Management Accounting Report: Financial Analysis of Harrods Ltd

VerifiedAdded on 2019/12/28

|19

|5256

|335

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles and their application to Harrods Ltd, a UK-based retail organization. The report begins with an introduction to management accounting, its essential requirements, and its role in effective business operations. It then delves into various management accounting reports, including ratio analysis, job cost reports, and performance analysis reports. The core of the report focuses on different costing methods, specifically marginal and absorption costing, comparing their approaches and implications for decision-making. The report also evaluates budgetary control systems, outlining their advantages and drawbacks. Finally, it suggests management accounting systems to address potential financial challenges faced by Harrods Ltd, including cost accounting, inventory management, and price optimization. The report concludes with a summary of the key findings and recommendations for enhancing Harrods Ltd's financial performance and strategic decision-making.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1) Management accounting and essential requirements of its systems................................1

P2) Different management accounting reports.......................................................................3

TASK 2............................................................................................................................................5

P3) Various costing and differences between marginal and absorption costing methods.....5

TASK 3..........................................................................................................................................10

P4) Advantages and drawbacks of budgetary control system.............................................10

P5) Management accounting systems for reducing financial problems of Harrods Ltd......12

CONCLUSION..............................................................................................................................15

REFERENCE.................................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1) Management accounting and essential requirements of its systems................................1

P2) Different management accounting reports.......................................................................3

TASK 2............................................................................................................................................5

P3) Various costing and differences between marginal and absorption costing methods.....5

TASK 3..........................................................................................................................................10

P4) Advantages and drawbacks of budgetary control system.............................................10

P5) Management accounting systems for reducing financial problems of Harrods Ltd......12

CONCLUSION..............................................................................................................................15

REFERENCE.................................................................................................................................16

Illustration Index

Illustration 1: Income statement through marginal costing method................................................6

Illustration 2: income statement through absorption costing method..............................................8

Illustration 1: Income statement through marginal costing method................................................6

Illustration 2: income statement through absorption costing method..............................................8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is an essential decision making tool for effective business

operations. It is useful for management of entire business activities organized by entity and

providing better quality of services. The present report is based on understanding different

aspects of management accounting for Harrods Ltd. It is a small scale retail sector's organization

of UK that provides clothing, food and drink services across country. Different management

accounting systems and their significance are to be expressed. In addition to this, through this

assignment, various methods used for implementing management accounting can be determined

through this assignment. However, several costing techniques and difference between marginal

and absorption costing is expressed. Moreover, critical evaluation on different budgetary control

systems regarding decision-making process is to be determined. Along with this, learners are

able to understand various accounting systems for improving services of Harrods' Ltd through

this study.

TASK 1

P1) Management accounting and essential requirements of its systems

Management accounting:- It is multidisciplinary approach remains helpful for

management of overall business operations effectively. In this regard, different factors involved

such as; finance, costing, inventory and performance of Harrods Ltd get managed efficiently.

However, it plays crucial role in expansion of small scale organization and increasing its

efficiency at high level. Including this, different costing methods are used for price determination

as well varieties of ideas are created to prepare strategies regarding business activities (Bennett,

Schaltegger and Zvezdov, 2013). It influences productivity and profitability of firm to sustain its

good reputation in market for long time period. It influences allocation of fund and resources for

providing better quality services by applying different techniques. Including this, it also affects

environment of organization to build up relationship among employees of the firm. Apart from

this, it is determined that management accounting is useful to make decisions for enhancing

business and competitive strategies of entity also to carrying on it effectively. Therefore, by

using management accounting tools, balance between production and distribution of goods can

be created systematically through its actual position and reasons behind imbalance. However,

varieties of innovative ideas are generated through this technique useful for expansion of entity

and making place in market by facing competition. Hence, management accounting is one of the

1

Management accounting is an essential decision making tool for effective business

operations. It is useful for management of entire business activities organized by entity and

providing better quality of services. The present report is based on understanding different

aspects of management accounting for Harrods Ltd. It is a small scale retail sector's organization

of UK that provides clothing, food and drink services across country. Different management

accounting systems and their significance are to be expressed. In addition to this, through this

assignment, various methods used for implementing management accounting can be determined

through this assignment. However, several costing techniques and difference between marginal

and absorption costing is expressed. Moreover, critical evaluation on different budgetary control

systems regarding decision-making process is to be determined. Along with this, learners are

able to understand various accounting systems for improving services of Harrods' Ltd through

this study.

TASK 1

P1) Management accounting and essential requirements of its systems

Management accounting:- It is multidisciplinary approach remains helpful for

management of overall business operations effectively. In this regard, different factors involved

such as; finance, costing, inventory and performance of Harrods Ltd get managed efficiently.

However, it plays crucial role in expansion of small scale organization and increasing its

efficiency at high level. Including this, different costing methods are used for price determination

as well varieties of ideas are created to prepare strategies regarding business activities (Bennett,

Schaltegger and Zvezdov, 2013). It influences productivity and profitability of firm to sustain its

good reputation in market for long time period. It influences allocation of fund and resources for

providing better quality services by applying different techniques. Including this, it also affects

environment of organization to build up relationship among employees of the firm. Apart from

this, it is determined that management accounting is useful to make decisions for enhancing

business and competitive strategies of entity also to carrying on it effectively. Therefore, by

using management accounting tools, balance between production and distribution of goods can

be created systematically through its actual position and reasons behind imbalance. However,

varieties of innovative ideas are generated through this technique useful for expansion of entity

and making place in market by facing competition. Hence, management accounting is one of the

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

great tool for providing better quality services as well generating ideas for optimum utilization

of resources (Bui and de Villiers, 2016). In this process, management accounting is beneficial

for creating effective goodwill in market for long term period and also to maintain customers'

attraction towards product services. Hence, management accounting is beneficial for marketing

and business approach to achieve systematic management of all business operations. Through

this system, forecasting and decision making for further business operations is created

adequately for management of all business activities expand small scale entity. Similarly,

enhancing organization's efficiency to attract consumer and increasing demand for products at

large scale. Thus, it has been determined that management accountant of organization prepares

planning strategy related to its expansion and uses different tools for decision making to

enhance quality services of product provided by Harrods' Ltd.

Requirement essentials of management accounting systems:- There are several

management accounting tools used for overall business operations and decision making process

to implement service qualities to achieve sustainability of firm for long term period. Some of the

main management accounting systems can be understood as follows:- Cost accounting system:- Under this accounting system, management accountant of

organization recognizes cost incurred on expenses in manufacturing and production

system of goods. However, by using costing methods, price determination is created that

proceed to prepare income statement. In this process, actual financial position of Harrods

Ltd is identified on the basis of which several ideas are created for balancing incurred

expenditures and gained revenues of the entity. Including this, profitability of firm can be

enhanced at high level through this system that is interlinked with further business

operations. Inventory management system:- Inventories organization keep safe through this system

that is useful for adequate production and distribution of goods. In this regard, optimum

allocation of resources and their management can be obtained efficiently. However,

keeping goods in warehouses, stores and business entities that is considered as decision-

making tool for producing and distributing goods. Including this, decisions are made

regarding inventory management and production of products.

2

of resources (Bui and de Villiers, 2016). In this process, management accounting is beneficial

for creating effective goodwill in market for long term period and also to maintain customers'

attraction towards product services. Hence, management accounting is beneficial for marketing

and business approach to achieve systematic management of all business operations. Through

this system, forecasting and decision making for further business operations is created

adequately for management of all business activities expand small scale entity. Similarly,

enhancing organization's efficiency to attract consumer and increasing demand for products at

large scale. Thus, it has been determined that management accountant of organization prepares

planning strategy related to its expansion and uses different tools for decision making to

enhance quality services of product provided by Harrods' Ltd.

Requirement essentials of management accounting systems:- There are several

management accounting tools used for overall business operations and decision making process

to implement service qualities to achieve sustainability of firm for long term period. Some of the

main management accounting systems can be understood as follows:- Cost accounting system:- Under this accounting system, management accountant of

organization recognizes cost incurred on expenses in manufacturing and production

system of goods. However, by using costing methods, price determination is created that

proceed to prepare income statement. In this process, actual financial position of Harrods

Ltd is identified on the basis of which several ideas are created for balancing incurred

expenditures and gained revenues of the entity. Including this, profitability of firm can be

enhanced at high level through this system that is interlinked with further business

operations. Inventory management system:- Inventories organization keep safe through this system

that is useful for adequate production and distribution of goods. In this regard, optimum

allocation of resources and their management can be obtained efficiently. However,

keeping goods in warehouses, stores and business entities that is considered as decision-

making tool for producing and distributing goods. Including this, decisions are made

regarding inventory management and production of products.

2

Price optimization system:- Under this management accounting system, different

techniques for optimizing prices are determined for cost effectiveness. As per which,

several ideas are created for setting adequate cost of product related to earning level of

customers. Thus, price optimization system is essential for determining proper cost of

products also affects productivity and profitability of Harrods' Ltd.

P2) Different management accounting reports

Management accountant of Harrods Ltd applies various methods for forecasting and

decision making to expand small scale enterprise and increasing its efficiency. However,

different tools applied for this system can be described as below:- Ratio analysis:- Several ratios are evaluated that presents financial position of

organization including liquidity, current, solvency and debt equity ratio etc. Therefore, by

analysing these ratios critically, different ideas are generated to increase profitability of

firm. In accordance to this, actual comparison is determined among previous years'

operations of Harrods Ltd. However, ratio analysis is essential to present profit earning

capacity of entity. On the basis of which, various techniques can be applied for enhancing

productivity and profit earning capacity of organization also for economic stability

(Corona, Nan and Zhang, 2014). Therefore, ratio analysis is considered as recognition of

actual monetary position as per which strategies are prepared for expansion of small scale

entity and enchanting its efficiency at high level. Hence, management accounting tool as

ratio analysis is beneficial for enhancing profitability of entity that impacts on market

position and reducing risks occur at workplace. However, by applying ratio analysis tool,

proper balance of production and supplement of goods can be obtained that is effective

for future business operations. Thus, ratio analysis is helpful to present monetary position

of entity that shows profit earning capacity of small scale enterprise.

Job cost reports:- Through this system, price is determined for operating business

activities in further years. However, costing is a technique to prepare income statement

that presents financial position of organization. Therefore, costing is determined on the

basis of market value, competition and quality used in manufacturing and production of

goods. Including this, costing is of different kinds such as; marginal and absorption

costing, activity based costing and so on. However, preparing income statement through

3

techniques for optimizing prices are determined for cost effectiveness. As per which,

several ideas are created for setting adequate cost of product related to earning level of

customers. Thus, price optimization system is essential for determining proper cost of

products also affects productivity and profitability of Harrods' Ltd.

P2) Different management accounting reports

Management accountant of Harrods Ltd applies various methods for forecasting and

decision making to expand small scale enterprise and increasing its efficiency. However,

different tools applied for this system can be described as below:- Ratio analysis:- Several ratios are evaluated that presents financial position of

organization including liquidity, current, solvency and debt equity ratio etc. Therefore, by

analysing these ratios critically, different ideas are generated to increase profitability of

firm. In accordance to this, actual comparison is determined among previous years'

operations of Harrods Ltd. However, ratio analysis is essential to present profit earning

capacity of entity. On the basis of which, various techniques can be applied for enhancing

productivity and profit earning capacity of organization also for economic stability

(Corona, Nan and Zhang, 2014). Therefore, ratio analysis is considered as recognition of

actual monetary position as per which strategies are prepared for expansion of small scale

entity and enchanting its efficiency at high level. Hence, management accounting tool as

ratio analysis is beneficial for enhancing profitability of entity that impacts on market

position and reducing risks occur at workplace. However, by applying ratio analysis tool,

proper balance of production and supplement of goods can be obtained that is effective

for future business operations. Thus, ratio analysis is helpful to present monetary position

of entity that shows profit earning capacity of small scale enterprise.

Job cost reports:- Through this system, price is determined for operating business

activities in further years. However, costing is a technique to prepare income statement

that presents financial position of organization. Therefore, costing is determined on the

basis of market value, competition and quality used in manufacturing and production of

goods. Including this, costing is of different kinds such as; marginal and absorption

costing, activity based costing and so on. However, preparing income statement through

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

marginal costing, gross profit is deducted to expenses incurred on variable overhead only

(Germak and et.al., 2014). While, preparation of income statement through absorption

costing, net profit is determined by deducting gross profit to total cost incurred on fixed

and current overheads. Thus, marginal costing is useful for short term decision making

process while in comparison to absorption, it is helpful for long term decision making

plans. However, management accounting tool as costing is a technique for determining

price of products. It present expenditure and income statement for production and

supplement of goods. In accordance to this, several ideas are created for creating balance

between income and expenses. Therefore, through this tool business performance can be

effective that affects profitability and further business operations.

Including this, cost for manufacturing and producing products are determined to prepare

income statement that presents economic profile of organization. In this regard, expenditure

incurred for purchasing raw materials and production are recognized. Therefore, actual price

determination is obtained for economic stability of firm.

Performance analysis reports:- As management accounting is multidisciplinary

approach, it is useful for increasing working efficiency of employees and analyzing their

contribution in team work for effectiveness of Harrods Ltd. In this way, management

accountant of organization analyses workers' contribution in team work as well entity's

organizational structure also effective for improving their skills (Holden and Lunduka,

2014). Therefore, on the basis of this recognition, different ideas are created for

expansion of small scale enterprise and increasing its efficiency at high level. In addition

to this, strategies are prepared for creating positive environment of entity by establishing

good relationship among employees of the firm. However, innovative techniques are

used for improving employees' skills and encouraging them for better work performance

and effective contribution in working in group. Thus, as per performance evaluation,

different innovative ideas are generated for enlargement of entity and enhancing service

qualities of small scale enterprise in efficient manner.

4

(Germak and et.al., 2014). While, preparation of income statement through absorption

costing, net profit is determined by deducting gross profit to total cost incurred on fixed

and current overheads. Thus, marginal costing is useful for short term decision making

process while in comparison to absorption, it is helpful for long term decision making

plans. However, management accounting tool as costing is a technique for determining

price of products. It present expenditure and income statement for production and

supplement of goods. In accordance to this, several ideas are created for creating balance

between income and expenses. Therefore, through this tool business performance can be

effective that affects profitability and further business operations.

Including this, cost for manufacturing and producing products are determined to prepare

income statement that presents economic profile of organization. In this regard, expenditure

incurred for purchasing raw materials and production are recognized. Therefore, actual price

determination is obtained for economic stability of firm.

Performance analysis reports:- As management accounting is multidisciplinary

approach, it is useful for increasing working efficiency of employees and analyzing their

contribution in team work for effectiveness of Harrods Ltd. In this way, management

accountant of organization analyses workers' contribution in team work as well entity's

organizational structure also effective for improving their skills (Holden and Lunduka,

2014). Therefore, on the basis of this recognition, different ideas are created for

expansion of small scale enterprise and increasing its efficiency at high level. In addition

to this, strategies are prepared for creating positive environment of entity by establishing

good relationship among employees of the firm. However, innovative techniques are

used for improving employees' skills and encouraging them for better work performance

and effective contribution in working in group. Thus, as per performance evaluation,

different innovative ideas are generated for enlargement of entity and enhancing service

qualities of small scale enterprise in efficient manner.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

P3) Various costing and differences between marginal and absorption costing methods

Costing is considered as determining price for producing goods and services of

organization. On the basis of this costing methods, income statement is prepared that present’s

financial position of Harrods Ltd. For this process, management accountant uses different

techniques such as marginal, absorption, demand based and competition costing, activity based

and so on. It generates position of incurred expenses and gained revenue therefore difference

between expenditures and income can be obtained (Hou and et.al., 2013). In this regard, costing

methods, their significance and comparison can be expressed as below:-

Marginal costing:- Under this costing method, net profit is evaluated by deducting gross

profit to variable costs incurred on expenses for production of goods. It is useful for

decision making for short time period business operations. It is because there is only

variable expenses are deducted with gross profit earned by Harrods Ltd. Therefore,

marginal costing believes that decisions related to get adjusted according uncertain

changes, different ideas can be generated for systematic planing procedures. Therefore,

marginal costing is interrelated with effective price determination and presenting income

statement in efficient manner (Pettersen and Solstad, 2014). In this regard, management

accountant of the entity evaluates following income statement that presents financial

position of Harrods Ltd can be described as below:-

5

P3) Various costing and differences between marginal and absorption costing methods

Costing is considered as determining price for producing goods and services of

organization. On the basis of this costing methods, income statement is prepared that present’s

financial position of Harrods Ltd. For this process, management accountant uses different

techniques such as marginal, absorption, demand based and competition costing, activity based

and so on. It generates position of incurred expenses and gained revenue therefore difference

between expenditures and income can be obtained (Hou and et.al., 2013). In this regard, costing

methods, their significance and comparison can be expressed as below:-

Marginal costing:- Under this costing method, net profit is evaluated by deducting gross

profit to variable costs incurred on expenses for production of goods. It is useful for

decision making for short time period business operations. It is because there is only

variable expenses are deducted with gross profit earned by Harrods Ltd. Therefore,

marginal costing believes that decisions related to get adjusted according uncertain

changes, different ideas can be generated for systematic planing procedures. Therefore,

marginal costing is interrelated with effective price determination and presenting income

statement in efficient manner (Pettersen and Solstad, 2014). In this regard, management

accountant of the entity evaluates following income statement that presents financial

position of Harrods Ltd can be described as below:-

5

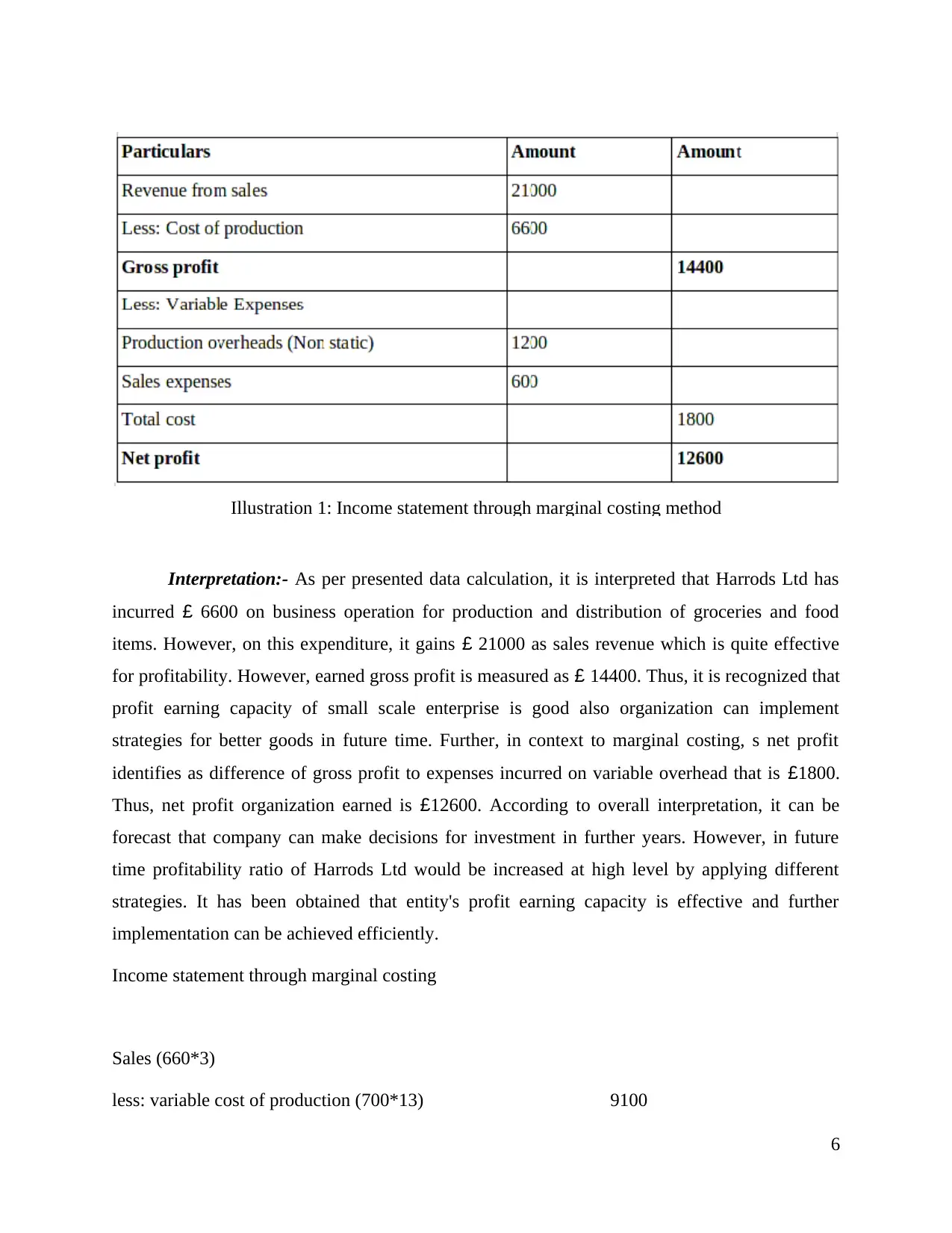

Interpretation:- As per presented data calculation, it is interpreted that Harrods Ltd has

incurred £ 6600 on business operation for production and distribution of groceries and food

items. However, on this expenditure, it gains £ 21000 as sales revenue which is quite effective

for profitability. However, earned gross profit is measured as £ 14400. Thus, it is recognized that

profit earning capacity of small scale enterprise is good also organization can implement

strategies for better goods in future time. Further, in context to marginal costing, s net profit

identifies as difference of gross profit to expenses incurred on variable overhead that is £1800.

Thus, net profit organization earned is £12600. According to overall interpretation, it can be

forecast that company can make decisions for investment in further years. However, in future

time profitability ratio of Harrods Ltd would be increased at high level by applying different

strategies. It has been obtained that entity's profit earning capacity is effective and further

implementation can be achieved efficiently.

Income statement through marginal costing

Sales (660*3)

less: variable cost of production (700*13) 9100

6

Illustration 1: Income statement through marginal costing method

incurred £ 6600 on business operation for production and distribution of groceries and food

items. However, on this expenditure, it gains £ 21000 as sales revenue which is quite effective

for profitability. However, earned gross profit is measured as £ 14400. Thus, it is recognized that

profit earning capacity of small scale enterprise is good also organization can implement

strategies for better goods in future time. Further, in context to marginal costing, s net profit

identifies as difference of gross profit to expenses incurred on variable overhead that is £1800.

Thus, net profit organization earned is £12600. According to overall interpretation, it can be

forecast that company can make decisions for investment in further years. However, in future

time profitability ratio of Harrods Ltd would be increased at high level by applying different

strategies. It has been obtained that entity's profit earning capacity is effective and further

implementation can be achieved efficiently.

Income statement through marginal costing

Sales (660*3)

less: variable cost of production (700*13) 9100

6

Illustration 1: Income statement through marginal costing method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

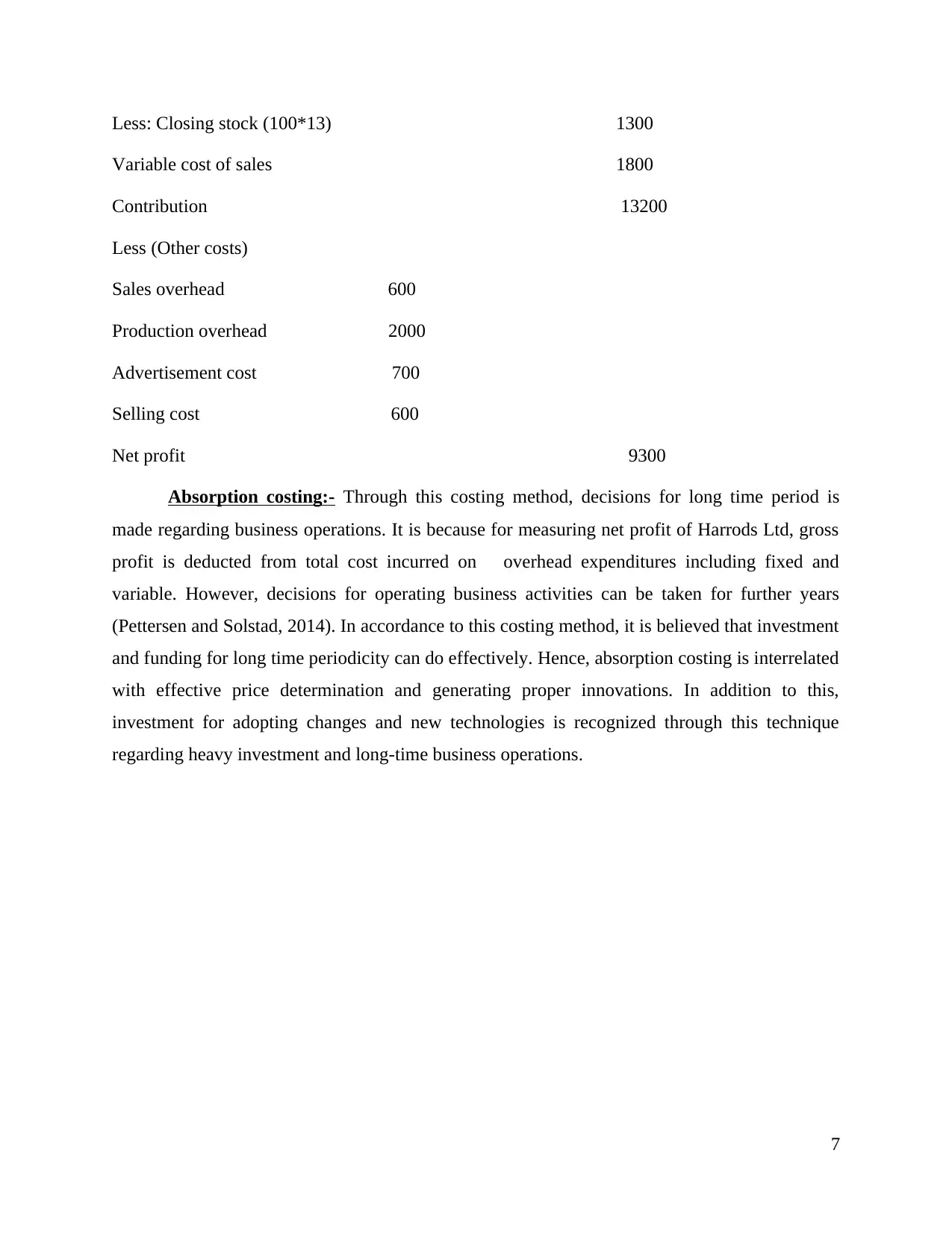

Less: Closing stock (100*13) 1300

Variable cost of sales 1800

Contribution 13200

Less (Other costs)

Sales overhead 600

Production overhead 2000

Advertisement cost 700

Selling cost 600

Net profit 9300

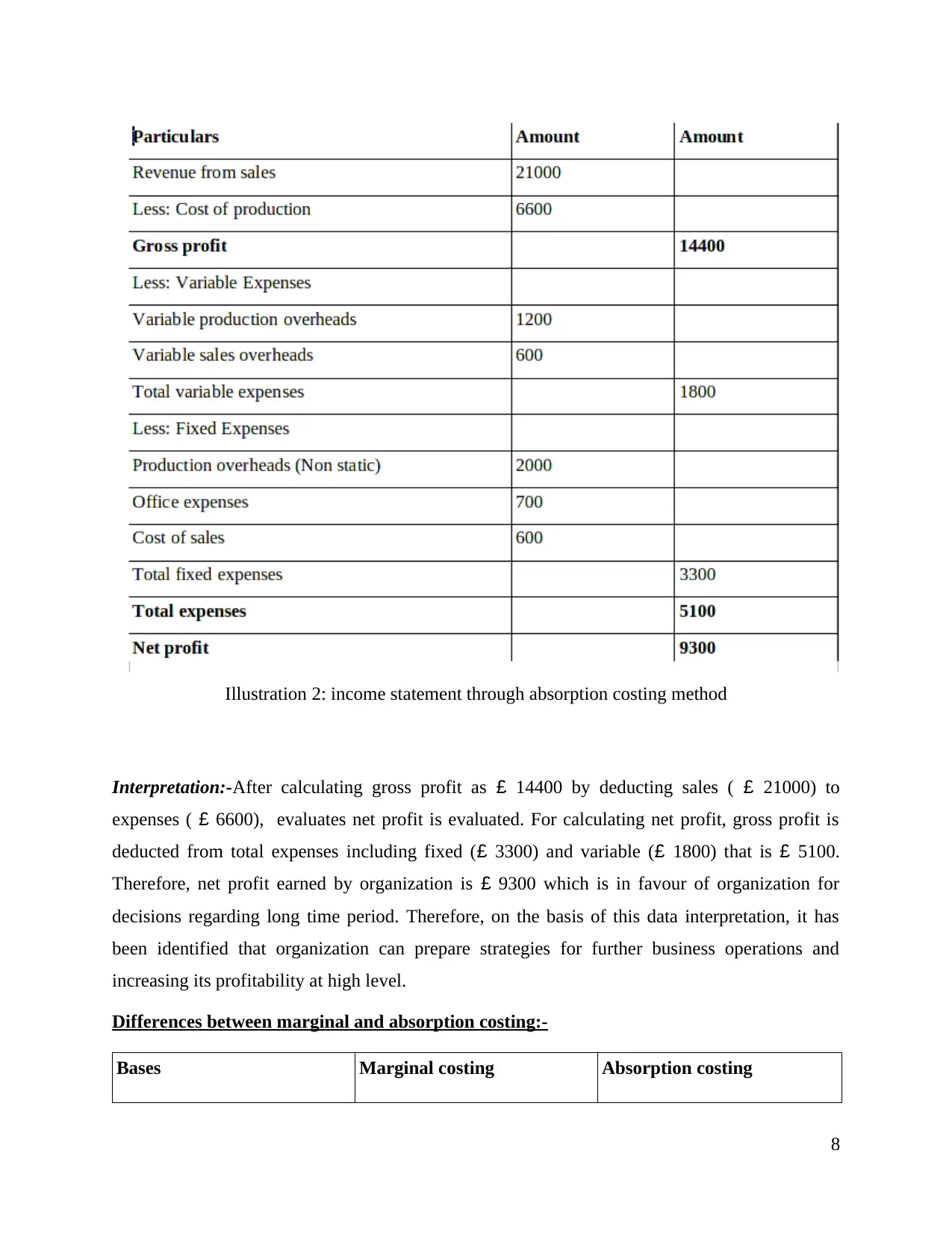

Absorption costing:- Through this costing method, decisions for long time period is

made regarding business operations. It is because for measuring net profit of Harrods Ltd, gross

profit is deducted from total cost incurred on overhead expenditures including fixed and

variable. However, decisions for operating business activities can be taken for further years

(Pettersen and Solstad, 2014). In accordance to this costing method, it is believed that investment

and funding for long time periodicity can do effectively. Hence, absorption costing is interrelated

with effective price determination and generating proper innovations. In addition to this,

investment for adopting changes and new technologies is recognized through this technique

regarding heavy investment and long-time business operations.

7

Variable cost of sales 1800

Contribution 13200

Less (Other costs)

Sales overhead 600

Production overhead 2000

Advertisement cost 700

Selling cost 600

Net profit 9300

Absorption costing:- Through this costing method, decisions for long time period is

made regarding business operations. It is because for measuring net profit of Harrods Ltd, gross

profit is deducted from total cost incurred on overhead expenditures including fixed and

variable. However, decisions for operating business activities can be taken for further years

(Pettersen and Solstad, 2014). In accordance to this costing method, it is believed that investment

and funding for long time periodicity can do effectively. Hence, absorption costing is interrelated

with effective price determination and generating proper innovations. In addition to this,

investment for adopting changes and new technologies is recognized through this technique

regarding heavy investment and long-time business operations.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interpretation:-After calculating gross profit as £ 14400 by deducting sales ( £ 21000) to

expenses ( £ 6600), evaluates net profit is evaluated. For calculating net profit, gross profit is

deducted from total expenses including fixed (£ 3300) and variable (£ 1800) that is £ 5100.

Therefore, net profit earned by organization is £ 9300 which is in favour of organization for

decisions regarding long time period. Therefore, on the basis of this data interpretation, it has

been identified that organization can prepare strategies for further business operations and

increasing its profitability at high level.

Differences between marginal and absorption costing:-

Bases Marginal costing Absorption costing

8

Illustration 2: income statement through absorption costing method

expenses ( £ 6600), evaluates net profit is evaluated. For calculating net profit, gross profit is

deducted from total expenses including fixed (£ 3300) and variable (£ 1800) that is £ 5100.

Therefore, net profit earned by organization is £ 9300 which is in favour of organization for

decisions regarding long time period. Therefore, on the basis of this data interpretation, it has

been identified that organization can prepare strategies for further business operations and

increasing its profitability at high level.

Differences between marginal and absorption costing:-

Bases Marginal costing Absorption costing

8

Illustration 2: income statement through absorption costing method

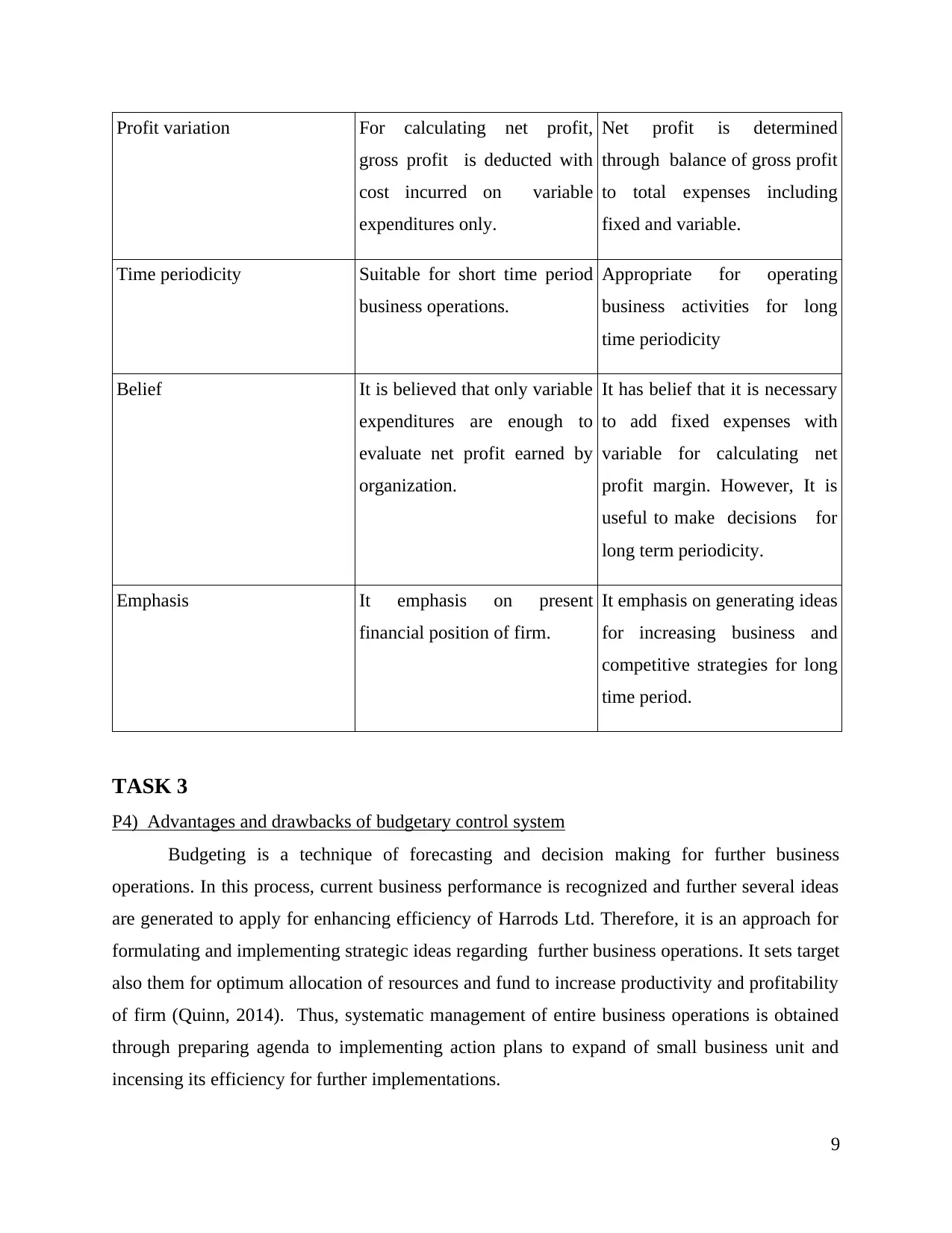

Profit variation For calculating net profit,

gross profit is deducted with

cost incurred on variable

expenditures only.

Net profit is determined

through balance of gross profit

to total expenses including

fixed and variable.

Time periodicity Suitable for short time period

business operations.

Appropriate for operating

business activities for long

time periodicity

Belief It is believed that only variable

expenditures are enough to

evaluate net profit earned by

organization.

It has belief that it is necessary

to add fixed expenses with

variable for calculating net

profit margin. However, It is

useful to make decisions for

long term periodicity.

Emphasis It emphasis on present

financial position of firm.

It emphasis on generating ideas

for increasing business and

competitive strategies for long

time period.

TASK 3

P4) Advantages and drawbacks of budgetary control system

Budgeting is a technique of forecasting and decision making for further business

operations. In this process, current business performance is recognized and further several ideas

are generated to apply for enhancing efficiency of Harrods Ltd. Therefore, it is an approach for

formulating and implementing strategic ideas regarding further business operations. It sets target

also them for optimum allocation of resources and fund to increase productivity and profitability

of firm (Quinn, 2014). Thus, systematic management of entire business operations is obtained

through preparing agenda to implementing action plans to expand of small business unit and

incensing its efficiency for further implementations.

9

gross profit is deducted with

cost incurred on variable

expenditures only.

Net profit is determined

through balance of gross profit

to total expenses including

fixed and variable.

Time periodicity Suitable for short time period

business operations.

Appropriate for operating

business activities for long

time periodicity

Belief It is believed that only variable

expenditures are enough to

evaluate net profit earned by

organization.

It has belief that it is necessary

to add fixed expenses with

variable for calculating net

profit margin. However, It is

useful to make decisions for

long term periodicity.

Emphasis It emphasis on present

financial position of firm.

It emphasis on generating ideas

for increasing business and

competitive strategies for long

time period.

TASK 3

P4) Advantages and drawbacks of budgetary control system

Budgeting is a technique of forecasting and decision making for further business

operations. In this process, current business performance is recognized and further several ideas

are generated to apply for enhancing efficiency of Harrods Ltd. Therefore, it is an approach for

formulating and implementing strategic ideas regarding further business operations. It sets target

also them for optimum allocation of resources and fund to increase productivity and profitability

of firm (Quinn, 2014). Thus, systematic management of entire business operations is obtained

through preparing agenda to implementing action plans to expand of small business unit and

incensing its efficiency for further implementations.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.