Financial Management Assignment: Valuation and Investment Analysis

VerifiedAdded on 2023/01/11

|16

|5065

|60

Homework Assignment

AI Summary

This assignment delves into financial management, focusing on valuation techniques and investment appraisal. It begins with an introduction to financial management, highlighting the significance of effective fund control. The core of the assignment addresses two key questions: The first question involves the application of valuation techniques, including the price earnings ratio, dividend valuation model (DDM), and discounted cash flow (DCF) methods, to analyze the value of Trojan Plc. The second question critically discusses the advantages and disadvantages of each valuation technique and recommends the most suitable method for Aztec Plc. The assignment also explores the payback period, a capital budgeting method, and its calculation for Lovewell Limited, aiding in investment decision-making. The solution provides detailed calculations, interpretations, and recommendations, offering a comprehensive analysis of financial management concepts.

FINANCIAL

MANAGEMENT

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Question 2........................................................................................................................................3

Question 3........................................................................................................................................7

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

Question 2........................................................................................................................................3

Question 3........................................................................................................................................7

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

INTRODUCTION

Financial management includes the preparation, management, supervision and control

and collection and utilization of the funds of the Company's financial transactions. In this

assessment, we have to address two problems which are focused on acquisition which takeover

and expenditure appraisal strategies (Brusca, Gómez‐villegas and Montesinos, 2016). Finance is

a company's lifeline. Finances, however, are always restricted, as are most other tools. In the

opposite, it still needs to remain infinite. It is therefore necessary for an organization to

effectively control its finances. Within this report, as an introduction to financial management is

mentioned. It includes applying the general management concepts to the financial resources of

the Business. There are many roles used for different purposes such as capital expenditure

forecasts, structure of money, the source of funds, allocation of funds, etc. In addition, second

problem is related to investment appraisal techniques.

Question 2

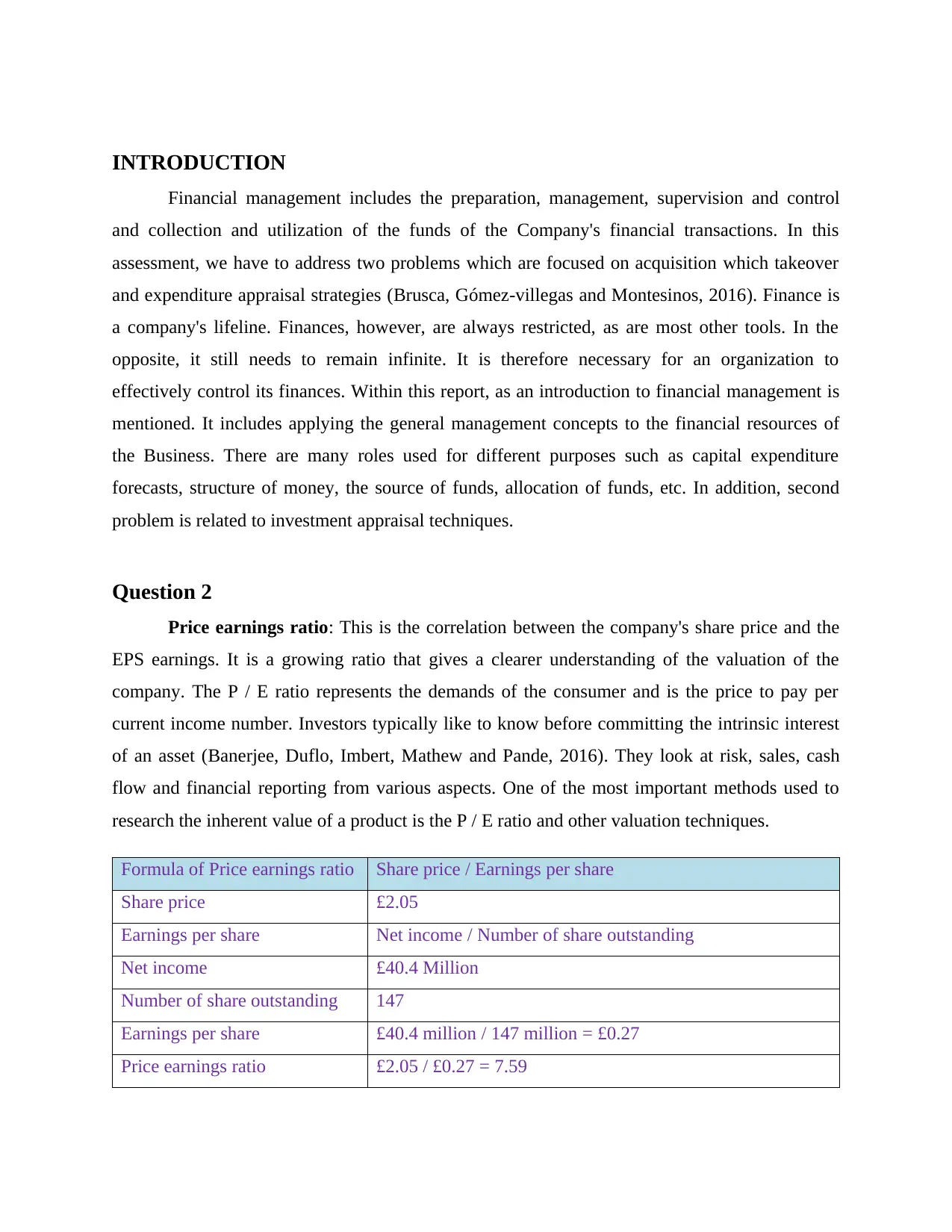

Price earnings ratio: This is the correlation between the company's share price and the

EPS earnings. It is a growing ratio that gives a clearer understanding of the valuation of the

company. The P / E ratio represents the demands of the consumer and is the price to pay per

current income number. Investors typically like to know before committing the intrinsic interest

of an asset (Banerjee, Duflo, Imbert, Mathew and Pande, 2016). They look at risk, sales, cash

flow and financial reporting from various aspects. One of the most important methods used to

research the inherent value of a product is the P / E ratio and other valuation techniques.

Formula of Price earnings ratio Share price / Earnings per share

Share price £2.05

Earnings per share Net income / Number of share outstanding

Net income £40.4 Million

Number of share outstanding 147

Earnings per share £40.4 million / 147 million = £0.27

Price earnings ratio £2.05 / £0.27 = 7.59

Financial management includes the preparation, management, supervision and control

and collection and utilization of the funds of the Company's financial transactions. In this

assessment, we have to address two problems which are focused on acquisition which takeover

and expenditure appraisal strategies (Brusca, Gómez‐villegas and Montesinos, 2016). Finance is

a company's lifeline. Finances, however, are always restricted, as are most other tools. In the

opposite, it still needs to remain infinite. It is therefore necessary for an organization to

effectively control its finances. Within this report, as an introduction to financial management is

mentioned. It includes applying the general management concepts to the financial resources of

the Business. There are many roles used for different purposes such as capital expenditure

forecasts, structure of money, the source of funds, allocation of funds, etc. In addition, second

problem is related to investment appraisal techniques.

Question 2

Price earnings ratio: This is the correlation between the company's share price and the

EPS earnings. It is a growing ratio that gives a clearer understanding of the valuation of the

company. The P / E ratio represents the demands of the consumer and is the price to pay per

current income number. Investors typically like to know before committing the intrinsic interest

of an asset (Banerjee, Duflo, Imbert, Mathew and Pande, 2016). They look at risk, sales, cash

flow and financial reporting from various aspects. One of the most important methods used to

research the inherent value of a product is the P / E ratio and other valuation techniques.

Formula of Price earnings ratio Share price / Earnings per share

Share price £2.05

Earnings per share Net income / Number of share outstanding

Net income £40.4 Million

Number of share outstanding 147

Earnings per share £40.4 million / 147 million = £0.27

Price earnings ratio £2.05 / £0.27 = 7.59

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation- There are various methods using which the valuation of an organization can be

determined. The method of price earnings ratio is a valuation method which helps in analyzing

the ability of an organization to earn from their stocks. From the above calculation, it has been

seen that price of share of Trojan Plc is £2.05 and their earnings per share is computed as £0.27.

By comparing these two values, the price earnings ratio of 7.59 is calculated.

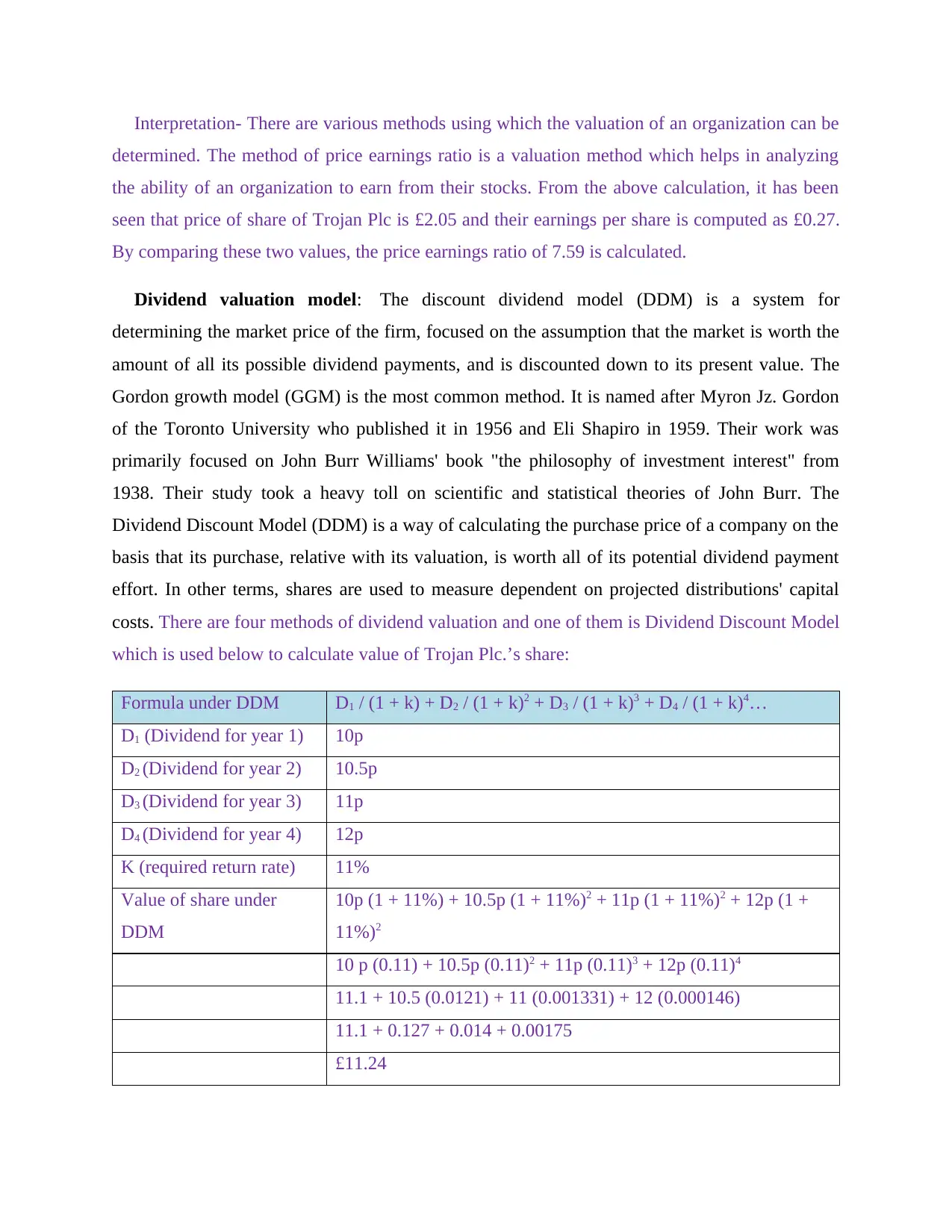

Dividend valuation model: The discount dividend model (DDM) is a system for

determining the market price of the firm, focused on the assumption that the market is worth the

amount of all its possible dividend payments, and is discounted down to its present value. The

Gordon growth model (GGM) is the most common method. It is named after Myron Jz. Gordon

of the Toronto University who published it in 1956 and Eli Shapiro in 1959. Their work was

primarily focused on John Burr Williams' book "the philosophy of investment interest" from

1938. Their study took a heavy toll on scientific and statistical theories of John Burr. The

Dividend Discount Model (DDM) is a way of calculating the purchase price of a company on the

basis that its purchase, relative with its valuation, is worth all of its potential dividend payment

effort. In other terms, shares are used to measure dependent on projected distributions' capital

costs. There are four methods of dividend valuation and one of them is Dividend Discount Model

which is used below to calculate value of Trojan Plc.’s share:

Formula under DDM D1 / (1 + k) + D2 / (1 + k)2 + D3 / (1 + k)3 + D4 / (1 + k)4…

D1 (Dividend for year 1) 10p

D2 (Dividend for year 2) 10.5p

D3 (Dividend for year 3) 11p

D4 (Dividend for year 4) 12p

K (required return rate) 11%

Value of share under

DDM

10p (1 + 11%) + 10.5p (1 + 11%)2 + 11p (1 + 11%)2 + 12p (1 +

11%)2

10 p (0.11) + 10.5p (0.11)2 + 11p (0.11)3 + 12p (0.11)4

11.1 + 10.5 (0.0121) + 11 (0.001331) + 12 (0.000146)

11.1 + 0.127 + 0.014 + 0.00175

£11.24

determined. The method of price earnings ratio is a valuation method which helps in analyzing

the ability of an organization to earn from their stocks. From the above calculation, it has been

seen that price of share of Trojan Plc is £2.05 and their earnings per share is computed as £0.27.

By comparing these two values, the price earnings ratio of 7.59 is calculated.

Dividend valuation model: The discount dividend model (DDM) is a system for

determining the market price of the firm, focused on the assumption that the market is worth the

amount of all its possible dividend payments, and is discounted down to its present value. The

Gordon growth model (GGM) is the most common method. It is named after Myron Jz. Gordon

of the Toronto University who published it in 1956 and Eli Shapiro in 1959. Their work was

primarily focused on John Burr Williams' book "the philosophy of investment interest" from

1938. Their study took a heavy toll on scientific and statistical theories of John Burr. The

Dividend Discount Model (DDM) is a way of calculating the purchase price of a company on the

basis that its purchase, relative with its valuation, is worth all of its potential dividend payment

effort. In other terms, shares are used to measure dependent on projected distributions' capital

costs. There are four methods of dividend valuation and one of them is Dividend Discount Model

which is used below to calculate value of Trojan Plc.’s share:

Formula under DDM D1 / (1 + k) + D2 / (1 + k)2 + D3 / (1 + k)3 + D4 / (1 + k)4…

D1 (Dividend for year 1) 10p

D2 (Dividend for year 2) 10.5p

D3 (Dividend for year 3) 11p

D4 (Dividend for year 4) 12p

K (required return rate) 11%

Value of share under

DDM

10p (1 + 11%) + 10.5p (1 + 11%)2 + 11p (1 + 11%)2 + 12p (1 +

11%)2

10 p (0.11) + 10.5p (0.11)2 + 11p (0.11)3 + 12p (0.11)4

11.1 + 10.5 (0.0121) + 11 (0.001331) + 12 (0.000146)

11.1 + 0.127 + 0.014 + 0.00175

£11.24

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

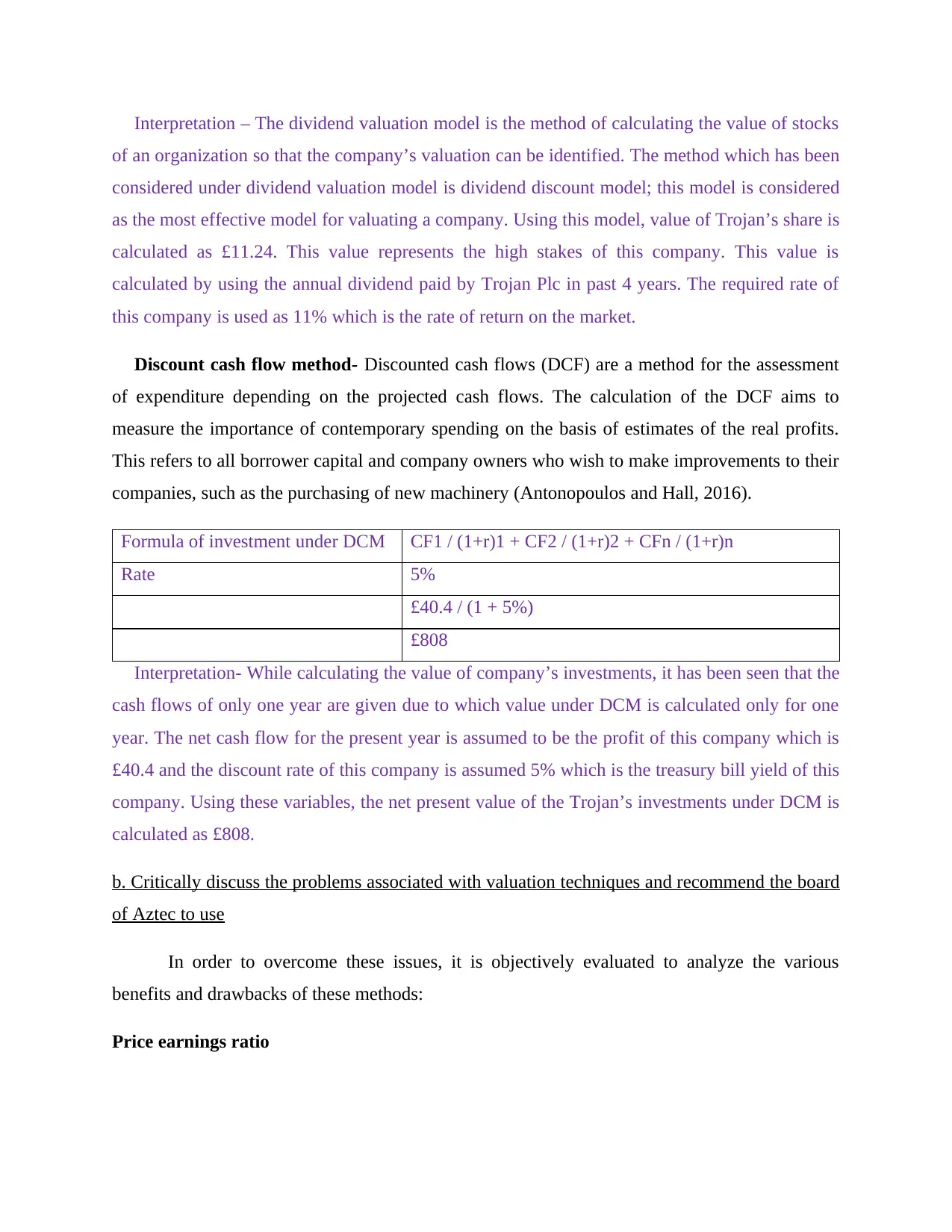

Interpretation – The dividend valuation model is the method of calculating the value of stocks

of an organization so that the company’s valuation can be identified. The method which has been

considered under dividend valuation model is dividend discount model; this model is considered

as the most effective model for valuating a company. Using this model, value of Trojan’s share is

calculated as £11.24. This value represents the high stakes of this company. This value is

calculated by using the annual dividend paid by Trojan Plc in past 4 years. The required rate of

this company is used as 11% which is the rate of return on the market.

Discount cash flow method- Discounted cash flows (DCF) are a method for the assessment

of expenditure depending on the projected cash flows. The calculation of the DCF aims to

measure the importance of contemporary spending on the basis of estimates of the real profits.

This refers to all borrower capital and company owners who wish to make improvements to their

companies, such as the purchasing of new machinery (Antonopoulos and Hall, 2016).

Formula of investment under DCM CF1 / (1+r)1 + CF2 / (1+r)2 + CFn / (1+r)n

Rate 5%

£40.4 / (1 + 5%)

£808

Interpretation- While calculating the value of company’s investments, it has been seen that the

cash flows of only one year are given due to which value under DCM is calculated only for one

year. The net cash flow for the present year is assumed to be the profit of this company which is

£40.4 and the discount rate of this company is assumed 5% which is the treasury bill yield of this

company. Using these variables, the net present value of the Trojan’s investments under DCM is

calculated as £808.

b. Critically discuss the problems associated with valuation techniques and recommend the board

of Aztec to use

In order to overcome these issues, it is objectively evaluated to analyze the various

benefits and drawbacks of these methods:

Price earnings ratio

of an organization so that the company’s valuation can be identified. The method which has been

considered under dividend valuation model is dividend discount model; this model is considered

as the most effective model for valuating a company. Using this model, value of Trojan’s share is

calculated as £11.24. This value represents the high stakes of this company. This value is

calculated by using the annual dividend paid by Trojan Plc in past 4 years. The required rate of

this company is used as 11% which is the rate of return on the market.

Discount cash flow method- Discounted cash flows (DCF) are a method for the assessment

of expenditure depending on the projected cash flows. The calculation of the DCF aims to

measure the importance of contemporary spending on the basis of estimates of the real profits.

This refers to all borrower capital and company owners who wish to make improvements to their

companies, such as the purchasing of new machinery (Antonopoulos and Hall, 2016).

Formula of investment under DCM CF1 / (1+r)1 + CF2 / (1+r)2 + CFn / (1+r)n

Rate 5%

£40.4 / (1 + 5%)

£808

Interpretation- While calculating the value of company’s investments, it has been seen that the

cash flows of only one year are given due to which value under DCM is calculated only for one

year. The net cash flow for the present year is assumed to be the profit of this company which is

£40.4 and the discount rate of this company is assumed 5% which is the treasury bill yield of this

company. Using these variables, the net present value of the Trojan’s investments under DCM is

calculated as £808.

b. Critically discuss the problems associated with valuation techniques and recommend the board

of Aztec to use

In order to overcome these issues, it is objectively evaluated to analyze the various

benefits and drawbacks of these methods:

Price earnings ratio

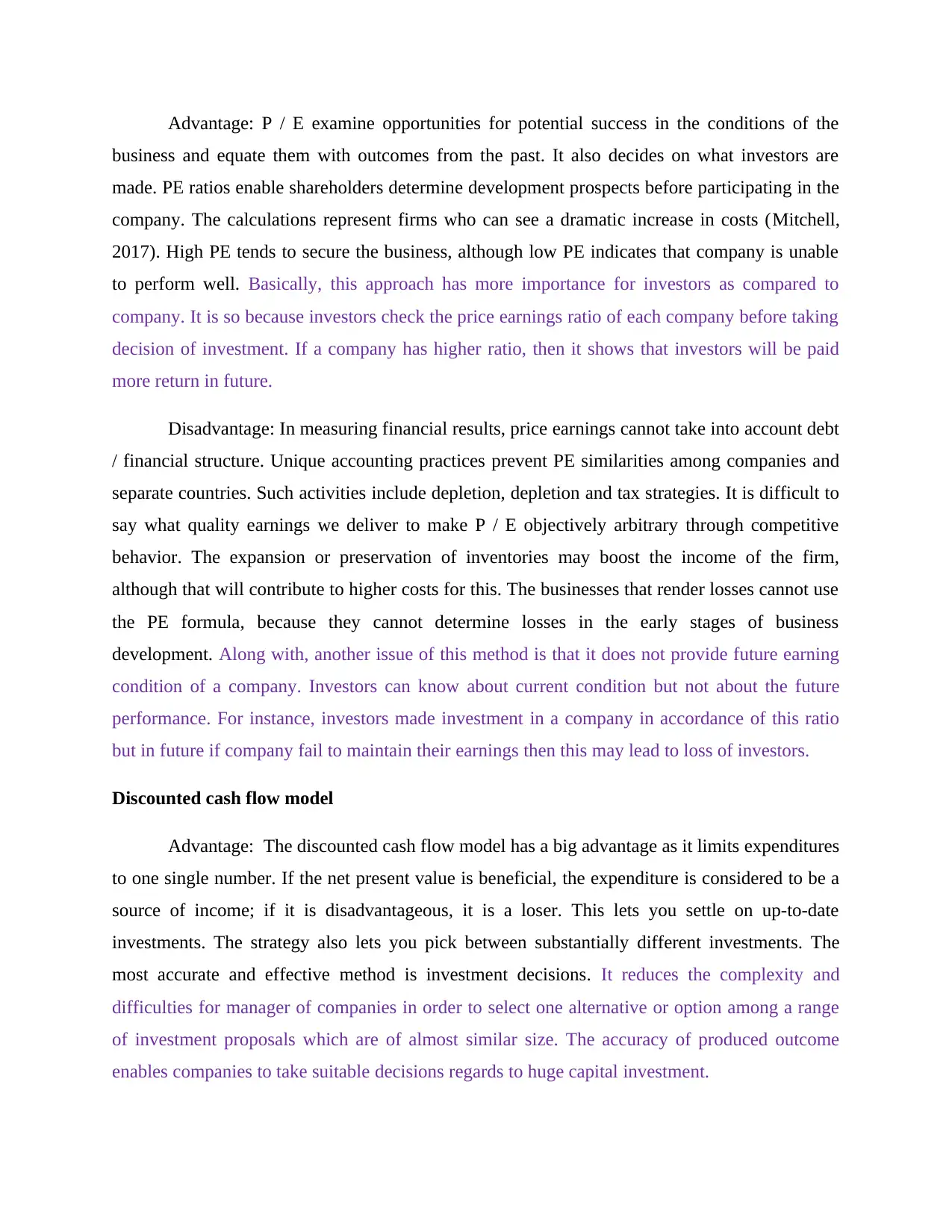

Advantage: P / E examine opportunities for potential success in the conditions of the

business and equate them with outcomes from the past. It also decides on what investors are

made. PE ratios enable shareholders determine development prospects before participating in the

company. The calculations represent firms who can see a dramatic increase in costs (Mitchell,

2017). High PE tends to secure the business, although low PE indicates that company is unable

to perform well. Basically, this approach has more importance for investors as compared to

company. It is so because investors check the price earnings ratio of each company before taking

decision of investment. If a company has higher ratio, then it shows that investors will be paid

more return in future.

Disadvantage: In measuring financial results, price earnings cannot take into account debt

/ financial structure. Unique accounting practices prevent PE similarities among companies and

separate countries. Such activities include depletion, depletion and tax strategies. It is difficult to

say what quality earnings we deliver to make P / E objectively arbitrary through competitive

behavior. The expansion or preservation of inventories may boost the income of the firm,

although that will contribute to higher costs for this. The businesses that render losses cannot use

the PE formula, because they cannot determine losses in the early stages of business

development. Along with, another issue of this method is that it does not provide future earning

condition of a company. Investors can know about current condition but not about the future

performance. For instance, investors made investment in a company in accordance of this ratio

but in future if company fail to maintain their earnings then this may lead to loss of investors.

Discounted cash flow model

Advantage: The discounted cash flow model has a big advantage as it limits expenditures

to one single number. If the net present value is beneficial, the expenditure is considered to be a

source of income; if it is disadvantageous, it is a loser. This lets you settle on up-to-date

investments. The strategy also lets you pick between substantially different investments. The

most accurate and effective method is investment decisions. It reduces the complexity and

difficulties for manager of companies in order to select one alternative or option among a range

of investment proposals which are of almost similar size. The accuracy of produced outcome

enables companies to take suitable decisions regards to huge capital investment.

business and equate them with outcomes from the past. It also decides on what investors are

made. PE ratios enable shareholders determine development prospects before participating in the

company. The calculations represent firms who can see a dramatic increase in costs (Mitchell,

2017). High PE tends to secure the business, although low PE indicates that company is unable

to perform well. Basically, this approach has more importance for investors as compared to

company. It is so because investors check the price earnings ratio of each company before taking

decision of investment. If a company has higher ratio, then it shows that investors will be paid

more return in future.

Disadvantage: In measuring financial results, price earnings cannot take into account debt

/ financial structure. Unique accounting practices prevent PE similarities among companies and

separate countries. Such activities include depletion, depletion and tax strategies. It is difficult to

say what quality earnings we deliver to make P / E objectively arbitrary through competitive

behavior. The expansion or preservation of inventories may boost the income of the firm,

although that will contribute to higher costs for this. The businesses that render losses cannot use

the PE formula, because they cannot determine losses in the early stages of business

development. Along with, another issue of this method is that it does not provide future earning

condition of a company. Investors can know about current condition but not about the future

performance. For instance, investors made investment in a company in accordance of this ratio

but in future if company fail to maintain their earnings then this may lead to loss of investors.

Discounted cash flow model

Advantage: The discounted cash flow model has a big advantage as it limits expenditures

to one single number. If the net present value is beneficial, the expenditure is considered to be a

source of income; if it is disadvantageous, it is a loser. This lets you settle on up-to-date

investments. The strategy also lets you pick between substantially different investments. The

most accurate and effective method is investment decisions. It reduces the complexity and

difficulties for manager of companies in order to select one alternative or option among a range

of investment proposals which are of almost similar size. The accuracy of produced outcome

enables companies to take suitable decisions regards to huge capital investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

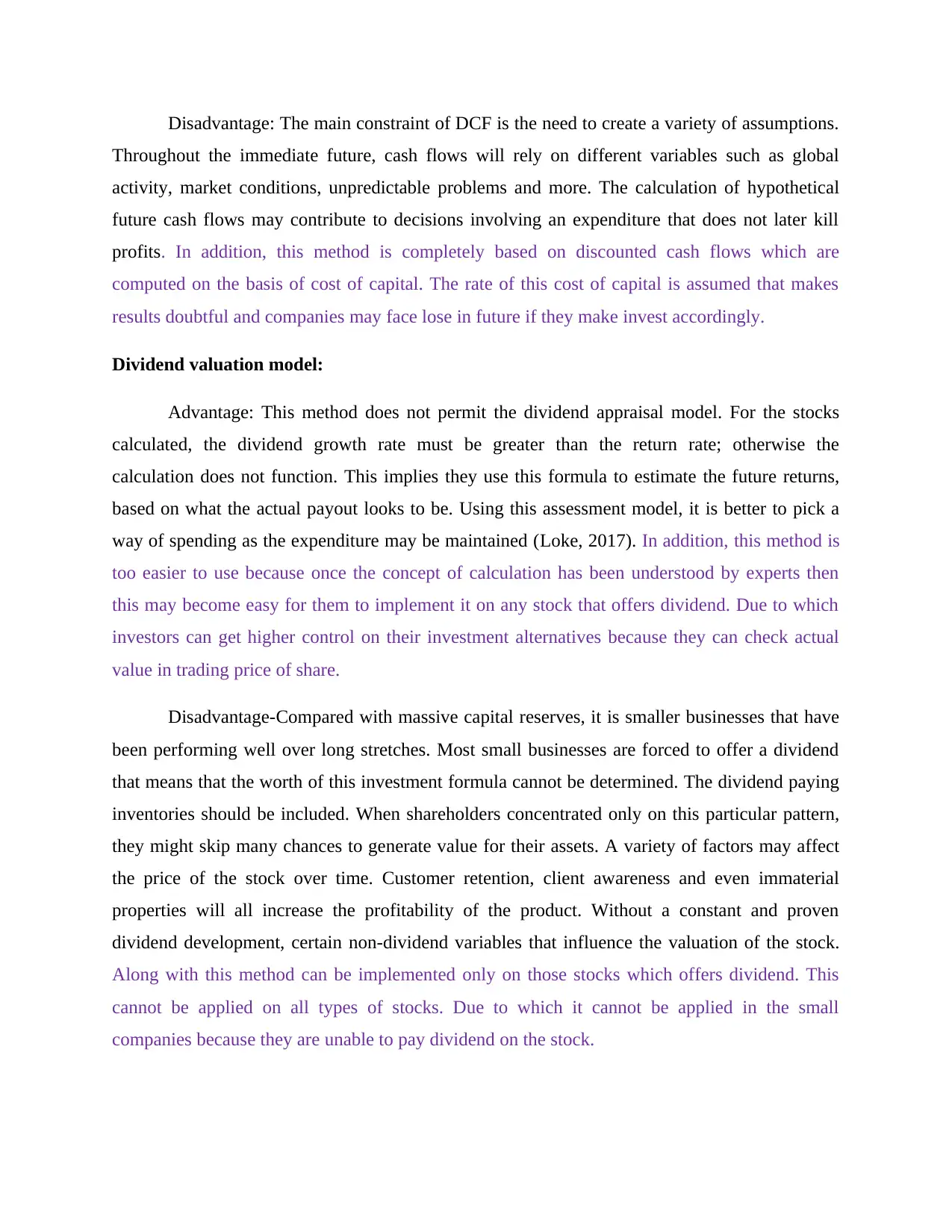

Disadvantage: The main constraint of DCF is the need to create a variety of assumptions.

Throughout the immediate future, cash flows will rely on different variables such as global

activity, market conditions, unpredictable problems and more. The calculation of hypothetical

future cash flows may contribute to decisions involving an expenditure that does not later kill

profits. In addition, this method is completely based on discounted cash flows which are

computed on the basis of cost of capital. The rate of this cost of capital is assumed that makes

results doubtful and companies may face lose in future if they make invest accordingly.

Dividend valuation model:

Advantage: This method does not permit the dividend appraisal model. For the stocks

calculated, the dividend growth rate must be greater than the return rate; otherwise the

calculation does not function. This implies they use this formula to estimate the future returns,

based on what the actual payout looks to be. Using this assessment model, it is better to pick a

way of spending as the expenditure may be maintained (Loke, 2017). In addition, this method is

too easier to use because once the concept of calculation has been understood by experts then

this may become easy for them to implement it on any stock that offers dividend. Due to which

investors can get higher control on their investment alternatives because they can check actual

value in trading price of share.

Disadvantage-Compared with massive capital reserves, it is smaller businesses that have

been performing well over long stretches. Most small businesses are forced to offer a dividend

that means that the worth of this investment formula cannot be determined. The dividend paying

inventories should be included. When shareholders concentrated only on this particular pattern,

they might skip many chances to generate value for their assets. A variety of factors may affect

the price of the stock over time. Customer retention, client awareness and even immaterial

properties will all increase the profitability of the product. Without a constant and proven

dividend development, certain non-dividend variables that influence the valuation of the stock.

Along with this method can be implemented only on those stocks which offers dividend. This

cannot be applied on all types of stocks. Due to which it cannot be applied in the small

companies because they are unable to pay dividend on the stock.

Throughout the immediate future, cash flows will rely on different variables such as global

activity, market conditions, unpredictable problems and more. The calculation of hypothetical

future cash flows may contribute to decisions involving an expenditure that does not later kill

profits. In addition, this method is completely based on discounted cash flows which are

computed on the basis of cost of capital. The rate of this cost of capital is assumed that makes

results doubtful and companies may face lose in future if they make invest accordingly.

Dividend valuation model:

Advantage: This method does not permit the dividend appraisal model. For the stocks

calculated, the dividend growth rate must be greater than the return rate; otherwise the

calculation does not function. This implies they use this formula to estimate the future returns,

based on what the actual payout looks to be. Using this assessment model, it is better to pick a

way of spending as the expenditure may be maintained (Loke, 2017). In addition, this method is

too easier to use because once the concept of calculation has been understood by experts then

this may become easy for them to implement it on any stock that offers dividend. Due to which

investors can get higher control on their investment alternatives because they can check actual

value in trading price of share.

Disadvantage-Compared with massive capital reserves, it is smaller businesses that have

been performing well over long stretches. Most small businesses are forced to offer a dividend

that means that the worth of this investment formula cannot be determined. The dividend paying

inventories should be included. When shareholders concentrated only on this particular pattern,

they might skip many chances to generate value for their assets. A variety of factors may affect

the price of the stock over time. Customer retention, client awareness and even immaterial

properties will all increase the profitability of the product. Without a constant and proven

dividend development, certain non-dividend variables that influence the valuation of the stock.

Along with this method can be implemented only on those stocks which offers dividend. This

cannot be applied on all types of stocks. Due to which it cannot be applied in the small

companies because they are unable to pay dividend on the stock.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Recommendation- Using the above review, DDM method should be adopted by Aztec plc. This

is so because under it, share value of a company is computed which is useful for all stakeholders.

While in the rest of two methods, valuation of earnings and cash flow is done that cannot be

useful for all parties of an organization. Hence, above company should choose DDM method.

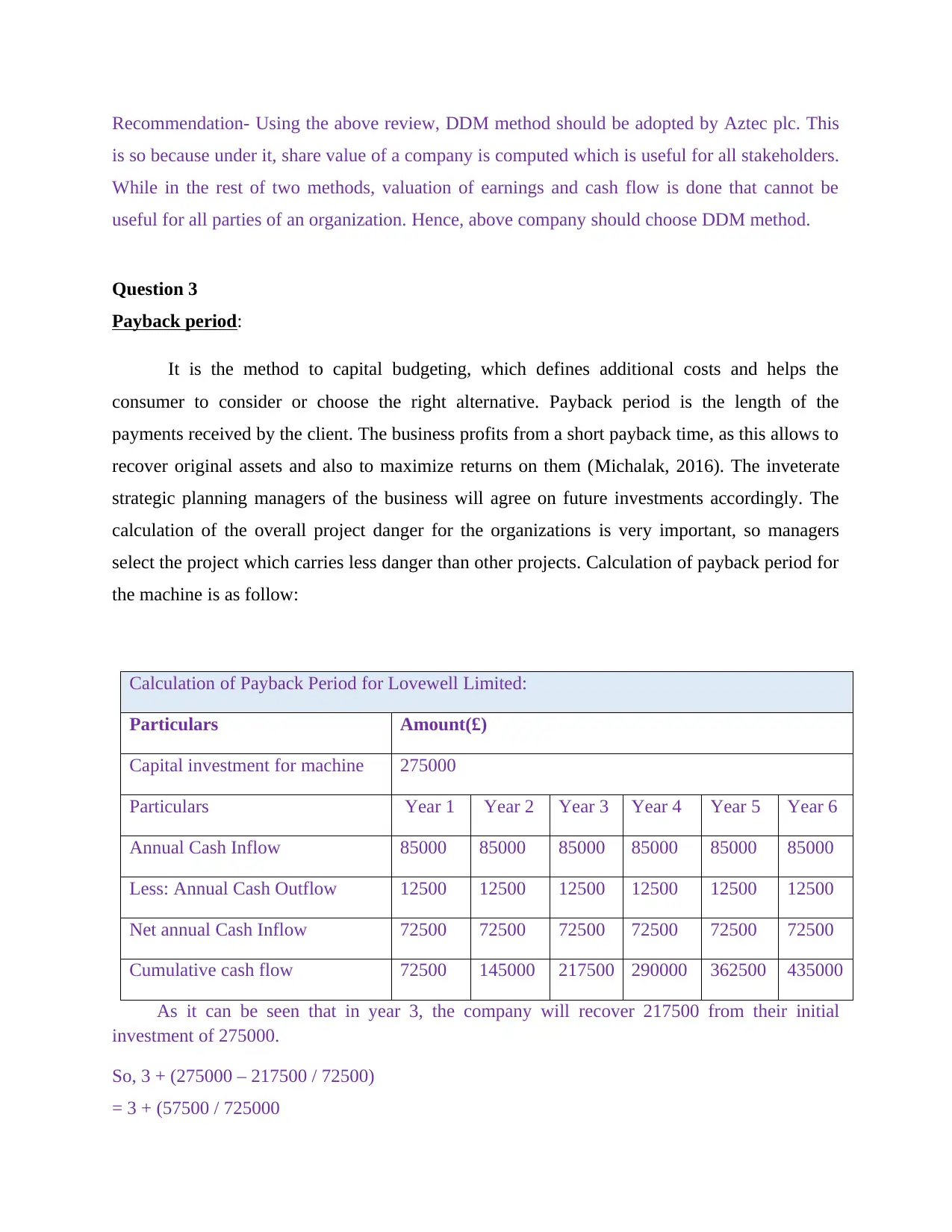

Question 3

Payback period:

It is the method to capital budgeting, which defines additional costs and helps the

consumer to consider or choose the right alternative. Payback period is the length of the

payments received by the client. The business profits from a short payback time, as this allows to

recover original assets and also to maximize returns on them (Michalak, 2016). The inveterate

strategic planning managers of the business will agree on future investments accordingly. The

calculation of the overall project danger for the organizations is very important, so managers

select the project which carries less danger than other projects. Calculation of payback period for

the machine is as follow:

Calculation of Payback Period for Lovewell Limited:

Particulars Amount(£)

Capital investment for machine 275000

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Annual Cash Inflow 85000 85000 85000 85000 85000 85000

Less: Annual Cash Outflow 12500 12500 12500 12500 12500 12500

Net annual Cash Inflow 72500 72500 72500 72500 72500 72500

Cumulative cash flow 72500 145000 217500 290000 362500 435000

As it can be seen that in year 3, the company will recover 217500 from their initial

investment of 275000.

So, 3 + (275000 – 217500 / 72500)

= 3 + (57500 / 725000

is so because under it, share value of a company is computed which is useful for all stakeholders.

While in the rest of two methods, valuation of earnings and cash flow is done that cannot be

useful for all parties of an organization. Hence, above company should choose DDM method.

Question 3

Payback period:

It is the method to capital budgeting, which defines additional costs and helps the

consumer to consider or choose the right alternative. Payback period is the length of the

payments received by the client. The business profits from a short payback time, as this allows to

recover original assets and also to maximize returns on them (Michalak, 2016). The inveterate

strategic planning managers of the business will agree on future investments accordingly. The

calculation of the overall project danger for the organizations is very important, so managers

select the project which carries less danger than other projects. Calculation of payback period for

the machine is as follow:

Calculation of Payback Period for Lovewell Limited:

Particulars Amount(£)

Capital investment for machine 275000

Particulars Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Annual Cash Inflow 85000 85000 85000 85000 85000 85000

Less: Annual Cash Outflow 12500 12500 12500 12500 12500 12500

Net annual Cash Inflow 72500 72500 72500 72500 72500 72500

Cumulative cash flow 72500 145000 217500 290000 362500 435000

As it can be seen that in year 3, the company will recover 217500 from their initial

investment of 275000.

So, 3 + (275000 – 217500 / 72500)

= 3 + (57500 / 725000

= 3 + 0.79

= 3.79 years

Interpretation- Cash flows are unfavorable for three years out of 6 in the table presented

above, so that it can be concluded that project expense should be protected in the 3.79 years. On

a simple examination of reality, it can be shown that whole years of the venture is went on

recovering the project's expense. Consequently, the project is considered modestly feasible for

the corporation.

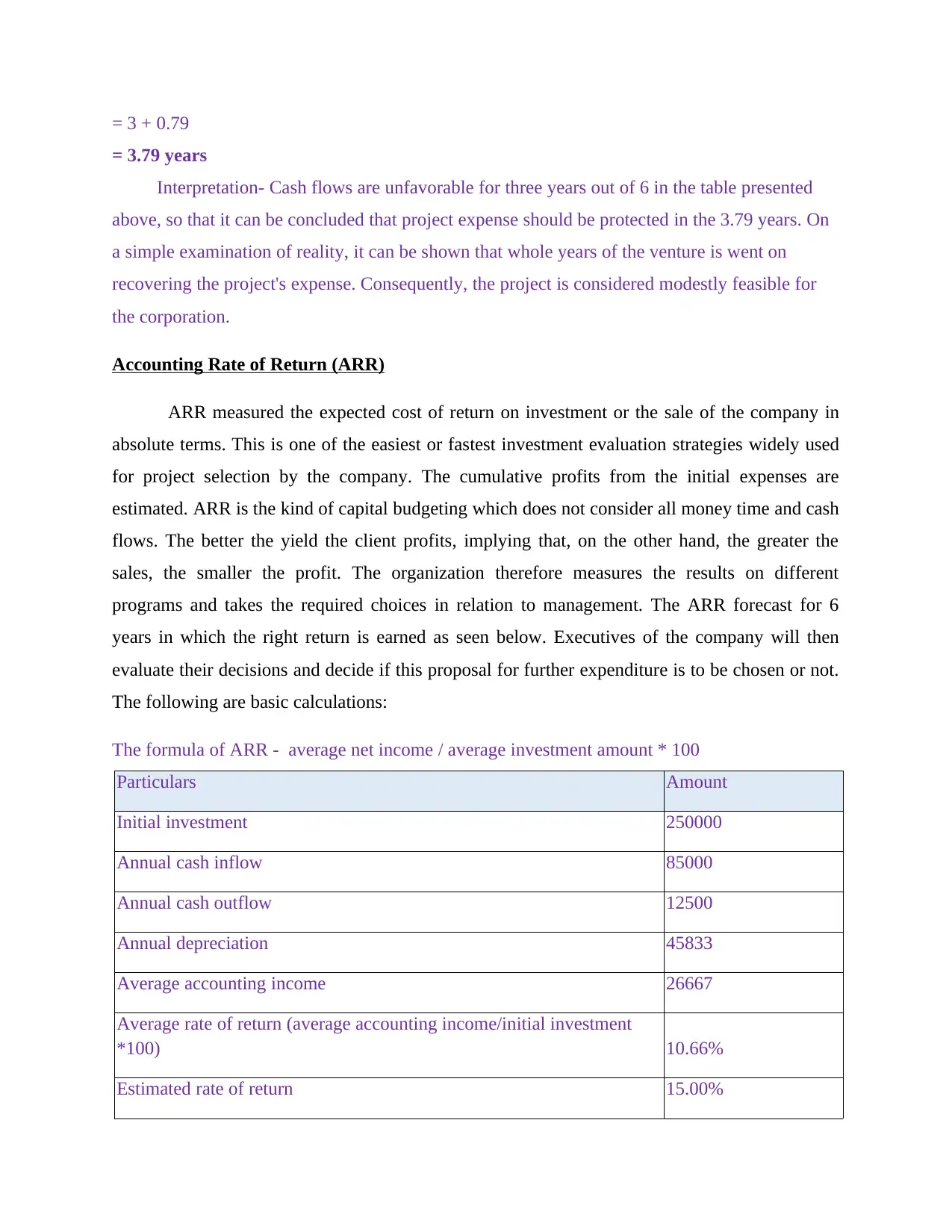

Accounting Rate of Return (ARR)

ARR measured the expected cost of return on investment or the sale of the company in

absolute terms. This is one of the easiest or fastest investment evaluation strategies widely used

for project selection by the company. The cumulative profits from the initial expenses are

estimated. ARR is the kind of capital budgeting which does not consider all money time and cash

flows. The better the yield the client profits, implying that, on the other hand, the greater the

sales, the smaller the profit. The organization therefore measures the results on different

programs and takes the required choices in relation to management. The ARR forecast for 6

years in which the right return is earned as seen below. Executives of the company will then

evaluate their decisions and decide if this proposal for further expenditure is to be chosen or not.

The following are basic calculations:

The formula of ARR - average net income / average investment amount * 100

Particulars Amount

Initial investment 250000

Annual cash inflow 85000

Annual cash outflow 12500

Annual depreciation 45833

Average accounting income 26667

Average rate of return (average accounting income/initial investment

*100) 10.66%

Estimated rate of return 15.00%

= 3.79 years

Interpretation- Cash flows are unfavorable for three years out of 6 in the table presented

above, so that it can be concluded that project expense should be protected in the 3.79 years. On

a simple examination of reality, it can be shown that whole years of the venture is went on

recovering the project's expense. Consequently, the project is considered modestly feasible for

the corporation.

Accounting Rate of Return (ARR)

ARR measured the expected cost of return on investment or the sale of the company in

absolute terms. This is one of the easiest or fastest investment evaluation strategies widely used

for project selection by the company. The cumulative profits from the initial expenses are

estimated. ARR is the kind of capital budgeting which does not consider all money time and cash

flows. The better the yield the client profits, implying that, on the other hand, the greater the

sales, the smaller the profit. The organization therefore measures the results on different

programs and takes the required choices in relation to management. The ARR forecast for 6

years in which the right return is earned as seen below. Executives of the company will then

evaluate their decisions and decide if this proposal for further expenditure is to be chosen or not.

The following are basic calculations:

The formula of ARR - average net income / average investment amount * 100

Particulars Amount

Initial investment 250000

Annual cash inflow 85000

Annual cash outflow 12500

Annual depreciation 45833

Average accounting income 26667

Average rate of return (average accounting income/initial investment

*100) 10.66%

Estimated rate of return 15.00%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation- The project's ARR is 10.66% which reflects that the investor can gain

10.66% return on an average project. The return is modest, so it can be concluded that it is

indeed to some degree profitable for the company. Investment in this plan is suggested, given

ARR.

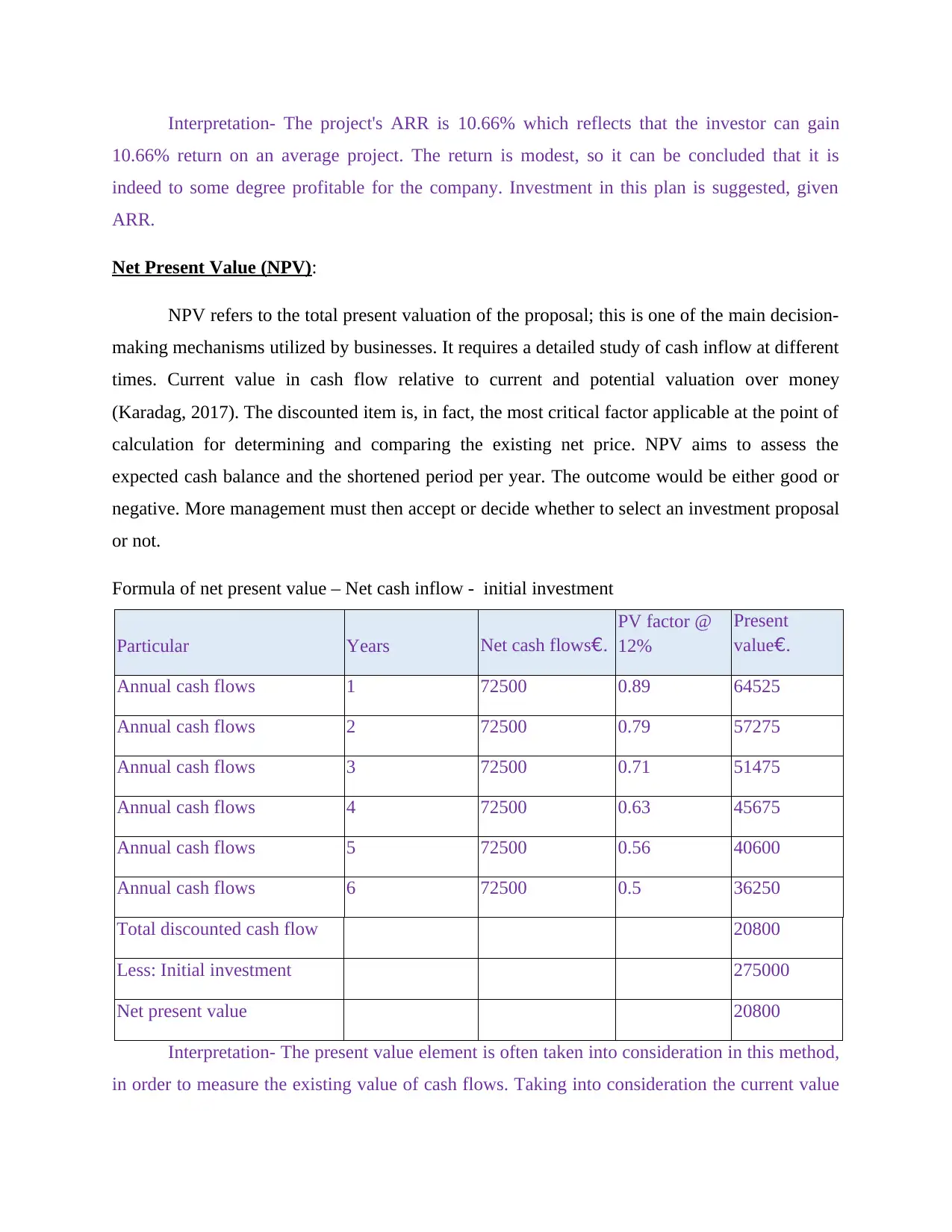

Net Present Value (NPV):

NPV refers to the total present valuation of the proposal; this is one of the main decision-

making mechanisms utilized by businesses. It requires a detailed study of cash inflow at different

times. Current value in cash flow relative to current and potential valuation over money

(Karadag, 2017). The discounted item is, in fact, the most critical factor applicable at the point of

calculation for determining and comparing the existing net price. NPV aims to assess the

expected cash balance and the shortened period per year. The outcome would be either good or

negative. More management must then accept or decide whether to select an investment proposal

or not.

Formula of net present value – Net cash inflow - initial investment

Particular Years Net cash flows€.

PV factor @

12%

Present

value€.

Annual cash flows 1 72500 0.89 64525

Annual cash flows 2 72500 0.79 57275

Annual cash flows 3 72500 0.71 51475

Annual cash flows 4 72500 0.63 45675

Annual cash flows 5 72500 0.56 40600

Annual cash flows 6 72500 0.5 36250

Total discounted cash flow 20800

Less: Initial investment 275000

Net present value 20800

Interpretation- The present value element is often taken into consideration in this method,

in order to measure the existing value of cash flows. Taking into consideration the current value

10.66% return on an average project. The return is modest, so it can be concluded that it is

indeed to some degree profitable for the company. Investment in this plan is suggested, given

ARR.

Net Present Value (NPV):

NPV refers to the total present valuation of the proposal; this is one of the main decision-

making mechanisms utilized by businesses. It requires a detailed study of cash inflow at different

times. Current value in cash flow relative to current and potential valuation over money

(Karadag, 2017). The discounted item is, in fact, the most critical factor applicable at the point of

calculation for determining and comparing the existing net price. NPV aims to assess the

expected cash balance and the shortened period per year. The outcome would be either good or

negative. More management must then accept or decide whether to select an investment proposal

or not.

Formula of net present value – Net cash inflow - initial investment

Particular Years Net cash flows€.

PV factor @

12%

Present

value€.

Annual cash flows 1 72500 0.89 64525

Annual cash flows 2 72500 0.79 57275

Annual cash flows 3 72500 0.71 51475

Annual cash flows 4 72500 0.63 45675

Annual cash flows 5 72500 0.56 40600

Annual cash flows 6 72500 0.5 36250

Total discounted cash flow 20800

Less: Initial investment 275000

Net present value 20800

Interpretation- The present value element is often taken into consideration in this method,

in order to measure the existing value of cash flows. Taking into consideration the current value

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

is 12 per cent (R1). We will note NPV is £20800. Plan is advised to be feasible for the business

and spending in this plan must not be made.

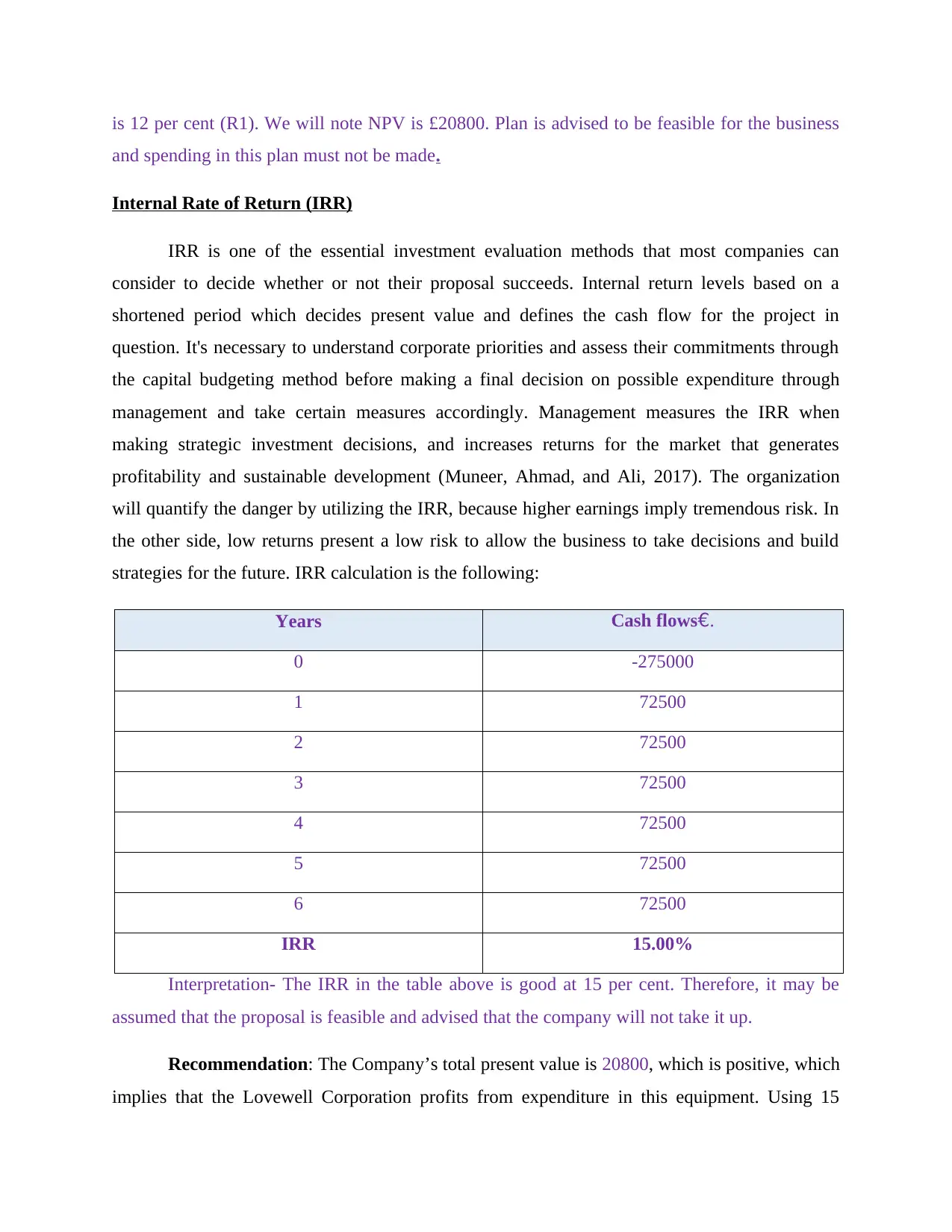

Internal Rate of Return (IRR)

IRR is one of the essential investment evaluation methods that most companies can

consider to decide whether or not their proposal succeeds. Internal return levels based on a

shortened period which decides present value and defines the cash flow for the project in

question. It's necessary to understand corporate priorities and assess their commitments through

the capital budgeting method before making a final decision on possible expenditure through

management and take certain measures accordingly. Management measures the IRR when

making strategic investment decisions, and increases returns for the market that generates

profitability and sustainable development (Muneer, Ahmad, and Ali, 2017). The organization

will quantify the danger by utilizing the IRR, because higher earnings imply tremendous risk. In

the other side, low returns present a low risk to allow the business to take decisions and build

strategies for the future. IRR calculation is the following:

Years Cash flows€.

0 -275000

1 72500

2 72500

3 72500

4 72500

5 72500

6 72500

IRR 15.00%

Interpretation- The IRR in the table above is good at 15 per cent. Therefore, it may be

assumed that the proposal is feasible and advised that the company will not take it up.

Recommendation: The Company’s total present value is 20800, which is positive, which

implies that the Lovewell Corporation profits from expenditure in this equipment. Using 15

and spending in this plan must not be made.

Internal Rate of Return (IRR)

IRR is one of the essential investment evaluation methods that most companies can

consider to decide whether or not their proposal succeeds. Internal return levels based on a

shortened period which decides present value and defines the cash flow for the project in

question. It's necessary to understand corporate priorities and assess their commitments through

the capital budgeting method before making a final decision on possible expenditure through

management and take certain measures accordingly. Management measures the IRR when

making strategic investment decisions, and increases returns for the market that generates

profitability and sustainable development (Muneer, Ahmad, and Ali, 2017). The organization

will quantify the danger by utilizing the IRR, because higher earnings imply tremendous risk. In

the other side, low returns present a low risk to allow the business to take decisions and build

strategies for the future. IRR calculation is the following:

Years Cash flows€.

0 -275000

1 72500

2 72500

3 72500

4 72500

5 72500

6 72500

IRR 15.00%

Interpretation- The IRR in the table above is good at 15 per cent. Therefore, it may be

assumed that the proposal is feasible and advised that the company will not take it up.

Recommendation: The Company’s total present value is 20800, which is positive, which

implies that the Lovewell Corporation profits from expenditure in this equipment. Using 15

percent of the IRR of this project is adequate to invest in new equipment or increase market

efficiency and profitability. With the assistance of above performance, managers are able to

determine with this project and is helpful for the company to invest in the latest development

machinery.

Critically evaluate the benefits or limitations of different investment appraisal techniques:

Payback period:

Benefits: One of the key benefits of the payback time approach is that the estimation

mechanism is overstated in nature and, for this purpose, any person in the organization who may

not have professional expertise may still apply this approach to the data for project assessment.

One of the key advantages of this approach is that it represents the time over which the volume

of expenditure that be compensated (Darwanis, Saputra and Kartini, 2016). In accordance of its

principles this can be said that users can quickly figure out how long or year the client begins

making income in the market. Therefore, it may be assumed that the payback period approach is

of immense importance to the management as it does not involve analytical expertise to interpret

the outcomes and calculate the feasibility of the project. That is one of the payback time

method's biggest strengths.

Drawbacks- Some of the main disadvantages to the payback cycle is that the idea of the

current interest is not utilized in this strategy. The definition of current value is complicated and

thus one that does not have experience cannot take advantage of this method. The payback

duration represents the feasibility of the project when evaluating all the years, but this does not

imply the project 's profitability when order to understand the current time frame. The value of

money or capital begins to adjust gradually regardless of a shift in the state's financial situation.

During the upcoming time frame, if there is strong uncertainty of the sector, then another volume

of cash flows will be expected to further propel. Because of this project which seems lucrative in

the current timeframe that appear unaffordable in the future timeframe. Hence, for this purpose,

most managers tend to use the approach which takes discounted cash flows into consideration.

No use of the theory of current value is one of the most significant demerit points of the payback

method.

Accounting rate of return:

efficiency and profitability. With the assistance of above performance, managers are able to

determine with this project and is helpful for the company to invest in the latest development

machinery.

Critically evaluate the benefits or limitations of different investment appraisal techniques:

Payback period:

Benefits: One of the key benefits of the payback time approach is that the estimation

mechanism is overstated in nature and, for this purpose, any person in the organization who may

not have professional expertise may still apply this approach to the data for project assessment.

One of the key advantages of this approach is that it represents the time over which the volume

of expenditure that be compensated (Darwanis, Saputra and Kartini, 2016). In accordance of its

principles this can be said that users can quickly figure out how long or year the client begins

making income in the market. Therefore, it may be assumed that the payback period approach is

of immense importance to the management as it does not involve analytical expertise to interpret

the outcomes and calculate the feasibility of the project. That is one of the payback time

method's biggest strengths.

Drawbacks- Some of the main disadvantages to the payback cycle is that the idea of the

current interest is not utilized in this strategy. The definition of current value is complicated and

thus one that does not have experience cannot take advantage of this method. The payback

duration represents the feasibility of the project when evaluating all the years, but this does not

imply the project 's profitability when order to understand the current time frame. The value of

money or capital begins to adjust gradually regardless of a shift in the state's financial situation.

During the upcoming time frame, if there is strong uncertainty of the sector, then another volume

of cash flows will be expected to further propel. Because of this project which seems lucrative in

the current timeframe that appear unaffordable in the future timeframe. Hence, for this purpose,

most managers tend to use the approach which takes discounted cash flows into consideration.

No use of the theory of current value is one of the most significant demerit points of the payback

method.

Accounting rate of return:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.