Financial Management Report: Approaches, Techniques, and Factors

VerifiedAdded on 2023/01/11

|17

|4996

|82

Report

AI Summary

This report delves into financial management, encompassing various approaches, techniques, and factors essential for effective decision-making. It evaluates different decision-making approaches, including autocratic and democratic methods, and highlights techniques like group discussions and financial analysis. The report also examines stakeholder management, emphasizing the importance of addressing conflicting objectives among stakeholder groups. Furthermore, it explores the value of management accounting techniques in cost control, such as marginal analysis, constraint analysis, and capital budgeting, all aimed at maximizing shareholder value. The report also addresses fraud detection and prevention techniques, including statistical parameters, auditing, and internal controls, alongside ethical decision-making considerations. Finally, the report reviews the use of financial statements, investment appraisal techniques, and the role of financial decision-making in ensuring long-term sustainability. The report concludes with recommendations for management accountants.

FINANCIAL

MANAGEMENT

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

INTRODUTION..............................................................................................................................1

SCENARIO A.................................................................................................................................1

1. Evaluation of different approaches and techniques and factors of effective decision making1

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group.........................................................................................................................2

3. Value of management accounting techniques in cost control and for maximising the

shareholder value.........................................................................................................................3

4. Techniques for fraud detection and prevention and ethical decision making.........................4

5. Reflection on understanding of the above techniques.............................................................5

SCENARIO 2..................................................................................................................................6

1. Financial information helps the business in making sound and effective business decisions.

.....................................................................................................................................................6

2. Three investment appraisal techniques..................................................................................10

3. value of techniques financial decision making......................................................................11

4. Financial decision making supports long-term sustainability...............................................12

5. Recommendation to Management Accountant......................................................................13

CONCLUSISON...........................................................................................................................13

REFERENCES..............................................................................................................................14

TABLE OF CONTENTS................................................................................................................2

INTRODUTION..............................................................................................................................1

SCENARIO A.................................................................................................................................1

1. Evaluation of different approaches and techniques and factors of effective decision making1

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group.........................................................................................................................2

3. Value of management accounting techniques in cost control and for maximising the

shareholder value.........................................................................................................................3

4. Techniques for fraud detection and prevention and ethical decision making.........................4

5. Reflection on understanding of the above techniques.............................................................5

SCENARIO 2..................................................................................................................................6

1. Financial information helps the business in making sound and effective business decisions.

.....................................................................................................................................................6

2. Three investment appraisal techniques..................................................................................10

3. value of techniques financial decision making......................................................................11

4. Financial decision making supports long-term sustainability...............................................12

5. Recommendation to Management Accountant......................................................................13

CONCLUSISON...........................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUTION

Financial management refers to planning, and organising the financial operations of an

enterprise like procurement and the utilisation of the funds of enterprise. This refers to

application of general principles of management to the financial resources of enterprise. it is also

concerned with analysing and dealing with money & investments for the business for the making

business decisions. It plays an crucial role in the growth and success of the success of the

organisation. It is directly responsible for financial health of organisation. It produces financial

reports and records, direct investments and to develop plans and strategies for long term goals

and objectives of business. It helps the company in making sound financial decisions for the

business. Present report will be providing about the approaches, techniques and factors that helps

in effective decision making. This will be providing about the management of conflicting

objectives of stakeholders, techniques of management accounting in cost control for maximising

shareholder value and the fraud detection and prevention techniques. Second part of the report

will provide about the use of financial statements, use of investment appraisal techniques and

analysis of how financial decision makings helps in long term sustainability of the enterprise.

SCENARIO A

1. Evaluation of different approaches and techniques and factors of effective decision making

For the success of business it is very essential for the company to have effective decision

making. This is majorly because of the reason that when the company takes into consideration all

the changes taking place in environment and decide to select one of them (Romiszowski, 2016).

Thus, for this there are many different approaches and other techniques to take the effective

decision which are as follows-

Approaches of decision making- there are different kinds of approaches of decision

making and these are as follows-

Autocratic approach- under this type of approach all the decisions are being taken by the

leaders or the head of the management team only. In this type of approach the other employees

working at the lower level are not included in the decision making process.

Democratic approach- this is a type of approach under which the decision are taken by

the consulting all the employees working within the company whether be it at high level or the

low level. This is a better approach of taking decision as it considers all the different views of the

employees before taking the decision.

1

Financial management refers to planning, and organising the financial operations of an

enterprise like procurement and the utilisation of the funds of enterprise. This refers to

application of general principles of management to the financial resources of enterprise. it is also

concerned with analysing and dealing with money & investments for the business for the making

business decisions. It plays an crucial role in the growth and success of the success of the

organisation. It is directly responsible for financial health of organisation. It produces financial

reports and records, direct investments and to develop plans and strategies for long term goals

and objectives of business. It helps the company in making sound financial decisions for the

business. Present report will be providing about the approaches, techniques and factors that helps

in effective decision making. This will be providing about the management of conflicting

objectives of stakeholders, techniques of management accounting in cost control for maximising

shareholder value and the fraud detection and prevention techniques. Second part of the report

will provide about the use of financial statements, use of investment appraisal techniques and

analysis of how financial decision makings helps in long term sustainability of the enterprise.

SCENARIO A

1. Evaluation of different approaches and techniques and factors of effective decision making

For the success of business it is very essential for the company to have effective decision

making. This is majorly because of the reason that when the company takes into consideration all

the changes taking place in environment and decide to select one of them (Romiszowski, 2016).

Thus, for this there are many different approaches and other techniques to take the effective

decision which are as follows-

Approaches of decision making- there are different kinds of approaches of decision

making and these are as follows-

Autocratic approach- under this type of approach all the decisions are being taken by the

leaders or the head of the management team only. In this type of approach the other employees

working at the lower level are not included in the decision making process.

Democratic approach- this is a type of approach under which the decision are taken by

the consulting all the employees working within the company whether be it at high level or the

low level. This is a better approach of taking decision as it considers all the different views of the

employees before taking the decision.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Techniques of decision making- there are different types of techniques which the

company can use at time of taking the decision which are as follows-

Group discussion- this is a technique under which all the management team and

employees sits together and then discusses the issue on which the decision need to be taken.

Then after discussing the whole situation the decision are being taken and finalised.

Financial analysis- this is also another important technique which can be used in order to

take the decision for the betterment of the company. Under this method all the financial

statements are analysed and on basis of these the decision are being taken by the company in the

growth and development of the business.

Factors affecting the effective decision making- along with these approaches and

techniques there are some of the factors also which will affect the decision making by the

company. These factors are as follows-

Thinking ability of employees- it is clear that the employees are different in their thinking

and perception and this affects the ability of decision making to a great extent. Thus, this impacts

the decision making capacity to a great extent as if the thinking of the employees will be

optimistic then this will foster the decision making (Ma, Liu and Zhan, 2017).

Attitude of working- this also affect the decision making to a great extent as if the attitude

will not be positive then the employees will not be able to take effective decision. Thus, this will

result in decrease in the working efficiency of the company and the employees.

Hence, in the end it can be said that for taking effective decision there are many different

types of approach, techniques and factors which foster the ability of person to take decision.

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group.

Stakeholder management could be described as process to maintain good relationships

with people who are having direct impact over the business. every company is required to

monitor, organise and for improving the relationship with the stakeholders. Stakeholder

management involves analysing the needs or expectations and planning and implementing the

various process of engaging with them. Entities are required to effectively coordinating with the

different stakeholders and relationship with different stakeholders. This helps the business in

generating benefits of increased risk management, higher stakeholder support and higher

2

company can use at time of taking the decision which are as follows-

Group discussion- this is a technique under which all the management team and

employees sits together and then discusses the issue on which the decision need to be taken.

Then after discussing the whole situation the decision are being taken and finalised.

Financial analysis- this is also another important technique which can be used in order to

take the decision for the betterment of the company. Under this method all the financial

statements are analysed and on basis of these the decision are being taken by the company in the

growth and development of the business.

Factors affecting the effective decision making- along with these approaches and

techniques there are some of the factors also which will affect the decision making by the

company. These factors are as follows-

Thinking ability of employees- it is clear that the employees are different in their thinking

and perception and this affects the ability of decision making to a great extent. Thus, this impacts

the decision making capacity to a great extent as if the thinking of the employees will be

optimistic then this will foster the decision making (Ma, Liu and Zhan, 2017).

Attitude of working- this also affect the decision making to a great extent as if the attitude

will not be positive then the employees will not be able to take effective decision. Thus, this will

result in decrease in the working efficiency of the company and the employees.

Hence, in the end it can be said that for taking effective decision there are many different

types of approach, techniques and factors which foster the ability of person to take decision.

2. Stakeholder management and management of the conflicting objectives of the different

stakeholder group.

Stakeholder management could be described as process to maintain good relationships

with people who are having direct impact over the business. every company is required to

monitor, organise and for improving the relationship with the stakeholders. Stakeholder

management involves analysing the needs or expectations and planning and implementing the

various process of engaging with them. Entities are required to effectively coordinating with the

different stakeholders and relationship with different stakeholders. This helps the business in

generating benefits of increased risk management, higher stakeholder support and higher

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

outcomes on ground. It also brings business intelligence that helps in effective management of

the stakeholders (Shapiro and Hanouna, 2019). The understanding of the stakeholders concerns

is essential for the business as it could lead to business ideas to develop product and services for

addressing the stakeholders’ needs and allowing company in reducing costs and maximising the

value.

Management of the conflicting objectives of the different stakeholders group is very

essential for the business. The different stakeholders groups is to be identified of the entity for

assessing the needs and interests so that it could frame effective strategies. In depth knowledge

and understanding is essential for framing effective relationship for managing the interests of

stakeholders. For effectively managing the stakeholders company is required to develop effective

communications so that the needs and requirement of stakeholder groups could be met

adequately. Conflicts between the different stakeholder groups arise when the interest of on

group is affected due to the interest of the others. Companies are required to ensure that the

interests of stakeholders are not affected due to the other.

3. Value of management accounting techniques in cost control and for maximising the

shareholder value.

Management accounting in an accounting branch which is concerned with identifying,

measuring, analysing and interpretation of the accounting information that could be used for

helping management to makes sound business decisions for managing the company operations.

There are various management accounting techniques that could be used by the management for

cost controls.

Marginal Analysis

The analysis is concerned with incremental benefits the increased production. It is an

essential technique used in managerial accounting for effective cost controls. It involves

calculating Breakeven point. This identifies the point at which revenues and expenses for the

business are equal (Madura, 2020). This helps in making effective business decisions for having

control over cost. it is required to identify the revenues required for meeting the break even.

Constraint analysis

Constraint analysis helps the business in identifying the principal bottlenecks,

inefficiencies created by the bottlenecks and impact over the ability of company in generating

3

the stakeholders (Shapiro and Hanouna, 2019). The understanding of the stakeholders concerns

is essential for the business as it could lead to business ideas to develop product and services for

addressing the stakeholders’ needs and allowing company in reducing costs and maximising the

value.

Management of the conflicting objectives of the different stakeholders group is very

essential for the business. The different stakeholders groups is to be identified of the entity for

assessing the needs and interests so that it could frame effective strategies. In depth knowledge

and understanding is essential for framing effective relationship for managing the interests of

stakeholders. For effectively managing the stakeholders company is required to develop effective

communications so that the needs and requirement of stakeholder groups could be met

adequately. Conflicts between the different stakeholder groups arise when the interest of on

group is affected due to the interest of the others. Companies are required to ensure that the

interests of stakeholders are not affected due to the other.

3. Value of management accounting techniques in cost control and for maximising the

shareholder value.

Management accounting in an accounting branch which is concerned with identifying,

measuring, analysing and interpretation of the accounting information that could be used for

helping management to makes sound business decisions for managing the company operations.

There are various management accounting techniques that could be used by the management for

cost controls.

Marginal Analysis

The analysis is concerned with incremental benefits the increased production. It is an

essential technique used in managerial accounting for effective cost controls. It involves

calculating Breakeven point. This identifies the point at which revenues and expenses for the

business are equal (Madura, 2020). This helps in making effective business decisions for having

control over cost. it is required to identify the revenues required for meeting the break even.

Constraint analysis

Constraint analysis helps the business in identifying the principal bottlenecks,

inefficiencies created by the bottlenecks and impact over the ability of company in generating

3

revenues. This helps the business in effectively controlling the cost by identifying the

bottlenecks.

Capital budgeting

It is concerned with identifying the techniques that helps the business to analyse the

information that is essential for making decision related with capital expenditures. In these

techniques managers identify the feasibility of investments using techniques such as NPV, IRR

and payback period. The techniques are intrinsic valuation used extensively in finance &

accounting to determine value of business and investment securities. Managers use these

techniques for making effective cost decisions and preventing unproductive investments.

These managerial accounting techniques help the business enterprise to control its cost.

Techniques enable the company to identify the areas of improvement for making effective cost

strategies. Management makes the plans that will help in the growth and success of the

organisation by producing the products at minimum costs and maximum benefits. It enables the

company in generating higher return over the business for achieving growth. Higher returns of

the business help in maximising the wealth of the shareholders (Jones and et.al., 2018). This is

achieved by increasing the value of company by constant growth and stability. Higher return

enables the company to make expansion of the business over new boundaries. With the success

of the company wealth of the shareholders is also increased, with the increase in the prices of

shares.

4. Techniques for fraud detection and prevention and ethical decision making.

Fraud detection and prevention is essential for the business. Fraud detection refers to

important technique for identifying the frauds being committed in the business. Along with the

advancement of business methods frauds are also changing. There are different techniques which

could be used for identifying and preventing frauds such as

Statistical parameter

It identifies that the values that exceeds the averages of the standard deviations. It is used

for identifying the high or low anomalies which are often indicators of fraud. Statistical

parameters identify the frauds identifying the deviation from averages.

Auditing

Auditing refers to the investigation of financial records that is conducted by the

organisations every year. In auditing financial record are investigated by the auditors ensuring

4

bottlenecks.

Capital budgeting

It is concerned with identifying the techniques that helps the business to analyse the

information that is essential for making decision related with capital expenditures. In these

techniques managers identify the feasibility of investments using techniques such as NPV, IRR

and payback period. The techniques are intrinsic valuation used extensively in finance &

accounting to determine value of business and investment securities. Managers use these

techniques for making effective cost decisions and preventing unproductive investments.

These managerial accounting techniques help the business enterprise to control its cost.

Techniques enable the company to identify the areas of improvement for making effective cost

strategies. Management makes the plans that will help in the growth and success of the

organisation by producing the products at minimum costs and maximum benefits. It enables the

company in generating higher return over the business for achieving growth. Higher returns of

the business help in maximising the wealth of the shareholders (Jones and et.al., 2018). This is

achieved by increasing the value of company by constant growth and stability. Higher return

enables the company to make expansion of the business over new boundaries. With the success

of the company wealth of the shareholders is also increased, with the increase in the prices of

shares.

4. Techniques for fraud detection and prevention and ethical decision making.

Fraud detection and prevention is essential for the business. Fraud detection refers to

important technique for identifying the frauds being committed in the business. Along with the

advancement of business methods frauds are also changing. There are different techniques which

could be used for identifying and preventing frauds such as

Statistical parameter

It identifies that the values that exceeds the averages of the standard deviations. It is used

for identifying the high or low anomalies which are often indicators of fraud. Statistical

parameters identify the frauds identifying the deviation from averages.

Auditing

Auditing refers to the investigation of financial records that is conducted by the

organisations every year. In auditing financial record are investigated by the auditors ensuring

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

that all the transactions are recorded and are representing true and fair view of the financial

statements

Internal Controls

The internal controls are established by the business for preventing the frauds in the

organisation. These controls are established at areas that are most prone to the frauds (Barr and

McClellan, 2018). Effective monitoring is done by the management so that any frauds conducted

are identified at the earlier stage.

Ethical decision making

Ethical consideration refers to the practice where company is conducting its business

ethically. A company is required to follow ethical concerns while making decisions for the

business. Organisation is expected to represent true and fair view of the financial position and

performance of the company. It should be free from errors and misstatements and is not adjusted

for showing profits and returns (Zietlow and et.al., 2018). Management should not make profits

by following illegal practices of the business and its operations should not be conducted with the

motive of deceiving others.

5. Reflection on understanding of the above techniques.

The above four questions have helped me in getting the understanding about the financial

management. It has enhanced my knowledge about the various concepts that are use in the

financial management for effective decision making. It is helping the organisations to keep

effectively manage the business operation for achieving the goals and objectives of the

enterprise. I have learned that there are different decision making approaches that help the

business to make effective decisions as per the requirement of the circumstances. Different

approaches are there such as functional, formal and informal approaches of business. Techniques

of decision enable the company to make choices when more than one options are available by

identifying the pros and cons of options. It has also given me knowledge about the factors that

have impact over the decision making process.

One of the important task of the company is effective stakeholder management.

Stakeholders are the people who are interested in the success and failure of the business. it

requires the company to have strategies for management of the stakeholders of company.

Stakeholder management is essential for the growth and success of organisations. It should

develop effective communication with different stakeholder groups for identifying their needs

5

statements

Internal Controls

The internal controls are established by the business for preventing the frauds in the

organisation. These controls are established at areas that are most prone to the frauds (Barr and

McClellan, 2018). Effective monitoring is done by the management so that any frauds conducted

are identified at the earlier stage.

Ethical decision making

Ethical consideration refers to the practice where company is conducting its business

ethically. A company is required to follow ethical concerns while making decisions for the

business. Organisation is expected to represent true and fair view of the financial position and

performance of the company. It should be free from errors and misstatements and is not adjusted

for showing profits and returns (Zietlow and et.al., 2018). Management should not make profits

by following illegal practices of the business and its operations should not be conducted with the

motive of deceiving others.

5. Reflection on understanding of the above techniques.

The above four questions have helped me in getting the understanding about the financial

management. It has enhanced my knowledge about the various concepts that are use in the

financial management for effective decision making. It is helping the organisations to keep

effectively manage the business operation for achieving the goals and objectives of the

enterprise. I have learned that there are different decision making approaches that help the

business to make effective decisions as per the requirement of the circumstances. Different

approaches are there such as functional, formal and informal approaches of business. Techniques

of decision enable the company to make choices when more than one options are available by

identifying the pros and cons of options. It has also given me knowledge about the factors that

have impact over the decision making process.

One of the important task of the company is effective stakeholder management.

Stakeholders are the people who are interested in the success and failure of the business. it

requires the company to have strategies for management of the stakeholders of company.

Stakeholder management is essential for the growth and success of organisations. It should

develop effective communication with different stakeholder groups for identifying their needs

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and requirement so that the business operation could be framed according by the companies. It

should efficiently manage the conflicting objectives of different stakeholder groups of the

enterprise. Investments are made by the shareholders in the company for earning sufficient rate

of return or for having additions in their wealth that is also called wealth maximisation. In was

not having understanding about how wealth maximisation is essential for the entity. It reflects

the growth of the company during the investment period.

Along with these concepts it is also equally important for the enterprise to have effective

fraud detection and prevention techniques. Frauds and errors can have serious implications over

the business and its operation. Company could identify and prevent frauds by establishing strong

internal control and timely audit of financial records of the firm.

SCENARIO 2

1. Financial information helps the business in making sound and effective business decisions.

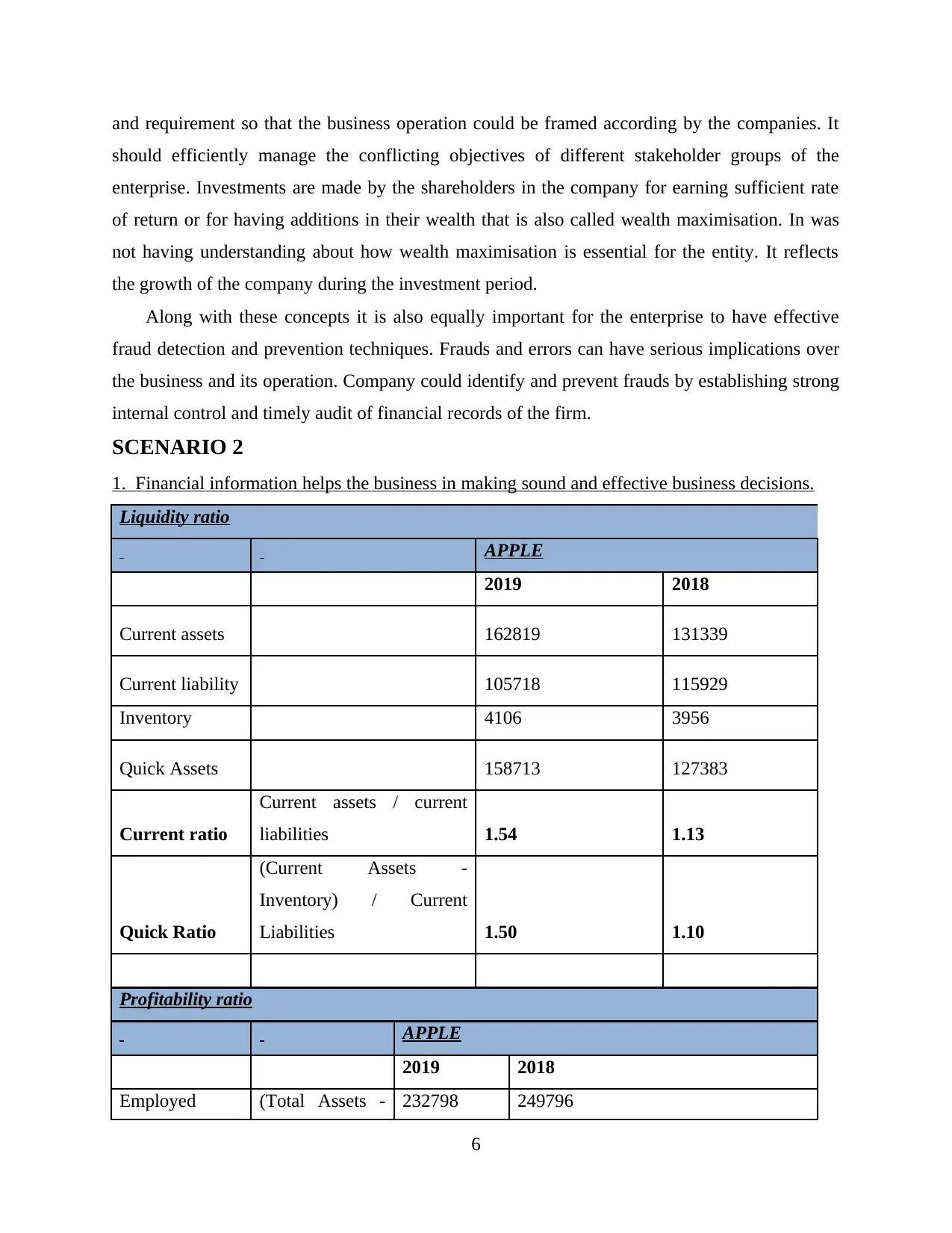

Liquidity ratio

APPLE

2019 2018

Current assets 162819 131339

Current liability 105718 115929

Inventory 4106 3956

Quick Assets 158713 127383

Current ratio

Current assets / current

liabilities 1.54 1.13

Quick Ratio

(Current Assets -

Inventory) / Current

Liabilities 1.50 1.10

Profitability ratio

APPLE

2019 2018

Employed (Total Assets - 232798 249796

6

should efficiently manage the conflicting objectives of different stakeholder groups of the

enterprise. Investments are made by the shareholders in the company for earning sufficient rate

of return or for having additions in their wealth that is also called wealth maximisation. In was

not having understanding about how wealth maximisation is essential for the entity. It reflects

the growth of the company during the investment period.

Along with these concepts it is also equally important for the enterprise to have effective

fraud detection and prevention techniques. Frauds and errors can have serious implications over

the business and its operation. Company could identify and prevent frauds by establishing strong

internal control and timely audit of financial records of the firm.

SCENARIO 2

1. Financial information helps the business in making sound and effective business decisions.

Liquidity ratio

APPLE

2019 2018

Current assets 162819 131339

Current liability 105718 115929

Inventory 4106 3956

Quick Assets 158713 127383

Current ratio

Current assets / current

liabilities 1.54 1.13

Quick Ratio

(Current Assets -

Inventory) / Current

Liabilities 1.50 1.10

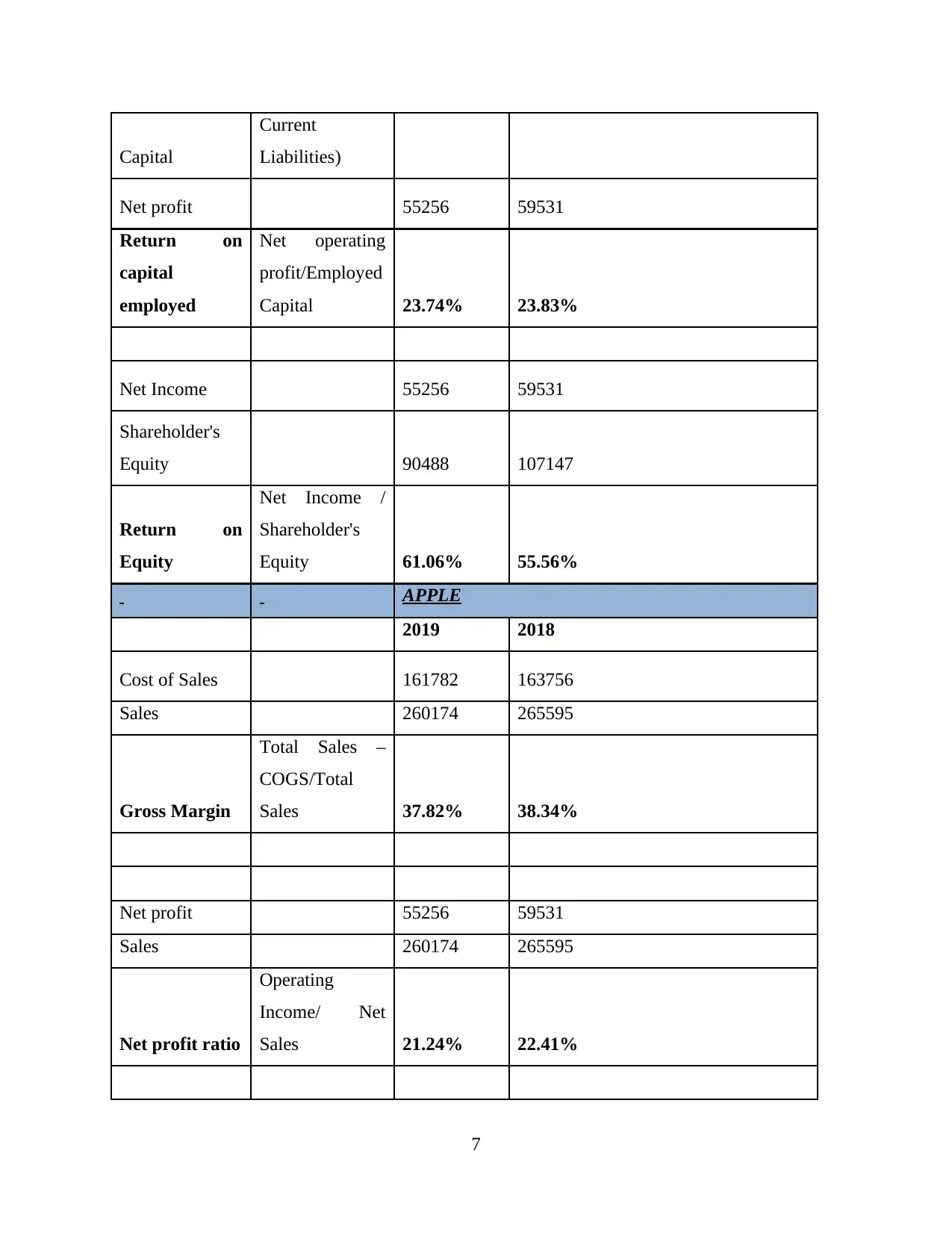

Profitability ratio

APPLE

2019 2018

Employed (Total Assets - 232798 249796

6

Capital

Current

Liabilities)

Net profit 55256 59531

Return on

capital

employed

Net operating

profit/Employed

Capital 23.74% 23.83%

Net Income 55256 59531

Shareholder's

Equity 90488 107147

Return on

Equity

Net Income /

Shareholder's

Equity 61.06% 55.56%

APPLE

2019 2018

Cost of Sales 161782 163756

Sales 260174 265595

Gross Margin

Total Sales –

COGS/Total

Sales 37.82% 38.34%

Net profit 55256 59531

Sales 260174 265595

Net profit ratio

Operating

Income/ Net

Sales 21.24% 22.41%

7

Current

Liabilities)

Net profit 55256 59531

Return on

capital

employed

Net operating

profit/Employed

Capital 23.74% 23.83%

Net Income 55256 59531

Shareholder's

Equity 90488 107147

Return on

Equity

Net Income /

Shareholder's

Equity 61.06% 55.56%

APPLE

2019 2018

Cost of Sales 161782 163756

Sales 260174 265595

Gross Margin

Total Sales –

COGS/Total

Sales 37.82% 38.34%

Net profit 55256 59531

Sales 260174 265595

Net profit ratio

Operating

Income/ Net

Sales 21.24% 22.41%

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

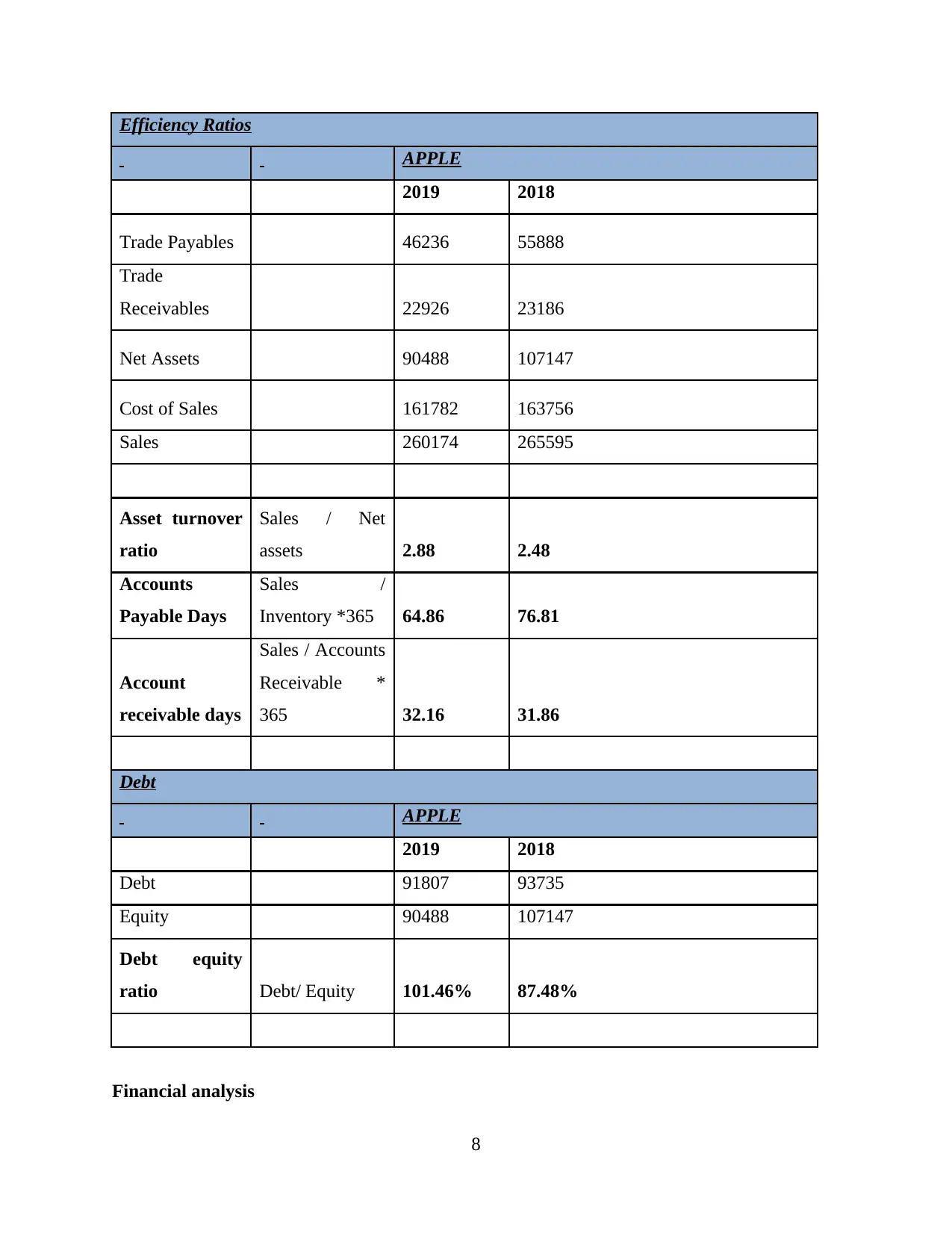

Efficiency Ratios

APPLE

2019 2018

Trade Payables 46236 55888

Trade

Receivables 22926 23186

Net Assets 90488 107147

Cost of Sales 161782 163756

Sales 260174 265595

Asset turnover

ratio

Sales / Net

assets 2.88 2.48

Accounts

Payable Days

Sales /

Inventory *365 64.86 76.81

Account

receivable days

Sales / Accounts

Receivable *

365 32.16 31.86

Debt

APPLE

2019 2018

Debt 91807 93735

Equity 90488 107147

Debt equity

ratio Debt/ Equity 101.46% 87.48%

Financial analysis

8

APPLE

2019 2018

Trade Payables 46236 55888

Trade

Receivables 22926 23186

Net Assets 90488 107147

Cost of Sales 161782 163756

Sales 260174 265595

Asset turnover

ratio

Sales / Net

assets 2.88 2.48

Accounts

Payable Days

Sales /

Inventory *365 64.86 76.81

Account

receivable days

Sales / Accounts

Receivable *

365 32.16 31.86

Debt

APPLE

2019 2018

Debt 91807 93735

Equity 90488 107147

Debt equity

ratio Debt/ Equity 101.46% 87.48%

Financial analysis

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The Financial statements of the company provide number of information that is essential

for the business enterprise. Ratio analysis is a tool used by organisation to assess the financial

performance and position of the enterprise. It is required for assesssing the efficiency of the

management in running the business operations.

Liquidity

Current ratio of the company measures the liquidity position of company. Current ratio is

1.54 that is adequate as per the industry average. It could be assessed that company is having

enough assets for meeting the short term financial obligations of the enterprise (Martin, 2016). It

invests the funds of the company in short term investment for generating adequate return over

short period.

Quick ratio is used for identifying liquidity excluding inventory from the current assets.

Quick ratio is 1.50 that has improved from the last year. Company is required to further pay

attention for strengthening the liquidity position.

Profitability

Return on capital employed is 23.74 with constant rate. It reflects that management is

effectively utilising the resources of the entity for generating returns (Chandra, 2017). Strategies

are framed by the business to ensure that the departments are provided with the resources where

they could be best utilised adding to the business of company.

Return on Equity measures the return earned by the equity investors over their equity

investments in company. It is having ROE of 61.06% with further increase from last year. This

shows the shareholders are getting significant returns over their investments.

Gross profit margin measures how efficiently the cost of sales are being managed by the

enterprise for earning returns. Gross profit of company is 37.82%. It is earning adequate gross

margin by keeping strong control over the cost of sales.

Net profit margin is 21.24% with slight decrease from last year. This requires the

company to have adequate returns over the revenues generated by company. Companies with

higher profits attract various opportunities for the business (Yermack, 2017). It also helps

company in increasing the return of shareholders maximising their wealth increasing the growth

prospects.

Efficiency

9

for the business enterprise. Ratio analysis is a tool used by organisation to assess the financial

performance and position of the enterprise. It is required for assesssing the efficiency of the

management in running the business operations.

Liquidity

Current ratio of the company measures the liquidity position of company. Current ratio is

1.54 that is adequate as per the industry average. It could be assessed that company is having

enough assets for meeting the short term financial obligations of the enterprise (Martin, 2016). It

invests the funds of the company in short term investment for generating adequate return over

short period.

Quick ratio is used for identifying liquidity excluding inventory from the current assets.

Quick ratio is 1.50 that has improved from the last year. Company is required to further pay

attention for strengthening the liquidity position.

Profitability

Return on capital employed is 23.74 with constant rate. It reflects that management is

effectively utilising the resources of the entity for generating returns (Chandra, 2017). Strategies

are framed by the business to ensure that the departments are provided with the resources where

they could be best utilised adding to the business of company.

Return on Equity measures the return earned by the equity investors over their equity

investments in company. It is having ROE of 61.06% with further increase from last year. This

shows the shareholders are getting significant returns over their investments.

Gross profit margin measures how efficiently the cost of sales are being managed by the

enterprise for earning returns. Gross profit of company is 37.82%. It is earning adequate gross

margin by keeping strong control over the cost of sales.

Net profit margin is 21.24% with slight decrease from last year. This requires the

company to have adequate returns over the revenues generated by company. Companies with

higher profits attract various opportunities for the business (Yermack, 2017). It also helps

company in increasing the return of shareholders maximising their wealth increasing the growth

prospects.

Efficiency

9

Efficiency of the company could be judged by the different turnover ratio. It reflects how

efficiently management is performing their role for increasing the growth of the business. Asset

turnover of the company is 2.88 that is remarkable. The turnover shows the efficiency of

management in generating sales over the assets.

Accounts payable days are 65 that have decreased from last year. Account receivable

days are 32. This shows that company is effectively managing the cash cycle of the business. this

will enable the company in meeting its cash requirements without interruptions.

Solvency

Debt equity ratio shows that company uses equal proportion of debt and equity in

maintaining its capital structure. Debts are equivalent to the equity that reflects that business is

having high financial risks (Mao and et.al., 2017). There should be optimum mix of capital

where the cost of capital is least for the company.

2. Three investment appraisal techniques

Payback period technique is the technique which generally used to help the investor in

getting the idea about the period of the time it will be take to get the good return out of the

investment which has been made in the organization. In this method cash flow are generally

computed by dividing the cost of the investment by the annual investment by net cash flow.

Biggest advantage of payback period is that this method is straight forward and very easy to

apply in the organization. On the other end it has been find out that this method does not used to

consider time value of money into the consideration (Garcia and et.al., 2016).

Internal rate of return is another type of investment appraisal technique which is used in the

organization to find out the estimates profitability of the different investment made. This is a

type of internal rate of return which is discount that make the different cash flow from a project

equal to the Zero. In this formula sum all the discounted cash flows is offset by the initial

investment and equal to NPV. This method generally used to consider the time value which is

not consider by the Payback period in the organization. At the same time this method in the

organization used to ignores the future cost which will be invested in the organization, also it

used to ignores size of project.

Accounting rate of return, that is also called as Average rate of return, which is used in the

capital budgeting in the organization. ARR generally used to calculate the return generated from

10

efficiently management is performing their role for increasing the growth of the business. Asset

turnover of the company is 2.88 that is remarkable. The turnover shows the efficiency of

management in generating sales over the assets.

Accounts payable days are 65 that have decreased from last year. Account receivable

days are 32. This shows that company is effectively managing the cash cycle of the business. this

will enable the company in meeting its cash requirements without interruptions.

Solvency

Debt equity ratio shows that company uses equal proportion of debt and equity in

maintaining its capital structure. Debts are equivalent to the equity that reflects that business is

having high financial risks (Mao and et.al., 2017). There should be optimum mix of capital

where the cost of capital is least for the company.

2. Three investment appraisal techniques

Payback period technique is the technique which generally used to help the investor in

getting the idea about the period of the time it will be take to get the good return out of the

investment which has been made in the organization. In this method cash flow are generally

computed by dividing the cost of the investment by the annual investment by net cash flow.

Biggest advantage of payback period is that this method is straight forward and very easy to

apply in the organization. On the other end it has been find out that this method does not used to

consider time value of money into the consideration (Garcia and et.al., 2016).

Internal rate of return is another type of investment appraisal technique which is used in the

organization to find out the estimates profitability of the different investment made. This is a

type of internal rate of return which is discount that make the different cash flow from a project

equal to the Zero. In this formula sum all the discounted cash flows is offset by the initial

investment and equal to NPV. This method generally used to consider the time value which is

not consider by the Payback period in the organization. At the same time this method in the

organization used to ignores the future cost which will be invested in the organization, also it

used to ignores size of project.

Accounting rate of return, that is also called as Average rate of return, which is used in the

capital budgeting in the organization. ARR generally used to calculate the return generated from

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.