Financial Performance Analysis of Cargills PLC and Investment Advice

VerifiedAdded on 2022/12/26

|17

|3402

|69

Report

AI Summary

This report conducts a financial analysis of Cargills PLC to provide an investment recommendation. It begins with a company description, highlighting Cargills' market position and business segments, followed by a comparison with its competitor, Keells Foods. The analysis employs trend analysis of financial statement items and ratio analysis, including profitability, liquidity, gearing, and asset utilization ratios, using data from the past five years. The report compares the financial performance of Cargills and Keells, culminating in an investment recommendation. It also addresses the assumptions and limitations of the analysis. The findings reveal Cargills' growth in revenue, profits, and assets, though its liquidity and financial leverage require attention. Key ratios such as gross margin, operating profit margin, ROE, and ROCE are compared, revealing insights into each company's financial health and performance. The report concludes with an investment recommendation based on the financial analysis.

Running Head: Financial Analysis of Cargills

Financial Analysis

Cargills

Student Name

Financial Analysis

Cargills

Student Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis of Cargills

Contents

1) Introduction...................................................................................................................................2

2) Company Description: Cargills......................................................................................................3

3) Comparison and Analysis of Financial Performance of Cargills and Keells..................................5

Trend Analysis:.................................................................................................................................5

Ratio Analysis:..................................................................................................................................6

4) Investment Recommendation.......................................................................................................12

5) Assumptions and limitations........................................................................................................13

6) Conclusion...................................................................................................................................14

7) References...................................................................................................................................15

1

Contents

1) Introduction...................................................................................................................................2

2) Company Description: Cargills......................................................................................................3

3) Comparison and Analysis of Financial Performance of Cargills and Keells..................................5

Trend Analysis:.................................................................................................................................5

Ratio Analysis:..................................................................................................................................6

4) Investment Recommendation.......................................................................................................12

5) Assumptions and limitations........................................................................................................13

6) Conclusion...................................................................................................................................14

7) References...................................................................................................................................15

1

Financial Analysis of Cargills

1) Introduction

This report performs the financial analysis of Cargills PLC to make an investment

recommendation regarding its equity investment. The report describes the business operations

of Cargills and compares its market position with its competitor Keells Foods. Trend analysis

of the income statement and balance sheet items and ratio analysis is used to perform this

financial analysis. The data used for this analysis is taken from the last five years annual

reports of both the companies. The various ratios used are profitability ratios, liquidity ratios,

gearing ratios and asset utilisation ratios. The report analyses and compares the financial

performance of Cargills with Keels. It then makes investment recommendation out of these

two companies. The report also lists the assumptions and limitations used in this analysis and

recommendation process.

2

1) Introduction

This report performs the financial analysis of Cargills PLC to make an investment

recommendation regarding its equity investment. The report describes the business operations

of Cargills and compares its market position with its competitor Keells Foods. Trend analysis

of the income statement and balance sheet items and ratio analysis is used to perform this

financial analysis. The data used for this analysis is taken from the last five years annual

reports of both the companies. The various ratios used are profitability ratios, liquidity ratios,

gearing ratios and asset utilisation ratios. The report analyses and compares the financial

performance of Cargills with Keels. It then makes investment recommendation out of these

two companies. The report also lists the assumptions and limitations used in this analysis and

recommendation process.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis of Cargills

2) Company Description: Cargills

Cargills (Ceylon) PLC is the largest food retailer in Sri Lanka. The company was established

in 1844. Its retail arm operates under the name of Cargills Food City and its manufacturing

brands operate under the name of: Goldi, Finest, Supremo and Sams (processed meats);

Magic, Kotmale and Heavenly (ice cream and dairy products); Kist (processed fruits and

vegetables); Knuckles (bottled water) (Cargills, n.d.).

The three segments in which Cargills deal are retail, fast moving consumer goods and

restaurant. The various products manufactured or processed by the company are meats, dairy,

ice cream, cheese, jams, nectars and fruit juices. Cargills operate more than 350 retail stores

and approximately 31 KFC and TGIF franchise restaurants in Sri Lanka (Bloomberg, n.d.).

The Sri Lankan brick and mortar food retail business has a lot of growth potential due to the

rapid urbanisation and increasing disposable incomes. It is expected that this market will

grow in the mid-teens over the mid-term. There is high competition as everyone wants to

grab maximum possible share of this growing industry. Cargills which operates more than

350 stores faces major competition from Keels which operates close to 100 stores and offers

similar product portfolio (Daily FT, 2018).

Cargills holds competitive advantage over its competitors because of its huge market share

that allows it to be a low cost producer. The company provides value proposition to its

customers in terms of price as its vast network of farmers and stores provides supply chain

efficiencies. Cargills has more of a sub-urban orientation but its competitor, Keells caters to

affluent urban regions with its lavish parking facilities and comparatively premium product

range (Jayasundera, 2018).

But the overall potential of the food retail industry is enormous so there is no issue of any one

company’s growth coming at the cost of others. It is perfect strategy to have unique business

models to strengthen the company’s position in the market and have sustainable growth.

What matters most is the rapid expansion by the existing players and the way in which they

present themselves (Daily FT, 2018). Cargills has been making continuous investments to

3

2) Company Description: Cargills

Cargills (Ceylon) PLC is the largest food retailer in Sri Lanka. The company was established

in 1844. Its retail arm operates under the name of Cargills Food City and its manufacturing

brands operate under the name of: Goldi, Finest, Supremo and Sams (processed meats);

Magic, Kotmale and Heavenly (ice cream and dairy products); Kist (processed fruits and

vegetables); Knuckles (bottled water) (Cargills, n.d.).

The three segments in which Cargills deal are retail, fast moving consumer goods and

restaurant. The various products manufactured or processed by the company are meats, dairy,

ice cream, cheese, jams, nectars and fruit juices. Cargills operate more than 350 retail stores

and approximately 31 KFC and TGIF franchise restaurants in Sri Lanka (Bloomberg, n.d.).

The Sri Lankan brick and mortar food retail business has a lot of growth potential due to the

rapid urbanisation and increasing disposable incomes. It is expected that this market will

grow in the mid-teens over the mid-term. There is high competition as everyone wants to

grab maximum possible share of this growing industry. Cargills which operates more than

350 stores faces major competition from Keels which operates close to 100 stores and offers

similar product portfolio (Daily FT, 2018).

Cargills holds competitive advantage over its competitors because of its huge market share

that allows it to be a low cost producer. The company provides value proposition to its

customers in terms of price as its vast network of farmers and stores provides supply chain

efficiencies. Cargills has more of a sub-urban orientation but its competitor, Keells caters to

affluent urban regions with its lavish parking facilities and comparatively premium product

range (Jayasundera, 2018).

But the overall potential of the food retail industry is enormous so there is no issue of any one

company’s growth coming at the cost of others. It is perfect strategy to have unique business

models to strengthen the company’s position in the market and have sustainable growth.

What matters most is the rapid expansion by the existing players and the way in which they

present themselves (Daily FT, 2018). Cargills has been making continuous investments to

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis of Cargills

increase its market share and to upgrade its manufactured capital. To achieve its goals

Cargills has been focusing towards improving its asset utilisation, increasing its capacity

utilisation, improving its pricing strategies with farmers/suppliers, improving its distribution

and warehousing operations, retaining its existing customers and identifying the untapped

markets (Cargills Annual Report, 2018).

4

increase its market share and to upgrade its manufactured capital. To achieve its goals

Cargills has been focusing towards improving its asset utilisation, increasing its capacity

utilisation, improving its pricing strategies with farmers/suppliers, improving its distribution

and warehousing operations, retaining its existing customers and identifying the untapped

markets (Cargills Annual Report, 2018).

4

Financial Analysis of Cargills

3) Comparison and Analysis of Financial Performance of Cargills and

Keells

Trend Analysis:

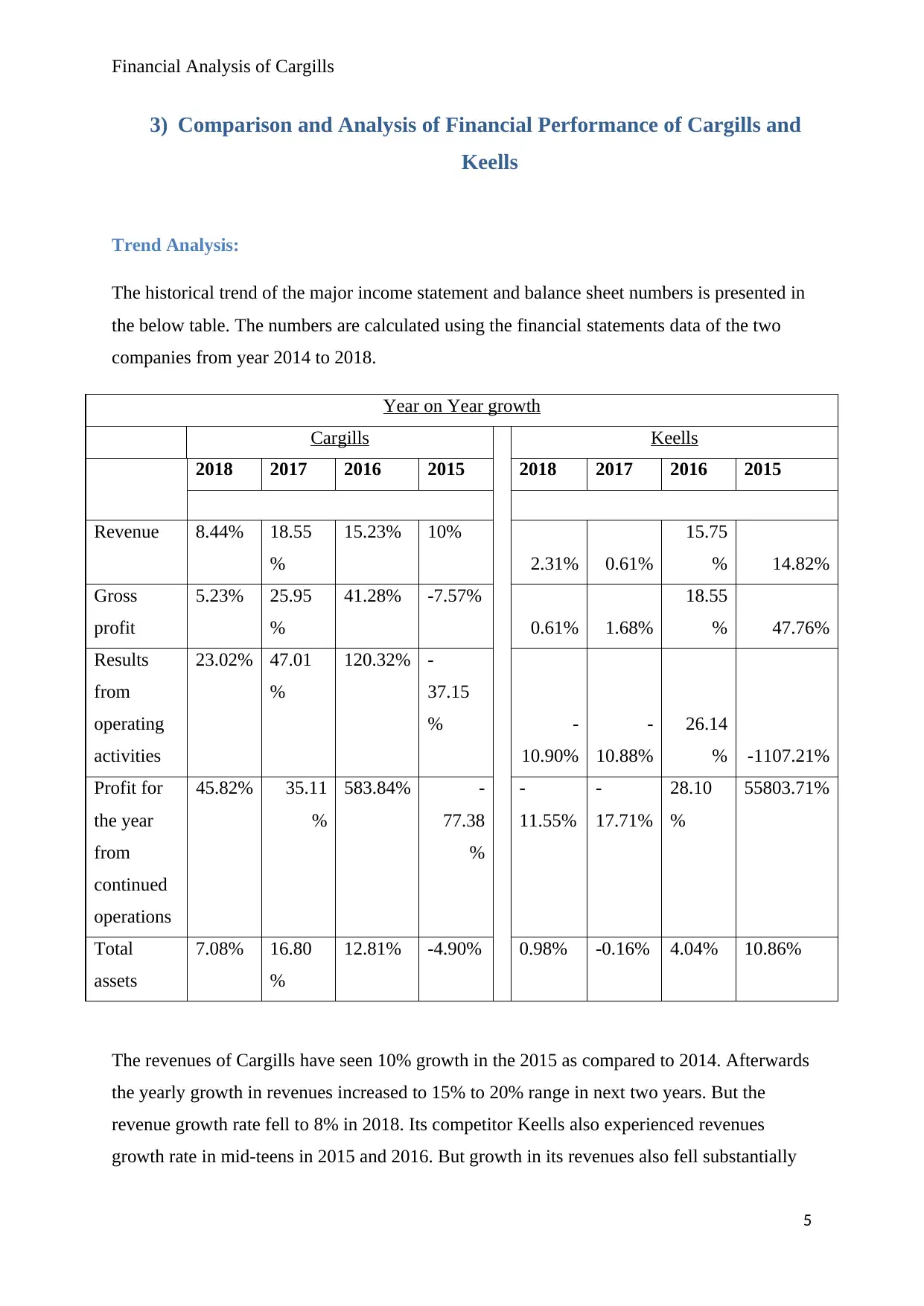

The historical trend of the major income statement and balance sheet numbers is presented in

the below table. The numbers are calculated using the financial statements data of the two

companies from year 2014 to 2018.

Year on Year growth

Cargills Keells

2018 2017 2016 2015 2018 2017 2016 2015

Revenue 8.44% 18.55

%

15.23% 10%

2.31% 0.61%

15.75

% 14.82%

Gross

profit

5.23% 25.95

%

41.28% -7.57%

0.61% 1.68%

18.55

% 47.76%

Results

from

operating

activities

23.02% 47.01

%

120.32% -

37.15

% -

10.90%

-

10.88%

26.14

% -1107.21%

Profit for

the year

from

continued

operations

45.82% 35.11

%

583.84% -

77.38

%

-

11.55%

-

17.71%

28.10

%

55803.71%

Total

assets

7.08% 16.80

%

12.81% -4.90% 0.98% -0.16% 4.04% 10.86%

The revenues of Cargills have seen 10% growth in the 2015 as compared to 2014. Afterwards

the yearly growth in revenues increased to 15% to 20% range in next two years. But the

revenue growth rate fell to 8% in 2018. Its competitor Keells also experienced revenues

growth rate in mid-teens in 2015 and 2016. But growth in its revenues also fell substantially

5

3) Comparison and Analysis of Financial Performance of Cargills and

Keells

Trend Analysis:

The historical trend of the major income statement and balance sheet numbers is presented in

the below table. The numbers are calculated using the financial statements data of the two

companies from year 2014 to 2018.

Year on Year growth

Cargills Keells

2018 2017 2016 2015 2018 2017 2016 2015

Revenue 8.44% 18.55

%

15.23% 10%

2.31% 0.61%

15.75

% 14.82%

Gross

profit

5.23% 25.95

%

41.28% -7.57%

0.61% 1.68%

18.55

% 47.76%

Results

from

operating

activities

23.02% 47.01

%

120.32% -

37.15

% -

10.90%

-

10.88%

26.14

% -1107.21%

Profit for

the year

from

continued

operations

45.82% 35.11

%

583.84% -

77.38

%

-

11.55%

-

17.71%

28.10

%

55803.71%

Total

assets

7.08% 16.80

%

12.81% -4.90% 0.98% -0.16% 4.04% 10.86%

The revenues of Cargills have seen 10% growth in the 2015 as compared to 2014. Afterwards

the yearly growth in revenues increased to 15% to 20% range in next two years. But the

revenue growth rate fell to 8% in 2018. Its competitor Keells also experienced revenues

growth rate in mid-teens in 2015 and 2016. But growth in its revenues also fell substantially

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial Analysis of Cargills

in next two years. This can be due to the subdued consumer demand for FMCG and related

products due to overall economic slowdown (Daily FT, 2018). The gross, operating and net

profits of Cargills noticed high annual growth in 2016 but they have grown at decreasing rate

in 2017 and 2018. Similar trend was also seen in growth rates of various profits of Keells.

The growth rate in most of the income statement numbers was higher in this period for

Cargills as compared to Keels. This shows that Cargills business has been growing at higher

rate.

The annual growth in the total assets of the Cargills was higher than Keells in this period,

which shows that Cargills has been making a lot of capital investments for its business

expansion.

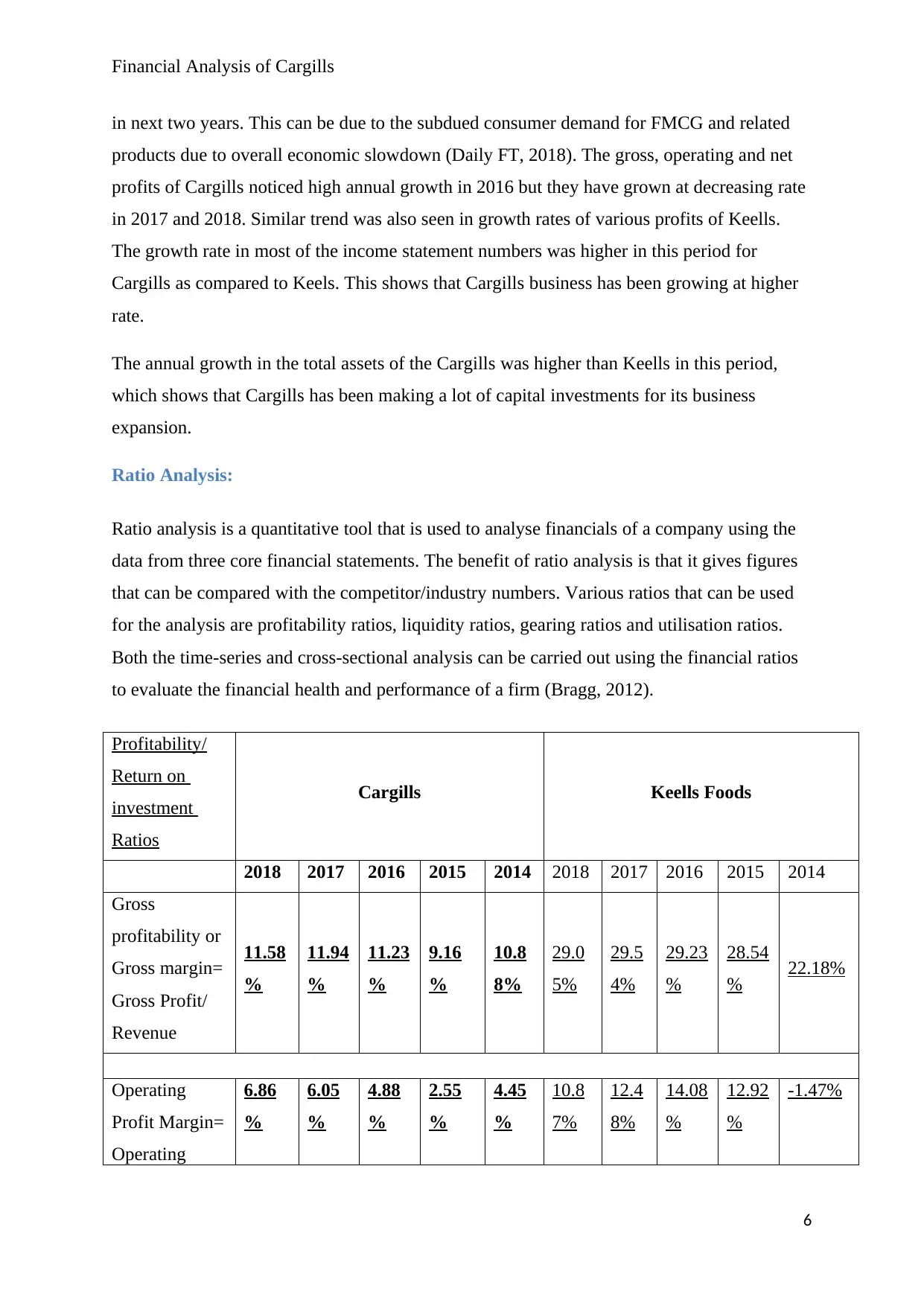

Ratio Analysis:

Ratio analysis is a quantitative tool that is used to analyse financials of a company using the

data from three core financial statements. The benefit of ratio analysis is that it gives figures

that can be compared with the competitor/industry numbers. Various ratios that can be used

for the analysis are profitability ratios, liquidity ratios, gearing ratios and utilisation ratios.

Both the time-series and cross-sectional analysis can be carried out using the financial ratios

to evaluate the financial health and performance of a firm (Bragg, 2012).

Profitability/

Return on

investment

Ratios

Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Gross

profitability or

Gross margin=

Gross Profit/

Revenue

11.58

%

11.94

%

11.23

%

9.16

%

10.8

8%

29.0

5%

29.5

4%

29.23

%

28.54

% 22.18%

Operating

Profit Margin=

Operating

6.86

%

6.05

%

4.88

%

2.55

%

4.45

%

10.8

7%

12.4

8%

14.08

%

12.92

%

-1.47%

6

in next two years. This can be due to the subdued consumer demand for FMCG and related

products due to overall economic slowdown (Daily FT, 2018). The gross, operating and net

profits of Cargills noticed high annual growth in 2016 but they have grown at decreasing rate

in 2017 and 2018. Similar trend was also seen in growth rates of various profits of Keells.

The growth rate in most of the income statement numbers was higher in this period for

Cargills as compared to Keels. This shows that Cargills business has been growing at higher

rate.

The annual growth in the total assets of the Cargills was higher than Keells in this period,

which shows that Cargills has been making a lot of capital investments for its business

expansion.

Ratio Analysis:

Ratio analysis is a quantitative tool that is used to analyse financials of a company using the

data from three core financial statements. The benefit of ratio analysis is that it gives figures

that can be compared with the competitor/industry numbers. Various ratios that can be used

for the analysis are profitability ratios, liquidity ratios, gearing ratios and utilisation ratios.

Both the time-series and cross-sectional analysis can be carried out using the financial ratios

to evaluate the financial health and performance of a firm (Bragg, 2012).

Profitability/

Return on

investment

Ratios

Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Gross

profitability or

Gross margin=

Gross Profit/

Revenue

11.58

%

11.94

%

11.23

%

9.16

%

10.8

8%

29.0

5%

29.5

4%

29.23

%

28.54

% 22.18%

Operating

Profit Margin=

Operating

6.86

%

6.05

%

4.88

%

2.55

%

4.45

%

10.8

7%

12.4

8%

14.08

%

12.92

%

-1.47%

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis of Cargills

Profit /

Revenue

Net

profitability or

Net margin=

Net Profit /

Revenue

3.65

%

2.71

%

2.38

%

0.40

%

1.95

%

7.81

%

9.03

%

11.05

%

9.98

% 0.02%

Return on

assets= Net

Profit /

Average Total

Assets

6.53

%

4.99

%

4.25

%

0.64

%

2.92

%

10.0

7%

11.4

3%

14.15

%

11.85

% 0.02%

Cash return on

sales= Net

cash flow from

operating

activity / Sales

or Revenue

4.05

%

4.46

%

7.51

%

0.82

%

1.76

%

0.12

%

0.12

%

0.18

%

0.02

% 0.04%

Return on

equity (ROE)

= Net Profit /

Average

Stockholder

equity

21.36

%

15.82

%

12.35

%

1.96

%

8.98

%

14.2

6%

16.0

1%

19.29

%

16.09

%

0.03%

Return on

Capital

Employed

(ROCE) =

Operating

Profit/Total

28.12

%

26.75

%

18.76

%

9.37

%

16.4

0%

16.3

5%

19.2

4%

20.43

%

17.05

%

-1.86%

7

Profit /

Revenue

Net

profitability or

Net margin=

Net Profit /

Revenue

3.65

%

2.71

%

2.38

%

0.40

%

1.95

%

7.81

%

9.03

%

11.05

%

9.98

% 0.02%

Return on

assets= Net

Profit /

Average Total

Assets

6.53

%

4.99

%

4.25

%

0.64

%

2.92

%

10.0

7%

11.4

3%

14.15

%

11.85

% 0.02%

Cash return on

sales= Net

cash flow from

operating

activity / Sales

or Revenue

4.05

%

4.46

%

7.51

%

0.82

%

1.76

%

0.12

%

0.12

%

0.18

%

0.02

% 0.04%

Return on

equity (ROE)

= Net Profit /

Average

Stockholder

equity

21.36

%

15.82

%

12.35

%

1.96

%

8.98

%

14.2

6%

16.0

1%

19.29

%

16.09

%

0.03%

Return on

Capital

Employed

(ROCE) =

Operating

Profit/Total

28.12

%

26.75

%

18.76

%

9.37

%

16.4

0%

16.3

5%

19.2

4%

20.43

%

17.05

%

-1.86%

7

Financial Analysis of Cargills

Capital

Employed

Profitability ratios tell about the profit making ability of the firm from its business. Gross

margin ratios tells about the profitability of the core business that is how much amount as a

proportion of revenues is left after deducting the cost of sales of the company. This ratio for

Cargills has stayed around 11% to 12% in last few years. The same is the trend for Keells but

its gross margin ratio was significantly higher around 29% in this period. The reason for this

is that Cargills business strategy is based upon the low pricing and high volumes but Keells

targets affluent urban customers, which make it possible for Keells to charge higher mark-up

on its relatively premium products (Jayasundera, 2018).

The operating profit margin tells how profitable a company is in selling its products after

considering all the operational costs like SG&A and advertisement costs. The net profitability

ratios tells how much proportion of total sales is reflected by the firm’s bottom line after

considering all the operating and non-operating costs like interest and tax costs. Return on

assets tells how much profit a firm is generating from its assets. For Cargills, these ratios

have been increasing consistently from last few years. For Keells, these ratios were higher

because of its business strategy as explained above but the trend for these ratios is decreasing.

This shows that in comparison to Keells, Cargills business has been consistently improving as

the firm has been investing to make its operations more efficient (Cargills Annual Report,

2018).

Cash return on sales tells how much cash a firm is generating from its operations in

proportion to the total sales. The trend for this ratio is decreasing for Cargills as well as its

competitor Keells but this ratio has been higher for Cargills maybe because its business does

not depend much upon the accrual method and its revenue recognition method is not that

aggressive. This shows Cargills has been generating more cash from its operations in

proportion to the sales.

ROE tells how much return a firm is generating for its shareholders and ROCE tells how

much return firm is generating on the employed capital. ROE for Cargills has grown from

1.96% in 2015 to 21.36% in 2018 but ROE of its competitor Keells has declined in last few

years. The higher ROE of Cargills in 2018 tells that firm has generated more returns for its

shareholders. It can be due to various reasons like increased financial leverage or increased

8

Capital

Employed

Profitability ratios tell about the profit making ability of the firm from its business. Gross

margin ratios tells about the profitability of the core business that is how much amount as a

proportion of revenues is left after deducting the cost of sales of the company. This ratio for

Cargills has stayed around 11% to 12% in last few years. The same is the trend for Keells but

its gross margin ratio was significantly higher around 29% in this period. The reason for this

is that Cargills business strategy is based upon the low pricing and high volumes but Keells

targets affluent urban customers, which make it possible for Keells to charge higher mark-up

on its relatively premium products (Jayasundera, 2018).

The operating profit margin tells how profitable a company is in selling its products after

considering all the operational costs like SG&A and advertisement costs. The net profitability

ratios tells how much proportion of total sales is reflected by the firm’s bottom line after

considering all the operating and non-operating costs like interest and tax costs. Return on

assets tells how much profit a firm is generating from its assets. For Cargills, these ratios

have been increasing consistently from last few years. For Keells, these ratios were higher

because of its business strategy as explained above but the trend for these ratios is decreasing.

This shows that in comparison to Keells, Cargills business has been consistently improving as

the firm has been investing to make its operations more efficient (Cargills Annual Report,

2018).

Cash return on sales tells how much cash a firm is generating from its operations in

proportion to the total sales. The trend for this ratio is decreasing for Cargills as well as its

competitor Keells but this ratio has been higher for Cargills maybe because its business does

not depend much upon the accrual method and its revenue recognition method is not that

aggressive. This shows Cargills has been generating more cash from its operations in

proportion to the sales.

ROE tells how much return a firm is generating for its shareholders and ROCE tells how

much return firm is generating on the employed capital. ROE for Cargills has grown from

1.96% in 2015 to 21.36% in 2018 but ROE of its competitor Keells has declined in last few

years. The higher ROE of Cargills in 2018 tells that firm has generated more returns for its

shareholders. It can be due to various reasons like increased financial leverage or increased

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

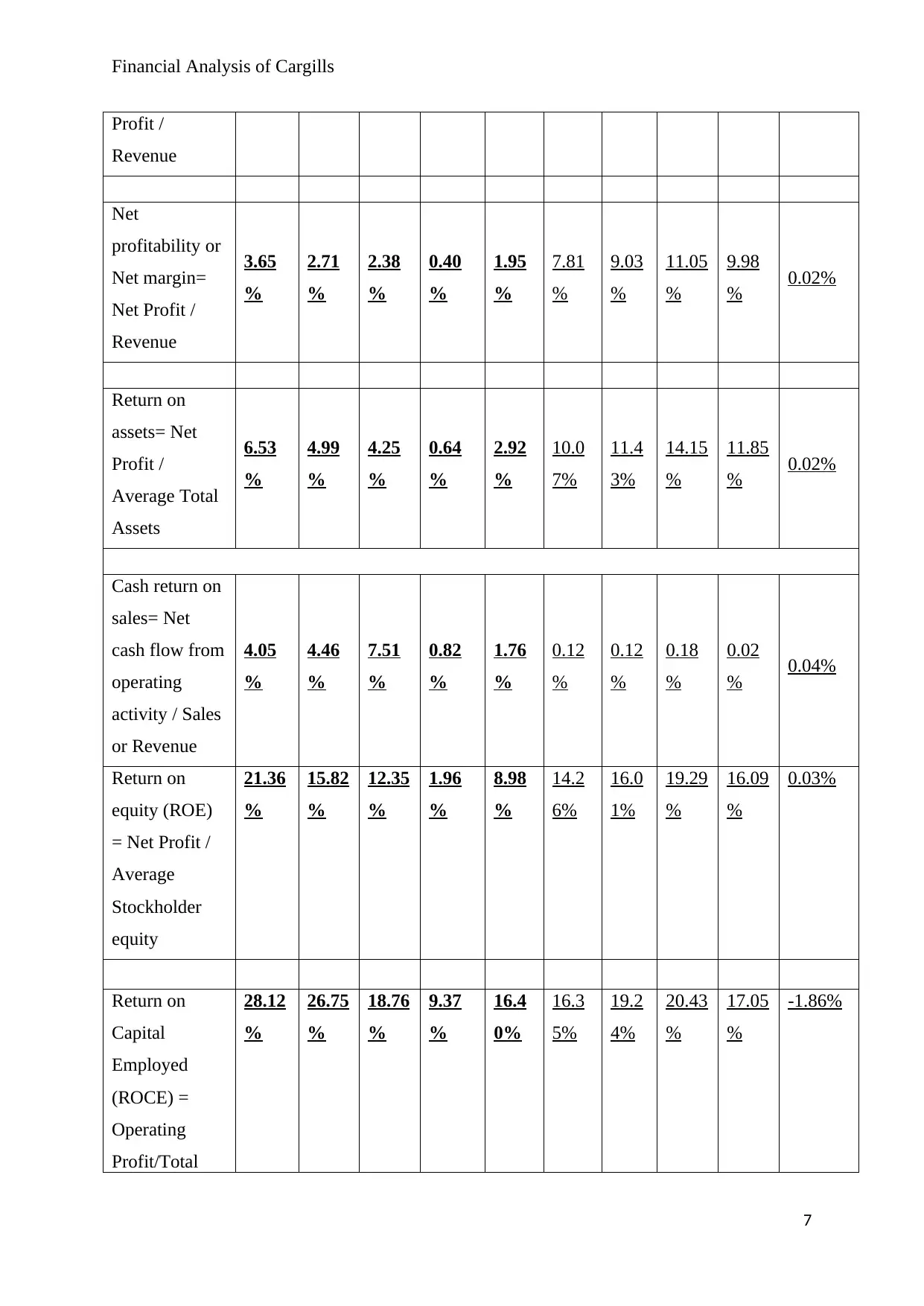

Financial Analysis of Cargills

efficiencies. ROCE for Cargills has increased from 9.37% in 2015 to 28.12% in 2018 but

Keells has experienced declining trend in ROCE for last few years. This again shows that

Cargills has generated higher returns on the employed capital in the recent times.

Liquidity

Ratios Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Current Ratio=

Current

Assets/Current

Liabilities

0.63 0.53 0.63 0.62 0.45 2.66 2.15 3.02 2.66 2.29

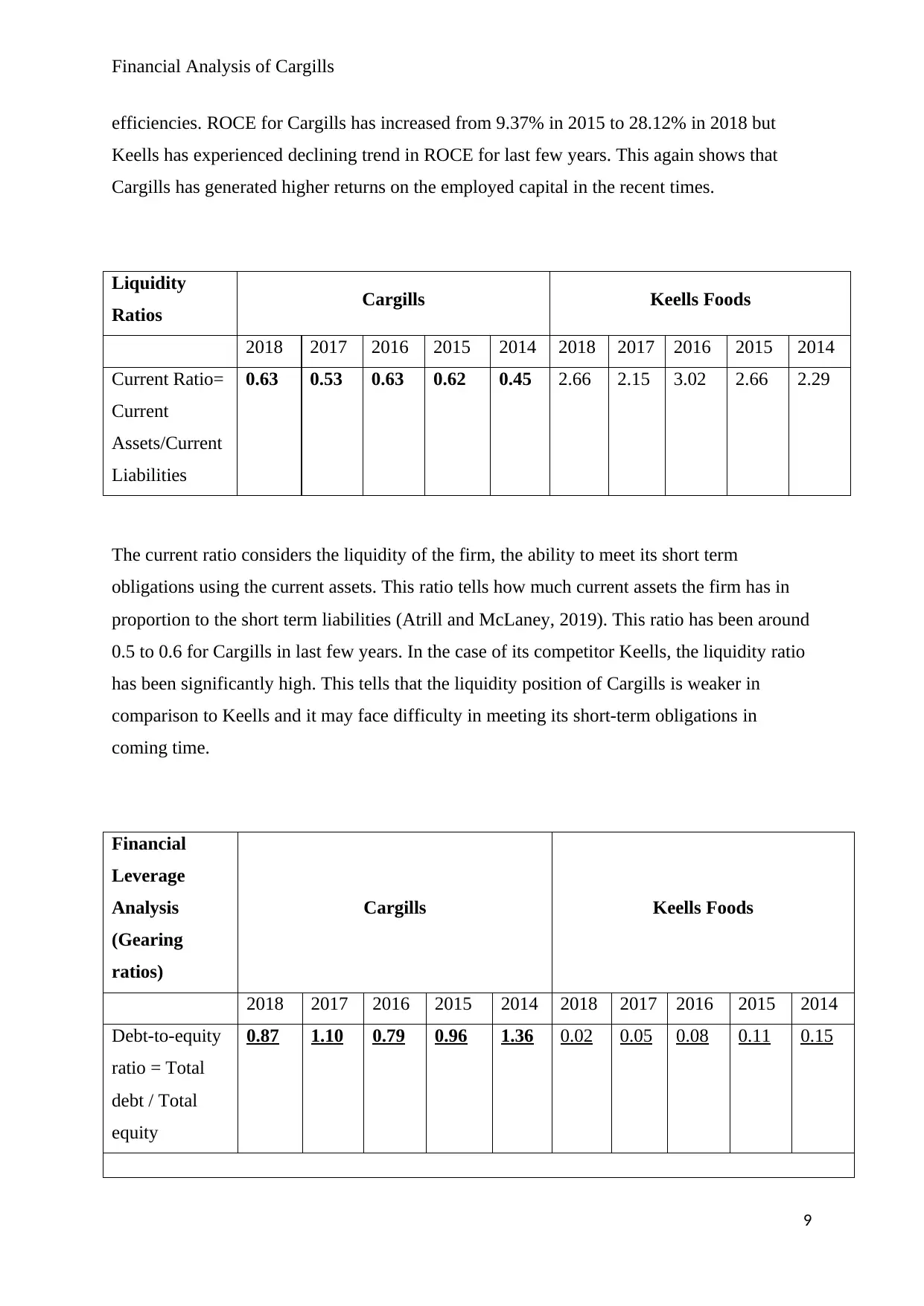

The current ratio considers the liquidity of the firm, the ability to meet its short term

obligations using the current assets. This ratio tells how much current assets the firm has in

proportion to the short term liabilities (Atrill and McLaney, 2019). This ratio has been around

0.5 to 0.6 for Cargills in last few years. In the case of its competitor Keells, the liquidity ratio

has been significantly high. This tells that the liquidity position of Cargills is weaker in

comparison to Keells and it may face difficulty in meeting its short-term obligations in

coming time.

Financial

Leverage

Analysis

(Gearing

ratios)

Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Debt-to-equity

ratio = Total

debt / Total

equity

0.87 1.10 0.79 0.96 1.36 0.02 0.05 0.08 0.11 0.15

9

efficiencies. ROCE for Cargills has increased from 9.37% in 2015 to 28.12% in 2018 but

Keells has experienced declining trend in ROCE for last few years. This again shows that

Cargills has generated higher returns on the employed capital in the recent times.

Liquidity

Ratios Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Current Ratio=

Current

Assets/Current

Liabilities

0.63 0.53 0.63 0.62 0.45 2.66 2.15 3.02 2.66 2.29

The current ratio considers the liquidity of the firm, the ability to meet its short term

obligations using the current assets. This ratio tells how much current assets the firm has in

proportion to the short term liabilities (Atrill and McLaney, 2019). This ratio has been around

0.5 to 0.6 for Cargills in last few years. In the case of its competitor Keells, the liquidity ratio

has been significantly high. This tells that the liquidity position of Cargills is weaker in

comparison to Keells and it may face difficulty in meeting its short-term obligations in

coming time.

Financial

Leverage

Analysis

(Gearing

ratios)

Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Debt-to-equity

ratio = Total

debt / Total

equity

0.87 1.10 0.79 0.96 1.36 0.02 0.05 0.08 0.11 0.15

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Analysis of Cargills

Interest

coverage or

times interest

earned =

Earnings

before interest

and taxes

(EBIT) / Total

interest

4.79 4.53 5.73 1.89 2.09 42.47 30.3

8

31.70 17.25 -0.94

Debt ratio =

Total debt /

Total assets

27.73

%

32.07

%

27.26

%

33.00

%

42.62

%

1.38

%

3.48

%

5.55

%

7.93

%

11.21

%

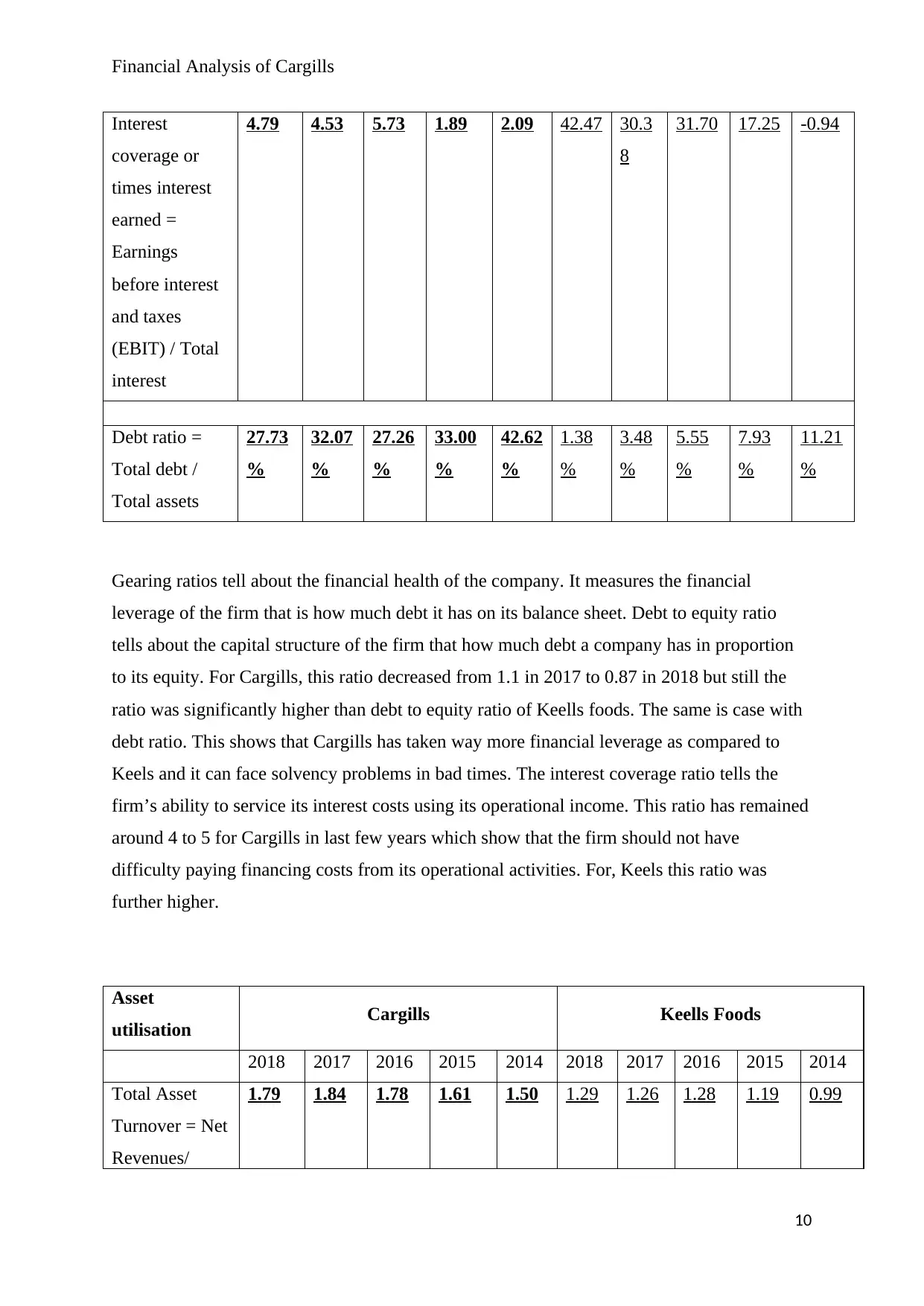

Gearing ratios tell about the financial health of the company. It measures the financial

leverage of the firm that is how much debt it has on its balance sheet. Debt to equity ratio

tells about the capital structure of the firm that how much debt a company has in proportion

to its equity. For Cargills, this ratio decreased from 1.1 in 2017 to 0.87 in 2018 but still the

ratio was significantly higher than debt to equity ratio of Keells foods. The same is case with

debt ratio. This shows that Cargills has taken way more financial leverage as compared to

Keels and it can face solvency problems in bad times. The interest coverage ratio tells the

firm’s ability to service its interest costs using its operational income. This ratio has remained

around 4 to 5 for Cargills in last few years which show that the firm should not have

difficulty paying financing costs from its operational activities. For, Keels this ratio was

further higher.

Asset

utilisation Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Total Asset

Turnover = Net

Revenues/

1.79 1.84 1.78 1.61 1.50 1.29 1.26 1.28 1.19 0.99

10

Interest

coverage or

times interest

earned =

Earnings

before interest

and taxes

(EBIT) / Total

interest

4.79 4.53 5.73 1.89 2.09 42.47 30.3

8

31.70 17.25 -0.94

Debt ratio =

Total debt /

Total assets

27.73

%

32.07

%

27.26

%

33.00

%

42.62

%

1.38

%

3.48

%

5.55

%

7.93

%

11.21

%

Gearing ratios tell about the financial health of the company. It measures the financial

leverage of the firm that is how much debt it has on its balance sheet. Debt to equity ratio

tells about the capital structure of the firm that how much debt a company has in proportion

to its equity. For Cargills, this ratio decreased from 1.1 in 2017 to 0.87 in 2018 but still the

ratio was significantly higher than debt to equity ratio of Keells foods. The same is case with

debt ratio. This shows that Cargills has taken way more financial leverage as compared to

Keels and it can face solvency problems in bad times. The interest coverage ratio tells the

firm’s ability to service its interest costs using its operational income. This ratio has remained

around 4 to 5 for Cargills in last few years which show that the firm should not have

difficulty paying financing costs from its operational activities. For, Keels this ratio was

further higher.

Asset

utilisation Cargills Keells Foods

2018 2017 2016 2015 2014 2018 2017 2016 2015 2014

Total Asset

Turnover = Net

Revenues/

1.79 1.84 1.78 1.61 1.50 1.29 1.26 1.28 1.19 0.99

10

Financial Analysis of Cargills

Average Total

assets

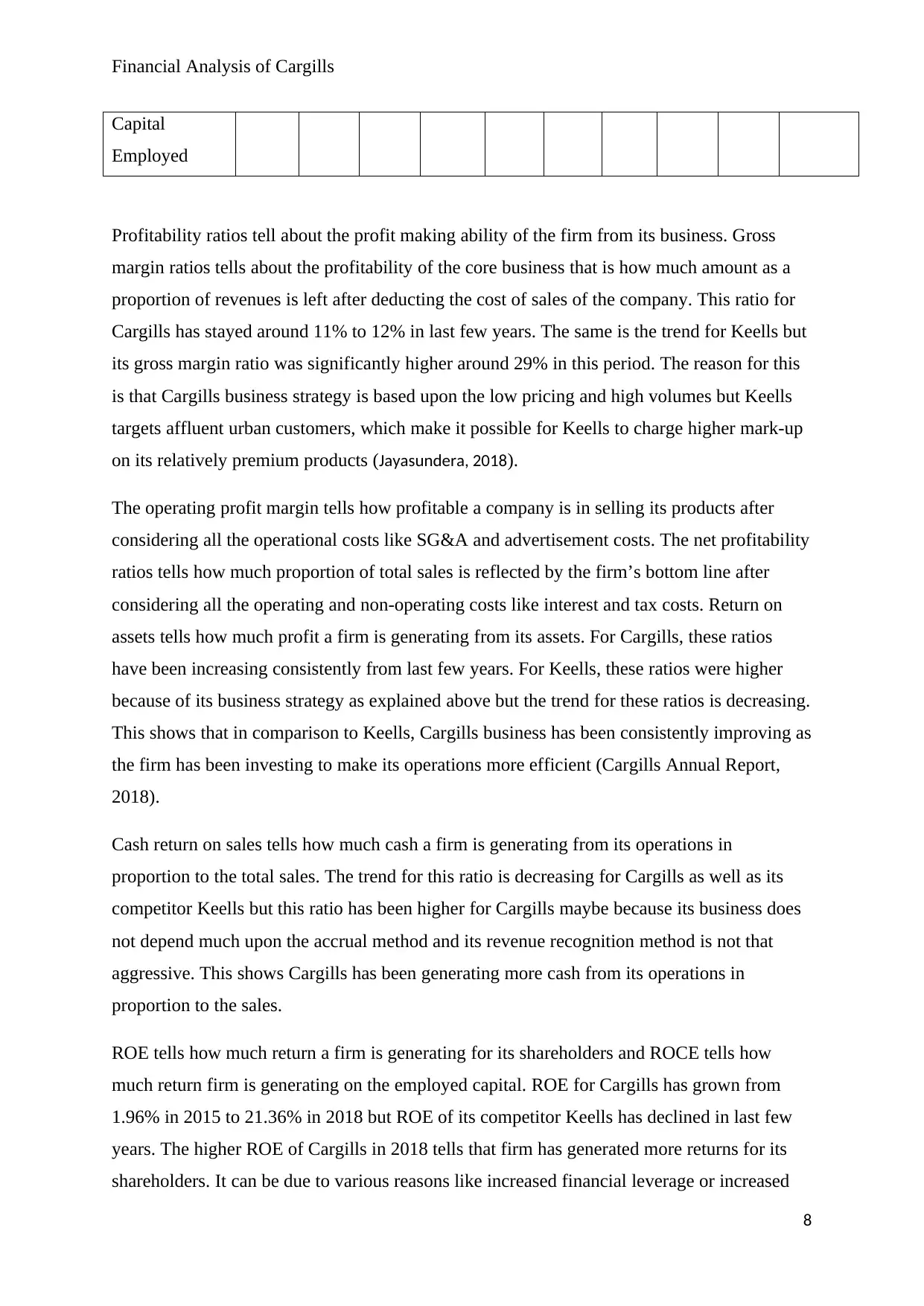

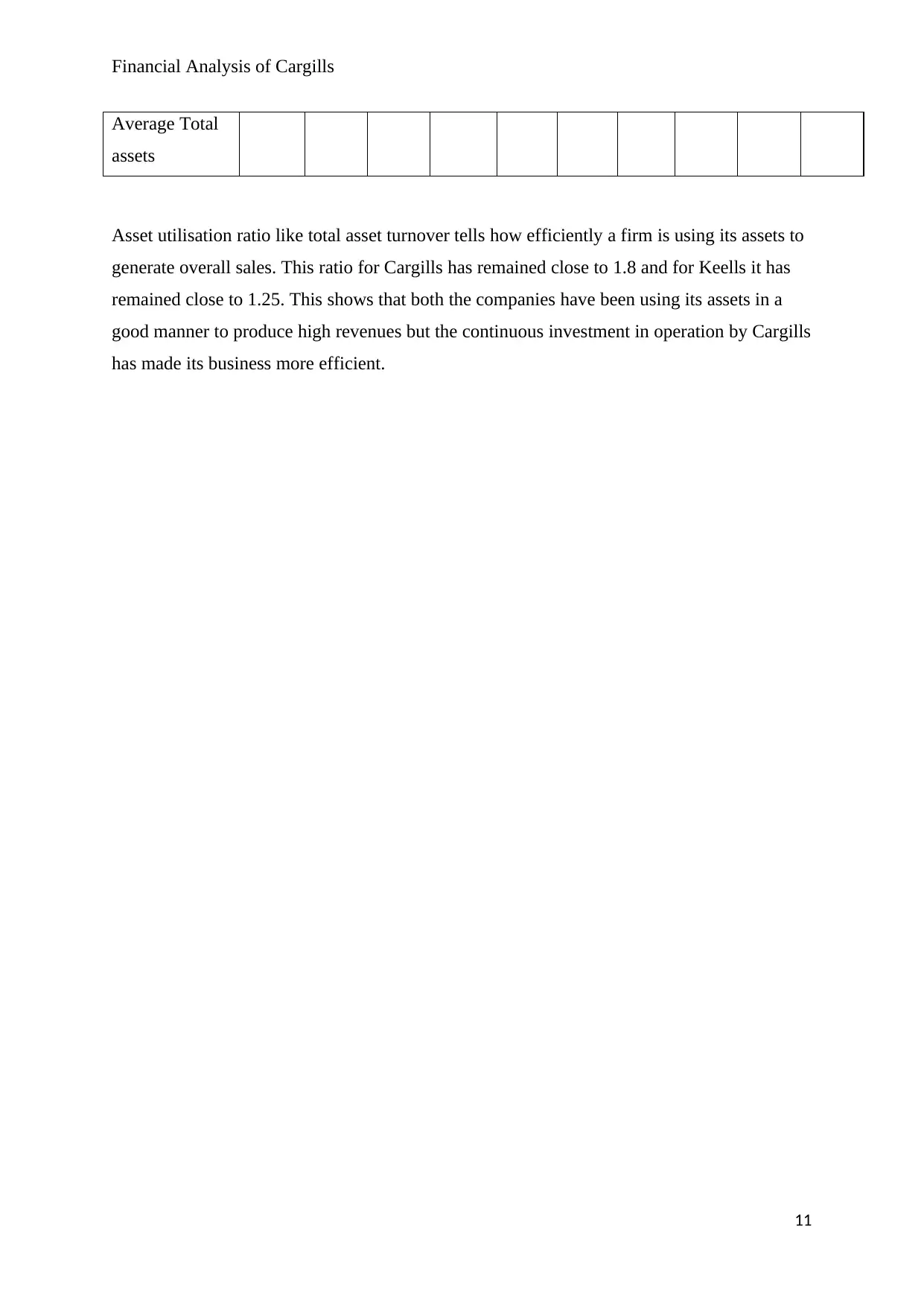

Asset utilisation ratio like total asset turnover tells how efficiently a firm is using its assets to

generate overall sales. This ratio for Cargills has remained close to 1.8 and for Keells it has

remained close to 1.25. This shows that both the companies have been using its assets in a

good manner to produce high revenues but the continuous investment in operation by Cargills

has made its business more efficient.

11

Average Total

assets

Asset utilisation ratio like total asset turnover tells how efficiently a firm is using its assets to

generate overall sales. This ratio for Cargills has remained close to 1.8 and for Keells it has

remained close to 1.25. This shows that both the companies have been using its assets in a

good manner to produce high revenues but the continuous investment in operation by Cargills

has made its business more efficient.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.