Financial Management Analysis: External Finance for Insurance Firms

VerifiedAdded on 2021/01/02

|19

|4734

|367

Report

AI Summary

This report provides a comprehensive analysis of financial management, focusing on external sources of finance available to organizations, specifically examining Legal & General Plc and Standard Life Aberdeen Plc. The report begins by classifying finance and describing various external sources, including common stock, bonds, preference shares, term loans, and leases, detailing their advantages and disadvantages. It then delves into the considerations organizations must take into account when choosing the right type of finance, such as cost, financial strength, and legal status. The methodology employed involves the use of secondary data from annual reports to conduct ratio analysis, assessing the soundness of the companies in terms of solvency. The aim is to evaluate the importance of capital structure in meeting financial requirements, providing valuable insights into the financial decisions of these insurance giants. The report concludes with recommendations based on the analysis.

Financial

Management Analysis

Management Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

1. Describing external sources of finance to organisations....................................................1

2. Enumerating considerations to be taken into account when choosing right type of finance. .6

RECOMMENDATIONS.................................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION...........................................................................................................................1

1. Describing external sources of finance to organisations....................................................1

2. Enumerating considerations to be taken into account when choosing right type of finance. .6

RECOMMENDATIONS.................................................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Purpose-

Main purpose is to evaluate source of finance available to company and also optimum

capital structure. Furthermore, to conduct ratio analysis for assessing soundness in terms of

solvency.

Aim-

To assess importance of capital structure of company in meeting finance requirements.

Scope-

The scope of this project is that capital structure of both insurance organisations are

assessed and outcome can be attained that mix of debt and equity should be present in overall

cost of capital.

Methodology-

Secondary data is used from annual reports of two companies for conducting ratio

analysis.

Limitations-

The limitation of ratio analysis is that it is based on past data. Future analysis cannot be

made because past financial data is used.

1. Describing external sources of finance to organisations

Classification of finance

The finance is needed to be raised by organisation so that it may be able to attain

operational requirements quite effectually (Burtonshaw-Gunn, 2017.). Legal & General Plc and

Standard Life Aberdeen Plc are two biggest insurance companies headquartered in UK and are

the oldest firms listed on LSE (London Stock Exchange). These insurance service provider giants

meet the demand of customers in an effective manner. Finance is classified in two elements such

as private and public finance. Firm uses business finance which is an integral part of private one

to raise funds. On the other hand, public finance is mainly for providing funds to organisation for

uplifting public welfare.

Common Stock

Common stock is also termed as equity shares which is one of the common sources of

finance raised by firm. Legal & General Plc can effectively raise funds by issuing to public and

attain requirements with ease. Equity financing is the safest source for attracting desired funds so

1

Purpose-

Main purpose is to evaluate source of finance available to company and also optimum

capital structure. Furthermore, to conduct ratio analysis for assessing soundness in terms of

solvency.

Aim-

To assess importance of capital structure of company in meeting finance requirements.

Scope-

The scope of this project is that capital structure of both insurance organisations are

assessed and outcome can be attained that mix of debt and equity should be present in overall

cost of capital.

Methodology-

Secondary data is used from annual reports of two companies for conducting ratio

analysis.

Limitations-

The limitation of ratio analysis is that it is based on past data. Future analysis cannot be

made because past financial data is used.

1. Describing external sources of finance to organisations

Classification of finance

The finance is needed to be raised by organisation so that it may be able to attain

operational requirements quite effectually (Burtonshaw-Gunn, 2017.). Legal & General Plc and

Standard Life Aberdeen Plc are two biggest insurance companies headquartered in UK and are

the oldest firms listed on LSE (London Stock Exchange). These insurance service provider giants

meet the demand of customers in an effective manner. Finance is classified in two elements such

as private and public finance. Firm uses business finance which is an integral part of private one

to raise funds. On the other hand, public finance is mainly for providing funds to organisation for

uplifting public welfare.

Common Stock

Common stock is also termed as equity shares which is one of the common sources of

finance raised by firm. Legal & General Plc can effectively raise funds by issuing to public and

attain requirements with ease. Equity financing is the safest source for attracting desired funds so

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

that financial needs can be fulfilled. This will help to attain necessary funding for gaining

operational tasks without any difficulty. Moreover, no liability arises to pay shareholders as they

are the owners and not creditors of organisation.

Advantages

It helps to absorb shocks which might be caused by worsening of economic conditions.

Financial risks are minimised as compared to funds raised by issuing bonds.

Large scale companies such as Standard Life Aberdeen Plc and Legal & General Plc can

easily trade and attain desired operations because of high liquidity.

Legal compliances are minimum on the behalf of firm and no action can be taken by

shareholders excluding financial investment (Advantages and Disadvantages of Common

Stock. 2018). Pre-emptive rights of shareholders are not violated as they are provided with right to

subscribe to additional shares, even before they are issued to public.

Disadvantages

Market price of shares of Legal & General Plc may fall leading to dissatisfaction among

shareholders and as a result, market share also gets affected.

It is one of the expensive sources of finance for funds purpose in comparison to debt

finance. Moreover, shareholders are suffered the most in case of company becomes

financially unsound.

Dividends are paid on the basis of effective performance of company. If economic

conditions become worse, then downsizing of dividends takes place affecting the holders

of common stock.

Another disadvantage of common stock is that investors are given with limited rights to

participate in management. Furthermore, financial statements are not understandable to

them and they rely on consultants for making investment and increases costs

unnecessarily on their investment.

Bonds

Bonds are one of the useful external form of raising finance that are generally backed by

terms and conditions (McPherson and Pincus, 2017). It carries certificate of indebtedness

because issuer is obliged to repay the principal amount under contract. In other words, debt

security is provided to bondholders who give funds to company. Moreover, interest accrued (on

2

operational tasks without any difficulty. Moreover, no liability arises to pay shareholders as they

are the owners and not creditors of organisation.

Advantages

It helps to absorb shocks which might be caused by worsening of economic conditions.

Financial risks are minimised as compared to funds raised by issuing bonds.

Large scale companies such as Standard Life Aberdeen Plc and Legal & General Plc can

easily trade and attain desired operations because of high liquidity.

Legal compliances are minimum on the behalf of firm and no action can be taken by

shareholders excluding financial investment (Advantages and Disadvantages of Common

Stock. 2018). Pre-emptive rights of shareholders are not violated as they are provided with right to

subscribe to additional shares, even before they are issued to public.

Disadvantages

Market price of shares of Legal & General Plc may fall leading to dissatisfaction among

shareholders and as a result, market share also gets affected.

It is one of the expensive sources of finance for funds purpose in comparison to debt

finance. Moreover, shareholders are suffered the most in case of company becomes

financially unsound.

Dividends are paid on the basis of effective performance of company. If economic

conditions become worse, then downsizing of dividends takes place affecting the holders

of common stock.

Another disadvantage of common stock is that investors are given with limited rights to

participate in management. Furthermore, financial statements are not understandable to

them and they rely on consultants for making investment and increases costs

unnecessarily on their investment.

Bonds

Bonds are one of the useful external form of raising finance that are generally backed by

terms and conditions (McPherson and Pincus, 2017). It carries certificate of indebtedness

because issuer is obliged to repay the principal amount under contract. In other words, debt

security is provided to bondholders who give funds to company. Moreover, interest accrued (on

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

coupon) has to be repaid along with principal loan amount at a stipulated date technically

referred as maturity. There are various types of bonds namely convertible, zero-coupon and

inflation-linked bonds to name a few. Interest is paid on any basis such as annually, semi-

annually or monthly.

Advantages

It is advantageous to Standard Life Aberdeen Plc and Legal & General Plc as bonds are

less volatile in comparison to common stock. It is regarded as the safest form of

investments carrying less fluctuation than equity (Altman, Iwanicz‐Drozdowska, Laitinen

and Suvas, 2017).

Another merit of bond is that it is highly liquid in nature which implies that firm can sell

good quantum of such security in the market and minimise price fluctuation up to a high

extent.

It is suitable for Legal & General Plc as it can effectively get money which can be repaid

with ease because fixed interest payment can be estimated and uncertainty is minimised. Moreover, in case organisation defaults in making outstanding payments, bondholders are

repaid firstly and legal protection is given to them which marks that recovery amount is

paid and thus, remains intact.

Disadvantages

It is unsuitable form of raising financing requirement as it is subjected to variety of risks

namely inflation, yield curve risk, credit risk and reinvestment risk to name a few. It

directly limits the usage.

Bonds are risky source of raising finance with the main reason that price changes or

fluctuation directly affects mutual funds holding such bonds. If value of bond declines,

portfolio of investment affects up to a major extent.

Since, two insurance organisations namely Legal & General Plc and Standard Life

Aberdeen Plc have global reach, exchange rate risk arises instantly which may be caused

in exchange of the foreign currencies (Crowther, 2018).

Preference Shares

Common stock is technically referred as ordinary or equity shares. On the other hand,

Standard Life Aberdeen Plc can attain desired funds with the help of issuance of preference

shares which is another source of funds generation for firm. It is mostly suitable for insurance

3

referred as maturity. There are various types of bonds namely convertible, zero-coupon and

inflation-linked bonds to name a few. Interest is paid on any basis such as annually, semi-

annually or monthly.

Advantages

It is advantageous to Standard Life Aberdeen Plc and Legal & General Plc as bonds are

less volatile in comparison to common stock. It is regarded as the safest form of

investments carrying less fluctuation than equity (Altman, Iwanicz‐Drozdowska, Laitinen

and Suvas, 2017).

Another merit of bond is that it is highly liquid in nature which implies that firm can sell

good quantum of such security in the market and minimise price fluctuation up to a high

extent.

It is suitable for Legal & General Plc as it can effectively get money which can be repaid

with ease because fixed interest payment can be estimated and uncertainty is minimised. Moreover, in case organisation defaults in making outstanding payments, bondholders are

repaid firstly and legal protection is given to them which marks that recovery amount is

paid and thus, remains intact.

Disadvantages

It is unsuitable form of raising financing requirement as it is subjected to variety of risks

namely inflation, yield curve risk, credit risk and reinvestment risk to name a few. It

directly limits the usage.

Bonds are risky source of raising finance with the main reason that price changes or

fluctuation directly affects mutual funds holding such bonds. If value of bond declines,

portfolio of investment affects up to a major extent.

Since, two insurance organisations namely Legal & General Plc and Standard Life

Aberdeen Plc have global reach, exchange rate risk arises instantly which may be caused

in exchange of the foreign currencies (Crowther, 2018).

Preference Shares

Common stock is technically referred as ordinary or equity shares. On the other hand,

Standard Life Aberdeen Plc can attain desired funds with the help of issuance of preference

shares which is another source of funds generation for firm. It is mostly suitable for insurance

3

services giant so as to meet uninterrupted operational activities on daily basis. It means that it

can be issued to shareholders on preferential rights as compared to equity holders.

Advantages

It is useful for Legal & General Plc as voting remains intact in company's management

itself and voting rights are not provided to them.

Fixed returns are provided to preference shareholders despite of earnings made by

company. Hence, profits could be maximised by the firm on major part of such

shareholding.

It is advantageous to firm as no charge on assets prevails to be paid to shareholders as

they are entitled to fixed dividends (Maina and Sakwa, 2017).

Capital market can be enhanced in an effective manner because fixed returns are

imparted to them which leads to safer investment from the perspective of investors.

Disadvantages

Fixed returns are provided which is disadvantageous to Standard Life Aberdeen Plc and

Legal & General Plc as they have to initiate returns despite of absence in profits in any

year.

Proper security is imparted to them even if organisation fails to comply with it and as

such, burden increases on firm.

Higher dividends are paid by company which automatically enhances cost of capital

which is not suitable for firm.

Creditworthiness is affected as assets are always on stake for making payments to them in

case of defaults.

Term loans

It is source for obtaining long-term finance which is generally ranges from the period of 5

to 10 years which can be availed by Legal & General Plc and other insurance giant in effective

manner. Term loans is secured debt which means that it is usually secured by collateral security

and as a result, in case of default, amount can be recovered without any difficulty by the lending

party. Loan agreement is also made which implies that it is secure type of raising finance.

4

can be issued to shareholders on preferential rights as compared to equity holders.

Advantages

It is useful for Legal & General Plc as voting remains intact in company's management

itself and voting rights are not provided to them.

Fixed returns are provided to preference shareholders despite of earnings made by

company. Hence, profits could be maximised by the firm on major part of such

shareholding.

It is advantageous to firm as no charge on assets prevails to be paid to shareholders as

they are entitled to fixed dividends (Maina and Sakwa, 2017).

Capital market can be enhanced in an effective manner because fixed returns are

imparted to them which leads to safer investment from the perspective of investors.

Disadvantages

Fixed returns are provided which is disadvantageous to Standard Life Aberdeen Plc and

Legal & General Plc as they have to initiate returns despite of absence in profits in any

year.

Proper security is imparted to them even if organisation fails to comply with it and as

such, burden increases on firm.

Higher dividends are paid by company which automatically enhances cost of capital

which is not suitable for firm.

Creditworthiness is affected as assets are always on stake for making payments to them in

case of defaults.

Term loans

It is source for obtaining long-term finance which is generally ranges from the period of 5

to 10 years which can be availed by Legal & General Plc and other insurance giant in effective

manner. Term loans is secured debt which means that it is usually secured by collateral security

and as a result, in case of default, amount can be recovered without any difficulty by the lending

party. Loan agreement is also made which implies that it is secure type of raising finance.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Companies can effectively channelise funds from financial institutions and meet financing

requirements with ease.

Advantages

It is advantageous for the firm as it helps to attain tax advantage. In simple words, interest

on term loans is tax-deductible and hence, tax is reduced up to a major level.

Control is not diluted in term loans and as such, Legal & General Plc and Standard Life

Aberdeen Plc can have full power over management.

Another advantage of taking such finance is that it is cost of debt is lower than that of

equity and as a result, term loan is cheaper finance for meeting requirements.

Moreover, maturity period of term loans may be altered in relation to requirement of

funds by company in effectual way (Yuniningsih, Widodo and Wajdi, 2017).

Disadvantages

It is disadvantageous for the main reason that interest accrued is needed to be paid

irrespective of having cash balance in appropriate manner along with principal loan

money.

Term loans eventually maximises financial leverage for the firm and as such, it increases

overall cost of equity of organisation.

Inflation prevailing in the country has also a direct impact on the cost of capital and as a

result, cost of debt would be higher than currently it is in the market.

It is legal obligation of company to pay principal amount and interest as well. If it

defaults to pay the same, it may become bankrupt.

Leases

Lease financing is suitable form of right to avail or use property or asset of lessor by the

lessee. This agreement is done with a view to use the asset for specific time frame usually against

the periodical payments for such usage. It can be clarified here that true owner or lessor remains

owner of asset and possession is not transferred to lessee and only payments or rentals are

5

requirements with ease.

Advantages

It is advantageous for the firm as it helps to attain tax advantage. In simple words, interest

on term loans is tax-deductible and hence, tax is reduced up to a major level.

Control is not diluted in term loans and as such, Legal & General Plc and Standard Life

Aberdeen Plc can have full power over management.

Another advantage of taking such finance is that it is cost of debt is lower than that of

equity and as a result, term loan is cheaper finance for meeting requirements.

Moreover, maturity period of term loans may be altered in relation to requirement of

funds by company in effectual way (Yuniningsih, Widodo and Wajdi, 2017).

Disadvantages

It is disadvantageous for the main reason that interest accrued is needed to be paid

irrespective of having cash balance in appropriate manner along with principal loan

money.

Term loans eventually maximises financial leverage for the firm and as such, it increases

overall cost of equity of organisation.

Inflation prevailing in the country has also a direct impact on the cost of capital and as a

result, cost of debt would be higher than currently it is in the market.

It is legal obligation of company to pay principal amount and interest as well. If it

defaults to pay the same, it may become bankrupt.

Leases

Lease financing is suitable form of right to avail or use property or asset of lessor by the

lessee. This agreement is done with a view to use the asset for specific time frame usually against

the periodical payments for such usage. It can be clarified here that true owner or lessor remains

owner of asset and possession is not transferred to lessee and only payments or rentals are

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

provided to them. There are various types of lease which can be availed by Legal & General Plc

and Standard Life Aberdeen Plc in order to attain right over the asset.

Advantages

Cash flows are not affected to a high extent because periodical payments are made and

not whole amount is paid by company. It is time-saving source of obtaining finance as

firm has to carry out formalities in case of bank loans whereas, it is absent in case of

lease financing (Pogrebova, Konnikov and Kurbanbaeva, 2017).

Moreover, liquidity remains intact on behalf of company as rentals are paid which are

beneficial for firm.

It is beneficial for the company which has a higher debt ratio as it do not affect

company's financial position and also do not worsen its solvency position.

Leasing is suitable particularly in era of dynamic business world where everything

undergoes changes. Hence, risk of obsolescence is minimised as assets are used

periodically and as such, it is beneficial for organisation.

Disadvantages

Regular payments are paid which means that operational cash flow are affected adversely

and liquidity gets affected (Hoobler, Masterson, Nkomo and Michel, 2018).

Improvements if any cannot be made by lessee as he has to obtain prior permission from

lessor limiting the use of it.

Lessee is not benefited as cost of maintenance has to be incurred by him. This means that

organisation which is a lessee incurs additional charges which increases costs.

Maintenance expenses are paid and no possession is transferred to it which restricts the

usage of the same.

6

and Standard Life Aberdeen Plc in order to attain right over the asset.

Advantages

Cash flows are not affected to a high extent because periodical payments are made and

not whole amount is paid by company. It is time-saving source of obtaining finance as

firm has to carry out formalities in case of bank loans whereas, it is absent in case of

lease financing (Pogrebova, Konnikov and Kurbanbaeva, 2017).

Moreover, liquidity remains intact on behalf of company as rentals are paid which are

beneficial for firm.

It is beneficial for the company which has a higher debt ratio as it do not affect

company's financial position and also do not worsen its solvency position.

Leasing is suitable particularly in era of dynamic business world where everything

undergoes changes. Hence, risk of obsolescence is minimised as assets are used

periodically and as such, it is beneficial for organisation.

Disadvantages

Regular payments are paid which means that operational cash flow are affected adversely

and liquidity gets affected (Hoobler, Masterson, Nkomo and Michel, 2018).

Improvements if any cannot be made by lessee as he has to obtain prior permission from

lessor limiting the use of it.

Lessee is not benefited as cost of maintenance has to be incurred by him. This means that

organisation which is a lessee incurs additional charges which increases costs.

Maintenance expenses are paid and no possession is transferred to it which restricts the

usage of the same.

6

2. Enumerating considerations to be taken into account when choosing right type of finance

Cost-

It is one of the important consideration as both insurance giants have to analyse cost of

finance in the best possible manner. Main objective of management while taking source of

finance is to maximise wealth of shareholders and effectively minimising cost of capital.

Financial strength and operational stability-

Financial strength is another essential factor because when firm has sound financial

position not only in terms of profitability, but also liquidity and solvency, it can raise debt with

much ease. Otherwise, raising debt will enhance debt burden on it and leading to deficiency in

performing operational tasks (Sweeting, 2017).

Organisation form and legal status-

The legal status and organisation form is important for raising finance because it is

required that firm should concentrate on its legal status before availing finance. Management of

both insurance companies such as Legal & General Plc and Standard Life Aberdeen Plc can take

debt and equity as financial standing is good.

Purpose and time period-

Legal & General Plc has to take into account purpose behind raising funds. If debt is to

be raised, then should carry out, short-term or long-term is to be attained as time period plays

major role.

Risk profile-

Risks has to be assessed in a better way because it is required that management of

Standard Life Aberdeen Plc is required to clarify whether they can repay money or not. Hence, if

solvency position is not good, it should be taken into account and debt should be avoided.

Control-

It is needed to be analysed because firm when issues further shares, control is diluted

because of new shares. Increment in dividends are to be made with existing shareholders. On the

other hand, relationship ends in case of debt finance, when firm pays-off liability (Wagner,

2017).

7

Cost-

It is one of the important consideration as both insurance giants have to analyse cost of

finance in the best possible manner. Main objective of management while taking source of

finance is to maximise wealth of shareholders and effectively minimising cost of capital.

Financial strength and operational stability-

Financial strength is another essential factor because when firm has sound financial

position not only in terms of profitability, but also liquidity and solvency, it can raise debt with

much ease. Otherwise, raising debt will enhance debt burden on it and leading to deficiency in

performing operational tasks (Sweeting, 2017).

Organisation form and legal status-

The legal status and organisation form is important for raising finance because it is

required that firm should concentrate on its legal status before availing finance. Management of

both insurance companies such as Legal & General Plc and Standard Life Aberdeen Plc can take

debt and equity as financial standing is good.

Purpose and time period-

Legal & General Plc has to take into account purpose behind raising funds. If debt is to

be raised, then should carry out, short-term or long-term is to be attained as time period plays

major role.

Risk profile-

Risks has to be assessed in a better way because it is required that management of

Standard Life Aberdeen Plc is required to clarify whether they can repay money or not. Hence, if

solvency position is not good, it should be taken into account and debt should be avoided.

Control-

It is needed to be analysed because firm when issues further shares, control is diluted

because of new shares. Increment in dividends are to be made with existing shareholders. On the

other hand, relationship ends in case of debt finance, when firm pays-off liability (Wagner,

2017).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Long-term & Short-term borrowings

Financing requirements are different in Legal & General Plc and Standard Life Aberdeen

Plc. Particularly, if non-current asset is to purchased, then long-term source of finance would be

feasible. While, short-term funds are to be accomplished, then suppliers' credit or overdrafts are

required for meeting requirement. The lending has certain merits and demerits which needed to

be analysed in accordance to the management viewpoint and thereof, decisions should be taken

Gearing level

Highly geared business should rely on equity financing to minimise risk up to a high

extent. Furthermore, if organisation is lowly geared, debt finance would be commercially viable

option for it. Hence, gearing position of Standard Life Abesrdeen Plc is low, it should use more

of debt.

Creditworthiness-

The credibility of organisation should be good enough to take more finance in the best

possible manner. When creditworthiness of Standard Life Aberdeen Plc is good, it can take

finance as lenders can provide after analysing solvency aspect.

Flexibility and ease-

Flexibility and ease is also vital factor because when firm is able to pay liabilities in

much flexibility, then, it can take funds with much ease.

RECOMMENDATIONS

Legal & General Plc

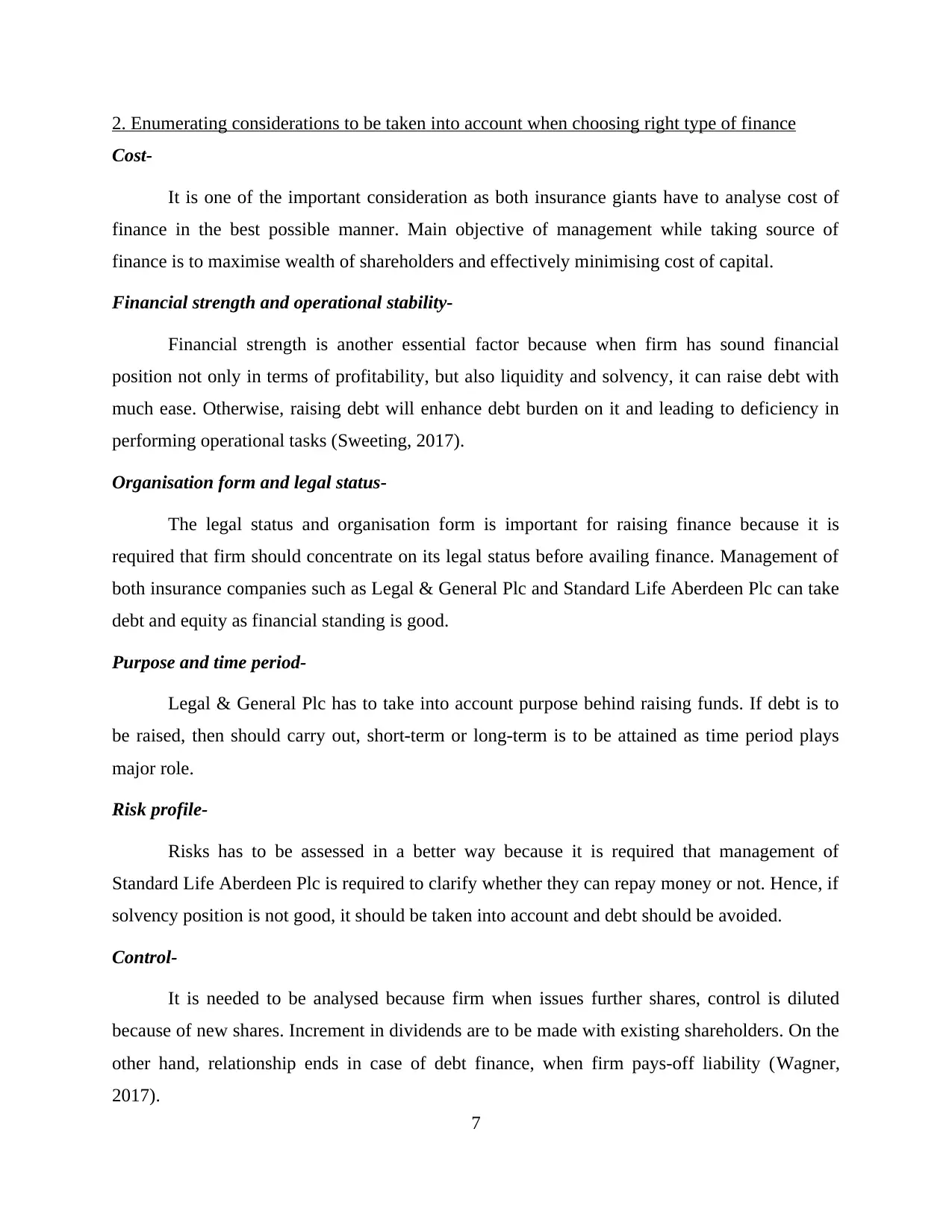

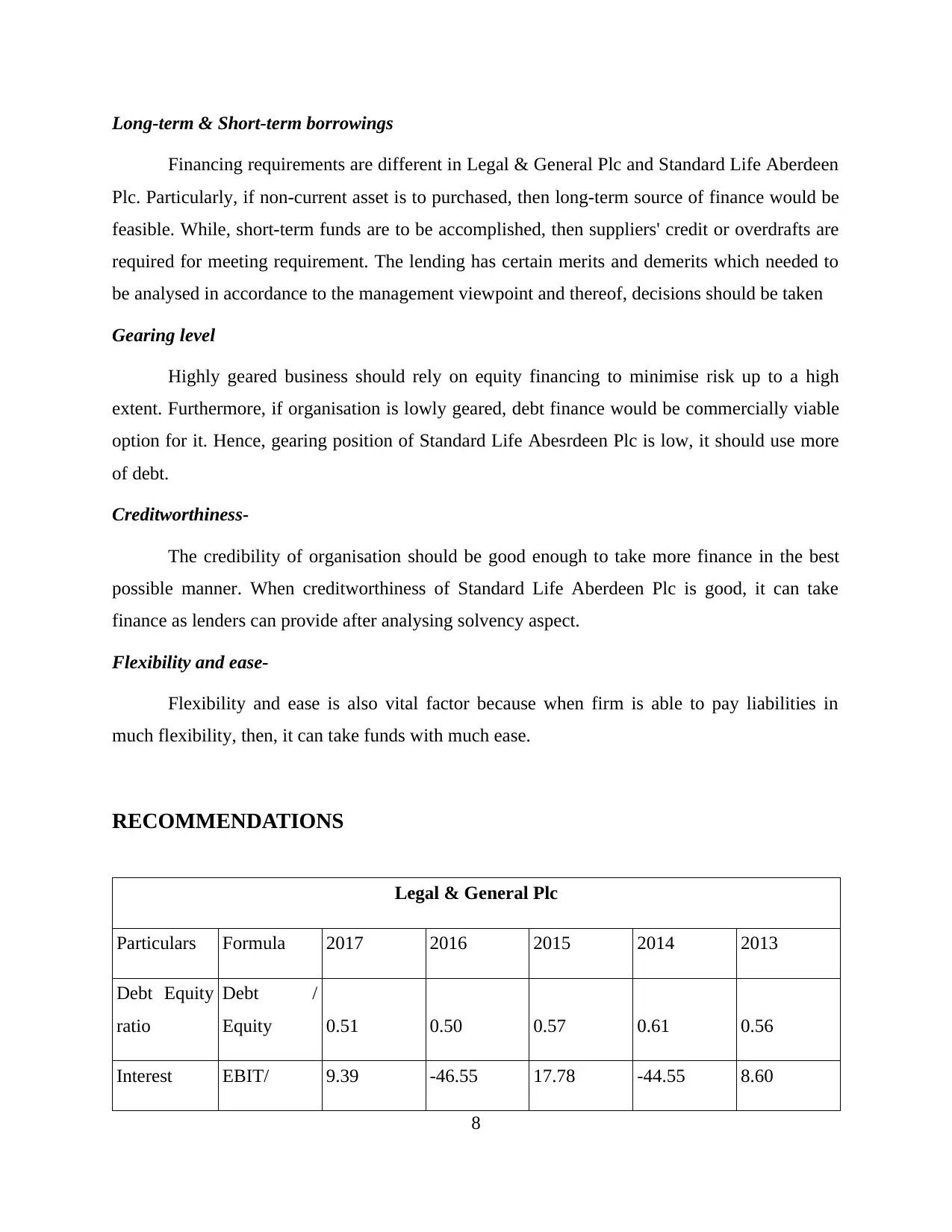

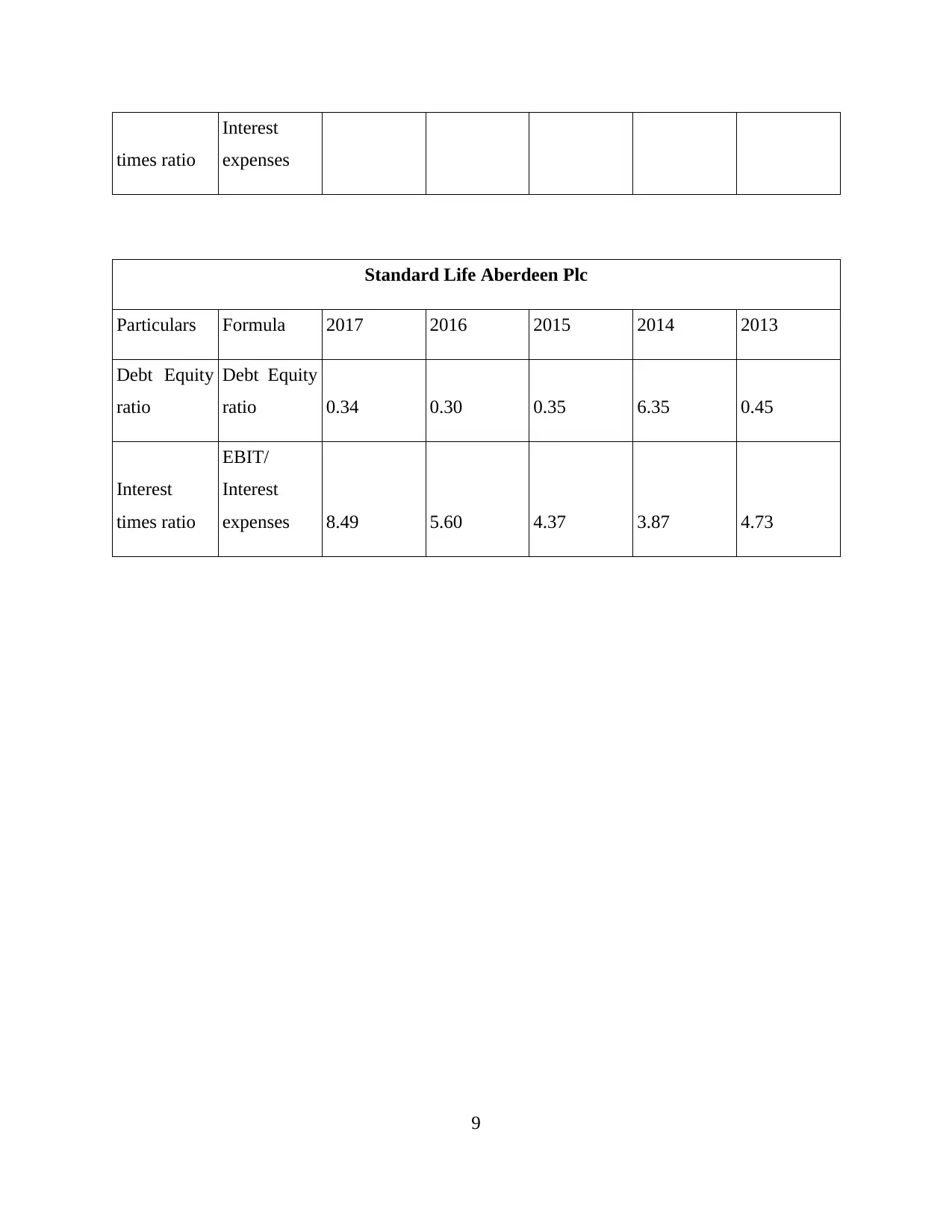

Particulars Formula 2017 2016 2015 2014 2013

Debt Equity

ratio

Debt /

Equity 0.51 0.50 0.57 0.61 0.56

Interest EBIT/ 9.39 -46.55 17.78 -44.55 8.60

8

Financing requirements are different in Legal & General Plc and Standard Life Aberdeen

Plc. Particularly, if non-current asset is to purchased, then long-term source of finance would be

feasible. While, short-term funds are to be accomplished, then suppliers' credit or overdrafts are

required for meeting requirement. The lending has certain merits and demerits which needed to

be analysed in accordance to the management viewpoint and thereof, decisions should be taken

Gearing level

Highly geared business should rely on equity financing to minimise risk up to a high

extent. Furthermore, if organisation is lowly geared, debt finance would be commercially viable

option for it. Hence, gearing position of Standard Life Abesrdeen Plc is low, it should use more

of debt.

Creditworthiness-

The credibility of organisation should be good enough to take more finance in the best

possible manner. When creditworthiness of Standard Life Aberdeen Plc is good, it can take

finance as lenders can provide after analysing solvency aspect.

Flexibility and ease-

Flexibility and ease is also vital factor because when firm is able to pay liabilities in

much flexibility, then, it can take funds with much ease.

RECOMMENDATIONS

Legal & General Plc

Particulars Formula 2017 2016 2015 2014 2013

Debt Equity

ratio

Debt /

Equity 0.51 0.50 0.57 0.61 0.56

Interest EBIT/ 9.39 -46.55 17.78 -44.55 8.60

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

times ratio

Interest

expenses

Standard Life Aberdeen Plc

Particulars Formula 2017 2016 2015 2014 2013

Debt Equity

ratio

Debt Equity

ratio 0.34 0.30 0.35 6.35 0.45

Interest

times ratio

EBIT/

Interest

expenses 8.49 5.60 4.37 3.87 4.73

9

Interest

expenses

Standard Life Aberdeen Plc

Particulars Formula 2017 2016 2015 2014 2013

Debt Equity

ratio

Debt Equity

ratio 0.34 0.30 0.35 6.35 0.45

Interest

times ratio

EBIT/

Interest

expenses 8.49 5.60 4.37 3.87 4.73

9

Illustration 1: Debt equity ratio

Illustration 2: Interest times ratio

The capital structure of both the firms are good. However, it can be said that Legal &

General Plc has adequate debt equity ratio as it is nearer to 0.4 which is considered to be ideal.

Interest time’s ratio is more in comparison to other firm and shows that it will easily pay-off its

debt payments. Considering the outcomes from both the organisations on which Legal & General

10

Illustration 2: Interest times ratio

The capital structure of both the firms are good. However, it can be said that Legal &

General Plc has adequate debt equity ratio as it is nearer to 0.4 which is considered to be ideal.

Interest time’s ratio is more in comparison to other firm and shows that it will easily pay-off its

debt payments. Considering the outcomes from both the organisations on which Legal & General

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.