Financial Planning and Funding for Clariton Antiques Business Report

VerifiedAdded on 2020/01/07

|25

|6061

|437

Report

AI Summary

This report provides a comprehensive financial analysis of Clariton Antiques, focusing on the identification of various funding sources, both internal and external, suitable for the business's expansion plans. It examines the implications of these funding sources, assessing their appropriateness for the organization. The report delves into the cost of funds, the importance of financial planning, and the information required for financial decision-making. It includes a cash budget and explores unit costs and pricing strategies. Furthermore, the report analyzes the elements of financial statements, comparing and interpreting them to provide insights into the company's financial health and performance. The report concludes with a summary of findings and recommendations for effective financial management.

MFRD

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1Identification of various sources of finance for the business.................................................1

1.2 Implication of the internal and external source of funds.......................................................2

1.3Asses the appropriate source of finance for the organisation................................................3

TASK 2............................................................................................................................................4

2.1Cost of sources of funds.........................................................................................................4

2.2 Importance of financial planning for the organisation..........................................................4

2.3Assesment of information that will be required in financial decisions..................................5

2.4

TASK 3............................................................................................................................................7

3.1 Cash Budget for Clariton Antiques.......................................................................................7

3.2 Unit cost and pricing for Clariton Antiques..........................................................................7

3.3

TASK 4..........................................................................................................................................11

4.1 The elements of financial statements of a company...........................................................11

4.2 Comparison between the financial statements of the two firms.........................................12

4.3 Interpretation of the financial statements............................................................................13

........................................................................................................................................................14

CONCLUSION..............................................................................................................................15

REFERENCES .............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1Identification of various sources of finance for the business.................................................1

1.2 Implication of the internal and external source of funds.......................................................2

1.3Asses the appropriate source of finance for the organisation................................................3

TASK 2............................................................................................................................................4

2.1Cost of sources of funds.........................................................................................................4

2.2 Importance of financial planning for the organisation..........................................................4

2.3Assesment of information that will be required in financial decisions..................................5

2.4

TASK 3............................................................................................................................................7

3.1 Cash Budget for Clariton Antiques.......................................................................................7

3.2 Unit cost and pricing for Clariton Antiques..........................................................................7

3.3

TASK 4..........................................................................................................................................11

4.1 The elements of financial statements of a company...........................................................11

4.2 Comparison between the financial statements of the two firms.........................................12

4.3 Interpretation of the financial statements............................................................................13

........................................................................................................................................................14

CONCLUSION..............................................................................................................................15

REFERENCES .............................................................................................................................16

INTRODUCTION

Finance is the most important part in the business for the running of company operations. If an organization does not have proper

management of financial resources then it will affect the position of the company. In order to make proper management of the financial

resources, a company needs to have a financial manager. The cited person provides direction to the company with reference to the finances.

The present report is based on case study of Clariton Antiques where the firm sells antique items to the customers. Presently, the firm is

operating in London but the partners aims at expanding the business by opening new branch. However, the partners are required to focus on

the appropriate sources for the management of funds effectively. This will allow them to make appropriate decision making with reference to

the opening of new branch. The document is prepared with a motive to clarify the concept of financial management with the respective case

study. Additionally, it is about to explained the importance of financial management for the current business operations (Van Rooij and

et.al., 2011).

TASK 1

1.1Identification of various sources of finance for the business

a) Unincorporated business- The type of business that are privately owned and managed by the more than two people. There are various

types of source of finance available to these business which are discussed below-

Personal saving- It is saving of all individual's earnings that can be used by the unincorporated business for the investment in a

profitable areas. This is a beneficial in future and highly effective for the firm as the result Zero interest rate (James, E., King, E.M. and

Suryadi, A., 2011. )

Retained earning- It is mainly focus on generating earnings by little investment and retained earning used by the expansion of

business for further investment. This is that part amount of profit used by a business for investment that remains after distribution of

dividend to their shareholders.

Working capital- It is a amount that can be used for financing day to day operations of a firm. This amount is a difference of current

assets and current liabilities. It used for short-term financing and it also aid the firm to achieve short-term financial needs (Madura, 2011).

Finance is the most important part in the business for the running of company operations. If an organization does not have proper

management of financial resources then it will affect the position of the company. In order to make proper management of the financial

resources, a company needs to have a financial manager. The cited person provides direction to the company with reference to the finances.

The present report is based on case study of Clariton Antiques where the firm sells antique items to the customers. Presently, the firm is

operating in London but the partners aims at expanding the business by opening new branch. However, the partners are required to focus on

the appropriate sources for the management of funds effectively. This will allow them to make appropriate decision making with reference to

the opening of new branch. The document is prepared with a motive to clarify the concept of financial management with the respective case

study. Additionally, it is about to explained the importance of financial management for the current business operations (Van Rooij and

et.al., 2011).

TASK 1

1.1Identification of various sources of finance for the business

a) Unincorporated business- The type of business that are privately owned and managed by the more than two people. There are various

types of source of finance available to these business which are discussed below-

Personal saving- It is saving of all individual's earnings that can be used by the unincorporated business for the investment in a

profitable areas. This is a beneficial in future and highly effective for the firm as the result Zero interest rate (James, E., King, E.M. and

Suryadi, A., 2011. )

Retained earning- It is mainly focus on generating earnings by little investment and retained earning used by the expansion of

business for further investment. This is that part amount of profit used by a business for investment that remains after distribution of

dividend to their shareholders.

Working capital- It is a amount that can be used for financing day to day operations of a firm. This amount is a difference of current

assets and current liabilities. It used for short-term financing and it also aid the firm to achieve short-term financial needs (Madura, 2011).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sale of an assets- It is an another internal source of finance in which an organisation generate its revenue by sale its assets such as

machinery,land and building etc.

b)Incorporated business- This type of business are usually formed with aim to develop an entity. They can generate revenue by sale of

products over the cost of production and these are mostly used by many organisations. Therefore, in context of Clarition Antiques limited the

main objective is that to expand in various markets so, they can generate more funds by used of various source of finance that are as follows-

Bank loan- This type of business expand by borrowing loan from various banking institution with best available rate of interest. The

cited firm should take loan either private or government banks. The purpose of these company is that they take additional loan for expanding

their business. They take loan at a fixed rate of interest (O'Riain, Curry and Harth, 2012).

Share capital- The cited company issue share capital to the public for create funds and these can be sale to the investors at the fixed

rate of interest. This allow the firm to manage the needed funds for expansion of business. They can issue share capital to either new or

existing shareholders. This leads to enhance the shares value of that issued share capital.

Debenture- This is a borrowed capital at some rate of interest borrowed for some maturity periods by the small and large size

organisation. They are borrowed debenture by the cited organisation at fixed rate of interest. This is the most appropriate external source of

funds and their some limitation is that the debenture holders does not have a right to vote in the meeting but they can take dividends

(Guthrie, Olson and Humphrey, 2010).

Government grants- It is a type of loan that can be borrow from the government agency where there is a project is done for the

purpose non-profit, public- welfare and benefits to the society by the organisation.

1.2 Implication of the internal and external source of funds

Internal sources- The firm generate funds internally or within the organisation by used of various sources that are as follows-

Personal sources- This can be discuss in the above that personal saving is that part of income's saving is used by the company for

some purpose. They can also generate revenues by taking funds from the family and friends. The implication of these source is that the

saving amount can be loss for the firm if, any loss arise in future that means they have no money in future to recover those losses. The

machinery,land and building etc.

b)Incorporated business- This type of business are usually formed with aim to develop an entity. They can generate revenue by sale of

products over the cost of production and these are mostly used by many organisations. Therefore, in context of Clarition Antiques limited the

main objective is that to expand in various markets so, they can generate more funds by used of various source of finance that are as follows-

Bank loan- This type of business expand by borrowing loan from various banking institution with best available rate of interest. The

cited firm should take loan either private or government banks. The purpose of these company is that they take additional loan for expanding

their business. They take loan at a fixed rate of interest (O'Riain, Curry and Harth, 2012).

Share capital- The cited company issue share capital to the public for create funds and these can be sale to the investors at the fixed

rate of interest. This allow the firm to manage the needed funds for expansion of business. They can issue share capital to either new or

existing shareholders. This leads to enhance the shares value of that issued share capital.

Debenture- This is a borrowed capital at some rate of interest borrowed for some maturity periods by the small and large size

organisation. They are borrowed debenture by the cited organisation at fixed rate of interest. This is the most appropriate external source of

funds and their some limitation is that the debenture holders does not have a right to vote in the meeting but they can take dividends

(Guthrie, Olson and Humphrey, 2010).

Government grants- It is a type of loan that can be borrow from the government agency where there is a project is done for the

purpose non-profit, public- welfare and benefits to the society by the organisation.

1.2 Implication of the internal and external source of funds

Internal sources- The firm generate funds internally or within the organisation by used of various sources that are as follows-

Personal sources- This can be discuss in the above that personal saving is that part of income's saving is used by the company for

some purpose. They can also generate revenues by taking funds from the family and friends. The implication of these source is that the

saving amount can be loss for the firm if, any loss arise in future that means they have no money in future to recover those losses. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company finance it business by usage of internal funds so, there is no legal implication of these funds and also their no financial implication.

Along with this, there is no dilution of control of these personal saving (Madura, 2011).

Retained earnings- The firm used its retained profit for reinvesting their own business for the future growth purpose so, there is zero

financial implication as the capital they used are the part of its firm's profit. Therefore, there is also no financial implication. This amount is

used by the company for itself so, there is also does not have any financial implication for the cited organisation. The usage of retained

profits ignore the expectation change of existing investor that resultant into new sharers issue. Along with that, this source of finance does

not need any legal formalities so, there is not a legal implication.

External sources- The cited company finance their functions and business activities by issue of the source of funds from externally that are

as follows-

Bank loan- In legal terms it can be said that if the cited company borrow amount of loan from bank it requires some legal formalities

and documentation are needed to be done. It can be essential to know the person credit worthiness and its position. Thus, there is a legal

implication of the bank loan that a company borrow capital from internally with the financial and banking institution. In addition to

this,Company borrow loan from bank so they have to pay monthly instalments at interest rate as per the terms of agreement. The firm have

to pay amount on that fixed rate of interest so, here is a financial implication of bank loan. Therefore,this loan does not have a dilution of

control over the businesses owner (Lusardi & Mitchell and et.al., 2008).

Debentures- The company borrow debentures from the other parties they require a legal formalities. They have to make agreements

with concerned parties whom they issue debentures so, there is a legal implication. In addition to this, the firm have to re-pay debentures at

fixed rate of interest on maturity period as they have a financial implication of debentures. Their is no dilution of control of the cited

organisation and it is an effective source of funds.

Along with this, there is no dilution of control of these personal saving (Madura, 2011).

Retained earnings- The firm used its retained profit for reinvesting their own business for the future growth purpose so, there is zero

financial implication as the capital they used are the part of its firm's profit. Therefore, there is also no financial implication. This amount is

used by the company for itself so, there is also does not have any financial implication for the cited organisation. The usage of retained

profits ignore the expectation change of existing investor that resultant into new sharers issue. Along with that, this source of finance does

not need any legal formalities so, there is not a legal implication.

External sources- The cited company finance their functions and business activities by issue of the source of funds from externally that are

as follows-

Bank loan- In legal terms it can be said that if the cited company borrow amount of loan from bank it requires some legal formalities

and documentation are needed to be done. It can be essential to know the person credit worthiness and its position. Thus, there is a legal

implication of the bank loan that a company borrow capital from internally with the financial and banking institution. In addition to

this,Company borrow loan from bank so they have to pay monthly instalments at interest rate as per the terms of agreement. The firm have

to pay amount on that fixed rate of interest so, here is a financial implication of bank loan. Therefore,this loan does not have a dilution of

control over the businesses owner (Lusardi & Mitchell and et.al., 2008).

Debentures- The company borrow debentures from the other parties they require a legal formalities. They have to make agreements

with concerned parties whom they issue debentures so, there is a legal implication. In addition to this, the firm have to re-pay debentures at

fixed rate of interest on maturity period as they have a financial implication of debentures. Their is no dilution of control of the cited

organisation and it is an effective source of funds.

1.3Asses the appropriate source of finance for the organisation

The Clarition Anitques limited use internal and external sources of funds for the purpose of expand business. As per the implication

of these source of finance and the firm adopt most appropriate source that are discussed below-

Bank loan-The Clarition Antiques limited use these type of source is taken from the banking institutions. It will aid in generating a

important implication on the expansion of business. Therefore, the management needs to pay the fixed rate of interest that will assist the

company to arrange the various resources. This is a less risk for the firm and help in establishment.

Government grant- This is an effective aspect that can be used by the company to achieve the financial requirements. The legal

authorities provide a grant loan at high interest rate. This will also help in meet the requirement funds of the company and minimize the

financial burden by managing. This type of grant is a risk free and cost-effective for the business.

Personal saving- The cited company can finance its firm by collect form the personal saving and it assist them to get the sum

amount of money above the zero interest rate. This resultant into generating revenues by investing at limited areas (Samiksha, S., 2016).

TASK 2

2.1Cost of sources of funds

The Clarition Antiques limited use source of funds for the operating activities and functioning properly that are discussed below-

Dividend- The cited organisation incurred cost when they issue share in form of dividend. The firm have to distribute its part of profit in the

form of dividend to its shareholders and remain part is kept with them for the further investment. The usage of these source will provide

benefits to the organisation without any burden of repayment of loan. The institution will not pay necessarily amount of debt cost at each and

every month. It assist them to make more wealth for the business.

Interest- The cited firm use this source of finance which assist them to get the needed funds for the expansion purpose. It will be required to

pay fixed amount of interest against the bank loan. Therefore, their in not a high rate of interest added on the expenses of business. The

amount of loan is repay in instalments that have a some maturity periods which increase the financial burden on the company (Lusardi &

Mitchell and et.al., 2008).

The Clarition Anitques limited use internal and external sources of funds for the purpose of expand business. As per the implication

of these source of finance and the firm adopt most appropriate source that are discussed below-

Bank loan-The Clarition Antiques limited use these type of source is taken from the banking institutions. It will aid in generating a

important implication on the expansion of business. Therefore, the management needs to pay the fixed rate of interest that will assist the

company to arrange the various resources. This is a less risk for the firm and help in establishment.

Government grant- This is an effective aspect that can be used by the company to achieve the financial requirements. The legal

authorities provide a grant loan at high interest rate. This will also help in meet the requirement funds of the company and minimize the

financial burden by managing. This type of grant is a risk free and cost-effective for the business.

Personal saving- The cited company can finance its firm by collect form the personal saving and it assist them to get the sum

amount of money above the zero interest rate. This resultant into generating revenues by investing at limited areas (Samiksha, S., 2016).

TASK 2

2.1Cost of sources of funds

The Clarition Antiques limited use source of funds for the operating activities and functioning properly that are discussed below-

Dividend- The cited organisation incurred cost when they issue share in form of dividend. The firm have to distribute its part of profit in the

form of dividend to its shareholders and remain part is kept with them for the further investment. The usage of these source will provide

benefits to the organisation without any burden of repayment of loan. The institution will not pay necessarily amount of debt cost at each and

every month. It assist them to make more wealth for the business.

Interest- The cited firm use this source of finance which assist them to get the needed funds for the expansion purpose. It will be required to

pay fixed amount of interest against the bank loan. Therefore, their in not a high rate of interest added on the expenses of business. The

amount of loan is repay in instalments that have a some maturity periods which increase the financial burden on the company (Lusardi &

Mitchell and et.al., 2008).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Tax- The bank loan is borrow from any bank or financial institution as there is a interest levied on it as it impact on the financial statements

of a firm. Therefore, there is a tax benefits in terms of tax save as the government allow various benefits who re-pay its loan.

Cost of Debentures- The firm gave to pay on average rate if they consist bond as well a bank loan. Thus, the cost of debentures can be

expressed in terms of annual % and they have to pay interest rate form.

Cost of equity shares- The cost of equity is that company have to distribute is part of profit in the form of dividend to its shareholders.

Thus, it a part of firm's capital structure and it measure in terms of shareholder return that are they demand in the stock market as they bear

risk.

Discussion of debentures and equity source of finance

Debentures is deliver through the external that are mainly bank and credit union. Whereas, the equity share capital is finance by the

company from externally.

The financial institution offer a short-term and long-term debentures and they offer some products that includes line of credit,

overdraft facility, asset finance etc. Therefore, on the other hand side equity finance involve personal finance as well as revenue from

the organisation.

The debentures holder have to repay its debts on maturity periods at some interest rate. Whereas, the equity capital have no maturity

period and the firm not compulsory pay dividends to the investors

of a firm. Therefore, there is a tax benefits in terms of tax save as the government allow various benefits who re-pay its loan.

Cost of Debentures- The firm gave to pay on average rate if they consist bond as well a bank loan. Thus, the cost of debentures can be

expressed in terms of annual % and they have to pay interest rate form.

Cost of equity shares- The cost of equity is that company have to distribute is part of profit in the form of dividend to its shareholders.

Thus, it a part of firm's capital structure and it measure in terms of shareholder return that are they demand in the stock market as they bear

risk.

Discussion of debentures and equity source of finance

Debentures is deliver through the external that are mainly bank and credit union. Whereas, the equity share capital is finance by the

company from externally.

The financial institution offer a short-term and long-term debentures and they offer some products that includes line of credit,

overdraft facility, asset finance etc. Therefore, on the other hand side equity finance involve personal finance as well as revenue from

the organisation.

The debentures holder have to repay its debts on maturity periods at some interest rate. Whereas, the equity capital have no maturity

period and the firm not compulsory pay dividends to the investors

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.2 Importance of financial planning for the organisation

The financial planning play a significant role for the firm if it is plan effectively. In the planning process it help the firm in providing

a useful guidance in terms of finance, investment and dividend decisions. In addition to this, they can be able to measure the both terms of

needs short and long period to the firm. Their are various importance that are discussed below- Income- The effective financial planning in the income aids the organisation to manage the cost of firm such as administrative,

selling and distribution and overheads cost etc. In addition to this, the cited company also able to evaluate the various sources that

help in generating more revenues. Investment- The appropriate financial planning assist the firm to asses the firm's objectives and goals. They also provide a right and

appropriate direction of business activities and also help them in making an effective investment decisions. The most important

positive impact of financial planning is that it help in formulating an appropriate strategies. This leads to achieve the objectives of

firms in an effective manner. Savings- The savings of the firm refer to some amount of money earn by company is kept by them in order to meet the company's

requirement in the emergency. Therefore, financial planning aid the manager of a company to use of these when there is any

uncertainty happen in the future. In some time there is good for the firm to invest where there is high liquidity chances ( Upton and

et.al., 2015). Budgeting- This design is effective that helps in making fixed and flexible budget for some time period and change when required.

This will help in starting different trading operations when there is need to pay some money. The company require to pay taxes on

time and also have to pay bills. For this reason, its is needed to make financial planning which aid in determine the investment and

saving for the organisation.

Develop financial understanding- The effective financial planning help in knowing the better understanding the financial terms.

This leads to achieve financial goals of the cited organisation by set the short-term as well as long-term goals. This also help in

making effective decisions so, it help in achieve company objectives (Lusardi & Mitchell and et.al., 2008).

The financial planning play a significant role for the firm if it is plan effectively. In the planning process it help the firm in providing

a useful guidance in terms of finance, investment and dividend decisions. In addition to this, they can be able to measure the both terms of

needs short and long period to the firm. Their are various importance that are discussed below- Income- The effective financial planning in the income aids the organisation to manage the cost of firm such as administrative,

selling and distribution and overheads cost etc. In addition to this, the cited company also able to evaluate the various sources that

help in generating more revenues. Investment- The appropriate financial planning assist the firm to asses the firm's objectives and goals. They also provide a right and

appropriate direction of business activities and also help them in making an effective investment decisions. The most important

positive impact of financial planning is that it help in formulating an appropriate strategies. This leads to achieve the objectives of

firms in an effective manner. Savings- The savings of the firm refer to some amount of money earn by company is kept by them in order to meet the company's

requirement in the emergency. Therefore, financial planning aid the manager of a company to use of these when there is any

uncertainty happen in the future. In some time there is good for the firm to invest where there is high liquidity chances ( Upton and

et.al., 2015). Budgeting- This design is effective that helps in making fixed and flexible budget for some time period and change when required.

This will help in starting different trading operations when there is need to pay some money. The company require to pay taxes on

time and also have to pay bills. For this reason, its is needed to make financial planning which aid in determine the investment and

saving for the organisation.

Develop financial understanding- The effective financial planning help in knowing the better understanding the financial terms.

This leads to achieve financial goals of the cited organisation by set the short-term as well as long-term goals. This also help in

making effective decisions so, it help in achieve company objectives (Lusardi & Mitchell and et.al., 2008).

2.3Assesment of information that will be required in financial decisions

The appropriate finance and business decisions which is categories into three parts and the cited company information is required for

three purpose which are as follows-

Partners- The partner of the cited organisation will be required a information related to business that are related to finance such as

balance sheet, trading account and profit and loss account. This will aid the firm to analyse their financial position by use of balance

sheet in which they will compare their current assets and current liabilities with the previous year. Along with this, also the

company's partner also identify the budgets for the organisation. It also assist the organisation to know their position on monthly

basis (Upton and et.al., 2015).

Venture capital- The venture capital help in analysing the risk and returns of the organisation. It mainly focus on numbers of staff

members needed by the company and their market positioning. The company have a good market share capture that means company

can invest in the profitable areas. It will help to make an effective business decisions so, it will help in taking an appropriate

information related to company. They deliver the understanding to know the company current position by analyse the profit and loss

and cash flow statements by comparing. With the all financial information they will provide an investment decisions in an effective

manner.

Finance broker- This is a person who is a come between the company and its customers. It suggest the customer information related

to investment and they also take brokerage or commission for their financial services. Along with this, when company invest in some

areas they will evaluate the capacity of earning of the company. They are mainly focus on the capability to firm in generating

revenues and earning profit. The brokers also asses and compare the balance sheet of that company and if the firm earn high profit

they suggest to its clients for invest some areas. They also evaluate the profit and loss account of the firm to know the net profit as

well as gross profit (Nobes, 2014).

2.4Impacts of financial statements

There is a highly impact on the financial statements of the mentioned company that has been discussed below-

The appropriate finance and business decisions which is categories into three parts and the cited company information is required for

three purpose which are as follows-

Partners- The partner of the cited organisation will be required a information related to business that are related to finance such as

balance sheet, trading account and profit and loss account. This will aid the firm to analyse their financial position by use of balance

sheet in which they will compare their current assets and current liabilities with the previous year. Along with this, also the

company's partner also identify the budgets for the organisation. It also assist the organisation to know their position on monthly

basis (Upton and et.al., 2015).

Venture capital- The venture capital help in analysing the risk and returns of the organisation. It mainly focus on numbers of staff

members needed by the company and their market positioning. The company have a good market share capture that means company

can invest in the profitable areas. It will help to make an effective business decisions so, it will help in taking an appropriate

information related to company. They deliver the understanding to know the company current position by analyse the profit and loss

and cash flow statements by comparing. With the all financial information they will provide an investment decisions in an effective

manner.

Finance broker- This is a person who is a come between the company and its customers. It suggest the customer information related

to investment and they also take brokerage or commission for their financial services. Along with this, when company invest in some

areas they will evaluate the capacity of earning of the company. They are mainly focus on the capability to firm in generating

revenues and earning profit. The brokers also asses and compare the balance sheet of that company and if the firm earn high profit

they suggest to its clients for invest some areas. They also evaluate the profit and loss account of the firm to know the net profit as

well as gross profit (Nobes, 2014).

2.4Impacts of financial statements

There is a highly impact on the financial statements of the mentioned company that has been discussed below-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

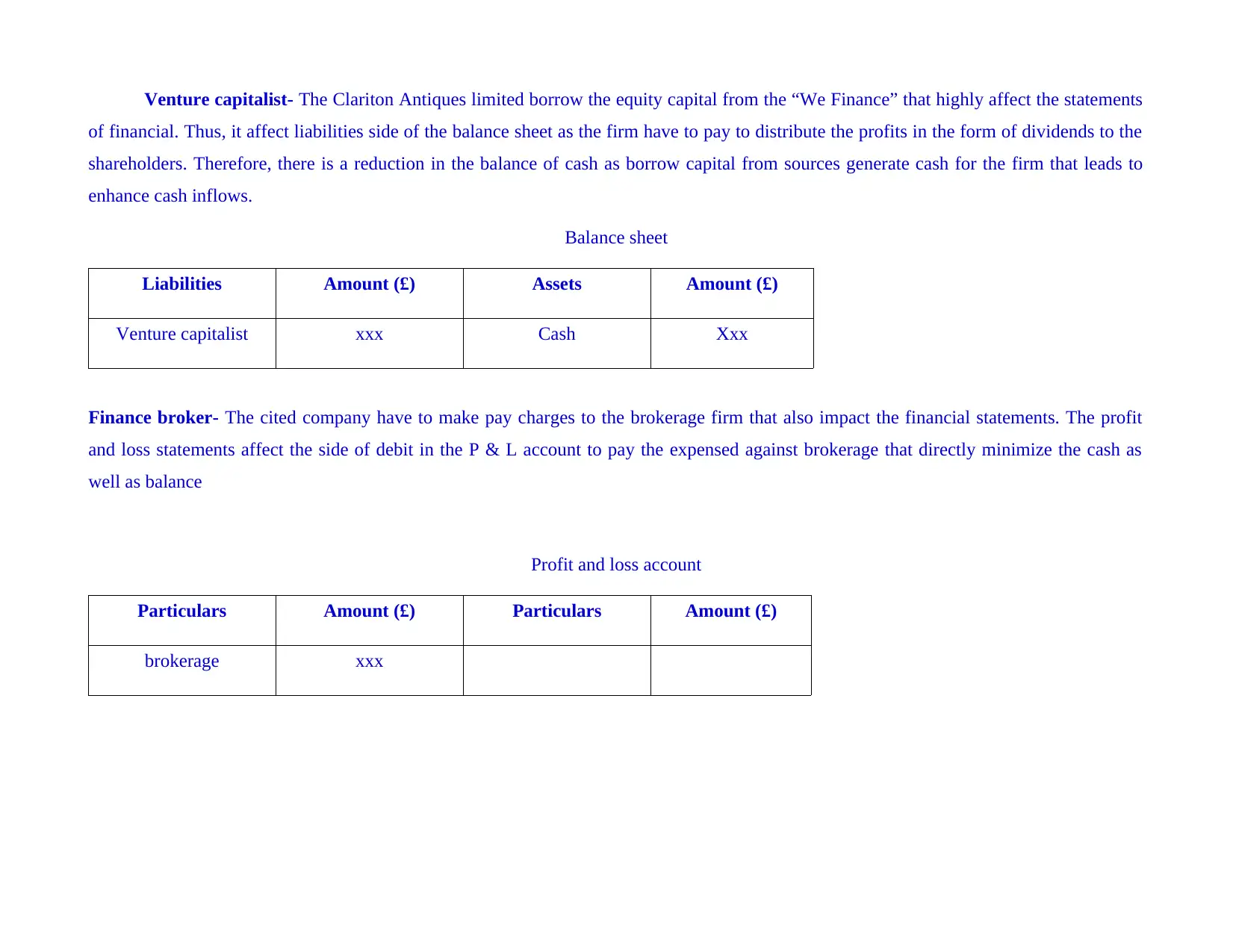

Venture capitalist- The Clariton Antiques limited borrow the equity capital from the “We Finance” that highly affect the statements

of financial. Thus, it affect liabilities side of the balance sheet as the firm have to pay to distribute the profits in the form of dividends to the

shareholders. Therefore, there is a reduction in the balance of cash as borrow capital from sources generate cash for the firm that leads to

enhance cash inflows.

Balance sheet

Liabilities Amount (£) Assets Amount (£)

Venture capitalist xxx Cash Xxx

Finance broker- The cited company have to make pay charges to the brokerage firm that also impact the financial statements. The profit

and loss statements affect the side of debit in the P & L account to pay the expensed against brokerage that directly minimize the cash as

well as balance

Profit and loss account

Particulars Amount (£) Particulars Amount (£)

brokerage xxx

of financial. Thus, it affect liabilities side of the balance sheet as the firm have to pay to distribute the profits in the form of dividends to the

shareholders. Therefore, there is a reduction in the balance of cash as borrow capital from sources generate cash for the firm that leads to

enhance cash inflows.

Balance sheet

Liabilities Amount (£) Assets Amount (£)

Venture capitalist xxx Cash Xxx

Finance broker- The cited company have to make pay charges to the brokerage firm that also impact the financial statements. The profit

and loss statements affect the side of debit in the P & L account to pay the expensed against brokerage that directly minimize the cash as

well as balance

Profit and loss account

Particulars Amount (£) Particulars Amount (£)

brokerage xxx

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

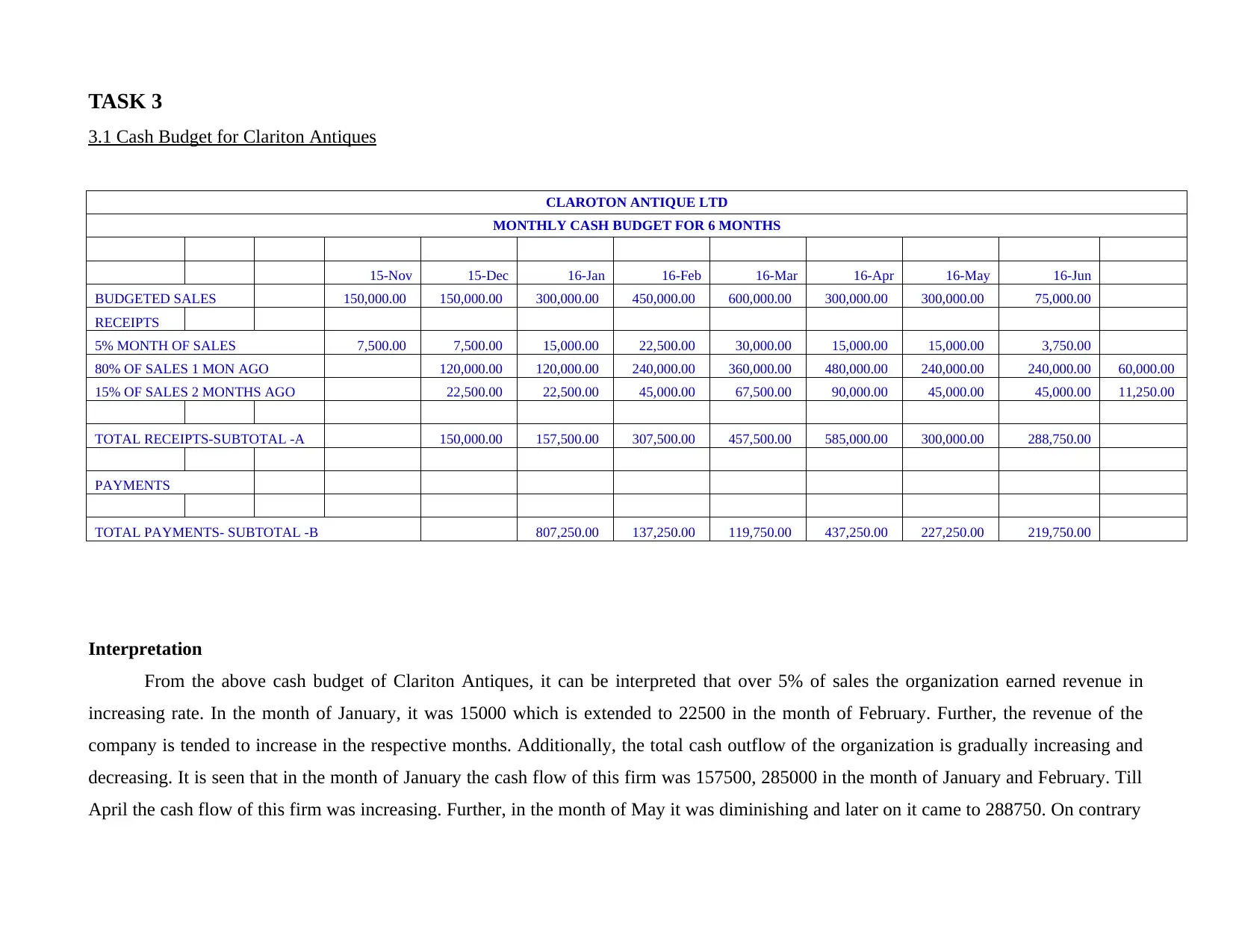

3.1 Cash Budget for Clariton Antiques

CLAROTON ANTIQUE LTD

MONTHLY CASH BUDGET FOR 6 MONTHS

15-Nov 15-Dec 16-Jan 16-Feb 16-Mar 16-Apr 16-May 16-Jun

BUDGETED SALES 150,000.00 150,000.00 300,000.00 450,000.00 600,000.00 300,000.00 300,000.00 75,000.00

RECEIPTS

5% MONTH OF SALES 7,500.00 7,500.00 15,000.00 22,500.00 30,000.00 15,000.00 15,000.00 3,750.00

80% OF SALES 1 MON AGO 120,000.00 120,000.00 240,000.00 360,000.00 480,000.00 240,000.00 240,000.00 60,000.00

15% OF SALES 2 MONTHS AGO 22,500.00 22,500.00 45,000.00 67,500.00 90,000.00 45,000.00 45,000.00 11,250.00

TOTAL RECEIPTS-SUBTOTAL -A 150,000.00 157,500.00 307,500.00 457,500.00 585,000.00 300,000.00 288,750.00

PAYMENTS

TOTAL PAYMENTS- SUBTOTAL -B 807,250.00 137,250.00 119,750.00 437,250.00 227,250.00 219,750.00

Interpretation

From the above cash budget of Clariton Antiques, it can be interpreted that over 5% of sales the organization earned revenue in

increasing rate. In the month of January, it was 15000 which is extended to 22500 in the month of February. Further, the revenue of the

company is tended to increase in the respective months. Additionally, the total cash outflow of the organization is gradually increasing and

decreasing. It is seen that in the month of January the cash flow of this firm was 157500, 285000 in the month of January and February. Till

April the cash flow of this firm was increasing. Further, in the month of May it was diminishing and later on it came to 288750. On contrary

3.1 Cash Budget for Clariton Antiques

CLAROTON ANTIQUE LTD

MONTHLY CASH BUDGET FOR 6 MONTHS

15-Nov 15-Dec 16-Jan 16-Feb 16-Mar 16-Apr 16-May 16-Jun

BUDGETED SALES 150,000.00 150,000.00 300,000.00 450,000.00 600,000.00 300,000.00 300,000.00 75,000.00

RECEIPTS

5% MONTH OF SALES 7,500.00 7,500.00 15,000.00 22,500.00 30,000.00 15,000.00 15,000.00 3,750.00

80% OF SALES 1 MON AGO 120,000.00 120,000.00 240,000.00 360,000.00 480,000.00 240,000.00 240,000.00 60,000.00

15% OF SALES 2 MONTHS AGO 22,500.00 22,500.00 45,000.00 67,500.00 90,000.00 45,000.00 45,000.00 11,250.00

TOTAL RECEIPTS-SUBTOTAL -A 150,000.00 157,500.00 307,500.00 457,500.00 585,000.00 300,000.00 288,750.00

PAYMENTS

TOTAL PAYMENTS- SUBTOTAL -B 807,250.00 137,250.00 119,750.00 437,250.00 227,250.00 219,750.00

Interpretation

From the above cash budget of Clariton Antiques, it can be interpreted that over 5% of sales the organization earned revenue in

increasing rate. In the month of January, it was 15000 which is extended to 22500 in the month of February. Further, the revenue of the

company is tended to increase in the respective months. Additionally, the total cash outflow of the organization is gradually increasing and

decreasing. It is seen that in the month of January the cash flow of this firm was 157500, 285000 in the month of January and February. Till

April the cash flow of this firm was increasing. Further, in the month of May it was diminishing and later on it came to 288750. On contrary

to this, the cash outflow of the firm was in deficit in the month of January and February. Later on, the cash outflow of the company in the

month of April, may and June was showing positive trend (Nobes, 2014).

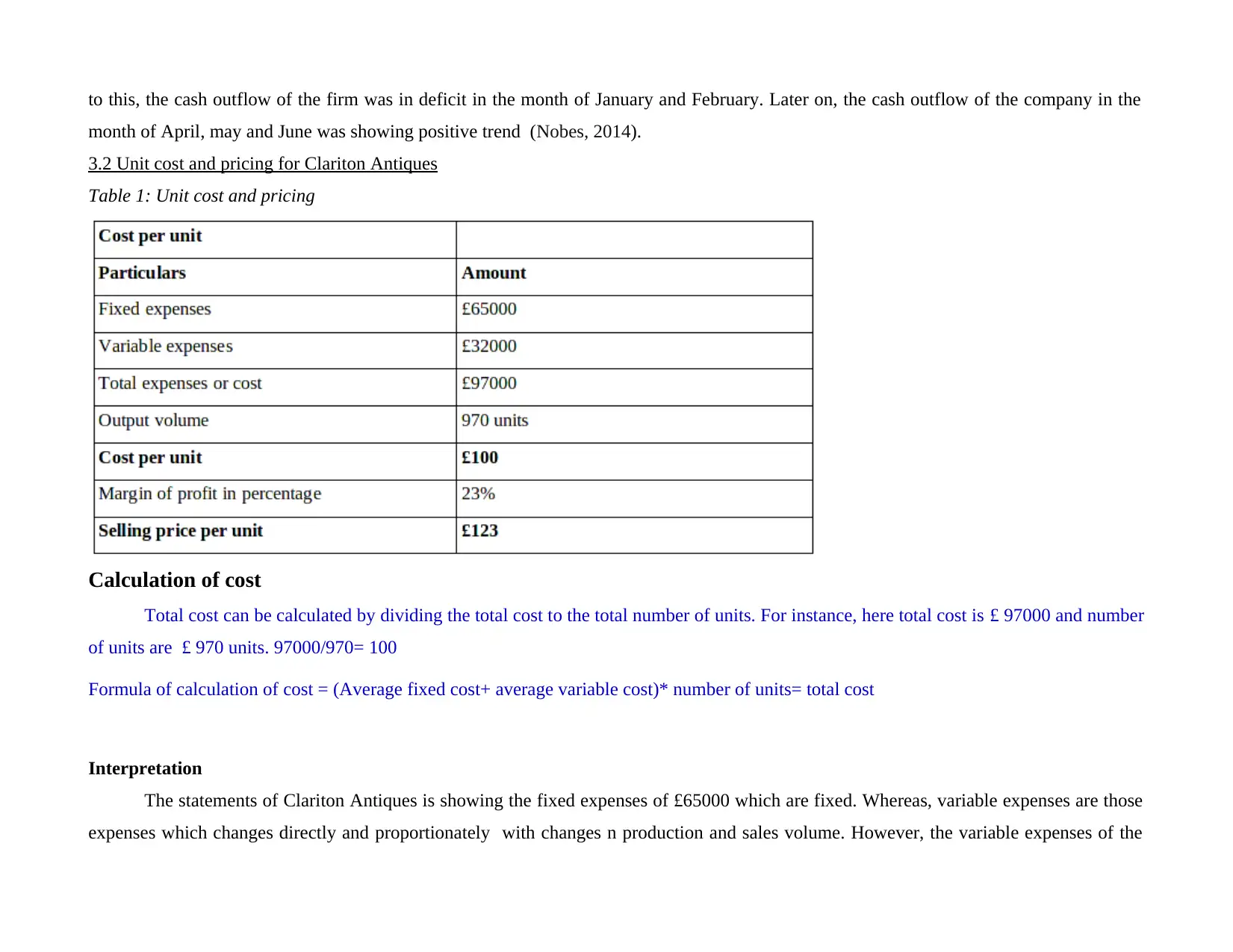

3.2 Unit cost and pricing for Clariton Antiques

Table 1: Unit cost and pricing

Calculation of cost

Total cost can be calculated by dividing the total cost to the total number of units. For instance, here total cost is £ 97000 and number

of units are £ 970 units. 97000/970= 100

Formula of calculation of cost = (Average fixed cost+ average variable cost)* number of units= total cost

Interpretation

The statements of Clariton Antiques is showing the fixed expenses of £65000 which are fixed. Whereas, variable expenses are those

expenses which changes directly and proportionately with changes n production and sales volume. However, the variable expenses of the

month of April, may and June was showing positive trend (Nobes, 2014).

3.2 Unit cost and pricing for Clariton Antiques

Table 1: Unit cost and pricing

Calculation of cost

Total cost can be calculated by dividing the total cost to the total number of units. For instance, here total cost is £ 97000 and number

of units are £ 970 units. 97000/970= 100

Formula of calculation of cost = (Average fixed cost+ average variable cost)* number of units= total cost

Interpretation

The statements of Clariton Antiques is showing the fixed expenses of £65000 which are fixed. Whereas, variable expenses are those

expenses which changes directly and proportionately with changes n production and sales volume. However, the variable expenses of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.