Comprehensive Financial Analysis of PepsiCo's Performance (2017-2018)

VerifiedAdded on 2022/11/29

|18

|2798

|212

Report

AI Summary

This report provides a comprehensive financial analysis of PepsiCo, examining its performance from 2017 to 2018. It begins with an overview of PepsiCo's history and operations, followed by an in-depth evaluation of its income statements, highlighting trends in revenue, gross profit, and operating income. The analysis extends to the statements of cash flow and financial position, scrutinizing the inflows and outflows from operating, investing, and financing activities, as well as changes in assets, liabilities, and equity. Key financial ratios, including short-term and long-term solvency ratios, inventory turnover, sales to accounts receivable, and return on equity (ROE), are calculated and interpreted to assess PepsiCo's financial health. The report also explores the company's capital structure, emphasizing the debt-to-equity ratio, and concludes with recommendations based on the financial analysis.

1

Theory and its use in the financial statement

Theory and its use in the financial statement

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Table of Contents

History and overview of PepsiCo..............................................................................................3

Evaluation of statement of Income............................................................................................3

Finding and analysis of Statement of outflow and inflow of Cash and statement of financial

position.......................................................................................................................................5

Evaluation and study of financial Ratios.................................................................................10

Finding and analysis of long term solvency.............................................................................11

Finding and analysis of Sales to inventory..............................................................................11

Findings and analysis of Sales to Account Receivables..........................................................12

Findings and analysis of Sales and Earning.............................................................................13

Return on Equity and leverage of PepsiCo..............................................................................15

Recommendation and conclusions...........................................................................................15

References................................................................................................................................17

Table of Contents

History and overview of PepsiCo..............................................................................................3

Evaluation of statement of Income............................................................................................3

Finding and analysis of Statement of outflow and inflow of Cash and statement of financial

position.......................................................................................................................................5

Evaluation and study of financial Ratios.................................................................................10

Finding and analysis of long term solvency.............................................................................11

Finding and analysis of Sales to inventory..............................................................................11

Findings and analysis of Sales to Account Receivables..........................................................12

Findings and analysis of Sales and Earning.............................................................................13

Return on Equity and leverage of PepsiCo..............................................................................15

Recommendation and conclusions...........................................................................................15

References................................................................................................................................17

3

History and overview of PepsiCo

PepsiCo is one of the largest sellers and manufacturers of beverage and food in the

industry of beverage and food. PepsiCo Food sector includes products such as pasta, cereals,

chips and flavored snacks. The beverage products are juices, sports drinks, coffee, tea, soft

drinks. Out of forty trademarks of packaged goods PepsiCo has already owned nine of them.

PepsiCo holds 22 different brands in its portfolio such as Lays, Pepsi, and Gatorade etc. In

1965 a huge merger took place between Frito Lay and PepsiCo. This merger assists PepsiCo

to expand its business in the industry of beverage and foods. The competitors of PepsiCo are

private, global and regional companies. Companies such as Kellogg, ConAgra foods are the

main competitor in the industry of food and companies such as Coca-Cola, Cott Corporation,

monster Beverage Company are the main competitors in beverage industry.

Evaluation of statement of Income

PepsiCo

Financial position of consolidated Income

(in millions)

Particulars

2018 2017

us

dollar

us

dollar

Revenue- Net 64,661 63,525

Less: Cost 29381 28796

GROSS Earnings 35280 34729

Operating Expenses of PepsiCo (25,170 (24,453

History and overview of PepsiCo

PepsiCo is one of the largest sellers and manufacturers of beverage and food in the

industry of beverage and food. PepsiCo Food sector includes products such as pasta, cereals,

chips and flavored snacks. The beverage products are juices, sports drinks, coffee, tea, soft

drinks. Out of forty trademarks of packaged goods PepsiCo has already owned nine of them.

PepsiCo holds 22 different brands in its portfolio such as Lays, Pepsi, and Gatorade etc. In

1965 a huge merger took place between Frito Lay and PepsiCo. This merger assists PepsiCo

to expand its business in the industry of beverage and foods. The competitors of PepsiCo are

private, global and regional companies. Companies such as Kellogg, ConAgra foods are the

main competitor in the industry of food and companies such as Coca-Cola, Cott Corporation,

monster Beverage Company are the main competitors in beverage industry.

Evaluation of statement of Income

PepsiCo

Financial position of consolidated Income

(in millions)

Particulars

2018 2017

us

dollar

us

dollar

Revenue- Net 64,661 63,525

Less: Cost 29381 28796

GROSS Earnings 35280 34729

Operating Expenses of PepsiCo (25,170 (24,453

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

) )

OPERATING PROFIT of PepsiCo 10,110 10,276

Expenses incurred on interest (1,525) (1,151)

Income- income accrued from interest 306 244

Other pension and retirement benefit income 298 233

INCOME BEFORE TAX 9,189 9,602

Income Tax Credit/(Expense) 3,370 (4,694)

INCOME AFTER TAX 12,559 4,908

Profit distributable to Non-Controlling Interests (44) (51)

Profit attributable to PepsiCo shareholders 12,515 4,857

Outstanding shares : Basic 1,415 1,425

Diluted 1,425 1,438

EPS- Diluted 8.78 3.38

EPS - Basic 8.84 3.41

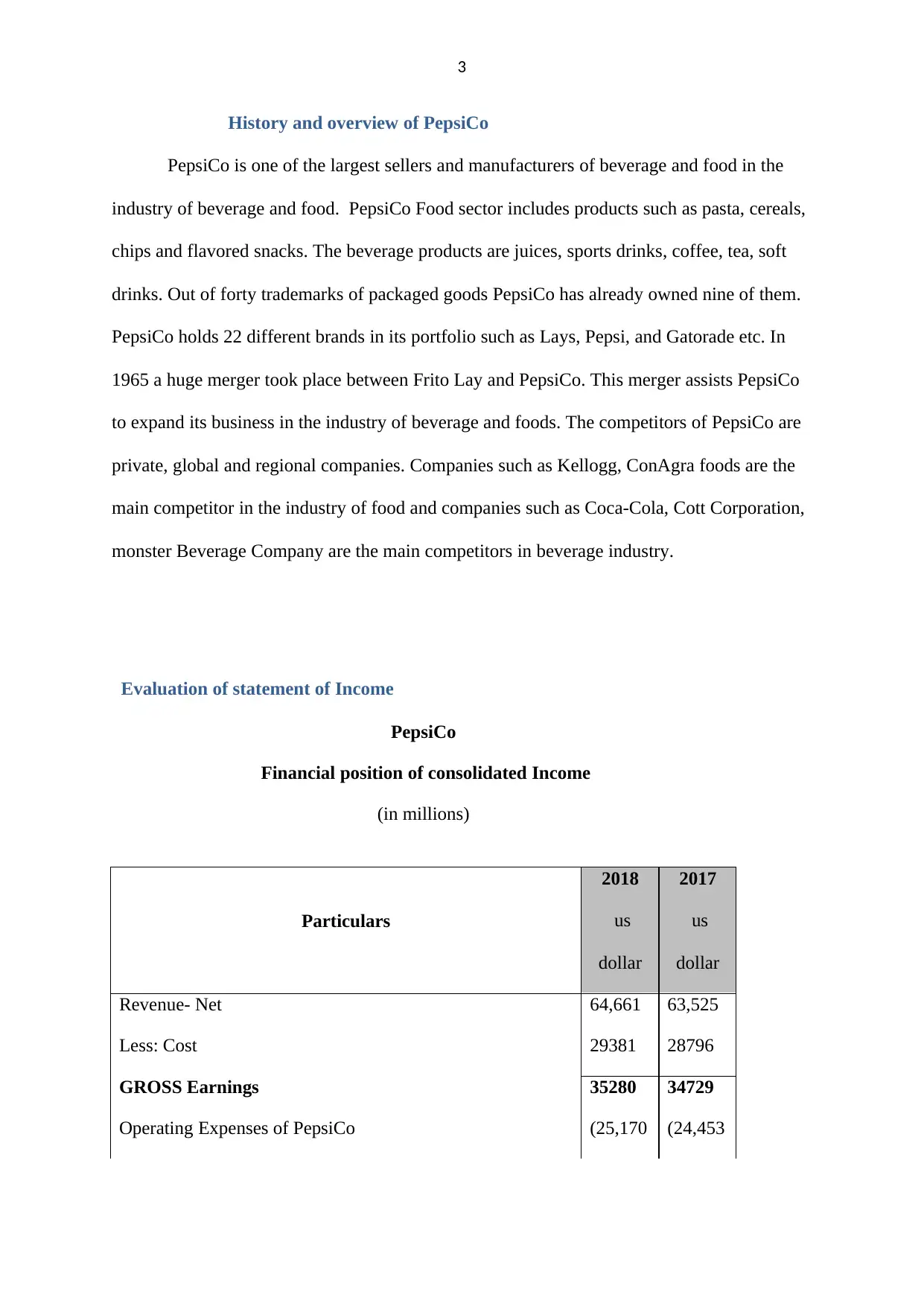

While evaluating the statement of income of 2018 and 2017 which is the most recent

year’s statement of income of PepsiCo, it has been studied that in 2017 net revenue was us

dollar 63525 million and in 2018 it become us dollar 64661 million. Trend which is noticed

net earnings of PepsiCo is increasing trend. The percentage increase in net revenue is 1.8

percent in 2018. The gross profit of PepsiCo rises above from us dollar 34729 to us dollar

35280 million. The percentage increased in the gross profit is 1.59 in 2018. This represents

that Sales of PepsiCo increased rapidly in 2018. PepsiCo by including the nutritional products

in the year 2017 has expanded its profit.

While studying the statement of income it has been seen that Operating income in 2018

decreases by us dollar 166 million. The diminishing trend represent that PepsiCo cost of

) )

OPERATING PROFIT of PepsiCo 10,110 10,276

Expenses incurred on interest (1,525) (1,151)

Income- income accrued from interest 306 244

Other pension and retirement benefit income 298 233

INCOME BEFORE TAX 9,189 9,602

Income Tax Credit/(Expense) 3,370 (4,694)

INCOME AFTER TAX 12,559 4,908

Profit distributable to Non-Controlling Interests (44) (51)

Profit attributable to PepsiCo shareholders 12,515 4,857

Outstanding shares : Basic 1,415 1,425

Diluted 1,425 1,438

EPS- Diluted 8.78 3.38

EPS - Basic 8.84 3.41

While evaluating the statement of income of 2018 and 2017 which is the most recent

year’s statement of income of PepsiCo, it has been studied that in 2017 net revenue was us

dollar 63525 million and in 2018 it become us dollar 64661 million. Trend which is noticed

net earnings of PepsiCo is increasing trend. The percentage increase in net revenue is 1.8

percent in 2018. The gross profit of PepsiCo rises above from us dollar 34729 to us dollar

35280 million. The percentage increased in the gross profit is 1.59 in 2018. This represents

that Sales of PepsiCo increased rapidly in 2018. PepsiCo by including the nutritional products

in the year 2017 has expanded its profit.

While studying the statement of income it has been seen that Operating income in 2018

decreases by us dollar 166 million. The diminishing trend represent that PepsiCo cost of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

operating activities also increases as compared to corresponding year 2017. Income which

accrued from interest by investment in different portfolio from interest has experienced a

trend which was above expectations by PepsiCo in 2018. The income accrued from interest

has experienced a growth rate of 25% in 2018. The income accrued before tax experienced a

diminishing trend in 2018. The income accrued before tax PepsiCo in 2017 was us dollar

9602 million and shown a fall down in the income amount in 2018. Total of 413 million US

dollar decreased in 2018. A fall down in the statistics of the income before tax in 2018 has

been noticed. The income before tax decreases by 4.3% in 2018.

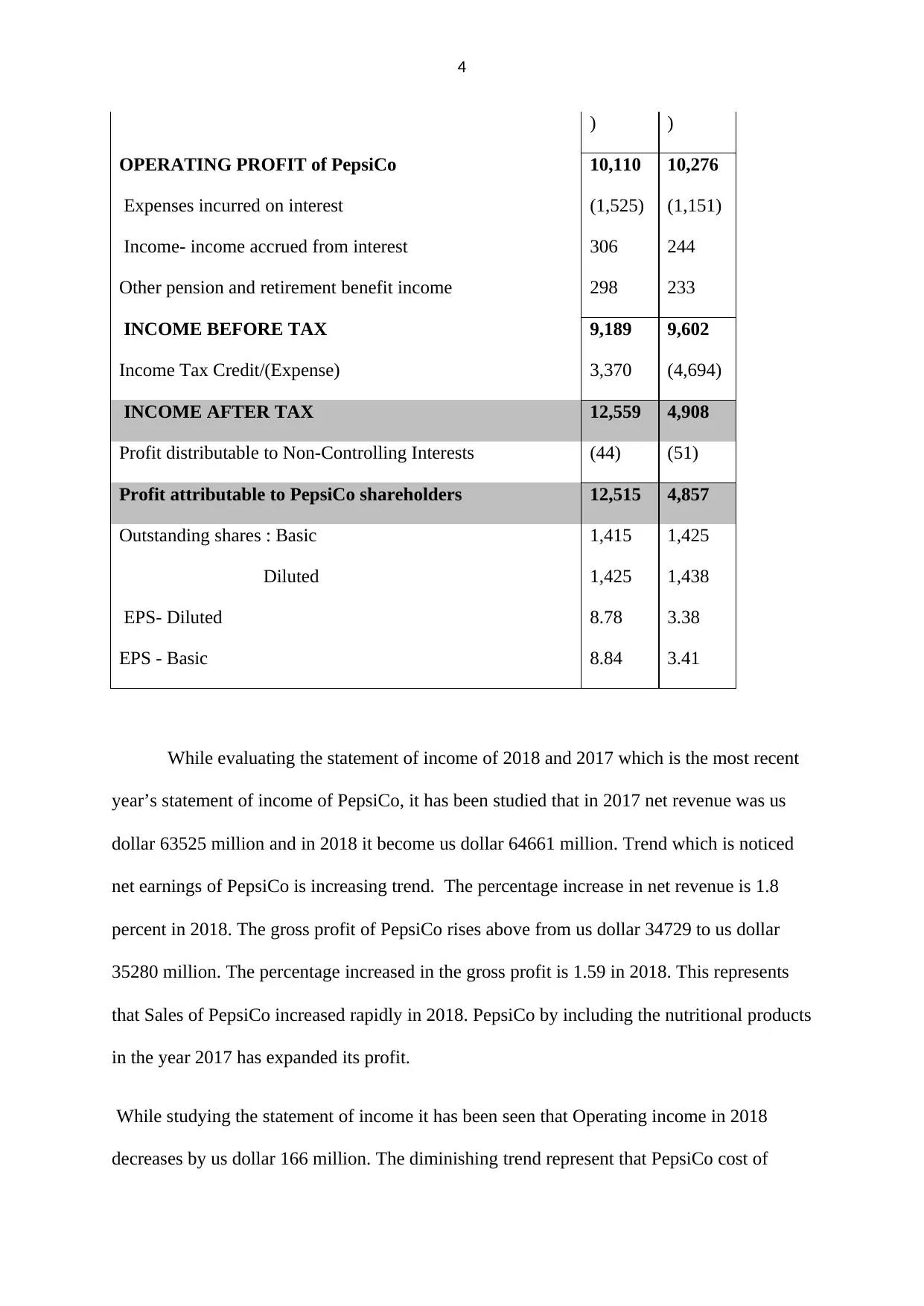

Finding and analysis of Statement of outflow and inflow of Cash and statement of

financial position

PepsiCo

Statement of Financial position

(in millions

Particulars

2018 2017

us dollar us dollar

LIABILITIES & Equities of PepsiCo

PepsiCo Common Shareholders’ Equity 14518 11045

Preferred stock- Repurchase - (197)

Interest- Non-Controlling 84 92

Stock - preferred - 41

Total Equity of PepsiCo 14602 10981

Liabilities- long term 28295 33796

Other obligations 9114 11283

operating activities also increases as compared to corresponding year 2017. Income which

accrued from interest by investment in different portfolio from interest has experienced a

trend which was above expectations by PepsiCo in 2018. The income accrued from interest

has experienced a growth rate of 25% in 2018. The income accrued before tax experienced a

diminishing trend in 2018. The income accrued before tax PepsiCo in 2017 was us dollar

9602 million and shown a fall down in the income amount in 2018. Total of 413 million US

dollar decreased in 2018. A fall down in the statistics of the income before tax in 2018 has

been noticed. The income before tax decreases by 4.3% in 2018.

Finding and analysis of Statement of outflow and inflow of Cash and statement of

financial position

PepsiCo

Statement of Financial position

(in millions

Particulars

2018 2017

us dollar us dollar

LIABILITIES & Equities of PepsiCo

PepsiCo Common Shareholders’ Equity 14518 11045

Preferred stock- Repurchase - (197)

Interest- Non-Controlling 84 92

Stock - preferred - 41

Total Equity of PepsiCo 14602 10981

Liabilities- long term 28295 33796

Other obligations 9114 11283

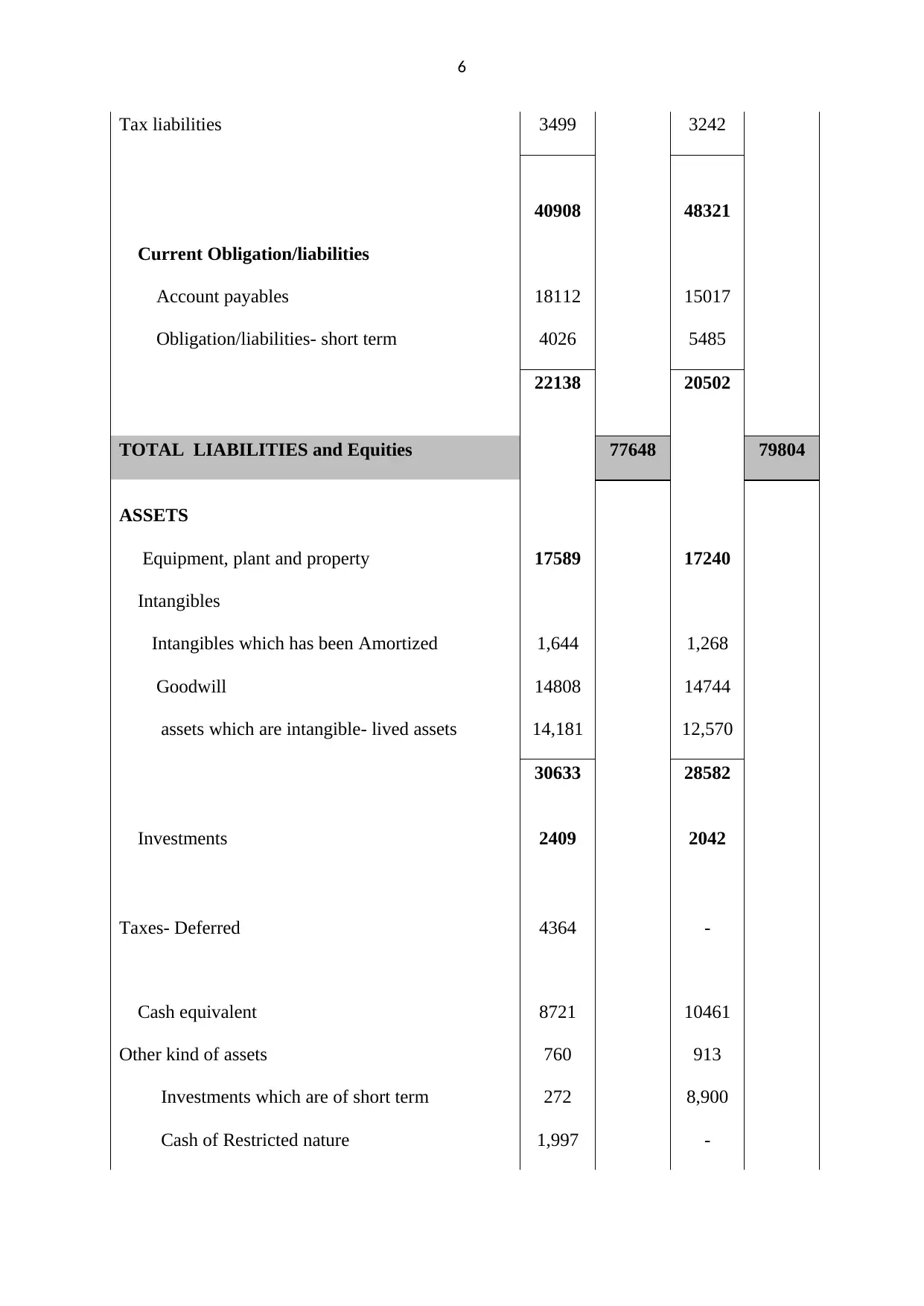

6

Tax liabilities 3499 3242

40908 48321

Current Obligation/liabilities

Account payables 18112 15017

Obligation/liabilities- short term 4026 5485

22138 20502

TOTAL LIABILITIES and Equities 77648 79804

ASSETS

Equipment, plant and property 17589 17240

Intangibles

Intangibles which has been Amortized 1,644 1,268

Goodwill 14808 14744

assets which are intangible- lived assets 14,181 12,570

30633 28582

Investments 2409 2042

Taxes- Deferred 4364 -

Cash equivalent 8721 10461

Other kind of assets 760 913

Investments which are of short term 272 8,900

Cash of Restricted nature 1,997 -

Tax liabilities 3499 3242

40908 48321

Current Obligation/liabilities

Account payables 18112 15017

Obligation/liabilities- short term 4026 5485

22138 20502

TOTAL LIABILITIES and Equities 77648 79804

ASSETS

Equipment, plant and property 17589 17240

Intangibles

Intangibles which has been Amortized 1,644 1,268

Goodwill 14808 14744

assets which are intangible- lived assets 14,181 12,570

30633 28582

Investments 2409 2042

Taxes- Deferred 4364 -

Cash equivalent 8721 10461

Other kind of assets 760 913

Investments which are of short term 272 8,900

Cash of Restricted nature 1,997 -

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

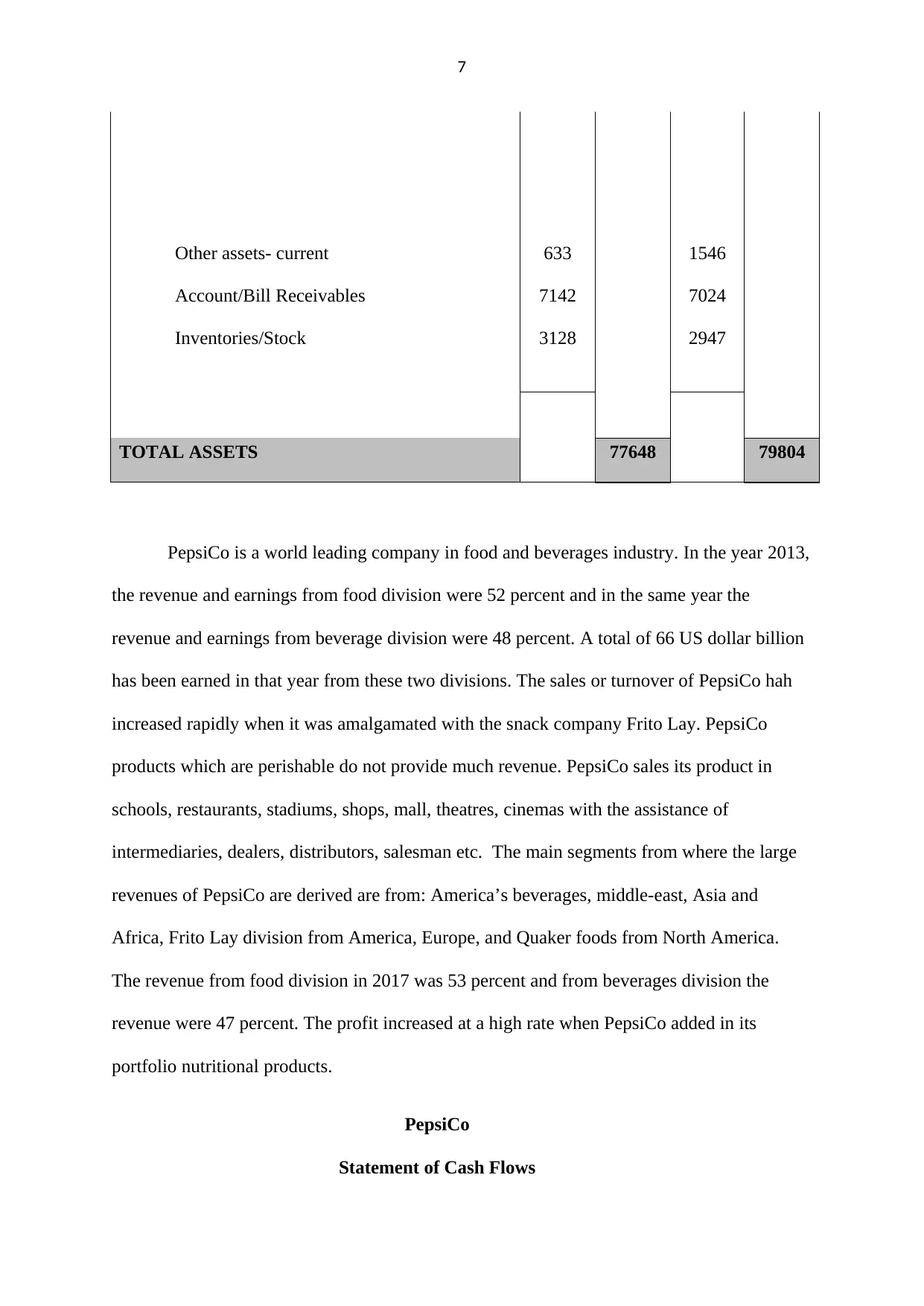

7

Other assets- current 633 1546

Account/Bill Receivables 7142 7024

Inventories/Stock 3128 2947

TOTAL ASSETS 77648 79804

PepsiCo is a world leading company in food and beverages industry. In the year 2013,

the revenue and earnings from food division were 52 percent and in the same year the

revenue and earnings from beverage division were 48 percent. A total of 66 US dollar billion

has been earned in that year from these two divisions. The sales or turnover of PepsiCo hah

increased rapidly when it was amalgamated with the snack company Frito Lay. PepsiCo

products which are perishable do not provide much revenue. PepsiCo sales its product in

schools, restaurants, stadiums, shops, mall, theatres, cinemas with the assistance of

intermediaries, dealers, distributors, salesman etc. The main segments from where the large

revenues of PepsiCo are derived are from: America’s beverages, middle-east, Asia and

Africa, Frito Lay division from America, Europe, and Quaker foods from North America.

The revenue from food division in 2017 was 53 percent and from beverages division the

revenue were 47 percent. The profit increased at a high rate when PepsiCo added in its

portfolio nutritional products.

PepsiCo

Statement of Cash Flows

Other assets- current 633 1546

Account/Bill Receivables 7142 7024

Inventories/Stock 3128 2947

TOTAL ASSETS 77648 79804

PepsiCo is a world leading company in food and beverages industry. In the year 2013,

the revenue and earnings from food division were 52 percent and in the same year the

revenue and earnings from beverage division were 48 percent. A total of 66 US dollar billion

has been earned in that year from these two divisions. The sales or turnover of PepsiCo hah

increased rapidly when it was amalgamated with the snack company Frito Lay. PepsiCo

products which are perishable do not provide much revenue. PepsiCo sales its product in

schools, restaurants, stadiums, shops, mall, theatres, cinemas with the assistance of

intermediaries, dealers, distributors, salesman etc. The main segments from where the large

revenues of PepsiCo are derived are from: America’s beverages, middle-east, Asia and

Africa, Frito Lay division from America, Europe, and Quaker foods from North America.

The revenue from food division in 2017 was 53 percent and from beverages division the

revenue were 47 percent. The profit increased at a high rate when PepsiCo added in its

portfolio nutritional products.

PepsiCo

Statement of Cash Flows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

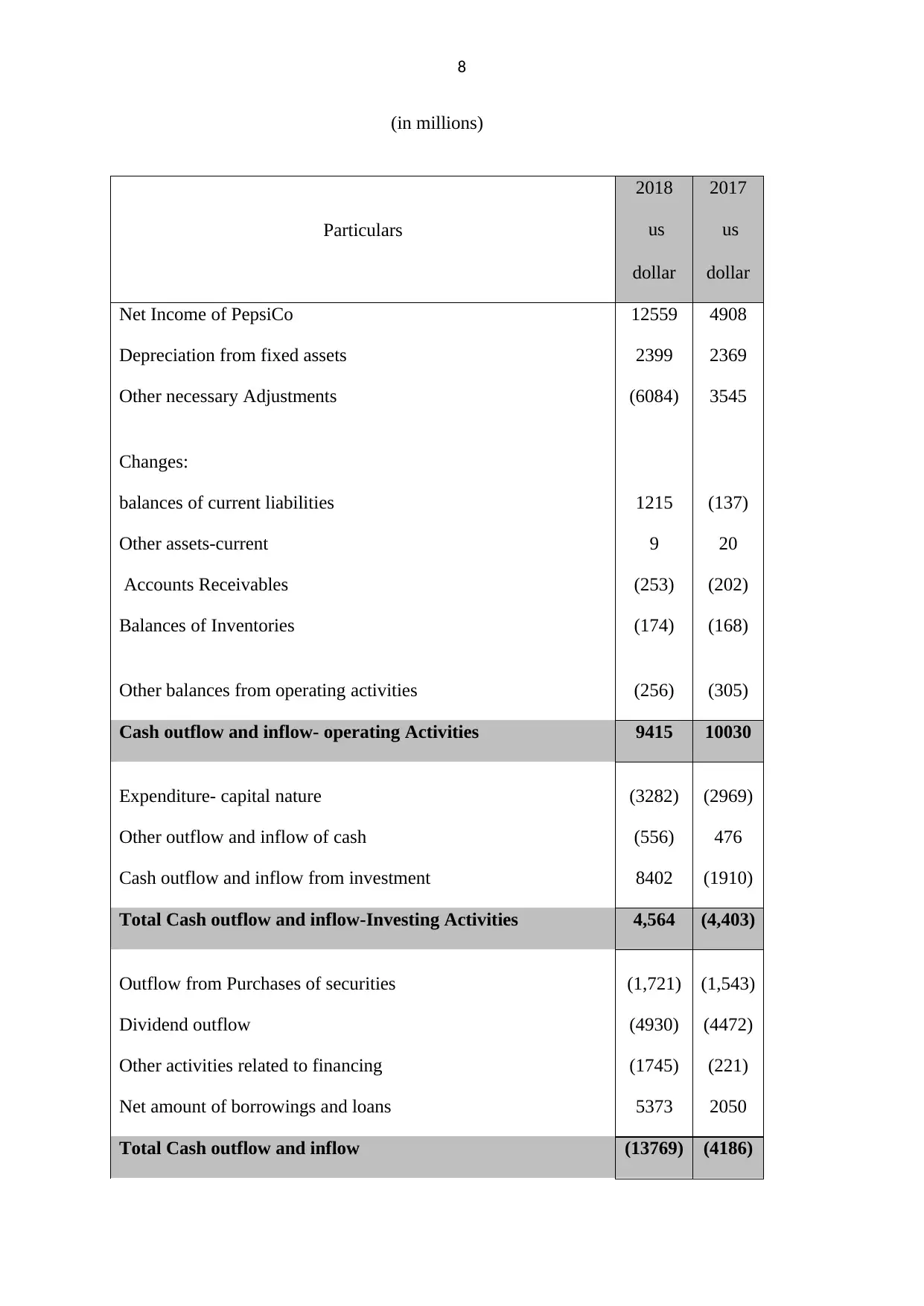

8

(in millions)

Particulars

2018 2017

us

dollar

us

dollar

Net Income of PepsiCo 12559 4908

Depreciation from fixed assets 2399 2369

Other necessary Adjustments (6084) 3545

Changes:

balances of current liabilities 1215 (137)

Other assets-current 9 20

Accounts Receivables (253) (202)

Balances of Inventories (174) (168)

Other balances from operating activities (256) (305)

Cash outflow and inflow- operating Activities 9415 10030

Expenditure- capital nature (3282) (2969)

Other outflow and inflow of cash (556) 476

Cash outflow and inflow from investment 8402 (1910)

Total Cash outflow and inflow-Investing Activities 4,564 (4,403)

Outflow from Purchases of securities (1,721) (1,543)

Dividend outflow (4930) (4472)

Other activities related to financing (1745) (221)

Net amount of borrowings and loans 5373 2050

Total Cash outflow and inflow (13769) (4186)

(in millions)

Particulars

2018 2017

us

dollar

us

dollar

Net Income of PepsiCo 12559 4908

Depreciation from fixed assets 2399 2369

Other necessary Adjustments (6084) 3545

Changes:

balances of current liabilities 1215 (137)

Other assets-current 9 20

Accounts Receivables (253) (202)

Balances of Inventories (174) (168)

Other balances from operating activities (256) (305)

Cash outflow and inflow- operating Activities 9415 10030

Expenditure- capital nature (3282) (2969)

Other outflow and inflow of cash (556) 476

Cash outflow and inflow from investment 8402 (1910)

Total Cash outflow and inflow-Investing Activities 4,564 (4,403)

Outflow from Purchases of securities (1,721) (1,543)

Dividend outflow (4930) (4472)

Other activities related to financing (1745) (221)

Net amount of borrowings and loans 5373 2050

Total Cash outflow and inflow (13769) (4186)

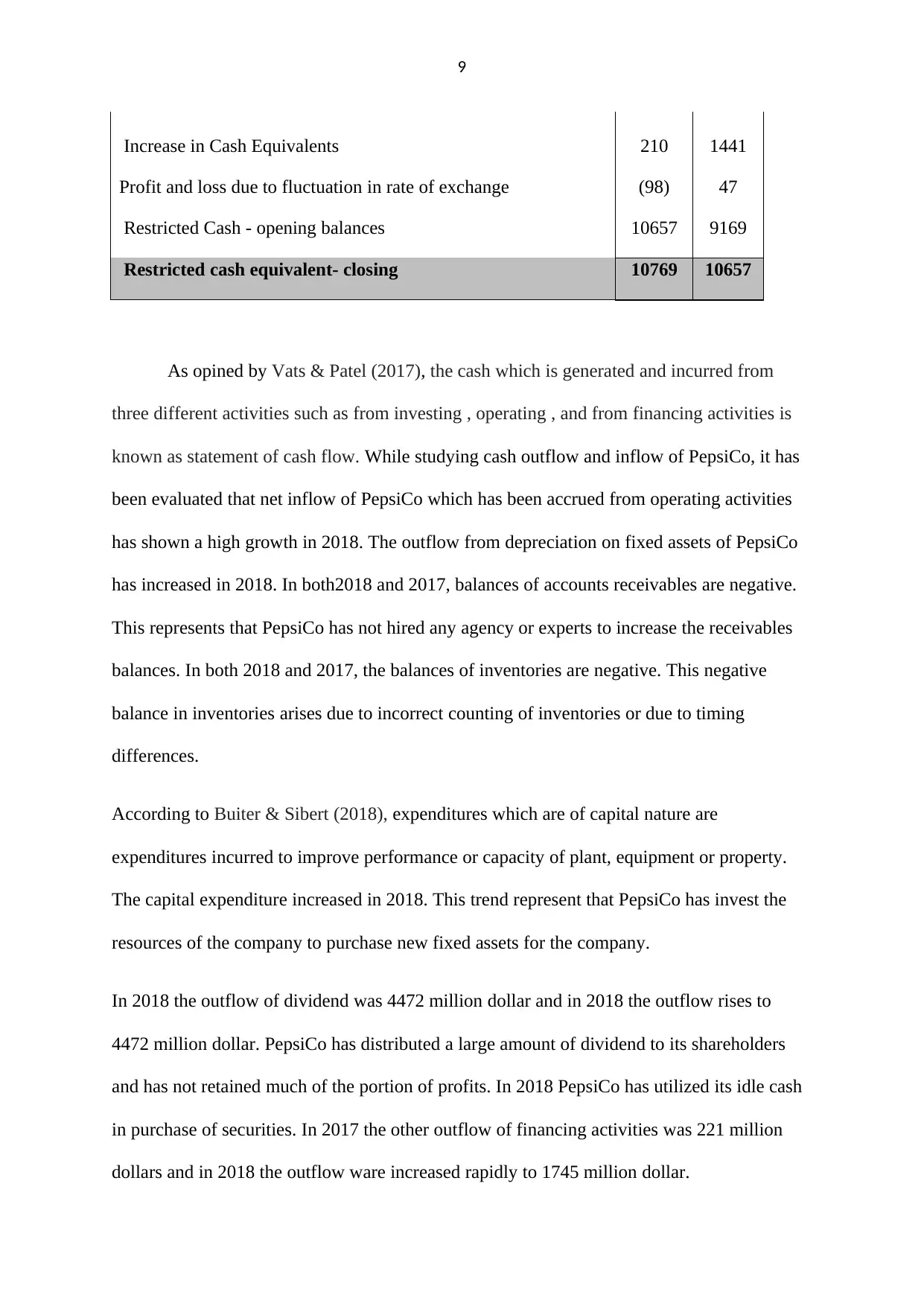

9

Increase in Cash Equivalents 210 1441

Profit and loss due to fluctuation in rate of exchange (98) 47

Restricted Cash - opening balances 10657 9169

Restricted cash equivalent- closing 10769 10657

As opined by Vats & Patel (2017), the cash which is generated and incurred from

three different activities such as from investing , operating , and from financing activities is

known as statement of cash flow. While studying cash outflow and inflow of PepsiCo, it has

been evaluated that net inflow of PepsiCo which has been accrued from operating activities

has shown a high growth in 2018. The outflow from depreciation on fixed assets of PepsiCo

has increased in 2018. In both2018 and 2017, balances of accounts receivables are negative.

This represents that PepsiCo has not hired any agency or experts to increase the receivables

balances. In both 2018 and 2017, the balances of inventories are negative. This negative

balance in inventories arises due to incorrect counting of inventories or due to timing

differences.

According to Buiter & Sibert (2018), expenditures which are of capital nature are

expenditures incurred to improve performance or capacity of plant, equipment or property.

The capital expenditure increased in 2018. This trend represent that PepsiCo has invest the

resources of the company to purchase new fixed assets for the company.

In 2018 the outflow of dividend was 4472 million dollar and in 2018 the outflow rises to

4472 million dollar. PepsiCo has distributed a large amount of dividend to its shareholders

and has not retained much of the portion of profits. In 2018 PepsiCo has utilized its idle cash

in purchase of securities. In 2017 the other outflow of financing activities was 221 million

dollars and in 2018 the outflow ware increased rapidly to 1745 million dollar.

Increase in Cash Equivalents 210 1441

Profit and loss due to fluctuation in rate of exchange (98) 47

Restricted Cash - opening balances 10657 9169

Restricted cash equivalent- closing 10769 10657

As opined by Vats & Patel (2017), the cash which is generated and incurred from

three different activities such as from investing , operating , and from financing activities is

known as statement of cash flow. While studying cash outflow and inflow of PepsiCo, it has

been evaluated that net inflow of PepsiCo which has been accrued from operating activities

has shown a high growth in 2018. The outflow from depreciation on fixed assets of PepsiCo

has increased in 2018. In both2018 and 2017, balances of accounts receivables are negative.

This represents that PepsiCo has not hired any agency or experts to increase the receivables

balances. In both 2018 and 2017, the balances of inventories are negative. This negative

balance in inventories arises due to incorrect counting of inventories or due to timing

differences.

According to Buiter & Sibert (2018), expenditures which are of capital nature are

expenditures incurred to improve performance or capacity of plant, equipment or property.

The capital expenditure increased in 2018. This trend represent that PepsiCo has invest the

resources of the company to purchase new fixed assets for the company.

In 2018 the outflow of dividend was 4472 million dollar and in 2018 the outflow rises to

4472 million dollar. PepsiCo has distributed a large amount of dividend to its shareholders

and has not retained much of the portion of profits. In 2018 PepsiCo has utilized its idle cash

in purchase of securities. In 2017 the other outflow of financing activities was 221 million

dollars and in 2018 the outflow ware increased rapidly to 1745 million dollar.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

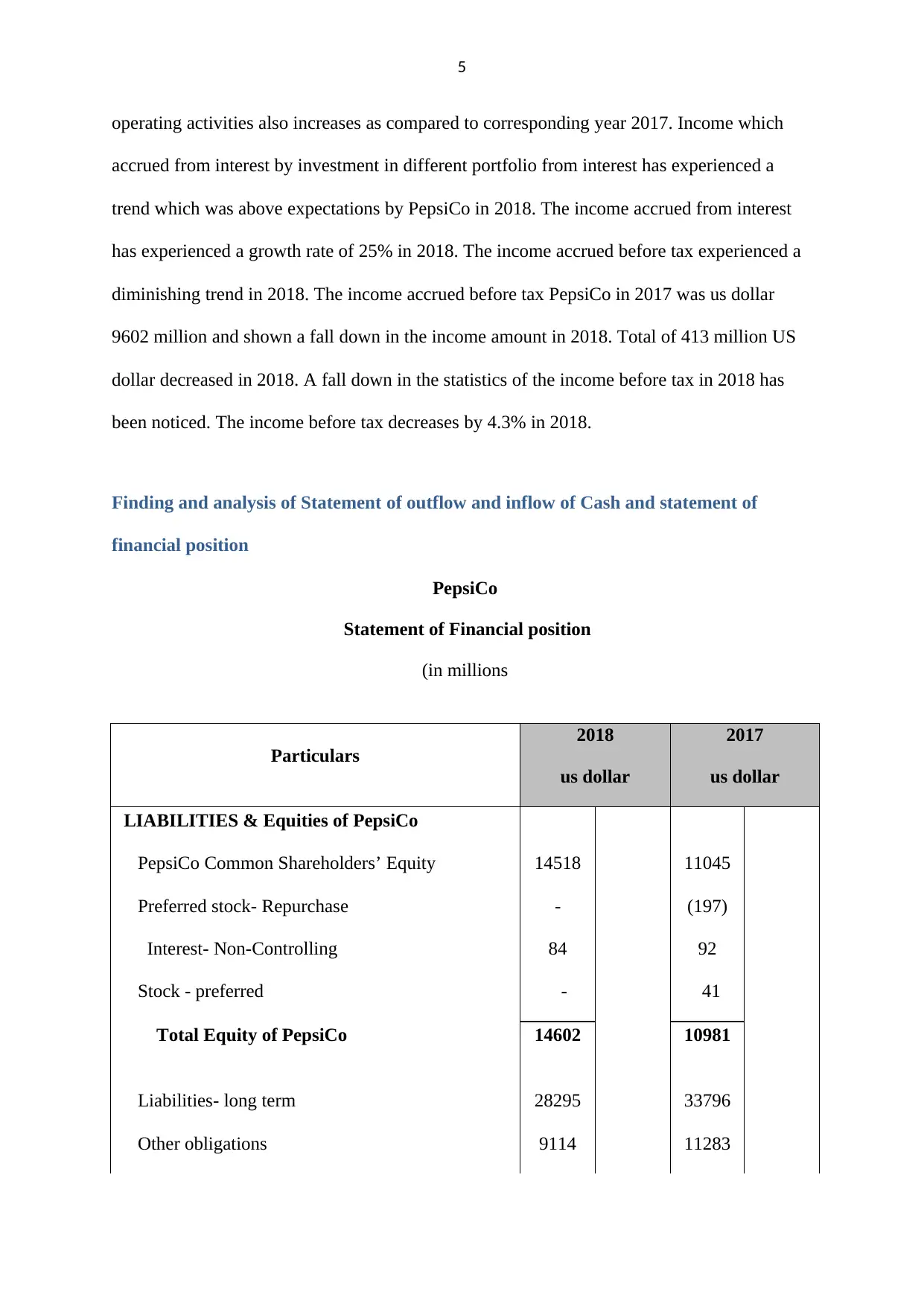

Evaluation and study of financial Ratios

PepsiCo

Analysis and evaluation of Financial Ratios

(in millions)

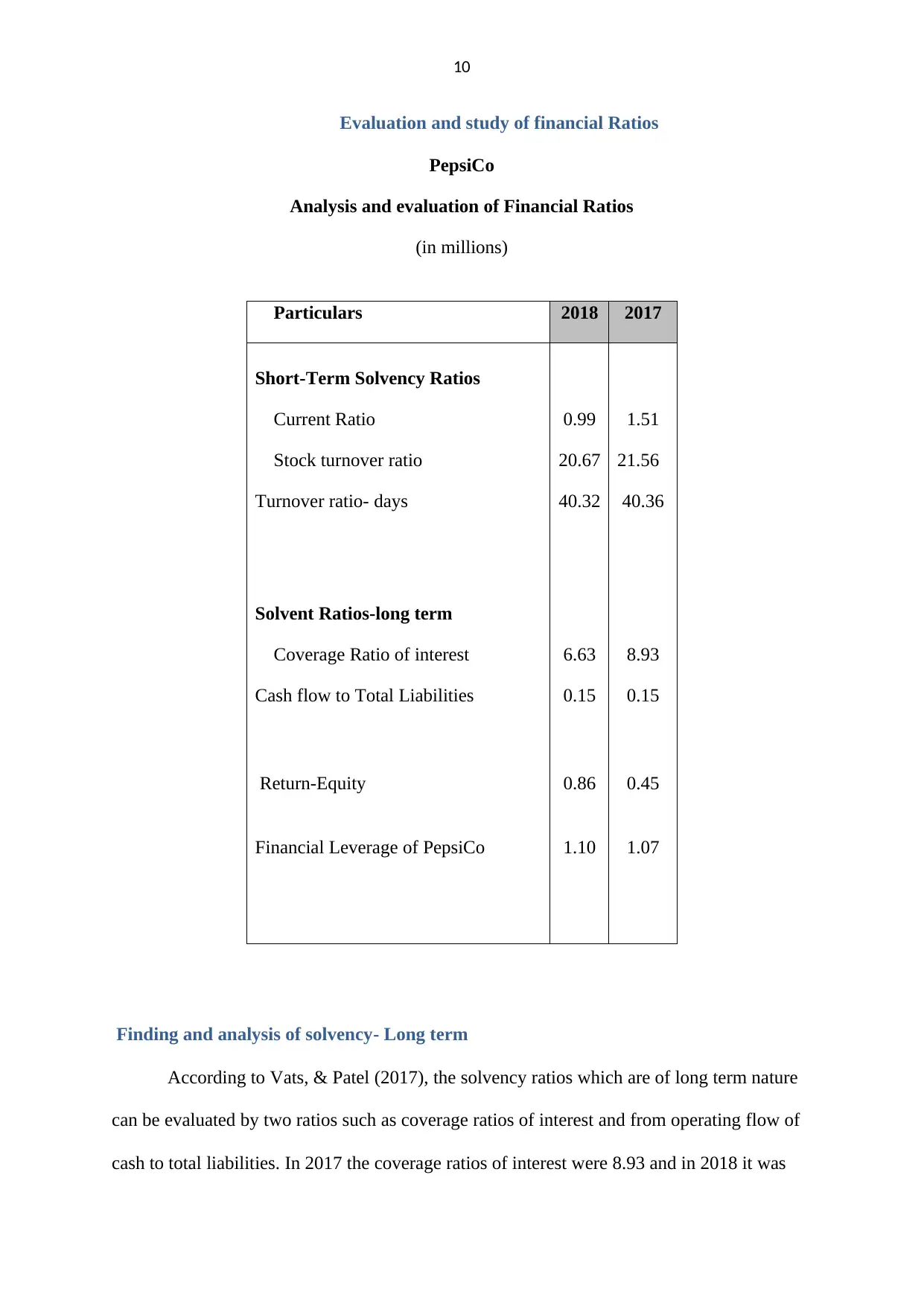

Particulars 2018 2017

Short-Term Solvency Ratios

Current Ratio 0.99 1.51

Stock turnover ratio 20.67 21.56

Turnover ratio- days 40.32 40.36

Solvent Ratios-long term

Coverage Ratio of interest 6.63 8.93

Cash flow to Total Liabilities 0.15 0.15

Return-Equity 0.86 0.45

Financial Leverage of PepsiCo 1.10 1.07

Finding and analysis of solvency- Long term

According to Vats, & Patel (2017), the solvency ratios which are of long term nature

can be evaluated by two ratios such as coverage ratios of interest and from operating flow of

cash to total liabilities. In 2017 the coverage ratios of interest were 8.93 and in 2018 it was

Evaluation and study of financial Ratios

PepsiCo

Analysis and evaluation of Financial Ratios

(in millions)

Particulars 2018 2017

Short-Term Solvency Ratios

Current Ratio 0.99 1.51

Stock turnover ratio 20.67 21.56

Turnover ratio- days 40.32 40.36

Solvent Ratios-long term

Coverage Ratio of interest 6.63 8.93

Cash flow to Total Liabilities 0.15 0.15

Return-Equity 0.86 0.45

Financial Leverage of PepsiCo 1.10 1.07

Finding and analysis of solvency- Long term

According to Vats, & Patel (2017), the solvency ratios which are of long term nature

can be evaluated by two ratios such as coverage ratios of interest and from operating flow of

cash to total liabilities. In 2017 the coverage ratios of interest were 8.93 and in 2018 it was

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

6.63. This diminishing trend represents that in 2018 PepsiCo ability to meet all its long term

obligations of interest decreases. The ability of PepsiCo to pay off the long term interest has

been lowered as compared to 2017. The financial leverage increased from 1.07 to 1.10 in

2018.

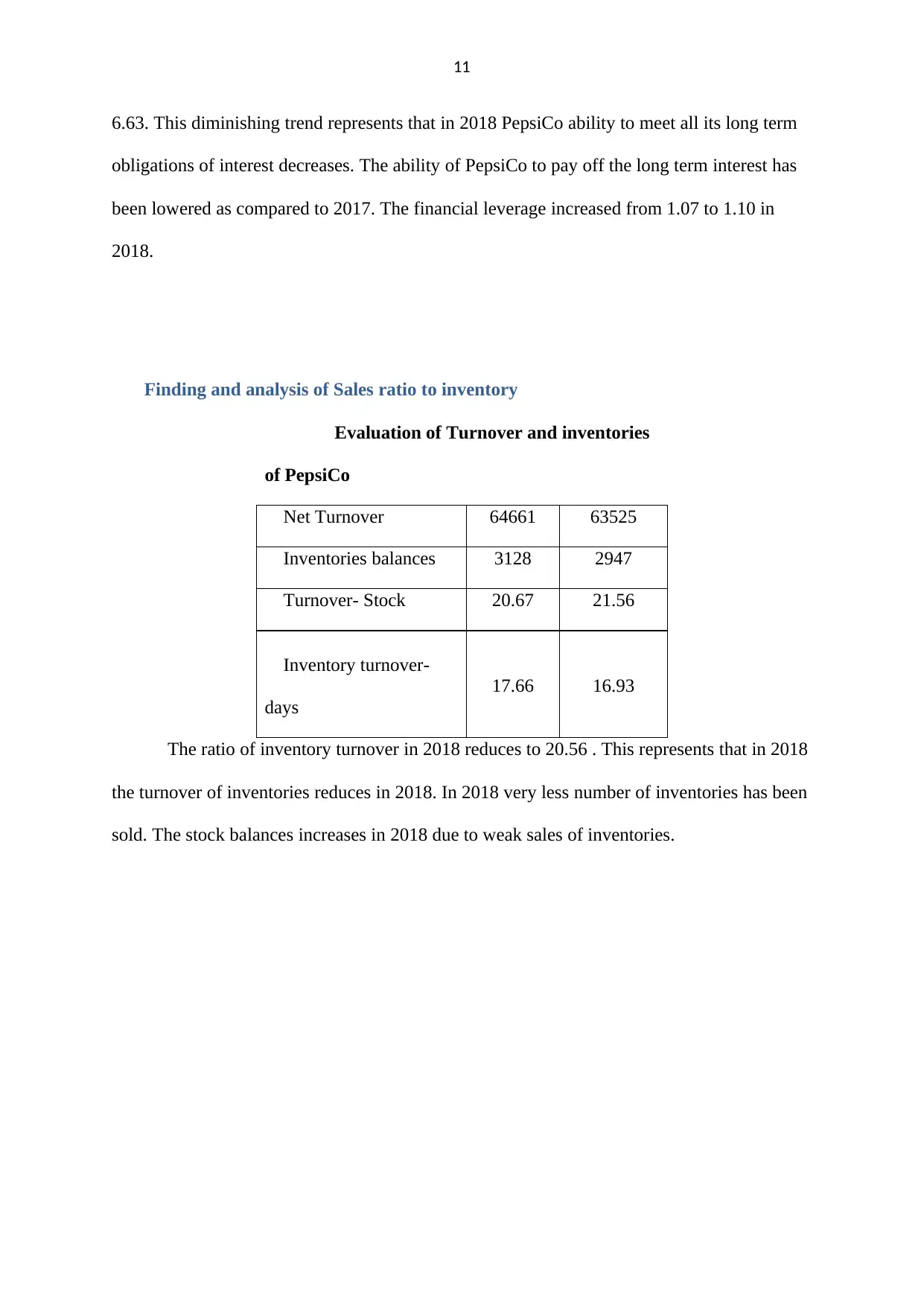

Finding and analysis of Sales ratio to inventory

Evaluation of Turnover and inventories

of PepsiCo

Net Turnover 64661 63525

Inventories balances 3128 2947

Turnover- Stock 20.67 21.56

Inventory turnover-

days

17.66 16.93

The ratio of inventory turnover in 2018 reduces to 20.56 . This represents that in 2018

the turnover of inventories reduces in 2018. In 2018 very less number of inventories has been

sold. The stock balances increases in 2018 due to weak sales of inventories.

6.63. This diminishing trend represents that in 2018 PepsiCo ability to meet all its long term

obligations of interest decreases. The ability of PepsiCo to pay off the long term interest has

been lowered as compared to 2017. The financial leverage increased from 1.07 to 1.10 in

2018.

Finding and analysis of Sales ratio to inventory

Evaluation of Turnover and inventories

of PepsiCo

Net Turnover 64661 63525

Inventories balances 3128 2947

Turnover- Stock 20.67 21.56

Inventory turnover-

days

17.66 16.93

The ratio of inventory turnover in 2018 reduces to 20.56 . This represents that in 2018

the turnover of inventories reduces in 2018. In 2018 very less number of inventories has been

sold. The stock balances increases in 2018 due to weak sales of inventories.

12

2018 2017

0

10000

20000

30000

40000

50000

60000

70000

Net revenue

Inventories

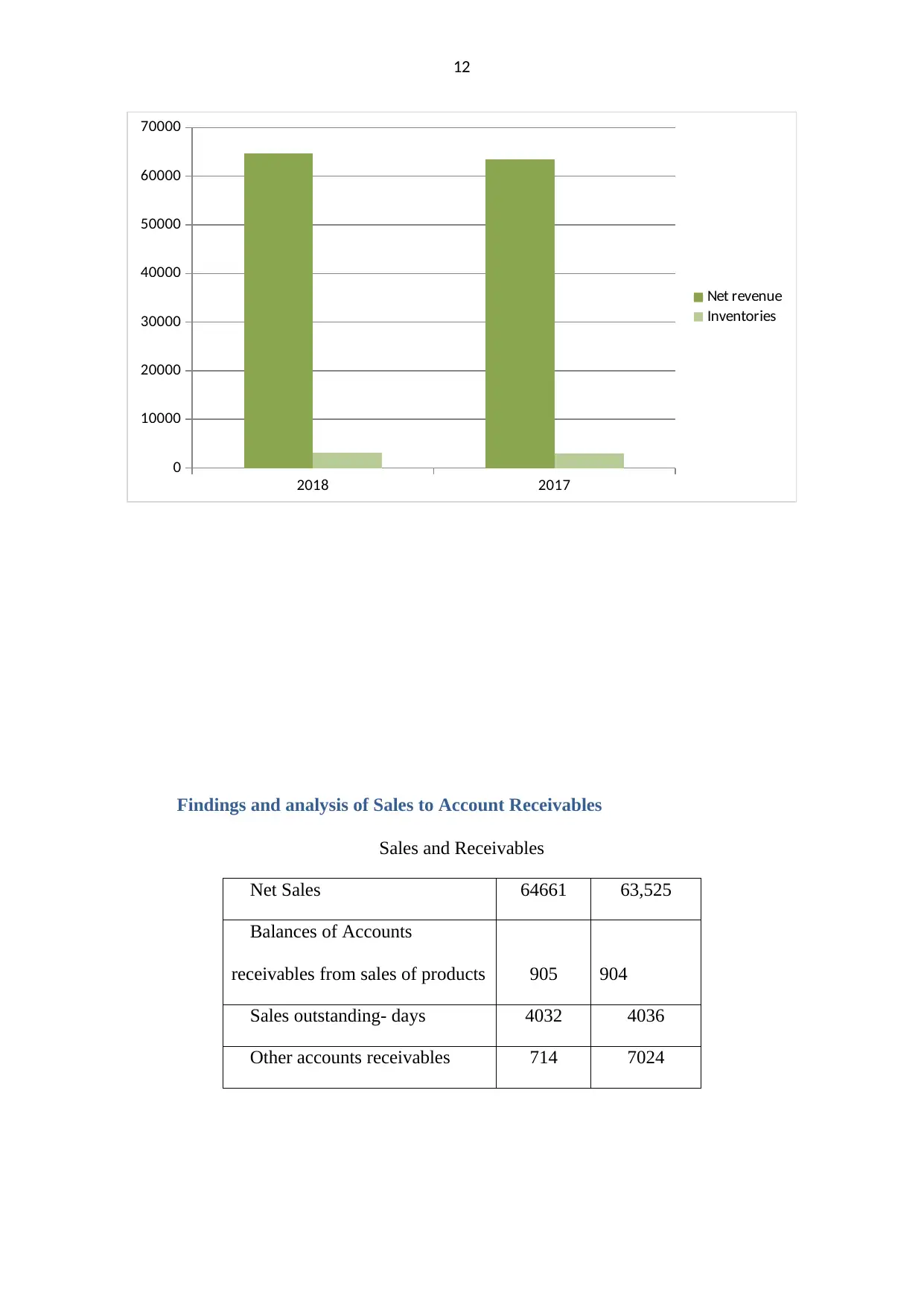

Findings and analysis of Sales to Account Receivables

Sales and Receivables

Net Sales 64661 63,525

Balances of Accounts

receivables from sales of products 905 904

Sales outstanding- days 4032 4036

Other accounts receivables 714 7024

2018 2017

0

10000

20000

30000

40000

50000

60000

70000

Net revenue

Inventories

Findings and analysis of Sales to Account Receivables

Sales and Receivables

Net Sales 64661 63,525

Balances of Accounts

receivables from sales of products 905 904

Sales outstanding- days 4032 4036

Other accounts receivables 714 7024

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.