Financial Analysis and Management Report: Balfour Beatty PLC

VerifiedAdded on 2023/03/17

|23

|6145

|73

Report

AI Summary

This report provides a comprehensive financial analysis of Balfour Beatty PLC, a UK-based infrastructure company. The report begins with an introduction to the company, including its business model, market position, and recent events. Part A covers the company's history, business operations, and major competitors. Part B delves into a critical review of Balfour Beatty's financial performance over a five-year period, calculating and evaluating key financial ratios such as liquidity, profitability, gearing, and efficiency. The analysis includes comparisons to competitors and sector averages. The report also offers recommendations for improving the company's financial management. Finally, Part C addresses investment appraisal techniques to evaluate two hypothetical projects. The report utilizes data from the company's annual reports and provides a detailed assessment of its financial health and strategic position in the market.

FINANCIAL MANAGEMENT1

Financial management

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Financial management

By (Name)

Course

Instructor’s Name

Institutional Affiliation

The City and State

The Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MANAGEMENT2

Introduction

Part A

Balfour Beatty PLC is a world-wide infrastructural company. The company is

headquartered in the UK. The company engages in the provision of construction services,

support services as well infrastructural investments. The company is involved in works across

the UK, the United States, Ireland, south and east Asia as well as Canada. Balfour Beatty was

incorporated in the 1909. It was started with a total capital of £50,000.00 (Schündeln, 2012).

George Balfour the engineer and his friend Andrew Beatty the accountant spear headed the

formation of the company (Halstead, 2012). The initial focus of the company was to deal with

tramways where their first contract included the construction of the Dunfermline and District

Tramways (Prior, 2017). Balfour Beatty played major part in the initiation, planning and

advancement of Scotland’s hydroelectric power, the construction of dams, power stations as well

creation of transmission lines (King, 2015). Balfour Beatty has attained tremendous success over

the years to the extent that by the end of September 2018, the company had grown to a rank of

the biggest construction company in the UK (Brodie, 2008). The company operates a business

model where its services are divided into three segments. The segments include the construction

service segment, the support service segment and the infrastructure development segment

(O’sullivan and Sheffrin, 2003). The construction service segment involves the physical

constructions of assets, while the support service segments engages in the provision of support to

the existing functions of assets (Roth, 2012). Some of these support services include asset

maintenance as well as renovation. In terms of the segment for Infrastructural Investments, it

engages in the procurement as well as disposal of the infrastructural assets (Huston, 2015).

These usually include the roads, the hospitals, military housings, waste as well as well as

Introduction

Part A

Balfour Beatty PLC is a world-wide infrastructural company. The company is

headquartered in the UK. The company engages in the provision of construction services,

support services as well infrastructural investments. The company is involved in works across

the UK, the United States, Ireland, south and east Asia as well as Canada. Balfour Beatty was

incorporated in the 1909. It was started with a total capital of £50,000.00 (Schündeln, 2012).

George Balfour the engineer and his friend Andrew Beatty the accountant spear headed the

formation of the company (Halstead, 2012). The initial focus of the company was to deal with

tramways where their first contract included the construction of the Dunfermline and District

Tramways (Prior, 2017). Balfour Beatty played major part in the initiation, planning and

advancement of Scotland’s hydroelectric power, the construction of dams, power stations as well

creation of transmission lines (King, 2015). Balfour Beatty has attained tremendous success over

the years to the extent that by the end of September 2018, the company had grown to a rank of

the biggest construction company in the UK (Brodie, 2008). The company operates a business

model where its services are divided into three segments. The segments include the construction

service segment, the support service segment and the infrastructure development segment

(O’sullivan and Sheffrin, 2003). The construction service segment involves the physical

constructions of assets, while the support service segments engages in the provision of support to

the existing functions of assets (Roth, 2012). Some of these support services include asset

maintenance as well as renovation. In terms of the segment for Infrastructural Investments, it

engages in the procurement as well as disposal of the infrastructural assets (Huston, 2015).

These usually include the roads, the hospitals, military housings, waste as well as well as

FINANCIAL MANAGEMENT3

biomass among other investments. The Infrastructure Investments segments also entails the

division for housing development (Menary, 2018). The business has been involved in the

management of construction business in both the UK and the USA. The company’s long-

standing strategy is to engage in the development of its business operations through foreign

expansion, acquisitions as well as disposals (Rob, 2009). The company’s fundamental aim is to

be a market leader through the development of both short and long term customer relationships

through sufficiently developed supply chains (Bill, 2008).

Balfour Beatty has investments across various markets. These are diversified through

both industry and geography (Obaidat and Al-Hajaia, 2013). Such a broad perspective alongside

focused industrial expertise as well as knowledge for every single market served ensures that

there is extra values in terms of the company and client relationships (Diaz, 2012). The company

operates within the UK, the USA, Canada, Ireland, Scotland, south and Middle East Asia and in

other oversee countries. Balfour Beatty has a number of competitors and some of the major ones

include Katerra. Hensel Phelps Construction, Fluor, Bechtel Corporation, Interserve and Costain

Group. Although, it has to be noted that Balfour has continued to position its self within the

market in manner that it can best defend its self against the competitive market forces and also

influence the forces in its favour( McConnell, 2009). The organisation is highly flexible and

adaptable in a way that it is able to change with the changing market environment (Slee, 2011). It

is because of such flexibility and adaptability that the company has managed to remain

sustainably competitive in spite of the enormous cut throat competitive within the market (Baron

and Michael, 2012).

Some of the major events to have taken place in the company over the past five years

include the resignation of Martin Chown, the company’s UK procurement director. There have

biomass among other investments. The Infrastructure Investments segments also entails the

division for housing development (Menary, 2018). The business has been involved in the

management of construction business in both the UK and the USA. The company’s long-

standing strategy is to engage in the development of its business operations through foreign

expansion, acquisitions as well as disposals (Rob, 2009). The company’s fundamental aim is to

be a market leader through the development of both short and long term customer relationships

through sufficiently developed supply chains (Bill, 2008).

Balfour Beatty has investments across various markets. These are diversified through

both industry and geography (Obaidat and Al-Hajaia, 2013). Such a broad perspective alongside

focused industrial expertise as well as knowledge for every single market served ensures that

there is extra values in terms of the company and client relationships (Diaz, 2012). The company

operates within the UK, the USA, Canada, Ireland, Scotland, south and Middle East Asia and in

other oversee countries. Balfour Beatty has a number of competitors and some of the major ones

include Katerra. Hensel Phelps Construction, Fluor, Bechtel Corporation, Interserve and Costain

Group. Although, it has to be noted that Balfour has continued to position its self within the

market in manner that it can best defend its self against the competitive market forces and also

influence the forces in its favour( McConnell, 2009). The organisation is highly flexible and

adaptable in a way that it is able to change with the changing market environment (Slee, 2011). It

is because of such flexibility and adaptability that the company has managed to remain

sustainably competitive in spite of the enormous cut throat competitive within the market (Baron

and Michael, 2012).

Some of the major events to have taken place in the company over the past five years

include the resignation of Martin Chown, the company’s UK procurement director. There have

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL MANAGEMENT4

also been accusations levied against Balfour Beatty on account of a series of labour abuses of

migrant workers that the company employees on a large scale basis. In the same manner, in the

month of august of the year 2014, the corporation did rebuff three proposals provided by their

competitor within the UK. The offer included a request for the two companies to form a merger

(Clarkson, 2010). The last bid which had put Balfour Beatty at a valuation of two billion pounds

was solidly vetoed by company’s board on the 20th /8/ 2014. Another major event took place on

the 22nd/1/ 2016 where the high court did order 30 construction firms to make a disclosure of all

the emails as well as correspondences associated with blacklisting by 12th/12/ 2016. This was

after it had appeared that supervisors at Balfour Beatty had made to reference to excluded

employees as sheep. Although, the company did agree some settlements on 11/5/2016 and an

official apology by forty firms implicated was pronounced in court before closing the case.

Part B

Company’s financial performances

Balfour Beatty PLC has current assets amounting to £2.33 Billion. This amount is big

enough to cover the company’s total liabilities valued at £966 Million (Hamilton, et al. 2011).

The implication for this kind of financial position is that the company is able to meet its financial

obligations. There is therefore no need for any potential investors to worry about the company’s

debt to equity ratio (Huang and Diewert, 2011). As much as any company’s operating cash flows

are of critical importance, it is the earnings which indicate the level of profitability of the

company (Alexander, 2015). This is usually after it has accounted for its overall gains as well as

losses for none core aspects and the non-cash expenditures. Beatty PLC does earn much more

interest than it pays out. In spite of the debt-to-equity ratio of the company being greater than

40%, the company looks to be in a sound financial condition (Hoskins, 2009). This is particularly

also been accusations levied against Balfour Beatty on account of a series of labour abuses of

migrant workers that the company employees on a large scale basis. In the same manner, in the

month of august of the year 2014, the corporation did rebuff three proposals provided by their

competitor within the UK. The offer included a request for the two companies to form a merger

(Clarkson, 2010). The last bid which had put Balfour Beatty at a valuation of two billion pounds

was solidly vetoed by company’s board on the 20th /8/ 2014. Another major event took place on

the 22nd/1/ 2016 where the high court did order 30 construction firms to make a disclosure of all

the emails as well as correspondences associated with blacklisting by 12th/12/ 2016. This was

after it had appeared that supervisors at Balfour Beatty had made to reference to excluded

employees as sheep. Although, the company did agree some settlements on 11/5/2016 and an

official apology by forty firms implicated was pronounced in court before closing the case.

Part B

Company’s financial performances

Balfour Beatty PLC has current assets amounting to £2.33 Billion. This amount is big

enough to cover the company’s total liabilities valued at £966 Million (Hamilton, et al. 2011).

The implication for this kind of financial position is that the company is able to meet its financial

obligations. There is therefore no need for any potential investors to worry about the company’s

debt to equity ratio (Huang and Diewert, 2011). As much as any company’s operating cash flows

are of critical importance, it is the earnings which indicate the level of profitability of the

company (Alexander, 2015). This is usually after it has accounted for its overall gains as well as

losses for none core aspects and the non-cash expenditures. Beatty PLC does earn much more

interest than it pays out. In spite of the debt-to-equity ratio of the company being greater than

40%, the company looks to be in a sound financial condition (Hoskins, 2009). This is particularly

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MANAGEMENT5

the case when the company’s earnings and current assets are compared against its interest

payments as well as overall liabilities correspondingly. The company can continue to be strong

by maintain a healthy operating cash flow. The company did experience a fall in the cash

reserves in 2018 to a tune of negative 307.0 million. Although, the company earned a cash flow

from its investment activities of 150.0 million. The implication in this case is that the company

did earn more from selling its present assets than the expenditure it incurred while purchasing

other assets (Richardson, 2006). Additionally, the company did use 130.0Millions for operations

while the cash spent for financing the operations totalled 349.0 million. Year after year there was

an increase in both earnings and dividends per share excluding extraordinary items at a rate of

33.3% and 4.0%, correspondingly. The positive trend in growth related to dividend payments is a

critical indicator because there only a handful of companies within the construction industry that

pay dividends.

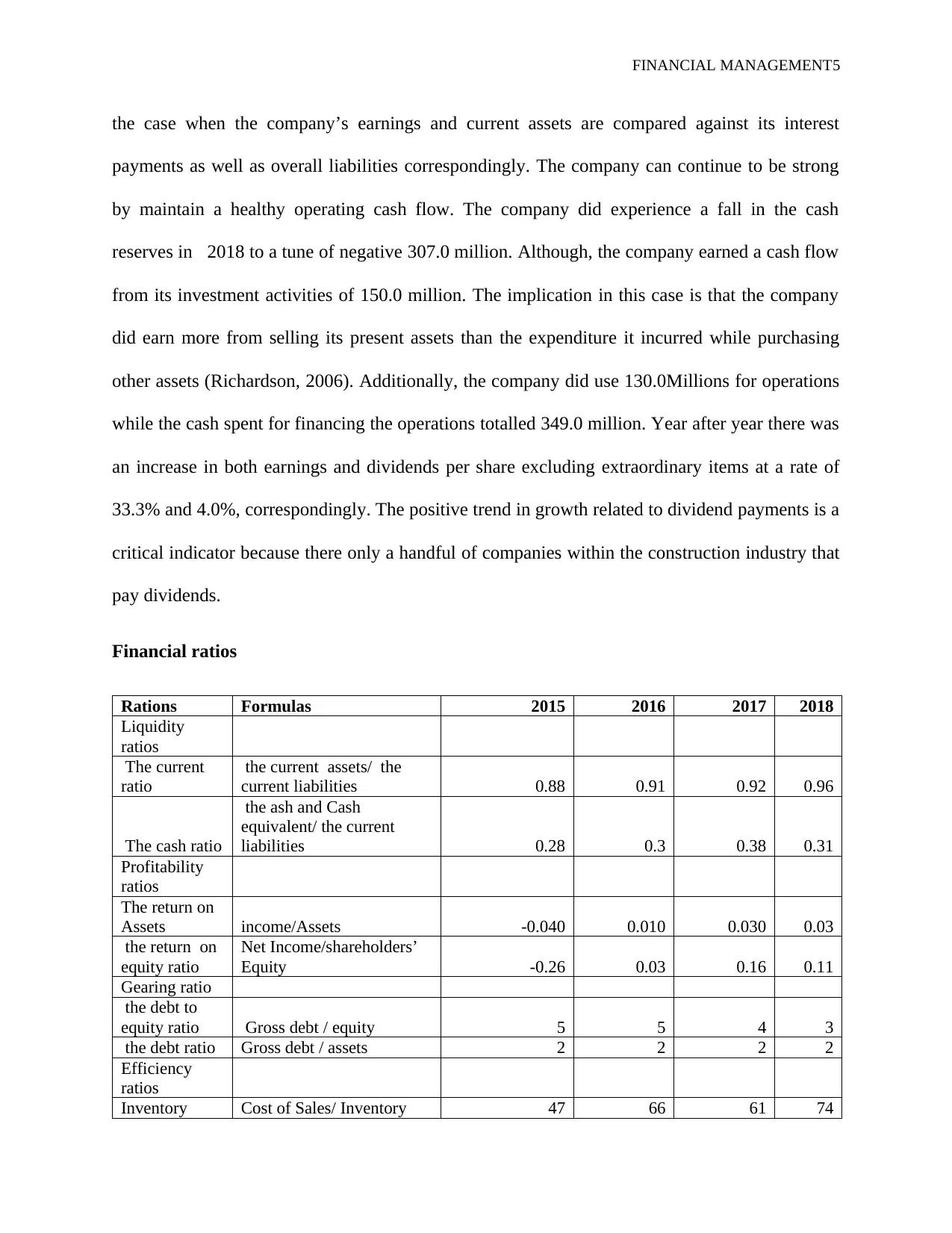

Financial ratios

Rations Formulas 2015 2016 2017 2018

Liquidity

ratios

The current

ratio

the current assets/ the

current liabilities 0.88 0.91 0.92 0.96

The cash ratio

the ash and Cash

equivalent/ the current

liabilities 0.28 0.3 0.38 0.31

Profitability

ratios

The return on

Assets income/Assets -0.040 0.010 0.030 0.03

the return on

equity ratio

Net Income/shareholders’

Equity -0.26 0.03 0.16 0.11

Gearing ratio

the debt to

equity ratio Gross debt / equity 5 5 4 3

the debt ratio Gross debt / assets 2 2 2 2

Efficiency

ratios

Inventory Cost of Sales/ Inventory 47 66 61 74

the case when the company’s earnings and current assets are compared against its interest

payments as well as overall liabilities correspondingly. The company can continue to be strong

by maintain a healthy operating cash flow. The company did experience a fall in the cash

reserves in 2018 to a tune of negative 307.0 million. Although, the company earned a cash flow

from its investment activities of 150.0 million. The implication in this case is that the company

did earn more from selling its present assets than the expenditure it incurred while purchasing

other assets (Richardson, 2006). Additionally, the company did use 130.0Millions for operations

while the cash spent for financing the operations totalled 349.0 million. Year after year there was

an increase in both earnings and dividends per share excluding extraordinary items at a rate of

33.3% and 4.0%, correspondingly. The positive trend in growth related to dividend payments is a

critical indicator because there only a handful of companies within the construction industry that

pay dividends.

Financial ratios

Rations Formulas 2015 2016 2017 2018

Liquidity

ratios

The current

ratio

the current assets/ the

current liabilities 0.88 0.91 0.92 0.96

The cash ratio

the ash and Cash

equivalent/ the current

liabilities 0.28 0.3 0.38 0.31

Profitability

ratios

The return on

Assets income/Assets -0.040 0.010 0.030 0.03

the return on

equity ratio

Net Income/shareholders’

Equity -0.26 0.03 0.16 0.11

Gearing ratio

the debt to

equity ratio Gross debt / equity 5 5 4 3

the debt ratio Gross debt / assets 2 2 2 2

Efficiency

ratios

Inventory Cost of Sales/ Inventory 47 66 61 74

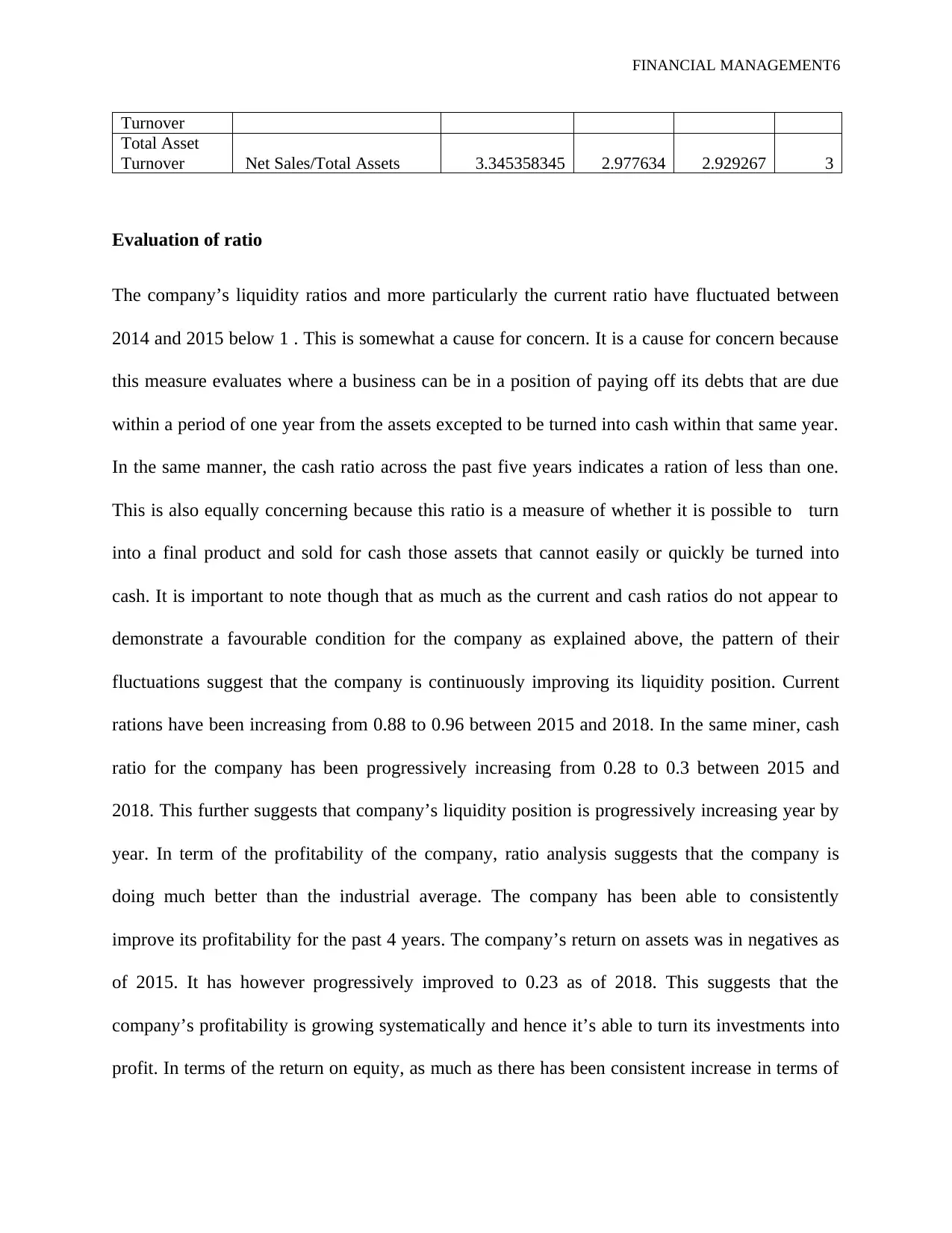

FINANCIAL MANAGEMENT6

Turnover

Total Asset

Turnover Net Sales/Total Assets 3.345358345 2.977634 2.929267 3

Evaluation of ratio

The company’s liquidity ratios and more particularly the current ratio have fluctuated between

2014 and 2015 below 1 . This is somewhat a cause for concern. It is a cause for concern because

this measure evaluates where a business can be in a position of paying off its debts that are due

within a period of one year from the assets excepted to be turned into cash within that same year.

In the same manner, the cash ratio across the past five years indicates a ration of less than one.

This is also equally concerning because this ratio is a measure of whether it is possible to turn

into a final product and sold for cash those assets that cannot easily or quickly be turned into

cash. It is important to note though that as much as the current and cash ratios do not appear to

demonstrate a favourable condition for the company as explained above, the pattern of their

fluctuations suggest that the company is continuously improving its liquidity position. Current

rations have been increasing from 0.88 to 0.96 between 2015 and 2018. In the same miner, cash

ratio for the company has been progressively increasing from 0.28 to 0.3 between 2015 and

2018. This further suggests that company’s liquidity position is progressively increasing year by

year. In term of the profitability of the company, ratio analysis suggests that the company is

doing much better than the industrial average. The company has been able to consistently

improve its profitability for the past 4 years. The company’s return on assets was in negatives as

of 2015. It has however progressively improved to 0.23 as of 2018. This suggests that the

company’s profitability is growing systematically and hence it’s able to turn its investments into

profit. In terms of the return on equity, as much as there has been consistent increase in terms of

Turnover

Total Asset

Turnover Net Sales/Total Assets 3.345358345 2.977634 2.929267 3

Evaluation of ratio

The company’s liquidity ratios and more particularly the current ratio have fluctuated between

2014 and 2015 below 1 . This is somewhat a cause for concern. It is a cause for concern because

this measure evaluates where a business can be in a position of paying off its debts that are due

within a period of one year from the assets excepted to be turned into cash within that same year.

In the same manner, the cash ratio across the past five years indicates a ration of less than one.

This is also equally concerning because this ratio is a measure of whether it is possible to turn

into a final product and sold for cash those assets that cannot easily or quickly be turned into

cash. It is important to note though that as much as the current and cash ratios do not appear to

demonstrate a favourable condition for the company as explained above, the pattern of their

fluctuations suggest that the company is continuously improving its liquidity position. Current

rations have been increasing from 0.88 to 0.96 between 2015 and 2018. In the same miner, cash

ratio for the company has been progressively increasing from 0.28 to 0.3 between 2015 and

2018. This further suggests that company’s liquidity position is progressively increasing year by

year. In term of the profitability of the company, ratio analysis suggests that the company is

doing much better than the industrial average. The company has been able to consistently

improve its profitability for the past 4 years. The company’s return on assets was in negatives as

of 2015. It has however progressively improved to 0.23 as of 2018. This suggests that the

company’s profitability is growing systematically and hence it’s able to turn its investments into

profit. In terms of the return on equity, as much as there has been consistent increase in terms of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL MANAGEMENT7

the return on equity, the company doesn’t demonstrate an efficient use of the shareholders

money to generate its profits since all the ratios for the past five years has been less than one. In

term of the gearing ratios which are basically debt ratios, the rations attained suggest that the

company has been aggressively pursuing its growth and expansion through debt. The analysis

suggest that the company has been heavily reliant on debt to finance its assets. Although, it

should be noted that the company’s Debt-to-equity ratio measures have been positive indicating

that company’s capacity to repay its obligations. As far the efficiency ratios are concerned, the

ratio did measure the number of times average inventory is sold or turned over the course of a

given period. The ratio focuses on measuring the amount of times the company did sale its total

average inventory dollar over a given financial period. In terms of Balfour Beatty PLC and the

ratios analysed, it is clear that the company has been efficient in its use of the assets to generate

sales. The company has consistently had a higher ratio for the past five years. These higher

turnover ratios suggest that the company uses its assets in an efficient manner. In addition, the

company’s inventory turnover ratios has progressively keep improving from 47 to 74 between

2015 and 2018. In the same manner, the total asset turnover ratio is a general efficiency ratio

which measures the degree of efficiently of the company’s asset management and application.

The company’s total asset turnover ratio has been progressively stable between 2015 and 2018. It

has fluctuated around three times which is generally better indication of the company’s positive

performance across the years.

Comparison to major competitor(s) and/or sector average

Through the acquisition of Mansell, Balfour has been able to differentiate itself while

also creating a competitive advantage. Although through its evolution, Balfour has been able to

develop distinct advantages such as size, geographic coverage as well as research and

the return on equity, the company doesn’t demonstrate an efficient use of the shareholders

money to generate its profits since all the ratios for the past five years has been less than one. In

term of the gearing ratios which are basically debt ratios, the rations attained suggest that the

company has been aggressively pursuing its growth and expansion through debt. The analysis

suggest that the company has been heavily reliant on debt to finance its assets. Although, it

should be noted that the company’s Debt-to-equity ratio measures have been positive indicating

that company’s capacity to repay its obligations. As far the efficiency ratios are concerned, the

ratio did measure the number of times average inventory is sold or turned over the course of a

given period. The ratio focuses on measuring the amount of times the company did sale its total

average inventory dollar over a given financial period. In terms of Balfour Beatty PLC and the

ratios analysed, it is clear that the company has been efficient in its use of the assets to generate

sales. The company has consistently had a higher ratio for the past five years. These higher

turnover ratios suggest that the company uses its assets in an efficient manner. In addition, the

company’s inventory turnover ratios has progressively keep improving from 47 to 74 between

2015 and 2018. In the same manner, the total asset turnover ratio is a general efficiency ratio

which measures the degree of efficiently of the company’s asset management and application.

The company’s total asset turnover ratio has been progressively stable between 2015 and 2018. It

has fluctuated around three times which is generally better indication of the company’s positive

performance across the years.

Comparison to major competitor(s) and/or sector average

Through the acquisition of Mansell, Balfour has been able to differentiate itself while

also creating a competitive advantage. Although through its evolution, Balfour has been able to

develop distinct advantages such as size, geographic coverage as well as research and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MANAGEMENT8

development competence. It has also acquired partnership arrangements which have further

reinforced is position. In addition, the company seeks to always improve and also upgrade its

products as well as service offering. It does it through reorganisation or acquires a merger. All

these make it quite hard for a new entrant to penetrate the market and threaten Balfour’s position

in any way. There are more than 80,000 companies contained within the UK building

construction industry and all of these are of variable sizes. In analysing Balfour’s major

competitors including Amec plc and Kier Group within the UK, certain aspects stand out.

Amec’s follows a strategy which is focused on making it the leading supplier for engineering of

high value, project management and consultancy services within distinct market sections in the

global energy as well as industrial development industries (Evans, 2016). To be able to

differentiate it’s self from Balfour, Amec’s engages it’s self in the production of offshore gas as

well as oil production engagements (Clarke, 2015). It has some similarities with Kier in the

sense that it also involved in metal and mineral mines which is basically a clear one stop shop

entity. The company’s major business offerings are in gas and oil (McLintock, 2009). It is also

involved in offering minerals as well as metal mining, industrial, wind energy, earth and nuclear

offerings. Unlike Balfour consequently, Amec has its focus on the non-domestic construction, as

opposed to social hosing and property development (Shiller, 2011). Just like Balfour, Amec is

predominantly prosperous within the public sector market. It has in addition embarked upon a

strategy which emphasizes growth through merging as well as acquisitions which continues to

aid its profitability.

The other company major competitor to Balfour as indicated already is Kier. Kier has a

wide network including regional contracting businesses within the UK. The company

demonstrates major project expertise and is in a position of offering a full life span of services

development competence. It has also acquired partnership arrangements which have further

reinforced is position. In addition, the company seeks to always improve and also upgrade its

products as well as service offering. It does it through reorganisation or acquires a merger. All

these make it quite hard for a new entrant to penetrate the market and threaten Balfour’s position

in any way. There are more than 80,000 companies contained within the UK building

construction industry and all of these are of variable sizes. In analysing Balfour’s major

competitors including Amec plc and Kier Group within the UK, certain aspects stand out.

Amec’s follows a strategy which is focused on making it the leading supplier for engineering of

high value, project management and consultancy services within distinct market sections in the

global energy as well as industrial development industries (Evans, 2016). To be able to

differentiate it’s self from Balfour, Amec’s engages it’s self in the production of offshore gas as

well as oil production engagements (Clarke, 2015). It has some similarities with Kier in the

sense that it also involved in metal and mineral mines which is basically a clear one stop shop

entity. The company’s major business offerings are in gas and oil (McLintock, 2009). It is also

involved in offering minerals as well as metal mining, industrial, wind energy, earth and nuclear

offerings. Unlike Balfour consequently, Amec has its focus on the non-domestic construction, as

opposed to social hosing and property development (Shiller, 2011). Just like Balfour, Amec is

predominantly prosperous within the public sector market. It has in addition embarked upon a

strategy which emphasizes growth through merging as well as acquisitions which continues to

aid its profitability.

The other company major competitor to Balfour as indicated already is Kier. Kier has a

wide network including regional contracting businesses within the UK. The company

demonstrates major project expertise and is in a position of offering a full life span of services

FINANCIAL MANAGEMENT9

for buildings, including the management of facilities (Hartcup, 2011). To put is simply, it is

construction, development as well as and service group. It is a specialist in building as well as

civil engineering, private house construction, property development as well as support services

(Trotman and Gibbins, 2009). Just like Balfour, Kier is a well-recognised business. In the same

manner like Balfour, Kier has also been able to develop its own infrastructure investment

corporation (Fernandes, 2014). Just like Balfour, Kier does embrace the social as well as

environmental facets of geared towards growth and sustainability. Unlike Balfour however, Kier

is engages in opencast mining and the administration of facilities. (Velez-Pareja, and Tham,

2008). It is also notable that Balfour as well as Kier have operations within distinctly comparable

markets and the expertise offered by both companies is more less the same (Hoskins, 2009). As

indicated through ratio analysis, it is evident that Balfour enjoyed a growth in its profitability

from 2015 to 2018(Dauchy, 2013). This growth in profitability is demonstrated by the positive

trend in terms of both the return on Assets and equity (Seow, et al.2010). The company’s return

on assets grew from -0.04 to 0.03 between 2015 and 2018. In the same manner, the company’s

return on equity equally grew from -0.26 in 2015 to 0.11 in 2018 (Labardin and Marc, 2009).

This could be attributed to lower operational costs across that span of operations and hence

enhanced profits. These performances are much better than kier which whose return on assets

and equity respectively were between -0.3 and 0.02 in the same period.

Recommendation on how to improve the financial management of the company

It is recommended that the company considers a union or an acquirement of Kier within

the near future. This would aid the provision of the added benefit of being able to consolidate its

position while also being able to create critical mass in terms of the share of the market in areas

like private house buildings as well as PFI. It is also critical that management considers hiring

for buildings, including the management of facilities (Hartcup, 2011). To put is simply, it is

construction, development as well as and service group. It is a specialist in building as well as

civil engineering, private house construction, property development as well as support services

(Trotman and Gibbins, 2009). Just like Balfour, Kier is a well-recognised business. In the same

manner like Balfour, Kier has also been able to develop its own infrastructure investment

corporation (Fernandes, 2014). Just like Balfour, Kier does embrace the social as well as

environmental facets of geared towards growth and sustainability. Unlike Balfour however, Kier

is engages in opencast mining and the administration of facilities. (Velez-Pareja, and Tham,

2008). It is also notable that Balfour as well as Kier have operations within distinctly comparable

markets and the expertise offered by both companies is more less the same (Hoskins, 2009). As

indicated through ratio analysis, it is evident that Balfour enjoyed a growth in its profitability

from 2015 to 2018(Dauchy, 2013). This growth in profitability is demonstrated by the positive

trend in terms of both the return on Assets and equity (Seow, et al.2010). The company’s return

on assets grew from -0.04 to 0.03 between 2015 and 2018. In the same manner, the company’s

return on equity equally grew from -0.26 in 2015 to 0.11 in 2018 (Labardin and Marc, 2009).

This could be attributed to lower operational costs across that span of operations and hence

enhanced profits. These performances are much better than kier which whose return on assets

and equity respectively were between -0.3 and 0.02 in the same period.

Recommendation on how to improve the financial management of the company

It is recommended that the company considers a union or an acquirement of Kier within

the near future. This would aid the provision of the added benefit of being able to consolidate its

position while also being able to create critical mass in terms of the share of the market in areas

like private house buildings as well as PFI. It is also critical that management considers hiring

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCIAL MANAGEMENT10

experts and external auditors to continuously investigate the debt level of the company to keep

them as low as possible. It is also recommended that the company adopts a much more

differentiated technique for its services and products to curb against duplication by the

competitors. It’s also recommended that the company invests a lot more in enhanced marketing

to ensure that its products and services reach a much wider audience and thereby growing its

sales. It is also important that the company considers the tailoring of its services to meet the local

needs as well as requirements. In so doing, the company would be in a position of improving its

relations with its customers and thereby enhancing its sales.

Part c)

Year Cash flow Cash flow

A B

0 -85 -90

1 10 25

2 20 30

3 40 35

4 55 40

Payback Period (PBP),

From the formula

Payback = A + (B - C)/D where,

A is the year before crossing Investment value within cumulative cash flows

B is initial cash outlay or Investment

C is cumulative flow of cash

Y

ear

C

ash

flow

C

ash

flow

cu

mulative

cu

mulative

A B A B

experts and external auditors to continuously investigate the debt level of the company to keep

them as low as possible. It is also recommended that the company adopts a much more

differentiated technique for its services and products to curb against duplication by the

competitors. It’s also recommended that the company invests a lot more in enhanced marketing

to ensure that its products and services reach a much wider audience and thereby growing its

sales. It is also important that the company considers the tailoring of its services to meet the local

needs as well as requirements. In so doing, the company would be in a position of improving its

relations with its customers and thereby enhancing its sales.

Part c)

Year Cash flow Cash flow

A B

0 -85 -90

1 10 25

2 20 30

3 40 35

4 55 40

Payback Period (PBP),

From the formula

Payback = A + (B - C)/D where,

A is the year before crossing Investment value within cumulative cash flows

B is initial cash outlay or Investment

C is cumulative flow of cash

Y

ear

C

ash

flow

C

ash

flow

cu

mulative

cu

mulative

A B A B

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCIAL MANAGEMENT11

0

-

85

-

90 -85 -90

1

1

0

2

5 -75 -70

2

2

0

3

0 -55 -40

3

4

0

3

5 -15 -5

4

5

5

4

0 40 35

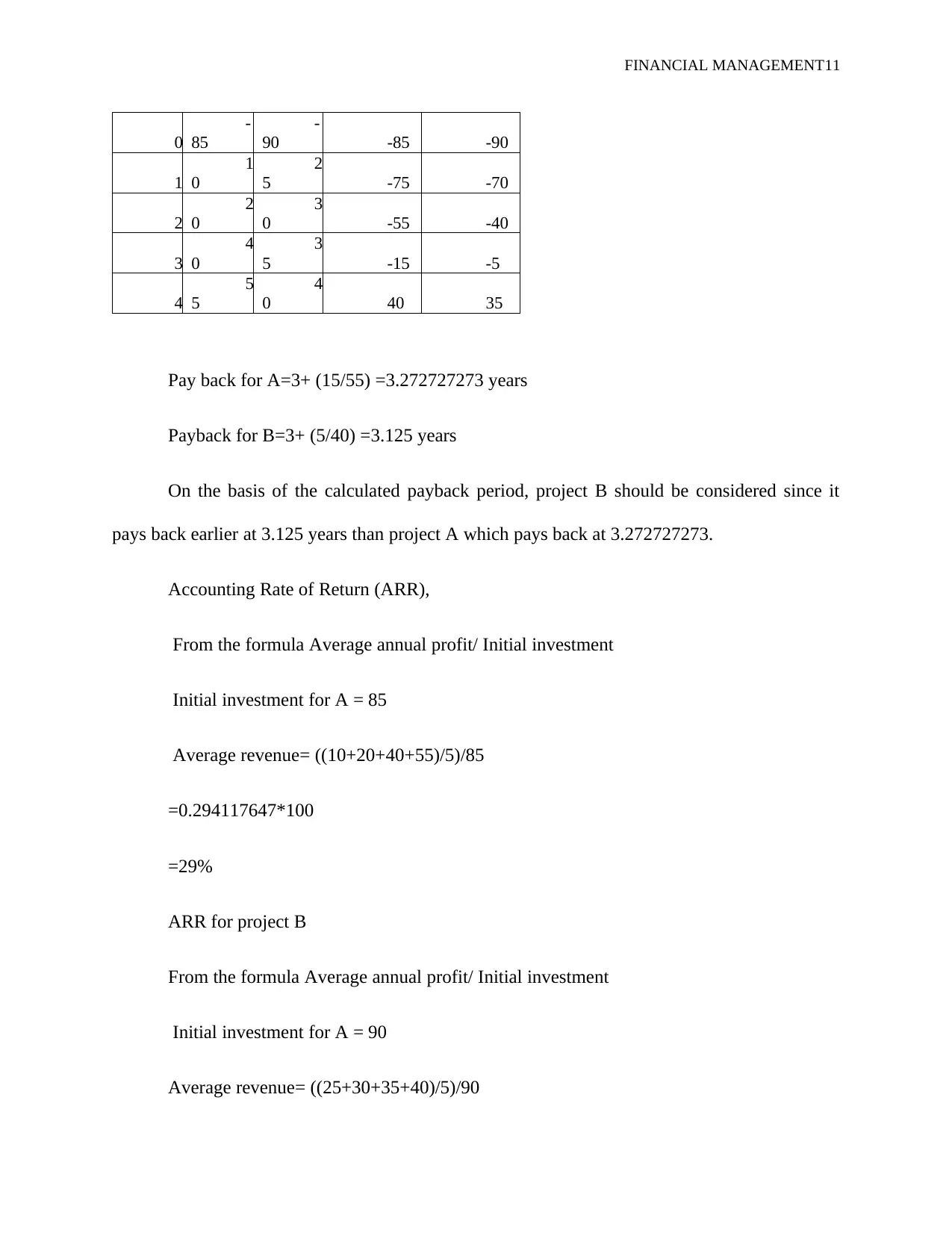

Pay back for A=3+ (15/55) =3.272727273 years

Payback for B=3+ (5/40) =3.125 years

On the basis of the calculated payback period, project B should be considered since it

pays back earlier at 3.125 years than project A which pays back at 3.272727273.

Accounting Rate of Return (ARR),

From the formula Average annual profit/ Initial investment

Initial investment for A = 85

Average revenue= ((10+20+40+55)/5)/85

=0.294117647*100

=29%

ARR for project B

From the formula Average annual profit/ Initial investment

Initial investment for A = 90

Average revenue= ((25+30+35+40)/5)/90

0

-

85

-

90 -85 -90

1

1

0

2

5 -75 -70

2

2

0

3

0 -55 -40

3

4

0

3

5 -15 -5

4

5

5

4

0 40 35

Pay back for A=3+ (15/55) =3.272727273 years

Payback for B=3+ (5/40) =3.125 years

On the basis of the calculated payback period, project B should be considered since it

pays back earlier at 3.125 years than project A which pays back at 3.272727273.

Accounting Rate of Return (ARR),

From the formula Average annual profit/ Initial investment

Initial investment for A = 85

Average revenue= ((10+20+40+55)/5)/85

=0.294117647*100

=29%

ARR for project B

From the formula Average annual profit/ Initial investment

Initial investment for A = 90

Average revenue= ((25+30+35+40)/5)/90

FINANCIAL MANAGEMENT12

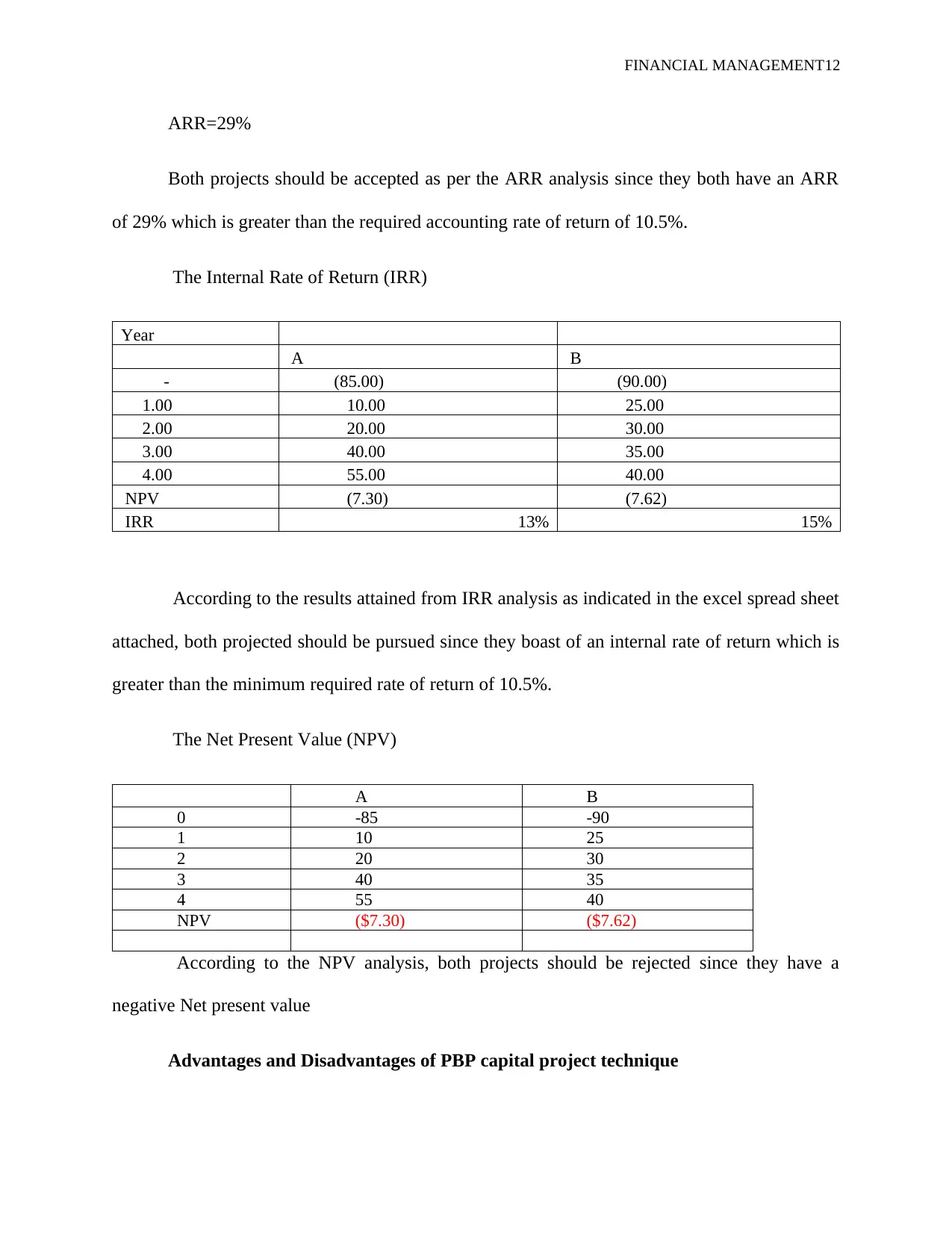

ARR=29%

Both projects should be accepted as per the ARR analysis since they both have an ARR

of 29% which is greater than the required accounting rate of return of 10.5%.

The Internal Rate of Return (IRR)

Year

A B

- (85.00) (90.00)

1.00 10.00 25.00

2.00 20.00 30.00

3.00 40.00 35.00

4.00 55.00 40.00

NPV (7.30) (7.62)

IRR 13% 15%

According to the results attained from IRR analysis as indicated in the excel spread sheet

attached, both projected should be pursued since they boast of an internal rate of return which is

greater than the minimum required rate of return of 10.5%.

The Net Present Value (NPV)

A B

0 -85 -90

1 10 25

2 20 30

3 40 35

4 55 40

NPV ($7.30) ($7.62)

According to the NPV analysis, both projects should be rejected since they have a

negative Net present value

Advantages and Disadvantages of PBP capital project technique

ARR=29%

Both projects should be accepted as per the ARR analysis since they both have an ARR

of 29% which is greater than the required accounting rate of return of 10.5%.

The Internal Rate of Return (IRR)

Year

A B

- (85.00) (90.00)

1.00 10.00 25.00

2.00 20.00 30.00

3.00 40.00 35.00

4.00 55.00 40.00

NPV (7.30) (7.62)

IRR 13% 15%

According to the results attained from IRR analysis as indicated in the excel spread sheet

attached, both projected should be pursued since they boast of an internal rate of return which is

greater than the minimum required rate of return of 10.5%.

The Net Present Value (NPV)

A B

0 -85 -90

1 10 25

2 20 30

3 40 35

4 55 40

NPV ($7.30) ($7.62)

According to the NPV analysis, both projects should be rejected since they have a

negative Net present value

Advantages and Disadvantages of PBP capital project technique

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.