Report on Financial Economics: Bank Profitability Analysis

VerifiedAdded on 2020/04/15

|23

|6033

|58

Report

AI Summary

This report examines the determinants of profitability for both state-owned and joint-stock Chinese commercial banks following the global economic crisis (GFC). The analysis categorizes determinants into internal factors (bank-specific, such as asset composition, capital adequacy, and operational efficiency) and external factors (macroeconomic environment and industry structure). The study employs principal component analysis and data envelopment analysis to assess profitability, focusing on metrics like ROA, ROE, and NIM. It explores the impact of bank size, cost-to-income ratio, capital adequacy, and non-performing loans, along with macroeconomic variables like inflation and GDP. The research highlights the importance of internal factors, including management quality and corporate governance, while also considering external influences on bank performance. The report concludes by synthesizing these factors to provide insights into the financial health and operational efficiency of Chinese commercial banks.

Running head: FINANCIAL ECONOMICS

FINANCIAL ECONOMICS

Name of the Student

Name of the University

Author’s Note

FINANCIAL ECONOMICS

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ECONOMICS

Table of Contents

Literature Review............................................................................................................................2

Introduction......................................................................................................................................2

Research methods of profitability of commercial banks.................................................................2

Principal component analysis......................................................................................................2

Data envelopment analysis..........................................................................................................4

Internal factors and profitability......................................................................................................5

Theoretical aspects.......................................................................................................................5

Empirical aspect...........................................................................................................................8

External factors and profitability...................................................................................................10

Macro environment....................................................................................................................10

Industry structure (Market concentration).................................................................................13

Conclusion.....................................................................................................................................14

References......................................................................................................................................16

Table of Contents

Literature Review............................................................................................................................2

Introduction......................................................................................................................................2

Research methods of profitability of commercial banks.................................................................2

Principal component analysis......................................................................................................2

Data envelopment analysis..........................................................................................................4

Internal factors and profitability......................................................................................................5

Theoretical aspects.......................................................................................................................5

Empirical aspect...........................................................................................................................8

External factors and profitability...................................................................................................10

Macro environment....................................................................................................................10

Industry structure (Market concentration).................................................................................13

Conclusion.....................................................................................................................................14

References......................................................................................................................................16

2FINANCIAL ECONOMICS

Literature Review

Introduction

This chapter examines the determinants of profitability of state-owned as well as joint-

stock Chinese commercial banks after the global economic crisis (GFC). The determinants of

profitability of the commercial banks are usually grouped into both the internal factors and

external factors. The internal factors are generally under the control of management while the

external factors are ahead of the bank management control. The internal determinants provide the

reflection of how the bank management policies as well as decisions vary regarding the

composition of assets (Allah Teng-su-dao & Yu-ming, 2013). This signifies the amount of

investment in both current as well as non-current assets, deposit composition interpreting current

as well as fixed deposits, capital adequacy indicating ratio of debt to equity, efficiency in

operative expense and the dependency on the liquidity management and debt leverage. Both the

theoretical and empirical aspect of these internal factors is analyzed in this study. On the other

hand, the external determinants of profitability including macro environment and industry

structure are also explained in this research study. A well –capitalized commercial bank is risk

averse and improves confidence of the public, reduces cost of bankruptcy and leads to positive

effect on profit margin.

Research methods of profitability of commercial banks

The determinant that affects the profitability in commercial banks is split into two groups that

includes- internal or bank specific factors and external or macroeconomic factors as well as

industry structure. The internal factors includes bank size, cost to income ratio, capital adequacy

Literature Review

Introduction

This chapter examines the determinants of profitability of state-owned as well as joint-

stock Chinese commercial banks after the global economic crisis (GFC). The determinants of

profitability of the commercial banks are usually grouped into both the internal factors and

external factors. The internal factors are generally under the control of management while the

external factors are ahead of the bank management control. The internal determinants provide the

reflection of how the bank management policies as well as decisions vary regarding the

composition of assets (Allah Teng-su-dao & Yu-ming, 2013). This signifies the amount of

investment in both current as well as non-current assets, deposit composition interpreting current

as well as fixed deposits, capital adequacy indicating ratio of debt to equity, efficiency in

operative expense and the dependency on the liquidity management and debt leverage. Both the

theoretical and empirical aspect of these internal factors is analyzed in this study. On the other

hand, the external determinants of profitability including macro environment and industry

structure are also explained in this research study. A well –capitalized commercial bank is risk

averse and improves confidence of the public, reduces cost of bankruptcy and leads to positive

effect on profit margin.

Research methods of profitability of commercial banks

The determinant that affects the profitability in commercial banks is split into two groups that

includes- internal or bank specific factors and external or macroeconomic factors as well as

industry structure. The internal factors includes bank size, cost to income ratio, capital adequacy

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ECONOMICS

ratio, interbank offered rate etc while the external factors includes inflation, GDP,

unemployment rate etc.

Bank size has been considered as the pertinent determinant of its profitability level. Large

size banks reduce cost due to economies of scale. In fact, diversification opportunities permit in

maintaining returns while reducing risk. On the contrary, large bank size implies that it can be

unmanageable to the management or it might be result of aggressive growth strategy of banks.

De Haan & Poghosyan (2012) states that, large bank size tend to be highly profitable in the

industrial nations. In case of Chinese banks, large bank size seems to be linked with more

government intervention as the they are the state owned commercial banks with huge portion of

government intervention and ownership.

Cost to income ratio refers to the measure of efficiency indicating the cost of operation in

banks as percentage of income. Qin & Dickson (2012) states that larger the cost to income ratio,

less efficient the commercial banks will be. This in turn adversely impacts on the banks profit

based on the extent of market competition.

Capital adequacy ratio (CAR) refers to the ratio of banks capital to their risk. This helps in

determining the capacity of banks for meeting time liabilities as well as other risk including

operational risk, credit risk etc. Zhao, Zuo & Zillante (2013) found out that this ratio affects the

performance of banks positively, although it is confined to state-owned banks.

Inter- bank offered rate refers to the interest rate at which the commercial banks lend as well

as borrow from each other in the inter- bank market. The commercial banks borrow as well as

lend money in the interbank market for managing liquidity and meeting reserve requirements

sited by regulators. This rate has been considered as the leading gauge for the central bank when

ratio, interbank offered rate etc while the external factors includes inflation, GDP,

unemployment rate etc.

Bank size has been considered as the pertinent determinant of its profitability level. Large

size banks reduce cost due to economies of scale. In fact, diversification opportunities permit in

maintaining returns while reducing risk. On the contrary, large bank size implies that it can be

unmanageable to the management or it might be result of aggressive growth strategy of banks.

De Haan & Poghosyan (2012) states that, large bank size tend to be highly profitable in the

industrial nations. In case of Chinese banks, large bank size seems to be linked with more

government intervention as the they are the state owned commercial banks with huge portion of

government intervention and ownership.

Cost to income ratio refers to the measure of efficiency indicating the cost of operation in

banks as percentage of income. Qin & Dickson (2012) states that larger the cost to income ratio,

less efficient the commercial banks will be. This in turn adversely impacts on the banks profit

based on the extent of market competition.

Capital adequacy ratio (CAR) refers to the ratio of banks capital to their risk. This helps in

determining the capacity of banks for meeting time liabilities as well as other risk including

operational risk, credit risk etc. Zhao, Zuo & Zillante (2013) found out that this ratio affects the

performance of banks positively, although it is confined to state-owned banks.

Inter- bank offered rate refers to the interest rate at which the commercial banks lend as well

as borrow from each other in the inter- bank market. The commercial banks borrow as well as

lend money in the interbank market for managing liquidity and meeting reserve requirements

sited by regulators. This rate has been considered as the leading gauge for the central bank when

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ECONOMICS

they creates as well as conducts monetary policies. This factor also helps in determining

profitability rate in the state owned as well as joint stocks commercial banks.

Nonperforming loan ratio refers to the sum of total amount borrowed upon which the

payments has not been made by the debtor for 90 days. The lending policy of the commercial

banks has vital influence on the NPLs. This lending decision of the banks in turn has huge

significance in the banks as it determines their future level of profitability and performance. As

stated by Tan & Floros (2012), the immediate result of huge amount of total NPLs leads to

failure in banks and economic slowdown.

Besides this, the profitability in banks can be measured in terms of return on

equity(ROE), return on assets (ROA) and net interest margin(NIM). The primary interest of bank

owners is ROE as with the help of this they earn on investment, which in turn depends on ROA

and total asset value. ROA refers to the financial ratio that reflects profit percentage that the bank

earns with respect to its total resources. Similarly, NIM reflects how well the commercial banks

earn income on their assets. Thus, high NIM signifies well-managed commercial banks and also

signifies future profitability.

Principal component analysis

Principal component analysis refers to the mathematical process that is used to transform

number of correlated variables into uncorrelated variables. It also represents powerful tool to

analyze data by declining several dimensions without any loss of information applied in datasets.

The PC is used for identifying risk exposure and determine profitability in banks

In order to measure the profitability of Chinese commercial banks, the principal

component analysis has been carried out. The principal component variable that is used in this

they creates as well as conducts monetary policies. This factor also helps in determining

profitability rate in the state owned as well as joint stocks commercial banks.

Nonperforming loan ratio refers to the sum of total amount borrowed upon which the

payments has not been made by the debtor for 90 days. The lending policy of the commercial

banks has vital influence on the NPLs. This lending decision of the banks in turn has huge

significance in the banks as it determines their future level of profitability and performance. As

stated by Tan & Floros (2012), the immediate result of huge amount of total NPLs leads to

failure in banks and economic slowdown.

Besides this, the profitability in banks can be measured in terms of return on

equity(ROE), return on assets (ROA) and net interest margin(NIM). The primary interest of bank

owners is ROE as with the help of this they earn on investment, which in turn depends on ROA

and total asset value. ROA refers to the financial ratio that reflects profit percentage that the bank

earns with respect to its total resources. Similarly, NIM reflects how well the commercial banks

earn income on their assets. Thus, high NIM signifies well-managed commercial banks and also

signifies future profitability.

Principal component analysis

Principal component analysis refers to the mathematical process that is used to transform

number of correlated variables into uncorrelated variables. It also represents powerful tool to

analyze data by declining several dimensions without any loss of information applied in datasets.

The PC is used for identifying risk exposure and determine profitability in banks

In order to measure the profitability of Chinese commercial banks, the principal

component analysis has been carried out. The principal component variable that is used in this

5FINANCIAL ECONOMICS

study includes ROAA, ROAE and NIM. ROAA, ROAE and NIM represents return on assets,

return on equity and net interest margin. The principal component analysis attempts in

reorganizing the multiple indicators with specific correlation into new set of indicators, which

are not dependent on each other (Chen, Chong & She, 2014). ROA refers to an indicator that

indicates the profitability level of bank or organization in relation to its total assets. It is

estimated by the ratio of net income to the total assets. It has been seen from the article

(Economics.uwo.ca, 2017) that, higher the ROA, lower the risk of banks’ financial instability.

The ability of bank helps in generating sufficient as well as sustainable profitability raises its

market continuity. However, in China, the ROA reflects positive sign of coefficient. This reflects

the fact that after the GFC, the profitability level of Chinese commercial banks increased and risk

of instability in banks also decreased.

ROE refers to the net amount of income returned in terms of percentage of the

shareholders equity. It determines profitability that is generated from the total amount of capital ,

which the shareholder. The ROE of the Chinese banks increased from 2009 to 2014 but suddenly

it fell in the last two years ( 2015 and 2016). This highlights that the level of profitability

increased from 2009 to 2014 but it fell in the last two years, which adversely affected their

financial performance. In comparison to ROE, ROA has been considered as the better measure of

the banks profitability as it is affected by banks capital structure.

Another principal component that has been used in determining the profitability of

Chinese commercial banks is NIM. NIM refers to the measurement of the divergence between

interest income that has been generated by banks and the interest given to the lenders (Ijsrp.org.

2017). Recent statistics shows that the NIM in Chinese banks has increased over the years 2009

study includes ROAA, ROAE and NIM. ROAA, ROAE and NIM represents return on assets,

return on equity and net interest margin. The principal component analysis attempts in

reorganizing the multiple indicators with specific correlation into new set of indicators, which

are not dependent on each other (Chen, Chong & She, 2014). ROA refers to an indicator that

indicates the profitability level of bank or organization in relation to its total assets. It is

estimated by the ratio of net income to the total assets. It has been seen from the article

(Economics.uwo.ca, 2017) that, higher the ROA, lower the risk of banks’ financial instability.

The ability of bank helps in generating sufficient as well as sustainable profitability raises its

market continuity. However, in China, the ROA reflects positive sign of coefficient. This reflects

the fact that after the GFC, the profitability level of Chinese commercial banks increased and risk

of instability in banks also decreased.

ROE refers to the net amount of income returned in terms of percentage of the

shareholders equity. It determines profitability that is generated from the total amount of capital ,

which the shareholder. The ROE of the Chinese banks increased from 2009 to 2014 but suddenly

it fell in the last two years ( 2015 and 2016). This highlights that the level of profitability

increased from 2009 to 2014 but it fell in the last two years, which adversely affected their

financial performance. In comparison to ROE, ROA has been considered as the better measure of

the banks profitability as it is affected by banks capital structure.

Another principal component that has been used in determining the profitability of

Chinese commercial banks is NIM. NIM refers to the measurement of the divergence between

interest income that has been generated by banks and the interest given to the lenders (Ijsrp.org.

2017). Recent statistics shows that the NIM in Chinese banks has increased over the years 2009

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ECONOMICS

to 2016. Therefore higher the NIM, larger will be the profit margin of banks. This variable is

attributable to the huge operational efficiency and better management.

After the GFC, these coefficients highlights that total assets as well as bank capitalization

had no adverse impact on the anticipated high value variables such as equity ratio, capital

adequacy ratio, ROE, ROA etc. Additionally, bank capitalization as well as assets exerted no

positive impact on the small value variables such as operating cost ratio (Johnston, 2014). The

size of bank capitalization had positive impact on the capital adequacy and equity ratio after the

sub-prime crisis period. This reflects that capitalization of bank counteracts the adverse impact

on the capital adequacy during the financial crisis period

Data envelopment analysis

DEA refers to the non-parametric efficiency evaluation methodology from output to input

that uses output with input and hence constrict effective decision-making unit (DMU). It is

specially used for measuring productive efficiency of the banks or decision-making units

(DMU). This tool is also utilized to benchmark in the banks operation management for

estimating production and profitability level.

After the GFC, the results of DEA reflect that the technical efficiency and profitability of

the commercial had less volatility. The output indicators shows that total loans of the five state

owned banks in China had decreased while the total deposits increased during this period

(Dietrich & Wanzenried, 2012). Likewise, the output indicators of joint stock commercial banks

indicates that the total loans had declined but the input indicators signifies that total deposit had

increased over the years. But the statistics reflects that the total deposits in state owned Chinese

commercial banks is higher than joint- stock banks (Luo & Liang, 2012) . This signifies that the

to 2016. Therefore higher the NIM, larger will be the profit margin of banks. This variable is

attributable to the huge operational efficiency and better management.

After the GFC, these coefficients highlights that total assets as well as bank capitalization

had no adverse impact on the anticipated high value variables such as equity ratio, capital

adequacy ratio, ROE, ROA etc. Additionally, bank capitalization as well as assets exerted no

positive impact on the small value variables such as operating cost ratio (Johnston, 2014). The

size of bank capitalization had positive impact on the capital adequacy and equity ratio after the

sub-prime crisis period. This reflects that capitalization of bank counteracts the adverse impact

on the capital adequacy during the financial crisis period

Data envelopment analysis

DEA refers to the non-parametric efficiency evaluation methodology from output to input

that uses output with input and hence constrict effective decision-making unit (DMU). It is

specially used for measuring productive efficiency of the banks or decision-making units

(DMU). This tool is also utilized to benchmark in the banks operation management for

estimating production and profitability level.

After the GFC, the results of DEA reflect that the technical efficiency and profitability of

the commercial had less volatility. The output indicators shows that total loans of the five state

owned banks in China had decreased while the total deposits increased during this period

(Dietrich & Wanzenried, 2012). Likewise, the output indicators of joint stock commercial banks

indicates that the total loans had declined but the input indicators signifies that total deposit had

increased over the years. But the statistics reflects that the total deposits in state owned Chinese

commercial banks is higher than joint- stock banks (Luo & Liang, 2012) . This signifies that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ECONOMICS

performance of state owned banks was better than joint owned banks in this nation after the

GFC. Chinese commercial banks adopts DEA as it benefits them in two ways that includes-

DEA does not require for constructing particular production function or coefficients of

functions that can avoid unwanted results caused by individuals wrong settings of pattern

function

DEA effectively deals with problems of both qualitative as well as quantitative indicators

that might settle the ratio scale and scale data compatibility along with less restraint of

the values.

Kapan & Minoiu (2013) found out that, DEA helps in analyzing the efficiency of both the state

–owned and joint- stock commercial banks in China. This in turn facilitates in determining

profitability of these banks.

Internal factors (bank specific)

Theoretical aspects

The internal factors of the commercial bank play significant role in finding its

profitability level. It has been opined by Zhao, Zuo & Zillante (2015) that, the internal factors of

the banks includes bank size, equity ratio, cost- to income ratio, core capital adequacy ratio,

inter-bank offered rate and non- performing loan ratio. Chen, Chen. & Gerlach (2013) has

founded that the commercial bank capital have direct effect on the profits of the bank. With the

increasing expansion as well as development of the commercial banking sector in China and its

vital position of this nation’s financial system, their operational efficiency has been mainly

focused on for increasing their profitability. The commercial banks of China have currently

adopted two main efficiency assessing methods that includes- SFA (Stochastic frontier approach)

performance of state owned banks was better than joint owned banks in this nation after the

GFC. Chinese commercial banks adopts DEA as it benefits them in two ways that includes-

DEA does not require for constructing particular production function or coefficients of

functions that can avoid unwanted results caused by individuals wrong settings of pattern

function

DEA effectively deals with problems of both qualitative as well as quantitative indicators

that might settle the ratio scale and scale data compatibility along with less restraint of

the values.

Kapan & Minoiu (2013) found out that, DEA helps in analyzing the efficiency of both the state

–owned and joint- stock commercial banks in China. This in turn facilitates in determining

profitability of these banks.

Internal factors (bank specific)

Theoretical aspects

The internal factors of the commercial bank play significant role in finding its

profitability level. It has been opined by Zhao, Zuo & Zillante (2015) that, the internal factors of

the banks includes bank size, equity ratio, cost- to income ratio, core capital adequacy ratio,

inter-bank offered rate and non- performing loan ratio. Chen, Chen. & Gerlach (2013) has

founded that the commercial bank capital have direct effect on the profits of the bank. With the

increasing expansion as well as development of the commercial banking sector in China and its

vital position of this nation’s financial system, their operational efficiency has been mainly

focused on for increasing their profitability. The commercial banks of China have currently

adopted two main efficiency assessing methods that includes- SFA (Stochastic frontier approach)

8FINANCIAL ECONOMICS

and DEA (data envelopment analysis). The efficiency of bank also includes technical efficiency

and scale efficiency. Technical efficiency has been used for measuring the ability of

manufactures receiving maximum output in the present technology level. On the other hand,

scale efficiency signifies the effect of changes in the efficiency size. Wang (2014) found that, the

profitability of bank measured in terms of return on equity (ROE) is directly related to

concentration of bank, ownership of bank and other macroeconomic variables. In addition, the

intangible bank specific determinants are also important in determining the profitability in the

banks. One of the example is the quality of bank managerial decisions. Martin (2012) stated that,

the quality of management of commercial bank is closely linked to corporate governance.

However, there have been peculiar circumstances in China in account of corporate governance,

taken from its transformation to the market economy. The Chinese banks in fact are subject to

huge extent to government intervention. There have been several cases in which the Chinese

commercial banks were not free in choosing their structure of asset as credit has been directly or

indirectly managed by the governments (Sun, 2013). Therefore, weak corporate governance

results in low quality of asset, high liquidity and hindering profitability. The Chinese banks that

are owned by government are subject to huge government intervention as compared to the banks

of private ownership.

Empirical Aspect

Both the state-owned and joint stock commercial banks in China gain profit from their

lending activities. The empirical aspect signifies that the structure of market was not the main

factor that influenced the profitability of banks. The profitability of banks has been measured by

using Return on Assets ( ROA) and return on equity ( ROE) and Net interest margin (NIM).

Besides, the ROA on the state –owned commercial banks has been lower than those of joint-

and DEA (data envelopment analysis). The efficiency of bank also includes technical efficiency

and scale efficiency. Technical efficiency has been used for measuring the ability of

manufactures receiving maximum output in the present technology level. On the other hand,

scale efficiency signifies the effect of changes in the efficiency size. Wang (2014) found that, the

profitability of bank measured in terms of return on equity (ROE) is directly related to

concentration of bank, ownership of bank and other macroeconomic variables. In addition, the

intangible bank specific determinants are also important in determining the profitability in the

banks. One of the example is the quality of bank managerial decisions. Martin (2012) stated that,

the quality of management of commercial bank is closely linked to corporate governance.

However, there have been peculiar circumstances in China in account of corporate governance,

taken from its transformation to the market economy. The Chinese banks in fact are subject to

huge extent to government intervention. There have been several cases in which the Chinese

commercial banks were not free in choosing their structure of asset as credit has been directly or

indirectly managed by the governments (Sun, 2013). Therefore, weak corporate governance

results in low quality of asset, high liquidity and hindering profitability. The Chinese banks that

are owned by government are subject to huge government intervention as compared to the banks

of private ownership.

Empirical Aspect

Both the state-owned and joint stock commercial banks in China gain profit from their

lending activities. The empirical aspect signifies that the structure of market was not the main

factor that influenced the profitability of banks. The profitability of banks has been measured by

using Return on Assets ( ROA) and return on equity ( ROE) and Net interest margin (NIM).

Besides, the ROA on the state –owned commercial banks has been lower than those of joint-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ECONOMICS

stock banks while the ROE for state –owned has been higher than that of joint –stock banks.

ROA has been used for two reasons, which includes-

Firstly, ROA is more comprehensive determinant of profitability

Secondly, it is allows comparison between the commercial banks of China

Recent study reflects that the total assets of the Chinese commercial banks had increased

during the period 2009 to 2016. However, this indicates that the profitability level of the state

owned and joint stock banks improved over this period.

Liang (2012) found that the cost to income ratio of the state-owned commercial bank in

China had decreased during the period 2009 to 2016. Likewise, the joint stock commercial banks

in this nation also decreased during this period. As a result, it leads to increase in efficiency and

profitability of the Chinese commercial banks after the GFC. Moreover, decline in loss of loan

rebounds in profit margin of this country.

In addition, the Tier 1 capital adequacy ratio of both the state-owned as well as joint stock

commercial bank in China had increased slightly increased over this period. The main reason

behind this is that the business kept on expanding, the risk were under the control and the

retained earnings outcomes into increase in capital. Thus, this adversely impacts on the

profitability level of the Chinese commercial banks.

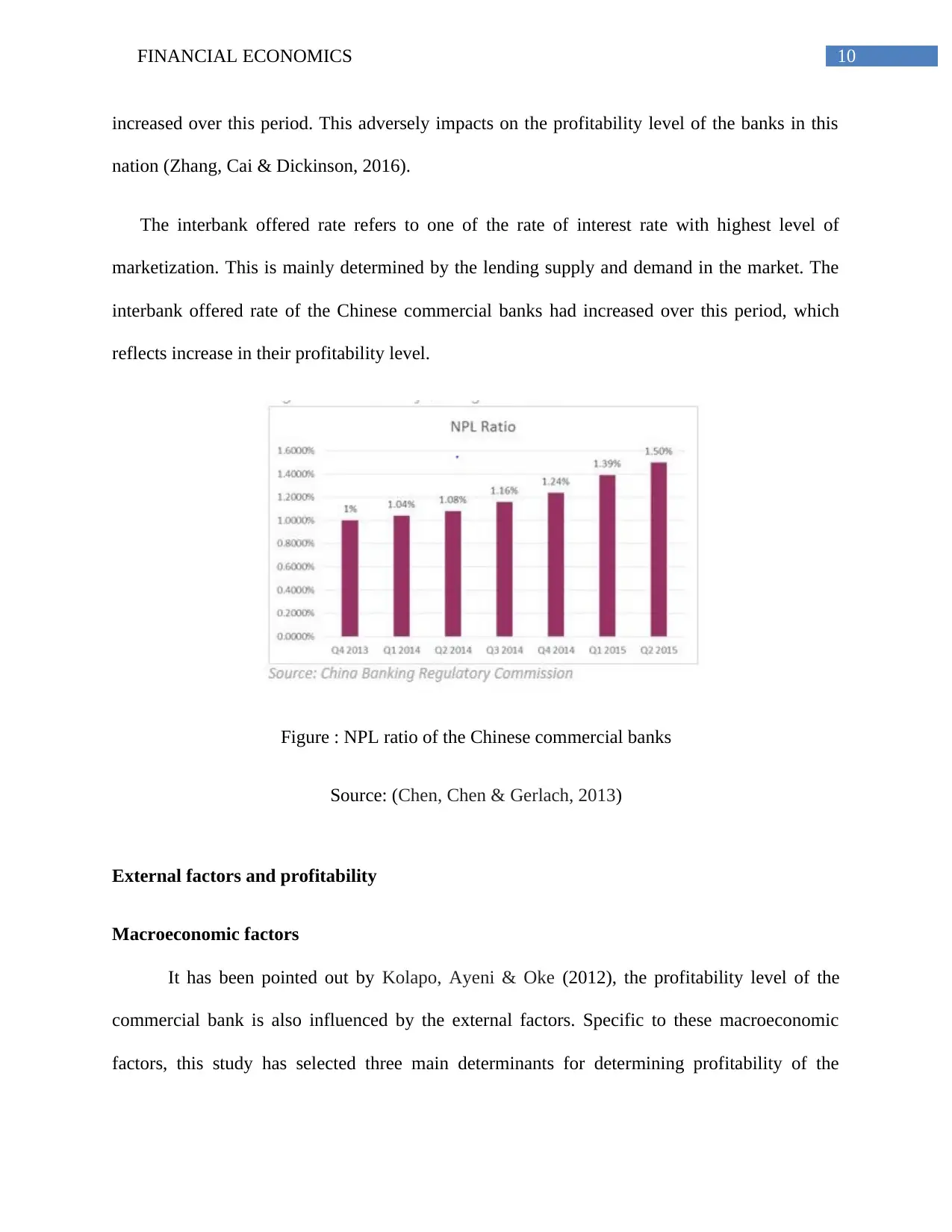

Furthermore, the nonperforming loan rate of the commercial banks in China has been rising

during this period. The rise in nonperforming loan rate (NPL) was due to general economic

downturn , decline in price of properties and bad operating conditions of the small and medium

enterprises (SME). Over this period, this NPL rate of the Chinese commercial banks had

stock banks while the ROE for state –owned has been higher than that of joint –stock banks.

ROA has been used for two reasons, which includes-

Firstly, ROA is more comprehensive determinant of profitability

Secondly, it is allows comparison between the commercial banks of China

Recent study reflects that the total assets of the Chinese commercial banks had increased

during the period 2009 to 2016. However, this indicates that the profitability level of the state

owned and joint stock banks improved over this period.

Liang (2012) found that the cost to income ratio of the state-owned commercial bank in

China had decreased during the period 2009 to 2016. Likewise, the joint stock commercial banks

in this nation also decreased during this period. As a result, it leads to increase in efficiency and

profitability of the Chinese commercial banks after the GFC. Moreover, decline in loss of loan

rebounds in profit margin of this country.

In addition, the Tier 1 capital adequacy ratio of both the state-owned as well as joint stock

commercial bank in China had increased slightly increased over this period. The main reason

behind this is that the business kept on expanding, the risk were under the control and the

retained earnings outcomes into increase in capital. Thus, this adversely impacts on the

profitability level of the Chinese commercial banks.

Furthermore, the nonperforming loan rate of the commercial banks in China has been rising

during this period. The rise in nonperforming loan rate (NPL) was due to general economic

downturn , decline in price of properties and bad operating conditions of the small and medium

enterprises (SME). Over this period, this NPL rate of the Chinese commercial banks had

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ECONOMICS

increased over this period. This adversely impacts on the profitability level of the banks in this

nation (Zhang, Cai & Dickinson, 2016).

The interbank offered rate refers to one of the rate of interest rate with highest level of

marketization. This is mainly determined by the lending supply and demand in the market. The

interbank offered rate of the Chinese commercial banks had increased over this period, which

reflects increase in their profitability level.

Figure : NPL ratio of the Chinese commercial banks

Source: (Chen, Chen & Gerlach, 2013)

External factors and profitability

Macroeconomic factors

It has been pointed out by Kolapo, Ayeni & Oke (2012), the profitability level of the

commercial bank is also influenced by the external factors. Specific to these macroeconomic

factors, this study has selected three main determinants for determining profitability of the

increased over this period. This adversely impacts on the profitability level of the banks in this

nation (Zhang, Cai & Dickinson, 2016).

The interbank offered rate refers to one of the rate of interest rate with highest level of

marketization. This is mainly determined by the lending supply and demand in the market. The

interbank offered rate of the Chinese commercial banks had increased over this period, which

reflects increase in their profitability level.

Figure : NPL ratio of the Chinese commercial banks

Source: (Chen, Chen & Gerlach, 2013)

External factors and profitability

Macroeconomic factors

It has been pointed out by Kolapo, Ayeni & Oke (2012), the profitability level of the

commercial bank is also influenced by the external factors. Specific to these macroeconomic

factors, this study has selected three main determinants for determining profitability of the

11FINANCIAL ECONOMICS

Chinese commercial banks. These determinants include- real GDP growth rate, growth rate of

money supply and rate of unemployment.

Real GDP growth rate refers to the measurement of the economic activity of the nation.

Increase in economic growth of this nation encourages the commercial banks in lending more

amounts and permitting them in charging higher margins and enhancing their asset quality.

Ongore & Kusa (2013) has founded direct relationship between the profitability of bank and the

real GDP. Firth, Li & Shuye (2016) opines that per capita income has been used and suggested

that this macroeconomic factor has strong positive influence on the earnings of the banks.

However, Martin (2012) findings recommended that there has been correlation between the

business cycle and profitability of banks. In addition, the real GDP growth rate influences

positively on the performance of the banks through three channels that includes- net interest

income, operating cost and improvement of loan losses. Therefore, higher GDP growth rate

causes increase in firm loans as well as deposits and makes net interest income of banks to

enhance. Rise in GDP growth rate entails higher disposable income and decline in

unemployment rate in the nation. Thus, net interest income as well as loan losses are pro-cyclical

with the growth in GDP (Yao, Luo & Loh, 2013). The real GDP growth rate during the period

2009-2016 in China had slowed significantly over the years after GFC, which reflects deposits in

banks have not increased at higher rate and hence increased the cost of loan payments.

Chinese commercial banks. These determinants include- real GDP growth rate, growth rate of

money supply and rate of unemployment.

Real GDP growth rate refers to the measurement of the economic activity of the nation.

Increase in economic growth of this nation encourages the commercial banks in lending more

amounts and permitting them in charging higher margins and enhancing their asset quality.

Ongore & Kusa (2013) has founded direct relationship between the profitability of bank and the

real GDP. Firth, Li & Shuye (2016) opines that per capita income has been used and suggested

that this macroeconomic factor has strong positive influence on the earnings of the banks.

However, Martin (2012) findings recommended that there has been correlation between the

business cycle and profitability of banks. In addition, the real GDP growth rate influences

positively on the performance of the banks through three channels that includes- net interest

income, operating cost and improvement of loan losses. Therefore, higher GDP growth rate

causes increase in firm loans as well as deposits and makes net interest income of banks to

enhance. Rise in GDP growth rate entails higher disposable income and decline in

unemployment rate in the nation. Thus, net interest income as well as loan losses are pro-cyclical

with the growth in GDP (Yao, Luo & Loh, 2013). The real GDP growth rate during the period

2009-2016 in China had slowed significantly over the years after GFC, which reflects deposits in

banks have not increased at higher rate and hence increased the cost of loan payments.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.