MBA Financial Analysis: A Financial Comparison of Ryanair & Air Arabia

VerifiedAdded on 2023/05/30

|41

|11848

|198

Report

AI Summary

This report provides a comparative financial analysis of Ryanair and Air Arabia, two airlines operating in Europe and the Middle East, respectively. The analysis utilizes profitability, liquidity, efficiency, and gearing ratios, along with horizontal and vertical analysis of financial statements from 2015 to 2017/2018. The study evaluates business performance, focusing on key financial and non-financial measures relevant to the airline industry. Ryanair demonstrates consistent revenue and higher efficiency, while Air Arabia shows better performance in profitability and leverage. Recommendations include cost optimization and standardization of aircraft models to improve financial performance. The report concludes with a detailed comparison, highlighting the strengths and weaknesses of each airline based on the analyzed financial metrics.

Financial Reporting and Analysis

Name of the Student

Name of the University

Author’s Note

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The study has performed financial comparison of Ryan Air and Air Arabia. The methodology

used in the report is a range of profitability ratios, liquidity ratios, efficiency ratios and gearing

ratios. The study has also used the technique of horizontal and vertical analysis for a more vivid

description of changes in the key areas of income statement and the balance sheet. This section

of the study has included the investigation of five main areas of financial statement ranging from

total Noncurrent assets, total current assets, total current liabilities, total long-term liabilities and

total shareholder. The overall evaluation has suggested that when comparing financial

parameters such as profitability, leverage and loans to capital employed Air Arabia performed

better than Ryan Air. When the income statements of both the airlines are compared for three

years, it could be stated that lower revenue fluctuations are observed in Ryanair and its

performance is deemed to be more consistent than Air Arabia. This is mainly owing to a range of

factors such as the operations of Ryanair in a stable geopolitical environment, favorable brand

image in the market. On the other hand, the regions of Air Arabia are reliant on the fuel sector

and hence, it is highly sensitive to changes in the prices of fuel. However, when parameters such

as efficiency are considered, Ryan Air has clearly excelled in performance. Some of the major

recommendations for improving the financial perspective is identified with optimizing the costs

incurred for the airlines. In addition to this, the achievement of targets is related to plane leasing

cost and seat revenue. This can be improved by standardizing the models of the planes used by

both the airliners.

The study has performed financial comparison of Ryan Air and Air Arabia. The methodology

used in the report is a range of profitability ratios, liquidity ratios, efficiency ratios and gearing

ratios. The study has also used the technique of horizontal and vertical analysis for a more vivid

description of changes in the key areas of income statement and the balance sheet. This section

of the study has included the investigation of five main areas of financial statement ranging from

total Noncurrent assets, total current assets, total current liabilities, total long-term liabilities and

total shareholder. The overall evaluation has suggested that when comparing financial

parameters such as profitability, leverage and loans to capital employed Air Arabia performed

better than Ryan Air. When the income statements of both the airlines are compared for three

years, it could be stated that lower revenue fluctuations are observed in Ryanair and its

performance is deemed to be more consistent than Air Arabia. This is mainly owing to a range of

factors such as the operations of Ryanair in a stable geopolitical environment, favorable brand

image in the market. On the other hand, the regions of Air Arabia are reliant on the fuel sector

and hence, it is highly sensitive to changes in the prices of fuel. However, when parameters such

as efficiency are considered, Ryan Air has clearly excelled in performance. Some of the major

recommendations for improving the financial perspective is identified with optimizing the costs

incurred for the airlines. In addition to this, the achievement of targets is related to plane leasing

cost and seat revenue. This can be improved by standardizing the models of the planes used by

both the airliners.

Table of Contents

Introduction..........................................................................................................................3

Profitability Ratios...............................................................................................................4

.............................................................................................................................................6

Efficiency Ratios.................................................................................................................6

Liquidity Ratios...................................................................................................................6

Gearing Ratios.....................................................................................................................7

Horizontal Analysis (Please use 2015 as the base year)......................................................8

Vertical Analysis.................................................................................................................9

Evaluation of Business Performance of Air Arabia..........................................................10

Structuring of the Airline...............................................................................................10

Identification of business success measured in the airline industry..............................10

Focus most applicable to the airline..............................................................................11

Examining financial and non-financial measure of performance..................................12

Using direct competition as a means of evaluating the performance............................21

Comparative Analysis between the airlines.......................................................................21

Conclusion.........................................................................................................................23

Recommendations..............................................................................................................24

References..........................................................................................................................26

List of Appendix................................................................................................................32

Ratio Analysis................................................................................................................32

Horizontal Analysis.......................................................................................................36

Vertical Analysis...........................................................................................................38

Introduction..........................................................................................................................3

Profitability Ratios...............................................................................................................4

.............................................................................................................................................6

Efficiency Ratios.................................................................................................................6

Liquidity Ratios...................................................................................................................6

Gearing Ratios.....................................................................................................................7

Horizontal Analysis (Please use 2015 as the base year)......................................................8

Vertical Analysis.................................................................................................................9

Evaluation of Business Performance of Air Arabia..........................................................10

Structuring of the Airline...............................................................................................10

Identification of business success measured in the airline industry..............................10

Focus most applicable to the airline..............................................................................11

Examining financial and non-financial measure of performance..................................12

Using direct competition as a means of evaluating the performance............................21

Comparative Analysis between the airlines.......................................................................21

Conclusion.........................................................................................................................23

Recommendations..............................................................................................................24

References..........................................................................................................................26

List of Appendix................................................................................................................32

Ratio Analysis................................................................................................................32

Horizontal Analysis.......................................................................................................36

Vertical Analysis...........................................................................................................38

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The report presents a comparative analysis of two chosen airlines. It investigates their

financial positions in the aviation industry of Europe and the Middle East. The two airlines that

have been chosen for this paper include Ryanair and Air Arabia. Ryanair is a low-cost Irish-

based airline established in 1984 having primary operational bases at London Stansted and

Dublin airports. It has become the largest European airline in 2016 in terms of passengers carried

and more precisely, it has carried more international passengers than any other airline

(Ryanair.com 2018). On the other hand, Air Arabia provides offers global commercial air

transportation, passenger transport, cargo services and aircraft rental. The airline is involved in

providing its passenger transport services via buses, cars, air travel and limousine to 130

destinations in Africa, Europe and the Middle East (Airarabia.com 2018). Although the financial

year ends for Ryanair and Air Arabia fall on different times during the year, for standardization

purposes, this report assumes the historical periods (2015-2018) for each organization to be the

same.

The analysis looked comparatively at three significant financial ratios, which include

profitability ratio, liquidity ratio and efficiency ratio for the two airlines. The business strategies

are evaluated as well by using the balanced scorecard approach for understanding the sustainable

ground for future prosperity. This analysis would assist the stakeholders in undertaking decisions

regarding the financial conditions of the airlines.

Profitability Ratios

Net and Gross Profit Margins

According to the profitability ratio table provided below, Ryanair’s net and gross profit

ratios follow a similar trend. The year 2016 yielded the highest ratios although it did not yield

The report presents a comparative analysis of two chosen airlines. It investigates their

financial positions in the aviation industry of Europe and the Middle East. The two airlines that

have been chosen for this paper include Ryanair and Air Arabia. Ryanair is a low-cost Irish-

based airline established in 1984 having primary operational bases at London Stansted and

Dublin airports. It has become the largest European airline in 2016 in terms of passengers carried

and more precisely, it has carried more international passengers than any other airline

(Ryanair.com 2018). On the other hand, Air Arabia provides offers global commercial air

transportation, passenger transport, cargo services and aircraft rental. The airline is involved in

providing its passenger transport services via buses, cars, air travel and limousine to 130

destinations in Africa, Europe and the Middle East (Airarabia.com 2018). Although the financial

year ends for Ryanair and Air Arabia fall on different times during the year, for standardization

purposes, this report assumes the historical periods (2015-2018) for each organization to be the

same.

The analysis looked comparatively at three significant financial ratios, which include

profitability ratio, liquidity ratio and efficiency ratio for the two airlines. The business strategies

are evaluated as well by using the balanced scorecard approach for understanding the sustainable

ground for future prosperity. This analysis would assist the stakeholders in undertaking decisions

regarding the financial conditions of the airlines.

Profitability Ratios

Net and Gross Profit Margins

According to the profitability ratio table provided below, Ryanair’s net and gross profit

ratios follow a similar trend. The year 2016 yielded the highest ratios although it did not yield

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the highest revenue. From the notes attached to the 2016 Ryanair financial report, this is credited

to the fact that Ryanair sold its holding in Aer Lingus in that year. This led to an increase in the

gross and net profits. Excluding this fact, Ryanair continued to show a steady growth in revenue

for the 3- year period. This was due to fuel prices going down worldwide while Ryanair’s market

share was getting bigger due to expansion and customer focus through launching the “Always

Getting Better” program.

Ryanair’s revenue in 2017 is higher than the previous year but this increment is marginal

when compared to the growth in revenue between 2015 and 2016. 2017 was a difficult year for

the aviation industry in Europe due to different terror attacks in the region and large charters

taking a large market share in Portugal and Spain, Ryanair’s lead markets (Ryanair-FY2017-

Annual-Report.pdf, 2018).

In contrast to Ryanair, Air Arabia has its worst financial performance within the 3-year

period in 2016. The drop in fuel prices negatively impacted the Middle East as it is an oil

producing region. The price drop led to a general regression in the region’s economy and

specifically hit the aviation sector, as it made it more challenging to obtain better yields per unit.

Added to this was the overcapacity of the Middle East’s aviation market when compared to the

demand on air travel. The Middle Eastern carriers continued their fleet expansion during difficult

economic times based on previous demand forecasts (Air Arabia Annual Report 2016, 2017).

This is reflected on Air Arabia’s financial statements for the year 2016 as its revenues went

down while its assets kept growing.

On the other hand, 2017 was a good year for Air Arabia as it succeeded in achieving an

all-time record profit. Although the revenue for this year was lower than that of 2016, Air Arabia

managed to substantially lower its costs thus resulting in bigger gross and net profits.

to the fact that Ryanair sold its holding in Aer Lingus in that year. This led to an increase in the

gross and net profits. Excluding this fact, Ryanair continued to show a steady growth in revenue

for the 3- year period. This was due to fuel prices going down worldwide while Ryanair’s market

share was getting bigger due to expansion and customer focus through launching the “Always

Getting Better” program.

Ryanair’s revenue in 2017 is higher than the previous year but this increment is marginal

when compared to the growth in revenue between 2015 and 2016. 2017 was a difficult year for

the aviation industry in Europe due to different terror attacks in the region and large charters

taking a large market share in Portugal and Spain, Ryanair’s lead markets (Ryanair-FY2017-

Annual-Report.pdf, 2018).

In contrast to Ryanair, Air Arabia has its worst financial performance within the 3-year

period in 2016. The drop in fuel prices negatively impacted the Middle East as it is an oil

producing region. The price drop led to a general regression in the region’s economy and

specifically hit the aviation sector, as it made it more challenging to obtain better yields per unit.

Added to this was the overcapacity of the Middle East’s aviation market when compared to the

demand on air travel. The Middle Eastern carriers continued their fleet expansion during difficult

economic times based on previous demand forecasts (Air Arabia Annual Report 2016, 2017).

This is reflected on Air Arabia’s financial statements for the year 2016 as its revenues went

down while its assets kept growing.

On the other hand, 2017 was a good year for Air Arabia as it succeeded in achieving an

all-time record profit. Although the revenue for this year was lower than that of 2016, Air Arabia

managed to substantially lower its costs thus resulting in bigger gross and net profits.

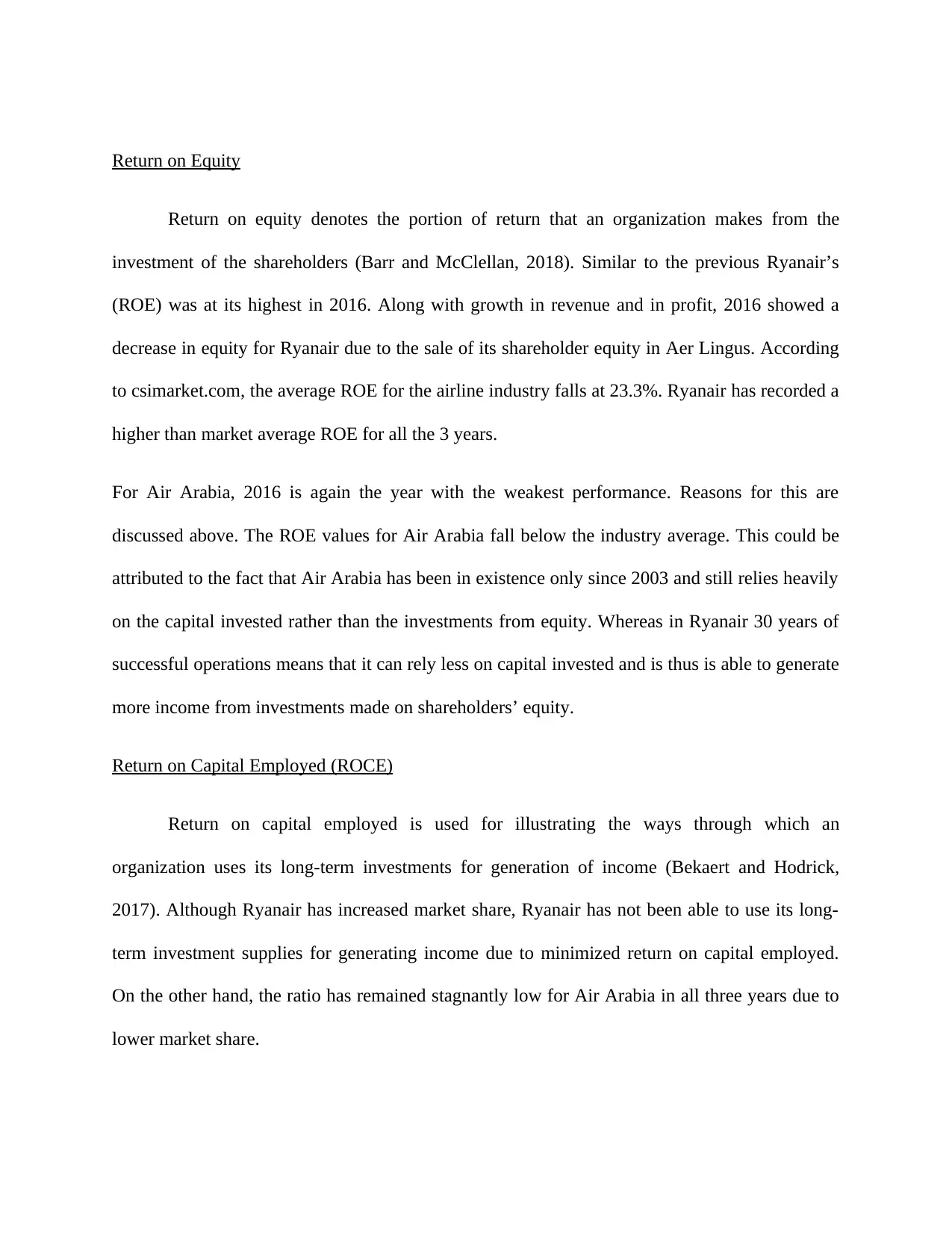

Return on Equity

Return on equity denotes the portion of return that an organization makes from the

investment of the shareholders (Barr and McClellan, 2018). Similar to the previous Ryanair’s

(ROE) was at its highest in 2016. Along with growth in revenue and in profit, 2016 showed a

decrease in equity for Ryanair due to the sale of its shareholder equity in Aer Lingus. According

to csimarket.com, the average ROE for the airline industry falls at 23.3%. Ryanair has recorded a

higher than market average ROE for all the 3 years.

For Air Arabia, 2016 is again the year with the weakest performance. Reasons for this are

discussed above. The ROE values for Air Arabia fall below the industry average. This could be

attributed to the fact that Air Arabia has been in existence only since 2003 and still relies heavily

on the capital invested rather than the investments from equity. Whereas in Ryanair 30 years of

successful operations means that it can rely less on capital invested and is thus is able to generate

more income from investments made on shareholders’ equity.

Return on Capital Employed (ROCE)

Return on capital employed is used for illustrating the ways through which an

organization uses its long-term investments for generation of income (Bekaert and Hodrick,

2017). Although Ryanair has increased market share, Ryanair has not been able to use its long-

term investment supplies for generating income due to minimized return on capital employed.

On the other hand, the ratio has remained stagnantly low for Air Arabia in all three years due to

lower market share.

Return on equity denotes the portion of return that an organization makes from the

investment of the shareholders (Barr and McClellan, 2018). Similar to the previous Ryanair’s

(ROE) was at its highest in 2016. Along with growth in revenue and in profit, 2016 showed a

decrease in equity for Ryanair due to the sale of its shareholder equity in Aer Lingus. According

to csimarket.com, the average ROE for the airline industry falls at 23.3%. Ryanair has recorded a

higher than market average ROE for all the 3 years.

For Air Arabia, 2016 is again the year with the weakest performance. Reasons for this are

discussed above. The ROE values for Air Arabia fall below the industry average. This could be

attributed to the fact that Air Arabia has been in existence only since 2003 and still relies heavily

on the capital invested rather than the investments from equity. Whereas in Ryanair 30 years of

successful operations means that it can rely less on capital invested and is thus is able to generate

more income from investments made on shareholders’ equity.

Return on Capital Employed (ROCE)

Return on capital employed is used for illustrating the ways through which an

organization uses its long-term investments for generation of income (Bekaert and Hodrick,

2017). Although Ryanair has increased market share, Ryanair has not been able to use its long-

term investment supplies for generating income due to minimized return on capital employed.

On the other hand, the ratio has remained stagnantly low for Air Arabia in all three years due to

lower market share.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Profitability Ratios:

Particulars 2017 2016 2015 2017 2016 2015

$m $m $m $m $m $m

Profit for the year A 1316.0 1559.0 867.0 631.0 490.0 511.0

Revenue B 6648.0 6536.0 5654.0 3739.0 3778.0 3826.0

Total Assets C 11990.0 11218.0 12185.0 12964.0 12513.0 11399.0

Total Equity D 4423.0 3597.0 4035.0 6036.0 5443.0 4962.0

Gross Profit I 1856.0 1753.0 1277.0 349.0 262.0 366.0

Capital Employed J 1694 1452 2396 993 559 282

Net Profit Margin E= A/B 19.80% 23.85% 15.33% 16.88% 12.97% 13.36%

Return on Equity (ROE) F=A/D 30% 43% 21% 10% 9% 10%

Return on Capital Employed (ROCE) G=A/J 78% 107% 36% 64% 88% 181%

Gross Profit Margin H=I/B 28% 27% 23% 9% 7% 10%

Ryanair AirArabia

Efficiency Ratios

The efficiency ratios that have been considered for both airlines include fixed asset

turnover ratio, total asset turnover ratio, debtor turnover ratio and revenue per passenger

kilometers (Refer to Appendix for detailed calculations). Asset turnover ratio denotes the

amount of revenue per unit value of assets used. A higher ratio is always favorable for an

organization, since it implies that the organization is making more money from every asset

utilized (Brigham et al. 2016). Despite the fact that both the airlines have lower asset turnovers

because of operating costs like additional security measures, Ryanair has recorded slightly

greater asset turnover ratio. This describes that Ryanair has been able of generating additional

money than Air Arabia. On the other hand, debtors’ turnover ratio denotes the amount of time

taken by an organization in collecting lent amounts from the debtors (Buehlmaier and Whited

2018). For both Ryanair and Air Arabia, the amounts are collected from the debtors at almost

same rates; however, Air Arabia has been collecting amounts from the debtors at a slightly

increased rate. Finally, in terms of revenue per passenger kilometers, Ryanair is observed to be

placed in a favorable position, as it has greater market share and international reputation.

Particulars 2017 2016 2015 2017 2016 2015

$m $m $m $m $m $m

Profit for the year A 1316.0 1559.0 867.0 631.0 490.0 511.0

Revenue B 6648.0 6536.0 5654.0 3739.0 3778.0 3826.0

Total Assets C 11990.0 11218.0 12185.0 12964.0 12513.0 11399.0

Total Equity D 4423.0 3597.0 4035.0 6036.0 5443.0 4962.0

Gross Profit I 1856.0 1753.0 1277.0 349.0 262.0 366.0

Capital Employed J 1694 1452 2396 993 559 282

Net Profit Margin E= A/B 19.80% 23.85% 15.33% 16.88% 12.97% 13.36%

Return on Equity (ROE) F=A/D 30% 43% 21% 10% 9% 10%

Return on Capital Employed (ROCE) G=A/J 78% 107% 36% 64% 88% 181%

Gross Profit Margin H=I/B 28% 27% 23% 9% 7% 10%

Ryanair AirArabia

Efficiency Ratios

The efficiency ratios that have been considered for both airlines include fixed asset

turnover ratio, total asset turnover ratio, debtor turnover ratio and revenue per passenger

kilometers (Refer to Appendix for detailed calculations). Asset turnover ratio denotes the

amount of revenue per unit value of assets used. A higher ratio is always favorable for an

organization, since it implies that the organization is making more money from every asset

utilized (Brigham et al. 2016). Despite the fact that both the airlines have lower asset turnovers

because of operating costs like additional security measures, Ryanair has recorded slightly

greater asset turnover ratio. This describes that Ryanair has been able of generating additional

money than Air Arabia. On the other hand, debtors’ turnover ratio denotes the amount of time

taken by an organization in collecting lent amounts from the debtors (Buehlmaier and Whited

2018). For both Ryanair and Air Arabia, the amounts are collected from the debtors at almost

same rates; however, Air Arabia has been collecting amounts from the debtors at a slightly

increased rate. Finally, in terms of revenue per passenger kilometers, Ryanair is observed to be

placed in a favorable position, as it has greater market share and international reputation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

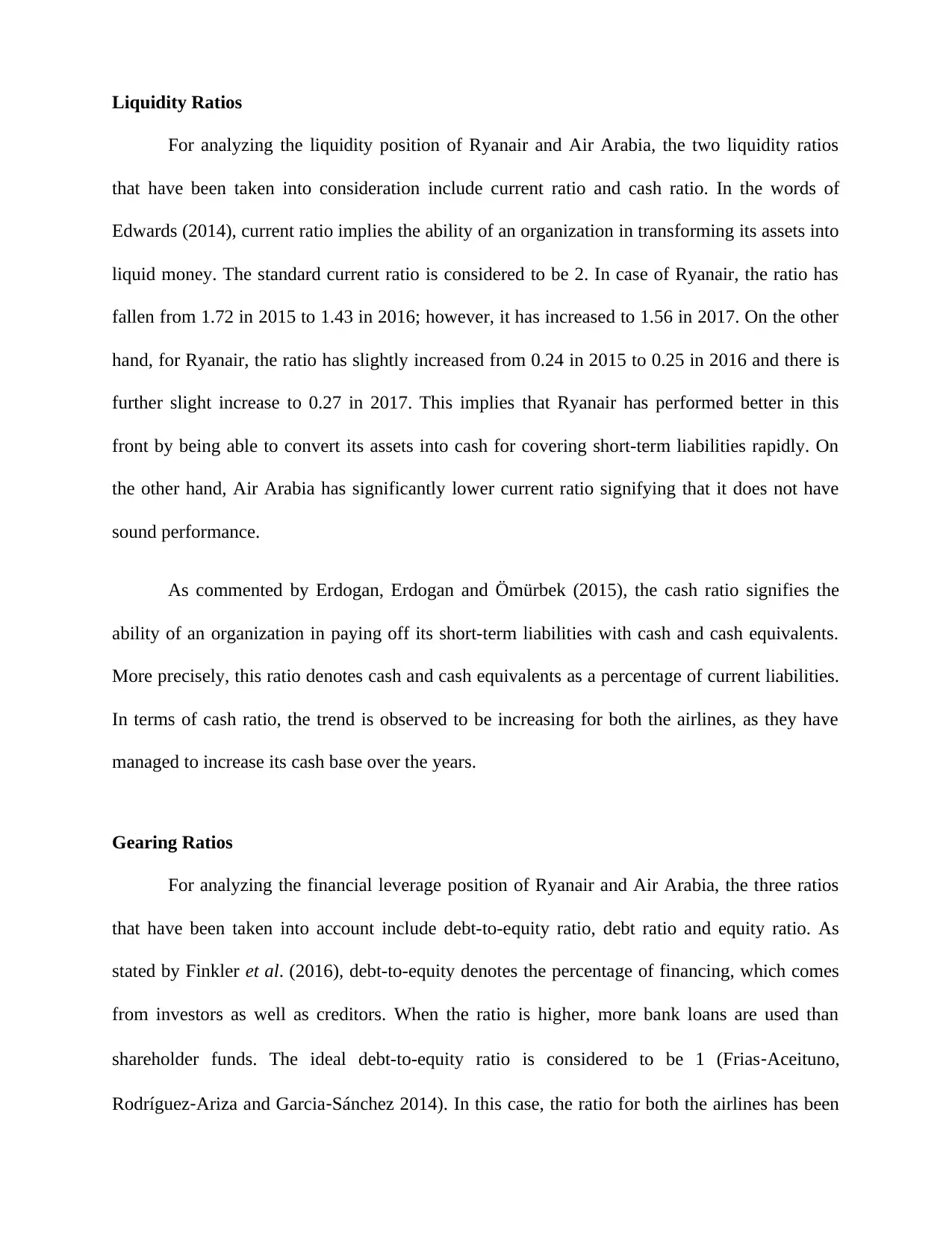

Liquidity Ratios

For analyzing the liquidity position of Ryanair and Air Arabia, the two liquidity ratios

that have been taken into consideration include current ratio and cash ratio. In the words of

Edwards (2014), current ratio implies the ability of an organization in transforming its assets into

liquid money. The standard current ratio is considered to be 2. In case of Ryanair, the ratio has

fallen from 1.72 in 2015 to 1.43 in 2016; however, it has increased to 1.56 in 2017. On the other

hand, for Ryanair, the ratio has slightly increased from 0.24 in 2015 to 0.25 in 2016 and there is

further slight increase to 0.27 in 2017. This implies that Ryanair has performed better in this

front by being able to convert its assets into cash for covering short-term liabilities rapidly. On

the other hand, Air Arabia has significantly lower current ratio signifying that it does not have

sound performance.

As commented by Erdogan, Erdogan and Ömürbek (2015), the cash ratio signifies the

ability of an organization in paying off its short-term liabilities with cash and cash equivalents.

More precisely, this ratio denotes cash and cash equivalents as a percentage of current liabilities.

In terms of cash ratio, the trend is observed to be increasing for both the airlines, as they have

managed to increase its cash base over the years.

Gearing Ratios

For analyzing the financial leverage position of Ryanair and Air Arabia, the three ratios

that have been taken into account include debt-to-equity ratio, debt ratio and equity ratio. As

stated by Finkler et al. (2016), debt-to-equity denotes the percentage of financing, which comes

from investors as well as creditors. When the ratio is higher, more bank loans are used than

shareholder funds. The ideal debt-to-equity ratio is considered to be 1 (Frias‐Aceituno,

Rodríguez‐Ariza and Garcia‐Sánchez 2014). In this case, the ratio for both the airlines has been

For analyzing the liquidity position of Ryanair and Air Arabia, the two liquidity ratios

that have been taken into consideration include current ratio and cash ratio. In the words of

Edwards (2014), current ratio implies the ability of an organization in transforming its assets into

liquid money. The standard current ratio is considered to be 2. In case of Ryanair, the ratio has

fallen from 1.72 in 2015 to 1.43 in 2016; however, it has increased to 1.56 in 2017. On the other

hand, for Ryanair, the ratio has slightly increased from 0.24 in 2015 to 0.25 in 2016 and there is

further slight increase to 0.27 in 2017. This implies that Ryanair has performed better in this

front by being able to convert its assets into cash for covering short-term liabilities rapidly. On

the other hand, Air Arabia has significantly lower current ratio signifying that it does not have

sound performance.

As commented by Erdogan, Erdogan and Ömürbek (2015), the cash ratio signifies the

ability of an organization in paying off its short-term liabilities with cash and cash equivalents.

More precisely, this ratio denotes cash and cash equivalents as a percentage of current liabilities.

In terms of cash ratio, the trend is observed to be increasing for both the airlines, as they have

managed to increase its cash base over the years.

Gearing Ratios

For analyzing the financial leverage position of Ryanair and Air Arabia, the three ratios

that have been taken into account include debt-to-equity ratio, debt ratio and equity ratio. As

stated by Finkler et al. (2016), debt-to-equity denotes the percentage of financing, which comes

from investors as well as creditors. When the ratio is higher, more bank loans are used than

shareholder funds. The ideal debt-to-equity ratio is considered to be 1 (Frias‐Aceituno,

Rodríguez‐Ariza and Garcia‐Sánchez 2014). In this case, the ratio for both the airlines has been

above 1 in all the three years, which clearly implies that they rely more on raising funds through

bank loans rather than issuing new equity shares in the market.

In terms of debt ratio, the ratio is observed to be falling for both the airlines in the year

2017; however, the figure is lower for Air Arabia. The trend is similar in case of equity ratio as

well, which implies that both the airlines have failed to generate adequate funds from the

shareholders/investors in the market.

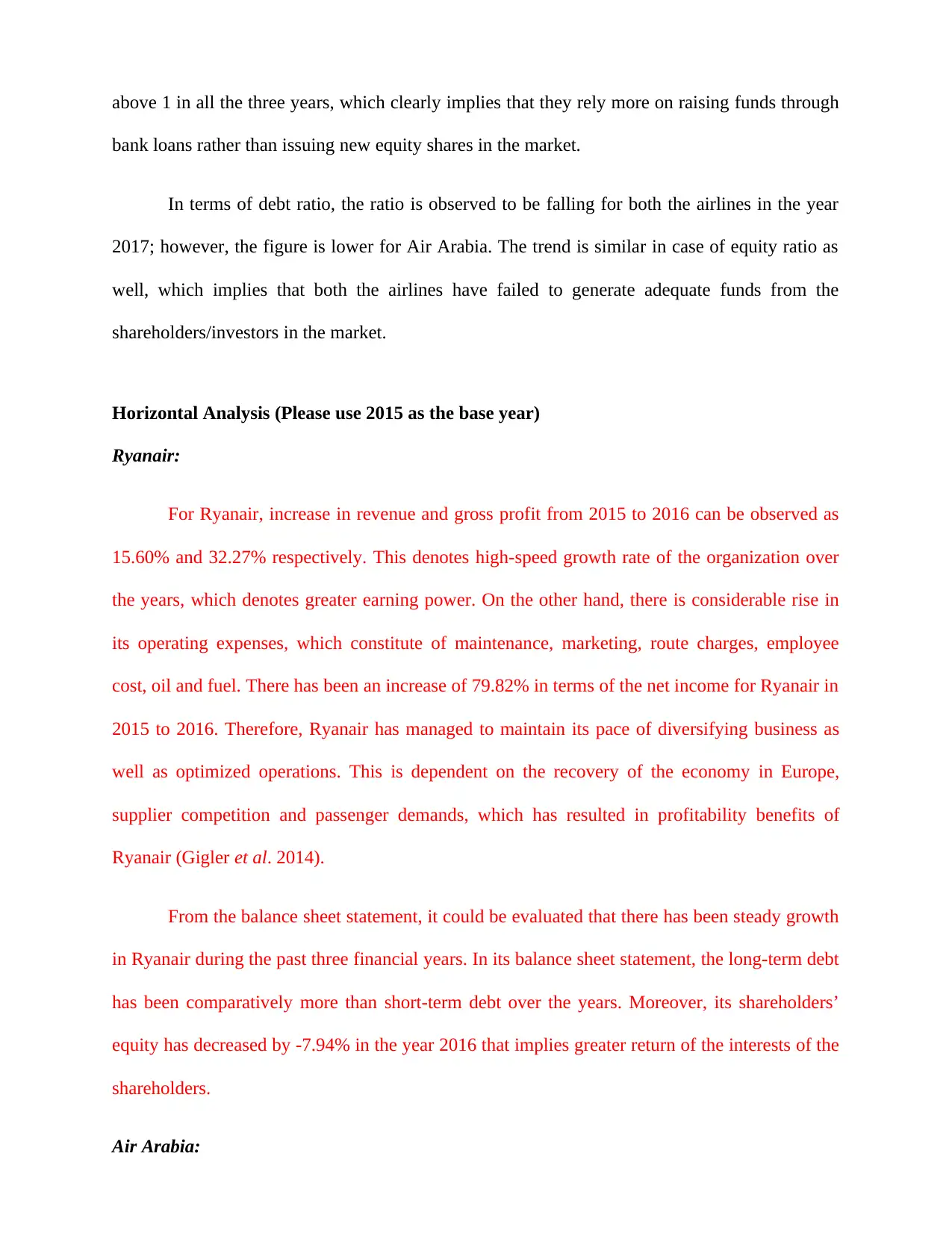

Horizontal Analysis (Please use 2015 as the base year)

Ryanair:

For Ryanair, increase in revenue and gross profit from 2015 to 2016 can be observed as

15.60% and 32.27% respectively. This denotes high-speed growth rate of the organization over

the years, which denotes greater earning power. On the other hand, there is considerable rise in

its operating expenses, which constitute of maintenance, marketing, route charges, employee

cost, oil and fuel. There has been an increase of 79.82% in terms of the net income for Ryanair in

2015 to 2016. Therefore, Ryanair has managed to maintain its pace of diversifying business as

well as optimized operations. This is dependent on the recovery of the economy in Europe,

supplier competition and passenger demands, which has resulted in profitability benefits of

Ryanair (Gigler et al. 2014).

From the balance sheet statement, it could be evaluated that there has been steady growth

in Ryanair during the past three financial years. In its balance sheet statement, the long-term debt

has been comparatively more than short-term debt over the years. Moreover, its shareholders’

equity has decreased by -7.94% in the year 2016 that implies greater return of the interests of the

shareholders.

Air Arabia:

bank loans rather than issuing new equity shares in the market.

In terms of debt ratio, the ratio is observed to be falling for both the airlines in the year

2017; however, the figure is lower for Air Arabia. The trend is similar in case of equity ratio as

well, which implies that both the airlines have failed to generate adequate funds from the

shareholders/investors in the market.

Horizontal Analysis (Please use 2015 as the base year)

Ryanair:

For Ryanair, increase in revenue and gross profit from 2015 to 2016 can be observed as

15.60% and 32.27% respectively. This denotes high-speed growth rate of the organization over

the years, which denotes greater earning power. On the other hand, there is considerable rise in

its operating expenses, which constitute of maintenance, marketing, route charges, employee

cost, oil and fuel. There has been an increase of 79.82% in terms of the net income for Ryanair in

2015 to 2016. Therefore, Ryanair has managed to maintain its pace of diversifying business as

well as optimized operations. This is dependent on the recovery of the economy in Europe,

supplier competition and passenger demands, which has resulted in profitability benefits of

Ryanair (Gigler et al. 2014).

From the balance sheet statement, it could be evaluated that there has been steady growth

in Ryanair during the past three financial years. In its balance sheet statement, the long-term debt

has been comparatively more than short-term debt over the years. Moreover, its shareholders’

equity has decreased by -7.94% in the year 2016 that implies greater return of the interests of the

shareholders.

Air Arabia:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In case of Air Arabia, the significant area to be investigated would be operating profit

that has declined by 35.28% from 2015 to 2016 and risen by 31.78% in 2017. The decline by

35.28% from 2015 to 2016 is mainly due to the fall in cost of sales by 5.82% in 2017. In the

meantime, the expenses had shown positive changes, as sales, general and administrative

expenses have declined by 2.61% in 2017. Despite the rapid rise in the price of jet fuel over the

years leading to rise in cost of fuel for the airline, it has formulated solutions where the

passengers have to bear additional charges for the consumption of jet fuel (Sullivan and

Mackenzie 2017). The ticket fares have still been attractive in contrast to the other full cost

airlines suffering from increased jet fuel prices.

In terms of the balance sheet statement, a considerable difference has taken place in

relation to current assets, particularly in cash and cash equivalents. This is because the

organization has minimized its short-term debt over the years and it has led to minimization of

non-current debt slightly as well by 0.34% in 2017. On the other hand, the growth in net profit

over the years has resulted in growth in shareholders’ equity over the years leading to better

returns for the shareholders (Grant 2016).

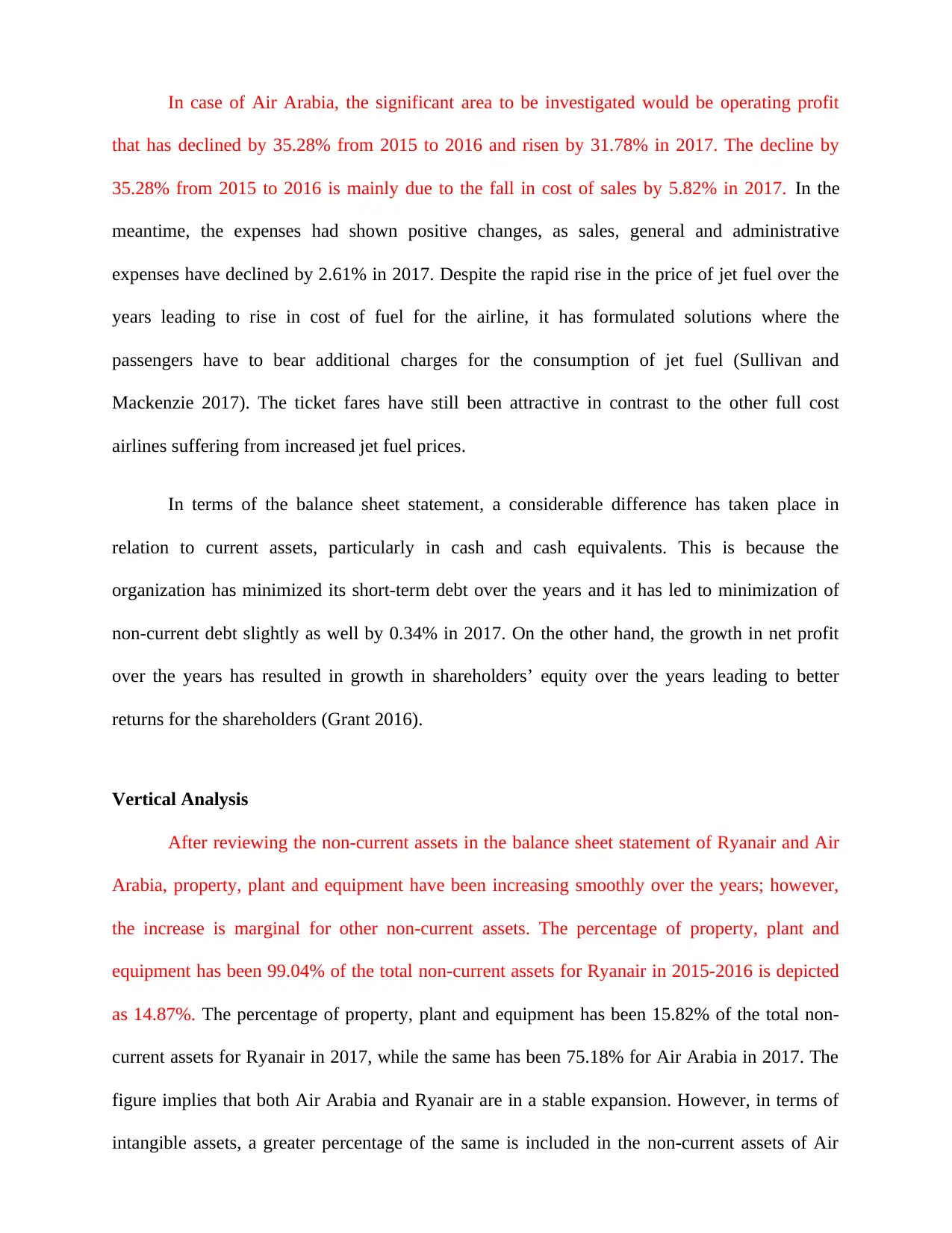

Vertical Analysis

After reviewing the non-current assets in the balance sheet statement of Ryanair and Air

Arabia, property, plant and equipment have been increasing smoothly over the years; however,

the increase is marginal for other non-current assets. The percentage of property, plant and

equipment has been 99.04% of the total non-current assets for Ryanair in 2015-2016 is depicted

as 14.87%. The percentage of property, plant and equipment has been 15.82% of the total non-

current assets for Ryanair in 2017, while the same has been 75.18% for Air Arabia in 2017. The

figure implies that both Air Arabia and Ryanair are in a stable expansion. However, in terms of

intangible assets, a greater percentage of the same is included in the non-current assets of Air

that has declined by 35.28% from 2015 to 2016 and risen by 31.78% in 2017. The decline by

35.28% from 2015 to 2016 is mainly due to the fall in cost of sales by 5.82% in 2017. In the

meantime, the expenses had shown positive changes, as sales, general and administrative

expenses have declined by 2.61% in 2017. Despite the rapid rise in the price of jet fuel over the

years leading to rise in cost of fuel for the airline, it has formulated solutions where the

passengers have to bear additional charges for the consumption of jet fuel (Sullivan and

Mackenzie 2017). The ticket fares have still been attractive in contrast to the other full cost

airlines suffering from increased jet fuel prices.

In terms of the balance sheet statement, a considerable difference has taken place in

relation to current assets, particularly in cash and cash equivalents. This is because the

organization has minimized its short-term debt over the years and it has led to minimization of

non-current debt slightly as well by 0.34% in 2017. On the other hand, the growth in net profit

over the years has resulted in growth in shareholders’ equity over the years leading to better

returns for the shareholders (Grant 2016).

Vertical Analysis

After reviewing the non-current assets in the balance sheet statement of Ryanair and Air

Arabia, property, plant and equipment have been increasing smoothly over the years; however,

the increase is marginal for other non-current assets. The percentage of property, plant and

equipment has been 99.04% of the total non-current assets for Ryanair in 2015-2016 is depicted

as 14.87%. The percentage of property, plant and equipment has been 15.82% of the total non-

current assets for Ryanair in 2017, while the same has been 75.18% for Air Arabia in 2017. The

figure implies that both Air Arabia and Ryanair are in a stable expansion. However, in terms of

intangible assets, a greater percentage of the same is included in the non-current assets of Air

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Arabia compared to Ryanair. Thus, it could be said that majority of the assets and liabilities are

in the form of slots and aircrafts.

In terms of current assets, steady increase could be observed over the years for both the

airlines, particularly with the rise in cash and cash equivalents. This is mainly due to the fact that

these two airlines have minimized their short-term bank borrowings over the years. The situation

is identical in case of non-current liabilities as well, in which the maximum elements are

increasing over the years after which a slow recovery took place. There have been reductions in

short-term and long-term borrowings for both the airlines in 2017 and decline in bank loans has

minimized the interest expenses for interest bearing loans by 15.49% for Ryanair. On the other

hand, Air Arabia has incurred increased interest expenses making up 3.18% of sales revenue.

Therefore, after considering all these aspects, Ryanair is observed to be in a competitive position

in the global aviation industry. This is due to the fact that it has wider reach to the market and it

has carried increased number of passengers over the years due to which it has managed to

maintain favorable financial standing in the operating market.

Evaluation of Business Performance of Air Arabia

Structuring of the Airline

Identification of business success measured in the airline industry

The measurement of the key success factors in the airline industry is depicted to ranging

with several number of factors. For instance, the measurement of success pertaining to attracting

the customers ranges from attractiveness of the airline’s service and effectiveness of the airline’s

promotional expenditures. The measure of success based on the effectiveness of the attracting the

customers is often defined with derivation of the promotional effectiveness. This measure is seen

with the sales per dollar pertaining to the promotional expense. Except where otherwise noted,

in the form of slots and aircrafts.

In terms of current assets, steady increase could be observed over the years for both the

airlines, particularly with the rise in cash and cash equivalents. This is mainly due to the fact that

these two airlines have minimized their short-term bank borrowings over the years. The situation

is identical in case of non-current liabilities as well, in which the maximum elements are

increasing over the years after which a slow recovery took place. There have been reductions in

short-term and long-term borrowings for both the airlines in 2017 and decline in bank loans has

minimized the interest expenses for interest bearing loans by 15.49% for Ryanair. On the other

hand, Air Arabia has incurred increased interest expenses making up 3.18% of sales revenue.

Therefore, after considering all these aspects, Ryanair is observed to be in a competitive position

in the global aviation industry. This is due to the fact that it has wider reach to the market and it

has carried increased number of passengers over the years due to which it has managed to

maintain favorable financial standing in the operating market.

Evaluation of Business Performance of Air Arabia

Structuring of the Airline

Identification of business success measured in the airline industry

The measurement of the key success factors in the airline industry is depicted to ranging

with several number of factors. For instance, the measurement of success pertaining to attracting

the customers ranges from attractiveness of the airline’s service and effectiveness of the airline’s

promotional expenditures. The measure of success based on the effectiveness of the attracting the

customers is often defined with derivation of the promotional effectiveness. This measure is seen

with the sales per dollar pertaining to the promotional expense. Except where otherwise noted,

the analysis of the data pertaining to the Department of Transportation databases in UAE

(Mohamad et al. 2017).

The second crucial factor is considered with managing people. This factor relates to

managing productivity in the airline. The measure for this is seen with capacity per employee

and this is often regarded as how effectively the employees work together for providing the

physical services in transporting the passengers from one place to another. The morale for this

is seen to be considered with how the committed employees are able to provide effective

physical service in getting the passengers from one place to another. More importantly morale is

considered as the measure of how committed employees are able to provide good service to the

customers involved in the aviation industry (Ellis et al. 2018).

Managing Finance is another determinant of the success factor among the airline

industry. More importantly unit revenue and unit cost are important by themselves and the

relationship among them should be also considered effectively by the company. The unit

revenues and unit costs are particularly seen to be effective for the long-term profit of the

company (Sweis et al. 2019).

Focus most applicable to the airline

Air Arabia is seen as a one of the budget airliners headquartered in the A1 Building

Sharjah Freight Center, Sharjah International Airport, in United Arab Emirates. The scheduled

service of the airline is seen to operate in more than 151 destinations. However, some of the

main areas of problem with the airliner is considered with comparatively lower performance

pertaining to the areas of maintaining a steady cash ratio. This is particularly evident with the

Cash & Cash equivalents as per the current liabilities. The focus pertaining to this aspect needs

to be seen with an augmented emphasis on the short-term cash available for maintaining a steady

cash ratio. The airliner needs to ensure steady cash by following up with the account’s

(Mohamad et al. 2017).

The second crucial factor is considered with managing people. This factor relates to

managing productivity in the airline. The measure for this is seen with capacity per employee

and this is often regarded as how effectively the employees work together for providing the

physical services in transporting the passengers from one place to another. The morale for this

is seen to be considered with how the committed employees are able to provide effective

physical service in getting the passengers from one place to another. More importantly morale is

considered as the measure of how committed employees are able to provide good service to the

customers involved in the aviation industry (Ellis et al. 2018).

Managing Finance is another determinant of the success factor among the airline

industry. More importantly unit revenue and unit cost are important by themselves and the

relationship among them should be also considered effectively by the company. The unit

revenues and unit costs are particularly seen to be effective for the long-term profit of the

company (Sweis et al. 2019).

Focus most applicable to the airline

Air Arabia is seen as a one of the budget airliners headquartered in the A1 Building

Sharjah Freight Center, Sharjah International Airport, in United Arab Emirates. The scheduled

service of the airline is seen to operate in more than 151 destinations. However, some of the

main areas of problem with the airliner is considered with comparatively lower performance

pertaining to the areas of maintaining a steady cash ratio. This is particularly evident with the

Cash & Cash equivalents as per the current liabilities. The focus pertaining to this aspect needs

to be seen with an augmented emphasis on the short-term cash available for maintaining a steady

cash ratio. The airliner needs to ensure steady cash by following up with the account’s

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 41

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.