Financial Statement Analysis of Kedison PLC: Accounting Report

VerifiedAdded on 2023/06/18

|17

|2407

|188

Report

AI Summary

This report provides a detailed analysis of accounting fundamentals, focusing on the financial statements of Kedison PLC. It includes an income statement and balance sheet, along with working notes explaining key adjustments and accounting principles. The report also features a financial ratio analysis of Chocco plc, a chocolate and confectionery manufacturer, covering ratios such as return on capital employed, return on equity, earnings per share, net profit margin, asset turnover ratio, stock holding days, debtors collection period, current ratio, gearing ratio, and inventory turnover ratio. Each ratio is interpreted to assess the company's profitability, efficiency, and liquidity, offering insights into its financial health and potential areas for improvement. Desklib offers this solved assignment and many more resources for students.

ACCOUNTING

FUNDAMENTALS

FUNDAMENTALS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

QUESTION- 1.................................................................................................................................3

a) Financial statements of Kedison PLC.....................................................................................3

b) Reason for balancing of the statement of financial position...................................................6

QUESTION- 2.................................................................................................................................6

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

QUESTION- 1.................................................................................................................................3

a) Financial statements of Kedison PLC.....................................................................................3

b) Reason for balancing of the statement of financial position...................................................6

QUESTION- 2.................................................................................................................................6

REFERENCES..............................................................................................................................17

INTRODUCTION

Accounting is the language of business and accounting fundamentals are base for

preparing income statement, cash flow statement and balance sheet. This project shall cover

income statements, balance sheet and financial ratios of the company data that are available.

Income statements will show profit and loss of the company and balance sheet will highlight

financial position (Glover, 2017). Moreover, financial ratios help in analysing company

performance in detail. Through this financial statement, company can analyse their performance,

profitability, efficient utilization of fund etc.

MAIN BODY

QUESTION- 1

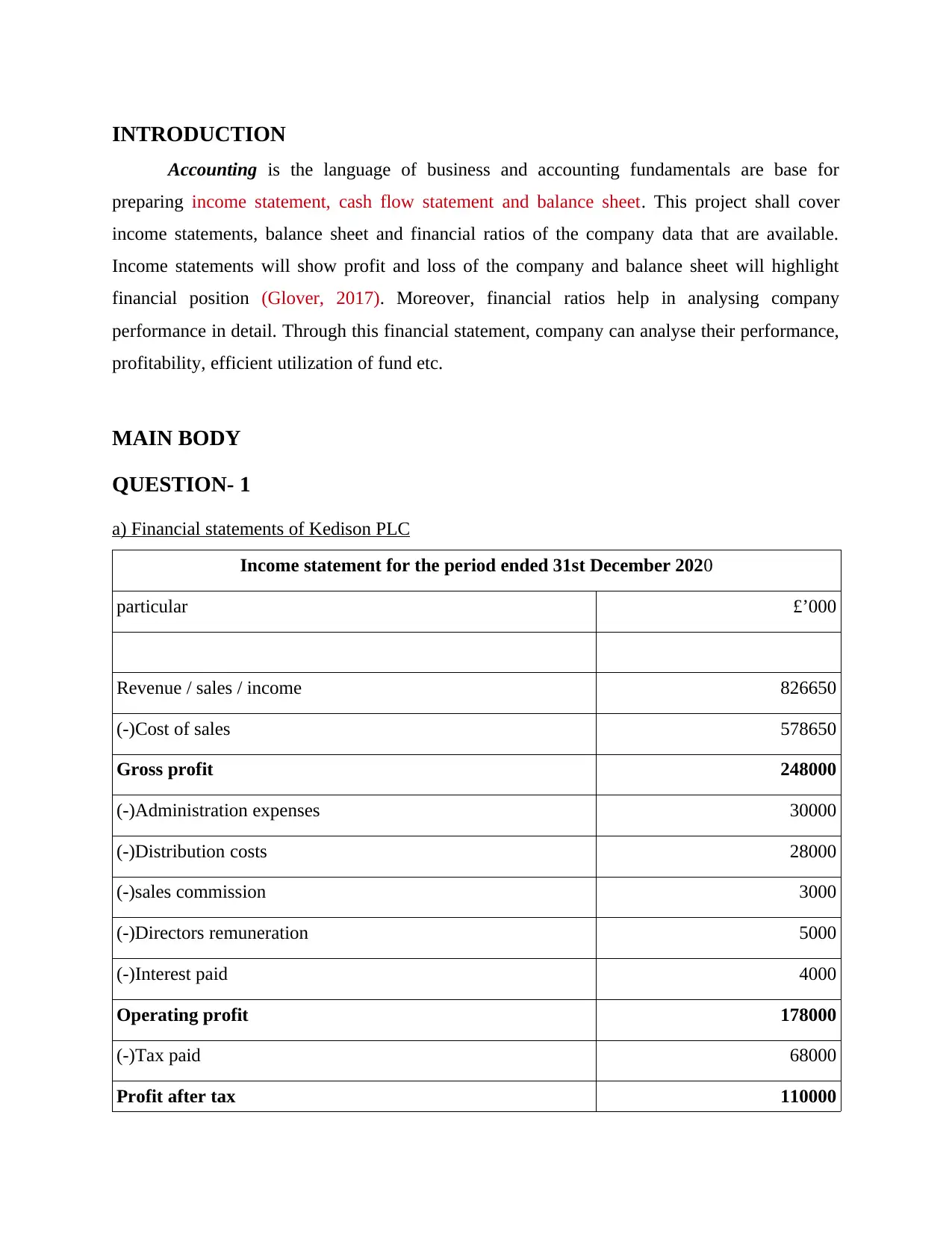

a) Financial statements of Kedison PLC

Income statement for the period ended 31st December 2020

particular £’000

Revenue / sales / income 826650

(-)Cost of sales 578650

Gross profit 248000

(-)Administration expenses 30000

(-)Distribution costs 28000

(-)sales commission 3000

(-)Directors remuneration 5000

(-)Interest paid 4000

Operating profit 178000

(-)Tax paid 68000

Profit after tax 110000

Accounting is the language of business and accounting fundamentals are base for

preparing income statement, cash flow statement and balance sheet. This project shall cover

income statements, balance sheet and financial ratios of the company data that are available.

Income statements will show profit and loss of the company and balance sheet will highlight

financial position (Glover, 2017). Moreover, financial ratios help in analysing company

performance in detail. Through this financial statement, company can analyse their performance,

profitability, efficient utilization of fund etc.

MAIN BODY

QUESTION- 1

a) Financial statements of Kedison PLC

Income statement for the period ended 31st December 2020

particular £’000

Revenue / sales / income 826650

(-)Cost of sales 578650

Gross profit 248000

(-)Administration expenses 30000

(-)Distribution costs 28000

(-)sales commission 3000

(-)Directors remuneration 5000

(-)Interest paid 4000

Operating profit 178000

(-)Tax paid 68000

Profit after tax 110000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

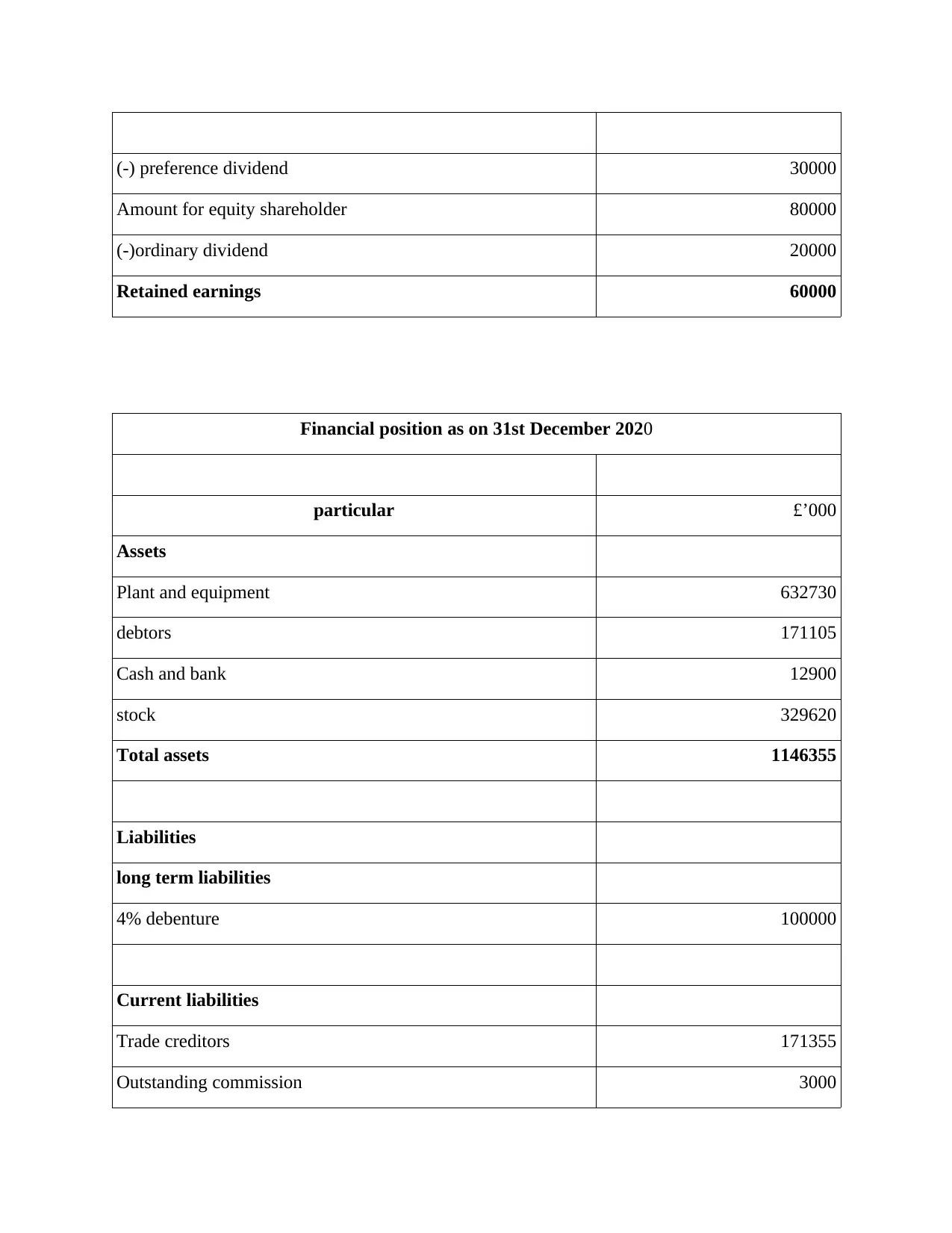

(-) preference dividend 30000

Amount for equity shareholder 80000

(-)ordinary dividend 20000

Retained earnings 60000

Financial position as on 31st December 2020

particular £’000

Assets

Plant and equipment 632730

debtors 171105

Cash and bank 12900

stock 329620

Total assets 1146355

Liabilities

long term liabilities

4% debenture 100000

Current liabilities

Trade creditors 171355

Outstanding commission 3000

Amount for equity shareholder 80000

(-)ordinary dividend 20000

Retained earnings 60000

Financial position as on 31st December 2020

particular £’000

Assets

Plant and equipment 632730

debtors 171105

Cash and bank 12900

stock 329620

Total assets 1146355

Liabilities

long term liabilities

4% debenture 100000

Current liabilities

Trade creditors 171355

Outstanding commission 3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate tax 68000

Outstanding interest 2000

Shareholder equity

Ordinary share 310000

Preference share 300000

profit 110000

Retained earnings 82000

Total liabilities 1146355

Working Note:

1. Interest paid on 4% debentures = 100000*4% =4000. From this, expense 2000 is already

paid which is shown in income statements and the remaining 2000 is outstanding interest.

On one side this amount will be deducted from income statement as expenses and on

other side this will be recorded in financial position statement in liability side as

outstanding interest.

2. Sales commission will be paid in January to sales man but this expense belong to current

year sales (Sumner, 2018). Hence, it is recorded in income statement as expense and in

balance sheet as outstanding commission which is liability for company.

3. Dividend payment which belong to shareholder's income shall not be recorded in profit

and loss account while calculating profit.

4. The inventory of the company shall be reduced by 980. Major reason behind this fact is

that the stock which had been delivered to customer on 31 December 2020, adjustment is

not recorded by the company.

5. Debtors shall be increased by 980. Customer is not making instant payment and this

payment will be received in next financial year.

6. The profit of the year is 110000 which will be recorded in balance sheet equity segment

(Wijaya and Mauren, 2020). This profit will be added in shareholder income.

Outstanding interest 2000

Shareholder equity

Ordinary share 310000

Preference share 300000

profit 110000

Retained earnings 82000

Total liabilities 1146355

Working Note:

1. Interest paid on 4% debentures = 100000*4% =4000. From this, expense 2000 is already

paid which is shown in income statements and the remaining 2000 is outstanding interest.

On one side this amount will be deducted from income statement as expenses and on

other side this will be recorded in financial position statement in liability side as

outstanding interest.

2. Sales commission will be paid in January to sales man but this expense belong to current

year sales (Sumner, 2018). Hence, it is recorded in income statement as expense and in

balance sheet as outstanding commission which is liability for company.

3. Dividend payment which belong to shareholder's income shall not be recorded in profit

and loss account while calculating profit.

4. The inventory of the company shall be reduced by 980. Major reason behind this fact is

that the stock which had been delivered to customer on 31 December 2020, adjustment is

not recorded by the company.

5. Debtors shall be increased by 980. Customer is not making instant payment and this

payment will be received in next financial year.

6. The profit of the year is 110000 which will be recorded in balance sheet equity segment

(Wijaya and Mauren, 2020). This profit will be added in shareholder income.

7. Retain earnings shall be used for dividend payment which are deducted from current year

retain earnings that is 132000-50000= 82000. This shall be paid 30000 to preference

shareholder and 20000 will to equity shareholder as dividend. So remaining 82000 shall

be recorded in balance sheet equity segment.

8. Corporate tax shall be paid, which is deducted from profit before tax (EBT) and on the

other side this shall be shown in balance sheet liabilities segment.

b) Reason for balancing of the statement of financial position

Accounting equation is known as base for double entry system in which assets is equivalent to

liabilities and shareholder equity. Balance sheet is based on this equation where one is assets side

and other is liabilities side to prove this equation, it needs to be balanced (Witczak and Zimny,

2021). Double entry system ensure that each entry has double aspect one is on debit side and

other is on credit side. This equation of accounting ensure that both the side of balance sheet are

equal and in addition to it also shows that how company is procuring and deploying the fund.

The accounting equation is also called as error detection tool because whenever debit accounts is

not equal to credit accounts means there is an error.

QUESTION- 2

Financial Ratio analysis of Chocco plc, A chocolate and confectionery manufacture

Financial Ratios

s.

no particular formulas 2020 2019

1

Return on capital

employed

Earnings before interest and tax / capital

employed 11.71% 10.23%

Earnings before interest

and tax 846 720

Capital employed Total assets- current liabilities 7225 7041

retain earnings that is 132000-50000= 82000. This shall be paid 30000 to preference

shareholder and 20000 will to equity shareholder as dividend. So remaining 82000 shall

be recorded in balance sheet equity segment.

8. Corporate tax shall be paid, which is deducted from profit before tax (EBT) and on the

other side this shall be shown in balance sheet liabilities segment.

b) Reason for balancing of the statement of financial position

Accounting equation is known as base for double entry system in which assets is equivalent to

liabilities and shareholder equity. Balance sheet is based on this equation where one is assets side

and other is liabilities side to prove this equation, it needs to be balanced (Witczak and Zimny,

2021). Double entry system ensure that each entry has double aspect one is on debit side and

other is on credit side. This equation of accounting ensure that both the side of balance sheet are

equal and in addition to it also shows that how company is procuring and deploying the fund.

The accounting equation is also called as error detection tool because whenever debit accounts is

not equal to credit accounts means there is an error.

QUESTION- 2

Financial Ratio analysis of Chocco plc, A chocolate and confectionery manufacture

Financial Ratios

s.

no particular formulas 2020 2019

1

Return on capital

employed

Earnings before interest and tax / capital

employed 11.71% 10.23%

Earnings before interest

and tax 846 720

Capital employed Total assets- current liabilities 7225 7041

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0.09

0.095

0.1

0.105

0.11

0.115

0.12

RETURN ON CAPITAL EMPLOYED

2020

2019

YEAR

PERCENTAGE

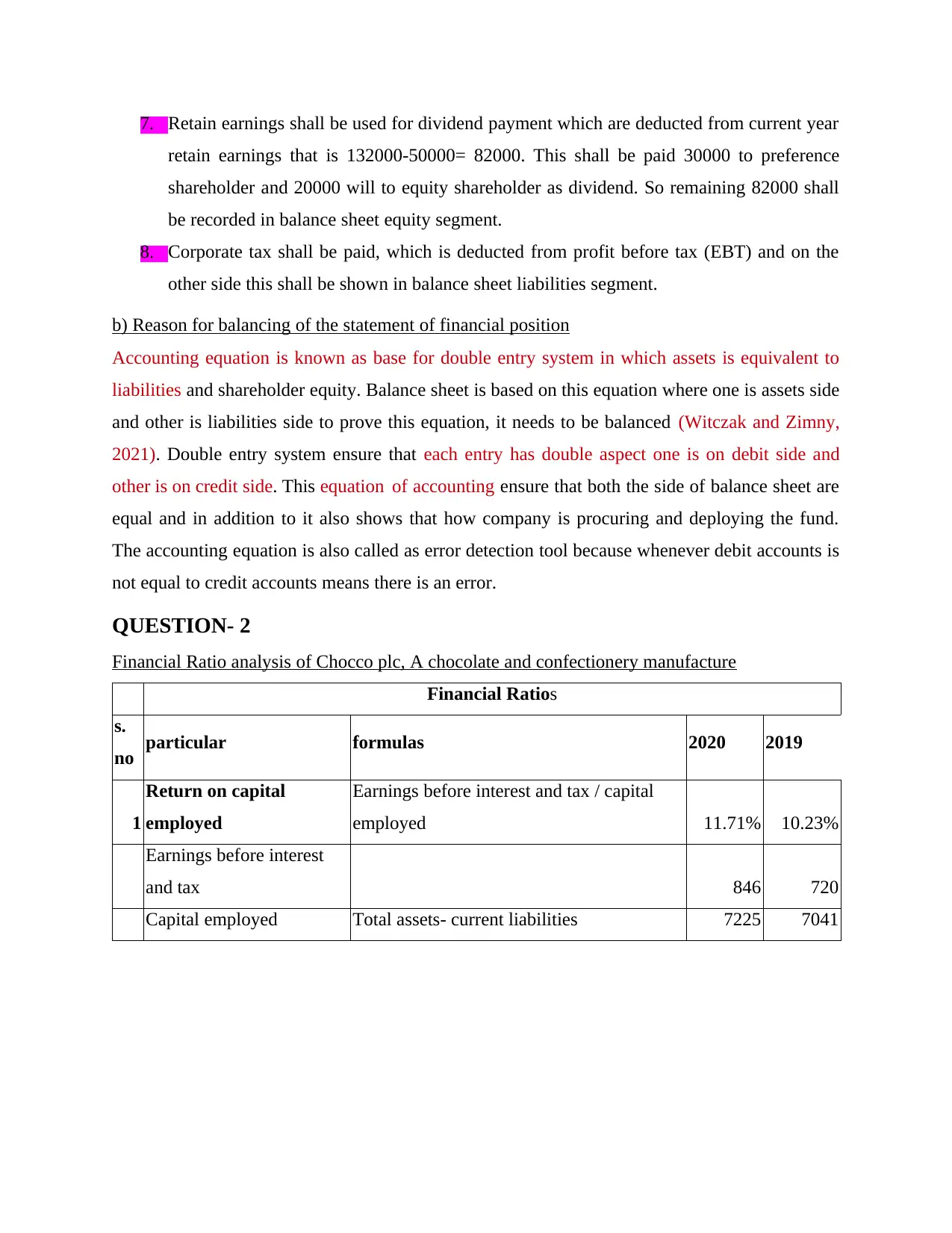

Interpretation:

Return on capital employed ratio is used to measure profitability of the company means how

efficiently company is utilizing their fund to generate profit. As above calculation, it has shown

that earning of the company increased by 1.48% means company is attractively using fund in

order to increase profit (Huo and et.al., 2018). It can be improved more by selling off

unprofitable assets or by paying off debt, inventory management etc.

2 Return on equity Net income / shareholder's equity 13.96% 12.57%

Net income 431 366

Shareholder's equity 3088 2912

0.095

0.1

0.105

0.11

0.115

0.12

RETURN ON CAPITAL EMPLOYED

2020

2019

YEAR

PERCENTAGE

Interpretation:

Return on capital employed ratio is used to measure profitability of the company means how

efficiently company is utilizing their fund to generate profit. As above calculation, it has shown

that earning of the company increased by 1.48% means company is attractively using fund in

order to increase profit (Huo and et.al., 2018). It can be improved more by selling off

unprofitable assets or by paying off debt, inventory management etc.

2 Return on equity Net income / shareholder's equity 13.96% 12.57%

Net income 431 366

Shareholder's equity 3088 2912

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0.052

0.054

0.056

0.058

0.06

0.062

0.064

RETURN ON EQUITY

2020

2019

YEAR

PERCENTAGE

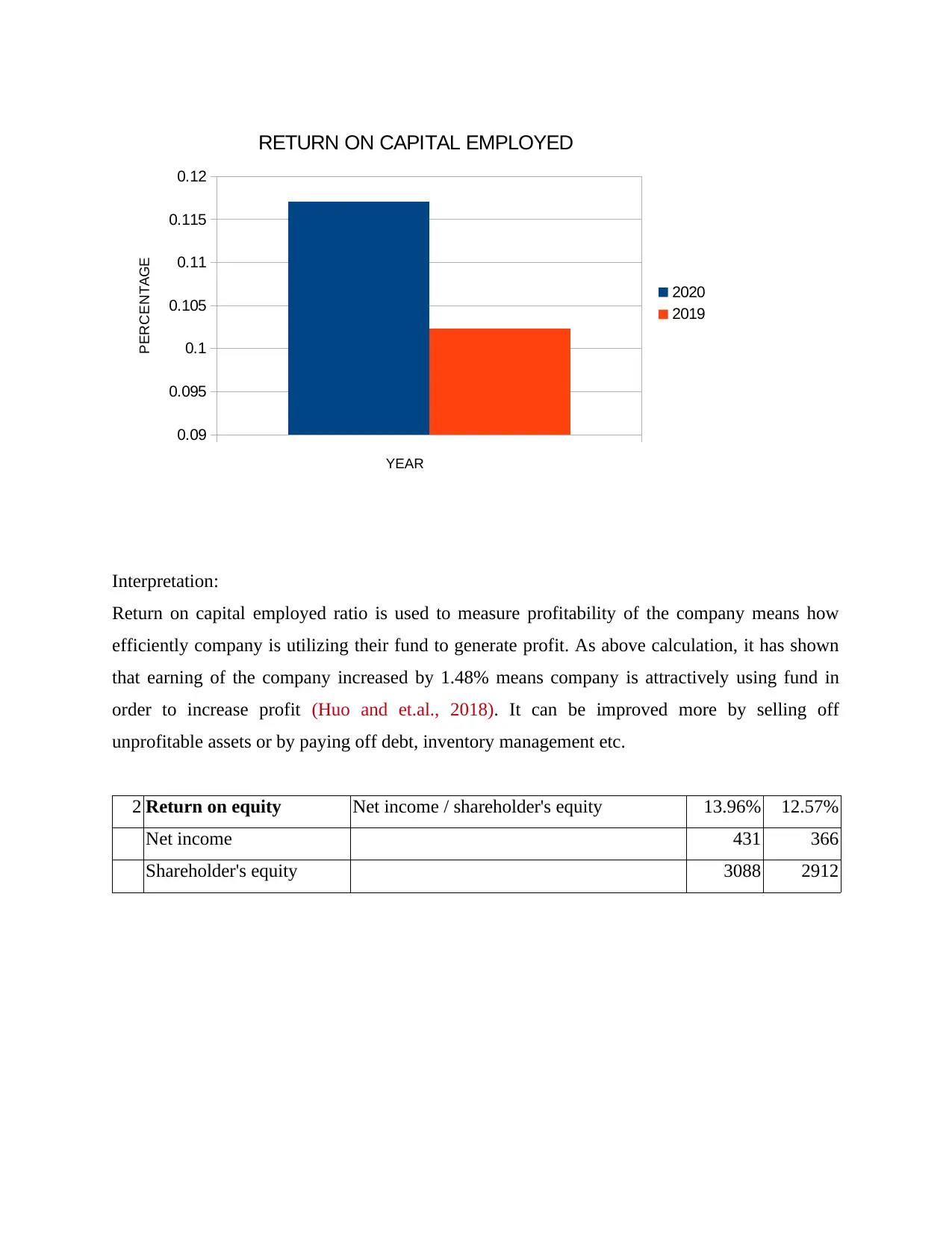

Interpretation:

Return on equity ratio is used to measure profitability of company in respect to equity. This ratio

ensures that how well equity fund is utilizing to get more profit. From the above calculation, it

has shown that company is efficiently utilizing their capital and this ratio is increased by 1.39%

from 2019 to 2020 which is good for the company (Felber, Campos and Sanchis, 2019 ). This

ratio can be improved by reducing cost or by raise the price of the product, investing idle cash,

use financial leverage to increase profitability.

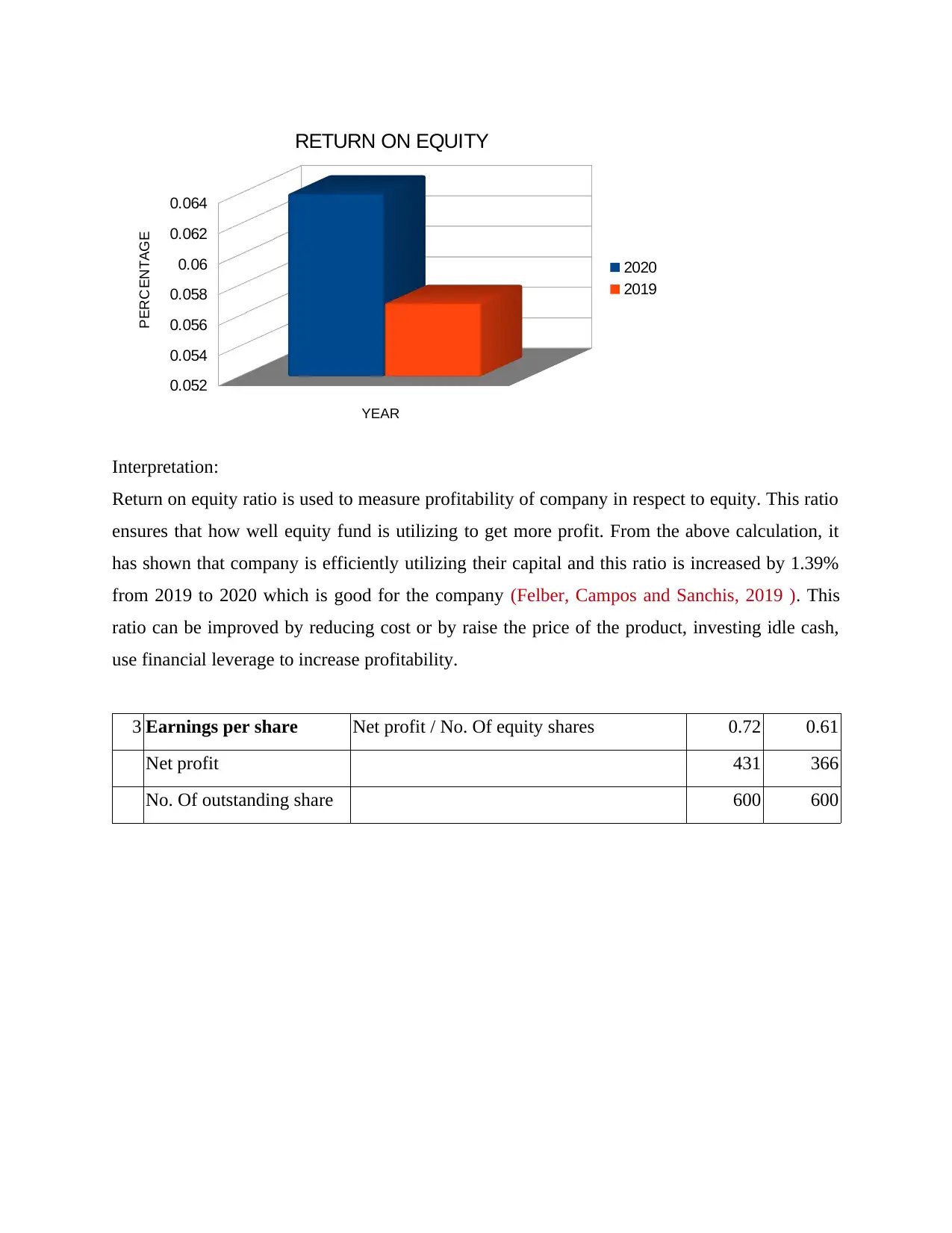

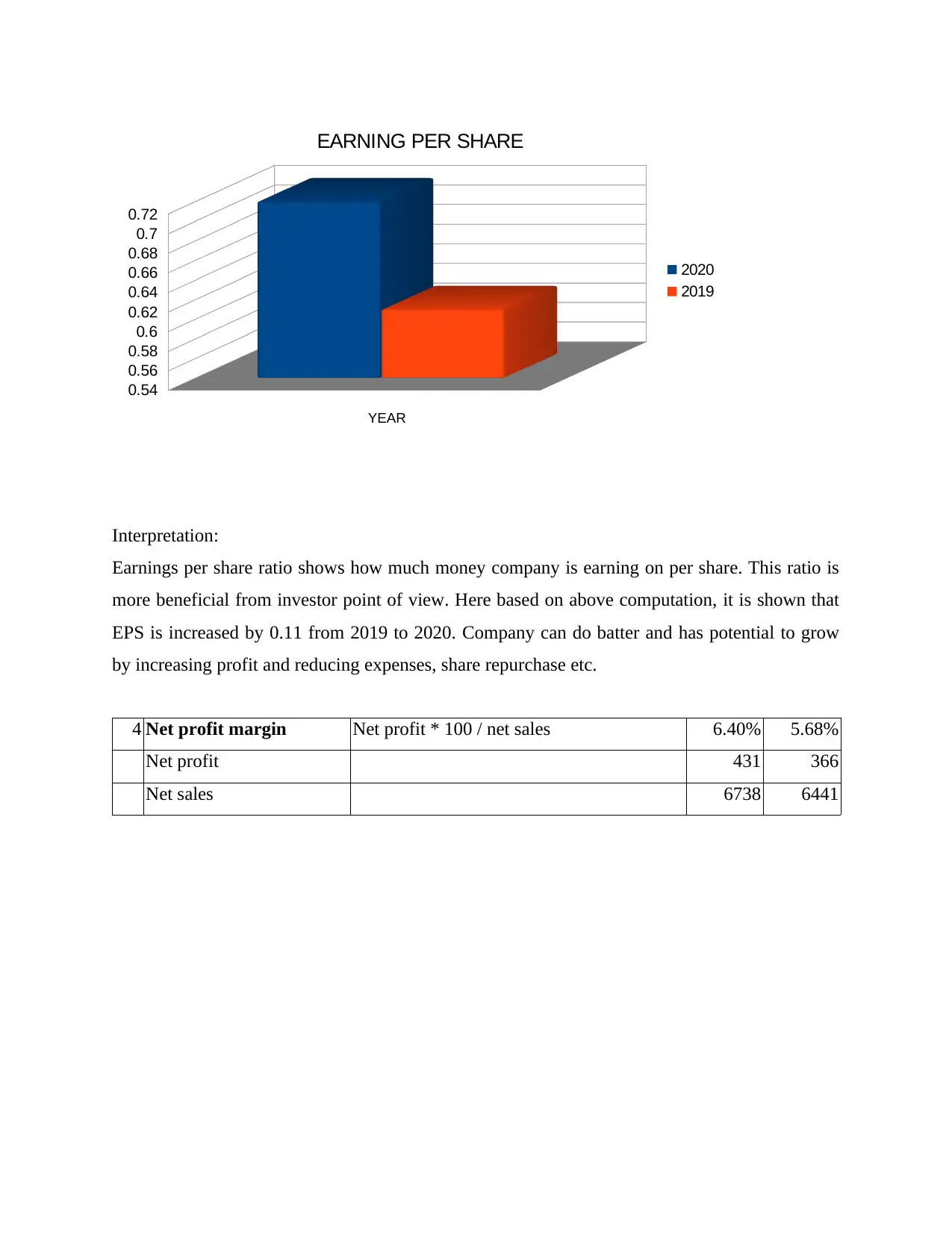

3 Earnings per share Net profit / No. Of equity shares 0.72 0.61

Net profit 431 366

No. Of outstanding share 600 600

0.054

0.056

0.058

0.06

0.062

0.064

RETURN ON EQUITY

2020

2019

YEAR

PERCENTAGE

Interpretation:

Return on equity ratio is used to measure profitability of company in respect to equity. This ratio

ensures that how well equity fund is utilizing to get more profit. From the above calculation, it

has shown that company is efficiently utilizing their capital and this ratio is increased by 1.39%

from 2019 to 2020 which is good for the company (Felber, Campos and Sanchis, 2019 ). This

ratio can be improved by reducing cost or by raise the price of the product, investing idle cash,

use financial leverage to increase profitability.

3 Earnings per share Net profit / No. Of equity shares 0.72 0.61

Net profit 431 366

No. Of outstanding share 600 600

0.54

0.56

0.58

0.6

0.62

0.64

0.66

0.68

0.7

0.72

EARNING PER SHARE

2020

2019

YEAR

Interpretation:

Earnings per share ratio shows how much money company is earning on per share. This ratio is

more beneficial from investor point of view. Here based on above computation, it is shown that

EPS is increased by 0.11 from 2019 to 2020. Company can do batter and has potential to grow

by increasing profit and reducing expenses, share repurchase etc.

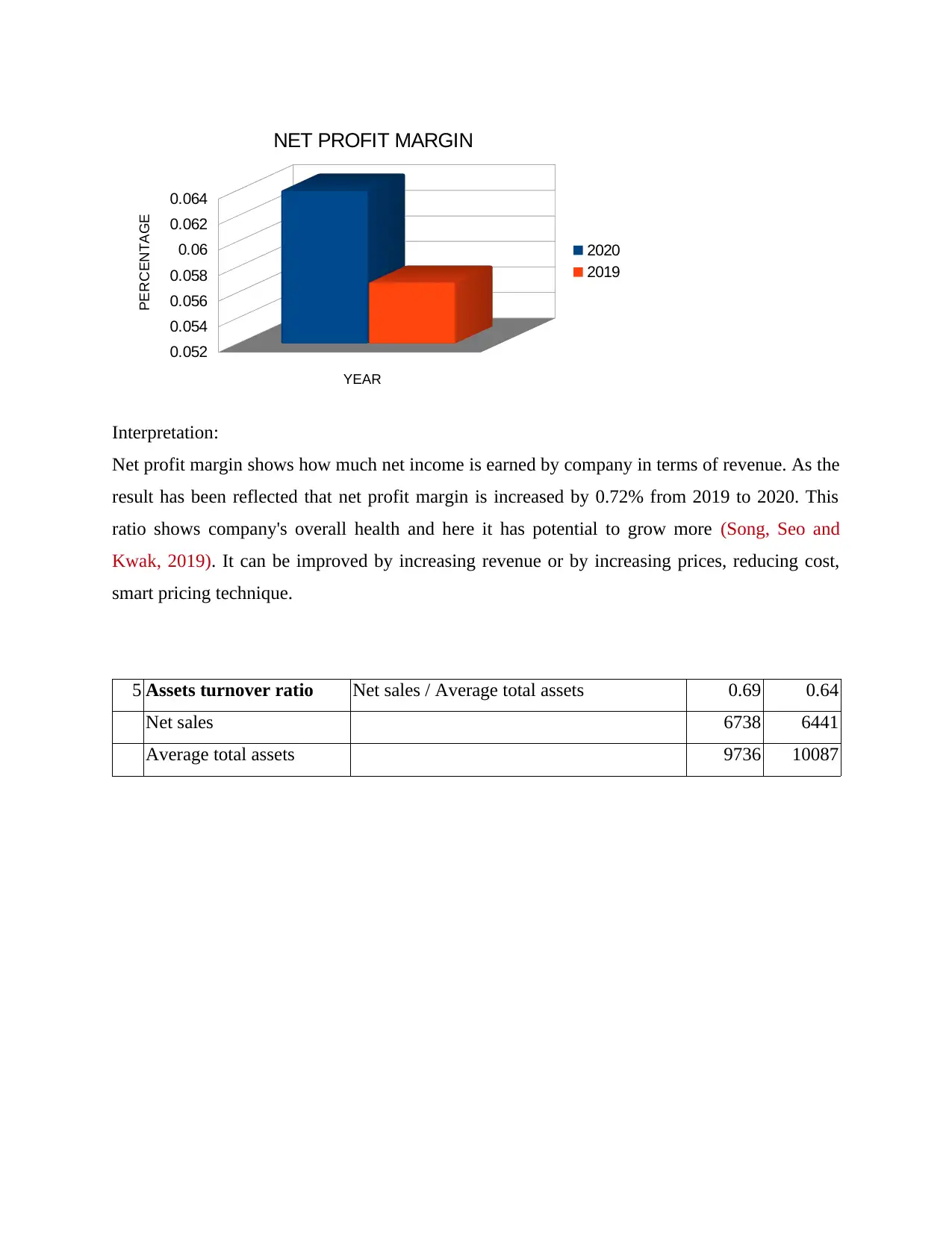

4 Net profit margin Net profit * 100 / net sales 6.40% 5.68%

Net profit 431 366

Net sales 6738 6441

0.56

0.58

0.6

0.62

0.64

0.66

0.68

0.7

0.72

EARNING PER SHARE

2020

2019

YEAR

Interpretation:

Earnings per share ratio shows how much money company is earning on per share. This ratio is

more beneficial from investor point of view. Here based on above computation, it is shown that

EPS is increased by 0.11 from 2019 to 2020. Company can do batter and has potential to grow

by increasing profit and reducing expenses, share repurchase etc.

4 Net profit margin Net profit * 100 / net sales 6.40% 5.68%

Net profit 431 366

Net sales 6738 6441

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0.052

0.054

0.056

0.058

0.06

0.062

0.064

NET PROFIT MARGIN

2020

2019

YEAR

PERCENTAGE

Interpretation:

Net profit margin shows how much net income is earned by company in terms of revenue. As the

result has been reflected that net profit margin is increased by 0.72% from 2019 to 2020. This

ratio shows company's overall health and here it has potential to grow more (Song, Seo and

Kwak, 2019). It can be improved by increasing revenue or by increasing prices, reducing cost,

smart pricing technique.

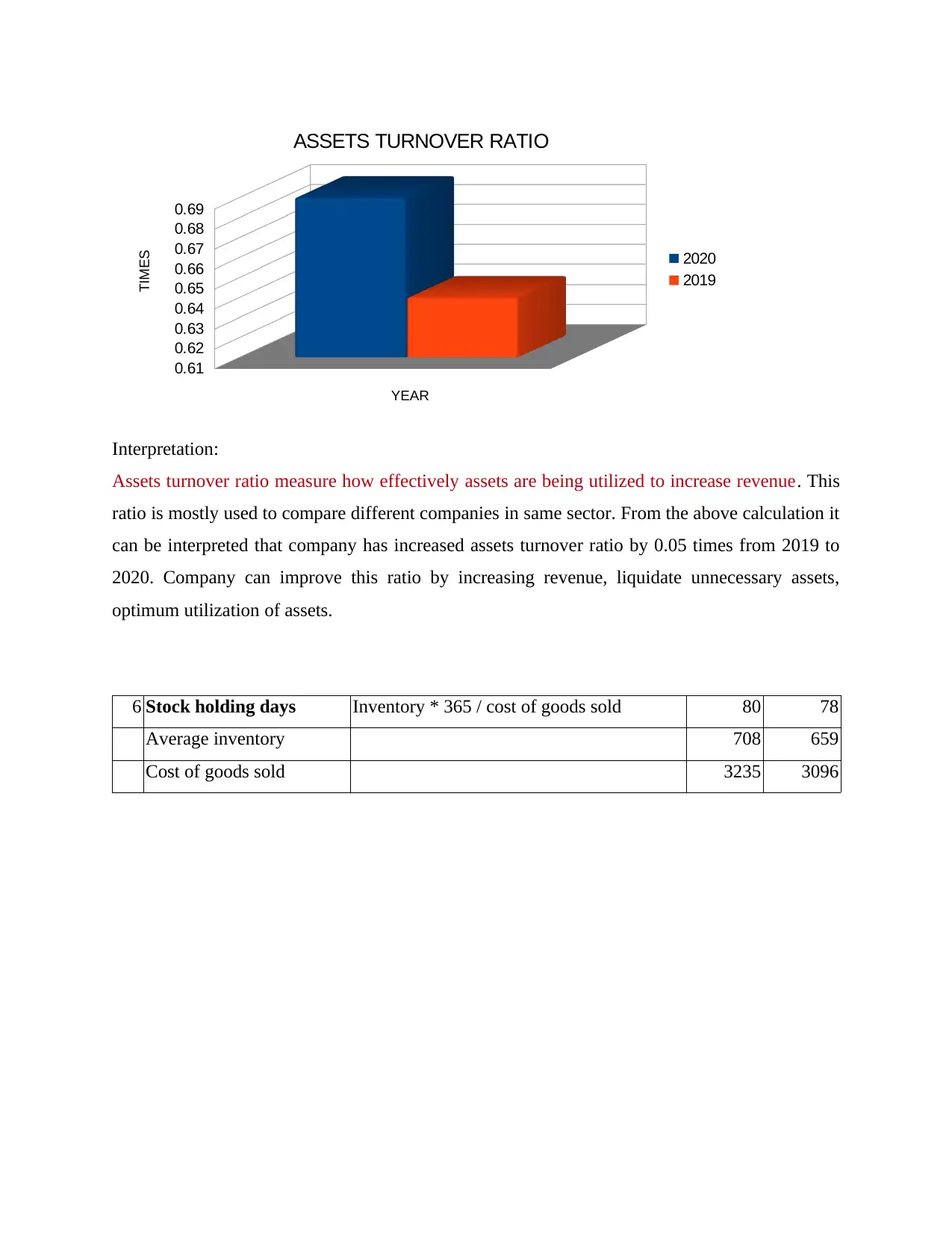

5 Assets turnover ratio Net sales / Average total assets 0.69 0.64

Net sales 6738 6441

Average total assets 9736 10087

0.054

0.056

0.058

0.06

0.062

0.064

NET PROFIT MARGIN

2020

2019

YEAR

PERCENTAGE

Interpretation:

Net profit margin shows how much net income is earned by company in terms of revenue. As the

result has been reflected that net profit margin is increased by 0.72% from 2019 to 2020. This

ratio shows company's overall health and here it has potential to grow more (Song, Seo and

Kwak, 2019). It can be improved by increasing revenue or by increasing prices, reducing cost,

smart pricing technique.

5 Assets turnover ratio Net sales / Average total assets 0.69 0.64

Net sales 6738 6441

Average total assets 9736 10087

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0.61

0.62

0.63

0.64

0.65

0.66

0.67

0.68

0.69

ASSETS TURNOVER RATIO

2020

2019

YEAR

TIMES

Interpretation:

Assets turnover ratio measure how effectively assets are being utilized to increase revenue. This

ratio is mostly used to compare different companies in same sector. From the above calculation it

can be interpreted that company has increased assets turnover ratio by 0.05 times from 2019 to

2020. Company can improve this ratio by increasing revenue, liquidate unnecessary assets,

optimum utilization of assets.

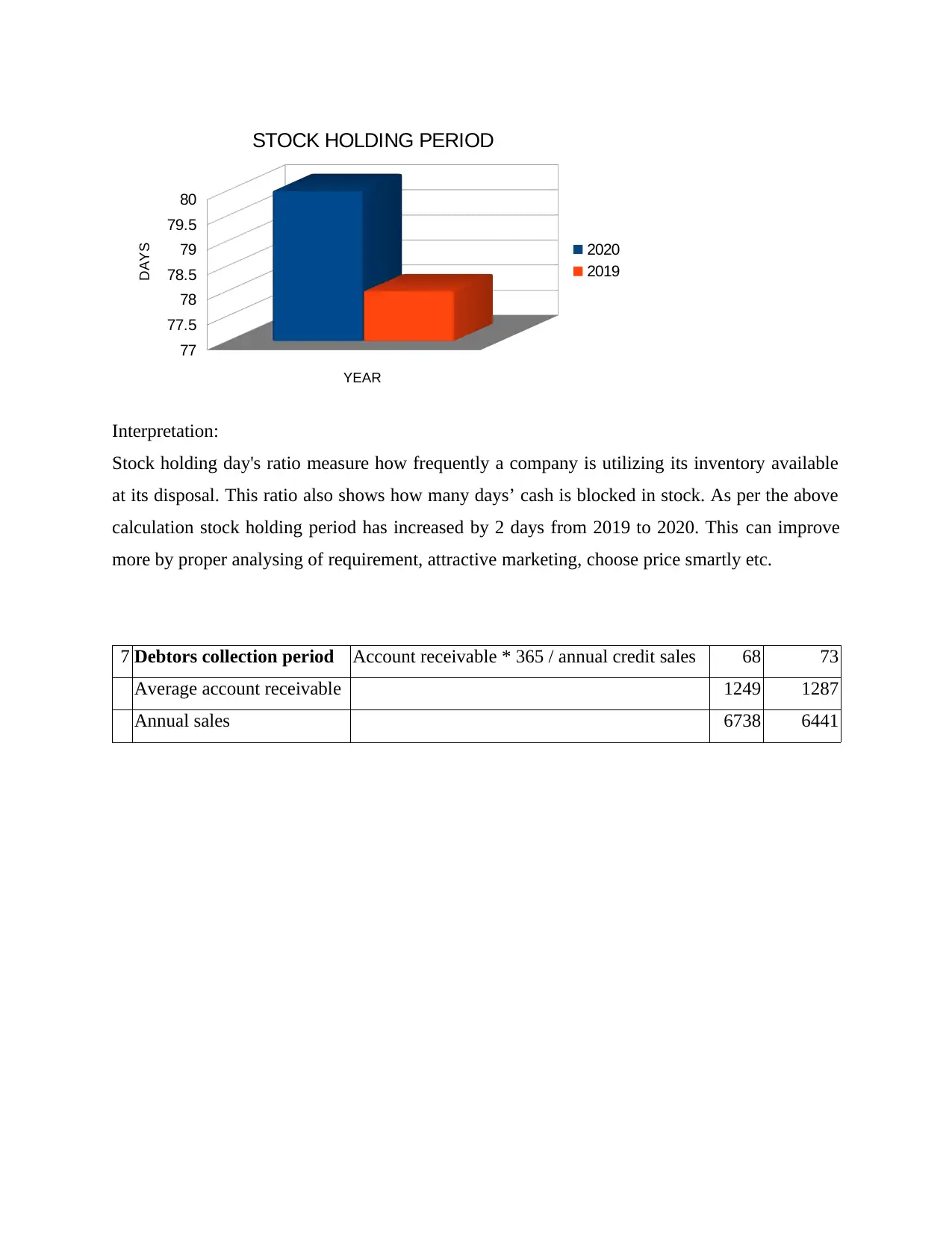

6 Stock holding days Inventory * 365 / cost of goods sold 80 78

Average inventory 708 659

Cost of goods sold 3235 3096

0.62

0.63

0.64

0.65

0.66

0.67

0.68

0.69

ASSETS TURNOVER RATIO

2020

2019

YEAR

TIMES

Interpretation:

Assets turnover ratio measure how effectively assets are being utilized to increase revenue. This

ratio is mostly used to compare different companies in same sector. From the above calculation it

can be interpreted that company has increased assets turnover ratio by 0.05 times from 2019 to

2020. Company can improve this ratio by increasing revenue, liquidate unnecessary assets,

optimum utilization of assets.

6 Stock holding days Inventory * 365 / cost of goods sold 80 78

Average inventory 708 659

Cost of goods sold 3235 3096

77

77.5

78

78.5

79

79.5

80

STOCK HOLDING PERIOD

2020

2019

YEAR

DAYS

Interpretation:

Stock holding day's ratio measure how frequently a company is utilizing its inventory available

at its disposal. This ratio also shows how many days’ cash is blocked in stock. As per the above

calculation stock holding period has increased by 2 days from 2019 to 2020. This can improve

more by proper analysing of requirement, attractive marketing, choose price smartly etc.

7 Debtors collection period Account receivable * 365 / annual credit sales 68 73

Average account receivable 1249 1287

Annual sales 6738 6441

77.5

78

78.5

79

79.5

80

STOCK HOLDING PERIOD

2020

2019

YEAR

DAYS

Interpretation:

Stock holding day's ratio measure how frequently a company is utilizing its inventory available

at its disposal. This ratio also shows how many days’ cash is blocked in stock. As per the above

calculation stock holding period has increased by 2 days from 2019 to 2020. This can improve

more by proper analysing of requirement, attractive marketing, choose price smartly etc.

7 Debtors collection period Account receivable * 365 / annual credit sales 68 73

Average account receivable 1249 1287

Annual sales 6738 6441

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.