Financial Decision Making Report

VerifiedAdded on 2023/01/05

|14

|3743

|90

Report

AI Summary

This report delves into the significance of the accounting and finance department within organizations, specifically focusing on Skanska Plc, a UK construction company. It discusses various financial concepts, including ratio analysis, the role of accounting, and the importance of financial planning. The report highlights how financial ratios can provide insights into a company's performance and areas for improvement, ultimately aiding investors in making informed decisions. The conclusion emphasizes the critical role of finance and accounting in supporting organizational growth and stability.

FINANCIAL DECISION

MAKING

MAKING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................4

Role Of Accounting And Finance Department

..........................................................................................................................................................3

Ratio Analysis……………………………………………………………………………………..7

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

1

INTRODUCTION...........................................................................................................................4

Role Of Accounting And Finance Department

..........................................................................................................................................................3

Ratio Analysis……………………………………………………………………………………..7

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

1

Executive Summary

The aim of the report is to bring an understanding of accounting and finance importance in an

organisation. Importance of concepts have been discussed relating to the type of company

chosen. Financial ratios to grasp a better understanding used in company’s valuation and

performance comparison with previous year help in getting a clear picture of company’s

financial strengths and weaknesses.

2

The aim of the report is to bring an understanding of accounting and finance importance in an

organisation. Importance of concepts have been discussed relating to the type of company

chosen. Financial ratios to grasp a better understanding used in company’s valuation and

performance comparison with previous year help in getting a clear picture of company’s

financial strengths and weaknesses.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The study revolves around importance of accounts and finance department and its techniques to

help an organisation respond well to financial matters. Skanska Plc is a UK Construction

company which is operating since 1887 and started by manufacturing concrete products. Skanska

since then has diversified in an international construction company and has played a pivotal role

for the infrastructure growth in Sweden. The study will also evaluate financial ratios to have a

better understanding of company’s performance since previous year and areas to work on.

Role Of Accounting And Finance Department

Accounts as the name suggests keeps the record of money going in and out of the business. It

prepares financial statements such as general ledgers, Balance sheet, Profit and loss statement

etc. to book the entries of financial transactions occurring within a fixed period say annually or

quarterly. These statements can be used for internal analysis of the company by the management

and also by shareholders who want to invest in the company (Brooks and Oikonomou,2018).

Finance department is responsible for management of cash through means of employing

capital, acquiring funds, managing funds within organisation’s other departments and planning

for asset acquisition for company as per future requirements. It has to manage the balance of

equity and debt for the company so as to maintain solvency of the company. It uses a number of

techniques to evaluate cash flows and calculating rate of return for better investment on projects.

Importance of Accounting Department

Accounting within an organization is necessary to keep a track of money spent on

production, overhead expenses, promotional expenses etc. Some advantages of

accounting are:

a) It helps in knowing how well the business is performing, who are the major source of

funding for business and who are its debtors.

b) Company abides by rules and regulations and follows statutory compliance and thus

avoids penalties by following rules of accounting.

3

The study revolves around importance of accounts and finance department and its techniques to

help an organisation respond well to financial matters. Skanska Plc is a UK Construction

company which is operating since 1887 and started by manufacturing concrete products. Skanska

since then has diversified in an international construction company and has played a pivotal role

for the infrastructure growth in Sweden. The study will also evaluate financial ratios to have a

better understanding of company’s performance since previous year and areas to work on.

Role Of Accounting And Finance Department

Accounts as the name suggests keeps the record of money going in and out of the business. It

prepares financial statements such as general ledgers, Balance sheet, Profit and loss statement

etc. to book the entries of financial transactions occurring within a fixed period say annually or

quarterly. These statements can be used for internal analysis of the company by the management

and also by shareholders who want to invest in the company (Brooks and Oikonomou,2018).

Finance department is responsible for management of cash through means of employing

capital, acquiring funds, managing funds within organisation’s other departments and planning

for asset acquisition for company as per future requirements. It has to manage the balance of

equity and debt for the company so as to maintain solvency of the company. It uses a number of

techniques to evaluate cash flows and calculating rate of return for better investment on projects.

Importance of Accounting Department

Accounting within an organization is necessary to keep a track of money spent on

production, overhead expenses, promotional expenses etc. Some advantages of

accounting are:

a) It helps in knowing how well the business is performing, who are the major source of

funding for business and who are its debtors.

b) Company abides by rules and regulations and follows statutory compliance and thus

avoids penalties by following rules of accounting.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

c) It helps in budgeting and financial ratios depict the state which has to be given more

attention to. The underperforming segment in the organisation is found out and

accordingly budget is allocated to bring improvement.

d) Accounting helps in filing financial statements at Registrar Office, at stock exchanges

where they are listed and for filing of taxes.

There are varied types of industries operating in commerce and thus accounting may differ in

some cases for them. Skanska being a construction company has its own way of evaluating

accounting techniques which suits its requirements for the type of industry it operates in

(Cockcroft and Russell, 2018).

There are although some common parameters in every organisation to assess and which are also

of importance to shareholders in financial accounting function which are:

a) Income statement: It lists all the gains on cost of goods sold and also expenses whether

variable or fixed with overheads counted in. The net profit or loss displays the

performance in profitability for the term, quarterly or annually.

b) Balance Sheet: It comprises of company’s assets and liabilities. Further it details into

current assets and current liabilities which help see the investors company’s current

liquidity and solvency in the market. Net working Capital can also be calculated with its

help which is necessary for company’s operations (Brooks and Oikonomou,2018).

c) Ledgers: Also called general ledgers, it records transactions in debit and credit for the

company. Debit records all the transactions coming in and credit all the transactions

going out for the company.

Management accounting covers cash flows and rate of return on investment projects. It

also prepares budget to be allocated to various departments.

d) Cash flow statement: Cash inflow and outflow are two aspects involved in accounting

which helps to know the source of funds, the expenditures and costs involved, company’s

payables and account receivables are known. It thus helps in knowing net cash available

for company’s operations.

e) Budget: It is prepared using previous year financials and ratios to judge the amount

allocation to each department and make provisions for the underperforming department.

4

attention to. The underperforming segment in the organisation is found out and

accordingly budget is allocated to bring improvement.

d) Accounting helps in filing financial statements at Registrar Office, at stock exchanges

where they are listed and for filing of taxes.

There are varied types of industries operating in commerce and thus accounting may differ in

some cases for them. Skanska being a construction company has its own way of evaluating

accounting techniques which suits its requirements for the type of industry it operates in

(Cockcroft and Russell, 2018).

There are although some common parameters in every organisation to assess and which are also

of importance to shareholders in financial accounting function which are:

a) Income statement: It lists all the gains on cost of goods sold and also expenses whether

variable or fixed with overheads counted in. The net profit or loss displays the

performance in profitability for the term, quarterly or annually.

b) Balance Sheet: It comprises of company’s assets and liabilities. Further it details into

current assets and current liabilities which help see the investors company’s current

liquidity and solvency in the market. Net working Capital can also be calculated with its

help which is necessary for company’s operations (Brooks and Oikonomou,2018).

c) Ledgers: Also called general ledgers, it records transactions in debit and credit for the

company. Debit records all the transactions coming in and credit all the transactions

going out for the company.

Management accounting covers cash flows and rate of return on investment projects. It

also prepares budget to be allocated to various departments.

d) Cash flow statement: Cash inflow and outflow are two aspects involved in accounting

which helps to know the source of funds, the expenditures and costs involved, company’s

payables and account receivables are known. It thus helps in knowing net cash available

for company’s operations.

e) Budget: It is prepared using previous year financials and ratios to judge the amount

allocation to each department and make provisions for the underperforming department.

4

Audit Function

A company has to abide by rules and regulations while performing its operations. Audit in

Skanska sees to it that compliance is being followed with statutory rules to avoid penalties.

Companies have their internal auditors who judge the operational reports and find out any errors

which may have crept in. The executives are informed to rectify the errors before the external

audit takes place. They also check for accuracy in financial statements and also have a look at the

company’s goals whether any change in policies is required to help company achieve its

objectives (Fischer-Pauzenberger and Schwaiger, 2017).

As discussed above, there are some aspects related to construction accounting which differ in

calculation of financials listed below:

Job Costing

Skanska being a construction company has contracts which employs a variety of projects or jobs.

It can become a complex process to account them in one go as all are having different set of

costs and expenses. Job Costing helps to account all the direct, indirect expenses along with

revenue of each job separately thus eliminating confusion. This has helped the company to cover

up all overhead expenses while determining profitability for each project. This organised way

helps company’s internal accountants to easily review the financial statements and make tax

filing easier (Cockcroft and Russell, 2018).

Cash basis

Cash basis accounting has benefitted Skanska to record revenue and expenses as and when they

come in a contract which has simplified the process of keeping records although the expenses

have to be distributed evenly throughout the years if it is a multi-year contract.

Percentage of Completion

A contract has varying length and as such matching final revenues and expenses is a bit difficult

task. Here arrives the tool of Percentage of Completion used in Skanska which helps the business

come over this hurdle. There is an estimation of expenses made on a particular job in the project

5

A company has to abide by rules and regulations while performing its operations. Audit in

Skanska sees to it that compliance is being followed with statutory rules to avoid penalties.

Companies have their internal auditors who judge the operational reports and find out any errors

which may have crept in. The executives are informed to rectify the errors before the external

audit takes place. They also check for accuracy in financial statements and also have a look at the

company’s goals whether any change in policies is required to help company achieve its

objectives (Fischer-Pauzenberger and Schwaiger, 2017).

As discussed above, there are some aspects related to construction accounting which differ in

calculation of financials listed below:

Job Costing

Skanska being a construction company has contracts which employs a variety of projects or jobs.

It can become a complex process to account them in one go as all are having different set of

costs and expenses. Job Costing helps to account all the direct, indirect expenses along with

revenue of each job separately thus eliminating confusion. This has helped the company to cover

up all overhead expenses while determining profitability for each project. This organised way

helps company’s internal accountants to easily review the financial statements and make tax

filing easier (Cockcroft and Russell, 2018).

Cash basis

Cash basis accounting has benefitted Skanska to record revenue and expenses as and when they

come in a contract which has simplified the process of keeping records although the expenses

have to be distributed evenly throughout the years if it is a multi-year contract.

Percentage of Completion

A contract has varying length and as such matching final revenues and expenses is a bit difficult

task. Here arrives the tool of Percentage of Completion used in Skanska which helps the business

come over this hurdle. There is an estimation of expenses made on a particular job in the project

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and then the actual expenses incurred in completion of the job is taken which is divided by the

former to get the profit or loss occurred. This helps to see whether a project is on the right track

or not. If there is a profit it is multiplied by percentage of completion of project till yet to get the

estimated gross profit. This has shown good results with not much deviation.

Tax function

Tax Strategies

Construction companies like Skanska have a difference in tax reporting as per approaches. For

completed contracts, income and expenses are recorded after the job is completed which allows

to defer taxes until project completion. However, Percentage of Completion is a better approach

to combat tax fluctuations which records income and expenses as per year received. Companies

get to defer taxes too with permission from Internal Revenue Service (Floyd and List, 2016).

Importance of Finance

Finance in any business plays prominent role in acquiring, managing and allocating funds to

various departments in the organisation. Financial planning requires methods and techniques

which are duly followed to get results for the organisation. The functions within finance are as

follows:

a) Investment function

Managers decide how to raise capital for company’s operations in Skanska. Company can launch

its IPOs, issue bonds and debentures in market to raise capital for company’s operations.

Skanska managers see to it that there is a balance of equity and debt as relying more on debt can

raise solvency issues in future (Loughran and McDonald, 2016). Debt can be in a form of bank

loan from company’s bank, a group giving credit etc.

b) Financing function

As business is generating revenues per day, it is necessary to rightly put money in areas like

pending payments, bills, finance for equipment and raw materials, for machinery, paying the

labour, suppliers along with delegating funds to various sections within the organisation.

Skanska with a good operating finance software is able to delegate funds in the right sections and

6

former to get the profit or loss occurred. This helps to see whether a project is on the right track

or not. If there is a profit it is multiplied by percentage of completion of project till yet to get the

estimated gross profit. This has shown good results with not much deviation.

Tax function

Tax Strategies

Construction companies like Skanska have a difference in tax reporting as per approaches. For

completed contracts, income and expenses are recorded after the job is completed which allows

to defer taxes until project completion. However, Percentage of Completion is a better approach

to combat tax fluctuations which records income and expenses as per year received. Companies

get to defer taxes too with permission from Internal Revenue Service (Floyd and List, 2016).

Importance of Finance

Finance in any business plays prominent role in acquiring, managing and allocating funds to

various departments in the organisation. Financial planning requires methods and techniques

which are duly followed to get results for the organisation. The functions within finance are as

follows:

a) Investment function

Managers decide how to raise capital for company’s operations in Skanska. Company can launch

its IPOs, issue bonds and debentures in market to raise capital for company’s operations.

Skanska managers see to it that there is a balance of equity and debt as relying more on debt can

raise solvency issues in future (Loughran and McDonald, 2016). Debt can be in a form of bank

loan from company’s bank, a group giving credit etc.

b) Financing function

As business is generating revenues per day, it is necessary to rightly put money in areas like

pending payments, bills, finance for equipment and raw materials, for machinery, paying the

labour, suppliers along with delegating funds to various sections within the organisation.

Skanska with a good operating finance software is able to delegate funds in the right sections and

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

able to maintain daily records. Previous financials are also used to match the funds delegated in

increase or decrease mode.

c) Dividend function

Skanska has to pay its investors certain amount of profits it generates on an annual basis. The

managers decide the amount to be given through calculations as per the stake of the shareholder.

This is dividend money which is taken out of gross profit generated. As the number of investors

are large in number, financial calculations are done with help of technology to allocate the funds

correctly.

d) Working Capital function

Skanska manages its working capital in a way that neither there is excess funds reported nor

there is a shortage of cash. Excess funds will mean the resources are not being optimally utilized

which is required for conducting day to day operations. Resources optimally utilised will

generate profits. Lower funds will mean company is not able to manage money for daily

operations and liquidity of the company is low (Floyd and List, 2016).

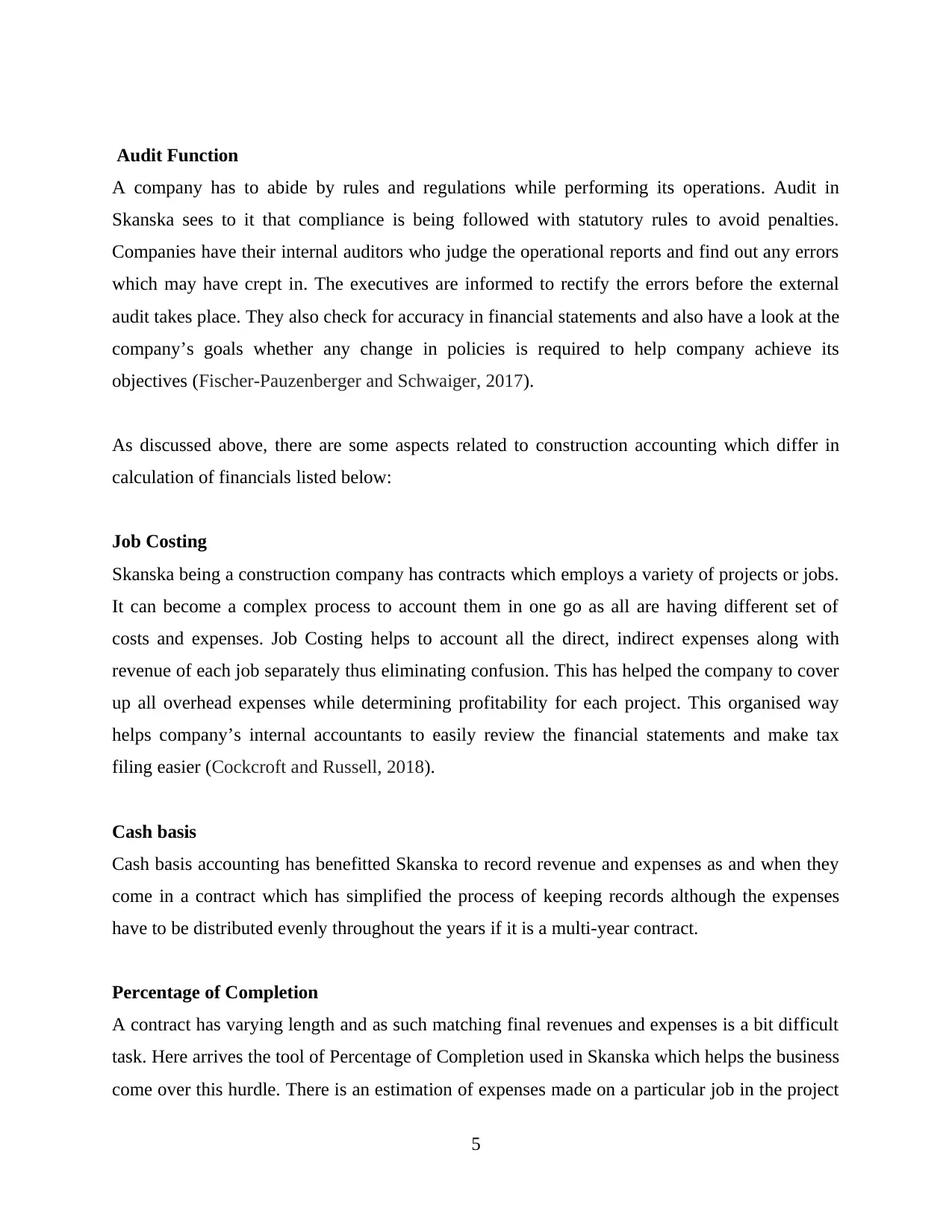

Ratio Analysis

Ratios 2018 2019

ROCE=Operating Profit/Total

Assets-Current Liabilities*100

750/(2955-645)*100= 32.46 975/(6000-2220)*100=25.79

Net Profit Margin=Net

Profit/Sales*100

600/4800*100=16.66 675/6000*100= 11.25

Current Ratio=Current

Assets/Current Liabilities

1515/645=2.34 2070/2220=0.93

Debtors Collection

Period=Receivables/Sales*365

900/4800*365=68.43 1200/6000*365=73

Creditors Payment

Period=Payables/Purchases*365

570/2700*365=77.05 2100/4800*365=159.68

7

increase or decrease mode.

c) Dividend function

Skanska has to pay its investors certain amount of profits it generates on an annual basis. The

managers decide the amount to be given through calculations as per the stake of the shareholder.

This is dividend money which is taken out of gross profit generated. As the number of investors

are large in number, financial calculations are done with help of technology to allocate the funds

correctly.

d) Working Capital function

Skanska manages its working capital in a way that neither there is excess funds reported nor

there is a shortage of cash. Excess funds will mean the resources are not being optimally utilized

which is required for conducting day to day operations. Resources optimally utilised will

generate profits. Lower funds will mean company is not able to manage money for daily

operations and liquidity of the company is low (Floyd and List, 2016).

Ratio Analysis

Ratios 2018 2019

ROCE=Operating Profit/Total

Assets-Current Liabilities*100

750/(2955-645)*100= 32.46 975/(6000-2220)*100=25.79

Net Profit Margin=Net

Profit/Sales*100

600/4800*100=16.66 675/6000*100= 11.25

Current Ratio=Current

Assets/Current Liabilities

1515/645=2.34 2070/2220=0.93

Debtors Collection

Period=Receivables/Sales*365

900/4800*365=68.43 1200/6000*365=73

Creditors Payment

Period=Payables/Purchases*365

570/2700*365=77.05 2100/4800*365=159.68

7

Return On Capital Employed

This ratio depicts a company’s profitability as to how well the capital has been employed to

generate earnings. Operating Profit is taken as numerator which is got by deducting operating

expenses from gross profit. It is also known as Earnings before Interest and tax on the company

depicting the amount company earns from its operations (Loughran and McDonald, 2016). EBIT

is calculated as revenue minus cost of sales plus the operating expenses. The capital employed is

taken out as current liabilities minus from total assets as the liabilities have to be paid off and

thus cannot be counted as capital.

Some analysts consider taking the average capital employed which is the average of opening and

closing capital employed for a period or term. As ROCE takes into consideration shareholder’s

equity with long term debt as capital employed it helps in better financial comparison of

companies having a prominent debt. It talks of revenue generated per $1 of capital employed.

Companies who have a stable or rising ROCE are generally preferred by investors rather

than the ones whose ROCE is lower.

Speaking of Skanska its ROCE has lowered in 2019 form 2018 which means less

profitability for the investors. Although Operating profit has risen with sales going up, but a

significant increase has been seen in total assets and current liabilities. With increase in a/c

payables, the current liabilities have increased. An increase in assets is a good sign but it could

also contain long term debt for the company. Secondly, the optimum utilisation of assets is

required here to generate a significant increase in operating profits or EBIT. Then it will help

company to generate a better ROCE.

Investors who are looking forward to invest will be concerned more in the increase in

operating profits than assets as higher the operating profit, higher will be the ROCE.

Net profit margin

The ratio shows the net profit or income generated from revenue shown in percentage terms and

sometimes in decimal. It is calculated by taking net profit as gross profit minus the operating

expenses and again minus the interest and taxes. This is also known as net earnings or revenue

8

This ratio depicts a company’s profitability as to how well the capital has been employed to

generate earnings. Operating Profit is taken as numerator which is got by deducting operating

expenses from gross profit. It is also known as Earnings before Interest and tax on the company

depicting the amount company earns from its operations (Loughran and McDonald, 2016). EBIT

is calculated as revenue minus cost of sales plus the operating expenses. The capital employed is

taken out as current liabilities minus from total assets as the liabilities have to be paid off and

thus cannot be counted as capital.

Some analysts consider taking the average capital employed which is the average of opening and

closing capital employed for a period or term. As ROCE takes into consideration shareholder’s

equity with long term debt as capital employed it helps in better financial comparison of

companies having a prominent debt. It talks of revenue generated per $1 of capital employed.

Companies who have a stable or rising ROCE are generally preferred by investors rather

than the ones whose ROCE is lower.

Speaking of Skanska its ROCE has lowered in 2019 form 2018 which means less

profitability for the investors. Although Operating profit has risen with sales going up, but a

significant increase has been seen in total assets and current liabilities. With increase in a/c

payables, the current liabilities have increased. An increase in assets is a good sign but it could

also contain long term debt for the company. Secondly, the optimum utilisation of assets is

required here to generate a significant increase in operating profits or EBIT. Then it will help

company to generate a better ROCE.

Investors who are looking forward to invest will be concerned more in the increase in

operating profits than assets as higher the operating profit, higher will be the ROCE.

Net profit margin

The ratio shows the net profit or income generated from revenue shown in percentage terms and

sometimes in decimal. It is calculated by taking net profit as gross profit minus the operating

expenses and again minus the interest and taxes. This is also known as net earnings or revenue

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

which has transformed itself into profits. The denominator is sales or revenue and reflects on per

dollar value of revenue which has become profit for the company. This margin shows how well

the company has covered up its operational costs and generated income. Net profit shows

whether a company’s operations are going in right direction or not. It signifies if a company

needs to decrease its operational expenses (Mburayi and Wall, 2018).

Investors see from the financials if the profit has been increasing and company being able

to generate returns from revenue and able to cover up operational and overhead expenses. Net

profit being expressed in percentage helps to compare company with different operational sizes

as well.

Speaking of Skanska it can be seen that net profit has declined in 2019 from the previous

year which is not a good sign as this reflects company’s earnings going down. From the balance

sheet it can be seen that overhead expenses like purchases have gone up significantly with a

slight increase in operational expenses. Company will have to boost up sales and try to reduce

operational expenses while seeing to it that purchases are controlled by cutting down on items

not coming useful in the process.

Although there is a decline in net profits an increase in gross profit is seen in 2019 which

means if the company takes right measures it will be able to cover up its overhead expenses in

next year assessment.

Current ratio

It falls under the heading of liquidity ratios and depicts company’s current assets and current

liabilities. It shows whether a company is able to pay its short-term obligations within a year and

also to maximize company’s current assets to balance its current liabilities and debts which will

also help increase its net working capital (McLaney and Atrill, 2016). Current assets are those

which have to be used or sold within a year to suit ongoing operations. They include cash, cash

equivalent, account receivables, stock inventory, marketable securities etc. Current liabilities are

those which have to be paid off within a year such as short-term debt, accounts payables, notes

payable etc. Current ratio in ideal situation would be one stating that company can cover its

current liabilities fully with its current assets. A higher current ratio than 1 is also acceptable

showing company’s current liquidity but a much higher ratio will mean company is not able to

manage its utilisation of assets effectively.

9

dollar value of revenue which has become profit for the company. This margin shows how well

the company has covered up its operational costs and generated income. Net profit shows

whether a company’s operations are going in right direction or not. It signifies if a company

needs to decrease its operational expenses (Mburayi and Wall, 2018).

Investors see from the financials if the profit has been increasing and company being able

to generate returns from revenue and able to cover up operational and overhead expenses. Net

profit being expressed in percentage helps to compare company with different operational sizes

as well.

Speaking of Skanska it can be seen that net profit has declined in 2019 from the previous

year which is not a good sign as this reflects company’s earnings going down. From the balance

sheet it can be seen that overhead expenses like purchases have gone up significantly with a

slight increase in operational expenses. Company will have to boost up sales and try to reduce

operational expenses while seeing to it that purchases are controlled by cutting down on items

not coming useful in the process.

Although there is a decline in net profits an increase in gross profit is seen in 2019 which

means if the company takes right measures it will be able to cover up its overhead expenses in

next year assessment.

Current ratio

It falls under the heading of liquidity ratios and depicts company’s current assets and current

liabilities. It shows whether a company is able to pay its short-term obligations within a year and

also to maximize company’s current assets to balance its current liabilities and debts which will

also help increase its net working capital (McLaney and Atrill, 2016). Current assets are those

which have to be used or sold within a year to suit ongoing operations. They include cash, cash

equivalent, account receivables, stock inventory, marketable securities etc. Current liabilities are

those which have to be paid off within a year such as short-term debt, accounts payables, notes

payable etc. Current ratio in ideal situation would be one stating that company can cover its

current liabilities fully with its current assets. A higher current ratio than 1 is also acceptable

showing company’s current liquidity but a much higher ratio will mean company is not able to

manage its utilisation of assets effectively.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Skanska has a decline in current ratio since 2018 which is not a good sign for the

company’s liquidity position as the ratio has gone below 1. It means company’s current assets

are less than current liabilities. Earlier the ratio was below 3 meaning good for company’s

liquidity as well as optimum utilisation of company’s assets.

It can be seen despite growth achieved in current assets cash in hand has declined and trade

payables have increased significantly adding up to the current liabilities. Company will have to

generate methods to increase cash to help pay off the payables.

Investors generally prefer current ratio higher than 1. Skanska will have to work on

increasing current assets to increase current ratio and hence attract investment.

Debtors Collection Period

The amount of time taken to collect receivables from debtors is known as debtors collection

period (Mburayi and Wall, 2018). The less time taken for debt recovery better it is for the

company to increase its cash segment and utilise it for company’s operations or maybe paying

the company’s credit. The denominator taken to calculate the ratio is sales as on the sales

generated how fast is the recovery rate of receivables. As sales is taken on an annual basis the

resultant of numerator and sales is multiplied by 365.It is thus denoted in days. A company when

doing an order of goods in advance or issuing debt knows the time line in which to recover debt.

If the receivables are collected in the time period it will show the efficiency of the company.

Speaking of Skanska it can be seen that a slight increase in debtors collection period has

been since 2018. A higher collection period will mean company having less cash at present

moment than the standard terms. Although not much of an increase is there which will prevent

deterrence of investors. Investors are looking for investment where the company doesn’t have

much pending payments as it can hamper their dividend payments at the right time.

Creditors Payment Period

It can be said as the ratio which depicts the time taken by the business to settle trade credits thus

mentioned also as account payables. The calculation is made on a yearly basis as the

denominator in the ratio is purchases done by the company on a yearly basis (McLaney and

Atrill, 2016). The company has to make use of credit for its operations and also ethically pay its

10

company’s liquidity position as the ratio has gone below 1. It means company’s current assets

are less than current liabilities. Earlier the ratio was below 3 meaning good for company’s

liquidity as well as optimum utilisation of company’s assets.

It can be seen despite growth achieved in current assets cash in hand has declined and trade

payables have increased significantly adding up to the current liabilities. Company will have to

generate methods to increase cash to help pay off the payables.

Investors generally prefer current ratio higher than 1. Skanska will have to work on

increasing current assets to increase current ratio and hence attract investment.

Debtors Collection Period

The amount of time taken to collect receivables from debtors is known as debtors collection

period (Mburayi and Wall, 2018). The less time taken for debt recovery better it is for the

company to increase its cash segment and utilise it for company’s operations or maybe paying

the company’s credit. The denominator taken to calculate the ratio is sales as on the sales

generated how fast is the recovery rate of receivables. As sales is taken on an annual basis the

resultant of numerator and sales is multiplied by 365.It is thus denoted in days. A company when

doing an order of goods in advance or issuing debt knows the time line in which to recover debt.

If the receivables are collected in the time period it will show the efficiency of the company.

Speaking of Skanska it can be seen that a slight increase in debtors collection period has

been since 2018. A higher collection period will mean company having less cash at present

moment than the standard terms. Although not much of an increase is there which will prevent

deterrence of investors. Investors are looking for investment where the company doesn’t have

much pending payments as it can hamper their dividend payments at the right time.

Creditors Payment Period

It can be said as the ratio which depicts the time taken by the business to settle trade credits thus

mentioned also as account payables. The calculation is made on a yearly basis as the

denominator in the ratio is purchases done by the company on a yearly basis (McLaney and

Atrill, 2016). The company has to make use of credit for its operations and also ethically pay its

10

dues on time to earn or maintain its reputation with its creditors. If a company is paying its dues

timely that shows the liquidity position of the company to be good.

Speaking of Skanska its payment period has increased more than double in 2019 with a

significant increase in account payables as well as purchases. Also it means company is taking

up longer to pay its dues. Company has to amend changes in a way that payments do not take

more duration and standardly payments can be done.

Investors may see it as a company’s way to use credit for a longer duration but it can

also raise questions whether company is facing a liquidity crunch or not. A lesser current ratio

will increase such doubts. A company’s tie up with its creditors has to be sound as to maintain

cash needs in future.

CONCLUSION

It can be concluded that accounting and finance are two pillars supporting the organisation in

both internal and external means. Internally they help in maintaining records and budget

allocation with supporting the need of better investments among projects. Externally the reports

being used by investors to put their money in safe place with returns thus boosting investment for

the company. It can also be seen with the help of financial ratios companies are able to find out

its own strengths and weaknesses and compare with the previous year performance of where they

need to work. It will help investors also to gauge the financial strength of the company.

Company’s profitability increases in an organised way with help of these functions.

11

timely that shows the liquidity position of the company to be good.

Speaking of Skanska its payment period has increased more than double in 2019 with a

significant increase in account payables as well as purchases. Also it means company is taking

up longer to pay its dues. Company has to amend changes in a way that payments do not take

more duration and standardly payments can be done.

Investors may see it as a company’s way to use credit for a longer duration but it can

also raise questions whether company is facing a liquidity crunch or not. A lesser current ratio

will increase such doubts. A company’s tie up with its creditors has to be sound as to maintain

cash needs in future.

CONCLUSION

It can be concluded that accounting and finance are two pillars supporting the organisation in

both internal and external means. Internally they help in maintaining records and budget

allocation with supporting the need of better investments among projects. Externally the reports

being used by investors to put their money in safe place with returns thus boosting investment for

the company. It can also be seen with the help of financial ratios companies are able to find out

its own strengths and weaknesses and compare with the previous year performance of where they

need to work. It will help investors also to gauge the financial strength of the company.

Company’s profitability increases in an organised way with help of these functions.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.