Finance in Hospitality: Funding, Cost Analysis, and Financial Ratios

VerifiedAdded on 2020/01/15

|25

|8229

|174

Report

AI Summary

This report delves into the financial landscape of the hospitality industry, encompassing various aspects of financial management. It begins by exploring diverse sources of funding, both internal and external, available to businesses within the sector, alongside an evaluation of different methods for generating income. The report then examines key elements of cost, including material, labor, and overhead, and their impact on gross profit percentages and selling prices. Furthermore, it covers methods for controlling stock and cash flow, essential for maintaining financial stability. The report also analyzes trial balances, evaluates business accounts, and makes adjustments. Ratio analysis is performed to assess the financial health and performance of a hypothetical company, with recommendations provided. Finally, the report discusses cost volume profit analysis, including fixed, variable, and semi-variable costs, and concludes with short-term management decisions based on break-even calculations. The report provides an in-depth view of financial decision-making in the hospitality sector.

FINANCE IN HOSPITALITY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

FINANCE IN HOSPITALITY.......................................................................................................1

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Reviewing the sources of funding which are available to business or service industries.....3

1.2 Evaluating the range of methods of generating income within the service or business

operations....................................................................................................................................4

TASK 2............................................................................................................................................4

2.1 Elements of cost, gross profit percentages and selling prices...............................................4

2.2 Methods of controlling stock and cash..................................................................................5

TASK 3............................................................................................................................................6

3.4 Analyze of variance and appropriate suggestions.................................................................7

3.1 Sources and structure of trial balance...................................................................................7

3.2 Evaluation of business accounts, adjustments and notes......................................................9

4.1, 4.2 Calculation of various ratios and recommendation......................................................11

TASK 5..........................................................................................................................................12

5.1 Fixed, variable and semi-variable cost................................................................................12

5.2 Calculation of cost volume profit analysis..........................................................................13

5.3 Short term management decision based on break even calculation....................................14

CONCLUSION..............................................................................................................................15

REFERENCES .............................................................................................................................16

1

FINANCE IN HOSPITALITY.......................................................................................................1

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Reviewing the sources of funding which are available to business or service industries.....3

1.2 Evaluating the range of methods of generating income within the service or business

operations....................................................................................................................................4

TASK 2............................................................................................................................................4

2.1 Elements of cost, gross profit percentages and selling prices...............................................4

2.2 Methods of controlling stock and cash..................................................................................5

TASK 3............................................................................................................................................6

3.4 Analyze of variance and appropriate suggestions.................................................................7

3.1 Sources and structure of trial balance...................................................................................7

3.2 Evaluation of business accounts, adjustments and notes......................................................9

4.1, 4.2 Calculation of various ratios and recommendation......................................................11

TASK 5..........................................................................................................................................12

5.1 Fixed, variable and semi-variable cost................................................................................12

5.2 Calculation of cost volume profit analysis..........................................................................13

5.3 Short term management decision based on break even calculation....................................14

CONCLUSION..............................................................................................................................15

REFERENCES .............................................................................................................................16

1

INTRODUCTION

Finance is the crucial element which plays a vital role in implementing strategies and

policies within the suitable time frame. In the present era, corporation can attain success only

when they have sufficient financial resources to conduct research and development activity

(Allen, Qian and Qian, 2005). In this, finance manager of the firm plays a significant role in

framing the competent strategies which facilitates effective utilization of financial resources to

the large extent. This project report is based on different scenario which helps in understanding

the sources of funding which are available to business and service industries. Besides this, it will

also develop an understanding about the relationship between cost, gross profit and selling price.

Further, the present report will discuss the purpose and process of budgetary control which helps

company in getting the desired output. In addition this, report will also examine the financial

health and performance of R. Riggs through ratio analysis.

TASK 1

1.1 Reviewing the sources of funding which are available to business or service industries

There are several internal and external sources of finance which are available to sole

trader in relation to the purchase of machinery worth of £50000 are as follows:

Internal source of finance: It refers to those sources which are available within the business

enterprise are as follows:

Retained profit: Sole trader can fulfil financial need by making use of retained profit

which he kept with itself for the contingent situation or liability.

Advantages: By making use of retained profit, company can save the amount of tax to a

large extent. Moreover, the amount of tax is calculated on the profitability aspect of firm.

Disadvantages: When organization undertakes retained profit to fulfil its financial need

then it is unable to provide dividend to their shareholders. This aspect negatively affects the

image of firm.

Sales of assets: Trader can also raise finance by selling non-performing assets of the firm.

It is the most effective source of finance which helps in small business in meeting its

monetary needs. Sole trader can easily fulfil his financial need by selling the assets which

have no further use in the productive activities of business unit. Through this, sole trader

is able to purchase machinery which helps him in enhancing the productivity and

profitability of firm.

2

Finance is the crucial element which plays a vital role in implementing strategies and

policies within the suitable time frame. In the present era, corporation can attain success only

when they have sufficient financial resources to conduct research and development activity

(Allen, Qian and Qian, 2005). In this, finance manager of the firm plays a significant role in

framing the competent strategies which facilitates effective utilization of financial resources to

the large extent. This project report is based on different scenario which helps in understanding

the sources of funding which are available to business and service industries. Besides this, it will

also develop an understanding about the relationship between cost, gross profit and selling price.

Further, the present report will discuss the purpose and process of budgetary control which helps

company in getting the desired output. In addition this, report will also examine the financial

health and performance of R. Riggs through ratio analysis.

TASK 1

1.1 Reviewing the sources of funding which are available to business or service industries

There are several internal and external sources of finance which are available to sole

trader in relation to the purchase of machinery worth of £50000 are as follows:

Internal source of finance: It refers to those sources which are available within the business

enterprise are as follows:

Retained profit: Sole trader can fulfil financial need by making use of retained profit

which he kept with itself for the contingent situation or liability.

Advantages: By making use of retained profit, company can save the amount of tax to a

large extent. Moreover, the amount of tax is calculated on the profitability aspect of firm.

Disadvantages: When organization undertakes retained profit to fulfil its financial need

then it is unable to provide dividend to their shareholders. This aspect negatively affects the

image of firm.

Sales of assets: Trader can also raise finance by selling non-performing assets of the firm.

It is the most effective source of finance which helps in small business in meeting its

monetary needs. Sole trader can easily fulfil his financial need by selling the assets which

have no further use in the productive activities of business unit. Through this, sole trader

is able to purchase machinery which helps him in enhancing the productivity and

profitability of firm.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advantages: By replacing an old asset with the new one, company can increase its

productivity and profitability aspects.

Disadvantages: When firm sells its assets then it places a bad impact on it brand image.

Moreover, stakeholders think that financial health and performance of organization is sound and

so, it starts selling assets for meeting their financial requirements.

Personal savings: Sole trader can also make use of his personal savings to meet out the

financial needs for the purchasing of machinery.

Advantages: Sole trader does not require making any payment of interest. Moreover,

interest charged by the institutions is always higher than the interest earned by the investor.

Disadvantages: In personal savings, business entity does not get interest for the money

which they use for the business purpose.

Angel investors: Friends as well as family members act as an angel when their loved one

requires finance. Thus, business entity can easily enhance his fund by approaching their

relatives for financial assistance.

Advantages: In case if sole trader takes financial assistance from their relatives then they

make payment to them on the basis of their convenience.

Disadvantages: Interference of the angel investors are increased when sole trader takes

financial assistance from them. Moreover, business entity requires giving the right of ownership

to the friends and family members to an extent to which fund is provided by them.

External sources of finance: It includes the sources which are present outside the business

organization. They are as follows:

Bank loan: Small business enterprise can purchase machinery by taking financial

assistance from bank on the basis of collateral security.

Advantages: Sole trade can enjoy tax benefits when he undertakes bank loan to meet

their needs.

Disadvantages: High interest amount is one of the main disadvantages of bank loan

which closely affects the profitability aspect of firm.

Leasing: Company can also make use of machinery by taking assistance of leasing

aspect. By making payment of rent sole trader can use machinery in productive purpose

for the predetermined time period. If offers opportunity to sole trader to use machinery

without making huge investment on it (Andreff, 2007).

3

productivity and profitability aspects.

Disadvantages: When firm sells its assets then it places a bad impact on it brand image.

Moreover, stakeholders think that financial health and performance of organization is sound and

so, it starts selling assets for meeting their financial requirements.

Personal savings: Sole trader can also make use of his personal savings to meet out the

financial needs for the purchasing of machinery.

Advantages: Sole trader does not require making any payment of interest. Moreover,

interest charged by the institutions is always higher than the interest earned by the investor.

Disadvantages: In personal savings, business entity does not get interest for the money

which they use for the business purpose.

Angel investors: Friends as well as family members act as an angel when their loved one

requires finance. Thus, business entity can easily enhance his fund by approaching their

relatives for financial assistance.

Advantages: In case if sole trader takes financial assistance from their relatives then they

make payment to them on the basis of their convenience.

Disadvantages: Interference of the angel investors are increased when sole trader takes

financial assistance from them. Moreover, business entity requires giving the right of ownership

to the friends and family members to an extent to which fund is provided by them.

External sources of finance: It includes the sources which are present outside the business

organization. They are as follows:

Bank loan: Small business enterprise can purchase machinery by taking financial

assistance from bank on the basis of collateral security.

Advantages: Sole trade can enjoy tax benefits when he undertakes bank loan to meet

their needs.

Disadvantages: High interest amount is one of the main disadvantages of bank loan

which closely affects the profitability aspect of firm.

Leasing: Company can also make use of machinery by taking assistance of leasing

aspect. By making payment of rent sole trader can use machinery in productive purpose

for the predetermined time period. If offers opportunity to sole trader to use machinery

without making huge investment on it (Andreff, 2007).

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Advantages: Sole trader can manage his cash inflow and outflow in an effectual manner

by taking asset on lease rather than making investment on it.

Disadvantages: Leasing expense may reduce the net income aspect of firm without any

appreciation in the value.

Bank overdraft: Individual can raise his financial need by approaching bank for the

overdraft facility. Usually, banks are ready to give financial assistance to business entity

that has good credit ratings.

Advantages: By making an effectual use of image, individual can easily raise finance to

some extent.

Disadvantages: Bank charges high interest on overdraft facility as compared to the bank

loan.

Factoring: It is a financial transaction or debtor finance in which business unit sells its

receivable to the third party at discount. Through this, sole trader can receive the amount

of bills receivable before its due date. Thus, by discounting bills from financial

institution, individual is able to purchase the machinery worth of £50000. For such

facility, financial institution charges high monetary cost from the business organization in

terms of discount. By this, sole trader is able to meet his present or immediate cash

requirements. For instance, sole trader has receivable of £50000. In this, by discounting

such receivables from the financial institution, he can easily meet his needs. On the basis

of cited example, bank charges £500 as factor and give £49500 to sole trader after

discounting such receivable.

Advantages: Sole trader can mitigate the risk of bad debt by making use of factoring as a

tool.

Disadvantages: Financial institution charges high percentage on the amount of bills

receivable which imposes high financial cost in front of the organization.

Recommending sources: On the basis of all above mentioned benefits and drawbacks, it

is recommended to the sole trader to undertake bank overdraft and to do factoring for meeting his

financial requirement for the purchase of machinery. In addition to this, sole trader also needs to

sell his assets which are no further in use in the productive activities. Thus, by making use of all

these sources, sole trader can make balance in his capital structure.

4

by taking asset on lease rather than making investment on it.

Disadvantages: Leasing expense may reduce the net income aspect of firm without any

appreciation in the value.

Bank overdraft: Individual can raise his financial need by approaching bank for the

overdraft facility. Usually, banks are ready to give financial assistance to business entity

that has good credit ratings.

Advantages: By making an effectual use of image, individual can easily raise finance to

some extent.

Disadvantages: Bank charges high interest on overdraft facility as compared to the bank

loan.

Factoring: It is a financial transaction or debtor finance in which business unit sells its

receivable to the third party at discount. Through this, sole trader can receive the amount

of bills receivable before its due date. Thus, by discounting bills from financial

institution, individual is able to purchase the machinery worth of £50000. For such

facility, financial institution charges high monetary cost from the business organization in

terms of discount. By this, sole trader is able to meet his present or immediate cash

requirements. For instance, sole trader has receivable of £50000. In this, by discounting

such receivables from the financial institution, he can easily meet his needs. On the basis

of cited example, bank charges £500 as factor and give £49500 to sole trader after

discounting such receivable.

Advantages: Sole trader can mitigate the risk of bad debt by making use of factoring as a

tool.

Disadvantages: Financial institution charges high percentage on the amount of bills

receivable which imposes high financial cost in front of the organization.

Recommending sources: On the basis of all above mentioned benefits and drawbacks, it

is recommended to the sole trader to undertake bank overdraft and to do factoring for meeting his

financial requirement for the purchase of machinery. In addition to this, sole trader also needs to

sell his assets which are no further in use in the productive activities. Thus, by making use of all

these sources, sole trader can make balance in his capital structure.

4

1.2 Evaluating the range of methods of generating income within the service or business

operations

There are wide ranges of methods are available to large chain restaurant which helps it in

achieving success in the strategic business arena.

Offering unique services: Restaurant can raise their revenue by offering the innovative

and unique services to their customers. This aspect helps restaurant in attracting large

number of customers and thereby maximize the sales and gross margin of the firm

(Atkinson, 2005).

Expansion of restaurant chain: Large unit of restaurant needs to expand its business

operations and functions by opening up new restaurants at famous places of UK. It

enables restaurant to serve the wide segment of customers and increase their profitability

aspects.

Charismatic ambiance: Restaurant needs to make focus upon the development of

attractive ambiance which helps them in encouraging the customers to make experience

of the restaurant chain. Thus, by taking into consideration all the above mentioned

aspects company is able to generate more income.

Advertisement: Large chain of restaurant can easily influence the number of customers by

placing advertisement on social networking sites. Through this, business unit is able to

provide information to a large segment of customers about the services which are offered

by them.

Recruiting skilled and efficient personnel: By hiring skilled and efficient personnel,

restaurant is able to deliver quality services to their customers. Moreover, in service

industry, personnel represent the business unit. Employees are the one who directly

interact with the customers. Thus, by greeting customers in a polite manner, restaurant

can evolve satisfaction among the customers. This is turn helps in raising the gross

revenue of firm.

Research and development: Restaurant can also enhance its income by taking into

consideration the research and development activity. Through this, restaurant is able to

identify the needs, wants and expectations of customers. It enables the restaurant to serve

customers according to their needs which helps it in building loyalty among customers.

5

operations

There are wide ranges of methods are available to large chain restaurant which helps it in

achieving success in the strategic business arena.

Offering unique services: Restaurant can raise their revenue by offering the innovative

and unique services to their customers. This aspect helps restaurant in attracting large

number of customers and thereby maximize the sales and gross margin of the firm

(Atkinson, 2005).

Expansion of restaurant chain: Large unit of restaurant needs to expand its business

operations and functions by opening up new restaurants at famous places of UK. It

enables restaurant to serve the wide segment of customers and increase their profitability

aspects.

Charismatic ambiance: Restaurant needs to make focus upon the development of

attractive ambiance which helps them in encouraging the customers to make experience

of the restaurant chain. Thus, by taking into consideration all the above mentioned

aspects company is able to generate more income.

Advertisement: Large chain of restaurant can easily influence the number of customers by

placing advertisement on social networking sites. Through this, business unit is able to

provide information to a large segment of customers about the services which are offered

by them.

Recruiting skilled and efficient personnel: By hiring skilled and efficient personnel,

restaurant is able to deliver quality services to their customers. Moreover, in service

industry, personnel represent the business unit. Employees are the one who directly

interact with the customers. Thus, by greeting customers in a polite manner, restaurant

can evolve satisfaction among the customers. This is turn helps in raising the gross

revenue of firm.

Research and development: Restaurant can also enhance its income by taking into

consideration the research and development activity. Through this, restaurant is able to

identify the needs, wants and expectations of customers. It enables the restaurant to serve

customers according to their needs which helps it in building loyalty among customers.

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Entry in the in new industry: Business unit can generate high income by entering in the

retail industry. This industry is continuously growing so; restaurant can expand its

business operations or functions and thereby, can take benefits from it.

TASK 2

2.1 Elements of cost, gross profit percentages and selling prices

Various elements of cost, gross profit and selling price are as follows:

Cost: Specifically two types of cost which business organization has to incur while

manufacturing the product or services. Material, labour and overheads are the main elements of

cost which are enumerated as below: Material: It includes the cost which is incurred by the firm on raw material for

manufacturing the product or services. Labour: Business organization also has to pay wages to their workers for the hours in

which work is performed by them. In addition to this, cost of employee benefits and

payroll taxes are also recognized as the labour cost. Overhead: It refers to all office and administration expenses as well as selling and

distribution expenses of the firm. Each organization has to incur overhead expenses for

smooth functioning of business operations and functions.

Direct cost: It is also known as prime cost which is directly attributable to the production

of goods and services. On the basis of cited case scenario direct cost incurred by Marks &

Spencer includes carrier bag, staffing cost etc.

Indirect cost: It many defined as those which not highly related to the production of a

product but organization has to incur such operation during their business operations. This kind

of expenses may be either fixed or variable depending upon the nature of expenses which are

incurred by them (Bhatt, Wening and Pai, 2006). Fixed cost includes rent of building and

machinery etc. which remain fixed at each level of output produced by the firm. However,

variable expenses are those which get changed in accordance with alteration made in the level of

output. Indirect cost also includes the following cost which is as follows:

6

retail industry. This industry is continuously growing so; restaurant can expand its

business operations or functions and thereby, can take benefits from it.

TASK 2

2.1 Elements of cost, gross profit percentages and selling prices

Various elements of cost, gross profit and selling price are as follows:

Cost: Specifically two types of cost which business organization has to incur while

manufacturing the product or services. Material, labour and overheads are the main elements of

cost which are enumerated as below: Material: It includes the cost which is incurred by the firm on raw material for

manufacturing the product or services. Labour: Business organization also has to pay wages to their workers for the hours in

which work is performed by them. In addition to this, cost of employee benefits and

payroll taxes are also recognized as the labour cost. Overhead: It refers to all office and administration expenses as well as selling and

distribution expenses of the firm. Each organization has to incur overhead expenses for

smooth functioning of business operations and functions.

Direct cost: It is also known as prime cost which is directly attributable to the production

of goods and services. On the basis of cited case scenario direct cost incurred by Marks &

Spencer includes carrier bag, staffing cost etc.

Indirect cost: It many defined as those which not highly related to the production of a

product but organization has to incur such operation during their business operations. This kind

of expenses may be either fixed or variable depending upon the nature of expenses which are

incurred by them (Bhatt, Wening and Pai, 2006). Fixed cost includes rent of building and

machinery etc. which remain fixed at each level of output produced by the firm. However,

variable expenses are those which get changed in accordance with alteration made in the level of

output. Indirect cost also includes the following cost which is as follows:

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

a. Fixed cost: It may be defined as a periodic cost which does not get changed irrespective of the

changes which take place in the level of output produced by the firm. For instance, salaries of

employees, rent of building, etc.

b. Variable cost: This cost includes electricity, insurance, advertisement and other office

expenses which vary with the production. It increases when volume of units get rise and vice

versa.

Gross margin: It refers the percentage of profit which Marks & Spencer wishes to earn

by selling per unit of product or services.

Selling price: It may be defined as a summation of cost and gross margin which provides

opportunity to earn profit by recovering the cost of product (Blocher, Chen and Lin, 2008).

Relationship between the cost, gross margin and selling price are enumerated as below:

Selling price = cost + cost *profit%

For example: cost= 1000

Profit%= 10%

Selling price = 1000+ (1000*10%)

=1000+100= £1100

On the basis of the above mentioned aspect Marks & Spencer requires to sell its

per unit of product @£1100 if it wishes to earn £100 by selling per unit of product.

2.2 Methods of controlling stock and cash

Stock refers to the goods or merchandise which is available to the business organization

for selling and distribution. Usually, companies prefer to maintain the stock of raw material and

finished goods in its warehouses for effective functioning.

Stages of stock: There are mainly five stages of stocks which include raw material

purchase, warehousing, production and packaging as well as finished goods. On the basis of

these five stages, company primarily makes purchase of material and then procures it in

warehouse. Thereafter, business unit sends it to production department for the manufacturing of

goods. After this, organization makes packaging of the finished goods.

Ways to control stock: Marks & Spencer can control its stock by making use of inventory

control techniques namely just in time, economic order quantity etc. Just in time is the best

method which helps organization in reducing the holding and inventory cost. According to this

method organization needs to make order of inventory only when they are needed for the

7

changes which take place in the level of output produced by the firm. For instance, salaries of

employees, rent of building, etc.

b. Variable cost: This cost includes electricity, insurance, advertisement and other office

expenses which vary with the production. It increases when volume of units get rise and vice

versa.

Gross margin: It refers the percentage of profit which Marks & Spencer wishes to earn

by selling per unit of product or services.

Selling price: It may be defined as a summation of cost and gross margin which provides

opportunity to earn profit by recovering the cost of product (Blocher, Chen and Lin, 2008).

Relationship between the cost, gross margin and selling price are enumerated as below:

Selling price = cost + cost *profit%

For example: cost= 1000

Profit%= 10%

Selling price = 1000+ (1000*10%)

=1000+100= £1100

On the basis of the above mentioned aspect Marks & Spencer requires to sell its

per unit of product @£1100 if it wishes to earn £100 by selling per unit of product.

2.2 Methods of controlling stock and cash

Stock refers to the goods or merchandise which is available to the business organization

for selling and distribution. Usually, companies prefer to maintain the stock of raw material and

finished goods in its warehouses for effective functioning.

Stages of stock: There are mainly five stages of stocks which include raw material

purchase, warehousing, production and packaging as well as finished goods. On the basis of

these five stages, company primarily makes purchase of material and then procures it in

warehouse. Thereafter, business unit sends it to production department for the manufacturing of

goods. After this, organization makes packaging of the finished goods.

Ways to control stock: Marks & Spencer can control its stock by making use of inventory

control techniques namely just in time, economic order quantity etc. Just in time is the best

method which helps organization in reducing the holding and inventory cost. According to this

method organization needs to make order of inventory only when they are needed for the

7

production of goods or services. It enable firm to control the level of inventory by making

reducing the wastage. However, it is to be critically evaluated that in just in time method affects

the smooth functioning of the business operations and functions.

Moreover, in just time company place order only when they require the raw material for

the production. In this, production function of an organization is closely affected because they

have to wait until and unless the raw material is not received by it (Brealey, 2012). Thus, Marks

& Spencer needs to undertake economic order quantity method which helps them in preventing

the situation of waiting time. In economic order quantity method, company make assessment of

the units which they require to produce the predetermined level of output. Through this, Marks &

Spencer is able to save their holding and ordering cost. It also ensures smooth production of the

goods or services.

EOQ = Square root of 2D * K/ h

k= cost per order

h = Carrying cost per unit

In addition to this, stock taking methods also have high level of influence on the cost and

profitability aspect of firm which is as follows: First in first out (FIFO): Under this method, manager prefers to make use of the product

which firstly came in organization.

Last in first out (LIFO): Unlike FIFO, business enterprise primarily prefers to make use

of its latest stock for production.

Marks & Spencer can also control its inventory level by adopting FIFO or LIFO method

according to their convenience.

Ways to control cash: Marks & Spencer can control cash related activities by making

internal audit of the financial statements. By assessing the income and cash flow statement

company can easily identify the areas of expenses in which they requires to make control.

Through this, organization is able to make optimum utilization of financial resources to the large

extent (DRURY, 2013). For instance: through internal audit it has been identifying that company

have incurred high electricity expenses due to the wastage of energy. In this, Marks & Spencer

can control the expenses by placing notice ion electricity board. This is the most effective way

through which Marks & Spencer can control cash and thereby increase money for further

investment. In addition this, company can also make control upon their monetary activities by

8

reducing the wastage. However, it is to be critically evaluated that in just in time method affects

the smooth functioning of the business operations and functions.

Moreover, in just time company place order only when they require the raw material for

the production. In this, production function of an organization is closely affected because they

have to wait until and unless the raw material is not received by it (Brealey, 2012). Thus, Marks

& Spencer needs to undertake economic order quantity method which helps them in preventing

the situation of waiting time. In economic order quantity method, company make assessment of

the units which they require to produce the predetermined level of output. Through this, Marks &

Spencer is able to save their holding and ordering cost. It also ensures smooth production of the

goods or services.

EOQ = Square root of 2D * K/ h

k= cost per order

h = Carrying cost per unit

In addition to this, stock taking methods also have high level of influence on the cost and

profitability aspect of firm which is as follows: First in first out (FIFO): Under this method, manager prefers to make use of the product

which firstly came in organization.

Last in first out (LIFO): Unlike FIFO, business enterprise primarily prefers to make use

of its latest stock for production.

Marks & Spencer can also control its inventory level by adopting FIFO or LIFO method

according to their convenience.

Ways to control cash: Marks & Spencer can control cash related activities by making

internal audit of the financial statements. By assessing the income and cash flow statement

company can easily identify the areas of expenses in which they requires to make control.

Through this, organization is able to make optimum utilization of financial resources to the large

extent (DRURY, 2013). For instance: through internal audit it has been identifying that company

have incurred high electricity expenses due to the wastage of energy. In this, Marks & Spencer

can control the expenses by placing notice ion electricity board. This is the most effective way

through which Marks & Spencer can control cash and thereby increase money for further

investment. In addition this, company can also make control upon their monetary activities by

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

making assessment of their cash flow statement. Through this, firm is able to frame competent

strategies and policies which make helps them in making effective utilization of cash aspects.

Along with this, Marks & Spencer can also make control upon cash by preparing bank

reconciliation statement. This statement provides deeper insight to the organization about the

difference between balance shown in organizational bank's statement and the amount recorded in

the accounting records of firm. This statement contains information about all financial

transactions such as deposit or withdrawal which are made by the firm during accounting year. It

also provides opportunity to the business organization to make verification of transaction which

is made by them. Besides this, it also entails the position of cash at bank. Through this, firm is

able to make effectual decisions in relation to their cash related activities. Thus, by keeping all

the above mentioned aspects in the mind, business organization can make optimum utilization of

financial resources. Moreover, cash is the most crucial element upon which the implementation

of business plan is highly dependent. For instance, payment of £1000 is made to the creditor

through cheque but is not presented by him in bank for the withdrawal. In this, amount of the

bank account is declined by £1000. Whereas, in the bank statement, there are no changes that

took place as cheque is not presented by the creditor in bank. Thus, by making verification of the

cash book and pass book, Marks & Spencer can easily assess the actual cash position of firm.

TASK 3

Budgetary control is the process which helps an organization in comparing its actual

figures with that of budgetary figures. By comparing both these figures, company will be able to

analyze its actual performance and in regard to which certain necessary measures can be taken

into consideration.

Process of budgetary control

Communicating details of budget policy and guidelines to those people responsible for

the preparation of budgets: - The very first step which should be taken into consideration is that

the management should make efforts and need to communicate the necessary information related

to the budget to the members who are responsible for the preparation of budget so that a proper

budget can be prepared.

Determining the factors that restrict output and taking action to sort those out: - After

the entire necessary information is collected and communicated, factors that can affect the

9

strategies and policies which make helps them in making effective utilization of cash aspects.

Along with this, Marks & Spencer can also make control upon cash by preparing bank

reconciliation statement. This statement provides deeper insight to the organization about the

difference between balance shown in organizational bank's statement and the amount recorded in

the accounting records of firm. This statement contains information about all financial

transactions such as deposit or withdrawal which are made by the firm during accounting year. It

also provides opportunity to the business organization to make verification of transaction which

is made by them. Besides this, it also entails the position of cash at bank. Through this, firm is

able to make effectual decisions in relation to their cash related activities. Thus, by keeping all

the above mentioned aspects in the mind, business organization can make optimum utilization of

financial resources. Moreover, cash is the most crucial element upon which the implementation

of business plan is highly dependent. For instance, payment of £1000 is made to the creditor

through cheque but is not presented by him in bank for the withdrawal. In this, amount of the

bank account is declined by £1000. Whereas, in the bank statement, there are no changes that

took place as cheque is not presented by the creditor in bank. Thus, by making verification of the

cash book and pass book, Marks & Spencer can easily assess the actual cash position of firm.

TASK 3

Budgetary control is the process which helps an organization in comparing its actual

figures with that of budgetary figures. By comparing both these figures, company will be able to

analyze its actual performance and in regard to which certain necessary measures can be taken

into consideration.

Process of budgetary control

Communicating details of budget policy and guidelines to those people responsible for

the preparation of budgets: - The very first step which should be taken into consideration is that

the management should make efforts and need to communicate the necessary information related

to the budget to the members who are responsible for the preparation of budget so that a proper

budget can be prepared.

Determining the factors that restrict output and taking action to sort those out: - After

the entire necessary information is collected and communicated, factors that can affect the

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

preparation of budget or can restrict company to achieve its goal should be identified and then, it

can be eliminated.

Preparation of the sales budget: - Once all the unwanted factors are eliminated then sales

budget should be prepared in order to analyze the sales that can take place during a year.

Initial preparation of various budgets: - Further, when sales budget is prepared, other

necessary budget should be made in order to achieve the main aim of preparing sales budgets.

Negotiation of budgets with superiors: - Once different budget has been prepared then all

that should be compared in order to find out the superior budget.

Coordination and review of budgets: - After selection and implementation of superior

budget, functioning of the budget should be reviewed in order coordinate all the activities and to

find out whether there is any drawback of the budget or not.

Final acceptance of budgets: - At last, the final budget prepared should be accepted in

order to achieve the actual objectives of preparing budget.

Ongoing review of budgets: - Lastly, ongoing budget should be reviewed with an aim to

find out whether there are any faults of budget or not.

Thus, these are some of the steps which are required to be followed at the time of

preparation of budgets.

Purpose of budgetary control

Motivation: - Purpose of budgetary control is to motivate the staff members. If budget is

prepared then in that case, all the employees working will be able to know the extent to which

they are required to work. If employees know in advance what they are required to do then they

will give their best to achieve that particular target.

Control: - If budget is prepared then in that case, an organization will be able to know the

extent to which they should invest. They will be able to know the amount at which they should

make expenses. If the set limit is extended then in that case, they can control their expenses.

Evaluation: - Budget prepared will help company to evaluate the limit at which they

reached and level to which they are far from achieving their desired target.

Budgetary Control Cycle

Responsibilities: - An organization should first set the responsibilities which each and

every employee is required to perform in order to achieve the desired objectives.

10

can be eliminated.

Preparation of the sales budget: - Once all the unwanted factors are eliminated then sales

budget should be prepared in order to analyze the sales that can take place during a year.

Initial preparation of various budgets: - Further, when sales budget is prepared, other

necessary budget should be made in order to achieve the main aim of preparing sales budgets.

Negotiation of budgets with superiors: - Once different budget has been prepared then all

that should be compared in order to find out the superior budget.

Coordination and review of budgets: - After selection and implementation of superior

budget, functioning of the budget should be reviewed in order coordinate all the activities and to

find out whether there is any drawback of the budget or not.

Final acceptance of budgets: - At last, the final budget prepared should be accepted in

order to achieve the actual objectives of preparing budget.

Ongoing review of budgets: - Lastly, ongoing budget should be reviewed with an aim to

find out whether there are any faults of budget or not.

Thus, these are some of the steps which are required to be followed at the time of

preparation of budgets.

Purpose of budgetary control

Motivation: - Purpose of budgetary control is to motivate the staff members. If budget is

prepared then in that case, all the employees working will be able to know the extent to which

they are required to work. If employees know in advance what they are required to do then they

will give their best to achieve that particular target.

Control: - If budget is prepared then in that case, an organization will be able to know the

extent to which they should invest. They will be able to know the amount at which they should

make expenses. If the set limit is extended then in that case, they can control their expenses.

Evaluation: - Budget prepared will help company to evaluate the limit at which they

reached and level to which they are far from achieving their desired target.

Budgetary Control Cycle

Responsibilities: - An organization should first set the responsibilities which each and

every employee is required to perform in order to achieve the desired objectives.

10

Action plan: - After this, an action plan should be prepared in order to find out what the

company is actually required to achieve.

Adherence: - Once action plan has been prepared then in that case, an organization should

prepare various small plans in order to achieve the main desired target.

Monitoring: - After preparation of various attachments, working of this plan should be

monitored in order to analyze whether the plan prepared is going in a correct way or not.

Correction: - Furthermore, after monitoring the progress of plan, management should

make efforts to correct wrong factors that may affect the success of plan prepared.

Approval & Variances: - At last, when plan has been monitored and necessary changes

have been made then the final plan should be approved with an aim to achieve the desired target.

3.4 Analyze of variance and appropriate suggestions

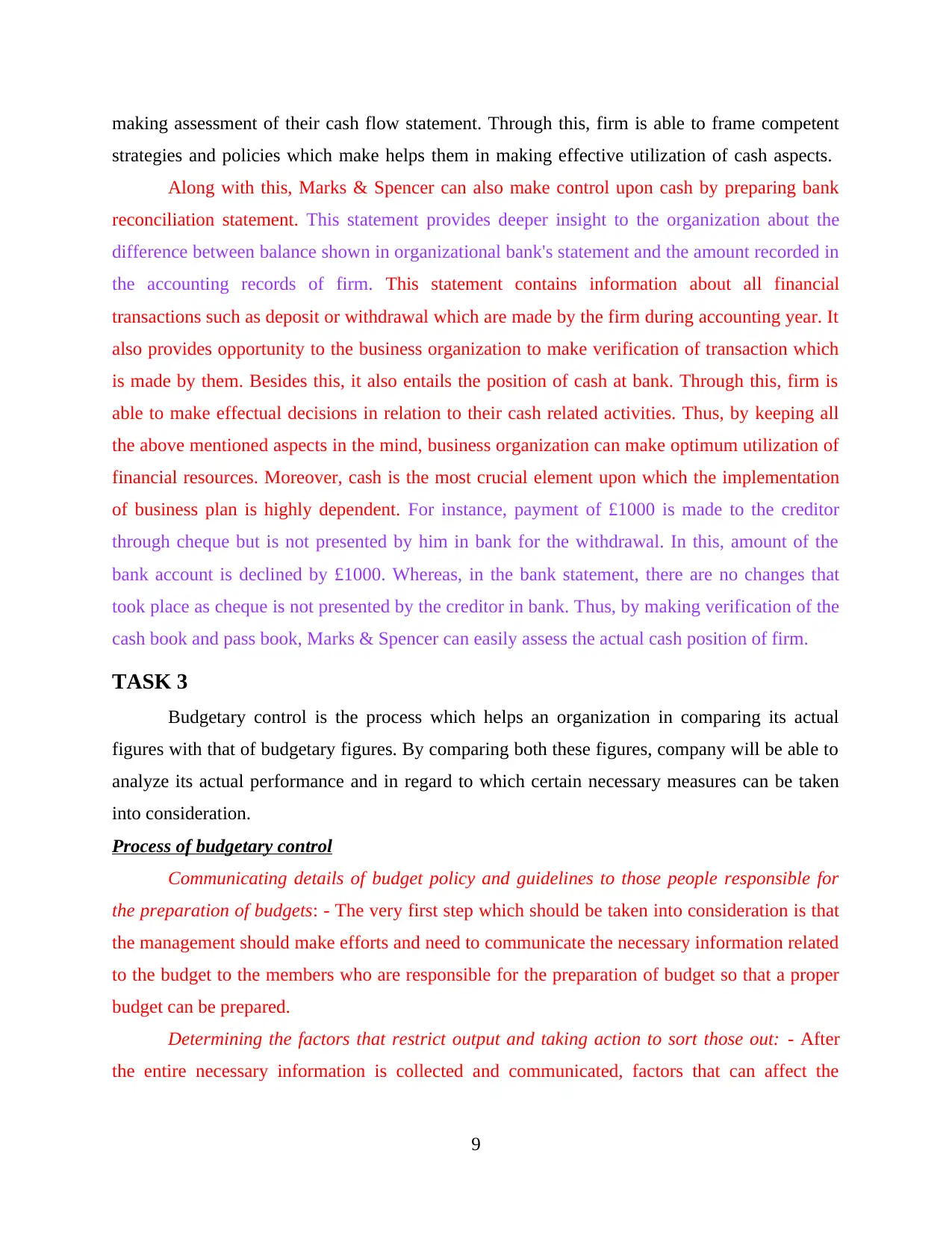

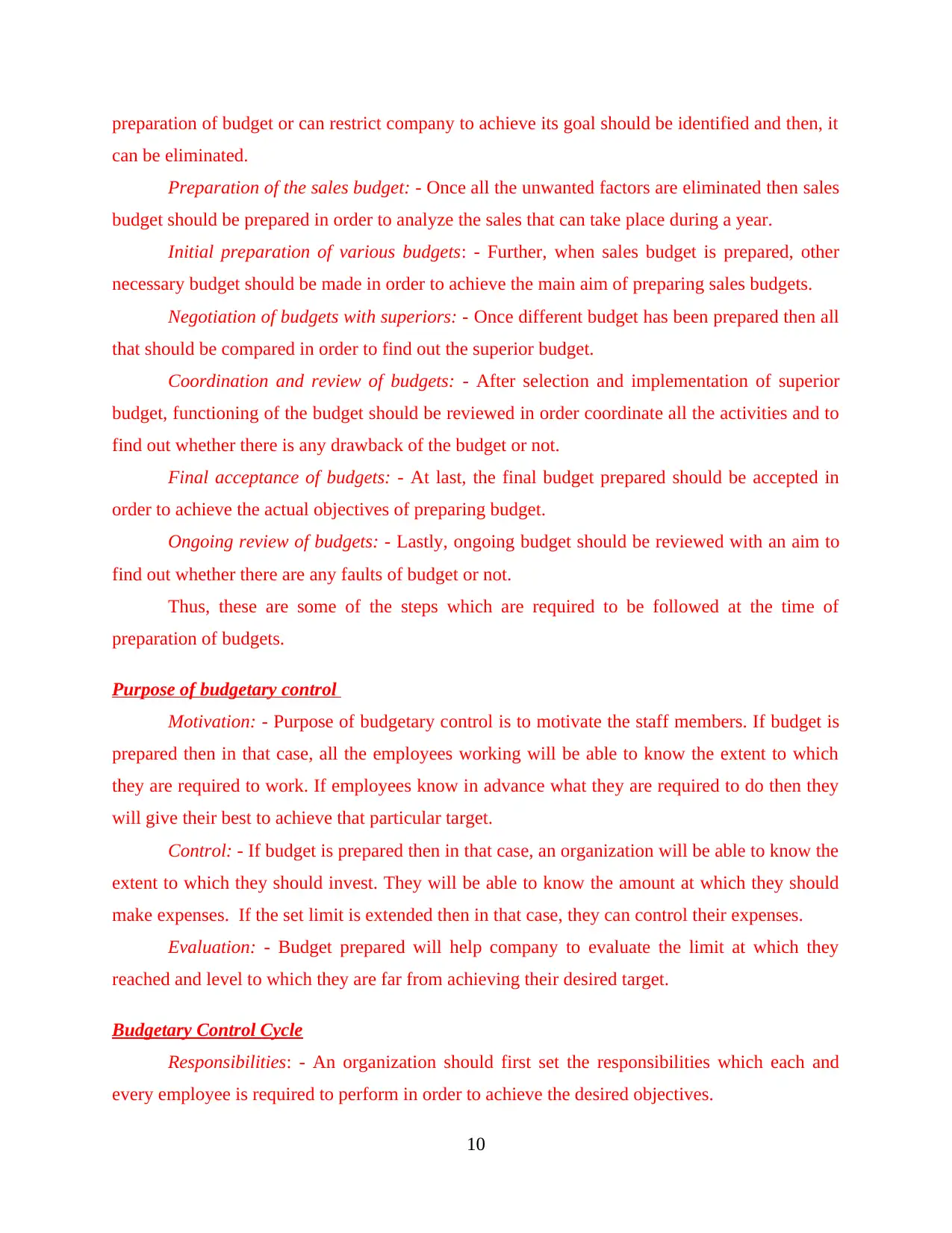

Table 1: Comparison of budgeted performance with actual performance

Budgeted Actual Variance

Units sold 100000 75000 -25000

Material 15000 22500 -7500

Direct labor 22500 24375 -1875

Table 2: Variance of direct material and labor

Material labor

Price/rate variance -4500 3750

Usage/ efficiency variance -3000 -5625

Total variance -7500 -1875

Interpretation

On the basis of the above calculation, it can be concluded that company is not able to sell

out the required units as compared to that of desired figures. On the other hand, cost of material

and labour increase than its desired cost. The following condition may occur due to uincertain

economic conditions in Europe, growing rate of unemployment, increase in standard wages of

the labour. Due to the availability of these factors, demand of the products have started to

decline and in respect to this company is not able to achieve its desired target. On the other hand,

it is seen that cost of material purchase has increased as compared to that of desired cost. The

reason behind this could be the incorrect prediction of demand. Similarly, cost of labour also

11

company is actually required to achieve.

Adherence: - Once action plan has been prepared then in that case, an organization should

prepare various small plans in order to achieve the main desired target.

Monitoring: - After preparation of various attachments, working of this plan should be

monitored in order to analyze whether the plan prepared is going in a correct way or not.

Correction: - Furthermore, after monitoring the progress of plan, management should

make efforts to correct wrong factors that may affect the success of plan prepared.

Approval & Variances: - At last, when plan has been monitored and necessary changes

have been made then the final plan should be approved with an aim to achieve the desired target.

3.4 Analyze of variance and appropriate suggestions

Table 1: Comparison of budgeted performance with actual performance

Budgeted Actual Variance

Units sold 100000 75000 -25000

Material 15000 22500 -7500

Direct labor 22500 24375 -1875

Table 2: Variance of direct material and labor

Material labor

Price/rate variance -4500 3750

Usage/ efficiency variance -3000 -5625

Total variance -7500 -1875

Interpretation

On the basis of the above calculation, it can be concluded that company is not able to sell

out the required units as compared to that of desired figures. On the other hand, cost of material

and labour increase than its desired cost. The following condition may occur due to uincertain

economic conditions in Europe, growing rate of unemployment, increase in standard wages of

the labour. Due to the availability of these factors, demand of the products have started to

decline and in respect to this company is not able to achieve its desired target. On the other hand,

it is seen that cost of material purchase has increased as compared to that of desired cost. The

reason behind this could be the incorrect prediction of demand. Similarly, cost of labour also

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.