Financial Management Assessment for BSB61015 - Term 2, 2017

VerifiedAdded on 2021/04/17

|22

|4778

|21

Homework Assignment

AI Summary

This document contains the solutions to a Financial Management assessment for the BSB61015 Advanced Diploma in Leadership and Management. The assessment is divided into three weeks, covering various topics in financial management. Week 2 focuses on short answer responses, exploring topics such as profitable businesses, reasons for business failures, fundamental accounting concepts (Business Entity, Dual Aspect, Money Measurement, Objectivity, Going Concern, Periodicity, Cost, Conservatism, Materiality, Realisation, Matching, and Full Disclosure), investment, financing, and financial management decisions, and financial ratios. Week 3 involves research on the Australian Tax Office (ATO), bilateral and regional trade agreements, the Trade Practices Act, key Australian taxation requirements (PAYG, company tax, GST, financial probity, ABN, BAS, superannuation, FBT, and income tax), International Commercial Terms (INCOTERMS), the role of the World Trade Organization (WTO), and the calculation of GST. Week 4 requires the preparation of a Profit & Loss Statement and a Balance Sheet using provided financial information. The document provides detailed answers and explanations for each question, offering a comprehensive solution to the assessment.

T-1.8.1

Details of Assessment

Term and Year 2, 2017 Time allowed Weeks

Assessment No 1 Assessment Weighting 100%

Assessment Type Portfolio of

Due Date Week Room TBA

Details of Subject

Qualification BSB61015 Advanced Diploma in Leadership and Management

Subject Name Financial Management

Details of Unit(s) of competency

Unit Code (s) and

Names

BSBFIM601 Manage finances

Details of Student

Student Name

College Student ID

Student Declaration: I declare that the work

submitted is my own, and has not been

copied or plagiarised from any person or

source.

Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name

Assessment Outcome

Results Competent Not Yet Competent Marks /

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive improvements:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I am also aware of my right to appeal and the

reassessment procedure.

Signature: ____________________________

Date: ____/_____/_____

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have provided

appropriate feedback

The student did not attend the feedback session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/_____/_____

Financial Management, Assessment No.1 Page 1

v1.1, Last updated on 10/04/2017

Details of Assessment

Term and Year 2, 2017 Time allowed Weeks

Assessment No 1 Assessment Weighting 100%

Assessment Type Portfolio of

Due Date Week Room TBA

Details of Subject

Qualification BSB61015 Advanced Diploma in Leadership and Management

Subject Name Financial Management

Details of Unit(s) of competency

Unit Code (s) and

Names

BSBFIM601 Manage finances

Details of Student

Student Name

College Student ID

Student Declaration: I declare that the work

submitted is my own, and has not been

copied or plagiarised from any person or

source.

Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name

Assessment Outcome

Results Competent Not Yet Competent Marks /

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive improvements:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I am also aware of my right to appeal and the

reassessment procedure.

Signature: ____________________________

Date: ____/_____/_____

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have provided

appropriate feedback

The student did not attend the feedback session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/_____/_____

Financial Management, Assessment No.1 Page 1

v1.1, Last updated on 10/04/2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Purpose of the Assessment

The purpose of this assessment is to assess the

student in the following learning outcomes:

Competent

(C)

Not Yet Competent

(NYC)

plan for financial management

read and review profit and loss statements, cash

flows and aging summaries

prepare, implement and revise a budget which aligns

with the business plan, is based on research and

analysis of previous financial data and cash flow

trends, and meets all compliance requirements

contribute to financial bids and estimates

establish a budget and allocate funds in accordance

with statutory and organizational requirements

communicate with other people including reporting

on financial activity and making recommendations,

identifying and prioritizing significant issues,

ensuring managers and supervisors are clear about

budgets

analyze the effectiveness of existing financial

management approaches including reviewing

financial management software, managing risks of

misappropriation of funds, ensuring systems are in

place to record all transactions, maintaining an audit

trail and complying with due diligence

Assessment/evidence gathering conditions

Each assessment component is recorded as either Competent (C) or Not Yet Competent (NYC). A student

can only achieve competence when all assessment components listed under “Purpose of the assessment”

section are recorded as competent. Your trainer will give you feedback after the completion of each

assessment. A student who is assessed as NYC (Not Yet Competent) is eligible for re-assessment.

Resources required for this Assessment

Computer with relevant software applications and access to the internet

Weekly eLearning notes relevant to the tasks/questions

Instructions for Students

Please read the following instructions carefully

This assessment has to be completed In class At home

The assessment is to be completed according to the instructions given by your assessor.

Feedback on each task will be provided to enable you to determine how your work could be improved.

You will be provided with feedback on your work within two weeks of the assessment due date. All other

feedback will be provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps

in knowledge. You will be given another opportunity to demonstrate your knowledge and skills to be

deemed competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your

assessor.

Please refer to the College re-assessment for more information (Student Handbook).

Financial Management, Assessment No.1 Page 2

v1.1, Last updated on 10/04/2017

Purpose of the Assessment

The purpose of this assessment is to assess the

student in the following learning outcomes:

Competent

(C)

Not Yet Competent

(NYC)

plan for financial management

read and review profit and loss statements, cash

flows and aging summaries

prepare, implement and revise a budget which aligns

with the business plan, is based on research and

analysis of previous financial data and cash flow

trends, and meets all compliance requirements

contribute to financial bids and estimates

establish a budget and allocate funds in accordance

with statutory and organizational requirements

communicate with other people including reporting

on financial activity and making recommendations,

identifying and prioritizing significant issues,

ensuring managers and supervisors are clear about

budgets

analyze the effectiveness of existing financial

management approaches including reviewing

financial management software, managing risks of

misappropriation of funds, ensuring systems are in

place to record all transactions, maintaining an audit

trail and complying with due diligence

Assessment/evidence gathering conditions

Each assessment component is recorded as either Competent (C) or Not Yet Competent (NYC). A student

can only achieve competence when all assessment components listed under “Purpose of the assessment”

section are recorded as competent. Your trainer will give you feedback after the completion of each

assessment. A student who is assessed as NYC (Not Yet Competent) is eligible for re-assessment.

Resources required for this Assessment

Computer with relevant software applications and access to the internet

Weekly eLearning notes relevant to the tasks/questions

Instructions for Students

Please read the following instructions carefully

This assessment has to be completed In class At home

The assessment is to be completed according to the instructions given by your assessor.

Feedback on each task will be provided to enable you to determine how your work could be improved.

You will be provided with feedback on your work within two weeks of the assessment due date. All other

feedback will be provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps

in knowledge. You will be given another opportunity to demonstrate your knowledge and skills to be

deemed competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your

assessor.

Please refer to the College re-assessment for more information (Student Handbook).

Financial Management, Assessment No.1 Page 2

v1.1, Last updated on 10/04/2017

T-1.8.1

FINANCIAL MANAGEMENT: ASSESSMENT

WEEK 2 (20 marks)

ASSESSMENT ACTIVITY: SHORT ANSWER RESPONSES

1. Describe at least one (1) business that is profitable and explains why you think it is enjoying

financial success.

A business that is profitable is YouTube channel. The business has been enjoying financial success

these days because of various subscribers and views.

2. While the evidence suggests otherwise, there is a common view that many new businesses fail

within the first year of operation. Why do you think a new business might not succeed?

There are many reasons for the failure of a new business in its first year of operation. Some of the

reasons can be :

No differentiation in the market

Not customer oriented

Not able to communicate value propositions

Leadership breakdown

Wrong strategy

3. Explain the following fundamental accounting concepts:

Business Entity Concept

According to this concept, the transactions associated with the business shall be recorded

separately from its owners or other businesses.

Dual Aspect Concept

According to this concept, every transaction has a double effect and shall be recorded on two

different accounts.

Money Measurement Concept

According to this concept, every transaction that is recorded shall be measured in terms of money.

Financial Management, Assessment No.1 Page 3

v1.1, Last updated on 10/04/2017

FINANCIAL MANAGEMENT: ASSESSMENT

WEEK 2 (20 marks)

ASSESSMENT ACTIVITY: SHORT ANSWER RESPONSES

1. Describe at least one (1) business that is profitable and explains why you think it is enjoying

financial success.

A business that is profitable is YouTube channel. The business has been enjoying financial success

these days because of various subscribers and views.

2. While the evidence suggests otherwise, there is a common view that many new businesses fail

within the first year of operation. Why do you think a new business might not succeed?

There are many reasons for the failure of a new business in its first year of operation. Some of the

reasons can be :

No differentiation in the market

Not customer oriented

Not able to communicate value propositions

Leadership breakdown

Wrong strategy

3. Explain the following fundamental accounting concepts:

Business Entity Concept

According to this concept, the transactions associated with the business shall be recorded

separately from its owners or other businesses.

Dual Aspect Concept

According to this concept, every transaction has a double effect and shall be recorded on two

different accounts.

Money Measurement Concept

According to this concept, every transaction that is recorded shall be measured in terms of money.

Financial Management, Assessment No.1 Page 3

v1.1, Last updated on 10/04/2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

T-1.8.1

4. Explain the following fundamental accounting concepts:

Objectivity Concept

According to this concept, it states that the financial statements in an organization shall always be

based on some solid evidence.

Going Concern Concept

It implies that the business will continue its operations in future and will not discontinue its operations

for many reasons.

Periodicity Concept

According to this concept, the accountants will report the net income and cash flows of the company

in each accounting period.

5. Explain the following fundamental accounting concepts:

Cost Concept

This concept implies that the assets shall be recorded at the cash amount at the time when they are

acquired.

Conservatism Concept

According to this principle, the liabilities and expenses are recognized as soon as possible as there

is

uncertainty about the outcome but the revenues are recognized only when they are received.

Materiality Concept

According to this concept, the important matters in accounting shall be disclosed and the trivial

matters are disregarded.

6. Explain the following fundamental accounting concepts:

Realisation Concept

Financial Management, Assessment No.1 Page 4

v1.1, Last updated on 10/04/2017

4. Explain the following fundamental accounting concepts:

Objectivity Concept

According to this concept, it states that the financial statements in an organization shall always be

based on some solid evidence.

Going Concern Concept

It implies that the business will continue its operations in future and will not discontinue its operations

for many reasons.

Periodicity Concept

According to this concept, the accountants will report the net income and cash flows of the company

in each accounting period.

5. Explain the following fundamental accounting concepts:

Cost Concept

This concept implies that the assets shall be recorded at the cash amount at the time when they are

acquired.

Conservatism Concept

According to this principle, the liabilities and expenses are recognized as soon as possible as there

is

uncertainty about the outcome but the revenues are recognized only when they are received.

Materiality Concept

According to this concept, the important matters in accounting shall be disclosed and the trivial

matters are disregarded.

6. Explain the following fundamental accounting concepts:

Realisation Concept

Financial Management, Assessment No.1 Page 4

v1.1, Last updated on 10/04/2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

According to this concept, the revenues can be recognized only when

the services for the same are rendered or goods delivered.

Matching Concept

In general, this concept means that the expenses are matched with the incomes that are generated

from these expenses.

Full Disclosure Concept

It requires the company to disclose all the important information related to the company so that the

people associated with the company can make informed decisions.

7. Provide four (4) examples of investment decisions

Investment in R&D (research and development)

Investment in plant and machinery

The decision of entering a new market

The takeover of a company

8. Provide five (5) examples of financing decisions

Capital investments

Debt financing

Revenue from sales

Paying for capital projects

Equity financing

9. Provide three (3) examples of financial management decisions.

Issuing new credit for paying old debts

Opening new store

Extending credit to customers

10. Explain the difference between financial accounting and management accounting.

Financial accounting Management accounting

Reports on the results of entire business It is reported at a detailed level like a profit of a

product or product line.

Pays less or no attention to the overall system It pays attention to small issues and finding ways

Financial Management, Assessment No.1 Page 5

v1.1, Last updated on 10/04/2017

According to this concept, the revenues can be recognized only when

the services for the same are rendered or goods delivered.

Matching Concept

In general, this concept means that the expenses are matched with the incomes that are generated

from these expenses.

Full Disclosure Concept

It requires the company to disclose all the important information related to the company so that the

people associated with the company can make informed decisions.

7. Provide four (4) examples of investment decisions

Investment in R&D (research and development)

Investment in plant and machinery

The decision of entering a new market

The takeover of a company

8. Provide five (5) examples of financing decisions

Capital investments

Debt financing

Revenue from sales

Paying for capital projects

Equity financing

9. Provide three (3) examples of financial management decisions.

Issuing new credit for paying old debts

Opening new store

Extending credit to customers

10. Explain the difference between financial accounting and management accounting.

Financial accounting Management accounting

Reports on the results of entire business It is reported at a detailed level like a profit of a

product or product line.

Pays less or no attention to the overall system It pays attention to small issues and finding ways

Financial Management, Assessment No.1 Page 5

v1.1, Last updated on 10/04/2017

T-1.8.1

to sort it out

Historical oriented Future-oriented

11. Provide five (5) examples of ratios that can be used for analysis and what they mean

Liquidity ratios: focuses on the ability of the firm to pay short-term debts.

Debt Ratios: focuses on the ability of the firm to meet its long-term obligations.

Turnover ratios: measures the firm’s efficiency for using its assets for the production of

sales.

Profitability ratios: focuses on the ability of the firm to generate the profits.

Market value ratios help in knowing or studying the market value of the firm.

12. Provide the formulas for the following ratios:

Gross Profit

Gross profit= Revenue-COGS/ total revenue

Net Profit

Net Profit =Revenue-(operating expenses +cogs and +tax and interest)

Inventory Turnover Ratio

Inventory Turnover Ratio = COGS/Average Inventory

Debt to Assets Ratio

Debt to Assets Ratio = Total Liabilities / Total Assets

Return on Investment

Return on Investment = gains –investment costs/investment costs

Financial Management, Assessment No.1 Page 6

v1.1, Last updated on 10/04/2017

to sort it out

Historical oriented Future-oriented

11. Provide five (5) examples of ratios that can be used for analysis and what they mean

Liquidity ratios: focuses on the ability of the firm to pay short-term debts.

Debt Ratios: focuses on the ability of the firm to meet its long-term obligations.

Turnover ratios: measures the firm’s efficiency for using its assets for the production of

sales.

Profitability ratios: focuses on the ability of the firm to generate the profits.

Market value ratios help in knowing or studying the market value of the firm.

12. Provide the formulas for the following ratios:

Gross Profit

Gross profit= Revenue-COGS/ total revenue

Net Profit

Net Profit =Revenue-(operating expenses +cogs and +tax and interest)

Inventory Turnover Ratio

Inventory Turnover Ratio = COGS/Average Inventory

Debt to Assets Ratio

Debt to Assets Ratio = Total Liabilities / Total Assets

Return on Investment

Return on Investment = gains –investment costs/investment costs

Financial Management, Assessment No.1 Page 6

v1.1, Last updated on 10/04/2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

T-1.8.1

WEEK 3 (20 marks)

ASSESSMENT ACTIVITY: RESEARCH

1.Research the following website http://ato.gov.au/ and summarize the services, facilities, and

products the Australian Tax Office provides for individuals and business.

Services:

Lodging tax returns’

Capital gain tax

Assessing Income

Paying tax

Products:

Registration

Paying the ATO

Small businesses

2. Explain and find one (1) example of a Bilateral or Regional Trade Agreement

The agreements between two nations at a time are called bilateral trade agreements. Example

The transatlantic trade and investment partnership that would remove the current barriers to

trade between European Union and the United States.

3. Explain the Trade Practices Act. What is it? Who does it apply to?

This act is the legislative vehicle for the competition law in Australia it is now known as The

Competition and Consumer Act 2010. It promotes fair trading and competition so that consumers

can be protected.

The act applies to consumers, companies, businesses and shareholders, stakeholders of the

company.

4. Explain the following key Australian Taxation requirements:

PAYG Withholding

Under this, the employer can withhold the tax from certain of the

payments that are made to others. The payments include:

Financial Management, Assessment No.1 Page 7

v1.1, Last updated on 10/04/2017

WEEK 3 (20 marks)

ASSESSMENT ACTIVITY: RESEARCH

1.Research the following website http://ato.gov.au/ and summarize the services, facilities, and

products the Australian Tax Office provides for individuals and business.

Services:

Lodging tax returns’

Capital gain tax

Assessing Income

Paying tax

Products:

Registration

Paying the ATO

Small businesses

2. Explain and find one (1) example of a Bilateral or Regional Trade Agreement

The agreements between two nations at a time are called bilateral trade agreements. Example

The transatlantic trade and investment partnership that would remove the current barriers to

trade between European Union and the United States.

3. Explain the Trade Practices Act. What is it? Who does it apply to?

This act is the legislative vehicle for the competition law in Australia it is now known as The

Competition and Consumer Act 2010. It promotes fair trading and competition so that consumers

can be protected.

The act applies to consumers, companies, businesses and shareholders, stakeholders of the

company.

4. Explain the following key Australian Taxation requirements:

PAYG Withholding

Under this, the employer can withhold the tax from certain of the

payments that are made to others. The payments include:

Financial Management, Assessment No.1 Page 7

v1.1, Last updated on 10/04/2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Payments made to workers under the labor-hire

agreement

Payments to employees

Payments under voluntary agreements

Company Tax

It is also called corporate tax or corporation tax and it is a direct tax that the jurisdictions

impose on the capital and income or the legal entities and corporations.

Goods and Services Tax (GS.)

It is a value-added tax that is levied on goods and services that are sold for domestic

consumption. The costumers pay the GST but the government remits the same from the

business that is selling the goods and services.

Financial Probity

Probity basically means integrity, honesty, and uprightness. The name in itself is summed up

in moral values. So financial probity means to be open and honest in all the financial and

commercial matters that are related to funding and research.

Australian Business Number (A.B.N)

ABN which is commonly known as Australian Business Number. It is an 11 digit number that

helps the business to be identified by the community and business.

Business Activity Statement (B.A.S)

BAS is required to be lodged if a business is registered for GST. It helps the company to pay

its GST, PAYG withholding tax, and other taxes.

Superannuation

It is a pension program that the company creates for its

Financial Management, Assessment No.1 Page 8

v1.1, Last updated on 10/04/2017

Payments made to workers under the labor-hire

agreement

Payments to employees

Payments under voluntary agreements

Company Tax

It is also called corporate tax or corporation tax and it is a direct tax that the jurisdictions

impose on the capital and income or the legal entities and corporations.

Goods and Services Tax (GS.)

It is a value-added tax that is levied on goods and services that are sold for domestic

consumption. The costumers pay the GST but the government remits the same from the

business that is selling the goods and services.

Financial Probity

Probity basically means integrity, honesty, and uprightness. The name in itself is summed up

in moral values. So financial probity means to be open and honest in all the financial and

commercial matters that are related to funding and research.

Australian Business Number (A.B.N)

ABN which is commonly known as Australian Business Number. It is an 11 digit number that

helps the business to be identified by the community and business.

Business Activity Statement (B.A.S)

BAS is required to be lodged if a business is registered for GST. It helps the company to pay

its GST, PAYG withholding tax, and other taxes.

Superannuation

It is a pension program that the company creates for its

Financial Management, Assessment No.1 Page 8

v1.1, Last updated on 10/04/2017

T-1.8.1

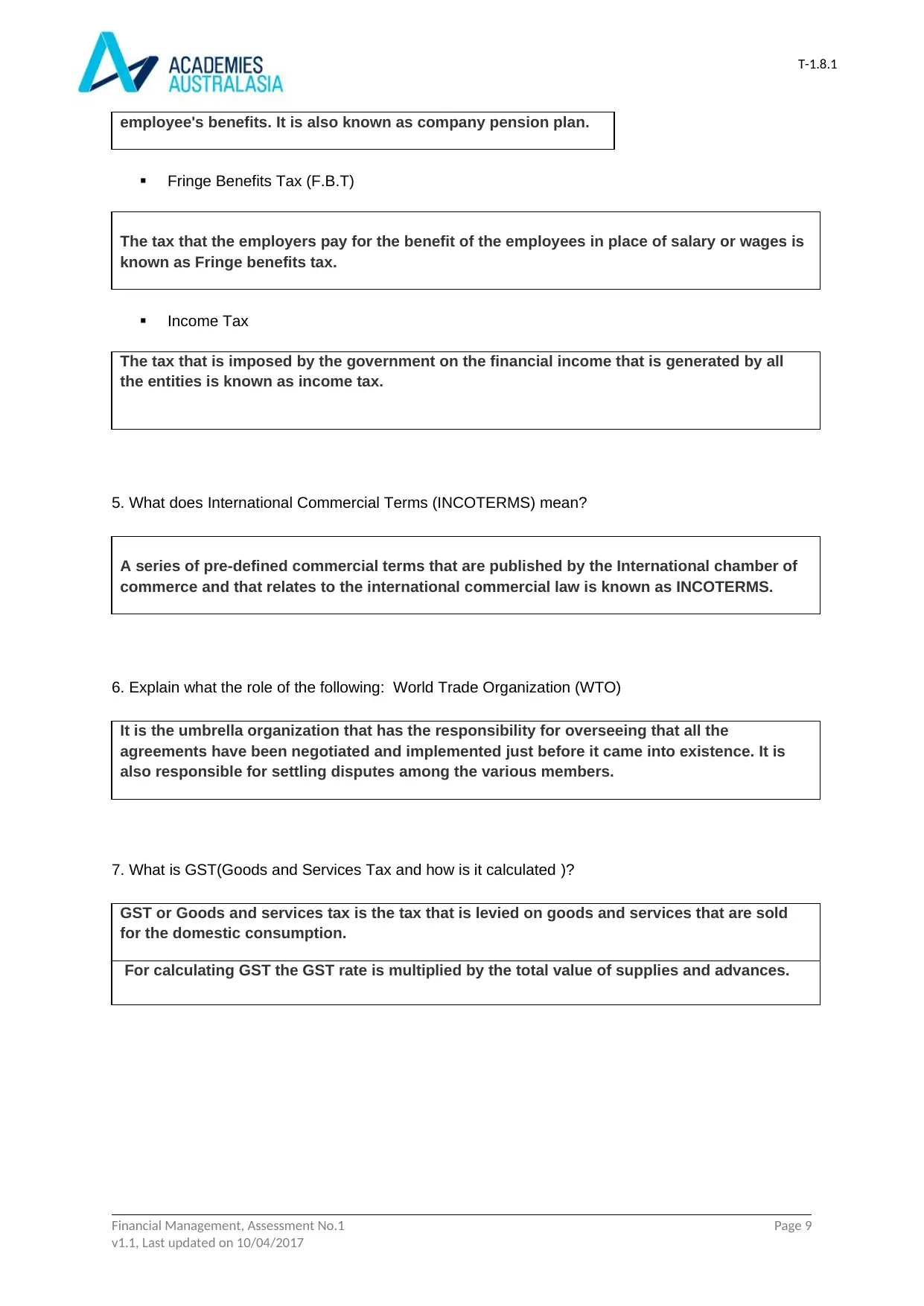

employee's benefits. It is also known as company pension plan.

Fringe Benefits Tax (F.B.T)

The tax that the employers pay for the benefit of the employees in place of salary or wages is

known as Fringe benefits tax.

Income Tax

The tax that is imposed by the government on the financial income that is generated by all

the entities is known as income tax.

5. What does International Commercial Terms (INCOTERMS) mean?

A series of pre-defined commercial terms that are published by the International chamber of

commerce and that relates to the international commercial law is known as INCOTERMS.

6. Explain what the role of the following: World Trade Organization (WTO)

It is the umbrella organization that has the responsibility for overseeing that all the

agreements have been negotiated and implemented just before it came into existence. It is

also responsible for settling disputes among the various members.

7. What is GST(Goods and Services Tax and how is it calculated )?

GST or Goods and services tax is the tax that is levied on goods and services that are sold

for the domestic consumption.

For calculating GST the GST rate is multiplied by the total value of supplies and advances.

Financial Management, Assessment No.1 Page 9

v1.1, Last updated on 10/04/2017

employee's benefits. It is also known as company pension plan.

Fringe Benefits Tax (F.B.T)

The tax that the employers pay for the benefit of the employees in place of salary or wages is

known as Fringe benefits tax.

Income Tax

The tax that is imposed by the government on the financial income that is generated by all

the entities is known as income tax.

5. What does International Commercial Terms (INCOTERMS) mean?

A series of pre-defined commercial terms that are published by the International chamber of

commerce and that relates to the international commercial law is known as INCOTERMS.

6. Explain what the role of the following: World Trade Organization (WTO)

It is the umbrella organization that has the responsibility for overseeing that all the

agreements have been negotiated and implemented just before it came into existence. It is

also responsible for settling disputes among the various members.

7. What is GST(Goods and Services Tax and how is it calculated )?

GST or Goods and services tax is the tax that is levied on goods and services that are sold

for the domestic consumption.

For calculating GST the GST rate is multiplied by the total value of supplies and advances.

Financial Management, Assessment No.1 Page 9

v1.1, Last updated on 10/04/2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

T-1.8.1

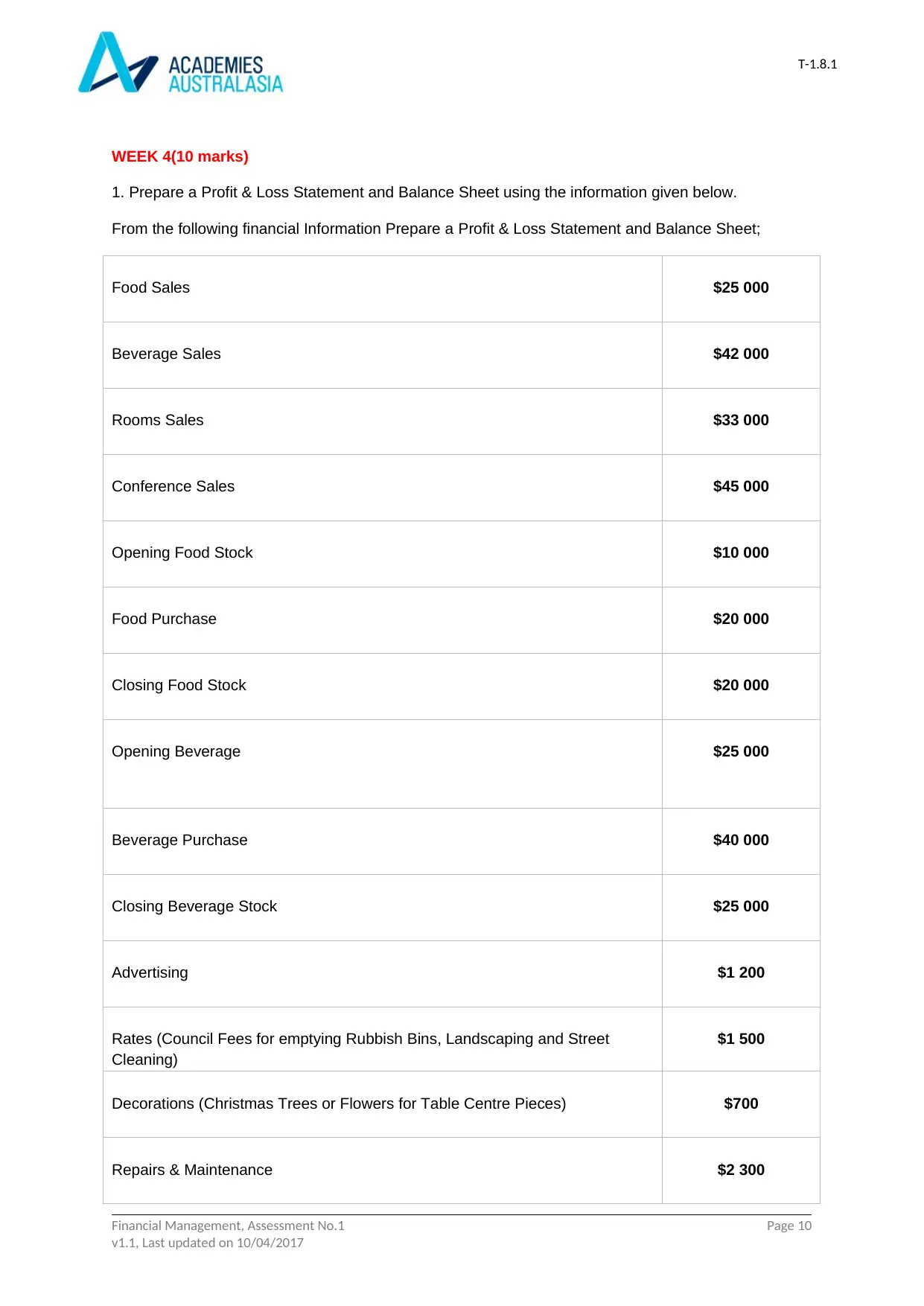

WEEK 4(10 marks)

1. Prepare a Profit & Loss Statement and Balance Sheet using the information given below.

From the following financial Information Prepare a Profit & Loss Statement and Balance Sheet;

Food Sales $25 000

Beverage Sales $42 000

Rooms Sales $33 000

Conference Sales $45 000

Opening Food Stock $10 000

Food Purchase $20 000

Closing Food Stock $20 000

Opening Beverage $25 000

Beverage Purchase $40 000

Closing Beverage Stock $25 000

Advertising $1 200

Rates (Council Fees for emptying Rubbish Bins, Landscaping and Street

Cleaning)

$1 500

Decorations (Christmas Trees or Flowers for Table Centre Pieces) $700

Repairs & Maintenance $2 300

Financial Management, Assessment No.1 Page 10

v1.1, Last updated on 10/04/2017

WEEK 4(10 marks)

1. Prepare a Profit & Loss Statement and Balance Sheet using the information given below.

From the following financial Information Prepare a Profit & Loss Statement and Balance Sheet;

Food Sales $25 000

Beverage Sales $42 000

Rooms Sales $33 000

Conference Sales $45 000

Opening Food Stock $10 000

Food Purchase $20 000

Closing Food Stock $20 000

Opening Beverage $25 000

Beverage Purchase $40 000

Closing Beverage Stock $25 000

Advertising $1 200

Rates (Council Fees for emptying Rubbish Bins, Landscaping and Street

Cleaning)

$1 500

Decorations (Christmas Trees or Flowers for Table Centre Pieces) $700

Repairs & Maintenance $2 300

Financial Management, Assessment No.1 Page 10

v1.1, Last updated on 10/04/2017

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

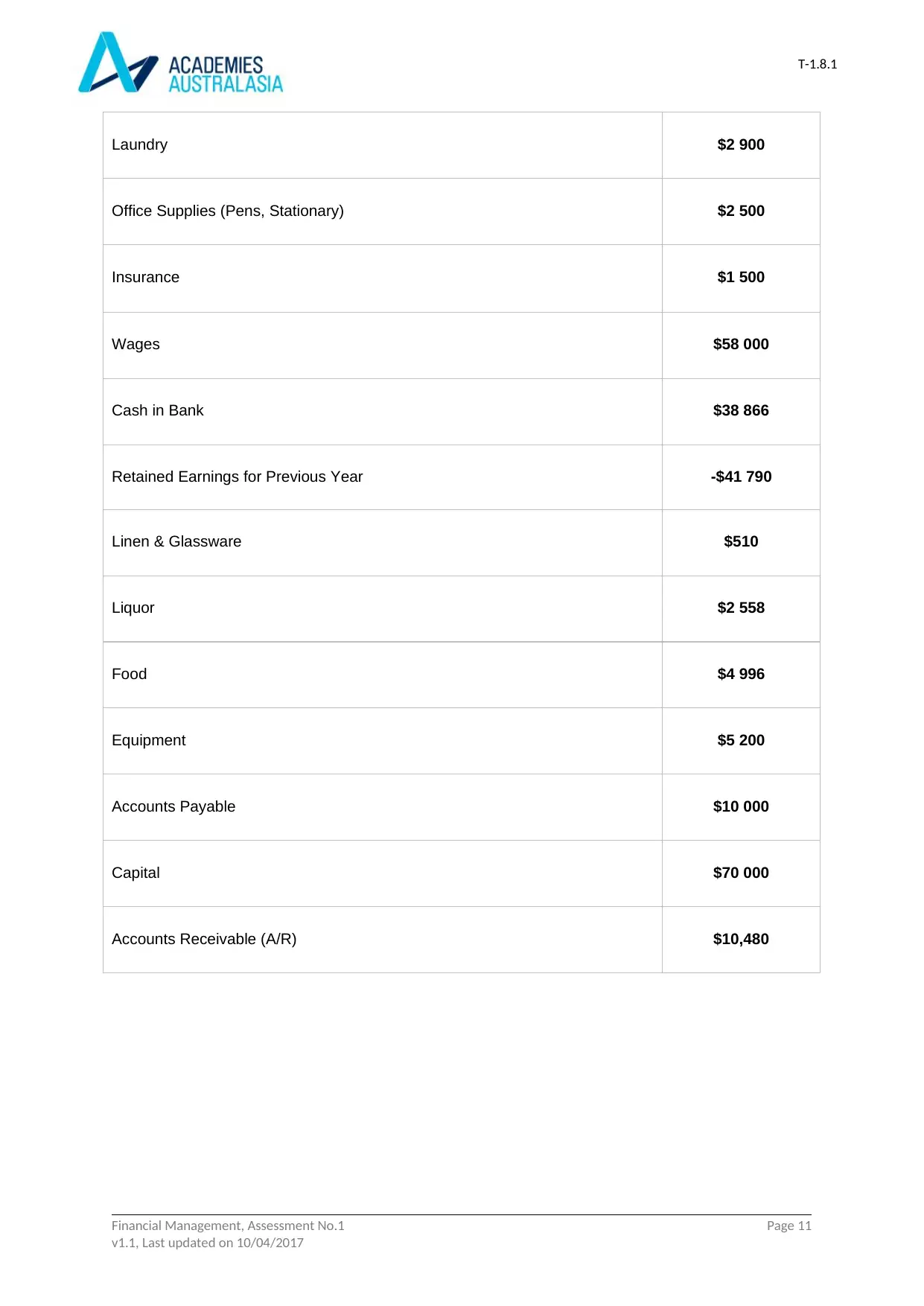

Laundry $2 900

Office Supplies (Pens, Stationary) $2 500

Insurance $1 500

Wages $58 000

Cash in Bank $38 866

Retained Earnings for Previous Year -$41 790

Linen & Glassware $510

Liquor $2 558

Food $4 996

Equipment $5 200

Accounts Payable $10 000

Capital $70 000

Accounts Receivable (A/R) $10,480

Financial Management, Assessment No.1 Page 11

v1.1, Last updated on 10/04/2017

Laundry $2 900

Office Supplies (Pens, Stationary) $2 500

Insurance $1 500

Wages $58 000

Cash in Bank $38 866

Retained Earnings for Previous Year -$41 790

Linen & Glassware $510

Liquor $2 558

Food $4 996

Equipment $5 200

Accounts Payable $10 000

Capital $70 000

Accounts Receivable (A/R) $10,480

Financial Management, Assessment No.1 Page 11

v1.1, Last updated on 10/04/2017

T-1.8.1

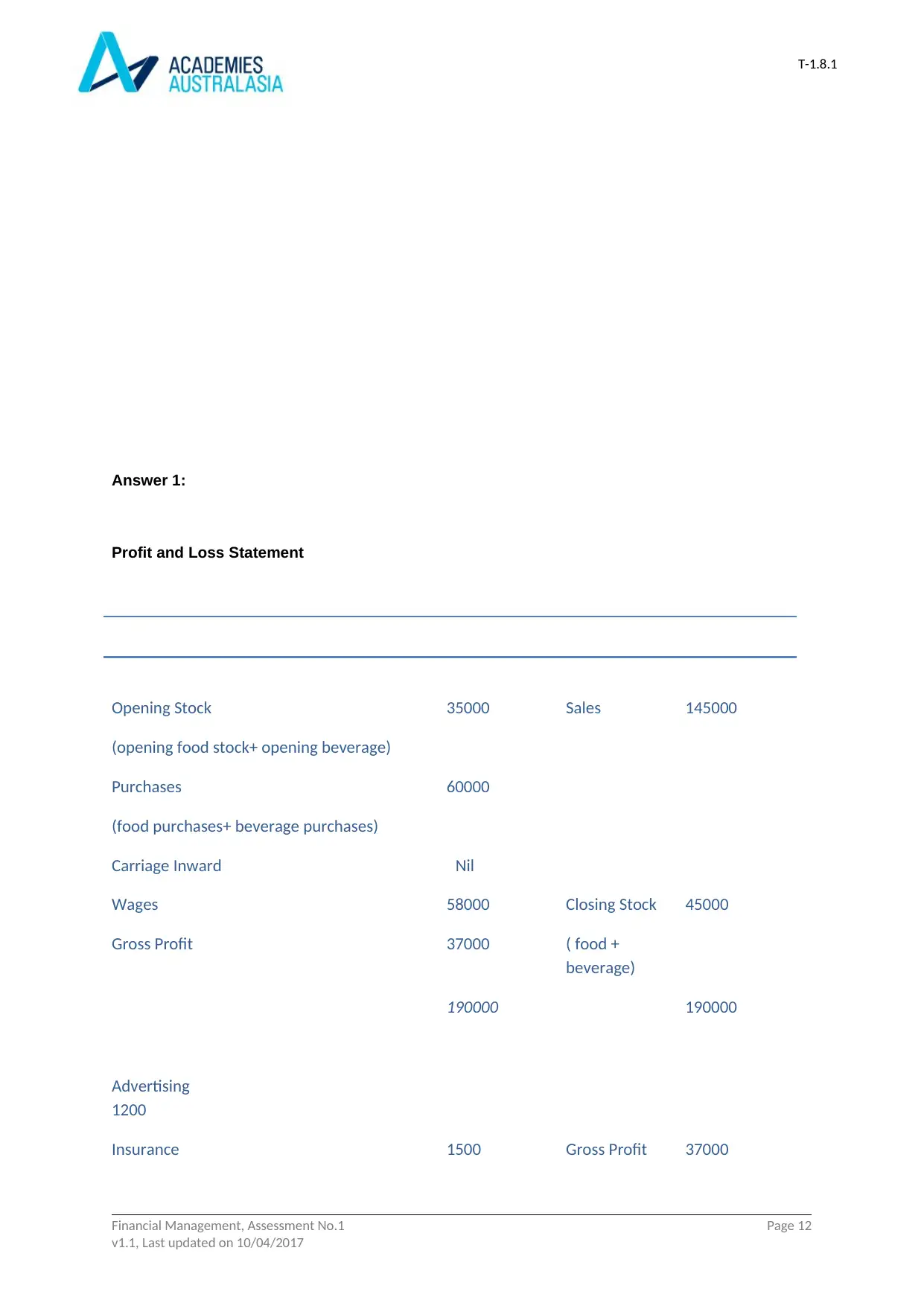

Answer 1:

Profit and Loss Statement

Opening Stock

(opening food stock+ opening beverage)

35000 Sales 145000

Purchases

(food purchases+ beverage purchases)

60000

Carriage Inward Nil

Wages 58000 Closing Stock 45000

Gross Profit 37000 ( food +

beverage)

190000 190000

Advertising

1200

Insurance 1500 Gross Profit 37000

Financial Management, Assessment No.1 Page 12

v1.1, Last updated on 10/04/2017

Answer 1:

Profit and Loss Statement

Opening Stock

(opening food stock+ opening beverage)

35000 Sales 145000

Purchases

(food purchases+ beverage purchases)

60000

Carriage Inward Nil

Wages 58000 Closing Stock 45000

Gross Profit 37000 ( food +

beverage)

190000 190000

Advertising

1200

Insurance 1500 Gross Profit 37000

Financial Management, Assessment No.1 Page 12

v1.1, Last updated on 10/04/2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.