Accounting for Managers: Financial Analysis, RFG Case Study

VerifiedAdded on 2023/06/05

|11

|1333

|99

Report

AI Summary

This report provides a financial analysis of RFG, focusing on cash flow statements, evaluating financial proposals, and determining special order quotations. The cash flow analysis examines operating, investing, and financing activities, noting key changes in FY2017. Three proposals are quantitatively and qualitatively analyzed, considering factors like sales volume, pricing, and competition. Sensitivity analysis is used to assess the impact of varying sales scenarios. The report also addresses a special order request, calculating incremental costs and providing a quotation based on capacity constraints and markup policies. Opportunities and disadvantages of accepting the special order are discussed, including capacity utilization, profit margins, and customer relationships. Desklib is your go-to platform for accessing solved assignments and study tools.

ACCOUNTING FOR MANAGERS

RFG

STUDENT ID:

[Pick the date]

RFG

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

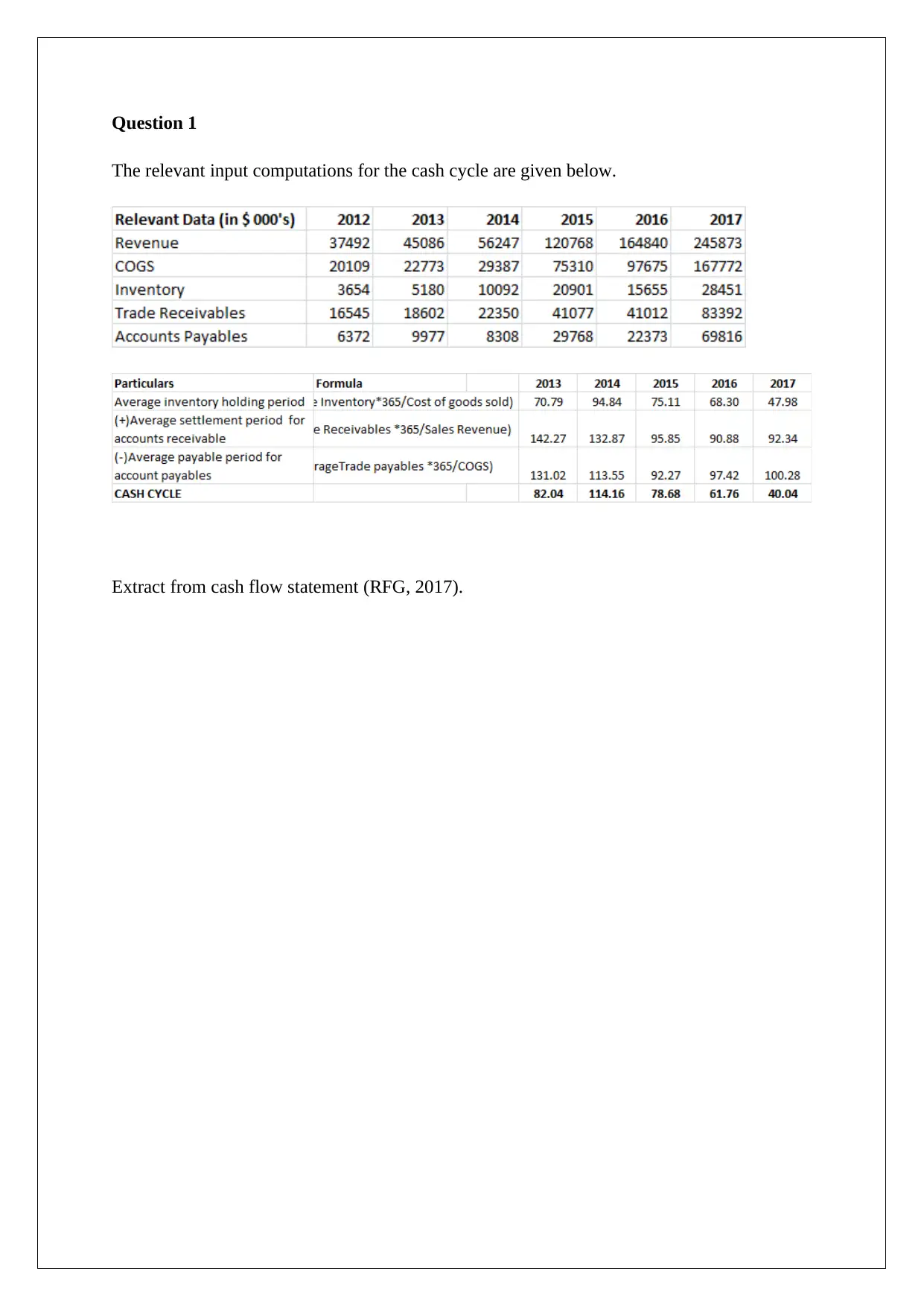

Question 1

The relevant input computations for the cash cycle are given below.

Extract from cash flow statement (RFG, 2017).

The relevant input computations for the cash cycle are given below.

Extract from cash flow statement (RFG, 2017).

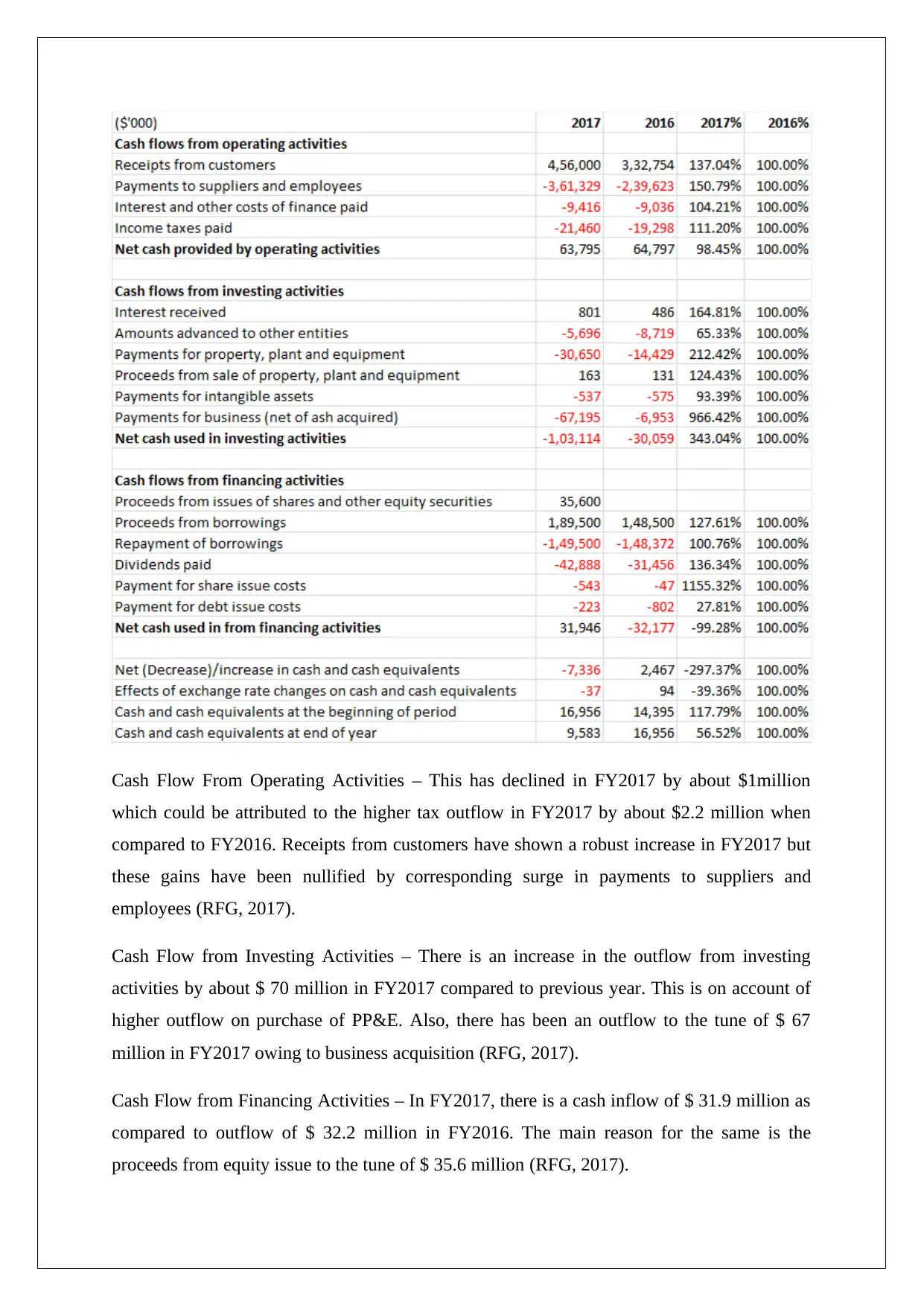

Cash Flow From Operating Activities – This has declined in FY2017 by about $1million

which could be attributed to the higher tax outflow in FY2017 by about $2.2 million when

compared to FY2016. Receipts from customers have shown a robust increase in FY2017 but

these gains have been nullified by corresponding surge in payments to suppliers and

employees (RFG, 2017).

Cash Flow from Investing Activities – There is an increase in the outflow from investing

activities by about $ 70 million in FY2017 compared to previous year. This is on account of

higher outflow on purchase of PP&E. Also, there has been an outflow to the tune of $ 67

million in FY2017 owing to business acquisition (RFG, 2017).

Cash Flow from Financing Activities – In FY2017, there is a cash inflow of $ 31.9 million as

compared to outflow of $ 32.2 million in FY2016. The main reason for the same is the

proceeds from equity issue to the tune of $ 35.6 million (RFG, 2017).

which could be attributed to the higher tax outflow in FY2017 by about $2.2 million when

compared to FY2016. Receipts from customers have shown a robust increase in FY2017 but

these gains have been nullified by corresponding surge in payments to suppliers and

employees (RFG, 2017).

Cash Flow from Investing Activities – There is an increase in the outflow from investing

activities by about $ 70 million in FY2017 compared to previous year. This is on account of

higher outflow on purchase of PP&E. Also, there has been an outflow to the tune of $ 67

million in FY2017 owing to business acquisition (RFG, 2017).

Cash Flow from Financing Activities – In FY2017, there is a cash inflow of $ 31.9 million as

compared to outflow of $ 32.2 million in FY2016. The main reason for the same is the

proceeds from equity issue to the tune of $ 35.6 million (RFG, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

.

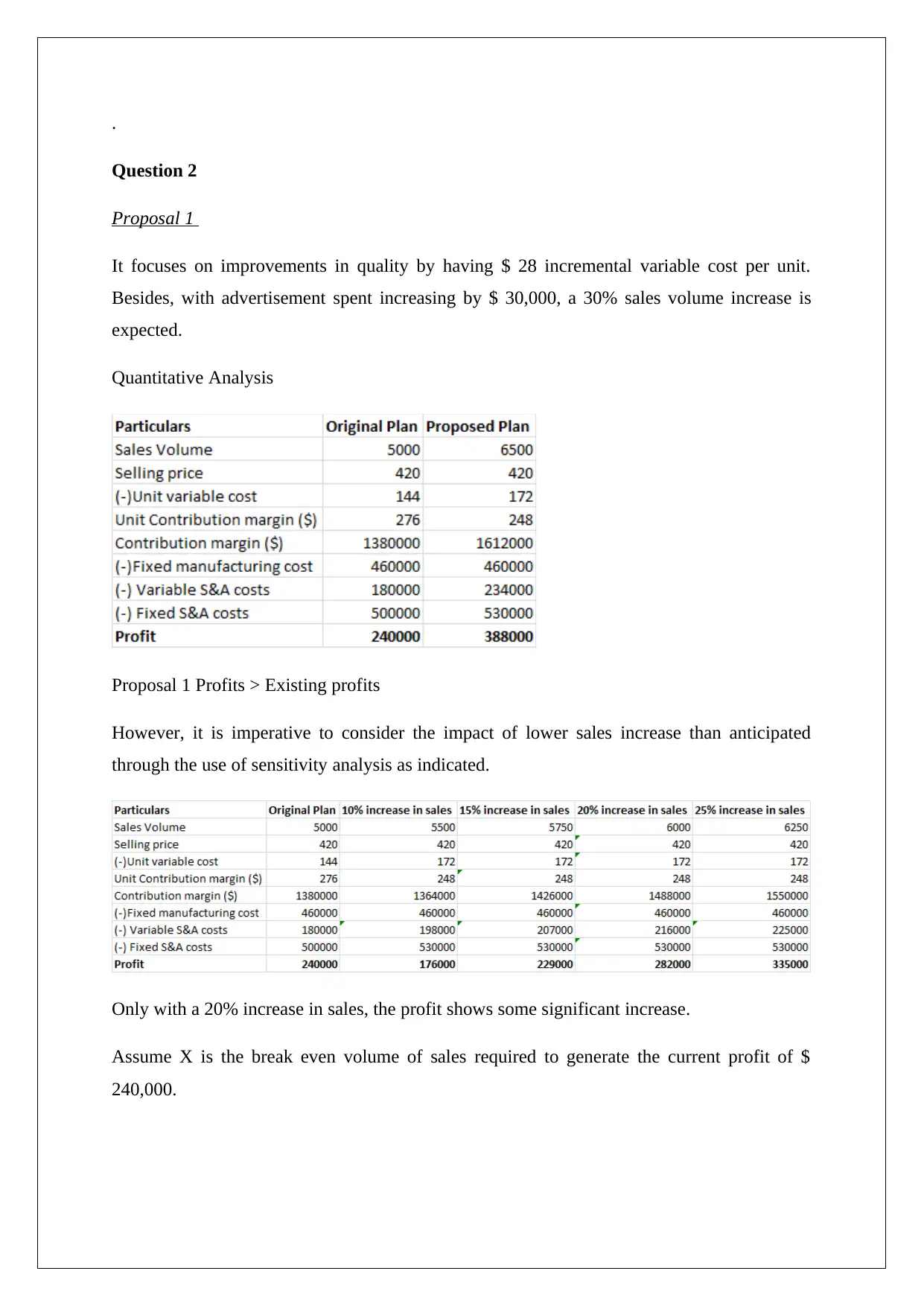

Question 2

Proposal 1

It focuses on improvements in quality by having $ 28 incremental variable cost per unit.

Besides, with advertisement spent increasing by $ 30,000, a 30% sales volume increase is

expected.

Quantitative Analysis

Proposal 1 Profits > Existing profits

However, it is imperative to consider the impact of lower sales increase than anticipated

through the use of sensitivity analysis as indicated.

Only with a 20% increase in sales, the profit shows some significant increase.

Assume X is the break even volume of sales required to generate the current profit of $

240,000.

Question 2

Proposal 1

It focuses on improvements in quality by having $ 28 incremental variable cost per unit.

Besides, with advertisement spent increasing by $ 30,000, a 30% sales volume increase is

expected.

Quantitative Analysis

Proposal 1 Profits > Existing profits

However, it is imperative to consider the impact of lower sales increase than anticipated

through the use of sensitivity analysis as indicated.

Only with a 20% increase in sales, the profit shows some significant increase.

Assume X is the break even volume of sales required to generate the current profit of $

240,000.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Qualitative factors are listed below (Damodaran, 2015).

Presence of spare capacity to accommodate the increase in production

Additional resource allocation to current product or development of new product for

competitive edge over competition.

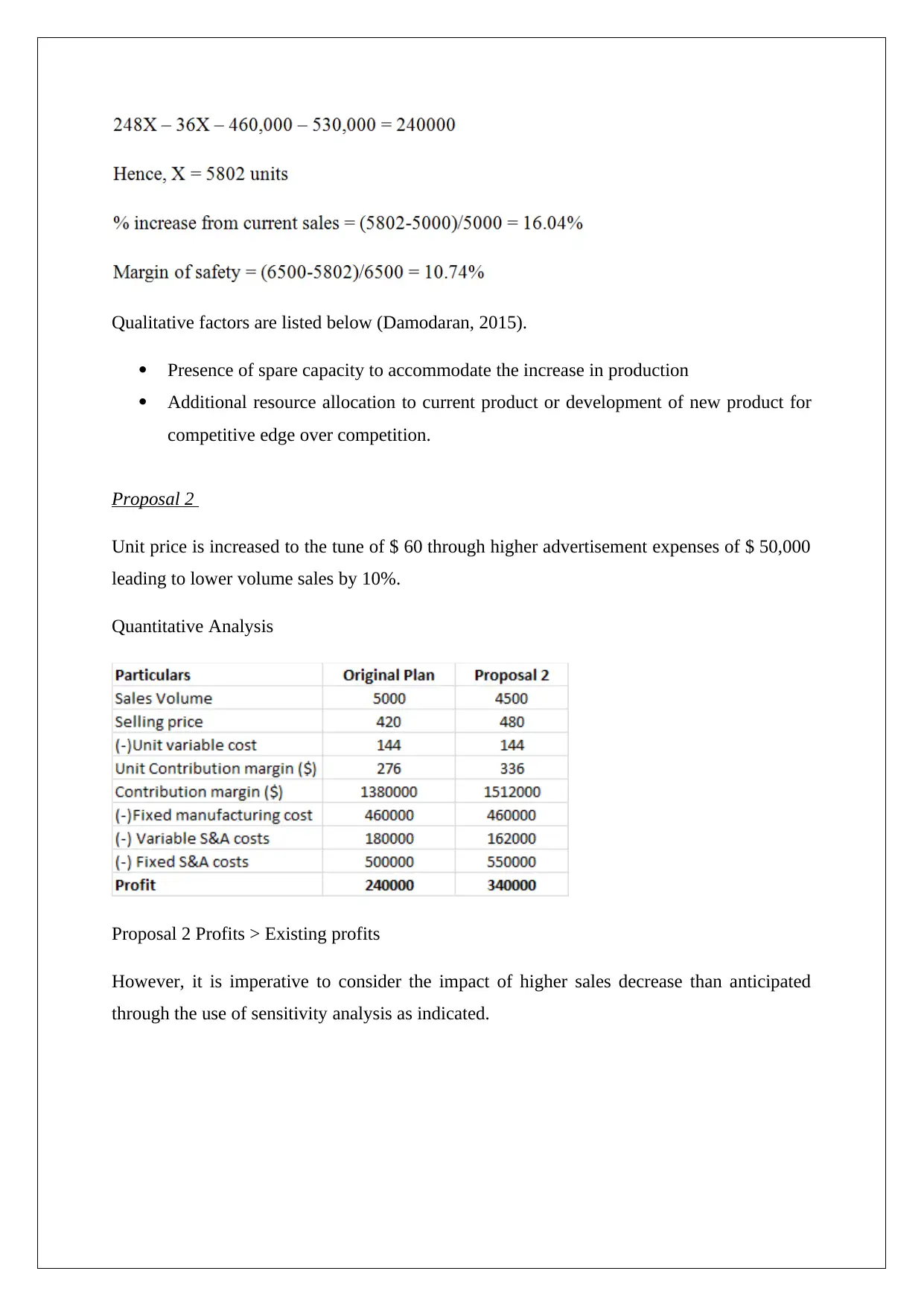

Proposal 2

Unit price is increased to the tune of $ 60 through higher advertisement expenses of $ 50,000

leading to lower volume sales by 10%.

Quantitative Analysis

Proposal 2 Profits > Existing profits

However, it is imperative to consider the impact of higher sales decrease than anticipated

through the use of sensitivity analysis as indicated.

Presence of spare capacity to accommodate the increase in production

Additional resource allocation to current product or development of new product for

competitive edge over competition.

Proposal 2

Unit price is increased to the tune of $ 60 through higher advertisement expenses of $ 50,000

leading to lower volume sales by 10%.

Quantitative Analysis

Proposal 2 Profits > Existing profits

However, it is imperative to consider the impact of higher sales decrease than anticipated

through the use of sensitivity analysis as indicated.

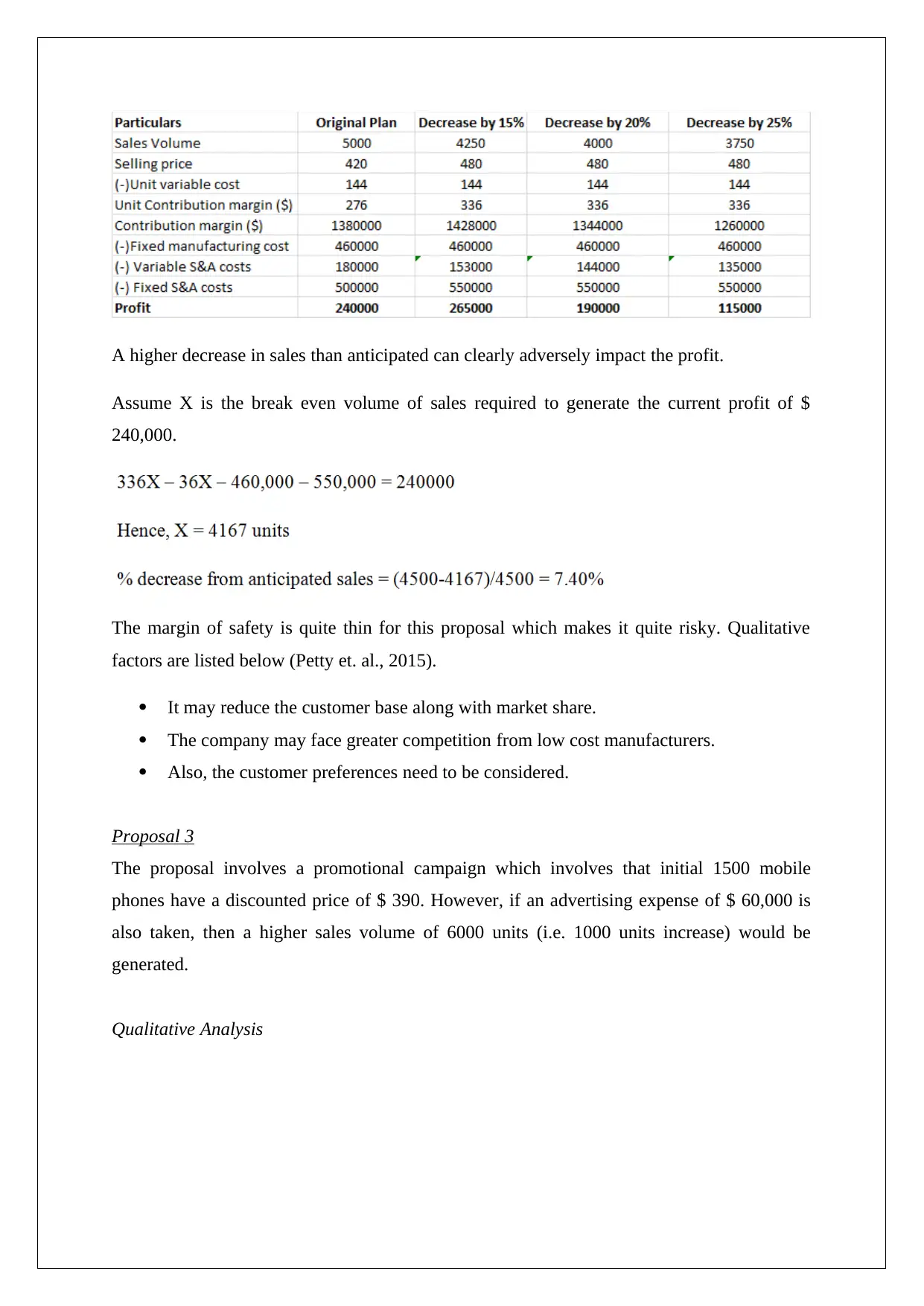

A higher decrease in sales than anticipated can clearly adversely impact the profit.

Assume X is the break even volume of sales required to generate the current profit of $

240,000.

The margin of safety is quite thin for this proposal which makes it quite risky. Qualitative

factors are listed below (Petty et. al., 2015).

It may reduce the customer base along with market share.

The company may face greater competition from low cost manufacturers.

Also, the customer preferences need to be considered.

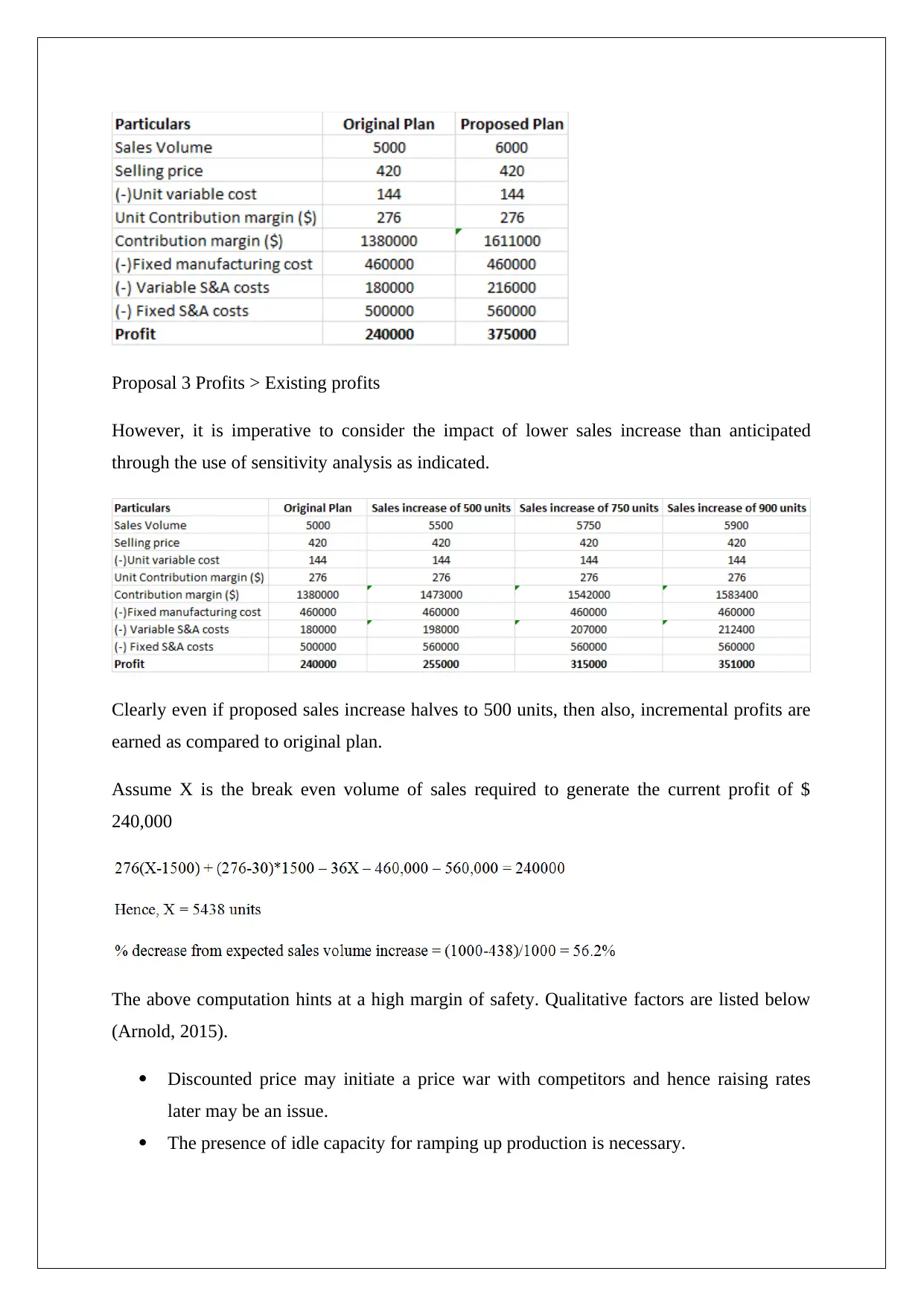

Proposal 3

The proposal involves a promotional campaign which involves that initial 1500 mobile

phones have a discounted price of $ 390. However, if an advertising expense of $ 60,000 is

also taken, then a higher sales volume of 6000 units (i.e. 1000 units increase) would be

generated.

Qualitative Analysis

Assume X is the break even volume of sales required to generate the current profit of $

240,000.

The margin of safety is quite thin for this proposal which makes it quite risky. Qualitative

factors are listed below (Petty et. al., 2015).

It may reduce the customer base along with market share.

The company may face greater competition from low cost manufacturers.

Also, the customer preferences need to be considered.

Proposal 3

The proposal involves a promotional campaign which involves that initial 1500 mobile

phones have a discounted price of $ 390. However, if an advertising expense of $ 60,000 is

also taken, then a higher sales volume of 6000 units (i.e. 1000 units increase) would be

generated.

Qualitative Analysis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Proposal 3 Profits > Existing profits

However, it is imperative to consider the impact of lower sales increase than anticipated

through the use of sensitivity analysis as indicated.

Clearly even if proposed sales increase halves to 500 units, then also, incremental profits are

earned as compared to original plan.

Assume X is the break even volume of sales required to generate the current profit of $

240,000

The above computation hints at a high margin of safety. Qualitative factors are listed below

(Arnold, 2015).

Discounted price may initiate a price war with competitors and hence raising rates

later may be an issue.

The presence of idle capacity for ramping up production is necessary.

However, it is imperative to consider the impact of lower sales increase than anticipated

through the use of sensitivity analysis as indicated.

Clearly even if proposed sales increase halves to 500 units, then also, incremental profits are

earned as compared to original plan.

Assume X is the break even volume of sales required to generate the current profit of $

240,000

The above computation hints at a high margin of safety. Qualitative factors are listed below

(Arnold, 2015).

Discounted price may initiate a price war with competitors and hence raising rates

later may be an issue.

The presence of idle capacity for ramping up production is necessary.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

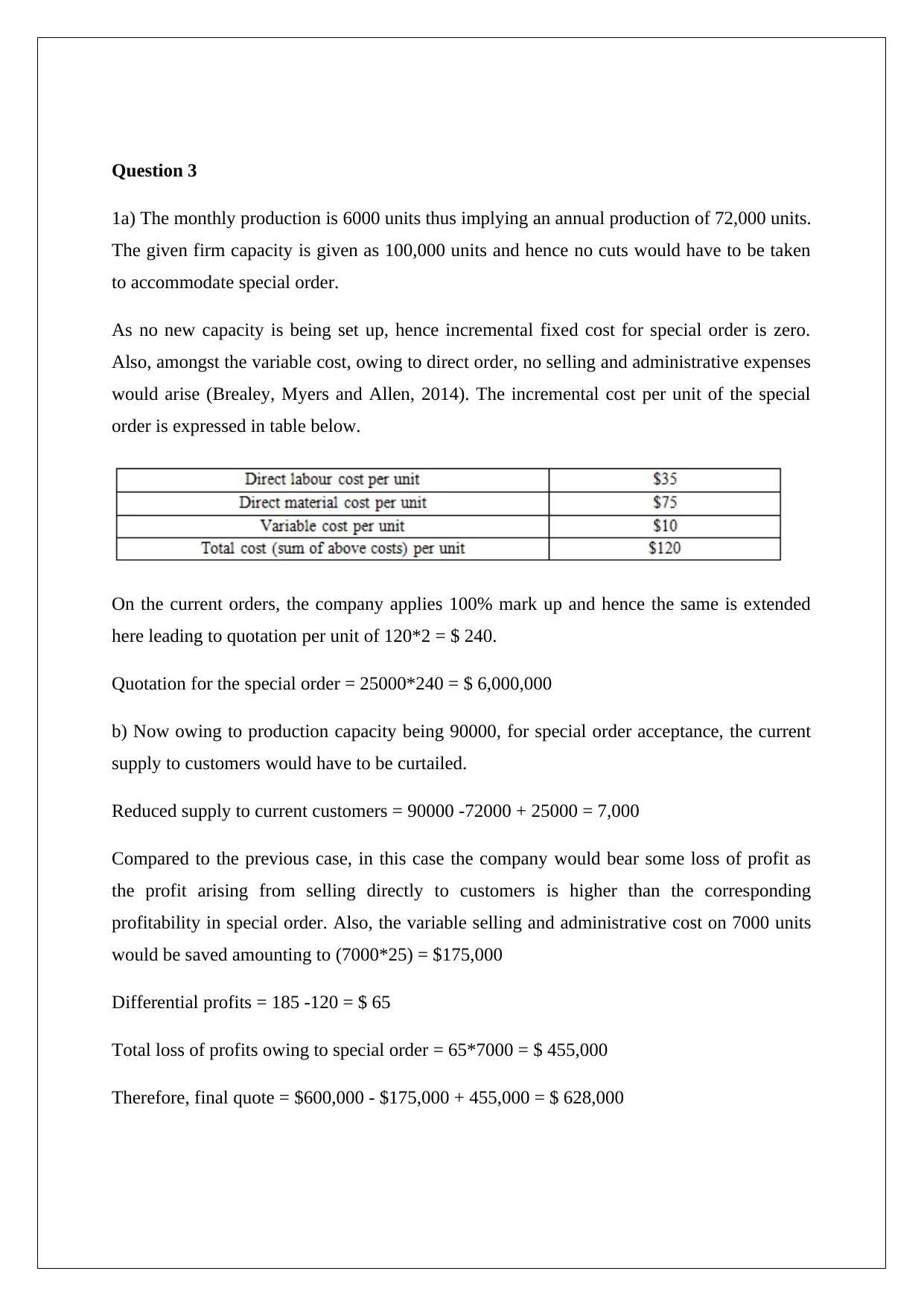

Question 3

1a) The monthly production is 6000 units thus implying an annual production of 72,000 units.

The given firm capacity is given as 100,000 units and hence no cuts would have to be taken

to accommodate special order.

As no new capacity is being set up, hence incremental fixed cost for special order is zero.

Also, amongst the variable cost, owing to direct order, no selling and administrative expenses

would arise (Brealey, Myers and Allen, 2014). The incremental cost per unit of the special

order is expressed in table below.

On the current orders, the company applies 100% mark up and hence the same is extended

here leading to quotation per unit of 120*2 = $ 240.

Quotation for the special order = 25000*240 = $ 6,000,000

b) Now owing to production capacity being 90000, for special order acceptance, the current

supply to customers would have to be curtailed.

Reduced supply to current customers = 90000 -72000 + 25000 = 7,000

Compared to the previous case, in this case the company would bear some loss of profit as

the profit arising from selling directly to customers is higher than the corresponding

profitability in special order. Also, the variable selling and administrative cost on 7000 units

would be saved amounting to (7000*25) = $175,000

Differential profits = 185 -120 = $ 65

Total loss of profits owing to special order = 65*7000 = $ 455,000

Therefore, final quote = $600,000 - $175,000 + 455,000 = $ 628,000

1a) The monthly production is 6000 units thus implying an annual production of 72,000 units.

The given firm capacity is given as 100,000 units and hence no cuts would have to be taken

to accommodate special order.

As no new capacity is being set up, hence incremental fixed cost for special order is zero.

Also, amongst the variable cost, owing to direct order, no selling and administrative expenses

would arise (Brealey, Myers and Allen, 2014). The incremental cost per unit of the special

order is expressed in table below.

On the current orders, the company applies 100% mark up and hence the same is extended

here leading to quotation per unit of 120*2 = $ 240.

Quotation for the special order = 25000*240 = $ 6,000,000

b) Now owing to production capacity being 90000, for special order acceptance, the current

supply to customers would have to be curtailed.

Reduced supply to current customers = 90000 -72000 + 25000 = 7,000

Compared to the previous case, in this case the company would bear some loss of profit as

the profit arising from selling directly to customers is higher than the corresponding

profitability in special order. Also, the variable selling and administrative cost on 7000 units

would be saved amounting to (7000*25) = $175,000

Differential profits = 185 -120 = $ 65

Total loss of profits owing to special order = 65*7000 = $ 455,000

Therefore, final quote = $600,000 - $175,000 + 455,000 = $ 628,000

2. The special order quote is based on namely two parameters, incremental cost per unit and

markup applied. It is essential that no fixed cost would be considered since for making the

special order, no incremental capacity is required. Also, since the order is directly sourced, no

administration and selling costs are incurred. Thus, after computation of production costs, a

mark-up of 100% as per the current practice of company is applied for reaching the quote

amount (Arnold, 2015).

Opportunities

Higher capacity utilisation leading to greater profit generation.

The order from Cycle World is potentially a beginning to receive bigger orders in the

future.

The company can market products to Cycle World customers and hence enhance sales

further.

Disadvantages

The profitability is adversely impacted since profit per unit is lower on special order

than direct client.

Increased dependence on Cycle World can limit the attention the company gives to

direct customers and thus increase concentration risk.

markup applied. It is essential that no fixed cost would be considered since for making the

special order, no incremental capacity is required. Also, since the order is directly sourced, no

administration and selling costs are incurred. Thus, after computation of production costs, a

mark-up of 100% as per the current practice of company is applied for reaching the quote

amount (Arnold, 2015).

Opportunities

Higher capacity utilisation leading to greater profit generation.

The order from Cycle World is potentially a beginning to receive bigger orders in the

future.

The company can market products to Cycle World customers and hence enhance sales

further.

Disadvantages

The profitability is adversely impacted since profit per unit is lower on special order

than direct client.

Increased dependence on Cycle World can limit the attention the company gives to

direct customers and thus increase concentration risk.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

Arnold, G. (2015) Corporate Financial Management. 3rd ed. Sydney: Financial Times

Management.

Brealey, R. A., Myers, S. C., & Allen, F. (2014) Principles of corporate finance, 2nd ed. New

York: McGraw-Hill Inc.

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., & Nguyen, H. (2015).

Financial Management, Principles and Applications, 6th ed.. NSW: Pearson Education, French

Forest Australia

RFG (2017) Annual Report 2017, [Online] Available at

http://www.rfg.com.au/wp-content/uploads/2018/02/RFGLAnnualReport2017.pdf [Accessed

September 8, 2018]

Arnold, G. (2015) Corporate Financial Management. 3rd ed. Sydney: Financial Times

Management.

Brealey, R. A., Myers, S. C., & Allen, F. (2014) Principles of corporate finance, 2nd ed. New

York: McGraw-Hill Inc.

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., & Nguyen, H. (2015).

Financial Management, Principles and Applications, 6th ed.. NSW: Pearson Education, French

Forest Australia

RFG (2017) Annual Report 2017, [Online] Available at

http://www.rfg.com.au/wp-content/uploads/2018/02/RFGLAnnualReport2017.pdf [Accessed

September 8, 2018]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.