FINA1108 Project: Evaluating Investment Strategies and Volatility

VerifiedAdded on 2023/01/19

|29

|3173

|50

Project

AI Summary

This project analyzes financial time series data from the FTSE100, focusing on portfolio optimization and volatility modeling. The assignment begins by verifying the stationarity of selected stocks using ACF and PACF tests. It then delves into mean-variance portfolio optimization, including covariance matrix estimation and the construction of an efficient frontier. Furthermore, the project involves forecasting volatility using the GARCH(1,1) model and concludes with an ARMA model analysis. The analysis utilizes data from eight stocks, covering the period from November 2018 to November 2019, to provide a comprehensive understanding of investment strategies and market dynamics. The project aims to provide insights into efficient portfolio construction and volatility forecasting techniques.

PROJECT METHODOLOGIES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

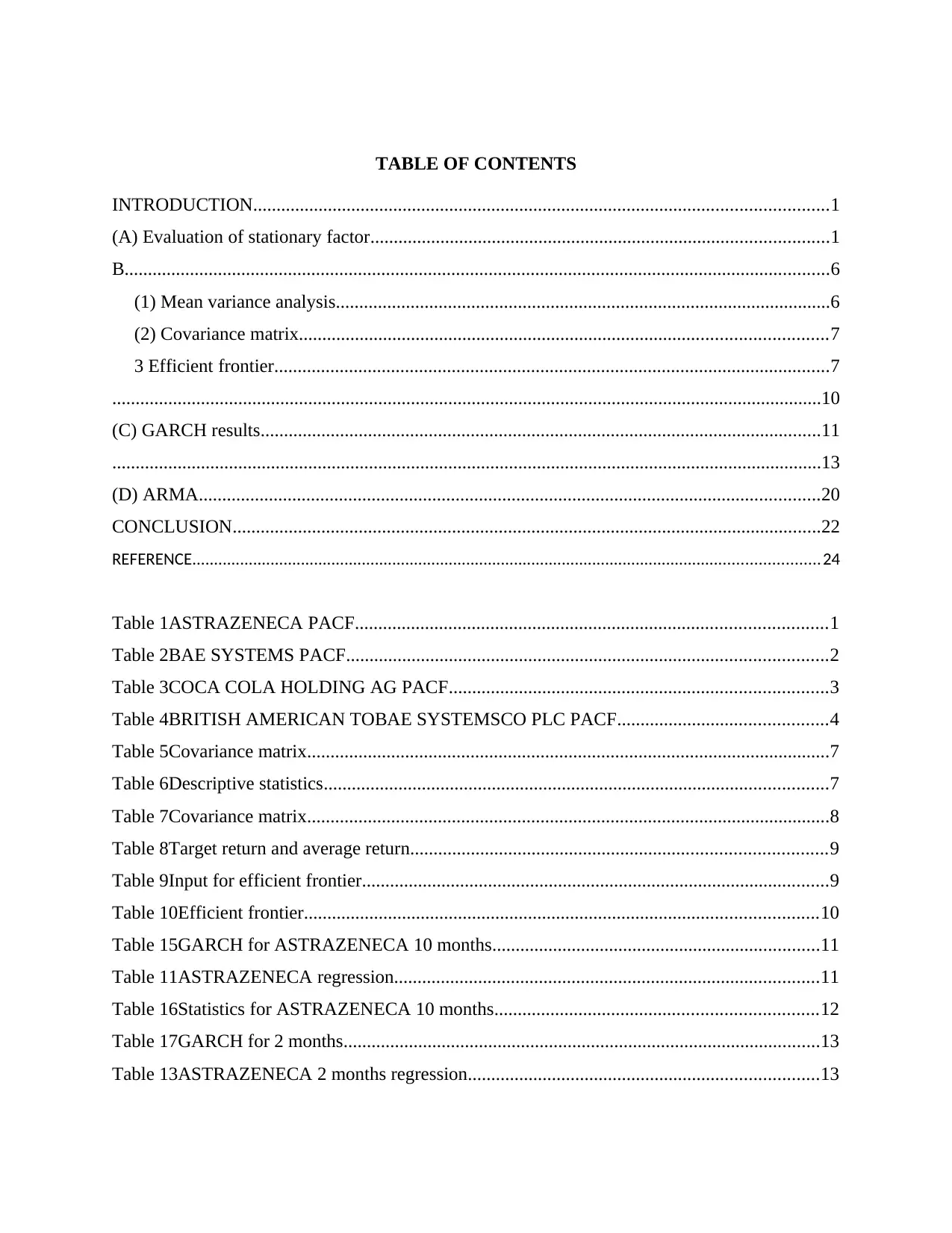

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

(A) Evaluation of stationary factor..................................................................................................1

B.......................................................................................................................................................6

(1) Mean variance analysis..........................................................................................................6

(2) Covariance matrix.................................................................................................................7

3 Efficient frontier.......................................................................................................................7

........................................................................................................................................................10

(C) GARCH results........................................................................................................................11

........................................................................................................................................................13

(D) ARMA.....................................................................................................................................20

CONCLUSION..............................................................................................................................22

REFERENCE................................................................................................................................................24

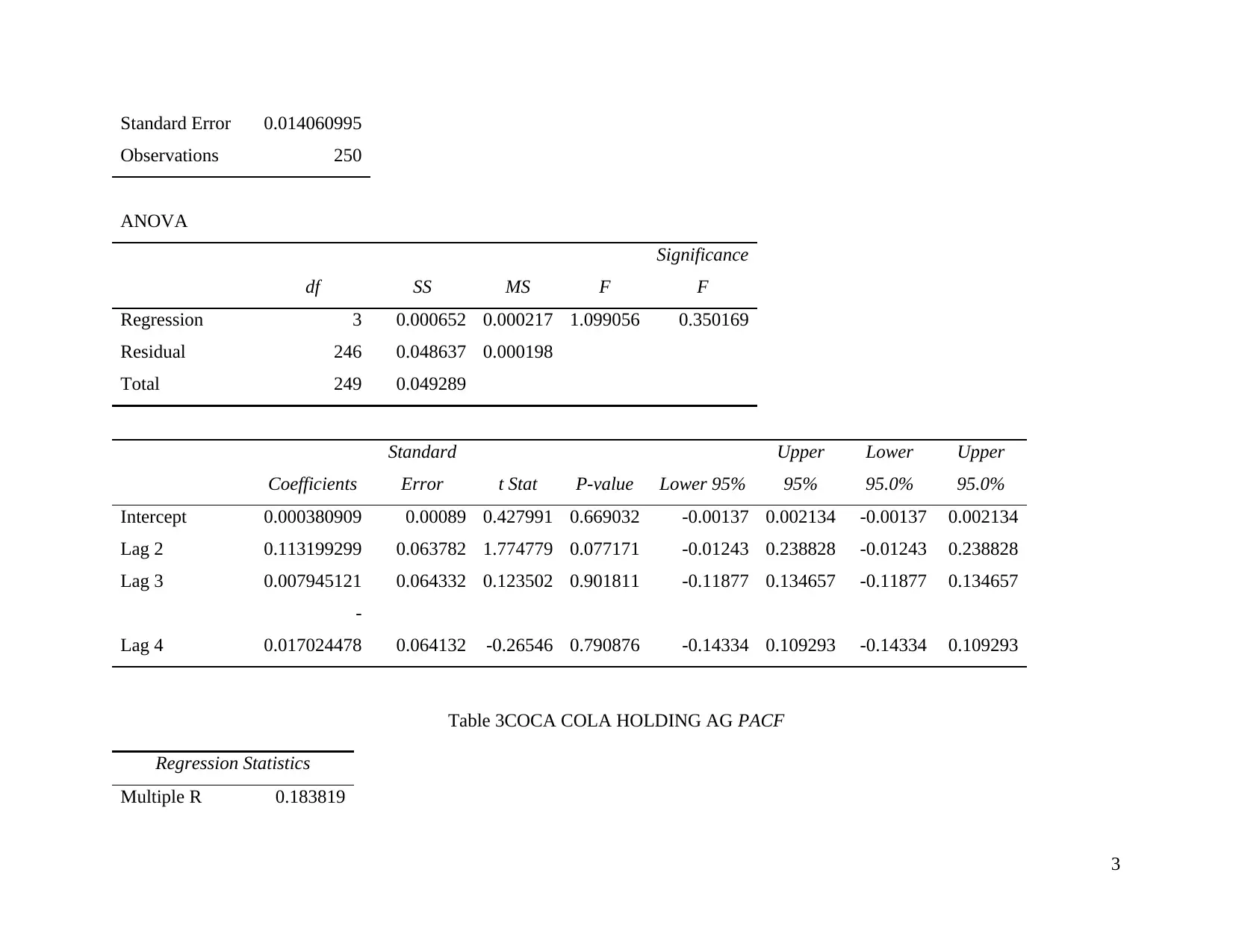

Table 1ASTRAZENECA PACF.....................................................................................................1

Table 2BAE SYSTEMS PACF.......................................................................................................2

Table 3COCA COLA HOLDING AG PACF.................................................................................3

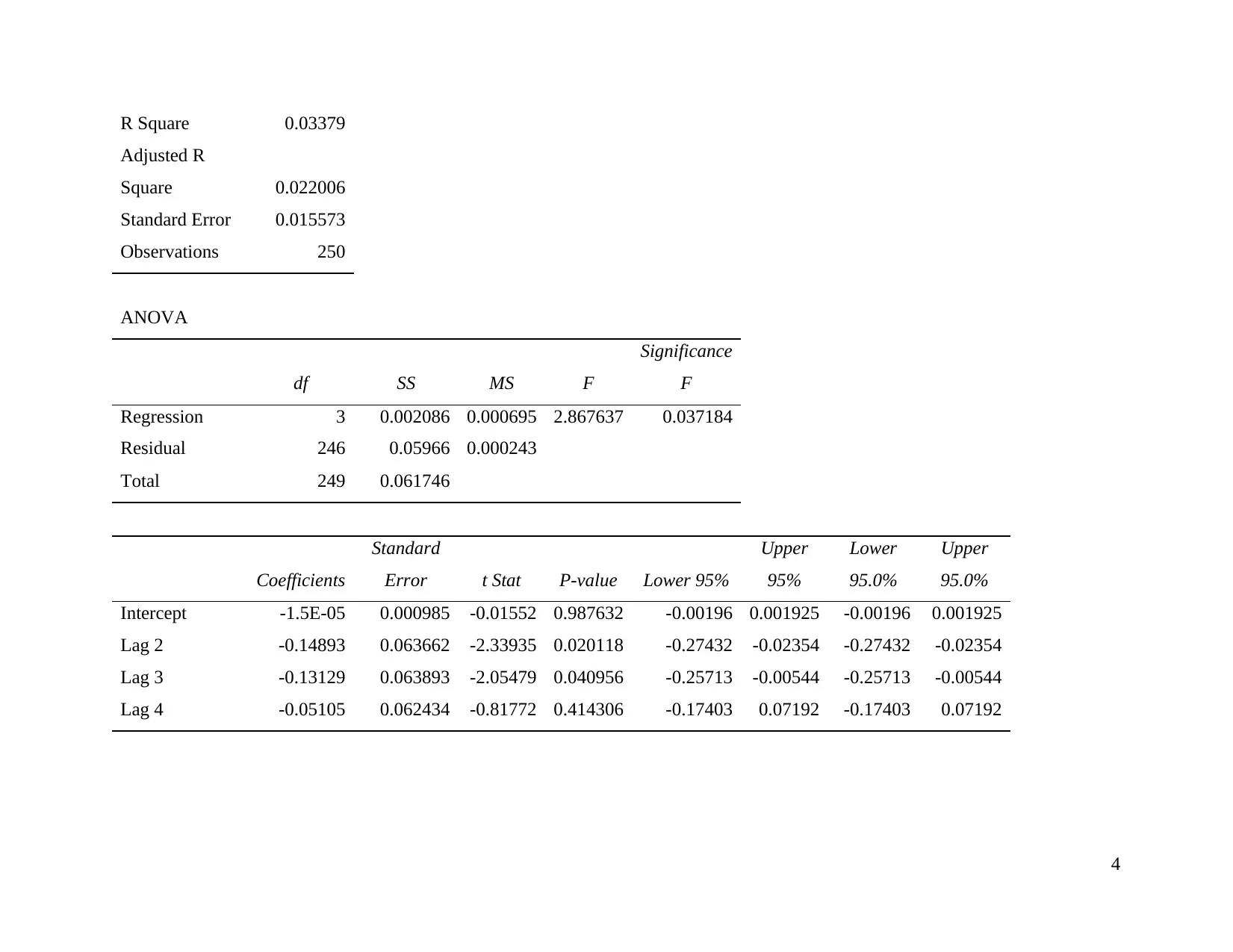

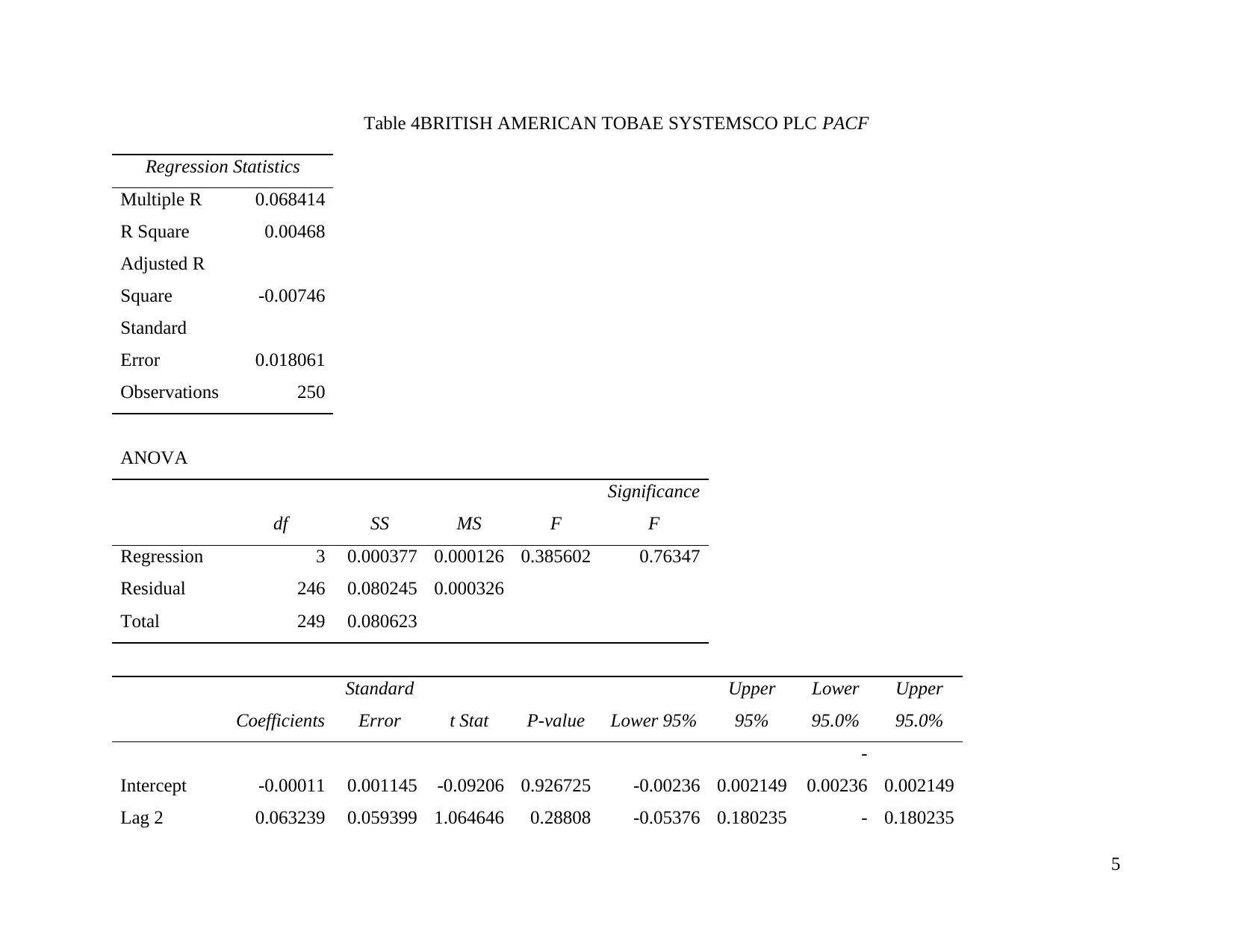

Table 4BRITISH AMERICAN TOBAE SYSTEMSCO PLC PACF.............................................4

Table 5Covariance matrix................................................................................................................7

Table 6Descriptive statistics............................................................................................................7

Table 7Covariance matrix................................................................................................................8

Table 8Target return and average return.........................................................................................9

Table 9Input for efficient frontier....................................................................................................9

Table 10Efficient frontier..............................................................................................................10

Table 15GARCH for ASTRAZENECA 10 months......................................................................11

Table 11ASTRAZENECA regression...........................................................................................11

Table 16Statistics for ASTRAZENECA 10 months.....................................................................12

Table 17GARCH for 2 months......................................................................................................13

Table 13ASTRAZENECA 2 months regression...........................................................................13

INTRODUCTION...........................................................................................................................1

(A) Evaluation of stationary factor..................................................................................................1

B.......................................................................................................................................................6

(1) Mean variance analysis..........................................................................................................6

(2) Covariance matrix.................................................................................................................7

3 Efficient frontier.......................................................................................................................7

........................................................................................................................................................10

(C) GARCH results........................................................................................................................11

........................................................................................................................................................13

(D) ARMA.....................................................................................................................................20

CONCLUSION..............................................................................................................................22

REFERENCE................................................................................................................................................24

Table 1ASTRAZENECA PACF.....................................................................................................1

Table 2BAE SYSTEMS PACF.......................................................................................................2

Table 3COCA COLA HOLDING AG PACF.................................................................................3

Table 4BRITISH AMERICAN TOBAE SYSTEMSCO PLC PACF.............................................4

Table 5Covariance matrix................................................................................................................7

Table 6Descriptive statistics............................................................................................................7

Table 7Covariance matrix................................................................................................................8

Table 8Target return and average return.........................................................................................9

Table 9Input for efficient frontier....................................................................................................9

Table 10Efficient frontier..............................................................................................................10

Table 15GARCH for ASTRAZENECA 10 months......................................................................11

Table 11ASTRAZENECA regression...........................................................................................11

Table 16Statistics for ASTRAZENECA 10 months.....................................................................12

Table 17GARCH for 2 months......................................................................................................13

Table 13ASTRAZENECA 2 months regression...........................................................................13

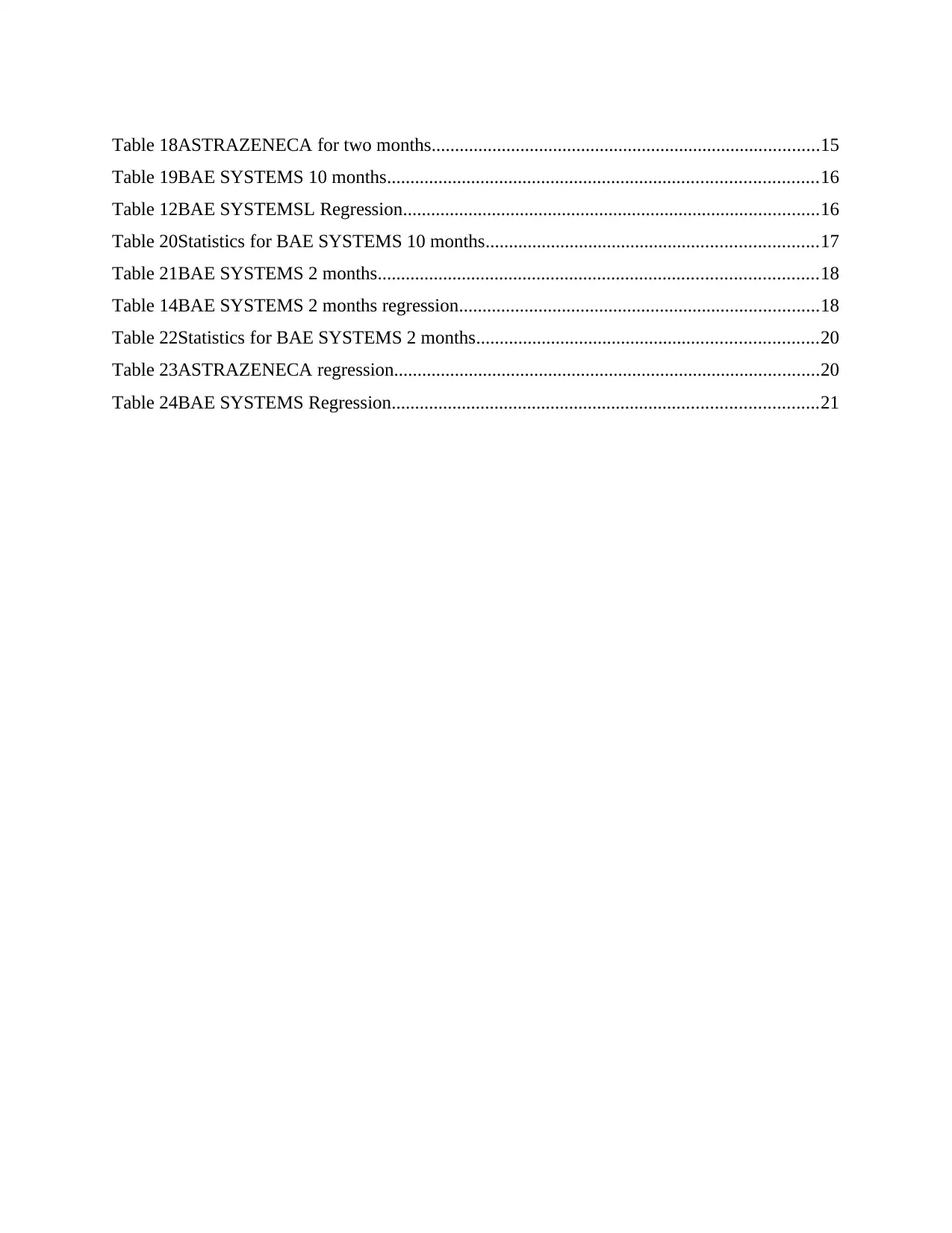

Table 18ASTRAZENECA for two months...................................................................................15

Table 19BAE SYSTEMS 10 months............................................................................................16

Table 12BAE SYSTEMSL Regression.........................................................................................16

Table 20Statistics for BAE SYSTEMS 10 months.......................................................................17

Table 21BAE SYSTEMS 2 months..............................................................................................18

Table 14BAE SYSTEMS 2 months regression.............................................................................18

Table 22Statistics for BAE SYSTEMS 2 months.........................................................................20

Table 23ASTRAZENECA regression...........................................................................................20

Table 24BAE SYSTEMS Regression...........................................................................................21

Table 19BAE SYSTEMS 10 months............................................................................................16

Table 12BAE SYSTEMSL Regression.........................................................................................16

Table 20Statistics for BAE SYSTEMS 10 months.......................................................................17

Table 21BAE SYSTEMS 2 months..............................................................................................18

Table 14BAE SYSTEMS 2 months regression.............................................................................18

Table 22Statistics for BAE SYSTEMS 2 months.........................................................................20

Table 23ASTRAZENECA regression...........................................................................................20

Table 24BAE SYSTEMS Regression...........................................................................................21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

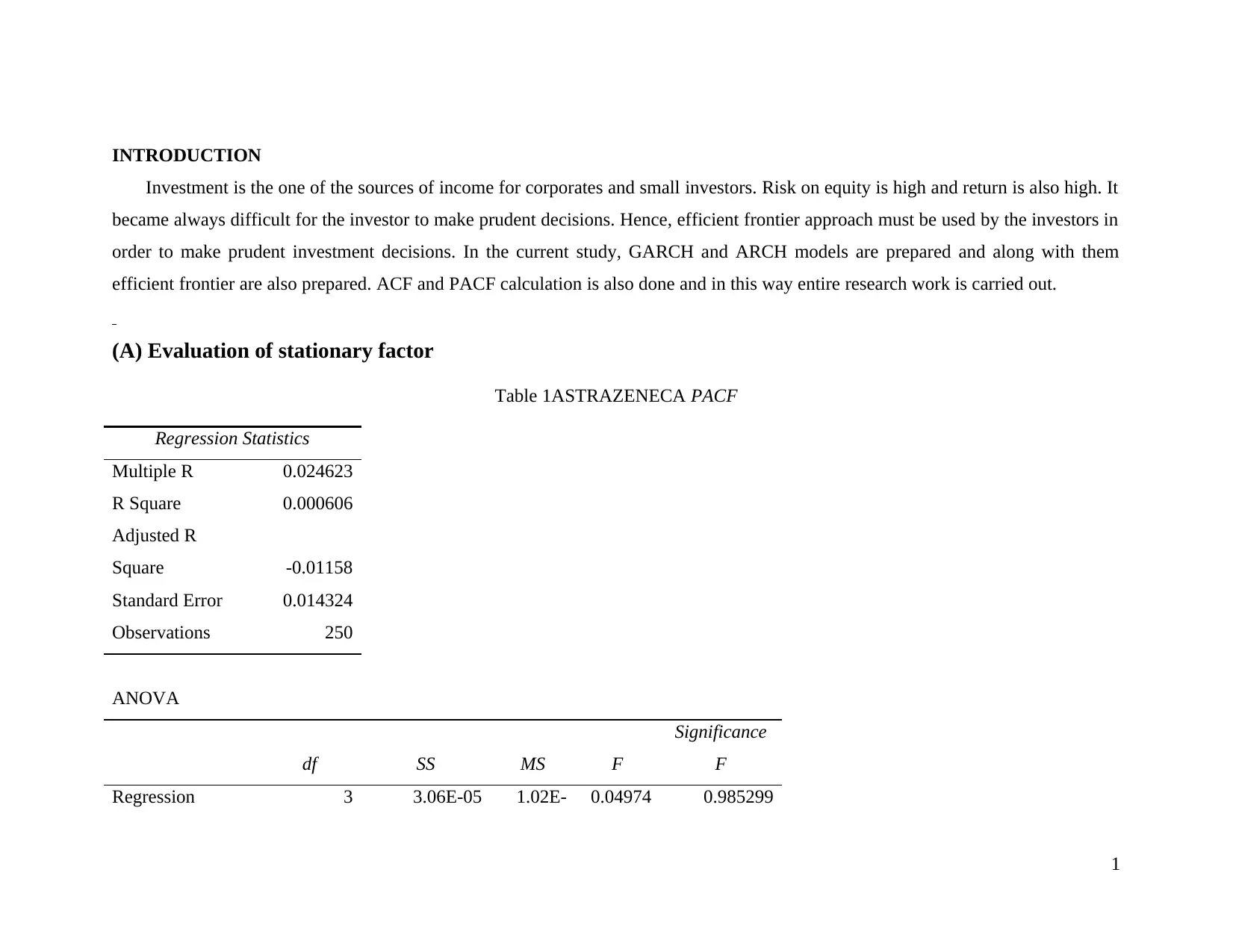

INTRODUCTION

Investment is the one of the sources of income for corporates and small investors. Risk on equity is high and return is also high. It

became always difficult for the investor to make prudent decisions. Hence, efficient frontier approach must be used by the investors in

order to make prudent investment decisions. In the current study, GARCH and ARCH models are prepared and along with them

efficient frontier are also prepared. ACF and PACF calculation is also done and in this way entire research work is carried out.

(A) Evaluation of stationary factor

Table 1ASTRAZENECA PACF

Regression Statistics

Multiple R 0.024623

R Square 0.000606

Adjusted R

Square -0.01158

Standard Error 0.014324

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 3.06E-05 1.02E- 0.04974 0.985299

1

Investment is the one of the sources of income for corporates and small investors. Risk on equity is high and return is also high. It

became always difficult for the investor to make prudent decisions. Hence, efficient frontier approach must be used by the investors in

order to make prudent investment decisions. In the current study, GARCH and ARCH models are prepared and along with them

efficient frontier are also prepared. ACF and PACF calculation is also done and in this way entire research work is carried out.

(A) Evaluation of stationary factor

Table 1ASTRAZENECA PACF

Regression Statistics

Multiple R 0.024623

R Square 0.000606

Adjusted R

Square -0.01158

Standard Error 0.014324

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 3.06E-05 1.02E- 0.04974 0.985299

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

05 4

Residual 246 0.050471

0.00020

5

Total 249 0.050502

Coefficient

s

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 0.000596 0.000909

0.65583

8

0.51254

1 -0.00119 0.002386 -0.00119 0.002386

Lag 2 0.023965 0.063764 0.37583

0.70736

7 -0.10163 0.149559 -0.10163 0.149559

Lag 3 -0.00472 0.063757 -0.0741

0.94099

3 -0.1303 0.120855 -0.1303 0.120855

Lag 4 -0.0036 0.062989 -0.05708

0.95453

1 -0.12766 0.120471 -0.12766 0.120471

Table 2BAE SYSTEMS PACF

Regression Statistics

Multiple R 0.115003739

R Square 0.01322586

Adjusted R

Square 0.001192029

2

Residual 246 0.050471

0.00020

5

Total 249 0.050502

Coefficient

s

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 0.000596 0.000909

0.65583

8

0.51254

1 -0.00119 0.002386 -0.00119 0.002386

Lag 2 0.023965 0.063764 0.37583

0.70736

7 -0.10163 0.149559 -0.10163 0.149559

Lag 3 -0.00472 0.063757 -0.0741

0.94099

3 -0.1303 0.120855 -0.1303 0.120855

Lag 4 -0.0036 0.062989 -0.05708

0.95453

1 -0.12766 0.120471 -0.12766 0.120471

Table 2BAE SYSTEMS PACF

Regression Statistics

Multiple R 0.115003739

R Square 0.01322586

Adjusted R

Square 0.001192029

2

Standard Error 0.014060995

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 0.000652 0.000217 1.099056 0.350169

Residual 246 0.048637 0.000198

Total 249 0.049289

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 0.000380909 0.00089 0.427991 0.669032 -0.00137 0.002134 -0.00137 0.002134

Lag 2 0.113199299 0.063782 1.774779 0.077171 -0.01243 0.238828 -0.01243 0.238828

Lag 3 0.007945121 0.064332 0.123502 0.901811 -0.11877 0.134657 -0.11877 0.134657

Lag 4

-

0.017024478 0.064132 -0.26546 0.790876 -0.14334 0.109293 -0.14334 0.109293

Table 3COCA COLA HOLDING AG PACF

Regression Statistics

Multiple R 0.183819

3

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 0.000652 0.000217 1.099056 0.350169

Residual 246 0.048637 0.000198

Total 249 0.049289

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 0.000380909 0.00089 0.427991 0.669032 -0.00137 0.002134 -0.00137 0.002134

Lag 2 0.113199299 0.063782 1.774779 0.077171 -0.01243 0.238828 -0.01243 0.238828

Lag 3 0.007945121 0.064332 0.123502 0.901811 -0.11877 0.134657 -0.11877 0.134657

Lag 4

-

0.017024478 0.064132 -0.26546 0.790876 -0.14334 0.109293 -0.14334 0.109293

Table 3COCA COLA HOLDING AG PACF

Regression Statistics

Multiple R 0.183819

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

R Square 0.03379

Adjusted R

Square 0.022006

Standard Error 0.015573

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 0.002086 0.000695 2.867637 0.037184

Residual 246 0.05966 0.000243

Total 249 0.061746

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept -1.5E-05 0.000985 -0.01552 0.987632 -0.00196 0.001925 -0.00196 0.001925

Lag 2 -0.14893 0.063662 -2.33935 0.020118 -0.27432 -0.02354 -0.27432 -0.02354

Lag 3 -0.13129 0.063893 -2.05479 0.040956 -0.25713 -0.00544 -0.25713 -0.00544

Lag 4 -0.05105 0.062434 -0.81772 0.414306 -0.17403 0.07192 -0.17403 0.07192

4

Adjusted R

Square 0.022006

Standard Error 0.015573

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 0.002086 0.000695 2.867637 0.037184

Residual 246 0.05966 0.000243

Total 249 0.061746

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept -1.5E-05 0.000985 -0.01552 0.987632 -0.00196 0.001925 -0.00196 0.001925

Lag 2 -0.14893 0.063662 -2.33935 0.020118 -0.27432 -0.02354 -0.27432 -0.02354

Lag 3 -0.13129 0.063893 -2.05479 0.040956 -0.25713 -0.00544 -0.25713 -0.00544

Lag 4 -0.05105 0.062434 -0.81772 0.414306 -0.17403 0.07192 -0.17403 0.07192

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 4BRITISH AMERICAN TOBAE SYSTEMSCO PLC PACF

Regression Statistics

Multiple R 0.068414

R Square 0.00468

Adjusted R

Square -0.00746

Standard

Error 0.018061

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 0.000377 0.000126 0.385602 0.76347

Residual 246 0.080245 0.000326

Total 249 0.080623

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept -0.00011 0.001145 -0.09206 0.926725 -0.00236 0.002149

-

0.00236 0.002149

Lag 2 0.063239 0.059399 1.064646 0.28808 -0.05376 0.180235 - 0.180235

5

Regression Statistics

Multiple R 0.068414

R Square 0.00468

Adjusted R

Square -0.00746

Standard

Error 0.018061

Observations 250

ANOVA

df SS MS F

Significance

F

Regression 3 0.000377 0.000126 0.385602 0.76347

Residual 246 0.080245 0.000326

Total 249 0.080623

Coefficients

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept -0.00011 0.001145 -0.09206 0.926725 -0.00236 0.002149

-

0.00236 0.002149

Lag 2 0.063239 0.059399 1.064646 0.28808 -0.05376 0.180235 - 0.180235

5

0.05376

Lag 3 -0.0077 0.059623 -0.12912 0.897368 -0.12514 0.109739

-

0.12514 0.109739

Lag 4 -0.00894 0.059364 -0.15059 0.880426 -0.12587 0.107988

-

0.12587 0.107988

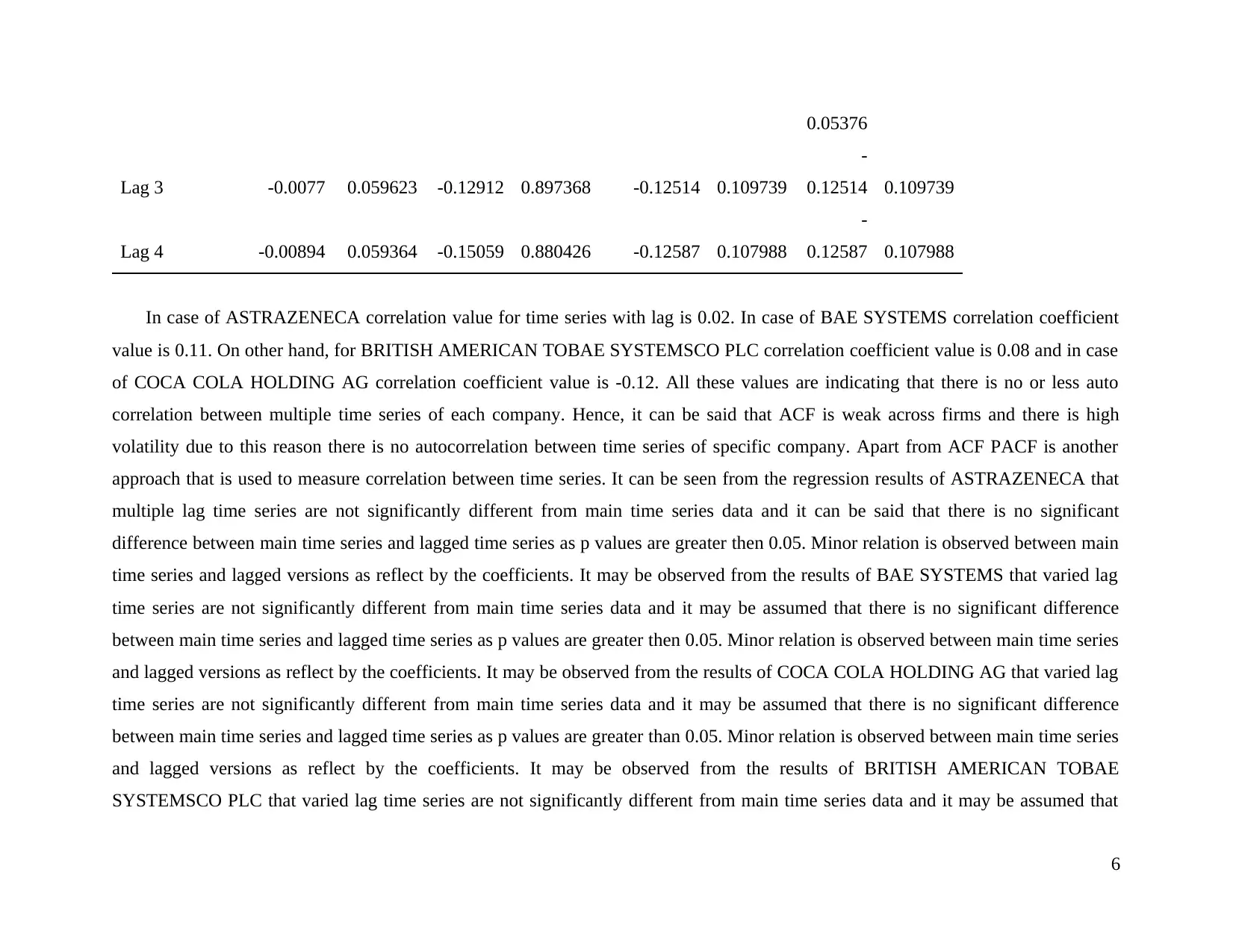

In case of ASTRAZENECA correlation value for time series with lag is 0.02. In case of BAE SYSTEMS correlation coefficient

value is 0.11. On other hand, for BRITISH AMERICAN TOBAE SYSTEMSCO PLC correlation coefficient value is 0.08 and in case

of COCA COLA HOLDING AG correlation coefficient value is -0.12. All these values are indicating that there is no or less auto

correlation between multiple time series of each company. Hence, it can be said that ACF is weak across firms and there is high

volatility due to this reason there is no autocorrelation between time series of specific company. Apart from ACF PACF is another

approach that is used to measure correlation between time series. It can be seen from the regression results of ASTRAZENECA that

multiple lag time series are not significantly different from main time series data and it can be said that there is no significant

difference between main time series and lagged time series as p values are greater then 0.05. Minor relation is observed between main

time series and lagged versions as reflect by the coefficients. It may be observed from the results of BAE SYSTEMS that varied lag

time series are not significantly different from main time series data and it may be assumed that there is no significant difference

between main time series and lagged time series as p values are greater then 0.05. Minor relation is observed between main time series

and lagged versions as reflect by the coefficients. It may be observed from the results of COCA COLA HOLDING AG that varied lag

time series are not significantly different from main time series data and it may be assumed that there is no significant difference

between main time series and lagged time series as p values are greater than 0.05. Minor relation is observed between main time series

and lagged versions as reflect by the coefficients. It may be observed from the results of BRITISH AMERICAN TOBAE

SYSTEMSCO PLC that varied lag time series are not significantly different from main time series data and it may be assumed that

6

Lag 3 -0.0077 0.059623 -0.12912 0.897368 -0.12514 0.109739

-

0.12514 0.109739

Lag 4 -0.00894 0.059364 -0.15059 0.880426 -0.12587 0.107988

-

0.12587 0.107988

In case of ASTRAZENECA correlation value for time series with lag is 0.02. In case of BAE SYSTEMS correlation coefficient

value is 0.11. On other hand, for BRITISH AMERICAN TOBAE SYSTEMSCO PLC correlation coefficient value is 0.08 and in case

of COCA COLA HOLDING AG correlation coefficient value is -0.12. All these values are indicating that there is no or less auto

correlation between multiple time series of each company. Hence, it can be said that ACF is weak across firms and there is high

volatility due to this reason there is no autocorrelation between time series of specific company. Apart from ACF PACF is another

approach that is used to measure correlation between time series. It can be seen from the regression results of ASTRAZENECA that

multiple lag time series are not significantly different from main time series data and it can be said that there is no significant

difference between main time series and lagged time series as p values are greater then 0.05. Minor relation is observed between main

time series and lagged versions as reflect by the coefficients. It may be observed from the results of BAE SYSTEMS that varied lag

time series are not significantly different from main time series data and it may be assumed that there is no significant difference

between main time series and lagged time series as p values are greater then 0.05. Minor relation is observed between main time series

and lagged versions as reflect by the coefficients. It may be observed from the results of COCA COLA HOLDING AG that varied lag

time series are not significantly different from main time series data and it may be assumed that there is no significant difference

between main time series and lagged time series as p values are greater than 0.05. Minor relation is observed between main time series

and lagged versions as reflect by the coefficients. It may be observed from the results of BRITISH AMERICAN TOBAE

SYSTEMSCO PLC that varied lag time series are not significantly different from main time series data and it may be assumed that

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

there is no significant difference between main time series and lagged time series as p values are greater than 0.05. Minor relation is

observed between main time series and lagged versions as reflect by the coefficients.

B

(1) Mean variance analysis

Mean variance analysis is the part of the modern portfolio theory. It is assumed that investor is able to make rational investment

decisions and can make accurate decisions if complete set of information will be available to them. Under this theory it is assumed

that investor want low risk and maximum profit. Hence, there are factors on which due importance is given in mean variance analysis

and they are variance and return. Variance indicate extent to which return deviate from its mean value and expected return reflect

percentage that can be gained on security if investment is made on it. This theory believed that if variance and expected return of an

asset is identified then in that case by making change in weight of securities portfolio return can be maximized by the business firm.

Due to this reason concept of efficient frontier is used by the business firms so that optimum portfolio can be identified where risk can

be reduced and profit can be maximized.

(2) Covariance matrix

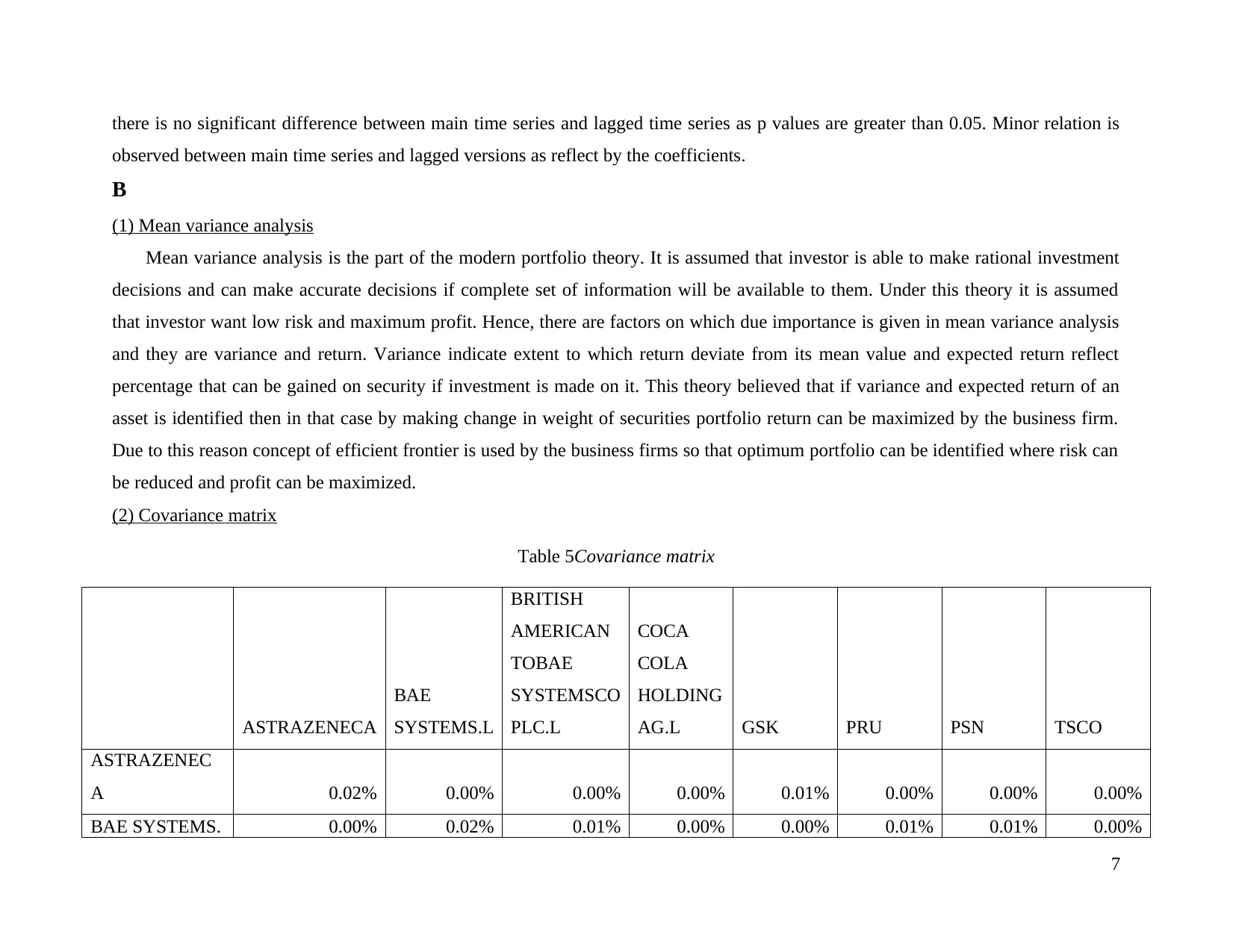

Table 5Covariance matrix

ASTRAZENECA

BAE

SYSTEMS.L

BRITISH

AMERICAN

TOBAE

SYSTEMSCO

PLC.L

COCA

COLA

HOLDING

AG.L GSK PRU PSN TSCO

ASTRAZENEC

A 0.02% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00%

BAE SYSTEMS. 0.00% 0.02% 0.01% 0.00% 0.00% 0.01% 0.01% 0.00%

7

observed between main time series and lagged versions as reflect by the coefficients.

B

(1) Mean variance analysis

Mean variance analysis is the part of the modern portfolio theory. It is assumed that investor is able to make rational investment

decisions and can make accurate decisions if complete set of information will be available to them. Under this theory it is assumed

that investor want low risk and maximum profit. Hence, there are factors on which due importance is given in mean variance analysis

and they are variance and return. Variance indicate extent to which return deviate from its mean value and expected return reflect

percentage that can be gained on security if investment is made on it. This theory believed that if variance and expected return of an

asset is identified then in that case by making change in weight of securities portfolio return can be maximized by the business firm.

Due to this reason concept of efficient frontier is used by the business firms so that optimum portfolio can be identified where risk can

be reduced and profit can be maximized.

(2) Covariance matrix

Table 5Covariance matrix

ASTRAZENECA

BAE

SYSTEMS.L

BRITISH

AMERICAN

TOBAE

SYSTEMSCO

PLC.L

COCA

COLA

HOLDING

AG.L GSK PRU PSN TSCO

ASTRAZENEC

A 0.02% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00%

BAE SYSTEMS. 0.00% 0.02% 0.01% 0.00% 0.00% 0.01% 0.01% 0.00%

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

L

BRITISH

AMERICAN

TOBAE

SYSTEMSCO

PLC.L 0.00% 0.01% 0.04% 0.01% 0.00% 0.01% 0.00% 0.00%

COCA COLA

HOLDING AG.L 0.00% 0.00% 0.01% 0.03% 0.00% 0.01% 0.00% 0.00%

GSK 0.01% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00%

PRU 0.00% 0.01% 0.01% 0.01% 0.00% 0.03% 0.01% 0.01%

PSN 0.00% 0.01% 0.00% 0.00% 0.00% 0.01% 0.04% 0.01%

TSCO 0.00% 0.00% 0.00% 0.00% 0.00% 0.01% 0.01% 0.02%

Covariance reflect change that come in one variable with change in another one. It can be observed from the above table that

covariance percentage is quite low and remain in range of 0.00% to 0.004%. Hence, it can be said that if firm prepare portfolio of

above given firms then in that case any big change will not come in one security with rise or fall in price of another security. Hence,

managers can not follow pair trading strategy in the business. Under this strategy usually association between varied firm’s equity is

identified and with decline in share price of one investment is made on other security. By doing so loss faced in equity of one

company is offset by gain made on another firm share.

8

BRITISH

AMERICAN

TOBAE

SYSTEMSCO

PLC.L 0.00% 0.01% 0.04% 0.01% 0.00% 0.01% 0.00% 0.00%

COCA COLA

HOLDING AG.L 0.00% 0.00% 0.01% 0.03% 0.00% 0.01% 0.00% 0.00%

GSK 0.01% 0.00% 0.00% 0.00% 0.01% 0.00% 0.00% 0.00%

PRU 0.00% 0.01% 0.01% 0.01% 0.00% 0.03% 0.01% 0.01%

PSN 0.00% 0.01% 0.00% 0.00% 0.00% 0.01% 0.04% 0.01%

TSCO 0.00% 0.00% 0.00% 0.00% 0.00% 0.01% 0.01% 0.02%

Covariance reflect change that come in one variable with change in another one. It can be observed from the above table that

covariance percentage is quite low and remain in range of 0.00% to 0.004%. Hence, it can be said that if firm prepare portfolio of

above given firms then in that case any big change will not come in one security with rise or fall in price of another security. Hence,

managers can not follow pair trading strategy in the business. Under this strategy usually association between varied firm’s equity is

identified and with decline in share price of one investment is made on other security. By doing so loss faced in equity of one

company is offset by gain made on another firm share.

8

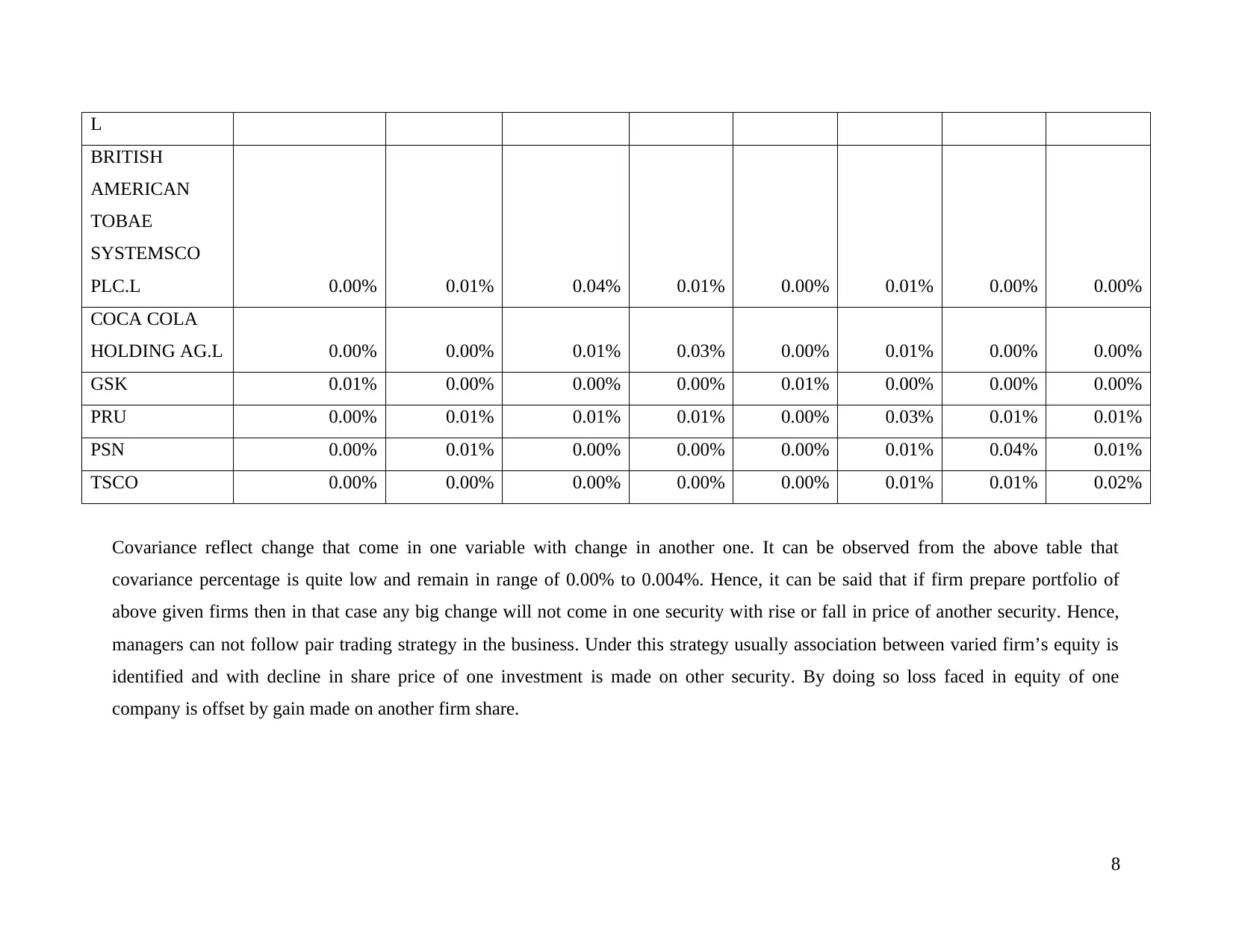

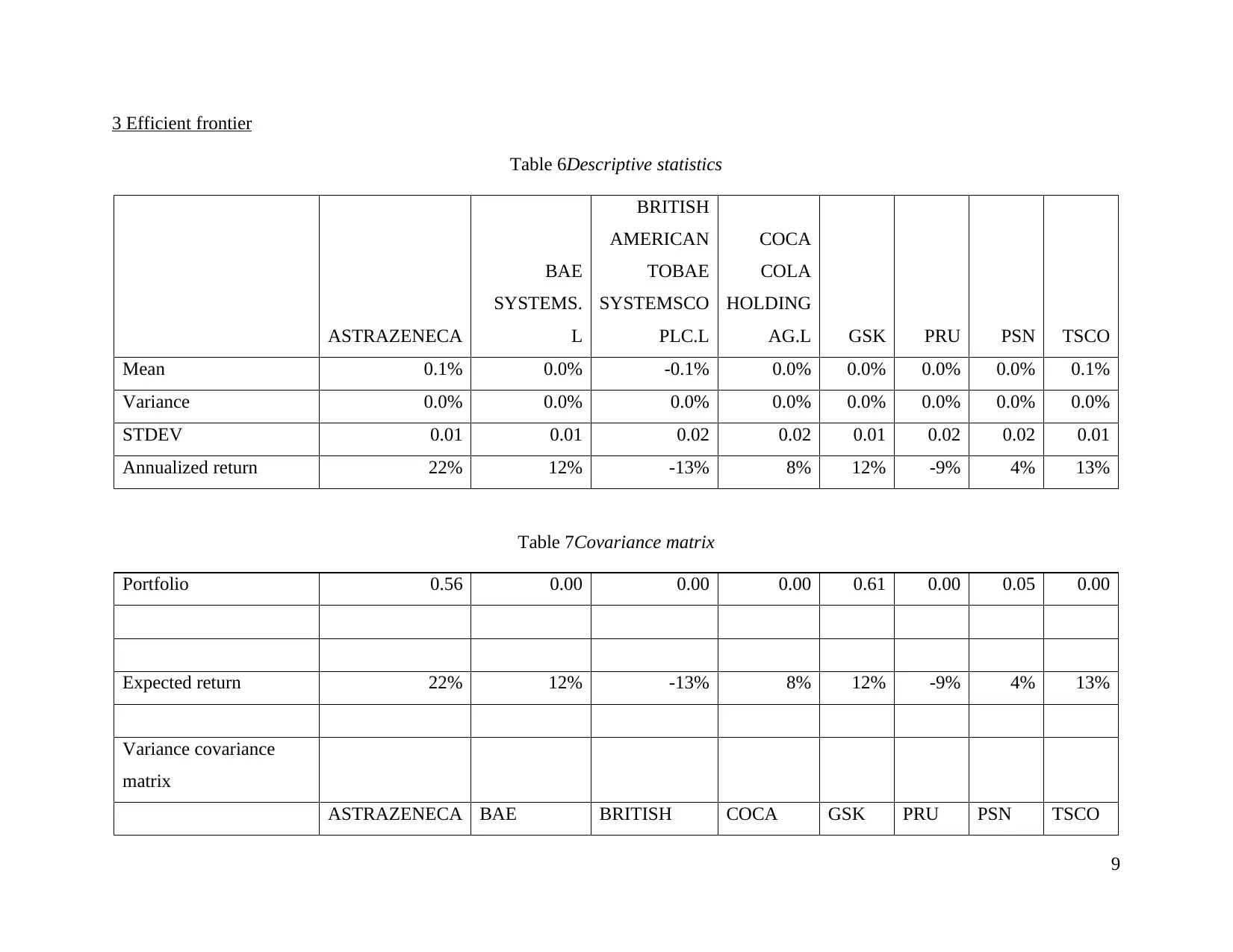

3 Efficient frontier

Table 6Descriptive statistics

ASTRAZENECA

BAE

SYSTEMS.

L

BRITISH

AMERICAN

TOBAE

SYSTEMSCO

PLC.L

COCA

COLA

HOLDING

AG.L GSK PRU PSN TSCO

Mean 0.1% 0.0% -0.1% 0.0% 0.0% 0.0% 0.0% 0.1%

Variance 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

STDEV 0.01 0.01 0.02 0.02 0.01 0.02 0.02 0.01

Annualized return 22% 12% -13% 8% 12% -9% 4% 13%

Table 7Covariance matrix

Portfolio 0.56 0.00 0.00 0.00 0.61 0.00 0.05 0.00

Expected return 22% 12% -13% 8% 12% -9% 4% 13%

Variance covariance

matrix

ASTRAZENECA BAE BRITISH COCA GSK PRU PSN TSCO

9

Table 6Descriptive statistics

ASTRAZENECA

BAE

SYSTEMS.

L

BRITISH

AMERICAN

TOBAE

SYSTEMSCO

PLC.L

COCA

COLA

HOLDING

AG.L GSK PRU PSN TSCO

Mean 0.1% 0.0% -0.1% 0.0% 0.0% 0.0% 0.0% 0.1%

Variance 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

STDEV 0.01 0.01 0.02 0.02 0.01 0.02 0.02 0.01

Annualized return 22% 12% -13% 8% 12% -9% 4% 13%

Table 7Covariance matrix

Portfolio 0.56 0.00 0.00 0.00 0.61 0.00 0.05 0.00

Expected return 22% 12% -13% 8% 12% -9% 4% 13%

Variance covariance

matrix

ASTRAZENECA BAE BRITISH COCA GSK PRU PSN TSCO

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 29

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.