BUS105 Computing Assignment: Financial Data Analysis and Report

VerifiedAdded on 2020/04/07

|16

|1318

|31

Homework Assignment

AI Summary

This computing assignment for BUS105 analyzes financial data using various statistical methods. It begins with a data scatter plot exploring the relationship between income and annual contribution, determining the annual contribution for a specific income level and calculating z-scores. The assignment then delves into pivot tables to assess the relationship between investment risk (high vs. low) and loss/profit, calculating proportions and p-values to test hypotheses. Further analysis involves box and whisker plots to compare returns for risky and safe investments, followed by the calculation of confidence intervals. Finally, the assignment explores mean and standard deviation computations in finance, demonstrating their application in portfolio theory to determine the risk-return profile of different securities and make investment choices based on the coefficient of variation. The assignment uses Excel functions and provides a practical example of calculating mean and standard deviation from historical data.

Computing Assignment

Bus105

Student id

[Pick the date]

Bus105

Student id

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1

Data

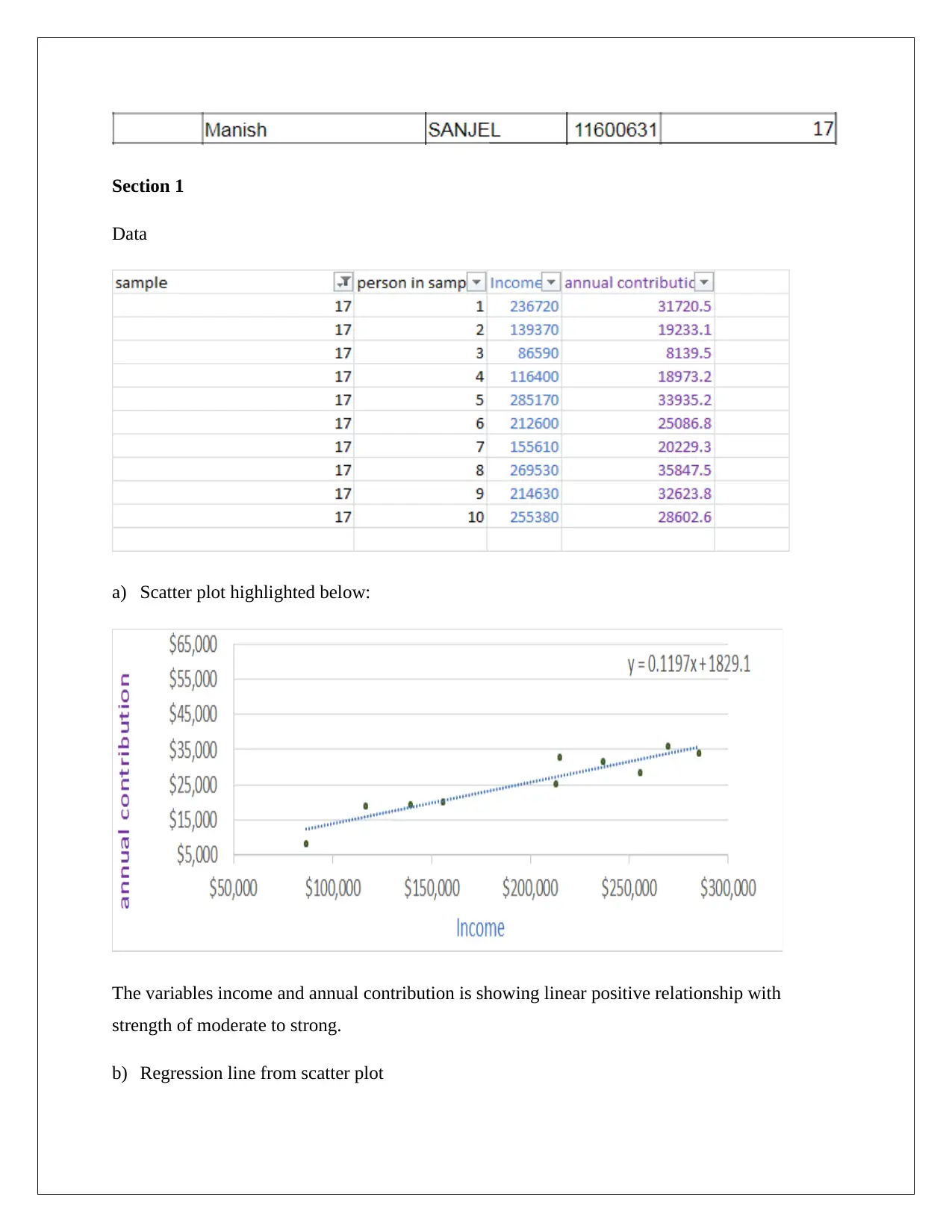

a) Scatter plot highlighted below:

The variables income and annual contribution is showing linear positive relationship with

strength of moderate to strong.

b) Regression line from scatter plot

Data

a) Scatter plot highlighted below:

The variables income and annual contribution is showing linear positive relationship with

strength of moderate to strong.

b) Regression line from scatter plot

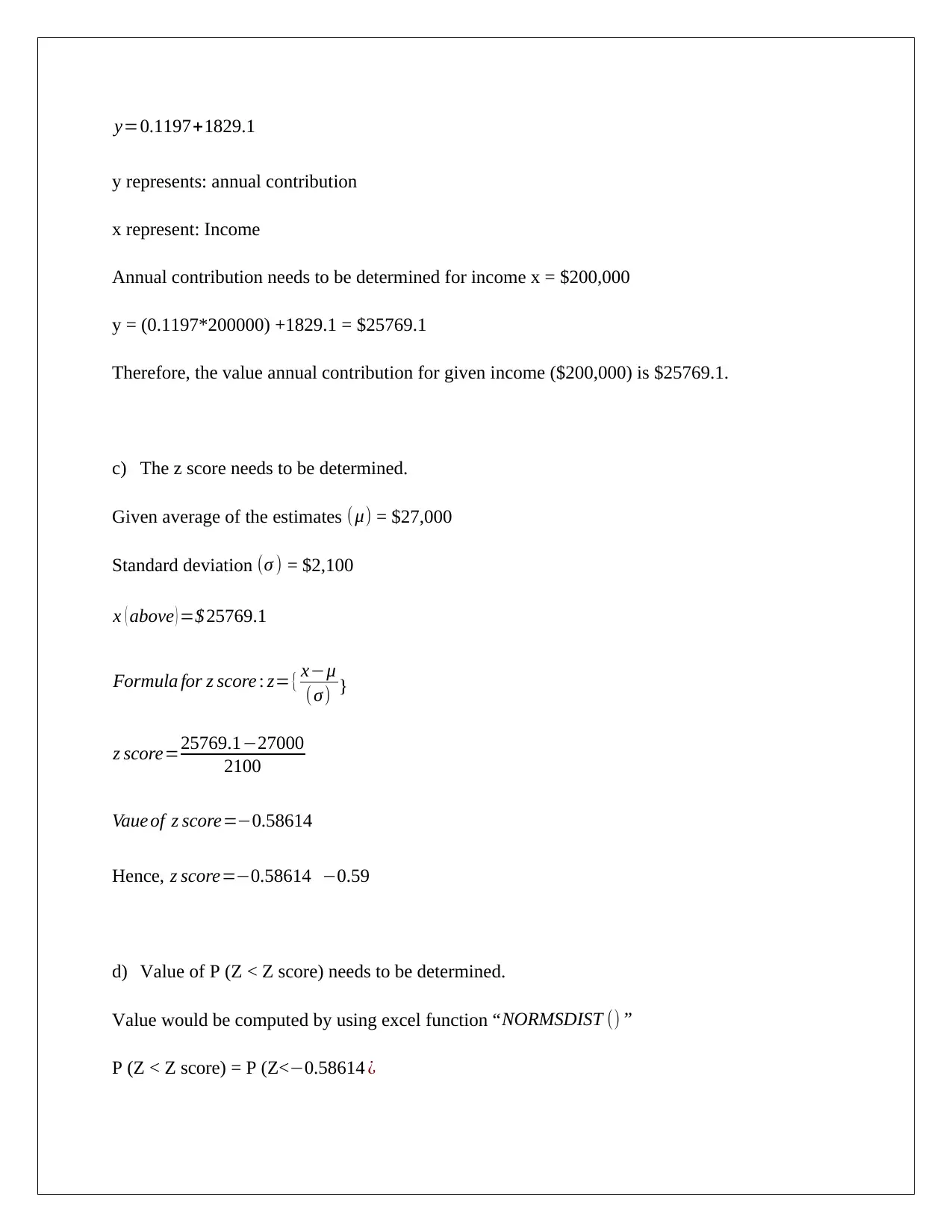

y=0.1197+1829.1

y represents: annual contribution

x represent: Income

Annual contribution needs to be determined for income x = $200,000

y = (0.1197*200000) +1829.1 = $25769.1

Therefore, the value annual contribution for given income ($200,000) is $25769.1.

c) The z score needs to be determined.

Given average of the estimates (μ) = $27,000

Standard deviation (σ ) = $2,100

x ( above ) =$ 25769.1

Formula for z score : z={ x−μ

(σ) }

z score=25769.1−27000

2100

Vaue of z score=−0.58614

Hence, z score=−0.58614 −0.59

d) Value of P (Z < Z score) needs to be determined.

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z<−0.58614 ¿

y represents: annual contribution

x represent: Income

Annual contribution needs to be determined for income x = $200,000

y = (0.1197*200000) +1829.1 = $25769.1

Therefore, the value annual contribution for given income ($200,000) is $25769.1.

c) The z score needs to be determined.

Given average of the estimates (μ) = $27,000

Standard deviation (σ ) = $2,100

x ( above ) =$ 25769.1

Formula for z score : z={ x−μ

(σ) }

z score=25769.1−27000

2100

Vaue of z score=−0.58614

Hence, z score=−0.58614 −0.59

d) Value of P (Z < Z score) needs to be determined.

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z<−0.58614 ¿

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

¿ NORMSDIST ( −0.58614 )

¿ 0.27889

e) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*10000

¿ P ( Z ←0.58614 )∗10000

¿ ( 0.27889 ) ∗10000

¿ 2788.9 2789

Section 2

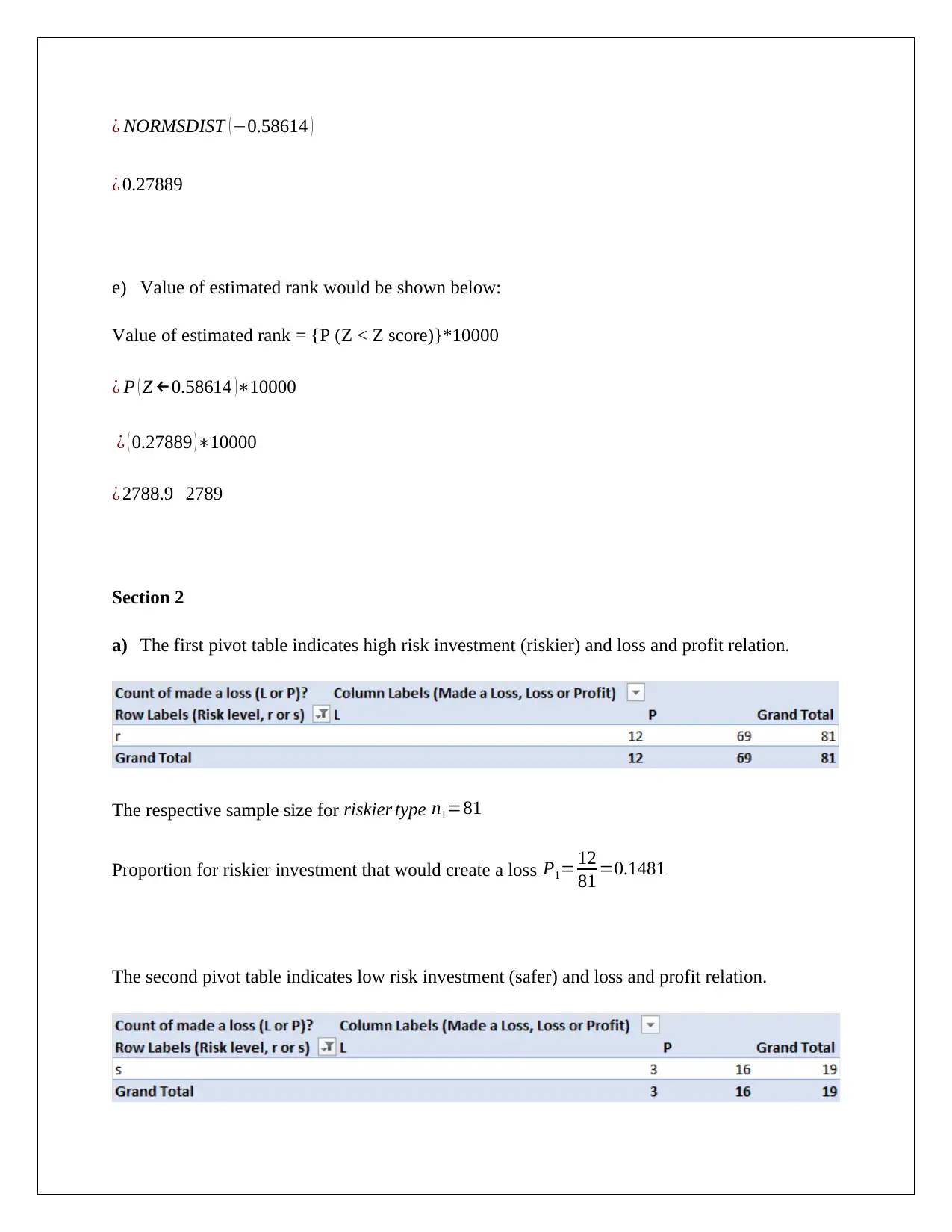

a) The first pivot table indicates high risk investment (riskier) and loss and profit relation.

The respective sample size for riskier type n1=81

Proportion for riskier investment that would create a loss P1= 12

81 =0.1481

The second pivot table indicates low risk investment (safer) and loss and profit relation.

¿ 0.27889

e) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*10000

¿ P ( Z ←0.58614 )∗10000

¿ ( 0.27889 ) ∗10000

¿ 2788.9 2789

Section 2

a) The first pivot table indicates high risk investment (riskier) and loss and profit relation.

The respective sample size for riskier type n1=81

Proportion for riskier investment that would create a loss P1= 12

81 =0.1481

The second pivot table indicates low risk investment (safer) and loss and profit relation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The respective sample size for safer type n2 =19

Proportion for safer investment that would create a loss P2= 3

19 =0.1578

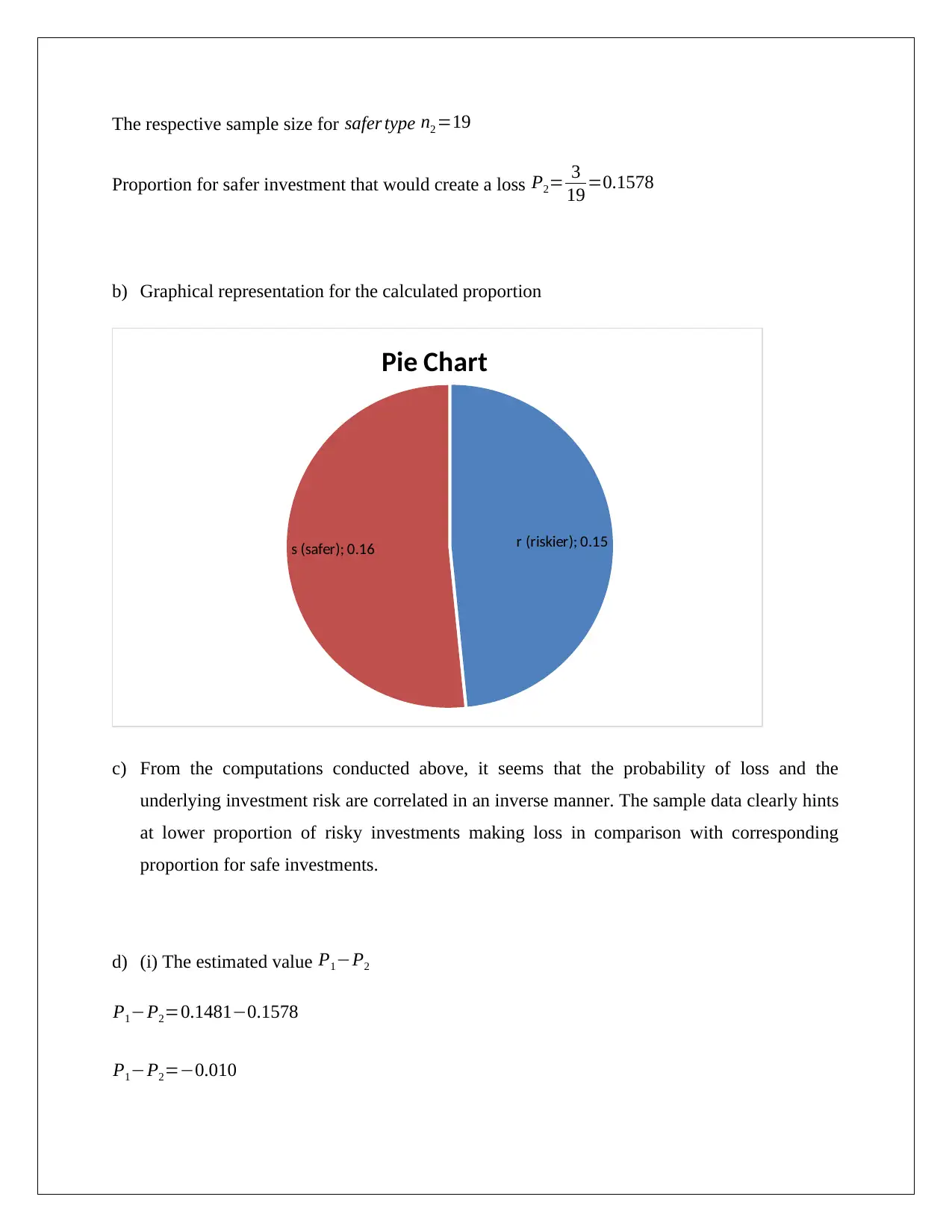

b) Graphical representation for the calculated proportion

r (riskier); 0.15

s (safer); 0.16

Pie Chart

c) From the computations conducted above, it seems that the probability of loss and the

underlying investment risk are correlated in an inverse manner. The sample data clearly hints

at lower proportion of risky investments making loss in comparison with corresponding

proportion for safe investments.

d) (i) The estimated value P1−P2

P1−P2=0.1481−0.1578

P1−P2=−0.010

Proportion for safer investment that would create a loss P2= 3

19 =0.1578

b) Graphical representation for the calculated proportion

r (riskier); 0.15

s (safer); 0.16

Pie Chart

c) From the computations conducted above, it seems that the probability of loss and the

underlying investment risk are correlated in an inverse manner. The sample data clearly hints

at lower proportion of risky investments making loss in comparison with corresponding

proportion for safe investments.

d) (i) The estimated value P1−P2

P1−P2=0.1481−0.1578

P1−P2=−0.010

(ii) The value of average of the estimates ( μ ) = 0.1

Standard deviation (σ ) = 0.0743

x ( above ) =−0.010

z= { x −μ

( σ ) }

z= { −0.010−0.1

0.0743 }

The z score=−1.477

(iii) P( Z<Z score)=?

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z< −1.477 ¿

¿ NORMSDIST (−1.477 )

¿ 0.0698

(iv) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*10000

¿ P ( Z ←1.477 )∗4000

¿ ( 0.0698 )∗4000

¿ 279.311

Standard deviation (σ ) = 0.0743

x ( above ) =−0.010

z= { x −μ

( σ ) }

z= { −0.010−0.1

0.0743 }

The z score=−1.477

(iii) P( Z<Z score)=?

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z< −1.477 ¿

¿ NORMSDIST (−1.477 )

¿ 0.0698

(iv) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*10000

¿ P ( Z ←1.477 )∗4000

¿ ( 0.0698 )∗4000

¿ 279.311

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

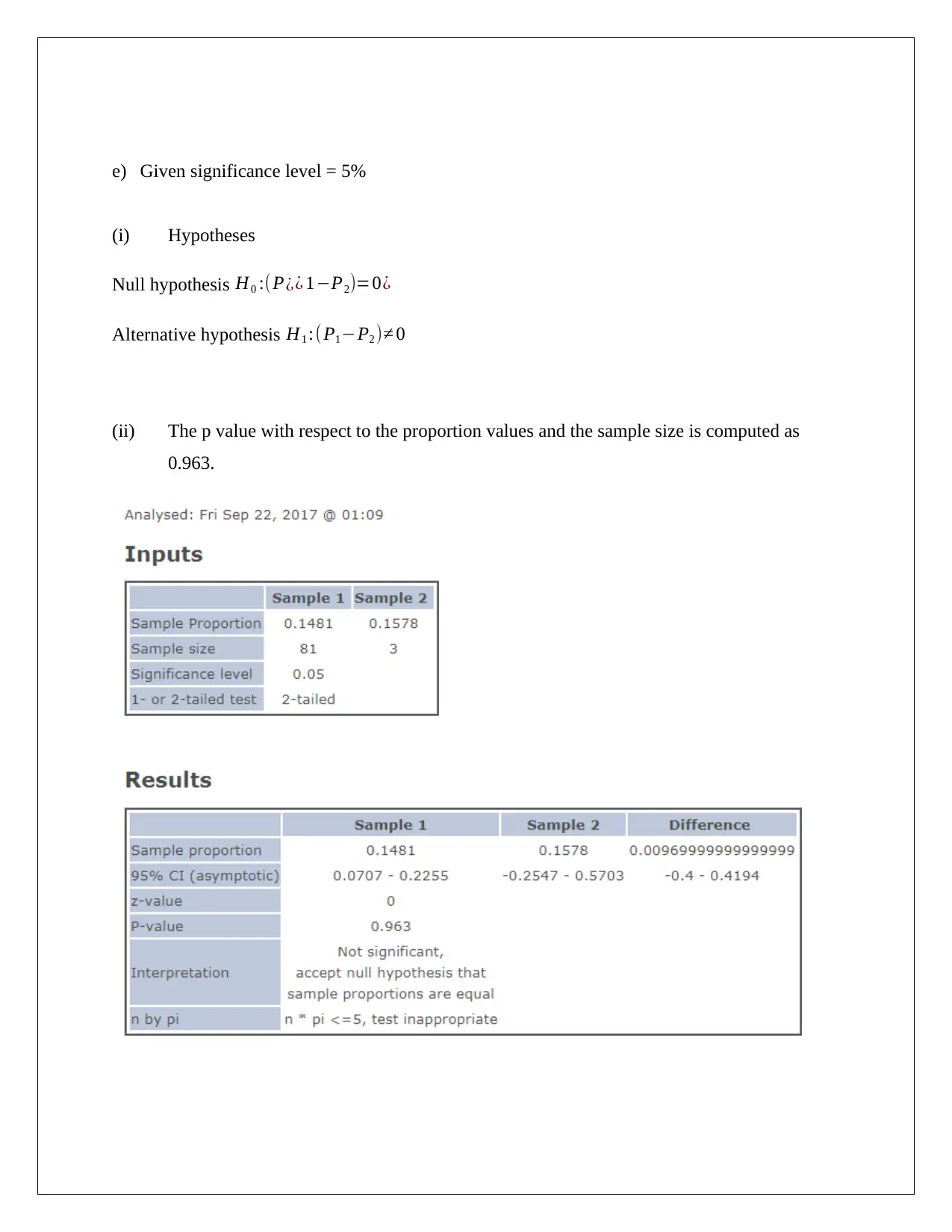

e) Given significance level = 5%

(i) Hypotheses

Null hypothesis H0 :(P¿¿ 1−P2)=0¿

Alternative hypothesis H1 :(P1−P2 )≠ 0

(ii) The p value with respect to the proportion values and the sample size is computed as

0.963.

(i) Hypotheses

Null hypothesis H0 :(P¿¿ 1−P2)=0¿

Alternative hypothesis H1 :(P1−P2 )≠ 0

(ii) The p value with respect to the proportion values and the sample size is computed as

0.963.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(iii) It is apparent from the above output than p value is 0.963 which is higher than level of

significance and hence, insufficient statistical evidence is present to reject null

hypothesis.

(iv) Hence, it may be concluded that no relationship is observed between the investment

making loss and their underlying risk.

Section 3

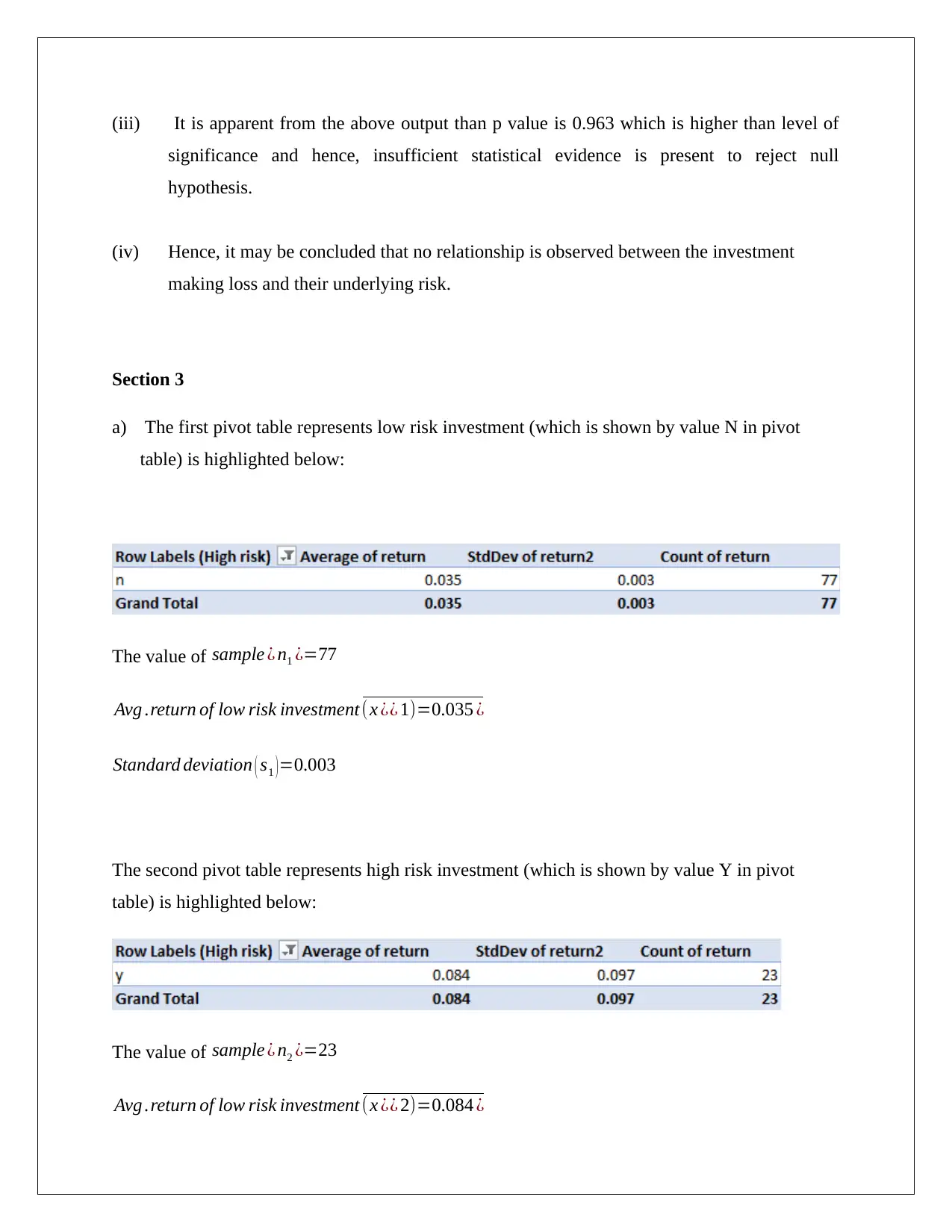

a) The first pivot table represents low risk investment (which is shown by value N in pivot

table) is highlighted below:

The value of sample ¿ n1 ¿=77

Avg .return of low risk investment (x ¿¿ 1)=0.035 ¿

Standard deviation ( s1 ) =0.003

The second pivot table represents high risk investment (which is shown by value Y in pivot

table) is highlighted below:

The value of sample ¿ n2 ¿=23

Avg .return of low risk investment (x ¿¿ 2)=0.084 ¿

significance and hence, insufficient statistical evidence is present to reject null

hypothesis.

(iv) Hence, it may be concluded that no relationship is observed between the investment

making loss and their underlying risk.

Section 3

a) The first pivot table represents low risk investment (which is shown by value N in pivot

table) is highlighted below:

The value of sample ¿ n1 ¿=77

Avg .return of low risk investment (x ¿¿ 1)=0.035 ¿

Standard deviation ( s1 ) =0.003

The second pivot table represents high risk investment (which is shown by value Y in pivot

table) is highlighted below:

The value of sample ¿ n2 ¿=23

Avg .return of low risk investment (x ¿¿ 2)=0.084 ¿

Standard deviation(s2 )=0.097

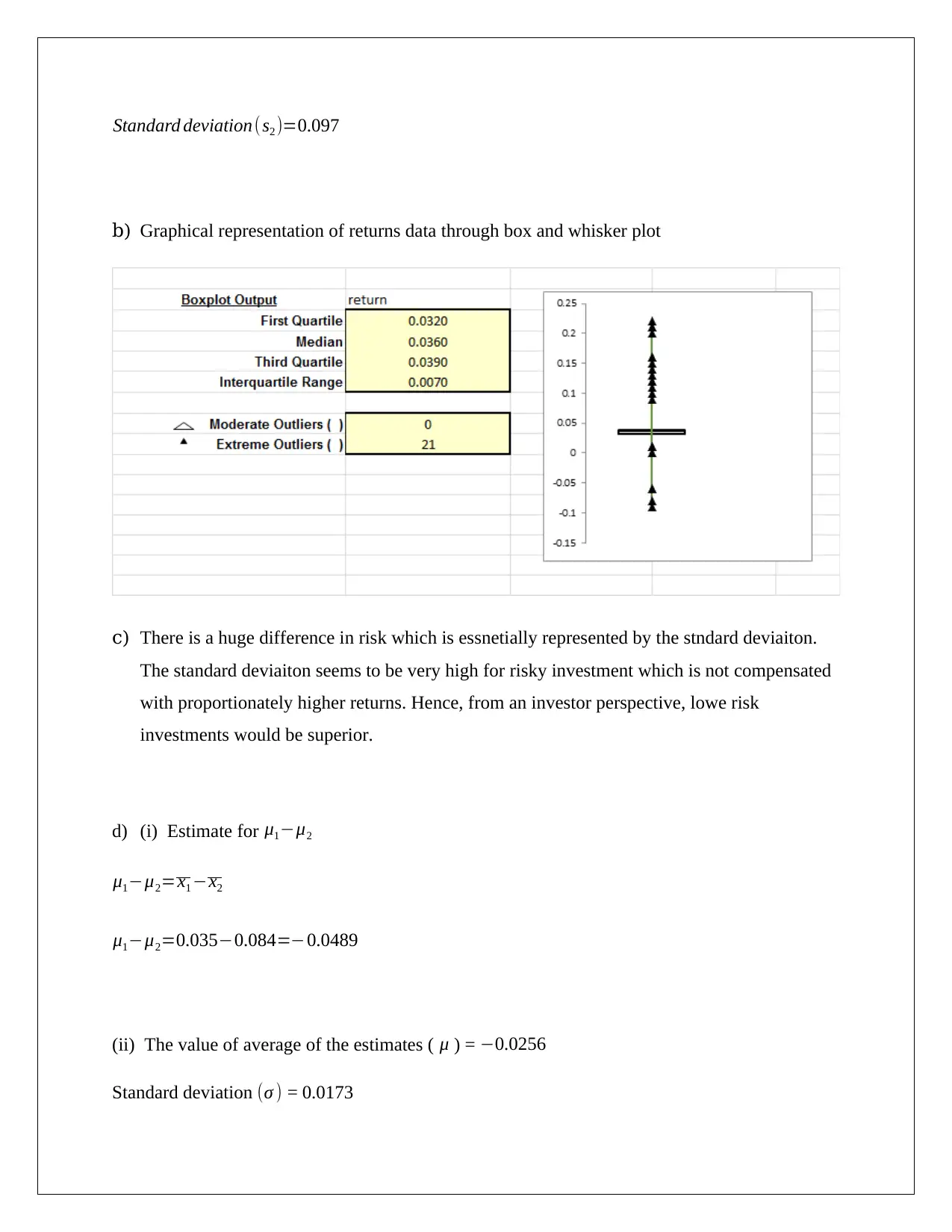

b) Graphical representation of returns data through box and whisker plot

c) There is a huge difference in risk which is essnetially represented by the stndard deviaiton.

The standard deviaiton seems to be very high for risky investment which is not compensated

with proportionately higher returns. Hence, from an investor perspective, lowe risk

investments would be superior.

d) (i) Estimate for μ1−μ2

μ1−μ2=x1 −x2

μ1−μ2=0.035−0.084=−0.0489

(ii) The value of average of the estimates ( μ ) = −0.0256

Standard deviation (σ ) = 0.0173

b) Graphical representation of returns data through box and whisker plot

c) There is a huge difference in risk which is essnetially represented by the stndard deviaiton.

The standard deviaiton seems to be very high for risky investment which is not compensated

with proportionately higher returns. Hence, from an investor perspective, lowe risk

investments would be superior.

d) (i) Estimate for μ1−μ2

μ1−μ2=x1 −x2

μ1−μ2=0.035−0.084=−0.0489

(ii) The value of average of the estimates ( μ ) = −0.0256

Standard deviation (σ ) = 0.0173

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

x=x1−x2 ( above ) =−0.0489

z= { x −μ

( σ ) }

z= { −0.0489−(−0.0256)

0.0173 }

The z score=−1.348

(iii) P(Z< Z score)=?

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z<−1.348 ¿

¿ NORMSDIST ( −1.348 )

¿ 0.0887

(iv) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*2000

¿ P ( Z ←1.348 )∗2000

¿ ( 0.0887 )∗2000

¿ 177.55

e) (i) Given significance level = 5%

Hypotheses

z= { x −μ

( σ ) }

z= { −0.0489−(−0.0256)

0.0173 }

The z score=−1.348

(iii) P(Z< Z score)=?

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z<−1.348 ¿

¿ NORMSDIST ( −1.348 )

¿ 0.0887

(iv) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*2000

¿ P ( Z ←1.348 )∗2000

¿ ( 0.0887 )∗2000

¿ 177.55

e) (i) Given significance level = 5%

Hypotheses

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

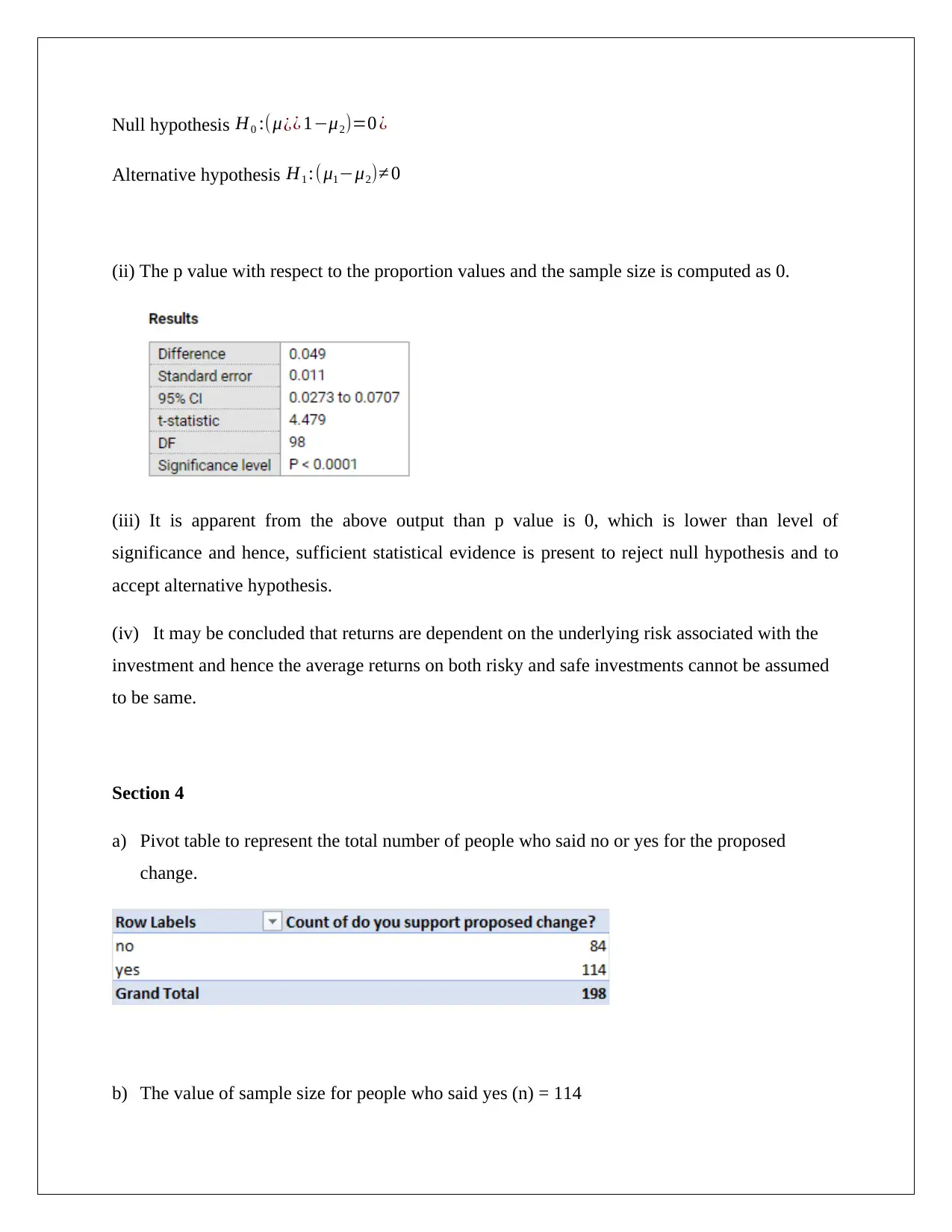

Null hypothesis H0 :(μ¿¿ 1−μ2)=0 ¿

Alternative hypothesis H1 :(μ1−μ2)≠ 0

(ii) The p value with respect to the proportion values and the sample size is computed as 0.

(iii) It is apparent from the above output than p value is 0, which is lower than level of

significance and hence, sufficient statistical evidence is present to reject null hypothesis and to

accept alternative hypothesis.

(iv) It may be concluded that returns are dependent on the underlying risk associated with the

investment and hence the average returns on both risky and safe investments cannot be assumed

to be same.

Section 4

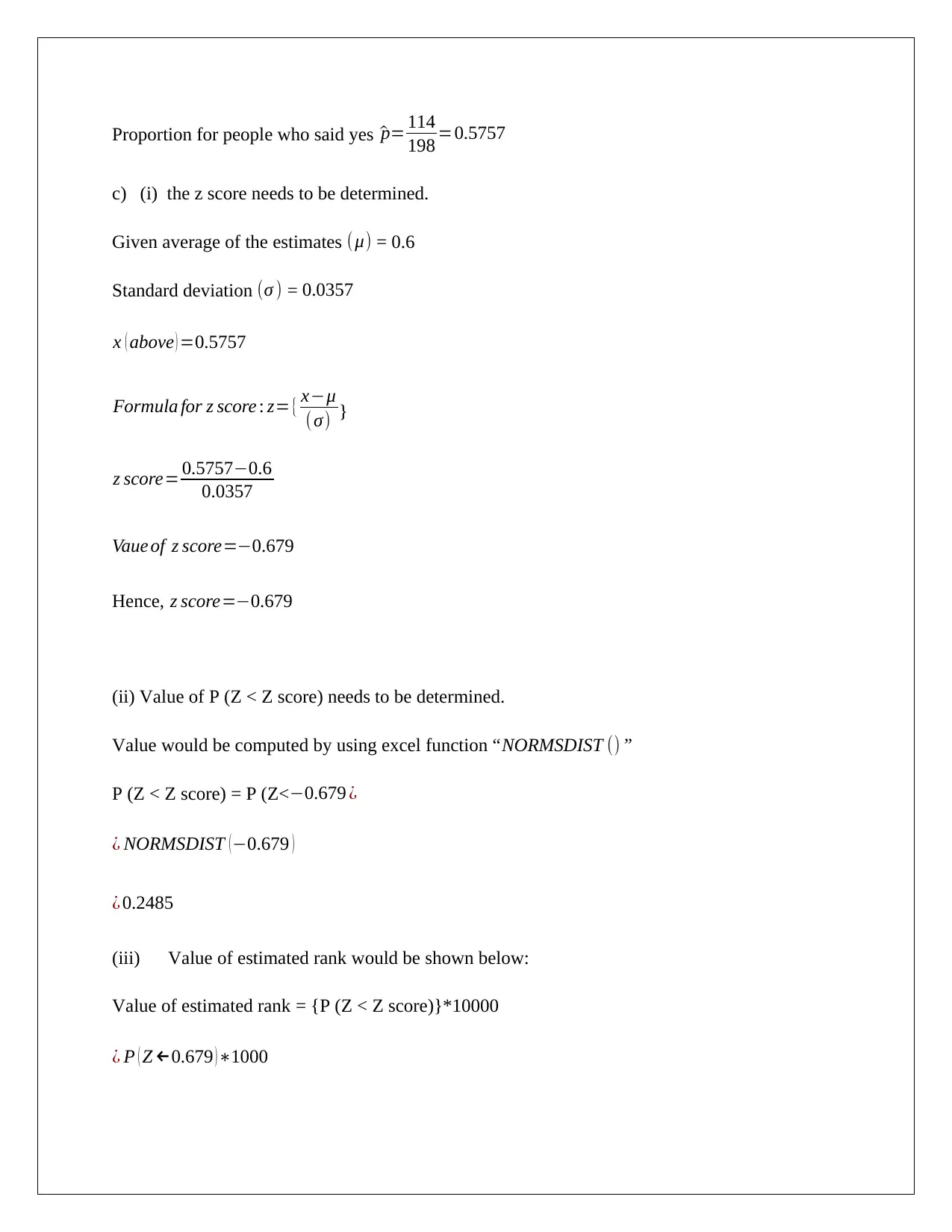

a) Pivot table to represent the total number of people who said no or yes for the proposed

change.

b) The value of sample size for people who said yes (n) = 114

Alternative hypothesis H1 :(μ1−μ2)≠ 0

(ii) The p value with respect to the proportion values and the sample size is computed as 0.

(iii) It is apparent from the above output than p value is 0, which is lower than level of

significance and hence, sufficient statistical evidence is present to reject null hypothesis and to

accept alternative hypothesis.

(iv) It may be concluded that returns are dependent on the underlying risk associated with the

investment and hence the average returns on both risky and safe investments cannot be assumed

to be same.

Section 4

a) Pivot table to represent the total number of people who said no or yes for the proposed

change.

b) The value of sample size for people who said yes (n) = 114

Proportion for people who said yes ^p= 114

198 =0.5757

c) (i) the z score needs to be determined.

Given average of the estimates (μ) = 0.6

Standard deviation (σ ) = 0.0357

x ( above ) =0.5757

Formula for z score : z={ x−μ

(σ) }

z score= 0.5757−0.6

0.0357

Vaue of z score=−0.679

Hence, z score=−0.679

(ii) Value of P (Z < Z score) needs to be determined.

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z<−0.679 ¿

¿ NORMSDIST (−0.679 )

¿ 0.2485

(iii) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*10000

¿ P ( Z ←0.679 )∗1000

198 =0.5757

c) (i) the z score needs to be determined.

Given average of the estimates (μ) = 0.6

Standard deviation (σ ) = 0.0357

x ( above ) =0.5757

Formula for z score : z={ x−μ

(σ) }

z score= 0.5757−0.6

0.0357

Vaue of z score=−0.679

Hence, z score=−0.679

(ii) Value of P (Z < Z score) needs to be determined.

Value would be computed by using excel function “NORMSDIST () ”

P (Z < Z score) = P (Z<−0.679 ¿

¿ NORMSDIST (−0.679 )

¿ 0.2485

(iii) Value of estimated rank would be shown below:

Value of estimated rank = {P (Z < Z score)}*10000

¿ P ( Z ←0.679 )∗1000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.