Analysis of Financial Lease Accounting and Impairment Loss

VerifiedAdded on 2023/04/25

|6

|1499

|442

Homework Assignment

AI Summary

This assignment solution provides a comprehensive analysis of financial lease accounting, focusing on the application of IAS 17 and the accounting treatment of impairment losses. Part A delves into the specifics of financial leases, defining key terms like lessor and lessee, and explaining the historical context of off-balance sheet financing. It elaborates on the accounting procedures for dealer lessors, including the recognition of finance lease receivables, the calculation of present values of minimum lease payments, and the impact on financial statements. Part B presents a practical calculation of impairment loss, detailing the allocation of losses across various assets such as equipment, goodwill, brand, fittings, and inventory. The solution includes journal entries to reflect the impairment loss and provides references to relevant accounting standards and literature. This assignment is a valuable resource for students studying financial accounting, offering a clear understanding of complex lease accounting principles and their practical application.

qwertyuiopasdfghjklzxcvbnmqwerty

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmrtyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

ACCOUNTING

uiopasdfghjklzxcvbnmqwertyuiopasd

fghjklzxcvbnmqwertyuiopasdfghjklzx

cvbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjklzxc

vbnmqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmrtyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyuiopas

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial lease

Part - A

A lease agreement is a contract that happens between two parties that is the lessor and the

lessee. The lessor can be defined as the owner of the asset that is the lessee will have the right

to utilise the asset in return for the payment of the rent. Historically, assets that are utilized

but not own are not projected on the statement of financial position, and hence, any liability

that is associated was also ignored out of the report – this was termed as off-balance sheet

finance and in a manner were able to keep the obligations low hence, distorting the gearing,

as well as main financial ratios (Deegan, 2011). This manner of accounting does not project

the transaction. The company often effectively own assets, as well as liability. When it comes

to modern-day accounting, the IASB framework provides that an asset is defined as a

resource controlled by an entity due to the past events, and from where the future economic

advantage are expected to accrue to the object and arise from the events of the past, the

settlement is likely to lead to the outflow from the entity of resources that embodies

economic benefits (Kieso et. al, 2010).

Lease accounting can be commented as a vital accounting section because it differs

depending on the end users. A lessor and the lessee report is prepared, and hence, accounting

of the leases happens. A lessor is the owner of the asset, and the lessee uses the leased asset

by making payment to the lessor. The accounting, as well as reporting of the lease in a

different manner has various impacts on the financial statement and ratio.

Finance lease accounting for Dealer Lessor

The initial accounting rests on the fact that the lessee must capitalise the finance leased asset

and establish lease liability for the valuation of the assets that are recognised. The accounting

for dealer lessor will be done in the following manner.

2

Part - A

A lease agreement is a contract that happens between two parties that is the lessor and the

lessee. The lessor can be defined as the owner of the asset that is the lessee will have the right

to utilise the asset in return for the payment of the rent. Historically, assets that are utilized

but not own are not projected on the statement of financial position, and hence, any liability

that is associated was also ignored out of the report – this was termed as off-balance sheet

finance and in a manner were able to keep the obligations low hence, distorting the gearing,

as well as main financial ratios (Deegan, 2011). This manner of accounting does not project

the transaction. The company often effectively own assets, as well as liability. When it comes

to modern-day accounting, the IASB framework provides that an asset is defined as a

resource controlled by an entity due to the past events, and from where the future economic

advantage are expected to accrue to the object and arise from the events of the past, the

settlement is likely to lead to the outflow from the entity of resources that embodies

economic benefits (Kieso et. al, 2010).

Lease accounting can be commented as a vital accounting section because it differs

depending on the end users. A lessor and the lessee report is prepared, and hence, accounting

of the leases happens. A lessor is the owner of the asset, and the lessee uses the leased asset

by making payment to the lessor. The accounting, as well as reporting of the lease in a

different manner has various impacts on the financial statement and ratio.

Finance lease accounting for Dealer Lessor

The initial accounting rests on the fact that the lessee must capitalise the finance leased asset

and establish lease liability for the valuation of the assets that are recognised. The accounting

for dealer lessor will be done in the following manner.

2

Financial lease

Non-current account Dr

To, Finance lease liability

(This needs to be projected by utilising the lower of the fair value of the asset or the PV of the

minimum lease payments. The PV of the lease payment on a minimum basis is essentially the

payment of lease over the discounted lease life. When it comes to the lessor, the commercial

lease can be commented to be of two major types resting under U.S GAAP. If the PV of

every lease payment is same as the carrying value of the leased asset, such lease is defined as

the financing lease. If the PV of the lease payment exceeds than the carrying value of the

leased asset, it is stated as a sales-type lease (Hamilton, Hyland & Dodd, 2011). Both the

lease are reported by the lessor ass reflected on various financial statements.

Balance sheet - The receivable lease is reported. The value is attained from the PV of the

lease that will happen in future. Even, the assets are reduced by the BV of the asset that is

leased (Needles & powers, 2013).

Income Statement – the reporting of revenue interest is done. The calculation is done on the

receivable lease at the beginning by utilising the lease interest rate.

Cash flow statement – the interest element of the lease revenue is projected as the operating

cash inflow, and the principal component of the payment is done as an investing cash flow.

When it comes to a financial lease, the dealer lessor takes into consideration the finance

income so that the regular periodic rate of return is reflected on the net investment in the

finance lease. This is attained by the allocation of the rentals that is net of any charges, etc.

received by the lessor that lies between the finance income to the lessor and the repayment of

the balance of the debtor (Petty et. al, 2012). When the lease commences, the dealer lessor

that is the company A will derecognise the asset and recognise when the finance lease is

receivable. The net investment in the lease will be termed as the lease receivable that is

computed as overall of the PV of the minimum lease payment that contains yearly rent and

the residual value that is unguaranteed (Hall, 2018). The PV of the minimum lease payment

is generally computed utilising the interest rate implicit observed in the lease. As per IAS

17:4 this rate is commented as the rate of discount that at the beginning of the lease leads to

the total of the present value of the payment of the minimum lease and residual value that is

unguaranteed that would be equivalent to the FV of the leased asset and any other cost that is

of direct nature.

3

Non-current account Dr

To, Finance lease liability

(This needs to be projected by utilising the lower of the fair value of the asset or the PV of the

minimum lease payments. The PV of the lease payment on a minimum basis is essentially the

payment of lease over the discounted lease life. When it comes to the lessor, the commercial

lease can be commented to be of two major types resting under U.S GAAP. If the PV of

every lease payment is same as the carrying value of the leased asset, such lease is defined as

the financing lease. If the PV of the lease payment exceeds than the carrying value of the

leased asset, it is stated as a sales-type lease (Hamilton, Hyland & Dodd, 2011). Both the

lease are reported by the lessor ass reflected on various financial statements.

Balance sheet - The receivable lease is reported. The value is attained from the PV of the

lease that will happen in future. Even, the assets are reduced by the BV of the asset that is

leased (Needles & powers, 2013).

Income Statement – the reporting of revenue interest is done. The calculation is done on the

receivable lease at the beginning by utilising the lease interest rate.

Cash flow statement – the interest element of the lease revenue is projected as the operating

cash inflow, and the principal component of the payment is done as an investing cash flow.

When it comes to a financial lease, the dealer lessor takes into consideration the finance

income so that the regular periodic rate of return is reflected on the net investment in the

finance lease. This is attained by the allocation of the rentals that is net of any charges, etc.

received by the lessor that lies between the finance income to the lessor and the repayment of

the balance of the debtor (Petty et. al, 2012). When the lease commences, the dealer lessor

that is the company A will derecognise the asset and recognise when the finance lease is

receivable. The net investment in the lease will be termed as the lease receivable that is

computed as overall of the PV of the minimum lease payment that contains yearly rent and

the residual value that is unguaranteed (Hall, 2018). The PV of the minimum lease payment

is generally computed utilising the interest rate implicit observed in the lease. As per IAS

17:4 this rate is commented as the rate of discount that at the beginning of the lease leads to

the total of the present value of the payment of the minimum lease and residual value that is

unguaranteed that would be equivalent to the FV of the leased asset and any other cost that is

of direct nature.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial lease

The accounting requirement needed for the lease commencement is as follows:

Finance lease receivable A/C Dr

To, P/L Ac

To, PPE A/C

To, Cash A/C

This is done to take into consideration the machine disposal and recognise the finance lease

receivable.

IAS 17:39 needs that the finance income needs to be recognised on a manner that projects a

regular periodic rate of return on the net investment of the lessor in the commercial lease

utilising the implicit rate in the lease. The dealer will consider annual payment of rent as

partly being the repayment of the financial lease and partly as interest income.

IAS 17 stress upon the fact that estimated residual value that is unguaranteed is utilised in

computing the gross investment of the lessor in a lease should be ascertained on a constant

basis (Hall, 2018). When there appears a decline in the projected residual value that is

unguaranteed, then the allocation of income over the lease term is recapped and any decline

regarding figures already accrued is recognised at once.

The main highlight of the discussion lies in the fact that the lease period of 75% or more of

the economic life has been scrapped, the conclusion that can be derived in this scenario is that

the standard of lease acknowledges some old rules (Porter & Norton, 2014). An approach that

is reasonable to ascertain whether the lease is for a major chunk of the life of the asset is the

limit of 75%. The conclusion that can be determined is the fact that 90 per cent of more can

be said to be the fair value of the asset that is underlying.

4

The accounting requirement needed for the lease commencement is as follows:

Finance lease receivable A/C Dr

To, P/L Ac

To, PPE A/C

To, Cash A/C

This is done to take into consideration the machine disposal and recognise the finance lease

receivable.

IAS 17:39 needs that the finance income needs to be recognised on a manner that projects a

regular periodic rate of return on the net investment of the lessor in the commercial lease

utilising the implicit rate in the lease. The dealer will consider annual payment of rent as

partly being the repayment of the financial lease and partly as interest income.

IAS 17 stress upon the fact that estimated residual value that is unguaranteed is utilised in

computing the gross investment of the lessor in a lease should be ascertained on a constant

basis (Hall, 2018). When there appears a decline in the projected residual value that is

unguaranteed, then the allocation of income over the lease term is recapped and any decline

regarding figures already accrued is recognised at once.

The main highlight of the discussion lies in the fact that the lease period of 75% or more of

the economic life has been scrapped, the conclusion that can be derived in this scenario is that

the standard of lease acknowledges some old rules (Porter & Norton, 2014). An approach that

is reasonable to ascertain whether the lease is for a major chunk of the life of the asset is the

limit of 75%. The conclusion that can be determined is the fact that 90 per cent of more can

be said to be the fair value of the asset that is underlying.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial lease

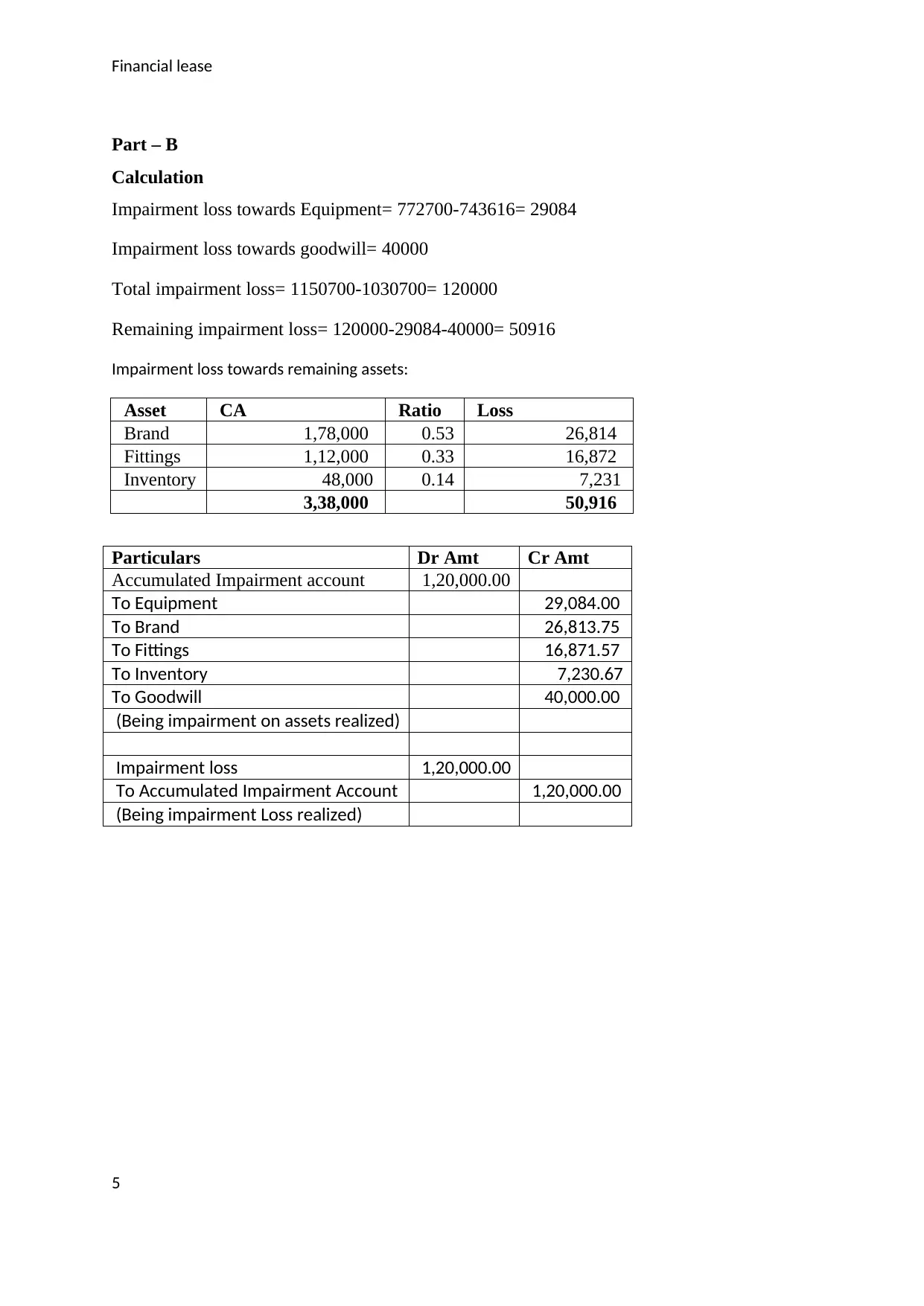

Part – B

Calculation

Impairment loss towards Equipment= 772700-743616= 29084

Impairment loss towards goodwill= 40000

Total impairment loss= 1150700-1030700= 120000

Remaining impairment loss= 120000-29084-40000= 50916

Impairment loss towards remaining assets:

Asset CA Ratio Loss

Brand 1,78,000 0.53 26,814

Fittings 1,12,000 0.33 16,872

Inventory 48,000 0.14 7,231

3,38,000 50,916

Particulars Dr Amt Cr Amt

Accumulated Impairment account 1,20,000.00

To Equipment 29,084.00

To Brand 26,813.75

To Fittings 16,871.57

To Inventory 7,230.67

To Goodwill 40,000.00

(Being impairment on assets realized)

Impairment loss 1,20,000.00

To Accumulated Impairment Account 1,20,000.00

(Being impairment Loss realized)

5

Part – B

Calculation

Impairment loss towards Equipment= 772700-743616= 29084

Impairment loss towards goodwill= 40000

Total impairment loss= 1150700-1030700= 120000

Remaining impairment loss= 120000-29084-40000= 50916

Impairment loss towards remaining assets:

Asset CA Ratio Loss

Brand 1,78,000 0.53 26,814

Fittings 1,12,000 0.33 16,872

Inventory 48,000 0.14 7,231

3,38,000 50,916

Particulars Dr Amt Cr Amt

Accumulated Impairment account 1,20,000.00

To Equipment 29,084.00

To Brand 26,813.75

To Fittings 16,871.57

To Inventory 7,230.67

To Goodwill 40,000.00

(Being impairment on assets realized)

Impairment loss 1,20,000.00

To Accumulated Impairment Account 1,20,000.00

(Being impairment Loss realized)

5

Financial lease

References

Deegan, C. M. (2011) In Financial accounting theory. North Ryde, N.S.W: McGraw-Hill

Hamilton, K., Hyland, B. and Dodd, J. L. (2011) Impairment: IASB-FASB Comparison.

Drake Management Review. [online]. 1(1), p. 55–67. Available from:

https://pdfs.semanticscholar.org/8d8f/5fd070193d6fa52e79d1dee9cc6632159d8a.pdf

[Accessed 26 January 2019]

Hall, C. (2018) Accounting. Available from: https://cpahalltalk.com/account-finance-

operating-leases/ [Accessed 26 January 2019]

Kieso, D., Weygandt, J., Warfield, T; Young, N. and Wiecek, I . (2010) Intermediate

accounting. Toronto: John Wiley & Sons Canada.

Needles, B.E., & Powers, M. (2013) Principles of Financial Accounting. Financial

Accounting Series: Cengage Learning.

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H. (2012)

Financial Management: Principles and Applications, 6th ed. Australia: Pearson Education

Australia.

Porter, G. and Norton, C. (2014) Financial Accounting: The Impact on Decision Maker.

Texas: Cengage Learning

6

References

Deegan, C. M. (2011) In Financial accounting theory. North Ryde, N.S.W: McGraw-Hill

Hamilton, K., Hyland, B. and Dodd, J. L. (2011) Impairment: IASB-FASB Comparison.

Drake Management Review. [online]. 1(1), p. 55–67. Available from:

https://pdfs.semanticscholar.org/8d8f/5fd070193d6fa52e79d1dee9cc6632159d8a.pdf

[Accessed 26 January 2019]

Hall, C. (2018) Accounting. Available from: https://cpahalltalk.com/account-finance-

operating-leases/ [Accessed 26 January 2019]

Kieso, D., Weygandt, J., Warfield, T; Young, N. and Wiecek, I . (2010) Intermediate

accounting. Toronto: John Wiley & Sons Canada.

Needles, B.E., & Powers, M. (2013) Principles of Financial Accounting. Financial

Accounting Series: Cengage Learning.

Petty, J. W, Titman, S., Keown, A. J., Martin, J. D., Burrow, M. and Nguyen, H. (2012)

Financial Management: Principles and Applications, 6th ed. Australia: Pearson Education

Australia.

Porter, G. and Norton, C. (2014) Financial Accounting: The Impact on Decision Maker.

Texas: Cengage Learning

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.