FELM4026 Spring 2018: Economic & Financial Literacy - UK Analysis

VerifiedAdded on 2023/06/13

|18

|3675

|408

Report

AI Summary

This report provides a comprehensive analysis of key aspects of the UK economy and business environment. It examines the business strategy of Co-op Food, focusing on its marketing tactics and competitive positioning within the oligopolistic supermarket sector. The report further investigates the dynamics of the UK housing market, exploring factors influencing housing demand and supply, and the role of the Bank of England's monetary policy. Additionally, it assesses the macroeconomic performance of the UK over the past five years, analyzing trends in GDP, inflation, interest rates, and unemployment. The report concludes with a discussion of financial leverage and its implications for businesses.

Running head: FINANCE AND ECONOMIC LITERACY

Finance and Economic Literacy

Name of the Student

Name of the University

Authors Note

Course ID

Finance and Economic Literacy

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCE AND ECONOMIC LITERACY

Table of Contents

Answer to question 1..................................................................................................................3

Introduction................................................................................................................................3

Co-op food.................................................................................................................................3

Marketing strategy of Co-op food..............................................................................................3

Conclusion..................................................................................................................................4

Answer to question 2..................................................................................................................5

Introduction................................................................................................................................5

Housing demand and housing supply in United Kingdom........................................................5

Bank of England’s policy for UK housing market.....................................................................6

Conclusion..................................................................................................................................7

Answer to question 3..................................................................................................................7

Introduction................................................................................................................................7

Gross domestic product..............................................................................................................7

Inflation......................................................................................................................................8

Interest rate.................................................................................................................................9

Unemployment.........................................................................................................................10

Conclusion................................................................................................................................11

Answer to question 4:...............................................................................................................11

Answer to question 5:...............................................................................................................12

Answer to A:............................................................................................................................12

Table of Contents

Answer to question 1..................................................................................................................3

Introduction................................................................................................................................3

Co-op food.................................................................................................................................3

Marketing strategy of Co-op food..............................................................................................3

Conclusion..................................................................................................................................4

Answer to question 2..................................................................................................................5

Introduction................................................................................................................................5

Housing demand and housing supply in United Kingdom........................................................5

Bank of England’s policy for UK housing market.....................................................................6

Conclusion..................................................................................................................................7

Answer to question 3..................................................................................................................7

Introduction................................................................................................................................7

Gross domestic product..............................................................................................................7

Inflation......................................................................................................................................8

Interest rate.................................................................................................................................9

Unemployment.........................................................................................................................10

Conclusion................................................................................................................................11

Answer to question 4:...............................................................................................................11

Answer to question 5:...............................................................................................................12

Answer to A:............................................................................................................................12

2FINANCE AND ECONOMIC LITERACY

Answer to B:............................................................................................................................14

Answer to C:............................................................................................................................14

Reference List:.........................................................................................................................16

Answer to B:............................................................................................................................14

Answer to C:............................................................................................................................14

Reference List:.........................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCE AND ECONOMIC LITERACY

Answer to question 1

Introduction

In UK economy, several business operates successfully positive contribution to

economic growth. The grocery supermarket is one of the widely extended business in UK.

Different sized firms operate in the supermarket chain. The report evaluates business strategy

of Co-op food, one of the grocery retailers in UK.

Co-op food

Co-op Food is a retail grocery brand operated by co-operative group in UK. In 2016,

the company accounted about 6.6% share of grocery market. Despite fall in co-operative

society’s market share from a peak of 30% in 1950 to 6.6% today, it still ranks fifth in the list

of grocery retailers in UK (co-operativefood.co.uk 2018).

The company operates in an oligopolistic market structure. A market is identified as

an oligopoly market when a market with large number of buyers is dominated by only few

large firms (Sloman and Jones 2017). The four dominating players in UK grocery

supermarket are Tesco, Morrison, Sainsbury and Asda.

Marketing strategy of Co-op food

In an oligopoly market, the operating firms take several strategies to capture a higher

market share by undercutting share of its rival. Some of the commonly used strategy

oligopolistic firms include product differentiation, advertising, price war and other specific

strategies (Ashwin, Taylor and Mankiw 2016). Co-op Food has taken some of these strategies

to retain its position in the market.

The company has made a gradual shift towards becoming one of the leading

convenience food retailers in UK. In order to achieve this the company has planned to double

Answer to question 1

Introduction

In UK economy, several business operates successfully positive contribution to

economic growth. The grocery supermarket is one of the widely extended business in UK.

Different sized firms operate in the supermarket chain. The report evaluates business strategy

of Co-op food, one of the grocery retailers in UK.

Co-op food

Co-op Food is a retail grocery brand operated by co-operative group in UK. In 2016,

the company accounted about 6.6% share of grocery market. Despite fall in co-operative

society’s market share from a peak of 30% in 1950 to 6.6% today, it still ranks fifth in the list

of grocery retailers in UK (co-operativefood.co.uk 2018).

The company operates in an oligopolistic market structure. A market is identified as

an oligopoly market when a market with large number of buyers is dominated by only few

large firms (Sloman and Jones 2017). The four dominating players in UK grocery

supermarket are Tesco, Morrison, Sainsbury and Asda.

Marketing strategy of Co-op food

In an oligopoly market, the operating firms take several strategies to capture a higher

market share by undercutting share of its rival. Some of the commonly used strategy

oligopolistic firms include product differentiation, advertising, price war and other specific

strategies (Ashwin, Taylor and Mankiw 2016). Co-op Food has taken some of these strategies

to retain its position in the market.

The company has made a gradual shift towards becoming one of the leading

convenience food retailers in UK. In order to achieve this the company has planned to double

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCE AND ECONOMIC LITERACY

size of the convenience stores estates. The firm announced to open 100-150 new stores every

year (conveniencestore.co.uk 2018) With this step the firm has no become one of the fastest

growing retailer in the supermarket chain with an increase in net worth to £46bn in the next

five years from £36bn in in 2013.

The company focused to increase investment in price. The strategy is taken in repose

to similar strategies taken by its rivals. The biggest rival Tesco has invested £200m in order

to offer customers a low and stable price. Asda has invested £1 bn in every day price to

counter the market share of Aldi and Lidl, the two biggest discounter (thegrocer.co.uk 2018).

The strategy of lowering price by grocery retailers has triggered a price war in the

supermarket. Co-op has reduced the price of 1-pint milk to 45p and that of 2-pint milk to 85p.

In order to compete with the rival firms in the industry, the company often uses two

popular strategy of market segmentation and market differentiation. Under market

segmentation strategy, the company identifies marketing areas with largest appeal. Then by

targeting this market segment the company can have significant scope to expand its business

(co-operativefood.co.uk 2018). For market differentiation the company needs to differentiate

its product from its close rival and attract more customers.

Conclusion

Co-op food is a grocery retailer brand operating in UK supermarket chain. The

company designs exclusive growth strategy to maintain its market share in the supermarket.

Investment in price, increasing number of convenience stores, market segmentation and

market differentiation are some strategies taken by the company.

size of the convenience stores estates. The firm announced to open 100-150 new stores every

year (conveniencestore.co.uk 2018) With this step the firm has no become one of the fastest

growing retailer in the supermarket chain with an increase in net worth to £46bn in the next

five years from £36bn in in 2013.

The company focused to increase investment in price. The strategy is taken in repose

to similar strategies taken by its rivals. The biggest rival Tesco has invested £200m in order

to offer customers a low and stable price. Asda has invested £1 bn in every day price to

counter the market share of Aldi and Lidl, the two biggest discounter (thegrocer.co.uk 2018).

The strategy of lowering price by grocery retailers has triggered a price war in the

supermarket. Co-op has reduced the price of 1-pint milk to 45p and that of 2-pint milk to 85p.

In order to compete with the rival firms in the industry, the company often uses two

popular strategy of market segmentation and market differentiation. Under market

segmentation strategy, the company identifies marketing areas with largest appeal. Then by

targeting this market segment the company can have significant scope to expand its business

(co-operativefood.co.uk 2018). For market differentiation the company needs to differentiate

its product from its close rival and attract more customers.

Conclusion

Co-op food is a grocery retailer brand operating in UK supermarket chain. The

company designs exclusive growth strategy to maintain its market share in the supermarket.

Investment in price, increasing number of convenience stores, market segmentation and

market differentiation are some strategies taken by the company.

5FINANCE AND ECONOMIC LITERACY

Answer to question 2

Introduction

In the last 25 years, housing market in UK had undergone as a serious crisis. In 2007,

housing price reached to the highest level relative to earnings. Price have particularly risen in

London and the South. In determining housing price, the supply and demand of housing play

an important role.

Housing demand and housing supply in United Kingdom

Factors affecting housing demand

Affordability: The first primary determinants of housing demand is the affordability. In time

of economic growth, average income increases leading to an increases in affordability and

housing demand. In UK, housing prices have increased at a much faster rate than

affordability does (Kim 2015).

Interest rate: Interest rate is an important factor determining housing affordability. Higher

interest rate reduces affordability causing a decline in demand. The average interest rate in

UK was at around 4.5% until 2008. After 2008, interest rate reduced drastically. During this

time, interest rate had reached to a recorded low level. The interest rate had remained since

then had remained at 0.5% (Zhang et al. 2017) The mortgage rate however did not fall in line

with the interest rate as many lenders targeted to maintain their stock of liquidity to increases

profitability. Additionally, fixed borrowers cannot take the advantage of low interest rate. In

2009, the variable rate of mortgage fell to 3.8%.

Credit availability: The demand for property depends on available credit. During financial

crisis of 2008-09, the credit supply has declined causing an associated decline in housing

demand and price (Kim 2015).

Answer to question 2

Introduction

In the last 25 years, housing market in UK had undergone as a serious crisis. In 2007,

housing price reached to the highest level relative to earnings. Price have particularly risen in

London and the South. In determining housing price, the supply and demand of housing play

an important role.

Housing demand and housing supply in United Kingdom

Factors affecting housing demand

Affordability: The first primary determinants of housing demand is the affordability. In time

of economic growth, average income increases leading to an increases in affordability and

housing demand. In UK, housing prices have increased at a much faster rate than

affordability does (Kim 2015).

Interest rate: Interest rate is an important factor determining housing affordability. Higher

interest rate reduces affordability causing a decline in demand. The average interest rate in

UK was at around 4.5% until 2008. After 2008, interest rate reduced drastically. During this

time, interest rate had reached to a recorded low level. The interest rate had remained since

then had remained at 0.5% (Zhang et al. 2017) The mortgage rate however did not fall in line

with the interest rate as many lenders targeted to maintain their stock of liquidity to increases

profitability. Additionally, fixed borrowers cannot take the advantage of low interest rate. In

2009, the variable rate of mortgage fell to 3.8%.

Credit availability: The demand for property depends on available credit. During financial

crisis of 2008-09, the credit supply has declined causing an associated decline in housing

demand and price (Kim 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCE AND ECONOMIC LITERACY

Price of substitutes: The substitute of buying a house is to rent a house. The cost of renting

property influences housing demand.

Expectation: People expectation regarding property prices play an important role in

determining housing demand. If property price continues to rise, then people expect to rise it

in future (Tsai and Tsai 2018). Increasing house price encourages speculative demand while

declining house price discourages speculative demand.

Factors affecting housing supply

The supply of housing depends on the new house construction by property developer.

Availability of credit is a primary determinant of housing supply. UK has suffered from a

persistent problem of housing shortage. Housing demand increases at a faster rate than

housing supply. The housing demand is forecasted to become 232000 by 2033. As against

this, housing supply is struggling to reach above 100,000 by the end of this year. The credit

crunch of 2008 significantly interrupted housing supply in UK (Zhang et al. 2017). Other

factors affecting housing supply are availability of land, profitability on new house

construction and restriction placed on construction.

Bank of England’s policy for UK housing market

Bank of England though not directly regulate housing market but it does regulate

banks through its monetary policy. Bank of England uses the tool of interest rate to influence

housing demand and supply. Bank also put restriction on proportion of mortgage loan along

with a restriction on people who can borrow. In order to increases affordability of people,

Bank of England has abolished stamp duty on first time home buyers for house valued

£300,000. In case property price exceed £300,000, no stamp duty needs to be paid on first

£300,000 (voxeu.org 2017). Under monetary policy targeting the Chancellor announced a

Price of substitutes: The substitute of buying a house is to rent a house. The cost of renting

property influences housing demand.

Expectation: People expectation regarding property prices play an important role in

determining housing demand. If property price continues to rise, then people expect to rise it

in future (Tsai and Tsai 2018). Increasing house price encourages speculative demand while

declining house price discourages speculative demand.

Factors affecting housing supply

The supply of housing depends on the new house construction by property developer.

Availability of credit is a primary determinant of housing supply. UK has suffered from a

persistent problem of housing shortage. Housing demand increases at a faster rate than

housing supply. The housing demand is forecasted to become 232000 by 2033. As against

this, housing supply is struggling to reach above 100,000 by the end of this year. The credit

crunch of 2008 significantly interrupted housing supply in UK (Zhang et al. 2017). Other

factors affecting housing supply are availability of land, profitability on new house

construction and restriction placed on construction.

Bank of England’s policy for UK housing market

Bank of England though not directly regulate housing market but it does regulate

banks through its monetary policy. Bank of England uses the tool of interest rate to influence

housing demand and supply. Bank also put restriction on proportion of mortgage loan along

with a restriction on people who can borrow. In order to increases affordability of people,

Bank of England has abolished stamp duty on first time home buyers for house valued

£300,000. In case property price exceed £300,000, no stamp duty needs to be paid on first

£300,000 (voxeu.org 2017). Under monetary policy targeting the Chancellor announced a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCE AND ECONOMIC LITERACY

plan of £44 billion in terms of direct government investment, loans and guarantees. The

money market reform has taken to increase housing supply.

Conclusion

In UK, demand of housing outweigh the supply of houses putting an upward pressure

on housing price. In order to stabilize housing market Bank of England is using monetary

policy tools either by restricting amount of credit or by limiting people who can borrow.

Answer to question 3

Introduction

The economic performance of a nation depends on number of macroeconomic

indicators and their trend. These indicators include Gross Domestic Product (GDP), rate of

inflation, interest rate, unemployment rate and others. The report analyzes macroeconomic

performance of UK for the last five years.

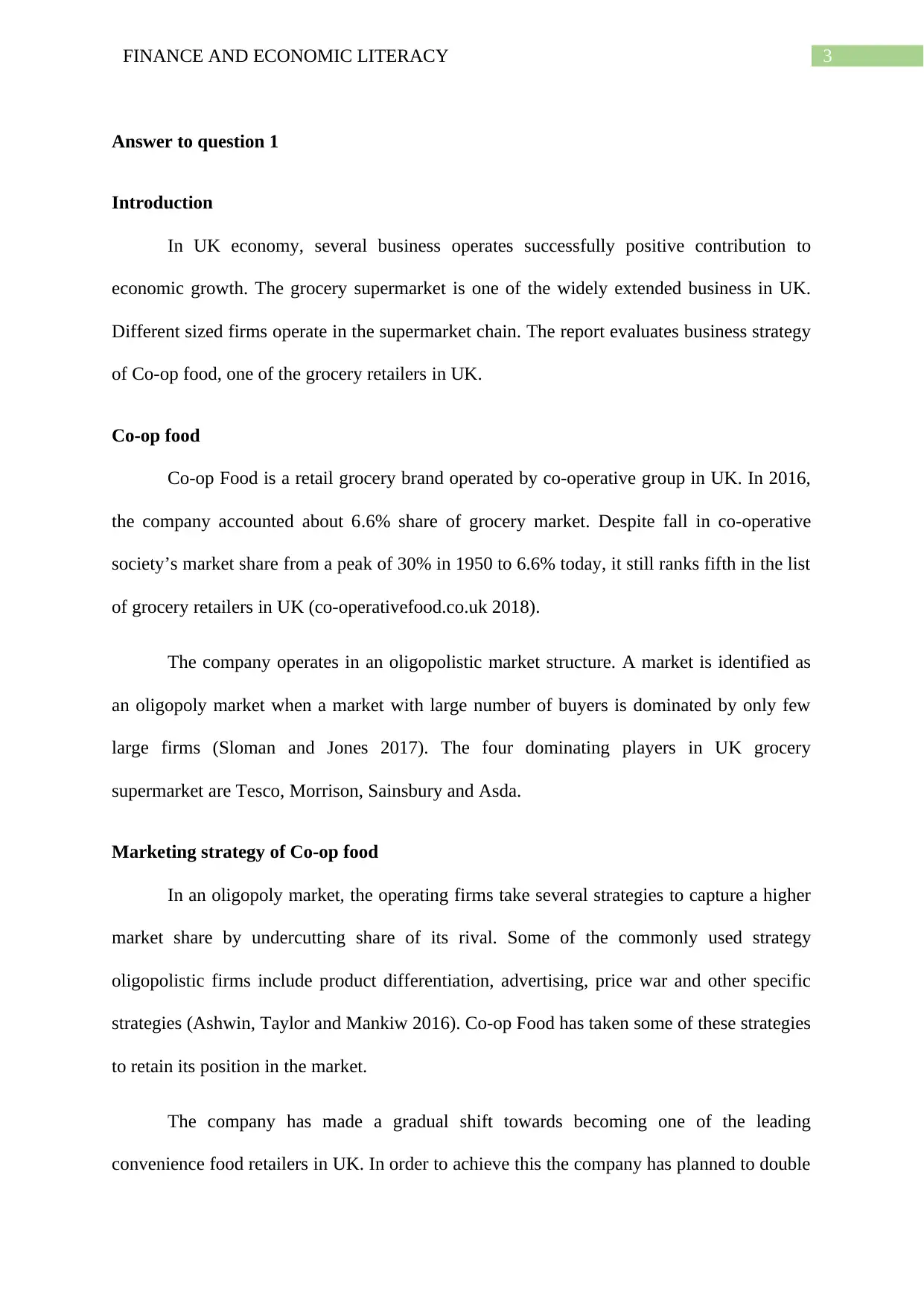

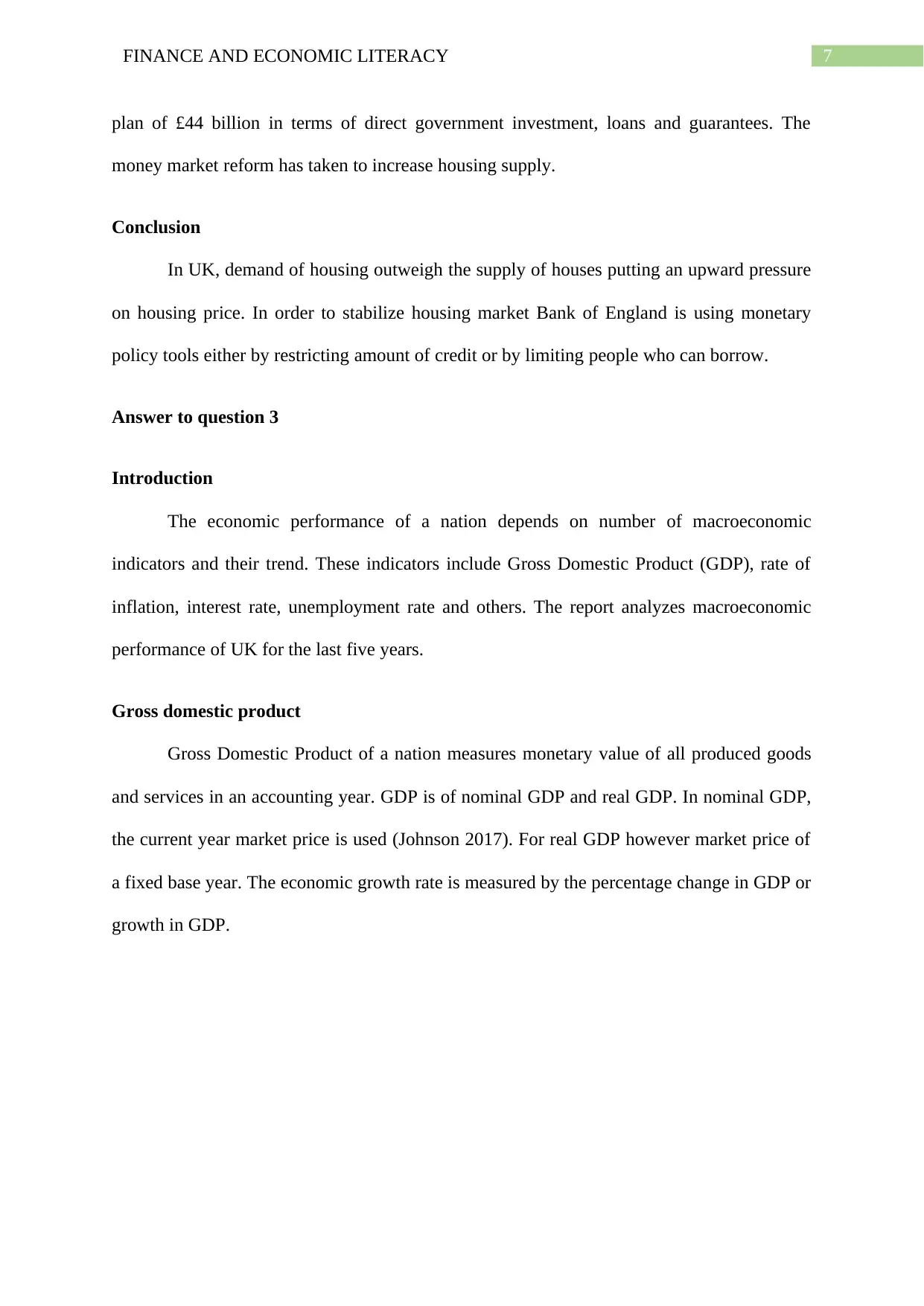

Gross domestic product

Gross Domestic Product of a nation measures monetary value of all produced goods

and services in an accounting year. GDP is of nominal GDP and real GDP. In nominal GDP,

the current year market price is used (Johnson 2017). For real GDP however market price of

a fixed base year. The economic growth rate is measured by the percentage change in GDP or

growth in GDP.

plan of £44 billion in terms of direct government investment, loans and guarantees. The

money market reform has taken to increase housing supply.

Conclusion

In UK, demand of housing outweigh the supply of houses putting an upward pressure

on housing price. In order to stabilize housing market Bank of England is using monetary

policy tools either by restricting amount of credit or by limiting people who can borrow.

Answer to question 3

Introduction

The economic performance of a nation depends on number of macroeconomic

indicators and their trend. These indicators include Gross Domestic Product (GDP), rate of

inflation, interest rate, unemployment rate and others. The report analyzes macroeconomic

performance of UK for the last five years.

Gross domestic product

Gross Domestic Product of a nation measures monetary value of all produced goods

and services in an accounting year. GDP is of nominal GDP and real GDP. In nominal GDP,

the current year market price is used (Johnson 2017). For real GDP however market price of

a fixed base year. The economic growth rate is measured by the percentage change in GDP or

growth in GDP.

8FINANCE AND ECONOMIC LITERACY

2013 2014 2015 2016 2017

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

2.1%

3.1%

2.3%

1.9% 1.8%

GDP growth

GDP growth

Year

Growth rate (%)

Figure 1: GDP growth in UK

(Source: statista.com 2018)

The trend in GDP growth of UK indicates that the economy is losing its momentum

following a growth slowdown in China, slump in the construction and manufacturing sector.

The nation has shown some sign of improvement. Some major factors contributing to growth

recovery of UK are improvement in oil and gas production and recovery of the mining sector.

The GDP growth at the second quarter was 0.7% (theguardian.com 2018) . Following a slow

growth, businesses in UK are facing the problem of slower demand both from home and

abroad. The manufacturing sector in UK is struggling to maintain its competitive position a

depreciated currency has made their goods and services more expensive abroad. Construction

sector, one of the important sector of economy has accounted a slowdown and failed to

contribute in GDP growth.

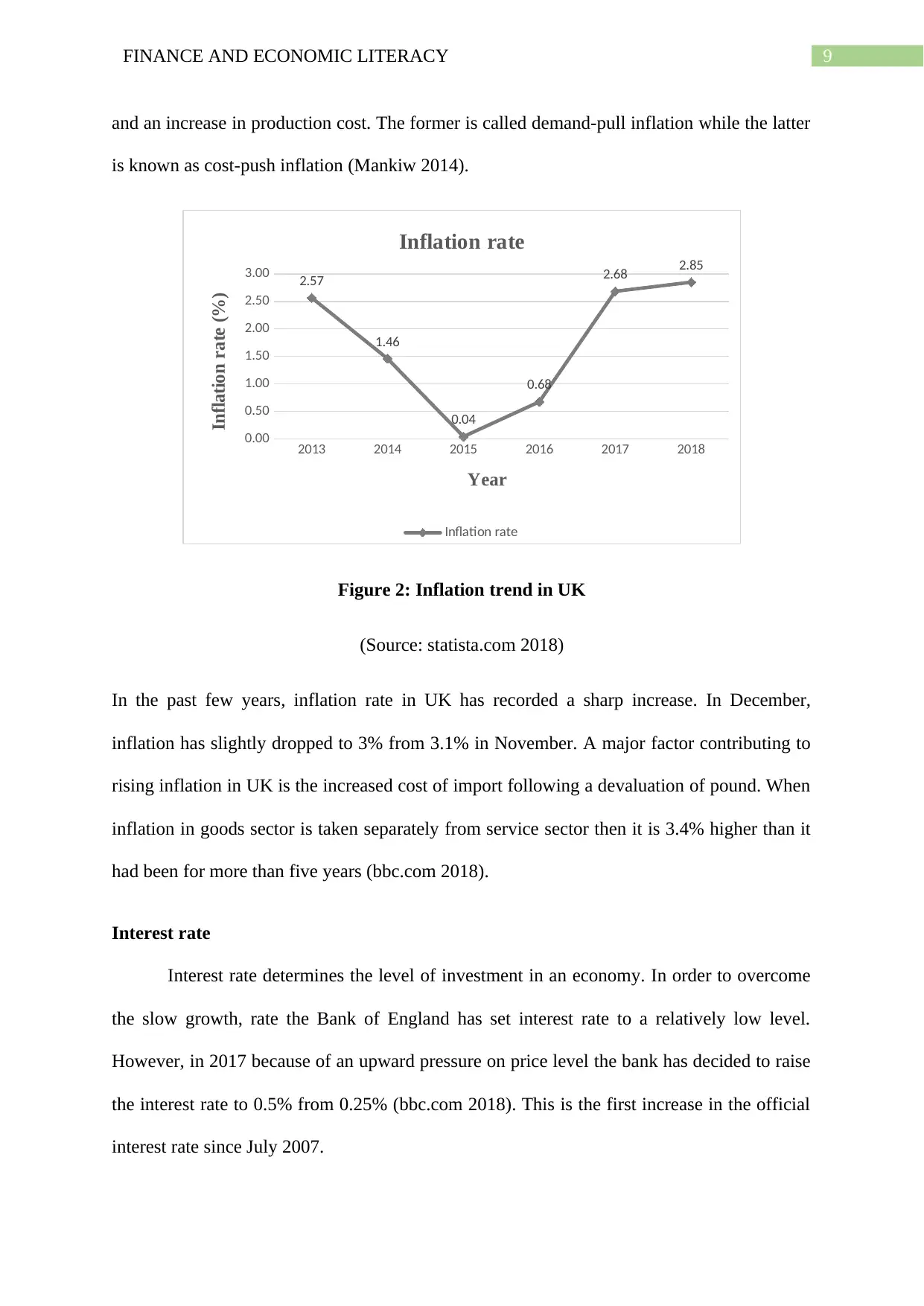

Inflation

Inflation indicates a situation of sustained increase in price resulting in a decline in

value of money and hence, a decline in purchasing power. The two root cause of inflation are

increase in overall demand that causes a supply shortage creating upward pressure on price

2013 2014 2015 2016 2017

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

2.1%

3.1%

2.3%

1.9% 1.8%

GDP growth

GDP growth

Year

Growth rate (%)

Figure 1: GDP growth in UK

(Source: statista.com 2018)

The trend in GDP growth of UK indicates that the economy is losing its momentum

following a growth slowdown in China, slump in the construction and manufacturing sector.

The nation has shown some sign of improvement. Some major factors contributing to growth

recovery of UK are improvement in oil and gas production and recovery of the mining sector.

The GDP growth at the second quarter was 0.7% (theguardian.com 2018) . Following a slow

growth, businesses in UK are facing the problem of slower demand both from home and

abroad. The manufacturing sector in UK is struggling to maintain its competitive position a

depreciated currency has made their goods and services more expensive abroad. Construction

sector, one of the important sector of economy has accounted a slowdown and failed to

contribute in GDP growth.

Inflation

Inflation indicates a situation of sustained increase in price resulting in a decline in

value of money and hence, a decline in purchasing power. The two root cause of inflation are

increase in overall demand that causes a supply shortage creating upward pressure on price

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCE AND ECONOMIC LITERACY

and an increase in production cost. The former is called demand-pull inflation while the latter

is known as cost-push inflation (Mankiw 2014).

2013 2014 2015 2016 2017 2018

0.00

0.50

1.00

1.50

2.00

2.50

3.00 2.57

1.46

0.04

0.68

2.68 2.85

Inflation rate

Inflation rate

Year

Inflation rate (%)

Figure 2: Inflation trend in UK

(Source: statista.com 2018)

In the past few years, inflation rate in UK has recorded a sharp increase. In December,

inflation has slightly dropped to 3% from 3.1% in November. A major factor contributing to

rising inflation in UK is the increased cost of import following a devaluation of pound. When

inflation in goods sector is taken separately from service sector then it is 3.4% higher than it

had been for more than five years (bbc.com 2018).

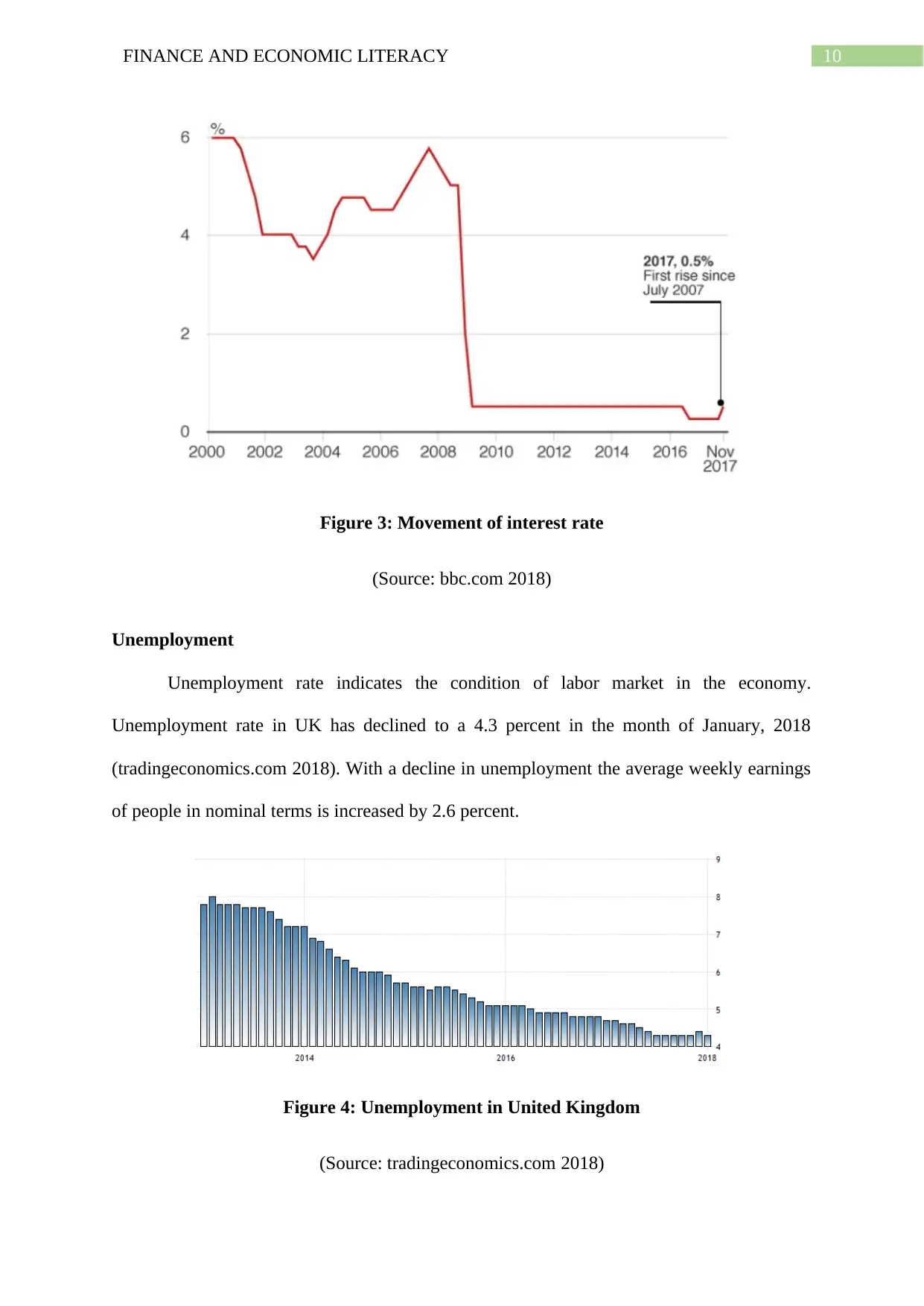

Interest rate

Interest rate determines the level of investment in an economy. In order to overcome

the slow growth, rate the Bank of England has set interest rate to a relatively low level.

However, in 2017 because of an upward pressure on price level the bank has decided to raise

the interest rate to 0.5% from 0.25% (bbc.com 2018). This is the first increase in the official

interest rate since July 2007.

and an increase in production cost. The former is called demand-pull inflation while the latter

is known as cost-push inflation (Mankiw 2014).

2013 2014 2015 2016 2017 2018

0.00

0.50

1.00

1.50

2.00

2.50

3.00 2.57

1.46

0.04

0.68

2.68 2.85

Inflation rate

Inflation rate

Year

Inflation rate (%)

Figure 2: Inflation trend in UK

(Source: statista.com 2018)

In the past few years, inflation rate in UK has recorded a sharp increase. In December,

inflation has slightly dropped to 3% from 3.1% in November. A major factor contributing to

rising inflation in UK is the increased cost of import following a devaluation of pound. When

inflation in goods sector is taken separately from service sector then it is 3.4% higher than it

had been for more than five years (bbc.com 2018).

Interest rate

Interest rate determines the level of investment in an economy. In order to overcome

the slow growth, rate the Bank of England has set interest rate to a relatively low level.

However, in 2017 because of an upward pressure on price level the bank has decided to raise

the interest rate to 0.5% from 0.25% (bbc.com 2018). This is the first increase in the official

interest rate since July 2007.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCE AND ECONOMIC LITERACY

Figure 3: Movement of interest rate

(Source: bbc.com 2018)

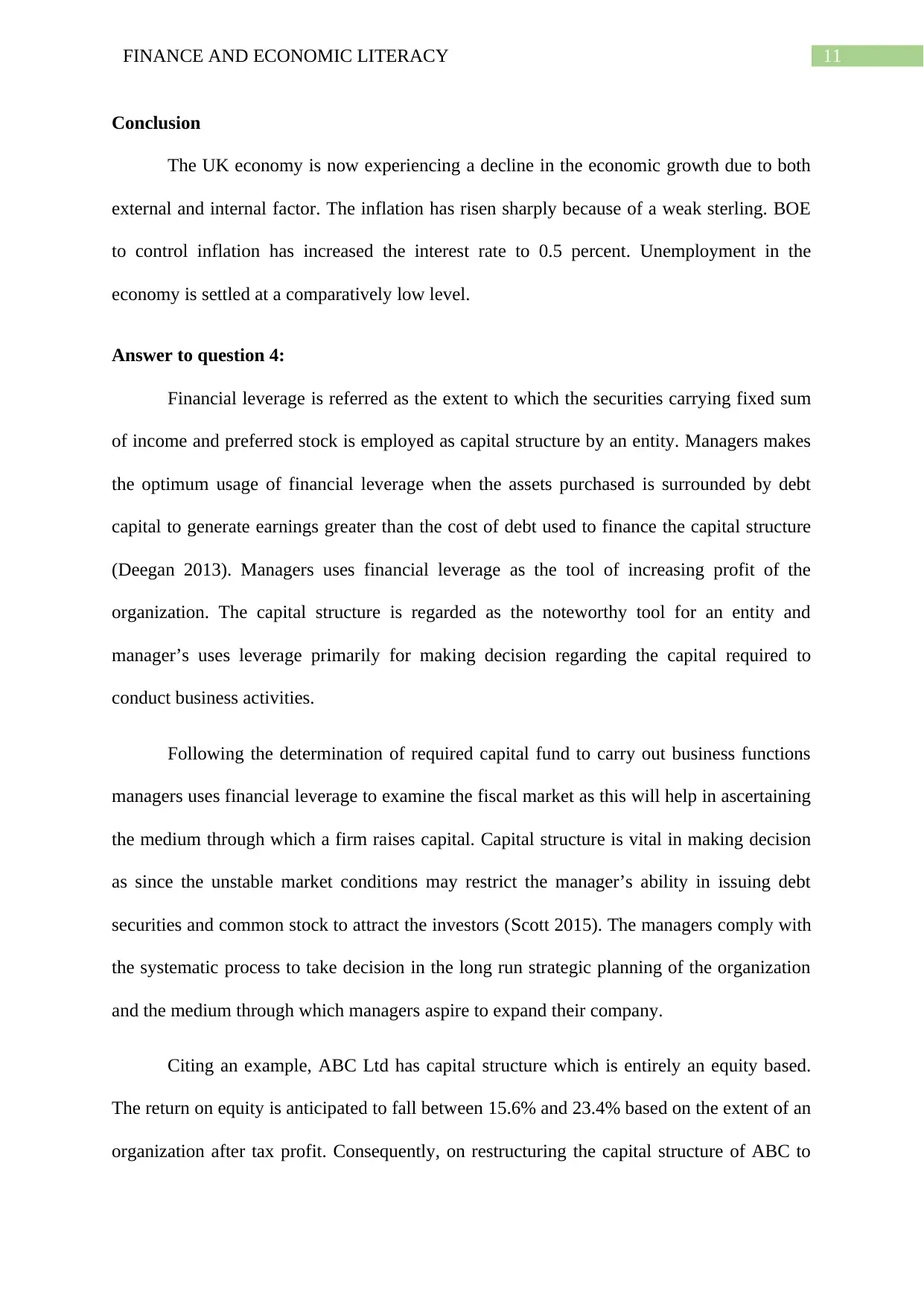

Unemployment

Unemployment rate indicates the condition of labor market in the economy.

Unemployment rate in UK has declined to a 4.3 percent in the month of January, 2018

(tradingeconomics.com 2018). With a decline in unemployment the average weekly earnings

of people in nominal terms is increased by 2.6 percent.

Figure 4: Unemployment in United Kingdom

(Source: tradingeconomics.com 2018)

Figure 3: Movement of interest rate

(Source: bbc.com 2018)

Unemployment

Unemployment rate indicates the condition of labor market in the economy.

Unemployment rate in UK has declined to a 4.3 percent in the month of January, 2018

(tradingeconomics.com 2018). With a decline in unemployment the average weekly earnings

of people in nominal terms is increased by 2.6 percent.

Figure 4: Unemployment in United Kingdom

(Source: tradingeconomics.com 2018)

11FINANCE AND ECONOMIC LITERACY

Conclusion

The UK economy is now experiencing a decline in the economic growth due to both

external and internal factor. The inflation has risen sharply because of a weak sterling. BOE

to control inflation has increased the interest rate to 0.5 percent. Unemployment in the

economy is settled at a comparatively low level.

Answer to question 4:

Financial leverage is referred as the extent to which the securities carrying fixed sum

of income and preferred stock is employed as capital structure by an entity. Managers makes

the optimum usage of financial leverage when the assets purchased is surrounded by debt

capital to generate earnings greater than the cost of debt used to finance the capital structure

(Deegan 2013). Managers uses financial leverage as the tool of increasing profit of the

organization. The capital structure is regarded as the noteworthy tool for an entity and

manager’s uses leverage primarily for making decision regarding the capital required to

conduct business activities.

Following the determination of required capital fund to carry out business functions

managers uses financial leverage to examine the fiscal market as this will help in ascertaining

the medium through which a firm raises capital. Capital structure is vital in making decision

as since the unstable market conditions may restrict the manager’s ability in issuing debt

securities and common stock to attract the investors (Scott 2015). The managers comply with

the systematic process to take decision in the long run strategic planning of the organization

and the medium through which managers aspire to expand their company.

Citing an example, ABC Ltd has capital structure which is entirely an equity based.

The return on equity is anticipated to fall between 15.6% and 23.4% based on the extent of an

organization after tax profit. Consequently, on restructuring the capital structure of ABC to

Conclusion

The UK economy is now experiencing a decline in the economic growth due to both

external and internal factor. The inflation has risen sharply because of a weak sterling. BOE

to control inflation has increased the interest rate to 0.5 percent. Unemployment in the

economy is settled at a comparatively low level.

Answer to question 4:

Financial leverage is referred as the extent to which the securities carrying fixed sum

of income and preferred stock is employed as capital structure by an entity. Managers makes

the optimum usage of financial leverage when the assets purchased is surrounded by debt

capital to generate earnings greater than the cost of debt used to finance the capital structure

(Deegan 2013). Managers uses financial leverage as the tool of increasing profit of the

organization. The capital structure is regarded as the noteworthy tool for an entity and

manager’s uses leverage primarily for making decision regarding the capital required to

conduct business activities.

Following the determination of required capital fund to carry out business functions

managers uses financial leverage to examine the fiscal market as this will help in ascertaining

the medium through which a firm raises capital. Capital structure is vital in making decision

as since the unstable market conditions may restrict the manager’s ability in issuing debt

securities and common stock to attract the investors (Scott 2015). The managers comply with

the systematic process to take decision in the long run strategic planning of the organization

and the medium through which managers aspire to expand their company.

Citing an example, ABC Ltd has capital structure which is entirely an equity based.

The return on equity is anticipated to fall between 15.6% and 23.4% based on the extent of an

organization after tax profit. Consequently, on restructuring the capital structure of ABC to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.