Financial Analysis & Share Market Decisions: Crown, Qantas & Seek

VerifiedAdded on 2023/04/23

|20

|3665

|119

Report

AI Summary

This report presents a financial analysis focused on share market decision-making, examining Crown Resorts, Qantas Airways, and Seek Limited. Part 1 details the total investment in these companies, while Part 2 provides a comparative analysis of their products, services, executive compensation, profitability, and dividend policies. Graphical representations compare the companies' average returns against the All Ordinaries Index. Part 3 involves a ratio analysis, including liquidity, profitability, and long-term solvency ratios, to assess the financial health of each company and provide investment recommendations. The analysis uses financial data such as revenue, interest expense, EBIT, net profit, assets, and liabilities to calculate key ratios like current ratio and asset turnover, offering insights for potential investors. This report is available on Desklib, where students can find more solved assignments and study resources.

Running Head: FINANCIAL ANALYSIS 0

Financial Analysis

Financial Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 1

Table of Contents

Part 1...........................................................................................................................................................1

TOTAL INVESTMENT..........................................................................................................................2

Part 2...........................................................................................................................................................2

Part A..........................................................................................................................................................2

Part B & C...................................................................................................................................................4

Part D..........................................................................................................................................................8

Part E...........................................................................................................................................................8

Crown Resorts.........................................................................................................................................8

Qantas Airways.......................................................................................................................................8

Seek Limited...........................................................................................................................................9

Part 3...........................................................................................................................................................9

Identification of the data..........................................................................................................................9

Ratio Analysis.......................................................................................................................................10

Liquidity Ratios.................................................................................................................................10

Profitability Ratios.............................................................................................................................11

Long Term Solvency Ratios..............................................................................................................13

Recommendations.....................................................................................................................................14

References.................................................................................................................................................14

Appendix 1................................................................................................................................................17

Table of Contents

Part 1...........................................................................................................................................................1

TOTAL INVESTMENT..........................................................................................................................2

Part 2...........................................................................................................................................................2

Part A..........................................................................................................................................................2

Part B & C...................................................................................................................................................4

Part D..........................................................................................................................................................8

Part E...........................................................................................................................................................8

Crown Resorts.........................................................................................................................................8

Qantas Airways.......................................................................................................................................8

Seek Limited...........................................................................................................................................9

Part 3...........................................................................................................................................................9

Identification of the data..........................................................................................................................9

Ratio Analysis.......................................................................................................................................10

Liquidity Ratios.................................................................................................................................10

Profitability Ratios.............................................................................................................................11

Long Term Solvency Ratios..............................................................................................................13

Recommendations.....................................................................................................................................14

References.................................................................................................................................................14

Appendix 1................................................................................................................................................17

FINANCIAL ANALYSIS 2

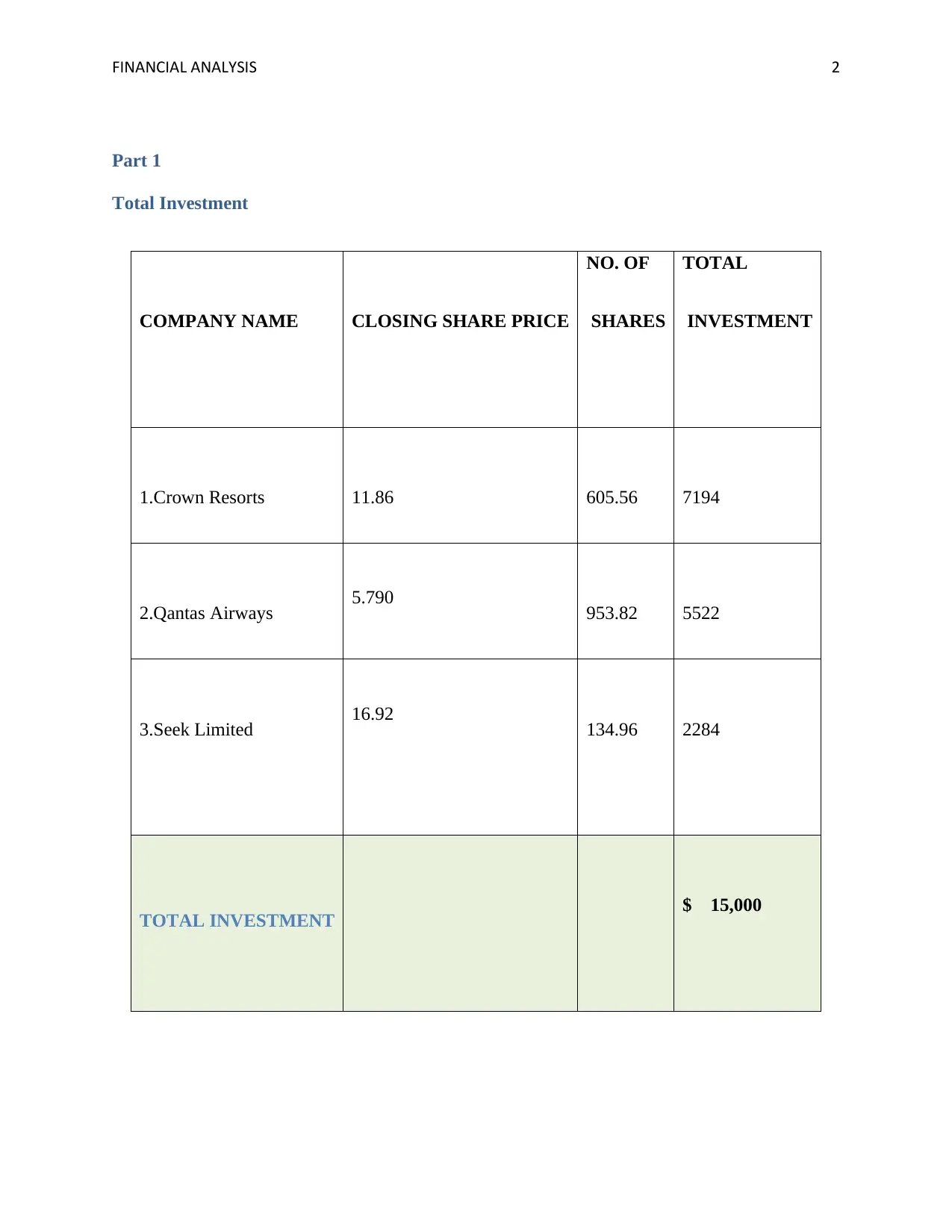

Part 1

Total Investment

COMPANY NAME CLOSING SHARE PRICE

NO. OF

SHARES

TOTAL

INVESTMENT

1.Crown Resorts 11.86 605.56 7194

2.Qantas Airways 5.790 953.82 5522

3.Seek Limited 16.92 134.96 2284

TOTAL INVESTMENT $ 15,000

Part 1

Total Investment

COMPANY NAME CLOSING SHARE PRICE

NO. OF

SHARES

TOTAL

INVESTMENT

1.Crown Resorts 11.86 605.56 7194

2.Qantas Airways 5.790 953.82 5522

3.Seek Limited 16.92 134.96 2284

TOTAL INVESTMENT $ 15,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL ANALYSIS 3

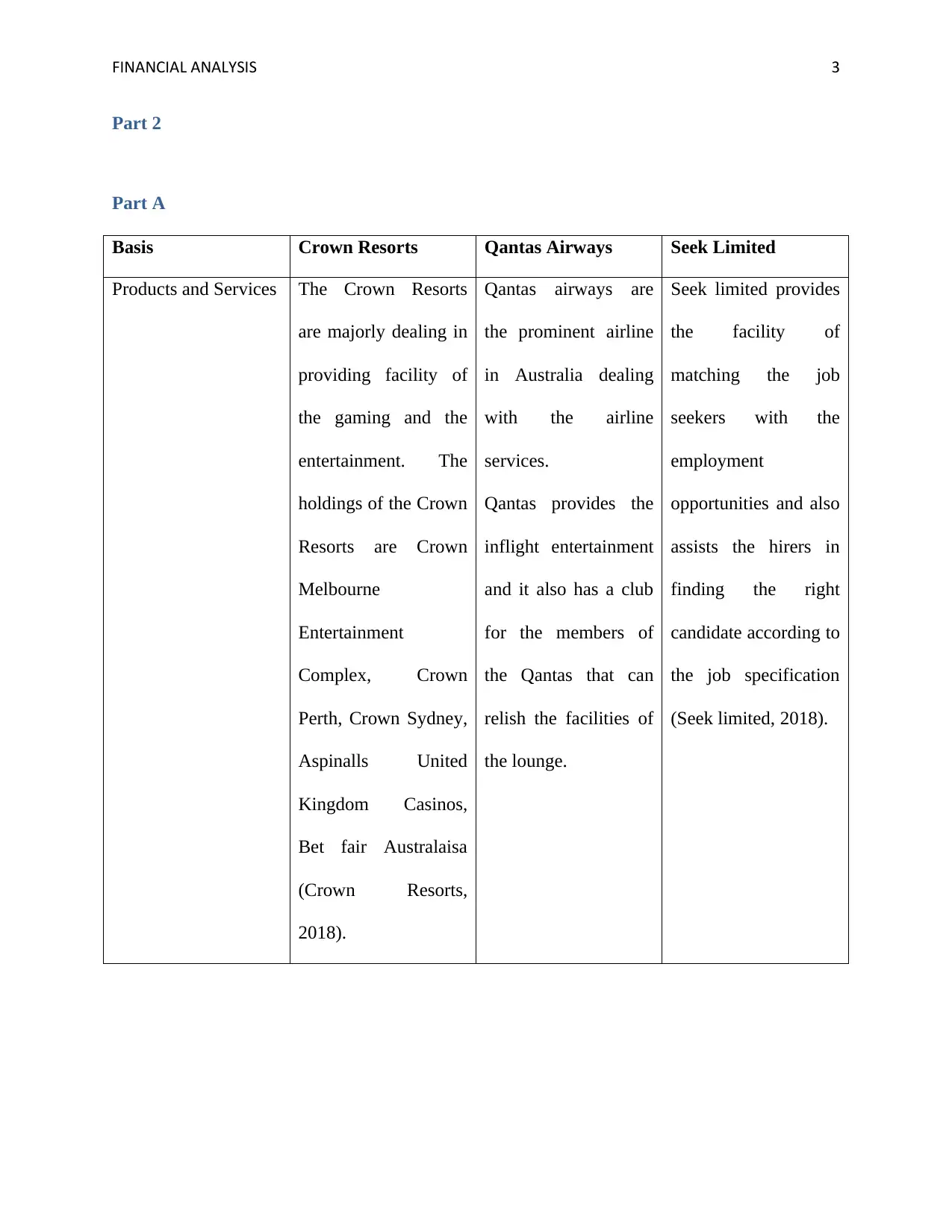

Part 2

Part A

Basis Crown Resorts Qantas Airways Seek Limited

Products and Services The Crown Resorts

are majorly dealing in

providing facility of

the gaming and the

entertainment. The

holdings of the Crown

Resorts are Crown

Melbourne

Entertainment

Complex, Crown

Perth, Crown Sydney,

Aspinalls United

Kingdom Casinos,

Bet fair Australaisa

(Crown Resorts,

2018).

Qantas airways are

the prominent airline

in Australia dealing

with the airline

services.

Qantas provides the

inflight entertainment

and it also has a club

for the members of

the Qantas that can

relish the facilities of

the lounge.

Seek limited provides

the facility of

matching the job

seekers with the

employment

opportunities and also

assists the hirers in

finding the right

candidate according to

the job specification

(Seek limited, 2018).

Part 2

Part A

Basis Crown Resorts Qantas Airways Seek Limited

Products and Services The Crown Resorts

are majorly dealing in

providing facility of

the gaming and the

entertainment. The

holdings of the Crown

Resorts are Crown

Melbourne

Entertainment

Complex, Crown

Perth, Crown Sydney,

Aspinalls United

Kingdom Casinos,

Bet fair Australaisa

(Crown Resorts,

2018).

Qantas airways are

the prominent airline

in Australia dealing

with the airline

services.

Qantas provides the

inflight entertainment

and it also has a club

for the members of

the Qantas that can

relish the facilities of

the lounge.

Seek limited provides

the facility of

matching the job

seekers with the

employment

opportunities and also

assists the hirers in

finding the right

candidate according to

the job specification

(Seek limited, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 4

Name of the Chief

Executive Officer

The CEO of crown

Resorts is Barry

Felstead (Crown

Resorts, 2018)

Alan Joseph Joyce is

holding the position

of CEO (Qantas,

2018).

Andrew Bassat is the

current CEO of Seek

Limited.

Salary of the Chief

Executive officer

The salary or

remuneration of Barry

Felstaed is $22.7

million (Crown

Resorts, 2018)

$10.9 million is the

current remuneration

of Alan Joseph Joyce

Andrew Bassat is

$42.09 million as per

the annual report of

the Seek Limited

(Seek limited, 2018).

Profit/Loss after tax The current profit and

loss of CROWN

Resorts is $573.2

million (Crown

Resorts, 2018).

The company is

operating at $980

million, serving

worldwide customers

(Qantas, 2018).

At present the

company is earning

$85.5 million and

reported for the

financial year 2018

(Seek limited, 2018).

Latest dividend paid The last dividend paid

to the company is 60

cents per share, 413

million.

The dividend paid by

the Qantas limited is

$10 cents per share

and $168 million is

reported in the current

year (Qantas, 2018).

The total dividends

per share are 46 per

share and the

dividends paid to

shareholders are

$157.7 million (Seek

limited, 2018).

Name of the Chief

Executive Officer

The CEO of crown

Resorts is Barry

Felstead (Crown

Resorts, 2018)

Alan Joseph Joyce is

holding the position

of CEO (Qantas,

2018).

Andrew Bassat is the

current CEO of Seek

Limited.

Salary of the Chief

Executive officer

The salary or

remuneration of Barry

Felstaed is $22.7

million (Crown

Resorts, 2018)

$10.9 million is the

current remuneration

of Alan Joseph Joyce

Andrew Bassat is

$42.09 million as per

the annual report of

the Seek Limited

(Seek limited, 2018).

Profit/Loss after tax The current profit and

loss of CROWN

Resorts is $573.2

million (Crown

Resorts, 2018).

The company is

operating at $980

million, serving

worldwide customers

(Qantas, 2018).

At present the

company is earning

$85.5 million and

reported for the

financial year 2018

(Seek limited, 2018).

Latest dividend paid The last dividend paid

to the company is 60

cents per share, 413

million.

The dividend paid by

the Qantas limited is

$10 cents per share

and $168 million is

reported in the current

year (Qantas, 2018).

The total dividends

per share are 46 per

share and the

dividends paid to

shareholders are

$157.7 million (Seek

limited, 2018).

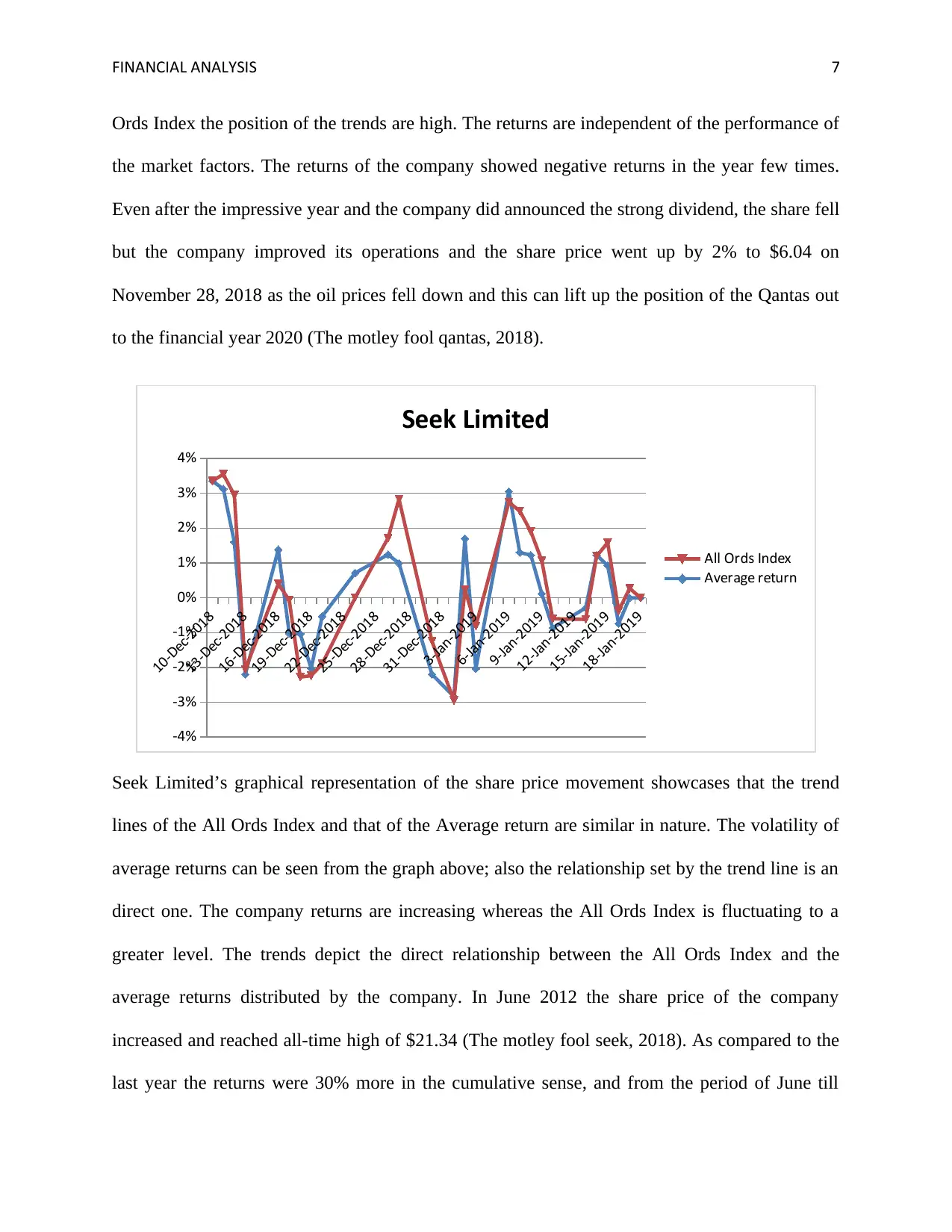

FINANCIAL ANALYSIS 5

Size of the business

by total assets

$8171 million $18647 million $3785 million

Number of Employees 12000 27000 805

Share Price $12.17 $43.01 $17.81

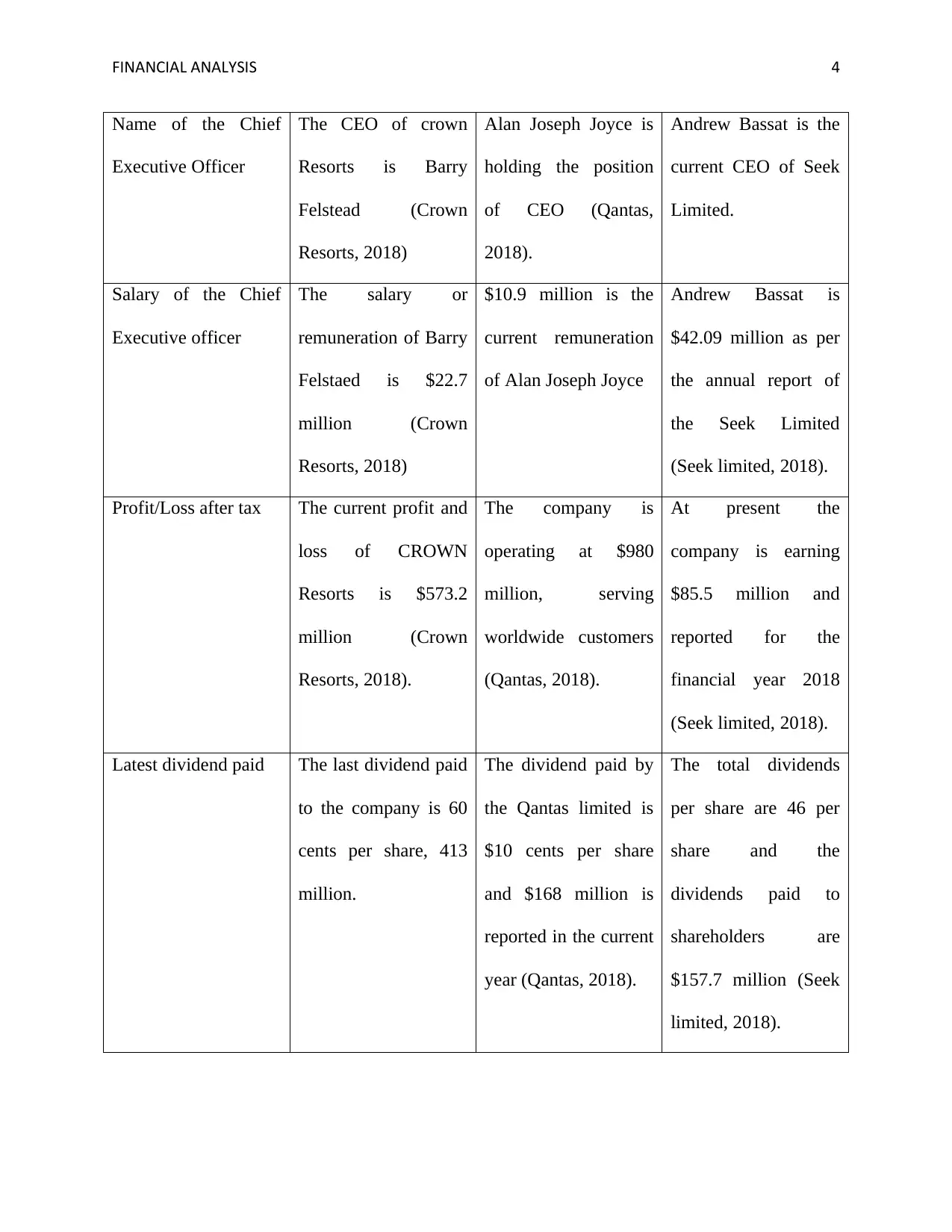

Part B & C

Below is the graphical representation of all the three companies namely, Crown Resorts, Qantas

and Seek Limited.

10-Dec-2018

13-Dec-2018

16-Dec-2018

19-Dec-2018

22-Dec-2018

25-Dec-2018

28-Dec-2018

31-Dec-2018

3-Jan-2019

6-Jan-2019

9-Jan-2019

12-Jan-2019

15-Jan-2019

18-Jan-2019

-4%

-2%

0%

2%

4%

Crown Resort

Average return

All Ords Index

The graphical representation of the Crown Resort suggests the comparison of the All Ords Index

and the average returns provided by the company. The average return of the company is

compared with the All Ords Index of Australia. The Ords All Index is considered as the

benchmark against which the returns of the companies are compared. The period taken for the

Size of the business

by total assets

$8171 million $18647 million $3785 million

Number of Employees 12000 27000 805

Share Price $12.17 $43.01 $17.81

Part B & C

Below is the graphical representation of all the three companies namely, Crown Resorts, Qantas

and Seek Limited.

10-Dec-2018

13-Dec-2018

16-Dec-2018

19-Dec-2018

22-Dec-2018

25-Dec-2018

28-Dec-2018

31-Dec-2018

3-Jan-2019

6-Jan-2019

9-Jan-2019

12-Jan-2019

15-Jan-2019

18-Jan-2019

-4%

-2%

0%

2%

4%

Crown Resort

Average return

All Ords Index

The graphical representation of the Crown Resort suggests the comparison of the All Ords Index

and the average returns provided by the company. The average return of the company is

compared with the All Ords Index of Australia. The Ords All Index is considered as the

benchmark against which the returns of the companies are compared. The period taken for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL ANALYSIS 6

comparison is the period of the 52 weeks and it can be interpreted for the graph that the average

return was always higher than the average returns posed by the All ORDS Index and this reflects

that the share price of the Crown Resorts are dependent of the market factors. Further the returns

produced by the company are giving tuff competition and are more volatile in nature. Moreover

this also reflects that the company is having the immediate connection with the All Ords Index.

The share price of the Crown Resorts Limited has been the biggest market mover on the market

on August 9, 2018. Further the company achieved the diluted earnings per share of 81.2 cents.

And the net profit after tax was down to 70% at $558 million (The motley fool crown, 2018).

10-Dec-2018

12-Dec-2018

14-Dec-2018

16-Dec-2018

18-Dec-2018

20-Dec-2018

22-Dec-2018

24-Dec-2018

26-Dec-2018

28-Dec-2018

30-Dec-2018

1-Jan-2019

3-Jan-2019

5-Jan-2019

7-Jan-2019

9-Jan-2019

11-Jan-2019

13-Jan-2019

15-Jan-2019

17-Jan-2019

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

QANTAS

Average return

All Ords Index

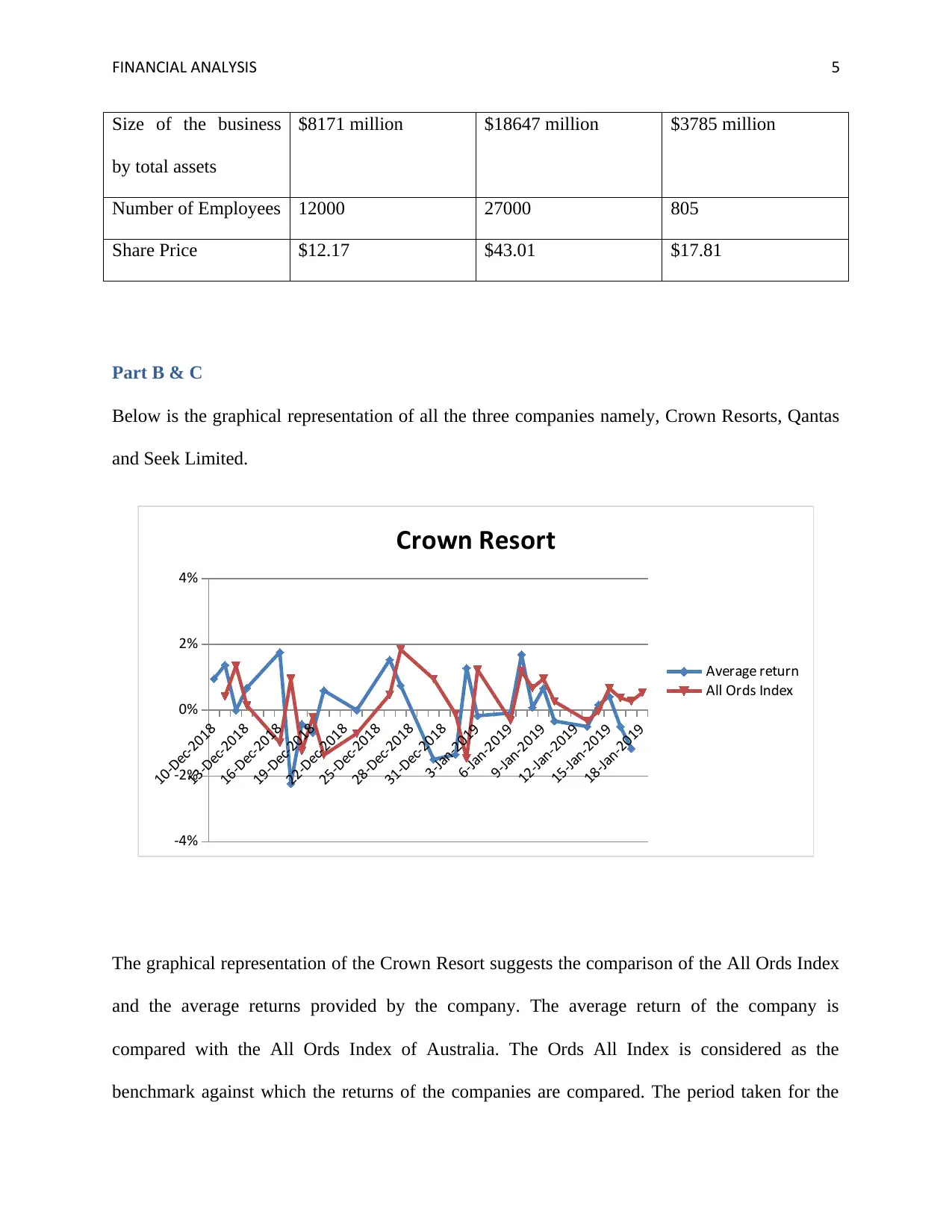

This graph represents the share price of the Qantas over the period of the 52 weeks against the

All Ords Index. The trend line basically reflects that the Qantas is performing way better than the

average returns achieved by the All Ords Index. The fluctuations are heavy and the bullish trend

in confirmed in the future according to the financial analysts and the experts. The wedge pattern

is upcoming and hence the price is showing a steep trend. Further when compared to the All

comparison is the period of the 52 weeks and it can be interpreted for the graph that the average

return was always higher than the average returns posed by the All ORDS Index and this reflects

that the share price of the Crown Resorts are dependent of the market factors. Further the returns

produced by the company are giving tuff competition and are more volatile in nature. Moreover

this also reflects that the company is having the immediate connection with the All Ords Index.

The share price of the Crown Resorts Limited has been the biggest market mover on the market

on August 9, 2018. Further the company achieved the diluted earnings per share of 81.2 cents.

And the net profit after tax was down to 70% at $558 million (The motley fool crown, 2018).

10-Dec-2018

12-Dec-2018

14-Dec-2018

16-Dec-2018

18-Dec-2018

20-Dec-2018

22-Dec-2018

24-Dec-2018

26-Dec-2018

28-Dec-2018

30-Dec-2018

1-Jan-2019

3-Jan-2019

5-Jan-2019

7-Jan-2019

9-Jan-2019

11-Jan-2019

13-Jan-2019

15-Jan-2019

17-Jan-2019

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

QANTAS

Average return

All Ords Index

This graph represents the share price of the Qantas over the period of the 52 weeks against the

All Ords Index. The trend line basically reflects that the Qantas is performing way better than the

average returns achieved by the All Ords Index. The fluctuations are heavy and the bullish trend

in confirmed in the future according to the financial analysts and the experts. The wedge pattern

is upcoming and hence the price is showing a steep trend. Further when compared to the All

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 7

Ords Index the position of the trends are high. The returns are independent of the performance of

the market factors. The returns of the company showed negative returns in the year few times.

Even after the impressive year and the company did announced the strong dividend, the share fell

but the company improved its operations and the share price went up by 2% to $6.04 on

November 28, 2018 as the oil prices fell down and this can lift up the position of the Qantas out

to the financial year 2020 (The motley fool qantas, 2018).

10-Dec-2018

13-Dec-2018

16-Dec-2018

19-Dec-2018

22-Dec-2018

25-Dec-2018

28-Dec-2018

31-Dec-2018

3-Jan-2019

6-Jan-2019

9-Jan-2019

12-Jan-2019

15-Jan-2019

18-Jan-2019

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

Seek Limited

All Ords Index

Average return

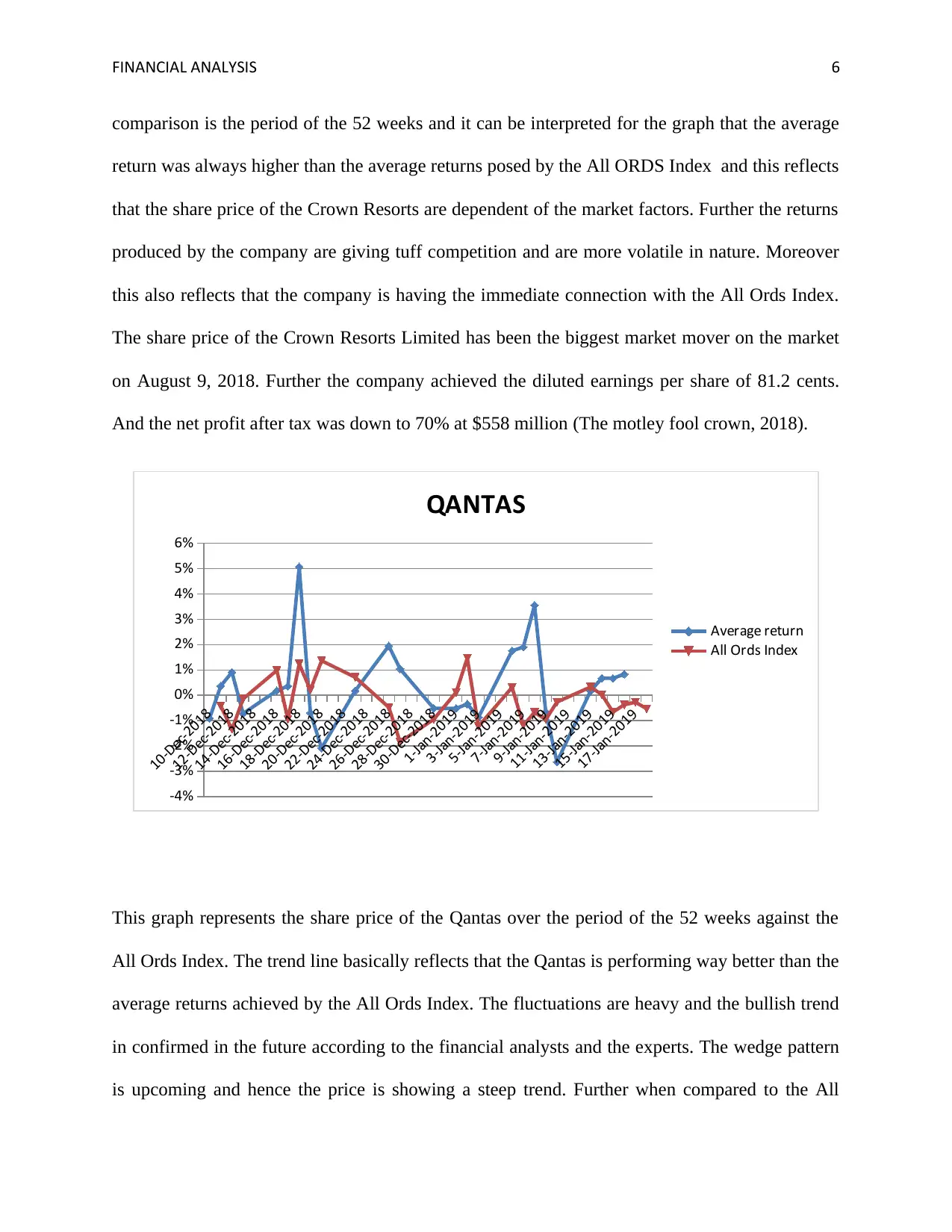

Seek Limited’s graphical representation of the share price movement showcases that the trend

lines of the All Ords Index and that of the Average return are similar in nature. The volatility of

average returns can be seen from the graph above; also the relationship set by the trend line is an

direct one. The company returns are increasing whereas the All Ords Index is fluctuating to a

greater level. The trends depict the direct relationship between the All Ords Index and the

average returns distributed by the company. In June 2012 the share price of the company

increased and reached all-time high of $21.34 (The motley fool seek, 2018). As compared to the

last year the returns were 30% more in the cumulative sense, and from the period of June till

Ords Index the position of the trends are high. The returns are independent of the performance of

the market factors. The returns of the company showed negative returns in the year few times.

Even after the impressive year and the company did announced the strong dividend, the share fell

but the company improved its operations and the share price went up by 2% to $6.04 on

November 28, 2018 as the oil prices fell down and this can lift up the position of the Qantas out

to the financial year 2020 (The motley fool qantas, 2018).

10-Dec-2018

13-Dec-2018

16-Dec-2018

19-Dec-2018

22-Dec-2018

25-Dec-2018

28-Dec-2018

31-Dec-2018

3-Jan-2019

6-Jan-2019

9-Jan-2019

12-Jan-2019

15-Jan-2019

18-Jan-2019

-4%

-3%

-2%

-1%

0%

1%

2%

3%

4%

Seek Limited

All Ords Index

Average return

Seek Limited’s graphical representation of the share price movement showcases that the trend

lines of the All Ords Index and that of the Average return are similar in nature. The volatility of

average returns can be seen from the graph above; also the relationship set by the trend line is an

direct one. The company returns are increasing whereas the All Ords Index is fluctuating to a

greater level. The trends depict the direct relationship between the All Ords Index and the

average returns distributed by the company. In June 2012 the share price of the company

increased and reached all-time high of $21.34 (The motley fool seek, 2018). As compared to the

last year the returns were 30% more in the cumulative sense, and from the period of June till

FINANCIAL ANALYSIS 8

November it can be seen that the price of the company rose and from the perspective of the

investors and the shareholders, this is the good option to hold or sell as it is going to deliver the

future returns. Further those who have already brought, these investments will result for the

longer duration benefits and hence the share shall be kept on hold (Mickeboror, 2018).

Part D

Closing

at

10/12/20

18

Closing

at

18/01/20

19

Differen

ce

Current

Numbe

r of

shares

Loss per

price

Crown

Resorts 11.86 11.88 -0.02 5157 48% -103.14

7193.8

1

60

5

Qantas

Airways 5.79 6.15 -0.36

3959.0

0 37% -1425.24

5522.6

4

89

7

Seek Limited 16.90 17.43 -0.53

1637.0

0 15% -867.61

2283.5

5

13

1

Total

10753.

00

100

%

15000.

00

November it can be seen that the price of the company rose and from the perspective of the

investors and the shareholders, this is the good option to hold or sell as it is going to deliver the

future returns. Further those who have already brought, these investments will result for the

longer duration benefits and hence the share shall be kept on hold (Mickeboror, 2018).

Part D

Closing

at

10/12/20

18

Closing

at

18/01/20

19

Differen

ce

Current

Numbe

r of

shares

Loss per

price

Crown

Resorts 11.86 11.88 -0.02 5157 48% -103.14

7193.8

1

60

5

Qantas

Airways 5.79 6.15 -0.36

3959.0

0 37% -1425.24

5522.6

4

89

7

Seek Limited 16.90 17.43 -0.53

1637.0

0 15% -867.61

2283.5

5

13

1

Total

10753.

00

100

%

15000.

00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL ANALYSIS 9

Part E

Crown Resorts

Therefore this is a great option from the point of view of the investors to gain exposure of the

tourism boom in Australia. The company was also going with the option of the repurchase at the

rate of the 4.4% of the issued capital. Hence this option is preferable for the investors having the

bullish attitude towards the shares of the Crown Resorts. Therefore the shares shall be purchased

(The motley fool crown, 2018).

Qantas Airways

The Qantas showed the break record performance for the significant year even after having the

ideology behind that the airline industry not suitable or say more fluctuating for the investors to

invest in. therefore it is advised to the investors to wait for the price of the shares to fall, as the

chances are that oil prices are going to fell considering the trend of the oil prices (The motley

fool qantas, 2018).

Seek Limited

The company is a low growth company but is investing for future heavily. Hence this option is a

good option to hold. Hence the Seek Limited’s investors are required to hold the options as the

opportunities will cater the investors once the investments are made by the company at the larger

scale.

Part 3

Identification of the data

Particulars Crown Resort Qantas Seek Limited

Part E

Crown Resorts

Therefore this is a great option from the point of view of the investors to gain exposure of the

tourism boom in Australia. The company was also going with the option of the repurchase at the

rate of the 4.4% of the issued capital. Hence this option is preferable for the investors having the

bullish attitude towards the shares of the Crown Resorts. Therefore the shares shall be purchased

(The motley fool crown, 2018).

Qantas Airways

The Qantas showed the break record performance for the significant year even after having the

ideology behind that the airline industry not suitable or say more fluctuating for the investors to

invest in. therefore it is advised to the investors to wait for the price of the shares to fall, as the

chances are that oil prices are going to fell considering the trend of the oil prices (The motley

fool qantas, 2018).

Seek Limited

The company is a low growth company but is investing for future heavily. Hence this option is a

good option to hold. Hence the Seek Limited’s investors are required to hold the options as the

opportunities will cater the investors once the investments are made by the company at the larger

scale.

Part 3

Identification of the data

Particulars Crown Resort Qantas Seek Limited

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL ANALYSIS 10

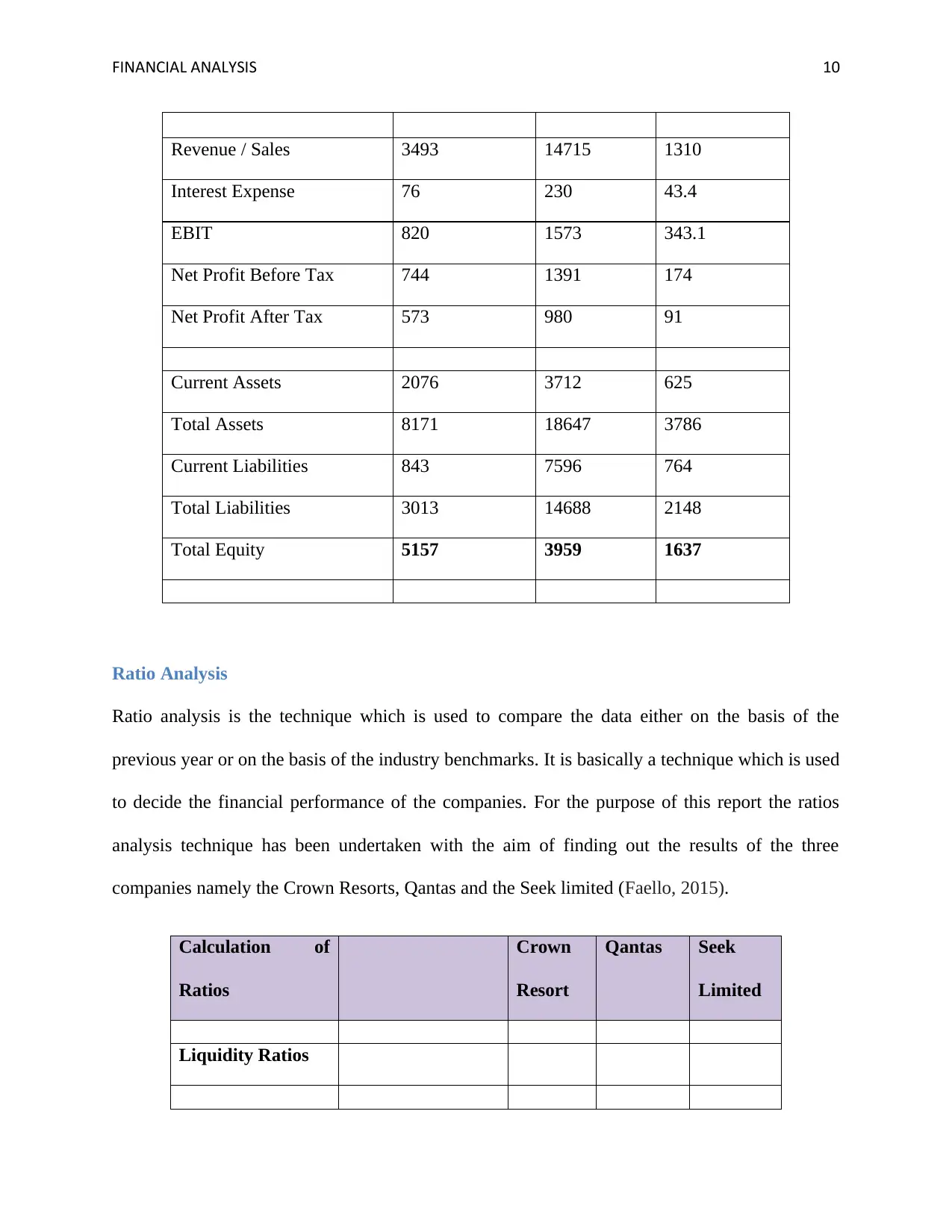

Revenue / Sales 3493 14715 1310

Interest Expense 76 230 43.4

EBIT 820 1573 343.1

Net Profit Before Tax 744 1391 174

Net Profit After Tax 573 980 91

Current Assets 2076 3712 625

Total Assets 8171 18647 3786

Current Liabilities 843 7596 764

Total Liabilities 3013 14688 2148

Total Equity 5157 3959 1637

Ratio Analysis

Ratio analysis is the technique which is used to compare the data either on the basis of the

previous year or on the basis of the industry benchmarks. It is basically a technique which is used

to decide the financial performance of the companies. For the purpose of this report the ratios

analysis technique has been undertaken with the aim of finding out the results of the three

companies namely the Crown Resorts, Qantas and the Seek limited (Faello, 2015).

Calculation of

Ratios

Crown

Resort

Qantas Seek

Limited

Liquidity Ratios

Revenue / Sales 3493 14715 1310

Interest Expense 76 230 43.4

EBIT 820 1573 343.1

Net Profit Before Tax 744 1391 174

Net Profit After Tax 573 980 91

Current Assets 2076 3712 625

Total Assets 8171 18647 3786

Current Liabilities 843 7596 764

Total Liabilities 3013 14688 2148

Total Equity 5157 3959 1637

Ratio Analysis

Ratio analysis is the technique which is used to compare the data either on the basis of the

previous year or on the basis of the industry benchmarks. It is basically a technique which is used

to decide the financial performance of the companies. For the purpose of this report the ratios

analysis technique has been undertaken with the aim of finding out the results of the three

companies namely the Crown Resorts, Qantas and the Seek limited (Faello, 2015).

Calculation of

Ratios

Crown

Resort

Qantas Seek

Limited

Liquidity Ratios

FINANCIAL ANALYSIS 11

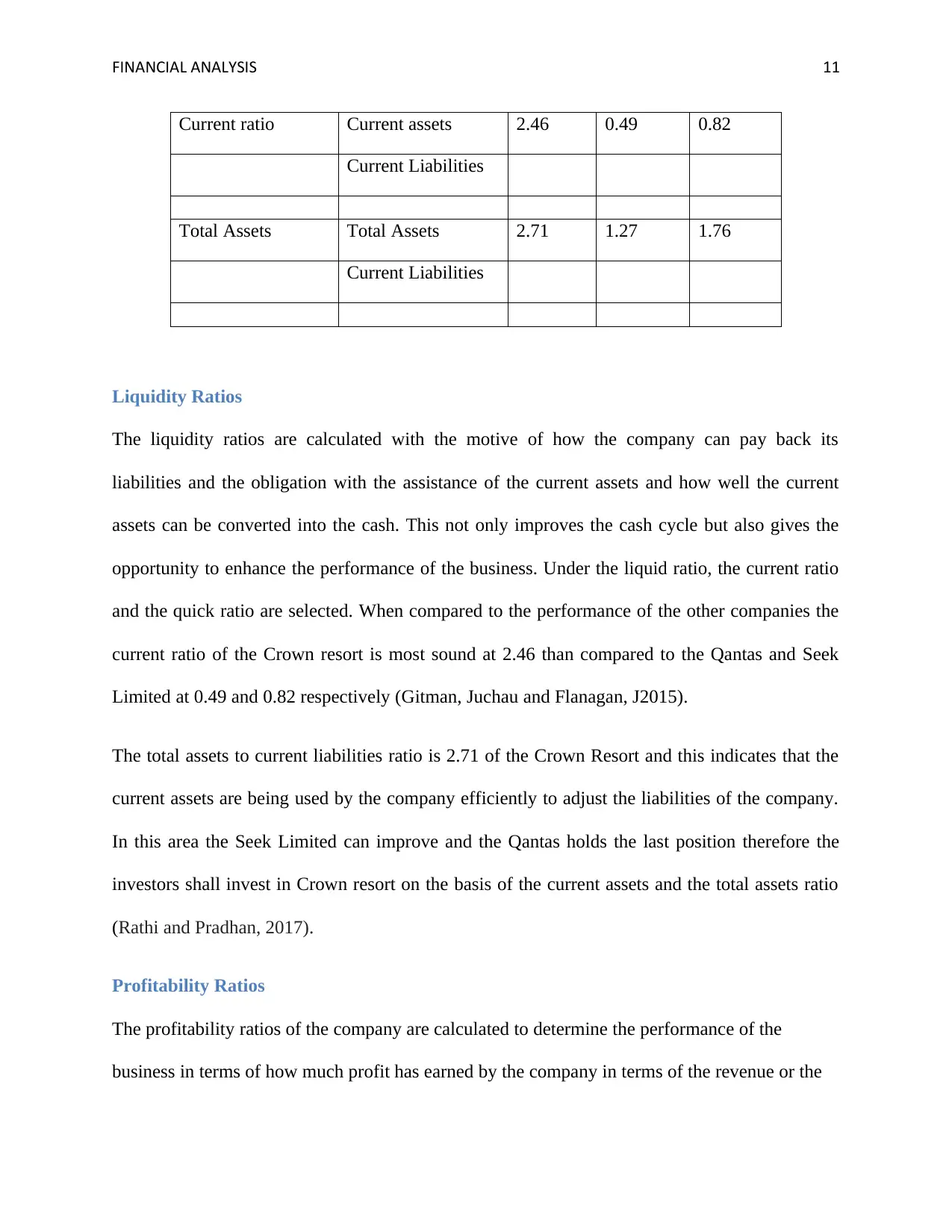

Current ratio Current assets 2.46 0.49 0.82

Current Liabilities

Total Assets Total Assets 2.71 1.27 1.76

Current Liabilities

Liquidity Ratios

The liquidity ratios are calculated with the motive of how the company can pay back its

liabilities and the obligation with the assistance of the current assets and how well the current

assets can be converted into the cash. This not only improves the cash cycle but also gives the

opportunity to enhance the performance of the business. Under the liquid ratio, the current ratio

and the quick ratio are selected. When compared to the performance of the other companies the

current ratio of the Crown resort is most sound at 2.46 than compared to the Qantas and Seek

Limited at 0.49 and 0.82 respectively (Gitman, Juchau and Flanagan, J2015).

The total assets to current liabilities ratio is 2.71 of the Crown Resort and this indicates that the

current assets are being used by the company efficiently to adjust the liabilities of the company.

In this area the Seek Limited can improve and the Qantas holds the last position therefore the

investors shall invest in Crown resort on the basis of the current assets and the total assets ratio

(Rathi and Pradhan, 2017).

Profitability Ratios

The profitability ratios of the company are calculated to determine the performance of the

business in terms of how much profit has earned by the company in terms of the revenue or the

Current ratio Current assets 2.46 0.49 0.82

Current Liabilities

Total Assets Total Assets 2.71 1.27 1.76

Current Liabilities

Liquidity Ratios

The liquidity ratios are calculated with the motive of how the company can pay back its

liabilities and the obligation with the assistance of the current assets and how well the current

assets can be converted into the cash. This not only improves the cash cycle but also gives the

opportunity to enhance the performance of the business. Under the liquid ratio, the current ratio

and the quick ratio are selected. When compared to the performance of the other companies the

current ratio of the Crown resort is most sound at 2.46 than compared to the Qantas and Seek

Limited at 0.49 and 0.82 respectively (Gitman, Juchau and Flanagan, J2015).

The total assets to current liabilities ratio is 2.71 of the Crown Resort and this indicates that the

current assets are being used by the company efficiently to adjust the liabilities of the company.

In this area the Seek Limited can improve and the Qantas holds the last position therefore the

investors shall invest in Crown resort on the basis of the current assets and the total assets ratio

(Rathi and Pradhan, 2017).

Profitability Ratios

The profitability ratios of the company are calculated to determine the performance of the

business in terms of how much profit has earned by the company in terms of the revenue or the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.