Finance 2 Project Report: Legend Corporation Financial Analysis

VerifiedAdded on 2022/12/27

|20

|3990

|2

Report

AI Summary

This finance project report provides a comprehensive financial analysis of Legend Corporation, an Australian engineering solutions company. The report begins with an introduction to the company, its establishment, and its operations across various sectors. It delves into the corporate governance structure, including the roles of the CEO and board of directors, and considers financial market factors such as stock performance. The analysis further examines risk and return parameters, including historical risk parameters, cost of equity, and default risk. The report also evaluates financial performance through profitability, liquidity, efficiency, and capital structure ratios, along with market efficiency ratios. The project includes an executive summary, detailed analysis of financial statements, and discussions on market performance, competitive strength, and financing aspects. The findings offer insights into the company's financial health, risk management, and overall market position, supported by references and appendices.

Running Head: Finance

1

Project Report: Finance

1

Project Report: Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

2

Contents

Introduction.......................................................................................................................3

Corporate governance.......................................................................................................4

Chief executive officer.................................................................................................4

The board of directors...................................................................................................4

Financial market consideration.....................................................................................5

Risk and return..................................................................................................................6

Historical risk parameters.............................................................................................6

Estimating default risk and cost of debt.......................................................................9

Estimating cost of capital............................................................................................12

Cash flows......................................................................................................................14

Existing investment and financial performance.........................................................14

Market performance....................................................................................................15

Competitive strength...................................................................................................15

Competitor analysis....................................................................................................16

Financing........................................................................................................................16

Dividends........................................................................................................................17

Conclusion......................................................................................................................18

References.......................................................................................................................19

Appendix.........................................................................................................................20

2

Contents

Introduction.......................................................................................................................3

Corporate governance.......................................................................................................4

Chief executive officer.................................................................................................4

The board of directors...................................................................................................4

Financial market consideration.....................................................................................5

Risk and return..................................................................................................................6

Historical risk parameters.............................................................................................6

Estimating default risk and cost of debt.......................................................................9

Estimating cost of capital............................................................................................12

Cash flows......................................................................................................................14

Existing investment and financial performance.........................................................14

Market performance....................................................................................................15

Competitive strength...................................................................................................15

Competitor analysis....................................................................................................16

Financing........................................................................................................................16

Dividends........................................................................................................................17

Conclusion......................................................................................................................18

References.......................................................................................................................19

Appendix.........................................................................................................................20

Finance

3

Introduction:

Legend Corporation limited is an Australian company which offers the engineering

solution to its customers. The main services of the company include operating in electrical,

rail, mining, power, information technology, medial, and semiconductor and defence

industries. Company is in the market since 1962 and had registered itself in ASX in the year

of 2004. Along with the Australian market, company has its operations in New Zealand and

pacific region. It offers a wide range of consumables, tools, measurements, test and

components relevant to client partners1.

The reports offer an idea about the performance of Legend Corporation in the capital

market. Financial performance, stock position and market level of the company has been

identified through focusing over financial statement of the company of last 5 years. The

report depicts about the corporate governance structure, WACC, risk level, cash management

performance and financial performance of the company. General information about the

company is as follows:

Company Legend Corporation

Establishment year 1962

Country of origin Australia

Sector Services

Service Engineering services

Listing ASX

Stock exchange listing

year

2004

ASX code LGD

Reporting currency AUD

Revenue (AUD '000) $ 114,901

EBIT (AUD '000) $ 9,922

NPAT (AUD '000) $ 5,9782

1 Home. (2019). Legend corporation. (Accessed 10 May 2019); available from:

https://www.legendcorporate.com/about/

2 annual report. (2019). Legend corporation. (Accessed 10 May 2019); available from

https://www.legendcorporate.com/investor_relations/annual_reports/AR2018.pdf

3

Introduction:

Legend Corporation limited is an Australian company which offers the engineering

solution to its customers. The main services of the company include operating in electrical,

rail, mining, power, information technology, medial, and semiconductor and defence

industries. Company is in the market since 1962 and had registered itself in ASX in the year

of 2004. Along with the Australian market, company has its operations in New Zealand and

pacific region. It offers a wide range of consumables, tools, measurements, test and

components relevant to client partners1.

The reports offer an idea about the performance of Legend Corporation in the capital

market. Financial performance, stock position and market level of the company has been

identified through focusing over financial statement of the company of last 5 years. The

report depicts about the corporate governance structure, WACC, risk level, cash management

performance and financial performance of the company. General information about the

company is as follows:

Company Legend Corporation

Establishment year 1962

Country of origin Australia

Sector Services

Service Engineering services

Listing ASX

Stock exchange listing

year

2004

ASX code LGD

Reporting currency AUD

Revenue (AUD '000) $ 114,901

EBIT (AUD '000) $ 9,922

NPAT (AUD '000) $ 5,9782

1 Home. (2019). Legend corporation. (Accessed 10 May 2019); available from:

https://www.legendcorporate.com/about/

2 annual report. (2019). Legend corporation. (Accessed 10 May 2019); available from

https://www.legendcorporate.com/investor_relations/annual_reports/AR2018.pdf

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

4

Corporate governance:

Corporate governance of the company has been studied initially to measure the

internal performance and position of the company.

Chief executive officer:

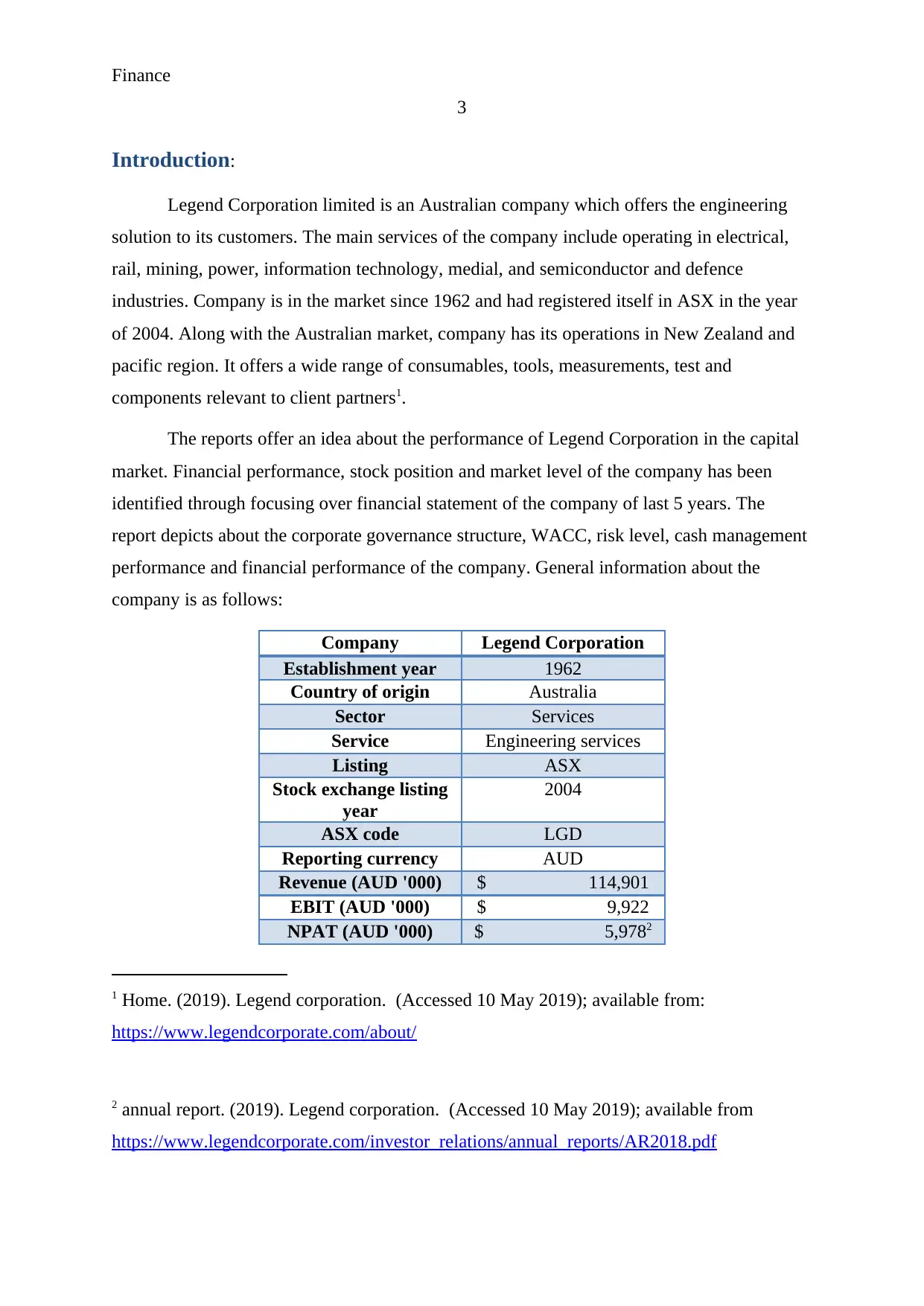

Brad Dowe is the chief executive officer of the company. He is in the company since

October, 2002 and handling all the activities of the company at best of his knowledge. Mr.

Dowe is the founder of the company and his knowledge about the engineering things has

helped him to achieve and maintain the position of CEO. Mr. Dowe owned 62,294,154 shares

in the company in financial year 2018. He has earned $ 445041 from the company in

financial year which is lesser than the previous year because of reduction in non monitory

appraisal of the CEO. Salary of CEO is dividend as follows:

Figure 1: CEO remuneration3

The board of directors:

Board of directors of the company are Bruce E Higgins, chairman and independent

non executive director, Bradely R Dowe, CEO and Ian L Fraser, independent non executive

director.

3 (Annual report, 2019).

4

Corporate governance:

Corporate governance of the company has been studied initially to measure the

internal performance and position of the company.

Chief executive officer:

Brad Dowe is the chief executive officer of the company. He is in the company since

October, 2002 and handling all the activities of the company at best of his knowledge. Mr.

Dowe is the founder of the company and his knowledge about the engineering things has

helped him to achieve and maintain the position of CEO. Mr. Dowe owned 62,294,154 shares

in the company in financial year 2018. He has earned $ 445041 from the company in

financial year which is lesser than the previous year because of reduction in non monitory

appraisal of the CEO. Salary of CEO is dividend as follows:

Figure 1: CEO remuneration3

The board of directors:

Board of directors of the company are Bruce E Higgins, chairman and independent

non executive director, Bradely R Dowe, CEO and Ian L Fraser, independent non executive

director.

3 (Annual report, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

5

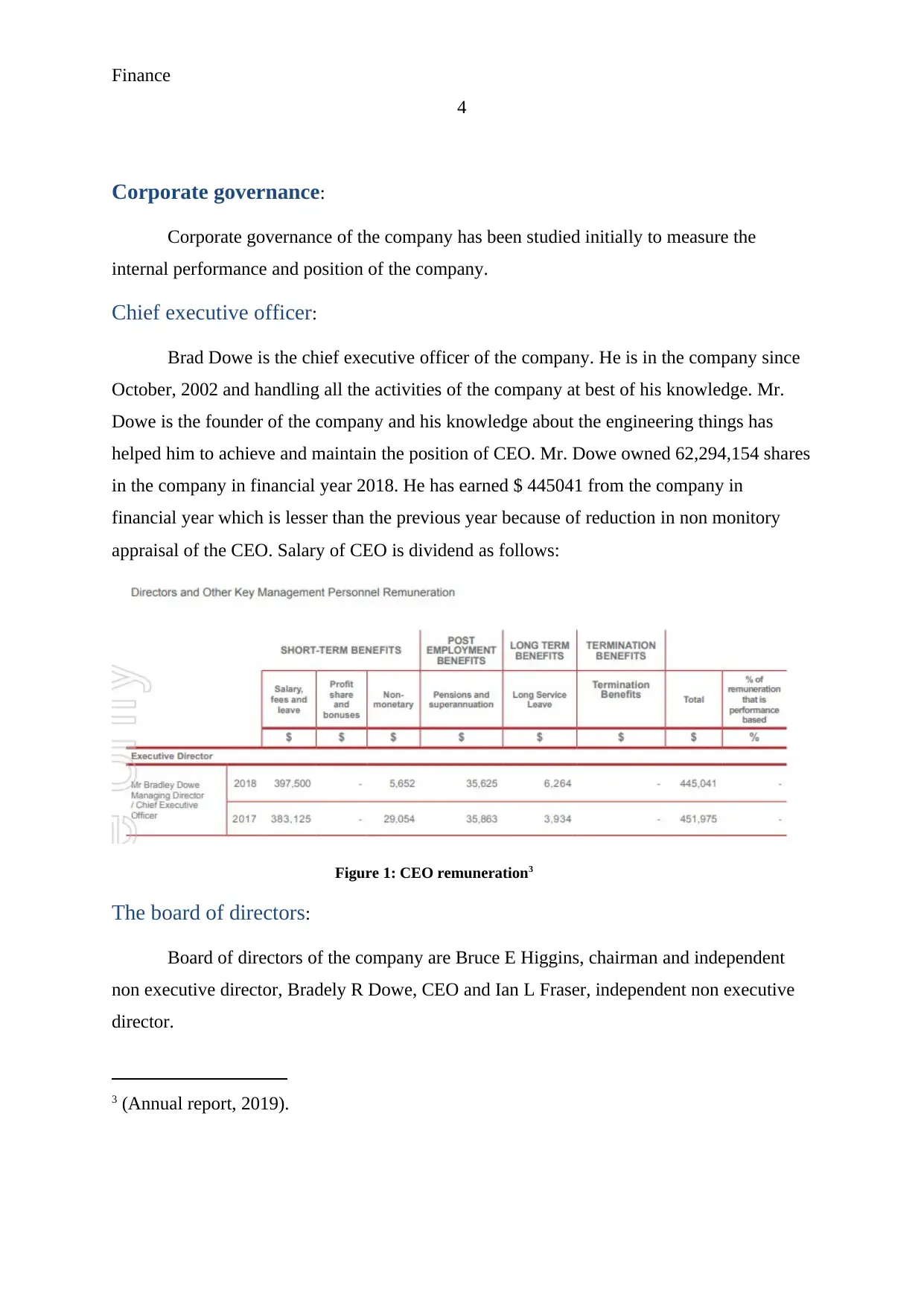

Bruce E Higgins is the director in the company since 2007 and his remuneration is $

129,194. He holds 3677150 stock of the company which is quite high. He is not involved in

any other company and doesn’t have any link with the external stockholders of the company.

Bradely R Dowe is the director in the company since 2002 and his remuneration is $

445,041. He holds 62,294,154 stock of the company which is quite high. He is not involved

in any other company and doesn’t have any link with the external stockholders of the

company4.

Ian L Fraser is the director in the company since 2008 and his remuneration is 73,396.

He holds 62,294,154 stock of the company which is quite high. He is involved in various

other companies such as pioneer sugar mills limited, Clyde industries limited etc. Along with

that, he doesn’t have any link with the external stockholders of the company.

5

Financial market consideration:

On the basis of market study and last 5 year annual report of the company, it has been

found that trading stock level of the company is quite higher. Currently, the trading stock

volume of the company is 12,478 thousand stock which is trading every day in the market to

manage the capital market of the company6. The recent stock performance of the company is

as follows:

4 (Annual report, 2019).

5 (Annual report, 2019).

5

Bruce E Higgins is the director in the company since 2007 and his remuneration is $

129,194. He holds 3677150 stock of the company which is quite high. He is not involved in

any other company and doesn’t have any link with the external stockholders of the company.

Bradely R Dowe is the director in the company since 2002 and his remuneration is $

445,041. He holds 62,294,154 stock of the company which is quite high. He is not involved

in any other company and doesn’t have any link with the external stockholders of the

company4.

Ian L Fraser is the director in the company since 2008 and his remuneration is 73,396.

He holds 62,294,154 stock of the company which is quite high. He is involved in various

other companies such as pioneer sugar mills limited, Clyde industries limited etc. Along with

that, he doesn’t have any link with the external stockholders of the company.

5

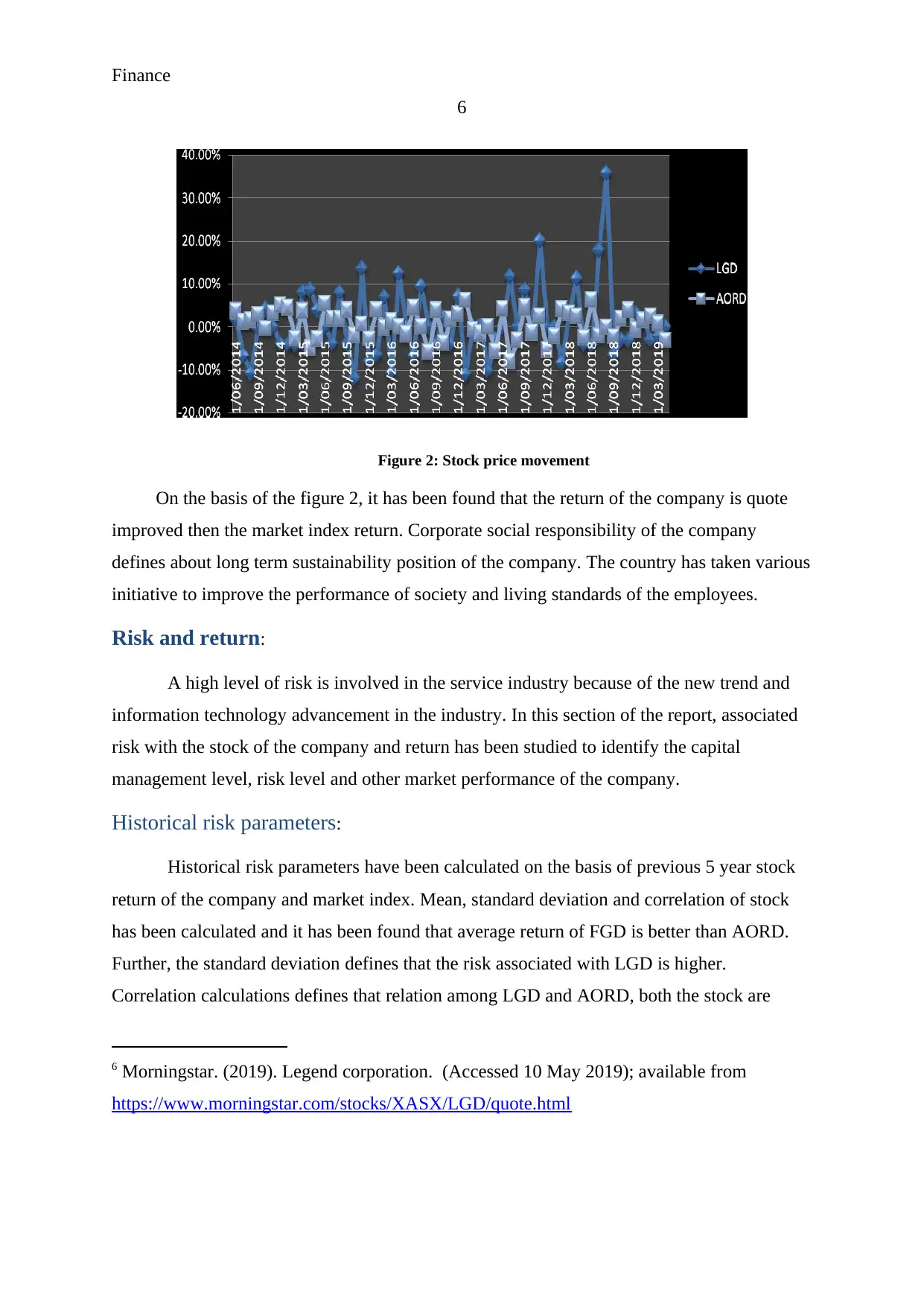

Financial market consideration:

On the basis of market study and last 5 year annual report of the company, it has been

found that trading stock level of the company is quite higher. Currently, the trading stock

volume of the company is 12,478 thousand stock which is trading every day in the market to

manage the capital market of the company6. The recent stock performance of the company is

as follows:

4 (Annual report, 2019).

5 (Annual report, 2019).

Finance

6

Figure 2: Stock price movement

On the basis of the figure 2, it has been found that the return of the company is quote

improved then the market index return. Corporate social responsibility of the company

defines about long term sustainability position of the company. The country has taken various

initiative to improve the performance of society and living standards of the employees.

Risk and return:

A high level of risk is involved in the service industry because of the new trend and

information technology advancement in the industry. In this section of the report, associated

risk with the stock of the company and return has been studied to identify the capital

management level, risk level and other market performance of the company.

Historical risk parameters:

Historical risk parameters have been calculated on the basis of previous 5 year stock

return of the company and market index. Mean, standard deviation and correlation of stock

has been calculated and it has been found that average return of FGD is better than AORD.

Further, the standard deviation defines that the risk associated with LGD is higher.

Correlation calculations defines that relation among LGD and AORD, both the stock are

6 Morningstar. (2019). Legend corporation. (Accessed 10 May 2019); available from

https://www.morningstar.com/stocks/XASX/LGD/quote.html

6

Figure 2: Stock price movement

On the basis of the figure 2, it has been found that the return of the company is quote

improved then the market index return. Corporate social responsibility of the company

defines about long term sustainability position of the company. The country has taken various

initiative to improve the performance of society and living standards of the employees.

Risk and return:

A high level of risk is involved in the service industry because of the new trend and

information technology advancement in the industry. In this section of the report, associated

risk with the stock of the company and return has been studied to identify the capital

management level, risk level and other market performance of the company.

Historical risk parameters:

Historical risk parameters have been calculated on the basis of previous 5 year stock

return of the company and market index. Mean, standard deviation and correlation of stock

has been calculated and it has been found that average return of FGD is better than AORD.

Further, the standard deviation defines that the risk associated with LGD is higher.

Correlation calculations defines that relation among LGD and AORD, both the stock are

6 Morningstar. (2019). Legend corporation. (Accessed 10 May 2019); available from

https://www.morningstar.com/stocks/XASX/LGD/quote.html

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

7

negative. Changes into one stock would also affect the other stock price but in opposite

terms. Coefficient of variation also defines that the associated risk with LGD stock is higher.

LGD AORD

Mean 0.88% 0.62%

Standard deviation 0.085097 0.033437

Correlation

-

0.158417

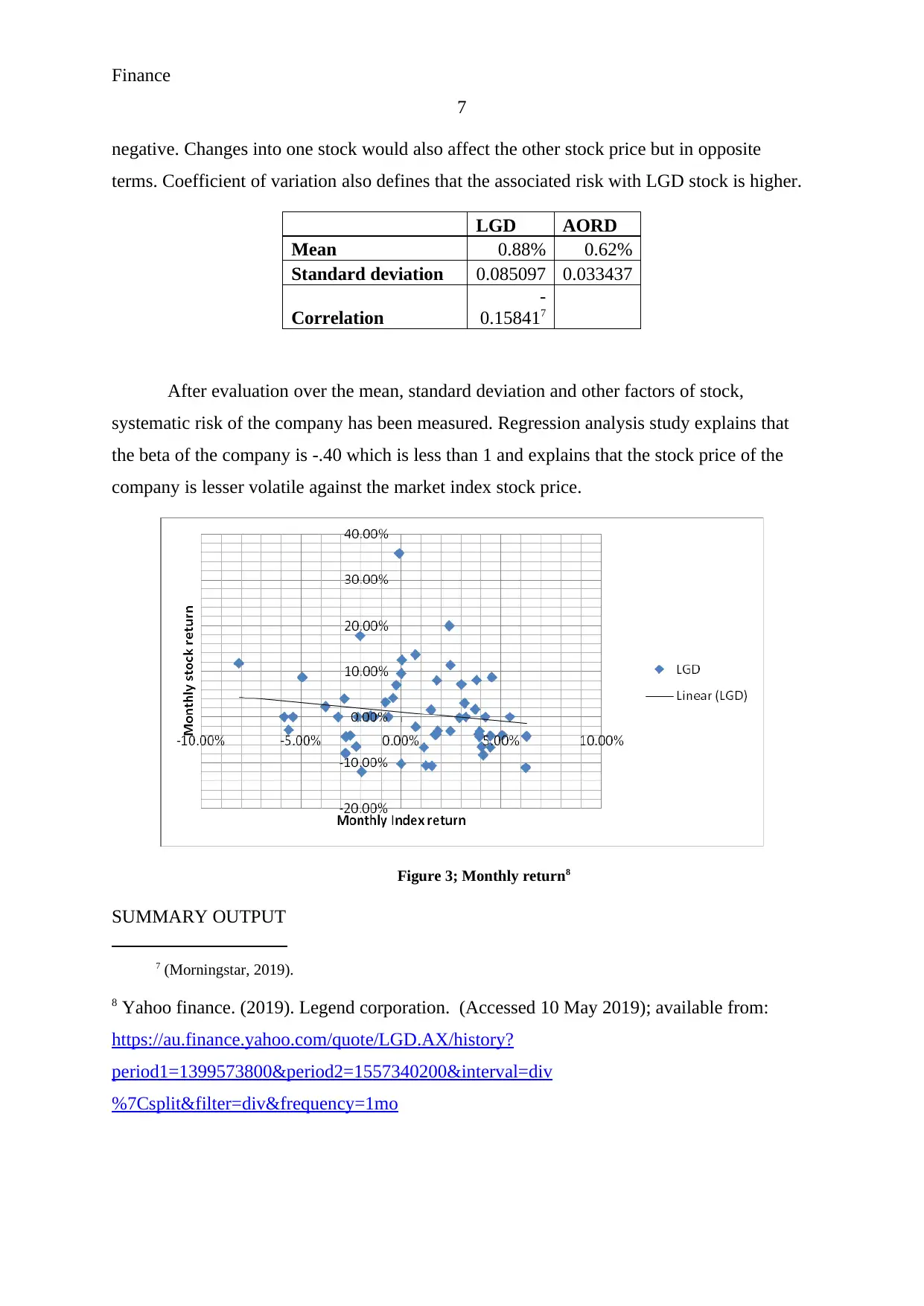

After evaluation over the mean, standard deviation and other factors of stock,

systematic risk of the company has been measured. Regression analysis study explains that

the beta of the company is -.40 which is less than 1 and explains that the stock price of the

company is lesser volatile against the market index stock price.

Figure 3; Monthly return8

SUMMARY OUTPUT

7 (Morningstar, 2019).

8 Yahoo finance. (2019). Legend corporation. (Accessed 10 May 2019); available from:

https://au.finance.yahoo.com/quote/LGD.AX/history?

period1=1399573800&period2=1557340200&interval=div

%7Csplit&filter=div&frequency=1mo

7

negative. Changes into one stock would also affect the other stock price but in opposite

terms. Coefficient of variation also defines that the associated risk with LGD stock is higher.

LGD AORD

Mean 0.88% 0.62%

Standard deviation 0.085097 0.033437

Correlation

-

0.158417

After evaluation over the mean, standard deviation and other factors of stock,

systematic risk of the company has been measured. Regression analysis study explains that

the beta of the company is -.40 which is less than 1 and explains that the stock price of the

company is lesser volatile against the market index stock price.

Figure 3; Monthly return8

SUMMARY OUTPUT

7 (Morningstar, 2019).

8 Yahoo finance. (2019). Legend corporation. (Accessed 10 May 2019); available from:

https://au.finance.yahoo.com/quote/LGD.AX/history?

period1=1399573800&period2=1557340200&interval=div

%7Csplit&filter=div&frequency=1mo

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

8

Regression Statistics

Multiple R

0.1584

11

R Square

0.0250

94

Adjusted R

Square

0.0079

91

Standard

Error

0.0847

56

Observatio

ns 59

ANOVA

df SS MS F

Significa

nce F

Regression 1 0.01054

0.010

54

1.467

183

0.23078

9

Residual 57 0.409468

0.007

184

Total 58 0.420007

Coeffic

ients

Standard

Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept

0.0112

48 0.011225

1.002

043

0.320

558 -0.01123

0.0337

25

-

0.01123

0.03372

5

X Variable

1

-

0.4031

5 0.332835

-

1.211

27

0.230

789 -1.06965

0.2633

37

-

1.06965

0.26333

7

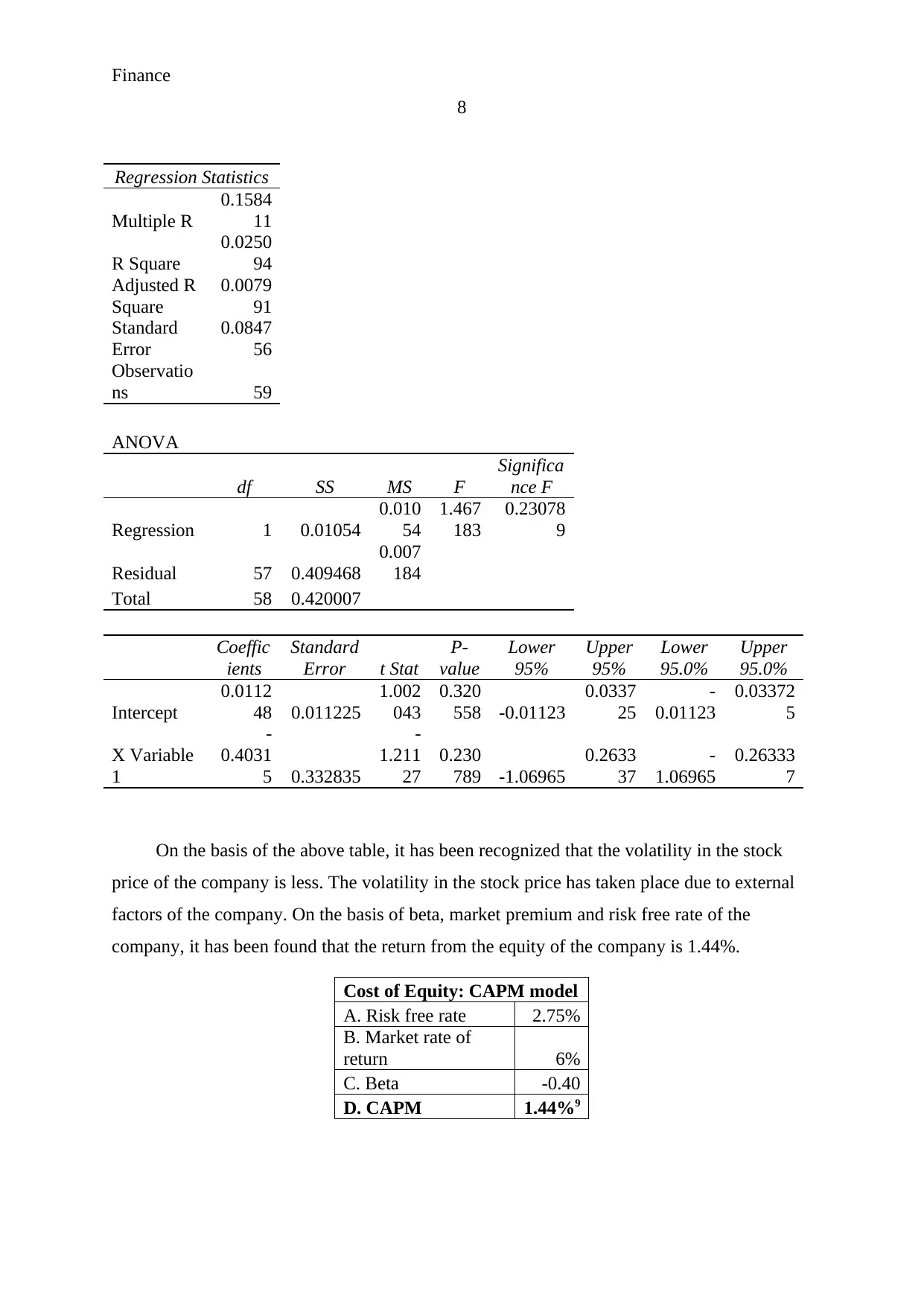

On the basis of the above table, it has been recognized that the volatility in the stock

price of the company is less. The volatility in the stock price has taken place due to external

factors of the company. On the basis of beta, market premium and risk free rate of the

company, it has been found that the return from the equity of the company is 1.44%.

Cost of Equity: CAPM model

A. Risk free rate 2.75%

B. Market rate of

return 6%

C. Beta -0.40

D. CAPM 1.44%9

8

Regression Statistics

Multiple R

0.1584

11

R Square

0.0250

94

Adjusted R

Square

0.0079

91

Standard

Error

0.0847

56

Observatio

ns 59

ANOVA

df SS MS F

Significa

nce F

Regression 1 0.01054

0.010

54

1.467

183

0.23078

9

Residual 57 0.409468

0.007

184

Total 58 0.420007

Coeffic

ients

Standard

Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept

0.0112

48 0.011225

1.002

043

0.320

558 -0.01123

0.0337

25

-

0.01123

0.03372

5

X Variable

1

-

0.4031

5 0.332835

-

1.211

27

0.230

789 -1.06965

0.2633

37

-

1.06965

0.26333

7

On the basis of the above table, it has been recognized that the volatility in the stock

price of the company is less. The volatility in the stock price has taken place due to external

factors of the company. On the basis of beta, market premium and risk free rate of the

company, it has been found that the return from the equity of the company is 1.44%.

Cost of Equity: CAPM model

A. Risk free rate 2.75%

B. Market rate of

return 6%

C. Beta -0.40

D. CAPM 1.44%9

Finance

9

Being a manager of the firm, it has been found that the cost of equity of the company is

quite lower which could be further controlled through managing the capital structure and

applying various dividend distribution strategies.

Estimating default risk and cost of debt:

On the basis of rating given to the debt of the company, it has been found that the debt

of the company is of a rating. It explains that the risk level associated with the debt of the

company is quite lower and investors could invest into the debt without any hesitation.

Further, financial ratios have been conducted on the company:

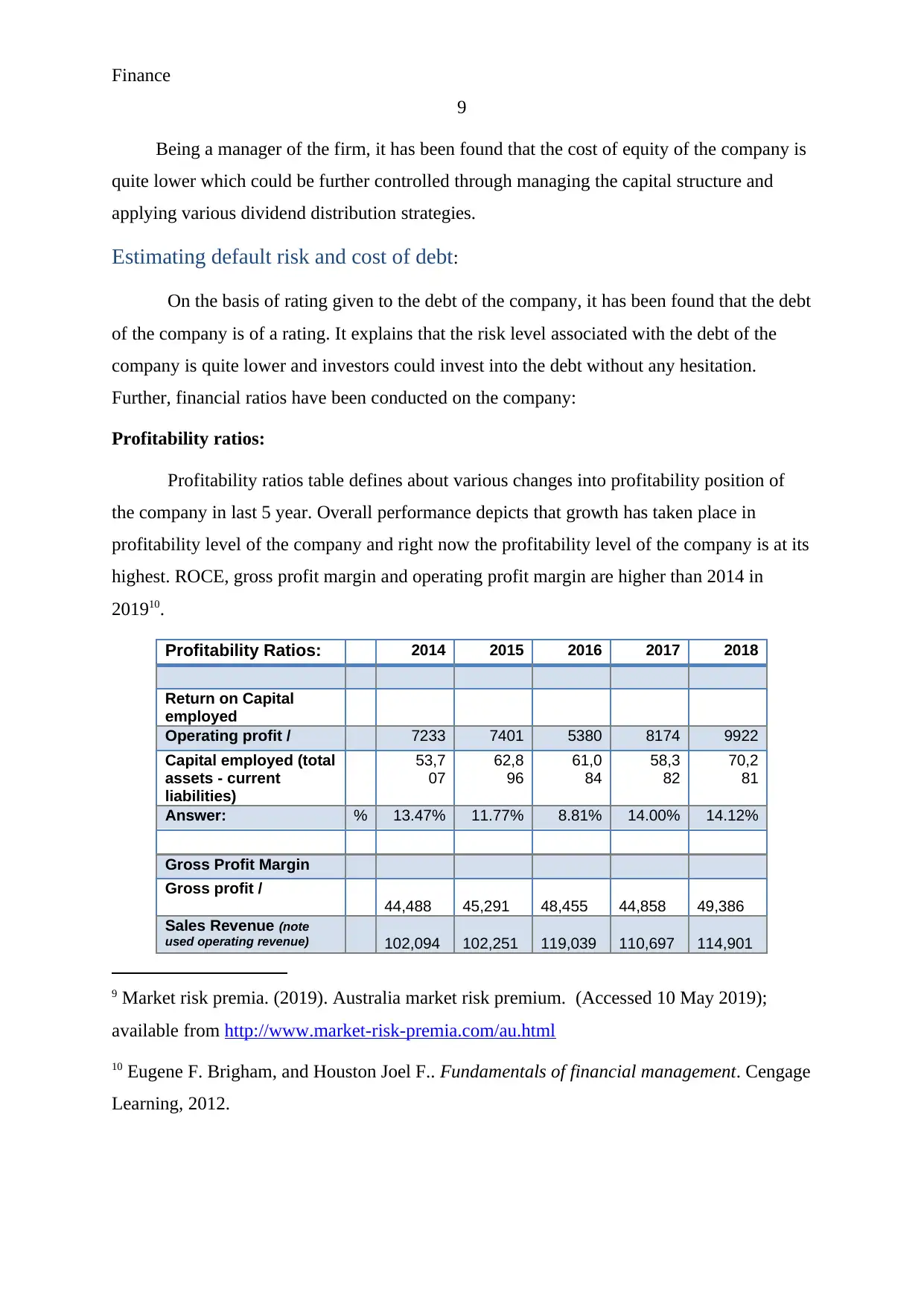

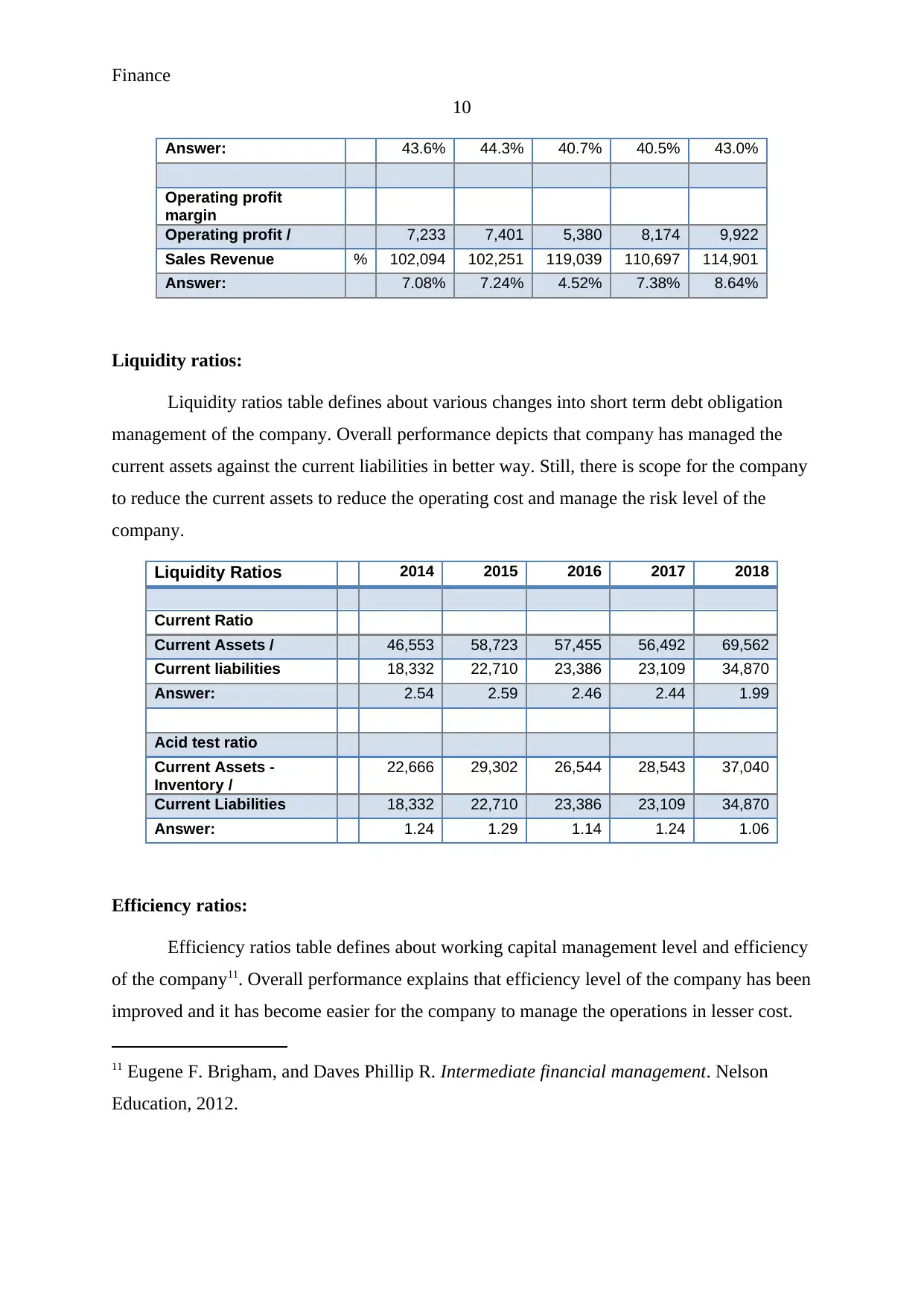

Profitability ratios:

Profitability ratios table defines about various changes into profitability position of

the company in last 5 year. Overall performance depicts that growth has taken place in

profitability level of the company and right now the profitability level of the company is at its

highest. ROCE, gross profit margin and operating profit margin are higher than 2014 in

201910.

Profitability Ratios: 2014 2015 2016 2017 2018

Return on Capital

employed

Operating profit / 7233 7401 5380 8174 9922

Capital employed (total

assets - current

liabilities)

53,7

07

62,8

96

61,0

84

58,3

82

70,2

81

Answer: % 13.47% 11.77% 8.81% 14.00% 14.12%

Gross Profit Margin

Gross profit /

44,488 45,291 48,455 44,858 49,386

Sales Revenue (note

used operating revenue) 102,094 102,251 119,039 110,697 114,901

9 Market risk premia. (2019). Australia market risk premium. (Accessed 10 May 2019);

available from http://www.market-risk-premia.com/au.html

10 Eugene F. Brigham, and Houston Joel F.. Fundamentals of financial management. Cengage

Learning, 2012.

9

Being a manager of the firm, it has been found that the cost of equity of the company is

quite lower which could be further controlled through managing the capital structure and

applying various dividend distribution strategies.

Estimating default risk and cost of debt:

On the basis of rating given to the debt of the company, it has been found that the debt

of the company is of a rating. It explains that the risk level associated with the debt of the

company is quite lower and investors could invest into the debt without any hesitation.

Further, financial ratios have been conducted on the company:

Profitability ratios:

Profitability ratios table defines about various changes into profitability position of

the company in last 5 year. Overall performance depicts that growth has taken place in

profitability level of the company and right now the profitability level of the company is at its

highest. ROCE, gross profit margin and operating profit margin are higher than 2014 in

201910.

Profitability Ratios: 2014 2015 2016 2017 2018

Return on Capital

employed

Operating profit / 7233 7401 5380 8174 9922

Capital employed (total

assets - current

liabilities)

53,7

07

62,8

96

61,0

84

58,3

82

70,2

81

Answer: % 13.47% 11.77% 8.81% 14.00% 14.12%

Gross Profit Margin

Gross profit /

44,488 45,291 48,455 44,858 49,386

Sales Revenue (note

used operating revenue) 102,094 102,251 119,039 110,697 114,901

9 Market risk premia. (2019). Australia market risk premium. (Accessed 10 May 2019);

available from http://www.market-risk-premia.com/au.html

10 Eugene F. Brigham, and Houston Joel F.. Fundamentals of financial management. Cengage

Learning, 2012.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Finance

10

Answer: 43.6% 44.3% 40.7% 40.5% 43.0%

Operating profit

margin

Operating profit / 7,233 7,401 5,380 8,174 9,922

Sales Revenue % 102,094 102,251 119,039 110,697 114,901

Answer: 7.08% 7.24% 4.52% 7.38% 8.64%

Liquidity ratios:

Liquidity ratios table defines about various changes into short term debt obligation

management of the company. Overall performance depicts that company has managed the

current assets against the current liabilities in better way. Still, there is scope for the company

to reduce the current assets to reduce the operating cost and manage the risk level of the

company.

Liquidity Ratios 2014 2015 2016 2017 2018

Current Ratio

Current Assets / 46,553 58,723 57,455 56,492 69,562

Current liabilities 18,332 22,710 23,386 23,109 34,870

Answer: 2.54 2.59 2.46 2.44 1.99

Acid test ratio

Current Assets -

Inventory /

22,666 29,302 26,544 28,543 37,040

Current Liabilities 18,332 22,710 23,386 23,109 34,870

Answer: 1.24 1.29 1.14 1.24 1.06

Efficiency ratios:

Efficiency ratios table defines about working capital management level and efficiency

of the company11. Overall performance explains that efficiency level of the company has been

improved and it has become easier for the company to manage the operations in lesser cost.

11 Eugene F. Brigham, and Daves Phillip R. Intermediate financial management. Nelson

Education, 2012.

10

Answer: 43.6% 44.3% 40.7% 40.5% 43.0%

Operating profit

margin

Operating profit / 7,233 7,401 5,380 8,174 9,922

Sales Revenue % 102,094 102,251 119,039 110,697 114,901

Answer: 7.08% 7.24% 4.52% 7.38% 8.64%

Liquidity ratios:

Liquidity ratios table defines about various changes into short term debt obligation

management of the company. Overall performance depicts that company has managed the

current assets against the current liabilities in better way. Still, there is scope for the company

to reduce the current assets to reduce the operating cost and manage the risk level of the

company.

Liquidity Ratios 2014 2015 2016 2017 2018

Current Ratio

Current Assets / 46,553 58,723 57,455 56,492 69,562

Current liabilities 18,332 22,710 23,386 23,109 34,870

Answer: 2.54 2.59 2.46 2.44 1.99

Acid test ratio

Current Assets -

Inventory /

22,666 29,302 26,544 28,543 37,040

Current Liabilities 18,332 22,710 23,386 23,109 34,870

Answer: 1.24 1.29 1.14 1.24 1.06

Efficiency ratios:

Efficiency ratios table defines about working capital management level and efficiency

of the company11. Overall performance explains that efficiency level of the company has been

improved and it has become easier for the company to manage the operations in lesser cost.

11 Eugene F. Brigham, and Daves Phillip R. Intermediate financial management. Nelson

Education, 2012.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

11

Asset Efficiency Ratios 2014 2015 2016 2017 2018

Trade payable payment period

ratio

Accounts payable/ 9,180 8,485 8,091 8,219 14,285

Cost of sales 57,606 56,960 70,584 65,839 65,515

Answer: (note the above needs

to be x 365)

58.17 54.37 41.84 45.56 79.59

Inventory Turnover (days)

Average Inventory / 23,887 29,421 30,911 27,949 32,522

Cost of Sales #

days

57,606 56,960 70,584 65,839 65,515

Answer: (note the above needs to be

x 365)

151.35 188.53 159.85 154.94 181.19

Receivables Turnover (days)

Average trade debtors / 15,4

38

22,7

43

21,0

30

20,4

27

27,7

54

Sales revenue (note used operating

revenue)

#

days

102,0

94

102,2

51

119,0

39

110,6

97

114,9

01

Answer: (note the above needs to be

x 365)

55.19 81.18 64.48 67.35 88.16

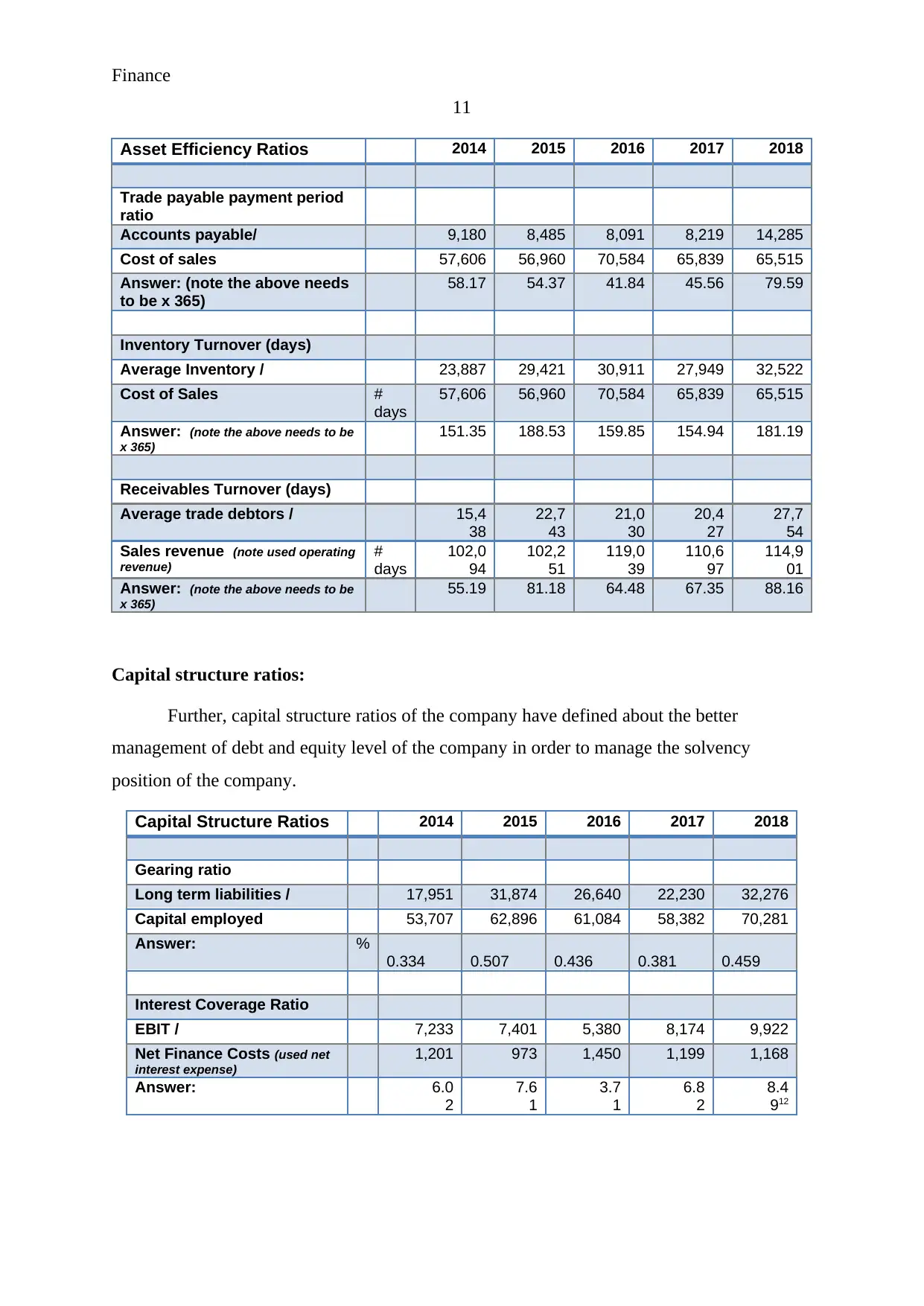

Capital structure ratios:

Further, capital structure ratios of the company have defined about the better

management of debt and equity level of the company in order to manage the solvency

position of the company.

Capital Structure Ratios 2014 2015 2016 2017 2018

Gearing ratio

Long term liabilities / 17,951 31,874 26,640 22,230 32,276

Capital employed 53,707 62,896 61,084 58,382 70,281

Answer: %

0.334 0.507 0.436 0.381 0.459

Interest Coverage Ratio

EBIT / 7,233 7,401 5,380 8,174 9,922

Net Finance Costs (used net

interest expense)

1,201 973 1,450 1,199 1,168

Answer: 6.0

2

7.6

1

3.7

1

6.8

2

8.4

912

11

Asset Efficiency Ratios 2014 2015 2016 2017 2018

Trade payable payment period

ratio

Accounts payable/ 9,180 8,485 8,091 8,219 14,285

Cost of sales 57,606 56,960 70,584 65,839 65,515

Answer: (note the above needs

to be x 365)

58.17 54.37 41.84 45.56 79.59

Inventory Turnover (days)

Average Inventory / 23,887 29,421 30,911 27,949 32,522

Cost of Sales #

days

57,606 56,960 70,584 65,839 65,515

Answer: (note the above needs to be

x 365)

151.35 188.53 159.85 154.94 181.19

Receivables Turnover (days)

Average trade debtors / 15,4

38

22,7

43

21,0

30

20,4

27

27,7

54

Sales revenue (note used operating

revenue)

#

days

102,0

94

102,2

51

119,0

39

110,6

97

114,9

01

Answer: (note the above needs to be

x 365)

55.19 81.18 64.48 67.35 88.16

Capital structure ratios:

Further, capital structure ratios of the company have defined about the better

management of debt and equity level of the company in order to manage the solvency

position of the company.

Capital Structure Ratios 2014 2015 2016 2017 2018

Gearing ratio

Long term liabilities / 17,951 31,874 26,640 22,230 32,276

Capital employed 53,707 62,896 61,084 58,382 70,281

Answer: %

0.334 0.507 0.436 0.381 0.459

Interest Coverage Ratio

EBIT / 7,233 7,401 5,380 8,174 9,922

Net Finance Costs (used net

interest expense)

1,201 973 1,450 1,199 1,168

Answer: 6.0

2

7.6

1

3.7

1

6.8

2

8.4

912

Finance

12

Market efficiency ratios:

Market efficiency ratios of the company also define about the better improvement in

the company performance from 2014 to 2019. Overall market performance of the company

has been improved at great extent.

Market value Ratios 2014 2015 2016 2017 2018

Earnings per share

Net income 6,694 6,856 5,171 3,741 5,978

Weighted average shares

outstanding

219,500 219,200 218,905 218,320 213,500

Answer:

0.030 0.031 0.024 0.017 0.028

Dividend coverage ratio

Net income / 6,694 6,856 5,171 3,741 5,978

Dividend paid to shareholders 4,061 3,836 3,502 2,620 2,817

Answer: 1.64

8

1.78

7

1.47

7

1.42

8

2.12

2

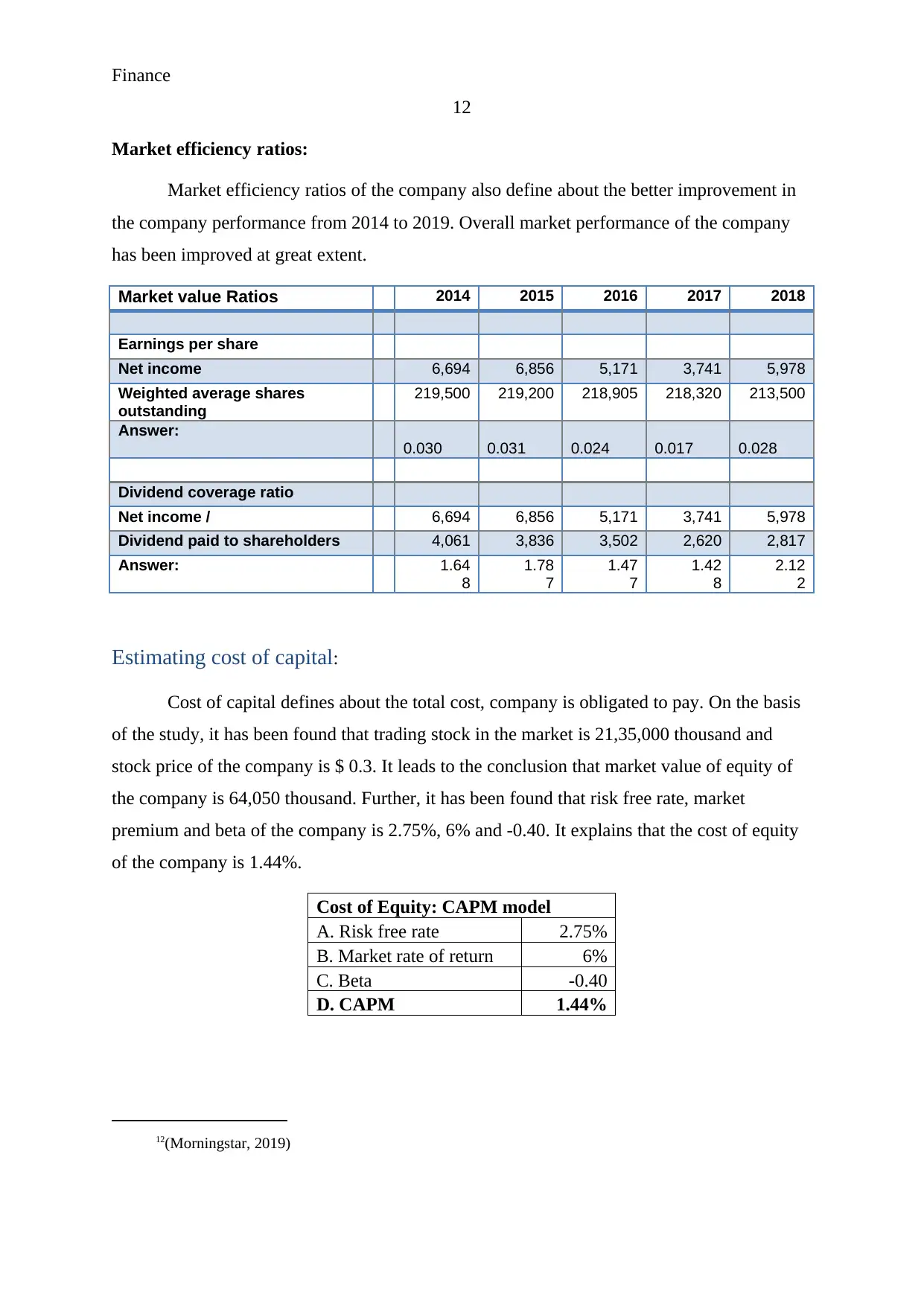

Estimating cost of capital:

Cost of capital defines about the total cost, company is obligated to pay. On the basis

of the study, it has been found that trading stock in the market is 21,35,000 thousand and

stock price of the company is $ 0.3. It leads to the conclusion that market value of equity of

the company is 64,050 thousand. Further, it has been found that risk free rate, market

premium and beta of the company is 2.75%, 6% and -0.40. It explains that the cost of equity

of the company is 1.44%.

Cost of Equity: CAPM model

A. Risk free rate 2.75%

B. Market rate of return 6%

C. Beta -0.40

D. CAPM 1.44%

12(Morningstar, 2019)

12

Market efficiency ratios:

Market efficiency ratios of the company also define about the better improvement in

the company performance from 2014 to 2019. Overall market performance of the company

has been improved at great extent.

Market value Ratios 2014 2015 2016 2017 2018

Earnings per share

Net income 6,694 6,856 5,171 3,741 5,978

Weighted average shares

outstanding

219,500 219,200 218,905 218,320 213,500

Answer:

0.030 0.031 0.024 0.017 0.028

Dividend coverage ratio

Net income / 6,694 6,856 5,171 3,741 5,978

Dividend paid to shareholders 4,061 3,836 3,502 2,620 2,817

Answer: 1.64

8

1.78

7

1.47

7

1.42

8

2.12

2

Estimating cost of capital:

Cost of capital defines about the total cost, company is obligated to pay. On the basis

of the study, it has been found that trading stock in the market is 21,35,000 thousand and

stock price of the company is $ 0.3. It leads to the conclusion that market value of equity of

the company is 64,050 thousand. Further, it has been found that risk free rate, market

premium and beta of the company is 2.75%, 6% and -0.40. It explains that the cost of equity

of the company is 1.44%.

Cost of Equity: CAPM model

A. Risk free rate 2.75%

B. Market rate of return 6%

C. Beta -0.40

D. CAPM 1.44%

12(Morningstar, 2019)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.