A Report on Managing Financial Resources in Residential Care Homes

VerifiedAdded on 2019/12/17

|23

|7341

|160

Report

AI Summary

This report provides a comprehensive analysis of financial resource management within the context of residential care homes. It begins by explaining the principles and business control systems crucial for effective financial management, including cost-benefit analysis, double-entry principles, and procurement processes. The report identifies key information needed for successful financial resource management, such as direct and indirect costs, variable and fixed costs, and the importance of short-term and long-term goals. It further outlines regulatory requirements, including tax compliance and maintaining accurate accounting records. The report evaluates the advantages and disadvantages of computer software solutions, such as Open Accounts, Cool Care, and CareSys, for managing financial resources, while also discussing the role of internal and external auditing. The analysis extends to different sources of income, factors affecting financial resource availability, and the application of various budgeting methods. The report also includes a cash budget forecast, explores fraud detection, and evaluates methods for budget monitoring and control. Furthermore, it examines the relationship between services, costs, and expenditures, and makes recommendations to improve service delivery based on financial considerations.

MANAGING FINANCIAL

RESOURCES

RESOURCES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Explanation of the principles and business control systems in a residential care............1

1.2 Identification of information for successfully manage financial resources......................3

1.3 Explanation of regulatory requirement for managing financial resources.......................3

1.4 Evaluation of computer software for manage financial resources...................................4

TASK 2............................................................................................................................................7

2.1 Discussing different sources of income for new care home.............................................7

2.2 Factors affects to availability of financial resources........................................................7

2.3 Different types of budget which are applicable to residential care..................................8

2.4 Evaluation of decisions regarding expenditure for residential home.............................11

TASK 3..........................................................................................................................................11

3.1 Cash budget for next three months and financial shortfalls...........................................11

3.2 Explanation in case of suspected fraud..........................................................................13

3.3 Suggestion and evaluation of methods for monitor and control budget.........................14

TASK 4..........................................................................................................................................14

4.1 Identifying information for purpose of decision making in order to offer level of services

..............................................................................................................................................14

4.2 Analysis of relationship among services, costs and expenditures..................................15

4.3 Evaluation of impact on individuals of financial considerations...................................16

4.4 Recommendations which are helpful to improve services.............................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Explanation of the principles and business control systems in a residential care............1

1.2 Identification of information for successfully manage financial resources......................3

1.3 Explanation of regulatory requirement for managing financial resources.......................3

1.4 Evaluation of computer software for manage financial resources...................................4

TASK 2............................................................................................................................................7

2.1 Discussing different sources of income for new care home.............................................7

2.2 Factors affects to availability of financial resources........................................................7

2.3 Different types of budget which are applicable to residential care..................................8

2.4 Evaluation of decisions regarding expenditure for residential home.............................11

TASK 3..........................................................................................................................................11

3.1 Cash budget for next three months and financial shortfalls...........................................11

3.2 Explanation in case of suspected fraud..........................................................................13

3.3 Suggestion and evaluation of methods for monitor and control budget.........................14

TASK 4..........................................................................................................................................14

4.1 Identifying information for purpose of decision making in order to offer level of services

..............................................................................................................................................14

4.2 Analysis of relationship among services, costs and expenditures..................................15

4.3 Evaluation of impact on individuals of financial considerations...................................16

4.4 Recommendations which are helpful to improve services.............................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION

Resources are an integral part of an enterprise without this a business cannot run in a

market. It is necessary to manage financial and accounting informations in order to derive

financial performance of the business. The present case is related to health and social care sector

where various principles and systems are described to effectively manage its financial resources.

The report focuses on the role of planning, various sources of income as well as various factors

influence the financial resources in a positive and negative manner. It describes about budgeting

and expenditures in terms of its importance in the health and social care business. The present

report indicates several types of financial systems as well as various processes which help the

management to manage the financial resources.

TASK 1

1.1 Explanation of the principles and business control systems in a residential care

For each and every element, various principles and control systems are there to manage

the business effectively. In order to this, costing also has several principles to manage financial

resources which are given as below: Cause effect relationship: In a business every cost is related with particular reason and

incurred to produce goods and services. (Swayne, Duncan and Ginter, 2012). According

to the principle cost must be passes from a function of organisation, if not then it will not

consider as a total cost of services. Cost is charged after its incurrence: A cost which is not incurred in production process,

will not be charged from the customers. For example: in company wastage are born by

the production process which is normal loss for the firm but it is not considered in total

cost of production. Double entry principle: Every financial transaction had a double entry system which

helps the management in reducing error at the time of preparing cost sheet. The system is

important for preparing proper and correct cost sheet where all the costs are controlled by

managers.

Past cost should not include in future cost: As per the principle, past costs of the

company are not to be included in the future cost (Conway, 2013). If firm will include

past cost in the future then it will lead to increase cost and price of products and services.

1

Resources are an integral part of an enterprise without this a business cannot run in a

market. It is necessary to manage financial and accounting informations in order to derive

financial performance of the business. The present case is related to health and social care sector

where various principles and systems are described to effectively manage its financial resources.

The report focuses on the role of planning, various sources of income as well as various factors

influence the financial resources in a positive and negative manner. It describes about budgeting

and expenditures in terms of its importance in the health and social care business. The present

report indicates several types of financial systems as well as various processes which help the

management to manage the financial resources.

TASK 1

1.1 Explanation of the principles and business control systems in a residential care

For each and every element, various principles and control systems are there to manage

the business effectively. In order to this, costing also has several principles to manage financial

resources which are given as below: Cause effect relationship: In a business every cost is related with particular reason and

incurred to produce goods and services. (Swayne, Duncan and Ginter, 2012). According

to the principle cost must be passes from a function of organisation, if not then it will not

consider as a total cost of services. Cost is charged after its incurrence: A cost which is not incurred in production process,

will not be charged from the customers. For example: in company wastage are born by

the production process which is normal loss for the firm but it is not considered in total

cost of production. Double entry principle: Every financial transaction had a double entry system which

helps the management in reducing error at the time of preparing cost sheet. The system is

important for preparing proper and correct cost sheet where all the costs are controlled by

managers.

Past cost should not include in future cost: As per the principle, past costs of the

company are not to be included in the future cost (Conway, 2013). If firm will include

past cost in the future then it will lead to increase cost and price of products and services.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

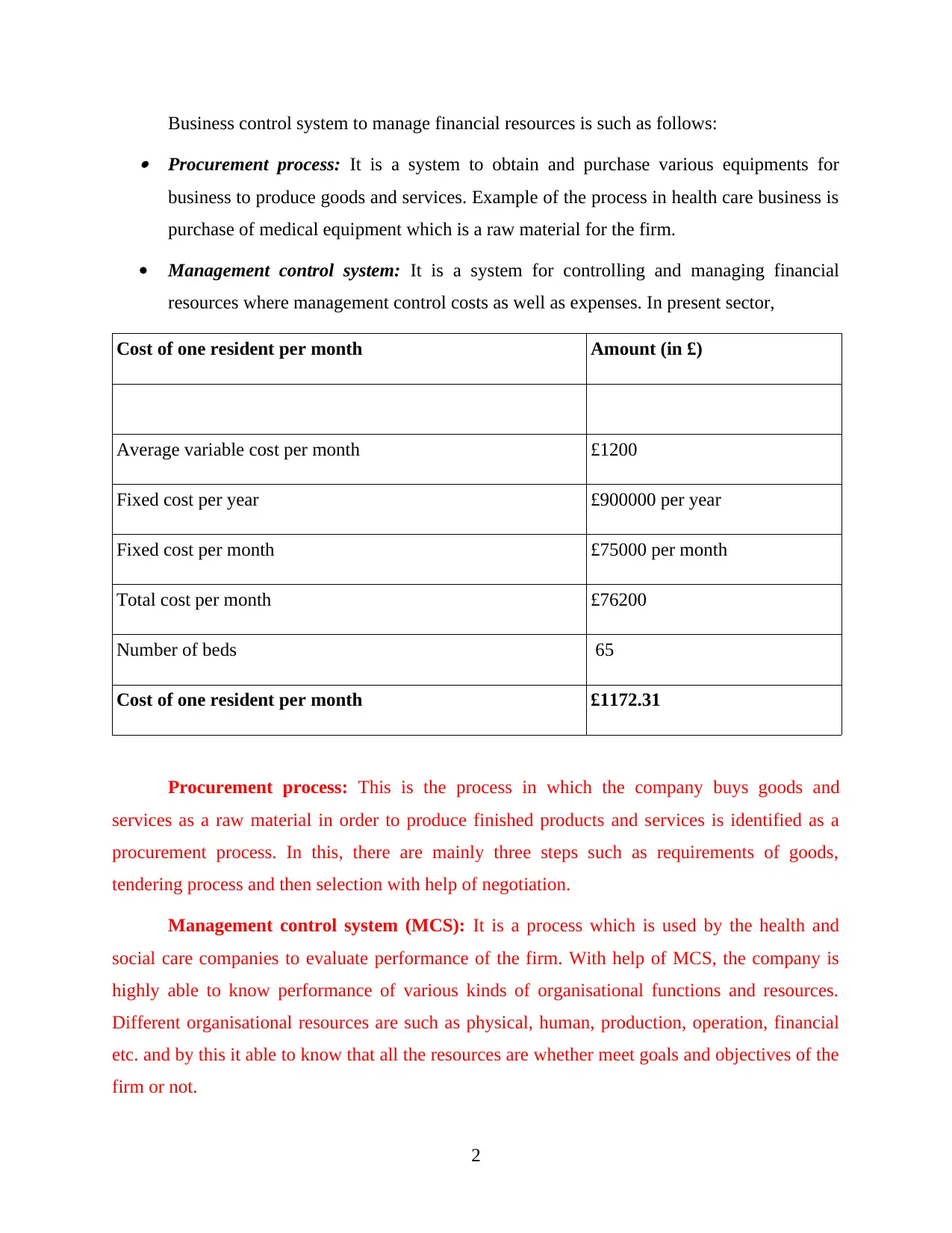

Business control system to manage financial resources is such as follows: Procurement process: It is a system to obtain and purchase various equipments for

business to produce goods and services. Example of the process in health care business is

purchase of medical equipment which is a raw material for the firm.

Management control system: It is a system for controlling and managing financial

resources where management control costs as well as expenses. In present sector,

Cost of one resident per month Amount (in £)

Average variable cost per month £1200

Fixed cost per year £900000 per year

Fixed cost per month £75000 per month

Total cost per month £76200

Number of beds 65

Cost of one resident per month £1172.31

Procurement process: This is the process in which the company buys goods and

services as a raw material in order to produce finished products and services is identified as a

procurement process. In this, there are mainly three steps such as requirements of goods,

tendering process and then selection with help of negotiation.

Management control system (MCS): It is a process which is used by the health and

social care companies to evaluate performance of the firm. With help of MCS, the company is

highly able to know performance of various kinds of organisational functions and resources.

Different organisational resources are such as physical, human, production, operation, financial

etc. and by this it able to know that all the resources are whether meet goals and objectives of the

firm or not.

2

business to produce goods and services. Example of the process in health care business is

purchase of medical equipment which is a raw material for the firm.

Management control system: It is a system for controlling and managing financial

resources where management control costs as well as expenses. In present sector,

Cost of one resident per month Amount (in £)

Average variable cost per month £1200

Fixed cost per year £900000 per year

Fixed cost per month £75000 per month

Total cost per month £76200

Number of beds 65

Cost of one resident per month £1172.31

Procurement process: This is the process in which the company buys goods and

services as a raw material in order to produce finished products and services is identified as a

procurement process. In this, there are mainly three steps such as requirements of goods,

tendering process and then selection with help of negotiation.

Management control system (MCS): It is a process which is used by the health and

social care companies to evaluate performance of the firm. With help of MCS, the company is

highly able to know performance of various kinds of organisational functions and resources.

Different organisational resources are such as physical, human, production, operation, financial

etc. and by this it able to know that all the resources are whether meet goals and objectives of the

firm or not.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.2 Identification of information for successfully manage financial resources

The management need various information to control and manage financial resources

which lead to increase profitability of the firm (Farmer and et.al., 2012). In healthcare business,

various needed information are such as below: Direct costs: Costs which are directly incurred in the production process are known as a

direct cost. In the healthcare business, examples of direct costs are purchase of

equipments, labour costs, laboratory testing etc. Indirect costs: A cost which not directly incurred in production process or to produce

goods and services known as a indirect cost. . For example: rent of building, loss of

productivity, administrative costs, depreciation on equipments etc. Variable costs: Variable costs are those which fluctuate with production volume in the

business. For example: therapeutic suppliers, wages to kitchen staff etc.

Fixed costs: The costs are not varied with the output level are known as the fixed costs.

Example of fixed cost in health and social care firm are such as salaries, maintenance

expenses, utilities etc (Lee and Lam, 2012).

Short term goals are those which are framed to achieve within short period while long

term goals are achieved in long time or once in a business. Long term goals of the firm are

achieved with help of short term goal in a health care business. . Hence, with help of short term

goal, company is able to attain long term goal of business.

1.3 Explanation of regulatory requirement for managing financial resources

To manage financial resources, there are various regulatory requirements for managers.

The regulatory requirements are given as below: Meet tax deadlines: When management fulfils its tax obligation and before deadline then

it is able to manage finance very properly and effectively. Keep up-to-date accounting records: Recording all accounting and financial transactions

on daily basis by which financial resources can be management effectively (Ledgerwood,

Earne and Nelson, 2013). In health and social care business, daily transactions are such as

medicines, patients admitted, drugs etc. are examples of day to day accounting records.

3

The management need various information to control and manage financial resources

which lead to increase profitability of the firm (Farmer and et.al., 2012). In healthcare business,

various needed information are such as below: Direct costs: Costs which are directly incurred in the production process are known as a

direct cost. In the healthcare business, examples of direct costs are purchase of

equipments, labour costs, laboratory testing etc. Indirect costs: A cost which not directly incurred in production process or to produce

goods and services known as a indirect cost. . For example: rent of building, loss of

productivity, administrative costs, depreciation on equipments etc. Variable costs: Variable costs are those which fluctuate with production volume in the

business. For example: therapeutic suppliers, wages to kitchen staff etc.

Fixed costs: The costs are not varied with the output level are known as the fixed costs.

Example of fixed cost in health and social care firm are such as salaries, maintenance

expenses, utilities etc (Lee and Lam, 2012).

Short term goals are those which are framed to achieve within short period while long

term goals are achieved in long time or once in a business. Long term goals of the firm are

achieved with help of short term goal in a health care business. . Hence, with help of short term

goal, company is able to attain long term goal of business.

1.3 Explanation of regulatory requirement for managing financial resources

To manage financial resources, there are various regulatory requirements for managers.

The regulatory requirements are given as below: Meet tax deadlines: When management fulfils its tax obligation and before deadline then

it is able to manage finance very properly and effectively. Keep up-to-date accounting records: Recording all accounting and financial transactions

on daily basis by which financial resources can be management effectively (Ledgerwood,

Earne and Nelson, 2013). In health and social care business, daily transactions are such as

medicines, patients admitted, drugs etc. are examples of day to day accounting records.

3

Day-to-day costs: Cost is sensitive factor of a business and company need to analyze day

to day costs which help to manage resources efficiently. It is key requirement of the

management to analyze and evaluate total costs by which financial resources are

managed. Develop a system of risk management: To manage financial resources, the firm have to

develop proper and effective system to manage risks. Adopt fair pricing policy: Fair prices of products and services are help to increase more

number of consumers by which financial resources will enhance. (Lodha, 2016). The

company's financial performance will increase which will enhance the financial

resources. Hence, company have to adopt fair policies of pricing by which financial

resources can be managed in an effective manner.

Internal Auditing: Internal auditing is done at the company level where day-to-day transactions

are evaluated. All the rules and regulations of internal audit are set out by the organisations and

for that company are required to pay cost. Main purpose to conduct the audit is to analyse,

evaluate and improve risk management of the company which can enhance performance level.

External Auditing: External auditing is conducted by the external party that is government and it

is done on an annual basis. The auditing system is conducted for the purpose of statutory. . As

per the auditing, all the rules and regulation of government required to be followed by the

organisation (Caplan, 2014).

1.4 Evaluation of computer software for manage financial resources

Computer software plays a significant role to run the company smoothly and manage the

business effectively. To manage financial resources, there are various software such as

management control system, enterprise resources planning etc. The management is able to

enhance financial performance by managing resources in an effective manner with help of the

software. Various advantages and drawbacks of computer software as given as below:

Advantages:

Computer software are helpful to record daily financial transactions in a simple way.

It is helpful to prepare proper plan to run business smoothly.

4

to day costs which help to manage resources efficiently. It is key requirement of the

management to analyze and evaluate total costs by which financial resources are

managed. Develop a system of risk management: To manage financial resources, the firm have to

develop proper and effective system to manage risks. Adopt fair pricing policy: Fair prices of products and services are help to increase more

number of consumers by which financial resources will enhance. (Lodha, 2016). The

company's financial performance will increase which will enhance the financial

resources. Hence, company have to adopt fair policies of pricing by which financial

resources can be managed in an effective manner.

Internal Auditing: Internal auditing is done at the company level where day-to-day transactions

are evaluated. All the rules and regulations of internal audit are set out by the organisations and

for that company are required to pay cost. Main purpose to conduct the audit is to analyse,

evaluate and improve risk management of the company which can enhance performance level.

External Auditing: External auditing is conducted by the external party that is government and it

is done on an annual basis. The auditing system is conducted for the purpose of statutory. . As

per the auditing, all the rules and regulation of government required to be followed by the

organisation (Caplan, 2014).

1.4 Evaluation of computer software for manage financial resources

Computer software plays a significant role to run the company smoothly and manage the

business effectively. To manage financial resources, there are various software such as

management control system, enterprise resources planning etc. The management is able to

enhance financial performance by managing resources in an effective manner with help of the

software. Various advantages and drawbacks of computer software as given as below:

Advantages:

Computer software are helpful to record daily financial transactions in a simple way.

It is helpful to prepare proper plan to run business smoothly.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

When calculation is done from software then it will reduce errors which have occurred

historically in the business.

Financial statements and reports are prepared very properly by software which helps in

managing financial resources.

It helps to make payments efficiently in the business.

With software manual processing is reduced and all the transactions and data are

automatically recorded in the statements.

Disadvantages:

Main drawback of using software is that, it increases cost because paper based system

incur fewer costs in comparison to the software system.

Another drawback is that, management fear of losing data due to hacking system and

computer viruses.

Fraud can occur in business if the company is not able to secure software which they are

using for managing financial resources.

Conclusion: It can be concluded that software are helpful to the managers for preparing financial

accounts as well as for keeping record of the business transactions. But on the other hand, cost

will increase as well as data can be disclosed and hacked.

Open Accounts: It is a one type of open software in which the management is able to record all

the transactions in a proper manner at the free of cost. By this, the firm is highly able to know

financially performance of the company.

Advantages:

It is created as well prepared by the highly skilled and talented people or engineers.

The software is cheaper in comparison to other accounting softwares. It helps to the firm for become more flexible and reliable for the management.

Disadvantages:

The open account software does not provide extensive report to the management.

It is not user friendly software.

5

historically in the business.

Financial statements and reports are prepared very properly by software which helps in

managing financial resources.

It helps to make payments efficiently in the business.

With software manual processing is reduced and all the transactions and data are

automatically recorded in the statements.

Disadvantages:

Main drawback of using software is that, it increases cost because paper based system

incur fewer costs in comparison to the software system.

Another drawback is that, management fear of losing data due to hacking system and

computer viruses.

Fraud can occur in business if the company is not able to secure software which they are

using for managing financial resources.

Conclusion: It can be concluded that software are helpful to the managers for preparing financial

accounts as well as for keeping record of the business transactions. But on the other hand, cost

will increase as well as data can be disclosed and hacked.

Open Accounts: It is a one type of open software in which the management is able to record all

the transactions in a proper manner at the free of cost. By this, the firm is highly able to know

financially performance of the company.

Advantages:

It is created as well prepared by the highly skilled and talented people or engineers.

The software is cheaper in comparison to other accounting softwares. It helps to the firm for become more flexible and reliable for the management.

Disadvantages:

The open account software does not provide extensive report to the management.

It is not user friendly software.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In such software, there are no commercial versions.

Cool care: It is also one of the most used software by the new care home which helps to manage

accounts and financial resource in a proper way.

Advantages:

Helps the new care home to manage financial resource.

By this, it is able to allocate financial resource in an adequate manner to the every

organisational functions and activities. Along with this, it is beneficial for the firm to control the extra expenses.

Disadvantages:

It takes higher cost by which profitability affects in a negative manner.

Required talented person who has knowledge about respective software and can run it

easily.

CareSys: The software i.e. CareSys is the complete and highly effective technology for the

health and care services firms. In this, the company is able to apply all the systems for operating

the firm in smooth way. The software includes various models and gives information about time

and attendance, finance, HR, Payroll of employees, income and expenses, care scheduling,

maintaining equipments in a proper manner etc.

Advantages:

It provides proper and reliable information of each and every sector of the care home.

It is cost effective software by which the firm do not bear extra expenditures.

It helps in growth of the firm and interacts with various databases.

Disadvantages:

Highly skilled and technical employees is required who takes higher wages and salaries.

Further, management are afraid from losing data if hacking system is used by the hacker.

6

Cool care: It is also one of the most used software by the new care home which helps to manage

accounts and financial resource in a proper way.

Advantages:

Helps the new care home to manage financial resource.

By this, it is able to allocate financial resource in an adequate manner to the every

organisational functions and activities. Along with this, it is beneficial for the firm to control the extra expenses.

Disadvantages:

It takes higher cost by which profitability affects in a negative manner.

Required talented person who has knowledge about respective software and can run it

easily.

CareSys: The software i.e. CareSys is the complete and highly effective technology for the

health and care services firms. In this, the company is able to apply all the systems for operating

the firm in smooth way. The software includes various models and gives information about time

and attendance, finance, HR, Payroll of employees, income and expenses, care scheduling,

maintaining equipments in a proper manner etc.

Advantages:

It provides proper and reliable information of each and every sector of the care home.

It is cost effective software by which the firm do not bear extra expenditures.

It helps in growth of the firm and interacts with various databases.

Disadvantages:

Highly skilled and technical employees is required who takes higher wages and salaries.

Further, management are afraid from losing data if hacking system is used by the hacker.

6

TASK 2

2.1 Discussing different sources of income for new care home

In every business, income is a compulsory part which is earned by several sources.

Different income sources are as below: Public: Income is generated by public sources in health and social care organisations. It

includes sources such as government, commercial banks, financial institutions etc. Voluntary: Other sources of income are voluntary where various charitable trusts, angel

investors etc. are involved (Borgelt, Anderson and Illes, 2013).

Private: Private sources of income are helps to new care home in order to raise capital.

The sources are such as organisations operating on large scale, private banks etc.

Sales: the main and key source of income for the new care home is selling of the services

offered to the customers. Further, by selling the care services the company is able to

generate sales and revenue of income in the company.

Capital gains: The company is able to earn income from capital which is gain in its

business. The new care home can use the profit and capital which is gain in the business

process is to be utilized for investment which provides return that is income for the firm.

Investment: As per the source the management or new care home make an investment in

different available avenues. The investment lead to provide profit and return which is one

type of income for it.

Royalties: Another source of income is royalty which is earned by the company in order

to provide creative, innovative as well as differentiate services compare to its rivalry

firms. Hence, it is also the best source of income.

2.2 Factors affects to availability of financial resources

In a health and social care home there are various factors which influence to the

availability financial resources. The several factors are given as below: Government funding: It is a financial resource which help to non government agencies

and companies in terms of funding. It helps to the business in order to raise fund as well

as it influence to financial resources in positive manner. In order to this a fiscal policy is

to be used by government where taxation and various rules and regulations are settled by

7

2.1 Discussing different sources of income for new care home

In every business, income is a compulsory part which is earned by several sources.

Different income sources are as below: Public: Income is generated by public sources in health and social care organisations. It

includes sources such as government, commercial banks, financial institutions etc. Voluntary: Other sources of income are voluntary where various charitable trusts, angel

investors etc. are involved (Borgelt, Anderson and Illes, 2013).

Private: Private sources of income are helps to new care home in order to raise capital.

The sources are such as organisations operating on large scale, private banks etc.

Sales: the main and key source of income for the new care home is selling of the services

offered to the customers. Further, by selling the care services the company is able to

generate sales and revenue of income in the company.

Capital gains: The company is able to earn income from capital which is gain in its

business. The new care home can use the profit and capital which is gain in the business

process is to be utilized for investment which provides return that is income for the firm.

Investment: As per the source the management or new care home make an investment in

different available avenues. The investment lead to provide profit and return which is one

type of income for it.

Royalties: Another source of income is royalty which is earned by the company in order

to provide creative, innovative as well as differentiate services compare to its rivalry

firms. Hence, it is also the best source of income.

2.2 Factors affects to availability of financial resources

In a health and social care home there are various factors which influence to the

availability financial resources. The several factors are given as below: Government funding: It is a financial resource which help to non government agencies

and companies in terms of funding. It helps to the business in order to raise fund as well

as it influence to financial resources in positive manner. In order to this a fiscal policy is

to be used by government where taxation and various rules and regulations are settled by

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

government. It provides fund to the respective firms which lead to increase capital

investment and revenue as well as company able to provide more number of facilities to

the consumers. Priority of the project: As per the factor company or government give priority to a

project which is the most important (Mistarihi, Hutchings and Shacklock, 2013). When

finance will be allocate to that particular project then overall financial resources are

influenced. For example, in health care sector there are two projects such as replacement

of new medical equipment and another is renovation of building. Here first project is

important so fund will be allocate to this which lead to affect finance for another project. Private funding: It is not necessary that all the health and social care enterprises are

raising funding through only government, instead of this company raise fund from

several private sources as well. It influences to availability of finance in the business in a

positive manner and helps to entity for capital investment. Examples of private funding

are such as New Wave Ventures company, Aberdeen private equity fund limited etc.

Social deprivation index: Deprivation means area which are not developed and

government has to give fund for develop that area which influence to financial resources

of social companies (MacDonald, 2012). It impacts to health care business in negative

term because fund which has to allocate firms, is given to undeveloped geographical

areas. Hence, the financial resources are greatly affected by social deprivation index.

Most deprived areas of the UK are such as Oldham, Walsall, West Bromwich, Liverpool,

Middlesbrough etc.

2.3 Different types of budget which are applicable to residential care

In financial term there are different types of budget which helpful to management in

order to forecast income and expenses for upcoming years. Various budgets are such as below: Cost centre: It is a type of responsibility centre in a business which plays a significant

role to analyse costs of production. Manager of the cost centre is responsible for different

types of cost incurred in an organisation to produce goods and services. In a budget cost

and expenditures are included and prepared on the basis of past financial data in

residential care firm (Simmons and de Jonge Oudraat, 2012). The manager is not

responsible for revenue generated by firm as well as using assets to generate sales. From

8

investment and revenue as well as company able to provide more number of facilities to

the consumers. Priority of the project: As per the factor company or government give priority to a

project which is the most important (Mistarihi, Hutchings and Shacklock, 2013). When

finance will be allocate to that particular project then overall financial resources are

influenced. For example, in health care sector there are two projects such as replacement

of new medical equipment and another is renovation of building. Here first project is

important so fund will be allocate to this which lead to affect finance for another project. Private funding: It is not necessary that all the health and social care enterprises are

raising funding through only government, instead of this company raise fund from

several private sources as well. It influences to availability of finance in the business in a

positive manner and helps to entity for capital investment. Examples of private funding

are such as New Wave Ventures company, Aberdeen private equity fund limited etc.

Social deprivation index: Deprivation means area which are not developed and

government has to give fund for develop that area which influence to financial resources

of social companies (MacDonald, 2012). It impacts to health care business in negative

term because fund which has to allocate firms, is given to undeveloped geographical

areas. Hence, the financial resources are greatly affected by social deprivation index.

Most deprived areas of the UK are such as Oldham, Walsall, West Bromwich, Liverpool,

Middlesbrough etc.

2.3 Different types of budget which are applicable to residential care

In financial term there are different types of budget which helpful to management in

order to forecast income and expenses for upcoming years. Various budgets are such as below: Cost centre: It is a type of responsibility centre in a business which plays a significant

role to analyse costs of production. Manager of the cost centre is responsible for different

types of cost incurred in an organisation to produce goods and services. In a budget cost

and expenditures are included and prepared on the basis of past financial data in

residential care firm (Simmons and de Jonge Oudraat, 2012). The manager is not

responsible for revenue generated by firm as well as using assets to generate sales. From

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the responsibility centre budget data and actual data both are compared and analysed that

whether firm is performing well in the industry or not. Both profit and cost centre are

interrelated in business which are responsible for cost and profit, incurred and generated

by management respectively. Examples of cost centre are such as research and

development costs, accounting department, IT department etc.

Advantages:

The cost centre helps the new care home to derive total cost of production and services

process in proper manner.

With help of cost centre price is decided of products and services and helpful for profit

centre. Helps to improve management and control over the costs and expenditures.

Disadvantages:

Lead to enhance paperwork as well as burden on the administration department. By this the company is unable to allocate financial resources and overheads effectively. Project management: It is a process of planning, organizing, controlling as well as

closing the work to achieve particular goal and objective of the business. It is very

important tool in order to prepare and analyse budget by which health care organisation

can know financial position for upcoming year. It has majorly three elements which are

given as below:

Advantages:

It helps the new care home services to make effective plan for completion of project as

well as particular objective.

By the project management, the company is able to reduce total time duration for

complete the project.

Firm able to deliver services in more effective manner. Helps to increase satisfaction level of consumers.

Disadvantages:

9

whether firm is performing well in the industry or not. Both profit and cost centre are

interrelated in business which are responsible for cost and profit, incurred and generated

by management respectively. Examples of cost centre are such as research and

development costs, accounting department, IT department etc.

Advantages:

The cost centre helps the new care home to derive total cost of production and services

process in proper manner.

With help of cost centre price is decided of products and services and helpful for profit

centre. Helps to improve management and control over the costs and expenditures.

Disadvantages:

Lead to enhance paperwork as well as burden on the administration department. By this the company is unable to allocate financial resources and overheads effectively. Project management: It is a process of planning, organizing, controlling as well as

closing the work to achieve particular goal and objective of the business. It is very

important tool in order to prepare and analyse budget by which health care organisation

can know financial position for upcoming year. It has majorly three elements which are

given as below:

Advantages:

It helps the new care home services to make effective plan for completion of project as

well as particular objective.

By the project management, the company is able to reduce total time duration for

complete the project.

Firm able to deliver services in more effective manner. Helps to increase satisfaction level of consumers.

Disadvantages:

9

Cost is to be increase which is unable to afford by some companies.

Highly talented and skilled employee are required who have specialization in project

management.

The base cost estimate: The element is related to various costs which are incurred to produce

goods and services (Bahn, 2015). In order to this component there are basic four types of costs

such as direct cost, indirect cost, variable cost and fixed cost.

Contingency: Another component of project management is contingency where some amount of

money is kept as reserve to respond risks and uncertainty occurred in business. Risks as well as

uncertainty are can be occurred or possible but unable to predict for particular risk.

Management reserve: It is sum of an amount which keep aside in business for purpose of

control the management.

Outsourcing: It is process in which the company takes help of external sources or

companies to complete the tasks. It transfers the tasks and works to another party rather than

doing such task on internal basis.

Advantages:

It helps the firm in order to reduce cost of production.

Helpful for complete tasks in an appropriate manner. By outsourcing firm able to take help of expertise and experiences employees.

Disadvantages:

Hidden costs are to be incurred which beard by the firm.

Problems occur in terms of quality.

Control over the management is diluted with external party.

2.4 Evaluation of decisions regarding expenditure for residential home

As per the view of Patterson, Grenny, McMillan and Switzler to make decisions related

to various expenditure there are some common ways, which are enumerated below: Command: It is a style of decision making related to expenditure in a business of health

and social care. In this the decisions are taken by the top manager of firm and not involve

10

Highly talented and skilled employee are required who have specialization in project

management.

The base cost estimate: The element is related to various costs which are incurred to produce

goods and services (Bahn, 2015). In order to this component there are basic four types of costs

such as direct cost, indirect cost, variable cost and fixed cost.

Contingency: Another component of project management is contingency where some amount of

money is kept as reserve to respond risks and uncertainty occurred in business. Risks as well as

uncertainty are can be occurred or possible but unable to predict for particular risk.

Management reserve: It is sum of an amount which keep aside in business for purpose of

control the management.

Outsourcing: It is process in which the company takes help of external sources or

companies to complete the tasks. It transfers the tasks and works to another party rather than

doing such task on internal basis.

Advantages:

It helps the firm in order to reduce cost of production.

Helpful for complete tasks in an appropriate manner. By outsourcing firm able to take help of expertise and experiences employees.

Disadvantages:

Hidden costs are to be incurred which beard by the firm.

Problems occur in terms of quality.

Control over the management is diluted with external party.

2.4 Evaluation of decisions regarding expenditure for residential home

As per the view of Patterson, Grenny, McMillan and Switzler to make decisions related

to various expenditure there are some common ways, which are enumerated below: Command: It is a style of decision making related to expenditure in a business of health

and social care. In this the decisions are taken by the top manager of firm and not involve

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.