Comprehensive Financial Analysis Report: Effective Distributors Ltd

VerifiedAdded on 2020/04/01

|15

|3066

|170

Report

AI Summary

This accounting report presents a comprehensive financial analysis of Effective Distributors Ltd. It begins with an executive summary highlighting key issues and then delves into a detailed examination of profitability ratios (ROE, ROA, net profit margin), inventory management, and other relevant financial ratios. The analysis covers the years 2015 and 2016, offering insights into the company's performance and identifying areas for improvement. The report also addresses ethical issues, specifically financial statement misrepresentation and accounting fraud, discussing the responsibilities of accountants and the potential consequences of unethical practices. The report further explores the role of computerized accounting systems, emphasizing their importance in managerial decision-making and overall business operations. Recommendations for cost reduction, customer acquisition, and inventory management are provided, offering practical strategies for enhancing the company's financial health and operational efficiency.

1

Accounting

Name:

Course

Professor’s name

University name

City, State

Date of submission

Accounting

Name:

Course

Professor’s name

University name

City, State

Date of submission

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Question 1

Executive summary

This is a report shall be highlighting the major problems that Effective Distributors ltd is

encountering. A comprehensive financial analysis will be carried out , starting from the

profitability ratios( i.e return on equity and return on assets) the gross profit margin for the

company and the net profit margin that will show how the company’s profit varies and how the

profits may be improved. The report will also cover how effective the company maintains its

inventory through the calculation of inventory ratios. Other ratios that the reports analyses are

the selling ratio, finance ratio, accounts receivable, current account, acid test ratio among others.

Recommendations on the ratio analysis will be provided.

Introduction

This is a comprehensive survey of the trading activities conducted by effective distributors

limited whose directors are concerned with the company’s operations and hence have asked for a

comprehensive report for the company. From the income statement for the year 2016 we shall

analyze all the important ratios for the company to evaluate and comment on which aspect of the

company it needs to improve on(Hodge, 2008).

Ratio analysis

Profitabilirty ratios

Question 1

Executive summary

This is a report shall be highlighting the major problems that Effective Distributors ltd is

encountering. A comprehensive financial analysis will be carried out , starting from the

profitability ratios( i.e return on equity and return on assets) the gross profit margin for the

company and the net profit margin that will show how the company’s profit varies and how the

profits may be improved. The report will also cover how effective the company maintains its

inventory through the calculation of inventory ratios. Other ratios that the reports analyses are

the selling ratio, finance ratio, accounts receivable, current account, acid test ratio among others.

Recommendations on the ratio analysis will be provided.

Introduction

This is a comprehensive survey of the trading activities conducted by effective distributors

limited whose directors are concerned with the company’s operations and hence have asked for a

comprehensive report for the company. From the income statement for the year 2016 we shall

analyze all the important ratios for the company to evaluate and comment on which aspect of the

company it needs to improve on(Hodge, 2008).

Ratio analysis

Profitabilirty ratios

3

These are ratios that assesses the ability of the company to generate earnings compared to the

relevant costs and expenses that it incurred during a specific period. Having a higher ratio

relative to the same ratio from the past period indicates that the company is doing well.

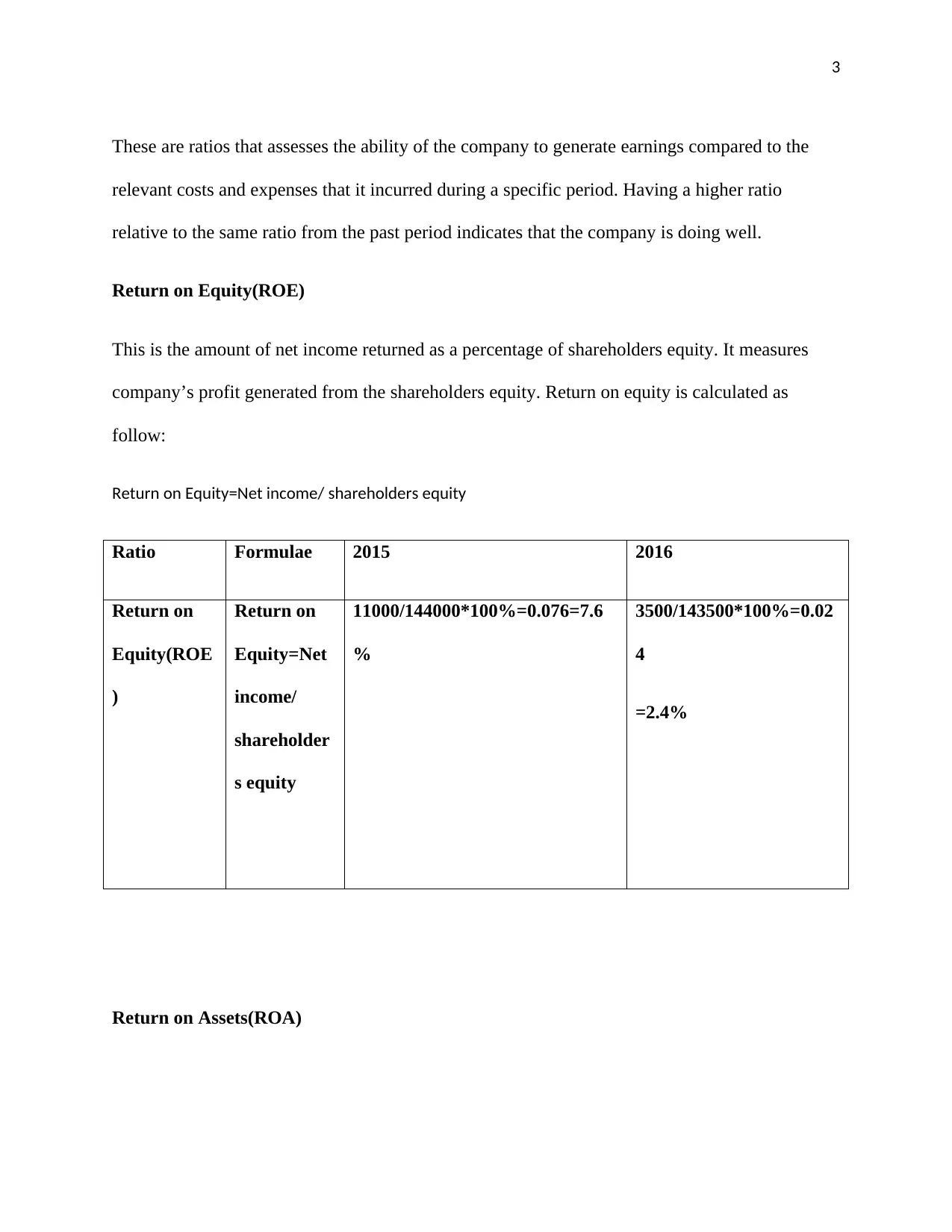

Return on Equity(ROE)

This is the amount of net income returned as a percentage of shareholders equity. It measures

company’s profit generated from the shareholders equity. Return on equity is calculated as

follow:

Return on Equity=Net income/ shareholders equity

Ratio Formulae 2015 2016

Return on

Equity(ROE

)

Return on

Equity=Net

income/

shareholder

s equity

11000/144000*100%=0.076=7.6

%

3500/143500*100%=0.02

4

=2.4%

Return on Assets(ROA)

These are ratios that assesses the ability of the company to generate earnings compared to the

relevant costs and expenses that it incurred during a specific period. Having a higher ratio

relative to the same ratio from the past period indicates that the company is doing well.

Return on Equity(ROE)

This is the amount of net income returned as a percentage of shareholders equity. It measures

company’s profit generated from the shareholders equity. Return on equity is calculated as

follow:

Return on Equity=Net income/ shareholders equity

Ratio Formulae 2015 2016

Return on

Equity(ROE

)

Return on

Equity=Net

income/

shareholder

s equity

11000/144000*100%=0.076=7.6

%

3500/143500*100%=0.02

4

=2.4%

Return on Assets(ROA)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

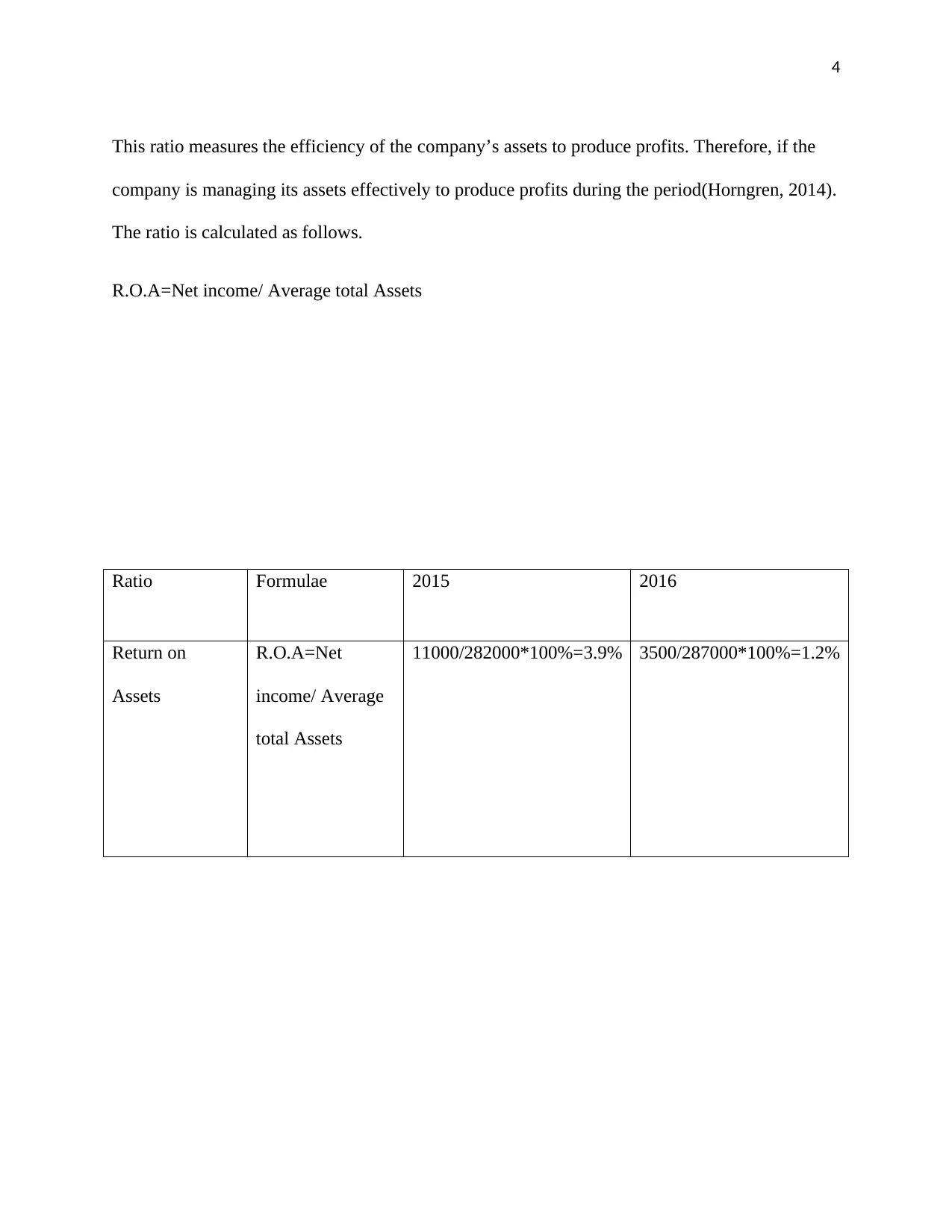

This ratio measures the efficiency of the company’s assets to produce profits. Therefore, if the

company is managing its assets effectively to produce profits during the period(Horngren, 2014).

The ratio is calculated as follows.

R.O.A=Net income/ Average total Assets

Ratio Formulae 2015 2016

Return on

Assets

R.O.A=Net

income/ Average

total Assets

11000/282000*100%=3.9% 3500/287000*100%=1.2%

This ratio measures the efficiency of the company’s assets to produce profits. Therefore, if the

company is managing its assets effectively to produce profits during the period(Horngren, 2014).

The ratio is calculated as follows.

R.O.A=Net income/ Average total Assets

Ratio Formulae 2015 2016

Return on

Assets

R.O.A=Net

income/ Average

total Assets

11000/282000*100%=3.9% 3500/287000*100%=1.2%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

The two ratios return on Equity and Return on Assets have decreased from 2015 to 2016 as

follows For R.OE 7.6%.in 2015 to 2.4% in 2016. For the return on Asset ratio, there is also a

decreased from 3.9% to 1.2%.

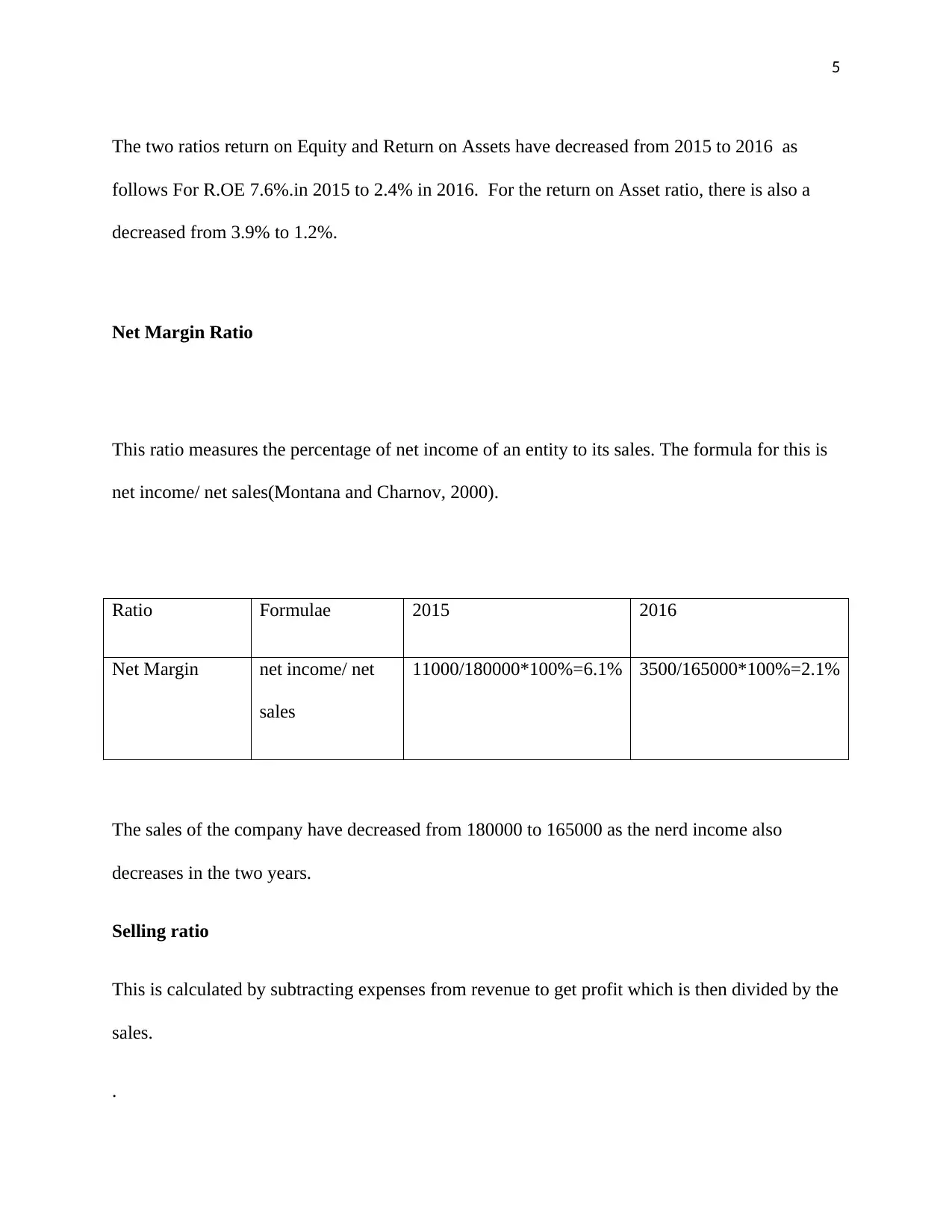

Net Margin Ratio

This ratio measures the percentage of net income of an entity to its sales. The formula for this is

net income/ net sales(Montana and Charnov, 2000).

Ratio Formulae 2015 2016

Net Margin net income/ net

sales

11000/180000*100%=6.1% 3500/165000*100%=2.1%

The sales of the company have decreased from 180000 to 165000 as the nerd income also

decreases in the two years.

Selling ratio

This is calculated by subtracting expenses from revenue to get profit which is then divided by the

sales.

.

The two ratios return on Equity and Return on Assets have decreased from 2015 to 2016 as

follows For R.OE 7.6%.in 2015 to 2.4% in 2016. For the return on Asset ratio, there is also a

decreased from 3.9% to 1.2%.

Net Margin Ratio

This ratio measures the percentage of net income of an entity to its sales. The formula for this is

net income/ net sales(Montana and Charnov, 2000).

Ratio Formulae 2015 2016

Net Margin net income/ net

sales

11000/180000*100%=6.1% 3500/165000*100%=2.1%

The sales of the company have decreased from 180000 to 165000 as the nerd income also

decreases in the two years.

Selling ratio

This is calculated by subtracting expenses from revenue to get profit which is then divided by the

sales.

.

6

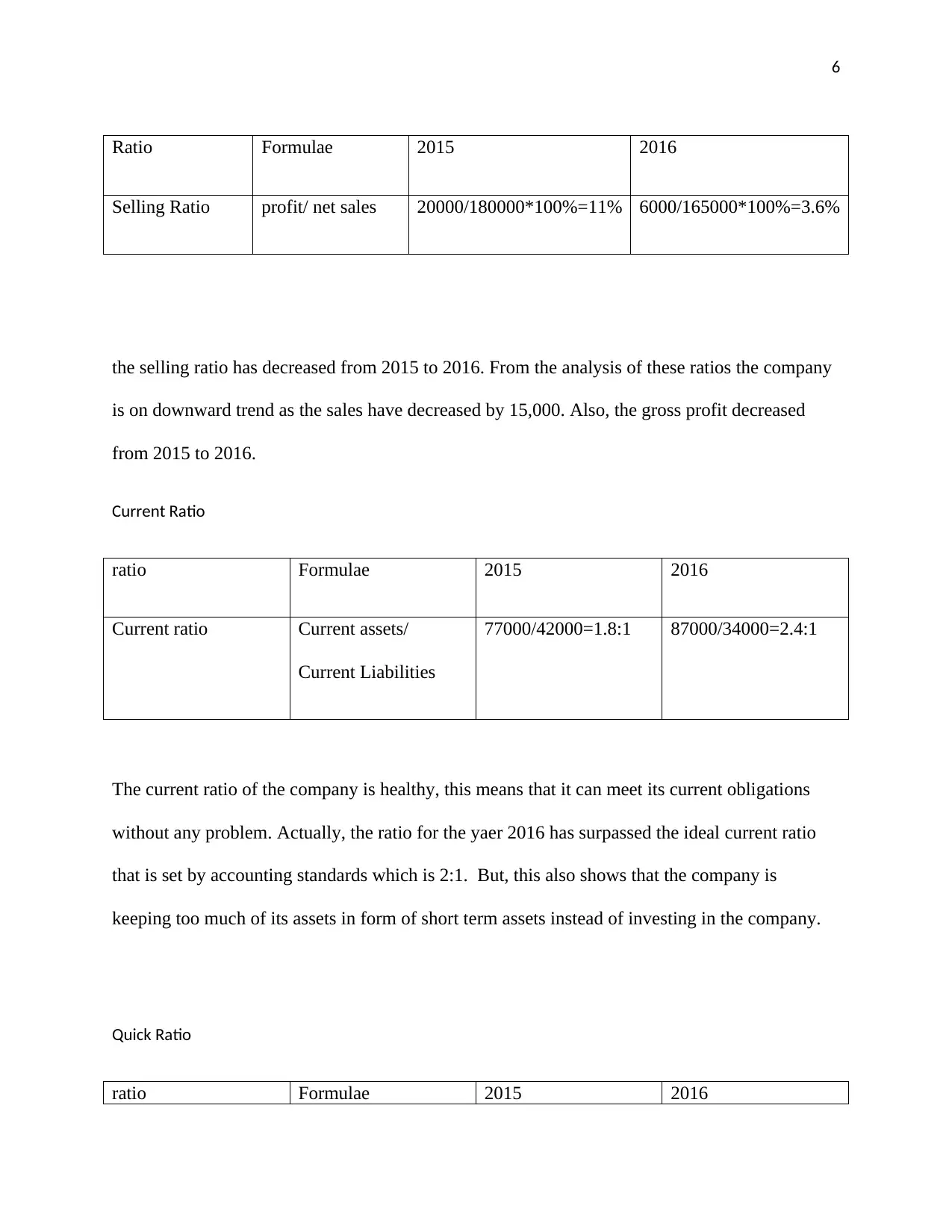

Ratio Formulae 2015 2016

Selling Ratio profit/ net sales 20000/180000*100%=11% 6000/165000*100%=3.6%

the selling ratio has decreased from 2015 to 2016. From the analysis of these ratios the company

is on downward trend as the sales have decreased by 15,000. Also, the gross profit decreased

from 2015 to 2016.

Current Ratio

ratio Formulae 2015 2016

Current ratio Current assets/

Current Liabilities

77000/42000=1.8:1 87000/34000=2.4:1

The current ratio of the company is healthy, this means that it can meet its current obligations

without any problem. Actually, the ratio for the yaer 2016 has surpassed the ideal current ratio

that is set by accounting standards which is 2:1. But, this also shows that the company is

keeping too much of its assets in form of short term assets instead of investing in the company.

Quick Ratio

ratio Formulae 2015 2016

Ratio Formulae 2015 2016

Selling Ratio profit/ net sales 20000/180000*100%=11% 6000/165000*100%=3.6%

the selling ratio has decreased from 2015 to 2016. From the analysis of these ratios the company

is on downward trend as the sales have decreased by 15,000. Also, the gross profit decreased

from 2015 to 2016.

Current Ratio

ratio Formulae 2015 2016

Current ratio Current assets/

Current Liabilities

77000/42000=1.8:1 87000/34000=2.4:1

The current ratio of the company is healthy, this means that it can meet its current obligations

without any problem. Actually, the ratio for the yaer 2016 has surpassed the ideal current ratio

that is set by accounting standards which is 2:1. But, this also shows that the company is

keeping too much of its assets in form of short term assets instead of investing in the company.

Quick Ratio

ratio Formulae 2015 2016

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

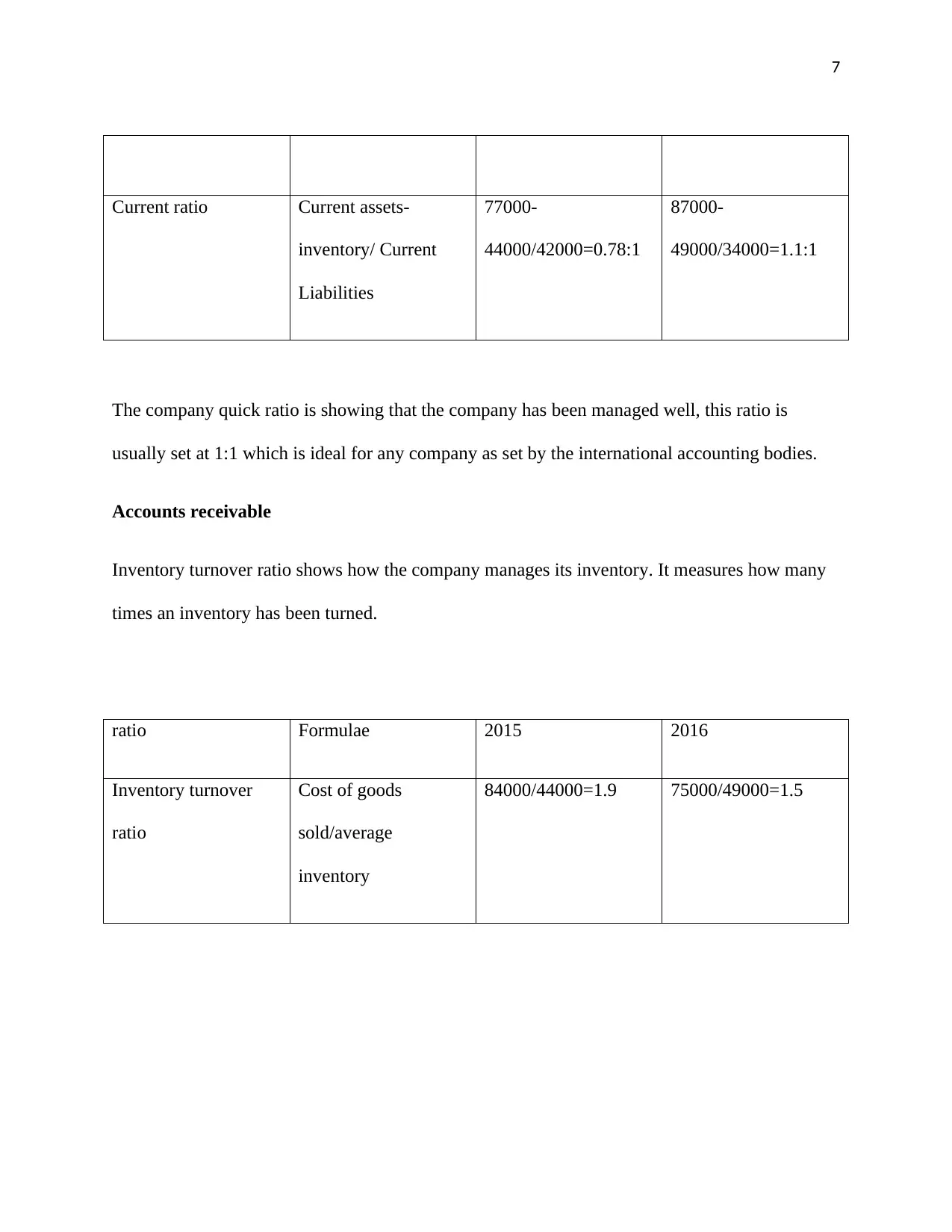

7

Current ratio Current assets-

inventory/ Current

Liabilities

77000-

44000/42000=0.78:1

87000-

49000/34000=1.1:1

The company quick ratio is showing that the company has been managed well, this ratio is

usually set at 1:1 which is ideal for any company as set by the international accounting bodies.

Accounts receivable

Inventory turnover ratio shows how the company manages its inventory. It measures how many

times an inventory has been turned.

ratio Formulae 2015 2016

Inventory turnover

ratio

Cost of goods

sold/average

inventory

84000/44000=1.9 75000/49000=1.5

Current ratio Current assets-

inventory/ Current

Liabilities

77000-

44000/42000=0.78:1

87000-

49000/34000=1.1:1

The company quick ratio is showing that the company has been managed well, this ratio is

usually set at 1:1 which is ideal for any company as set by the international accounting bodies.

Accounts receivable

Inventory turnover ratio shows how the company manages its inventory. It measures how many

times an inventory has been turned.

ratio Formulae 2015 2016

Inventory turnover

ratio

Cost of goods

sold/average

inventory

84000/44000=1.9 75000/49000=1.5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

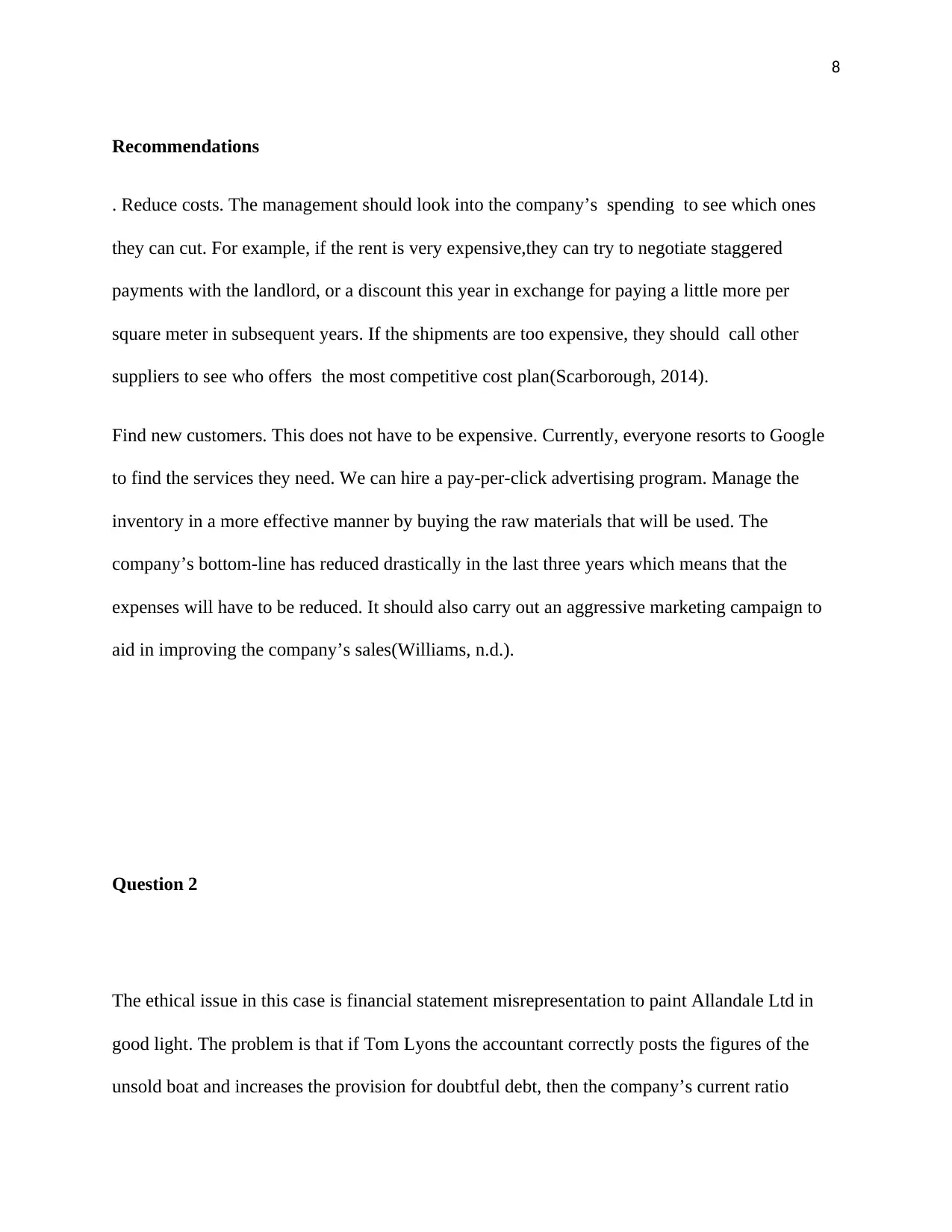

Recommendations

. Reduce costs. The management should look into the company’s spending to see which ones

they can cut. For example, if the rent is very expensive,they can try to negotiate staggered

payments with the landlord, or a discount this year in exchange for paying a little more per

square meter in subsequent years. If the shipments are too expensive, they should call other

suppliers to see who offers the most competitive cost plan(Scarborough, 2014).

Find new customers. This does not have to be expensive. Currently, everyone resorts to Google

to find the services they need. We can hire a pay-per-click advertising program. Manage the

inventory in a more effective manner by buying the raw materials that will be used. The

company’s bottom-line has reduced drastically in the last three years which means that the

expenses will have to be reduced. It should also carry out an aggressive marketing campaign to

aid in improving the company’s sales(Williams, n.d.).

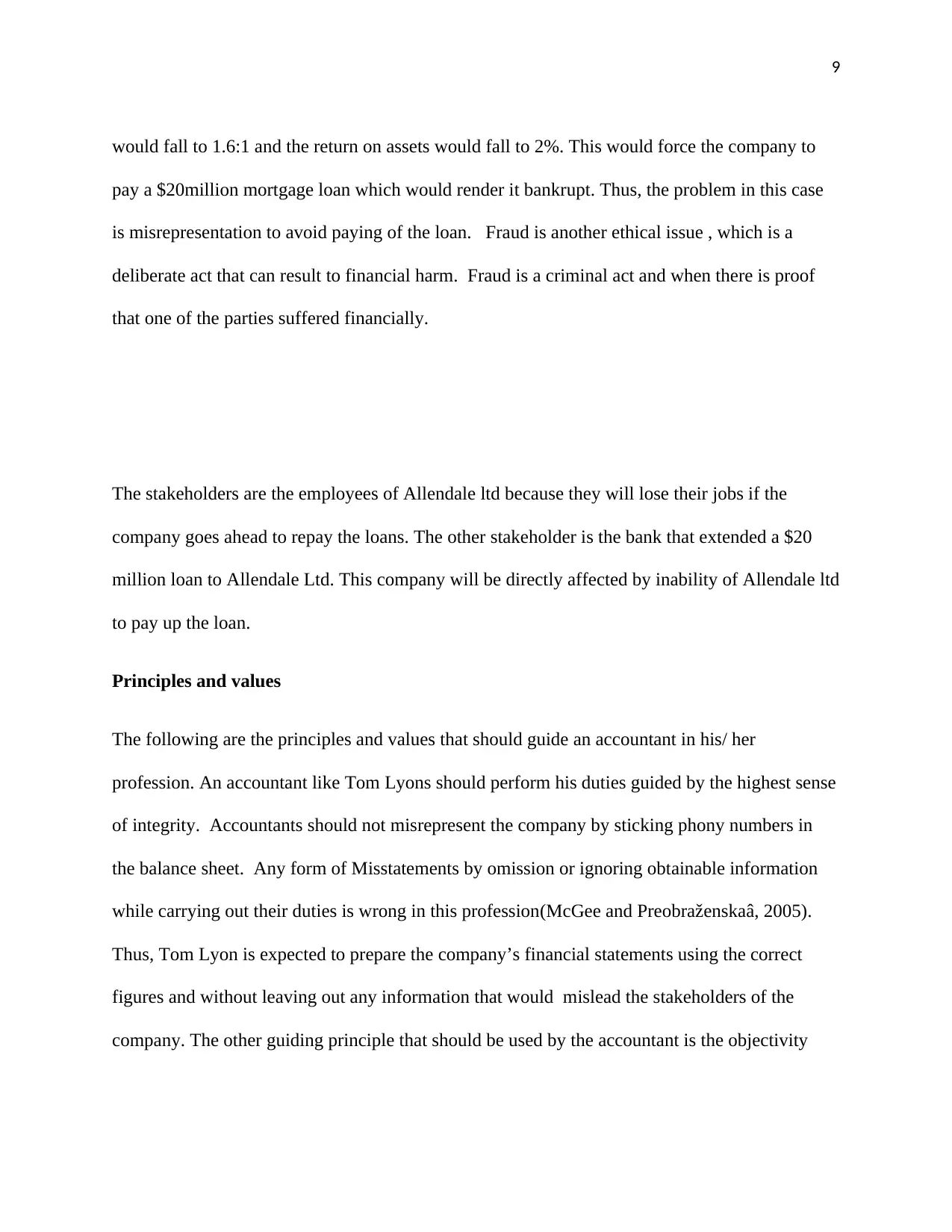

Question 2

The ethical issue in this case is financial statement misrepresentation to paint Allandale Ltd in

good light. The problem is that if Tom Lyons the accountant correctly posts the figures of the

unsold boat and increases the provision for doubtful debt, then the company’s current ratio

Recommendations

. Reduce costs. The management should look into the company’s spending to see which ones

they can cut. For example, if the rent is very expensive,they can try to negotiate staggered

payments with the landlord, or a discount this year in exchange for paying a little more per

square meter in subsequent years. If the shipments are too expensive, they should call other

suppliers to see who offers the most competitive cost plan(Scarborough, 2014).

Find new customers. This does not have to be expensive. Currently, everyone resorts to Google

to find the services they need. We can hire a pay-per-click advertising program. Manage the

inventory in a more effective manner by buying the raw materials that will be used. The

company’s bottom-line has reduced drastically in the last three years which means that the

expenses will have to be reduced. It should also carry out an aggressive marketing campaign to

aid in improving the company’s sales(Williams, n.d.).

Question 2

The ethical issue in this case is financial statement misrepresentation to paint Allandale Ltd in

good light. The problem is that if Tom Lyons the accountant correctly posts the figures of the

unsold boat and increases the provision for doubtful debt, then the company’s current ratio

9

would fall to 1.6:1 and the return on assets would fall to 2%. This would force the company to

pay a $20million mortgage loan which would render it bankrupt. Thus, the problem in this case

is misrepresentation to avoid paying of the loan. Fraud is another ethical issue , which is a

deliberate act that can result to financial harm. Fraud is a criminal act and when there is proof

that one of the parties suffered financially.

The stakeholders are the employees of Allendale ltd because they will lose their jobs if the

company goes ahead to repay the loans. The other stakeholder is the bank that extended a $20

million loan to Allendale Ltd. This company will be directly affected by inability of Allendale ltd

to pay up the loan.

Principles and values

The following are the principles and values that should guide an accountant in his/ her

profession. An accountant like Tom Lyons should perform his duties guided by the highest sense

of integrity. Accountants should not misrepresent the company by sticking phony numbers in

the balance sheet. Any form of Misstatements by omission or ignoring obtainable information

while carrying out their duties is wrong in this profession(McGee and Preobraženskaâ, 2005) .

Thus, Tom Lyon is expected to prepare the company’s financial statements using the correct

figures and without leaving out any information that would mislead the stakeholders of the

company. The other guiding principle that should be used by the accountant is the objectivity

would fall to 1.6:1 and the return on assets would fall to 2%. This would force the company to

pay a $20million mortgage loan which would render it bankrupt. Thus, the problem in this case

is misrepresentation to avoid paying of the loan. Fraud is another ethical issue , which is a

deliberate act that can result to financial harm. Fraud is a criminal act and when there is proof

that one of the parties suffered financially.

The stakeholders are the employees of Allendale ltd because they will lose their jobs if the

company goes ahead to repay the loans. The other stakeholder is the bank that extended a $20

million loan to Allendale Ltd. This company will be directly affected by inability of Allendale ltd

to pay up the loan.

Principles and values

The following are the principles and values that should guide an accountant in his/ her

profession. An accountant like Tom Lyons should perform his duties guided by the highest sense

of integrity. Accountants should not misrepresent the company by sticking phony numbers in

the balance sheet. Any form of Misstatements by omission or ignoring obtainable information

while carrying out their duties is wrong in this profession(McGee and Preobraženskaâ, 2005) .

Thus, Tom Lyon is expected to prepare the company’s financial statements using the correct

figures and without leaving out any information that would mislead the stakeholders of the

company. The other guiding principle that should be used by the accountant is the objectivity

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

principle. The objectivity principle states that all measures and figures used in accounting

should be verifiable, objective and true.

Approach to accounting fraud and its main effects

The effects on the financial statements arising from the existence of accounting fraud, they do

not reflect the economic reality of the company, thus violating the basic accounting principles

governing

both the conduct of the accountant, and his work and product. Different users of accounting

information are affected directly with fraudulent financial statements, since the decisions that

they take tend to be wrong since the base information is not real and therefore they can suffer

effects in the decisions of investment, financing and others(Stice, Stice and Diamond, 2006).

Frauds that directly affect the financial statements are focused on in the overvaluation and

undervaluation of revenues, costs and expenses, inadequate increases or decreases in balance

sheet accounts, incorrect disclosure and inadequate application of the principles of accounting.

Causes of action

If the accountant goes ahead and manipulates the financial statement then one of the stakeholders

suffers due to the manipulation, then it is only right to bring action against those responsible in

this case , Tom Lyon the accountant is the one who should be sued. It is important to collect

enough evidence to show that the manipulation of the financial statements happened. Tom

should accurately represent the company by disclosing the true and fair value of an assets that

includes the boat and also disclose the true figure of the doubtful debt. Then proceed to talk to

principle. The objectivity principle states that all measures and figures used in accounting

should be verifiable, objective and true.

Approach to accounting fraud and its main effects

The effects on the financial statements arising from the existence of accounting fraud, they do

not reflect the economic reality of the company, thus violating the basic accounting principles

governing

both the conduct of the accountant, and his work and product. Different users of accounting

information are affected directly with fraudulent financial statements, since the decisions that

they take tend to be wrong since the base information is not real and therefore they can suffer

effects in the decisions of investment, financing and others(Stice, Stice and Diamond, 2006).

Frauds that directly affect the financial statements are focused on in the overvaluation and

undervaluation of revenues, costs and expenses, inadequate increases or decreases in balance

sheet accounts, incorrect disclosure and inadequate application of the principles of accounting.

Causes of action

If the accountant goes ahead and manipulates the financial statement then one of the stakeholders

suffers due to the manipulation, then it is only right to bring action against those responsible in

this case , Tom Lyon the accountant is the one who should be sued. It is important to collect

enough evidence to show that the manipulation of the financial statements happened. Tom

should accurately represent the company by disclosing the true and fair value of an assets that

includes the boat and also disclose the true figure of the doubtful debt. Then proceed to talk to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

the bank to see if they can be allowed some more time to repay the loan(Schaltegger, Bennett

and Burritt, 2006).

Question 3

Question 3

Accounting is the basis on which managerial decisions and therefore financial decisions are

based.

There is no economic activity outside the registry and involvement of the techniques of

accounting science. From the smallest economic activity to the economic transactions of large

corporations, accounting science contributes to a great deal of knowledge, which requires them

to be applied by highly trained public accounting professionals. Giggling brothers is no

exception(Peltonen, n.d.)..

Computerized Accounting system is a system adapted to classify the economic facts that occur

in a business. In such a way, it becomes the central axis to carry out various procedures that will

lead to the obtaining of the maximum economic return that implies to constitute a determined

company. Therefore, if Giggling brothers uses this system it will have more accurate figures and

projections for all departments(Jones and Robinson, 2012)..

Today, computerised accounting system are present in all areas of organizations. This

generalized implementation of IS has been carried out in many cases without the necessary

planning, partly because the necessary concepts are not sufficiently developed. The trend

towards open systems, global interconnection and consumers' desire to become independent from

manufacturers bring with them the need for a deeper study of IS before decision-making.

the bank to see if they can be allowed some more time to repay the loan(Schaltegger, Bennett

and Burritt, 2006).

Question 3

Question 3

Accounting is the basis on which managerial decisions and therefore financial decisions are

based.

There is no economic activity outside the registry and involvement of the techniques of

accounting science. From the smallest economic activity to the economic transactions of large

corporations, accounting science contributes to a great deal of knowledge, which requires them

to be applied by highly trained public accounting professionals. Giggling brothers is no

exception(Peltonen, n.d.)..

Computerized Accounting system is a system adapted to classify the economic facts that occur

in a business. In such a way, it becomes the central axis to carry out various procedures that will

lead to the obtaining of the maximum economic return that implies to constitute a determined

company. Therefore, if Giggling brothers uses this system it will have more accurate figures and

projections for all departments(Jones and Robinson, 2012)..

Today, computerised accounting system are present in all areas of organizations. This

generalized implementation of IS has been carried out in many cases without the necessary

planning, partly because the necessary concepts are not sufficiently developed. The trend

towards open systems, global interconnection and consumers' desire to become independent from

manufacturers bring with them the need for a deeper study of IS before decision-making.

12

Therefore, it is necessary to improve the planning of future implementations, the compatibility

between systems and the organization of personnel and the company(Gaither and Gaither, 2004).

.

In recent years, the exercise of audit and control activities in information technology has

supported a more than accelerated development of all other activities in the economy of a

country. This leads one to think that the tasks performed by them must be equally audited.

In modern organizations, like Giggling brothers, the mission of computerized accounting system

is to facilitate the achievement of its strategic objectives. To this end, a considerable amount of

resources are invested in personnel, equipment and technology, in addition to the costs derived

from the possible structural organization that often entails the introduction of these technologies.

This important investment must be constantly justified in terms of efficiency and

effectiveness(Greasley, 2008).. Therefore, the purpose to be achieved by an organization that

contracts the audit of any part of its IS is to ensure that its strategic objectives are the same as

those of the organization itself and that the systems provide adequate support to the achievement

of these objectives, both in the present and in its future evolution.

At present, both processes and systems have been automated within which accounting

information is integrated, ordered and presented to all departments. This integration is done

globally within the company, in this system are fed different factors such as production, storage

inventories, etc. Which provide accounting information necessary not only to make necessary

decisions, but also for the daily operation of the company(Greasley, 2008)..

Therefore, it is necessary to improve the planning of future implementations, the compatibility

between systems and the organization of personnel and the company(Gaither and Gaither, 2004).

.

In recent years, the exercise of audit and control activities in information technology has

supported a more than accelerated development of all other activities in the economy of a

country. This leads one to think that the tasks performed by them must be equally audited.

In modern organizations, like Giggling brothers, the mission of computerized accounting system

is to facilitate the achievement of its strategic objectives. To this end, a considerable amount of

resources are invested in personnel, equipment and technology, in addition to the costs derived

from the possible structural organization that often entails the introduction of these technologies.

This important investment must be constantly justified in terms of efficiency and

effectiveness(Greasley, 2008).. Therefore, the purpose to be achieved by an organization that

contracts the audit of any part of its IS is to ensure that its strategic objectives are the same as

those of the organization itself and that the systems provide adequate support to the achievement

of these objectives, both in the present and in its future evolution.

At present, both processes and systems have been automated within which accounting

information is integrated, ordered and presented to all departments. This integration is done

globally within the company, in this system are fed different factors such as production, storage

inventories, etc. Which provide accounting information necessary not only to make necessary

decisions, but also for the daily operation of the company(Greasley, 2008)..

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.