Equity Valuation and Financial Analysis: A Management Report

VerifiedAdded on 2024/05/30

|16

|1845

|350

Report

AI Summary

This managerial finance report evaluates techniques for assessing business performance, focusing on equity valuation methods. It calculates the value of shares for ten listed Australian companies using the Dividend Growth Model and Warren Buffet's intrinsic value approach. The report ranks these investments based on desirability, recommending Caltex Australia due to its high share value and growth prospects. It compares the Dividend Growth Model with Warren Buffet’s approach, favoring the former for its precise measurement of company value. The report concludes by emphasizing the importance of appropriate share valuation criteria in financial analysis and recommends the dividend growth model for its accuracy in determining company value. Desklib provides access to similar solved assignments and study resources for students.

Financial Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive summary:

The managerial finance assignment will include evaluation of various techniques which helps in

determining the effectiveness with which the business is operating internally and externally. The

process of managerial finance helps in improving the techniques associated with financial

improvement of the company. The report will involve a description about various techniques

available for valuing the shares of company in respect of valuing the business value of company.

The report will thus involve a preparation of equity valuation model in which the shares will be

valued based ion a prescribed and recommended technique.

2

The managerial finance assignment will include evaluation of various techniques which helps in

determining the effectiveness with which the business is operating internally and externally. The

process of managerial finance helps in improving the techniques associated with financial

improvement of the company. The report will involve a description about various techniques

available for valuing the shares of company in respect of valuing the business value of company.

The report will thus involve a preparation of equity valuation model in which the shares will be

valued based ion a prescribed and recommended technique.

2

Contents

Executive summary:........................................................................................................................2

Introduction:....................................................................................................................................4

Content:............................................................................................................................................5

Task 1:.........................................................................................................................................5

Task 2:.......................................................................................................................................12

Task 3:.......................................................................................................................................13

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

3

Executive summary:........................................................................................................................2

Introduction:....................................................................................................................................4

Content:............................................................................................................................................5

Task 1:.........................................................................................................................................5

Task 2:.......................................................................................................................................12

Task 3:.......................................................................................................................................13

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction:

The purpose of the report is to enable the users in developing an understanding about the share

valuation techniques applied in various firms in order to analyse the financial viability and

investment decision of the company. In order to prepare this report ten listed companies of

Australia form different sectors will be chosen and a dividend valuation model will be applied in

order to value the shares of company. Further a comparable technique of intrinsic value valuation

method as suggested by Warren Buffet will be used to value the shares of these companies. A

recommendation will be made for adopting a suitable method of valuation.

4

The purpose of the report is to enable the users in developing an understanding about the share

valuation techniques applied in various firms in order to analyse the financial viability and

investment decision of the company. In order to prepare this report ten listed companies of

Australia form different sectors will be chosen and a dividend valuation model will be applied in

order to value the shares of company. Further a comparable technique of intrinsic value valuation

method as suggested by Warren Buffet will be used to value the shares of these companies. A

recommendation will be made for adopting a suitable method of valuation.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

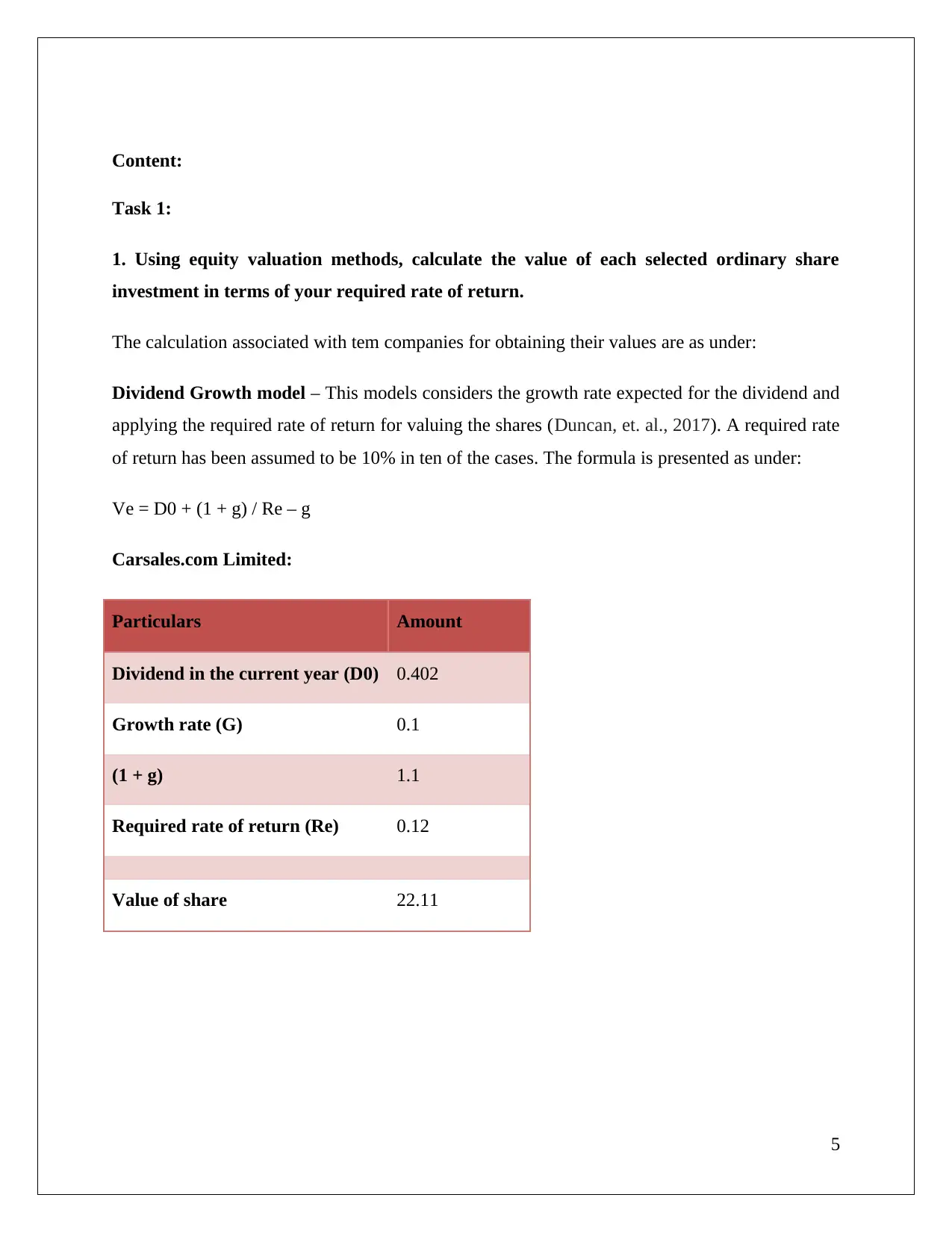

Content:

Task 1:

1. Using equity valuation methods, calculate the value of each selected ordinary share

investment in terms of your required rate of return.

The calculation associated with tem companies for obtaining their values are as under:

Dividend Growth model – This models considers the growth rate expected for the dividend and

applying the required rate of return for valuing the shares (Duncan, et. al., 2017). A required rate

of return has been assumed to be 10% in ten of the cases. The formula is presented as under:

Ve = D0 + (1 + g) / Re – g

Carsales.com Limited:

Particulars Amount

Dividend in the current year (D0) 0.402

Growth rate (G) 0.1

(1 + g) 1.1

Required rate of return (Re) 0.12

Value of share 22.11

5

Task 1:

1. Using equity valuation methods, calculate the value of each selected ordinary share

investment in terms of your required rate of return.

The calculation associated with tem companies for obtaining their values are as under:

Dividend Growth model – This models considers the growth rate expected for the dividend and

applying the required rate of return for valuing the shares (Duncan, et. al., 2017). A required rate

of return has been assumed to be 10% in ten of the cases. The formula is presented as under:

Ve = D0 + (1 + g) / Re – g

Carsales.com Limited:

Particulars Amount

Dividend in the current year (D0) 0.402

Growth rate (G) 0.1

(1 + g) 1.1

Required rate of return (Re) 0.12

Value of share 22.11

5

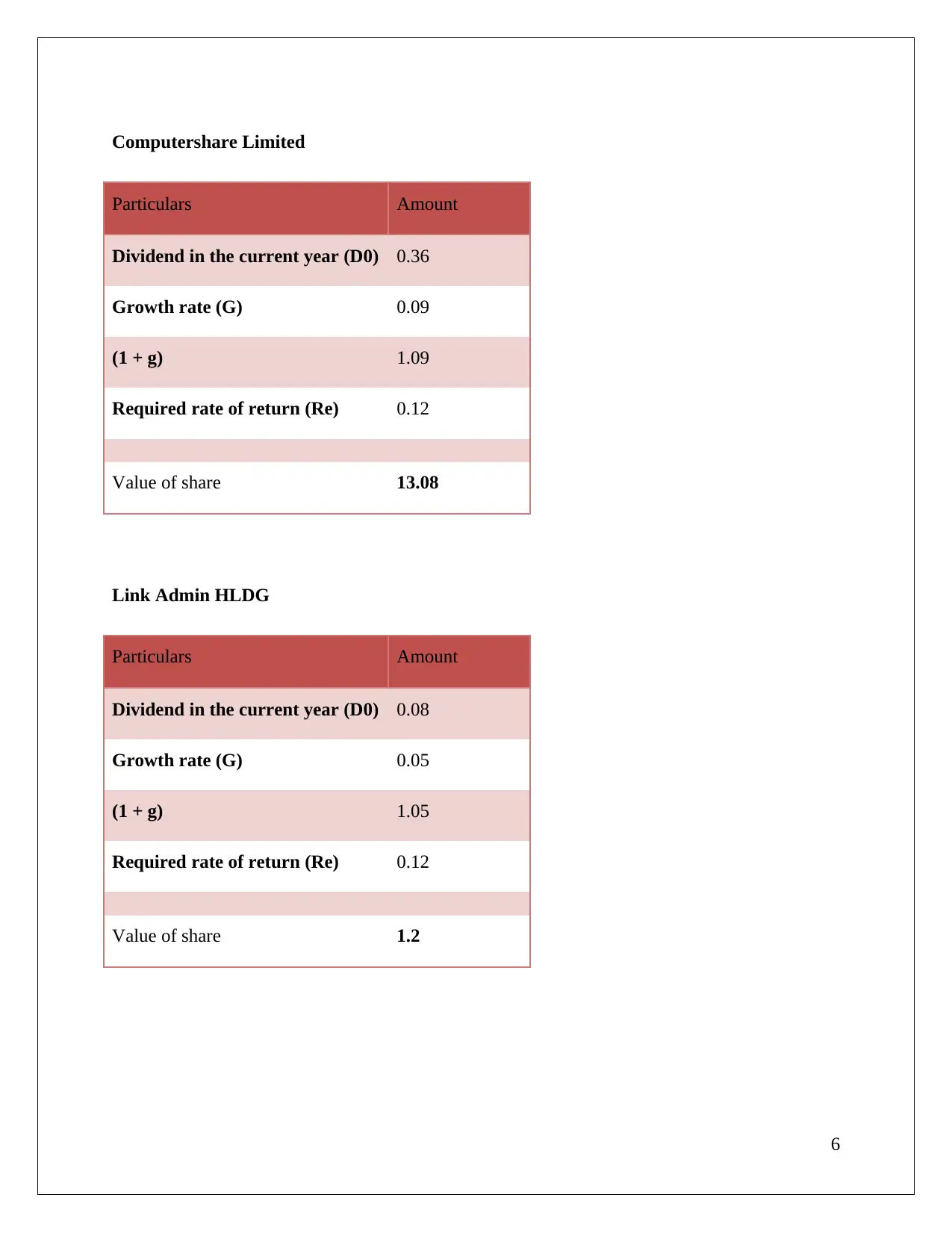

Computershare Limited

Particulars Amount

Dividend in the current year (D0) 0.36

Growth rate (G) 0.09

(1 + g) 1.09

Required rate of return (Re) 0.12

Value of share 13.08

Link Admin HLDG

Particulars Amount

Dividend in the current year (D0) 0.08

Growth rate (G) 0.05

(1 + g) 1.05

Required rate of return (Re) 0.12

Value of share 1.2

6

Particulars Amount

Dividend in the current year (D0) 0.36

Growth rate (G) 0.09

(1 + g) 1.09

Required rate of return (Re) 0.12

Value of share 13.08

Link Admin HLDG

Particulars Amount

Dividend in the current year (D0) 0.08

Growth rate (G) 0.05

(1 + g) 1.05

Required rate of return (Re) 0.12

Value of share 1.2

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

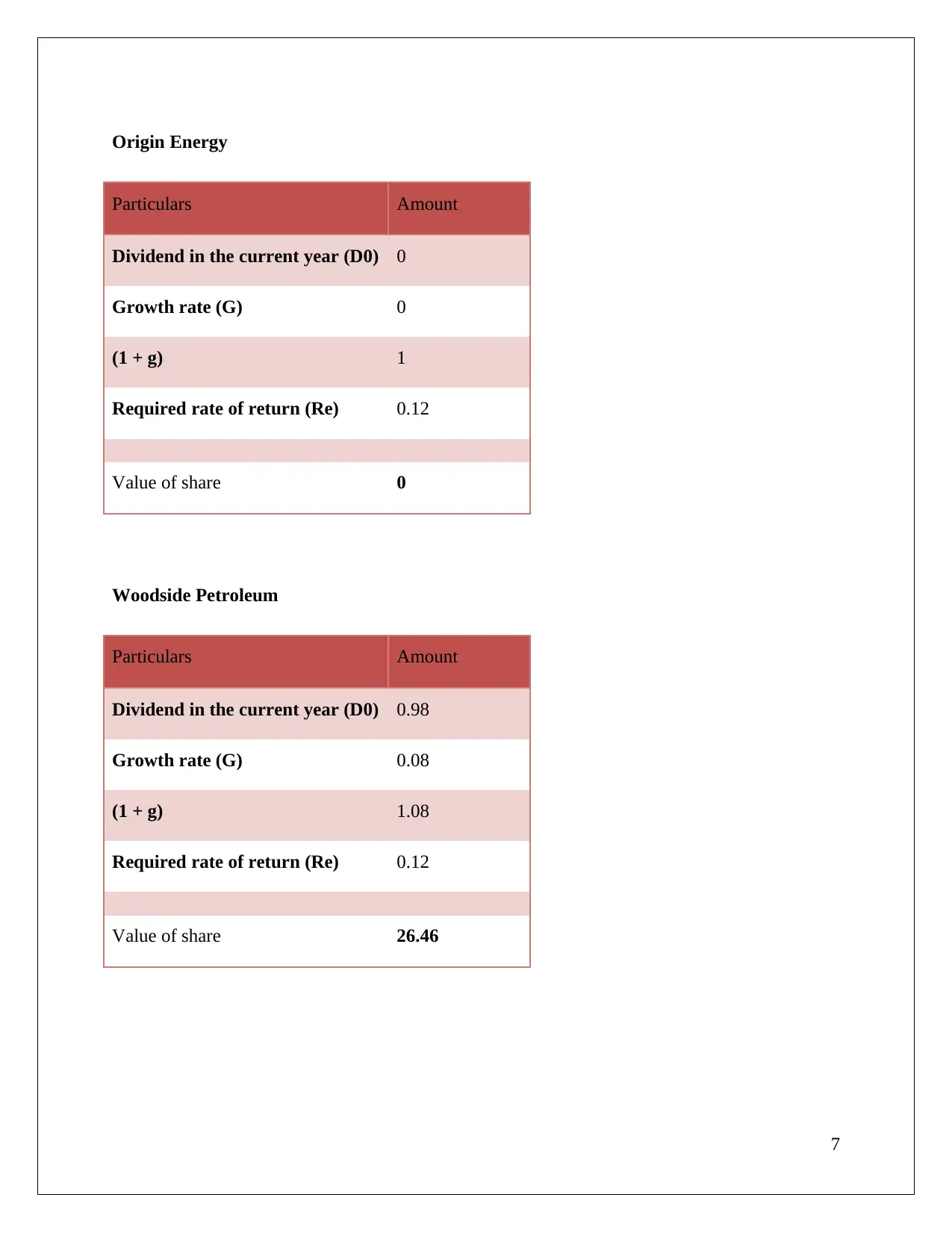

Origin Energy

Particulars Amount

Dividend in the current year (D0) 0

Growth rate (G) 0

(1 + g) 1

Required rate of return (Re) 0.12

Value of share 0

Woodside Petroleum

Particulars Amount

Dividend in the current year (D0) 0.98

Growth rate (G) 0.08

(1 + g) 1.08

Required rate of return (Re) 0.12

Value of share 26.46

7

Particulars Amount

Dividend in the current year (D0) 0

Growth rate (G) 0

(1 + g) 1

Required rate of return (Re) 0.12

Value of share 0

Woodside Petroleum

Particulars Amount

Dividend in the current year (D0) 0.98

Growth rate (G) 0.08

(1 + g) 1.08

Required rate of return (Re) 0.12

Value of share 26.46

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

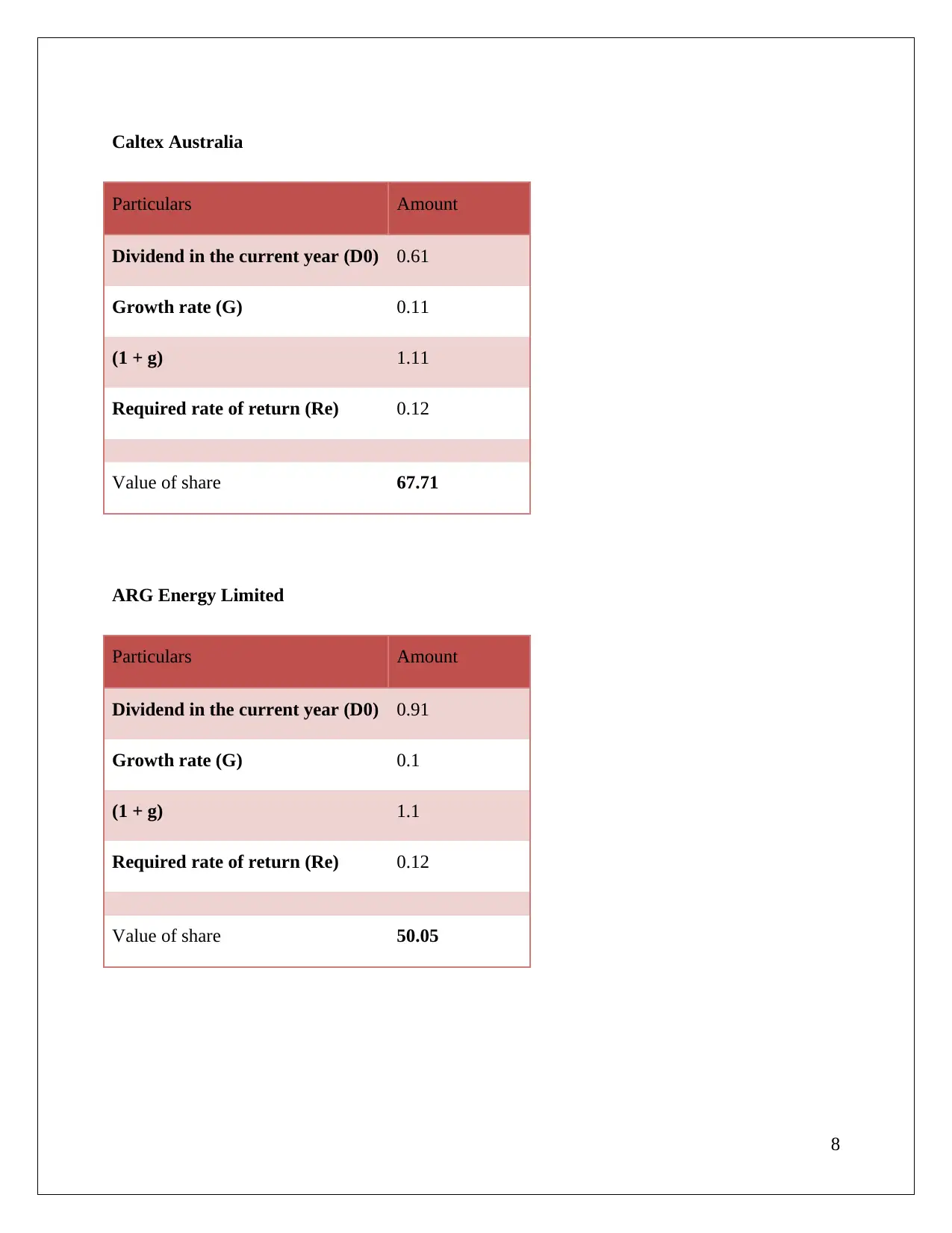

Caltex Australia

Particulars Amount

Dividend in the current year (D0) 0.61

Growth rate (G) 0.11

(1 + g) 1.11

Required rate of return (Re) 0.12

Value of share 67.71

ARG Energy Limited

Particulars Amount

Dividend in the current year (D0) 0.91

Growth rate (G) 0.1

(1 + g) 1.1

Required rate of return (Re) 0.12

Value of share 50.05

8

Particulars Amount

Dividend in the current year (D0) 0.61

Growth rate (G) 0.11

(1 + g) 1.11

Required rate of return (Re) 0.12

Value of share 67.71

ARG Energy Limited

Particulars Amount

Dividend in the current year (D0) 0.91

Growth rate (G) 0.1

(1 + g) 1.1

Required rate of return (Re) 0.12

Value of share 50.05

8

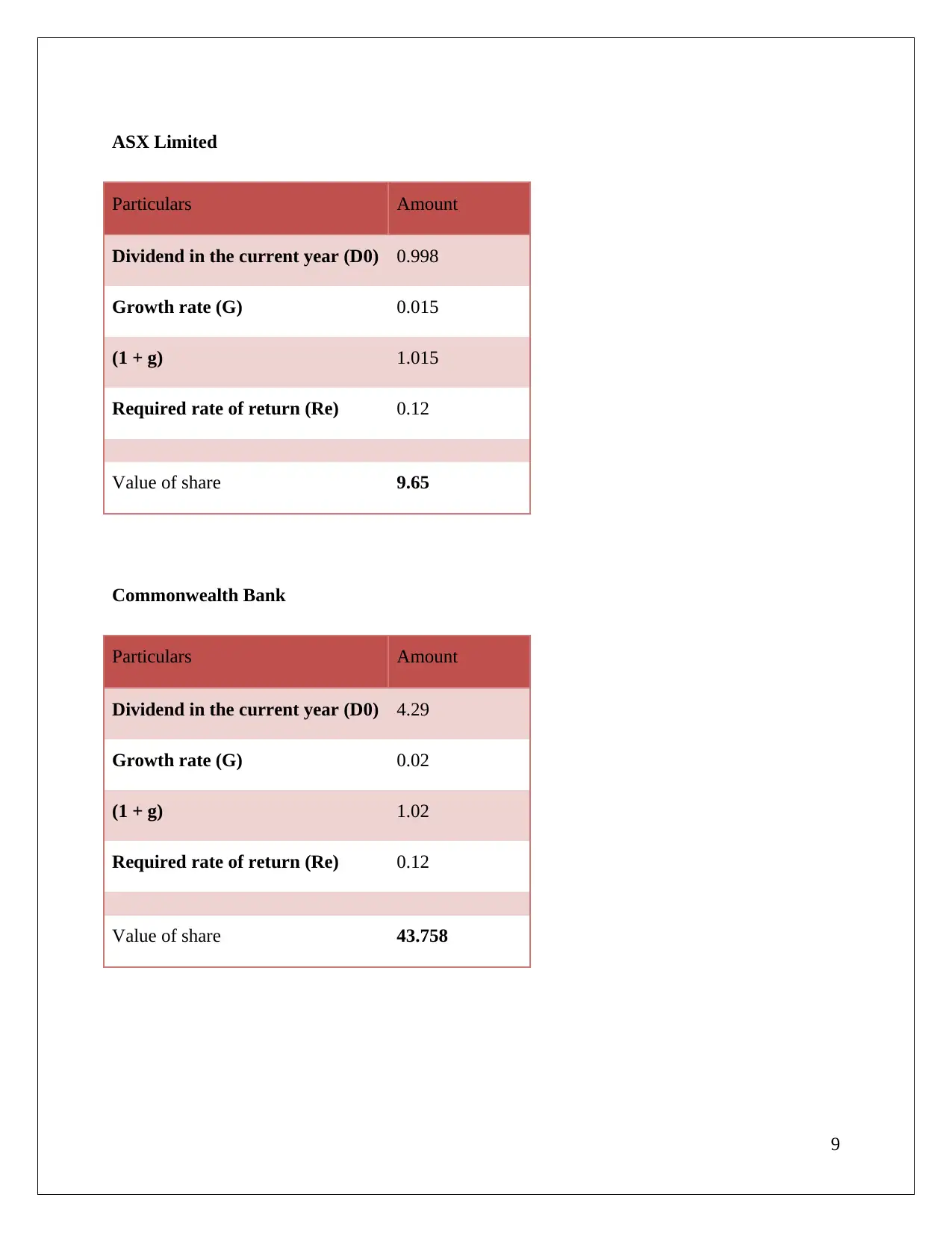

ASX Limited

Particulars Amount

Dividend in the current year (D0) 0.998

Growth rate (G) 0.015

(1 + g) 1.015

Required rate of return (Re) 0.12

Value of share 9.65

Commonwealth Bank

Particulars Amount

Dividend in the current year (D0) 4.29

Growth rate (G) 0.02

(1 + g) 1.02

Required rate of return (Re) 0.12

Value of share 43.758

9

Particulars Amount

Dividend in the current year (D0) 0.998

Growth rate (G) 0.015

(1 + g) 1.015

Required rate of return (Re) 0.12

Value of share 9.65

Commonwealth Bank

Particulars Amount

Dividend in the current year (D0) 4.29

Growth rate (G) 0.02

(1 + g) 1.02

Required rate of return (Re) 0.12

Value of share 43.758

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

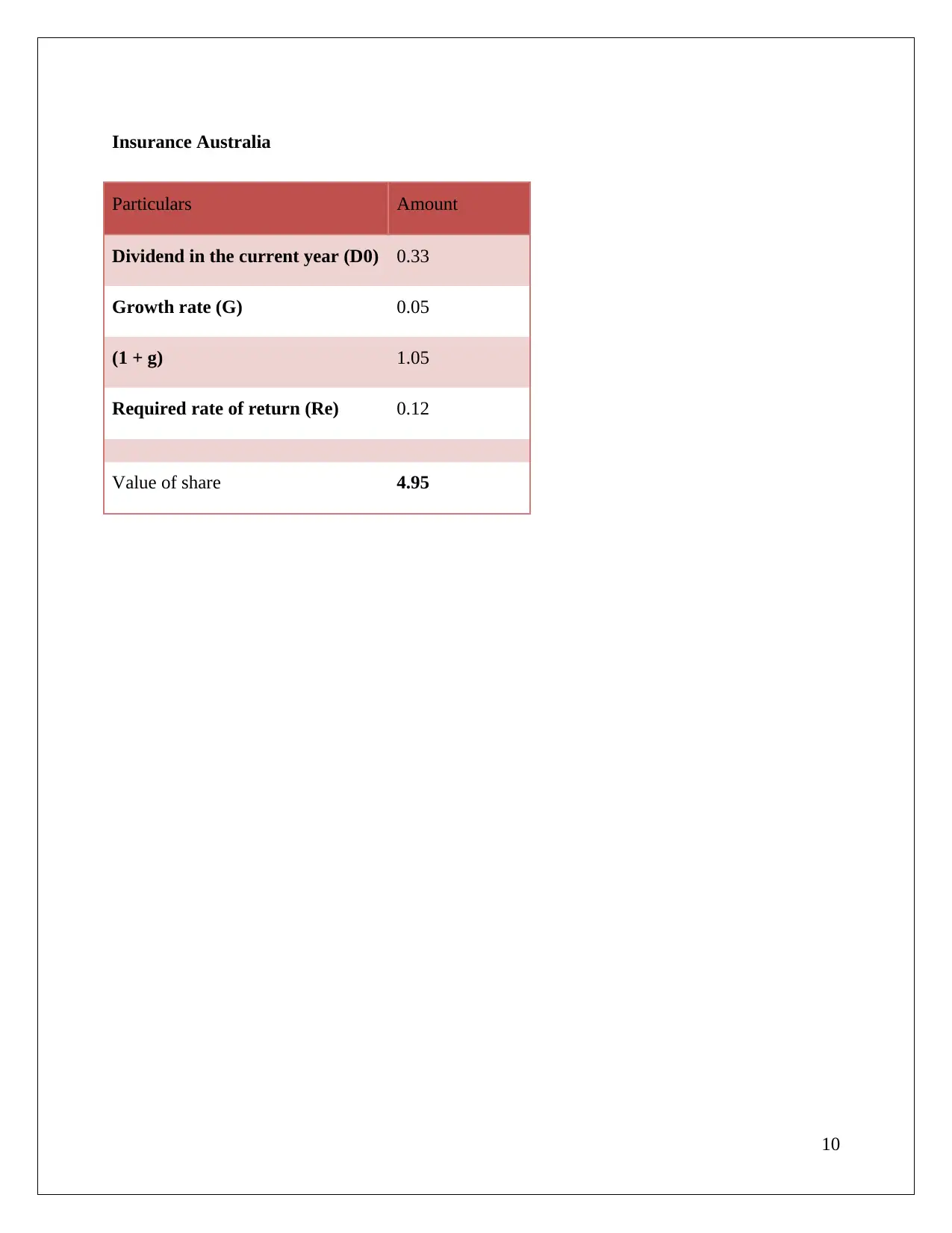

Insurance Australia

Particulars Amount

Dividend in the current year (D0) 0.33

Growth rate (G) 0.05

(1 + g) 1.05

Required rate of return (Re) 0.12

Value of share 4.95

10

Particulars Amount

Dividend in the current year (D0) 0.33

Growth rate (G) 0.05

(1 + g) 1.05

Required rate of return (Re) 0.12

Value of share 4.95

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

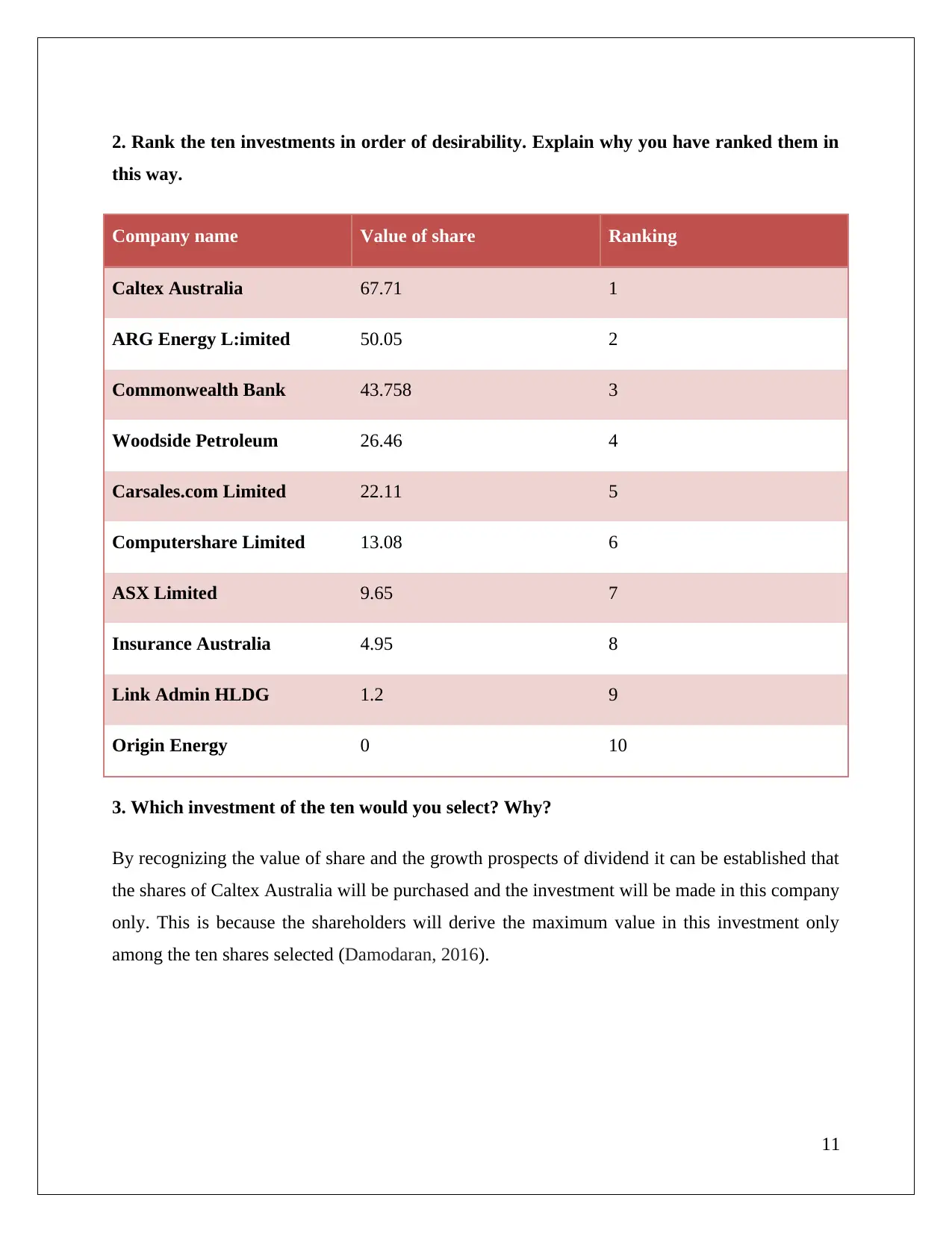

2. Rank the ten investments in order of desirability. Explain why you have ranked them in

this way.

Company name Value of share Ranking

Caltex Australia 67.71 1

ARG Energy L:imited 50.05 2

Commonwealth Bank 43.758 3

Woodside Petroleum 26.46 4

Carsales.com Limited 22.11 5

Computershare Limited 13.08 6

ASX Limited 9.65 7

Insurance Australia 4.95 8

Link Admin HLDG 1.2 9

Origin Energy 0 10

3. Which investment of the ten would you select? Why?

By recognizing the value of share and the growth prospects of dividend it can be established that

the shares of Caltex Australia will be purchased and the investment will be made in this company

only. This is because the shareholders will derive the maximum value in this investment only

among the ten shares selected (Damodaran, 2016).

11

this way.

Company name Value of share Ranking

Caltex Australia 67.71 1

ARG Energy L:imited 50.05 2

Commonwealth Bank 43.758 3

Woodside Petroleum 26.46 4

Carsales.com Limited 22.11 5

Computershare Limited 13.08 6

ASX Limited 9.65 7

Insurance Australia 4.95 8

Link Admin HLDG 1.2 9

Origin Energy 0 10

3. Which investment of the ten would you select? Why?

By recognizing the value of share and the growth prospects of dividend it can be established that

the shares of Caltex Australia will be purchased and the investment will be made in this company

only. This is because the shareholders will derive the maximum value in this investment only

among the ten shares selected (Damodaran, 2016).

11

Task 2:

Research and summaries some interesting facts about Warren Buffet that you can relate to

the companies you have selected from the Financial Review to analyse.

As per the research conducted into Warren Buffet valuation of businesses the intrinsic value of

the company represents the most accurate estimate for investing in the shares of the company

(Damodaran, 2016). As per the model of Warren Buffet the companies having the ability of

paying off their liabilities are preferential based ion the current earnings. His emphasis on

companies having the ability of paying their debts in full. There are two approaches of valuing

the intrinsic value of the shares:

Present value method – The model will utilize the dividend value expected to be paid by the

company in future and considering the same with recognizing the time value of money (Duncan,

et. al., 2017). The total cash inflows in terms of dividends will be analysed and the total value b

ascertained in those terms.

Relative value method – This is the intrinsic value method in which the comparison is

performed for the stock price of the company in relation to the company’s fundamentals. These

fundamentals are determined while making an investment plan for the company.

All of these stocks can be evaluated based ion these intrinsic values however the same will not

be a preferential method for valuing the business due to some reasons explained below:

The instability of intrinsic value – The intrinsic value is calculated after considering the

fundamentals and these fundamentals will not remain stable and will change based on the

market and industry factors. Therefore there will be instability in intrinsic value (Pinto,

et. al., 2015).

Estimation is not possible for all asset class – The intrinsic value approach can’t be used

for all assets including stock\k which is a major drawback for the company.

Market value does not approach intrinsic value fewer times – The prices of the stock may

not appreciate enough in order to equal the intrinsic value calculated.

12

Research and summaries some interesting facts about Warren Buffet that you can relate to

the companies you have selected from the Financial Review to analyse.

As per the research conducted into Warren Buffet valuation of businesses the intrinsic value of

the company represents the most accurate estimate for investing in the shares of the company

(Damodaran, 2016). As per the model of Warren Buffet the companies having the ability of

paying off their liabilities are preferential based ion the current earnings. His emphasis on

companies having the ability of paying their debts in full. There are two approaches of valuing

the intrinsic value of the shares:

Present value method – The model will utilize the dividend value expected to be paid by the

company in future and considering the same with recognizing the time value of money (Duncan,

et. al., 2017). The total cash inflows in terms of dividends will be analysed and the total value b

ascertained in those terms.

Relative value method – This is the intrinsic value method in which the comparison is

performed for the stock price of the company in relation to the company’s fundamentals. These

fundamentals are determined while making an investment plan for the company.

All of these stocks can be evaluated based ion these intrinsic values however the same will not

be a preferential method for valuing the business due to some reasons explained below:

The instability of intrinsic value – The intrinsic value is calculated after considering the

fundamentals and these fundamentals will not remain stable and will change based on the

market and industry factors. Therefore there will be instability in intrinsic value (Pinto,

et. al., 2015).

Estimation is not possible for all asset class – The intrinsic value approach can’t be used

for all assets including stock\k which is a major drawback for the company.

Market value does not approach intrinsic value fewer times – The prices of the stock may

not appreciate enough in order to equal the intrinsic value calculated.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.