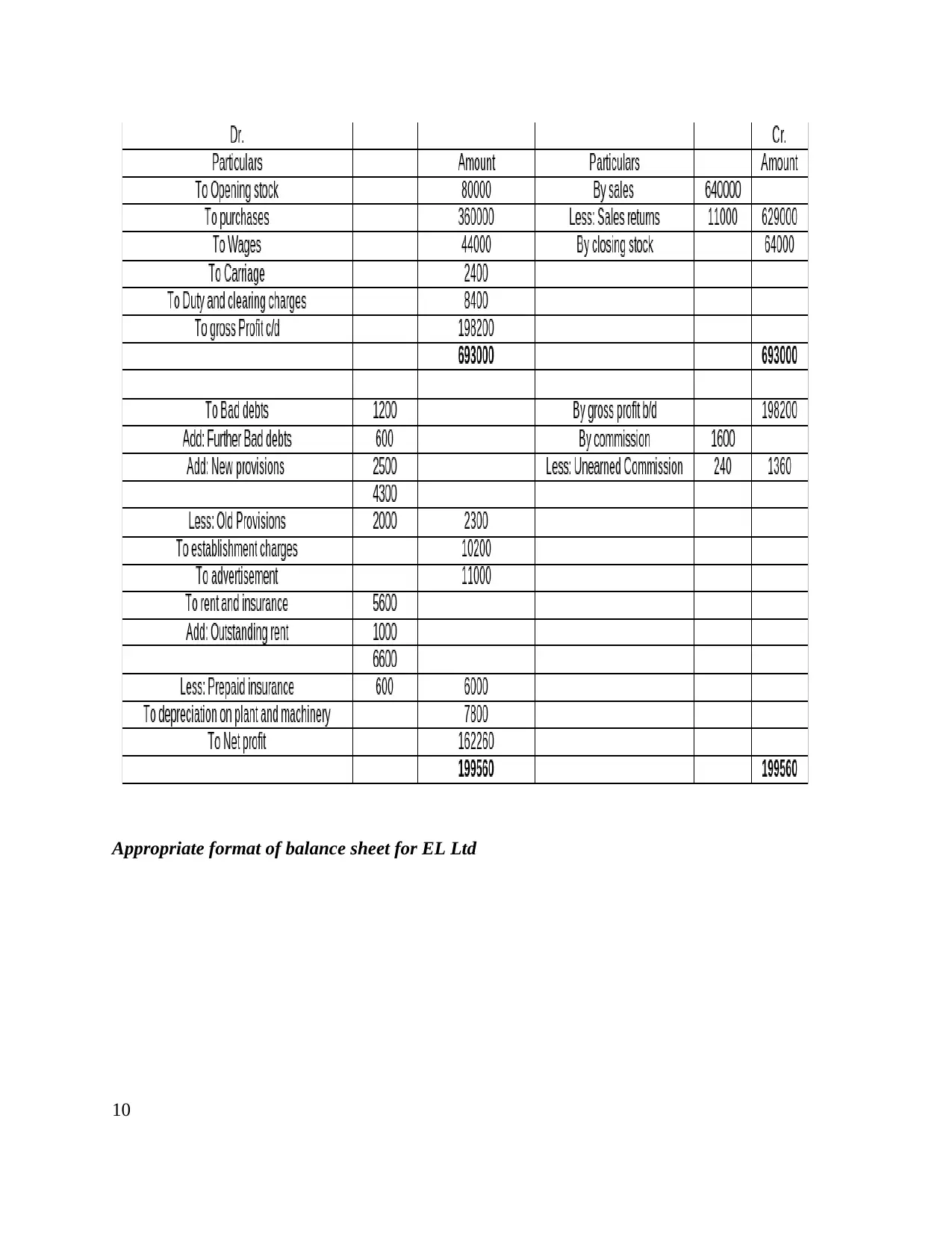

Appropriate format of profitability statements for EL Ltd,

9

duration of time. The concept of business entity demonstrates that owner of firm is separate from

his organization (Introduction to Accounting, 2010). Thus any withdrawal made by the owner

would be considered as drawing. The principal of materiality reflects that all the information

needs to be recorded. On the other hand the money measurement concept reflects that

transactions that are quantitative in nature that can be measured in monetary terms would be

reported. The principle of consistency demonstrate that principle of accounting would be

complied with for preparation of financial statements for varied period. However duality

principle demonstrate that each transactions would be recorded under both credit and debit side

that is referred to as double entry system.

Appropriate format of profitability statements for EL Ltd,

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

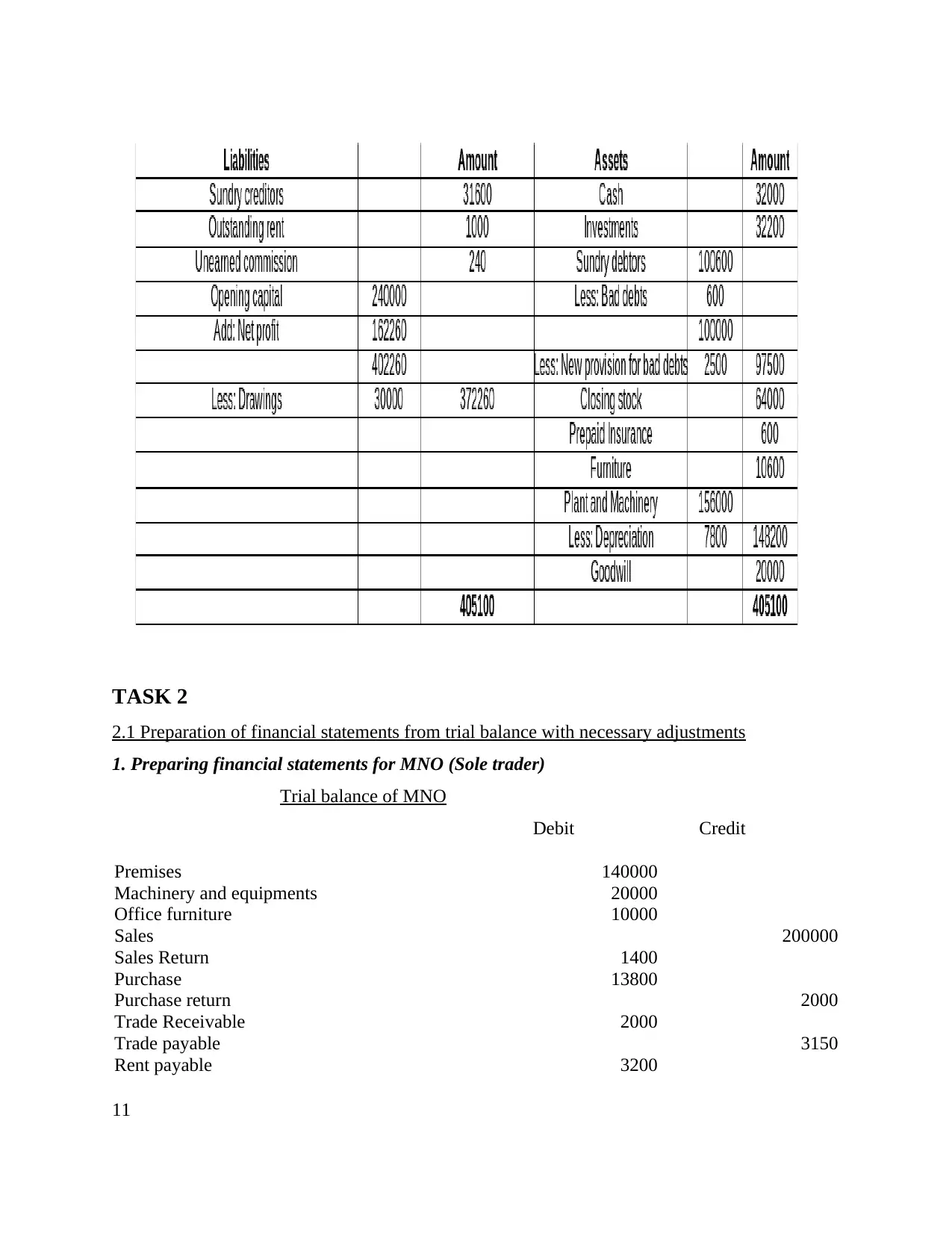

Appropriate format of balance sheet for EL Ltd

10

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

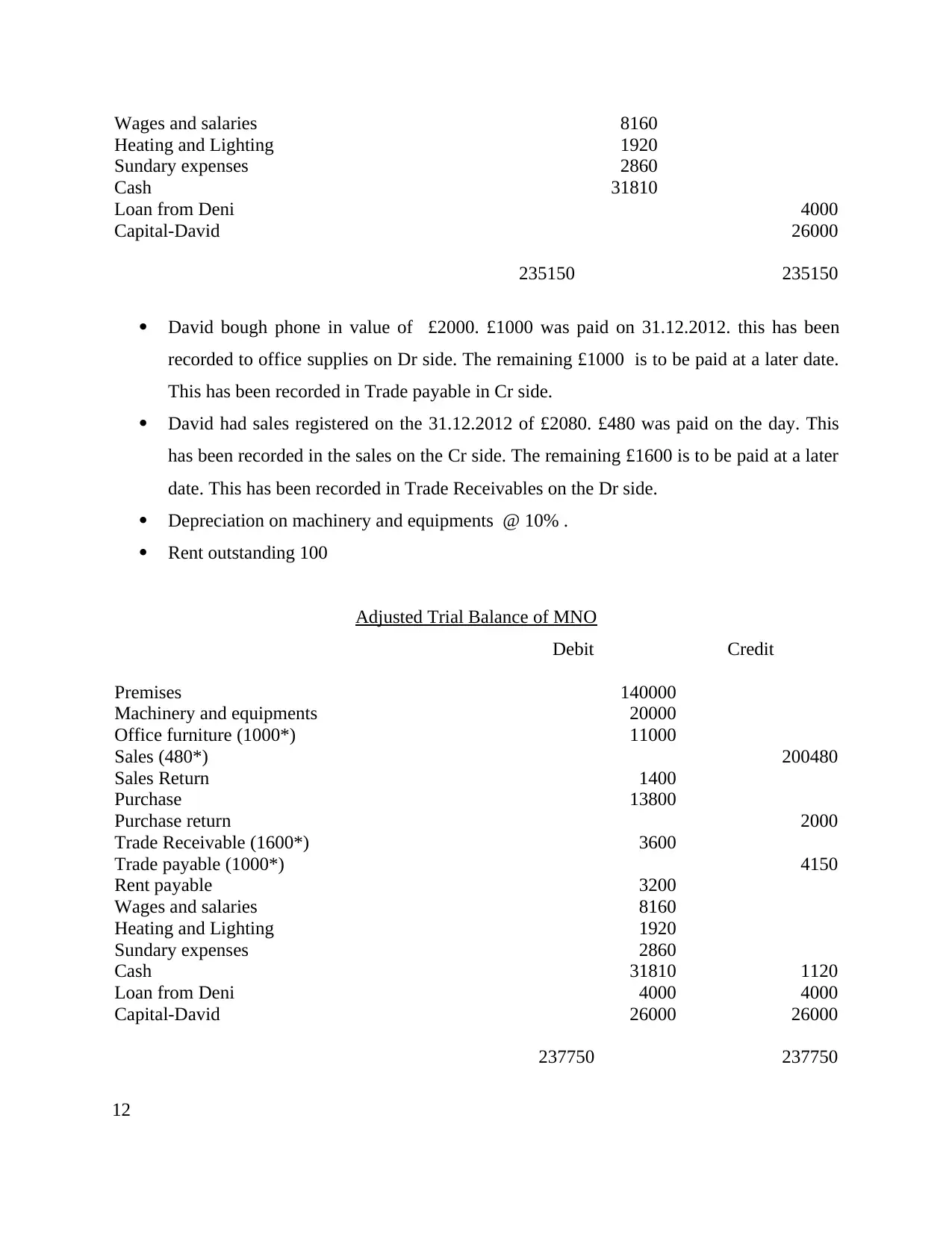

TASK 2

2.1 Preparation of financial statements from trial balance with necessary adjustments

1. Preparing financial statements for MNO (Sole trader)

Trial balance of MNO

Debit Credit

Premises 140000

Machinery and equipments 20000

Office furniture 10000

Sales 200000

Sales Return 1400

Purchase 13800

Purchase return 2000

Trade Receivable 2000

Trade payable 3150

Rent payable 3200

11

2.1 Preparation of financial statements from trial balance with necessary adjustments

1. Preparing financial statements for MNO (Sole trader)

Trial balance of MNO

Debit Credit

Premises 140000

Machinery and equipments 20000

Office furniture 10000

Sales 200000

Sales Return 1400

Purchase 13800

Purchase return 2000

Trade Receivable 2000

Trade payable 3150

Rent payable 3200

11

Wages and salaries 8160

Heating and Lighting 1920

Sundary expenses 2860

Cash 31810

Loan from Deni 4000

Capital-David 26000

235150 235150

David bough phone in value of £2000. £1000 was paid on 31.12.2012. this has been

recorded to office supplies on Dr side. The remaining £1000 is to be paid at a later date.

This has been recorded in Trade payable in Cr side.

David had sales registered on the 31.12.2012 of £2080. £480 was paid on the day. This

has been recorded in the sales on the Cr side. The remaining £1600 is to be paid at a later

date. This has been recorded in Trade Receivables on the Dr side.

Depreciation on machinery and equipments @ 10% .

Rent outstanding 100

Adjusted Trial Balance of MNO

Debit Credit

Premises 140000

Machinery and equipments 20000

Office furniture (1000*) 11000

Sales (480*) 200480

Sales Return 1400

Purchase 13800

Purchase return 2000

Trade Receivable (1600*) 3600

Trade payable (1000*) 4150

Rent payable 3200

Wages and salaries 8160

Heating and Lighting 1920

Sundary expenses 2860

Cash 31810 1120

Loan from Deni 4000 4000

Capital-David 26000 26000

237750 237750

12

Heating and Lighting 1920

Sundary expenses 2860

Cash 31810

Loan from Deni 4000

Capital-David 26000

235150 235150

David bough phone in value of £2000. £1000 was paid on 31.12.2012. this has been

recorded to office supplies on Dr side. The remaining £1000 is to be paid at a later date.

This has been recorded in Trade payable in Cr side.

David had sales registered on the 31.12.2012 of £2080. £480 was paid on the day. This

has been recorded in the sales on the Cr side. The remaining £1600 is to be paid at a later

date. This has been recorded in Trade Receivables on the Dr side.

Depreciation on machinery and equipments @ 10% .

Rent outstanding 100

Adjusted Trial Balance of MNO

Debit Credit

Premises 140000

Machinery and equipments 20000

Office furniture (1000*) 11000

Sales (480*) 200480

Sales Return 1400

Purchase 13800

Purchase return 2000

Trade Receivable (1600*) 3600

Trade payable (1000*) 4150

Rent payable 3200

Wages and salaries 8160

Heating and Lighting 1920

Sundary expenses 2860

Cash 31810 1120

Loan from Deni 4000 4000

Capital-David 26000 26000

237750 237750

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.