Financial Resource Management in Residential Care Homes: A Report

VerifiedAdded on 2019/12/17

|18

|6760

|395

Report

AI Summary

This report provides a comprehensive analysis of financial resource management within a residential care home context. It begins by outlining the principles of costing and business control systems, emphasizing cost-effect relationships and the classification of costs, including direct, indirect, variable, and fixed costs. The report then delves into regulatory requirements for managing financial resources, such as tax payments, maintaining accurate records, and adopting fair pricing policies. An evaluation of accounting software options is presented, comparing their functions, advantages, and disadvantages. The report further examines sources of income, factors affecting finance availability, and different types of budgets. It covers decision-making processes for expenditure, the preparation of cash budgets, fraud management strategies, and measures to control and monitor budgets. The analysis extends to service level identification, the relationship between service levels and associated costs, and the financial considerations affecting residents. The report concludes by exploring financial systems designed to improve service delivery and overall financial performance within the care home setting.

MANAGING FINANCIAL RESOURCES

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ...............................................................................................................................2

TASK 1.................................................................................................................................................3

1.1 Principles of Costing and Business Control Systems................................................................3

1.2 Classification of costs residential home has to bear..................................................................5

1.3 Regulatory Requirement for managing financial resources......................................................5

1.4 Evaluation of Accounting software............................................................................................6

TASK 2................................................................................................................................................7

2.1 Sources Of Income.....................................................................................................................7

2.2 Analysis of Factors affecting availability of Finance................................................................8

2.3 Reviewing types of Budget........................................................................................................9

2.4 Decision Making ways for expenditure.....................................................................................9

TASK 3 ..............................................................................................................................................10

3.1 Preparation of Cash Budget.....................................................................................................10

3.2 Fraud Management..................................................................................................................11

3.3 Measures to control and monitor Budgets...............................................................................11

TASK 4...............................................................................................................................................12

4.1 Identification of level of service..............................................................................................12

4.2 Analysis of relationship between level of service and associated costs..................................13

4.3 Effect of Financial considerations on residents.......................................................................13

4.4 Financial systems to improve the services...............................................................................14

CONCLUSION..................................................................................................................................15

REFERENCES...................................................................................................................................16

Index of Tables

Table 1: Calculation of per unit cost for resident in a month..............................................................6

Table 2: Functions, advantages and disadvantages for various software............................................8

Table 3: Cash budget for 3 months ending December, 2016..............................................................11

2

INTRODUCTION ...............................................................................................................................2

TASK 1.................................................................................................................................................3

1.1 Principles of Costing and Business Control Systems................................................................3

1.2 Classification of costs residential home has to bear..................................................................5

1.3 Regulatory Requirement for managing financial resources......................................................5

1.4 Evaluation of Accounting software............................................................................................6

TASK 2................................................................................................................................................7

2.1 Sources Of Income.....................................................................................................................7

2.2 Analysis of Factors affecting availability of Finance................................................................8

2.3 Reviewing types of Budget........................................................................................................9

2.4 Decision Making ways for expenditure.....................................................................................9

TASK 3 ..............................................................................................................................................10

3.1 Preparation of Cash Budget.....................................................................................................10

3.2 Fraud Management..................................................................................................................11

3.3 Measures to control and monitor Budgets...............................................................................11

TASK 4...............................................................................................................................................12

4.1 Identification of level of service..............................................................................................12

4.2 Analysis of relationship between level of service and associated costs..................................13

4.3 Effect of Financial considerations on residents.......................................................................13

4.4 Financial systems to improve the services...............................................................................14

CONCLUSION..................................................................................................................................15

REFERENCES...................................................................................................................................16

Index of Tables

Table 1: Calculation of per unit cost for resident in a month..............................................................6

Table 2: Functions, advantages and disadvantages for various software............................................8

Table 3: Cash budget for 3 months ending December, 2016..............................................................11

2

INTRODUCTION

Finance is very crucial part of business and therefore managing is the important function.

Functioning of a care home has several activities involved and costs associated with them. This

report closely deals with costs to be undertaken and its broad classification. Further budgeting is

applied and its importance are explained in decision making. It demonstrates the budgeting in

planning expenditures and managing and controlling them to provide effective services and

maintaining existing customers. Planning is praised in management accounting and decision

making. This report further creates the understanding the efforts of financial planning in

management accounting and reflects its contribution towards success of the residential care unit.

TASK 1

1.1 Principles of Costing and Business Control Systems

Principles of accounting

Costing is based on fundamental principles and guidelines which leads to extract meaningful

information. Major principles are explained below:

Cost effect relationship : Cost is recorded on the basis of cause and effect relationship.

Cause relationship drives the allocation of cost on the basis of its nature. This principal

defines that figures are analysed according to the nature of the cost and it is necessary to

allocate these on the basis of the relationship. It explains that cost is required to be shared by

those units which is passing through the particular department. For instance; if retailer is

purchasing the material from whole seller, it will record the transaction at cash price that

actual paid by the retailer. Cost would be equal to the amount which is paid in the

transaction.

Cost is charged after the occurrence : Costing follows the principle that cost is charged

only if the product is produced. For example: normal loss is included in cost of only those

products concerned and not on all the products to be manufactured. This principal says that

only those costs are to be included which are actually incurred. For instance; unit cost can

not be charged with selling cost because some of them activities are related with the

production.

Abnormal cost are charged in costing :The cost which are abnormal or non routine in

nature are not charged to the production. Since these are not directly related with the

production process of the entity. For example: In case of care unit is fire occurs then damage

cost will not be charged to cost centres rather it will be debited to Income Statement. Some

costs are not related to the production such as fire, riot, accidents etc. These are distorted

3

Finance is very crucial part of business and therefore managing is the important function.

Functioning of a care home has several activities involved and costs associated with them. This

report closely deals with costs to be undertaken and its broad classification. Further budgeting is

applied and its importance are explained in decision making. It demonstrates the budgeting in

planning expenditures and managing and controlling them to provide effective services and

maintaining existing customers. Planning is praised in management accounting and decision

making. This report further creates the understanding the efforts of financial planning in

management accounting and reflects its contribution towards success of the residential care unit.

TASK 1

1.1 Principles of Costing and Business Control Systems

Principles of accounting

Costing is based on fundamental principles and guidelines which leads to extract meaningful

information. Major principles are explained below:

Cost effect relationship : Cost is recorded on the basis of cause and effect relationship.

Cause relationship drives the allocation of cost on the basis of its nature. This principal

defines that figures are analysed according to the nature of the cost and it is necessary to

allocate these on the basis of the relationship. It explains that cost is required to be shared by

those units which is passing through the particular department. For instance; if retailer is

purchasing the material from whole seller, it will record the transaction at cash price that

actual paid by the retailer. Cost would be equal to the amount which is paid in the

transaction.

Cost is charged after the occurrence : Costing follows the principle that cost is charged

only if the product is produced. For example: normal loss is included in cost of only those

products concerned and not on all the products to be manufactured. This principal says that

only those costs are to be included which are actually incurred. For instance; unit cost can

not be charged with selling cost because some of them activities are related with the

production.

Abnormal cost are charged in costing :The cost which are abnormal or non routine in

nature are not charged to the production. Since these are not directly related with the

production process of the entity. For example: In case of care unit is fire occurs then damage

cost will not be charged to cost centres rather it will be debited to Income Statement. Some

costs are not related to the production such as fire, riot, accidents etc. These are distorted

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

cost figures that can mislead the management. So this principal says that only normal costs

are to be charged and abnormal costs are not charges to costing.

Past cost not taken into future: It depicts that cost of particular period are treated as cost of

the that period itself and cannot be deferred. As it will unnecessary burden the future cost

and display blurred picture. However advertisement is an exception as it involves huge cost

and benefits will be derived in future as well therefore deferred in future period as well. This

principal says that past costs are not to be included in future costing calculations, it can

create misunderstanding.

Business Control System

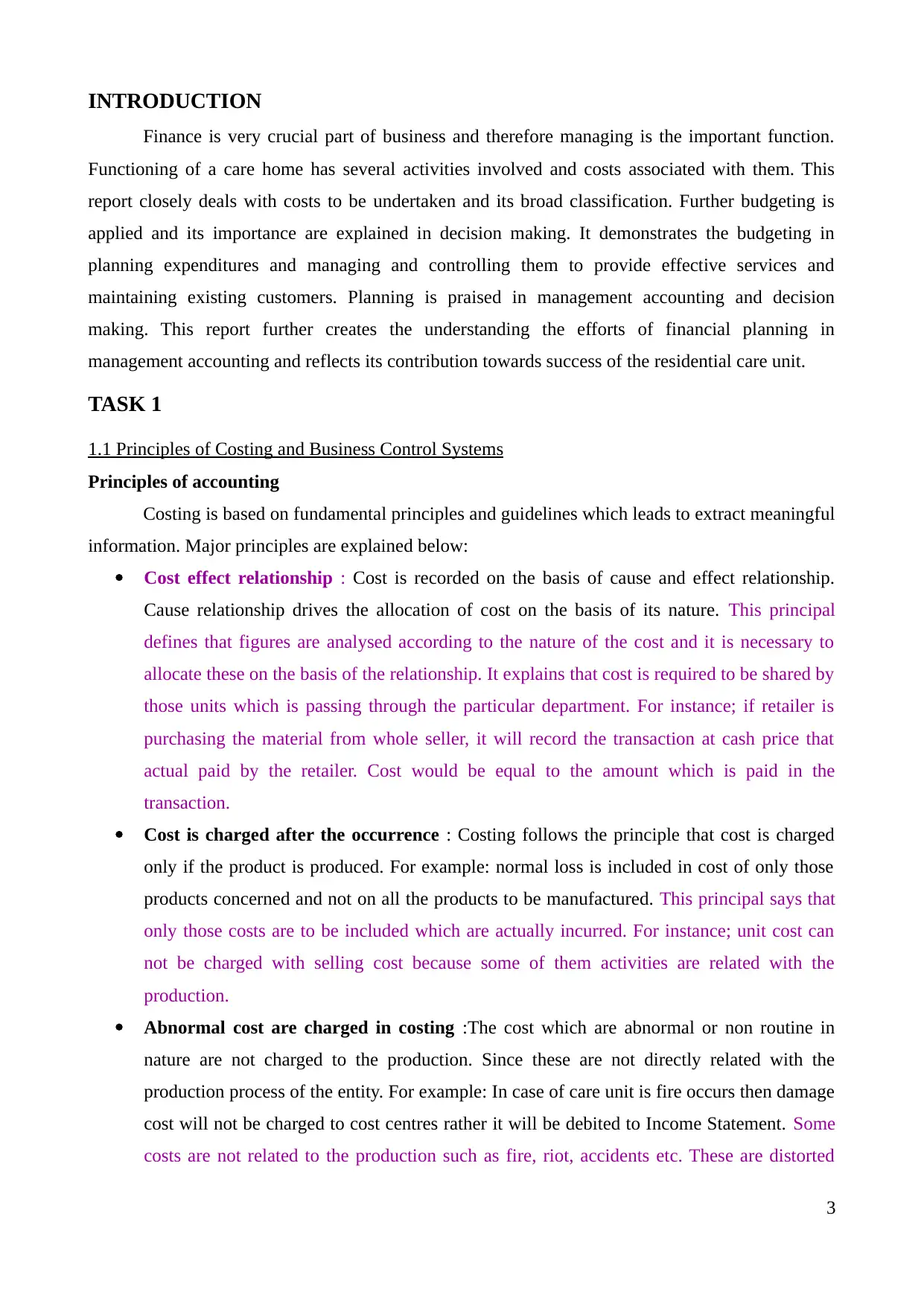

Some of major Business control systems which assists organisation are depicted below:

The Procurement Process

Defining the Business Need: Objectives of the requirement of the system should be clearly

communicated to the supplier. It deals with the need which laid the comapmny to think

about control system. Care unit would like to go online for greater access therefore it

defined the need(Ndolo and Njagi, 2014).

Development of procurement strategy : Procurement strategy is to wisely decided for

application of system. There are various options available for Care unit to apply controls

such as waterfall method, pilot method etc. which offers wide range of options to the client.

Supplier Selection and Evaluation : Selection of supplier is a tedious task and requires lots

of tests and decisions. Vendor can be selected on basis of its past records or performing

benchmarking or checklist test on the services offered. Point scoring method can be applied

to give point to various vendors and selecting the best among the rest.

Negotiating and Awarding the contact : Once the vendor is selected negotiations should

be entered in terms of quality of services or in cost measures to improve the efficiency of

money invested(Miller and Rice, 2013). Further order and scheduled delivery of modules to

be pre determined for care unit for effective and timely set up of systems.

Induction and Integration : Terms of delivery should be clearly mentioned and reviewed

to avoid any default on supplier side. Care unit should also controls and check on timely

basis that agreed quality is offered and no compromises are entered with contacted terms.

Management Control System

4

are to be charged and abnormal costs are not charges to costing.

Past cost not taken into future: It depicts that cost of particular period are treated as cost of

the that period itself and cannot be deferred. As it will unnecessary burden the future cost

and display blurred picture. However advertisement is an exception as it involves huge cost

and benefits will be derived in future as well therefore deferred in future period as well. This

principal says that past costs are not to be included in future costing calculations, it can

create misunderstanding.

Business Control System

Some of major Business control systems which assists organisation are depicted below:

The Procurement Process

Defining the Business Need: Objectives of the requirement of the system should be clearly

communicated to the supplier. It deals with the need which laid the comapmny to think

about control system. Care unit would like to go online for greater access therefore it

defined the need(Ndolo and Njagi, 2014).

Development of procurement strategy : Procurement strategy is to wisely decided for

application of system. There are various options available for Care unit to apply controls

such as waterfall method, pilot method etc. which offers wide range of options to the client.

Supplier Selection and Evaluation : Selection of supplier is a tedious task and requires lots

of tests and decisions. Vendor can be selected on basis of its past records or performing

benchmarking or checklist test on the services offered. Point scoring method can be applied

to give point to various vendors and selecting the best among the rest.

Negotiating and Awarding the contact : Once the vendor is selected negotiations should

be entered in terms of quality of services or in cost measures to improve the efficiency of

money invested(Miller and Rice, 2013). Further order and scheduled delivery of modules to

be pre determined for care unit for effective and timely set up of systems.

Induction and Integration : Terms of delivery should be clearly mentioned and reviewed

to avoid any default on supplier side. Care unit should also controls and check on timely

basis that agreed quality is offered and no compromises are entered with contacted terms.

Management Control System

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Under management control system various resources of organisation such as human,

physical or financial are analysed under financial microscope of organisation strategies. This

includes six elements which are listed below:

Strategic Planning : As per this element of management control system strategic planning

is preformed to create a roadmap and setting objectives to achieve organisational

goals(Kerzner, 2013).

Budgeting : Budgeting involves setting standards on basis of past records for the revenues,

expenses and other items on basis of future forecasting.

Allocation of resources : This involves allocation of human, physical and financial

resources as per the budgeted plans and achieving desired objectives. Example: Allocating

the appropriate budget to each sector such as housekeeping, pantry etc.

Measuring Performance : Once the resources are allocated and control system in unit

starts operating performance is measured as per the standard.

Rewards and Evaluations : Rewarding of ranks to resource allocation and performance is

evaluated and loopholes are overcome and rewards to be given in case of exceptional

situation.

Responsibility centre Allocation : Responsibility for application of system is to be

allocated to personnel for effective development and timely adoption of system into

organisation. For example: head of acre unit is to be assigned this task.

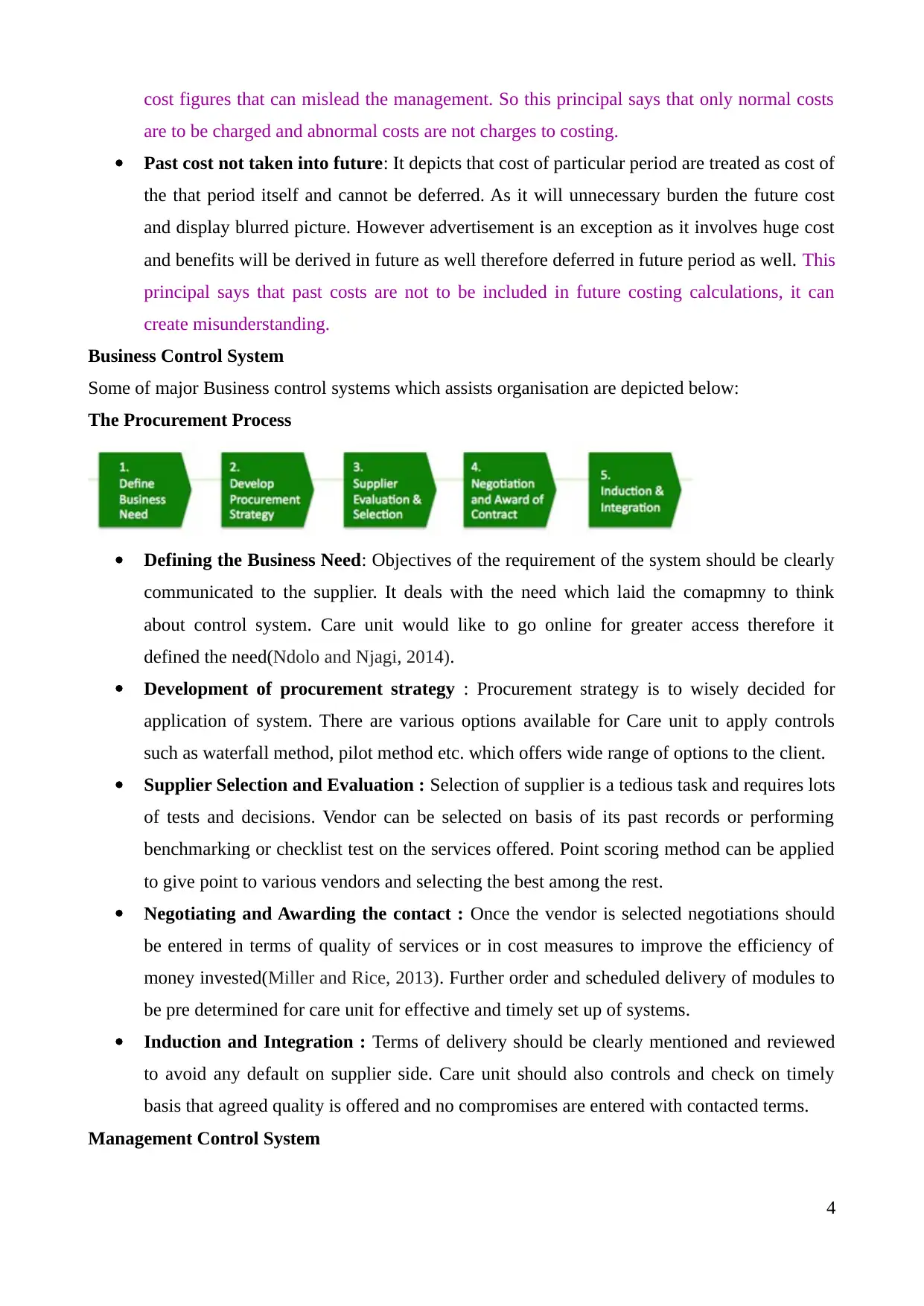

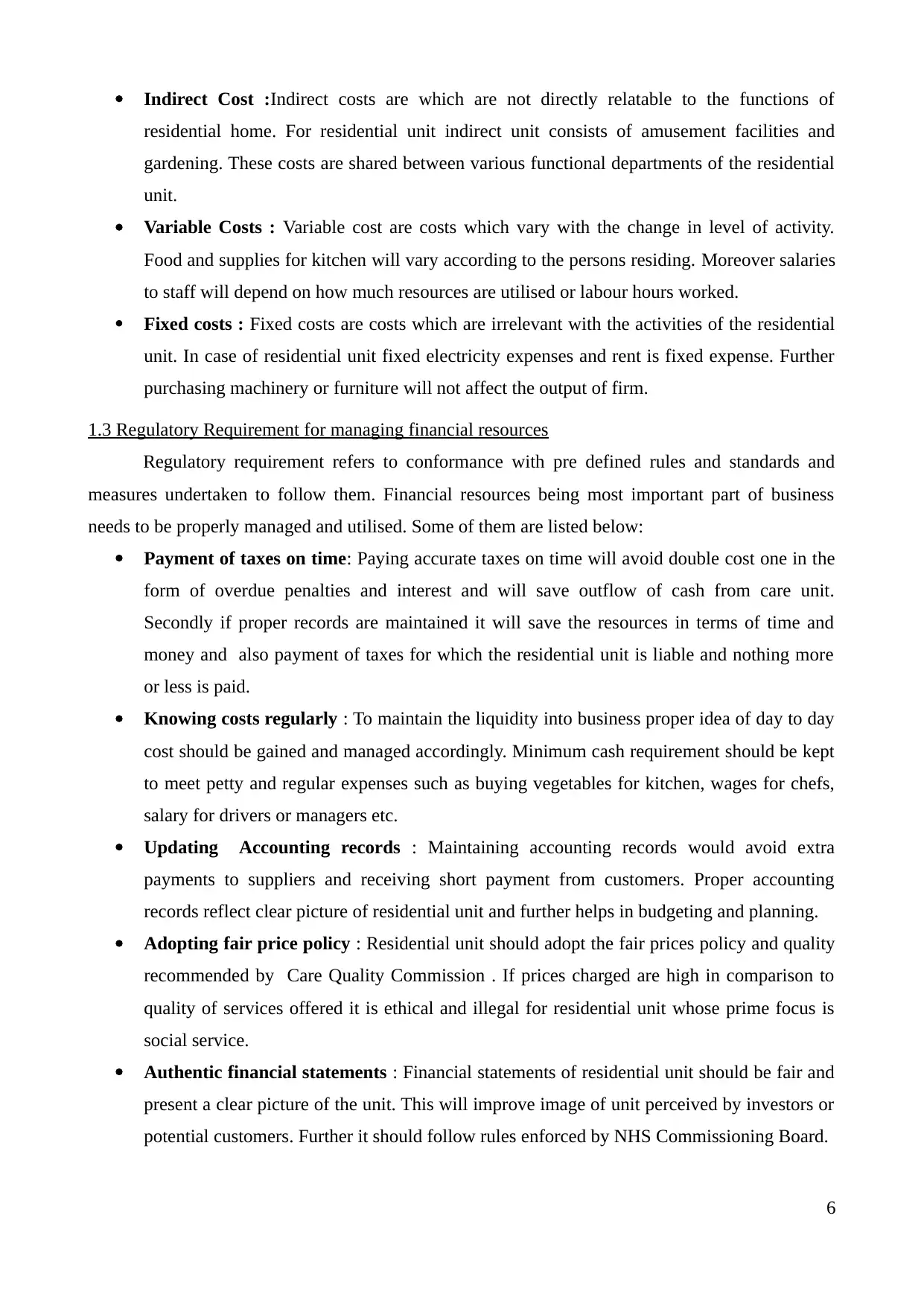

Calculation of cost per unit for one resident in a month

Table 1: Calculation of per unit cost for resident in a month

Particulars Amount in £

Variable Cost 1200

Fixed Cost 75000

Total cost 76200

No of beds 65

Per unit cost of resident in a month

Total cost/no. Of unit produces

(1200+75000/65) 1172.31

1.2 Classification of costs residential home has to bear

Costs can be classified into different sectors by residential home and apportioned

accordingly.

Direct cost : Direct cost refers to those cost which are directly attributable to the prime

activity and fluctuate with level of production(Drury, 2013). For example: house keeping

services are directly related with residential home.

5

physical or financial are analysed under financial microscope of organisation strategies. This

includes six elements which are listed below:

Strategic Planning : As per this element of management control system strategic planning

is preformed to create a roadmap and setting objectives to achieve organisational

goals(Kerzner, 2013).

Budgeting : Budgeting involves setting standards on basis of past records for the revenues,

expenses and other items on basis of future forecasting.

Allocation of resources : This involves allocation of human, physical and financial

resources as per the budgeted plans and achieving desired objectives. Example: Allocating

the appropriate budget to each sector such as housekeeping, pantry etc.

Measuring Performance : Once the resources are allocated and control system in unit

starts operating performance is measured as per the standard.

Rewards and Evaluations : Rewarding of ranks to resource allocation and performance is

evaluated and loopholes are overcome and rewards to be given in case of exceptional

situation.

Responsibility centre Allocation : Responsibility for application of system is to be

allocated to personnel for effective development and timely adoption of system into

organisation. For example: head of acre unit is to be assigned this task.

Calculation of cost per unit for one resident in a month

Table 1: Calculation of per unit cost for resident in a month

Particulars Amount in £

Variable Cost 1200

Fixed Cost 75000

Total cost 76200

No of beds 65

Per unit cost of resident in a month

Total cost/no. Of unit produces

(1200+75000/65) 1172.31

1.2 Classification of costs residential home has to bear

Costs can be classified into different sectors by residential home and apportioned

accordingly.

Direct cost : Direct cost refers to those cost which are directly attributable to the prime

activity and fluctuate with level of production(Drury, 2013). For example: house keeping

services are directly related with residential home.

5

Indirect Cost :Indirect costs are which are not directly relatable to the functions of

residential home. For residential unit indirect unit consists of amusement facilities and

gardening. These costs are shared between various functional departments of the residential

unit.

Variable Costs : Variable cost are costs which vary with the change in level of activity.

Food and supplies for kitchen will vary according to the persons residing. Moreover salaries

to staff will depend on how much resources are utilised or labour hours worked.

Fixed costs : Fixed costs are costs which are irrelevant with the activities of the residential

unit. In case of residential unit fixed electricity expenses and rent is fixed expense. Further

purchasing machinery or furniture will not affect the output of firm.

1.3 Regulatory Requirement for managing financial resources

Regulatory requirement refers to conformance with pre defined rules and standards and

measures undertaken to follow them. Financial resources being most important part of business

needs to be properly managed and utilised. Some of them are listed below:

Payment of taxes on time: Paying accurate taxes on time will avoid double cost one in the

form of overdue penalties and interest and will save outflow of cash from care unit.

Secondly if proper records are maintained it will save the resources in terms of time and

money and also payment of taxes for which the residential unit is liable and nothing more

or less is paid.

Knowing costs regularly : To maintain the liquidity into business proper idea of day to day

cost should be gained and managed accordingly. Minimum cash requirement should be kept

to meet petty and regular expenses such as buying vegetables for kitchen, wages for chefs,

salary for drivers or managers etc.

Updating Accounting records : Maintaining accounting records would avoid extra

payments to suppliers and receiving short payment from customers. Proper accounting

records reflect clear picture of residential unit and further helps in budgeting and planning.

Adopting fair price policy : Residential unit should adopt the fair prices policy and quality

recommended by Care Quality Commission . If prices charged are high in comparison to

quality of services offered it is ethical and illegal for residential unit whose prime focus is

social service.

Authentic financial statements : Financial statements of residential unit should be fair and

present a clear picture of the unit. This will improve image of unit perceived by investors or

potential customers. Further it should follow rules enforced by NHS Commissioning Board.

6

residential home. For residential unit indirect unit consists of amusement facilities and

gardening. These costs are shared between various functional departments of the residential

unit.

Variable Costs : Variable cost are costs which vary with the change in level of activity.

Food and supplies for kitchen will vary according to the persons residing. Moreover salaries

to staff will depend on how much resources are utilised or labour hours worked.

Fixed costs : Fixed costs are costs which are irrelevant with the activities of the residential

unit. In case of residential unit fixed electricity expenses and rent is fixed expense. Further

purchasing machinery or furniture will not affect the output of firm.

1.3 Regulatory Requirement for managing financial resources

Regulatory requirement refers to conformance with pre defined rules and standards and

measures undertaken to follow them. Financial resources being most important part of business

needs to be properly managed and utilised. Some of them are listed below:

Payment of taxes on time: Paying accurate taxes on time will avoid double cost one in the

form of overdue penalties and interest and will save outflow of cash from care unit.

Secondly if proper records are maintained it will save the resources in terms of time and

money and also payment of taxes for which the residential unit is liable and nothing more

or less is paid.

Knowing costs regularly : To maintain the liquidity into business proper idea of day to day

cost should be gained and managed accordingly. Minimum cash requirement should be kept

to meet petty and regular expenses such as buying vegetables for kitchen, wages for chefs,

salary for drivers or managers etc.

Updating Accounting records : Maintaining accounting records would avoid extra

payments to suppliers and receiving short payment from customers. Proper accounting

records reflect clear picture of residential unit and further helps in budgeting and planning.

Adopting fair price policy : Residential unit should adopt the fair prices policy and quality

recommended by Care Quality Commission . If prices charged are high in comparison to

quality of services offered it is ethical and illegal for residential unit whose prime focus is

social service.

Authentic financial statements : Financial statements of residential unit should be fair and

present a clear picture of the unit. This will improve image of unit perceived by investors or

potential customers. Further it should follow rules enforced by NHS Commissioning Board.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Respecting legal contracts: Agreement which re enforceable by civil laws or Healthcare

Sector Regulator Monitor should be respected by residential unit to avoid legal

repercussions and avoid fines or penalties. Moreover the residential unit is engaged in health

and social care and all the quality standards and contracts should be respected and

considered in its day to day working(Jonathan, 2014).

Internal Auditing : Internal auditing is performed on internal operations, controls and comment on

the efficiency of risk management process engaged into business. In case of residential unit internal

audit function will check the quality of food, safety measures in the kitchen etc.

External Auditing : External Auditing is an independent body governed by statutory provisions

which present report commenting about fairness and accuracy in the information presented in

financial statements. For illustration: Auditor appointed to comment upon financial statements of a

residential unit.

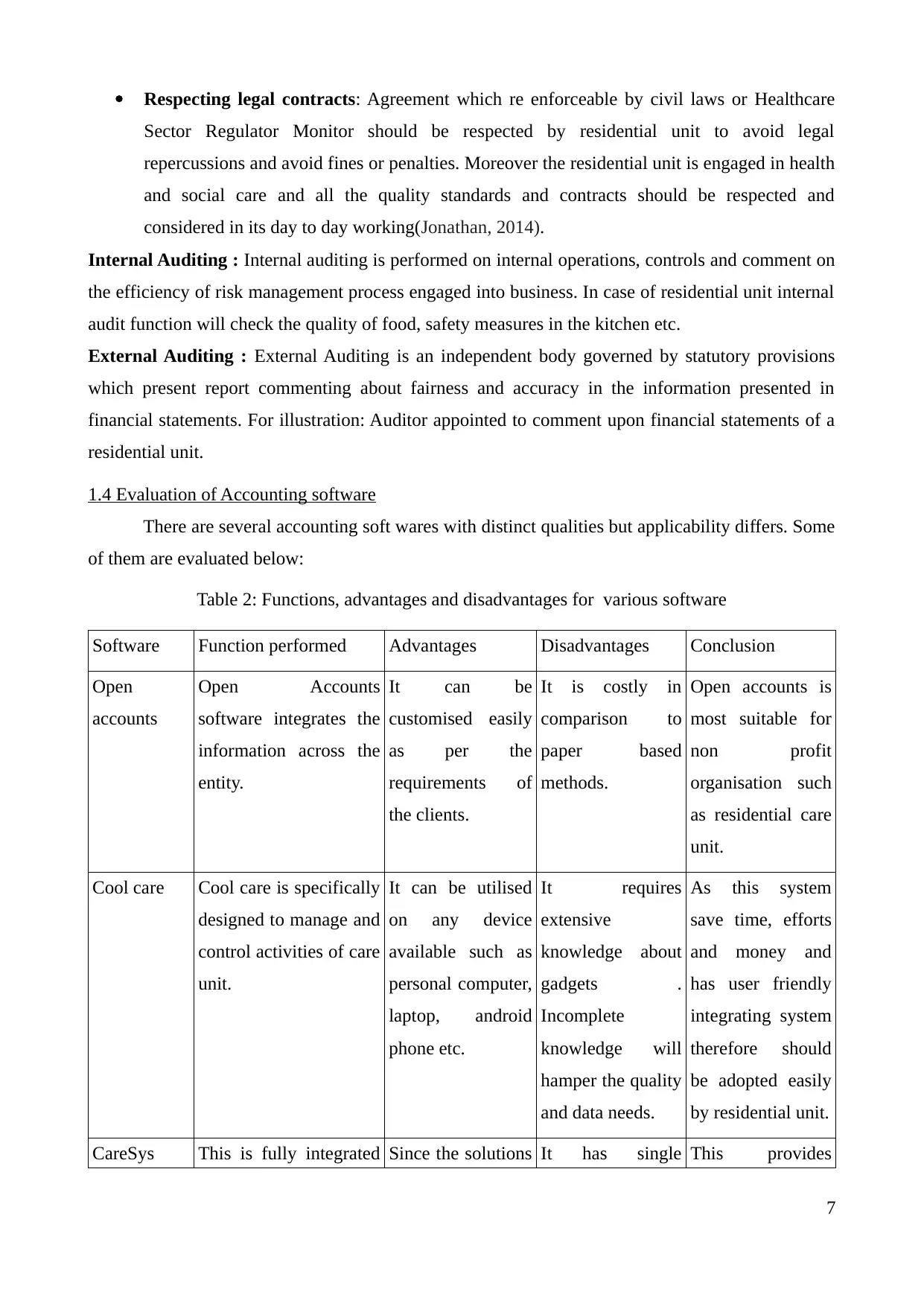

1.4 Evaluation of Accounting software

There are several accounting soft wares with distinct qualities but applicability differs. Some

of them are evaluated below:

Table 2: Functions, advantages and disadvantages for various software

Software Function performed Advantages Disadvantages Conclusion

Open

accounts

Open Accounts

software integrates the

information across the

entity.

It can be

customised easily

as per the

requirements of

the clients.

It is costly in

comparison to

paper based

methods.

Open accounts is

most suitable for

non profit

organisation such

as residential care

unit.

Cool care Cool care is specifically

designed to manage and

control activities of care

unit.

It can be utilised

on any device

available such as

personal computer,

laptop, android

phone etc.

It requires

extensive

knowledge about

gadgets .

Incomplete

knowledge will

hamper the quality

and data needs.

As this system

save time, efforts

and money and

has user friendly

integrating system

therefore should

be adopted easily

by residential unit.

CareSys This is fully integrated Since the solutions It has single This provides

7

Sector Regulator Monitor should be respected by residential unit to avoid legal

repercussions and avoid fines or penalties. Moreover the residential unit is engaged in health

and social care and all the quality standards and contracts should be respected and

considered in its day to day working(Jonathan, 2014).

Internal Auditing : Internal auditing is performed on internal operations, controls and comment on

the efficiency of risk management process engaged into business. In case of residential unit internal

audit function will check the quality of food, safety measures in the kitchen etc.

External Auditing : External Auditing is an independent body governed by statutory provisions

which present report commenting about fairness and accuracy in the information presented in

financial statements. For illustration: Auditor appointed to comment upon financial statements of a

residential unit.

1.4 Evaluation of Accounting software

There are several accounting soft wares with distinct qualities but applicability differs. Some

of them are evaluated below:

Table 2: Functions, advantages and disadvantages for various software

Software Function performed Advantages Disadvantages Conclusion

Open

accounts

Open Accounts

software integrates the

information across the

entity.

It can be

customised easily

as per the

requirements of

the clients.

It is costly in

comparison to

paper based

methods.

Open accounts is

most suitable for

non profit

organisation such

as residential care

unit.

Cool care Cool care is specifically

designed to manage and

control activities of care

unit.

It can be utilised

on any device

available such as

personal computer,

laptop, android

phone etc.

It requires

extensive

knowledge about

gadgets .

Incomplete

knowledge will

hamper the quality

and data needs.

As this system

save time, efforts

and money and

has user friendly

integrating system

therefore should

be adopted easily

by residential unit.

CareSys This is fully integrated Since the solutions It has single This provides

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

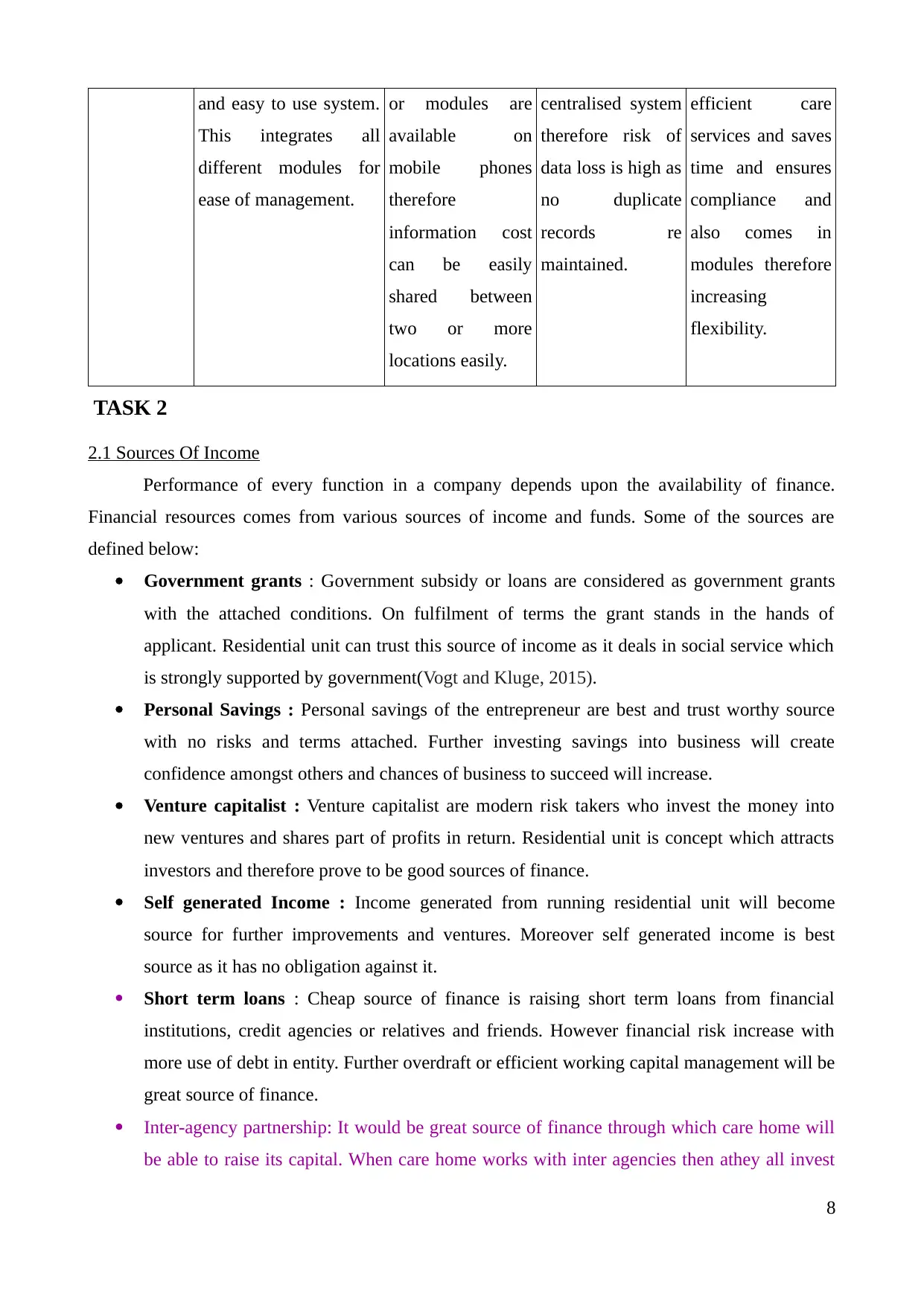

and easy to use system.

This integrates all

different modules for

ease of management.

or modules are

available on

mobile phones

therefore

information cost

can be easily

shared between

two or more

locations easily.

centralised system

therefore risk of

data loss is high as

no duplicate

records re

maintained.

efficient care

services and saves

time and ensures

compliance and

also comes in

modules therefore

increasing

flexibility.

TASK 2

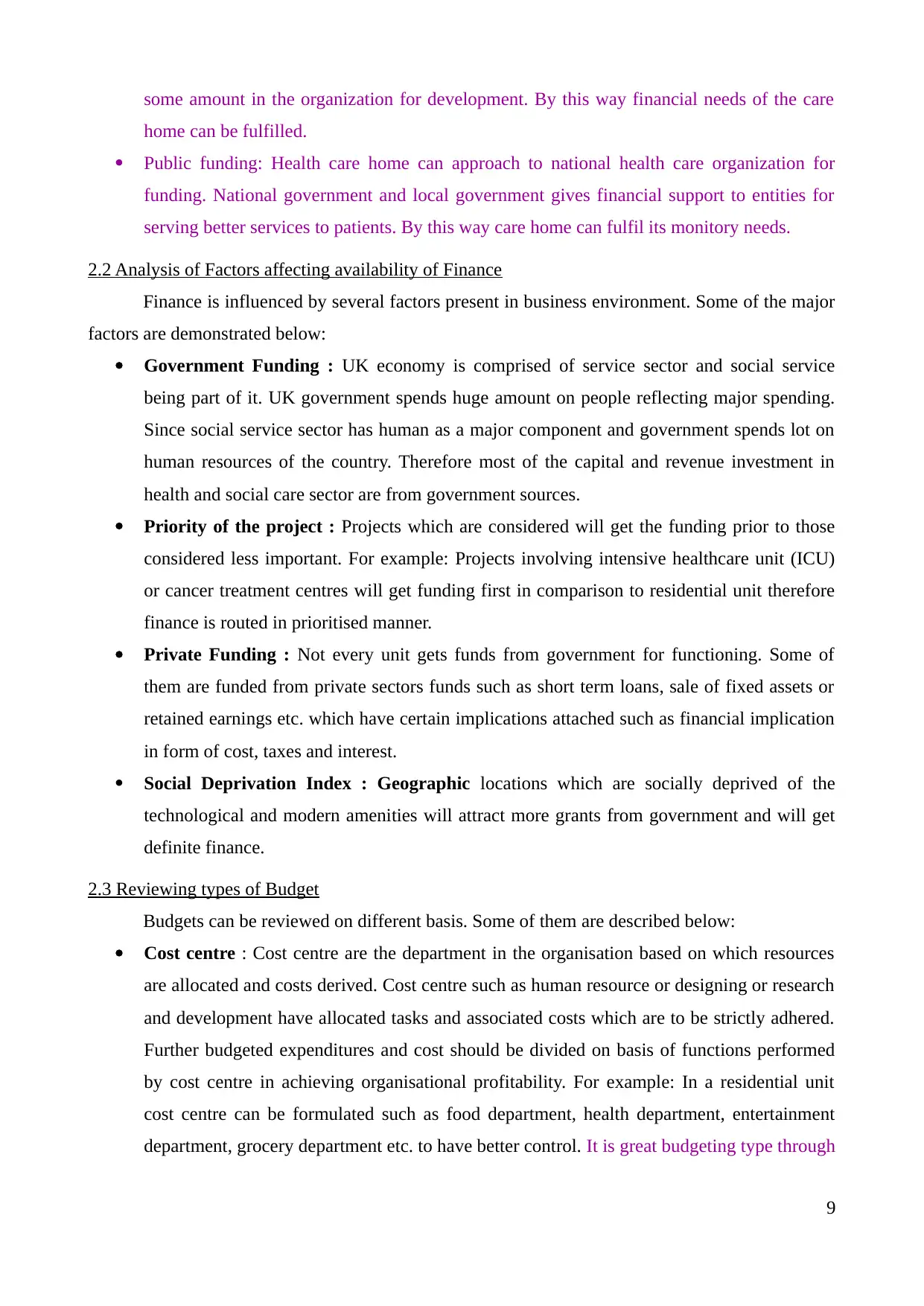

2.1 Sources Of Income

Performance of every function in a company depends upon the availability of finance.

Financial resources comes from various sources of income and funds. Some of the sources are

defined below:

Government grants : Government subsidy or loans are considered as government grants

with the attached conditions. On fulfilment of terms the grant stands in the hands of

applicant. Residential unit can trust this source of income as it deals in social service which

is strongly supported by government(Vogt and Kluge, 2015).

Personal Savings : Personal savings of the entrepreneur are best and trust worthy source

with no risks and terms attached. Further investing savings into business will create

confidence amongst others and chances of business to succeed will increase.

Venture capitalist : Venture capitalist are modern risk takers who invest the money into

new ventures and shares part of profits in return. Residential unit is concept which attracts

investors and therefore prove to be good sources of finance.

Self generated Income : Income generated from running residential unit will become

source for further improvements and ventures. Moreover self generated income is best

source as it has no obligation against it.

Short term loans : Cheap source of finance is raising short term loans from financial

institutions, credit agencies or relatives and friends. However financial risk increase with

more use of debt in entity. Further overdraft or efficient working capital management will be

great source of finance.

Inter-agency partnership: It would be great source of finance through which care home will

be able to raise its capital. When care home works with inter agencies then athey all invest

8

This integrates all

different modules for

ease of management.

or modules are

available on

mobile phones

therefore

information cost

can be easily

shared between

two or more

locations easily.

centralised system

therefore risk of

data loss is high as

no duplicate

records re

maintained.

efficient care

services and saves

time and ensures

compliance and

also comes in

modules therefore

increasing

flexibility.

TASK 2

2.1 Sources Of Income

Performance of every function in a company depends upon the availability of finance.

Financial resources comes from various sources of income and funds. Some of the sources are

defined below:

Government grants : Government subsidy or loans are considered as government grants

with the attached conditions. On fulfilment of terms the grant stands in the hands of

applicant. Residential unit can trust this source of income as it deals in social service which

is strongly supported by government(Vogt and Kluge, 2015).

Personal Savings : Personal savings of the entrepreneur are best and trust worthy source

with no risks and terms attached. Further investing savings into business will create

confidence amongst others and chances of business to succeed will increase.

Venture capitalist : Venture capitalist are modern risk takers who invest the money into

new ventures and shares part of profits in return. Residential unit is concept which attracts

investors and therefore prove to be good sources of finance.

Self generated Income : Income generated from running residential unit will become

source for further improvements and ventures. Moreover self generated income is best

source as it has no obligation against it.

Short term loans : Cheap source of finance is raising short term loans from financial

institutions, credit agencies or relatives and friends. However financial risk increase with

more use of debt in entity. Further overdraft or efficient working capital management will be

great source of finance.

Inter-agency partnership: It would be great source of finance through which care home will

be able to raise its capital. When care home works with inter agencies then athey all invest

8

some amount in the organization for development. By this way financial needs of the care

home can be fulfilled.

Public funding: Health care home can approach to national health care organization for

funding. National government and local government gives financial support to entities for

serving better services to patients. By this way care home can fulfil its monitory needs.

2.2 Analysis of Factors affecting availability of Finance

Finance is influenced by several factors present in business environment. Some of the major

factors are demonstrated below:

Government Funding : UK economy is comprised of service sector and social service

being part of it. UK government spends huge amount on people reflecting major spending.

Since social service sector has human as a major component and government spends lot on

human resources of the country. Therefore most of the capital and revenue investment in

health and social care sector are from government sources.

Priority of the project : Projects which are considered will get the funding prior to those

considered less important. For example: Projects involving intensive healthcare unit (ICU)

or cancer treatment centres will get funding first in comparison to residential unit therefore

finance is routed in prioritised manner.

Private Funding : Not every unit gets funds from government for functioning. Some of

them are funded from private sectors funds such as short term loans, sale of fixed assets or

retained earnings etc. which have certain implications attached such as financial implication

in form of cost, taxes and interest.

Social Deprivation Index : Geographic locations which are socially deprived of the

technological and modern amenities will attract more grants from government and will get

definite finance.

2.3 Reviewing types of Budget

Budgets can be reviewed on different basis. Some of them are described below:

Cost centre : Cost centre are the department in the organisation based on which resources

are allocated and costs derived. Cost centre such as human resource or designing or research

and development have allocated tasks and associated costs which are to be strictly adhered.

Further budgeted expenditures and cost should be divided on basis of functions performed

by cost centre in achieving organisational profitability. For example: In a residential unit

cost centre can be formulated such as food department, health department, entertainment

department, grocery department etc. to have better control. It is great budgeting type through

9

home can be fulfilled.

Public funding: Health care home can approach to national health care organization for

funding. National government and local government gives financial support to entities for

serving better services to patients. By this way care home can fulfil its monitory needs.

2.2 Analysis of Factors affecting availability of Finance

Finance is influenced by several factors present in business environment. Some of the major

factors are demonstrated below:

Government Funding : UK economy is comprised of service sector and social service

being part of it. UK government spends huge amount on people reflecting major spending.

Since social service sector has human as a major component and government spends lot on

human resources of the country. Therefore most of the capital and revenue investment in

health and social care sector are from government sources.

Priority of the project : Projects which are considered will get the funding prior to those

considered less important. For example: Projects involving intensive healthcare unit (ICU)

or cancer treatment centres will get funding first in comparison to residential unit therefore

finance is routed in prioritised manner.

Private Funding : Not every unit gets funds from government for functioning. Some of

them are funded from private sectors funds such as short term loans, sale of fixed assets or

retained earnings etc. which have certain implications attached such as financial implication

in form of cost, taxes and interest.

Social Deprivation Index : Geographic locations which are socially deprived of the

technological and modern amenities will attract more grants from government and will get

definite finance.

2.3 Reviewing types of Budget

Budgets can be reviewed on different basis. Some of them are described below:

Cost centre : Cost centre are the department in the organisation based on which resources

are allocated and costs derived. Cost centre such as human resource or designing or research

and development have allocated tasks and associated costs which are to be strictly adhered.

Further budgeted expenditures and cost should be divided on basis of functions performed

by cost centre in achieving organisational profitability. For example: In a residential unit

cost centre can be formulated such as food department, health department, entertainment

department, grocery department etc. to have better control. It is great budgeting type through

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

which care home can control over its unnecessary expenditures and can develop working

environment of the care home. On other hand It has not particular guidelines as department

head can allocate funds as per their understanding so it may give negative results as well.

Project Management Budget : Project should be governed by comparing actual with

budgets and controlling the variances. However major components are firstly base cost

estimates which includes estimating the costs of routine nature on the assumptions that

everything remains favourable. Secondly a good budget should have space for any sort of

contingency that would arise in course of action. Contingency money is financial resources

kept aside for emergency situations. Thirdly management reserves are created for events

which are unfortunate and unforeseen such as fire in house or floods in town etc. By this

way management can allocate funds to uncertain events as well that can be beneficial for the

care home. As at the time of loss it would not have to get troubled for money. On other

hand it is based on assumptions so results may be differed from expectations.

Outsourcing : That is another type of budget in which outside agencies support the firm for

preparing budget. Outsourcing is assigning the support services of entity to outside agencies.

Outsourcing reduces the cost of entity in training activities and moreover it can lay more

focus ion the prime activity of the business. Residential unit can outsource the cleanliness

services so that it can focus on food and healthcare facilities. Support from outsourcing

agencies can give huge benefit to the organization, but that can create confusion as well.

Some times budget may get over due to involvement of outsource agencies.

2.4 Decision Making ways for expenditure

Planning the expenditure is crucial function for achieving profitability targets for the entity.

Command : This type of decision making focuses on following the commands given be one

individual and following the command blindly(Zsambok and Klein, 2014). Residential unit

should not apply this model as it will make the leader a hated figure and affect the

organisational structure.

Consult : This is good strategy for decision making a sit involves the suggestions from all

the people concerned(Pettigrew, 2014). It adds the value to decisions and involves various

experts to present the expenditure management in effective manner in a residential unit. For

managing cost consultant should be approached.

Vote : This type of decision making is applicable when options are available and choice is to

made then. People concerned are asked to vote in favour or against and the one with

majority is selected. Discussion should be based to justify the votes and reasons explaining

10

environment of the care home. On other hand It has not particular guidelines as department

head can allocate funds as per their understanding so it may give negative results as well.

Project Management Budget : Project should be governed by comparing actual with

budgets and controlling the variances. However major components are firstly base cost

estimates which includes estimating the costs of routine nature on the assumptions that

everything remains favourable. Secondly a good budget should have space for any sort of

contingency that would arise in course of action. Contingency money is financial resources

kept aside for emergency situations. Thirdly management reserves are created for events

which are unfortunate and unforeseen such as fire in house or floods in town etc. By this

way management can allocate funds to uncertain events as well that can be beneficial for the

care home. As at the time of loss it would not have to get troubled for money. On other

hand it is based on assumptions so results may be differed from expectations.

Outsourcing : That is another type of budget in which outside agencies support the firm for

preparing budget. Outsourcing is assigning the support services of entity to outside agencies.

Outsourcing reduces the cost of entity in training activities and moreover it can lay more

focus ion the prime activity of the business. Residential unit can outsource the cleanliness

services so that it can focus on food and healthcare facilities. Support from outsourcing

agencies can give huge benefit to the organization, but that can create confusion as well.

Some times budget may get over due to involvement of outsource agencies.

2.4 Decision Making ways for expenditure

Planning the expenditure is crucial function for achieving profitability targets for the entity.

Command : This type of decision making focuses on following the commands given be one

individual and following the command blindly(Zsambok and Klein, 2014). Residential unit

should not apply this model as it will make the leader a hated figure and affect the

organisational structure.

Consult : This is good strategy for decision making a sit involves the suggestions from all

the people concerned(Pettigrew, 2014). It adds the value to decisions and involves various

experts to present the expenditure management in effective manner in a residential unit. For

managing cost consultant should be approached.

Vote : This type of decision making is applicable when options are available and choice is to

made then. People concerned are asked to vote in favour or against and the one with

majority is selected. Discussion should be based to justify the votes and reasons explaining

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the action in a residential unit. Regarding changing the food services expenditure or menu

replacement voting should be applied .

Consensus : This method is used to bring integrity and high quality decisions s it refers to

discussions until everyone concerned agrees at a single point. It is applicable only when

support from everyone is needed or issue is complex. Suppose residential unit wants to open

a new branch then it is a complex decision and consensus method can be adopted to plan the

expenditure for the same.

TASK 3

3.1 Preparation of Cash Budget

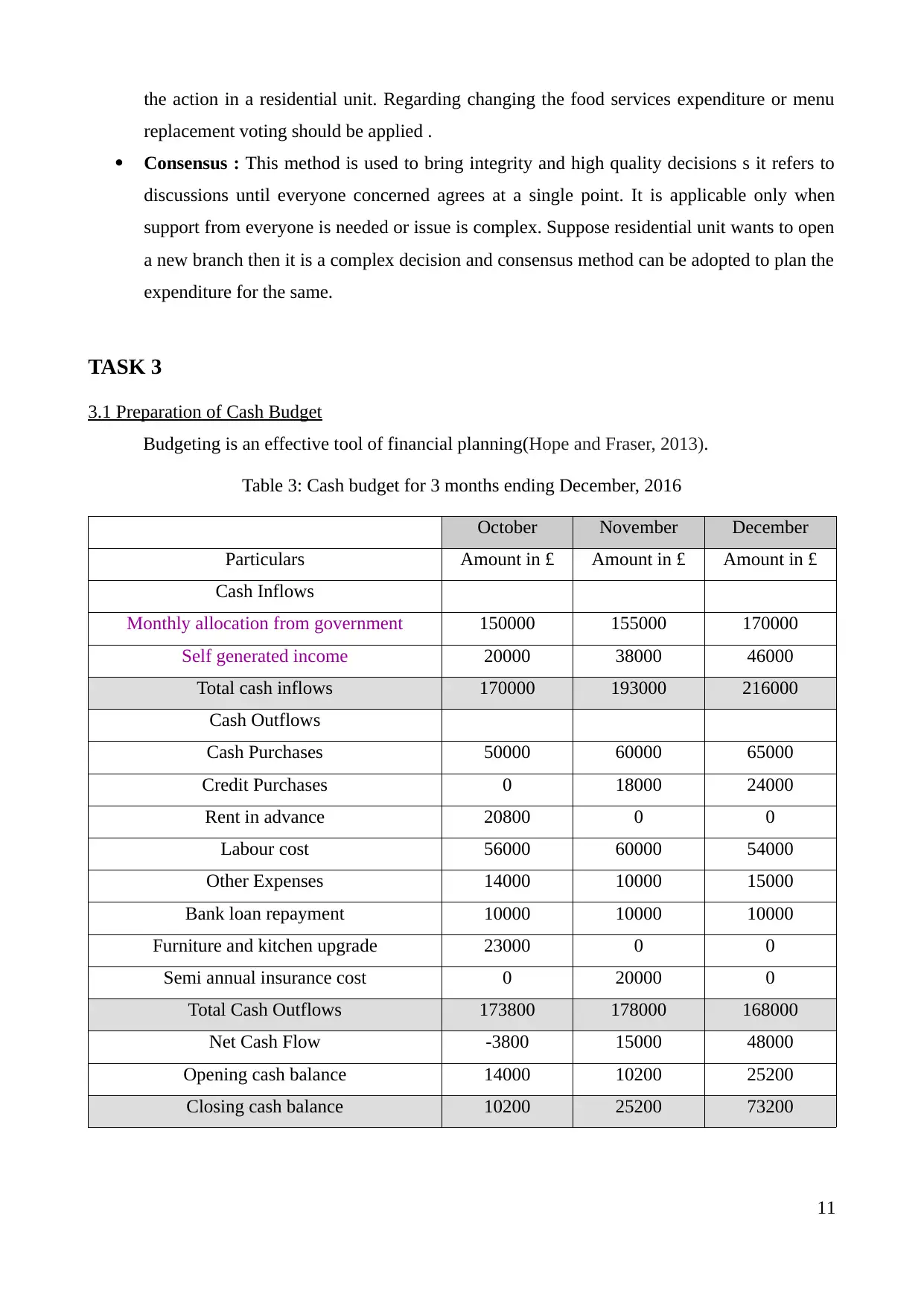

Budgeting is an effective tool of financial planning(Hope and Fraser, 2013).

Table 3: Cash budget for 3 months ending December, 2016

October November December

Particulars Amount in £ Amount in £ Amount in £

Cash Inflows

Monthly allocation from government 150000 155000 170000

Self generated income 20000 38000 46000

Total cash inflows 170000 193000 216000

Cash Outflows

Cash Purchases 50000 60000 65000

Credit Purchases 0 18000 24000

Rent in advance 20800 0 0

Labour cost 56000 60000 54000

Other Expenses 14000 10000 15000

Bank loan repayment 10000 10000 10000

Furniture and kitchen upgrade 23000 0 0

Semi annual insurance cost 0 20000 0

Total Cash Outflows 173800 178000 168000

Net Cash Flow -3800 15000 48000

Opening cash balance 14000 10200 25200

Closing cash balance 10200 25200 73200

11

replacement voting should be applied .

Consensus : This method is used to bring integrity and high quality decisions s it refers to

discussions until everyone concerned agrees at a single point. It is applicable only when

support from everyone is needed or issue is complex. Suppose residential unit wants to open

a new branch then it is a complex decision and consensus method can be adopted to plan the

expenditure for the same.

TASK 3

3.1 Preparation of Cash Budget

Budgeting is an effective tool of financial planning(Hope and Fraser, 2013).

Table 3: Cash budget for 3 months ending December, 2016

October November December

Particulars Amount in £ Amount in £ Amount in £

Cash Inflows

Monthly allocation from government 150000 155000 170000

Self generated income 20000 38000 46000

Total cash inflows 170000 193000 216000

Cash Outflows

Cash Purchases 50000 60000 65000

Credit Purchases 0 18000 24000

Rent in advance 20800 0 0

Labour cost 56000 60000 54000

Other Expenses 14000 10000 15000

Bank loan repayment 10000 10000 10000

Furniture and kitchen upgrade 23000 0 0

Semi annual insurance cost 0 20000 0

Total Cash Outflows 173800 178000 168000

Net Cash Flow -3800 15000 48000

Opening cash balance 14000 10200 25200

Closing cash balance 10200 25200 73200

11

Since the income is below the expenditures for the month of October however the same is

compensated by the initial cash balance available. However residential care unit can invest the

surplus cash into fixed interest bonds as they are lying under utilised(Callaghan, Hawke and

Mignerey, 2014). Moreover cash is managed effectively and managed as per the expenses planned.

Budgeting is an important tool to provide insight into future about future expenses and income. Self

generated income can be increased by attracting more customers and maintaining existing by

improving quality of service(Rigby and Bilodeau, 2015). Since plenty of cash is available it can

provide extra services as agreed as discount and motivate customers.

3.2 Fraud Management

Fraud is a term which address all the criminal deceptions which cause wrongful gain to one

and loss to others financially or personally. Evidence for all the frauds should be collected and the

person who has committed the offence to be reasonably punished(Hess and Cottrell, 2016). This

will avoid others to perform the same wrongful task.

Financial Frauds : Frauds which includes finance or money in action. This fraud affects the

residential unit adversely. In a residential unit financial fraud such as embezzlement of cash

common and if detected should be avoided by tracking the movement of cash on regular

basis. Further maker should not be checker in case of passing vouchers for expenses(Shi,

Connelly and Hoskisson, 2016).

Accounting frauds : Frauds detected in recording transactions magnificently or illusionary

which misleads the user of financial statements. If such frauds are detected than audit

function is to be held responsible and scope of audit is to be widened by residential

unit(Chen and et.al., 2016). Major fraud occurs when vouchers are prepare on name sake

without any evidence. Leakage of information will bring disrepute therefore security

measures should be adopted such as CCTV cameras, details of visitors etc.

Personal frauds : Personal benefit or harassment of others is criminal offence and once

detected culprit should be handed over to police. Fraud in terms of sexual or physical

assortment is a major concern for residential unit and should be prevented by undertaking

proper measures and controls.

◦ At the time of suspecting fraud care home can analyses the financial information so that

reliability of the details can be examined. By this way fraud will be in front and care

home will be able to take suitable action for reducing such type of situation in the

organization. Validity and sufficiency of the information and activities can be examined

time to time that would help in reducing such type of conditions in the care home.

12

compensated by the initial cash balance available. However residential care unit can invest the

surplus cash into fixed interest bonds as they are lying under utilised(Callaghan, Hawke and

Mignerey, 2014). Moreover cash is managed effectively and managed as per the expenses planned.

Budgeting is an important tool to provide insight into future about future expenses and income. Self

generated income can be increased by attracting more customers and maintaining existing by

improving quality of service(Rigby and Bilodeau, 2015). Since plenty of cash is available it can

provide extra services as agreed as discount and motivate customers.

3.2 Fraud Management

Fraud is a term which address all the criminal deceptions which cause wrongful gain to one

and loss to others financially or personally. Evidence for all the frauds should be collected and the

person who has committed the offence to be reasonably punished(Hess and Cottrell, 2016). This

will avoid others to perform the same wrongful task.

Financial Frauds : Frauds which includes finance or money in action. This fraud affects the

residential unit adversely. In a residential unit financial fraud such as embezzlement of cash

common and if detected should be avoided by tracking the movement of cash on regular

basis. Further maker should not be checker in case of passing vouchers for expenses(Shi,

Connelly and Hoskisson, 2016).

Accounting frauds : Frauds detected in recording transactions magnificently or illusionary

which misleads the user of financial statements. If such frauds are detected than audit

function is to be held responsible and scope of audit is to be widened by residential

unit(Chen and et.al., 2016). Major fraud occurs when vouchers are prepare on name sake

without any evidence. Leakage of information will bring disrepute therefore security

measures should be adopted such as CCTV cameras, details of visitors etc.

Personal frauds : Personal benefit or harassment of others is criminal offence and once

detected culprit should be handed over to police. Fraud in terms of sexual or physical

assortment is a major concern for residential unit and should be prevented by undertaking

proper measures and controls.

◦ At the time of suspecting fraud care home can analyses the financial information so that

reliability of the details can be examined. By this way fraud will be in front and care

home will be able to take suitable action for reducing such type of situation in the

organization. Validity and sufficiency of the information and activities can be examined

time to time that would help in reducing such type of conditions in the care home.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.