Financial Accounting Homework - Depreciation, Assets, and Receivables

VerifiedAdded on 2022/12/27

|5

|617

|41

Homework Assignment

AI Summary

This document presents a detailed solution to a financial accounting homework assignment, covering several key areas. The solution includes calculations for depreciation on buildings, plant and machinery, and lorries, along with the profit or loss on the disposal of assets. It also explains the concept of non-current assets, their classification (property, plant, equipment, and goodwill), and the adjustments involved in their valuation. Furthermore, the assignment addresses the calculation of allowance for irrecoverable receivables, providing a step-by-step breakdown of the process. This resource from Desklib offers students a comprehensive understanding of these critical accounting principles.

Financial accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

A).....................................................................................................................................................1

B).....................................................................................................................................................1

C).....................................................................................................................................................2

Contents...........................................................................................................................................2

A).....................................................................................................................................................1

B).....................................................................................................................................................1

C).....................................................................................................................................................2

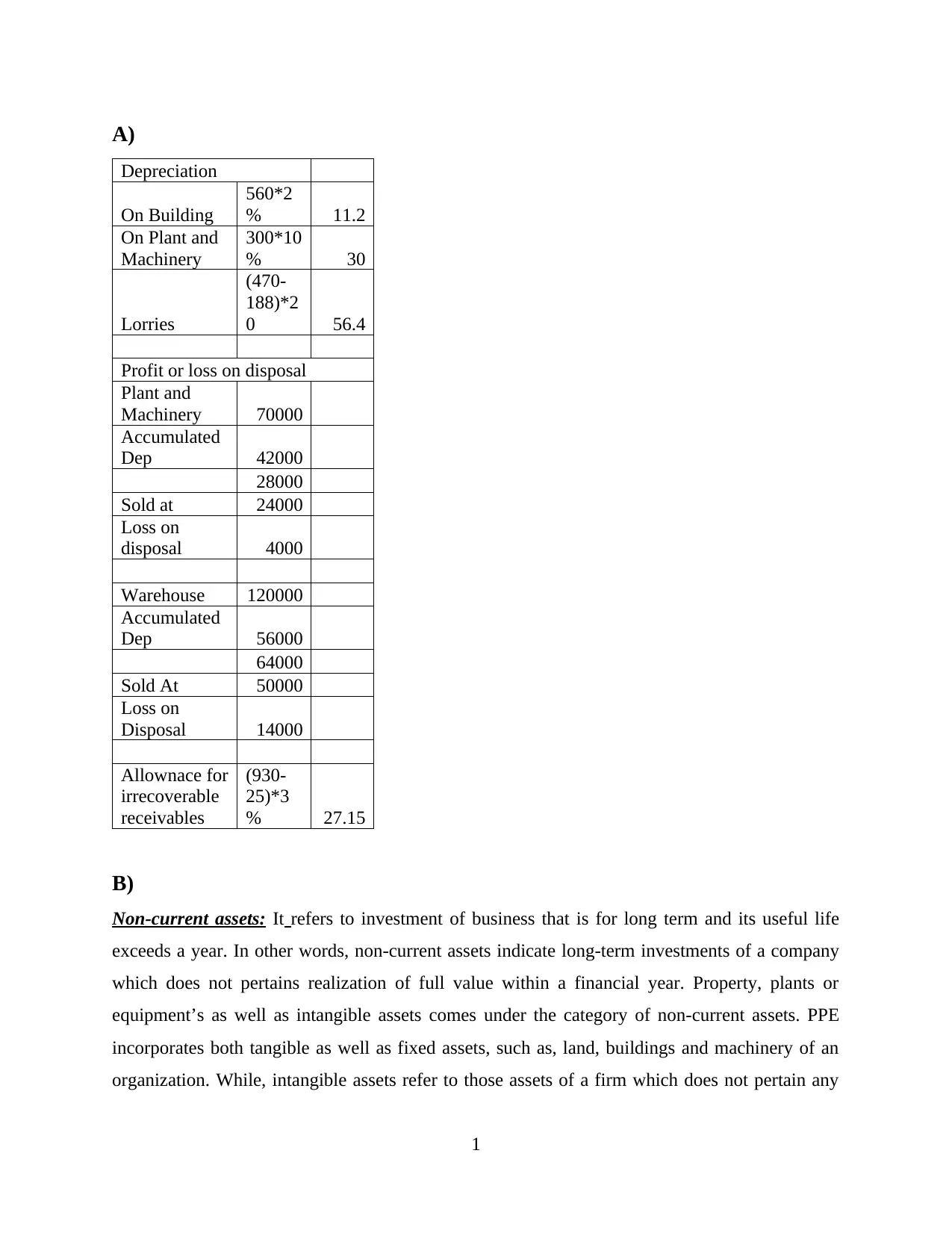

A)

Depreciation

On Building

560*2

% 11.2

On Plant and

Machinery

300*10

% 30

Lorries

(470-

188)*2

0 56.4

Profit or loss on disposal

Plant and

Machinery 70000

Accumulated

Dep 42000

28000

Sold at 24000

Loss on

disposal 4000

Warehouse 120000

Accumulated

Dep 56000

64000

Sold At 50000

Loss on

Disposal 14000

Allownace for

irrecoverable

receivables

(930-

25)*3

% 27.15

B)

Non-current assets: It refers to investment of business that is for long term and its useful life

exceeds a year. In other words, non-current assets indicate long-term investments of a company

which does not pertains realization of full value within a financial year. Property, plants or

equipment’s as well as intangible assets comes under the category of non-current assets. PPE

incorporates both tangible as well as fixed assets, such as, land, buildings and machinery of an

organization. While, intangible assets refer to those assets of a firm which does not pertain any

1

Depreciation

On Building

560*2

% 11.2

On Plant and

Machinery

300*10

% 30

Lorries

(470-

188)*2

0 56.4

Profit or loss on disposal

Plant and

Machinery 70000

Accumulated

Dep 42000

28000

Sold at 24000

Loss on

disposal 4000

Warehouse 120000

Accumulated

Dep 56000

64000

Sold At 50000

Loss on

Disposal 14000

Allownace for

irrecoverable

receivables

(930-

25)*3

% 27.15

B)

Non-current assets: It refers to investment of business that is for long term and its useful life

exceeds a year. In other words, non-current assets indicate long-term investments of a company

which does not pertains realization of full value within a financial year. Property, plants or

equipment’s as well as intangible assets comes under the category of non-current assets. PPE

incorporates both tangible as well as fixed assets, such as, land, buildings and machinery of an

organization. While, intangible assets refer to those assets of a firm which does not pertain any

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

physical appearance. Such assets are evaluated as a non-current asset because intangible assets

cannot be liquidated in the form of cash within a year. It involves patents, trademarks and

copyright of an enterprise. While considering tax implications of non-current assets it can be

noted that, selling of such assets leads to capital gains, hence, tax of capital gain is applied.

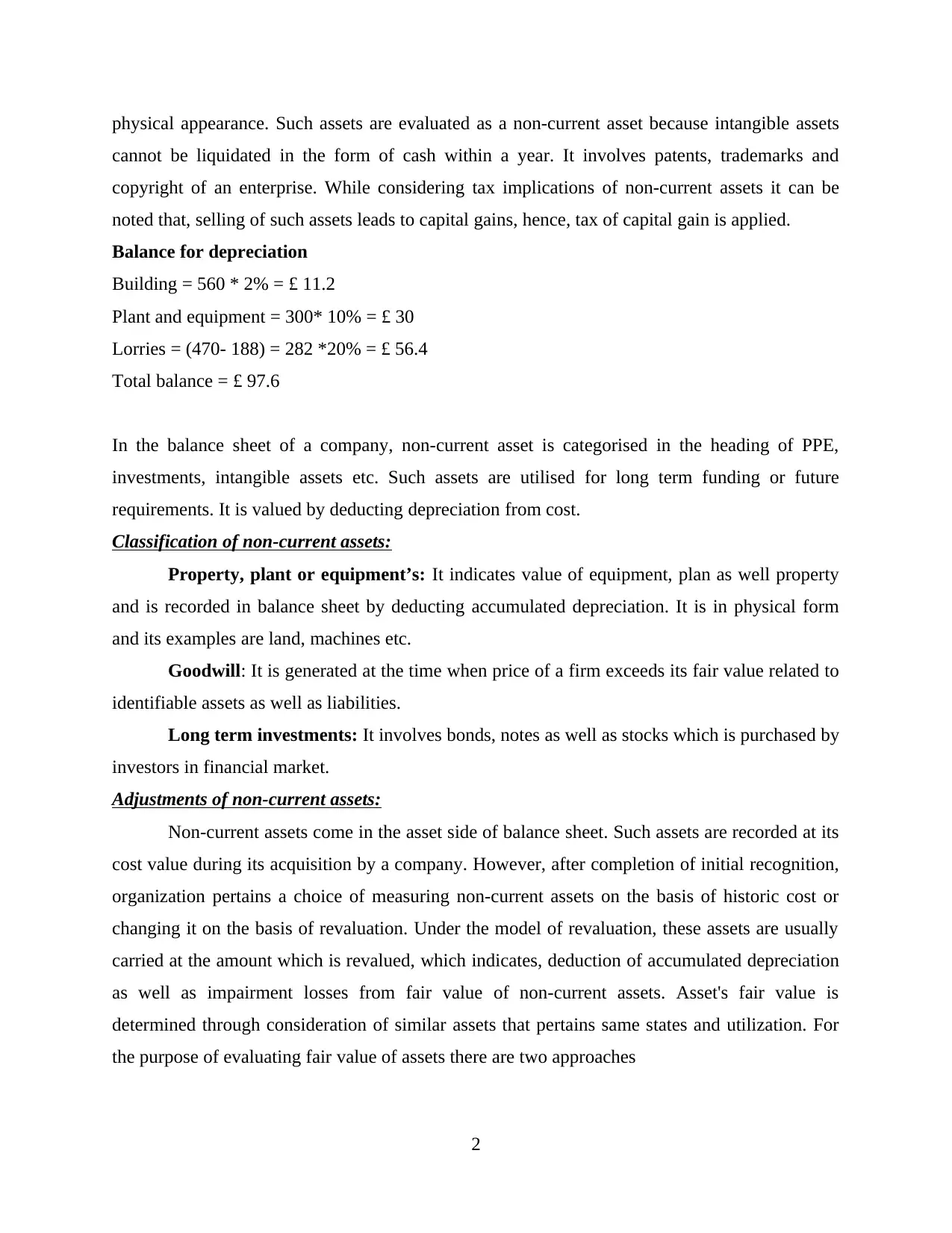

Balance for depreciation

Building = 560 * 2% = £ 11.2

Plant and equipment = 300* 10% = £ 30

Lorries = (470- 188) = 282 *20% = £ 56.4

Total balance = £ 97.6

In the balance sheet of a company, non-current asset is categorised in the heading of PPE,

investments, intangible assets etc. Such assets are utilised for long term funding or future

requirements. It is valued by deducting depreciation from cost.

Classification of non-current assets:

Property, plant or equipment’s: It indicates value of equipment, plan as well property

and is recorded in balance sheet by deducting accumulated depreciation. It is in physical form

and its examples are land, machines etc.

Goodwill: It is generated at the time when price of a firm exceeds its fair value related to

identifiable assets as well as liabilities.

Long term investments: It involves bonds, notes as well as stocks which is purchased by

investors in financial market.

Adjustments of non-current assets:

Non-current assets come in the asset side of balance sheet. Such assets are recorded at its

cost value during its acquisition by a company. However, after completion of initial recognition,

organization pertains a choice of measuring non-current assets on the basis of historic cost or

changing it on the basis of revaluation. Under the model of revaluation, these assets are usually

carried at the amount which is revalued, which indicates, deduction of accumulated depreciation

as well as impairment losses from fair value of non-current assets. Asset's fair value is

determined through consideration of similar assets that pertains same states and utilization. For

the purpose of evaluating fair value of assets there are two approaches

2

cannot be liquidated in the form of cash within a year. It involves patents, trademarks and

copyright of an enterprise. While considering tax implications of non-current assets it can be

noted that, selling of such assets leads to capital gains, hence, tax of capital gain is applied.

Balance for depreciation

Building = 560 * 2% = £ 11.2

Plant and equipment = 300* 10% = £ 30

Lorries = (470- 188) = 282 *20% = £ 56.4

Total balance = £ 97.6

In the balance sheet of a company, non-current asset is categorised in the heading of PPE,

investments, intangible assets etc. Such assets are utilised for long term funding or future

requirements. It is valued by deducting depreciation from cost.

Classification of non-current assets:

Property, plant or equipment’s: It indicates value of equipment, plan as well property

and is recorded in balance sheet by deducting accumulated depreciation. It is in physical form

and its examples are land, machines etc.

Goodwill: It is generated at the time when price of a firm exceeds its fair value related to

identifiable assets as well as liabilities.

Long term investments: It involves bonds, notes as well as stocks which is purchased by

investors in financial market.

Adjustments of non-current assets:

Non-current assets come in the asset side of balance sheet. Such assets are recorded at its

cost value during its acquisition by a company. However, after completion of initial recognition,

organization pertains a choice of measuring non-current assets on the basis of historic cost or

changing it on the basis of revaluation. Under the model of revaluation, these assets are usually

carried at the amount which is revalued, which indicates, deduction of accumulated depreciation

as well as impairment losses from fair value of non-current assets. Asset's fair value is

determined through consideration of similar assets that pertains same states and utilization. For

the purpose of evaluating fair value of assets there are two approaches

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

C)

Opening balance of receivables = £ 930

Allowance for irrecoverable receivables = £ (25)

930-250 = £ 905

Percentage for irrecoverable receivables = 3%

905*3/100= 27.15

905-27.15= £ 875.85

3

Opening balance of receivables = £ 930

Allowance for irrecoverable receivables = £ (25)

930-250 = £ 905

Percentage for irrecoverable receivables = 3%

905*3/100= 27.15

905-27.15= £ 875.85

3

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.