Financial Management Assignment: Investment and Risk Analysis

VerifiedAdded on 2023/01/18

|10

|859

|72

Homework Assignment

AI Summary

This document presents a comprehensive solution to a financial management assignment, addressing several key areas. The assignment includes calculations and analysis related to investment products (Product Aee and Product Bee), bond valuation, and stock portfolio allocation. The student analyzes the impact of economic recession on investment returns, evaluates bond coupon rates and yields, and determines optimal stock allocations based on expected returns and risk. The solution also covers market risk premium calculation and identifies the riskiest asset within the portfolio. The assignment demonstrates the application of financial concepts such as time value of money, risk and return, and portfolio diversification to make sound financial decisions. The document includes tables, calculations, and bibliographical references.

Running head: FINANCIAL MANAGEMENT

Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Financial Management

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MANAGEMENT

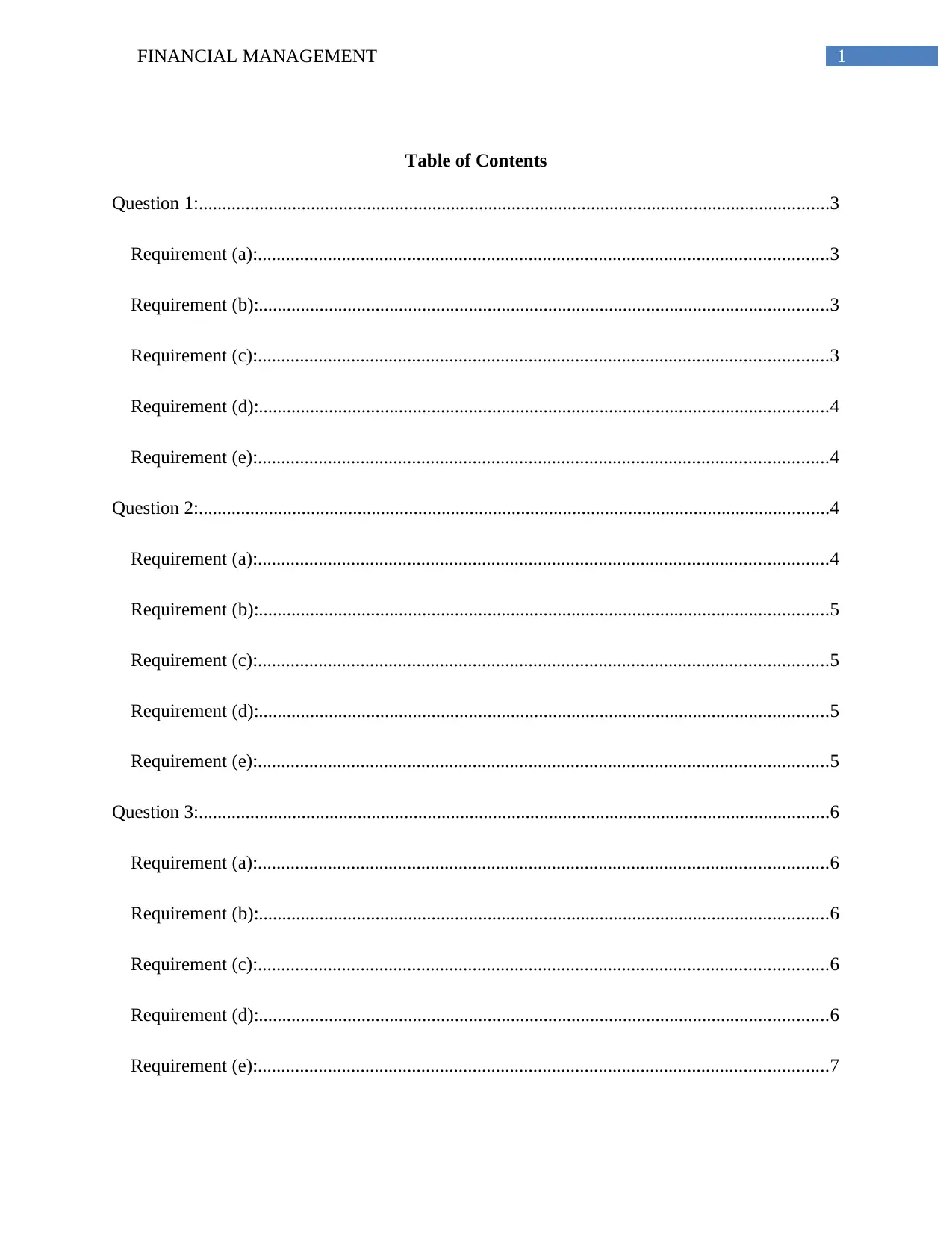

Table of Contents

Question 1:.......................................................................................................................................3

Requirement (a):..........................................................................................................................3

Requirement (b):..........................................................................................................................3

Requirement (c):..........................................................................................................................3

Requirement (d):..........................................................................................................................4

Requirement (e):..........................................................................................................................4

Question 2:.......................................................................................................................................4

Requirement (a):..........................................................................................................................4

Requirement (b):..........................................................................................................................5

Requirement (c):..........................................................................................................................5

Requirement (d):..........................................................................................................................5

Requirement (e):..........................................................................................................................5

Question 3:.......................................................................................................................................6

Requirement (a):..........................................................................................................................6

Requirement (b):..........................................................................................................................6

Requirement (c):..........................................................................................................................6

Requirement (d):..........................................................................................................................6

Requirement (e):..........................................................................................................................7

Table of Contents

Question 1:.......................................................................................................................................3

Requirement (a):..........................................................................................................................3

Requirement (b):..........................................................................................................................3

Requirement (c):..........................................................................................................................3

Requirement (d):..........................................................................................................................4

Requirement (e):..........................................................................................................................4

Question 2:.......................................................................................................................................4

Requirement (a):..........................................................................................................................4

Requirement (b):..........................................................................................................................5

Requirement (c):..........................................................................................................................5

Requirement (d):..........................................................................................................................5

Requirement (e):..........................................................................................................................5

Question 3:.......................................................................................................................................6

Requirement (a):..........................................................................................................................6

Requirement (b):..........................................................................................................................6

Requirement (c):..........................................................................................................................6

Requirement (d):..........................................................................................................................6

Requirement (e):..........................................................................................................................7

2FINANCIAL MANAGEMENT

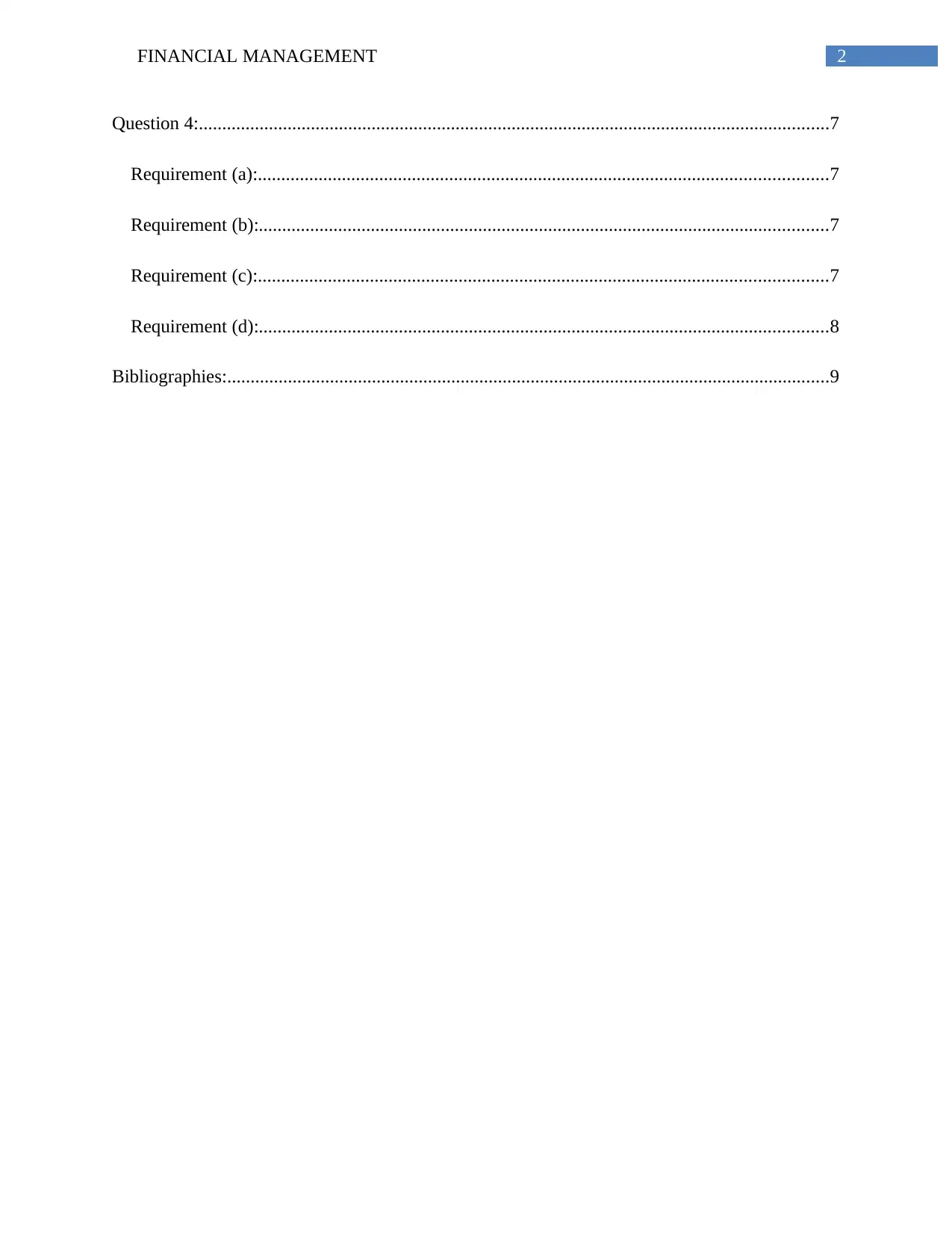

Question 4:.......................................................................................................................................7

Requirement (a):..........................................................................................................................7

Requirement (b):..........................................................................................................................7

Requirement (c):..........................................................................................................................7

Requirement (d):..........................................................................................................................8

Bibliographies:.................................................................................................................................9

Question 4:.......................................................................................................................................7

Requirement (a):..........................................................................................................................7

Requirement (b):..........................................................................................................................7

Requirement (c):..........................................................................................................................7

Requirement (d):..........................................................................................................................8

Bibliographies:.................................................................................................................................9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MANAGEMENT

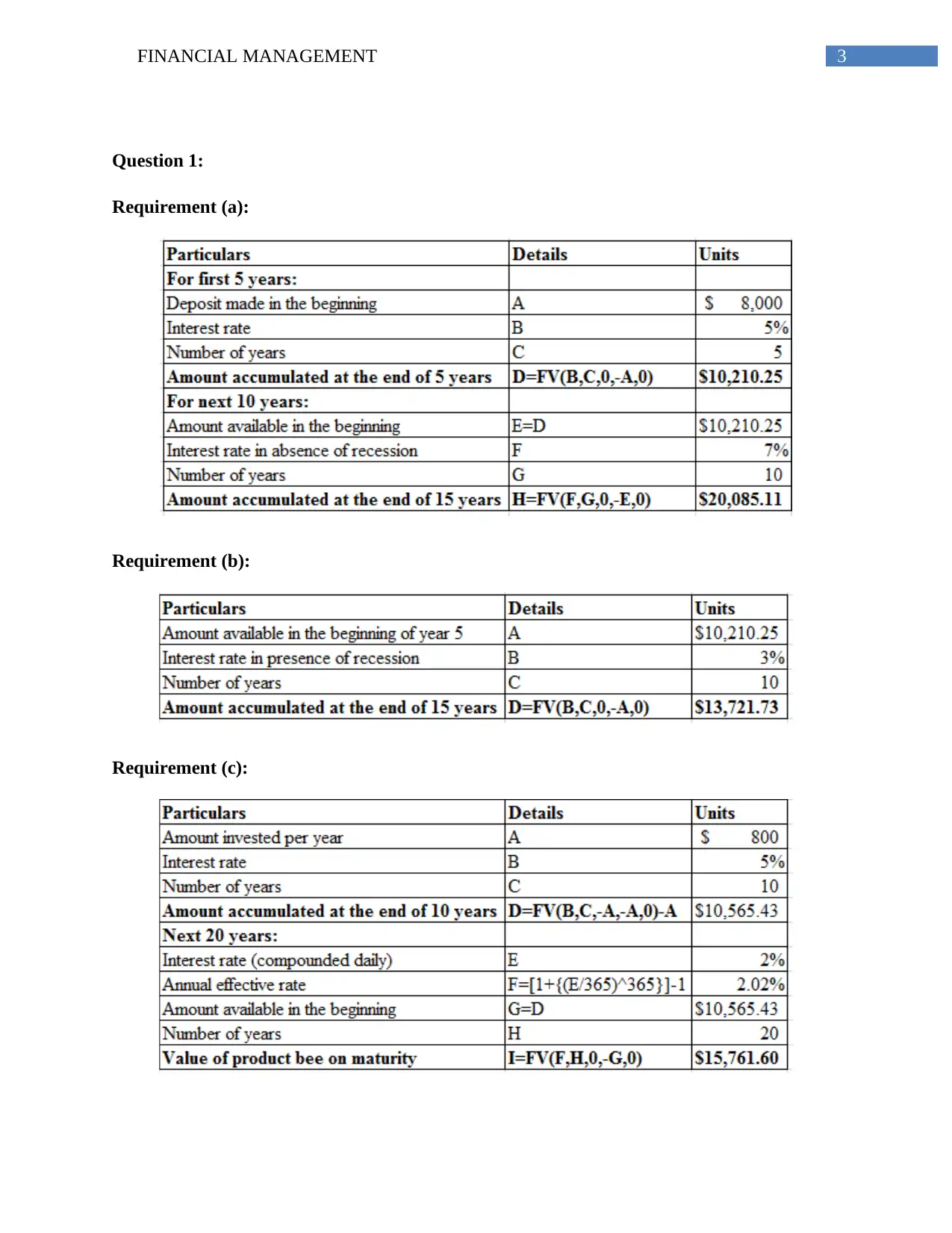

Question 1:

Requirement (a):

Requirement (b):

Requirement (c):

Question 1:

Requirement (a):

Requirement (b):

Requirement (c):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MANAGEMENT

Requirement (d):

Requirement (e):

From the above tables, it could be seen that if there is no recession, Product Aee would

fetch a value of $20,085.11. However, during recession, the return would be minimised to

$13,721.73. On the other hand, the return for Product Bee is calculated as $15,761.60. Hence, by

considering all these figures, Product Aee has to be chosen, as the amount to be accumulated

from this product would be more than the Product Bee. However, this decision is undertaken by

assuming that there would be no recession and if recession takes place, the return would be

minimised. Thus, this decision carries more risk than investing in Product Bee; however, the

same is undertaken by assuming lower possibility of recession and the return to be obtained

would be more than Product Bee.

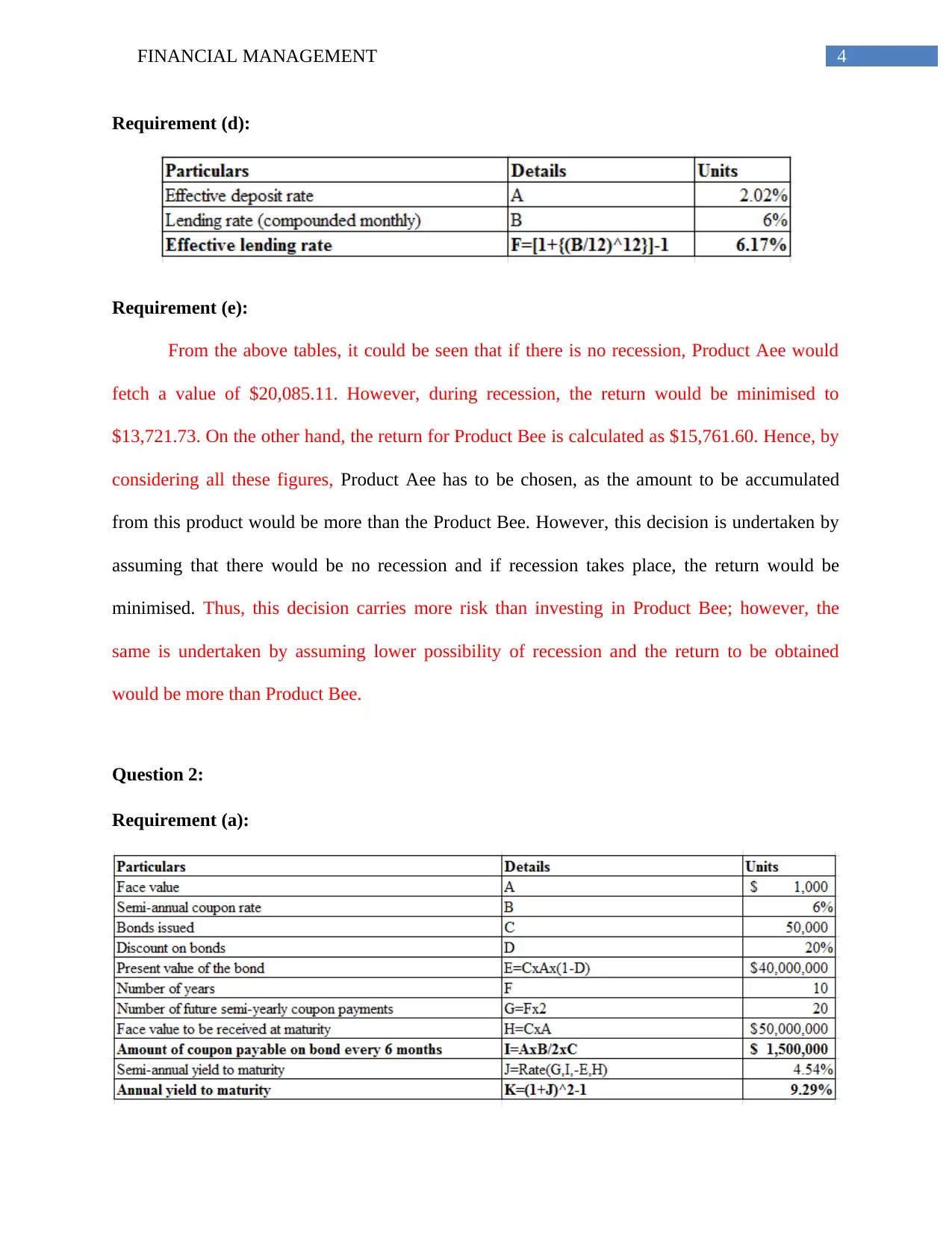

Question 2:

Requirement (a):

Requirement (d):

Requirement (e):

From the above tables, it could be seen that if there is no recession, Product Aee would

fetch a value of $20,085.11. However, during recession, the return would be minimised to

$13,721.73. On the other hand, the return for Product Bee is calculated as $15,761.60. Hence, by

considering all these figures, Product Aee has to be chosen, as the amount to be accumulated

from this product would be more than the Product Bee. However, this decision is undertaken by

assuming that there would be no recession and if recession takes place, the return would be

minimised. Thus, this decision carries more risk than investing in Product Bee; however, the

same is undertaken by assuming lower possibility of recession and the return to be obtained

would be more than Product Bee.

Question 2:

Requirement (a):

5FINANCIAL MANAGEMENT

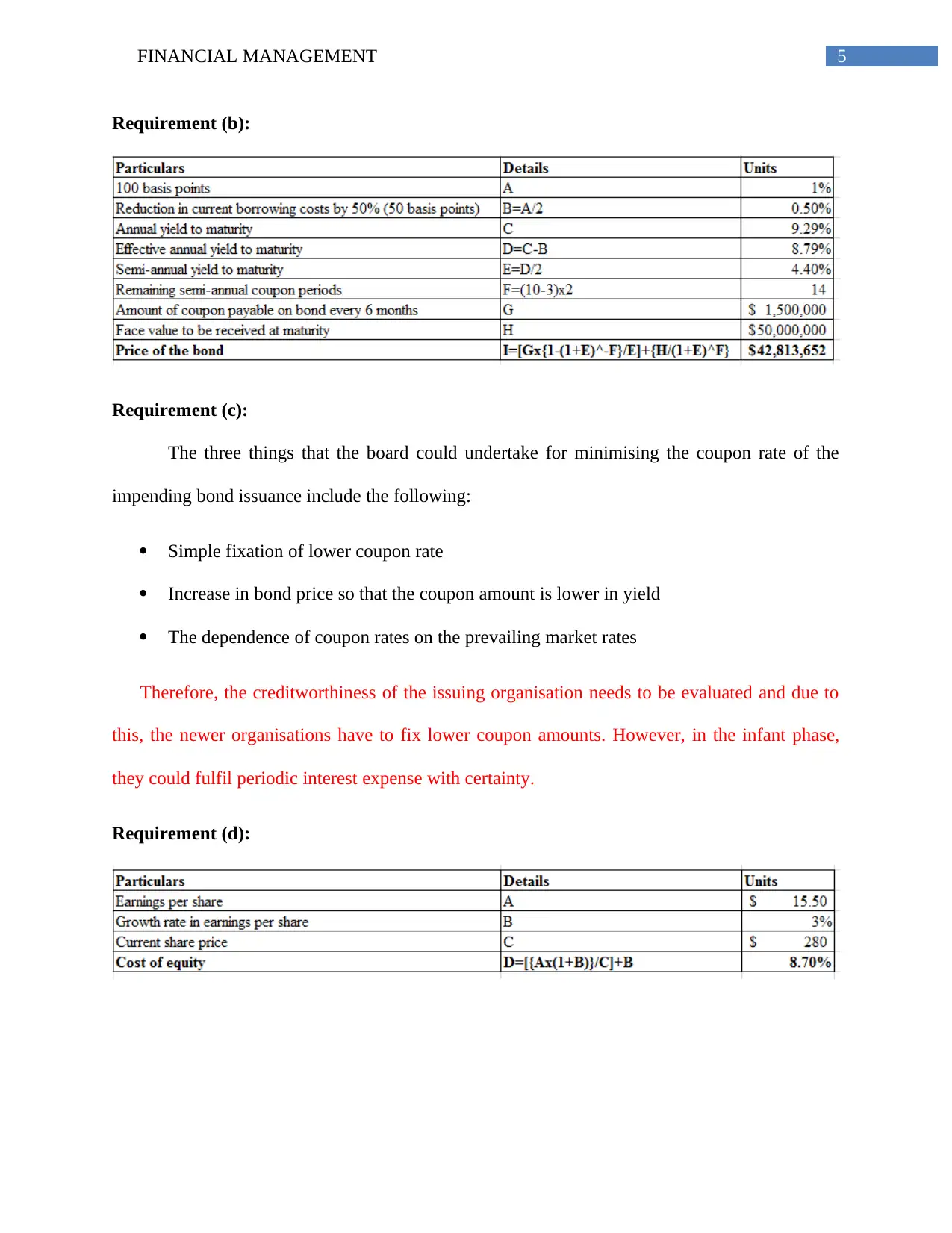

Requirement (b):

Requirement (c):

The three things that the board could undertake for minimising the coupon rate of the

impending bond issuance include the following:

Simple fixation of lower coupon rate

Increase in bond price so that the coupon amount is lower in yield

The dependence of coupon rates on the prevailing market rates

Therefore, the creditworthiness of the issuing organisation needs to be evaluated and due to

this, the newer organisations have to fix lower coupon amounts. However, in the infant phase,

they could fulfil periodic interest expense with certainty.

Requirement (d):

Requirement (b):

Requirement (c):

The three things that the board could undertake for minimising the coupon rate of the

impending bond issuance include the following:

Simple fixation of lower coupon rate

Increase in bond price so that the coupon amount is lower in yield

The dependence of coupon rates on the prevailing market rates

Therefore, the creditworthiness of the issuing organisation needs to be evaluated and due to

this, the newer organisations have to fix lower coupon amounts. However, in the infant phase,

they could fulfil periodic interest expense with certainty.

Requirement (d):

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MANAGEMENT

Requirement (e):

In the provided case, bond yield is more than cost of equity. The bond yield is computed

as 8.79%, which is more than the cost of equity computed as 8.70%. It might have been issued

on a discount when lower proceeds from issuance raise yield to maturity, which implies that the

effective interest rate is more than the coupon rate.

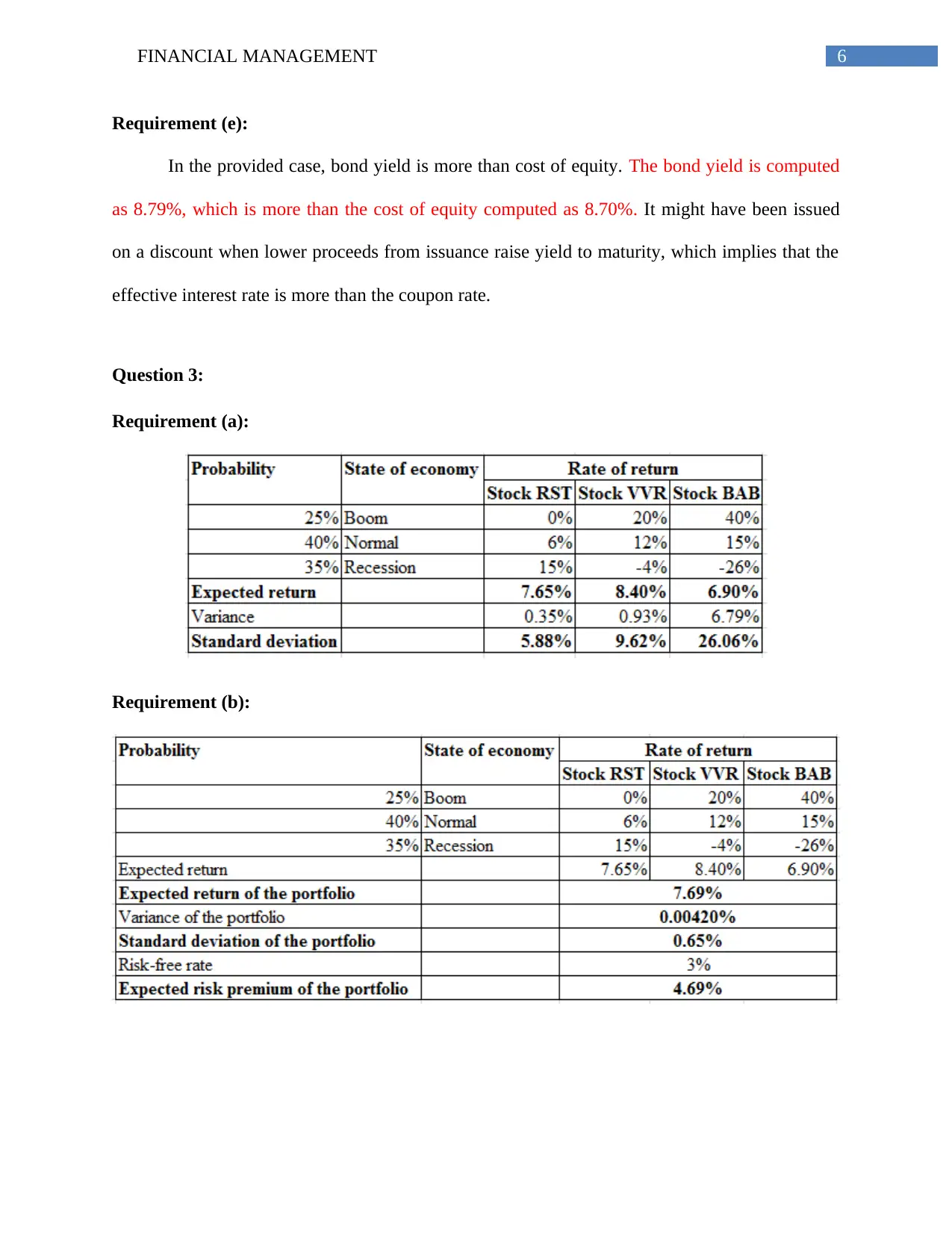

Question 3:

Requirement (a):

Requirement (b):

Requirement (e):

In the provided case, bond yield is more than cost of equity. The bond yield is computed

as 8.79%, which is more than the cost of equity computed as 8.70%. It might have been issued

on a discount when lower proceeds from issuance raise yield to maturity, which implies that the

effective interest rate is more than the coupon rate.

Question 3:

Requirement (a):

Requirement (b):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MANAGEMENT

Requirement (c):

The expected return of stock VVR is highest and thus, maximum investment needs to be

made in this stock followed by Stock RST and Stock BAB. On the other hand, the risk in stock

VVR is greater and thus, effective allocation needs to be made by Ravi for generating the desired

return on investment. By taking into consideration all the above-discussed factors, Ravi needs to

allocate 40% weight in stock VVR and 30% weights each in the remaining two stocks.

Requirement (d):

Market risk premium = Expected return – Risk-free return

Market risk premium = 7.69% - 3% = 4.69%

Requirement (e):

The most risky asset is VVR due to its higher standard deviation denoting more risk.

However, this stock would provide greater return, which is evident from the above calculations.

On the other hand, investing only in this asset might result in loss for the investor; hence,

appropriate allocation of asset needs to be made for hedging against risk and uncertainty.

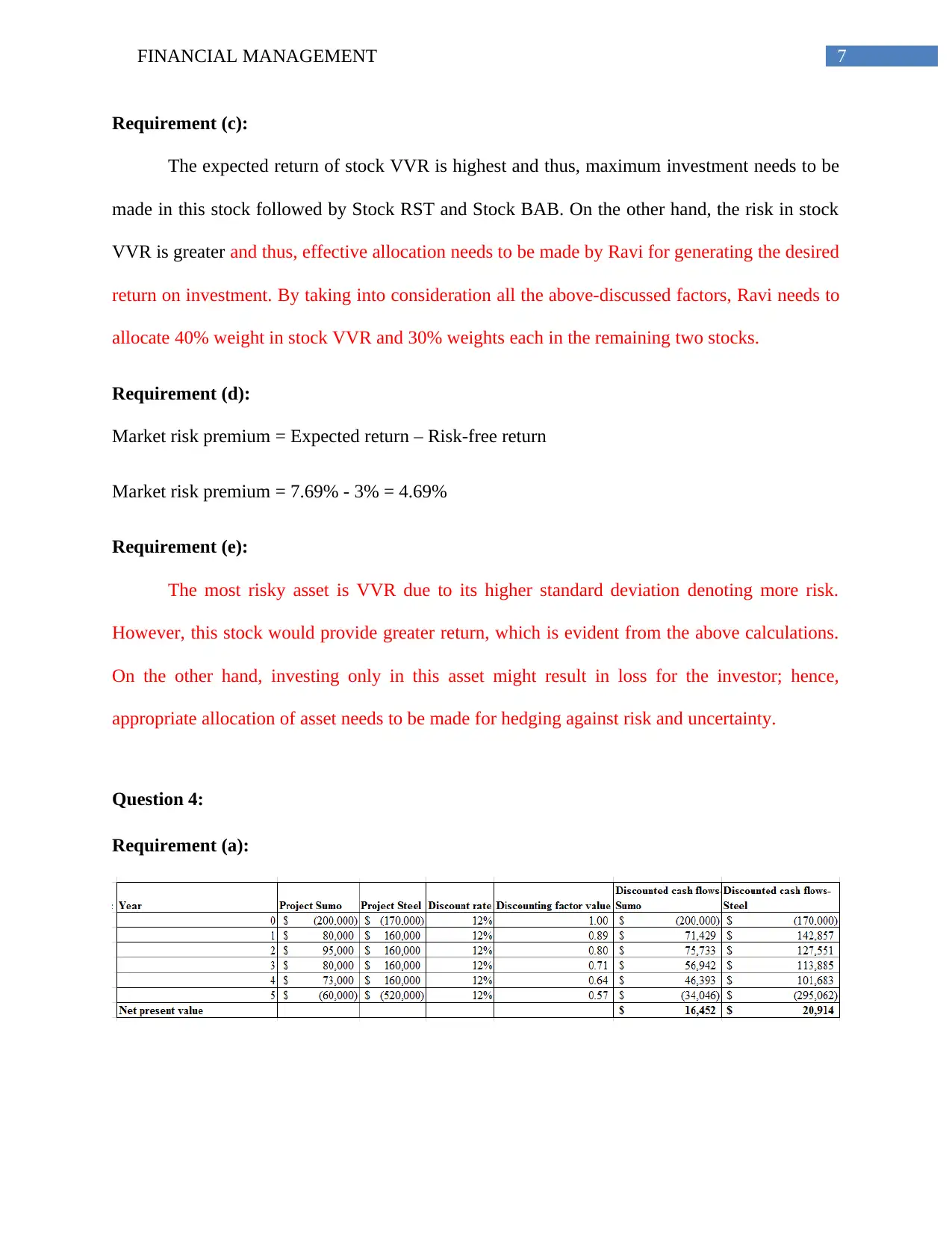

Question 4:

Requirement (a):

Requirement (c):

The expected return of stock VVR is highest and thus, maximum investment needs to be

made in this stock followed by Stock RST and Stock BAB. On the other hand, the risk in stock

VVR is greater and thus, effective allocation needs to be made by Ravi for generating the desired

return on investment. By taking into consideration all the above-discussed factors, Ravi needs to

allocate 40% weight in stock VVR and 30% weights each in the remaining two stocks.

Requirement (d):

Market risk premium = Expected return – Risk-free return

Market risk premium = 7.69% - 3% = 4.69%

Requirement (e):

The most risky asset is VVR due to its higher standard deviation denoting more risk.

However, this stock would provide greater return, which is evident from the above calculations.

On the other hand, investing only in this asset might result in loss for the investor; hence,

appropriate allocation of asset needs to be made for hedging against risk and uncertainty.

Question 4:

Requirement (a):

8FINANCIAL MANAGEMENT

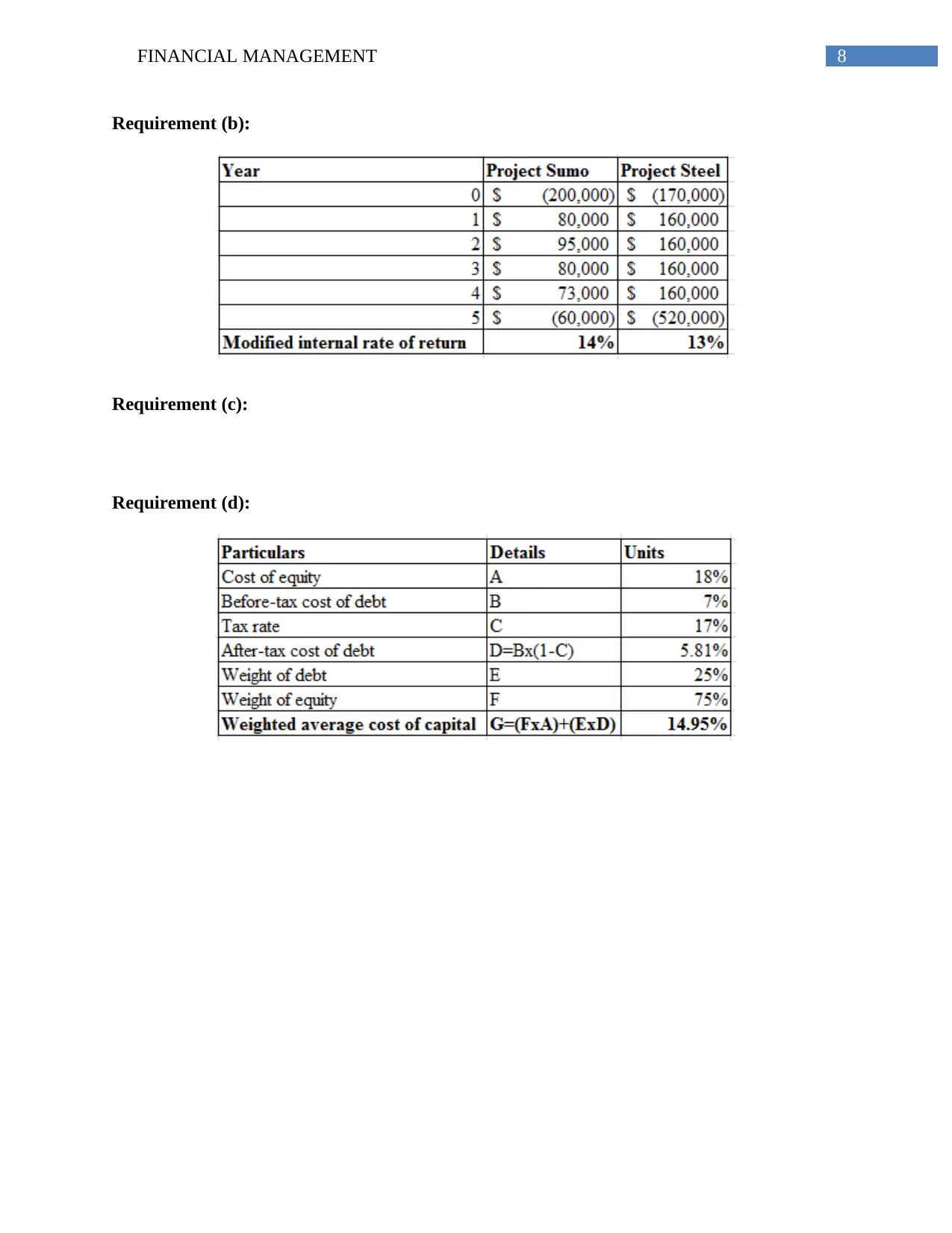

Requirement (b):

Requirement (c):

Requirement (d):

Requirement (b):

Requirement (c):

Requirement (d):

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MANAGEMENT

Bibliographies:

Bekaert, G., & Hodrick, R. (2017). International financial management. Cambridge University

Press.

Wang, X. S. (2014). Financial management in the public sector: tools, applications and cases.

Routledge.

Bibliographies:

Bekaert, G., & Hodrick, R. (2017). International financial management. Cambridge University

Press.

Wang, X. S. (2014). Financial management in the public sector: tools, applications and cases.

Routledge.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.