Financial Control and Budgeting Report - Health and Social Care Module

VerifiedAdded on 2022/12/23

|17

|5327

|412

Report

AI Summary

This report provides a comprehensive analysis of financial control and budgeting within the National Health Service (NHS) and the broader health and social care sector. It begins by critically analyzing the legal, financial, and regulatory environments, including the impact of legislation, financial structures, and regulatory frameworks on healthcare operations. The report then evaluates alternative funding options like Private Finance Initiatives (PFI), agency partnerships, competitive tendering, and outsourcing, assessing their advantages and disadvantages. Agency theory is discussed in the context of the NHS, emphasizing the importance of stakeholder communication in budgeting processes. The report also explores the impact of financial constraints, costs, and budgets on service managers, clients, and stakeholders. It examines the challenges of budgeting in the public sector and critically discusses the advantages and disadvantages of incremental and zero-based budgeting. Furthermore, the report includes a break-even analysis, calculating break-even points and margins of safety, followed by a critical discussion of the assumptions underlying the break-even model. The report concludes with an overview of the key findings and recommendations, supported by relevant references.

Financial Control and

Budgeting

Budgeting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

(a) Critically analyse the legal, financial and regulatory environment of health and social care

.....................................................................................................................................................1

(b) Critically evaluate the use of alternative funding options and outsourcing in health and

social care sector.........................................................................................................................2

(c) Discuss agency theory in the context of the NHS. Explain the importance of and ways of

communicating with stakeholders in the context of budgeting...................................................4

QUESTION 2...................................................................................................................................5

(a) Critically discuss the impact of financial constraints, costs and budgets on health and

social care service managers, their clients and other stakeholders.............................................5

(b) Explain the particular challenges of budgeting in public sector organisations.....................6

(c) Critically discuss the advantages and disadvantages of incremental and zero-based

budgeting.....................................................................................................................................7

QUESTION 3...................................................................................................................................9

(a) Calculate the break-even point and margin of safety in both units and revenue for the two

years, 2018 and 2019, and briefly comment upon the results.....................................................9

(b) Critically discuss key assumptions attached to the break even model, within the light of

the reality of today’s business environments............................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

QUESTION 1...................................................................................................................................1

(a) Critically analyse the legal, financial and regulatory environment of health and social care

.....................................................................................................................................................1

(b) Critically evaluate the use of alternative funding options and outsourcing in health and

social care sector.........................................................................................................................2

(c) Discuss agency theory in the context of the NHS. Explain the importance of and ways of

communicating with stakeholders in the context of budgeting...................................................4

QUESTION 2...................................................................................................................................5

(a) Critically discuss the impact of financial constraints, costs and budgets on health and

social care service managers, their clients and other stakeholders.............................................5

(b) Explain the particular challenges of budgeting in public sector organisations.....................6

(c) Critically discuss the advantages and disadvantages of incremental and zero-based

budgeting.....................................................................................................................................7

QUESTION 3...................................................................................................................................9

(a) Calculate the break-even point and margin of safety in both units and revenue for the two

years, 2018 and 2019, and briefly comment upon the results.....................................................9

(b) Critically discuss key assumptions attached to the break even model, within the light of

the reality of today’s business environments............................................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

INTRODUCTION

Financial control is a procedures, policies and means by which an organization. For this

require to monitor and control the direction and usage of its financial resources. It is essential to

control very core of resources management and operational efficiency in any entity. Moreover,

Budgetary control is a procedure by which budgets are produced for upcoming period and are

compare with the actual efficiency for finding out variances. The comparison of budgeted figures

with actual figures will supports in proper management to find out variances and take right

decision without any delay (Bleyen and et.al, 2017). This report based on the NHS (National

health service) is the publicly publicly funded healthcare system in England (United Kingdom).

It is the second biggest single payer health care system in the world. In this report consist of

evaluate of financial, legal, regulatory and structural atmosphere under health and social care.

Analysis alternative funding options in the health and social care sector and apply agency theory

in context of NHS. Moreover, define impact of financial constraints, costs and budgets and

particular challenges in public sector. Along with advantage and disadvantage of zero based and

incremental budget and calculate break even point and margin safety in units and amounts.

QUESTION 1

(a) Critically analyse the legal, financial and regulatory environment of health and social care

The health and social care industry involve various organisation that consist of health

care support to individual like hospitals, specialist and many others. The legal as well as

regulatory perspective can attach with funding arrangement, duty of care of the local dominance

and also commissioning of service and the tendering processes in the public sector provision for

the support and care service. This industry follow a particular legal, financial and regulatory

framework that are mentioned below:

Legal environment: The health and social care industry follow a legal structure that is

identified as crucial of health care department that is related with deduction of increasing

infections, viruses that are very critically for human health (Ellul and Hodges, 2019). A

particular nation requires to follow a particular legal structure that helps to follow all the

regulations in proper manner. Such as, The NHS follow quality issues that have been set forth by

the government and these issues are adhered so that the patients in the hospital are safe. To

operate NHS in UK follow the different legislation like social work 1968, National assistance act

1

Financial control is a procedures, policies and means by which an organization. For this

require to monitor and control the direction and usage of its financial resources. It is essential to

control very core of resources management and operational efficiency in any entity. Moreover,

Budgetary control is a procedure by which budgets are produced for upcoming period and are

compare with the actual efficiency for finding out variances. The comparison of budgeted figures

with actual figures will supports in proper management to find out variances and take right

decision without any delay (Bleyen and et.al, 2017). This report based on the NHS (National

health service) is the publicly publicly funded healthcare system in England (United Kingdom).

It is the second biggest single payer health care system in the world. In this report consist of

evaluate of financial, legal, regulatory and structural atmosphere under health and social care.

Analysis alternative funding options in the health and social care sector and apply agency theory

in context of NHS. Moreover, define impact of financial constraints, costs and budgets and

particular challenges in public sector. Along with advantage and disadvantage of zero based and

incremental budget and calculate break even point and margin safety in units and amounts.

QUESTION 1

(a) Critically analyse the legal, financial and regulatory environment of health and social care

The health and social care industry involve various organisation that consist of health

care support to individual like hospitals, specialist and many others. The legal as well as

regulatory perspective can attach with funding arrangement, duty of care of the local dominance

and also commissioning of service and the tendering processes in the public sector provision for

the support and care service. This industry follow a particular legal, financial and regulatory

framework that are mentioned below:

Legal environment: The health and social care industry follow a legal structure that is

identified as crucial of health care department that is related with deduction of increasing

infections, viruses that are very critically for human health (Ellul and Hodges, 2019). A

particular nation requires to follow a particular legal structure that helps to follow all the

regulations in proper manner. Such as, The NHS follow quality issues that have been set forth by

the government and these issues are adhered so that the patients in the hospital are safe. To

operate NHS in UK follow the different legislation like social work 1968, National assistance act

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1948, Human rights act 1988 and many others. NHS being national health service provider in

UK where are following different regulations like safety at work 1974, human right act 1998 and

many other. These acts applied by NHS in good manner through an entity so that no legal

complications will originate further in working activities.

Financial environment: It is most essential part of economy that plays major role in any

industry that could be regulated on basis of health and social care activities. In this sector

organisation mainly concentrate on financial support to the patients having ill health by

insurance and other claims. Such as, NHS is treating various patients but has not accomplished

any key transformation in finance and service authorities required to meet increasing demand.

The short term fixes that are regulated by DHSC in England and NHS improvement put in place

to arranging different resources in a affected financial environment are not sustainable (Kamawar

and et.al, 2019).

Regulatory environment: Health care industry based on the different resources that has

receiving particular inputs of material, water and energy that outcomes in waste, effluents and

emission pollution. Regulation in the NHS is applied by a mix of command as well as control,

self regulation and varying forms of agency. In modern years, NHS follow new regulatory

techniques and instruments have been formulated and expanded in which consist of risk based

profiling, national quality standards and results indicators. This environment impacts on patient

safety and measures have largely been assumed instead of explored. These regulatory activity

enhance organisational efficiency and patient results beyond some alteration of existing

development plans.

It is highly critical regulatory environment with different, overlapping assurances wanted

by outer bodies. Different challenges lie ahead that deserve systematic, high quality examination.

Effective regulation is held to be one of the foundations of high quality and safe patient care.

(b) Critically evaluate the use of alternative funding options and outsourcing in health and social

care sector

Funding is the money that lenders as well as equity holders provide to an entity for daily

and long term requirements (Górnik-Durose and Boroń, 2018). In the health and social care

sector, different types of entities which are taking funds from different sources to conduct their

business activities that are mentioned below:

2

UK where are following different regulations like safety at work 1974, human right act 1998 and

many other. These acts applied by NHS in good manner through an entity so that no legal

complications will originate further in working activities.

Financial environment: It is most essential part of economy that plays major role in any

industry that could be regulated on basis of health and social care activities. In this sector

organisation mainly concentrate on financial support to the patients having ill health by

insurance and other claims. Such as, NHS is treating various patients but has not accomplished

any key transformation in finance and service authorities required to meet increasing demand.

The short term fixes that are regulated by DHSC in England and NHS improvement put in place

to arranging different resources in a affected financial environment are not sustainable (Kamawar

and et.al, 2019).

Regulatory environment: Health care industry based on the different resources that has

receiving particular inputs of material, water and energy that outcomes in waste, effluents and

emission pollution. Regulation in the NHS is applied by a mix of command as well as control,

self regulation and varying forms of agency. In modern years, NHS follow new regulatory

techniques and instruments have been formulated and expanded in which consist of risk based

profiling, national quality standards and results indicators. This environment impacts on patient

safety and measures have largely been assumed instead of explored. These regulatory activity

enhance organisational efficiency and patient results beyond some alteration of existing

development plans.

It is highly critical regulatory environment with different, overlapping assurances wanted

by outer bodies. Different challenges lie ahead that deserve systematic, high quality examination.

Effective regulation is held to be one of the foundations of high quality and safe patient care.

(b) Critically evaluate the use of alternative funding options and outsourcing in health and social

care sector

Funding is the money that lenders as well as equity holders provide to an entity for daily

and long term requirements (Górnik-Durose and Boroń, 2018). In the health and social care

sector, different types of entities which are taking funds from different sources to conduct their

business activities that are mentioned below:

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Private finance initiatives: It is a way of financing for public sector projects by the

private sector. It is alleviating with the government and taxpayers of the direct burden of coming

up with the capital for such projects. It is critically analysed that PFI analysis the different ways

to increased health care efficiency as well as effectiveness that motivated for the medical

innovation. Such as, NHS can use this way for financing for their different projects and the

government authority makes yearly payments to the private organisation. These agreements are

mainly provide to construction firms and can last as long as 30 years and more. NHS got heavy

funding from the private initiative that is £13bn which will be grossed to £80bn till end of

project.

Agency partnership: It is a most changing, comprehensive and effective means of

disabling firm to draw the greatest return on investment from the marketing budget. Different

organisations fail to increase their marketing reach and effectiveness because of lack of a clear

and well defined relationship with the particular marketing agency (Michael, Oyewale and

Oladosu, 2017). NHS coordinate with various entity at national and local stage to enhance results

and meet with the necessities of the mandate and assure that NHS operates within its financial

resources. NHS England and NHS improvement relies on different strategic partnership at local

as well as national level to supply business activities.

Competitive tendering: A competitive tendering is a bid put forward by higher investor

like institutional investor. Every bidder is limited to 35 percent of the amount of the contribution

per auction. Each bid put forward specifies the lowest rate, discount margin, yield that the

investor is willing to accept for the debt securities. For the tendering procedure an entity follow

particular steps such as: Issue of prior information, Issue of contract notice, market warming &

events, issue of selection questionnaire and at the end announcement of preferred bidder and

contract award.

Outsourcing: It is a business practice in which recruiting outsider organisation to present

services and develop goods that traditionally were performed in house by the organisation's own

staff. In this practice mainly interpreted by entities as a cost cutting measure. In health care

business outsourcing means outsourced different business activity and procedure that provide

support to medial people, institutions and entities. Mainly consider activities are coding, billing

service and transcription (Mohamad and Karbhari, 2019). Such as, NHS use outsourcing term to

outsourced different activities to private institution like diagnosis, surgery, mental health etc.

3

private sector. It is alleviating with the government and taxpayers of the direct burden of coming

up with the capital for such projects. It is critically analysed that PFI analysis the different ways

to increased health care efficiency as well as effectiveness that motivated for the medical

innovation. Such as, NHS can use this way for financing for their different projects and the

government authority makes yearly payments to the private organisation. These agreements are

mainly provide to construction firms and can last as long as 30 years and more. NHS got heavy

funding from the private initiative that is £13bn which will be grossed to £80bn till end of

project.

Agency partnership: It is a most changing, comprehensive and effective means of

disabling firm to draw the greatest return on investment from the marketing budget. Different

organisations fail to increase their marketing reach and effectiveness because of lack of a clear

and well defined relationship with the particular marketing agency (Michael, Oyewale and

Oladosu, 2017). NHS coordinate with various entity at national and local stage to enhance results

and meet with the necessities of the mandate and assure that NHS operates within its financial

resources. NHS England and NHS improvement relies on different strategic partnership at local

as well as national level to supply business activities.

Competitive tendering: A competitive tendering is a bid put forward by higher investor

like institutional investor. Every bidder is limited to 35 percent of the amount of the contribution

per auction. Each bid put forward specifies the lowest rate, discount margin, yield that the

investor is willing to accept for the debt securities. For the tendering procedure an entity follow

particular steps such as: Issue of prior information, Issue of contract notice, market warming &

events, issue of selection questionnaire and at the end announcement of preferred bidder and

contract award.

Outsourcing: It is a business practice in which recruiting outsider organisation to present

services and develop goods that traditionally were performed in house by the organisation's own

staff. In this practice mainly interpreted by entities as a cost cutting measure. In health care

business outsourcing means outsourced different business activity and procedure that provide

support to medial people, institutions and entities. Mainly consider activities are coding, billing

service and transcription (Mohamad and Karbhari, 2019). Such as, NHS use outsourcing term to

outsourced different activities to private institution like diagnosis, surgery, mental health etc.

3

(c) Discuss agency theory in the context of the NHS. Explain the importance of and ways of

communicating with stakeholders in the context of budgeting

Agency theory: It is a principle which is utilised to define and resolve issues in the

relation between business principles and their agents. Mainly such relationship is one between

shareholders as principle and organisation executives as agents. This theory apply by NHS to

define and resolve conflicts over priorities between principle and their agents. These differences

based on the performance which is one way that utilised to accomplish a balance between

principle and agent (Kewo, 2017). It is essential in NHS because it helps in developments in

microeconomics in the previous 20 years. It has application of accounting, industrial

organization, labour economics as well as become basis of the economic model of compensation.

In the broad manner, this theory present relationship between two parties in which one agent and

second other representatives that present daily transactions.

Importance and ways of communication: It is essential for any business entity to work

closure with stakeholder that related with business activities whose opinion and actions direct

impact on the project results. When an organisation plan for new project so for this require to

prepare a budget that must approved from the different stakeholders. To inform about the budget

apply different types of communication ways that helps to provide present things in front of

stakeholders. For the communication with stakeholders in the context of budget select these ways

of communication such as:

Send out a newsletter: By using the organisation's intranet or collaboration platform

already in place that effectively define a news letter to be sent out to stakeholders at

particular time period. It can be great for consisting even stakeholders are not directly

involve in the project activities. When company prepare a budget so send soft copy of

budget at their main and take feedback from them. If any one have any issues so they are

raising questions and provide their suggestions in regard of modifications (Indrawan and

et.al, 2019).

Schedule a meeting: Stakeholder meeting is most common method of communication in

which corporation easily save their time in conveying message to a large number of

members. When company prepare any budget in regard of investment and for any other

activities so for this schedule a meeting where inviting all the stakeholders. It is best ways

4

communicating with stakeholders in the context of budgeting

Agency theory: It is a principle which is utilised to define and resolve issues in the

relation between business principles and their agents. Mainly such relationship is one between

shareholders as principle and organisation executives as agents. This theory apply by NHS to

define and resolve conflicts over priorities between principle and their agents. These differences

based on the performance which is one way that utilised to accomplish a balance between

principle and agent (Kewo, 2017). It is essential in NHS because it helps in developments in

microeconomics in the previous 20 years. It has application of accounting, industrial

organization, labour economics as well as become basis of the economic model of compensation.

In the broad manner, this theory present relationship between two parties in which one agent and

second other representatives that present daily transactions.

Importance and ways of communication: It is essential for any business entity to work

closure with stakeholder that related with business activities whose opinion and actions direct

impact on the project results. When an organisation plan for new project so for this require to

prepare a budget that must approved from the different stakeholders. To inform about the budget

apply different types of communication ways that helps to provide present things in front of

stakeholders. For the communication with stakeholders in the context of budget select these ways

of communication such as:

Send out a newsletter: By using the organisation's intranet or collaboration platform

already in place that effectively define a news letter to be sent out to stakeholders at

particular time period. It can be great for consisting even stakeholders are not directly

involve in the project activities. When company prepare a budget so send soft copy of

budget at their main and take feedback from them. If any one have any issues so they are

raising questions and provide their suggestions in regard of modifications (Indrawan and

et.al, 2019).

Schedule a meeting: Stakeholder meeting is most common method of communication in

which corporation easily save their time in conveying message to a large number of

members. When company prepare any budget in regard of investment and for any other

activities so for this schedule a meeting where inviting all the stakeholders. It is best ways

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to communicate the message would be Power point, Excel and any type of software

solution. In this meeting discuss about the budget and outcomes from the project.

Schedule a conference call: Conferences call are mostly used by the different entities for

the communication with stakeholder in regard of budgeting. When an entity face any

obstacle so require to resolved immediately and create a conference call that can be

arranged in the matter of minutes. Through call apply changes n budget that prepare by

the finance department and approve by all the stakeholders (Deering and Sá, 2018).

QUESTION 2

(a) Critically discuss the impact of financial constraints, costs and budgets on health and social

care service managers, their clients and other stakeholders

Financial constraint is any element that restricts the amount or quality of investment

alternatives. It can be related with internal and external activities like lack of knowledge and

poor cash flow management. These are actual problems that should not be confused with

subjective as well as emotional excuses for not leading a particular course of action. Such as, in

NHS current financial challenges is impacting on patients access to high quality care and

pressure are felt differently in various parts of system that take in depth in four service areas

these are, different nursing, Genito urinary medicine (GUM) clinics, elective hip replacement

and neonatal services.

There are identifying funding gaps in local authority that become constraint for NHS,

budgets cuts, efficiency and cost savings in public sector funding. When NHS received funding

from private institution so it presents a great deal of variation among states in the

progressiveness as well as graduated of funding. If company has not able to maintain their

efficiency so it impact on the business in negative manner (Setyawan, Priyono and Iswanaji,

2017).

Role of stakeholders: A stakeholder is a person who has interest in different activities

that occur in the business and take decision in their actions. These stakeholders are playing

essential role to defining the future of business and presents its day to day workings. They have

legal decision making rights that control project activities as well as budgetary issues, mainly in

this project stakeholders have responsibilities to entity that consist of improve developers,

financing projects, developing scheduling parameters and set milestone dates.

5

solution. In this meeting discuss about the budget and outcomes from the project.

Schedule a conference call: Conferences call are mostly used by the different entities for

the communication with stakeholder in regard of budgeting. When an entity face any

obstacle so require to resolved immediately and create a conference call that can be

arranged in the matter of minutes. Through call apply changes n budget that prepare by

the finance department and approve by all the stakeholders (Deering and Sá, 2018).

QUESTION 2

(a) Critically discuss the impact of financial constraints, costs and budgets on health and social

care service managers, their clients and other stakeholders

Financial constraint is any element that restricts the amount or quality of investment

alternatives. It can be related with internal and external activities like lack of knowledge and

poor cash flow management. These are actual problems that should not be confused with

subjective as well as emotional excuses for not leading a particular course of action. Such as, in

NHS current financial challenges is impacting on patients access to high quality care and

pressure are felt differently in various parts of system that take in depth in four service areas

these are, different nursing, Genito urinary medicine (GUM) clinics, elective hip replacement

and neonatal services.

There are identifying funding gaps in local authority that become constraint for NHS,

budgets cuts, efficiency and cost savings in public sector funding. When NHS received funding

from private institution so it presents a great deal of variation among states in the

progressiveness as well as graduated of funding. If company has not able to maintain their

efficiency so it impact on the business in negative manner (Setyawan, Priyono and Iswanaji,

2017).

Role of stakeholders: A stakeholder is a person who has interest in different activities

that occur in the business and take decision in their actions. These stakeholders are playing

essential role to defining the future of business and presents its day to day workings. They have

legal decision making rights that control project activities as well as budgetary issues, mainly in

this project stakeholders have responsibilities to entity that consist of improve developers,

financing projects, developing scheduling parameters and set milestone dates.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In the procurement procedure stakeholders are classified into two parts such as, internal

as well as external stakeholders. In internal consist of budget owners, legal professionals, senior

management on the other side in external stakeholders consist of suppliers and other partners. In

this procedure they are collecting knowledge, understanding any ideas from key people inside

the organisation. These are relating with the right internal people can assure about the

procurement function that achieve understanding in regard of strategic issues, value added

activities, cost saving goals, compliance as well as organisational input moving forward

(Aryshev and Ivanyuk, 2020).

Importance of budgeting: It is essential for any firm because it supports business to

control their spending, track expenditure and save more money. Moreover, by budgeting can

support in make better financial decision, prepare for emergencies, get out of debts and remain

concentrated for longer term financial goals. In the health and social care without budget a

manager do not able to make decision in regard of investment and their clients are focusing on

different activities in better manner to achieve good results. When NHS wants to open new

hospital so for this require to proper planning and arranging fund in effective manner. Thus,

company use budgeting activities and effectively planning about each item appropriately.

(b) Explain the particular challenges of budgeting in public sector organisations

Budgeting is a procedure of developing a plan to spend amount effectively. In this

spending plan allows to analysis in advance manner and whether will have sufficient amount to

do things as per the requirement. It is mainly balancing expenditure with income.

Budget reduction: It is amount of reduction which is related with different department

inside an entity or government may spend in certified period of time. Budgets cuts mainly

outcomes from deducted revenues and prioritization of different sources. Such as NHS The

treasury said the cut came from emergency funds that directly related with pandemic with NHS

core funding still set to increase by 7 billion. In the context of health and social care the total

funding for the department is to fall from 199.2 billion in 2020/21 to 169.1 billion next year with

decline allocated from COVID 19 spending (Maziriri, Mapuranga and Madinga, 2018).

For the planning of budget require to neglect excess spending and get rebates from

government and allows them to concentrate funds on areas as well as services that require them

the most. NHS face many challenges in the context of budgeting that are mentioned below:

6

as well as external stakeholders. In internal consist of budget owners, legal professionals, senior

management on the other side in external stakeholders consist of suppliers and other partners. In

this procedure they are collecting knowledge, understanding any ideas from key people inside

the organisation. These are relating with the right internal people can assure about the

procurement function that achieve understanding in regard of strategic issues, value added

activities, cost saving goals, compliance as well as organisational input moving forward

(Aryshev and Ivanyuk, 2020).

Importance of budgeting: It is essential for any firm because it supports business to

control their spending, track expenditure and save more money. Moreover, by budgeting can

support in make better financial decision, prepare for emergencies, get out of debts and remain

concentrated for longer term financial goals. In the health and social care without budget a

manager do not able to make decision in regard of investment and their clients are focusing on

different activities in better manner to achieve good results. When NHS wants to open new

hospital so for this require to proper planning and arranging fund in effective manner. Thus,

company use budgeting activities and effectively planning about each item appropriately.

(b) Explain the particular challenges of budgeting in public sector organisations

Budgeting is a procedure of developing a plan to spend amount effectively. In this

spending plan allows to analysis in advance manner and whether will have sufficient amount to

do things as per the requirement. It is mainly balancing expenditure with income.

Budget reduction: It is amount of reduction which is related with different department

inside an entity or government may spend in certified period of time. Budgets cuts mainly

outcomes from deducted revenues and prioritization of different sources. Such as NHS The

treasury said the cut came from emergency funds that directly related with pandemic with NHS

core funding still set to increase by 7 billion. In the context of health and social care the total

funding for the department is to fall from 199.2 billion in 2020/21 to 169.1 billion next year with

decline allocated from COVID 19 spending (Maziriri, Mapuranga and Madinga, 2018).

For the planning of budget require to neglect excess spending and get rebates from

government and allows them to concentrate funds on areas as well as services that require them

the most. NHS face many challenges in the context of budgeting that are mentioned below:

6

Time required: For the budgeting procedure require to more time as well as man power in

specified period of time. Through budgeting take assumption in regard of future activities

and take right decision in regard of the business.

There are requirement manage balancing in the budgeting of a company otherwise it

impact on the decision making procedure in negative manner. Moreover, an entity face

many problems in the context of different business activities.

If there are identifying any gap in the budget so it is difficult to take decision in regard of

business and impact on the business activities (Kigume, Maluka and Kamuzora, 2018).

Expense allocation: This budget may prescribe that particular amounts of overhead costs

to be allotted to different division at the time of budget period. It is particular challenge

that face by the department when do not allowed to substitute services are supported from

the entity for lower cost services that are available elsewhere.

Only considers financial results: at the time of budget preparation only focus on monetary

activities, do not consider non monitor activities so it impact on the decision making

procedure in direct manner.

(c) Critically discuss the advantages and disadvantages of incremental and zero-based budgeting.

Incremental budgeting: It is a type of budgeting procedure that depend on the idea that

a new budget can best be produced by making only some extra modification to the current

budget. In other words, this budget is produced by using a past period budget or analysis actual

performance with incremental amounts that added for the new budget period. It is a common

approach in business in which management does not specify to spend a great deal of time

applying budgets and it does not perceive and other requirement to conduct by re assessment of

an entity.

Advantage

Simplicity: It is simply approach of budgeting which is utilising for current period to

assignment the future budget and do not require complex solutions. There are also few

assumptions are needed in this budgeting method. Therefore, it allows organisation to

proper management to save time at the budgeting procedure.

Funding stability: This budget may help to assure that funding keep stable over time as

expenditure are related to easily with project. It will beneficial for an organisation with

7

specified period of time. Through budgeting take assumption in regard of future activities

and take right decision in regard of the business.

There are requirement manage balancing in the budgeting of a company otherwise it

impact on the decision making procedure in negative manner. Moreover, an entity face

many problems in the context of different business activities.

If there are identifying any gap in the budget so it is difficult to take decision in regard of

business and impact on the business activities (Kigume, Maluka and Kamuzora, 2018).

Expense allocation: This budget may prescribe that particular amounts of overhead costs

to be allotted to different division at the time of budget period. It is particular challenge

that face by the department when do not allowed to substitute services are supported from

the entity for lower cost services that are available elsewhere.

Only considers financial results: at the time of budget preparation only focus on monetary

activities, do not consider non monitor activities so it impact on the decision making

procedure in direct manner.

(c) Critically discuss the advantages and disadvantages of incremental and zero-based budgeting.

Incremental budgeting: It is a type of budgeting procedure that depend on the idea that

a new budget can best be produced by making only some extra modification to the current

budget. In other words, this budget is produced by using a past period budget or analysis actual

performance with incremental amounts that added for the new budget period. It is a common

approach in business in which management does not specify to spend a great deal of time

applying budgets and it does not perceive and other requirement to conduct by re assessment of

an entity.

Advantage

Simplicity: It is simply approach of budgeting which is utilising for current period to

assignment the future budget and do not require complex solutions. There are also few

assumptions are needed in this budgeting method. Therefore, it allows organisation to

proper management to save time at the budgeting procedure.

Funding stability: This budget may help to assure that funding keep stable over time as

expenditure are related to easily with project. It will beneficial for an organisation with

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

projects that needed for funding for different years (Bentley-Goode, Newton and

Thompson, 2017).

Disadvantage

Promotes unnecessary spending: It can carry out outcomes in unnecessary spending for

an entity. The main cause behind this is that different division insider an entity an

organisation mainly tend to spend all the amounts that have been allocated in a budget

once a year. This budget takes the position of enhancing part of the budget by a particular

amount every year.

Discourage innovation: In this kind of budgeting may discourage the manufacturing of

innovative ideas as well as growth. Since new budgets are depend on different figures

from previous budgets where little room for financing for completely new ideas and

activities.

Zero based budgeting: It is a method of budgeting in which include all the expenditure

must be justified for each new period. This budget involves re evaluating each line item for cash

statement and clearly presents all the expenses which to be incurred through the division. For the

preparation of this budget analysis all the expenses are calculated on the basis of actual

expenditure. According to this method each activity require to be justified and defining revenues

that each cost will generate for an entity.

Advantage

Accuracy: It is a part of traditional budgeting method in which consist of arbitrary

modifications in the earlier of budget. This methodology supports in cost deduction to a

particular extent as it provides a actual picture of costs in the context of desired

performance.

Efficiency: This budget supports an entity in the allocation of resources effectively as it

does not look at the past year budgets so concentrate on the actual amount (Piatti-

Fünfkirchen and Schneider, 2018).

Disadvantage

Higher man power turnover: To preparation of this budget start from zero so according to

this budget is required to proper planning and organising. For this needed expertise who

have knowledge to prepare this budget and the involvement of large number of staff

members. Different departments may not have effective manpower and time for the same.

8

Thompson, 2017).

Disadvantage

Promotes unnecessary spending: It can carry out outcomes in unnecessary spending for

an entity. The main cause behind this is that different division insider an entity an

organisation mainly tend to spend all the amounts that have been allocated in a budget

once a year. This budget takes the position of enhancing part of the budget by a particular

amount every year.

Discourage innovation: In this kind of budgeting may discourage the manufacturing of

innovative ideas as well as growth. Since new budgets are depend on different figures

from previous budgets where little room for financing for completely new ideas and

activities.

Zero based budgeting: It is a method of budgeting in which include all the expenditure

must be justified for each new period. This budget involves re evaluating each line item for cash

statement and clearly presents all the expenses which to be incurred through the division. For the

preparation of this budget analysis all the expenses are calculated on the basis of actual

expenditure. According to this method each activity require to be justified and defining revenues

that each cost will generate for an entity.

Advantage

Accuracy: It is a part of traditional budgeting method in which consist of arbitrary

modifications in the earlier of budget. This methodology supports in cost deduction to a

particular extent as it provides a actual picture of costs in the context of desired

performance.

Efficiency: This budget supports an entity in the allocation of resources effectively as it

does not look at the past year budgets so concentrate on the actual amount (Piatti-

Fünfkirchen and Schneider, 2018).

Disadvantage

Higher man power turnover: To preparation of this budget start from zero so according to

this budget is required to proper planning and organising. For this needed expertise who

have knowledge to prepare this budget and the involvement of large number of staff

members. Different departments may not have effective manpower and time for the same.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Time consuming: This budget takes lots of time for the preparation and highly time

intensive for an entity to do yearly as against incremental budgeting approach that is far

easier method.

QUESTION 3

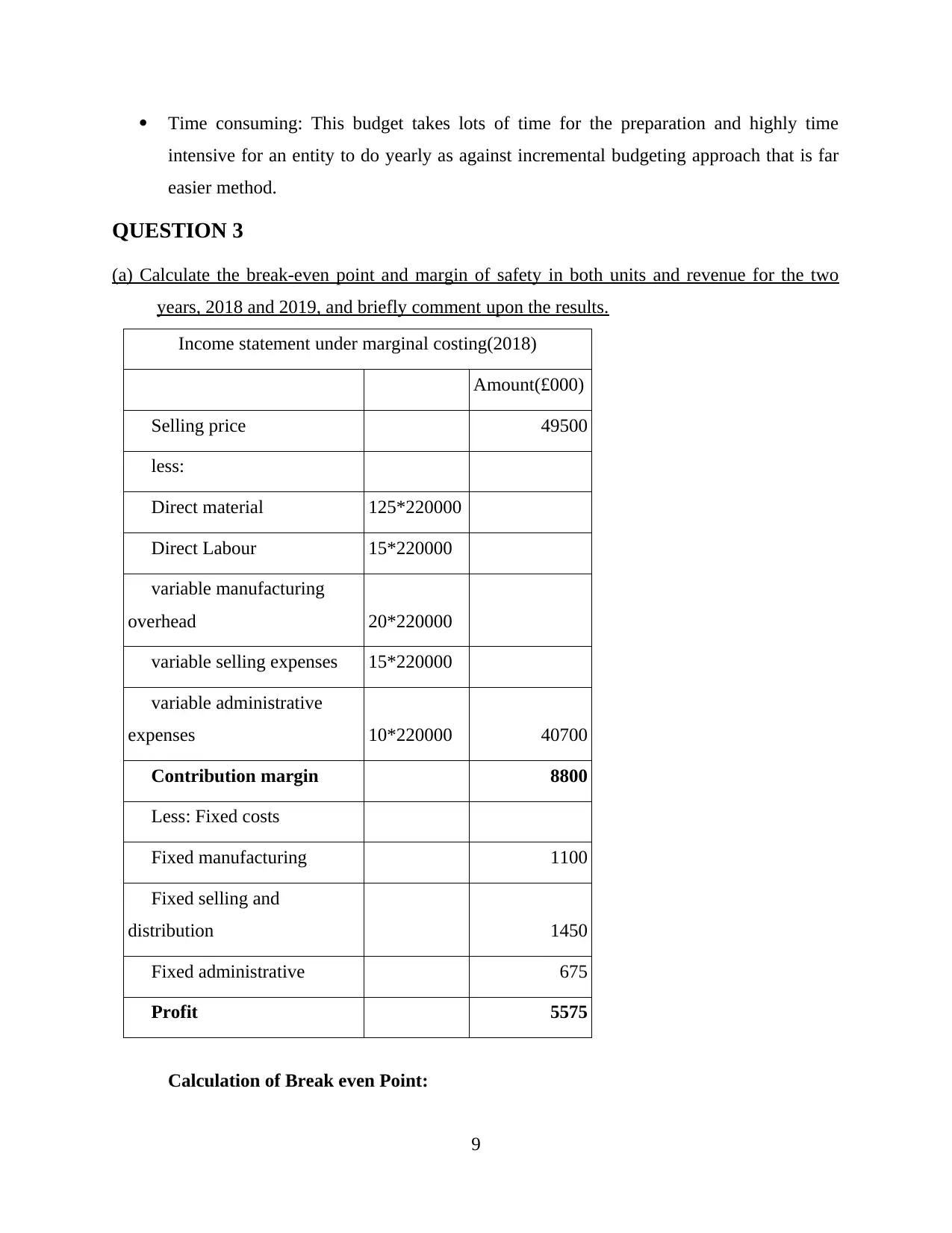

(a) Calculate the break-even point and margin of safety in both units and revenue for the two

years, 2018 and 2019, and briefly comment upon the results.

Income statement under marginal costing(2018)

Amount(£000)

….Selling price 49500

….less:

….Direct material 125*220000

….Direct Labour 15*220000

….variable manufacturing

overhead 20*220000

….variable selling expenses 15*220000

….variable administrative

expenses 10*220000 40700

….Contribution margin 8800

….Less: Fixed costs

….Fixed manufacturing 1100

….Fixed selling and

distribution 1450

….Fixed administrative 675

….Profit 5575

Calculation of Break even Point:

9

intensive for an entity to do yearly as against incremental budgeting approach that is far

easier method.

QUESTION 3

(a) Calculate the break-even point and margin of safety in both units and revenue for the two

years, 2018 and 2019, and briefly comment upon the results.

Income statement under marginal costing(2018)

Amount(£000)

….Selling price 49500

….less:

….Direct material 125*220000

….Direct Labour 15*220000

….variable manufacturing

overhead 20*220000

….variable selling expenses 15*220000

….variable administrative

expenses 10*220000 40700

….Contribution margin 8800

….Less: Fixed costs

….Fixed manufacturing 1100

….Fixed selling and

distribution 1450

….Fixed administrative 675

….Profit 5575

Calculation of Break even Point:

9

….BEP(in units): Fixed cost/ contribution per unit= 80625 units

….BEP(in revenue): Fixed cost/ PV ratio= £18140625

….Note: PV Ratio= contribution/ sales* 100= 8800000/49500000*100=17.778%

Calculation of Margin of Safety(MOS):

….Margin of Safety(in units): (Current Sales Units – Break-even Point)= 139375 units

….Margin of Safety(in revenues): (Actual Sales – BEP Sales)= £31359375

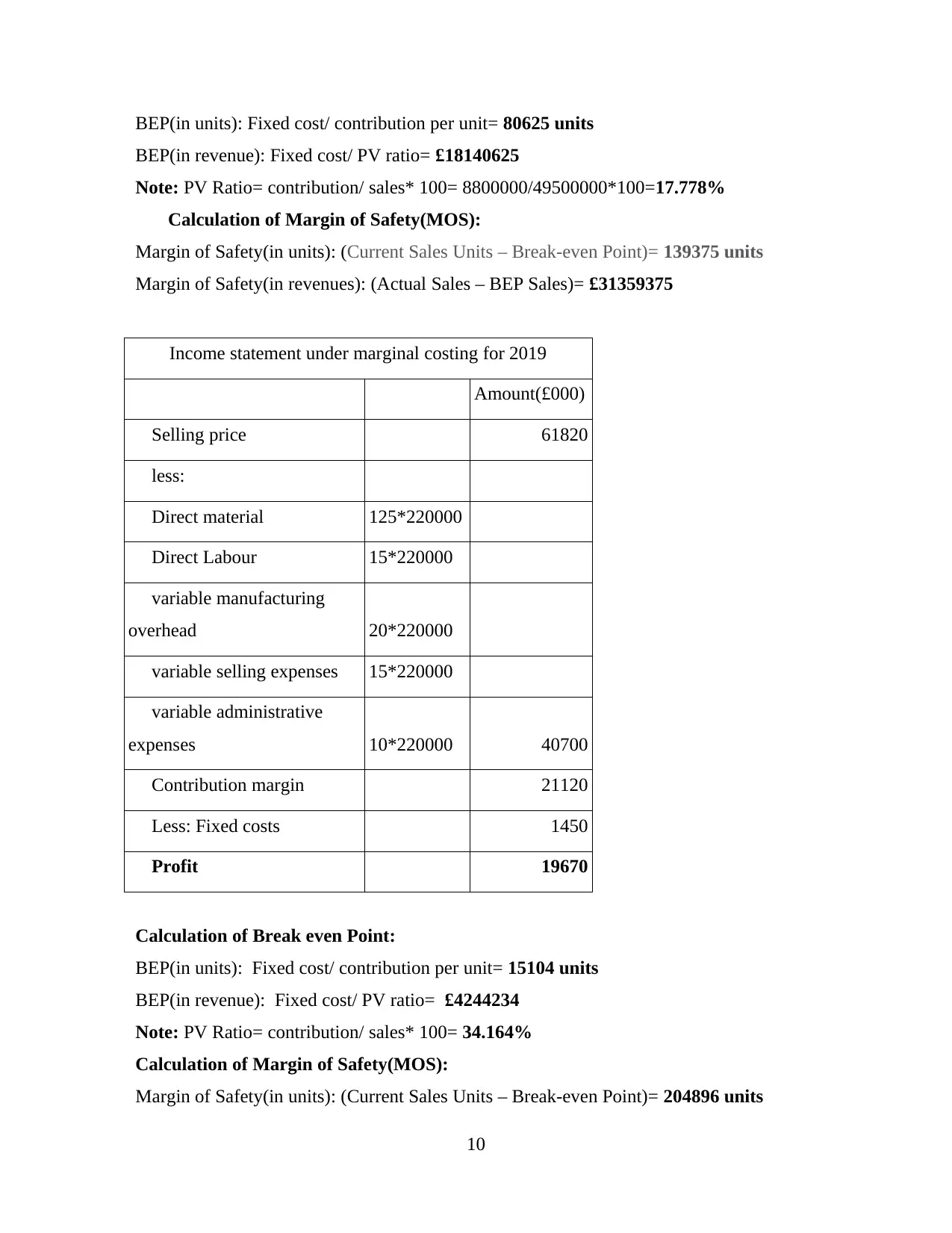

Income statement under marginal costing for 2019

Amount(£000)

….Selling price 61820

….less:

….Direct material 125*220000

….Direct Labour 15*220000

….variable manufacturing

overhead 20*220000

….variable selling expenses 15*220000

….variable administrative

expenses 10*220000 40700

….Contribution margin 21120

….Less: Fixed costs 1450

….Profit 19670

….Calculation of Break even Point:

….BEP(in units): Fixed cost/ contribution per unit= 15104 units

….BEP(in revenue): Fixed cost/ PV ratio= £4244234

….Note: PV Ratio= contribution/ sales* 100= 34.164%

….Calculation of Margin of Safety(MOS):

….Margin of Safety(in units): (Current Sales Units – Break-even Point)= 204896 units

10

….BEP(in revenue): Fixed cost/ PV ratio= £18140625

….Note: PV Ratio= contribution/ sales* 100= 8800000/49500000*100=17.778%

Calculation of Margin of Safety(MOS):

….Margin of Safety(in units): (Current Sales Units – Break-even Point)= 139375 units

….Margin of Safety(in revenues): (Actual Sales – BEP Sales)= £31359375

Income statement under marginal costing for 2019

Amount(£000)

….Selling price 61820

….less:

….Direct material 125*220000

….Direct Labour 15*220000

….variable manufacturing

overhead 20*220000

….variable selling expenses 15*220000

….variable administrative

expenses 10*220000 40700

….Contribution margin 21120

….Less: Fixed costs 1450

….Profit 19670

….Calculation of Break even Point:

….BEP(in units): Fixed cost/ contribution per unit= 15104 units

….BEP(in revenue): Fixed cost/ PV ratio= £4244234

….Note: PV Ratio= contribution/ sales* 100= 34.164%

….Calculation of Margin of Safety(MOS):

….Margin of Safety(in units): (Current Sales Units – Break-even Point)= 204896 units

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.