Financial Problems Analysis: Finance Assignment for [University Name]

VerifiedAdded on 2020/04/07

|30

|4155

|82

Homework Assignment

AI Summary

This assignment provides a comprehensive analysis of various financial problems. It begins with detailed calculations related to loan installments, interest, and refinancing decisions. The document then delves into bond valuation, exploring market returns and the impact of coupon rates on bond prices. Capital budgeting techniques, including payback period, NPV, and IRR, are applied to evaluate investment projects. Risk classification and its impact on financial decisions are also discussed. Furthermore, the assignment analyzes the impact of different investment strategies, and offers solutions for the renovation vs. replacement of an asset. Finally, the assignment concludes with an analysis of financial ratios and portfolio management using the CAPM model, offering valuable insights into company valuation and investment strategies.

Running Head: Financial Problems Analysis

Financial Problems

Analysis

Financial Problems

Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Problems Analysis

1

Table of Contents

Question-1.............................................................................................................................................1

Question-2.............................................................................................................................................5

Question-3.............................................................................................................................................6

Question 4.............................................................................................................................................7

Question 5.............................................................................................................................................8

Question -6..........................................................................................................................................10

Question 7...........................................................................................................................................13

Question 8...........................................................................................................................................16

Question 9...........................................................................................................................................18

Question10..........................................................................................................................................19

References...........................................................................................................................................22

Appendix-1......................................................................................................................................23

Appendix 2......................................................................................................................................27

Appendix 3......................................................................................................................................29

.........................................................................................................................................................29

1

Table of Contents

Question-1.............................................................................................................................................1

Question-2.............................................................................................................................................5

Question-3.............................................................................................................................................6

Question 4.............................................................................................................................................7

Question 5.............................................................................................................................................8

Question -6..........................................................................................................................................10

Question 7...........................................................................................................................................13

Question 8...........................................................................................................................................16

Question 9...........................................................................................................................................18

Question10..........................................................................................................................................19

References...........................................................................................................................................22

Appendix-1......................................................................................................................................23

Appendix 2......................................................................................................................................27

Appendix 3......................................................................................................................................29

.........................................................................................................................................................29

Financial Problems Analysis

2

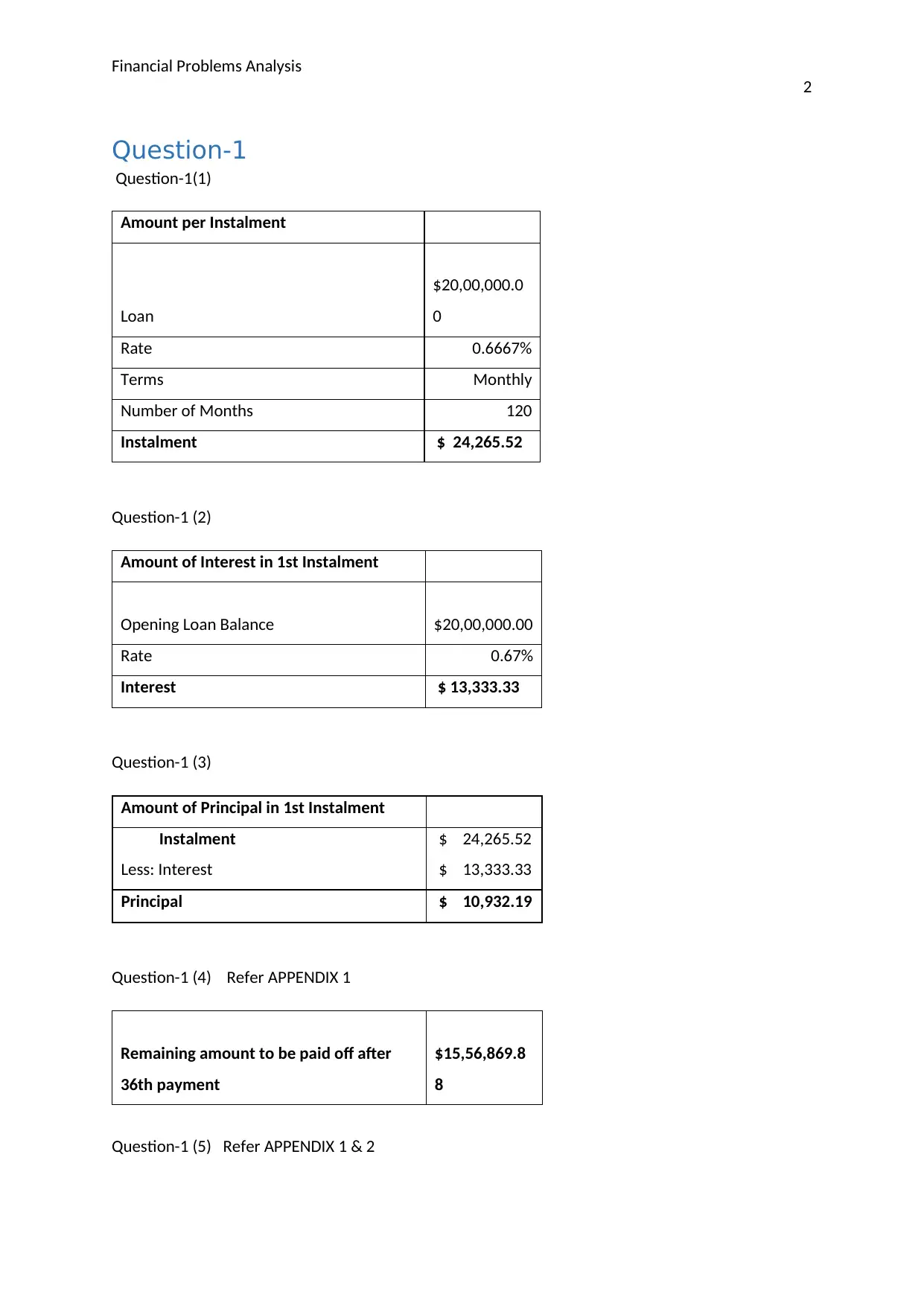

Question-1

Question-1(1)

Amount per Instalment

Loan

$20,00,000.0

0

Rate 0.6667%

Terms Monthly

Number of Months 120

Instalment $ 24,265.52

Question-1 (2)

Amount of Interest in 1st Instalment

Opening Loan Balance $20,00,000.00

Rate 0.67%

Interest $ 13,333.33

Question-1 (3)

Amount of Principal in 1st Instalment

Instalment $ 24,265.52

Less: Interest $ 13,333.33

Principal $ 10,932.19

Question-1 (4) Refer APPENDIX 1

Remaining amount to be paid off after

36th payment

$15,56,869.8

8

Question-1 (5) Refer APPENDIX 1 & 2

2

Question-1

Question-1(1)

Amount per Instalment

Loan

$20,00,000.0

0

Rate 0.6667%

Terms Monthly

Number of Months 120

Instalment $ 24,265.52

Question-1 (2)

Amount of Interest in 1st Instalment

Opening Loan Balance $20,00,000.00

Rate 0.67%

Interest $ 13,333.33

Question-1 (3)

Amount of Principal in 1st Instalment

Instalment $ 24,265.52

Less: Interest $ 13,333.33

Principal $ 10,932.19

Question-1 (4) Refer APPENDIX 1

Remaining amount to be paid off after

36th payment

$15,56,869.8

8

Question-1 (5) Refer APPENDIX 1 & 2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Problems Analysis

3

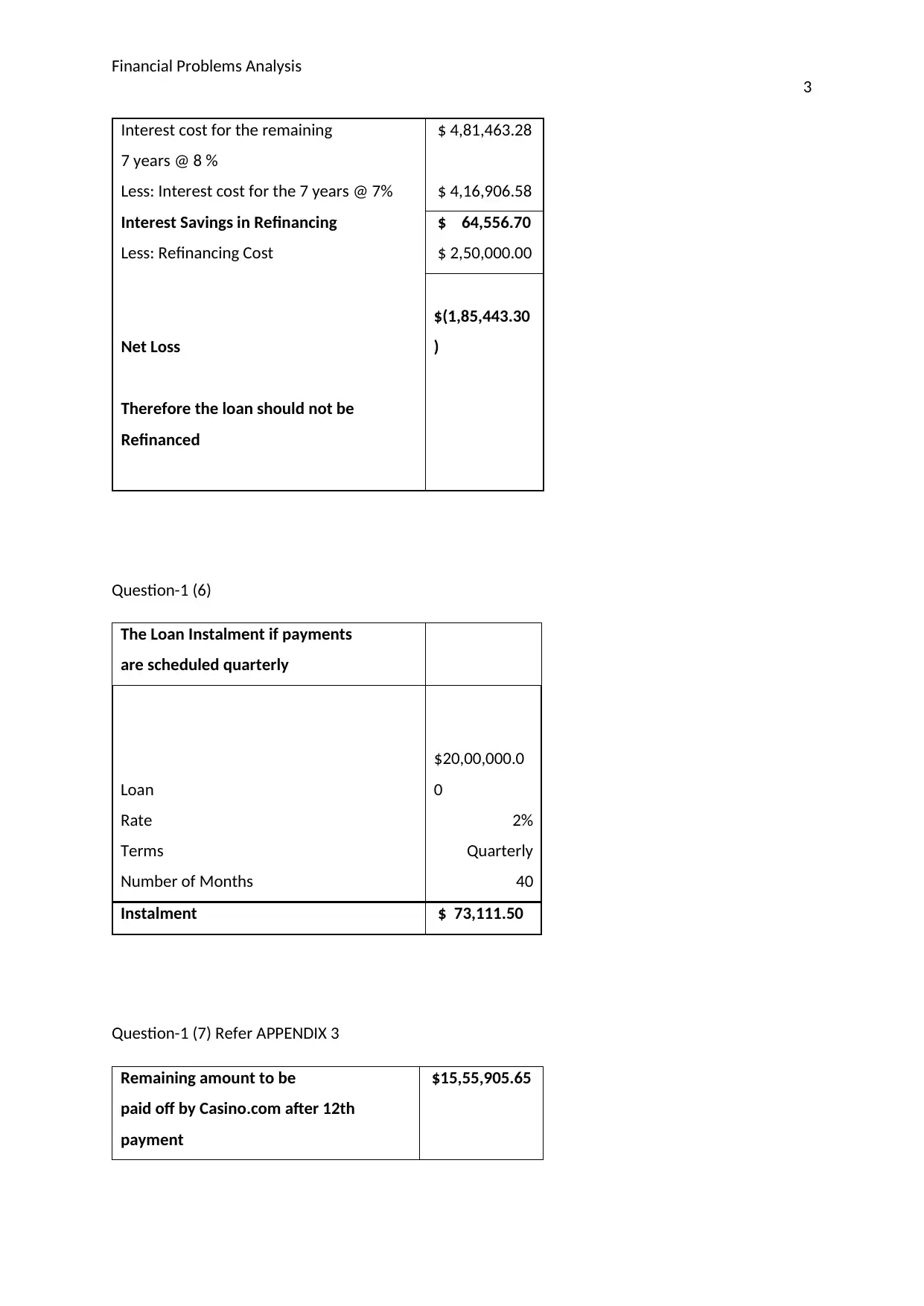

Interest cost for the remaining $ 4,81,463.28

7 years @ 8 %

Less: Interest cost for the 7 years @ 7% $ 4,16,906.58

Interest Savings in Refinancing $ 64,556.70

Less: Refinancing Cost $ 2,50,000.00

Net Loss

$(1,85,443.30

)

Therefore the loan should not be

Refinanced

Question-1 (6)

The Loan Instalment if payments

are scheduled quarterly

Loan

$20,00,000.0

0

Rate 2%

Terms Quarterly

Number of Months 40

Instalment $ 73,111.50

Question-1 (7) Refer APPENDIX 3

Remaining amount to be $15,55,905.65

paid off by Casino.com after 12th

payment

3

Interest cost for the remaining $ 4,81,463.28

7 years @ 8 %

Less: Interest cost for the 7 years @ 7% $ 4,16,906.58

Interest Savings in Refinancing $ 64,556.70

Less: Refinancing Cost $ 2,50,000.00

Net Loss

$(1,85,443.30

)

Therefore the loan should not be

Refinanced

Question-1 (6)

The Loan Instalment if payments

are scheduled quarterly

Loan

$20,00,000.0

0

Rate 2%

Terms Quarterly

Number of Months 40

Instalment $ 73,111.50

Question-1 (7) Refer APPENDIX 3

Remaining amount to be $15,55,905.65

paid off by Casino.com after 12th

payment

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Problems Analysis

4

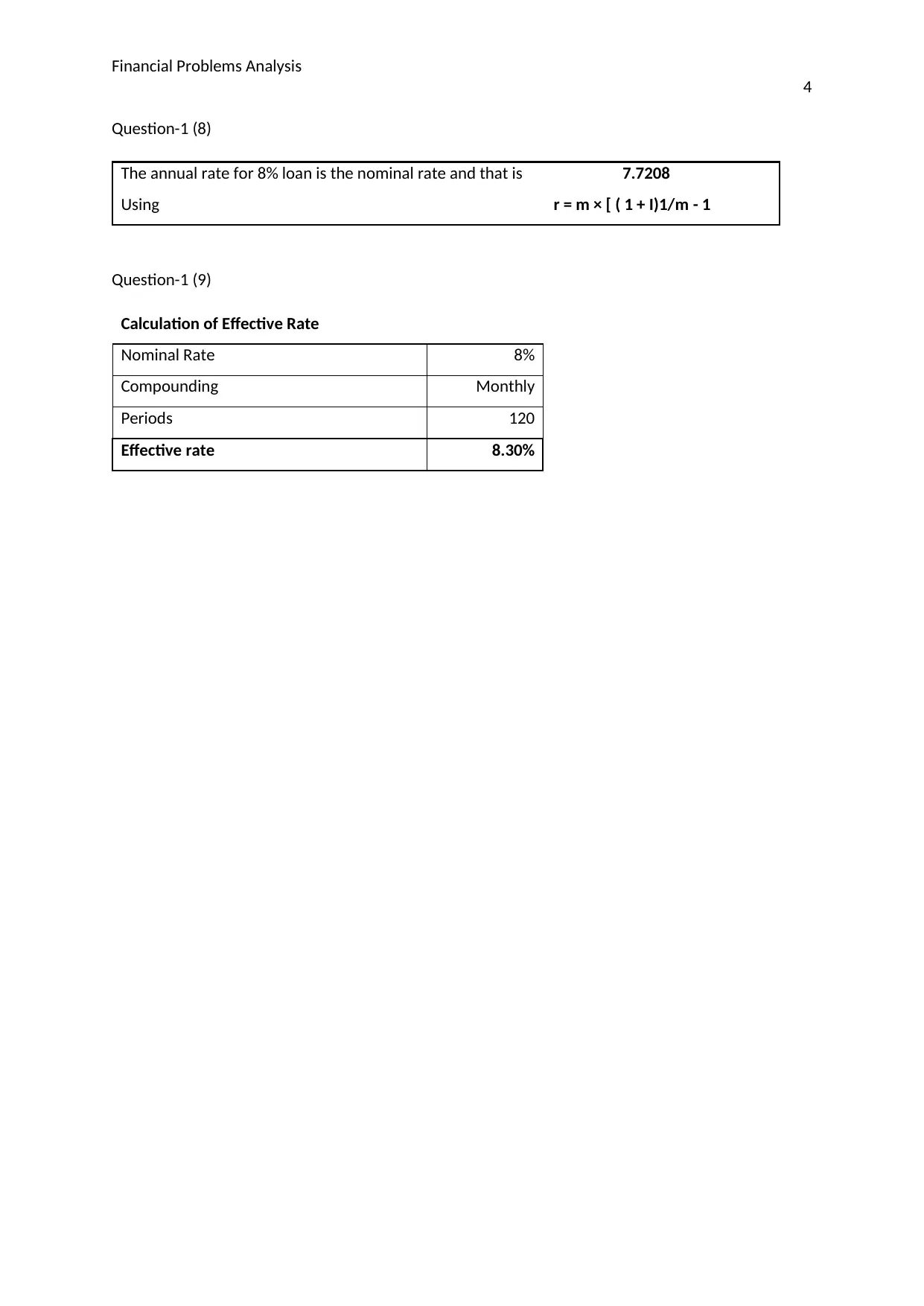

Question-1 (8)

The annual rate for 8% loan is the nominal rate and that is 7.7208

Using r = m × [ ( 1 + I)1/m - 1

Question-1 (9)

Calculation of Effective Rate

Nominal Rate 8%

Compounding Monthly

Periods 120

Effective rate 8.30%

4

Question-1 (8)

The annual rate for 8% loan is the nominal rate and that is 7.7208

Using r = m × [ ( 1 + I)1/m - 1

Question-1 (9)

Calculation of Effective Rate

Nominal Rate 8%

Compounding Monthly

Periods 120

Effective rate 8.30%

Financial Problems Analysis

5

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Problems Analysis

6

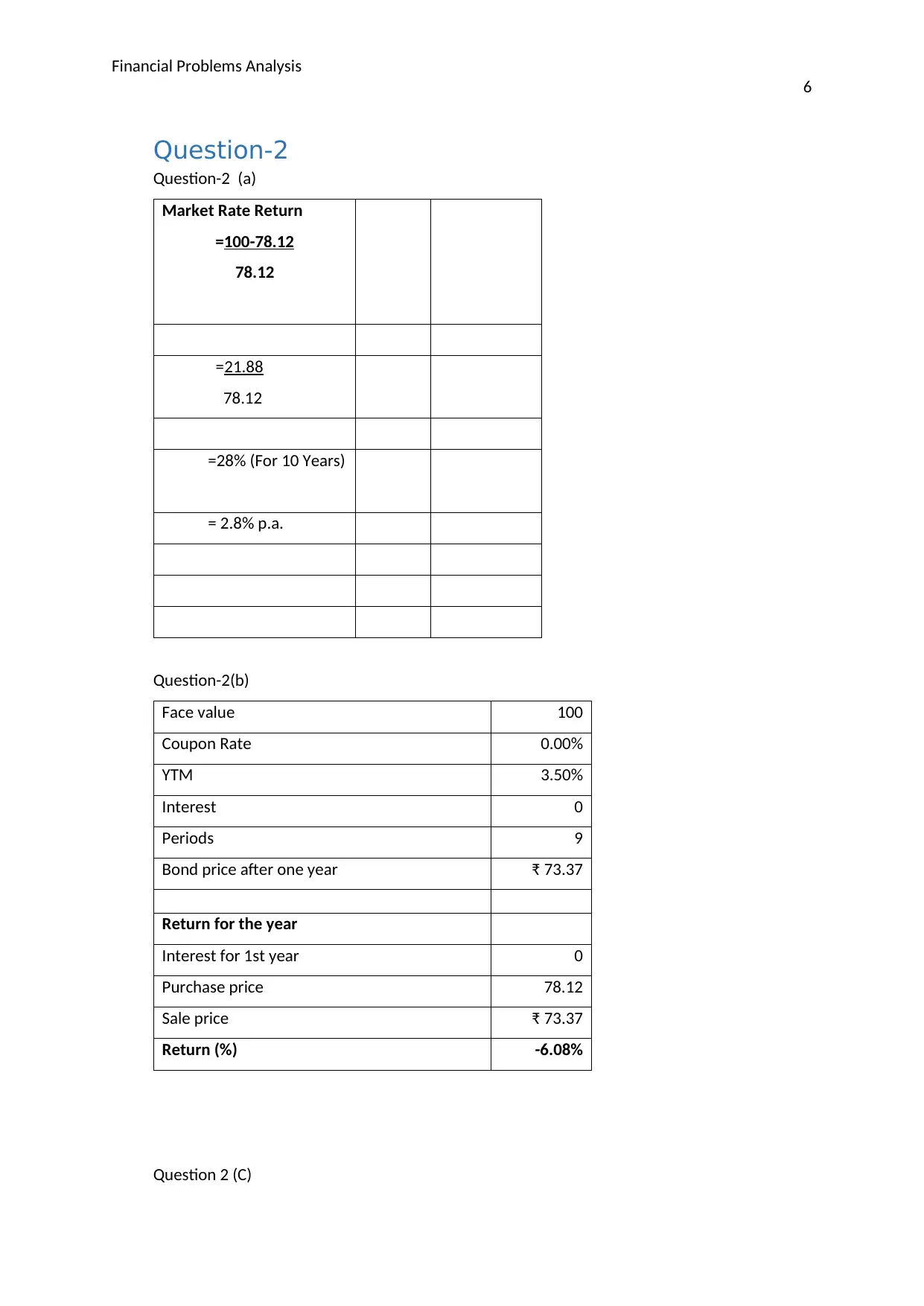

Question-2

Question-2 (a)

Market Rate Return

=100-78.12

78.12

=21.88

78.12

=28% (For 10 Years)

= 2.8% p.a.

Question-2(b)

Face value 100

Coupon Rate 0.00%

YTM 3.50%

Interest 0

Periods 9

Bond price after one year ₹ 73.37

Return for the year

Interest for 1st year 0

Purchase price 78.12

Sale price ₹ 73.37

Return (%) -6.08%

Question 2 (C)

6

Question-2

Question-2 (a)

Market Rate Return

=100-78.12

78.12

=21.88

78.12

=28% (For 10 Years)

= 2.8% p.a.

Question-2(b)

Face value 100

Coupon Rate 0.00%

YTM 3.50%

Interest 0

Periods 9

Bond price after one year ₹ 73.37

Return for the year

Interest for 1st year 0

Purchase price 78.12

Sale price ₹ 73.37

Return (%) -6.08%

Question 2 (C)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Problems Analysis

7

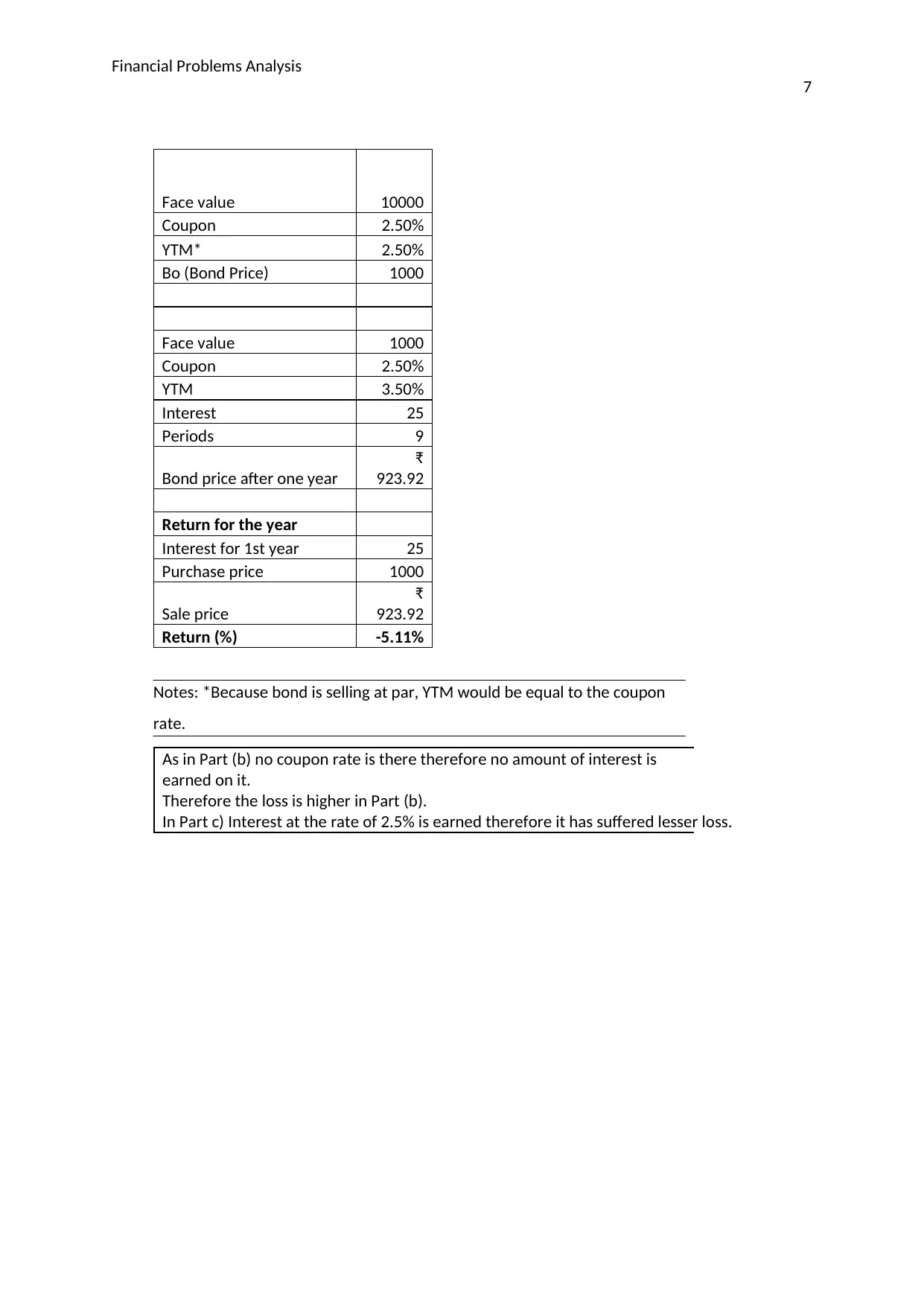

Face value 10000

Coupon 2.50%

YTM* 2.50%

Bo (Bond Price) 1000

Face value 1000

Coupon 2.50%

YTM 3.50%

Interest 25

Periods 9

Bond price after one year

₹

923.92

Return for the year

Interest for 1st year 25

Purchase price 1000

Sale price

₹

923.92

Return (%) -5.11%

Notes: *Because bond is selling at par, YTM would be equal to the coupon

rate.

As in Part (b) no coupon rate is there therefore no amount of interest is

earned on it.

Therefore the loss is higher in Part (b).

In Part c) Interest at the rate of 2.5% is earned therefore it has suffered lesser loss.

7

Face value 10000

Coupon 2.50%

YTM* 2.50%

Bo (Bond Price) 1000

Face value 1000

Coupon 2.50%

YTM 3.50%

Interest 25

Periods 9

Bond price after one year

₹

923.92

Return for the year

Interest for 1st year 25

Purchase price 1000

Sale price

₹

923.92

Return (%) -5.11%

Notes: *Because bond is selling at par, YTM would be equal to the coupon

rate.

As in Part (b) no coupon rate is there therefore no amount of interest is

earned on it.

Therefore the loss is higher in Part (b).

In Part c) Interest at the rate of 2.5% is earned therefore it has suffered lesser loss.

Financial Problems Analysis

8

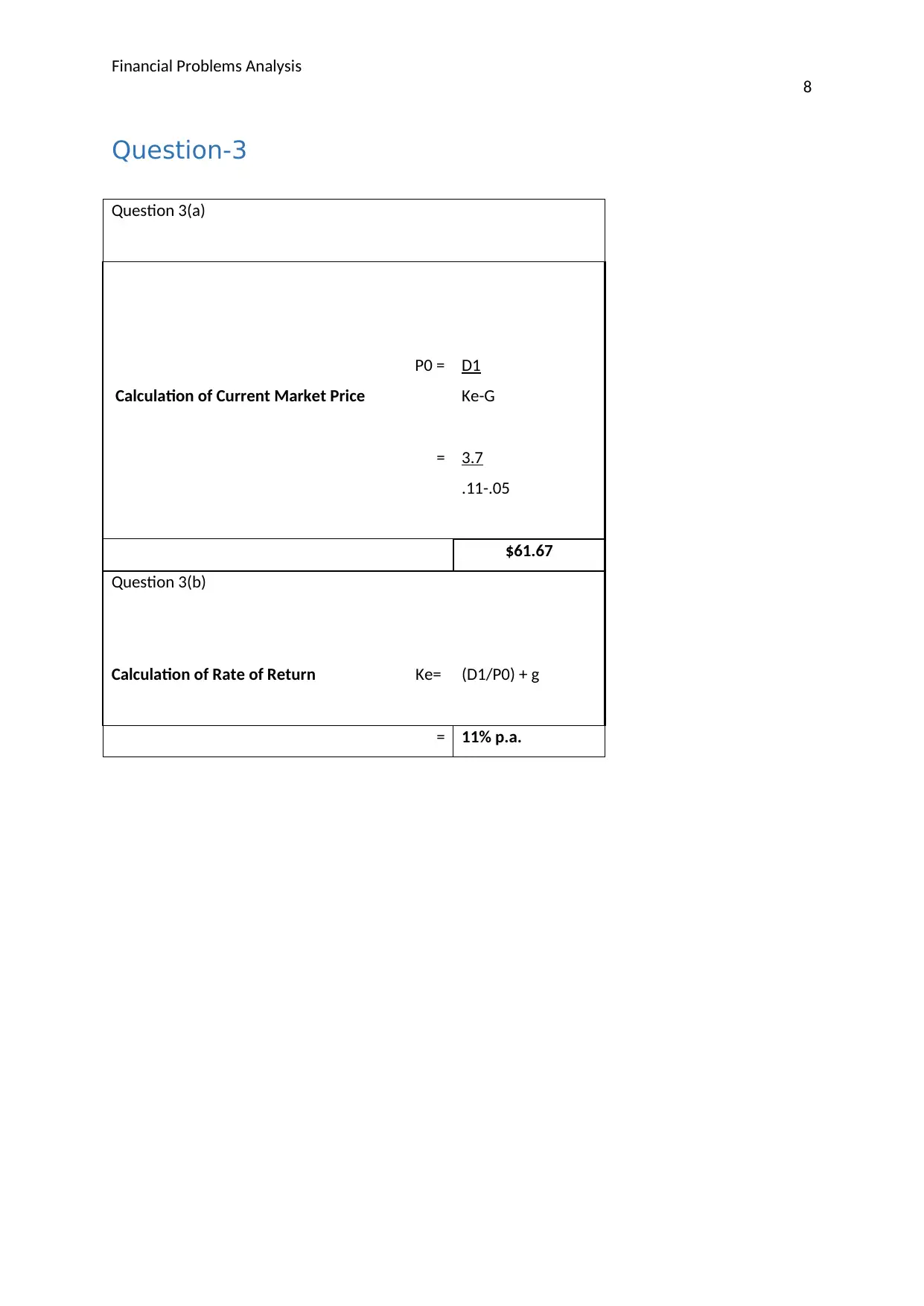

Question-3

Question 3(a)

P0 = D1

Calculation of Current Market Price Ke-G

= 3.7

.11-.05

$61.67

Question 3(b)

Calculation of Rate of Return Ke= (D1/P0) + g

= 11% p.a.

8

Question-3

Question 3(a)

P0 = D1

Calculation of Current Market Price Ke-G

= 3.7

.11-.05

$61.67

Question 3(b)

Calculation of Rate of Return Ke= (D1/P0) + g

= 11% p.a.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Problems Analysis

9

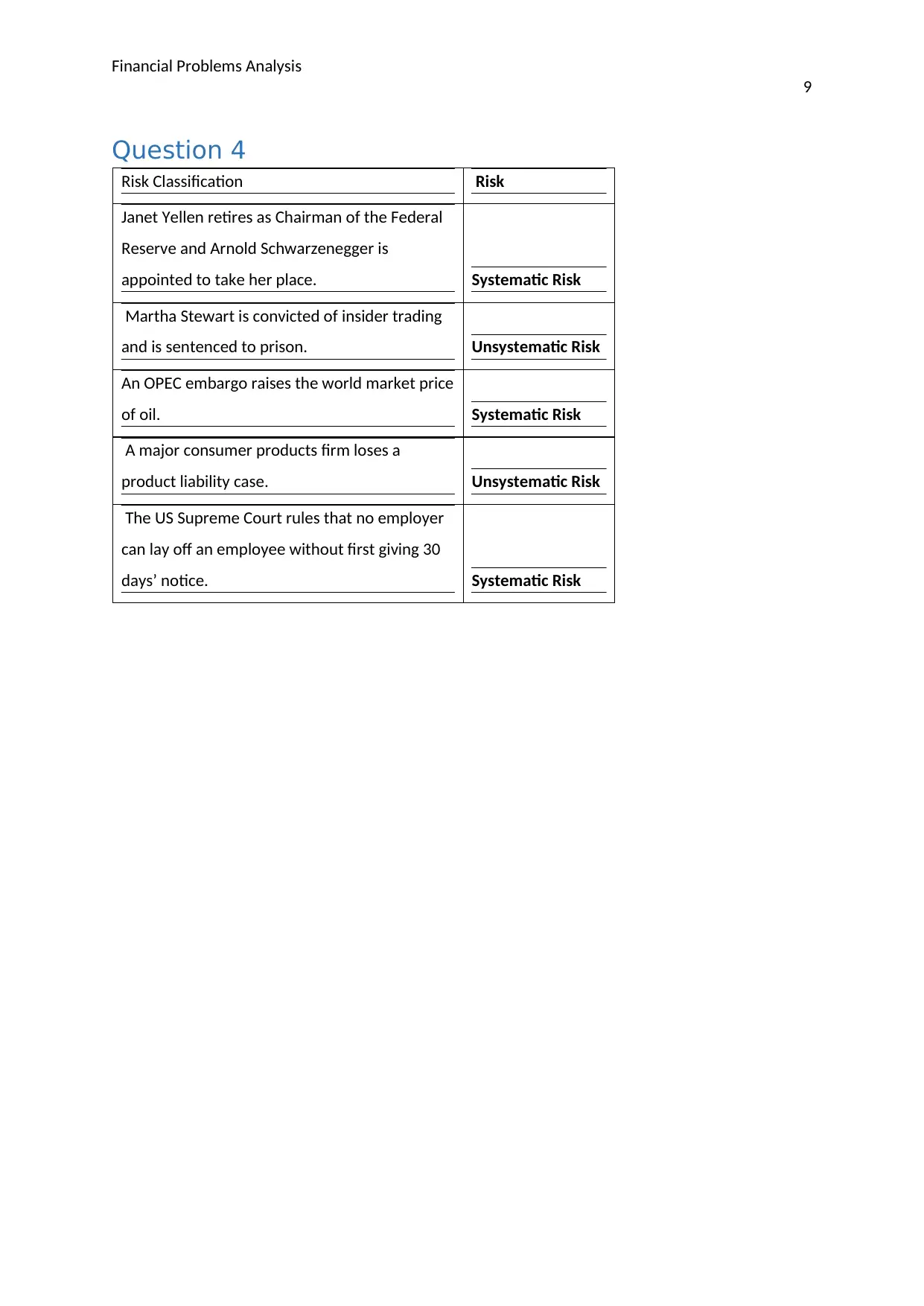

Question 4

Risk Classification Risk

Janet Yellen retires as Chairman of the Federal

Reserve and Arnold Schwarzenegger is

appointed to take her place. Systematic Risk

Martha Stewart is convicted of insider trading

and is sentenced to prison. Unsystematic Risk

An OPEC embargo raises the world market price

of oil. Systematic Risk

A major consumer products firm loses a

product liability case. Unsystematic Risk

The US Supreme Court rules that no employer

can lay off an employee without first giving 30

days’ notice. Systematic Risk

9

Question 4

Risk Classification Risk

Janet Yellen retires as Chairman of the Federal

Reserve and Arnold Schwarzenegger is

appointed to take her place. Systematic Risk

Martha Stewart is convicted of insider trading

and is sentenced to prison. Unsystematic Risk

An OPEC embargo raises the world market price

of oil. Systematic Risk

A major consumer products firm loses a

product liability case. Unsystematic Risk

The US Supreme Court rules that no employer

can lay off an employee without first giving 30

days’ notice. Systematic Risk

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Problems Analysis

10

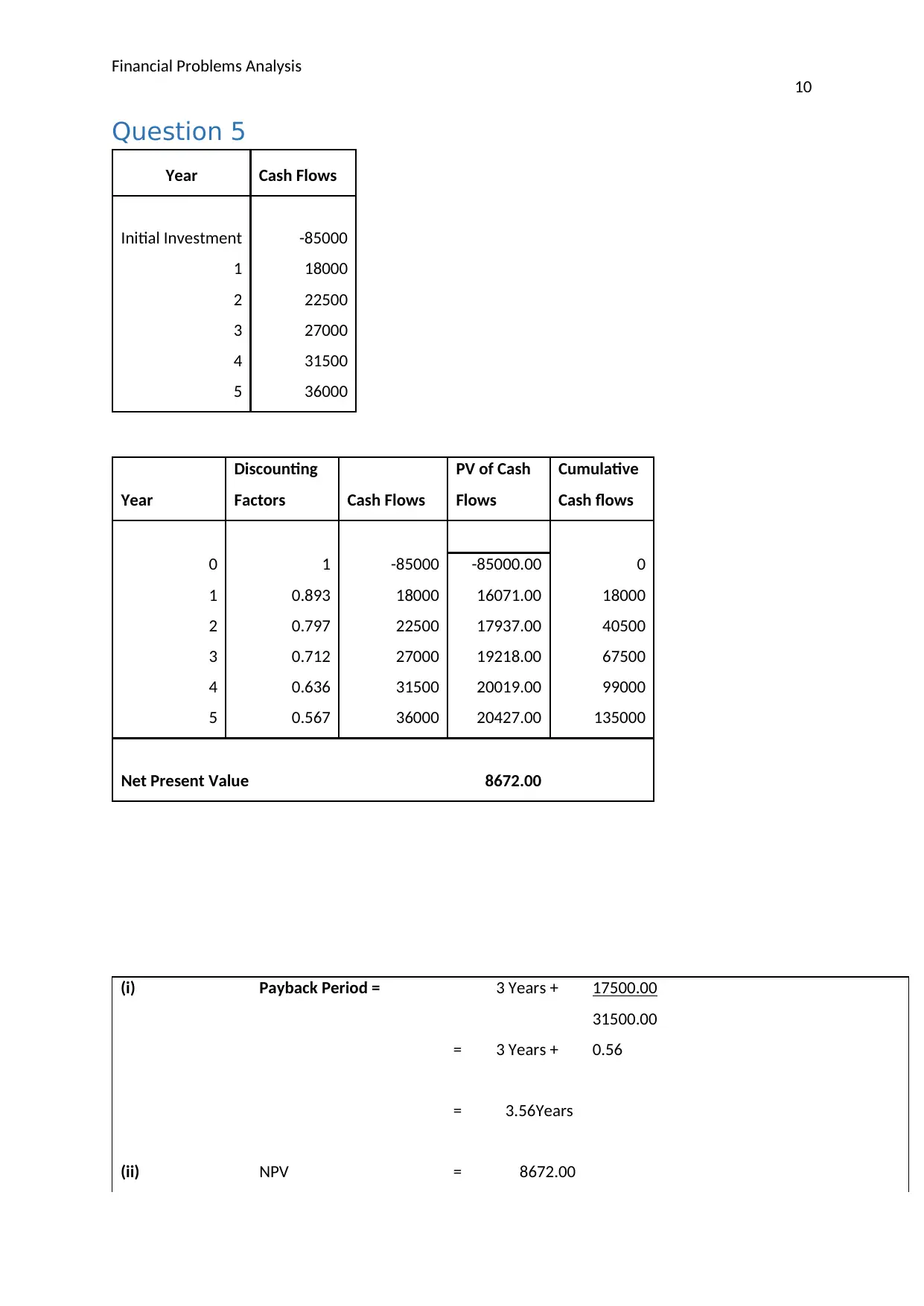

Question 5

Year Cash Flows

Initial Investment -85000

1 18000

2 22500

3 27000

4 31500

5 36000

Year

Discounting

Factors Cash Flows

PV of Cash

Flows

Cumulative

Cash flows

0 1 -85000 -85000.00 0

1 0.893 18000 16071.00 18000

2 0.797 22500 17937.00 40500

3 0.712 27000 19218.00 67500

4 0.636 31500 20019.00 99000

5 0.567 36000 20427.00 135000

Net Present Value 8672.00

(i) Payback Period = 3 Years + 17500.00

31500.00

= 3 Years + 0.56

= 3.56Years

(ii) NPV = 8672.00

10

Question 5

Year Cash Flows

Initial Investment -85000

1 18000

2 22500

3 27000

4 31500

5 36000

Year

Discounting

Factors Cash Flows

PV of Cash

Flows

Cumulative

Cash flows

0 1 -85000 -85000.00 0

1 0.893 18000 16071.00 18000

2 0.797 22500 17937.00 40500

3 0.712 27000 19218.00 67500

4 0.636 31500 20019.00 99000

5 0.567 36000 20427.00 135000

Net Present Value 8672.00

(i) Payback Period = 3 Years + 17500.00

31500.00

= 3 Years + 0.56

= 3.56Years

(ii) NPV = 8672.00

Financial Problems Analysis

11

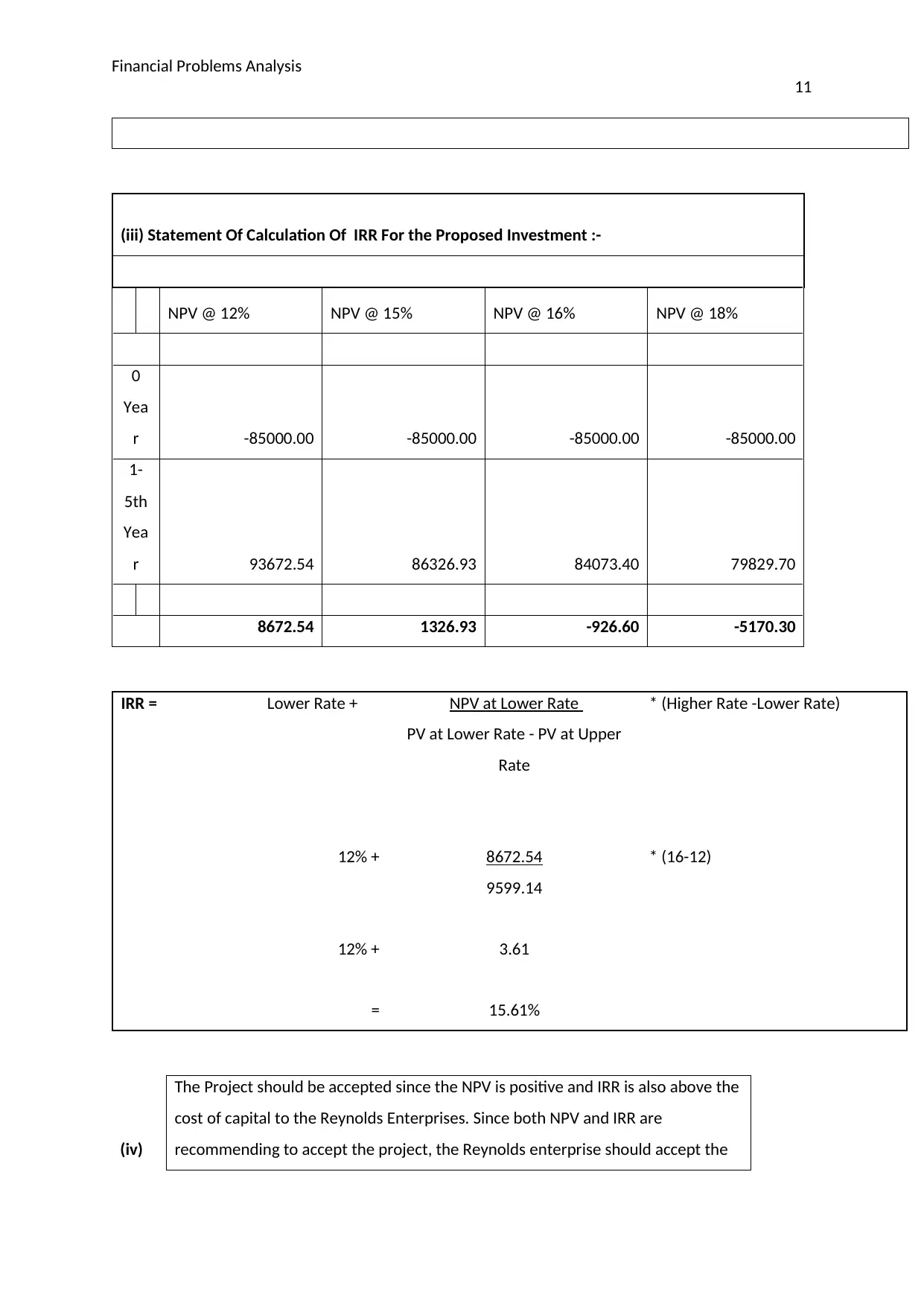

(iii) Statement Of Calculation Of IRR For the Proposed Investment :-

NPV @ 12% NPV @ 15% NPV @ 16% NPV @ 18%

0

Yea

r -85000.00 -85000.00 -85000.00 -85000.00

1-

5th

Yea

r 93672.54 86326.93 84073.40 79829.70

8672.54 1326.93 -926.60 -5170.30

IRR = Lower Rate + NPV at Lower Rate * (Higher Rate -Lower Rate)

PV at Lower Rate - PV at Upper

Rate

12% + 8672.54 * (16-12)

9599.14

12% + 3.61

= 15.61%

The Project should be accepted since the NPV is positive and IRR is also above the

cost of capital to the Reynolds Enterprises. Since both NPV and IRR are

recommending to accept the project, the Reynolds enterprise should accept the(iv)

11

(iii) Statement Of Calculation Of IRR For the Proposed Investment :-

NPV @ 12% NPV @ 15% NPV @ 16% NPV @ 18%

0

Yea

r -85000.00 -85000.00 -85000.00 -85000.00

1-

5th

Yea

r 93672.54 86326.93 84073.40 79829.70

8672.54 1326.93 -926.60 -5170.30

IRR = Lower Rate + NPV at Lower Rate * (Higher Rate -Lower Rate)

PV at Lower Rate - PV at Upper

Rate

12% + 8672.54 * (16-12)

9599.14

12% + 3.61

= 15.61%

The Project should be accepted since the NPV is positive and IRR is also above the

cost of capital to the Reynolds Enterprises. Since both NPV and IRR are

recommending to accept the project, the Reynolds enterprise should accept the(iv)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.