MBA Assignment: Financial Performance Analysis of Travelobreak Company

VerifiedAdded on 2020/05/03

|6

|842

|64

Report

AI Summary

This MBA assignment analyzes the financial performance of Travelobreak, a company focused on bringing travelers together. The report includes a detailed income statement spanning three years (2017-2019), showing revenue, cost of sales, operating expenses, and net profit. A balance sheet for the same period is also provided, detailing assets, liabilities, and shareholder's equity. The analysis highlights increasing revenue trends, consistent cost of sales, and the impact of rising salaries on net profit margins. Depreciation and changes in trade payables and receivables are also discussed. The report concludes with a bibliography of relevant financial accounting resources.

Running head: MBA ASSIGNMENT

MBA Assignment

Name of the student

Name of the university

Author note

MBA Assignment

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MBA ASSIGNMENT

Table of Contents

Income statement of Travelobreak.............................................................................................2

Balance sheet of Travelobreak Limited.....................................................................................3

Analysis report...........................................................................................................................3

Bibliography...............................................................................................................................5

Table of Contents

Income statement of Travelobreak.............................................................................................2

Balance sheet of Travelobreak Limited.....................................................................................3

Analysis report...........................................................................................................................3

Bibliography...............................................................................................................................5

2MBA ASSIGNMENT

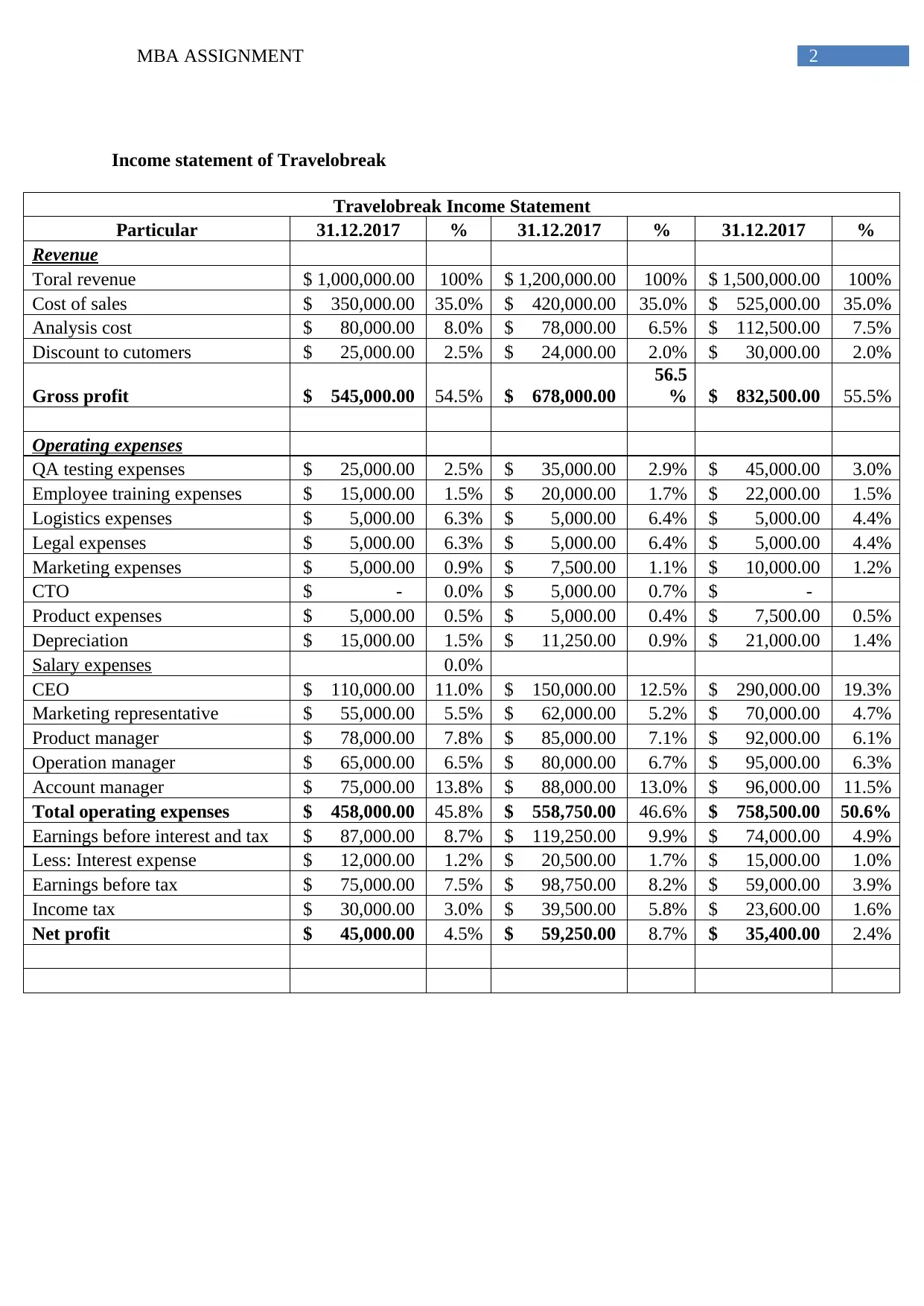

Income statement of Travelobreak

Travelobreak Income Statement

Particular 31.12.2017 % 31.12.2017 % 31.12.2017 %

Revenue

Toral revenue $ 1,000,000.00 100% $ 1,200,000.00 100% $ 1,500,000.00 100%

Cost of sales $ 350,000.00 35.0% $ 420,000.00 35.0% $ 525,000.00 35.0%

Analysis cost $ 80,000.00 8.0% $ 78,000.00 6.5% $ 112,500.00 7.5%

Discount to cutomers $ 25,000.00 2.5% $ 24,000.00 2.0% $ 30,000.00 2.0%

Gross profit $ 545,000.00 54.5% $ 678,000.00

56.5

% $ 832,500.00 55.5%

Operating expenses

QA testing expenses $ 25,000.00 2.5% $ 35,000.00 2.9% $ 45,000.00 3.0%

Employee training expenses $ 15,000.00 1.5% $ 20,000.00 1.7% $ 22,000.00 1.5%

Logistics expenses $ 5,000.00 6.3% $ 5,000.00 6.4% $ 5,000.00 4.4%

Legal expenses $ 5,000.00 6.3% $ 5,000.00 6.4% $ 5,000.00 4.4%

Marketing expenses $ 5,000.00 0.9% $ 7,500.00 1.1% $ 10,000.00 1.2%

CTO $ - 0.0% $ 5,000.00 0.7% $ -

Product expenses $ 5,000.00 0.5% $ 5,000.00 0.4% $ 7,500.00 0.5%

Depreciation $ 15,000.00 1.5% $ 11,250.00 0.9% $ 21,000.00 1.4%

Salary expenses 0.0%

CEO $ 110,000.00 11.0% $ 150,000.00 12.5% $ 290,000.00 19.3%

Marketing representative $ 55,000.00 5.5% $ 62,000.00 5.2% $ 70,000.00 4.7%

Product manager $ 78,000.00 7.8% $ 85,000.00 7.1% $ 92,000.00 6.1%

Operation manager $ 65,000.00 6.5% $ 80,000.00 6.7% $ 95,000.00 6.3%

Account manager $ 75,000.00 13.8% $ 88,000.00 13.0% $ 96,000.00 11.5%

Total operating expenses $ 458,000.00 45.8% $ 558,750.00 46.6% $ 758,500.00 50.6%

Earnings before interest and tax $ 87,000.00 8.7% $ 119,250.00 9.9% $ 74,000.00 4.9%

Less: Interest expense $ 12,000.00 1.2% $ 20,500.00 1.7% $ 15,000.00 1.0%

Earnings before tax $ 75,000.00 7.5% $ 98,750.00 8.2% $ 59,000.00 3.9%

Income tax $ 30,000.00 3.0% $ 39,500.00 5.8% $ 23,600.00 1.6%

Net profit $ 45,000.00 4.5% $ 59,250.00 8.7% $ 35,400.00 2.4%

Income statement of Travelobreak

Travelobreak Income Statement

Particular 31.12.2017 % 31.12.2017 % 31.12.2017 %

Revenue

Toral revenue $ 1,000,000.00 100% $ 1,200,000.00 100% $ 1,500,000.00 100%

Cost of sales $ 350,000.00 35.0% $ 420,000.00 35.0% $ 525,000.00 35.0%

Analysis cost $ 80,000.00 8.0% $ 78,000.00 6.5% $ 112,500.00 7.5%

Discount to cutomers $ 25,000.00 2.5% $ 24,000.00 2.0% $ 30,000.00 2.0%

Gross profit $ 545,000.00 54.5% $ 678,000.00

56.5

% $ 832,500.00 55.5%

Operating expenses

QA testing expenses $ 25,000.00 2.5% $ 35,000.00 2.9% $ 45,000.00 3.0%

Employee training expenses $ 15,000.00 1.5% $ 20,000.00 1.7% $ 22,000.00 1.5%

Logistics expenses $ 5,000.00 6.3% $ 5,000.00 6.4% $ 5,000.00 4.4%

Legal expenses $ 5,000.00 6.3% $ 5,000.00 6.4% $ 5,000.00 4.4%

Marketing expenses $ 5,000.00 0.9% $ 7,500.00 1.1% $ 10,000.00 1.2%

CTO $ - 0.0% $ 5,000.00 0.7% $ -

Product expenses $ 5,000.00 0.5% $ 5,000.00 0.4% $ 7,500.00 0.5%

Depreciation $ 15,000.00 1.5% $ 11,250.00 0.9% $ 21,000.00 1.4%

Salary expenses 0.0%

CEO $ 110,000.00 11.0% $ 150,000.00 12.5% $ 290,000.00 19.3%

Marketing representative $ 55,000.00 5.5% $ 62,000.00 5.2% $ 70,000.00 4.7%

Product manager $ 78,000.00 7.8% $ 85,000.00 7.1% $ 92,000.00 6.1%

Operation manager $ 65,000.00 6.5% $ 80,000.00 6.7% $ 95,000.00 6.3%

Account manager $ 75,000.00 13.8% $ 88,000.00 13.0% $ 96,000.00 11.5%

Total operating expenses $ 458,000.00 45.8% $ 558,750.00 46.6% $ 758,500.00 50.6%

Earnings before interest and tax $ 87,000.00 8.7% $ 119,250.00 9.9% $ 74,000.00 4.9%

Less: Interest expense $ 12,000.00 1.2% $ 20,500.00 1.7% $ 15,000.00 1.0%

Earnings before tax $ 75,000.00 7.5% $ 98,750.00 8.2% $ 59,000.00 3.9%

Income tax $ 30,000.00 3.0% $ 39,500.00 5.8% $ 23,600.00 1.6%

Net profit $ 45,000.00 4.5% $ 59,250.00 8.7% $ 35,400.00 2.4%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MBA ASSIGNMENT

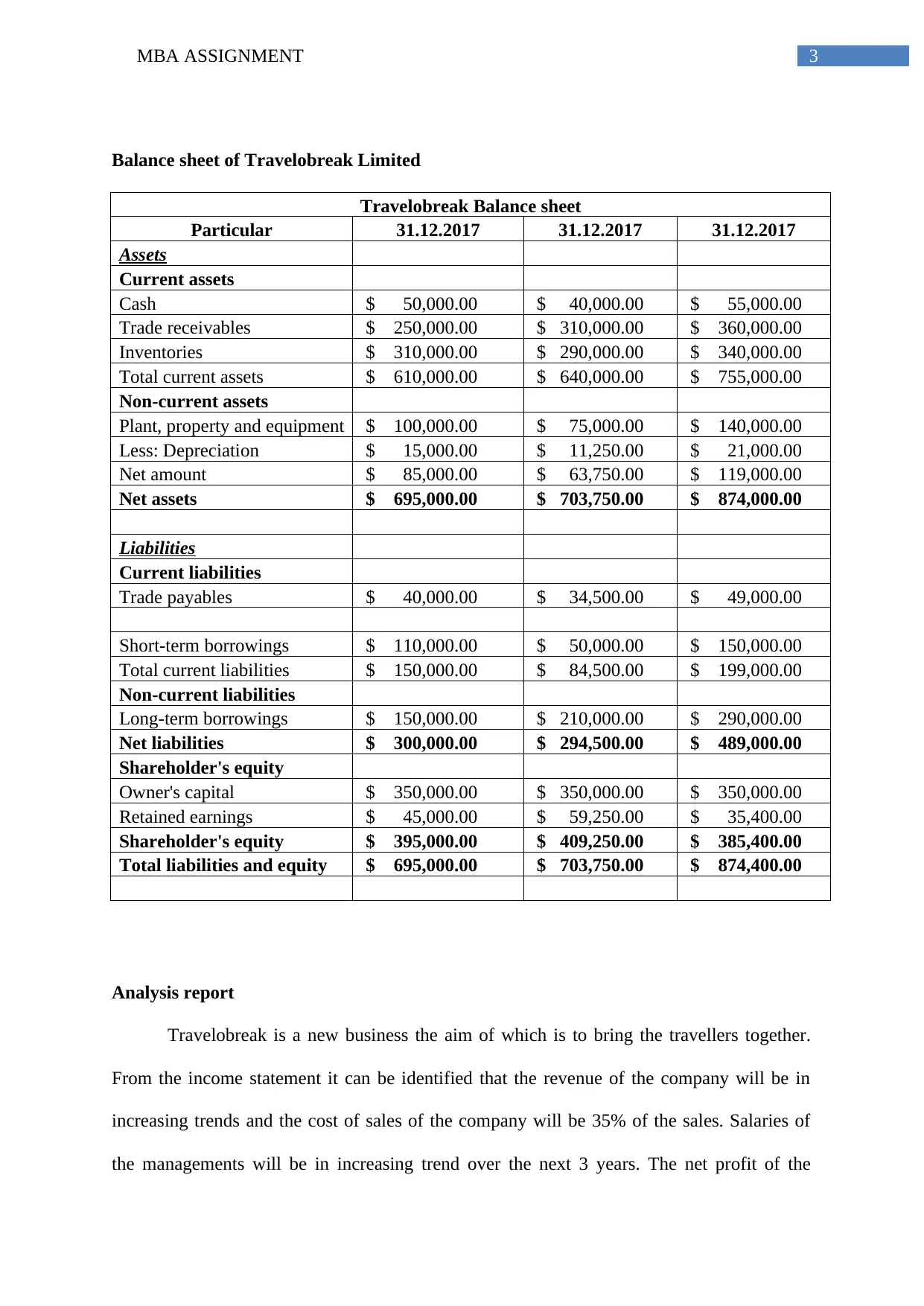

Balance sheet of Travelobreak Limited

Travelobreak Balance sheet

Particular 31.12.2017 31.12.2017 31.12.2017

Assets

Current assets

Cash $ 50,000.00 $ 40,000.00 $ 55,000.00

Trade receivables $ 250,000.00 $ 310,000.00 $ 360,000.00

Inventories $ 310,000.00 $ 290,000.00 $ 340,000.00

Total current assets $ 610,000.00 $ 640,000.00 $ 755,000.00

Non-current assets

Plant, property and equipment $ 100,000.00 $ 75,000.00 $ 140,000.00

Less: Depreciation $ 15,000.00 $ 11,250.00 $ 21,000.00

Net amount $ 85,000.00 $ 63,750.00 $ 119,000.00

Net assets $ 695,000.00 $ 703,750.00 $ 874,000.00

Liabilities

Current liabilities

Trade payables $ 40,000.00 $ 34,500.00 $ 49,000.00

Short-term borrowings $ 110,000.00 $ 50,000.00 $ 150,000.00

Total current liabilities $ 150,000.00 $ 84,500.00 $ 199,000.00

Non-current liabilities

Long-term borrowings $ 150,000.00 $ 210,000.00 $ 290,000.00

Net liabilities $ 300,000.00 $ 294,500.00 $ 489,000.00

Shareholder's equity

Owner's capital $ 350,000.00 $ 350,000.00 $ 350,000.00

Retained earnings $ 45,000.00 $ 59,250.00 $ 35,400.00

Shareholder's equity $ 395,000.00 $ 409,250.00 $ 385,400.00

Total liabilities and equity $ 695,000.00 $ 703,750.00 $ 874,400.00

Analysis report

Travelobreak is a new business the aim of which is to bring the travellers together.

From the income statement it can be identified that the revenue of the company will be in

increasing trends and the cost of sales of the company will be 35% of the sales. Salaries of

the managements will be in increasing trend over the next 3 years. The net profit of the

Balance sheet of Travelobreak Limited

Travelobreak Balance sheet

Particular 31.12.2017 31.12.2017 31.12.2017

Assets

Current assets

Cash $ 50,000.00 $ 40,000.00 $ 55,000.00

Trade receivables $ 250,000.00 $ 310,000.00 $ 360,000.00

Inventories $ 310,000.00 $ 290,000.00 $ 340,000.00

Total current assets $ 610,000.00 $ 640,000.00 $ 755,000.00

Non-current assets

Plant, property and equipment $ 100,000.00 $ 75,000.00 $ 140,000.00

Less: Depreciation $ 15,000.00 $ 11,250.00 $ 21,000.00

Net amount $ 85,000.00 $ 63,750.00 $ 119,000.00

Net assets $ 695,000.00 $ 703,750.00 $ 874,000.00

Liabilities

Current liabilities

Trade payables $ 40,000.00 $ 34,500.00 $ 49,000.00

Short-term borrowings $ 110,000.00 $ 50,000.00 $ 150,000.00

Total current liabilities $ 150,000.00 $ 84,500.00 $ 199,000.00

Non-current liabilities

Long-term borrowings $ 150,000.00 $ 210,000.00 $ 290,000.00

Net liabilities $ 300,000.00 $ 294,500.00 $ 489,000.00

Shareholder's equity

Owner's capital $ 350,000.00 $ 350,000.00 $ 350,000.00

Retained earnings $ 45,000.00 $ 59,250.00 $ 35,400.00

Shareholder's equity $ 395,000.00 $ 409,250.00 $ 385,400.00

Total liabilities and equity $ 695,000.00 $ 703,750.00 $ 874,400.00

Analysis report

Travelobreak is a new business the aim of which is to bring the travellers together.

From the income statement it can be identified that the revenue of the company will be in

increasing trends and the cost of sales of the company will be 35% of the sales. Salaries of

the managements will be in increasing trend over the next 3 years. The net profit of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MBA ASSIGNMENT

company will go up to 8.7% in 208 as compared to 4.5% of 2017. However, in 2019 the

profit will reduce to 2.4% due to the increase in the salaries. Looking into the balance sheet it

can be identified that the depreciation on plant and equipment will be provided at 15% for all

the three years. Trade payables will be reduced in 2018 and will again increase in 2019. The

borrowings and trade receivable of the company will be in decreasing trend.

company will go up to 8.7% in 208 as compared to 4.5% of 2017. However, in 2019 the

profit will reduce to 2.4% due to the increase in the salaries. Looking into the balance sheet it

can be identified that the depreciation on plant and equipment will be provided at 15% for all

the three years. Trade payables will be reduced in 2018 and will again increase in 2019. The

borrowings and trade receivable of the company will be in decreasing trend.

5MBA ASSIGNMENT

Bibliography

Henry, E. and Robinson, T.R., 2015. Chapter 1. Financial Statement Analysis: An

Introduction. CFA Institute Investment Books, 2015(2), pp.1-35.

Konchitchki, Y. and Patatoukas, P.N., 2013. Taking the pulse of the real economy using

financial statement analysis: Implications for macro forecasting and stock valuation.

Marshall, D., 2016. Accounting: What the numbers mean. McGraw-Hill Higher Education.

Wahlen, J., Baginski, S. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

Bibliography

Henry, E. and Robinson, T.R., 2015. Chapter 1. Financial Statement Analysis: An

Introduction. CFA Institute Investment Books, 2015(2), pp.1-35.

Konchitchki, Y. and Patatoukas, P.N., 2013. Taking the pulse of the real economy using

financial statement analysis: Implications for macro forecasting and stock valuation.

Marshall, D., 2016. Accounting: What the numbers mean. McGraw-Hill Higher Education.

Wahlen, J., Baginski, S. and Bradshaw, M., 2014. Financial reporting, financial statement

analysis and valuation. Nelson Education.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.