Financial Accounting Assignment - Course FINC101 - Solutions

VerifiedAdded on 2022/09/11

|18

|1797

|27

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial accounting assignment, addressing multiple questions and concepts. The assignment covers a wide array of topics, including bad debts, depreciation methods (straight-line, reducing balance, and units of output), asset accounting, income statements, balance sheets, inventory valuation (FIFO, LIFO, and AVCO), and cash flow statements. It also explores ratio analysis, providing insights into profitability, liquidity, and efficiency. Detailed calculations, journal entries, and financial statements are included to demonstrate the application of accounting principles. The solutions provide a thorough understanding of financial accounting concepts and their practical application.

Running head: FINANCIAL ACCOUNTING ASSIGNMENT

Financial Accounting Assignment

Name of the Student

Name of the University

Author Note

Financial Accounting Assignment

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ACCOUNTING ASSIGNMENT

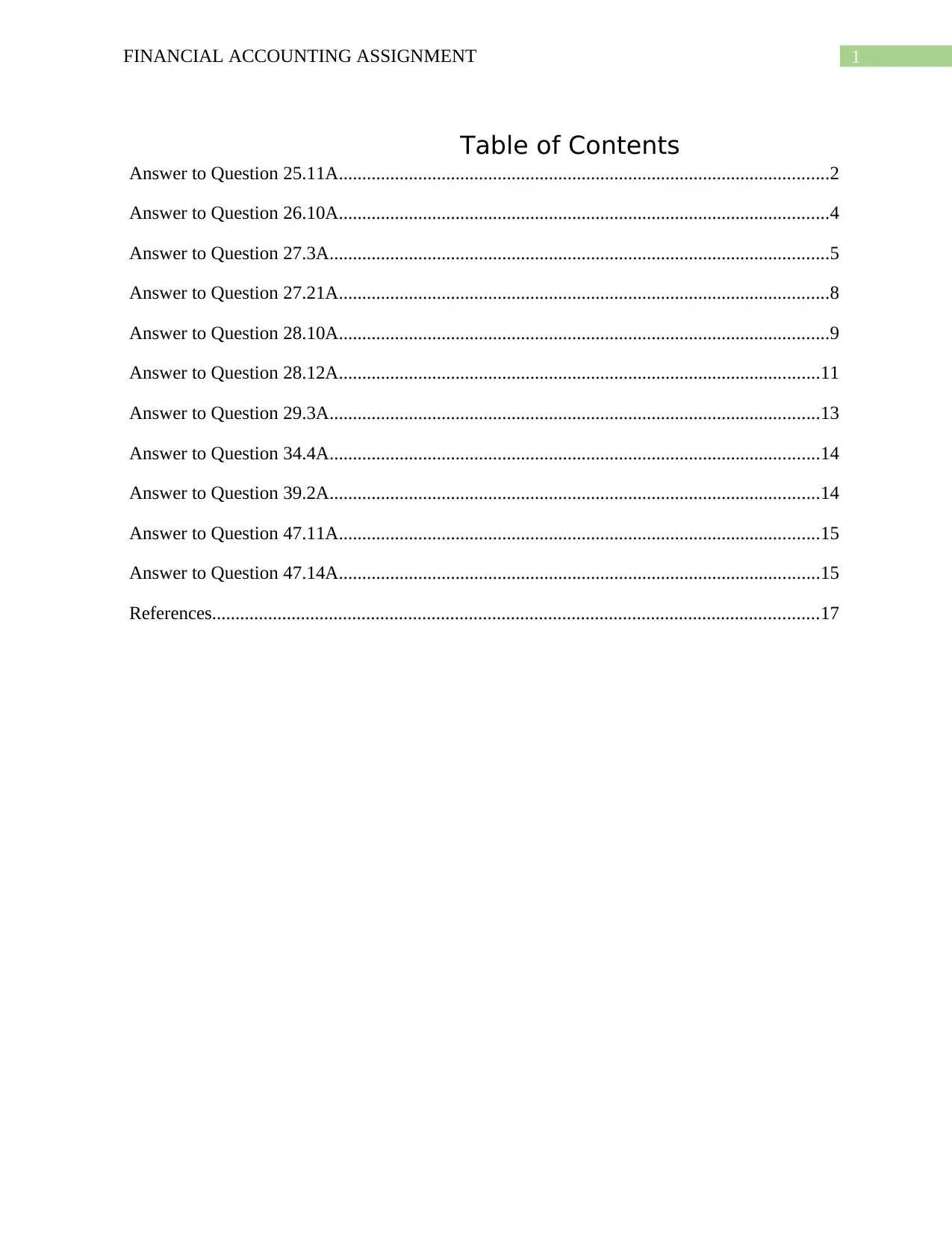

Table of Contents

Answer to Question 25.11A.........................................................................................................2

Answer to Question 26.10A.........................................................................................................4

Answer to Question 27.3A...........................................................................................................5

Answer to Question 27.21A.........................................................................................................8

Answer to Question 28.10A.........................................................................................................9

Answer to Question 28.12A.......................................................................................................11

Answer to Question 29.3A.........................................................................................................13

Answer to Question 34.4A.........................................................................................................14

Answer to Question 39.2A.........................................................................................................14

Answer to Question 47.11A.......................................................................................................15

Answer to Question 47.14A.......................................................................................................15

References..................................................................................................................................17

Table of Contents

Answer to Question 25.11A.........................................................................................................2

Answer to Question 26.10A.........................................................................................................4

Answer to Question 27.3A...........................................................................................................5

Answer to Question 27.21A.........................................................................................................8

Answer to Question 28.10A.........................................................................................................9

Answer to Question 28.12A.......................................................................................................11

Answer to Question 29.3A.........................................................................................................13

Answer to Question 34.4A.........................................................................................................14

Answer to Question 39.2A.........................................................................................................14

Answer to Question 47.11A.......................................................................................................15

Answer to Question 47.14A.......................................................................................................15

References..................................................................................................................................17

2FINANCIAL ACCOUNTING ASSIGNMENT

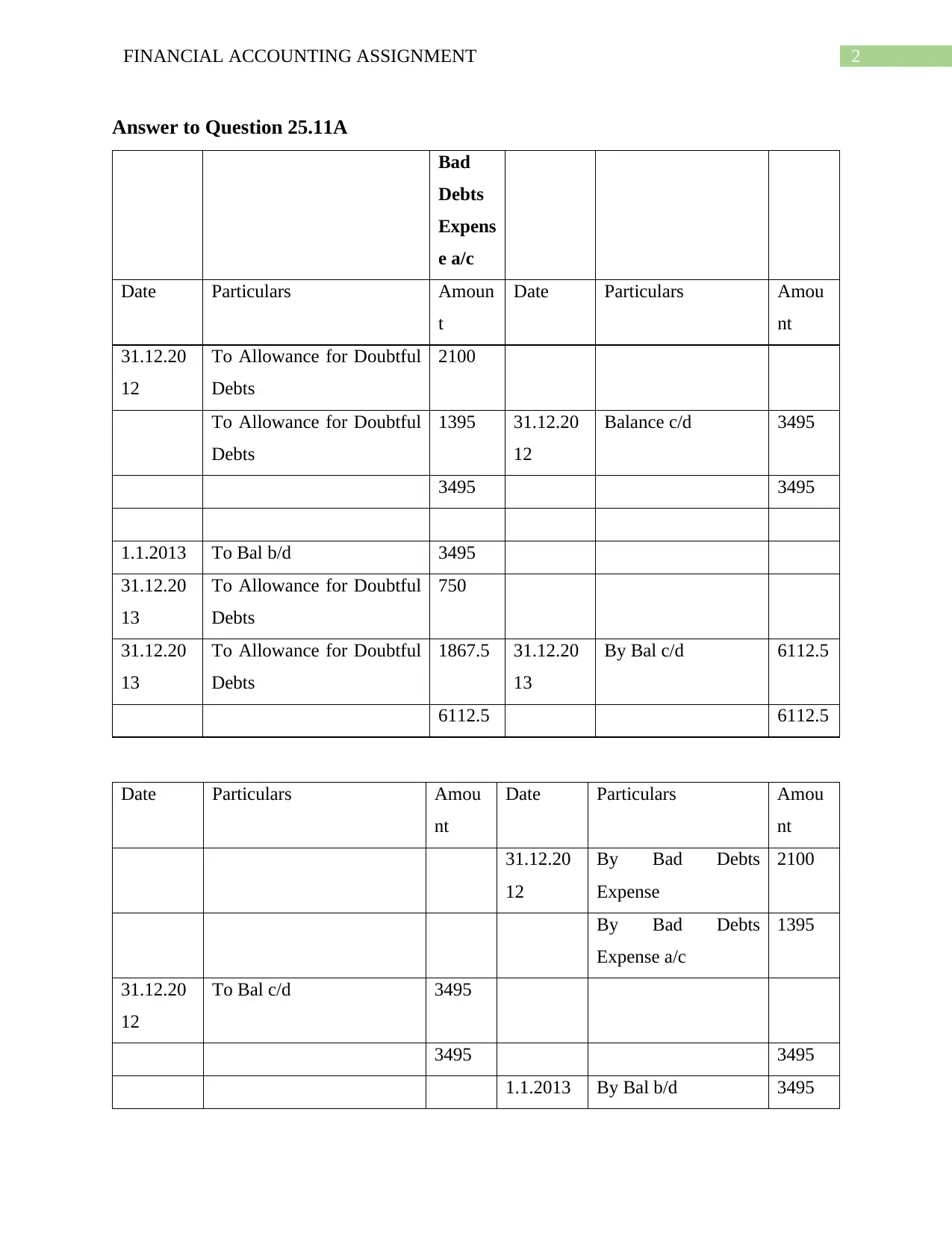

Answer to Question 25.11A

Bad

Debts

Expens

e a/c

Date Particulars Amoun

t

Date Particulars Amou

nt

31.12.20

12

To Allowance for Doubtful

Debts

2100

To Allowance for Doubtful

Debts

1395 31.12.20

12

Balance c/d 3495

3495 3495

1.1.2013 To Bal b/d 3495

31.12.20

13

To Allowance for Doubtful

Debts

750

31.12.20

13

To Allowance for Doubtful

Debts

1867.5 31.12.20

13

By Bal c/d 6112.5

6112.5 6112.5

Date Particulars Amou

nt

Date Particulars Amou

nt

31.12.20

12

By Bad Debts

Expense

2100

By Bad Debts

Expense a/c

1395

31.12.20

12

To Bal c/d 3495

3495 3495

1.1.2013 By Bal b/d 3495

Answer to Question 25.11A

Bad

Debts

Expens

e a/c

Date Particulars Amoun

t

Date Particulars Amou

nt

31.12.20

12

To Allowance for Doubtful

Debts

2100

To Allowance for Doubtful

Debts

1395 31.12.20

12

Balance c/d 3495

3495 3495

1.1.2013 To Bal b/d 3495

31.12.20

13

To Allowance for Doubtful

Debts

750

31.12.20

13

To Allowance for Doubtful

Debts

1867.5 31.12.20

13

By Bal c/d 6112.5

6112.5 6112.5

Date Particulars Amou

nt

Date Particulars Amou

nt

31.12.20

12

By Bad Debts

Expense

2100

By Bad Debts

Expense a/c

1395

31.12.20

12

To Bal c/d 3495

3495 3495

1.1.2013 By Bal b/d 3495

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ACCOUNTING ASSIGNMENT

31.12.20

13

To Balance c/d 6112.5 31.12.20

13

By Bad Debts

Expense a/c

2617.5

6112.5 6112.5

31.12.20

14

To Bal c/d 6112.5 1.1.2014 By Bal b/d 6112.5

6112.5 6112.5

b)

Accounts Receivable -

B. Roke

Date Particulars Amount Date Particulars Amo

unt

31.12.2

012

To Allowance for

doubtful debts

70 31.12.2

012

By Profit and

Loss a/c

70

70 70

Accounts Receivable -

H.A. Ditt

Date Particulars Amount Date Particulars Amo

unt

31.12.2

012

To Allowance for

doubtful debts

42 31.12.2

012

By Profit and

Loss a/c

42

42 42

31.12.20

13

To Balance c/d 6112.5 31.12.20

13

By Bad Debts

Expense a/c

2617.5

6112.5 6112.5

31.12.20

14

To Bal c/d 6112.5 1.1.2014 By Bal b/d 6112.5

6112.5 6112.5

b)

Accounts Receivable -

B. Roke

Date Particulars Amount Date Particulars Amo

unt

31.12.2

012

To Allowance for

doubtful debts

70 31.12.2

012

By Profit and

Loss a/c

70

70 70

Accounts Receivable -

H.A. Ditt

Date Particulars Amount Date Particulars Amo

unt

31.12.2

012

To Allowance for

doubtful debts

42 31.12.2

012

By Profit and

Loss a/c

42

42 42

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ACCOUNTING ASSIGNMENT

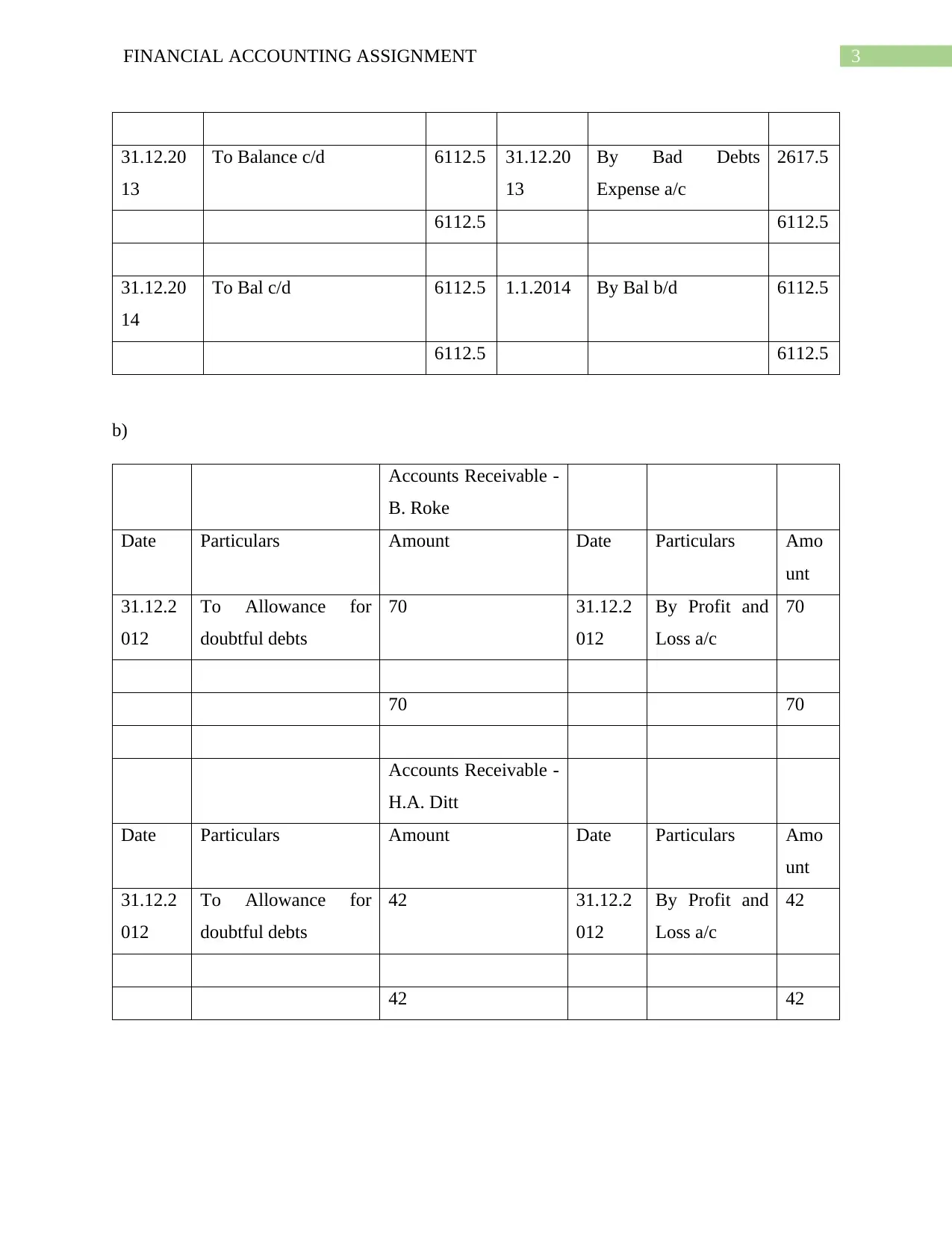

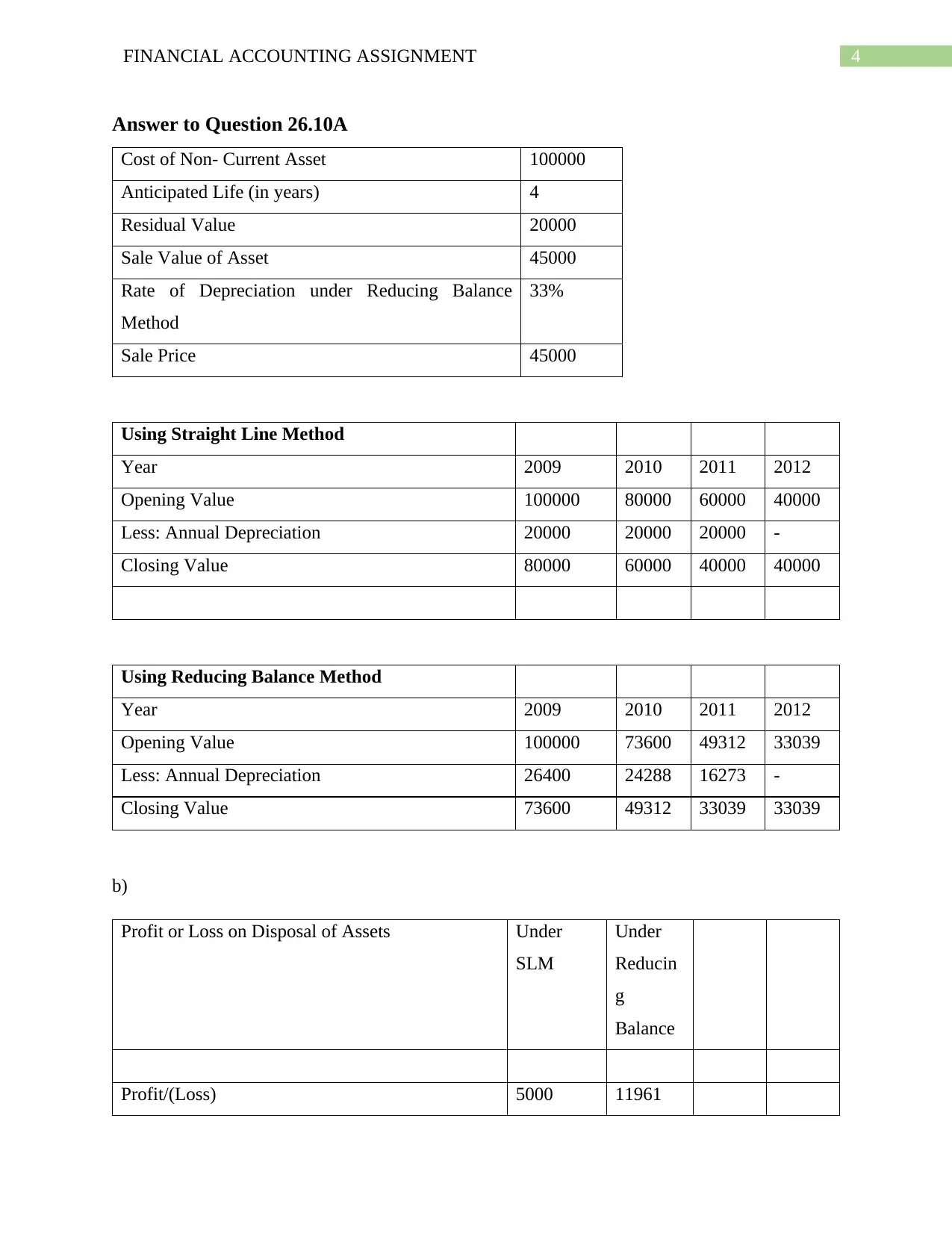

Answer to Question 26.10A

Cost of Non- Current Asset 100000

Anticipated Life (in years) 4

Residual Value 20000

Sale Value of Asset 45000

Rate of Depreciation under Reducing Balance

Method

33%

Sale Price 45000

Using Straight Line Method

Year 2009 2010 2011 2012

Opening Value 100000 80000 60000 40000

Less: Annual Depreciation 20000 20000 20000 -

Closing Value 80000 60000 40000 40000

Using Reducing Balance Method

Year 2009 2010 2011 2012

Opening Value 100000 73600 49312 33039

Less: Annual Depreciation 26400 24288 16273 -

Closing Value 73600 49312 33039 33039

b)

Profit or Loss on Disposal of Assets Under

SLM

Under

Reducin

g

Balance

Profit/(Loss) 5000 11961

Answer to Question 26.10A

Cost of Non- Current Asset 100000

Anticipated Life (in years) 4

Residual Value 20000

Sale Value of Asset 45000

Rate of Depreciation under Reducing Balance

Method

33%

Sale Price 45000

Using Straight Line Method

Year 2009 2010 2011 2012

Opening Value 100000 80000 60000 40000

Less: Annual Depreciation 20000 20000 20000 -

Closing Value 80000 60000 40000 40000

Using Reducing Balance Method

Year 2009 2010 2011 2012

Opening Value 100000 73600 49312 33039

Less: Annual Depreciation 26400 24288 16273 -

Closing Value 73600 49312 33039 33039

b)

Profit or Loss on Disposal of Assets Under

SLM

Under

Reducin

g

Balance

Profit/(Loss) 5000 11961

5FINANCIAL ACCOUNTING ASSIGNMENT

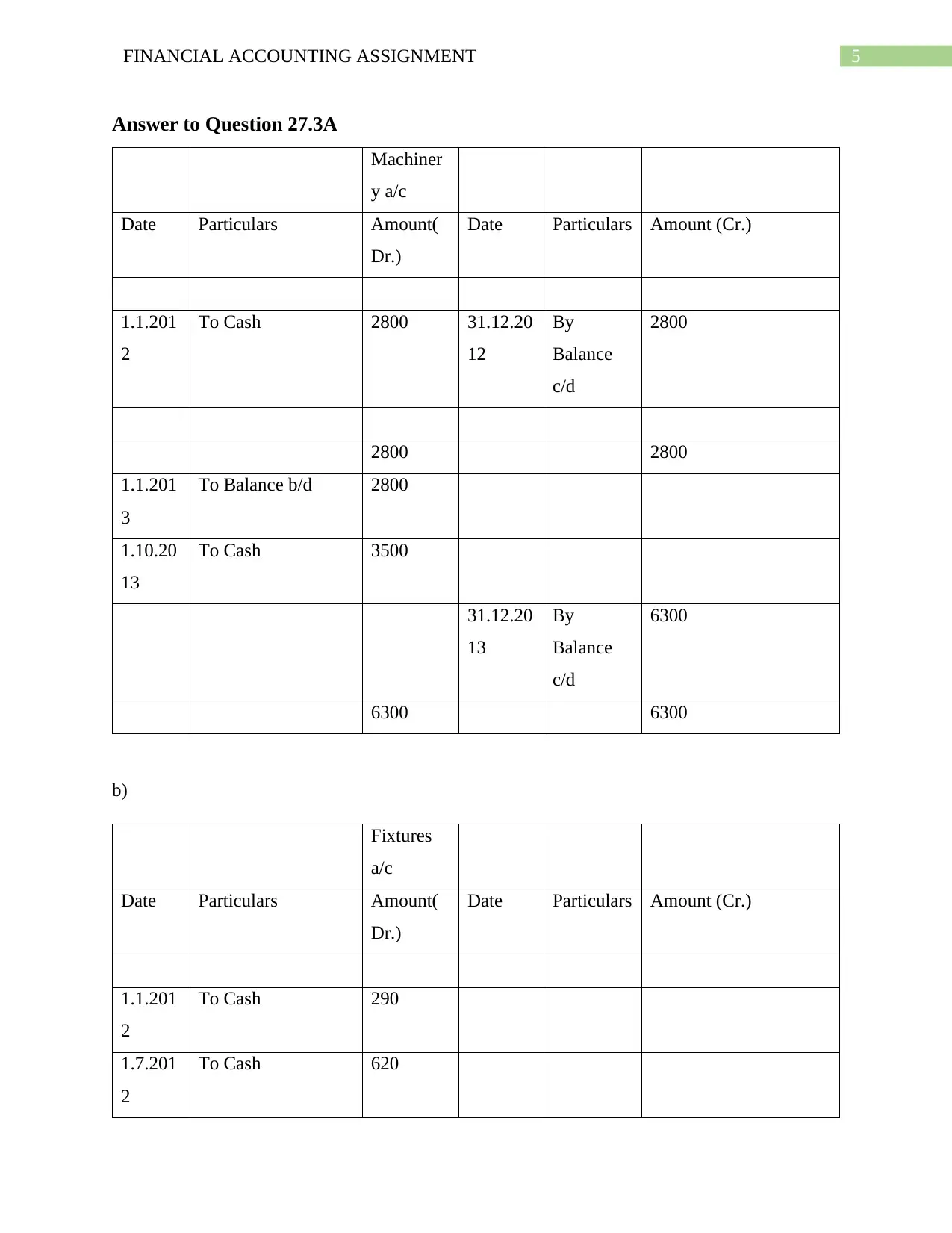

Answer to Question 27.3A

Machiner

y a/c

Date Particulars Amount(

Dr.)

Date Particulars Amount (Cr.)

1.1.201

2

To Cash 2800 31.12.20

12

By

Balance

c/d

2800

2800 2800

1.1.201

3

To Balance b/d 2800

1.10.20

13

To Cash 3500

31.12.20

13

By

Balance

c/d

6300

6300 6300

b)

Fixtures

a/c

Date Particulars Amount(

Dr.)

Date Particulars Amount (Cr.)

1.1.201

2

To Cash 290

1.7.201

2

To Cash 620

Answer to Question 27.3A

Machiner

y a/c

Date Particulars Amount(

Dr.)

Date Particulars Amount (Cr.)

1.1.201

2

To Cash 2800 31.12.20

12

By

Balance

c/d

2800

2800 2800

1.1.201

3

To Balance b/d 2800

1.10.20

13

To Cash 3500

31.12.20

13

By

Balance

c/d

6300

6300 6300

b)

Fixtures

a/c

Date Particulars Amount(

Dr.)

Date Particulars Amount (Cr.)

1.1.201

2

To Cash 290

1.7.201

2

To Cash 620

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

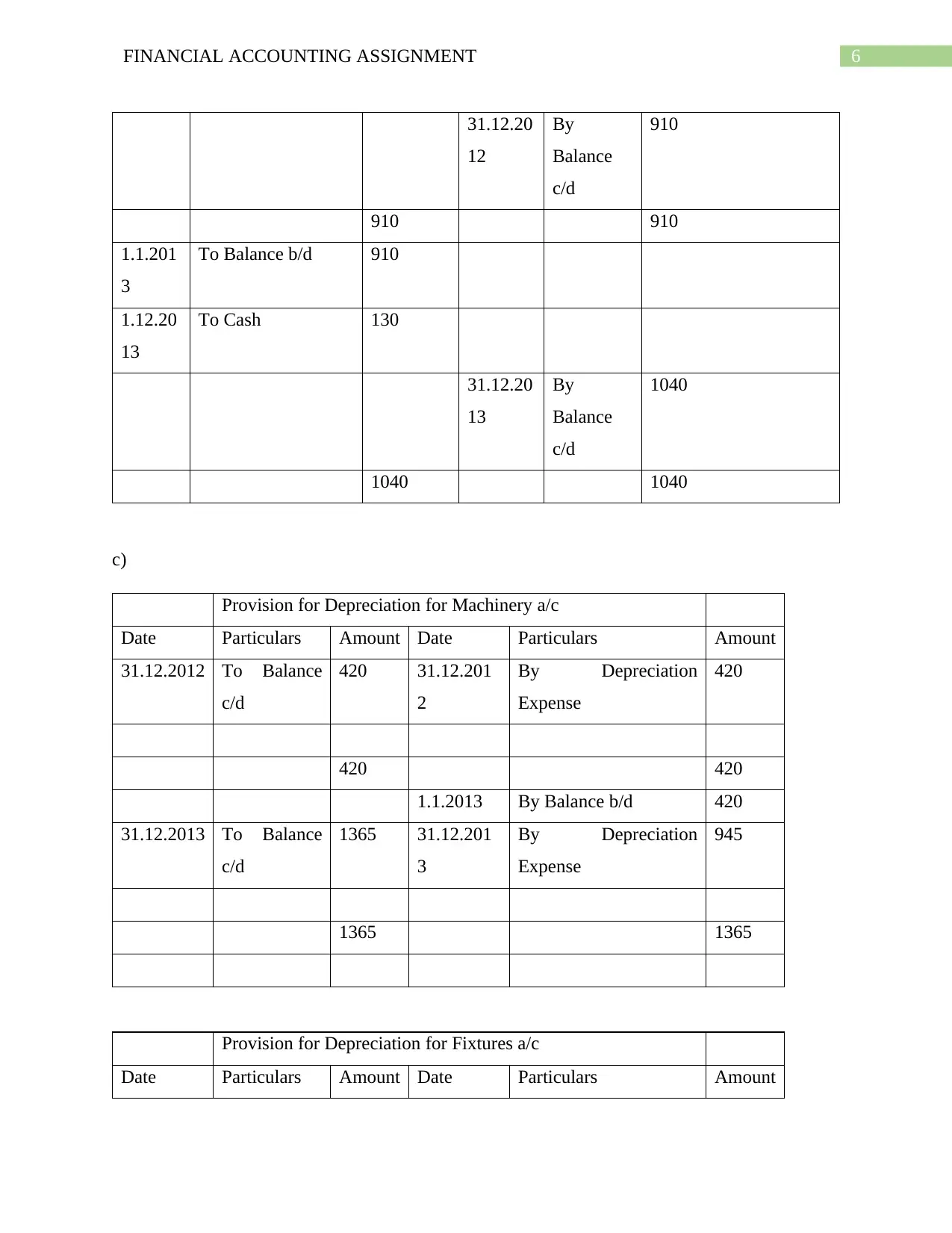

6FINANCIAL ACCOUNTING ASSIGNMENT

31.12.20

12

By

Balance

c/d

910

910 910

1.1.201

3

To Balance b/d 910

1.12.20

13

To Cash 130

31.12.20

13

By

Balance

c/d

1040

1040 1040

c)

Provision for Depreciation for Machinery a/c

Date Particulars Amount Date Particulars Amount

31.12.2012 To Balance

c/d

420 31.12.201

2

By Depreciation

Expense

420

420 420

1.1.2013 By Balance b/d 420

31.12.2013 To Balance

c/d

1365 31.12.201

3

By Depreciation

Expense

945

1365 1365

Provision for Depreciation for Fixtures a/c

Date Particulars Amount Date Particulars Amount

31.12.20

12

By

Balance

c/d

910

910 910

1.1.201

3

To Balance b/d 910

1.12.20

13

To Cash 130

31.12.20

13

By

Balance

c/d

1040

1040 1040

c)

Provision for Depreciation for Machinery a/c

Date Particulars Amount Date Particulars Amount

31.12.2012 To Balance

c/d

420 31.12.201

2

By Depreciation

Expense

420

420 420

1.1.2013 By Balance b/d 420

31.12.2013 To Balance

c/d

1365 31.12.201

3

By Depreciation

Expense

945

1365 1365

Provision for Depreciation for Fixtures a/c

Date Particulars Amount Date Particulars Amount

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

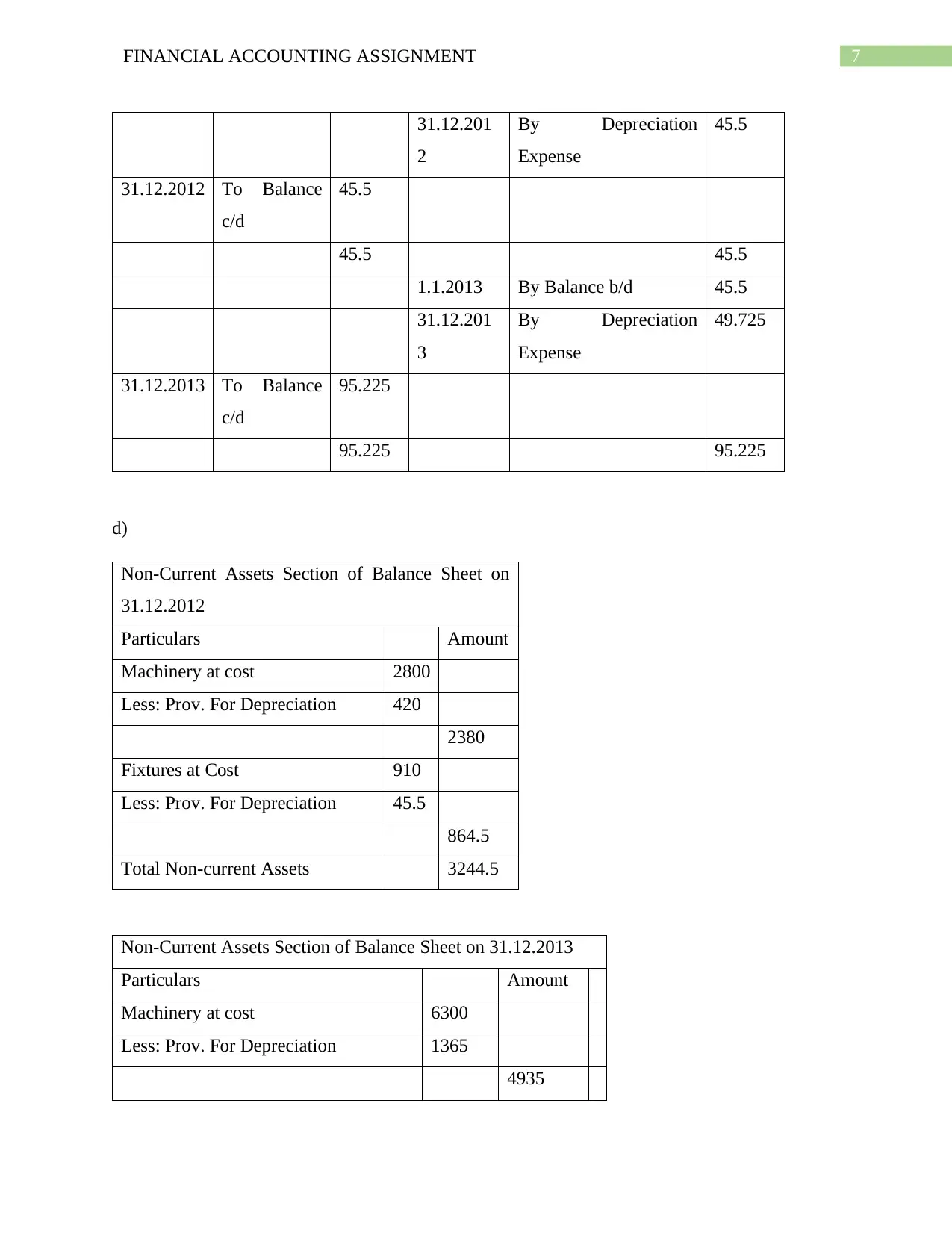

7FINANCIAL ACCOUNTING ASSIGNMENT

31.12.201

2

By Depreciation

Expense

45.5

31.12.2012 To Balance

c/d

45.5

45.5 45.5

1.1.2013 By Balance b/d 45.5

31.12.201

3

By Depreciation

Expense

49.725

31.12.2013 To Balance

c/d

95.225

95.225 95.225

d)

Non-Current Assets Section of Balance Sheet on

31.12.2012

Particulars Amount

Machinery at cost 2800

Less: Prov. For Depreciation 420

2380

Fixtures at Cost 910

Less: Prov. For Depreciation 45.5

864.5

Total Non-current Assets 3244.5

Non-Current Assets Section of Balance Sheet on 31.12.2013

Particulars Amount

Machinery at cost 6300

Less: Prov. For Depreciation 1365

4935

31.12.201

2

By Depreciation

Expense

45.5

31.12.2012 To Balance

c/d

45.5

45.5 45.5

1.1.2013 By Balance b/d 45.5

31.12.201

3

By Depreciation

Expense

49.725

31.12.2013 To Balance

c/d

95.225

95.225 95.225

d)

Non-Current Assets Section of Balance Sheet on

31.12.2012

Particulars Amount

Machinery at cost 2800

Less: Prov. For Depreciation 420

2380

Fixtures at Cost 910

Less: Prov. For Depreciation 45.5

864.5

Total Non-current Assets 3244.5

Non-Current Assets Section of Balance Sheet on 31.12.2013

Particulars Amount

Machinery at cost 6300

Less: Prov. For Depreciation 1365

4935

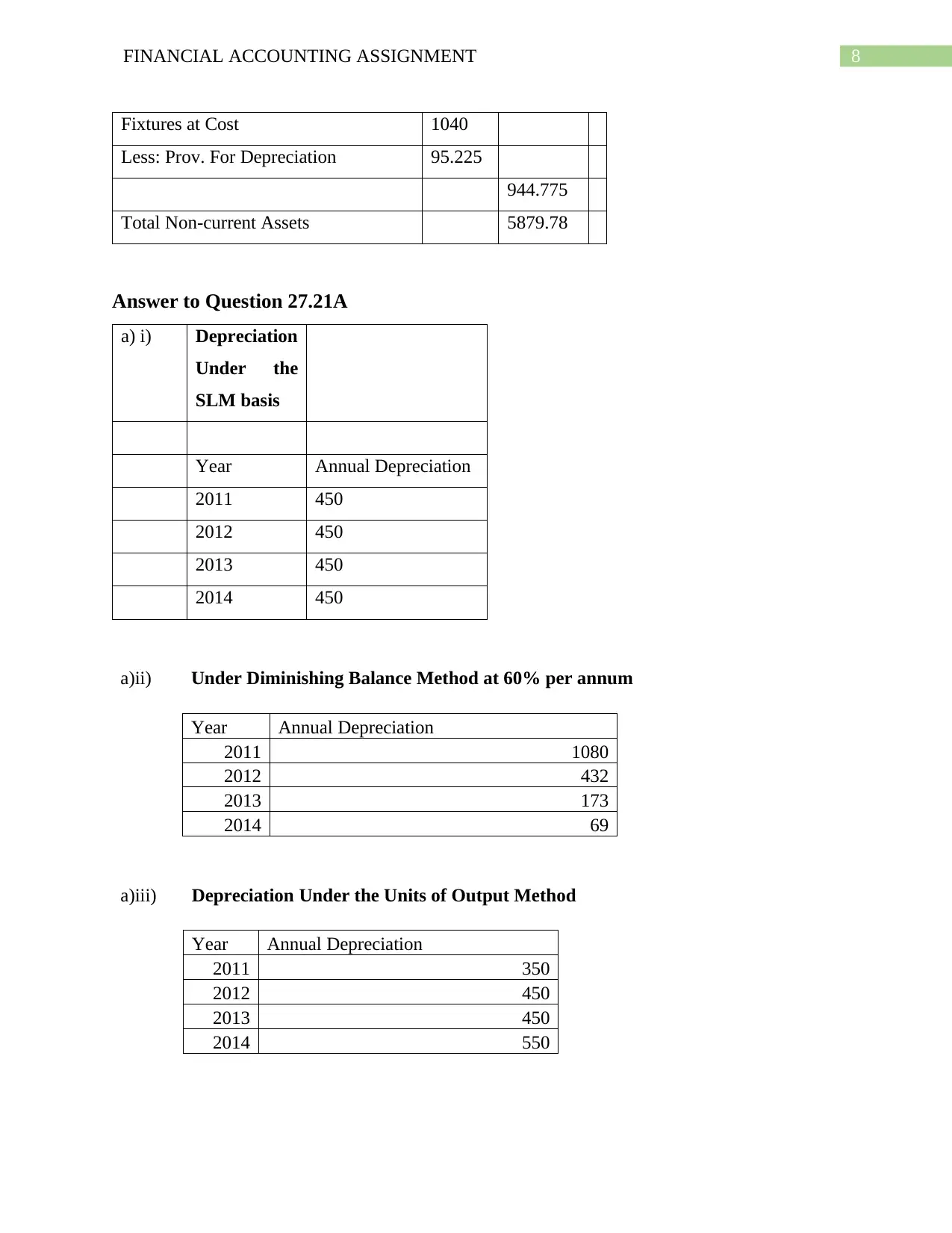

8FINANCIAL ACCOUNTING ASSIGNMENT

Fixtures at Cost 1040

Less: Prov. For Depreciation 95.225

944.775

Total Non-current Assets 5879.78

Answer to Question 27.21A

a) i) Depreciation

Under the

SLM basis

Year Annual Depreciation

2011 450

2012 450

2013 450

2014 450

a)ii) Under Diminishing Balance Method at 60% per annum

Year Annual Depreciation

2011 1080

2012 432

2013 173

2014 69

a)iii) Depreciation Under the Units of Output Method

Year Annual Depreciation

2011 350

2012 450

2013 450

2014 550

Fixtures at Cost 1040

Less: Prov. For Depreciation 95.225

944.775

Total Non-current Assets 5879.78

Answer to Question 27.21A

a) i) Depreciation

Under the

SLM basis

Year Annual Depreciation

2011 450

2012 450

2013 450

2014 450

a)ii) Under Diminishing Balance Method at 60% per annum

Year Annual Depreciation

2011 1080

2012 432

2013 173

2014 69

a)iii) Depreciation Under the Units of Output Method

Year Annual Depreciation

2011 350

2012 450

2013 450

2014 550

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ACCOUNTING ASSIGNMENT

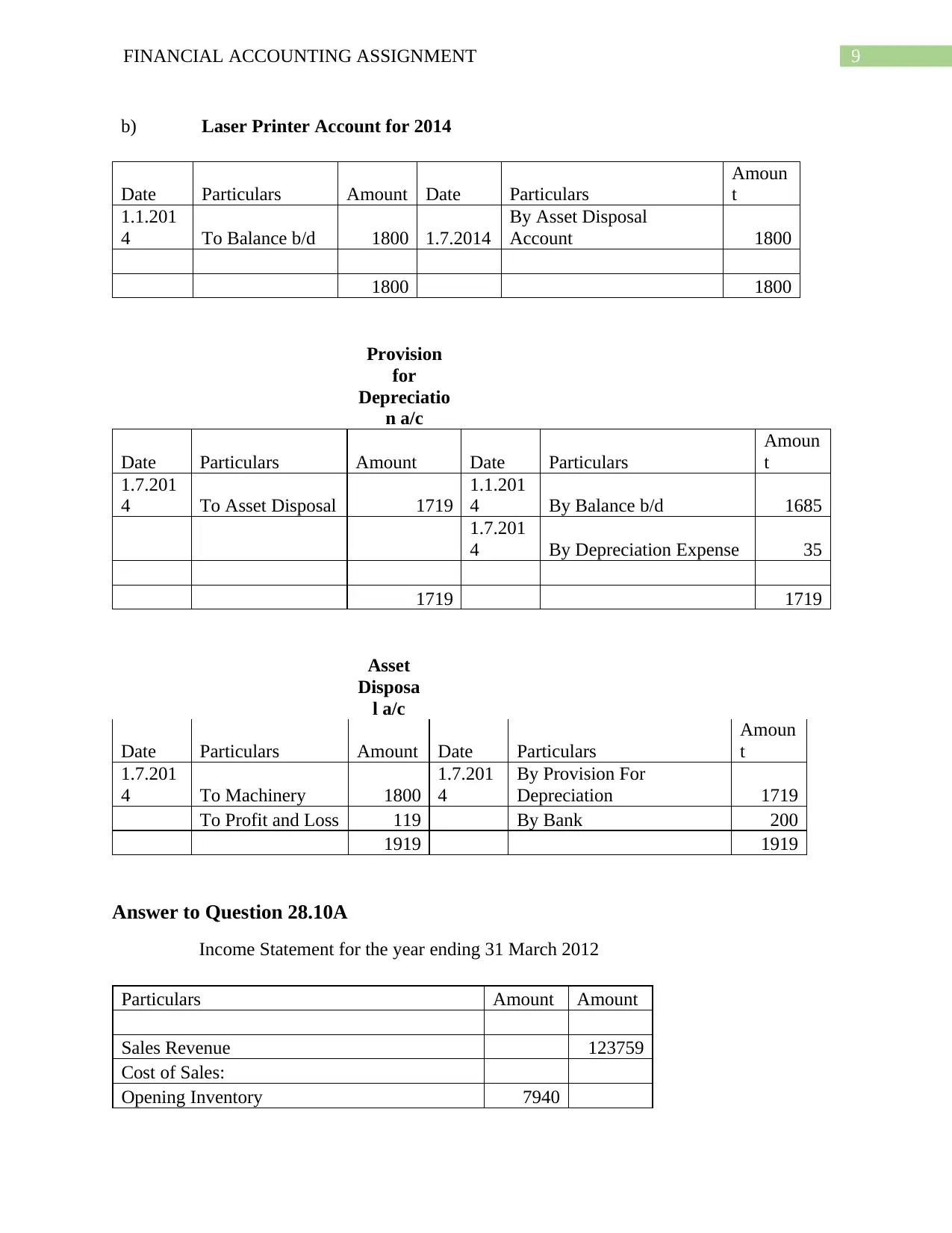

b) Laser Printer Account for 2014

Date Particulars Amount Date Particulars

Amoun

t

1.1.201

4 To Balance b/d 1800 1.7.2014

By Asset Disposal

Account 1800

1800 1800

Provision

for

Depreciatio

n a/c

Date Particulars Amount Date Particulars

Amoun

t

1.7.201

4 To Asset Disposal 1719

1.1.201

4 By Balance b/d 1685

1.7.201

4 By Depreciation Expense 35

1719 1719

Asset

Disposa

l a/c

Date Particulars Amount Date Particulars

Amoun

t

1.7.201

4 To Machinery 1800

1.7.201

4

By Provision For

Depreciation 1719

To Profit and Loss 119 By Bank 200

1919 1919

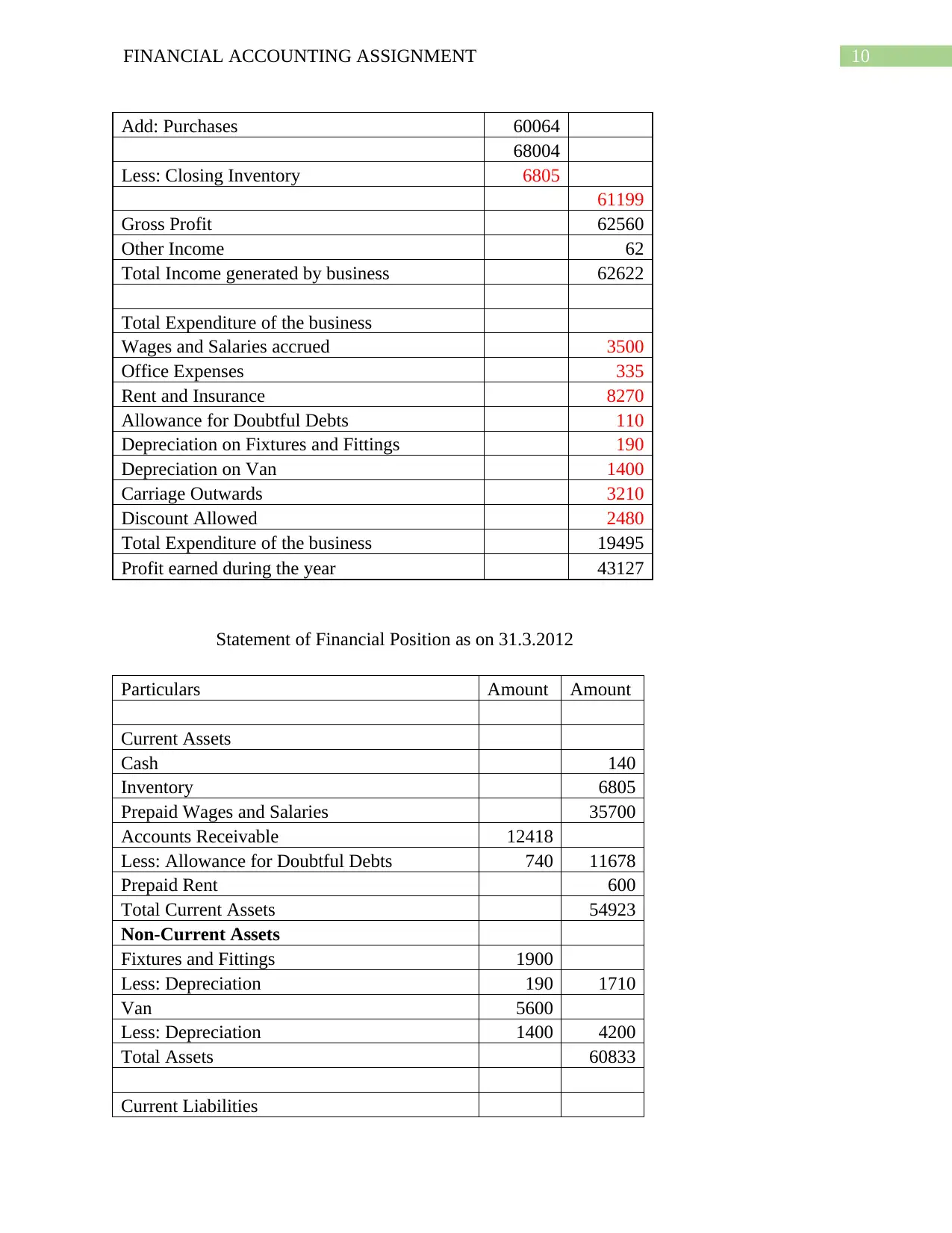

Answer to Question 28.10A

Income Statement for the year ending 31 March 2012

Particulars Amount Amount

Sales Revenue 123759

Cost of Sales:

Opening Inventory 7940

b) Laser Printer Account for 2014

Date Particulars Amount Date Particulars

Amoun

t

1.1.201

4 To Balance b/d 1800 1.7.2014

By Asset Disposal

Account 1800

1800 1800

Provision

for

Depreciatio

n a/c

Date Particulars Amount Date Particulars

Amoun

t

1.7.201

4 To Asset Disposal 1719

1.1.201

4 By Balance b/d 1685

1.7.201

4 By Depreciation Expense 35

1719 1719

Asset

Disposa

l a/c

Date Particulars Amount Date Particulars

Amoun

t

1.7.201

4 To Machinery 1800

1.7.201

4

By Provision For

Depreciation 1719

To Profit and Loss 119 By Bank 200

1919 1919

Answer to Question 28.10A

Income Statement for the year ending 31 March 2012

Particulars Amount Amount

Sales Revenue 123759

Cost of Sales:

Opening Inventory 7940

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ACCOUNTING ASSIGNMENT

Add: Purchases 60064

68004

Less: Closing Inventory 6805

61199

Gross Profit 62560

Other Income 62

Total Income generated by business 62622

Total Expenditure of the business

Wages and Salaries accrued 3500

Office Expenses 335

Rent and Insurance 8270

Allowance for Doubtful Debts 110

Depreciation on Fixtures and Fittings 190

Depreciation on Van 1400

Carriage Outwards 3210

Discount Allowed 2480

Total Expenditure of the business 19495

Profit earned during the year 43127

Statement of Financial Position as on 31.3.2012

Particulars Amount Amount

Current Assets

Cash 140

Inventory 6805

Prepaid Wages and Salaries 35700

Accounts Receivable 12418

Less: Allowance for Doubtful Debts 740 11678

Prepaid Rent 600

Total Current Assets 54923

Non-Current Assets

Fixtures and Fittings 1900

Less: Depreciation 190 1710

Van 5600

Less: Depreciation 1400 4200

Total Assets 60833

Current Liabilities

Add: Purchases 60064

68004

Less: Closing Inventory 6805

61199

Gross Profit 62560

Other Income 62

Total Income generated by business 62622

Total Expenditure of the business

Wages and Salaries accrued 3500

Office Expenses 335

Rent and Insurance 8270

Allowance for Doubtful Debts 110

Depreciation on Fixtures and Fittings 190

Depreciation on Van 1400

Carriage Outwards 3210

Discount Allowed 2480

Total Expenditure of the business 19495

Profit earned during the year 43127

Statement of Financial Position as on 31.3.2012

Particulars Amount Amount

Current Assets

Cash 140

Inventory 6805

Prepaid Wages and Salaries 35700

Accounts Receivable 12418

Less: Allowance for Doubtful Debts 740 11678

Prepaid Rent 600

Total Current Assets 54923

Non-Current Assets

Fixtures and Fittings 1900

Less: Depreciation 190 1710

Van 5600

Less: Depreciation 1400 4200

Total Assets 60833

Current Liabilities

11FINANCIAL ACCOUNTING ASSIGNMENT

Bank Overdraft 2490

Office Expenses Payable 16

Non-Current Liabilities

Accounts Payable 11400

Total Liabilities 13906

Net Assets 46927

Capital at the beginning of the year 25200

Add: Profit during the year 43127

Less: Drawings made during the year 21400

Capital at the end of the year 46927

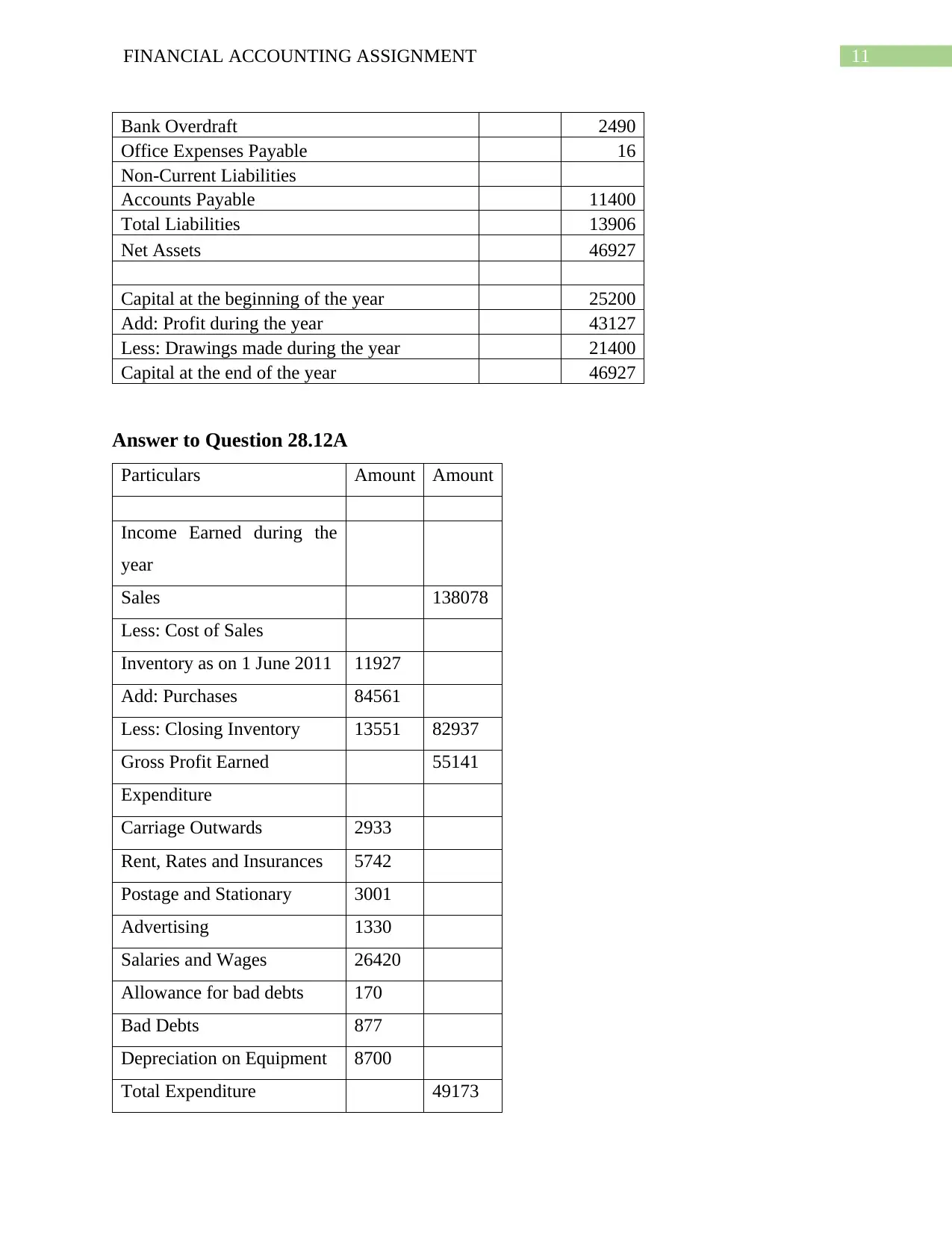

Answer to Question 28.12A

Particulars Amount Amount

Income Earned during the

year

Sales 138078

Less: Cost of Sales

Inventory as on 1 June 2011 11927

Add: Purchases 84561

Less: Closing Inventory 13551 82937

Gross Profit Earned 55141

Expenditure

Carriage Outwards 2933

Rent, Rates and Insurances 5742

Postage and Stationary 3001

Advertising 1330

Salaries and Wages 26420

Allowance for bad debts 170

Bad Debts 877

Depreciation on Equipment 8700

Total Expenditure 49173

Bank Overdraft 2490

Office Expenses Payable 16

Non-Current Liabilities

Accounts Payable 11400

Total Liabilities 13906

Net Assets 46927

Capital at the beginning of the year 25200

Add: Profit during the year 43127

Less: Drawings made during the year 21400

Capital at the end of the year 46927

Answer to Question 28.12A

Particulars Amount Amount

Income Earned during the

year

Sales 138078

Less: Cost of Sales

Inventory as on 1 June 2011 11927

Add: Purchases 84561

Less: Closing Inventory 13551 82937

Gross Profit Earned 55141

Expenditure

Carriage Outwards 2933

Rent, Rates and Insurances 5742

Postage and Stationary 3001

Advertising 1330

Salaries and Wages 26420

Allowance for bad debts 170

Bad Debts 877

Depreciation on Equipment 8700

Total Expenditure 49173

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.