University of Greenwich: Stock Valuation Report FINA 1082

VerifiedAdded on 2023/04/23

|4

|426

|432

Report

AI Summary

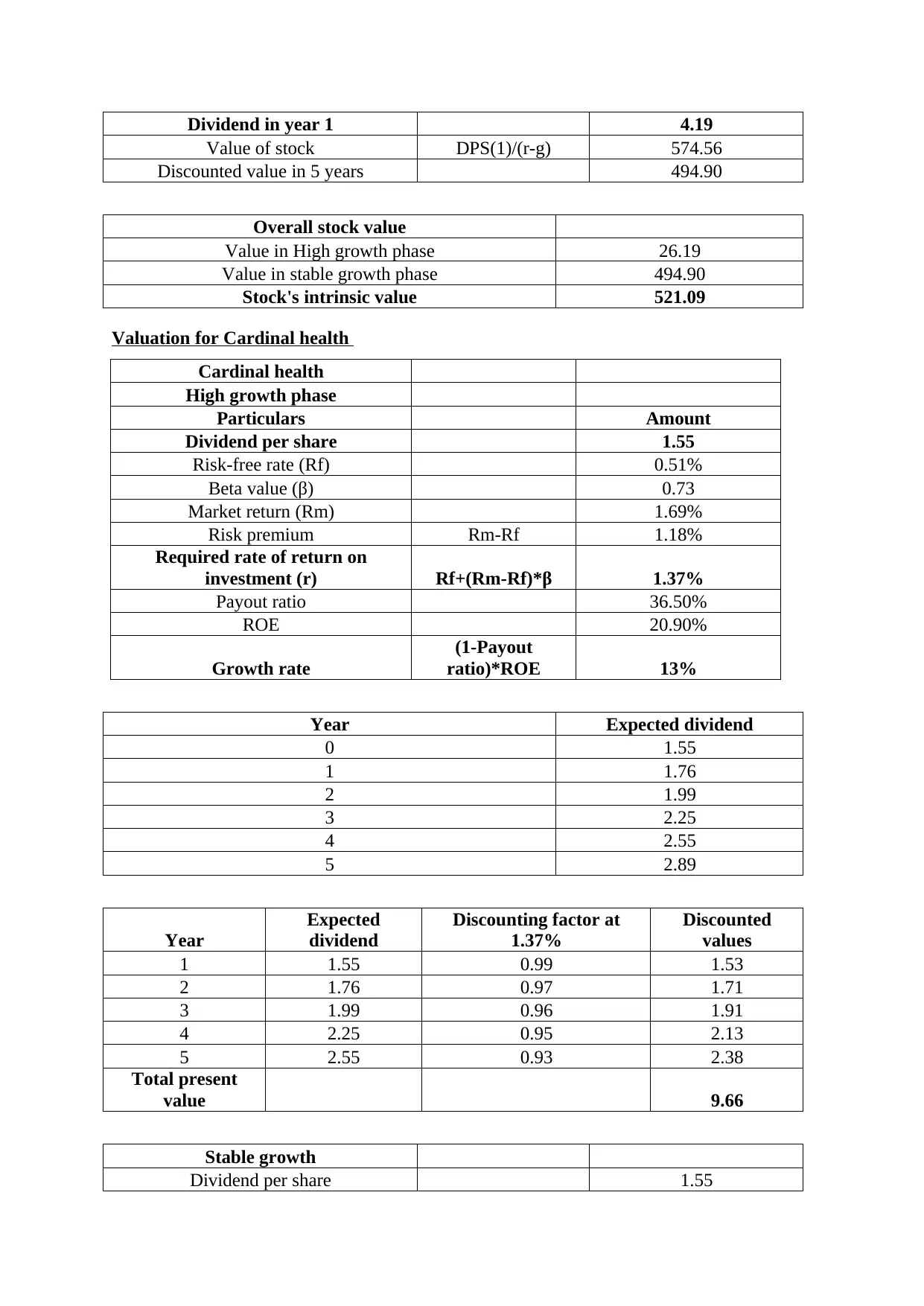

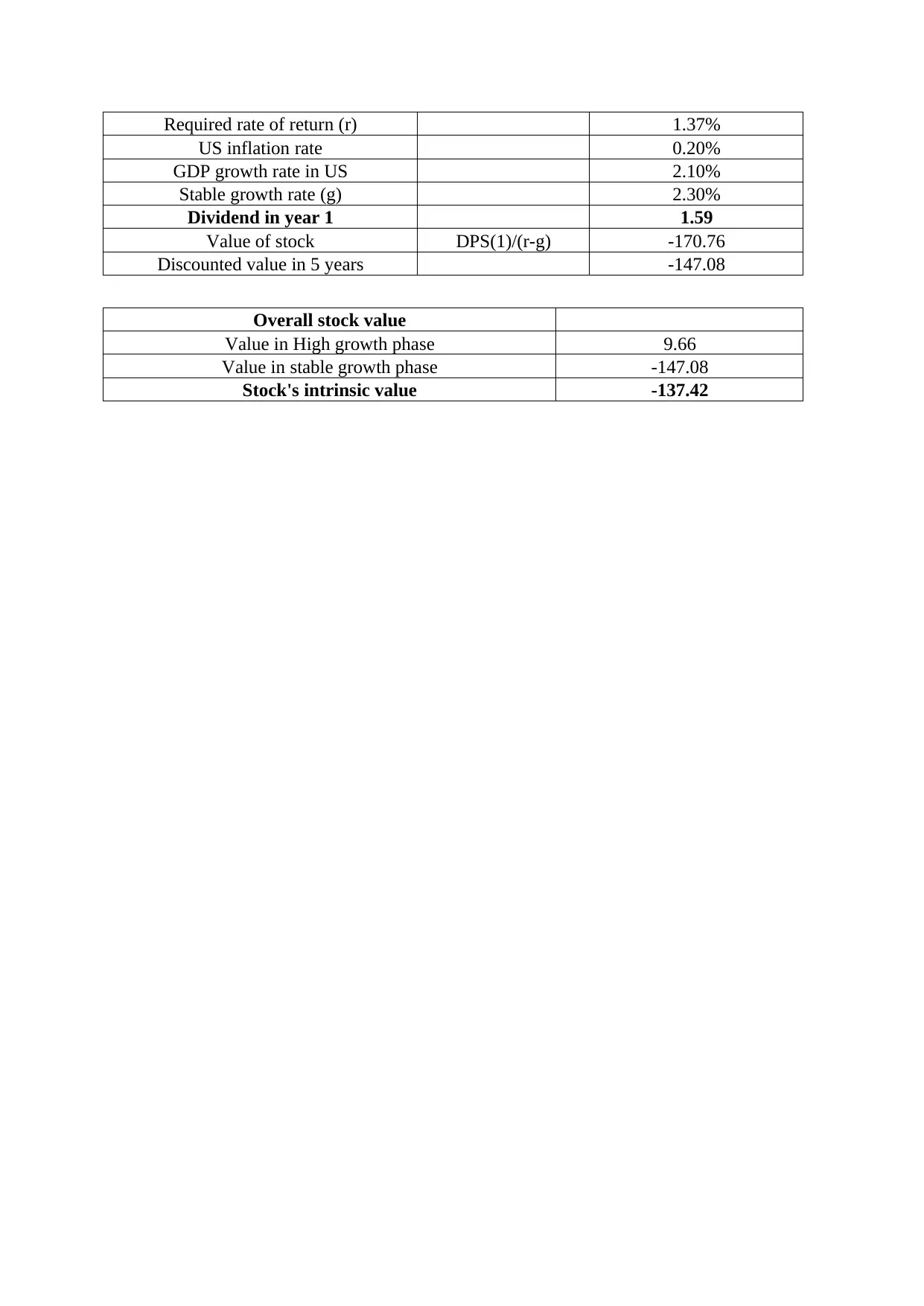

This report presents a stock valuation analysis of two companies: 3M (industrial) and Cardinal Health (healthcare and social care). The analysis includes calculations for the high growth and stable growth phases, considering dividend per share, risk-free rate, beta, market return, and other relevant financial metrics. The intrinsic value of each stock is determined by discounting future dividends and considering the required rate of return. The report provides detailed calculations and insights into the stock valuation process, offering a comprehensive financial analysis of both companies. The report also includes the application of the dividend discount model to determine the stock values. The analysis aims to determine the fair value of each stock based on the given financial data.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)