Cost Accounting and Budgeting Analysis for Smart Looks Company

VerifiedAdded on 2020/02/14

|15

|3452

|96

Report

AI Summary

This report provides a comprehensive analysis of the cost accounting and budgeting practices of Smart Looks, a cloth manufacturing company. The report begins by classifying various costs (fixed, variable, and semi-variable) and presents unit cost calculations for different production levels. Graphical representations are used to analyze cost data, highlighting the impact of variable costs on profitability. The report then delves into inventory valuation, demonstrating the application of FIFO, LIFO, and average cost methods. Furthermore, the report explores critical success factors (CSFs) for Smart Looks, including customer experience, product quality, operational efficiency, and cost reduction, providing key performance indicators (KPIs) for each. The report also defines the purpose and methods of budgeting, including zero-based, fixed, and flexible budgeting, and recommends zero-based budgeting for Smart Looks. Overall, the report offers a detailed examination of financial management techniques relevant to the company's operations, with the goal of improving financial performance and decision-making.

Management Accounting: Costing and

Budgeting

Budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction.....................................................................................................................................3

Task 1...............................................................................................................................................3

Q1.................................................................................................................................................3

Q2.................................................................................................................................................4

Q3.................................................................................................................................................6

Q4 ................................................................................................................................................7

Q5.................................................................................................................................................8

Task 2.............................................................................................................................................10

Q6...............................................................................................................................................10

Q7...............................................................................................................................................11

Q8...............................................................................................................................................12

Task 3.............................................................................................................................................12

Q9...............................................................................................................................................12

Q10.............................................................................................................................................14

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

2

Introduction.....................................................................................................................................3

Task 1...............................................................................................................................................3

Q1.................................................................................................................................................3

Q2.................................................................................................................................................4

Q3.................................................................................................................................................6

Q4 ................................................................................................................................................7

Q5.................................................................................................................................................8

Task 2.............................................................................................................................................10

Q6...............................................................................................................................................10

Q7...............................................................................................................................................11

Q8...............................................................................................................................................12

Task 3.............................................................................................................................................12

Q9...............................................................................................................................................12

Q10.............................................................................................................................................14

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

2

INTRODUCTION

Management accounting can be defined as form of accounting which enable organization

in conducting their operation with more efficiency. It gives statistical information to the

managers so that they can take effective decisions for the growth of the companies. That is the

great tool that assists in planning, budgeting, controlling and measuring the overall performance

of the entity to great extent (Lobo and Zhao, 2013). For the present report Smart Looks is being

taken into account which is a cloth making organization and supply its products to various

retailers. Current assignment will classify the various type of costs of the cited firm. It will

calculate the unit cost and these costs will be analyzed in graphical way. Furthermore, FIFO,

LIFO and average cost methods will be used in order to compute the inventory. Sales,

production, labour, total overhead budget will be prepared in this study.

TASK 1

Q1

A) Classification of costs Fixed cost: It is the type of cost which remain constant in each situation. These are

operating expenditures which are necessary for the entities for running the business

smoothly. These are unavoidable spending which help the management of Smart Looks

in analyzing the break even point (Schreinemachers, Ebert and Wu, 2014). Variable costs: This is another type of expenditures that are directly depended upon the

quantity of output. If production volume get changed then it affects the variable costs as

well. Semi variable costs: It is the type of costing which is nature of both fixed and variable

costs. It is fixed when amount of spending is within specific level but when it gets

surpassed then it turns into variable thus, called as semi-variable costs (Tsai P. and et.al,

2015).

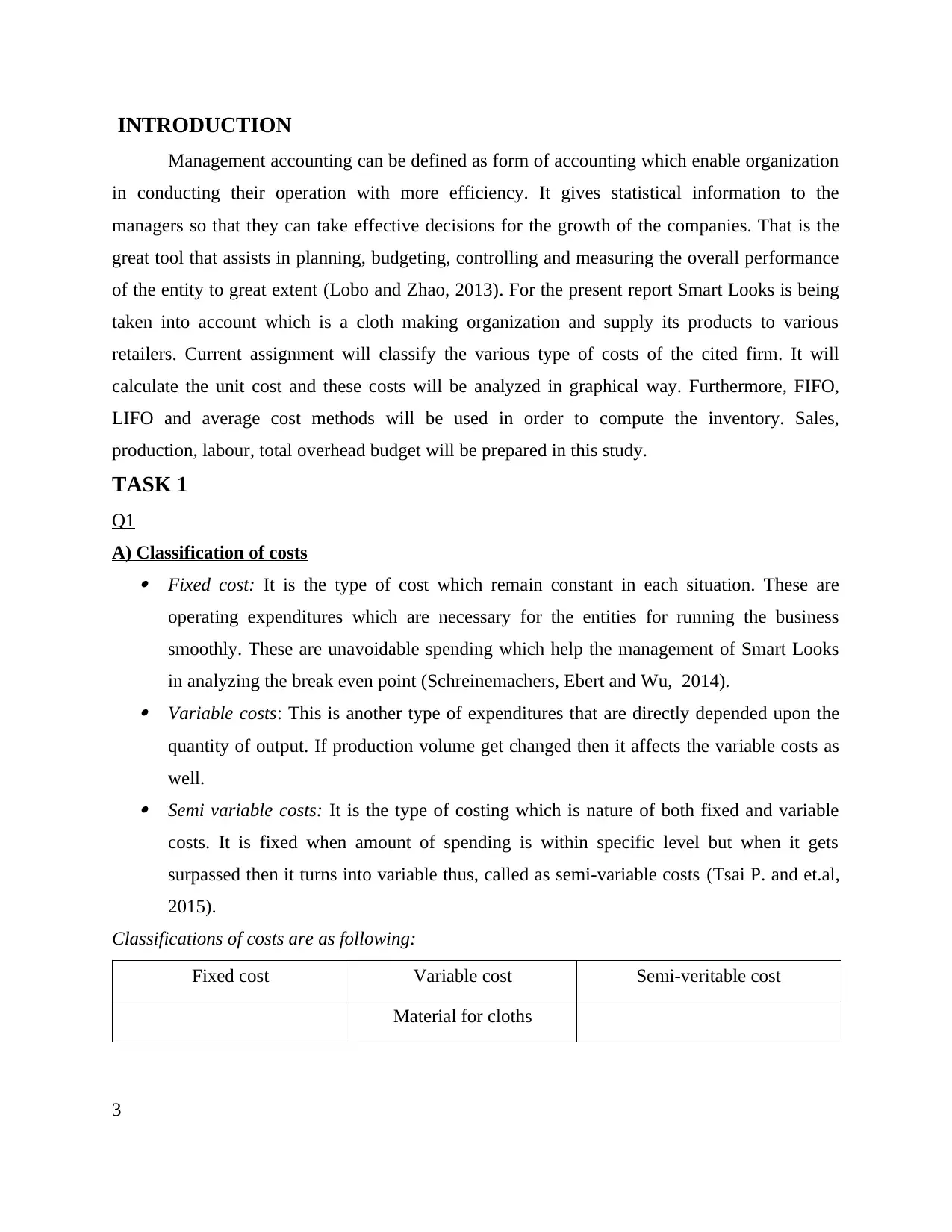

Classifications of costs are as following:

Fixed cost Variable cost Semi-veritable cost

Material for cloths

3

Management accounting can be defined as form of accounting which enable organization

in conducting their operation with more efficiency. It gives statistical information to the

managers so that they can take effective decisions for the growth of the companies. That is the

great tool that assists in planning, budgeting, controlling and measuring the overall performance

of the entity to great extent (Lobo and Zhao, 2013). For the present report Smart Looks is being

taken into account which is a cloth making organization and supply its products to various

retailers. Current assignment will classify the various type of costs of the cited firm. It will

calculate the unit cost and these costs will be analyzed in graphical way. Furthermore, FIFO,

LIFO and average cost methods will be used in order to compute the inventory. Sales,

production, labour, total overhead budget will be prepared in this study.

TASK 1

Q1

A) Classification of costs Fixed cost: It is the type of cost which remain constant in each situation. These are

operating expenditures which are necessary for the entities for running the business

smoothly. These are unavoidable spending which help the management of Smart Looks

in analyzing the break even point (Schreinemachers, Ebert and Wu, 2014). Variable costs: This is another type of expenditures that are directly depended upon the

quantity of output. If production volume get changed then it affects the variable costs as

well. Semi variable costs: It is the type of costing which is nature of both fixed and variable

costs. It is fixed when amount of spending is within specific level but when it gets

surpassed then it turns into variable thus, called as semi-variable costs (Tsai P. and et.al,

2015).

Classifications of costs are as following:

Fixed cost Variable cost Semi-veritable cost

Material for cloths

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Factory rent

Power for sewing machines

in factory

Factory supervisors wages

Packaging material

Telephone

Office rates

Delivery drivers pay

Factory heating

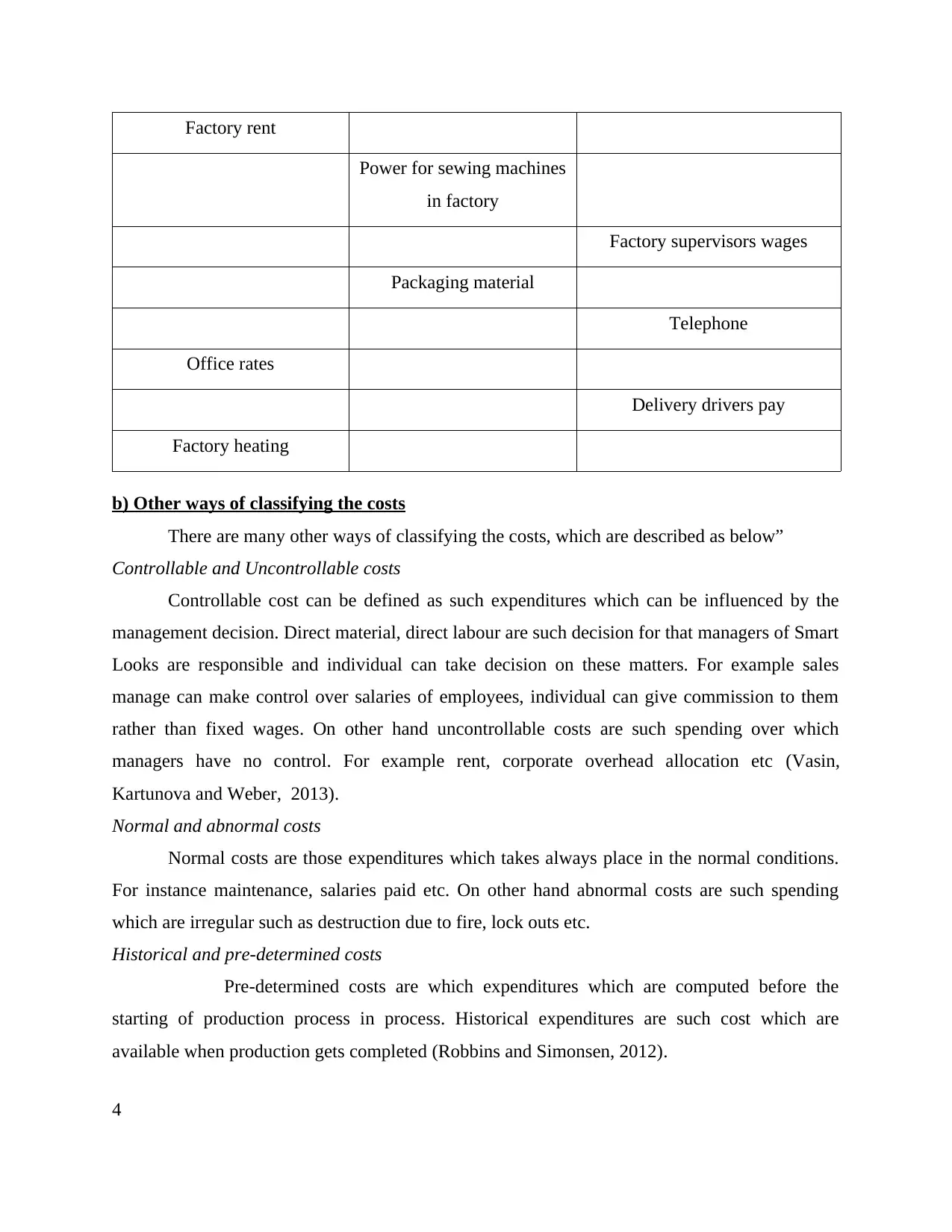

b) Other ways of classifying the costs

There are many other ways of classifying the costs, which are described as below”

Controllable and Uncontrollable costs

Controllable cost can be defined as such expenditures which can be influenced by the

management decision. Direct material, direct labour are such decision for that managers of Smart

Looks are responsible and individual can take decision on these matters. For example sales

manage can make control over salaries of employees, individual can give commission to them

rather than fixed wages. On other hand uncontrollable costs are such spending over which

managers have no control. For example rent, corporate overhead allocation etc (Vasin,

Kartunova and Weber, 2013).

Normal and abnormal costs

Normal costs are those expenditures which takes always place in the normal conditions.

For instance maintenance, salaries paid etc. On other hand abnormal costs are such spending

which are irregular such as destruction due to fire, lock outs etc.

Historical and pre-determined costs

Pre-determined costs are which expenditures which are computed before the

starting of production process in process. Historical expenditures are such cost which are

available when production gets completed (Robbins and Simonsen, 2012).

4

Power for sewing machines

in factory

Factory supervisors wages

Packaging material

Telephone

Office rates

Delivery drivers pay

Factory heating

b) Other ways of classifying the costs

There are many other ways of classifying the costs, which are described as below”

Controllable and Uncontrollable costs

Controllable cost can be defined as such expenditures which can be influenced by the

management decision. Direct material, direct labour are such decision for that managers of Smart

Looks are responsible and individual can take decision on these matters. For example sales

manage can make control over salaries of employees, individual can give commission to them

rather than fixed wages. On other hand uncontrollable costs are such spending over which

managers have no control. For example rent, corporate overhead allocation etc (Vasin,

Kartunova and Weber, 2013).

Normal and abnormal costs

Normal costs are those expenditures which takes always place in the normal conditions.

For instance maintenance, salaries paid etc. On other hand abnormal costs are such spending

which are irregular such as destruction due to fire, lock outs etc.

Historical and pre-determined costs

Pre-determined costs are which expenditures which are computed before the

starting of production process in process. Historical expenditures are such cost which are

available when production gets completed (Robbins and Simonsen, 2012).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Q2

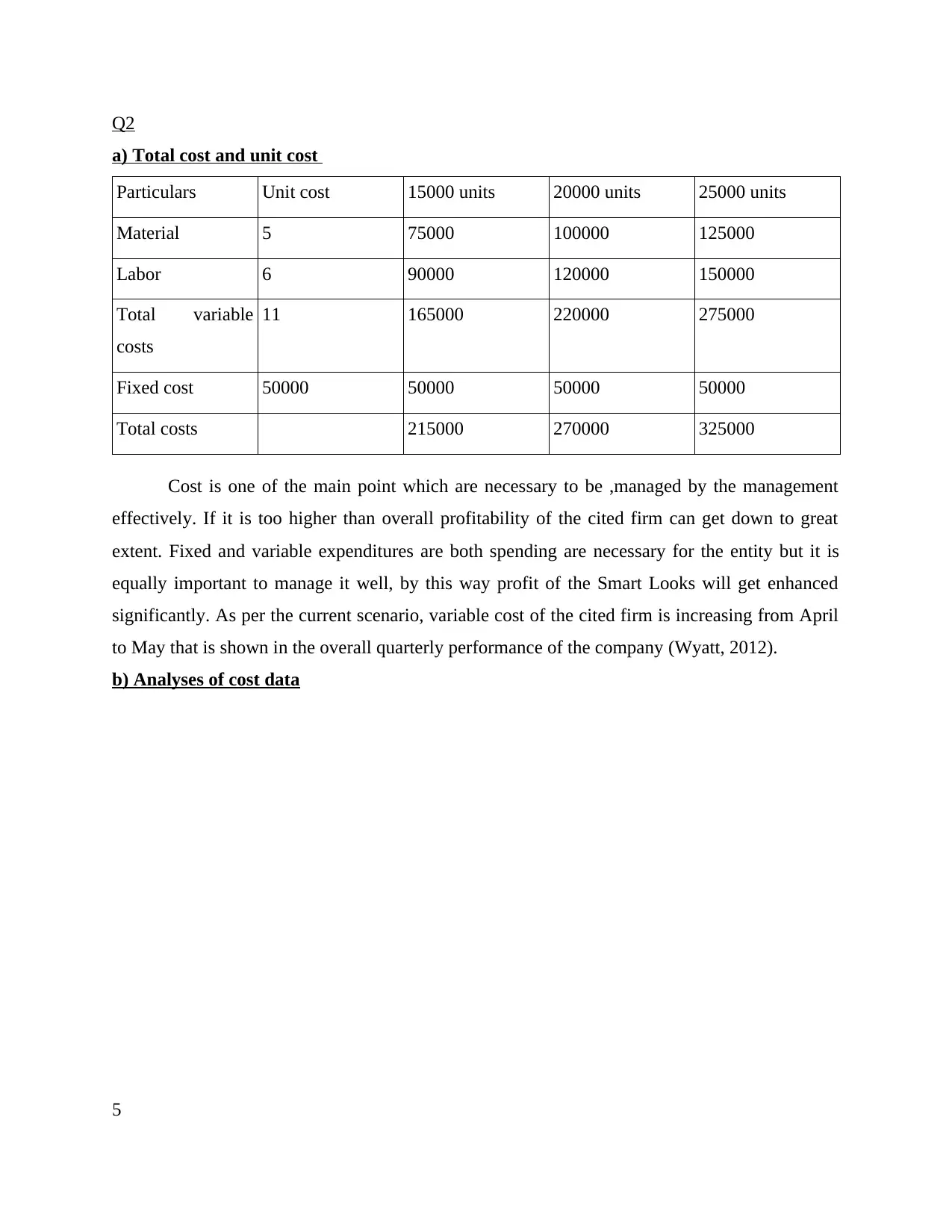

a) Total cost and unit cost

Particulars Unit cost 15000 units 20000 units 25000 units

Material 5 75000 100000 125000

Labor 6 90000 120000 150000

Total variable

costs

11 165000 220000 275000

Fixed cost 50000 50000 50000 50000

Total costs 215000 270000 325000

Cost is one of the main point which are necessary to be ,managed by the management

effectively. If it is too higher than overall profitability of the cited firm can get down to great

extent. Fixed and variable expenditures are both spending are necessary for the entity but it is

equally important to manage it well, by this way profit of the Smart Looks will get enhanced

significantly. As per the current scenario, variable cost of the cited firm is increasing from April

to May that is shown in the overall quarterly performance of the company (Wyatt, 2012).

b) Analyses of cost data

5

a) Total cost and unit cost

Particulars Unit cost 15000 units 20000 units 25000 units

Material 5 75000 100000 125000

Labor 6 90000 120000 150000

Total variable

costs

11 165000 220000 275000

Fixed cost 50000 50000 50000 50000

Total costs 215000 270000 325000

Cost is one of the main point which are necessary to be ,managed by the management

effectively. If it is too higher than overall profitability of the cited firm can get down to great

extent. Fixed and variable expenditures are both spending are necessary for the entity but it is

equally important to manage it well, by this way profit of the Smart Looks will get enhanced

significantly. As per the current scenario, variable cost of the cited firm is increasing from April

to May that is shown in the overall quarterly performance of the company (Wyatt, 2012).

b) Analyses of cost data

5

Material

Labor

Total variable costs

Fixed cost

Total costs

0

50000

100000

150000

200000

250000

300000

350000

15000 units

20000 units

25000 units

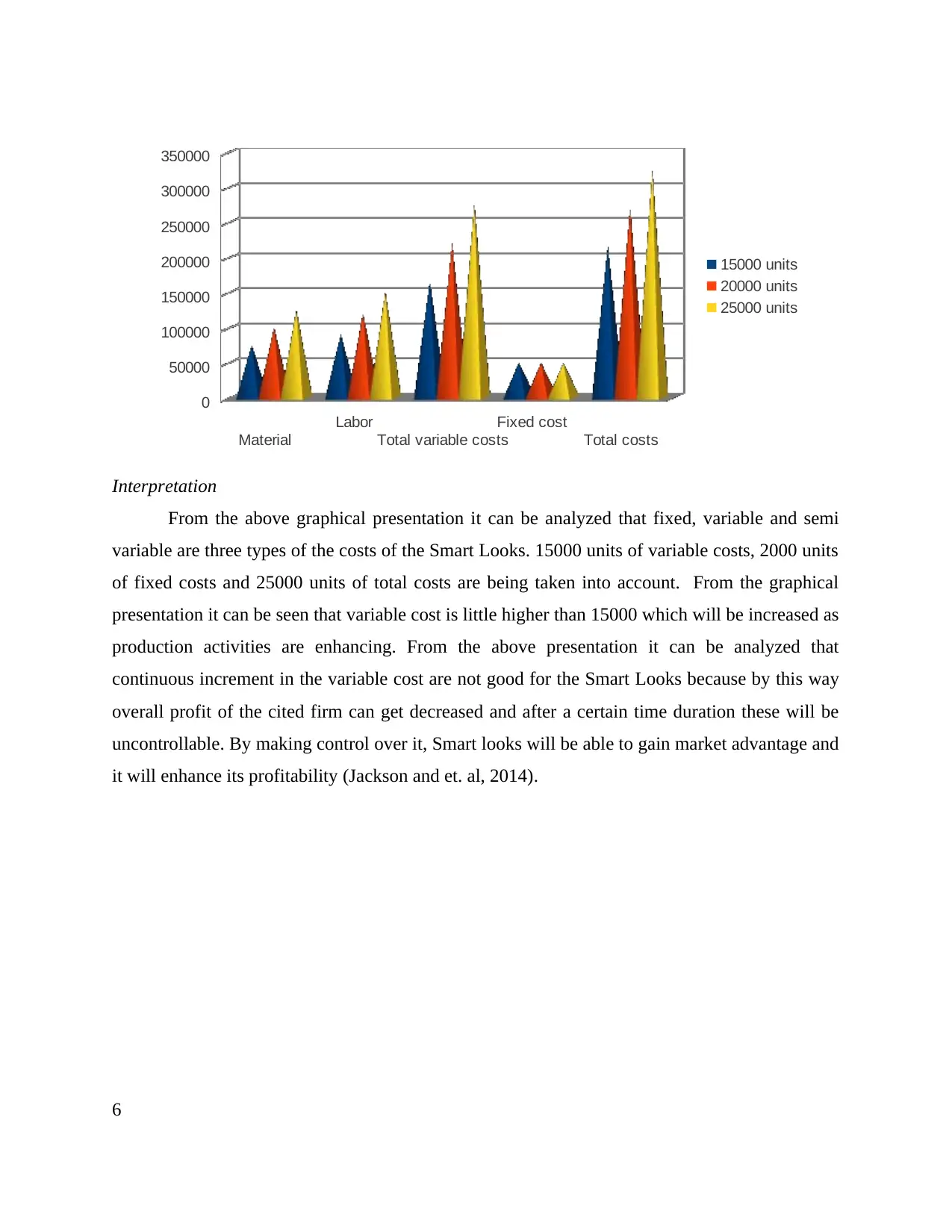

Interpretation

From the above graphical presentation it can be analyzed that fixed, variable and semi

variable are three types of the costs of the Smart Looks. 15000 units of variable costs, 2000 units

of fixed costs and 25000 units of total costs are being taken into account. From the graphical

presentation it can be seen that variable cost is little higher than 15000 which will be increased as

production activities are enhancing. From the above presentation it can be analyzed that

continuous increment in the variable cost are not good for the Smart Looks because by this way

overall profit of the cited firm can get decreased and after a certain time duration these will be

uncontrollable. By making control over it, Smart looks will be able to gain market advantage and

it will enhance its profitability (Jackson and et. al, 2014).

6

Labor

Total variable costs

Fixed cost

Total costs

0

50000

100000

150000

200000

250000

300000

350000

15000 units

20000 units

25000 units

Interpretation

From the above graphical presentation it can be analyzed that fixed, variable and semi

variable are three types of the costs of the Smart Looks. 15000 units of variable costs, 2000 units

of fixed costs and 25000 units of total costs are being taken into account. From the graphical

presentation it can be seen that variable cost is little higher than 15000 which will be increased as

production activities are enhancing. From the above presentation it can be analyzed that

continuous increment in the variable cost are not good for the Smart Looks because by this way

overall profit of the cited firm can get decreased and after a certain time duration these will be

uncontrollable. By making control over it, Smart looks will be able to gain market advantage and

it will enhance its profitability (Jackson and et. al, 2014).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

15000 units 20000 units 25000 units

0

50000

100000

150000

200000

250000

300000

350000

Total variable costs

Fixed cost

Total costs

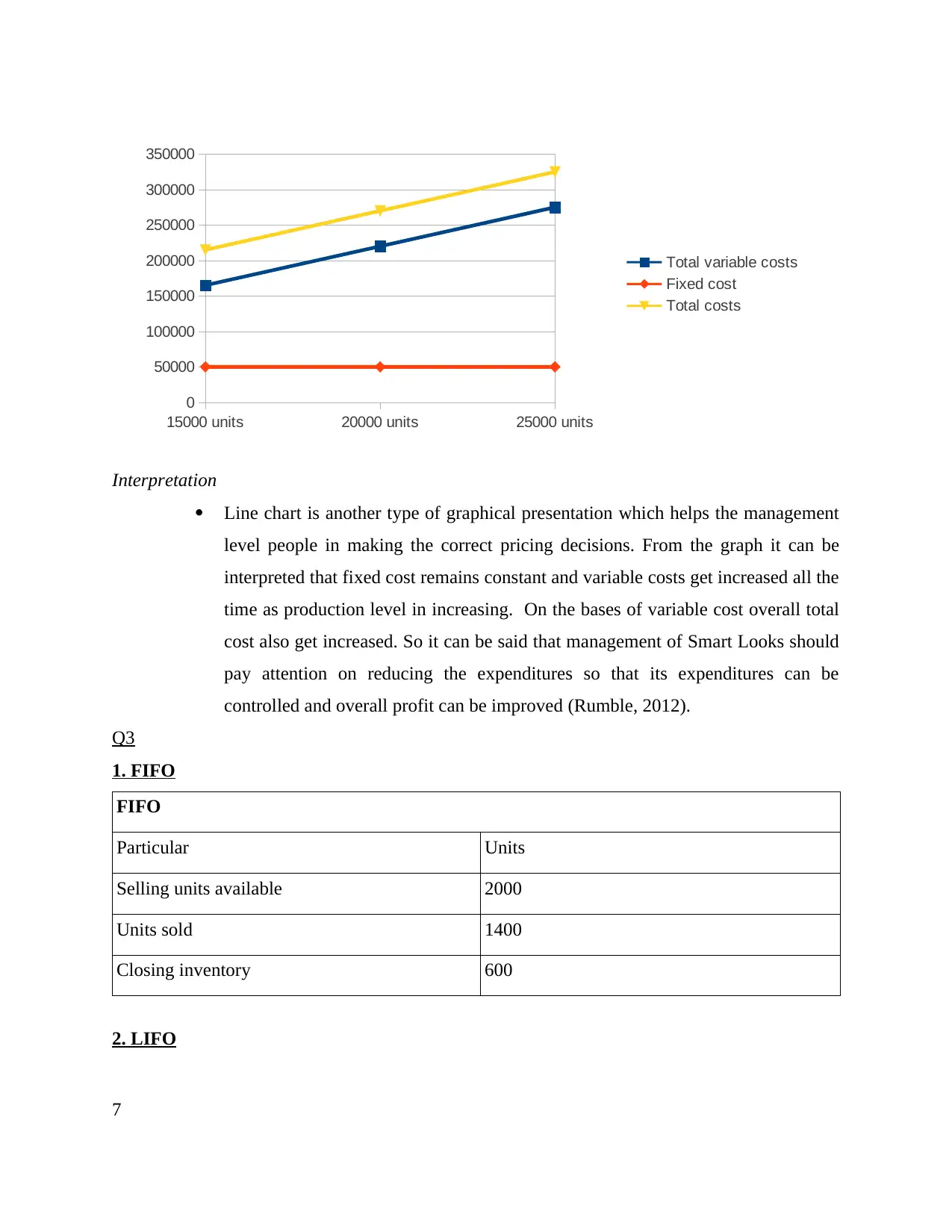

Interpretation

Line chart is another type of graphical presentation which helps the management

level people in making the correct pricing decisions. From the graph it can be

interpreted that fixed cost remains constant and variable costs get increased all the

time as production level in increasing. On the bases of variable cost overall total

cost also get increased. So it can be said that management of Smart Looks should

pay attention on reducing the expenditures so that its expenditures can be

controlled and overall profit can be improved (Rumble, 2012).

Q3

1. FIFO

FIFO

Particular Units

Selling units available 2000

Units sold 1400

Closing inventory 600

2. LIFO

7

0

50000

100000

150000

200000

250000

300000

350000

Total variable costs

Fixed cost

Total costs

Interpretation

Line chart is another type of graphical presentation which helps the management

level people in making the correct pricing decisions. From the graph it can be

interpreted that fixed cost remains constant and variable costs get increased all the

time as production level in increasing. On the bases of variable cost overall total

cost also get increased. So it can be said that management of Smart Looks should

pay attention on reducing the expenditures so that its expenditures can be

controlled and overall profit can be improved (Rumble, 2012).

Q3

1. FIFO

FIFO

Particular Units

Selling units available 2000

Units sold 1400

Closing inventory 600

2. LIFO

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LIFO

Particular Units

Selling units available 2000

Units sold 1400

Closing inventory 600

3. Average cost

Average cost

Particular Units

Selling units available 2000

Units sold 1400

Closing inventory 600

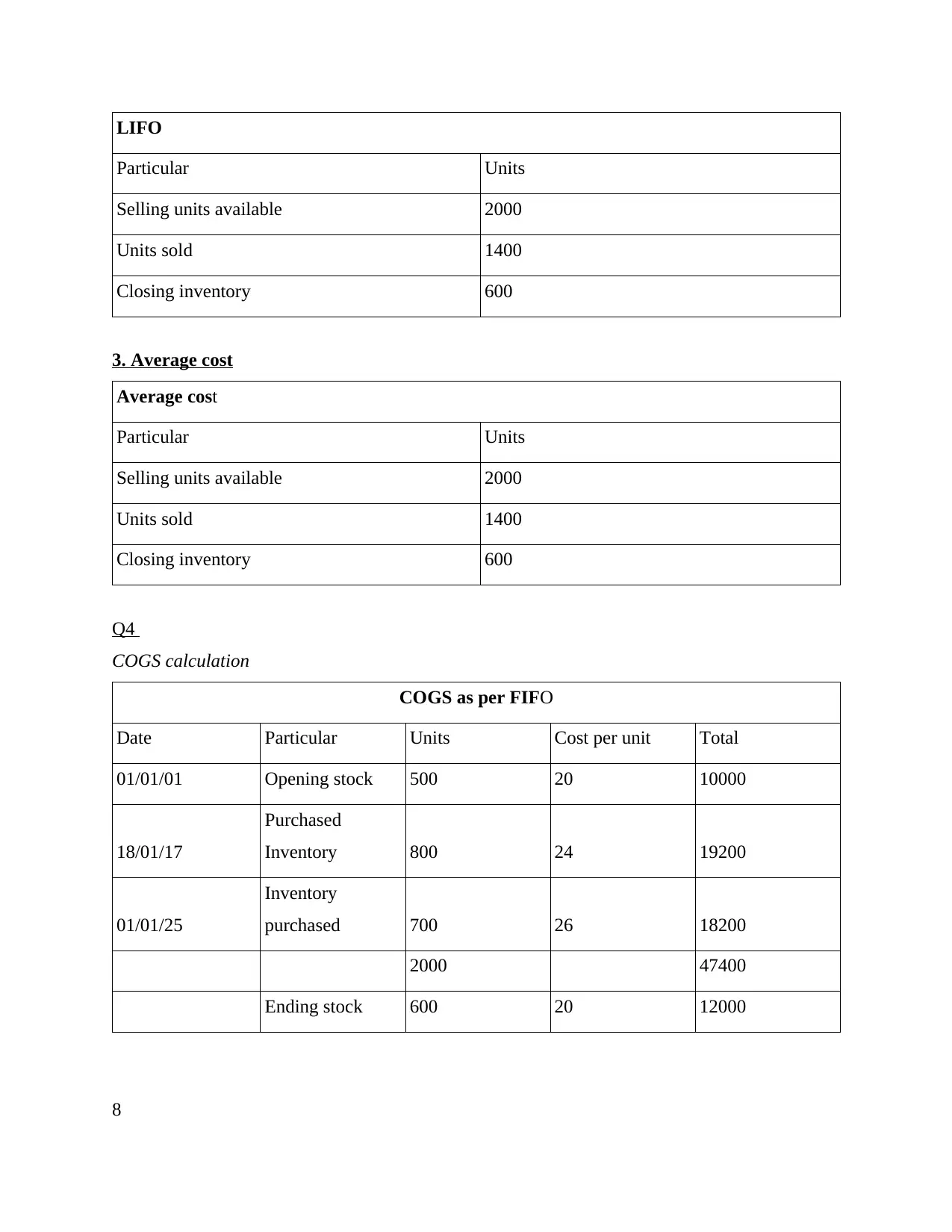

Q4

COGS calculation

COGS as per FIFO

Date Particular Units Cost per unit Total

01/01/01 Opening stock 500 20 10000

18/01/17

Purchased

Inventory 800 24 19200

01/01/25

Inventory

purchased 700 26 18200

2000 47400

Ending stock 600 20 12000

8

Particular Units

Selling units available 2000

Units sold 1400

Closing inventory 600

3. Average cost

Average cost

Particular Units

Selling units available 2000

Units sold 1400

Closing inventory 600

Q4

COGS calculation

COGS as per FIFO

Date Particular Units Cost per unit Total

01/01/01 Opening stock 500 20 10000

18/01/17

Purchased

Inventory 800 24 19200

01/01/25

Inventory

purchased 700 26 18200

2000 47400

Ending stock 600 20 12000

8

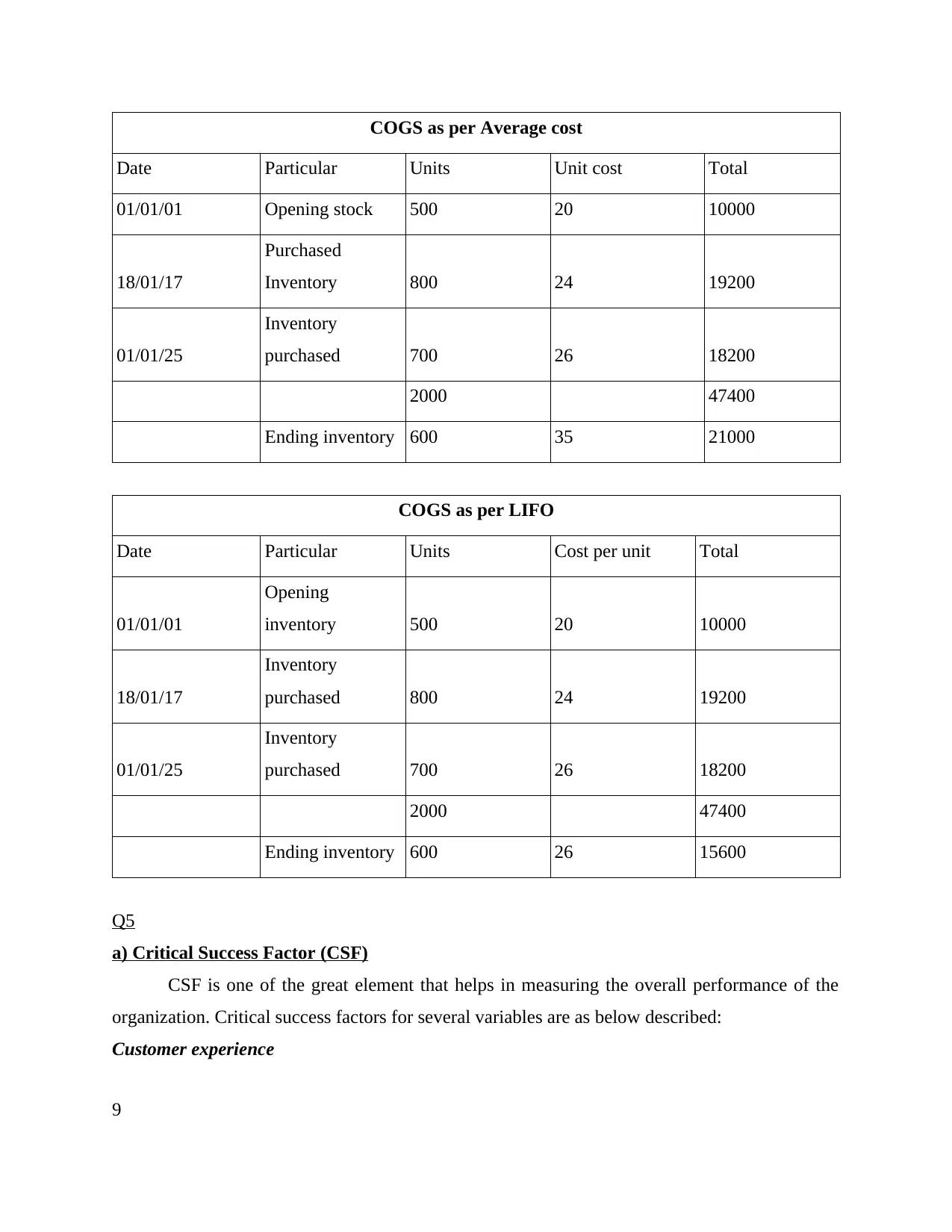

COGS as per Average cost

Date Particular Units Unit cost Total

01/01/01 Opening stock 500 20 10000

18/01/17

Purchased

Inventory 800 24 19200

01/01/25

Inventory

purchased 700 26 18200

2000 47400

Ending inventory 600 35 21000

COGS as per LIFO

Date Particular Units Cost per unit Total

01/01/01

Opening

inventory 500 20 10000

18/01/17

Inventory

purchased 800 24 19200

01/01/25

Inventory

purchased 700 26 18200

2000 47400

Ending inventory 600 26 15600

Q5

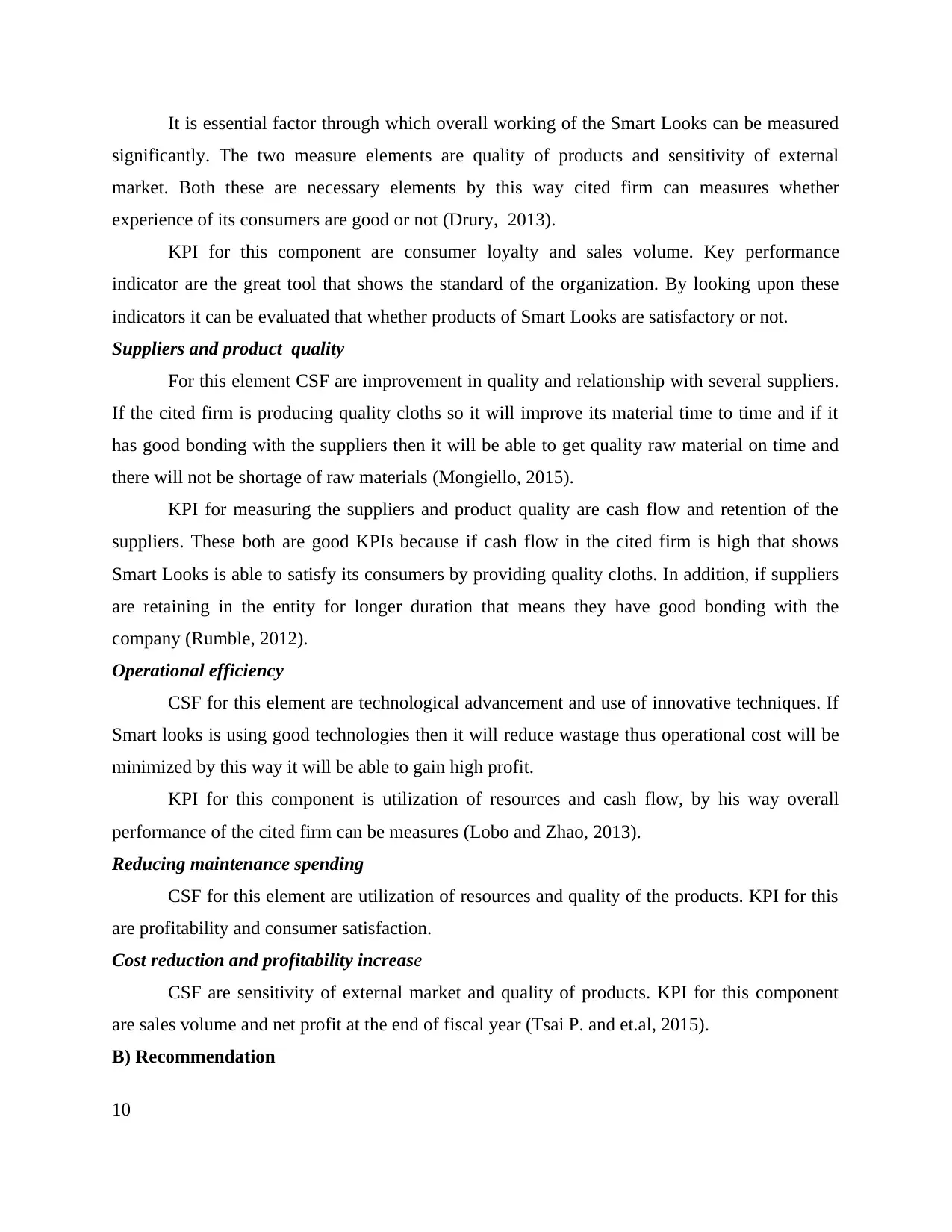

a) Critical Success Factor (CSF)

CSF is one of the great element that helps in measuring the overall performance of the

organization. Critical success factors for several variables are as below described:

Customer experience

9

Date Particular Units Unit cost Total

01/01/01 Opening stock 500 20 10000

18/01/17

Purchased

Inventory 800 24 19200

01/01/25

Inventory

purchased 700 26 18200

2000 47400

Ending inventory 600 35 21000

COGS as per LIFO

Date Particular Units Cost per unit Total

01/01/01

Opening

inventory 500 20 10000

18/01/17

Inventory

purchased 800 24 19200

01/01/25

Inventory

purchased 700 26 18200

2000 47400

Ending inventory 600 26 15600

Q5

a) Critical Success Factor (CSF)

CSF is one of the great element that helps in measuring the overall performance of the

organization. Critical success factors for several variables are as below described:

Customer experience

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is essential factor through which overall working of the Smart Looks can be measured

significantly. The two measure elements are quality of products and sensitivity of external

market. Both these are necessary elements by this way cited firm can measures whether

experience of its consumers are good or not (Drury, 2013).

KPI for this component are consumer loyalty and sales volume. Key performance

indicator are the great tool that shows the standard of the organization. By looking upon these

indicators it can be evaluated that whether products of Smart Looks are satisfactory or not.

Suppliers and product quality

For this element CSF are improvement in quality and relationship with several suppliers.

If the cited firm is producing quality cloths so it will improve its material time to time and if it

has good bonding with the suppliers then it will be able to get quality raw material on time and

there will not be shortage of raw materials (Mongiello, 2015).

KPI for measuring the suppliers and product quality are cash flow and retention of the

suppliers. These both are good KPIs because if cash flow in the cited firm is high that shows

Smart Looks is able to satisfy its consumers by providing quality cloths. In addition, if suppliers

are retaining in the entity for longer duration that means they have good bonding with the

company (Rumble, 2012).

Operational efficiency

CSF for this element are technological advancement and use of innovative techniques. If

Smart looks is using good technologies then it will reduce wastage thus operational cost will be

minimized by this way it will be able to gain high profit.

KPI for this component is utilization of resources and cash flow, by his way overall

performance of the cited firm can be measures (Lobo and Zhao, 2013).

Reducing maintenance spending

CSF for this element are utilization of resources and quality of the products. KPI for this

are profitability and consumer satisfaction.

Cost reduction and profitability increase

CSF are sensitivity of external market and quality of products. KPI for this component

are sales volume and net profit at the end of fiscal year (Tsai P. and et.al, 2015).

B) Recommendation

10

significantly. The two measure elements are quality of products and sensitivity of external

market. Both these are necessary elements by this way cited firm can measures whether

experience of its consumers are good or not (Drury, 2013).

KPI for this component are consumer loyalty and sales volume. Key performance

indicator are the great tool that shows the standard of the organization. By looking upon these

indicators it can be evaluated that whether products of Smart Looks are satisfactory or not.

Suppliers and product quality

For this element CSF are improvement in quality and relationship with several suppliers.

If the cited firm is producing quality cloths so it will improve its material time to time and if it

has good bonding with the suppliers then it will be able to get quality raw material on time and

there will not be shortage of raw materials (Mongiello, 2015).

KPI for measuring the suppliers and product quality are cash flow and retention of the

suppliers. These both are good KPIs because if cash flow in the cited firm is high that shows

Smart Looks is able to satisfy its consumers by providing quality cloths. In addition, if suppliers

are retaining in the entity for longer duration that means they have good bonding with the

company (Rumble, 2012).

Operational efficiency

CSF for this element are technological advancement and use of innovative techniques. If

Smart looks is using good technologies then it will reduce wastage thus operational cost will be

minimized by this way it will be able to gain high profit.

KPI for this component is utilization of resources and cash flow, by his way overall

performance of the cited firm can be measures (Lobo and Zhao, 2013).

Reducing maintenance spending

CSF for this element are utilization of resources and quality of the products. KPI for this

are profitability and consumer satisfaction.

Cost reduction and profitability increase

CSF are sensitivity of external market and quality of products. KPI for this component

are sales volume and net profit at the end of fiscal year (Tsai P. and et.al, 2015).

B) Recommendation

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Reduction of cost is very essential for the Smart looks company, that is only possible

when cited firm utilize its resources well. By effective utilization of resources

corporation will be able to cut the cost. In addition, if entity enhances production level

then it will be beneficial for the firm and overall cost will get reduced to great extent

2. Value and quality is the important factor for making improvement in this section

managers of Smart Looks can monitor and control the activities of the business. By this

way mistakes will be identified that will help in making solutions for eliminating the

mistakes.

TASK 2

Q6

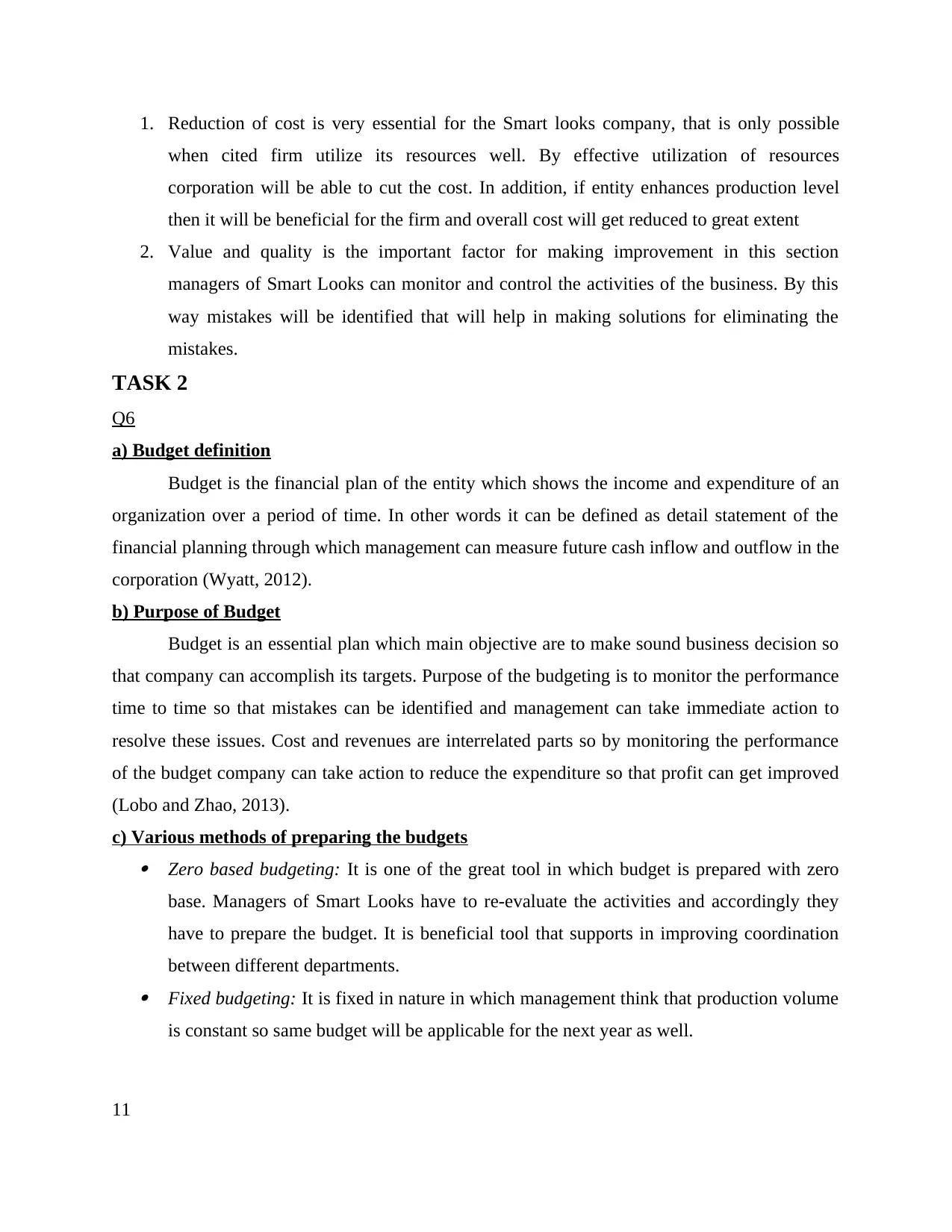

a) Budget definition

Budget is the financial plan of the entity which shows the income and expenditure of an

organization over a period of time. In other words it can be defined as detail statement of the

financial planning through which management can measure future cash inflow and outflow in the

corporation (Wyatt, 2012).

b) Purpose of Budget

Budget is an essential plan which main objective are to make sound business decision so

that company can accomplish its targets. Purpose of the budgeting is to monitor the performance

time to time so that mistakes can be identified and management can take immediate action to

resolve these issues. Cost and revenues are interrelated parts so by monitoring the performance

of the budget company can take action to reduce the expenditure so that profit can get improved

(Lobo and Zhao, 2013).

c) Various methods of preparing the budgets Zero based budgeting: It is one of the great tool in which budget is prepared with zero

base. Managers of Smart Looks have to re-evaluate the activities and accordingly they

have to prepare the budget. It is beneficial tool that supports in improving coordination

between different departments. Fixed budgeting: It is fixed in nature in which management think that production volume

is constant so same budget will be applicable for the next year as well.

11

when cited firm utilize its resources well. By effective utilization of resources

corporation will be able to cut the cost. In addition, if entity enhances production level

then it will be beneficial for the firm and overall cost will get reduced to great extent

2. Value and quality is the important factor for making improvement in this section

managers of Smart Looks can monitor and control the activities of the business. By this

way mistakes will be identified that will help in making solutions for eliminating the

mistakes.

TASK 2

Q6

a) Budget definition

Budget is the financial plan of the entity which shows the income and expenditure of an

organization over a period of time. In other words it can be defined as detail statement of the

financial planning through which management can measure future cash inflow and outflow in the

corporation (Wyatt, 2012).

b) Purpose of Budget

Budget is an essential plan which main objective are to make sound business decision so

that company can accomplish its targets. Purpose of the budgeting is to monitor the performance

time to time so that mistakes can be identified and management can take immediate action to

resolve these issues. Cost and revenues are interrelated parts so by monitoring the performance

of the budget company can take action to reduce the expenditure so that profit can get improved

(Lobo and Zhao, 2013).

c) Various methods of preparing the budgets Zero based budgeting: It is one of the great tool in which budget is prepared with zero

base. Managers of Smart Looks have to re-evaluate the activities and accordingly they

have to prepare the budget. It is beneficial tool that supports in improving coordination

between different departments. Fixed budgeting: It is fixed in nature in which management think that production volume

is constant so same budget will be applicable for the next year as well.

11

Flexible budgeting: It is flexible in nature and volume of production gets changed and

accordingly budget also get influenced (Robbins and Simonsen, 2012).

By analyzing the overall explained budget it can be suggested that zero based budgeting

would be better for the Smart Looks Company because in this it will be able to evaluate each

expenditure and with effective utilization 0of resources it will be able to prepare the budget. That

would help in reducing the issue of fund shortage and that will give huge benefit to the cited firm

(Jackson and et. al, 2014).

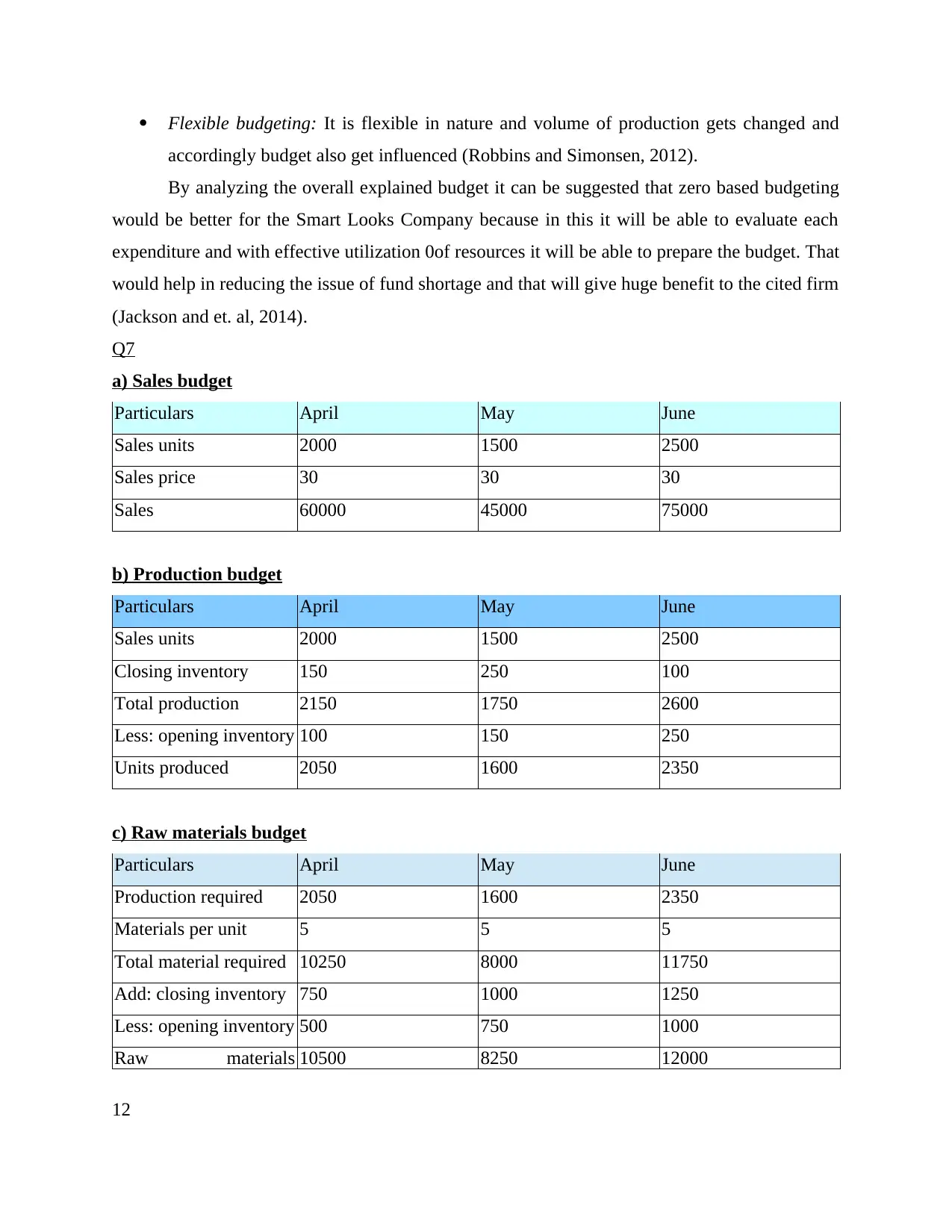

Q7

a) Sales budget

Particulars April May June

Sales units 2000 1500 2500

Sales price 30 30 30

Sales 60000 45000 75000

b) Production budget

Particulars April May June

Sales units 2000 1500 2500

Closing inventory 150 250 100

Total production 2150 1750 2600

Less: opening inventory 100 150 250

Units produced 2050 1600 2350

c) Raw materials budget

Particulars April May June

Production required 2050 1600 2350

Materials per unit 5 5 5

Total material required 10250 8000 11750

Add: closing inventory 750 1000 1250

Less: opening inventory 500 750 1000

Raw materials 10500 8250 12000

12

accordingly budget also get influenced (Robbins and Simonsen, 2012).

By analyzing the overall explained budget it can be suggested that zero based budgeting

would be better for the Smart Looks Company because in this it will be able to evaluate each

expenditure and with effective utilization 0of resources it will be able to prepare the budget. That

would help in reducing the issue of fund shortage and that will give huge benefit to the cited firm

(Jackson and et. al, 2014).

Q7

a) Sales budget

Particulars April May June

Sales units 2000 1500 2500

Sales price 30 30 30

Sales 60000 45000 75000

b) Production budget

Particulars April May June

Sales units 2000 1500 2500

Closing inventory 150 250 100

Total production 2150 1750 2600

Less: opening inventory 100 150 250

Units produced 2050 1600 2350

c) Raw materials budget

Particulars April May June

Production required 2050 1600 2350

Materials per unit 5 5 5

Total material required 10250 8000 11750

Add: closing inventory 750 1000 1250

Less: opening inventory 500 750 1000

Raw materials 10500 8250 12000

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.