Financial Management (BSBFIM601) - Obligations, Legislation, Budgets

VerifiedAdded on 2022/12/23

|16

|5565

|4

Homework Assignment

AI Summary

This document provides a comprehensive solution to a BSBFIM601 financial management assignment. It begins by outlining obligations under the Corporations Act 2001, detailing the importance of acting in good faith, with care and diligence, and avoiding misuse of information or position. The assignment then explores relevant Australian, international, and local legislation and conventions, including Australian Accounting Standards, the Australian Securities and Investments Commission (ASIC), and Privacy Acts and Principles. It delves into tax law compliance, covering Goods and Services Tax (GST), payroll tax, income tax, fringe benefit tax, PAYG withholding, and company tax. Furthermore, the document describes the principles of accounting and financial systems, specifically revenue recognition and full disclosure. It also explains the requirements and implications of financial probity and recommends commercially available software suitable for financial management, such as QuickBooks, Zoho Finance Plus, and Xero. Finally, the document provides a case study analysis, including the development of sales, profit, and cash flow budgets, as well as a debtor aging summary.

ASSESSMENT

GUIDE

Student

GUIDE

Student

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BSBFIM601 Manage finances

Question1

List the obligations under the Corporations Act 2001 List at least six (6) obligations)

The Corporation Act 2001 regulates the matter relating to formation and operation of companies

and the duties present of company and other relating parties. There are many obligation and

duties under the Corporation act and these are listed as follows-

Obligation to act in good faith for the best interest of company and proper purpose of corporation

must be met. This is the obligation wherein the company has to act in good faith for every party

which is involved and interacts with the company. This is done in order to fulfill the purpose for

which the company is being set up and is working.

Another obligation is to act with care and diligence. Section 180 of the Corporation act provides

for civil obligation that the director or the other people within company must ensure that they

work in ethical and effective manner. They must behave in rational way and must make

judgment in good faith and without any discrimination.

Along with this another major obligation under Corporation act 2001 is to avoid improper use of

information. Section 183 states that there is obligation of corporation that a person who is

obtaining information because they have authority to seek information must not make improper

use of this information. This is pertaining to the fact that this information might be of somebody

else and this will affect the working of that person.

In addition to this section 182 defines another civil obligation of corporation which restricts the

directors to make improper use of their position. This is pertaining to the fact that when the

person is in position then they must not misuse their position. This is because there are many

people who misuse their position for their personal comfort and because of this it may affect

performance of corporation. Hence, this obligation states that director or any person at higher

position must not misuse their post.

Moreover, section 191 under Corporation act states that it is the obligation of the director of

company that material information must not be shared with any other person. Also, if there is any

material information or personal interest of director then they must give a notice to company.

Along with this Corporation act 2001 also states that when these statutory obligations will not be

performed by the required people will have to pay penalties ranging to $200000.

Question2

Briefly explain the following Australian, international and local legislation and conventions that are

relevant to financial management in the organisation

(a) Australian Accounting Standards

The Australian accounting standards board (AASB) is a type of agency owned by the Australian

government which assists in maintaining and developing financial reporting standards. For any

company the most essential thing is to manage and check its profitability which they undertake

with help of accounting. Hence, for undertaking the accounting process they have to follow the

accounting standards provided by AASB. With respect to financial management within the

company all the list of regulation and standards are being provided which every organization has

to follow in accordance with AASB.

(b) Australian Securities and Investments Commission

Australian Securities and Investments Commission is an independent government body of

Australia. This body is an integration of market, corporate, consumer credit regulator ad financial

services regulator. The major role of ASIC is to manage and maintain and improve and facilitate

performance of financial systems and other related entities. They also works in promoting the

informed participation of the consumer and investors within the financial system. Along with this

StudentAssessment Guidev 1January 2019 Page 2 of 16

Question1

List the obligations under the Corporations Act 2001 List at least six (6) obligations)

The Corporation Act 2001 regulates the matter relating to formation and operation of companies

and the duties present of company and other relating parties. There are many obligation and

duties under the Corporation act and these are listed as follows-

Obligation to act in good faith for the best interest of company and proper purpose of corporation

must be met. This is the obligation wherein the company has to act in good faith for every party

which is involved and interacts with the company. This is done in order to fulfill the purpose for

which the company is being set up and is working.

Another obligation is to act with care and diligence. Section 180 of the Corporation act provides

for civil obligation that the director or the other people within company must ensure that they

work in ethical and effective manner. They must behave in rational way and must make

judgment in good faith and without any discrimination.

Along with this another major obligation under Corporation act 2001 is to avoid improper use of

information. Section 183 states that there is obligation of corporation that a person who is

obtaining information because they have authority to seek information must not make improper

use of this information. This is pertaining to the fact that this information might be of somebody

else and this will affect the working of that person.

In addition to this section 182 defines another civil obligation of corporation which restricts the

directors to make improper use of their position. This is pertaining to the fact that when the

person is in position then they must not misuse their position. This is because there are many

people who misuse their position for their personal comfort and because of this it may affect

performance of corporation. Hence, this obligation states that director or any person at higher

position must not misuse their post.

Moreover, section 191 under Corporation act states that it is the obligation of the director of

company that material information must not be shared with any other person. Also, if there is any

material information or personal interest of director then they must give a notice to company.

Along with this Corporation act 2001 also states that when these statutory obligations will not be

performed by the required people will have to pay penalties ranging to $200000.

Question2

Briefly explain the following Australian, international and local legislation and conventions that are

relevant to financial management in the organisation

(a) Australian Accounting Standards

The Australian accounting standards board (AASB) is a type of agency owned by the Australian

government which assists in maintaining and developing financial reporting standards. For any

company the most essential thing is to manage and check its profitability which they undertake

with help of accounting. Hence, for undertaking the accounting process they have to follow the

accounting standards provided by AASB. With respect to financial management within the

company all the list of regulation and standards are being provided which every organization has

to follow in accordance with AASB.

(b) Australian Securities and Investments Commission

Australian Securities and Investments Commission is an independent government body of

Australia. This body is an integration of market, corporate, consumer credit regulator ad financial

services regulator. The major role of ASIC is to manage and maintain and improve and facilitate

performance of financial systems and other related entities. They also works in promoting the

informed participation of the consumer and investors within the financial system. Along with this

StudentAssessment Guidev 1January 2019 Page 2 of 16

BSBFIM601 Manage finances

another major role of ASIC is to mark information about all the companies and other bodies

which are available to public for dealing in financial services.

(c) Privacy Acts and Principles

The Australian privacy principles of APP are the main pillar of the privacy protection framework

within the Privacy act 1988. This act is being applicable to every type of organization and

especially the one which deals in financial services. This involves 13 Australian privacy

principles and these principles guides and governs the rights, standard and obligation. These

obligation relates to the following aspect-

Use, collection and disclosing the personal information of the client.

Integration and correcting the person information

Accountability and governance of company or the agency.

Right of an individual person in order to access personal information.

(d) International regulations (a brief overview)

The International regulations are the laws and legislations which occur at time of dealing at

international level. This is very essential for the companies to have the proper knowledge of all

the international laws and regulations as all these are different in comparison to the domestic

laws and legislations. Hence, for every company it is very important to have proper knowledge

and information relating to laws especially in field of accounting. This is because of the reason

that every country has different accounting standards and in international market the

requirement relating to accounting also changes.

Question3

Research tax law compliance and outline statutory requirements related to each of the following:

Tax Requirements

(a) Goods and Services Tax This is a type of tax which is applicable over goods and

services which business deals. This is a tax that is

applicable from 1st July 2017 and this tax rate is 10 %.

This tax is applicable over the supply of all tangible

services directly to the Australian consumers. This is

applicable in case where the sale to Australian consumer

is through EDP then in that case EDO operator will be

responsible for GST payable of this sale. Only the supply

which is made to consumer are exempted that is

business to business transaction are exempted from

GST.

(b) Payroll tax This is a type of tax which is defined as percentage that

is withheld from the pay of employee by employer who

pays is to the government of country on behalf of

employee. This Payroll tax rate in Australia is 4.85 %

except for the regional Victorian employers. For the year

2020- 21 the payroll tax rate for regional Victorian

employer is 2.02 %. For the payment of this tax it is

necessary for the company to get themselves register

with the website and then all payrolls is recorded over

website. Also there may be interest and penalties

charged are registration is not done.

StudentAssessment Guidev 1January 2019 Page 3 of 16

another major role of ASIC is to mark information about all the companies and other bodies

which are available to public for dealing in financial services.

(c) Privacy Acts and Principles

The Australian privacy principles of APP are the main pillar of the privacy protection framework

within the Privacy act 1988. This act is being applicable to every type of organization and

especially the one which deals in financial services. This involves 13 Australian privacy

principles and these principles guides and governs the rights, standard and obligation. These

obligation relates to the following aspect-

Use, collection and disclosing the personal information of the client.

Integration and correcting the person information

Accountability and governance of company or the agency.

Right of an individual person in order to access personal information.

(d) International regulations (a brief overview)

The International regulations are the laws and legislations which occur at time of dealing at

international level. This is very essential for the companies to have the proper knowledge of all

the international laws and regulations as all these are different in comparison to the domestic

laws and legislations. Hence, for every company it is very important to have proper knowledge

and information relating to laws especially in field of accounting. This is because of the reason

that every country has different accounting standards and in international market the

requirement relating to accounting also changes.

Question3

Research tax law compliance and outline statutory requirements related to each of the following:

Tax Requirements

(a) Goods and Services Tax This is a type of tax which is applicable over goods and

services which business deals. This is a tax that is

applicable from 1st July 2017 and this tax rate is 10 %.

This tax is applicable over the supply of all tangible

services directly to the Australian consumers. This is

applicable in case where the sale to Australian consumer

is through EDP then in that case EDO operator will be

responsible for GST payable of this sale. Only the supply

which is made to consumer are exempted that is

business to business transaction are exempted from

GST.

(b) Payroll tax This is a type of tax which is defined as percentage that

is withheld from the pay of employee by employer who

pays is to the government of country on behalf of

employee. This Payroll tax rate in Australia is 4.85 %

except for the regional Victorian employers. For the year

2020- 21 the payroll tax rate for regional Victorian

employer is 2.02 %. For the payment of this tax it is

necessary for the company to get themselves register

with the website and then all payrolls is recorded over

website. Also there may be interest and penalties

charged are registration is not done.

StudentAssessment Guidev 1January 2019 Page 3 of 16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSBFIM601 Manage finances

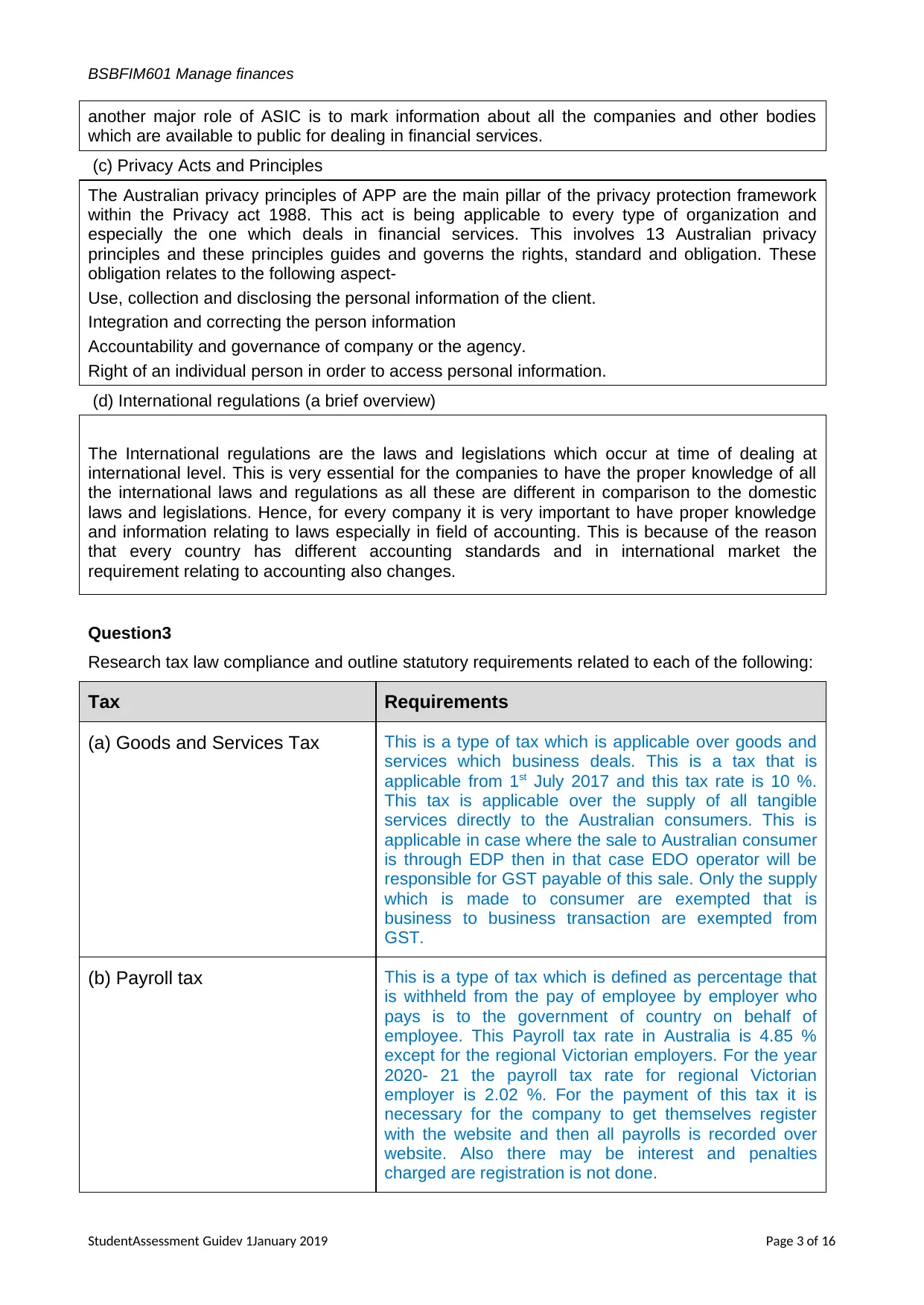

(c) Income tax This is a type of tax which government of country

charges over income of business and individuals. In

Australia for resident is as follows-

(d) Fringe benefit tax The Fringe benefit tax is the one which employers pay on

the benefits which are paid to employee in addition to

their wages or salary. This Fringe benefit tax is

calculated over the taxable value relating to the benefit

which is provided. This is applicable in condition only

when fringe benefit is being provided to the employees.

This Fringe benefit tax runs from april 1 to 31 March and

in the years 2017- 18 to 2021- 22 the Fringe benefit tax

rate is 47 %.

(e) PAYG withholding payable PAYG withholding payable or Pay as you go withholding

is a type of system wherein the withholding income tax

from the salary or wage of employee or contractor. Under

this, the payer of income instead of recipient of incomes

pays the tax directly to the ATO on behalf of the

employee.

(f) Company tax Under the Company tax all the business or

companies are eligible to a federal tax rate of 30

% over the taxable income. This excludes the

small business companies and these are subject

to rtax rate of 26 % for the current income year

which 2020- 21while will be reducing to 25 %

from next year that is 2021/ 22.

Question4

Describe the “principles of accounting” and financial systems.

Principles of accounting are the principles which need to be followed at time of making

accounts and calculating the profit. All the companies and business have to follow these

principles of accounting and these are same to all the companies. These are same

because of the reason that when all the business will be using same principle then the

accounting process will be same for every business and this will result in same base of

accounting. Hence, with help of this accounting principle the financial system will be

working in the same manner and will create better result and some common base for

comparison.

StudentAssessment Guidev 1January 2019 Page 4 of 16

(c) Income tax This is a type of tax which government of country

charges over income of business and individuals. In

Australia for resident is as follows-

(d) Fringe benefit tax The Fringe benefit tax is the one which employers pay on

the benefits which are paid to employee in addition to

their wages or salary. This Fringe benefit tax is

calculated over the taxable value relating to the benefit

which is provided. This is applicable in condition only

when fringe benefit is being provided to the employees.

This Fringe benefit tax runs from april 1 to 31 March and

in the years 2017- 18 to 2021- 22 the Fringe benefit tax

rate is 47 %.

(e) PAYG withholding payable PAYG withholding payable or Pay as you go withholding

is a type of system wherein the withholding income tax

from the salary or wage of employee or contractor. Under

this, the payer of income instead of recipient of incomes

pays the tax directly to the ATO on behalf of the

employee.

(f) Company tax Under the Company tax all the business or

companies are eligible to a federal tax rate of 30

% over the taxable income. This excludes the

small business companies and these are subject

to rtax rate of 26 % for the current income year

which 2020- 21while will be reducing to 25 %

from next year that is 2021/ 22.

Question4

Describe the “principles of accounting” and financial systems.

Principles of accounting are the principles which need to be followed at time of making

accounts and calculating the profit. All the companies and business have to follow these

principles of accounting and these are same to all the companies. These are same

because of the reason that when all the business will be using same principle then the

accounting process will be same for every business and this will result in same base of

accounting. Hence, with help of this accounting principle the financial system will be

working in the same manner and will create better result and some common base for

comparison.

StudentAssessment Guidev 1January 2019 Page 4 of 16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BSBFIM601 Manage finances

Revenue recognition principle- this is a type of principle which states that revenue is

being recognized at the time when it is generate that is at the point of sale and not when

buyer takes the possession of product.

Full disclosure principle- this is the principle which states that all the material and

relevant information must be communicated to the relevant parties. This is pertaining to

the fact that with help of this information all the necessary information must be shared to

the required party so that they can use that information for this required purpose.

Question5

Describe the requirements and implications of “financial probity”.

Financial probity is being defined as the strict obedience to the code of ethics which are

based on the honesty within the financial matters. All the decision relating to probity

must be honest, sensible, tailored and inclusive. This is the evidence of ethical

behaviour and this can be defined as complete and confirmed integrity honesty and

uprightness in a particular process. There are different types of principles which guide

the ethics and probity under the Australian government like official must not make

improper use of this position, must not accept gifts and other benefits from suppliers and

other stakeholder of business and many others.

Question6

Recommend commercially available software that is suitable for financial management.

The commercially available software for the financial management are as follows-

QuickBook- this is a software relating to the financial management which is made to help

small and medium companies and accountant. This helps the companies in bank

reconciliation, tracking invoices, advance reporting, payroll and much other related

aspect.

Zoho finance plus- this is another software which involves the breaking down of the

departmental silos and offering an end- to- end platform to all the back office department

and function. This involves the functions like inventory, tax compliance, expense

management and many other different types of the expenses and aspect relating to

financial management within the business.

Xero- this is also a type of the software relating to accounting which assist in creating

professional recurring of invoices. In addition to this it also analyses the reconcile

banking, credit card scheme and many others. This system is very to use and also assist

companies in their sales and purchase orders, inventory, payroll and other related

aspect.

StudentAssessment Guidev 1January 2019 Page 5 of 16

Revenue recognition principle- this is a type of principle which states that revenue is

being recognized at the time when it is generate that is at the point of sale and not when

buyer takes the possession of product.

Full disclosure principle- this is the principle which states that all the material and

relevant information must be communicated to the relevant parties. This is pertaining to

the fact that with help of this information all the necessary information must be shared to

the required party so that they can use that information for this required purpose.

Question5

Describe the requirements and implications of “financial probity”.

Financial probity is being defined as the strict obedience to the code of ethics which are

based on the honesty within the financial matters. All the decision relating to probity

must be honest, sensible, tailored and inclusive. This is the evidence of ethical

behaviour and this can be defined as complete and confirmed integrity honesty and

uprightness in a particular process. There are different types of principles which guide

the ethics and probity under the Australian government like official must not make

improper use of this position, must not accept gifts and other benefits from suppliers and

other stakeholder of business and many others.

Question6

Recommend commercially available software that is suitable for financial management.

The commercially available software for the financial management are as follows-

QuickBook- this is a software relating to the financial management which is made to help

small and medium companies and accountant. This helps the companies in bank

reconciliation, tracking invoices, advance reporting, payroll and much other related

aspect.

Zoho finance plus- this is another software which involves the breaking down of the

departmental silos and offering an end- to- end platform to all the back office department

and function. This involves the functions like inventory, tax compliance, expense

management and many other different types of the expenses and aspect relating to

financial management within the business.

Xero- this is also a type of the software relating to accounting which assist in creating

professional recurring of invoices. In addition to this it also analyses the reconcile

banking, credit card scheme and many others. This system is very to use and also assist

companies in their sales and purchase orders, inventory, payroll and other related

aspect.

StudentAssessment Guidev 1January 2019 Page 5 of 16

BSBFIM601 Manage finances

Suggested Resources:

Manage finance – BSBFIM601, 2015, 1st Edition, Version 1, Innovation and Business Industry Skills

Council Ltd Australia, East Melbourne, VIC, Australia

Australian Taxation Office viewed November 2017

https://www.ato.gov.au/

Policy and legislation, Australian Government, Department of finance, viewed November2017

https://finance.gov.au/policy-legislation.html

Federal register of legislation, Corporations Act 2001- C2017C00328, In force-latest

version,

Australian Government, viewed November 2017

https://www.legislation.gov.au/Details/C2017C00328

Budget 2017-18 Viewed November 2017

http://www.budget.gov.au/

Budget, budgeting and variance analysis, Building the business case analysis, viewed

November 2017

https://www.business-case-analysis.com/budget.html

StudentAssessment Guidev 1January 2019 Page 6 of 16

Suggested Resources:

Manage finance – BSBFIM601, 2015, 1st Edition, Version 1, Innovation and Business Industry Skills

Council Ltd Australia, East Melbourne, VIC, Australia

Australian Taxation Office viewed November 2017

https://www.ato.gov.au/

Policy and legislation, Australian Government, Department of finance, viewed November2017

https://finance.gov.au/policy-legislation.html

Federal register of legislation, Corporations Act 2001- C2017C00328, In force-latest

version,

Australian Government, viewed November 2017

https://www.legislation.gov.au/Details/C2017C00328

Budget 2017-18 Viewed November 2017

http://www.budget.gov.au/

Budget, budgeting and variance analysis, Building the business case analysis, viewed

November 2017

https://www.business-case-analysis.com/budget.html

StudentAssessment Guidev 1January 2019 Page 6 of 16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSBFIM601 Manage finances

ASSESSMENT 2: CASE STUDY – STAGE ONE

Tasks:

Part A

Read and analyse the case study information that follows and complete the tasks or answer the

questions.

Make sure you analyse the business plan summary, and the previous year’s financial data.

Now complete the following.

1. Develop a:

(a) Sales Budget,

(b) Profit Budget,

(c) Cash Flow Budget

(d) Debtor Ageing Summary

Instructions:

You must use electronic spreadsheets, for example MS Excel, and each budget must be in

a separate worksheet

Each budget must be divided into quarterly periods

Make sure that you use the previous year’s financial data to determine allocations for

resources.

Ensure each budget you prepare complies with the organisational and policies and

procedures as provided.

StudentAssessment Guidev 1January 2019 Page 7 of 16

ASSESSMENT 2: CASE STUDY – STAGE ONE

Tasks:

Part A

Read and analyse the case study information that follows and complete the tasks or answer the

questions.

Make sure you analyse the business plan summary, and the previous year’s financial data.

Now complete the following.

1. Develop a:

(a) Sales Budget,

(b) Profit Budget,

(c) Cash Flow Budget

(d) Debtor Ageing Summary

Instructions:

You must use electronic spreadsheets, for example MS Excel, and each budget must be in

a separate worksheet

Each budget must be divided into quarterly periods

Make sure that you use the previous year’s financial data to determine allocations for

resources.

Ensure each budget you prepare complies with the organisational and policies and

procedures as provided.

StudentAssessment Guidev 1January 2019 Page 7 of 16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BSBFIM601 Manage finances

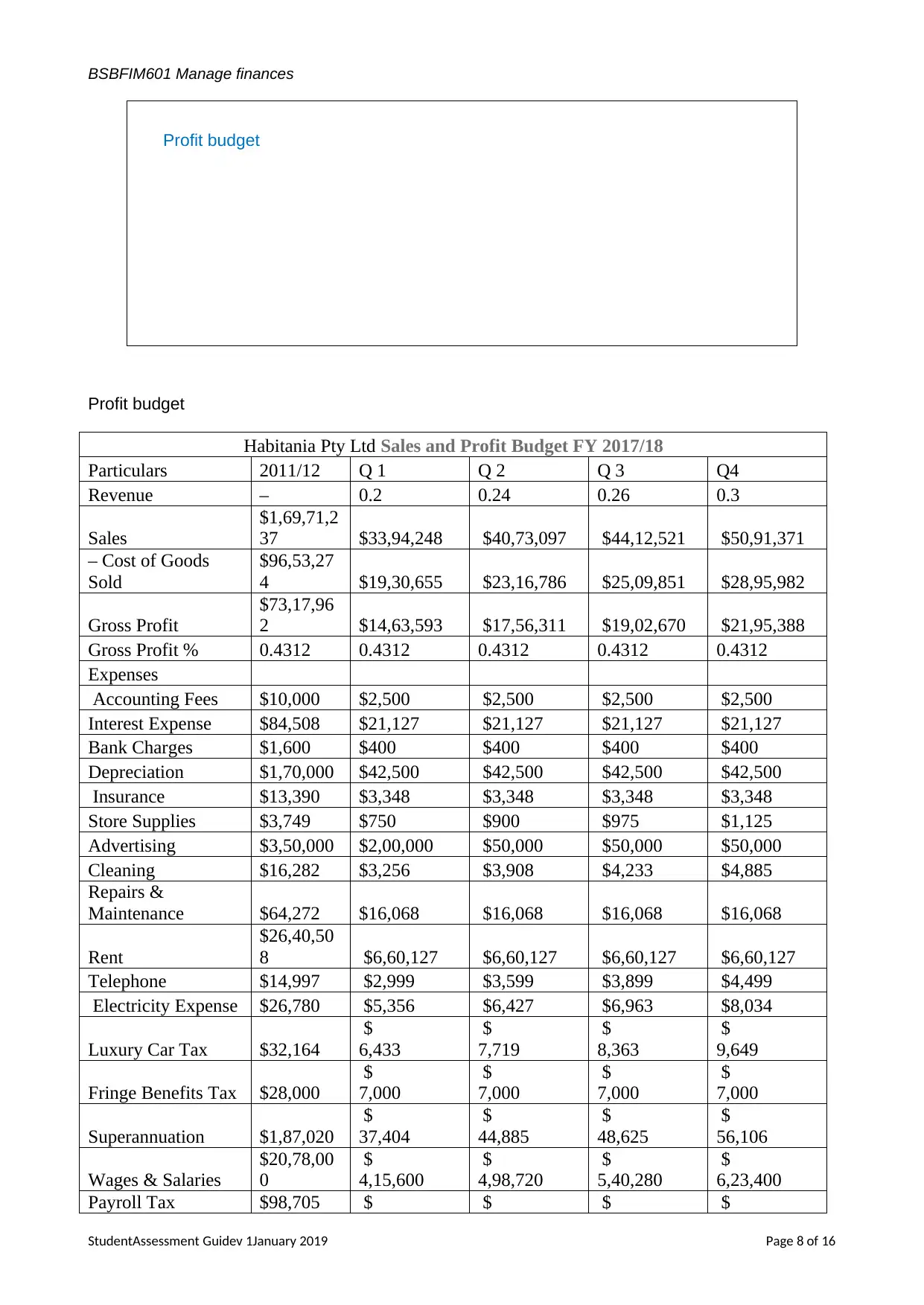

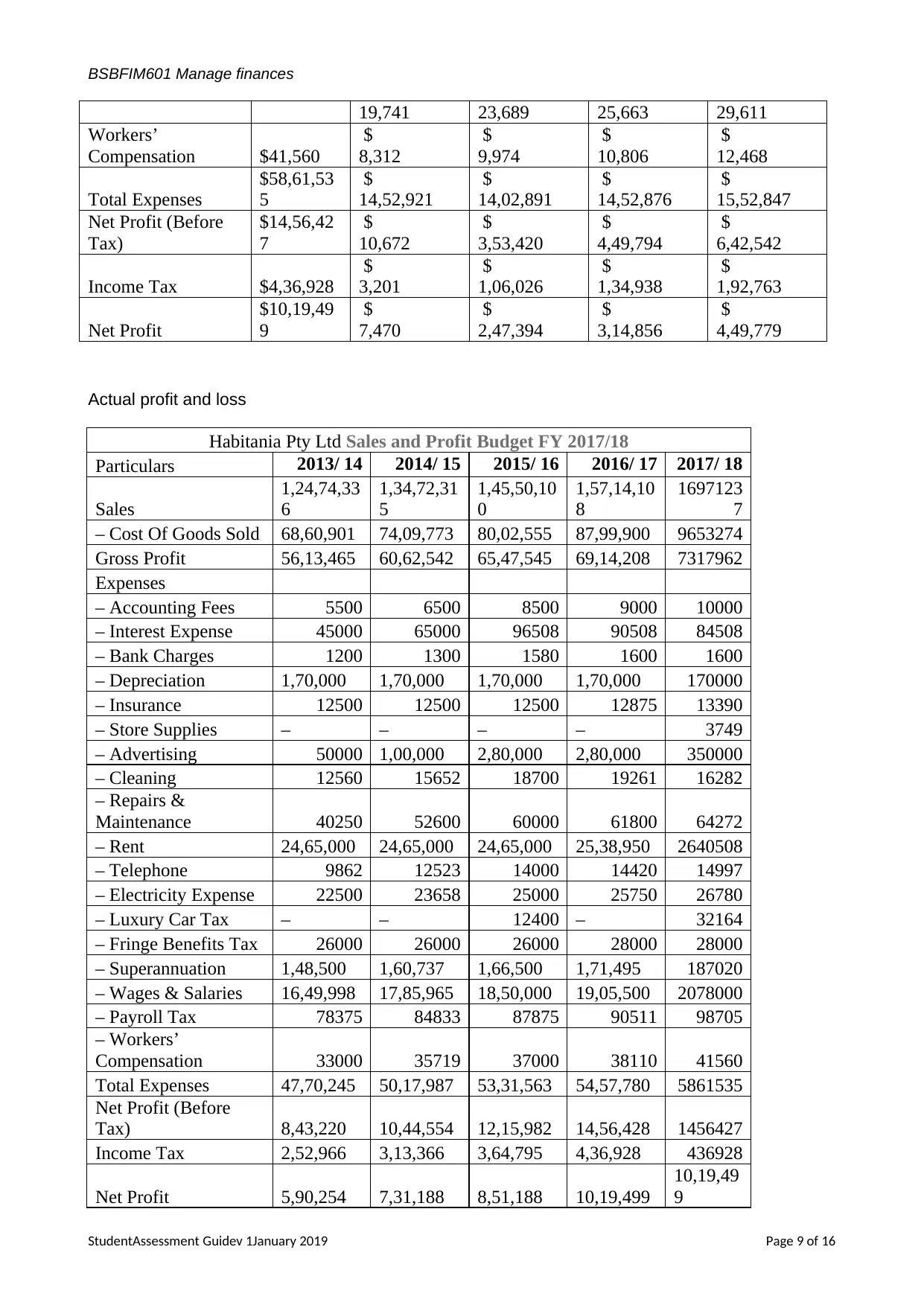

Profit budget

Profit budget

Habitania Pty Ltd Sales and Profit Budget FY 2017/18

Particulars 2011/12 Q 1 Q 2 Q 3 Q4

Revenue – 0.2 0.24 0.26 0.3

Sales

$1,69,71,2

37 $33,94,248 $40,73,097 $44,12,521 $50,91,371

– Cost of Goods

Sold

$96,53,27

4 $19,30,655 $23,16,786 $25,09,851 $28,95,982

Gross Profit

$73,17,96

2 $14,63,593 $17,56,311 $19,02,670 $21,95,388

Gross Profit % 0.4312 0.4312 0.4312 0.4312 0.4312

Expenses

Accounting Fees $10,000 $2,500 $2,500 $2,500 $2,500

Interest Expense $84,508 $21,127 $21,127 $21,127 $21,127

Bank Charges $1,600 $400 $400 $400 $400

Depreciation $1,70,000 $42,500 $42,500 $42,500 $42,500

Insurance $13,390 $3,348 $3,348 $3,348 $3,348

Store Supplies $3,749 $750 $900 $975 $1,125

Advertising $3,50,000 $2,00,000 $50,000 $50,000 $50,000

Cleaning $16,282 $3,256 $3,908 $4,233 $4,885

Repairs &

Maintenance $64,272 $16,068 $16,068 $16,068 $16,068

Rent

$26,40,50

8 $6,60,127 $6,60,127 $6,60,127 $6,60,127

Telephone $14,997 $2,999 $3,599 $3,899 $4,499

Electricity Expense $26,780 $5,356 $6,427 $6,963 $8,034

Luxury Car Tax $32,164

$

6,433

$

7,719

$

8,363

$

9,649

Fringe Benefits Tax $28,000

$

7,000

$

7,000

$

7,000

$

7,000

Superannuation $1,87,020

$

37,404

$

44,885

$

48,625

$

56,106

Wages & Salaries

$20,78,00

0

$

4,15,600

$

4,98,720

$

5,40,280

$

6,23,400

Payroll Tax $98,705 $ $ $ $

StudentAssessment Guidev 1January 2019 Page 8 of 16

Profit budget

Profit budget

Habitania Pty Ltd Sales and Profit Budget FY 2017/18

Particulars 2011/12 Q 1 Q 2 Q 3 Q4

Revenue – 0.2 0.24 0.26 0.3

Sales

$1,69,71,2

37 $33,94,248 $40,73,097 $44,12,521 $50,91,371

– Cost of Goods

Sold

$96,53,27

4 $19,30,655 $23,16,786 $25,09,851 $28,95,982

Gross Profit

$73,17,96

2 $14,63,593 $17,56,311 $19,02,670 $21,95,388

Gross Profit % 0.4312 0.4312 0.4312 0.4312 0.4312

Expenses

Accounting Fees $10,000 $2,500 $2,500 $2,500 $2,500

Interest Expense $84,508 $21,127 $21,127 $21,127 $21,127

Bank Charges $1,600 $400 $400 $400 $400

Depreciation $1,70,000 $42,500 $42,500 $42,500 $42,500

Insurance $13,390 $3,348 $3,348 $3,348 $3,348

Store Supplies $3,749 $750 $900 $975 $1,125

Advertising $3,50,000 $2,00,000 $50,000 $50,000 $50,000

Cleaning $16,282 $3,256 $3,908 $4,233 $4,885

Repairs &

Maintenance $64,272 $16,068 $16,068 $16,068 $16,068

Rent

$26,40,50

8 $6,60,127 $6,60,127 $6,60,127 $6,60,127

Telephone $14,997 $2,999 $3,599 $3,899 $4,499

Electricity Expense $26,780 $5,356 $6,427 $6,963 $8,034

Luxury Car Tax $32,164

$

6,433

$

7,719

$

8,363

$

9,649

Fringe Benefits Tax $28,000

$

7,000

$

7,000

$

7,000

$

7,000

Superannuation $1,87,020

$

37,404

$

44,885

$

48,625

$

56,106

Wages & Salaries

$20,78,00

0

$

4,15,600

$

4,98,720

$

5,40,280

$

6,23,400

Payroll Tax $98,705 $ $ $ $

StudentAssessment Guidev 1January 2019 Page 8 of 16

BSBFIM601 Manage finances

19,741 23,689 25,663 29,611

Workers’

Compensation $41,560

$

8,312

$

9,974

$

10,806

$

12,468

Total Expenses

$58,61,53

5

$

14,52,921

$

14,02,891

$

14,52,876

$

15,52,847

Net Profit (Before

Tax)

$14,56,42

7

$

10,672

$

3,53,420

$

4,49,794

$

6,42,542

Income Tax $4,36,928

$

3,201

$

1,06,026

$

1,34,938

$

1,92,763

Net Profit

$10,19,49

9

$

7,470

$

2,47,394

$

3,14,856

$

4,49,779

Actual profit and loss

Habitania Pty Ltd Sales and Profit Budget FY 2017/18

Particulars 2013/ 14 2014/ 15 2015/ 16 2016/ 17 2017/ 18

Sales

1,24,74,33

6

1,34,72,31

5

1,45,50,10

0

1,57,14,10

8

1697123

7

– Cost Of Goods Sold 68,60,901 74,09,773 80,02,555 87,99,900 9653274

Gross Profit 56,13,465 60,62,542 65,47,545 69,14,208 7317962

Expenses

– Accounting Fees 5500 6500 8500 9000 10000

– Interest Expense 45000 65000 96508 90508 84508

– Bank Charges 1200 1300 1580 1600 1600

– Depreciation 1,70,000 1,70,000 1,70,000 1,70,000 170000

– Insurance 12500 12500 12500 12875 13390

– Store Supplies – – – – 3749

– Advertising 50000 1,00,000 2,80,000 2,80,000 350000

– Cleaning 12560 15652 18700 19261 16282

– Repairs &

Maintenance 40250 52600 60000 61800 64272

– Rent 24,65,000 24,65,000 24,65,000 25,38,950 2640508

– Telephone 9862 12523 14000 14420 14997

– Electricity Expense 22500 23658 25000 25750 26780

– Luxury Car Tax – – 12400 – 32164

– Fringe Benefits Tax 26000 26000 26000 28000 28000

– Superannuation 1,48,500 1,60,737 1,66,500 1,71,495 187020

– Wages & Salaries 16,49,998 17,85,965 18,50,000 19,05,500 2078000

– Payroll Tax 78375 84833 87875 90511 98705

– Workers’

Compensation 33000 35719 37000 38110 41560

Total Expenses 47,70,245 50,17,987 53,31,563 54,57,780 5861535

Net Profit (Before

Tax) 8,43,220 10,44,554 12,15,982 14,56,428 1456427

Income Tax 2,52,966 3,13,366 3,64,795 4,36,928 436928

Net Profit 5,90,254 7,31,188 8,51,188 10,19,499

10,19,49

9

StudentAssessment Guidev 1January 2019 Page 9 of 16

19,741 23,689 25,663 29,611

Workers’

Compensation $41,560

$

8,312

$

9,974

$

10,806

$

12,468

Total Expenses

$58,61,53

5

$

14,52,921

$

14,02,891

$

14,52,876

$

15,52,847

Net Profit (Before

Tax)

$14,56,42

7

$

10,672

$

3,53,420

$

4,49,794

$

6,42,542

Income Tax $4,36,928

$

3,201

$

1,06,026

$

1,34,938

$

1,92,763

Net Profit

$10,19,49

9

$

7,470

$

2,47,394

$

3,14,856

$

4,49,779

Actual profit and loss

Habitania Pty Ltd Sales and Profit Budget FY 2017/18

Particulars 2013/ 14 2014/ 15 2015/ 16 2016/ 17 2017/ 18

Sales

1,24,74,33

6

1,34,72,31

5

1,45,50,10

0

1,57,14,10

8

1697123

7

– Cost Of Goods Sold 68,60,901 74,09,773 80,02,555 87,99,900 9653274

Gross Profit 56,13,465 60,62,542 65,47,545 69,14,208 7317962

Expenses

– Accounting Fees 5500 6500 8500 9000 10000

– Interest Expense 45000 65000 96508 90508 84508

– Bank Charges 1200 1300 1580 1600 1600

– Depreciation 1,70,000 1,70,000 1,70,000 1,70,000 170000

– Insurance 12500 12500 12500 12875 13390

– Store Supplies – – – – 3749

– Advertising 50000 1,00,000 2,80,000 2,80,000 350000

– Cleaning 12560 15652 18700 19261 16282

– Repairs &

Maintenance 40250 52600 60000 61800 64272

– Rent 24,65,000 24,65,000 24,65,000 25,38,950 2640508

– Telephone 9862 12523 14000 14420 14997

– Electricity Expense 22500 23658 25000 25750 26780

– Luxury Car Tax – – 12400 – 32164

– Fringe Benefits Tax 26000 26000 26000 28000 28000

– Superannuation 1,48,500 1,60,737 1,66,500 1,71,495 187020

– Wages & Salaries 16,49,998 17,85,965 18,50,000 19,05,500 2078000

– Payroll Tax 78375 84833 87875 90511 98705

– Workers’

Compensation 33000 35719 37000 38110 41560

Total Expenses 47,70,245 50,17,987 53,31,563 54,57,780 5861535

Net Profit (Before

Tax) 8,43,220 10,44,554 12,15,982 14,56,428 1456427

Income Tax 2,52,966 3,13,366 3,64,795 4,36,928 436928

Net Profit 5,90,254 7,31,188 8,51,188 10,19,499

10,19,49

9

StudentAssessment Guidev 1January 2019 Page 9 of 16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BSBFIM601 Manage finances

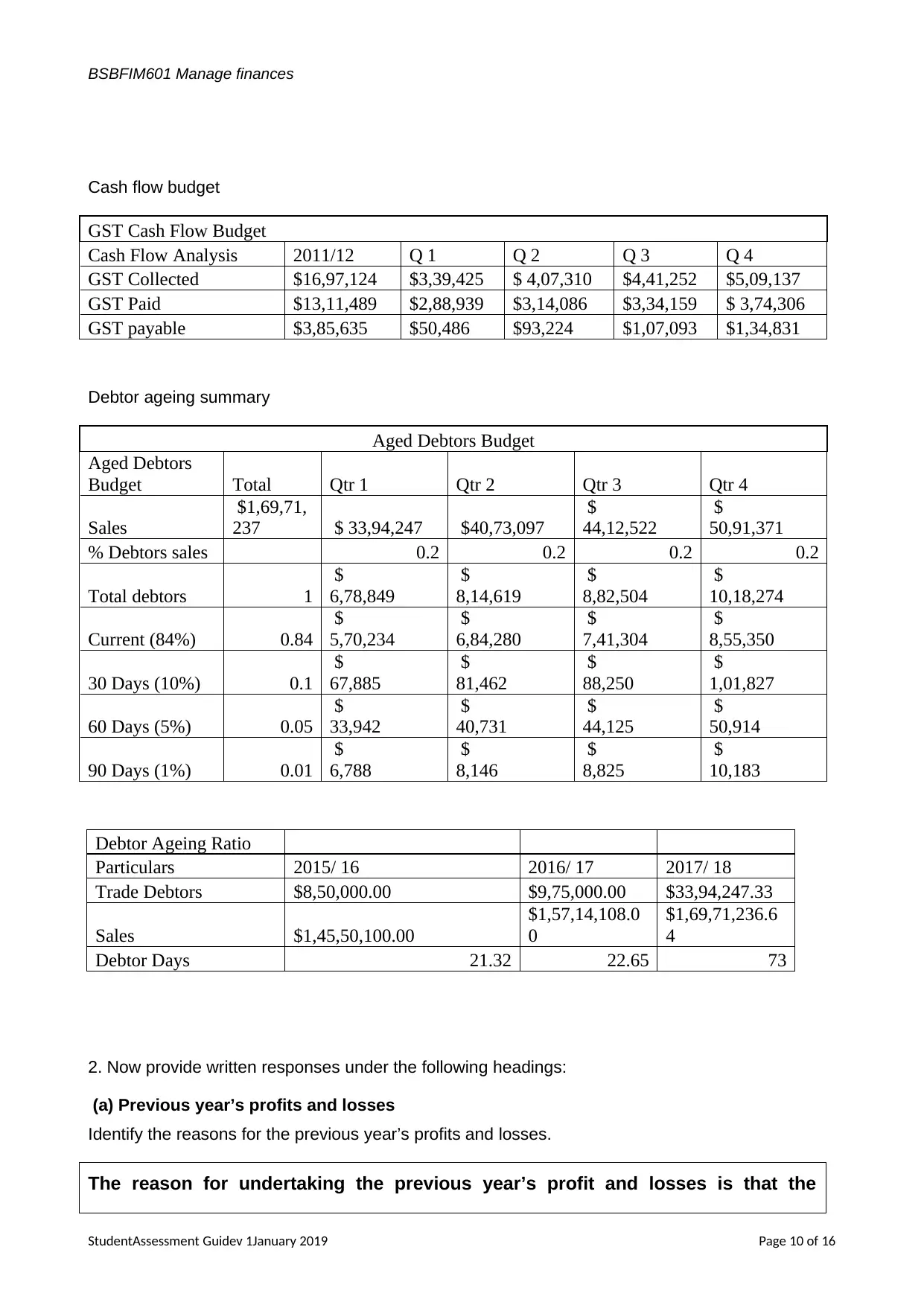

Cash flow budget

GST Cash Flow Budget

Cash Flow Analysis 2011/12 Q 1 Q 2 Q 3 Q 4

GST Collected $16,97,124 $3,39,425 $ 4,07,310 $4,41,252 $5,09,137

GST Paid $13,11,489 $2,88,939 $3,14,086 $3,34,159 $ 3,74,306

GST payable $3,85,635 $50,486 $93,224 $1,07,093 $1,34,831

Debtor ageing summary

Aged Debtors Budget

Aged Debtors

Budget Total Qtr 1 Qtr 2 Qtr 3 Qtr 4

Sales

$1,69,71,

237 $ 33,94,247 $40,73,097

$

44,12,522

$

50,91,371

% Debtors sales 0.2 0.2 0.2 0.2

Total debtors 1

$

6,78,849

$

8,14,619

$

8,82,504

$

10,18,274

Current (84%) 0.84

$

5,70,234

$

6,84,280

$

7,41,304

$

8,55,350

30 Days (10%) 0.1

$

67,885

$

81,462

$

88,250

$

1,01,827

60 Days (5%) 0.05

$

33,942

$

40,731

$

44,125

$

50,914

90 Days (1%) 0.01

$

6,788

$

8,146

$

8,825

$

10,183

Debtor Ageing Ratio

Particulars 2015/ 16 2016/ 17 2017/ 18

Trade Debtors $8,50,000.00 $9,75,000.00 $33,94,247.33

Sales $1,45,50,100.00

$1,57,14,108.0

0

$1,69,71,236.6

4

Debtor Days 21.32 22.65 73

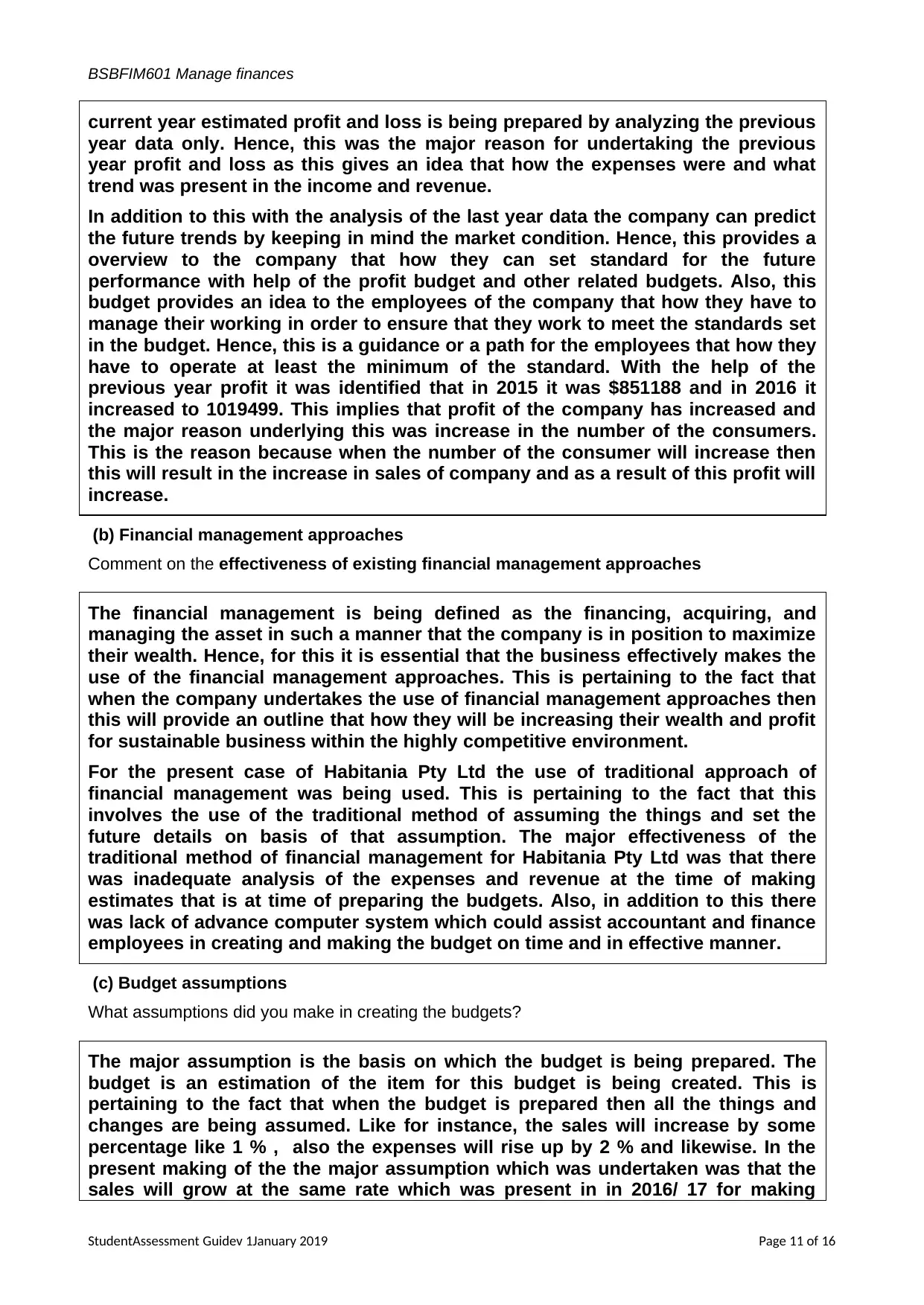

2. Now provide written responses under the following headings:

(a) Previous year’s profits and losses

Identify the reasons for the previous year’s profits and losses.

The reason for undertaking the previous year’s profit and losses is that the

StudentAssessment Guidev 1January 2019 Page 10 of 16

Cash flow budget

GST Cash Flow Budget

Cash Flow Analysis 2011/12 Q 1 Q 2 Q 3 Q 4

GST Collected $16,97,124 $3,39,425 $ 4,07,310 $4,41,252 $5,09,137

GST Paid $13,11,489 $2,88,939 $3,14,086 $3,34,159 $ 3,74,306

GST payable $3,85,635 $50,486 $93,224 $1,07,093 $1,34,831

Debtor ageing summary

Aged Debtors Budget

Aged Debtors

Budget Total Qtr 1 Qtr 2 Qtr 3 Qtr 4

Sales

$1,69,71,

237 $ 33,94,247 $40,73,097

$

44,12,522

$

50,91,371

% Debtors sales 0.2 0.2 0.2 0.2

Total debtors 1

$

6,78,849

$

8,14,619

$

8,82,504

$

10,18,274

Current (84%) 0.84

$

5,70,234

$

6,84,280

$

7,41,304

$

8,55,350

30 Days (10%) 0.1

$

67,885

$

81,462

$

88,250

$

1,01,827

60 Days (5%) 0.05

$

33,942

$

40,731

$

44,125

$

50,914

90 Days (1%) 0.01

$

6,788

$

8,146

$

8,825

$

10,183

Debtor Ageing Ratio

Particulars 2015/ 16 2016/ 17 2017/ 18

Trade Debtors $8,50,000.00 $9,75,000.00 $33,94,247.33

Sales $1,45,50,100.00

$1,57,14,108.0

0

$1,69,71,236.6

4

Debtor Days 21.32 22.65 73

2. Now provide written responses under the following headings:

(a) Previous year’s profits and losses

Identify the reasons for the previous year’s profits and losses.

The reason for undertaking the previous year’s profit and losses is that the

StudentAssessment Guidev 1January 2019 Page 10 of 16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BSBFIM601 Manage finances

current year estimated profit and loss is being prepared by analyzing the previous

year data only. Hence, this was the major reason for undertaking the previous

year profit and loss as this gives an idea that how the expenses were and what

trend was present in the income and revenue.

In addition to this with the analysis of the last year data the company can predict

the future trends by keeping in mind the market condition. Hence, this provides a

overview to the company that how they can set standard for the future

performance with help of the profit budget and other related budgets. Also, this

budget provides an idea to the employees of the company that how they have to

manage their working in order to ensure that they work to meet the standards set

in the budget. Hence, this is a guidance or a path for the employees that how they

have to operate at least the minimum of the standard. With the help of the

previous year profit it was identified that in 2015 it was $851188 and in 2016 it

increased to 1019499. This implies that profit of the company has increased and

the major reason underlying this was increase in the number of the consumers.

This is the reason because when the number of the consumer will increase then

this will result in the increase in sales of company and as a result of this profit will

increase.

(b) Financial management approaches

Comment on the effectiveness of existing financial management approaches

The financial management is being defined as the financing, acquiring, and

managing the asset in such a manner that the company is in position to maximize

their wealth. Hence, for this it is essential that the business effectively makes the

use of the financial management approaches. This is pertaining to the fact that

when the company undertakes the use of financial management approaches then

this will provide an outline that how they will be increasing their wealth and profit

for sustainable business within the highly competitive environment.

For the present case of Habitania Pty Ltd the use of traditional approach of

financial management was being used. This is pertaining to the fact that this

involves the use of the traditional method of assuming the things and set the

future details on basis of that assumption. The major effectiveness of the

traditional method of financial management for Habitania Pty Ltd was that there

was inadequate analysis of the expenses and revenue at the time of making

estimates that is at time of preparing the budgets. Also, in addition to this there

was lack of advance computer system which could assist accountant and finance

employees in creating and making the budget on time and in effective manner.

(c) Budget assumptions

What assumptions did you make in creating the budgets?

The major assumption is the basis on which the budget is being prepared. The

budget is an estimation of the item for this budget is being created. This is

pertaining to the fact that when the budget is prepared then all the things and

changes are being assumed. Like for instance, the sales will increase by some

percentage like 1 % , also the expenses will rise up by 2 % and likewise. In the

present making of the the major assumption which was undertaken was that the

sales will grow at the same rate which was present in in 2016/ 17 for making

StudentAssessment Guidev 1January 2019 Page 11 of 16

current year estimated profit and loss is being prepared by analyzing the previous

year data only. Hence, this was the major reason for undertaking the previous

year profit and loss as this gives an idea that how the expenses were and what

trend was present in the income and revenue.

In addition to this with the analysis of the last year data the company can predict

the future trends by keeping in mind the market condition. Hence, this provides a

overview to the company that how they can set standard for the future

performance with help of the profit budget and other related budgets. Also, this

budget provides an idea to the employees of the company that how they have to

manage their working in order to ensure that they work to meet the standards set

in the budget. Hence, this is a guidance or a path for the employees that how they

have to operate at least the minimum of the standard. With the help of the

previous year profit it was identified that in 2015 it was $851188 and in 2016 it

increased to 1019499. This implies that profit of the company has increased and

the major reason underlying this was increase in the number of the consumers.

This is the reason because when the number of the consumer will increase then

this will result in the increase in sales of company and as a result of this profit will

increase.

(b) Financial management approaches

Comment on the effectiveness of existing financial management approaches

The financial management is being defined as the financing, acquiring, and

managing the asset in such a manner that the company is in position to maximize

their wealth. Hence, for this it is essential that the business effectively makes the

use of the financial management approaches. This is pertaining to the fact that

when the company undertakes the use of financial management approaches then

this will provide an outline that how they will be increasing their wealth and profit

for sustainable business within the highly competitive environment.

For the present case of Habitania Pty Ltd the use of traditional approach of

financial management was being used. This is pertaining to the fact that this

involves the use of the traditional method of assuming the things and set the

future details on basis of that assumption. The major effectiveness of the

traditional method of financial management for Habitania Pty Ltd was that there

was inadequate analysis of the expenses and revenue at the time of making

estimates that is at time of preparing the budgets. Also, in addition to this there

was lack of advance computer system which could assist accountant and finance

employees in creating and making the budget on time and in effective manner.

(c) Budget assumptions

What assumptions did you make in creating the budgets?

The major assumption is the basis on which the budget is being prepared. The

budget is an estimation of the item for this budget is being created. This is

pertaining to the fact that when the budget is prepared then all the things and

changes are being assumed. Like for instance, the sales will increase by some

percentage like 1 % , also the expenses will rise up by 2 % and likewise. In the

present making of the the major assumption which was undertaken was that the

sales will grow at the same rate which was present in in 2016/ 17 for making

StudentAssessment Guidev 1January 2019 Page 11 of 16

BSBFIM601 Manage finances

budget for 2017/ 18 as well. Along with this it was assumed that the inflation will

be at 4 % per annum which in turn reflected that all the expenses will rise at the

rate of 4 %. Also, it was assumed that there will be a decrease of 1 % in the gross

profit. This was assumed because of the reason that there was inflation and the

sales growth was also based on the last year rate only.

(d) Implementation and monitoring of budget

What relevant thoughts do you have regarding the implementation and monitoring of budget

expenditure?

At the time of implementation and monitoring the budget the most essential aspect is that

the planned activities undertake the working in the same and intended manner. This is

pertaining to the fact that when the thought steps will not be undertaken then this will be

affecting the budget implementation. The reason pertaining to the fact is that when the

budget is being prepared then it is prepared on basis of the assumption and if this assumption

will not be correct then whole budget will go wrong. Hence, implementation and monitoring

of budget need to be undertaken in proper and effective manner. for ensuring that the

implementation and monitoring of budget expenditure following points need to be kept in

mind which are as follows-

The division of sales is on the following basis that is it will include 30 % for bathroom fitting,

25 % for the fittings in bedroom, 15 % for the mirrors, 10 % for the decorative products and

items and 20 % for the lighting fixtures. Also, for the effective implementation of the budget

the advertising expense will be increased by $ 70000 as compared to the last year. This is

pertaining to the fact that when the advertising will be increased then more people will come

to know about the products of Habitania Pty Ltd and this will ensure that profit of the

company is increased up to at least the estimated profits.

Part B

Based on the information provided in the case study answer the following questions in the space

provided below: You must read and analyse the information in the case study on page 12

1. Identify the current statutory requirements for tax compliance and list and calculate the

tax liabilities for Habitania Pty Ltd under taxation legislation.

For the purpose of GST following calculation is being undertaken

$1571411 is collected – 987626 paid = 583785.

This is the total goods and service tax liability which is payable by the company.

Income tax liability is $436928

Along with this PAYG that is pay as you go withholding liability of the company payable is $ 44872.

StudentAssessment Guidev 1January 2019 Page 12 of 16

budget for 2017/ 18 as well. Along with this it was assumed that the inflation will

be at 4 % per annum which in turn reflected that all the expenses will rise at the

rate of 4 %. Also, it was assumed that there will be a decrease of 1 % in the gross

profit. This was assumed because of the reason that there was inflation and the

sales growth was also based on the last year rate only.

(d) Implementation and monitoring of budget

What relevant thoughts do you have regarding the implementation and monitoring of budget

expenditure?

At the time of implementation and monitoring the budget the most essential aspect is that

the planned activities undertake the working in the same and intended manner. This is

pertaining to the fact that when the thought steps will not be undertaken then this will be

affecting the budget implementation. The reason pertaining to the fact is that when the

budget is being prepared then it is prepared on basis of the assumption and if this assumption

will not be correct then whole budget will go wrong. Hence, implementation and monitoring

of budget need to be undertaken in proper and effective manner. for ensuring that the

implementation and monitoring of budget expenditure following points need to be kept in

mind which are as follows-

The division of sales is on the following basis that is it will include 30 % for bathroom fitting,

25 % for the fittings in bedroom, 15 % for the mirrors, 10 % for the decorative products and

items and 20 % for the lighting fixtures. Also, for the effective implementation of the budget

the advertising expense will be increased by $ 70000 as compared to the last year. This is

pertaining to the fact that when the advertising will be increased then more people will come

to know about the products of Habitania Pty Ltd and this will ensure that profit of the

company is increased up to at least the estimated profits.

Part B

Based on the information provided in the case study answer the following questions in the space

provided below: You must read and analyse the information in the case study on page 12

1. Identify the current statutory requirements for tax compliance and list and calculate the

tax liabilities for Habitania Pty Ltd under taxation legislation.

For the purpose of GST following calculation is being undertaken

$1571411 is collected – 987626 paid = 583785.

This is the total goods and service tax liability which is payable by the company.

Income tax liability is $436928

Along with this PAYG that is pay as you go withholding liability of the company payable is $ 44872.

StudentAssessment Guidev 1January 2019 Page 12 of 16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.