University Financial Accounting: Consolidated Balance Sheet Analysis

VerifiedAdded on 2022/08/25

|8

|898

|24

Homework Assignment

AI Summary

This assignment provides a comprehensive solution to advanced financial accounting problems, specifically focusing on the preparation of consolidated financial statements. The solution addresses three key questions: The first question involves preparing a consolidated statement of financial position using both the identifiable net assets method and the fair value entity method, demonstrating the calculation of goodwill and non-controlling interest. The second question requires the preparation of a consolidated balance sheet, incorporating fair value adjustments for various assets and liabilities, and calculating goodwill. The third question analyzes an acquisition scenario, including the calculation of equity attributable to the acquiring company, amortization schedules, and impairment of goodwill. The assignment covers key concepts such as consolidation methods, fair value adjustments, goodwill calculations, non-controlling interest, and balance sheet preparation.

Running head: ADVANCED FINANCIAL ACCOUNTING

Advanced Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Advanced Financial Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ADVANCED FINANCIAL ACCOUNTING

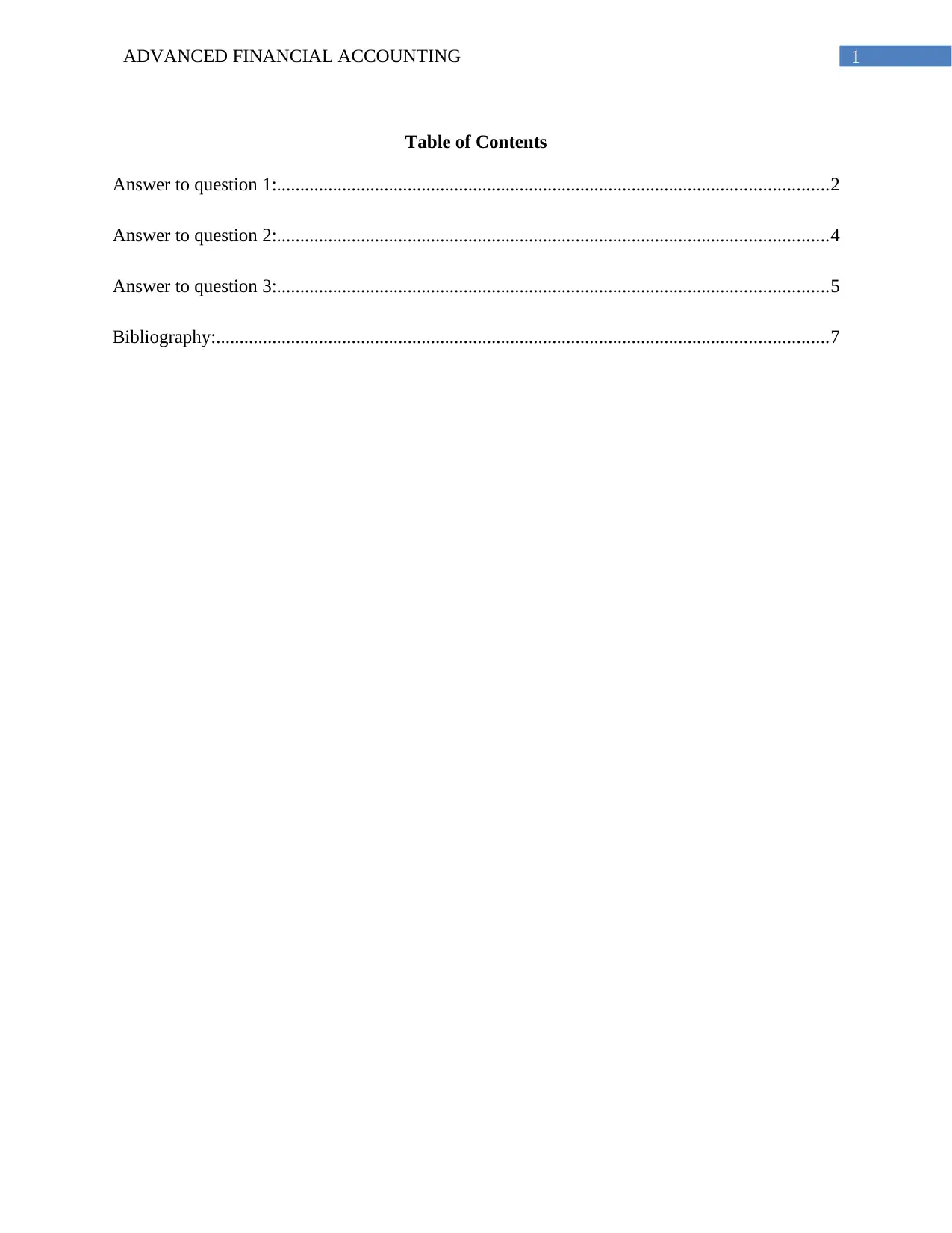

Table of Contents

Answer to question 1:......................................................................................................................2

Answer to question 2:......................................................................................................................4

Answer to question 3:......................................................................................................................5

Bibliography:...................................................................................................................................7

Table of Contents

Answer to question 1:......................................................................................................................2

Answer to question 2:......................................................................................................................4

Answer to question 3:......................................................................................................................5

Bibliography:...................................................................................................................................7

2ADVANCED FINANCIAL ACCOUNTING

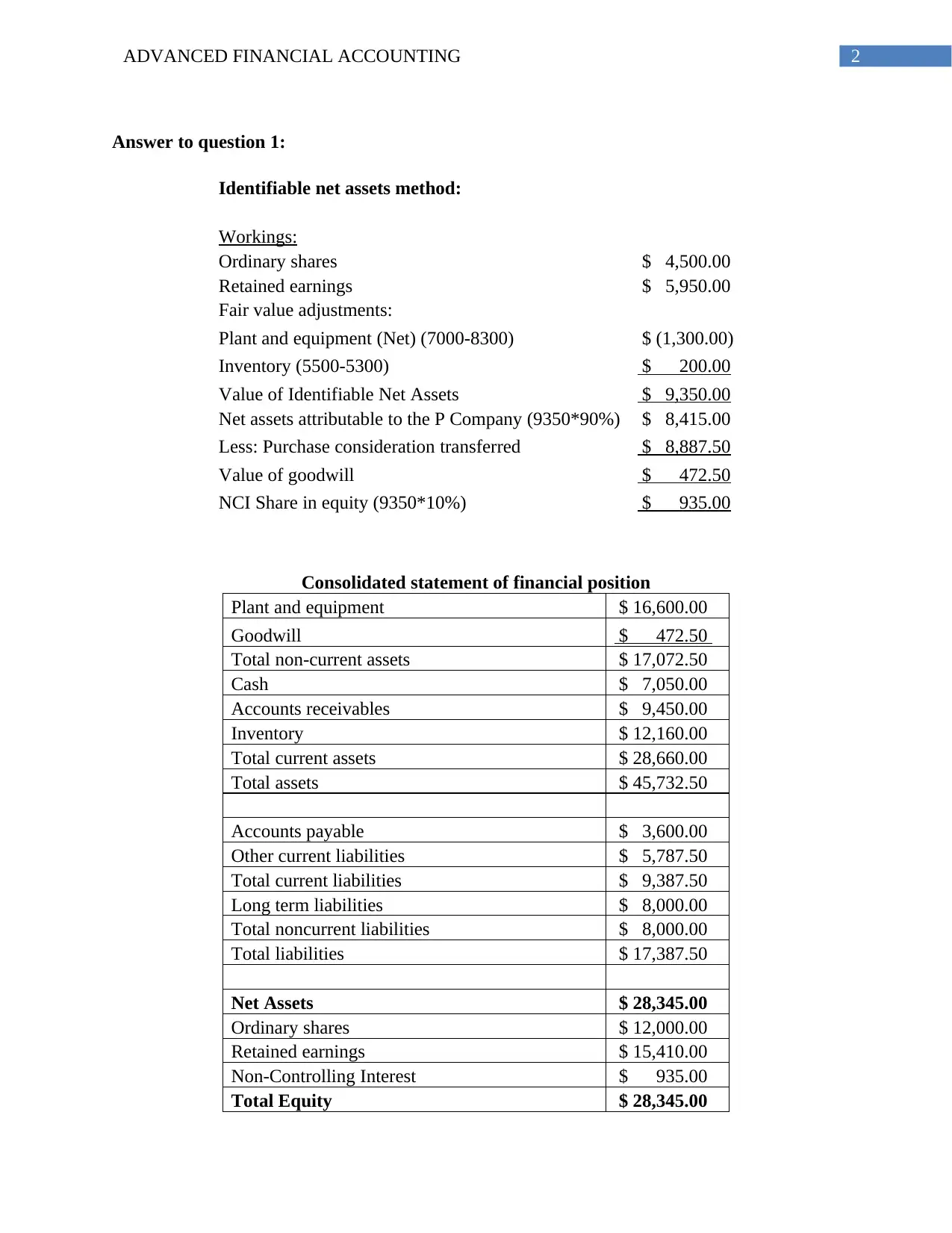

Answer to question 1:

Identifiable net assets method:

Workings:

Ordinary shares $ 4,500.00

Retained earnings $ 5,950.00

Fair value adjustments:

Plant and equipment (Net) (7000-8300) $ (1,300.00)

Inventory (5500-5300) $ 200.00

Value of Identifiable Net Assets $ 9,350.00

Net assets attributable to the P Company (9350*90%) $ 8,415.00

Less: Purchase consideration transferred $ 8,887.50

Value of goodwill $ 472.50

NCI Share in equity (9350*10%) $ 935.00

Consolidated statement of financial position

Plant and equipment $ 16,600.00

Goodwill $ 472.50

Total non-current assets $ 17,072.50

Cash $ 7,050.00

Accounts receivables $ 9,450.00

Inventory $ 12,160.00

Total current assets $ 28,660.00

Total assets $ 45,732.50

Accounts payable $ 3,600.00

Other current liabilities $ 5,787.50

Total current liabilities $ 9,387.50

Long term liabilities $ 8,000.00

Total noncurrent liabilities $ 8,000.00

Total liabilities $ 17,387.50

Net Assets $ 28,345.00

Ordinary shares $ 12,000.00

Retained earnings $ 15,410.00

Non-Controlling Interest $ 935.00

Total Equity $ 28,345.00

Answer to question 1:

Identifiable net assets method:

Workings:

Ordinary shares $ 4,500.00

Retained earnings $ 5,950.00

Fair value adjustments:

Plant and equipment (Net) (7000-8300) $ (1,300.00)

Inventory (5500-5300) $ 200.00

Value of Identifiable Net Assets $ 9,350.00

Net assets attributable to the P Company (9350*90%) $ 8,415.00

Less: Purchase consideration transferred $ 8,887.50

Value of goodwill $ 472.50

NCI Share in equity (9350*10%) $ 935.00

Consolidated statement of financial position

Plant and equipment $ 16,600.00

Goodwill $ 472.50

Total non-current assets $ 17,072.50

Cash $ 7,050.00

Accounts receivables $ 9,450.00

Inventory $ 12,160.00

Total current assets $ 28,660.00

Total assets $ 45,732.50

Accounts payable $ 3,600.00

Other current liabilities $ 5,787.50

Total current liabilities $ 9,387.50

Long term liabilities $ 8,000.00

Total noncurrent liabilities $ 8,000.00

Total liabilities $ 17,387.50

Net Assets $ 28,345.00

Ordinary shares $ 12,000.00

Retained earnings $ 15,410.00

Non-Controlling Interest $ 935.00

Total Equity $ 28,345.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ADVANCED FINANCIAL ACCOUNTING

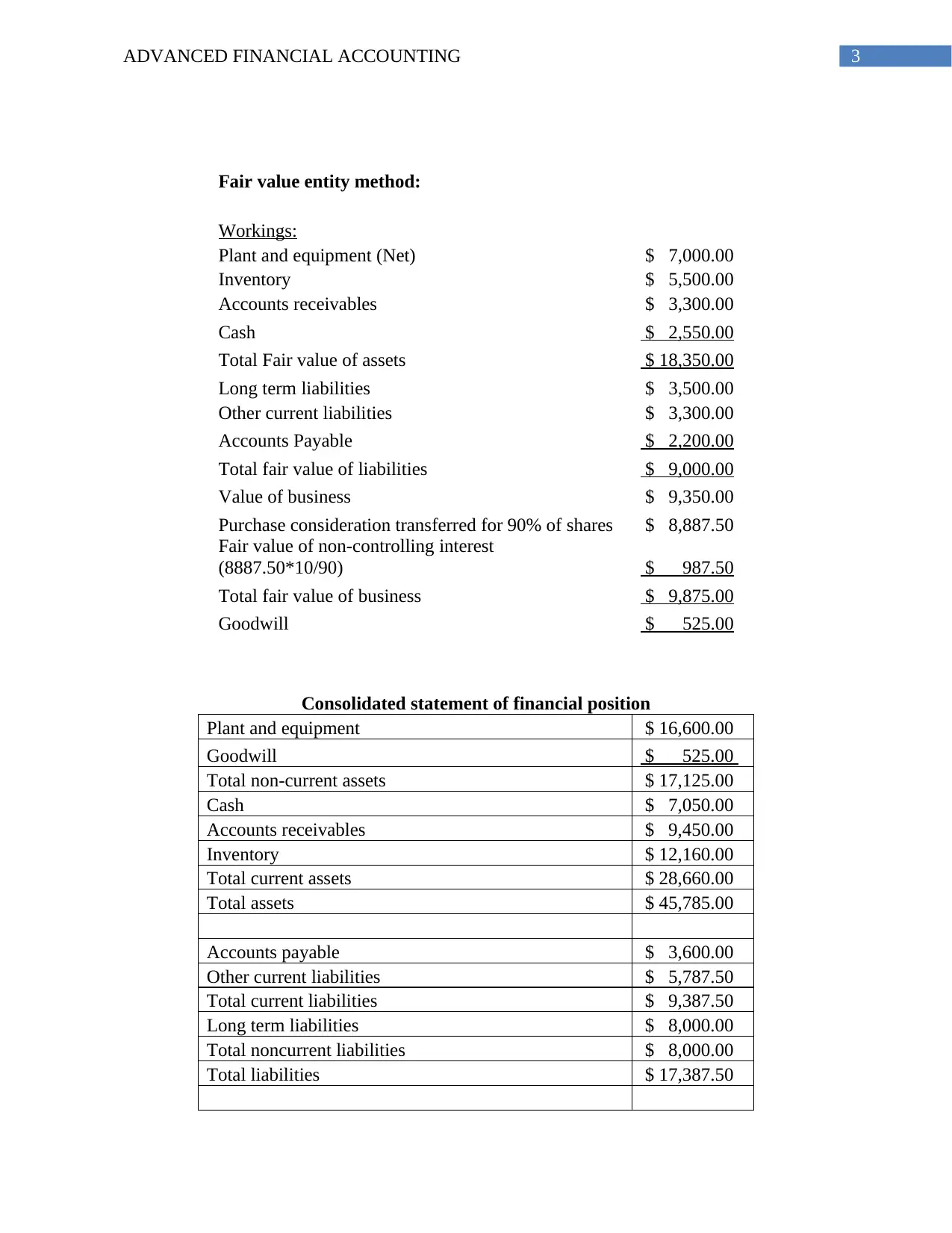

Fair value entity method:

Workings:

Plant and equipment (Net) $ 7,000.00

Inventory $ 5,500.00

Accounts receivables $ 3,300.00

Cash $ 2,550.00

Total Fair value of assets $ 18,350.00

Long term liabilities $ 3,500.00

Other current liabilities $ 3,300.00

Accounts Payable $ 2,200.00

Total fair value of liabilities $ 9,000.00

Value of business $ 9,350.00

Purchase consideration transferred for 90% of shares $ 8,887.50

Fair value of non-controlling interest

(8887.50*10/90) $ 987.50

Total fair value of business $ 9,875.00

Goodwill $ 525.00

Consolidated statement of financial position

Plant and equipment $ 16,600.00

Goodwill $ 525.00

Total non-current assets $ 17,125.00

Cash $ 7,050.00

Accounts receivables $ 9,450.00

Inventory $ 12,160.00

Total current assets $ 28,660.00

Total assets $ 45,785.00

Accounts payable $ 3,600.00

Other current liabilities $ 5,787.50

Total current liabilities $ 9,387.50

Long term liabilities $ 8,000.00

Total noncurrent liabilities $ 8,000.00

Total liabilities $ 17,387.50

Fair value entity method:

Workings:

Plant and equipment (Net) $ 7,000.00

Inventory $ 5,500.00

Accounts receivables $ 3,300.00

Cash $ 2,550.00

Total Fair value of assets $ 18,350.00

Long term liabilities $ 3,500.00

Other current liabilities $ 3,300.00

Accounts Payable $ 2,200.00

Total fair value of liabilities $ 9,000.00

Value of business $ 9,350.00

Purchase consideration transferred for 90% of shares $ 8,887.50

Fair value of non-controlling interest

(8887.50*10/90) $ 987.50

Total fair value of business $ 9,875.00

Goodwill $ 525.00

Consolidated statement of financial position

Plant and equipment $ 16,600.00

Goodwill $ 525.00

Total non-current assets $ 17,125.00

Cash $ 7,050.00

Accounts receivables $ 9,450.00

Inventory $ 12,160.00

Total current assets $ 28,660.00

Total assets $ 45,785.00

Accounts payable $ 3,600.00

Other current liabilities $ 5,787.50

Total current liabilities $ 9,387.50

Long term liabilities $ 8,000.00

Total noncurrent liabilities $ 8,000.00

Total liabilities $ 17,387.50

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ADVANCED FINANCIAL ACCOUNTING

Net Assets $ 28,397.50

Ordinary shares $ 12,000.00

Retained earnings $ 15,410.00

Non-Controlling Interest $ 987.50

Total Equity $ 28,397.50

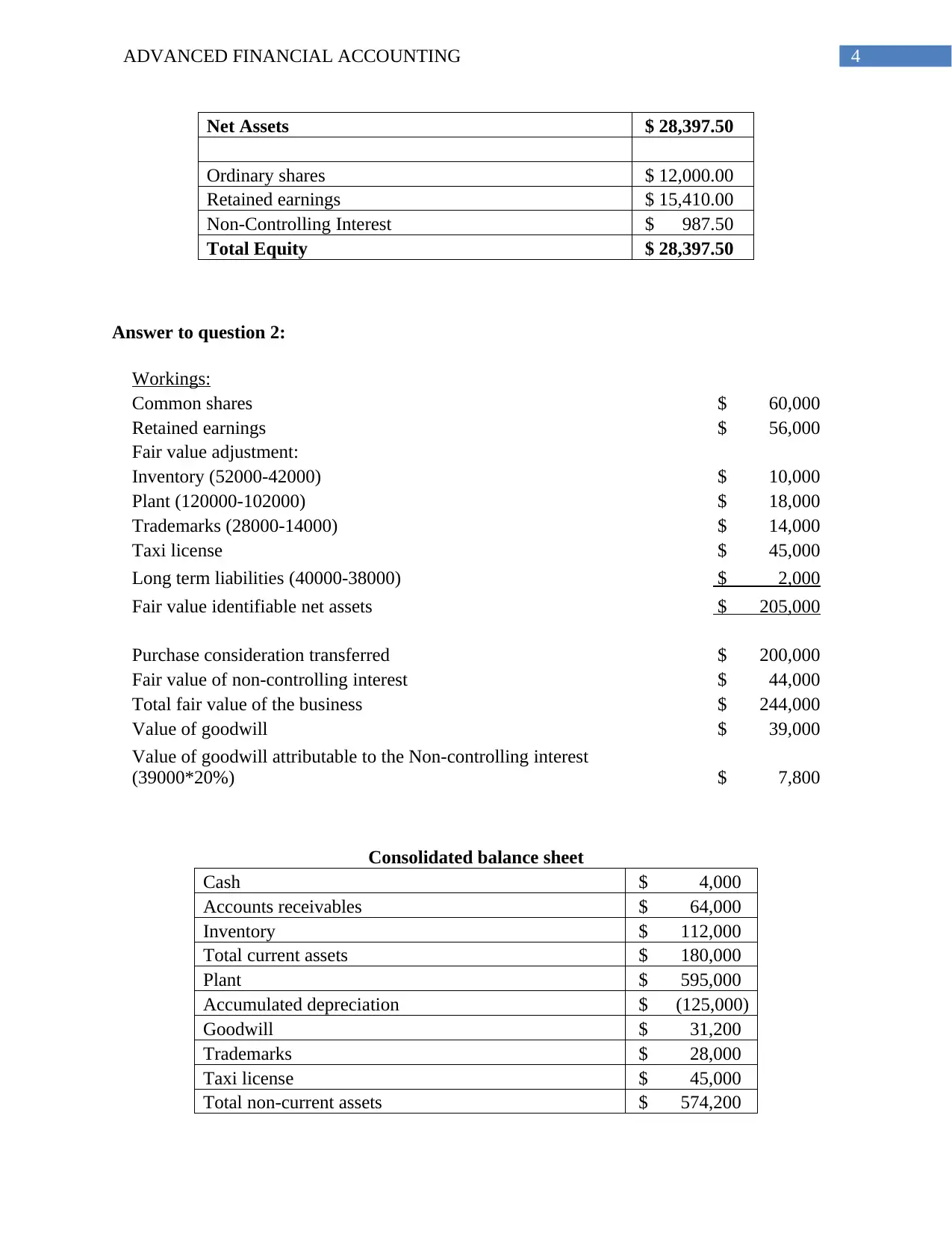

Answer to question 2:

Workings:

Common shares $ 60,000

Retained earnings $ 56,000

Fair value adjustment:

Inventory (52000-42000) $ 10,000

Plant (120000-102000) $ 18,000

Trademarks (28000-14000) $ 14,000

Taxi license $ 45,000

Long term liabilities (40000-38000) $ 2,000

Fair value identifiable net assets $ 205,000

Purchase consideration transferred $ 200,000

Fair value of non-controlling interest $ 44,000

Total fair value of the business $ 244,000

Value of goodwill $ 39,000

Value of goodwill attributable to the Non-controlling interest

(39000*20%) $ 7,800

Consolidated balance sheet

Cash $ 4,000

Accounts receivables $ 64,000

Inventory $ 112,000

Total current assets $ 180,000

Plant $ 595,000

Accumulated depreciation $ (125,000)

Goodwill $ 31,200

Trademarks $ 28,000

Taxi license $ 45,000

Total non-current assets $ 574,200

Net Assets $ 28,397.50

Ordinary shares $ 12,000.00

Retained earnings $ 15,410.00

Non-Controlling Interest $ 987.50

Total Equity $ 28,397.50

Answer to question 2:

Workings:

Common shares $ 60,000

Retained earnings $ 56,000

Fair value adjustment:

Inventory (52000-42000) $ 10,000

Plant (120000-102000) $ 18,000

Trademarks (28000-14000) $ 14,000

Taxi license $ 45,000

Long term liabilities (40000-38000) $ 2,000

Fair value identifiable net assets $ 205,000

Purchase consideration transferred $ 200,000

Fair value of non-controlling interest $ 44,000

Total fair value of the business $ 244,000

Value of goodwill $ 39,000

Value of goodwill attributable to the Non-controlling interest

(39000*20%) $ 7,800

Consolidated balance sheet

Cash $ 4,000

Accounts receivables $ 64,000

Inventory $ 112,000

Total current assets $ 180,000

Plant $ 595,000

Accumulated depreciation $ (125,000)

Goodwill $ 31,200

Trademarks $ 28,000

Taxi license $ 45,000

Total non-current assets $ 574,200

5ADVANCED FINANCIAL ACCOUNTING

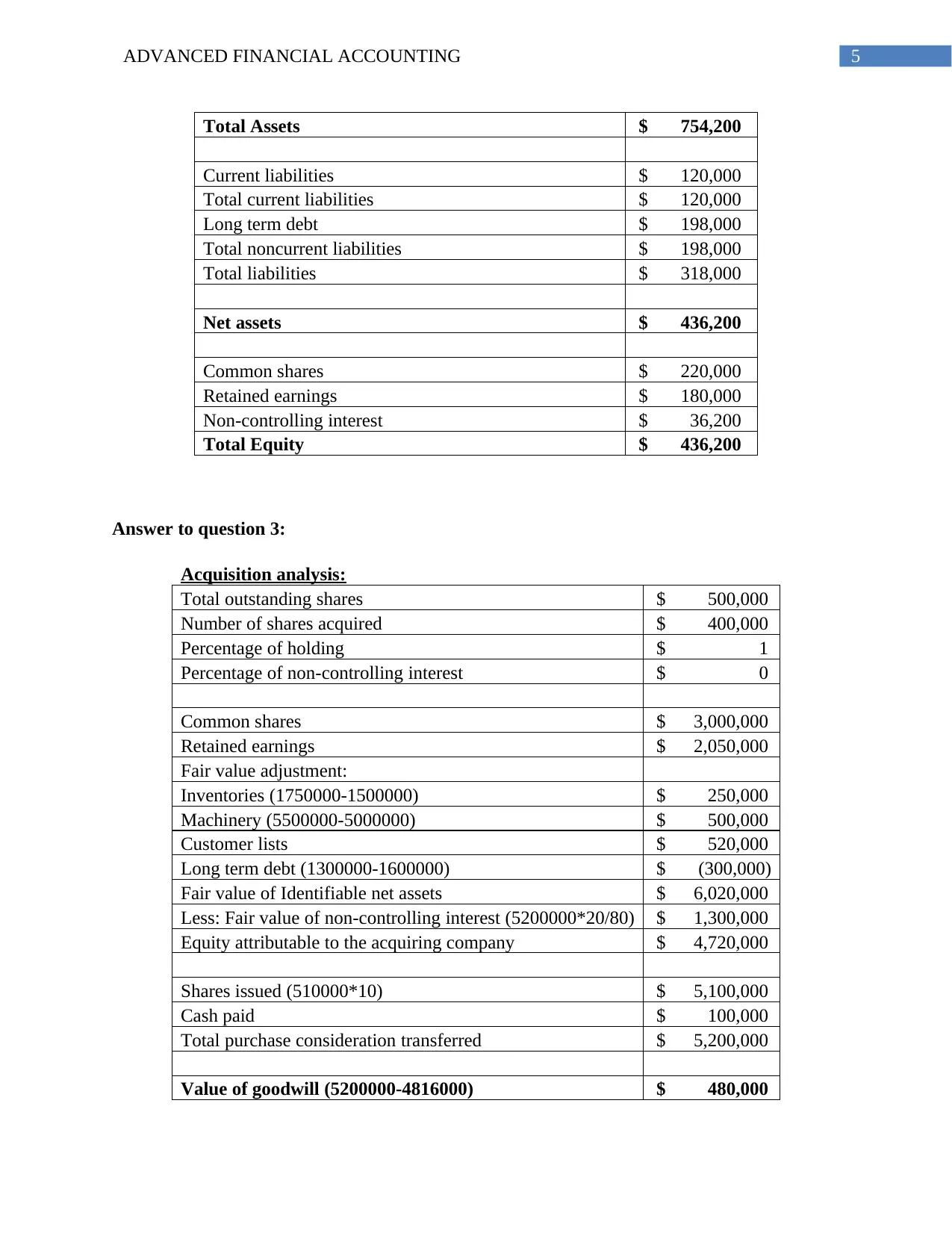

Total Assets $ 754,200

Current liabilities $ 120,000

Total current liabilities $ 120,000

Long term debt $ 198,000

Total noncurrent liabilities $ 198,000

Total liabilities $ 318,000

Net assets $ 436,200

Common shares $ 220,000

Retained earnings $ 180,000

Non-controlling interest $ 36,200

Total Equity $ 436,200

Answer to question 3:

Acquisition analysis:

Total outstanding shares $ 500,000

Number of shares acquired $ 400,000

Percentage of holding $ 1

Percentage of non-controlling interest $ 0

Common shares $ 3,000,000

Retained earnings $ 2,050,000

Fair value adjustment:

Inventories (1750000-1500000) $ 250,000

Machinery (5500000-5000000) $ 500,000

Customer lists $ 520,000

Long term debt (1300000-1600000) $ (300,000)

Fair value of Identifiable net assets $ 6,020,000

Less: Fair value of non-controlling interest (5200000*20/80) $ 1,300,000

Equity attributable to the acquiring company $ 4,720,000

Shares issued (510000*10) $ 5,100,000

Cash paid $ 100,000

Total purchase consideration transferred $ 5,200,000

Value of goodwill (5200000-4816000) $ 480,000

Total Assets $ 754,200

Current liabilities $ 120,000

Total current liabilities $ 120,000

Long term debt $ 198,000

Total noncurrent liabilities $ 198,000

Total liabilities $ 318,000

Net assets $ 436,200

Common shares $ 220,000

Retained earnings $ 180,000

Non-controlling interest $ 36,200

Total Equity $ 436,200

Answer to question 3:

Acquisition analysis:

Total outstanding shares $ 500,000

Number of shares acquired $ 400,000

Percentage of holding $ 1

Percentage of non-controlling interest $ 0

Common shares $ 3,000,000

Retained earnings $ 2,050,000

Fair value adjustment:

Inventories (1750000-1500000) $ 250,000

Machinery (5500000-5000000) $ 500,000

Customer lists $ 520,000

Long term debt (1300000-1600000) $ (300,000)

Fair value of Identifiable net assets $ 6,020,000

Less: Fair value of non-controlling interest (5200000*20/80) $ 1,300,000

Equity attributable to the acquiring company $ 4,720,000

Shares issued (510000*10) $ 5,100,000

Cash paid $ 100,000

Total purchase consideration transferred $ 5,200,000

Value of goodwill (5200000-4816000) $ 480,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ADVANCED FINANCIAL ACCOUNTING

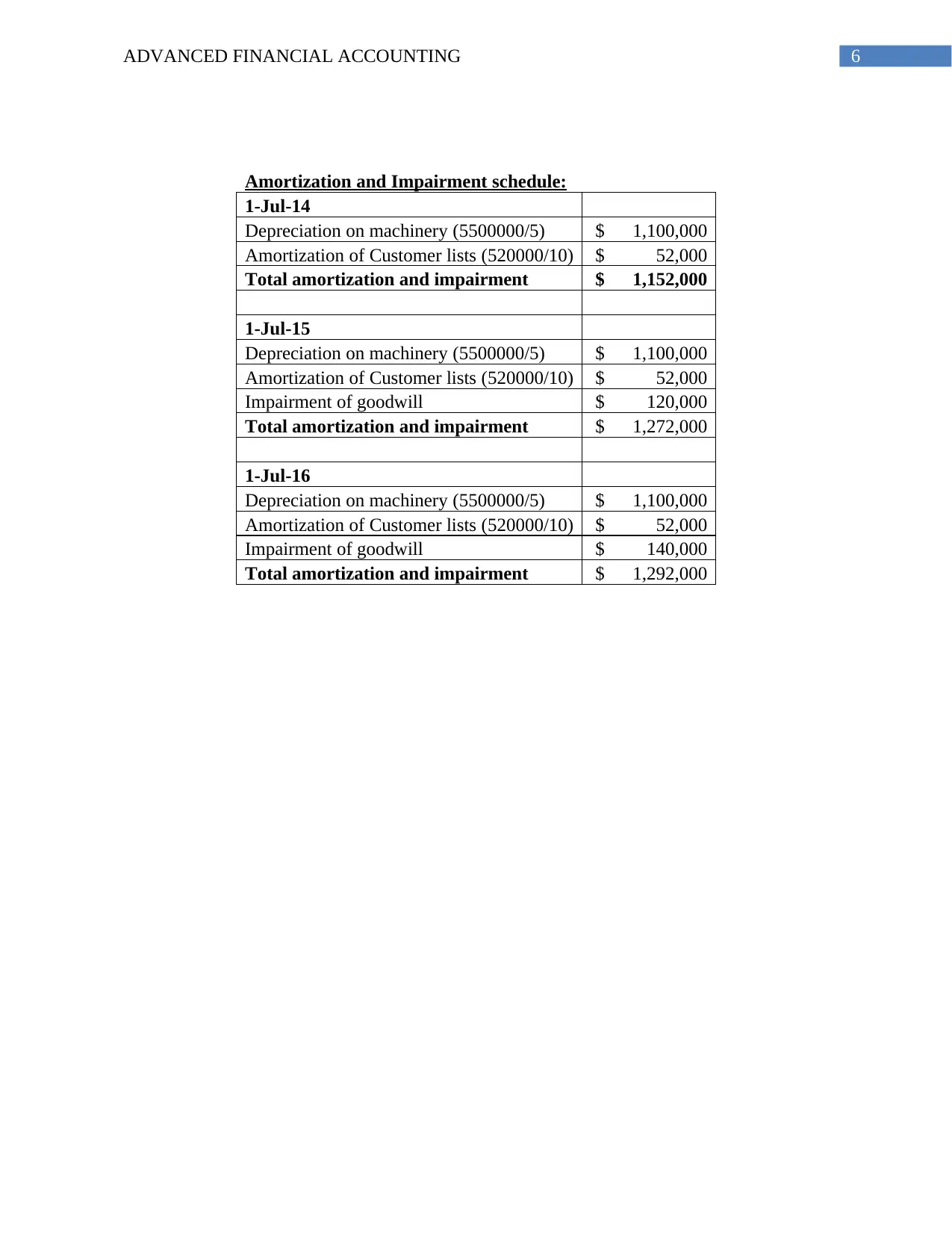

Amortization and Impairment schedule:

1-Jul-14

Depreciation on machinery (5500000/5) $ 1,100,000

Amortization of Customer lists (520000/10) $ 52,000

Total amortization and impairment $ 1,152,000

1-Jul-15

Depreciation on machinery (5500000/5) $ 1,100,000

Amortization of Customer lists (520000/10) $ 52,000

Impairment of goodwill $ 120,000

Total amortization and impairment $ 1,272,000

1-Jul-16

Depreciation on machinery (5500000/5) $ 1,100,000

Amortization of Customer lists (520000/10) $ 52,000

Impairment of goodwill $ 140,000

Total amortization and impairment $ 1,292,000

Amortization and Impairment schedule:

1-Jul-14

Depreciation on machinery (5500000/5) $ 1,100,000

Amortization of Customer lists (520000/10) $ 52,000

Total amortization and impairment $ 1,152,000

1-Jul-15

Depreciation on machinery (5500000/5) $ 1,100,000

Amortization of Customer lists (520000/10) $ 52,000

Impairment of goodwill $ 120,000

Total amortization and impairment $ 1,272,000

1-Jul-16

Depreciation on machinery (5500000/5) $ 1,100,000

Amortization of Customer lists (520000/10) $ 52,000

Impairment of goodwill $ 140,000

Total amortization and impairment $ 1,292,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ADVANCED FINANCIAL ACCOUNTING

Bibliography:

Hadi, K.T., 2015. Consolidated financial statements.

Hoyle, J.B., Schaefer, T. and Doupnik, T., 2015. Advanced accounting. McGraw Hill.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning Pvt.

Ltd..

Sedki, S.S., Smith, A. and Strickland, A., 2014. Differences and similarities between IFRS and

GAAP on inventory, revenue recognition and consolidated financial statements. Journal of

Accounting and Finance, 14(2), p.120.

Bibliography:

Hadi, K.T., 2015. Consolidated financial statements.

Hoyle, J.B., Schaefer, T. and Doupnik, T., 2015. Advanced accounting. McGraw Hill.

Narayanaswamy, R., 2017. Financial accounting: a managerial perspective. PHI Learning Pvt.

Ltd..

Sedki, S.S., Smith, A. and Strickland, A., 2014. Differences and similarities between IFRS and

GAAP on inventory, revenue recognition and consolidated financial statements. Journal of

Accounting and Finance, 14(2), p.120.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.