Comparative Financial Analysis: BHP Billiton vs Fortescue Metals Group

VerifiedAdded on 2022/09/01

|15

|2982

|20

Report

AI Summary

This report presents a financial analysis of two major mining companies, BHP Billiton Limited and Fortescue Metals Group Limited. The analysis employs various financial tools, including ratio analysis (liquidity, profitability, and capital structure ratios) and common size analysis (both horizontal and vertical), to evaluate and compare the companies' financial performance. The report examines key financial metrics, such as current ratio, quick ratio, net profit margin, return on capital employed, return on equity, and debt-to-equity ratio, over a specific period. It also delves into the interpretation and evaluation of these ratios to assess the financial health, efficiency, and stability of each company. Furthermore, the study includes a comparative analysis of the income statements and balance sheets using common size analysis to identify trends and differences in financial structure and performance between the two organizations. The findings highlight the strengths and weaknesses of each company, offering insights into their financial strategies and overall market positions.

ACCOUNTING AND FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction................................................................................................................................2

BHP Billiton limited..................................................................................................................2

Fortescue metals group..............................................................................................................2

Interpretation and evaluation......................................................................................................3

Ratio Analysis............................................................................................................................3

Horizontal common size analysis...............................................................................................9

Vertical common size analysis.................................................................................................11

References................................................................................................................................13

Introduction................................................................................................................................2

BHP Billiton limited..................................................................................................................2

Fortescue metals group..............................................................................................................2

Interpretation and evaluation......................................................................................................3

Ratio Analysis............................................................................................................................3

Horizontal common size analysis...............................................................................................9

Vertical common size analysis.................................................................................................11

References................................................................................................................................13

Introduction

Financial analysis is the procedure of evaluating projects, budgets, and businesses to

determine the suitability and performance. The report analyse the financial analysis of two

companies of mining industry. Financial analysis conducts by focusing on ratios and

conducting comparison between both the organisations named as BHP Billiton limited and

Fortescue metal group limited. For vertical and horizontal analysis, common size analysis is

the way through which each element of the financial statement is measured as a proportion

base for same period. For this, the company can use and analyse through balance sheet and

income statement. Moreover, it is important to conduct common size financial statement

analysis displaying all the particular items as a proportion of common figure rather than the

exact numerical figures. This analysis is conducted to examine the financial statement by

comparing it within the organisation (Brigham, & Houston, 2012).

BHP Billiton limited

BHP Billiton limited is ASX registered multinational mining, petroleum and Metal Company.

The company is headquartered in Victoria, Australia. In 2017, BHP Billiton is the largest

mining organisation based on market capitalisation. The company offers coal, petroleum,

natural gas, uranium, and nickel with current employee base of 62000 people. In 2018, the

revenue generated was 43.638 billion dollars. In 2018, the operating income is US$ 17.561

billion. In 2018, net income is US$ 4.823 billion in 2018. Total assets owned is estimated at

US$ 111993000000 (BHP Billiton limited, 2018).

Fortescue metals group

Fortescue metal group limited is an ASX registered iron ore organisation. Fortescue is fourth

largest producer of iron ore after Rio Tinto, and BHP Billiton. The company is headquartered

Financial analysis is the procedure of evaluating projects, budgets, and businesses to

determine the suitability and performance. The report analyse the financial analysis of two

companies of mining industry. Financial analysis conducts by focusing on ratios and

conducting comparison between both the organisations named as BHP Billiton limited and

Fortescue metal group limited. For vertical and horizontal analysis, common size analysis is

the way through which each element of the financial statement is measured as a proportion

base for same period. For this, the company can use and analyse through balance sheet and

income statement. Moreover, it is important to conduct common size financial statement

analysis displaying all the particular items as a proportion of common figure rather than the

exact numerical figures. This analysis is conducted to examine the financial statement by

comparing it within the organisation (Brigham, & Houston, 2012).

BHP Billiton limited

BHP Billiton limited is ASX registered multinational mining, petroleum and Metal Company.

The company is headquartered in Victoria, Australia. In 2017, BHP Billiton is the largest

mining organisation based on market capitalisation. The company offers coal, petroleum,

natural gas, uranium, and nickel with current employee base of 62000 people. In 2018, the

revenue generated was 43.638 billion dollars. In 2018, the operating income is US$ 17.561

billion. In 2018, net income is US$ 4.823 billion in 2018. Total assets owned is estimated at

US$ 111993000000 (BHP Billiton limited, 2018).

Fortescue metals group

Fortescue metal group limited is an ASX registered iron ore organisation. Fortescue is fourth

largest producer of iron ore after Rio Tinto, and BHP Billiton. The company is headquartered

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

in Western Australia by offering products such as Steel, Copper, Gold, Iron ore and Lithium.

The organisation was founded in 2003. Currently, the company has been serving worldwide.

In 2019, the revenue is estimated at 14.37 billion dollars. In 2019, the operating income is

nearly 8.84 billion dollars. In 2019, net income is estimated at $4.71 billion. In 2019, total

assets are estimated at $22.26 billion and total equity is estimated at $22.26 billion. Currently,

the company has an employee base of 5455 (Fortescue metal group, 2018).

Interpretation and evaluation

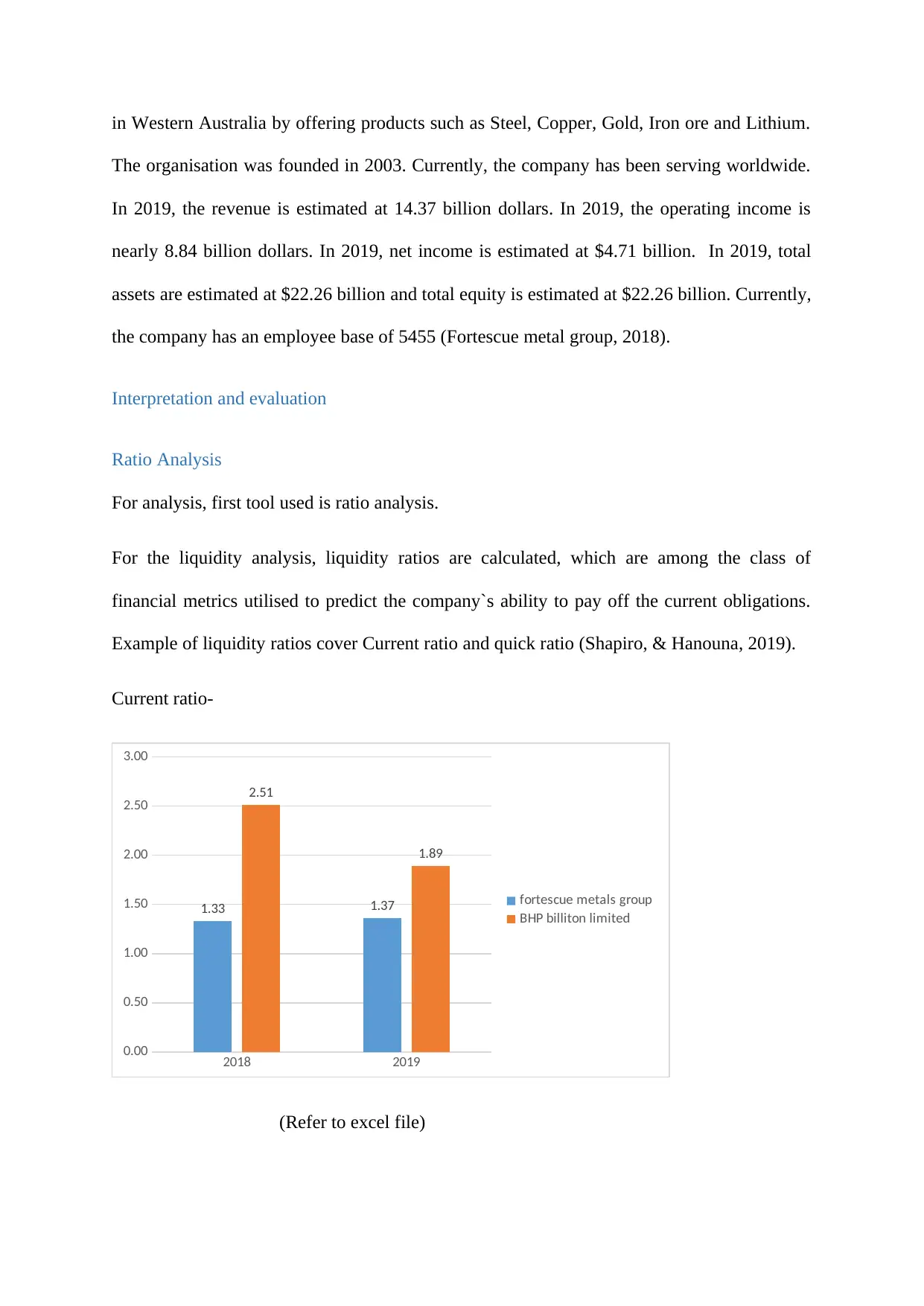

Ratio Analysis

For analysis, first tool used is ratio analysis.

For the liquidity analysis, liquidity ratios are calculated, which are among the class of

financial metrics utilised to predict the company`s ability to pay off the current obligations.

Example of liquidity ratios cover Current ratio and quick ratio (Shapiro, & Hanouna, 2019).

Current ratio-

2018 2019

0.00

0.50

1.00

1.50

2.00

2.50

3.00

1.33 1.37

2.51

1.89

fortescue metals group

BHP billiton limited

(Refer to excel file)

The organisation was founded in 2003. Currently, the company has been serving worldwide.

In 2019, the revenue is estimated at 14.37 billion dollars. In 2019, the operating income is

nearly 8.84 billion dollars. In 2019, net income is estimated at $4.71 billion. In 2019, total

assets are estimated at $22.26 billion and total equity is estimated at $22.26 billion. Currently,

the company has an employee base of 5455 (Fortescue metal group, 2018).

Interpretation and evaluation

Ratio Analysis

For analysis, first tool used is ratio analysis.

For the liquidity analysis, liquidity ratios are calculated, which are among the class of

financial metrics utilised to predict the company`s ability to pay off the current obligations.

Example of liquidity ratios cover Current ratio and quick ratio (Shapiro, & Hanouna, 2019).

Current ratio-

2018 2019

0.00

0.50

1.00

1.50

2.00

2.50

3.00

1.33 1.37

2.51

1.89

fortescue metals group

BHP billiton limited

(Refer to excel file)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

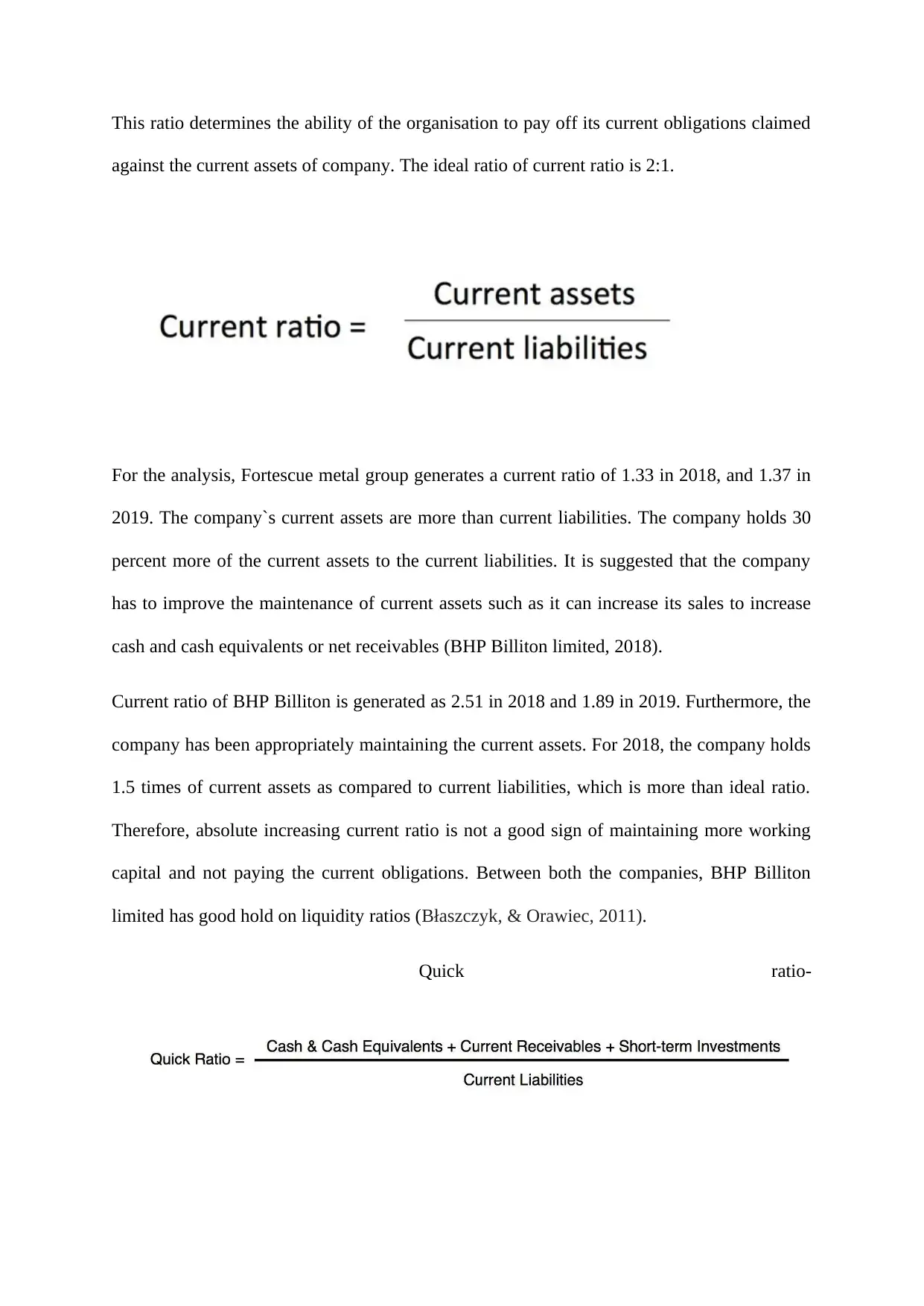

This ratio determines the ability of the organisation to pay off its current obligations claimed

against the current assets of company. The ideal ratio of current ratio is 2:1.

For the analysis, Fortescue metal group generates a current ratio of 1.33 in 2018, and 1.37 in

2019. The company`s current assets are more than current liabilities. The company holds 30

percent more of the current assets to the current liabilities. It is suggested that the company

has to improve the maintenance of current assets such as it can increase its sales to increase

cash and cash equivalents or net receivables (BHP Billiton limited, 2018).

Current ratio of BHP Billiton is generated as 2.51 in 2018 and 1.89 in 2019. Furthermore, the

company has been appropriately maintaining the current assets. For 2018, the company holds

1.5 times of current assets as compared to current liabilities, which is more than ideal ratio.

Therefore, absolute increasing current ratio is not a good sign of maintaining more working

capital and not paying the current obligations. Between both the companies, BHP Billiton

limited has good hold on liquidity ratios (Błaszczyk, & Orawiec, 2011).

Quick ratio-

against the current assets of company. The ideal ratio of current ratio is 2:1.

For the analysis, Fortescue metal group generates a current ratio of 1.33 in 2018, and 1.37 in

2019. The company`s current assets are more than current liabilities. The company holds 30

percent more of the current assets to the current liabilities. It is suggested that the company

has to improve the maintenance of current assets such as it can increase its sales to increase

cash and cash equivalents or net receivables (BHP Billiton limited, 2018).

Current ratio of BHP Billiton is generated as 2.51 in 2018 and 1.89 in 2019. Furthermore, the

company has been appropriately maintaining the current assets. For 2018, the company holds

1.5 times of current assets as compared to current liabilities, which is more than ideal ratio.

Therefore, absolute increasing current ratio is not a good sign of maintaining more working

capital and not paying the current obligations. Between both the companies, BHP Billiton

limited has good hold on liquidity ratios (Błaszczyk, & Orawiec, 2011).

Quick ratio-

2018 2019

0.00

0.50

1.00

1.50

2.00

2.50

0.93

1.07

2.24

1.58

fortescue metals group

BHP billiton limited

(Refer to excel file)

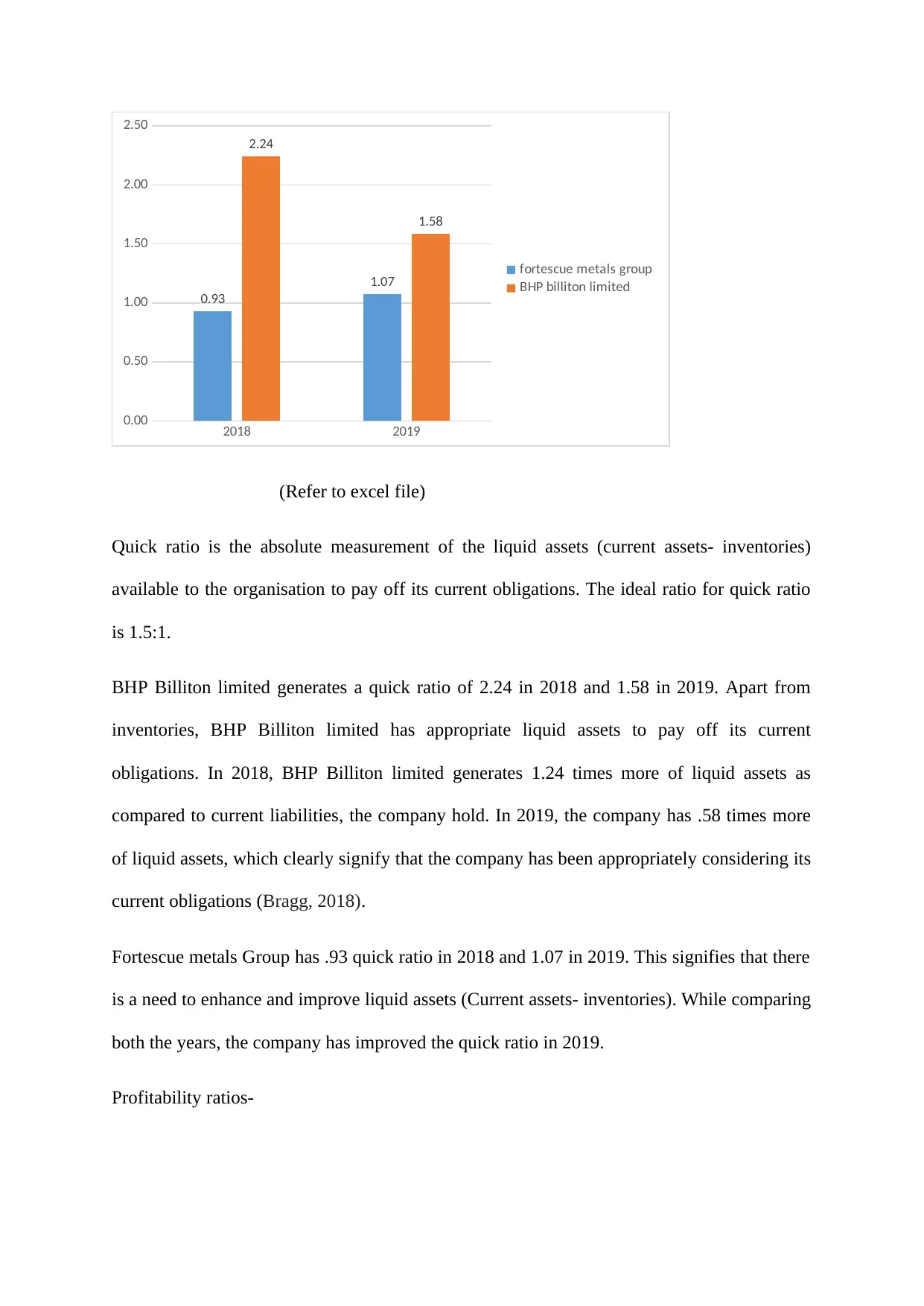

Quick ratio is the absolute measurement of the liquid assets (current assets- inventories)

available to the organisation to pay off its current obligations. The ideal ratio for quick ratio

is 1.5:1.

BHP Billiton limited generates a quick ratio of 2.24 in 2018 and 1.58 in 2019. Apart from

inventories, BHP Billiton limited has appropriate liquid assets to pay off its current

obligations. In 2018, BHP Billiton limited generates 1.24 times more of liquid assets as

compared to current liabilities, the company hold. In 2019, the company has .58 times more

of liquid assets, which clearly signify that the company has been appropriately considering its

current obligations (Bragg, 2018).

Fortescue metals Group has .93 quick ratio in 2018 and 1.07 in 2019. This signifies that there

is a need to enhance and improve liquid assets (Current assets- inventories). While comparing

both the years, the company has improved the quick ratio in 2019.

Profitability ratios-

0.00

0.50

1.00

1.50

2.00

2.50

0.93

1.07

2.24

1.58

fortescue metals group

BHP billiton limited

(Refer to excel file)

Quick ratio is the absolute measurement of the liquid assets (current assets- inventories)

available to the organisation to pay off its current obligations. The ideal ratio for quick ratio

is 1.5:1.

BHP Billiton limited generates a quick ratio of 2.24 in 2018 and 1.58 in 2019. Apart from

inventories, BHP Billiton limited has appropriate liquid assets to pay off its current

obligations. In 2018, BHP Billiton limited generates 1.24 times more of liquid assets as

compared to current liabilities, the company hold. In 2019, the company has .58 times more

of liquid assets, which clearly signify that the company has been appropriately considering its

current obligations (Bragg, 2018).

Fortescue metals Group has .93 quick ratio in 2018 and 1.07 in 2019. This signifies that there

is a need to enhance and improve liquid assets (Current assets- inventories). While comparing

both the years, the company has improved the quick ratio in 2019.

Profitability ratios-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

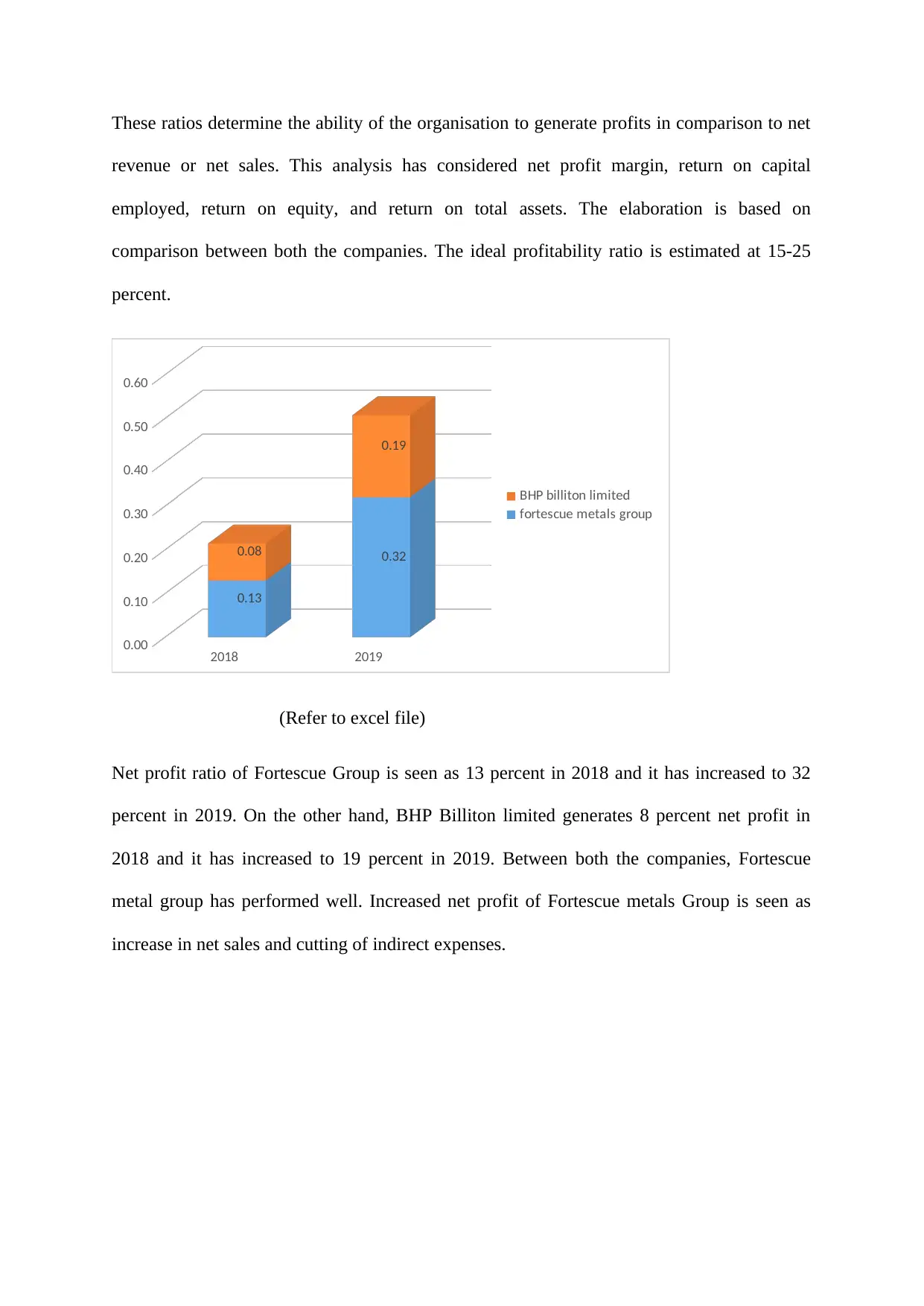

These ratios determine the ability of the organisation to generate profits in comparison to net

revenue or net sales. This analysis has considered net profit margin, return on capital

employed, return on equity, and return on total assets. The elaboration is based on

comparison between both the companies. The ideal profitability ratio is estimated at 15-25

percent.

2018 2019

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.13

0.320.08

0.19

BHP billiton limited

fortescue metals group

(Refer to excel file)

Net profit ratio of Fortescue Group is seen as 13 percent in 2018 and it has increased to 32

percent in 2019. On the other hand, BHP Billiton limited generates 8 percent net profit in

2018 and it has increased to 19 percent in 2019. Between both the companies, Fortescue

metal group has performed well. Increased net profit of Fortescue metals Group is seen as

increase in net sales and cutting of indirect expenses.

revenue or net sales. This analysis has considered net profit margin, return on capital

employed, return on equity, and return on total assets. The elaboration is based on

comparison between both the companies. The ideal profitability ratio is estimated at 15-25

percent.

2018 2019

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.13

0.320.08

0.19

BHP billiton limited

fortescue metals group

(Refer to excel file)

Net profit ratio of Fortescue Group is seen as 13 percent in 2018 and it has increased to 32

percent in 2019. On the other hand, BHP Billiton limited generates 8 percent net profit in

2018 and it has increased to 19 percent in 2019. Between both the companies, Fortescue

metal group has performed well. Increased net profit of Fortescue metals Group is seen as

increase in net sales and cutting of indirect expenses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2018 2019

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

0.11

0.270.06

0.16

BHP billiton limited

fortescue metals group

(Refer to excel file)

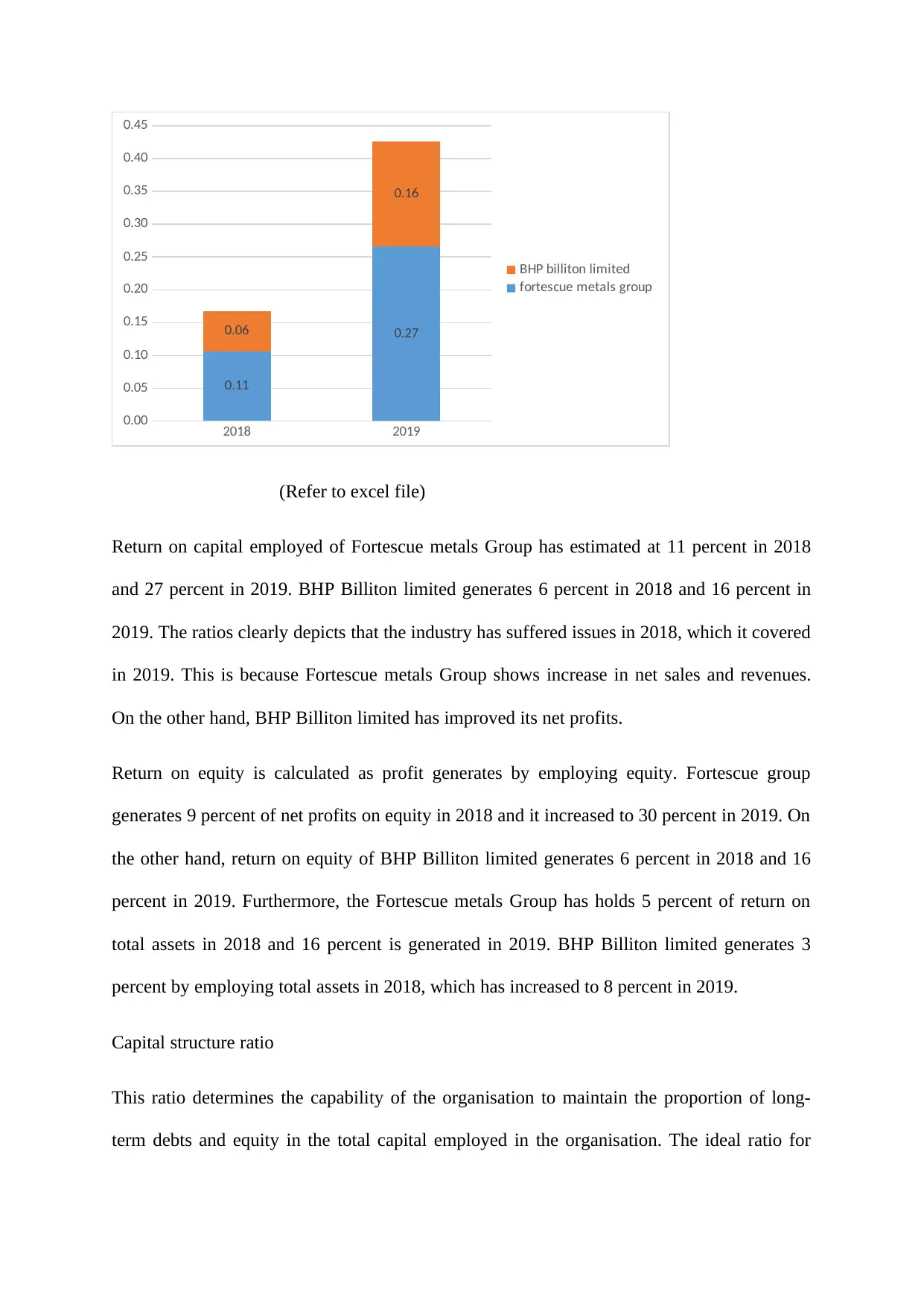

Return on capital employed of Fortescue metals Group has estimated at 11 percent in 2018

and 27 percent in 2019. BHP Billiton limited generates 6 percent in 2018 and 16 percent in

2019. The ratios clearly depicts that the industry has suffered issues in 2018, which it covered

in 2019. This is because Fortescue metals Group shows increase in net sales and revenues.

On the other hand, BHP Billiton limited has improved its net profits.

Return on equity is calculated as profit generates by employing equity. Fortescue group

generates 9 percent of net profits on equity in 2018 and it increased to 30 percent in 2019. On

the other hand, return on equity of BHP Billiton limited generates 6 percent in 2018 and 16

percent in 2019. Furthermore, the Fortescue metals Group has holds 5 percent of return on

total assets in 2018 and 16 percent is generated in 2019. BHP Billiton limited generates 3

percent by employing total assets in 2018, which has increased to 8 percent in 2019.

Capital structure ratio

This ratio determines the capability of the organisation to maintain the proportion of long-

term debts and equity in the total capital employed in the organisation. The ideal ratio for

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

0.40

0.45

0.11

0.270.06

0.16

BHP billiton limited

fortescue metals group

(Refer to excel file)

Return on capital employed of Fortescue metals Group has estimated at 11 percent in 2018

and 27 percent in 2019. BHP Billiton limited generates 6 percent in 2018 and 16 percent in

2019. The ratios clearly depicts that the industry has suffered issues in 2018, which it covered

in 2019. This is because Fortescue metals Group shows increase in net sales and revenues.

On the other hand, BHP Billiton limited has improved its net profits.

Return on equity is calculated as profit generates by employing equity. Fortescue group

generates 9 percent of net profits on equity in 2018 and it increased to 30 percent in 2019. On

the other hand, return on equity of BHP Billiton limited generates 6 percent in 2018 and 16

percent in 2019. Furthermore, the Fortescue metals Group has holds 5 percent of return on

total assets in 2018 and 16 percent is generated in 2019. BHP Billiton limited generates 3

percent by employing total assets in 2018, which has increased to 8 percent in 2019.

Capital structure ratio

This ratio determines the capability of the organisation to maintain the proportion of long-

term debts and equity in the total capital employed in the organisation. The ideal ratio for

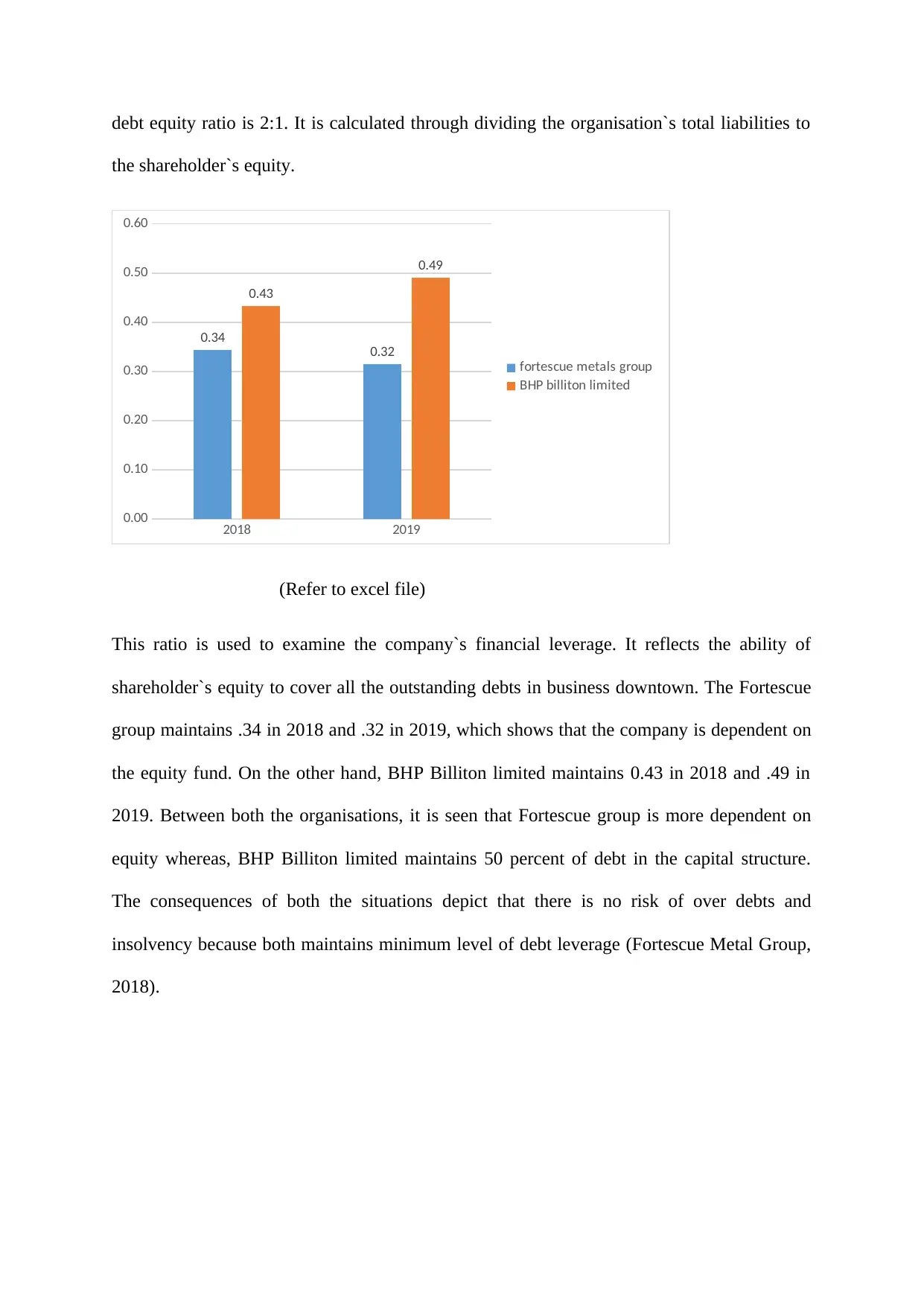

debt equity ratio is 2:1. It is calculated through dividing the organisation`s total liabilities to

the shareholder`s equity.

2018 2019

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.34

0.32

0.43

0.49

fortescue metals group

BHP billiton limited

(Refer to excel file)

This ratio is used to examine the company`s financial leverage. It reflects the ability of

shareholder`s equity to cover all the outstanding debts in business downtown. The Fortescue

group maintains .34 in 2018 and .32 in 2019, which shows that the company is dependent on

the equity fund. On the other hand, BHP Billiton limited maintains 0.43 in 2018 and .49 in

2019. Between both the organisations, it is seen that Fortescue group is more dependent on

equity whereas, BHP Billiton limited maintains 50 percent of debt in the capital structure.

The consequences of both the situations depict that there is no risk of over debts and

insolvency because both maintains minimum level of debt leverage (Fortescue Metal Group,

2018).

the shareholder`s equity.

2018 2019

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.34

0.32

0.43

0.49

fortescue metals group

BHP billiton limited

(Refer to excel file)

This ratio is used to examine the company`s financial leverage. It reflects the ability of

shareholder`s equity to cover all the outstanding debts in business downtown. The Fortescue

group maintains .34 in 2018 and .32 in 2019, which shows that the company is dependent on

the equity fund. On the other hand, BHP Billiton limited maintains 0.43 in 2018 and .49 in

2019. Between both the organisations, it is seen that Fortescue group is more dependent on

equity whereas, BHP Billiton limited maintains 50 percent of debt in the capital structure.

The consequences of both the situations depict that there is no risk of over debts and

insolvency because both maintains minimum level of debt leverage (Fortescue Metal Group,

2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Horizontal common size analysis

Particulars 2018 comparison 2019 Comparison2

AUD$ '000 AUD$ '000

Total revenue 4,36,38,000 100% 4,42,88,000 100%

COGS 1,72,04,000 39% 16730000 38%

Gross Profit 2,64,34,000 61% 27558000.0 62%

Selling general and administration 44,11,000 10% 4437000.0 10%

Total operating expenses 2,77,89,000 64% 2,76,29,000 62%

Operating income 1,58,49,000 36% 1,66,59,000 38%

Interest Expense 10,29,000 2% 10,95,000 2%

Other income/expense 1,02,000 0% -4,72,000 -1%

Income tax expense 70,07,000 16% 5529000 12%

Income from continous operations 77,44,000 18% 9520000 21%

Net income 37,05,000 8% 8306000 19%

BHP Billiton Group

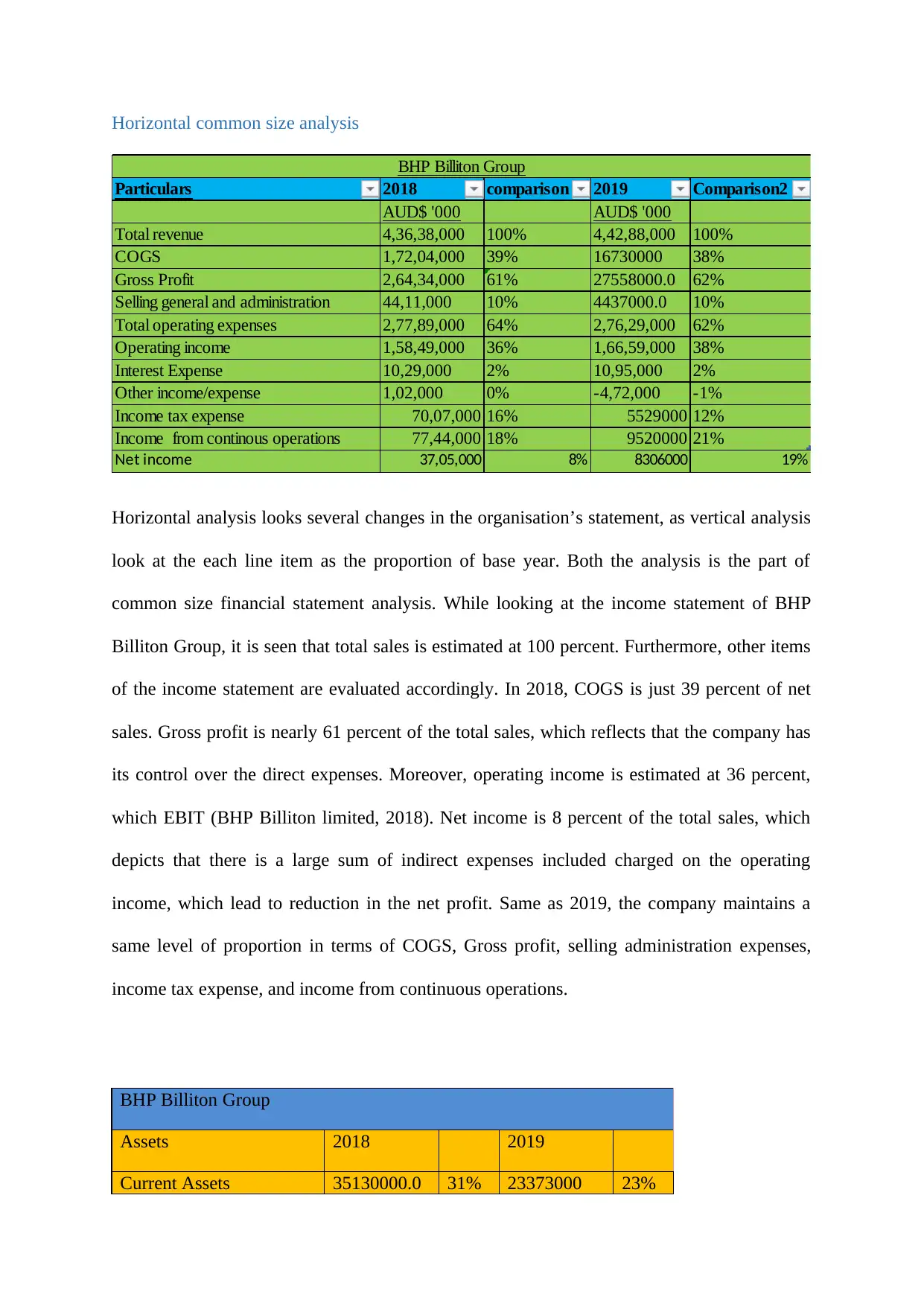

Horizontal analysis looks several changes in the organisation’s statement, as vertical analysis

look at the each line item as the proportion of base year. Both the analysis is the part of

common size financial statement analysis. While looking at the income statement of BHP

Billiton Group, it is seen that total sales is estimated at 100 percent. Furthermore, other items

of the income statement are evaluated accordingly. In 2018, COGS is just 39 percent of net

sales. Gross profit is nearly 61 percent of the total sales, which reflects that the company has

its control over the direct expenses. Moreover, operating income is estimated at 36 percent,

which EBIT (BHP Billiton limited, 2018). Net income is 8 percent of the total sales, which

depicts that there is a large sum of indirect expenses included charged on the operating

income, which lead to reduction in the net profit. Same as 2019, the company maintains a

same level of proportion in terms of COGS, Gross profit, selling administration expenses,

income tax expense, and income from continuous operations.

BHP Billiton Group

Assets 2018 2019

Current Assets 35130000.0 31% 23373000 23%

Particulars 2018 comparison 2019 Comparison2

AUD$ '000 AUD$ '000

Total revenue 4,36,38,000 100% 4,42,88,000 100%

COGS 1,72,04,000 39% 16730000 38%

Gross Profit 2,64,34,000 61% 27558000.0 62%

Selling general and administration 44,11,000 10% 4437000.0 10%

Total operating expenses 2,77,89,000 64% 2,76,29,000 62%

Operating income 1,58,49,000 36% 1,66,59,000 38%

Interest Expense 10,29,000 2% 10,95,000 2%

Other income/expense 1,02,000 0% -4,72,000 -1%

Income tax expense 70,07,000 16% 5529000 12%

Income from continous operations 77,44,000 18% 9520000 21%

Net income 37,05,000 8% 8306000 19%

BHP Billiton Group

Horizontal analysis looks several changes in the organisation’s statement, as vertical analysis

look at the each line item as the proportion of base year. Both the analysis is the part of

common size financial statement analysis. While looking at the income statement of BHP

Billiton Group, it is seen that total sales is estimated at 100 percent. Furthermore, other items

of the income statement are evaluated accordingly. In 2018, COGS is just 39 percent of net

sales. Gross profit is nearly 61 percent of the total sales, which reflects that the company has

its control over the direct expenses. Moreover, operating income is estimated at 36 percent,

which EBIT (BHP Billiton limited, 2018). Net income is 8 percent of the total sales, which

depicts that there is a large sum of indirect expenses included charged on the operating

income, which lead to reduction in the net profit. Same as 2019, the company maintains a

same level of proportion in terms of COGS, Gross profit, selling administration expenses,

income tax expense, and income from continuous operations.

BHP Billiton Group

Assets 2018 2019

Current Assets 35130000.0 31% 23373000 23%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Quick Assets 31366000.0 28% 19533000.0 19%

Inventory 3764000.0 3% 3840000.0 4%

Trade

receivables/Debtors 3096000.0 3% 3462000.0 3%

Total Assets 111993000.0 100% 10,08,61,000 100%

Liabilities

Current Liabilities 13989000.0 12% 12339000.0 12%

Trade Payables/Creditors 5977000.0 5% 67,17,000 7%

Total Liabilities 51323000.0 46% 49037000 49%

Capital Employed 60670000.0 54% 51824000.0 51%

Long term loans 24069000.0 21% 2,31,67,000 23%

Shareholders' Equity 55592000.0 50% 47240000 47%

Same as the income statement, total assets in the balance sheet of BHP Billiton Group is

estimated at 100 percent. Current assets are 31 percent of total assets. Current liabilities are

12 percent of the total assets. Total liabilities is 46 percent of total assets (BHP Billiton

limited, 2019).

Particulars 2018 2019

AUD$ '000 AUD$ '000

Total Revenue 91,66,554 100% 1,42,06,474 100%

COGS 49,58,734 54% 56,05,304 39%

Gross Profit 4207820.0 46% 8601170.0 61%

Total operating expenses 1865783.0 20% 18,85,071 13%

Interest Expense 422135 5% 86981 1%

Income tax expense 496550 5% 1970626 14%

Income from continous operations 1187931 13% 4544418 32%

Income statement of fortescue metals group

Inventory 3764000.0 3% 3840000.0 4%

Trade

receivables/Debtors 3096000.0 3% 3462000.0 3%

Total Assets 111993000.0 100% 10,08,61,000 100%

Liabilities

Current Liabilities 13989000.0 12% 12339000.0 12%

Trade Payables/Creditors 5977000.0 5% 67,17,000 7%

Total Liabilities 51323000.0 46% 49037000 49%

Capital Employed 60670000.0 54% 51824000.0 51%

Long term loans 24069000.0 21% 2,31,67,000 23%

Shareholders' Equity 55592000.0 50% 47240000 47%

Same as the income statement, total assets in the balance sheet of BHP Billiton Group is

estimated at 100 percent. Current assets are 31 percent of total assets. Current liabilities are

12 percent of the total assets. Total liabilities is 46 percent of total assets (BHP Billiton

limited, 2019).

Particulars 2018 2019

AUD$ '000 AUD$ '000

Total Revenue 91,66,554 100% 1,42,06,474 100%

COGS 49,58,734 54% 56,05,304 39%

Gross Profit 4207820.0 46% 8601170.0 61%

Total operating expenses 1865783.0 20% 18,85,071 13%

Interest Expense 422135 5% 86981 1%

Income tax expense 496550 5% 1970626 14%

Income from continous operations 1187931 13% 4544418 32%

Income statement of fortescue metals group

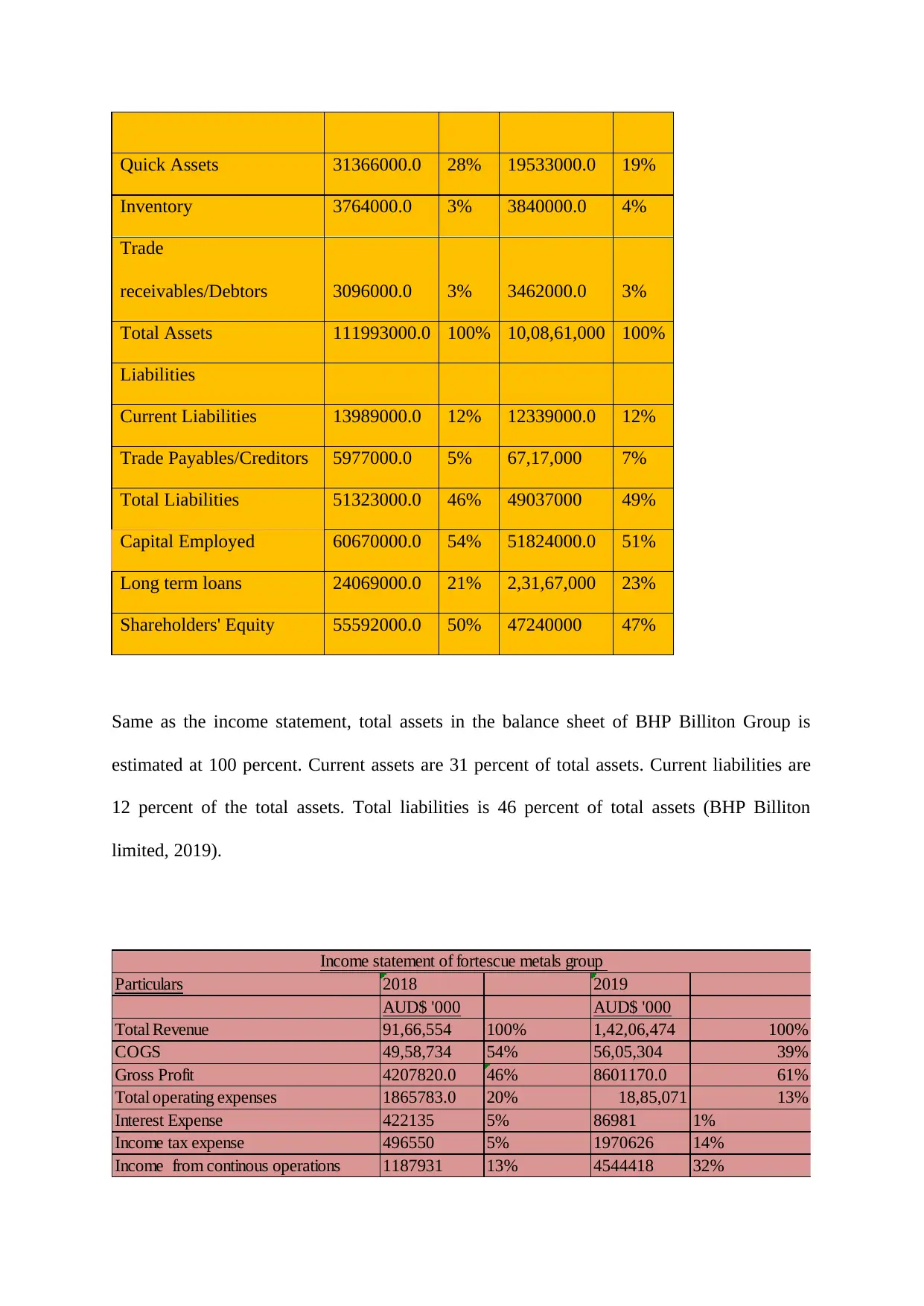

While evaluating the income statement of Fortescue Group, it is seen that total revenue is

seen at 100 percent. In 2018, COGS is at 54 percent of total sales Gross profit is 46 percent in

2018. Income from the continuous operations is estimated at 13 percent. In 2019, COGS is

estimated at 39 percent, Gross profit is seen at 61 percent, and income from the operations is

seen at 32 percent (Drake, Quinn, & Thornock, 2017).

Assets 2018 2019

Current Assets 2232445.0 9% 5150435 18%

Inventory 671086.0 3% 1100813.0 4%

Trade receivables/Debtors 120417.0 0% 125664.0 0%

Total Assets 2,41,49,641 100% 2,80,82,133 100%

Current Liabilities 1676363.0 7% 3772993.0 13%

Liabilities

Trade Payables/Creditors 368015.0 2% 4,49,166 2%

Total Liabilities 12965920.0 54% 10982276 39%

Capital Employed 11183721.0 46% 17099857.0 61%

Long term loans 4527128.0 19% 47,64,010 17%

Shareholders' Equity 13149777.0 54% 15097676 54%

fortescue metals group

For analysing the balance sheet of the Fortescue group, total liabilities is seen at 54 percent of

the total assets. Capital employed is estimated at 46 percent of total assets in 2018.

Shareholder`s equity is seen at 54 percent of total assets. In 2019, capital employed has

increased to 61 percent, total liabilities is seen at 39 percent of total assets (Fortescue Metal

Group, 2019).

Vertical common size analysis

The following segment would shed light on the vertical analysis of the financial statements of

both the entities. The vertical analysis of the financial statements aid in the compassion of the

financial variations over the years and over the industry participants (Brigham & Houston,

2012). It is evident that the cost of goods percentage to the revenue is constant in the case of

seen at 100 percent. In 2018, COGS is at 54 percent of total sales Gross profit is 46 percent in

2018. Income from the continuous operations is estimated at 13 percent. In 2019, COGS is

estimated at 39 percent, Gross profit is seen at 61 percent, and income from the operations is

seen at 32 percent (Drake, Quinn, & Thornock, 2017).

Assets 2018 2019

Current Assets 2232445.0 9% 5150435 18%

Inventory 671086.0 3% 1100813.0 4%

Trade receivables/Debtors 120417.0 0% 125664.0 0%

Total Assets 2,41,49,641 100% 2,80,82,133 100%

Current Liabilities 1676363.0 7% 3772993.0 13%

Liabilities

Trade Payables/Creditors 368015.0 2% 4,49,166 2%

Total Liabilities 12965920.0 54% 10982276 39%

Capital Employed 11183721.0 46% 17099857.0 61%

Long term loans 4527128.0 19% 47,64,010 17%

Shareholders' Equity 13149777.0 54% 15097676 54%

fortescue metals group

For analysing the balance sheet of the Fortescue group, total liabilities is seen at 54 percent of

the total assets. Capital employed is estimated at 46 percent of total assets in 2018.

Shareholder`s equity is seen at 54 percent of total assets. In 2019, capital employed has

increased to 61 percent, total liabilities is seen at 39 percent of total assets (Fortescue Metal

Group, 2019).

Vertical common size analysis

The following segment would shed light on the vertical analysis of the financial statements of

both the entities. The vertical analysis of the financial statements aid in the compassion of the

financial variations over the years and over the industry participants (Brigham & Houston,

2012). It is evident that the cost of goods percentage to the revenue is constant in the case of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.