Financial Management Project: Detailed Analysis of a Startup Business

VerifiedAdded on 2022/08/20

|20

|4545

|12

Project

AI Summary

This financial management project analyzes a business startup venture in Toronto, Canada, over a seven-year period. The project focuses on evaluating the feasibility of Mr. Isaac's new business by assessing its cash flows using a discounted cash flow approach. Revenue streams include sales of goods in Canada and a collaboration with a travel agency. The project includes monthly and annual cash flow projections, sensitivity analysis, and a positive net present value (NPV) for the project. The analysis considers initial investments, working capital, and foreign exchange rates. The project recommends accepting the project, with an expected return of approximately 16.07% from the initial investment, and the document is contributed by a student to be published on the website Desklib, a platform which provides all the necessary AI based study tools for students.

Running head: FINANCIAL MANAGEMENT

Financial Management:

Name of the Student:

Name of the University:

Author’s Note:

Financial Management:

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MANAGEMENT

Executive Summary

The aim of the assignment is to evaluate the business start-up project that Mr. Isaac will be

evaluating based on the various cash flows that the company expects to receive from the business

operations of the company. The new startup operations of the company would be initiated in

Toronto, Canada. The business operations would be for a sum of seven years of time period

whereby relevant cash flows that would be flowing to the company would be considered. In

order to well analyze the feasibility of the business operation a valuation model would be applied

that is discounted cash flow approach whereby relevant cash flows flowing to the company

would be well taken into consideration. The business operations of the new startup venture has

been drawn on a monthly basis and on an annual basis. The business operations of the company

would be primarily distributed into key parts, in the first part the company would be well

receiving its revenue from the sales of goods in the Canada itself. While the other half of the

business revenue would be coming from the Toronto Business Collaboration from Mr. Jane who

runs a travel agent business in the Toronto. The business collaboration would be for a sum of two

years and in order to better analyze the cash flows respectively flowing from this collaboration

we have created a monthly budgeted cash flow statement for the company. The net present value

for the project has been positive for the company for the overall seven year trend period that has

been analyzed. The project feasibility was found to be on a positive scale for Mr. Isaac new

project venture and it is well recommended that he should accept the project. It is important to

note that there were several assumptions and figures base which were planned out for the

company and if the same materializes then Mr. Isaac on a turn would be creating a wealth of

around CAD 118,713 from the business, that is around 16.07% of return from the initial

investment of CAD 456,700 that would be done by the company.

Executive Summary

The aim of the assignment is to evaluate the business start-up project that Mr. Isaac will be

evaluating based on the various cash flows that the company expects to receive from the business

operations of the company. The new startup operations of the company would be initiated in

Toronto, Canada. The business operations would be for a sum of seven years of time period

whereby relevant cash flows that would be flowing to the company would be considered. In

order to well analyze the feasibility of the business operation a valuation model would be applied

that is discounted cash flow approach whereby relevant cash flows flowing to the company

would be well taken into consideration. The business operations of the new startup venture has

been drawn on a monthly basis and on an annual basis. The business operations of the company

would be primarily distributed into key parts, in the first part the company would be well

receiving its revenue from the sales of goods in the Canada itself. While the other half of the

business revenue would be coming from the Toronto Business Collaboration from Mr. Jane who

runs a travel agent business in the Toronto. The business collaboration would be for a sum of two

years and in order to better analyze the cash flows respectively flowing from this collaboration

we have created a monthly budgeted cash flow statement for the company. The net present value

for the project has been positive for the company for the overall seven year trend period that has

been analyzed. The project feasibility was found to be on a positive scale for Mr. Isaac new

project venture and it is well recommended that he should accept the project. It is important to

note that there were several assumptions and figures base which were planned out for the

company and if the same materializes then Mr. Isaac on a turn would be creating a wealth of

around CAD 118,713 from the business, that is around 16.07% of return from the initial

investment of CAD 456,700 that would be done by the company.

2FINANCIAL MANAGEMENT

Table of Contents

Business Project Analysis................................................................................................................2

Assumptions, Estimates and Sensitivity Analysis...........................................................................3

Key Assumptions and Estimates.................................................................................................3

Sensitivity Analysis.....................................................................................................................5

Cash Flow and Viability Analysis...................................................................................................7

Other Financial Details..................................................................................................................11

Finance/Capital Available.........................................................................................................11

Depreciation Expenses...............................................................................................................11

Profit and Loss Statement..........................................................................................................12

Sales Growth..............................................................................................................................13

Purchase Cost Analysis..............................................................................................................13

Critical Reflection..........................................................................................................................14

References......................................................................................................................................15

Table of Contents

Business Project Analysis................................................................................................................2

Assumptions, Estimates and Sensitivity Analysis...........................................................................3

Key Assumptions and Estimates.................................................................................................3

Sensitivity Analysis.....................................................................................................................5

Cash Flow and Viability Analysis...................................................................................................7

Other Financial Details..................................................................................................................11

Finance/Capital Available.........................................................................................................11

Depreciation Expenses...............................................................................................................11

Profit and Loss Statement..........................................................................................................12

Sales Growth..............................................................................................................................13

Purchase Cost Analysis..............................................................................................................13

Critical Reflection..........................................................................................................................14

References......................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MANAGEMENT

Business Project Analysis

The business analysis of the new project has been analyzed based on the cash flows that

would be flowing from the project for a sum period of seven years. Mr. Isaac in particular would

be running down a line of business in which he would be considering buying chocolates from

AlpenChoc, which is located in Germany and would be allowing Mr. Isaac to well sell their

associated range of product for an upfront premium for a seven year of trend period. The

business operations of the company would be simple it would be by buying chocolates from

Germany at a discounted rate and then selling the same at the estimated selling price in order to

earn profits. The chocolates considered varies from the normal range and types of chocolates that

are offered in the market. Mr. Isaac would be buying Artistic Innovative Flavored Chocolates

which would be having a sound demand as the same would be introduced in the market for the

first time. Expenses in particular would be in the field of shipping cost from Germany to Canada,

Purchase Cost of Products, Wages and Salaries, Credit Card Expenses and Depreciation

Expenses will be some of the key expenses that the company would be incurring for the trend

period. In particular Mr. Isaac has also well managed to go through a business operation or

business agreement with Mr. Jade who has well agreed to enter into a two year business

agreement for buying a defined set of chocolates units for its travel customers. The cash flow

analysis has been done separately for both the operations that the company would be running and

that would be helping us better analyze the cash flows that is flowing from each of the operations

of the company (Levin and Hallgren 2017). Several assumptions has been made with respect to

the business operations and cash flows that were forecasted for the company and accordingly

detailed discounted cash flow model has been built. The initial sum of money with which the

Business Project Analysis

The business analysis of the new project has been analyzed based on the cash flows that

would be flowing from the project for a sum period of seven years. Mr. Isaac in particular would

be running down a line of business in which he would be considering buying chocolates from

AlpenChoc, which is located in Germany and would be allowing Mr. Isaac to well sell their

associated range of product for an upfront premium for a seven year of trend period. The

business operations of the company would be simple it would be by buying chocolates from

Germany at a discounted rate and then selling the same at the estimated selling price in order to

earn profits. The chocolates considered varies from the normal range and types of chocolates that

are offered in the market. Mr. Isaac would be buying Artistic Innovative Flavored Chocolates

which would be having a sound demand as the same would be introduced in the market for the

first time. Expenses in particular would be in the field of shipping cost from Germany to Canada,

Purchase Cost of Products, Wages and Salaries, Credit Card Expenses and Depreciation

Expenses will be some of the key expenses that the company would be incurring for the trend

period. In particular Mr. Isaac has also well managed to go through a business operation or

business agreement with Mr. Jade who has well agreed to enter into a two year business

agreement for buying a defined set of chocolates units for its travel customers. The cash flow

analysis has been done separately for both the operations that the company would be running and

that would be helping us better analyze the cash flows that is flowing from each of the operations

of the company (Levin and Hallgren 2017). Several assumptions has been made with respect to

the business operations and cash flows that were forecasted for the company and accordingly

detailed discounted cash flow model has been built. The initial sum of money with which the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MANAGEMENT

company well be initiating the project would be around CAD456700 and the same would be

primarily in the form of upfront premium, asset purchase, security deposit and investment into

working capital of the business (Su et al., 2018). In particular since the business operations of the

company would be involving two different economies and exchange of goods would also be

done in a different currency that is EURO/CAD the exchange rate for EURO/CAD has also been

taken into consideration in order to well incorporate the forex factor that the business would be

undergoing. Risk and Return are some of the crucial aspects of the business and in order to well

account that sensitivity analysis for the business has been specially carried.

Assumptions, Estimates and Sensitivity Analysis

Key Assumptions and Estimates

The project investment has been well prepared based on a set of assumptions and factors

that might be relevant for the cash flows for the company (Siziba and Hall 2019). The key

assumptions that was made for the project investment are as follows:

Initial Investment: The initial investment for the project would be around

CAD456,700 and that would be primarily in the field of Upfront Premium which is

expected to be around 40% of the available capital that is CAD800,000 that comes to

around CAD320,000 for the company. Capital Expenditure that the company would be

doing will be primarily purchase of key assets for the company that is Refrigerator

Expense and Table Top Wrapping Machine. The total amount of capital expenditure

would be around CAD17700 for the company. Other investments like security fees, e-

commerce sites and working capital for the company would be jointly contributing for

the total initial investment available for the company (Nawaiseh et al., 2017).

company well be initiating the project would be around CAD456700 and the same would be

primarily in the form of upfront premium, asset purchase, security deposit and investment into

working capital of the business (Su et al., 2018). In particular since the business operations of the

company would be involving two different economies and exchange of goods would also be

done in a different currency that is EURO/CAD the exchange rate for EURO/CAD has also been

taken into consideration in order to well incorporate the forex factor that the business would be

undergoing. Risk and Return are some of the crucial aspects of the business and in order to well

account that sensitivity analysis for the business has been specially carried.

Assumptions, Estimates and Sensitivity Analysis

Key Assumptions and Estimates

The project investment has been well prepared based on a set of assumptions and factors

that might be relevant for the cash flows for the company (Siziba and Hall 2019). The key

assumptions that was made for the project investment are as follows:

Initial Investment: The initial investment for the project would be around

CAD456,700 and that would be primarily in the field of Upfront Premium which is

expected to be around 40% of the available capital that is CAD800,000 that comes to

around CAD320,000 for the company. Capital Expenditure that the company would be

doing will be primarily purchase of key assets for the company that is Refrigerator

Expense and Table Top Wrapping Machine. The total amount of capital expenditure

would be around CAD17700 for the company. Other investments like security fees, e-

commerce sites and working capital for the company would be jointly contributing for

the total initial investment available for the company (Nawaiseh et al., 2017).

5FINANCIAL MANAGEMENT

Working Capital: The working capital that would be available with the company will

be around CAD100,000 and the key reason why the given number has been done in

order to well account for the various operational and business expenses that Mr. Isaac

would be requiring for a sum of seven years. The investment into the working capital is

estimated to be well recovered by the company after a sum of seven years and is well

accounted in the drawn cash flow budget for the company.

Forex Exchange Rate: The business operations of the company would be in particular

involving two economy that is Germany and Canada whereby the forex exchange rate

that is EUR/CAD would be considered. The current exchange rate for the currency pair

of EUR/CAD is around 1.55 and the same would be well considered for exchanging

the goods from Germany to Canada.

Market Research Cost: Mr. Isaac in particular would be conducting a market survey

that would be involving around CAD5000 has been treated as suck cost and would not

be well accounted in the cash flow budget that has been prepared for the company.

Discount Rate Assumption: The discount rate that would be well considered by the

company is rounded to 10% and the same has been well considered based on the risk

return basis that an investor can well generate by investing into the stock market. The

return generated by the S&P/TSX Composite Index has been around 10.4% and the

same has been well accounted while projecting the financials of the business venture

(Rothery and Rothery 2016).

Additional Income/Investment Income: The total amount of capital that is available

with the company is around CAD800,000 and the amount that would be well utilized

Working Capital: The working capital that would be available with the company will

be around CAD100,000 and the key reason why the given number has been done in

order to well account for the various operational and business expenses that Mr. Isaac

would be requiring for a sum of seven years. The investment into the working capital is

estimated to be well recovered by the company after a sum of seven years and is well

accounted in the drawn cash flow budget for the company.

Forex Exchange Rate: The business operations of the company would be in particular

involving two economy that is Germany and Canada whereby the forex exchange rate

that is EUR/CAD would be considered. The current exchange rate for the currency pair

of EUR/CAD is around 1.55 and the same would be well considered for exchanging

the goods from Germany to Canada.

Market Research Cost: Mr. Isaac in particular would be conducting a market survey

that would be involving around CAD5000 has been treated as suck cost and would not

be well accounted in the cash flow budget that has been prepared for the company.

Discount Rate Assumption: The discount rate that would be well considered by the

company is rounded to 10% and the same has been well considered based on the risk

return basis that an investor can well generate by investing into the stock market. The

return generated by the S&P/TSX Composite Index has been around 10.4% and the

same has been well accounted while projecting the financials of the business venture

(Rothery and Rothery 2016).

Additional Income/Investment Income: The total amount of capital that is available

with the company is around CAD800,000 and the amount that would be well utilized

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MANAGEMENT

in the financial course of business operation will be around CAD4567,000. The

remaining amount CAD343,300 will be well invested into a risk free account that

would be well helping the company earn an additional set of 3% on the amount

invested on a yearly basis and the same has been well accounted in the Profit and Loss

Statement that has been drawn for the new venture.

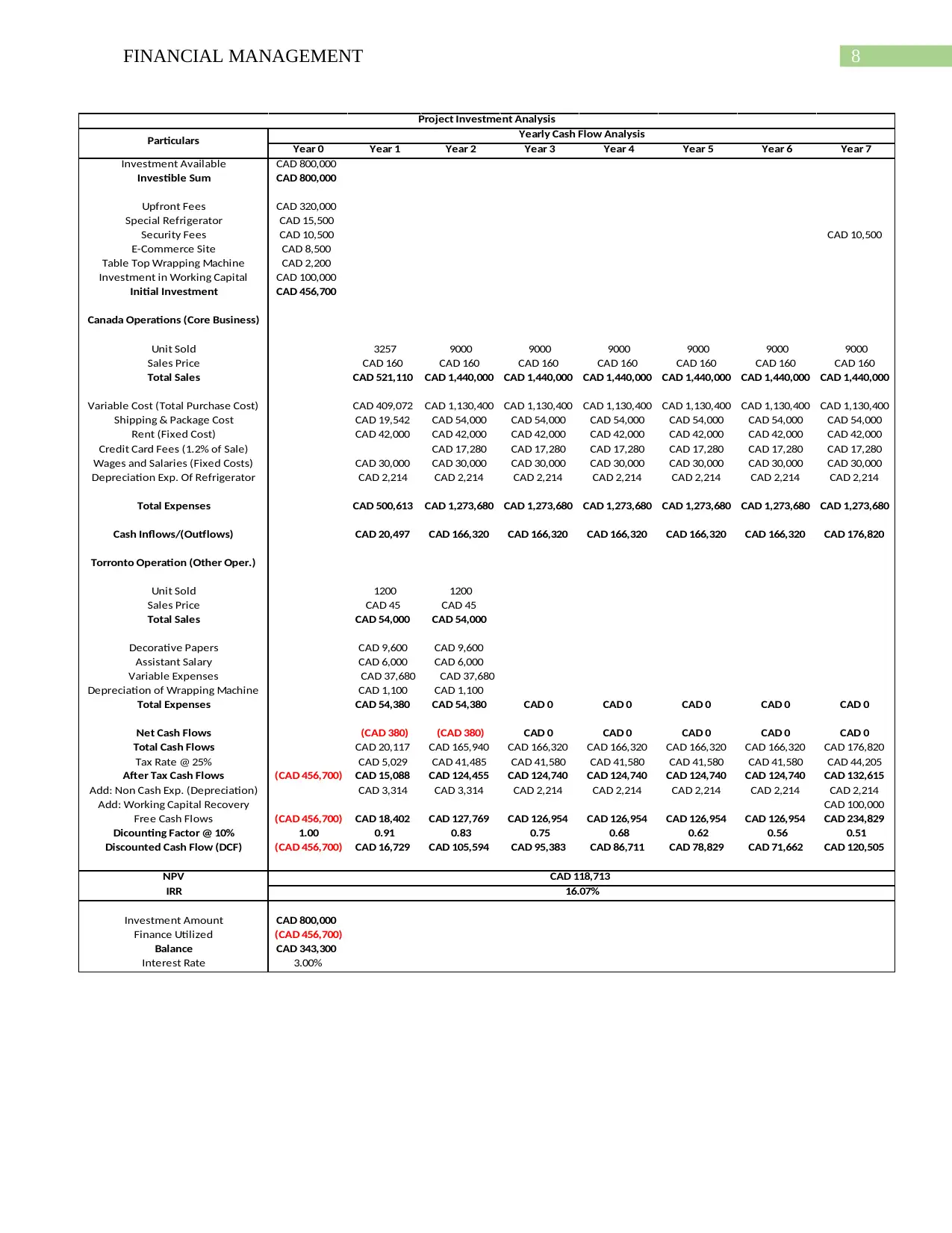

Sensitivity Analysis

The sensitivity analysis shows the changes that would be well observed in the company if

a key component or factor well changes for a given period of time and the impact that it would

be creating on the cash flows of the company (Marchioni and Magni 2018). The key factor

which has been well changed in order to well account for performing the sensitivity analysis has

been the discount rate. In the base case of analysis the discount rate that has been well considered

for the analysis purpose has been around 10%, however, the same can well increase in order to

account for the forex risk and the increasing business risk (Batra and Verma 2017). The new set

of discount rate which was considered in order to well account for the increasing risks and

volatile sales base can be in respect to using a discount rate of 15% for the company’s

operations. The changes that would be well observed after accounting for the higher discount

rate would be a reduced amount of return or the NPV that the project would be creating. After

accounting for the changes the cash flows on a net present value that would be created from the

investment is expected to be around CAD18,260 for the company (Etemadi, Koosha and Salari

2018).

In particular the key aim of the sensitivity analysis has been to show the effect how a

change in a key factor can well influence the overall business decisions that the company would

be undertaking. In the case analyzed even if the discount rates well changes from 10% to 15%

in the financial course of business operation will be around CAD4567,000. The

remaining amount CAD343,300 will be well invested into a risk free account that

would be well helping the company earn an additional set of 3% on the amount

invested on a yearly basis and the same has been well accounted in the Profit and Loss

Statement that has been drawn for the new venture.

Sensitivity Analysis

The sensitivity analysis shows the changes that would be well observed in the company if

a key component or factor well changes for a given period of time and the impact that it would

be creating on the cash flows of the company (Marchioni and Magni 2018). The key factor

which has been well changed in order to well account for performing the sensitivity analysis has

been the discount rate. In the base case of analysis the discount rate that has been well considered

for the analysis purpose has been around 10%, however, the same can well increase in order to

account for the forex risk and the increasing business risk (Batra and Verma 2017). The new set

of discount rate which was considered in order to well account for the increasing risks and

volatile sales base can be in respect to using a discount rate of 15% for the company’s

operations. The changes that would be well observed after accounting for the higher discount

rate would be a reduced amount of return or the NPV that the project would be creating. After

accounting for the changes the cash flows on a net present value that would be created from the

investment is expected to be around CAD18,260 for the company (Etemadi, Koosha and Salari

2018).

In particular the key aim of the sensitivity analysis has been to show the effect how a

change in a key factor can well influence the overall business decisions that the company would

be undertaking. In the case analyzed even if the discount rates well changes from 10% to 15%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MANAGEMENT

then the overall value that would be created from the project is projected to be around

CAD18,260, which in the base case at a 10% discount level was calculated to be around CAD

118,713 for the company (Shaban, Al-Zubi and Abdallah 2017).

then the overall value that would be created from the project is projected to be around

CAD18,260, which in the base case at a 10% discount level was calculated to be around CAD

118,713 for the company (Shaban, Al-Zubi and Abdallah 2017).

8FINANCIAL MANAGEMENT

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Investment Available CAD 800,000

Investible Sum CAD 800,000

Upfront Fees CAD 320,000

Special Refrigerator CAD 15,500

Security Fees CAD 10,500 CAD 10,500

E-Commerce Site CAD 8,500

Table Top Wrapping Machine CAD 2,200

Investment in Working Capital CAD 100,000

Initial Investment CAD 456,700

Canada Operations (Core Business)

Unit Sold 3257 9000 9000 9000 9000 9000 9000

Sales Price CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160

Total Sales CAD 521,110 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000

Variable Cost (Total Purchase Cost) CAD 409,072 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400

Shipping & Package Cost CAD 19,542 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000

Rent (Fixed Cost) CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000

Credit Card Fees (1.2% of Sale) CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280

Wages and Salaries (Fixed Costs) CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000

Depreciation Exp. Of Refrigerator CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Total Expenses CAD 500,613 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680

Cash Inflows/(Outflows) CAD 20,497 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 176,820

Torronto Operation (Other Oper.)

Unit Sold 1200 1200

Sales Price CAD 45 CAD 45

Total Sales CAD 54,000 CAD 54,000

Decorative Papers CAD 9,600 CAD 9,600

Assistant Salary CAD 6,000 CAD 6,000

Variable Expenses CAD 37,680 CAD 37,680

Depreciation of Wrapping Machine CAD 1,100 CAD 1,100

Total Expenses CAD 54,380 CAD 54,380 CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Net Cash Flows (CAD 380) (CAD 380) CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Total Cash Flows CAD 20,117 CAD 165,940 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 176,820

Tax Rate @ 25% CAD 5,029 CAD 41,485 CAD 41,580 CAD 41,580 CAD 41,580 CAD 41,580 CAD 44,205

After Tax Cash Flows (CAD 456,700) CAD 15,088 CAD 124,455 CAD 124,740 CAD 124,740 CAD 124,740 CAD 124,740 CAD 132,615

Add: Non Cash Exp. (Depreciation) CAD 3,314 CAD 3,314 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Add: Working Capital Recovery CAD 100,000

Free Cash Flows (CAD 456,700) CAD 18,402 CAD 127,769 CAD 126,954 CAD 126,954 CAD 126,954 CAD 126,954 CAD 234,829

Dicounting Factor @ 10% 1.00 0.91 0.83 0.75 0.68 0.62 0.56 0.51

Discounted Cash Flow (DCF) (CAD 456,700) CAD 16,729 CAD 105,594 CAD 95,383 CAD 86,711 CAD 78,829 CAD 71,662 CAD 120,505

NPV

IRR

Investment Amount CAD 800,000

Finance Utilized (CAD 456,700)

Balance CAD 343,300

Interest Rate 3.00%

CAD 118,713

16.07%

Project Investment Analysis

Particulars Yearly Cash Flow Analysis

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Investment Available CAD 800,000

Investible Sum CAD 800,000

Upfront Fees CAD 320,000

Special Refrigerator CAD 15,500

Security Fees CAD 10,500 CAD 10,500

E-Commerce Site CAD 8,500

Table Top Wrapping Machine CAD 2,200

Investment in Working Capital CAD 100,000

Initial Investment CAD 456,700

Canada Operations (Core Business)

Unit Sold 3257 9000 9000 9000 9000 9000 9000

Sales Price CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160

Total Sales CAD 521,110 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000 CAD 1,440,000

Variable Cost (Total Purchase Cost) CAD 409,072 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400 CAD 1,130,400

Shipping & Package Cost CAD 19,542 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000

Rent (Fixed Cost) CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000

Credit Card Fees (1.2% of Sale) CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280

Wages and Salaries (Fixed Costs) CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000

Depreciation Exp. Of Refrigerator CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Total Expenses CAD 500,613 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680 CAD 1,273,680

Cash Inflows/(Outflows) CAD 20,497 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 176,820

Torronto Operation (Other Oper.)

Unit Sold 1200 1200

Sales Price CAD 45 CAD 45

Total Sales CAD 54,000 CAD 54,000

Decorative Papers CAD 9,600 CAD 9,600

Assistant Salary CAD 6,000 CAD 6,000

Variable Expenses CAD 37,680 CAD 37,680

Depreciation of Wrapping Machine CAD 1,100 CAD 1,100

Total Expenses CAD 54,380 CAD 54,380 CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Net Cash Flows (CAD 380) (CAD 380) CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Total Cash Flows CAD 20,117 CAD 165,940 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 176,820

Tax Rate @ 25% CAD 5,029 CAD 41,485 CAD 41,580 CAD 41,580 CAD 41,580 CAD 41,580 CAD 44,205

After Tax Cash Flows (CAD 456,700) CAD 15,088 CAD 124,455 CAD 124,740 CAD 124,740 CAD 124,740 CAD 124,740 CAD 132,615

Add: Non Cash Exp. (Depreciation) CAD 3,314 CAD 3,314 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Add: Working Capital Recovery CAD 100,000

Free Cash Flows (CAD 456,700) CAD 18,402 CAD 127,769 CAD 126,954 CAD 126,954 CAD 126,954 CAD 126,954 CAD 234,829

Dicounting Factor @ 10% 1.00 0.91 0.83 0.75 0.68 0.62 0.56 0.51

Discounted Cash Flow (DCF) (CAD 456,700) CAD 16,729 CAD 105,594 CAD 95,383 CAD 86,711 CAD 78,829 CAD 71,662 CAD 120,505

NPV

IRR

Investment Amount CAD 800,000

Finance Utilized (CAD 456,700)

Balance CAD 343,300

Interest Rate 3.00%

CAD 118,713

16.07%

Project Investment Analysis

Particulars Yearly Cash Flow Analysis

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MANAGEMENT

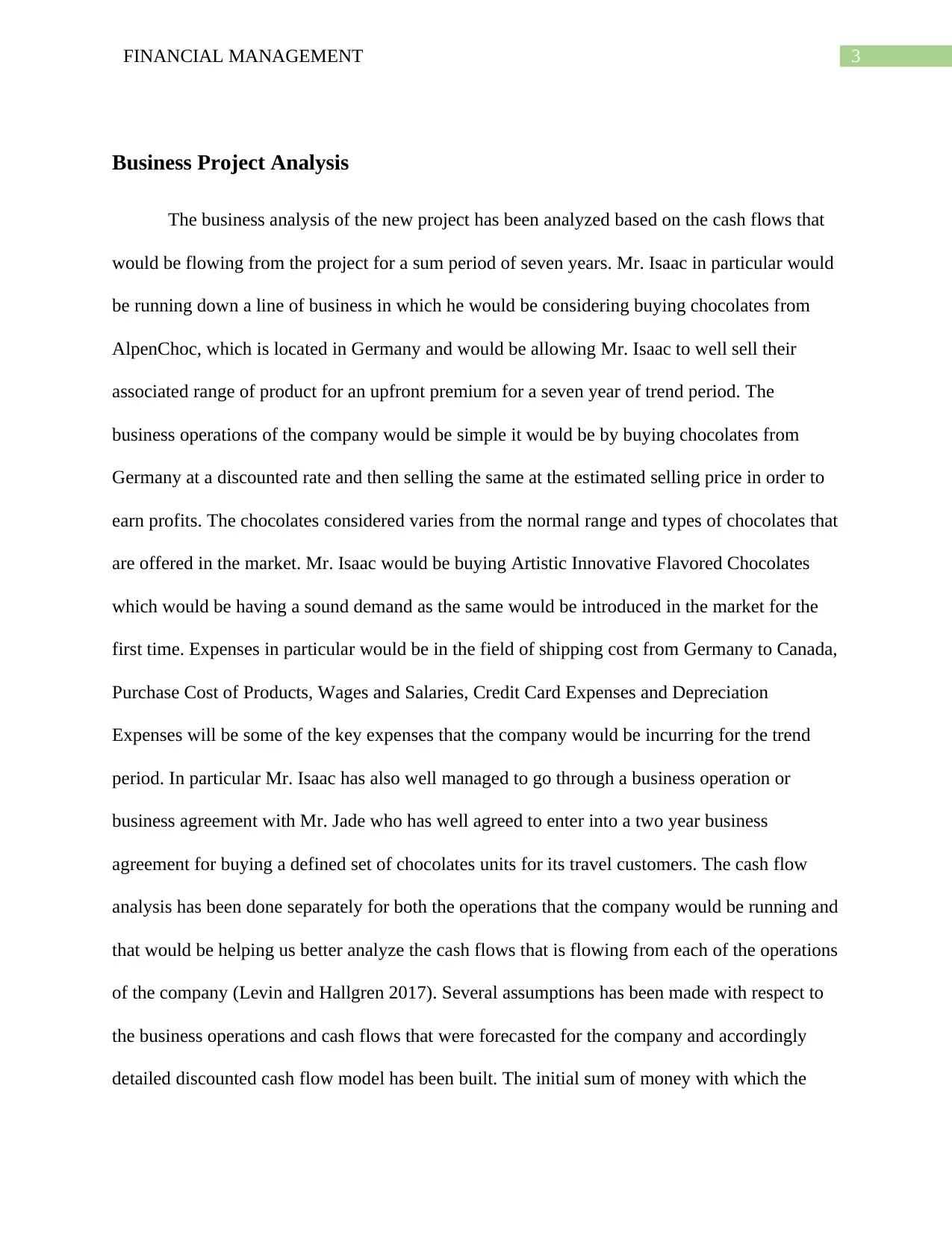

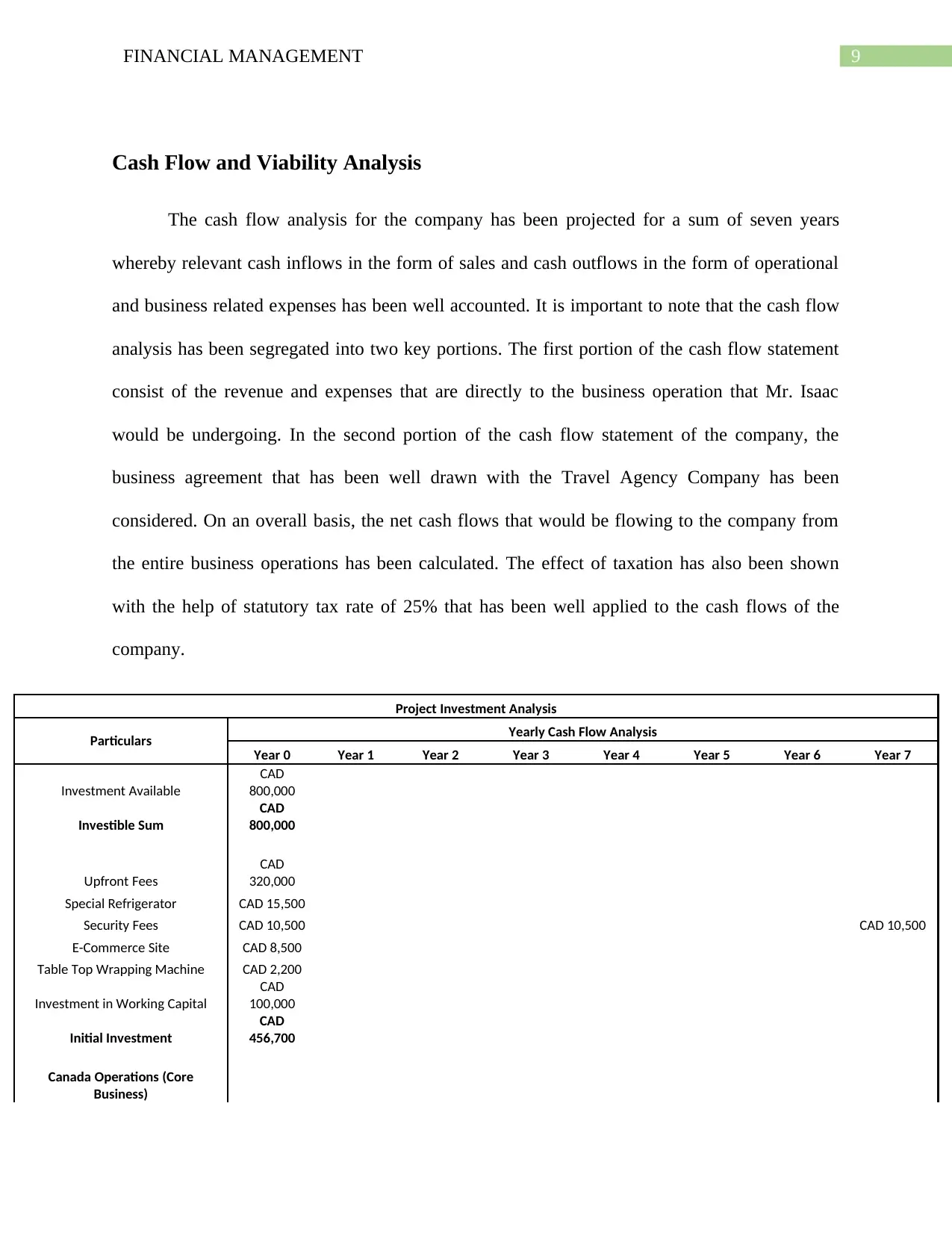

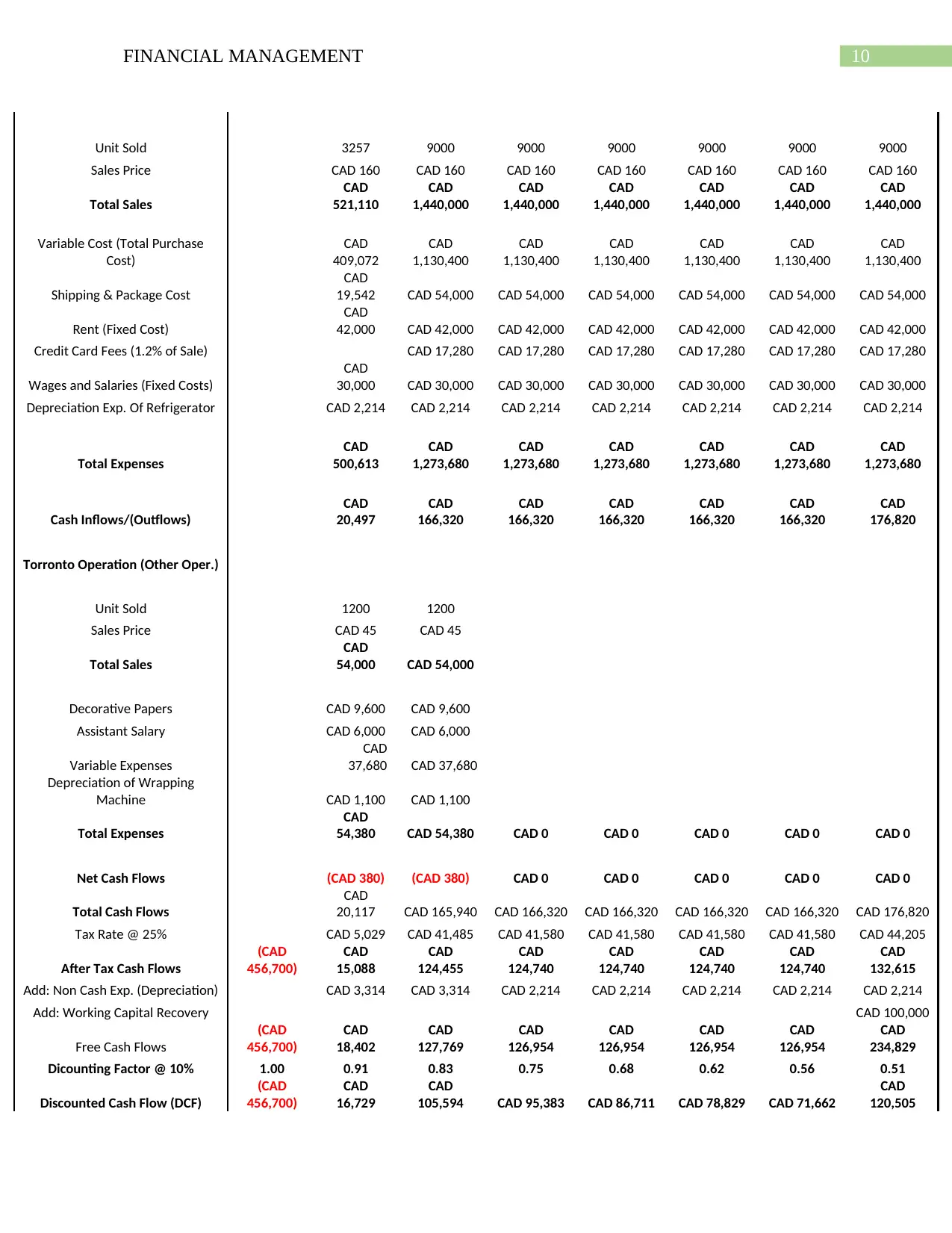

Cash Flow and Viability Analysis

The cash flow analysis for the company has been projected for a sum of seven years

whereby relevant cash inflows in the form of sales and cash outflows in the form of operational

and business related expenses has been well accounted. It is important to note that the cash flow

analysis has been segregated into two key portions. The first portion of the cash flow statement

consist of the revenue and expenses that are directly to the business operation that Mr. Isaac

would be undergoing. In the second portion of the cash flow statement of the company, the

business agreement that has been well drawn with the Travel Agency Company has been

considered. On an overall basis, the net cash flows that would be flowing to the company from

the entire business operations has been calculated. The effect of taxation has also been shown

with the help of statutory tax rate of 25% that has been well applied to the cash flows of the

company.

Project Investment Analysis

Particulars Yearly Cash Flow Analysis

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Investment Available

CAD

800,000

Investible Sum

CAD

800,000

Upfront Fees

CAD

320,000

Special Refrigerator CAD 15,500

Security Fees CAD 10,500 CAD 10,500

E-Commerce Site CAD 8,500

Table Top Wrapping Machine CAD 2,200

Investment in Working Capital

CAD

100,000

Initial Investment

CAD

456,700

Canada Operations (Core

Business)

Cash Flow and Viability Analysis

The cash flow analysis for the company has been projected for a sum of seven years

whereby relevant cash inflows in the form of sales and cash outflows in the form of operational

and business related expenses has been well accounted. It is important to note that the cash flow

analysis has been segregated into two key portions. The first portion of the cash flow statement

consist of the revenue and expenses that are directly to the business operation that Mr. Isaac

would be undergoing. In the second portion of the cash flow statement of the company, the

business agreement that has been well drawn with the Travel Agency Company has been

considered. On an overall basis, the net cash flows that would be flowing to the company from

the entire business operations has been calculated. The effect of taxation has also been shown

with the help of statutory tax rate of 25% that has been well applied to the cash flows of the

company.

Project Investment Analysis

Particulars Yearly Cash Flow Analysis

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Investment Available

CAD

800,000

Investible Sum

CAD

800,000

Upfront Fees

CAD

320,000

Special Refrigerator CAD 15,500

Security Fees CAD 10,500 CAD 10,500

E-Commerce Site CAD 8,500

Table Top Wrapping Machine CAD 2,200

Investment in Working Capital

CAD

100,000

Initial Investment

CAD

456,700

Canada Operations (Core

Business)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MANAGEMENT

Unit Sold 3257 9000 9000 9000 9000 9000 9000

Sales Price CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160

Total Sales

CAD

521,110

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

Variable Cost (Total Purchase

Cost)

CAD

409,072

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

Shipping & Package Cost

CAD

19,542 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000

Rent (Fixed Cost)

CAD

42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000

Credit Card Fees (1.2% of Sale) CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280

Wages and Salaries (Fixed Costs)

CAD

30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000

Depreciation Exp. Of Refrigerator CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Total Expenses

CAD

500,613

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

Cash Inflows/(Outflows)

CAD

20,497

CAD

166,320

CAD

166,320

CAD

166,320

CAD

166,320

CAD

166,320

CAD

176,820

Torronto Operation (Other Oper.)

Unit Sold 1200 1200

Sales Price CAD 45 CAD 45

Total Sales

CAD

54,000 CAD 54,000

Decorative Papers CAD 9,600 CAD 9,600

Assistant Salary CAD 6,000 CAD 6,000

Variable Expenses

CAD

37,680 CAD 37,680

Depreciation of Wrapping

Machine CAD 1,100 CAD 1,100

Total Expenses

CAD

54,380 CAD 54,380 CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Net Cash Flows (CAD 380) (CAD 380) CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Total Cash Flows

CAD

20,117 CAD 165,940 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 176,820

Tax Rate @ 25% CAD 5,029 CAD 41,485 CAD 41,580 CAD 41,580 CAD 41,580 CAD 41,580 CAD 44,205

After Tax Cash Flows

(CAD

456,700)

CAD

15,088

CAD

124,455

CAD

124,740

CAD

124,740

CAD

124,740

CAD

124,740

CAD

132,615

Add: Non Cash Exp. (Depreciation) CAD 3,314 CAD 3,314 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Add: Working Capital Recovery CAD 100,000

Free Cash Flows

(CAD

456,700)

CAD

18,402

CAD

127,769

CAD

126,954

CAD

126,954

CAD

126,954

CAD

126,954

CAD

234,829

Dicounting Factor @ 10% 1.00 0.91 0.83 0.75 0.68 0.62 0.56 0.51

Discounted Cash Flow (DCF)

(CAD

456,700)

CAD

16,729

CAD

105,594 CAD 95,383 CAD 86,711 CAD 78,829 CAD 71,662

CAD

120,505

Unit Sold 3257 9000 9000 9000 9000 9000 9000

Sales Price CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160 CAD 160

Total Sales

CAD

521,110

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

CAD

1,440,000

Variable Cost (Total Purchase

Cost)

CAD

409,072

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

CAD

1,130,400

Shipping & Package Cost

CAD

19,542 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000 CAD 54,000

Rent (Fixed Cost)

CAD

42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000 CAD 42,000

Credit Card Fees (1.2% of Sale) CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280 CAD 17,280

Wages and Salaries (Fixed Costs)

CAD

30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000 CAD 30,000

Depreciation Exp. Of Refrigerator CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Total Expenses

CAD

500,613

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

CAD

1,273,680

Cash Inflows/(Outflows)

CAD

20,497

CAD

166,320

CAD

166,320

CAD

166,320

CAD

166,320

CAD

166,320

CAD

176,820

Torronto Operation (Other Oper.)

Unit Sold 1200 1200

Sales Price CAD 45 CAD 45

Total Sales

CAD

54,000 CAD 54,000

Decorative Papers CAD 9,600 CAD 9,600

Assistant Salary CAD 6,000 CAD 6,000

Variable Expenses

CAD

37,680 CAD 37,680

Depreciation of Wrapping

Machine CAD 1,100 CAD 1,100

Total Expenses

CAD

54,380 CAD 54,380 CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Net Cash Flows (CAD 380) (CAD 380) CAD 0 CAD 0 CAD 0 CAD 0 CAD 0

Total Cash Flows

CAD

20,117 CAD 165,940 CAD 166,320 CAD 166,320 CAD 166,320 CAD 166,320 CAD 176,820

Tax Rate @ 25% CAD 5,029 CAD 41,485 CAD 41,580 CAD 41,580 CAD 41,580 CAD 41,580 CAD 44,205

After Tax Cash Flows

(CAD

456,700)

CAD

15,088

CAD

124,455

CAD

124,740

CAD

124,740

CAD

124,740

CAD

124,740

CAD

132,615

Add: Non Cash Exp. (Depreciation) CAD 3,314 CAD 3,314 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214 CAD 2,214

Add: Working Capital Recovery CAD 100,000

Free Cash Flows

(CAD

456,700)

CAD

18,402

CAD

127,769

CAD

126,954

CAD

126,954

CAD

126,954

CAD

126,954

CAD

234,829

Dicounting Factor @ 10% 1.00 0.91 0.83 0.75 0.68 0.62 0.56 0.51

Discounted Cash Flow (DCF)

(CAD

456,700)

CAD

16,729

CAD

105,594 CAD 95,383 CAD 86,711 CAD 78,829 CAD 71,662

CAD

120,505

11FINANCIAL MANAGEMENT

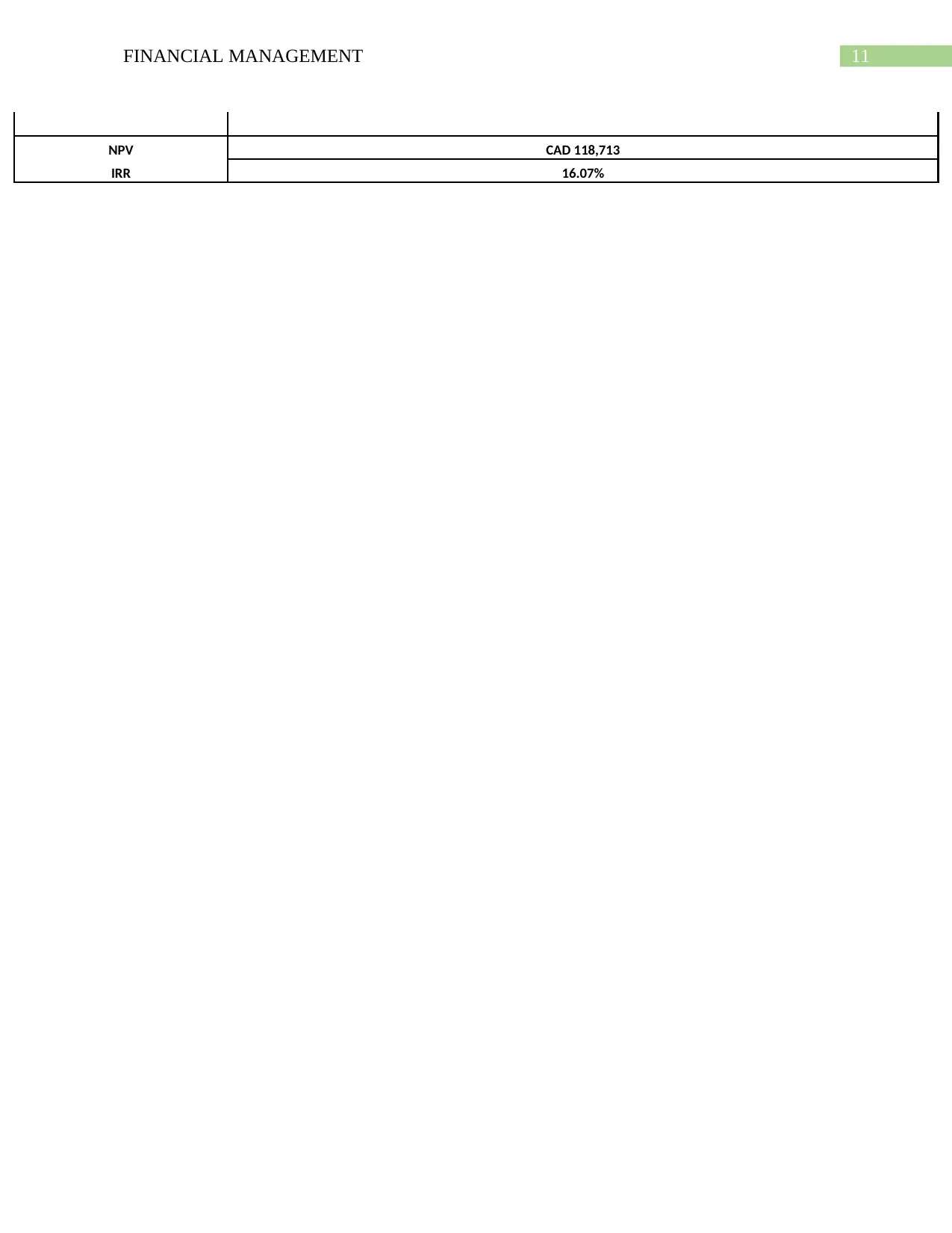

NPV CAD 118,713

IRR 16.07%

NPV CAD 118,713

IRR 16.07%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.