Management Accounting Report: Financial Analysis for TESCO Retail

VerifiedAdded on 2020/11/23

|18

|5762

|387

Report

AI Summary

This report offers a comprehensive analysis of management accounting principles applied to TESCO, a major player in the retail industry. The report begins with an introduction to management accounting, outlining its core functions and distinguishing it from financial accounting. It explores various types of management accounting systems, such as price optimization, cost accounting, job costing, and inventory management, and their importance in making informed business decisions. The report then delves into different management accounting reports, including performance reports, accounts receivable reports, and sales reports, highlighting their significance in forecasting, decision-making, and variance analysis. Furthermore, it provides a detailed calculation of costs using marginal and absorption costing techniques to prepare an income statement, offering practical insights into cost analysis. Finally, the report covers the advantages and disadvantages of planning tools used for budgetary control and includes a comparison of TESCO with other organizations in response to financial problems.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Types of management accounting systems and its essential requirements......................1

P2: Different Management accounting reports and its importance to management..............4

M1: Importance of management accounting reports to management....................................5

TASK 2............................................................................................................................................6

P3 Calculate cost using appropriate techniques of cost analysis to prepare income statement

using marginal and absorption costing...................................................................................6

TASK 3............................................................................................................................................1

P4. Advantage and disadvantage of planning tool used for budgetary control......................1

TASK 4............................................................................................................................................4

P5. Comparison with other organisation in response to financial problem............................4

CONCLUSION................................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Types of management accounting systems and its essential requirements......................1

P2: Different Management accounting reports and its importance to management..............4

M1: Importance of management accounting reports to management....................................5

TASK 2............................................................................................................................................6

P3 Calculate cost using appropriate techniques of cost analysis to prepare income statement

using marginal and absorption costing...................................................................................6

TASK 3............................................................................................................................................1

P4. Advantage and disadvantage of planning tool used for budgetary control......................1

TASK 4............................................................................................................................................4

P5. Comparison with other organisation in response to financial problem............................4

CONCLUSION................................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION

Management accounting is the practice that includes identifying, measuring, determining,

interpreting and providing expertise in financial reporting for the purpose of formulating

appropriate strategies. It involves preparation of various financial and statistical reports such as

Profit & Loss a/c, balance sheets etc. that assists management in making authentic and reliable

short and long term decisions. It involves ascertaining policies about day to business activities to

making future investment decisions etc. TESCO is a British multinational supermarket chain

belonging to retail industry (Abrahamsson, Englund and Gerdin, 2011). The report will provide a

brief understanding about management accounting including its types and methods used. Further

an income statement for company will be prepared by using marginal and absorption costs.

Project will also provide synopsis about various planning tools with their advantages and

disadvantages along with comparing ways in which a firm could adopt various management

systems to resolve its financial issues.

TASK 1

P1: Types of management accounting systems and its essential requirements

Definition: According to Management Accounting Practices Committee “management

accounting is the procedure of identification, measurement, accumulation, analysis, preparation,

interpretation and communication of financial information used by management to plan ,

evaluate and control within an organisation and to ensure appropriate use of and accountability

for its resources.”

Management accounting involves various internal systems that is used by a company to

measure and evaluate its various procedures for effective control of firm's operations.

Management accounting differs from financial accounting as the later one focus majorly on

formulating information from external parties like public, stockholders,lenders etc. according to

general accepted accounting principles (Boyns and Edwards, 2013). On the other hand

management accounting take into consideration organisation's financial information such as

break even charts, trend charts, product cost analysis etc. and prepares reports for internal and

confidential usage so as to enable managers for making decisions and determine most feasible

ways to conduct firms operations effectively.

1

Management accounting is the practice that includes identifying, measuring, determining,

interpreting and providing expertise in financial reporting for the purpose of formulating

appropriate strategies. It involves preparation of various financial and statistical reports such as

Profit & Loss a/c, balance sheets etc. that assists management in making authentic and reliable

short and long term decisions. It involves ascertaining policies about day to business activities to

making future investment decisions etc. TESCO is a British multinational supermarket chain

belonging to retail industry (Abrahamsson, Englund and Gerdin, 2011). The report will provide a

brief understanding about management accounting including its types and methods used. Further

an income statement for company will be prepared by using marginal and absorption costs.

Project will also provide synopsis about various planning tools with their advantages and

disadvantages along with comparing ways in which a firm could adopt various management

systems to resolve its financial issues.

TASK 1

P1: Types of management accounting systems and its essential requirements

Definition: According to Management Accounting Practices Committee “management

accounting is the procedure of identification, measurement, accumulation, analysis, preparation,

interpretation and communication of financial information used by management to plan ,

evaluate and control within an organisation and to ensure appropriate use of and accountability

for its resources.”

Management accounting involves various internal systems that is used by a company to

measure and evaluate its various procedures for effective control of firm's operations.

Management accounting differs from financial accounting as the later one focus majorly on

formulating information from external parties like public, stockholders,lenders etc. according to

general accepted accounting principles (Boyns and Edwards, 2013). On the other hand

management accounting take into consideration organisation's financial information such as

break even charts, trend charts, product cost analysis etc. and prepares reports for internal and

confidential usage so as to enable managers for making decisions and determine most feasible

ways to conduct firms operations effectively.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The main role of management accounting is to perform a series of activities to ensure its

organisation's financial security, managing essentially all finance related matters and thereby

assisting in effectively drive the overall business management and its related strategies.

Management accounting has four major principles :

Influence: Communication is way to provide insight about the future that is influential.

The whole concept of management accounting starts and ends with conversation. The principles

are designed in such a manner that allows company to improve its business actions by facilitating

integrated thinking at all stages. This involves discussing about needs of decision makers so as to

get most relevant in formation could be sourced out and determined (Chenhall and Moers,

2015).

Relevance: It strives to attain information that is relevant. Management accounting

critically examines information related to micro – macro factors, past, present and future and

other financial-non finance data. This help management to analyse and scan out the most

relevant information for making authentic and reliable decisions.

Value: management Accounting by comparing firm's proposed strategies with its

business models n light of its macro environment reveals out value that is expected to generated

by their application.

Trust: Accountability and examination enhances the quality of decision making process

that helps firm to fulfil interests of its stakeholders that increases their trust and credibility on

company. Management accounting professionals are thus trusted to be accountable, ethical and

considerable in context to firm's values, government norms and social conduct.

In context to TESCO which is the third largest retail brand in world in terms of revenues

it becomes critically important to maintain its financial credibility and performance levels by

effectively preparing various finance reports for each accounting year with the help of various

management accounting systems. These reports helps firm in taking various critical financial

decisions such as reducing down its operating costs, generating cash from operations, introduce

product innovation etc. Mentioned below are some most prominent management accounting

system (Chiwamit, Modell and Yang, 2014)

TYPE OF MANAGEMENT ACCOUNTING SYSTEMS:

Price Optimisation System: It is a mathematical system that focuses on calculating

relationship between the demand of a product at different price levels. This information related

2

organisation's financial security, managing essentially all finance related matters and thereby

assisting in effectively drive the overall business management and its related strategies.

Management accounting has four major principles :

Influence: Communication is way to provide insight about the future that is influential.

The whole concept of management accounting starts and ends with conversation. The principles

are designed in such a manner that allows company to improve its business actions by facilitating

integrated thinking at all stages. This involves discussing about needs of decision makers so as to

get most relevant in formation could be sourced out and determined (Chenhall and Moers,

2015).

Relevance: It strives to attain information that is relevant. Management accounting

critically examines information related to micro – macro factors, past, present and future and

other financial-non finance data. This help management to analyse and scan out the most

relevant information for making authentic and reliable decisions.

Value: management Accounting by comparing firm's proposed strategies with its

business models n light of its macro environment reveals out value that is expected to generated

by their application.

Trust: Accountability and examination enhances the quality of decision making process

that helps firm to fulfil interests of its stakeholders that increases their trust and credibility on

company. Management accounting professionals are thus trusted to be accountable, ethical and

considerable in context to firm's values, government norms and social conduct.

In context to TESCO which is the third largest retail brand in world in terms of revenues

it becomes critically important to maintain its financial credibility and performance levels by

effectively preparing various finance reports for each accounting year with the help of various

management accounting systems. These reports helps firm in taking various critical financial

decisions such as reducing down its operating costs, generating cash from operations, introduce

product innovation etc. Mentioned below are some most prominent management accounting

system (Chiwamit, Modell and Yang, 2014)

TYPE OF MANAGEMENT ACCOUNTING SYSTEMS:

Price Optimisation System: It is a mathematical system that focuses on calculating

relationship between the demand of a product at different price levels. This information related

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to cost and inventory helps management to ascertain best and most competitive pricing strategy

that could provide maximum ROI and higher profits. It data that is considered under price

optimization include operating cost, inventories, historic price and sales. Thus it helps TESCO to

set prices of its products and services in as way that it is most affordable and competitive in

relation to its its business rivals. This helps company to attract maximum consumers and capture

high market share. fits of management accounting systems:

Assist in achieving loyalty of targeted clients: Various accounting systems help in

identifying the actual perception and buying behaviour of targeted clients as well as actual

inventory present with company to meet market needs and demands. For example, using price

optimisation system by Imperial Crown Jewels Ltd. help in identifying the perception of targeted

clients i.e. women towards its existing pricing policies which assist them (Cullen and et. al.,

2013)

Cost accounting system: It is one of the most effective accounting system that is utilized

by firms to ascertain their cost of goods and services with intent of cost control, profitability

analysis and inventory valuation. TESCO in order to diversify its business and to introduce new

innovation products/services requires huge capital funding. Thus, cost accounting system could

assist firm to undertake various activities and functions within limited budgeted cost so as to earn

higher profitability and productivity in its business operations.

Job costing system: This techniques includes identifying and determining total expense

that firm is subject to incurred in manufacturing an single product or bulk production. For this a

firm is subject to formulate budget by critically analysing future demand of its products,cost of

production and profitability index so that appropriate funds could be allocated to each process.

TESCO can make use of this system to determine about its most demanded products in a

previous year and accordingly could allocate funds for manufacturing those products to readily

meets its customers demand and attain high sales volumes.

Inventory management system: It is a technique that combines technology and

procedures to monitor and maintain proper stock of products involving firm's assets, raw

materials or finished goods (Dosch and Wilson, 2010). It helps firm to maintain detailed record

of every new or returned products, to ensure proper flow of goods and products in

organization, to get a access to centralized information related to items, vendors, suppliers and

total number of particular items that are presently in stock. In reference to TESCO uses IBM

3

that could provide maximum ROI and higher profits. It data that is considered under price

optimization include operating cost, inventories, historic price and sales. Thus it helps TESCO to

set prices of its products and services in as way that it is most affordable and competitive in

relation to its its business rivals. This helps company to attract maximum consumers and capture

high market share. fits of management accounting systems:

Assist in achieving loyalty of targeted clients: Various accounting systems help in

identifying the actual perception and buying behaviour of targeted clients as well as actual

inventory present with company to meet market needs and demands. For example, using price

optimisation system by Imperial Crown Jewels Ltd. help in identifying the perception of targeted

clients i.e. women towards its existing pricing policies which assist them (Cullen and et. al.,

2013)

Cost accounting system: It is one of the most effective accounting system that is utilized

by firms to ascertain their cost of goods and services with intent of cost control, profitability

analysis and inventory valuation. TESCO in order to diversify its business and to introduce new

innovation products/services requires huge capital funding. Thus, cost accounting system could

assist firm to undertake various activities and functions within limited budgeted cost so as to earn

higher profitability and productivity in its business operations.

Job costing system: This techniques includes identifying and determining total expense

that firm is subject to incurred in manufacturing an single product or bulk production. For this a

firm is subject to formulate budget by critically analysing future demand of its products,cost of

production and profitability index so that appropriate funds could be allocated to each process.

TESCO can make use of this system to determine about its most demanded products in a

previous year and accordingly could allocate funds for manufacturing those products to readily

meets its customers demand and attain high sales volumes.

Inventory management system: It is a technique that combines technology and

procedures to monitor and maintain proper stock of products involving firm's assets, raw

materials or finished goods (Dosch and Wilson, 2010). It helps firm to maintain detailed record

of every new or returned products, to ensure proper flow of goods and products in

organization, to get a access to centralized information related to items, vendors, suppliers and

total number of particular items that are presently in stock. In reference to TESCO uses IBM

3

System p that helps firm to minimize cost of inventory, to attain better control over its high

value products and readily and timely meeting its customers demands.

IMPORTANCE OF MANAGEMENT ACCOUNTING:

It helps in providing most authentic and reliable data about latest financial trends by

making using a various techniques of marginal costing,cost volume analysis etc. This

help management to take realistic and practical decisions about company's pricing

policies, operational costs etc.

It helps a firm to undertake feasibility study of its particular project. It is so by applying

cost benefit analysis firm could ascertain strength and weakness, total expected cost and

total expected benefited and other critical information related to a particular project (Faÿ,

Introna and Puyou, 2010).

P2: Different Management accounting reports and its importance to management

There are different types of report which are used by managers of TESCO in order to

have proper knowledge related to it. Some reports are discussed as under-

Performance report: These reports are performance indicators for the company that are

generally prepared for measuring its achievements and effectiveness of its various programs,

policies, strategies etc. These reports present the information related to outcome of a work

performed by a person or department in given set of time period. Further it assist in measuring

performance by comparing the actual with expected outcome on basis of set benchmarks. This

helps in identifying any deviations or gaps that might become problem in near future to attain

desired level of performance. Also it assist managers to prepare strategies for reducing and

removing the deviations by determining factors that are forming hindrances.

Account Receivable Report: These reports help firm to efficiently handle its cash flow

of organisation. This report provides knowledge about extend credit to customers is given. In

case of issue in collecting revenue from debtors, it can be detected from this report. This report

has columns for bills for 30, 60 or say 90 days. In case creditor is not able to pay back money,

then managers of TESCO has tighten their credit policies (Fourie, Opperman, Scott and Kumar,

2015).

Sales report- sales report shows sales of particular period. In this report sales with same

of customers are entered as per date. This report can be prepared for quarterly, half-yearly

period. Income earned, sales, are entered in this, so total amount of sales of TESCO can be

4

value products and readily and timely meeting its customers demands.

IMPORTANCE OF MANAGEMENT ACCOUNTING:

It helps in providing most authentic and reliable data about latest financial trends by

making using a various techniques of marginal costing,cost volume analysis etc. This

help management to take realistic and practical decisions about company's pricing

policies, operational costs etc.

It helps a firm to undertake feasibility study of its particular project. It is so by applying

cost benefit analysis firm could ascertain strength and weakness, total expected cost and

total expected benefited and other critical information related to a particular project (Faÿ,

Introna and Puyou, 2010).

P2: Different Management accounting reports and its importance to management

There are different types of report which are used by managers of TESCO in order to

have proper knowledge related to it. Some reports are discussed as under-

Performance report: These reports are performance indicators for the company that are

generally prepared for measuring its achievements and effectiveness of its various programs,

policies, strategies etc. These reports present the information related to outcome of a work

performed by a person or department in given set of time period. Further it assist in measuring

performance by comparing the actual with expected outcome on basis of set benchmarks. This

helps in identifying any deviations or gaps that might become problem in near future to attain

desired level of performance. Also it assist managers to prepare strategies for reducing and

removing the deviations by determining factors that are forming hindrances.

Account Receivable Report: These reports help firm to efficiently handle its cash flow

of organisation. This report provides knowledge about extend credit to customers is given. In

case of issue in collecting revenue from debtors, it can be detected from this report. This report

has columns for bills for 30, 60 or say 90 days. In case creditor is not able to pay back money,

then managers of TESCO has tighten their credit policies (Fourie, Opperman, Scott and Kumar,

2015).

Sales report- sales report shows sales of particular period. In this report sales with same

of customers are entered as per date. This report can be prepared for quarterly, half-yearly

period. Income earned, sales, are entered in this, so total amount of sales of TESCO can be

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

known from this report. In this report, entry related to sales volume, new creditors and any cost

related to sales are entered.

Benefits of management accounting reports to management

Ease in forecasting- There is requirement of forecasting data for future use. Business has

many activities such as purchase, sales, manufacturing, etc. so through these report it is easy to

make strategies for near future. For instance, amount due from debtors can be known from

account receivable report.

Decision making technique- These reports are important for making strategy in smooth

running of business. Performance report helps to know about performance level of last year and

present year. This helps to compare and accordingly decisions can be made.

Helps to judge variances- In business ups and downs are happening, so with the help of

these report, variance can be known. There are some budget set by managers of TESCO, after

specified period they are able to compare and then actions can be taken to overcome it (Gates,

Nicolas and Walker, 2012).

Integration of management accounting systems and reporting with organisational process:

Tesco Plc has adopted various accounting systems and reporting in order to assist

management in making an effective decision and suitable plans in advance for the betterment of

an organisation. Management accounting and reporting systems provides adequate knowledge

about the current situation of company as well as market needs and required which makes easy

for company to make efforts in enhancing their profitability. For example, cost accounting

system assist Tesco Plc to identify the total cost that will be incurred in future project activities

which makes easy for managers to prepare an effective budget. It minimises the misuse of

resources which directly makes positive impact on profitability of company. Another example is

inventory management system and report which assist managers in knowing their actual

inventory position that will either meet customers needs and demands or not. It reduces

inventory storage cost due to supplying raw material directly from suppliers to production

process.

5

related to sales are entered.

Benefits of management accounting reports to management

Ease in forecasting- There is requirement of forecasting data for future use. Business has

many activities such as purchase, sales, manufacturing, etc. so through these report it is easy to

make strategies for near future. For instance, amount due from debtors can be known from

account receivable report.

Decision making technique- These reports are important for making strategy in smooth

running of business. Performance report helps to know about performance level of last year and

present year. This helps to compare and accordingly decisions can be made.

Helps to judge variances- In business ups and downs are happening, so with the help of

these report, variance can be known. There are some budget set by managers of TESCO, after

specified period they are able to compare and then actions can be taken to overcome it (Gates,

Nicolas and Walker, 2012).

Integration of management accounting systems and reporting with organisational process:

Tesco Plc has adopted various accounting systems and reporting in order to assist

management in making an effective decision and suitable plans in advance for the betterment of

an organisation. Management accounting and reporting systems provides adequate knowledge

about the current situation of company as well as market needs and required which makes easy

for company to make efforts in enhancing their profitability. For example, cost accounting

system assist Tesco Plc to identify the total cost that will be incurred in future project activities

which makes easy for managers to prepare an effective budget. It minimises the misuse of

resources which directly makes positive impact on profitability of company. Another example is

inventory management system and report which assist managers in knowing their actual

inventory position that will either meet customers needs and demands or not. It reduces

inventory storage cost due to supplying raw material directly from suppliers to production

process.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

P3 Calculate cost using appropriate techniques of cost analysis to prepare income statement

using marginal and absorption costing

Cost- A payment which is mad by buyer in lieu of product and services. This is the monetary

value of efforts, material, time, risk, time, etc. in producing product or service.

DIFFERENT TYPES OF COST

Direct cost- This is the cost is directly related to production of product. In case of

TESCO cost incurred in manufacturing such as raw material cost, manufacturing cost, etc. are

included in this.

Indirect cost- This is the cost which is related to production but not directly. For instance

warehouse rent cost, machine maintenance cost, etc. are included in indirect cost. This is added

in value of manufacturing of product and services (Harris and Durden, 2012).

Fixed cost- Fixed cost refers to expense which will definitely incurred irrespective of

numbers of unit produced. For instance, rental cost of building, salary to supervisor, etc. are

components of fixed cost.

Variable cost- Variable cost is directly associated with number of units produced. This

cost includes packaging cost is part of variable cost. Number of units produced are packed so

there is difference in variable cost as per difference in level of production.

COST VOLUME PROFIT ANALYSIS

This analysis provides knowledge about impact of change of cost and volume on

operation and net profit of TESCO. In this analysis there is requirement of every cost associated

with production, operating and selling of product. Break even point can be known with cost

volume profit analysis. It is the situation where TESCO does not have profit as well as loss.

FLEXIBLE BUDGET NAD COST VARIANCE

Flexible budget is prepared as per data available of specific period. These are more

effective and significant in knowing revenue of particular period. This is more effective as

compared to fixed budget (Hutaibat, 2012).

There is some specific cost for particular task is fixed by managers of TESCO. There are

possibilities of positive and negative results as compared to specified cost. This difference is

known as cost variance.

ABSORPTION AND MARGINAL COSTING

6

P3 Calculate cost using appropriate techniques of cost analysis to prepare income statement

using marginal and absorption costing

Cost- A payment which is mad by buyer in lieu of product and services. This is the monetary

value of efforts, material, time, risk, time, etc. in producing product or service.

DIFFERENT TYPES OF COST

Direct cost- This is the cost is directly related to production of product. In case of

TESCO cost incurred in manufacturing such as raw material cost, manufacturing cost, etc. are

included in this.

Indirect cost- This is the cost which is related to production but not directly. For instance

warehouse rent cost, machine maintenance cost, etc. are included in indirect cost. This is added

in value of manufacturing of product and services (Harris and Durden, 2012).

Fixed cost- Fixed cost refers to expense which will definitely incurred irrespective of

numbers of unit produced. For instance, rental cost of building, salary to supervisor, etc. are

components of fixed cost.

Variable cost- Variable cost is directly associated with number of units produced. This

cost includes packaging cost is part of variable cost. Number of units produced are packed so

there is difference in variable cost as per difference in level of production.

COST VOLUME PROFIT ANALYSIS

This analysis provides knowledge about impact of change of cost and volume on

operation and net profit of TESCO. In this analysis there is requirement of every cost associated

with production, operating and selling of product. Break even point can be known with cost

volume profit analysis. It is the situation where TESCO does not have profit as well as loss.

FLEXIBLE BUDGET NAD COST VARIANCE

Flexible budget is prepared as per data available of specific period. These are more

effective and significant in knowing revenue of particular period. This is more effective as

compared to fixed budget (Hutaibat, 2012).

There is some specific cost for particular task is fixed by managers of TESCO. There are

possibilities of positive and negative results as compared to specified cost. This difference is

known as cost variance.

ABSORPTION AND MARGINAL COSTING

6

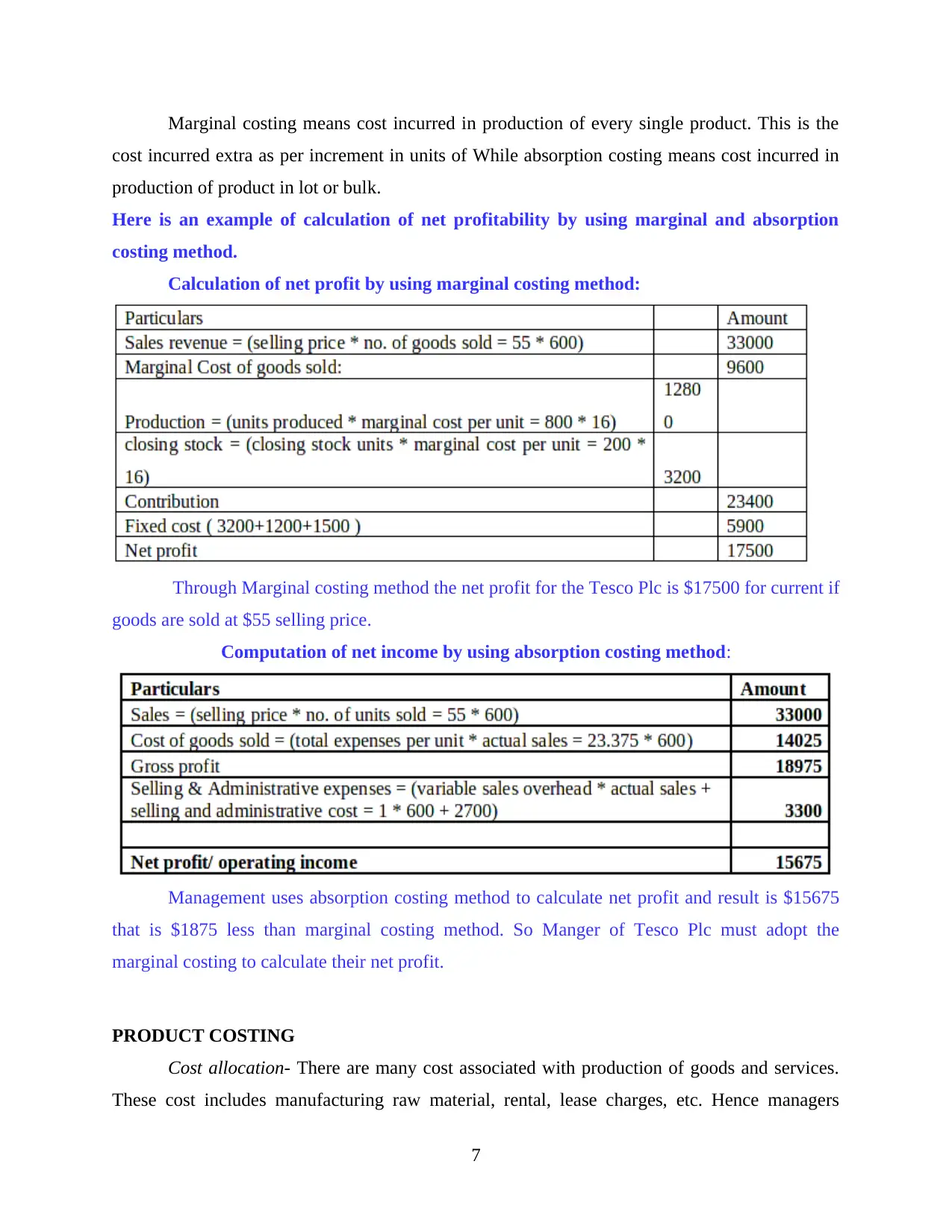

Marginal costing means cost incurred in production of every single product. This is the

cost incurred extra as per increment in units of While absorption costing means cost incurred in

production of product in lot or bulk.

Here is an example of calculation of net profitability by using marginal and absorption

costing method.

Calculation of net profit by using marginal costing method:

Through Marginal costing method the net profit for the Tesco Plc is $17500 for current if

goods are sold at $55 selling price.

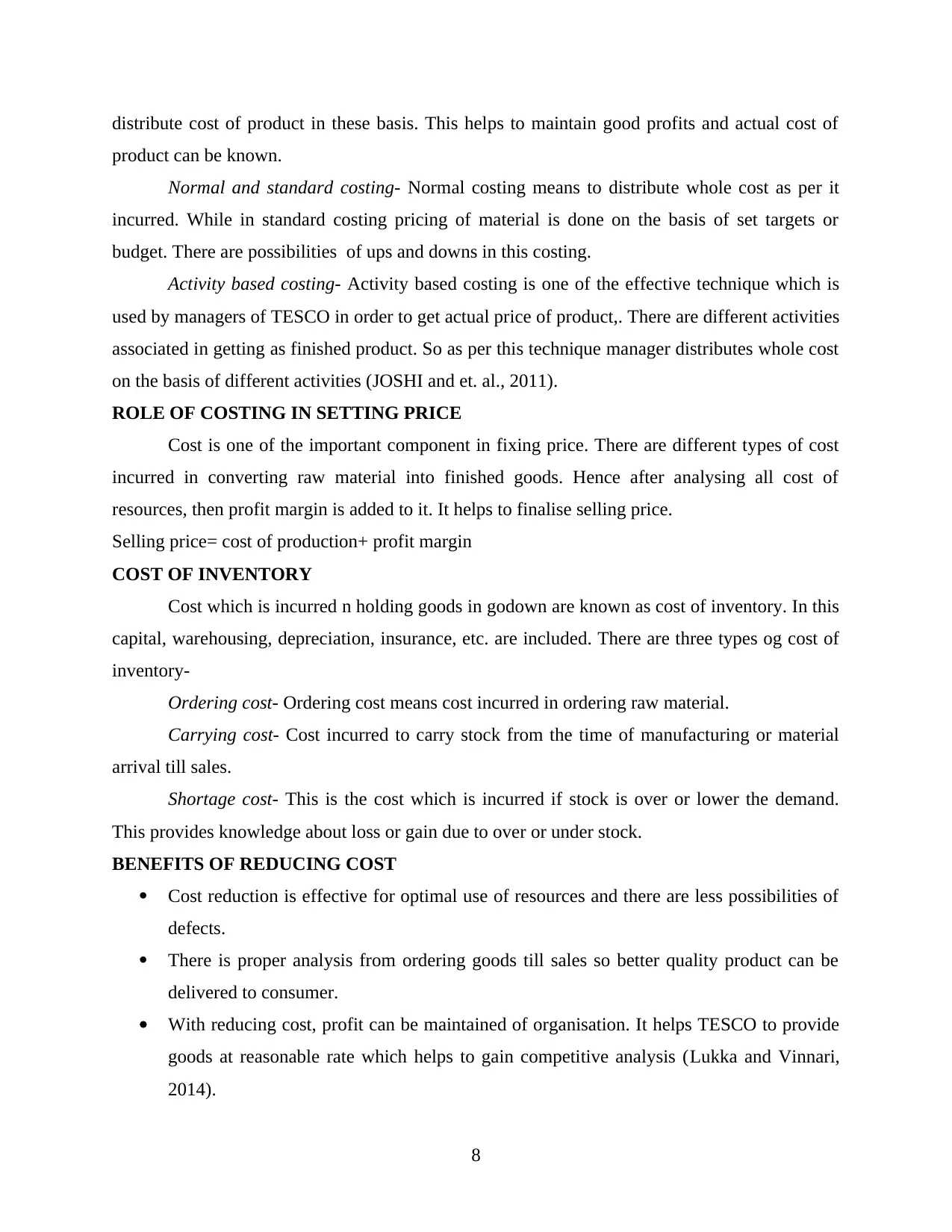

Computation of net income by using absorption costing method:

Management uses absorption costing method to calculate net profit and result is $15675

that is $1875 less than marginal costing method. So Manger of Tesco Plc must adopt the

marginal costing to calculate their net profit.

PRODUCT COSTING

Cost allocation- There are many cost associated with production of goods and services.

These cost includes manufacturing raw material, rental, lease charges, etc. Hence managers

7

cost incurred extra as per increment in units of While absorption costing means cost incurred in

production of product in lot or bulk.

Here is an example of calculation of net profitability by using marginal and absorption

costing method.

Calculation of net profit by using marginal costing method:

Through Marginal costing method the net profit for the Tesco Plc is $17500 for current if

goods are sold at $55 selling price.

Computation of net income by using absorption costing method:

Management uses absorption costing method to calculate net profit and result is $15675

that is $1875 less than marginal costing method. So Manger of Tesco Plc must adopt the

marginal costing to calculate their net profit.

PRODUCT COSTING

Cost allocation- There are many cost associated with production of goods and services.

These cost includes manufacturing raw material, rental, lease charges, etc. Hence managers

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

distribute cost of product in these basis. This helps to maintain good profits and actual cost of

product can be known.

Normal and standard costing- Normal costing means to distribute whole cost as per it

incurred. While in standard costing pricing of material is done on the basis of set targets or

budget. There are possibilities of ups and downs in this costing.

Activity based costing- Activity based costing is one of the effective technique which is

used by managers of TESCO in order to get actual price of product,. There are different activities

associated in getting as finished product. So as per this technique manager distributes whole cost

on the basis of different activities (JOSHI and et. al., 2011).

ROLE OF COSTING IN SETTING PRICE

Cost is one of the important component in fixing price. There are different types of cost

incurred in converting raw material into finished goods. Hence after analysing all cost of

resources, then profit margin is added to it. It helps to finalise selling price.

Selling price= cost of production+ profit margin

COST OF INVENTORY

Cost which is incurred n holding goods in godown are known as cost of inventory. In this

capital, warehousing, depreciation, insurance, etc. are included. There are three types og cost of

inventory-

Ordering cost- Ordering cost means cost incurred in ordering raw material.

Carrying cost- Cost incurred to carry stock from the time of manufacturing or material

arrival till sales.

Shortage cost- This is the cost which is incurred if stock is over or lower the demand.

This provides knowledge about loss or gain due to over or under stock.

BENEFITS OF REDUCING COST

Cost reduction is effective for optimal use of resources and there are less possibilities of

defects.

There is proper analysis from ordering goods till sales so better quality product can be

delivered to consumer.

With reducing cost, profit can be maintained of organisation. It helps TESCO to provide

goods at reasonable rate which helps to gain competitive analysis (Lukka and Vinnari,

2014).

8

product can be known.

Normal and standard costing- Normal costing means to distribute whole cost as per it

incurred. While in standard costing pricing of material is done on the basis of set targets or

budget. There are possibilities of ups and downs in this costing.

Activity based costing- Activity based costing is one of the effective technique which is

used by managers of TESCO in order to get actual price of product,. There are different activities

associated in getting as finished product. So as per this technique manager distributes whole cost

on the basis of different activities (JOSHI and et. al., 2011).

ROLE OF COSTING IN SETTING PRICE

Cost is one of the important component in fixing price. There are different types of cost

incurred in converting raw material into finished goods. Hence after analysing all cost of

resources, then profit margin is added to it. It helps to finalise selling price.

Selling price= cost of production+ profit margin

COST OF INVENTORY

Cost which is incurred n holding goods in godown are known as cost of inventory. In this

capital, warehousing, depreciation, insurance, etc. are included. There are three types og cost of

inventory-

Ordering cost- Ordering cost means cost incurred in ordering raw material.

Carrying cost- Cost incurred to carry stock from the time of manufacturing or material

arrival till sales.

Shortage cost- This is the cost which is incurred if stock is over or lower the demand.

This provides knowledge about loss or gain due to over or under stock.

BENEFITS OF REDUCING COST

Cost reduction is effective for optimal use of resources and there are less possibilities of

defects.

There is proper analysis from ordering goods till sales so better quality product can be

delivered to consumer.

With reducing cost, profit can be maintained of organisation. It helps TESCO to provide

goods at reasonable rate which helps to gain competitive analysis (Lukka and Vinnari,

2014).

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Valuation methods

LIFO- LIFO stands of last in first out. As per this method TESCO sells product which

enter in store at last. Then they sell product which entered earlier.

FIFO- FIFO stands for first in first out. As per this theory, there is goods which is

entered first in godown are available for sale and then sale later entered material.

COST VARIATION-

There are some budgets set for cost, it means there is some specified amount set by

managers of TESCO to incurred on particular activity. If there is difference in actual and set

budget, then it is known as cost variation. This variation can be positive or negative.

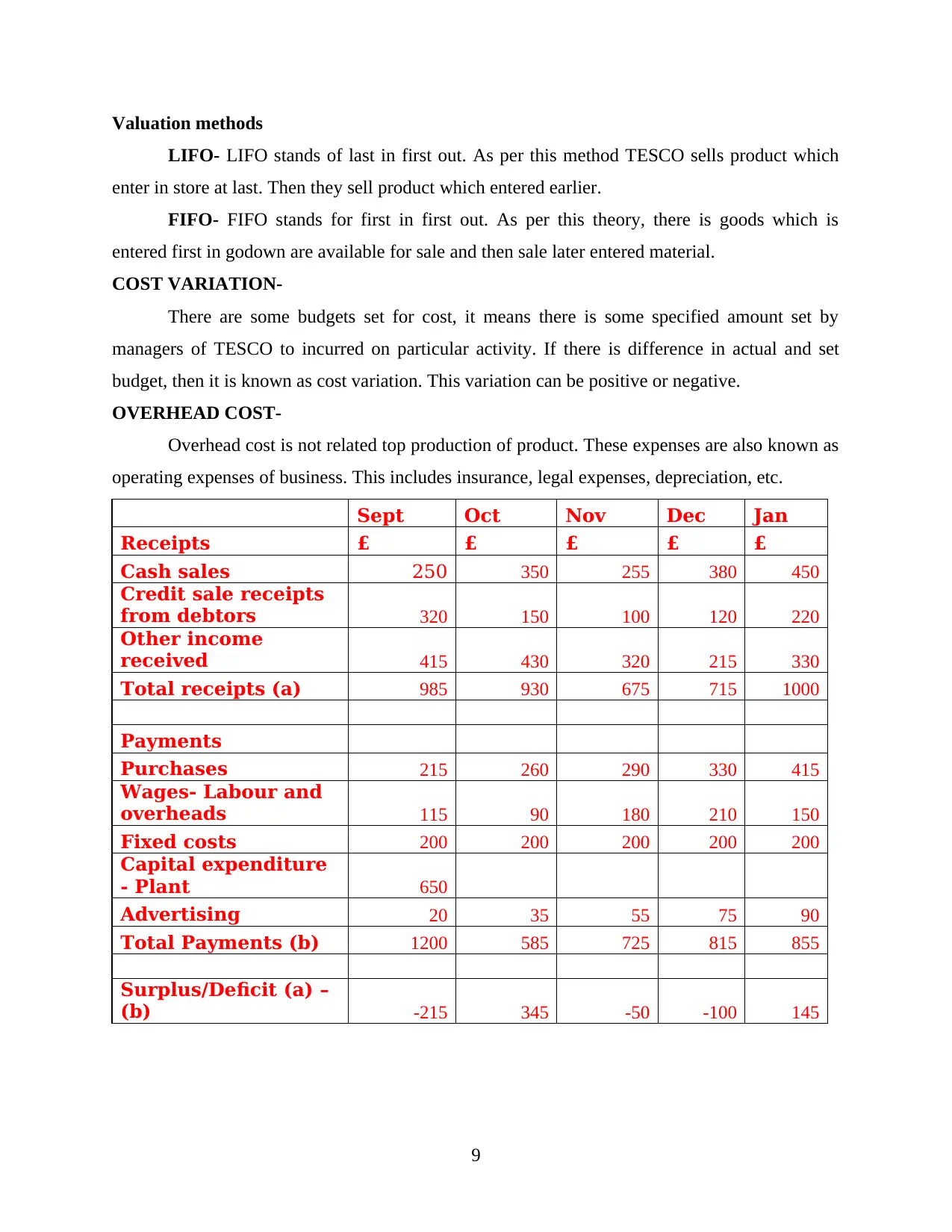

OVERHEAD COST-

Overhead cost is not related top production of product. These expenses are also known as

operating expenses of business. This includes insurance, legal expenses, depreciation, etc.

Sept Oct Nov Dec Jan

Receipts £ £ £ £ £

Cash sales 250 350 255 380 450

Credit sale receipts

from debtors 320 150 100 120 220

Other income

received 415 430 320 215 330

Total receipts (a) 985 930 675 715 1000

Payments

Purchases 215 260 290 330 415

Wages- Labour and

overheads 115 90 180 210 150

Fixed costs 200 200 200 200 200

Capital expenditure

- Plant 650

Advertising 20 35 55 75 90

Total Payments (b) 1200 585 725 815 855

Surplus/Deficit (a) –

(b) -215 345 -50 -100 145

9

LIFO- LIFO stands of last in first out. As per this method TESCO sells product which

enter in store at last. Then they sell product which entered earlier.

FIFO- FIFO stands for first in first out. As per this theory, there is goods which is

entered first in godown are available for sale and then sale later entered material.

COST VARIATION-

There are some budgets set for cost, it means there is some specified amount set by

managers of TESCO to incurred on particular activity. If there is difference in actual and set

budget, then it is known as cost variation. This variation can be positive or negative.

OVERHEAD COST-

Overhead cost is not related top production of product. These expenses are also known as

operating expenses of business. This includes insurance, legal expenses, depreciation, etc.

Sept Oct Nov Dec Jan

Receipts £ £ £ £ £

Cash sales 250 350 255 380 450

Credit sale receipts

from debtors 320 150 100 120 220

Other income

received 415 430 320 215 330

Total receipts (a) 985 930 675 715 1000

Payments

Purchases 215 260 290 330 415

Wages- Labour and

overheads 115 90 180 210 150

Fixed costs 200 200 200 200 200

Capital expenditure

- Plant 650

Advertising 20 35 55 75 90

Total Payments (b) 1200 585 725 815 855

Surplus/Deficit (a) –

(b) -215 345 -50 -100 145

9

TASK 3

P4. Advantage and disadvantage of planning tool used for budgetary control

Budget refers to a financial plan that estimates costs, revenue and resources for a specific

period of time. It is a document that a company makes in order to estimates income as well as

expenses for future based on goals and objective that it want to achieve. It is generally used as

tool for planning and control process of an organisation. As it help managers in formulating

plans at the beginning of a year by providing the information about the financial condition of the

company. Using this information, company plan the activities to be performed throughout the

year according to the availability of fund. After the completion of year this budget statement act

as a control tool by allowing the management to measure their actual performance against the

plan. This further help in identifying the gap between performance and reason behind it so that

the future performance of the company can be improved (Mat, Smith and Djajadikerta, 2010).

Types of budget

Budget help companies like TESCO in operating their business activities effectively by

managing their resources. Following are the types of budget that can be used by TESCO Master budget:- It refers to a budget which is prepared to represent the complete picture

of company's financial position and activities. It integrates factors like operating

expenses, sales, asset and income streams, so that TESCO can set their goals and

examine overall performance. Operating budget:- It refers to a budget prepare for forecasting and analysing the

projected expenses as well as income over a specific time period. Operating budget are

created on monthly, weekly or yearly basis. Cash flow budget:- This statement help in estimating how and when cash flow in or goes

out of the company within a specific time period. Cash flow statement mainly focuses on

ensuring that company have required cash in hand for operating its activities and extent to

which it is using finance effectively. Financial budget:- This statement presents company's strategy for managing its cash

flow, asset and expenses Financial budget focuses on presenting the company's overview

of its spending to generation of revenue from core operations.

P4. Advantage and disadvantage of planning tool used for budgetary control

Budget refers to a financial plan that estimates costs, revenue and resources for a specific

period of time. It is a document that a company makes in order to estimates income as well as

expenses for future based on goals and objective that it want to achieve. It is generally used as

tool for planning and control process of an organisation. As it help managers in formulating

plans at the beginning of a year by providing the information about the financial condition of the

company. Using this information, company plan the activities to be performed throughout the

year according to the availability of fund. After the completion of year this budget statement act

as a control tool by allowing the management to measure their actual performance against the

plan. This further help in identifying the gap between performance and reason behind it so that

the future performance of the company can be improved (Mat, Smith and Djajadikerta, 2010).

Types of budget

Budget help companies like TESCO in operating their business activities effectively by

managing their resources. Following are the types of budget that can be used by TESCO Master budget:- It refers to a budget which is prepared to represent the complete picture

of company's financial position and activities. It integrates factors like operating

expenses, sales, asset and income streams, so that TESCO can set their goals and

examine overall performance. Operating budget:- It refers to a budget prepare for forecasting and analysing the

projected expenses as well as income over a specific time period. Operating budget are

created on monthly, weekly or yearly basis. Cash flow budget:- This statement help in estimating how and when cash flow in or goes

out of the company within a specific time period. Cash flow statement mainly focuses on

ensuring that company have required cash in hand for operating its activities and extent to

which it is using finance effectively. Financial budget:- This statement presents company's strategy for managing its cash

flow, asset and expenses Financial budget focuses on presenting the company's overview

of its spending to generation of revenue from core operations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.