V361 Financial Management Homework 2 - Present Value Analysis

VerifiedAdded on 2022/08/10

|12

|773

|393

Homework Assignment

AI Summary

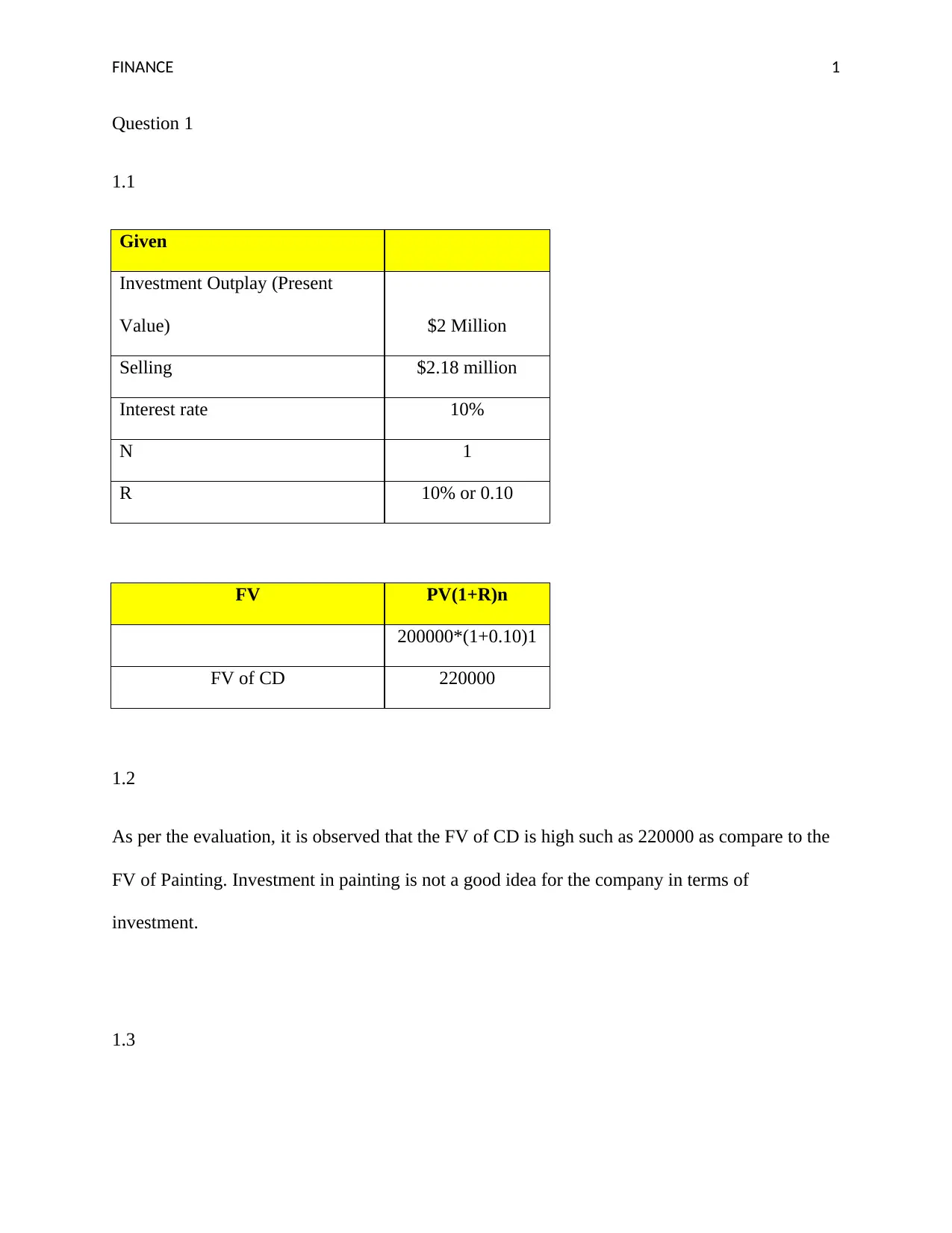

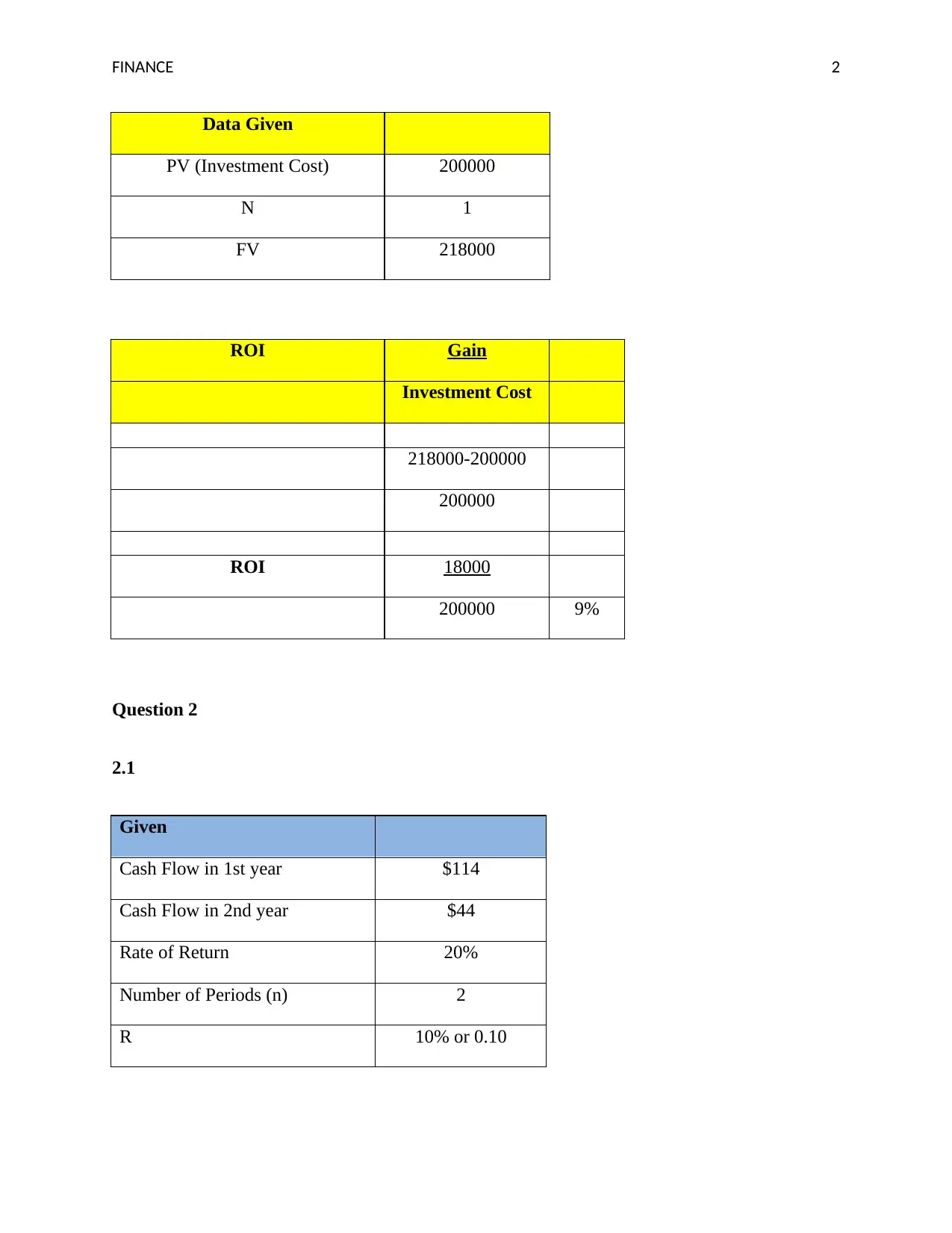

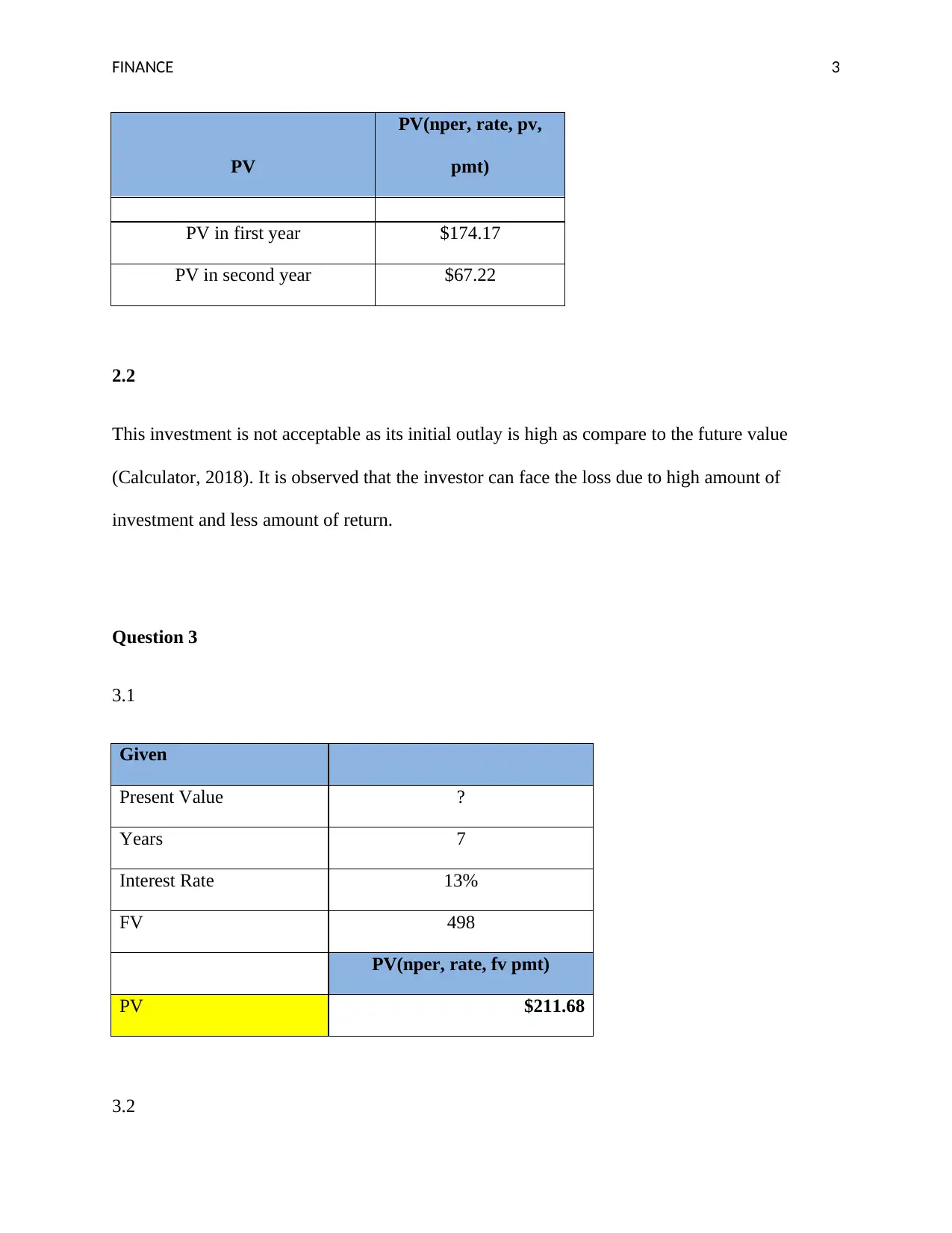

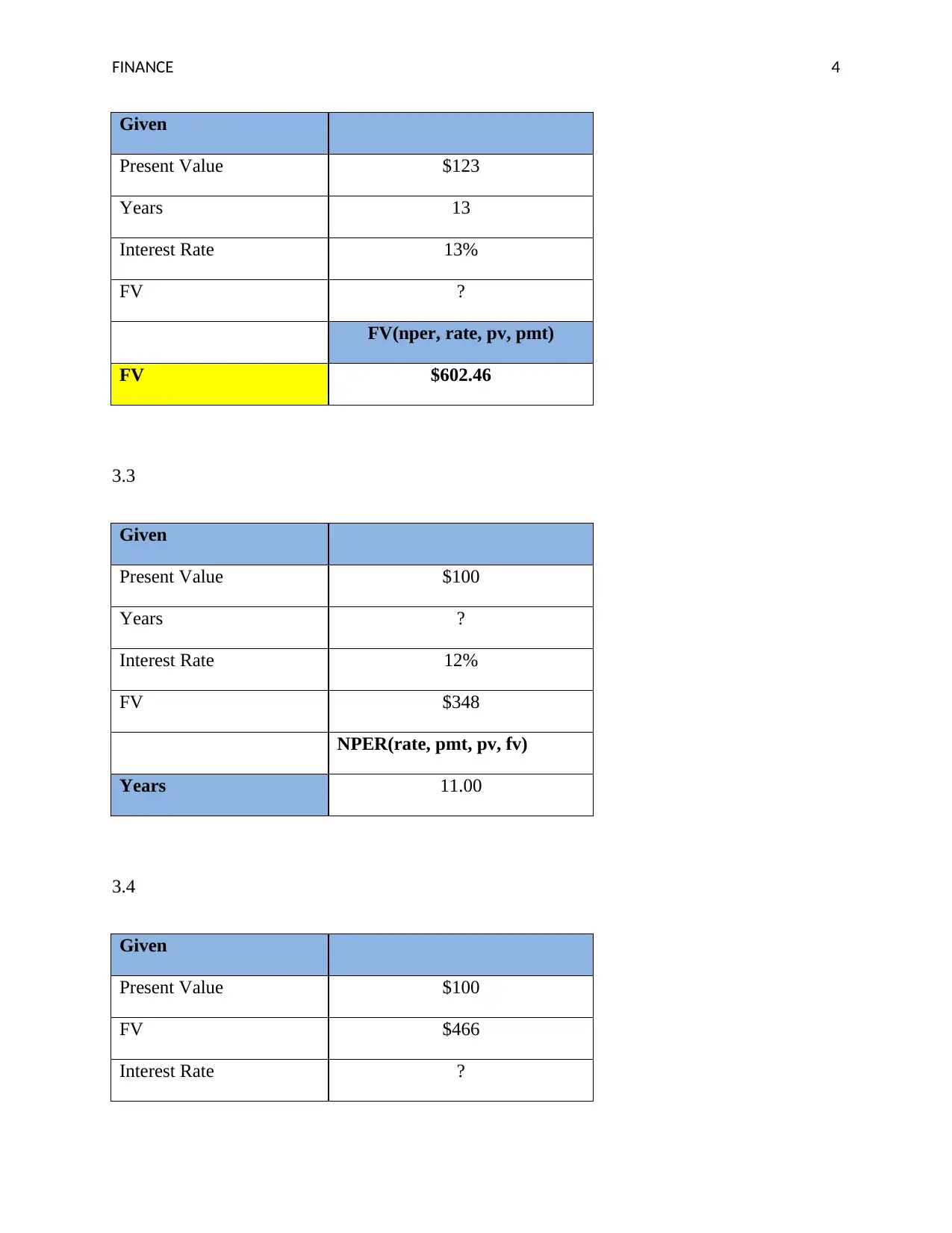

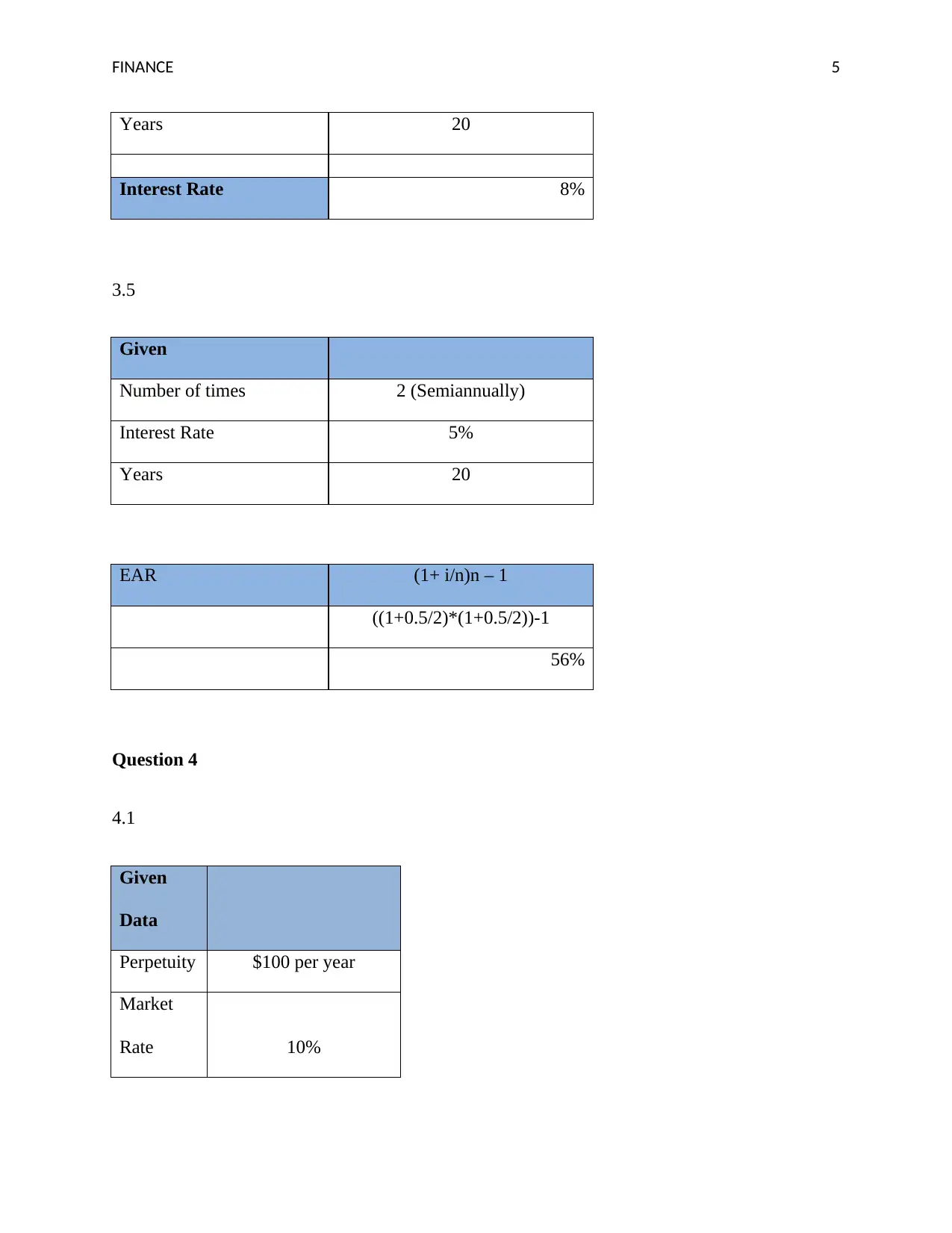

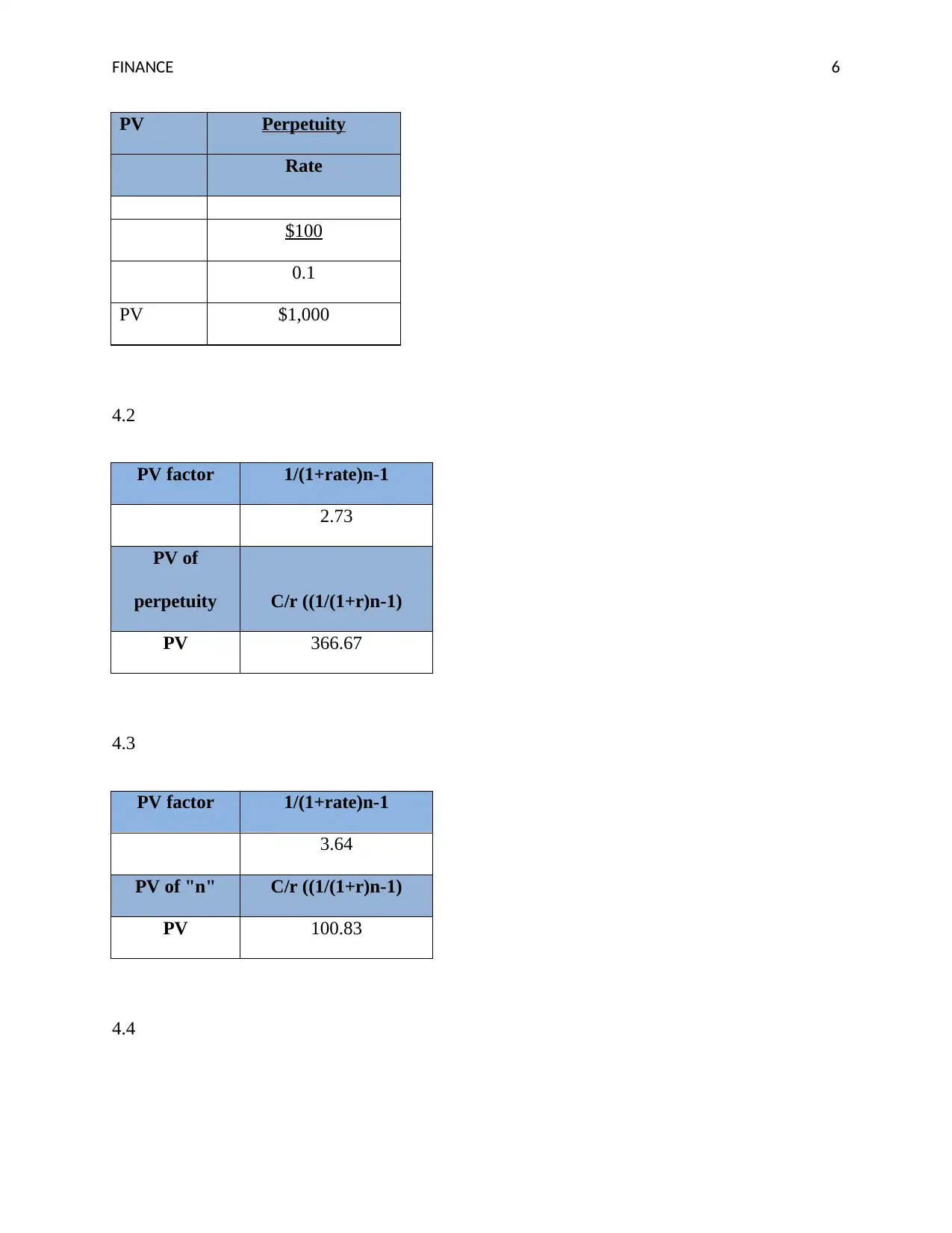

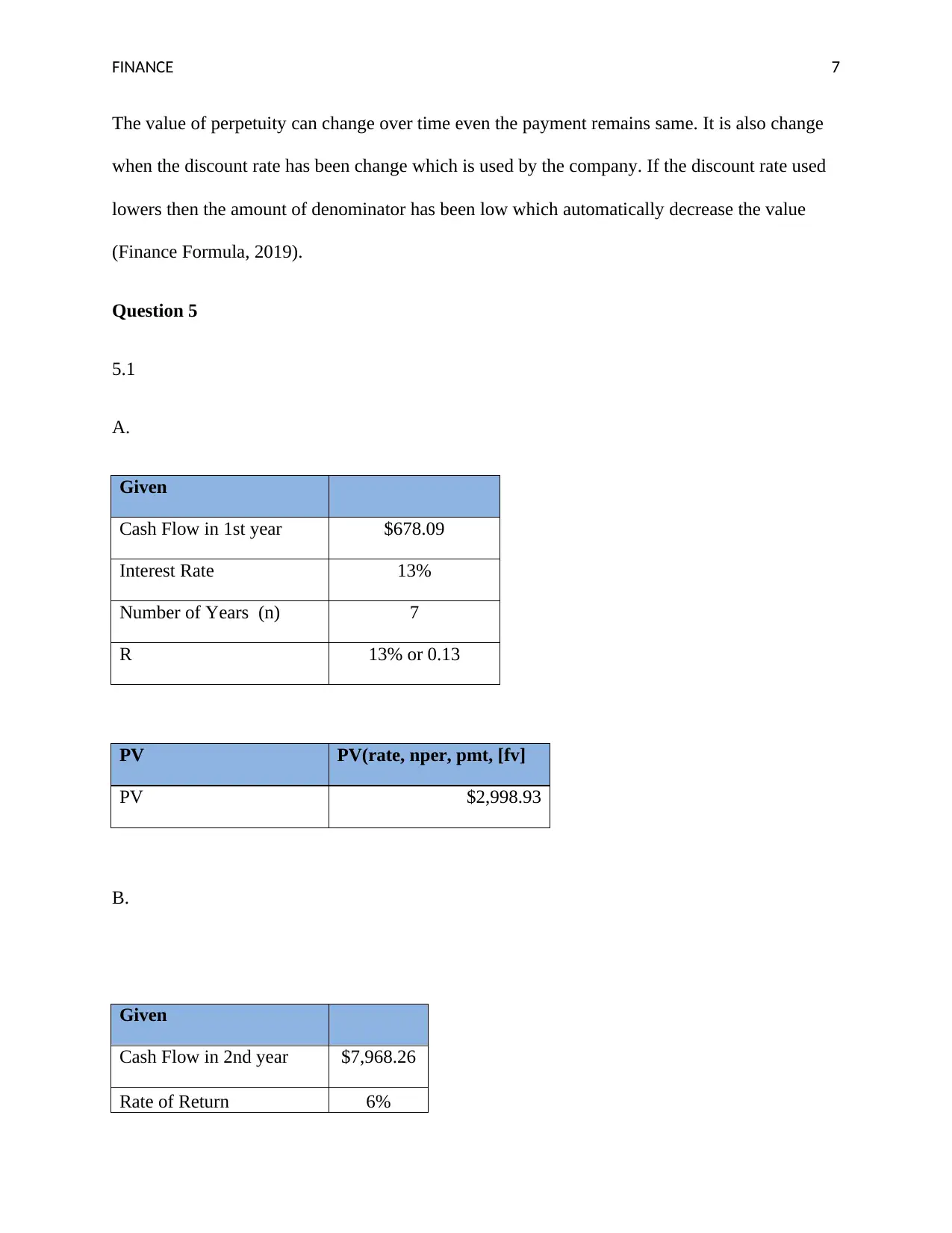

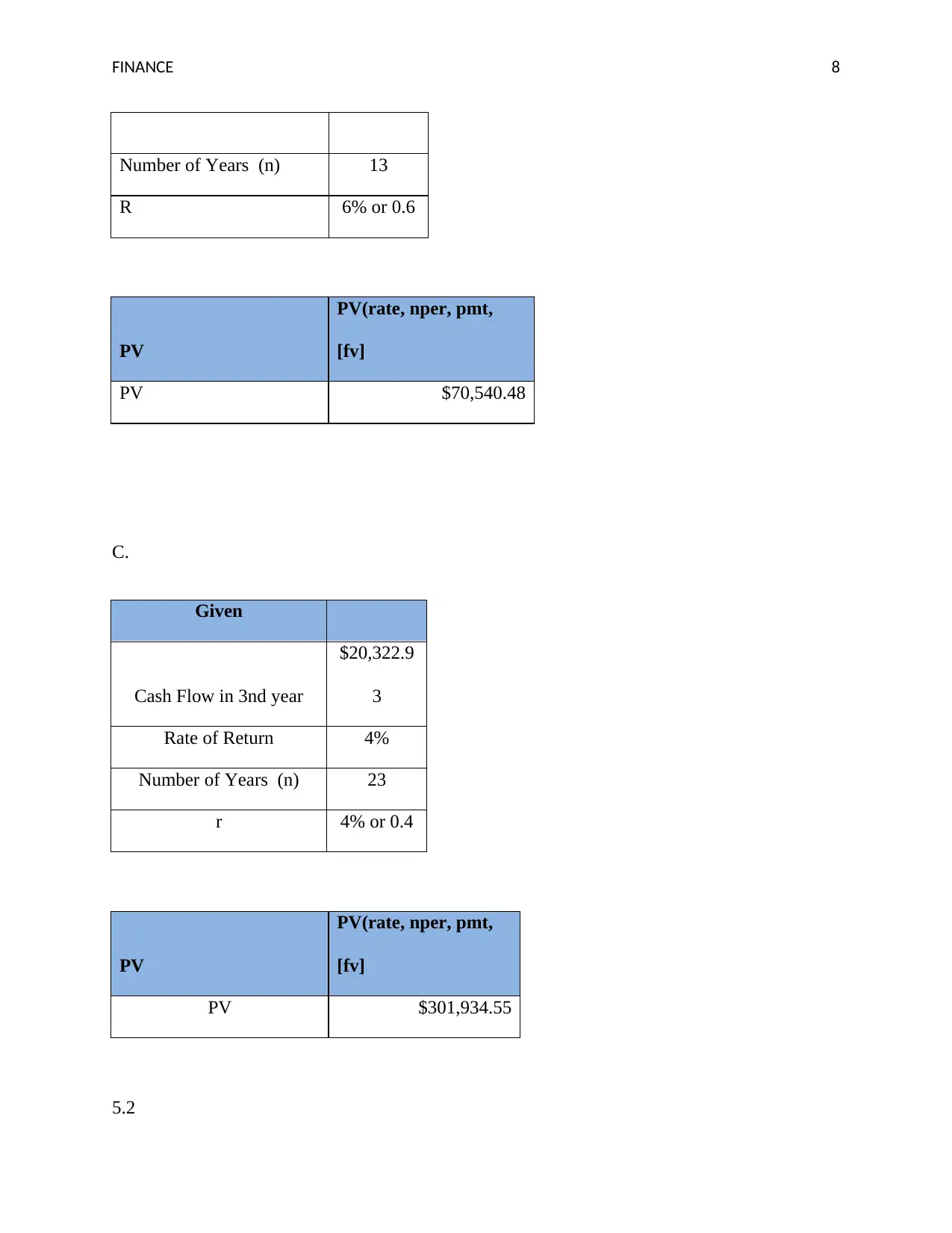

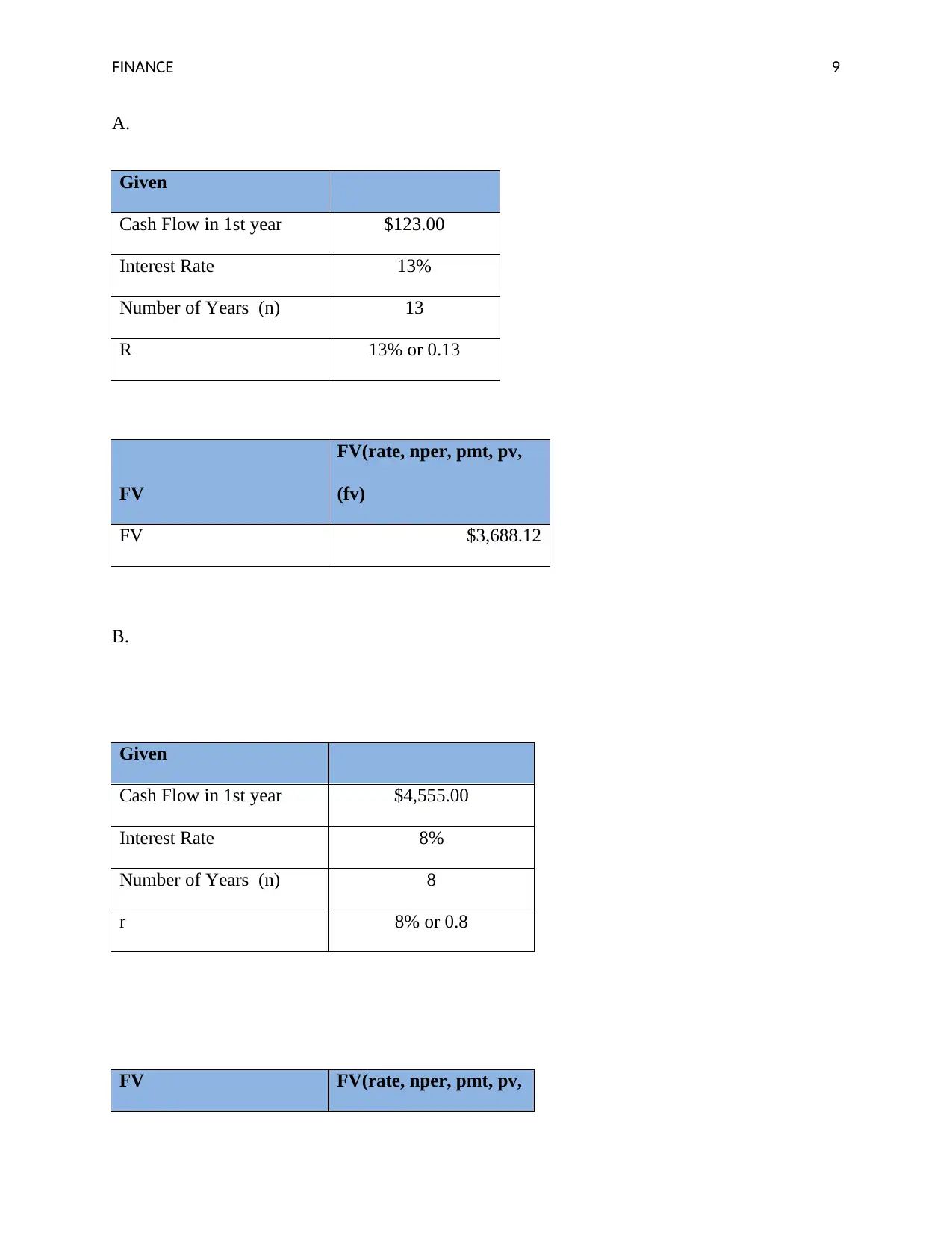

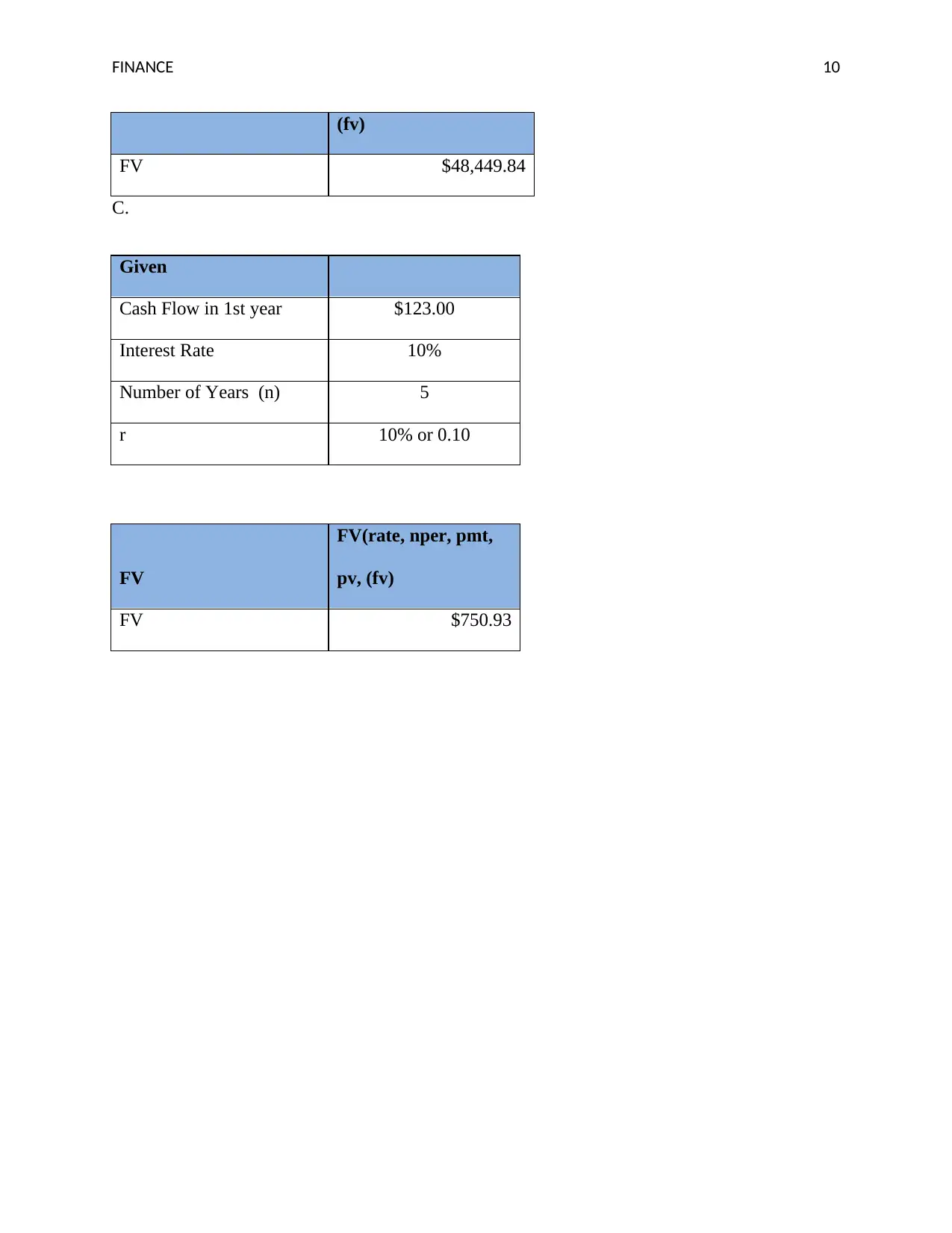

This document presents a detailed solution to a Finance homework assignment, focusing on key financial concepts. The assignment includes questions on present value, future value, and investment analysis. The solution provides step-by-step calculations, including the use of relevant formulas and data to determine the future value of investments in certificates of deposit and paintings, as well as the calculation of return on investment. Additional problems address present value calculations for various scenarios, including annuities and perpetuities, and calculating the effective annual rate (EAR). The assignment also covers the application of these concepts to real-world investment decisions and cash flow analysis. The solutions demonstrate the application of financial formulas and provide a comprehensive understanding of time value of money principles.

1 out of 12

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)