Financial Management Report: Techniques for Decision Making

VerifiedAdded on 2023/01/11

|23

|5490

|53

Report

AI Summary

This report delves into the intricacies of financial management, presenting two distinct scenarios to illustrate key concepts and practical applications. Scenario 1 explores decision-making approaches, stakeholder management, cost control through management accounting techniques, fraud detection, and ethical considerations. It evaluates various decision-making techniques and factors influencing effectiveness, discusses stakeholder management and conflict resolution, examines management accounting's role in cost control and shareholder value maximization, and covers fraud detection and ethical decision-making methods. Scenario 2 focuses on how financial data aids in strategic and operational decisions, comparing and contrasting investment appraisal tools, demonstrating financial decision-making techniques, analyzing long-term sustainability, and recommending solutions for financial improvement. The report utilizes financial analysis, trend analysis, and capital budgeting techniques to provide a comprehensive understanding of financial management principles. The report also incorporates real-world examples and data to support its findings and recommendations. This comprehensive analysis provides valuable insights for students seeking to understand the complexities of financial management and its practical applications within a business context. The report also includes a detailed analysis of Sainsbury's financial data to illustrate the practical application of financial management principles.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION......................................................................................................................3

SCENARIO 1.............................................................................................................................3

1. Evaluation of different approaches and techniques and factors of effective decision

making....................................................................................................................................3

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group...................................................................................................................4

3. Value of management accounting techniques in cost control and for maximizing the

shareholder value...................................................................................................................4

4. Techniques for fraud detection and prevention and ethical decision making....................5

5. Reflection on understanding of the above techniques........................................................5

SCENARIO 2.............................................................................................................................6

Identifying how financial data helps company in taking decisions pertaining to strategic

and operational aspects..........................................................................................................6

Comparing and contrasting three investment appraisal tools along with their effectiveness

for decision making..............................................................................................................12

Demonstrating the value of different techniques for financial decision making.................16

Analyzing how financial decision making supports long term sustainability aspect...........18

Recommending solutions to the business unit for improving financial sustainability.........19

CONCLUSION........................................................................................................................19

REFERENCES.........................................................................................................................20

INTRODUCTION......................................................................................................................3

SCENARIO 1.............................................................................................................................3

1. Evaluation of different approaches and techniques and factors of effective decision

making....................................................................................................................................3

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group...................................................................................................................4

3. Value of management accounting techniques in cost control and for maximizing the

shareholder value...................................................................................................................4

4. Techniques for fraud detection and prevention and ethical decision making....................5

5. Reflection on understanding of the above techniques........................................................5

SCENARIO 2.............................................................................................................................6

Identifying how financial data helps company in taking decisions pertaining to strategic

and operational aspects..........................................................................................................6

Comparing and contrasting three investment appraisal tools along with their effectiveness

for decision making..............................................................................................................12

Demonstrating the value of different techniques for financial decision making.................16

Analyzing how financial decision making supports long term sustainability aspect...........18

Recommending solutions to the business unit for improving financial sustainability.........19

CONCLUSION........................................................................................................................19

REFERENCES.........................................................................................................................20

INTRODUCTION

Financial management may be served as a practice of managing funds in such a

manner that contributes in organizational goals and objectives. In the content of business unit,

manager undertakes and applies financial management principles so that optimum utilization

of financial resources can be ensured. This project is based on varied scenario which will

provide deeper insight about the factors which help business unit in decision making. Beside

this, it will shed light on the techniques that facilitate fraud detection and prevention to the

significant level. It also entails how ratio analysis tool helps in analyzing company’s financial

performance and position. Along with this, report will also develop understanding about the

extent to which varied techniques aid in effectual decision-making.

SCENARIO 1

1. Evaluation of different approaches and techniques and factors of effective decision making

It is very essential for all the business to have effective decision making in the organization

(Madura, 2020). Main reason behind the same is that effective decision making not only help

the company in improving the current position of the business also helps company in getting

ready for future activity. Some of the decision making approaches are as follows:

Autocratic Approach: In Autocratic Approach all the decisions are generally taken by

the different leader or head of the management team in the organization. Leader generally

used to not include any subordinate in the decision making.

Democratic Approach: This is the type of the decision making in the organization in

which leader used to take the different decision in the organization on the basis of consulting

with all the employee in organization.

Different technique of decision making:

Group Discussion: This is the technique in which senior management in the

organization used to seat with other senior management or employee in the organization to

make the variety of the different decision in the organization.

Financial analysis: It is another type of the technique in the organization in which

leader or senior management in the organization used to analysis different financial document

of the company to make different decision in an organization.

Financial management may be served as a practice of managing funds in such a

manner that contributes in organizational goals and objectives. In the content of business unit,

manager undertakes and applies financial management principles so that optimum utilization

of financial resources can be ensured. This project is based on varied scenario which will

provide deeper insight about the factors which help business unit in decision making. Beside

this, it will shed light on the techniques that facilitate fraud detection and prevention to the

significant level. It also entails how ratio analysis tool helps in analyzing company’s financial

performance and position. Along with this, report will also develop understanding about the

extent to which varied techniques aid in effectual decision-making.

SCENARIO 1

1. Evaluation of different approaches and techniques and factors of effective decision making

It is very essential for all the business to have effective decision making in the organization

(Madura, 2020). Main reason behind the same is that effective decision making not only help

the company in improving the current position of the business also helps company in getting

ready for future activity. Some of the decision making approaches are as follows:

Autocratic Approach: In Autocratic Approach all the decisions are generally taken by

the different leader or head of the management team in the organization. Leader generally

used to not include any subordinate in the decision making.

Democratic Approach: This is the type of the decision making in the organization in

which leader used to take the different decision in the organization on the basis of consulting

with all the employee in organization.

Different technique of decision making:

Group Discussion: This is the technique in which senior management in the

organization used to seat with other senior management or employee in the organization to

make the variety of the different decision in the organization.

Financial analysis: It is another type of the technique in the organization in which

leader or senior management in the organization used to analysis different financial document

of the company to make different decision in an organization.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Generally organization also used to make the decision in the organization in regarding of

make or buy concept. For example: A automobile company XYZ is having option of making

the window glass by their own. It will cost them 20,000 pounds a year. At the same time one

of the supplier in the nation is providing the same amount of the product in 18,000 pound. So

there is option in front of company to make or buy decision. For the same reason organization

has decided to buy the product in regards of making the same.

There are many factors which also used to impact the decision making in organization, some

of the factor are as follows:

Employee ability: All the employee used to have different ability in the organization this

eventually used to make difficult for the organization to take different decision in a way that

ability of all the employee can be maintain (Madura, 2020).

Attitude of working: This also used to impact the decision making in the organization as

different attitude of employee generally bring good sort of fluctuation in decision making,

this used to create good challenge.

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group.

Stakeholder management generally means maintaining good relationship who

generally have direct impact over the business. Every organization generally used to monitor,

organise for improving the level of stakeholder. Managing different relationship in the

organization used to help the organization in managing the risk and improves the stakeholder

support and outcome on ground. Stakeholder concern are generally essential for the business

as it could lead to new idea development and also can help company in getting cost benefit in

an organization (Jones, and et.al., 2018). Also stakeholder in the organization used to provide

the varieties of the information on the basis of the same variety of different decision are

generally made in the organization.

Also it is very important for the organization in maintaining and managing the

objectives of the different stakeholder. It is very important for all the business to identify the

different need of the stakeholder in the market and should different strategy to effective

manage the same. For the same it is very important for all the organization to have a in depth

knowledge about effective relationship for managing interest of different stakeholder. For

example: For doing the same in the organization, organization can organize a meeting in the

make or buy concept. For example: A automobile company XYZ is having option of making

the window glass by their own. It will cost them 20,000 pounds a year. At the same time one

of the supplier in the nation is providing the same amount of the product in 18,000 pound. So

there is option in front of company to make or buy decision. For the same reason organization

has decided to buy the product in regards of making the same.

There are many factors which also used to impact the decision making in organization, some

of the factor are as follows:

Employee ability: All the employee used to have different ability in the organization this

eventually used to make difficult for the organization to take different decision in a way that

ability of all the employee can be maintain (Madura, 2020).

Attitude of working: This also used to impact the decision making in the organization as

different attitude of employee generally bring good sort of fluctuation in decision making,

this used to create good challenge.

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group.

Stakeholder management generally means maintaining good relationship who

generally have direct impact over the business. Every organization generally used to monitor,

organise for improving the level of stakeholder. Managing different relationship in the

organization used to help the organization in managing the risk and improves the stakeholder

support and outcome on ground. Stakeholder concern are generally essential for the business

as it could lead to new idea development and also can help company in getting cost benefit in

an organization (Jones, and et.al., 2018). Also stakeholder in the organization used to provide

the varieties of the information on the basis of the same variety of different decision are

generally made in the organization.

Also it is very important for the organization in maintaining and managing the

objectives of the different stakeholder. It is very important for all the business to identify the

different need of the stakeholder in the market and should different strategy to effective

manage the same. For the same it is very important for all the organization to have a in depth

knowledge about effective relationship for managing interest of different stakeholder. For

example: For doing the same in the organization, organization can organize a meeting in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organization before bringing something new in the workplace. In meeting different

stakeholder will take part and provide different need and preference of them in the market.

Conflict between stakeholder and management

Stakeholder are the owner of the company at the same time management individual are the

driver in the organization who used to carryout different objective of stakeholder. This

correlation in Stakeholder and management sometime used to create the situation of conflict

in between them. Some of the conflicting issue may be mismatching of interest as some

stakeholder in the organization used to look at the process of carrying out activity. At the

same time some stakeholder looks at the profit of the company this eventually used to create

the uncertainty in the mind of the management individual and sometime give rise to conflict

type situation in the organization.

3. Value of management accounting techniques in cost control and for maximizing the

shareholder value.

There are many different type of management accounting technique which will can be used in

cost control. Some of them are as follows:

Marginal analysis: This is the analysis which is concerned with the incremental

benefit which helps in improving production. This is generally used in the organization for

cost control in the organization; it is generally done on basis of breakeven point (Barr, and

McClellan, 2018). Companies use marginal analysis as a decision-making tool to help them

maximize their potential profits

Constraint Analysis: Constraint analysis at the same time helps the different business

in identifying principle bottlenecks. This help the business in effectively control cost by

identifying the bottlenecks. Manager in the organization only focuses on maximizing the

profit in the organization. For example, Constraint for making a decision in the organization

is that there are many risk associated with every decision which are being taken in the

organization.

Capital Budgeting: It is another technique that help the business in analyzing different

information which can help the business in making different decision related to capital

expenditure. In these technique managers identify the feasibility of investment with the help

of NPV, IRR and payback period in the organization.

stakeholder will take part and provide different need and preference of them in the market.

Conflict between stakeholder and management

Stakeholder are the owner of the company at the same time management individual are the

driver in the organization who used to carryout different objective of stakeholder. This

correlation in Stakeholder and management sometime used to create the situation of conflict

in between them. Some of the conflicting issue may be mismatching of interest as some

stakeholder in the organization used to look at the process of carrying out activity. At the

same time some stakeholder looks at the profit of the company this eventually used to create

the uncertainty in the mind of the management individual and sometime give rise to conflict

type situation in the organization.

3. Value of management accounting techniques in cost control and for maximizing the

shareholder value.

There are many different type of management accounting technique which will can be used in

cost control. Some of them are as follows:

Marginal analysis: This is the analysis which is concerned with the incremental

benefit which helps in improving production. This is generally used in the organization for

cost control in the organization; it is generally done on basis of breakeven point (Barr, and

McClellan, 2018). Companies use marginal analysis as a decision-making tool to help them

maximize their potential profits

Constraint Analysis: Constraint analysis at the same time helps the different business

in identifying principle bottlenecks. This help the business in effectively control cost by

identifying the bottlenecks. Manager in the organization only focuses on maximizing the

profit in the organization. For example, Constraint for making a decision in the organization

is that there are many risk associated with every decision which are being taken in the

organization.

Capital Budgeting: It is another technique that help the business in analyzing different

information which can help the business in making different decision related to capital

expenditure. In these technique managers identify the feasibility of investment with the help

of NPV, IRR and payback period in the organization.

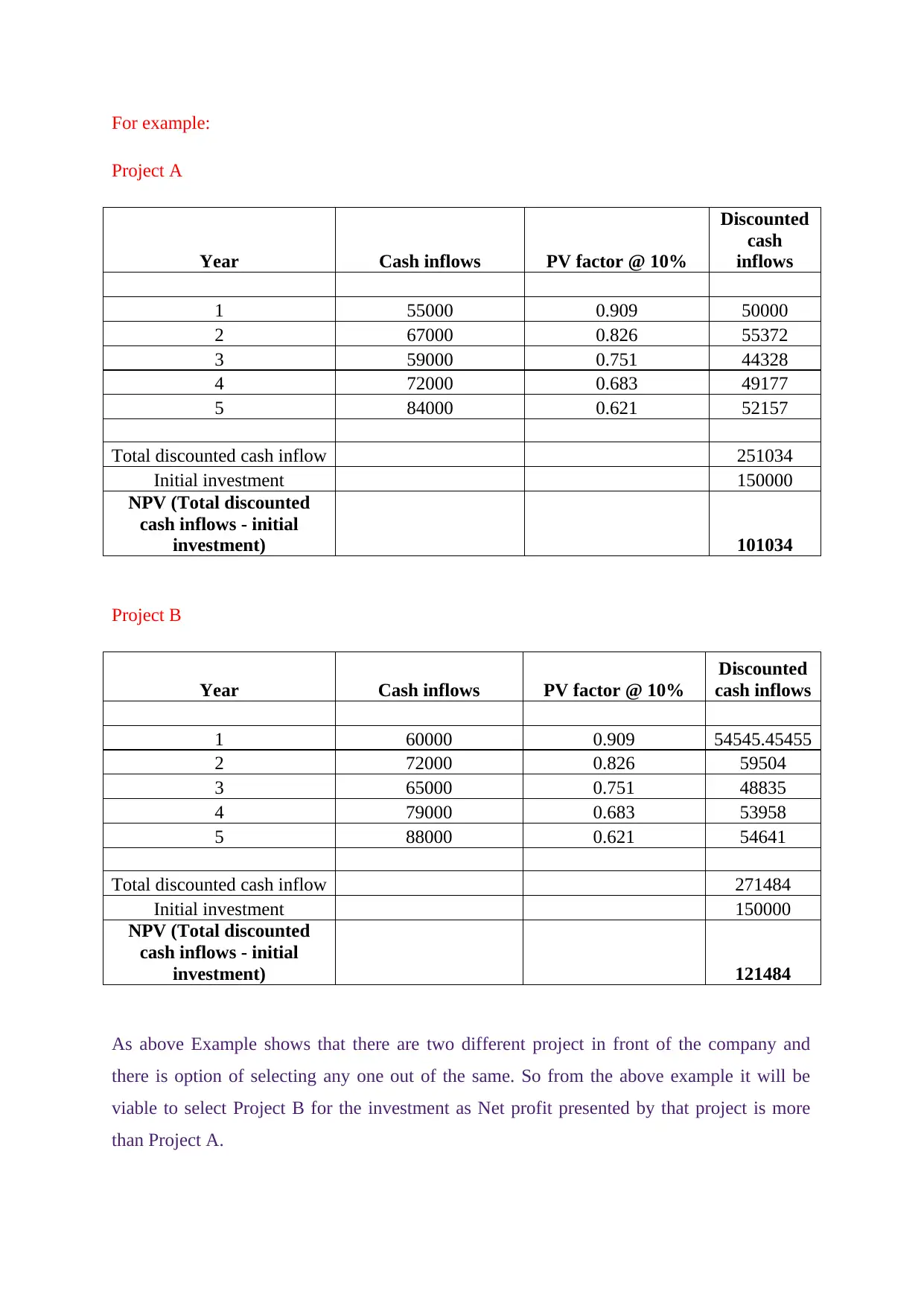

For example:

Project A

Year Cash inflows PV factor @ 10%

Discounted

cash

inflows

1 55000 0.909 50000

2 67000 0.826 55372

3 59000 0.751 44328

4 72000 0.683 49177

5 84000 0.621 52157

Total discounted cash inflow 251034

Initial investment 150000

NPV (Total discounted

cash inflows - initial

investment) 101034

Project B

Year Cash inflows PV factor @ 10%

Discounted

cash inflows

1 60000 0.909 54545.45455

2 72000 0.826 59504

3 65000 0.751 48835

4 79000 0.683 53958

5 88000 0.621 54641

Total discounted cash inflow 271484

Initial investment 150000

NPV (Total discounted

cash inflows - initial

investment) 121484

As above Example shows that there are two different project in front of the company and

there is option of selecting any one out of the same. So from the above example it will be

viable to select Project B for the investment as Net profit presented by that project is more

than Project A.

Project A

Year Cash inflows PV factor @ 10%

Discounted

cash

inflows

1 55000 0.909 50000

2 67000 0.826 55372

3 59000 0.751 44328

4 72000 0.683 49177

5 84000 0.621 52157

Total discounted cash inflow 251034

Initial investment 150000

NPV (Total discounted

cash inflows - initial

investment) 101034

Project B

Year Cash inflows PV factor @ 10%

Discounted

cash inflows

1 60000 0.909 54545.45455

2 72000 0.826 59504

3 65000 0.751 48835

4 79000 0.683 53958

5 88000 0.621 54641

Total discounted cash inflow 271484

Initial investment 150000

NPV (Total discounted

cash inflows - initial

investment) 121484

As above Example shows that there are two different project in front of the company and

there is option of selecting any one out of the same. So from the above example it will be

viable to select Project B for the investment as Net profit presented by that project is more

than Project A.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4. Techniques for fraud detection and prevention and ethical decision making.

Some of the technique of fraud detection and ethical decision making is as follows:

Statistical Parameter: This is the technique which is generally used in the

organization for the purpose of identifying high or low anomalies which are indicator of

different fraud (Yermack, 2017). It generally help the organization in understanding the

statistical error which are their and on the basis of the same different decision are made.

Auditing: It is the technique in which different financial record are investigated by

different auditor and on the basis of the same different fraud are generally identified in the

organization. Auditing generally used to take on fixed time interval to maintain good sort of

organizational position.

Ethical decision making: A company is requiring following all the ethical concern in

the organization while making different decision in the business. Organization is generally

expected to represent the true and fair value of all the financial position of the company.

Reason behind the same as there are many different decisions which are generally depended

on the same and also it help the company in maintain the trust of different interested parties.

5. Reflection on understanding of the above techniques.

Solving above 4 questions has helped me in gaining the variety of the learning about

the different aspect of financial management in the long run as it has helped me in going

through the variety of different aspect of different technique of financial management.

Biggest learning out of the all was about different technique of carrying out management

accounting in the organization. One skill which was developed by me in this process was the

sourcing skill of mine, as all the above question has asked me to source the variety of the

information to solve all the 4 question. For the same I have used variety of different type of

sources in the organization.

There was many difficulty which was also faced by me during the same, one of the

biggest challenge which was seen by me was finding out the best source through which

different aspect of technique can be understand by me as there were many different sources

which used to provide different sort of the information. For overcoming the same issue in the

project I have decided to take help of my senior and this has helped me in gaining good sort

of confidence in carrying out different activity in the organization.

Some of the technique of fraud detection and ethical decision making is as follows:

Statistical Parameter: This is the technique which is generally used in the

organization for the purpose of identifying high or low anomalies which are indicator of

different fraud (Yermack, 2017). It generally help the organization in understanding the

statistical error which are their and on the basis of the same different decision are made.

Auditing: It is the technique in which different financial record are investigated by

different auditor and on the basis of the same different fraud are generally identified in the

organization. Auditing generally used to take on fixed time interval to maintain good sort of

organizational position.

Ethical decision making: A company is requiring following all the ethical concern in

the organization while making different decision in the business. Organization is generally

expected to represent the true and fair value of all the financial position of the company.

Reason behind the same as there are many different decisions which are generally depended

on the same and also it help the company in maintain the trust of different interested parties.

5. Reflection on understanding of the above techniques.

Solving above 4 questions has helped me in gaining the variety of the learning about

the different aspect of financial management in the long run as it has helped me in going

through the variety of different aspect of different technique of financial management.

Biggest learning out of the all was about different technique of carrying out management

accounting in the organization. One skill which was developed by me in this process was the

sourcing skill of mine, as all the above question has asked me to source the variety of the

information to solve all the 4 question. For the same I have used variety of different type of

sources in the organization.

There was many difficulty which was also faced by me during the same, one of the

biggest challenge which was seen by me was finding out the best source through which

different aspect of technique can be understand by me as there were many different sources

which used to provide different sort of the information. For overcoming the same issue in the

project I have decided to take help of my senior and this has helped me in gaining good sort

of confidence in carrying out different activity in the organization.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

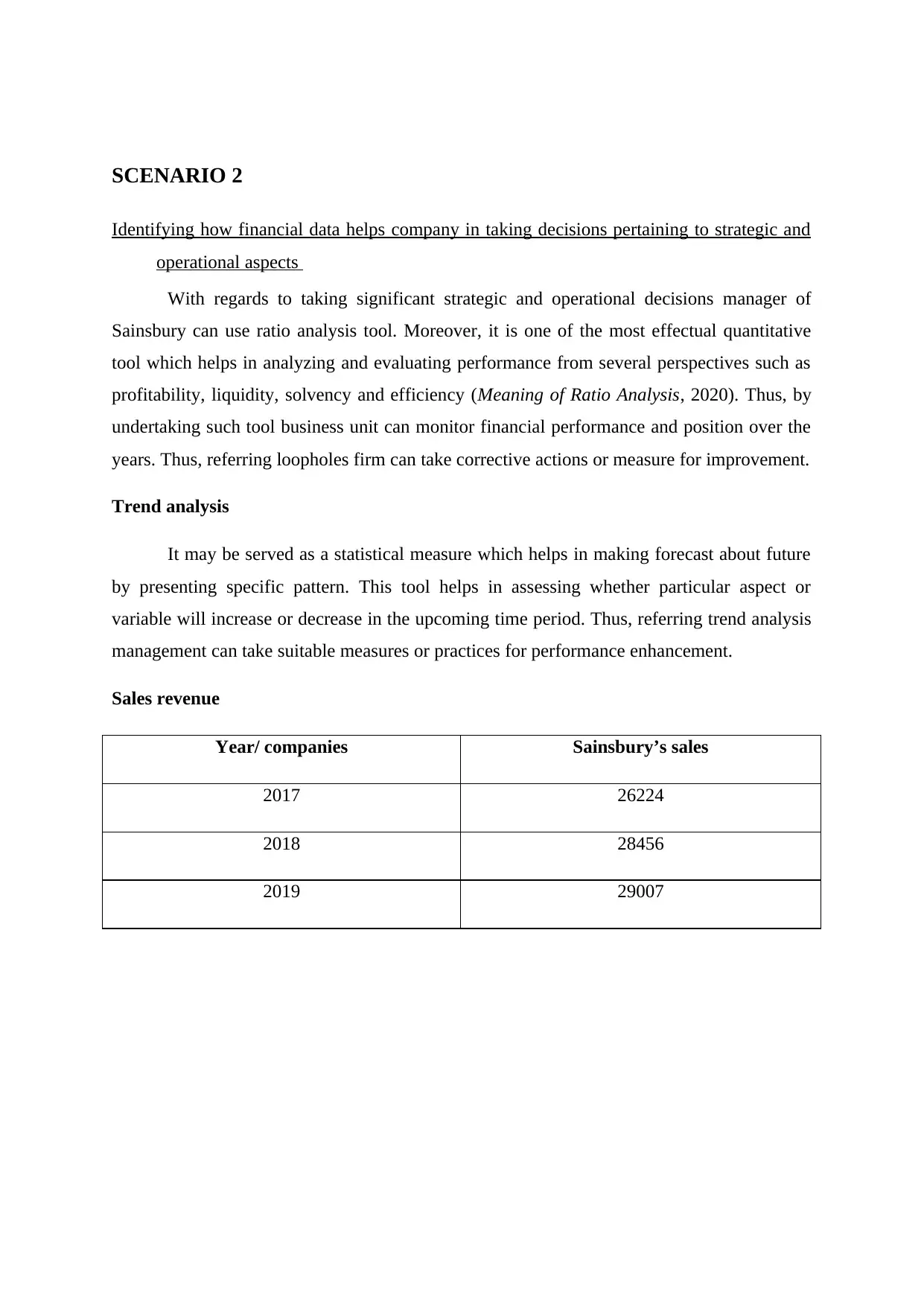

SCENARIO 2

Identifying how financial data helps company in taking decisions pertaining to strategic and

operational aspects

With regards to taking significant strategic and operational decisions manager of

Sainsbury can use ratio analysis tool. Moreover, it is one of the most effectual quantitative

tool which helps in analyzing and evaluating performance from several perspectives such as

profitability, liquidity, solvency and efficiency (Meaning of Ratio Analysis, 2020). Thus, by

undertaking such tool business unit can monitor financial performance and position over the

years. Thus, referring loopholes firm can take corrective actions or measure for improvement.

Trend analysis

It may be served as a statistical measure which helps in making forecast about future

by presenting specific pattern. This tool helps in assessing whether particular aspect or

variable will increase or decrease in the upcoming time period. Thus, referring trend analysis

management can take suitable measures or practices for performance enhancement.

Sales revenue

Year/ companies Sainsbury’s sales

2017 26224

2018 28456

2019 29007

Identifying how financial data helps company in taking decisions pertaining to strategic and

operational aspects

With regards to taking significant strategic and operational decisions manager of

Sainsbury can use ratio analysis tool. Moreover, it is one of the most effectual quantitative

tool which helps in analyzing and evaluating performance from several perspectives such as

profitability, liquidity, solvency and efficiency (Meaning of Ratio Analysis, 2020). Thus, by

undertaking such tool business unit can monitor financial performance and position over the

years. Thus, referring loopholes firm can take corrective actions or measure for improvement.

Trend analysis

It may be served as a statistical measure which helps in making forecast about future

by presenting specific pattern. This tool helps in assessing whether particular aspect or

variable will increase or decrease in the upcoming time period. Thus, referring trend analysis

management can take suitable measures or practices for performance enhancement.

Sales revenue

Year/ companies Sainsbury’s sales

2017 26224

2018 28456

2019 29007

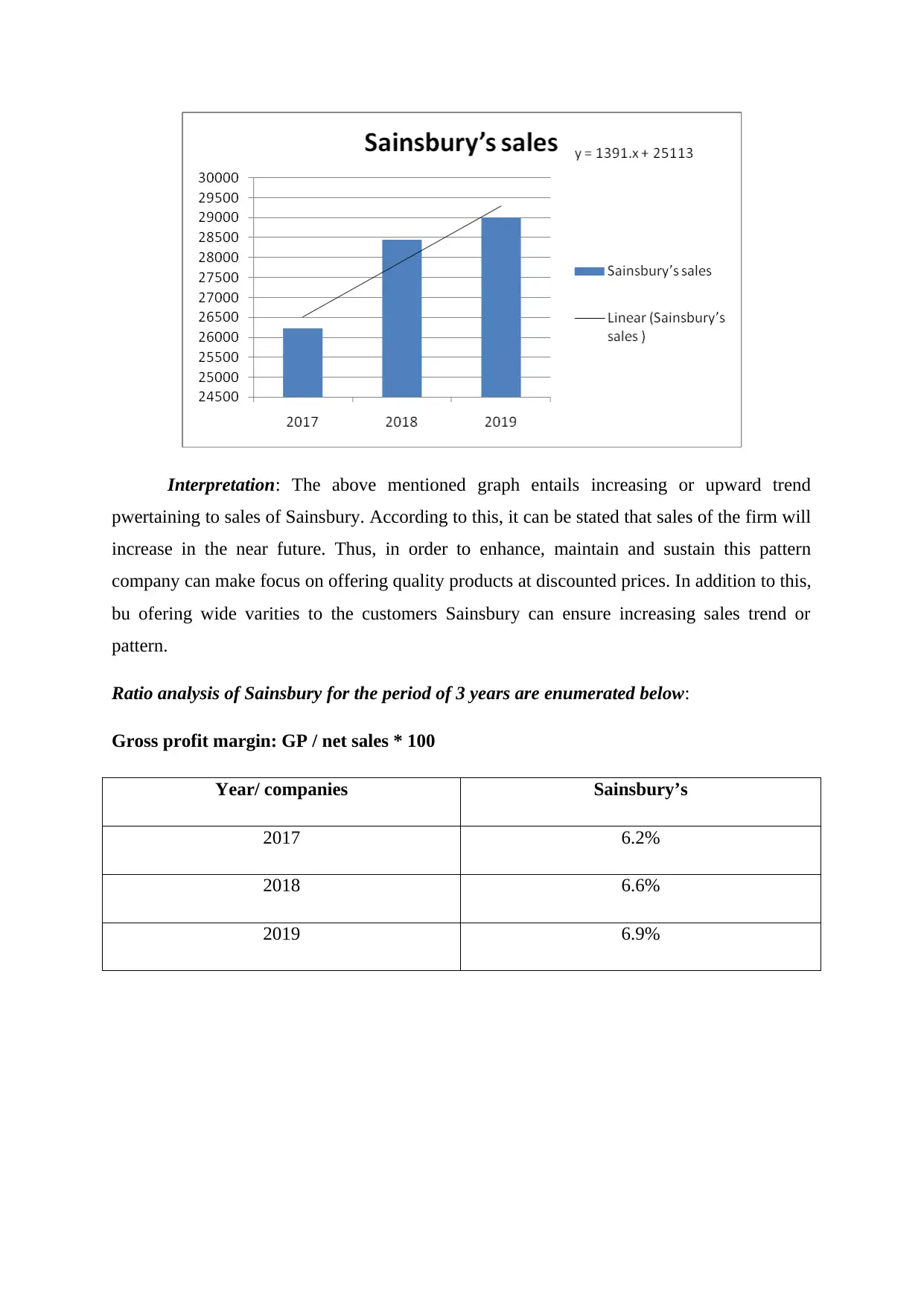

Interpretation: The above mentioned graph entails increasing or upward trend

pwertaining to sales of Sainsbury. According to this, it can be stated that sales of the firm will

increase in the near future. Thus, in order to enhance, maintain and sustain this pattern

company can make focus on offering quality products at discounted prices. In addition to this,

bu ofering wide varities to the customers Sainsbury can ensure increasing sales trend or

pattern.

Ratio analysis of Sainsbury for the period of 3 years are enumerated below:

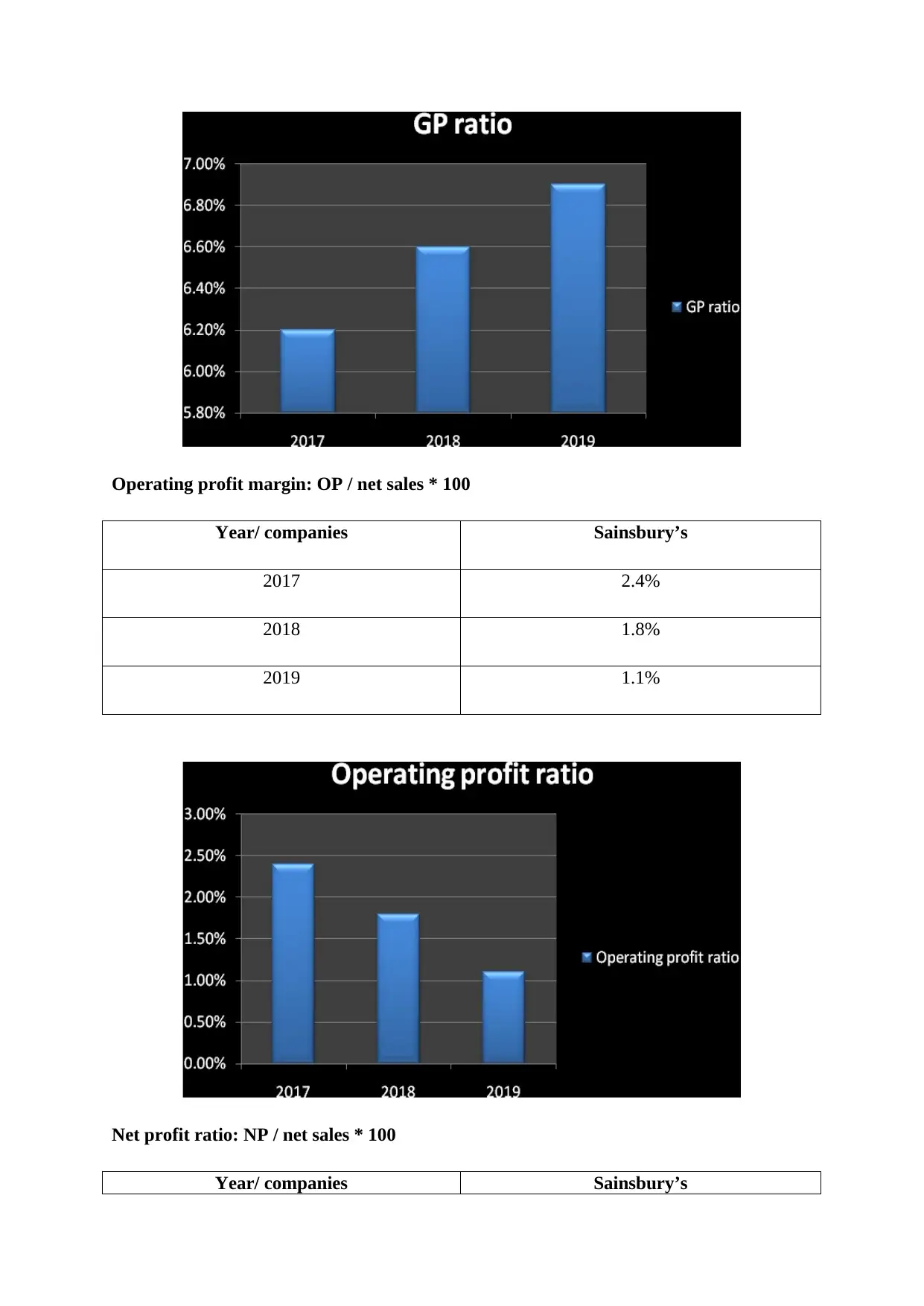

Gross profit margin: GP / net sales * 100

Year/ companies Sainsbury’s

2017 6.2%

2018 6.6%

2019 6.9%

pwertaining to sales of Sainsbury. According to this, it can be stated that sales of the firm will

increase in the near future. Thus, in order to enhance, maintain and sustain this pattern

company can make focus on offering quality products at discounted prices. In addition to this,

bu ofering wide varities to the customers Sainsbury can ensure increasing sales trend or

pattern.

Ratio analysis of Sainsbury for the period of 3 years are enumerated below:

Gross profit margin: GP / net sales * 100

Year/ companies Sainsbury’s

2017 6.2%

2018 6.6%

2019 6.9%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

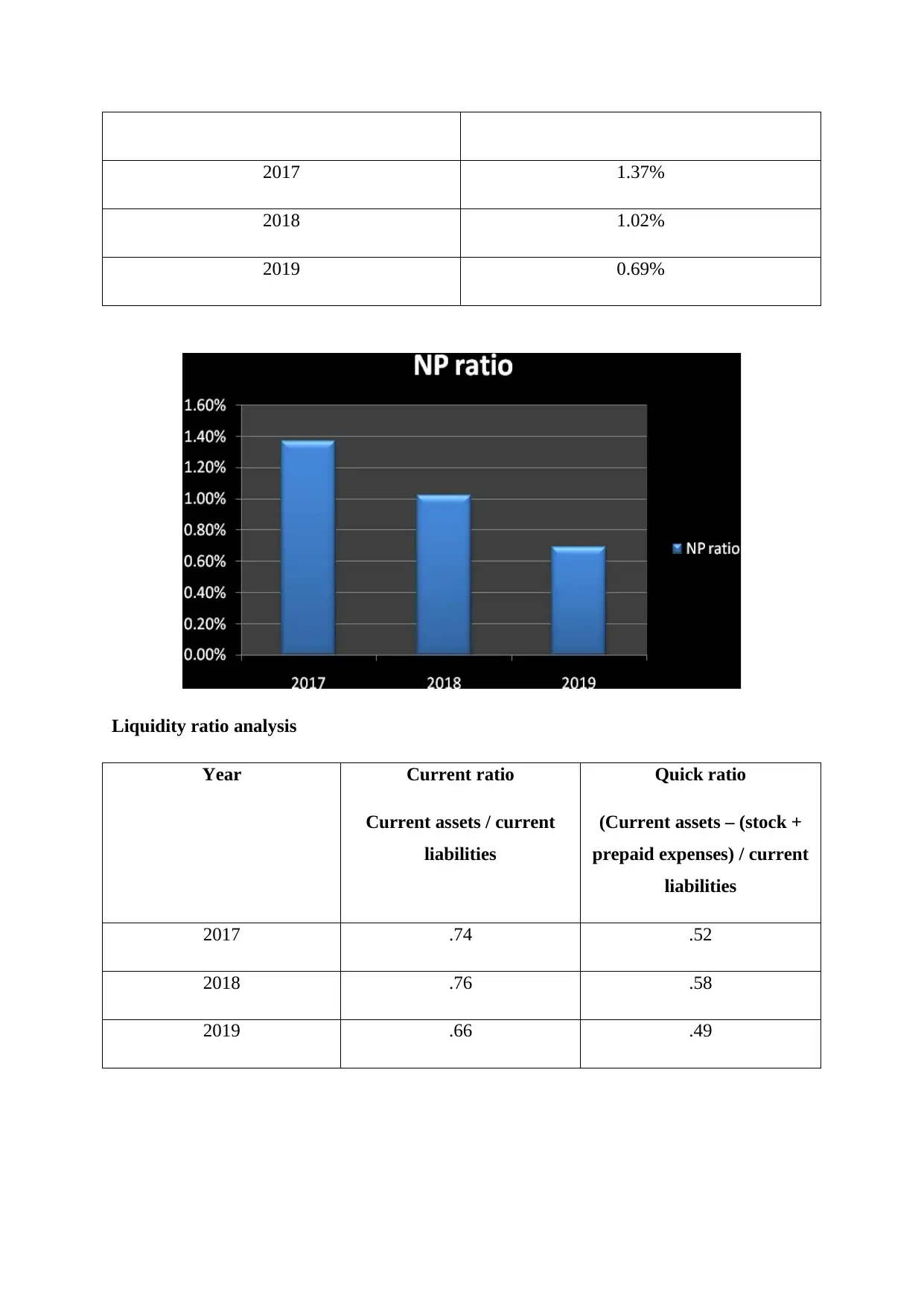

Operating profit margin: OP / net sales * 100

Year/ companies Sainsbury’s

2017 2.4%

2018 1.8%

2019 1.1%

Net profit ratio: NP / net sales * 100

Year/ companies Sainsbury’s

Year/ companies Sainsbury’s

2017 2.4%

2018 1.8%

2019 1.1%

Net profit ratio: NP / net sales * 100

Year/ companies Sainsbury’s

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2017 1.37%

2018 1.02%

2019 0.69%

Liquidity ratio analysis

Year Current ratio

Current assets / current

liabilities

Quick ratio

(Current assets – (stock +

prepaid expenses) / current

liabilities

2017 .74 .52

2018 .76 .58

2019 .66 .49

2018 1.02%

2019 0.69%

Liquidity ratio analysis

Year Current ratio

Current assets / current

liabilities

Quick ratio

(Current assets – (stock +

prepaid expenses) / current

liabilities

2017 .74 .52

2018 .76 .58

2019 .66 .49

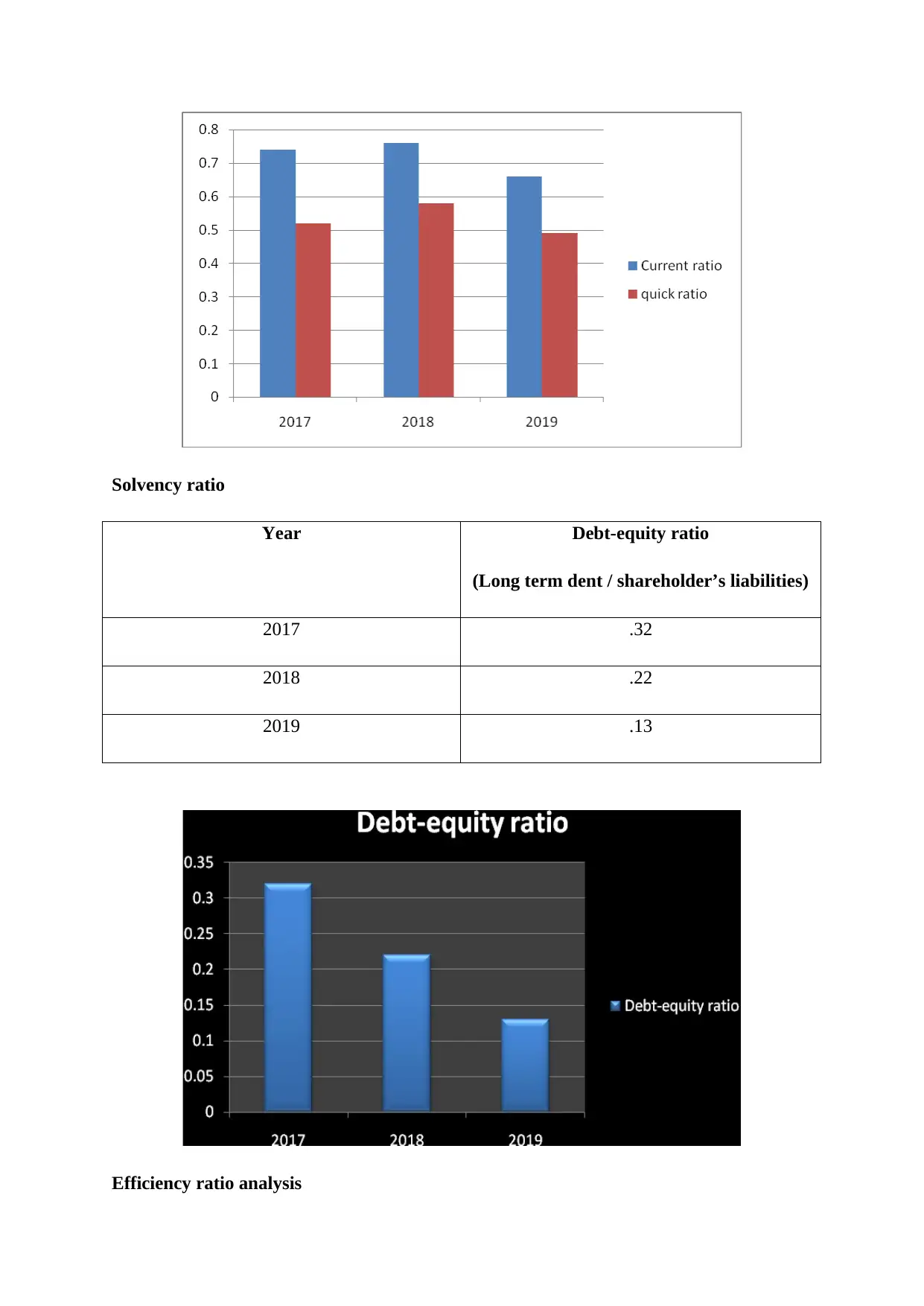

Solvency ratio

Year Debt-equity ratio

(Long term dent / shareholder’s liabilities)

2017 .32

2018 .22

2019 .13

Efficiency ratio analysis

Year Debt-equity ratio

(Long term dent / shareholder’s liabilities)

2017 .32

2018 .22

2019 .13

Efficiency ratio analysis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.