Financial Market Analysis: Capital Allocation in UK and China Report

VerifiedAdded on 2020/04/15

|22

|4901

|35

Report

AI Summary

This report provides an in-depth analysis of financial markets, with a specific focus on capital allocation within the United Kingdom and China. It begins with an executive summary and an introduction outlining the structure of financial markets and their importance in economic growth, trade, and investment. The report then delves into the background of financial markets, discussing financial assets, securities, and the role of financial institutions and intermediaries. A key section is dedicated to capital allocation within the domestic economy of the UK, examining fiscal policies, borrowing rates, and investment trends. The report also explores capital allocation in international markets, highlighting trade theories and the dynamics of emerging economies. A significant portion of the report evaluates the Chinese economy, addressing its development, resources, and the challenges it faces due to industrialization and trade policies. The analysis includes discussions on stock and debt markets, asset management, and the fiscal policies of both countries, concluding with an overview of emerging market trends and the challenges these economies encounter. The report emphasizes the significance of finance in economic growth and the allocation of capital to drive productive customs and investment.

Running head: BUSINESS

Business

Name of the Student

Name of the University

Author Note

Business

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS

Executive Summary

This report consists of the evaluation of the financial market. As a junior consultant, there

is a need to know the requirement of finance for trade and investment in an International

investment organization. The manager of the firm having its head office in London is very eager

to sign in the contracts with the new prospective clients since there are many opportunities

available from the emerging markets .The clients have visited the head office in London and they

are very keen on the fact that they wants to have knowledge about finance and investment

According to the structural approach, the economic system of a scaling-down consists of

three key mechanisms firstly, the monetary markets secondly the economic institutions and

finally the monetary regulators, both of the gears acting a limitation position in the

economy. Accordingly the monetary markets facilitate the flood of burial in direction to finance

money by corporations, governments and individuals.

The report explains the allocation of capital within the domestic economy and the

emerging economy, United Kingdom and China respectively. The analysis of this project has

been done taking into consideration the stock market, debt market and the management of assets

explaining the fiscal policy of the Countries. In the last part of the report, the emerging market

trends have been explained and the challenges faced by the emerging economy due to the rapid

changes in trade and industrialization are conveyed.

Executive Summary

This report consists of the evaluation of the financial market. As a junior consultant, there

is a need to know the requirement of finance for trade and investment in an International

investment organization. The manager of the firm having its head office in London is very eager

to sign in the contracts with the new prospective clients since there are many opportunities

available from the emerging markets .The clients have visited the head office in London and they

are very keen on the fact that they wants to have knowledge about finance and investment

According to the structural approach, the economic system of a scaling-down consists of

three key mechanisms firstly, the monetary markets secondly the economic institutions and

finally the monetary regulators, both of the gears acting a limitation position in the

economy. Accordingly the monetary markets facilitate the flood of burial in direction to finance

money by corporations, governments and individuals.

The report explains the allocation of capital within the domestic economy and the

emerging economy, United Kingdom and China respectively. The analysis of this project has

been done taking into consideration the stock market, debt market and the management of assets

explaining the fiscal policy of the Countries. In the last part of the report, the emerging market

trends have been explained and the challenges faced by the emerging economy due to the rapid

changes in trade and industrialization are conveyed.

2BUSINESS

Table of Contents

Table of Contents.............................................................................................................................2

Introduction......................................................................................................................................3

Background of financial markets.....................................................................................................4

Capital allocation within domestic economy (United Kingdom)....................................................6

Capital allocation within international markets (United Kingdom)................................................9

Evaluation of the emerging economy (China)...............................................................................11

Development of the Chinese resources..........................................................................................12

Challenges faced by China due to industrialization and trade policies.........................................15

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

Table of Contents

Table of Contents.............................................................................................................................2

Introduction......................................................................................................................................3

Background of financial markets.....................................................................................................4

Capital allocation within domestic economy (United Kingdom)....................................................6

Capital allocation within international markets (United Kingdom)................................................9

Evaluation of the emerging economy (China)...............................................................................11

Development of the Chinese resources..........................................................................................12

Challenges faced by China due to industrialization and trade policies.........................................15

Conclusion.....................................................................................................................................17

References......................................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS

Introduction

The report explains the structure of the financial market and how the economy does

operate. The monetary system acts as a source in the budget by stimulating fiscal growth thereby

influencing financial feat of the actors, moving cost-effective welfare. This is achieved by fiscal

infrastructure, in which entities with money allocate folks burial to folks who engage in

potentially further productive customs to invest individual’s funds. A monetary system makes it

on the cards an added useful route to handing over the funds (Madura 2014).

Finance is crucial for growth and improvement of the economy. The whole of the

economy depends on the exports and imports which is a part of trade, finance and investment.

After the creation of World Trade Organization, the trade is open and the agreements are signed

by many parties so that trade is free and there is no restrictive practices performed by any of the

Countries. These polices if WTO have helped lot in the advancement and improvement of the

economy. Many companies are opened to help the people of different Countries to come into

agreement for doing and commerce (Valdez and Molyneux 2015). Almost all the items are

traded nowadays after the invention of WTO in 1995.This helps one to get the products of other

Countries; this increased the trade of the products of various Countries.

Introduction

The report explains the structure of the financial market and how the economy does

operate. The monetary system acts as a source in the budget by stimulating fiscal growth thereby

influencing financial feat of the actors, moving cost-effective welfare. This is achieved by fiscal

infrastructure, in which entities with money allocate folks burial to folks who engage in

potentially further productive customs to invest individual’s funds. A monetary system makes it

on the cards an added useful route to handing over the funds (Madura 2014).

Finance is crucial for growth and improvement of the economy. The whole of the

economy depends on the exports and imports which is a part of trade, finance and investment.

After the creation of World Trade Organization, the trade is open and the agreements are signed

by many parties so that trade is free and there is no restrictive practices performed by any of the

Countries. These polices if WTO have helped lot in the advancement and improvement of the

economy. Many companies are opened to help the people of different Countries to come into

agreement for doing and commerce (Valdez and Molyneux 2015). Almost all the items are

traded nowadays after the invention of WTO in 1995.This helps one to get the products of other

Countries; this increased the trade of the products of various Countries.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS

Background of financial markets

Finance is the life blood of economy. Financial Management, as a discipline, is

interlinked with other activities that occur within a business organization such as production,

marketing, purchasing, personnel functions, and etc. Depending on the organization and the

industry in which it operates, this function may do simple or complex. The finance function

consists of the people, technology, processes, and policies that dictate tasks and decisions related

into financial resources of a company (Grinblatt and Titman 2016).

The financial market consists of financial assets, and the securities, debt and equity

market. The financial system helps in the facilitation and allocation of funds which helps in the

progress of the economy.

The financial sector consists of two types:

1. Concrete components and.

2. Financial Intermediaries and Institution

Concrete components include all aspects of infrastructure including technology, software

applications, and processes, as well as the people who manage them (Sornette 2017). Soft

components include the standards, strategies, models, and vision that drive the finance or

accounting aspect of the business. Each component stands on its own into an extent; however,

ultimately all components must do woven together in a way that serves the overall organization

objectives. It is not enough that all component parts exist; rather they must exist in harmony with

one another, yielding synergies that serve the company's needs today and provide for the future.

The financial Institutions are:

Background of financial markets

Finance is the life blood of economy. Financial Management, as a discipline, is

interlinked with other activities that occur within a business organization such as production,

marketing, purchasing, personnel functions, and etc. Depending on the organization and the

industry in which it operates, this function may do simple or complex. The finance function

consists of the people, technology, processes, and policies that dictate tasks and decisions related

into financial resources of a company (Grinblatt and Titman 2016).

The financial market consists of financial assets, and the securities, debt and equity

market. The financial system helps in the facilitation and allocation of funds which helps in the

progress of the economy.

The financial sector consists of two types:

1. Concrete components and.

2. Financial Intermediaries and Institution

Concrete components include all aspects of infrastructure including technology, software

applications, and processes, as well as the people who manage them (Sornette 2017). Soft

components include the standards, strategies, models, and vision that drive the finance or

accounting aspect of the business. Each component stands on its own into an extent; however,

ultimately all components must do woven together in a way that serves the overall organization

objectives. It is not enough that all component parts exist; rather they must exist in harmony with

one another, yielding synergies that serve the company's needs today and provide for the future.

The financial Institutions are:

5BUSINESS

Financial instruments are crucial constituents of the financial market and this helps to

claim for future income. Financial market instruments are as follows:

Money market instruments- These are those instrument which are easily converted into

cash at a minimum cost. The money market consists of the call money, term money, treasury

bills, commercial paper and certificate of deposits.

Capital market instruments- These are in the form of equity shares, preference shares

and non convertible preference shares. Instruments of equity market in equity segments involve

zero coupon bonds, debentures and deep discount bonds (Levinson 2014).

Cash instruments- Cash instruments are those which are transferable having its value

derived from the market. Deposit accounts, loan and receivables are also financial assets and

cash instruments.

System (stock market how does it work)

Derivative instruments- The value of derivative market instruments are those which are

derived from underlying entities such as index, assets and the interest rate.

Hybrid instruments- Hybrid instruments are those instruments having both the features

of debentures and equity such as the warrants and the convertible debentures (Moloney 2014).

Financial instruments are crucial constituents of the financial market and this helps to

claim for future income. Financial market instruments are as follows:

Money market instruments- These are those instrument which are easily converted into

cash at a minimum cost. The money market consists of the call money, term money, treasury

bills, commercial paper and certificate of deposits.

Capital market instruments- These are in the form of equity shares, preference shares

and non convertible preference shares. Instruments of equity market in equity segments involve

zero coupon bonds, debentures and deep discount bonds (Levinson 2014).

Cash instruments- Cash instruments are those which are transferable having its value

derived from the market. Deposit accounts, loan and receivables are also financial assets and

cash instruments.

System (stock market how does it work)

Derivative instruments- The value of derivative market instruments are those which are

derived from underlying entities such as index, assets and the interest rate.

Hybrid instruments- Hybrid instruments are those instruments having both the features

of debentures and equity such as the warrants and the convertible debentures (Moloney 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS

Capital allocation within domestic economy (United Kingdom)

United Kingdom is considered to be the largest financial sector in the economy of

European Union, thus it helps in the capital allocation and growth of the economy. There are

some ways where the domestic market helps in the allocation of capital. Firstly, there is growth

of the economy and this can happen due to falling state ownership. Secondly, the stock price of

the countries restores specific information in individual stock price (Gibson and Thirlwall 2016).

Lastly, there is a strong right of investors which helps in the allocation of capital in a proper way

UK government fiscal policy or Fiscal /monetary policy (public sector) and how it work

-The Country of UK has started its fiscal policy which has helped in boosting the economic

activities throughout the nations. There are two types of fiscal policy automatic and discretionary

which are practiced by UK government. The Government has spent a lot in the year 2016 for

education, pension and health (Werbner 2015). The Government has initiated to take measures

on cutting down the taxes. The impact of Brexit was also to a great extent in the UK government

(Hechter 2017).

Capital allocation within domestic economy (United Kingdom)

United Kingdom is considered to be the largest financial sector in the economy of

European Union, thus it helps in the capital allocation and growth of the economy. There are

some ways where the domestic market helps in the allocation of capital. Firstly, there is growth

of the economy and this can happen due to falling state ownership. Secondly, the stock price of

the countries restores specific information in individual stock price (Gibson and Thirlwall 2016).

Lastly, there is a strong right of investors which helps in the allocation of capital in a proper way

UK government fiscal policy or Fiscal /monetary policy (public sector) and how it work

-The Country of UK has started its fiscal policy which has helped in boosting the economic

activities throughout the nations. There are two types of fiscal policy automatic and discretionary

which are practiced by UK government. The Government has spent a lot in the year 2016 for

education, pension and health (Werbner 2015). The Government has initiated to take measures

on cutting down the taxes. The impact of Brexit was also to a great extent in the UK government

(Hechter 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS

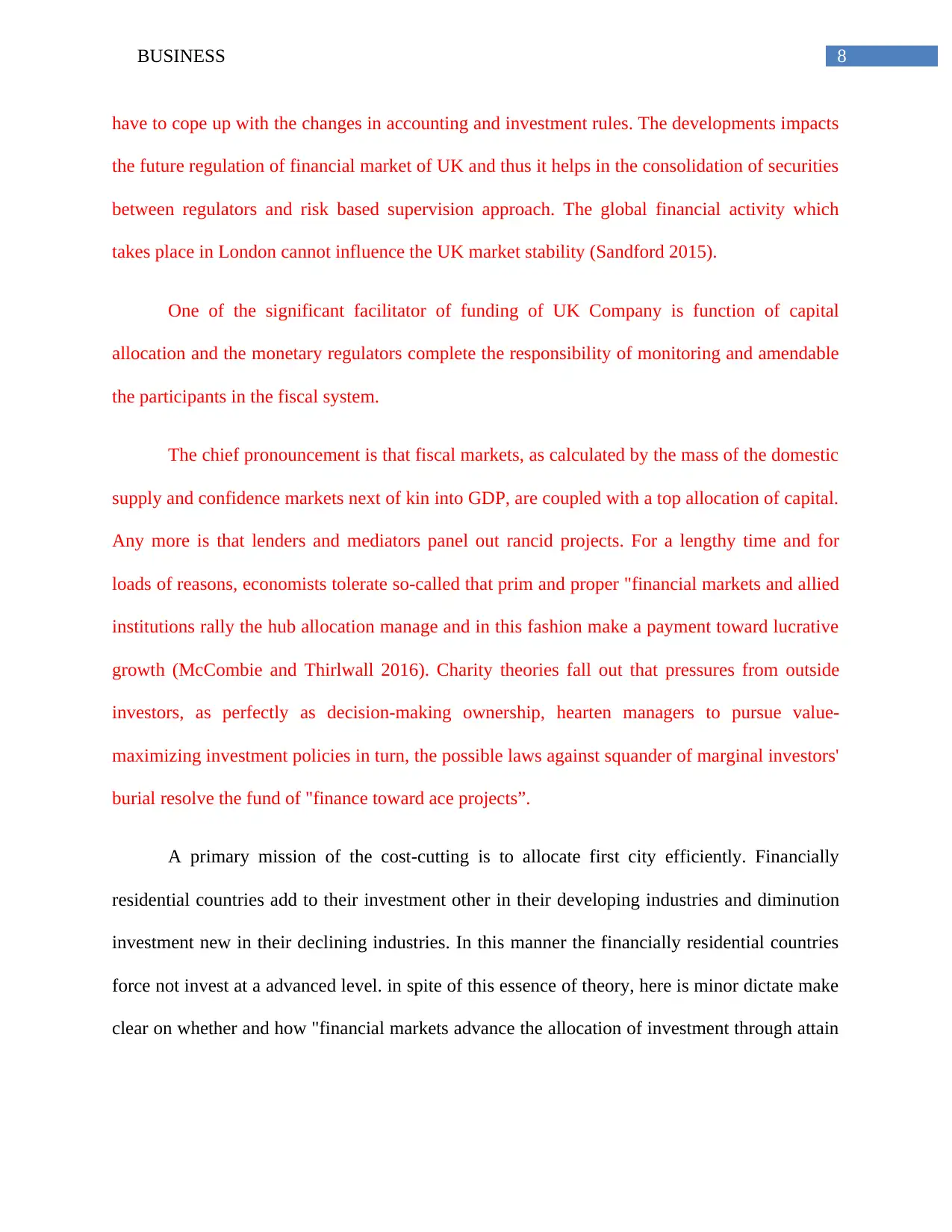

UK government spending:

(Source: Un.org 2017)

Borrowing-/Exchange rate- Bank The bank of London helps the commercial or apex

banks in strengthening the financial position by giving them facility such as loans and credit

cards, various loans on assets personal loans. The lending by the banks is much easier and

consumers are now able to purchase goods and get services on credit. Thus with the

liberalization, it is seen that the total borrowings of the consumers will rise and net borrowing as

gross domestic value proportion is higher compared to previous year (Rodan 2016).

Ownership of financial assets by UK households:

(Source: Theinvestmentassociation.org 2017)

Investment- The financial exchange market helps in the exchange of funds and securities

between domestic and international investors. There are constant changes and the companies

UK government spending:

(Source: Un.org 2017)

Borrowing-/Exchange rate- Bank The bank of London helps the commercial or apex

banks in strengthening the financial position by giving them facility such as loans and credit

cards, various loans on assets personal loans. The lending by the banks is much easier and

consumers are now able to purchase goods and get services on credit. Thus with the

liberalization, it is seen that the total borrowings of the consumers will rise and net borrowing as

gross domestic value proportion is higher compared to previous year (Rodan 2016).

Ownership of financial assets by UK households:

(Source: Theinvestmentassociation.org 2017)

Investment- The financial exchange market helps in the exchange of funds and securities

between domestic and international investors. There are constant changes and the companies

8BUSINESS

have to cope up with the changes in accounting and investment rules. The developments impacts

the future regulation of financial market of UK and thus it helps in the consolidation of securities

between regulators and risk based supervision approach. The global financial activity which

takes place in London cannot influence the UK market stability (Sandford 2015).

One of the significant facilitator of funding of UK Company is function of capital

allocation and the monetary regulators complete the responsibility of monitoring and amendable

the participants in the fiscal system.

The chief pronouncement is that fiscal markets, as calculated by the mass of the domestic

supply and confidence markets next of kin into GDP, are coupled with a top allocation of capital.

Any more is that lenders and mediators panel out rancid projects. For a lengthy time and for

loads of reasons, economists tolerate so-called that prim and proper "financial markets and allied

institutions rally the hub allocation manage and in this fashion make a payment toward lucrative

growth (McCombie and Thirlwall 2016). Charity theories fall out that pressures from outside

investors, as perfectly as decision-making ownership, hearten managers to pursue value-

maximizing investment policies in turn, the possible laws against squander of marginal investors'

burial resolve the fund of "finance toward ace projects”.

A primary mission of the cost-cutting is to allocate first city efficiently. Financially

residential countries add to their investment other in their developing industries and diminution

investment new in their declining industries. In this manner the financially residential countries

force not invest at a advanced level. in spite of this essence of theory, here is minor dictate make

clear on whether and how "financial markets advance the allocation of investment through attain

have to cope up with the changes in accounting and investment rules. The developments impacts

the future regulation of financial market of UK and thus it helps in the consolidation of securities

between regulators and risk based supervision approach. The global financial activity which

takes place in London cannot influence the UK market stability (Sandford 2015).

One of the significant facilitator of funding of UK Company is function of capital

allocation and the monetary regulators complete the responsibility of monitoring and amendable

the participants in the fiscal system.

The chief pronouncement is that fiscal markets, as calculated by the mass of the domestic

supply and confidence markets next of kin into GDP, are coupled with a top allocation of capital.

Any more is that lenders and mediators panel out rancid projects. For a lengthy time and for

loads of reasons, economists tolerate so-called that prim and proper "financial markets and allied

institutions rally the hub allocation manage and in this fashion make a payment toward lucrative

growth (McCombie and Thirlwall 2016). Charity theories fall out that pressures from outside

investors, as perfectly as decision-making ownership, hearten managers to pursue value-

maximizing investment policies in turn, the possible laws against squander of marginal investors'

burial resolve the fund of "finance toward ace projects”.

A primary mission of the cost-cutting is to allocate first city efficiently. Financially

residential countries add to their investment other in their developing industries and diminution

investment new in their declining industries. In this manner the financially residential countries

force not invest at a advanced level. in spite of this essence of theory, here is minor dictate make

clear on whether and how "financial markets advance the allocation of investment through attain

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9BUSINESS

this, funds is said through live invested in the sectors that are predictable toward obtain

prominent income and be withdrawn from sectors with destitute prospects (Pike et al. 2015).

Capital allocation within international markets (United Kingdom)

The economic system is potential to take extra care while passing on of funds. The

economic system shows that business is the fundamental position and it helps in stimulating

financial growth, influencing lucrative inflow of funds, and disturbing financial welfare.

According to the structural approach, the fiscal system of a nation consists of three central

components: fiscal markets; fiscal UN armed forces (Maggiori, Neiman and Schreger 2017).

In spite of this intense overall sell position, the previous act of the income sector is no

pledge for its future. The capital sector has completed a big donation into China’s riches over a

portly element of its postcolonial history. The sector operates contained by an abundantly

competitive globalised environment. Its forthcoming depends on its power through keep on

globally competitive, period pursuing sustainable expansion to a permutation of funds discovery

and exploitation, socially dependable increase and effectual environmental stewardship (Matvos

and Seru 2014).

A mishmash of important marble and energy resources, perceived depleted absolute risk,

a skilled workforce, technological leadership, ingenuousness through tell irrelevant investment

and qualified openness from interventionist administration policies has shaped the Chinese

property sector toward a very well competitive supplier of mineral deposits and energy food

toward comprehensive markets (Rodan 2016).

Trade theories helps in fund allocation, the countries get involved in trading activities

because the goods and services in the domestic market have potential economic disadvantage.

this, funds is said through live invested in the sectors that are predictable toward obtain

prominent income and be withdrawn from sectors with destitute prospects (Pike et al. 2015).

Capital allocation within international markets (United Kingdom)

The economic system is potential to take extra care while passing on of funds. The

economic system shows that business is the fundamental position and it helps in stimulating

financial growth, influencing lucrative inflow of funds, and disturbing financial welfare.

According to the structural approach, the fiscal system of a nation consists of three central

components: fiscal markets; fiscal UN armed forces (Maggiori, Neiman and Schreger 2017).

In spite of this intense overall sell position, the previous act of the income sector is no

pledge for its future. The capital sector has completed a big donation into China’s riches over a

portly element of its postcolonial history. The sector operates contained by an abundantly

competitive globalised environment. Its forthcoming depends on its power through keep on

globally competitive, period pursuing sustainable expansion to a permutation of funds discovery

and exploitation, socially dependable increase and effectual environmental stewardship (Matvos

and Seru 2014).

A mishmash of important marble and energy resources, perceived depleted absolute risk,

a skilled workforce, technological leadership, ingenuousness through tell irrelevant investment

and qualified openness from interventionist administration policies has shaped the Chinese

property sector toward a very well competitive supplier of mineral deposits and energy food

toward comprehensive markets (Rodan 2016).

Trade theories helps in fund allocation, the countries get involved in trading activities

because the goods and services in the domestic market have potential economic disadvantage.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BUSINESS

Factor proportion theory and classical trade theory are theories which assist in the international

trade between countries. A country that are producing goods and services which are having

competitive price advantage is able to derive the gains and benefits in importing and exporting of

goods that are trading as per classical theory. The goods which are produced at a competitive

price are imported from other countries (Grinblatt and Titman 2016). The emerging economies

have inflation risks, and weaker financial institutions. Organizations try to balance the capital

allocation between maintenance investment and strategic replacement.

Factor proportion theory and classical trade theory are theories which assist in the international

trade between countries. A country that are producing goods and services which are having

competitive price advantage is able to derive the gains and benefits in importing and exporting of

goods that are trading as per classical theory. The goods which are produced at a competitive

price are imported from other countries (Grinblatt and Titman 2016). The emerging economies

have inflation risks, and weaker financial institutions. Organizations try to balance the capital

allocation between maintenance investment and strategic replacement.

11BUSINESS

Evaluation of the emerging economy (China).

In the context of China, there are two highest risks connected to intercontinental

operations identified in the examination that were extreme domestic outlay in China and the

chance of adverse substitute evaluation of movements. Respondents furthermore try they were

nervous about bigger global rivalry and the menace of financially viable or economic disaster is

the key in markets, but were reasonably hopeful about the threats posed by protectionism,

criminal or terrorist acts, and cybercrime (Gupta et al. 2014).

The value of shareholders can be maximized by efficient allocation of capital through the

targeted incentive of business unit earnings and products that is superior adjusted risk return.

Financial liberalization in the country of Chine also helps in proper allocation of capital to

highest value. It has been seen that the funds are allocated within the Country and this helps in

the reform of banking sector as a part of financial liberalization (Li, Cui and Lu 2018.). In the

early period of liberalization, the capital was not allocated properly which led to rise in

investment allocation efficiency

Thus, regulators are obliged to be aware of the truth that any variation in control in one

section of the universal monetary system is probable to boast overall move effects. The Firms tap

the universal monetary markets to bring up first city and the gravity and liquidity of the total

fiscal promote comfort companies shrink their price of resources and expand read to funds, so

facilitating funds and intercontinental monetary Markets (Gupta et al. 2015). The Diverse

System is the basic to retail.

Thus, better-developed overall economic markets spur entrepreneurship, investment,

employment growth, and never-ending hill in GDP.The macroeconomic system promotes overall

Evaluation of the emerging economy (China).

In the context of China, there are two highest risks connected to intercontinental

operations identified in the examination that were extreme domestic outlay in China and the

chance of adverse substitute evaluation of movements. Respondents furthermore try they were

nervous about bigger global rivalry and the menace of financially viable or economic disaster is

the key in markets, but were reasonably hopeful about the threats posed by protectionism,

criminal or terrorist acts, and cybercrime (Gupta et al. 2014).

The value of shareholders can be maximized by efficient allocation of capital through the

targeted incentive of business unit earnings and products that is superior adjusted risk return.

Financial liberalization in the country of Chine also helps in proper allocation of capital to

highest value. It has been seen that the funds are allocated within the Country and this helps in

the reform of banking sector as a part of financial liberalization (Li, Cui and Lu 2018.). In the

early period of liberalization, the capital was not allocated properly which led to rise in

investment allocation efficiency

Thus, regulators are obliged to be aware of the truth that any variation in control in one

section of the universal monetary system is probable to boast overall move effects. The Firms tap

the universal monetary markets to bring up first city and the gravity and liquidity of the total

fiscal promote comfort companies shrink their price of resources and expand read to funds, so

facilitating funds and intercontinental monetary Markets (Gupta et al. 2015). The Diverse

System is the basic to retail.

Thus, better-developed overall economic markets spur entrepreneurship, investment,

employment growth, and never-ending hill in GDP.The macroeconomic system promotes overall

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.