Financial Markets and Institutes Assignment - Semester 1

VerifiedAdded on 2022/08/31

|18

|3597

|19

Homework Assignment

AI Summary

This assignment delves into the core concepts of financial markets and institutions, covering a range of topics essential for understanding finance. The assignment begins with an analysis of equity valuation, examining the P/E ratio, beta, and the Capital Asset Pricing Model (CAPM) to assess investment viability. It then explores interest rate dynamics, including calculating inflation rates and analyzing yield curves, considering the impact of inflation and changing interest rate expectations. The assignment further examines the use of sensitivity analysis for financial institutions and the application of derivative instruments like futures contracts for hedging. The final section examines the regulatory environment for financial institutions, including capital adequacy, risk management, and the separation of commercial and investment banking, as well as the role of shadow banking and technology companies in the financial sector. The assignment provides detailed calculations and interpretations to support the analysis.

Running head: FINANCIAL MARKETS AND INSTITUTES

Financial Markets and Institutes

Name of the Student:

Name of the University:

Author Note

Financial Markets and Institutes

Name of the Student:

Name of the University:

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MARKETS AND INSTITUTES

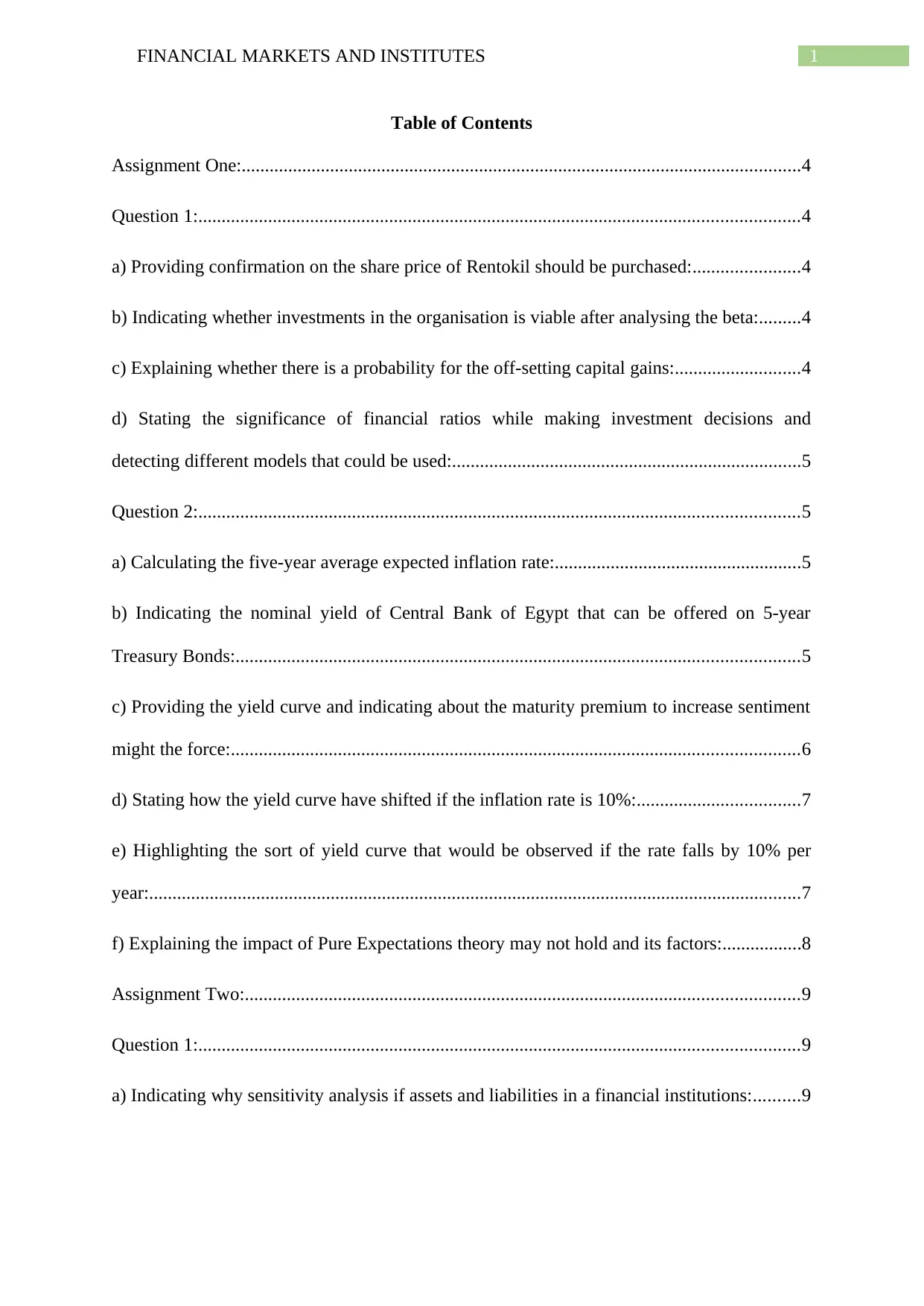

Table of Contents

Assignment One:........................................................................................................................4

Question 1:.................................................................................................................................4

a) Providing confirmation on the share price of Rentokil should be purchased:.......................4

b) Indicating whether investments in the organisation is viable after analysing the beta:.........4

c) Explaining whether there is a probability for the off-setting capital gains:...........................4

d) Stating the significance of financial ratios while making investment decisions and

detecting different models that could be used:...........................................................................5

Question 2:.................................................................................................................................5

a) Calculating the five-year average expected inflation rate:.....................................................5

b) Indicating the nominal yield of Central Bank of Egypt that can be offered on 5-year

Treasury Bonds:.........................................................................................................................5

c) Providing the yield curve and indicating about the maturity premium to increase sentiment

might the force:..........................................................................................................................6

d) Stating how the yield curve have shifted if the inflation rate is 10%:...................................7

e) Highlighting the sort of yield curve that would be observed if the rate falls by 10% per

year:............................................................................................................................................7

f) Explaining the impact of Pure Expectations theory may not hold and its factors:.................8

Assignment Two:.......................................................................................................................9

Question 1:.................................................................................................................................9

a) Indicating why sensitivity analysis if assets and liabilities in a financial institutions:..........9

Table of Contents

Assignment One:........................................................................................................................4

Question 1:.................................................................................................................................4

a) Providing confirmation on the share price of Rentokil should be purchased:.......................4

b) Indicating whether investments in the organisation is viable after analysing the beta:.........4

c) Explaining whether there is a probability for the off-setting capital gains:...........................4

d) Stating the significance of financial ratios while making investment decisions and

detecting different models that could be used:...........................................................................5

Question 2:.................................................................................................................................5

a) Calculating the five-year average expected inflation rate:.....................................................5

b) Indicating the nominal yield of Central Bank of Egypt that can be offered on 5-year

Treasury Bonds:.........................................................................................................................5

c) Providing the yield curve and indicating about the maturity premium to increase sentiment

might the force:..........................................................................................................................6

d) Stating how the yield curve have shifted if the inflation rate is 10%:...................................7

e) Highlighting the sort of yield curve that would be observed if the rate falls by 10% per

year:............................................................................................................................................7

f) Explaining the impact of Pure Expectations theory may not hold and its factors:.................8

Assignment Two:.......................................................................................................................9

Question 1:.................................................................................................................................9

a) Indicating why sensitivity analysis if assets and liabilities in a financial institutions:..........9

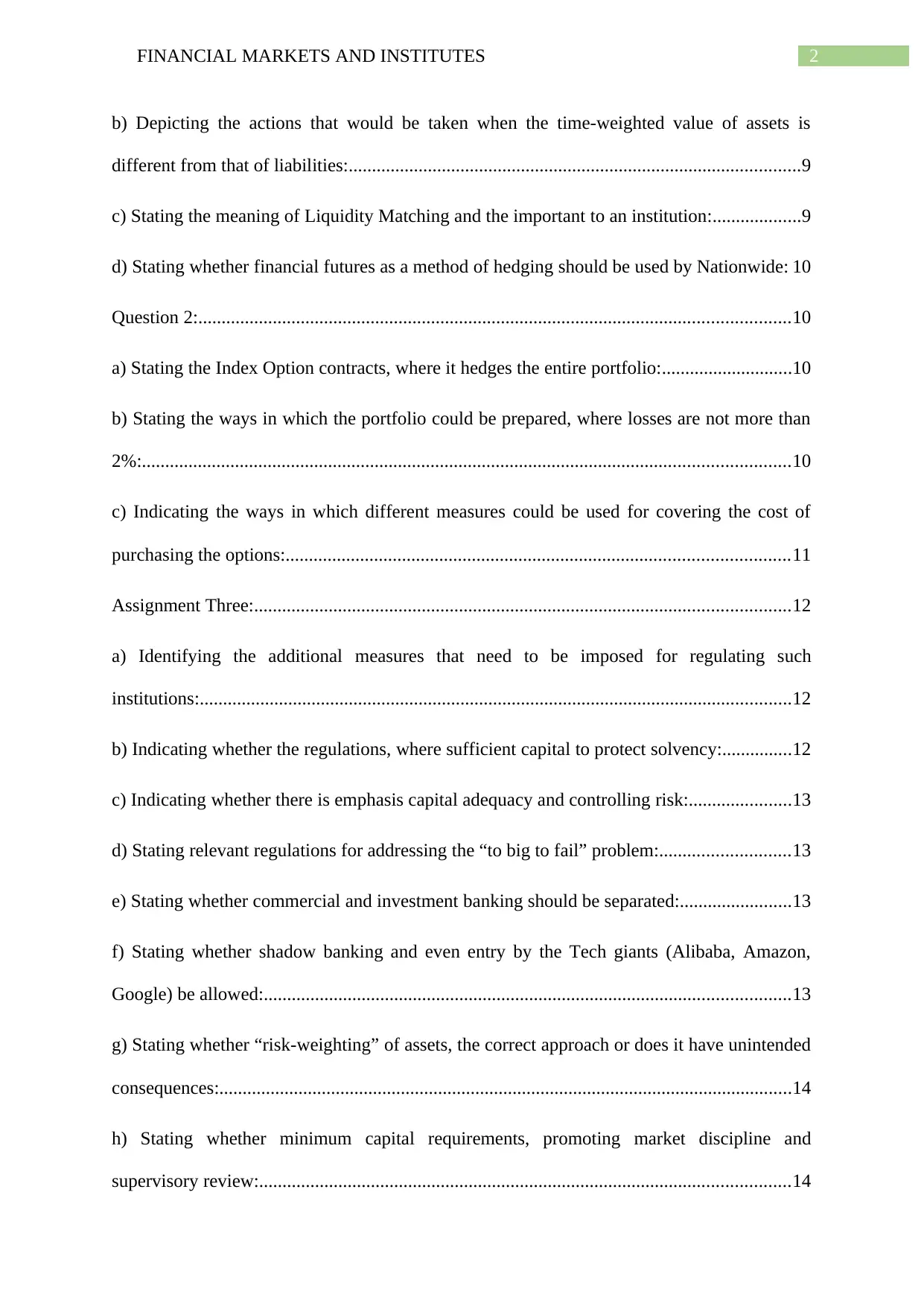

2FINANCIAL MARKETS AND INSTITUTES

b) Depicting the actions that would be taken when the time-weighted value of assets is

different from that of liabilities:.................................................................................................9

c) Stating the meaning of Liquidity Matching and the important to an institution:...................9

d) Stating whether financial futures as a method of hedging should be used by Nationwide: 10

Question 2:...............................................................................................................................10

a) Stating the Index Option contracts, where it hedges the entire portfolio:............................10

b) Stating the ways in which the portfolio could be prepared, where losses are not more than

2%:...........................................................................................................................................10

c) Indicating the ways in which different measures could be used for covering the cost of

purchasing the options:............................................................................................................11

Assignment Three:...................................................................................................................12

a) Identifying the additional measures that need to be imposed for regulating such

institutions:...............................................................................................................................12

b) Indicating whether the regulations, where sufficient capital to protect solvency:...............12

c) Indicating whether there is emphasis capital adequacy and controlling risk:......................13

d) Stating relevant regulations for addressing the “to big to fail” problem:............................13

e) Stating whether commercial and investment banking should be separated:........................13

f) Stating whether shadow banking and even entry by the Tech giants (Alibaba, Amazon,

Google) be allowed:.................................................................................................................13

g) Stating whether “risk-weighting” of assets, the correct approach or does it have unintended

consequences:...........................................................................................................................14

h) Stating whether minimum capital requirements, promoting market discipline and

supervisory review:..................................................................................................................14

b) Depicting the actions that would be taken when the time-weighted value of assets is

different from that of liabilities:.................................................................................................9

c) Stating the meaning of Liquidity Matching and the important to an institution:...................9

d) Stating whether financial futures as a method of hedging should be used by Nationwide: 10

Question 2:...............................................................................................................................10

a) Stating the Index Option contracts, where it hedges the entire portfolio:............................10

b) Stating the ways in which the portfolio could be prepared, where losses are not more than

2%:...........................................................................................................................................10

c) Indicating the ways in which different measures could be used for covering the cost of

purchasing the options:............................................................................................................11

Assignment Three:...................................................................................................................12

a) Identifying the additional measures that need to be imposed for regulating such

institutions:...............................................................................................................................12

b) Indicating whether the regulations, where sufficient capital to protect solvency:...............12

c) Indicating whether there is emphasis capital adequacy and controlling risk:......................13

d) Stating relevant regulations for addressing the “to big to fail” problem:............................13

e) Stating whether commercial and investment banking should be separated:........................13

f) Stating whether shadow banking and even entry by the Tech giants (Alibaba, Amazon,

Google) be allowed:.................................................................................................................13

g) Stating whether “risk-weighting” of assets, the correct approach or does it have unintended

consequences:...........................................................................................................................14

h) Stating whether minimum capital requirements, promoting market discipline and

supervisory review:..................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MARKETS AND INSTITUTES

i) Stating whether the supervisor regulation and prudential regulation correct:......................15

References:...............................................................................................................................16

i) Stating whether the supervisor regulation and prudential regulation correct:......................15

References:...............................................................................................................................16

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MARKETS AND INSTITUTES

Assignment One:

Question 1:

a) Providing confirmation on the share price of Rentokil should be purchased:

The value of P/E for Rentokil is at the levels of 6 versus the industry average of 8,

which mainly indicates that prices of the stock could increase in future to contemplate with

the low level of P/E ratio. P/E ratio is considered as one of the major components for

detecting the valuation of the stock by dividing the level of share price with the current EPS

derived during the financial year. Therefore, the low level of P/E ratio in comparison to the

industry average mainly states that the overall share price of the company would increase in

future.

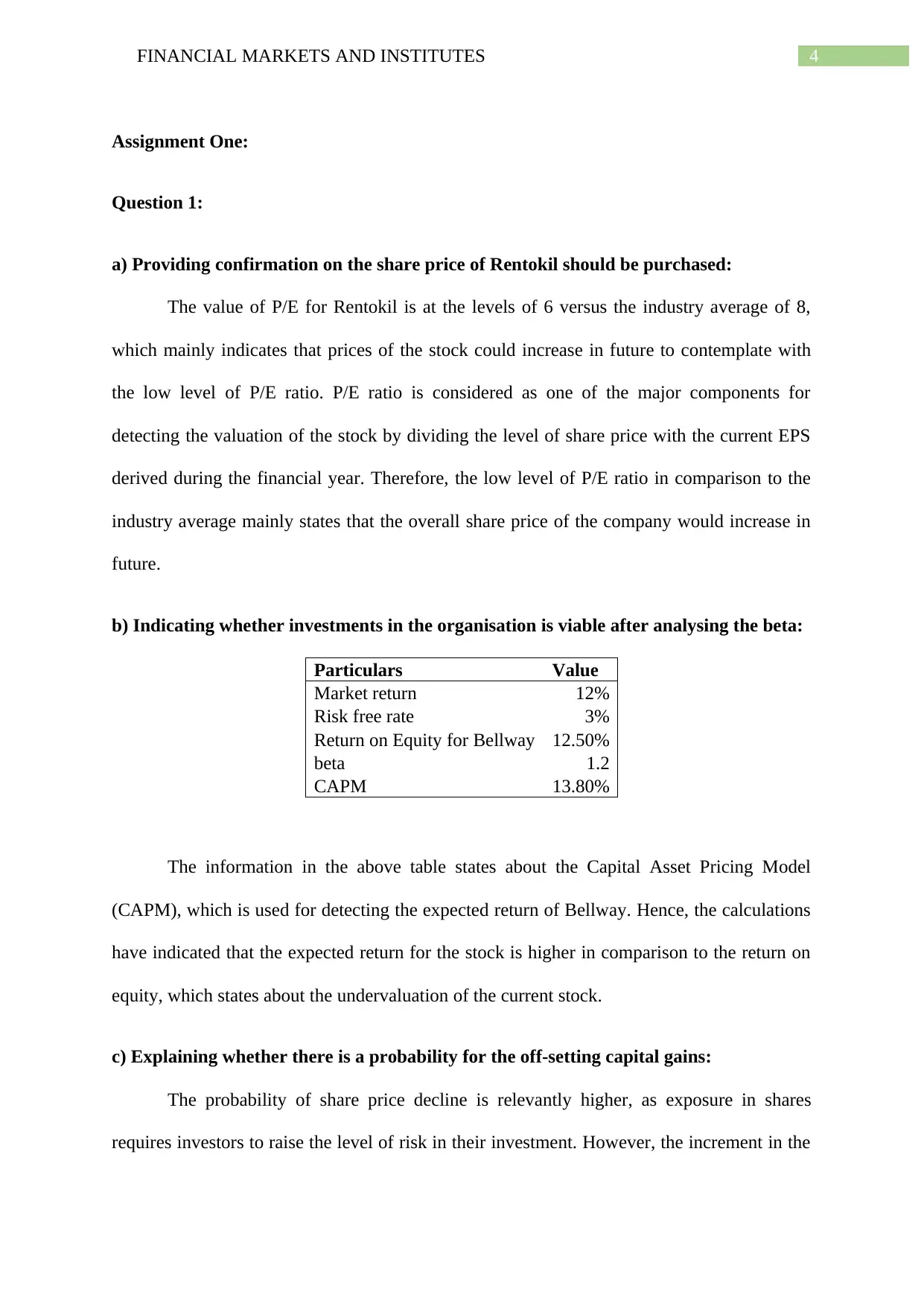

b) Indicating whether investments in the organisation is viable after analysing the beta:

Particulars Value

Market return 12%

Risk free rate 3%

Return on Equity for Bellway 12.50%

beta 1.2

CAPM 13.80%

The information in the above table states about the Capital Asset Pricing Model

(CAPM), which is used for detecting the expected return of Bellway. Hence, the calculations

have indicated that the expected return for the stock is higher in comparison to the return on

equity, which states about the undervaluation of the current stock.

c) Explaining whether there is a probability for the off-setting capital gains:

The probability of share price decline is relevantly higher, as exposure in shares

requires investors to raise the level of risk in their investment. However, the increment in the

Assignment One:

Question 1:

a) Providing confirmation on the share price of Rentokil should be purchased:

The value of P/E for Rentokil is at the levels of 6 versus the industry average of 8,

which mainly indicates that prices of the stock could increase in future to contemplate with

the low level of P/E ratio. P/E ratio is considered as one of the major components for

detecting the valuation of the stock by dividing the level of share price with the current EPS

derived during the financial year. Therefore, the low level of P/E ratio in comparison to the

industry average mainly states that the overall share price of the company would increase in

future.

b) Indicating whether investments in the organisation is viable after analysing the beta:

Particulars Value

Market return 12%

Risk free rate 3%

Return on Equity for Bellway 12.50%

beta 1.2

CAPM 13.80%

The information in the above table states about the Capital Asset Pricing Model

(CAPM), which is used for detecting the expected return of Bellway. Hence, the calculations

have indicated that the expected return for the stock is higher in comparison to the return on

equity, which states about the undervaluation of the current stock.

c) Explaining whether there is a probability for the off-setting capital gains:

The probability of share price decline is relevantly higher, as exposure in shares

requires investors to raise the level of risk in their investment. However, the increment in the

5FINANCIAL MARKETS AND INSTITUTES

interest rate would attract more investors, as it would allow them to generate higher returns

and reduce the level of risk from the investment exposure. Therefore, the buying drive in the

shares would decline and might contribute towards its decline, as investors would require

capital for increasing their exposure in the higher interest rate options.

d) Stating the significance of financial ratios while making investment decisions and

detecting different models that could be used:

The significance of financial ratios such as P/E ratio only provides small information

regarding the current trend of the organisation. Moreover, other models such as dividend

discount model and FCFE approach could be used by investors to understanding the current

valuation of the company and determine whether it is undervalued or overvalued. Thus, P/E

ratio is used for confirmation, whereas DDM and FCFE is used for confirming whether the

current valuation of the company is appropriate for investment for not.

Question 2:

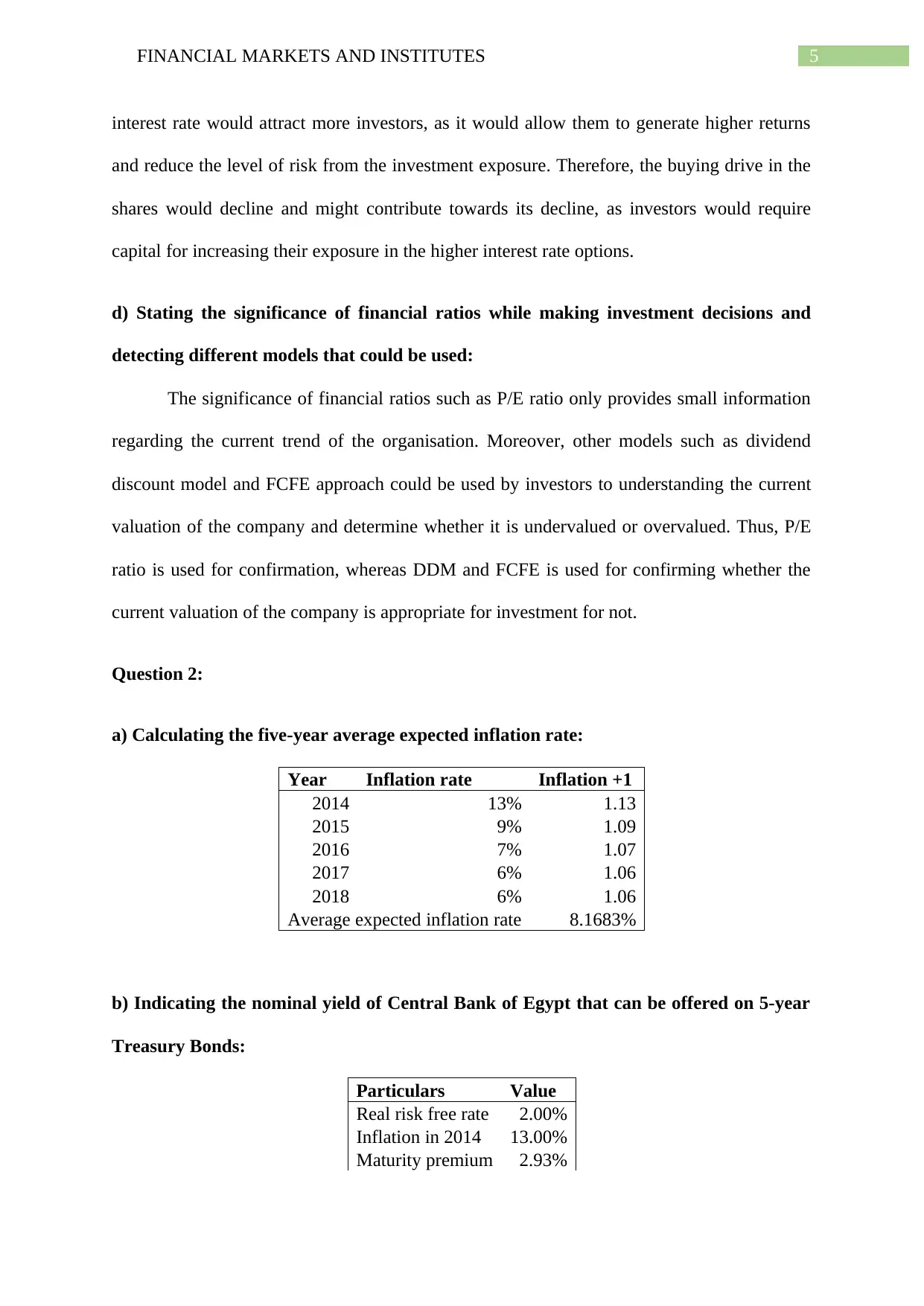

a) Calculating the five-year average expected inflation rate:

Year Inflation rate Inflation +1

2014 13% 1.13

2015 9% 1.09

2016 7% 1.07

2017 6% 1.06

2018 6% 1.06

Average expected inflation rate 8.1683%

b) Indicating the nominal yield of Central Bank of Egypt that can be offered on 5-year

Treasury Bonds:

Particulars Value

Real risk free rate 2.00%

Inflation in 2014 13.00%

Maturity premium 2.93%

interest rate would attract more investors, as it would allow them to generate higher returns

and reduce the level of risk from the investment exposure. Therefore, the buying drive in the

shares would decline and might contribute towards its decline, as investors would require

capital for increasing their exposure in the higher interest rate options.

d) Stating the significance of financial ratios while making investment decisions and

detecting different models that could be used:

The significance of financial ratios such as P/E ratio only provides small information

regarding the current trend of the organisation. Moreover, other models such as dividend

discount model and FCFE approach could be used by investors to understanding the current

valuation of the company and determine whether it is undervalued or overvalued. Thus, P/E

ratio is used for confirmation, whereas DDM and FCFE is used for confirming whether the

current valuation of the company is appropriate for investment for not.

Question 2:

a) Calculating the five-year average expected inflation rate:

Year Inflation rate Inflation +1

2014 13% 1.13

2015 9% 1.09

2016 7% 1.07

2017 6% 1.06

2018 6% 1.06

Average expected inflation rate 8.1683%

b) Indicating the nominal yield of Central Bank of Egypt that can be offered on 5-year

Treasury Bonds:

Particulars Value

Real risk free rate 2.00%

Inflation in 2014 13.00%

Maturity premium 2.93%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MARKETS AND INSTITUTES

Nominal yield 17.93%

The analysis states that there is low chance for the bond to default, as the government,

which makes the value risk free rate, backs it. However, the bond would be matured in 5

years, where maturity premium needs to be added.

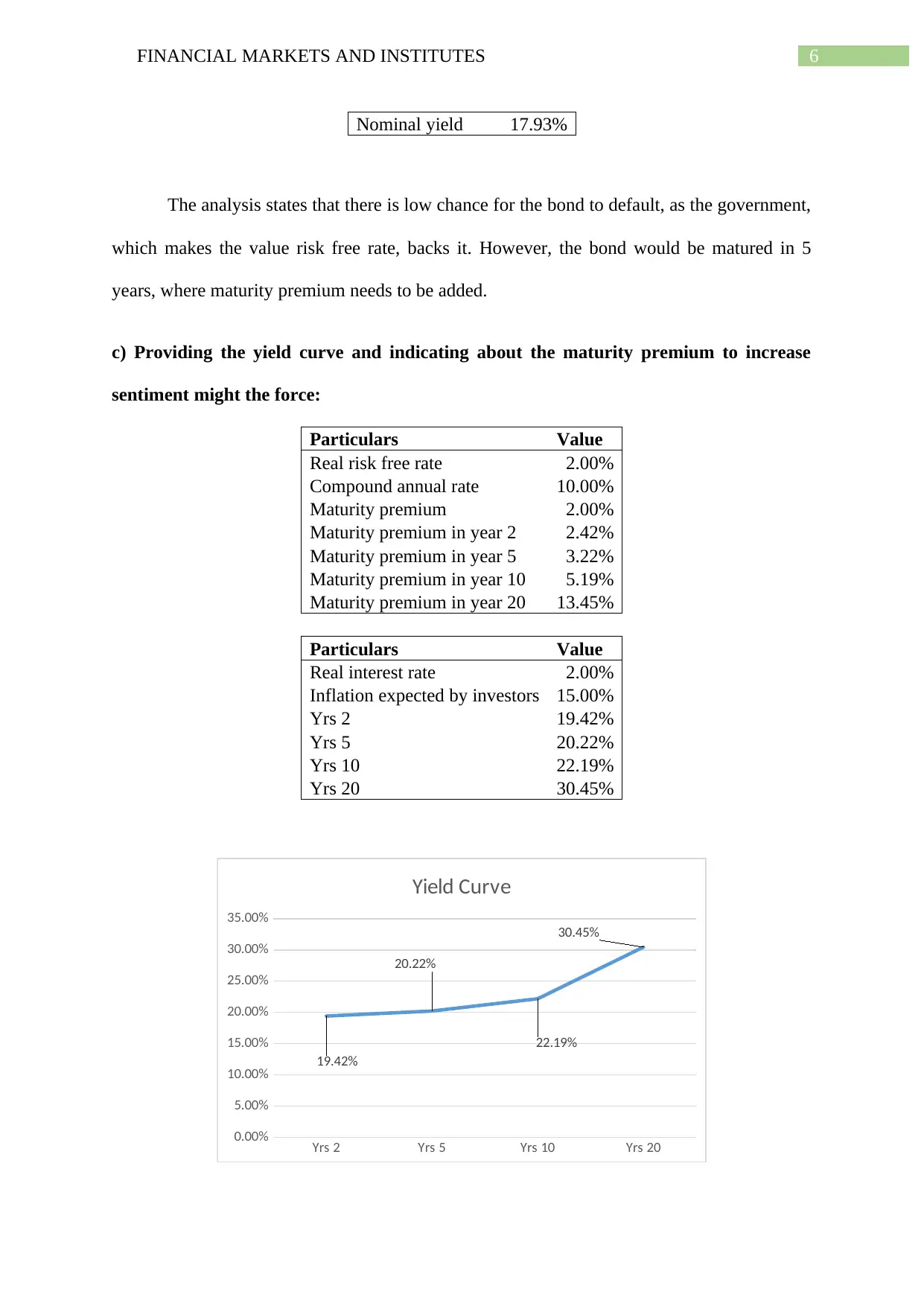

c) Providing the yield curve and indicating about the maturity premium to increase

sentiment might the force:

Particulars Value

Real risk free rate 2.00%

Compound annual rate 10.00%

Maturity premium 2.00%

Maturity premium in year 2 2.42%

Maturity premium in year 5 3.22%

Maturity premium in year 10 5.19%

Maturity premium in year 20 13.45%

Particulars Value

Real interest rate 2.00%

Inflation expected by investors 15.00%

Yrs 2 19.42%

Yrs 5 20.22%

Yrs 10 22.19%

Yrs 20 30.45%

Yrs 2 Yrs 5 Yrs 10 Yrs 20

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

19.42%

20.22%

22.19%

30.45%

Yield Curve

Nominal yield 17.93%

The analysis states that there is low chance for the bond to default, as the government,

which makes the value risk free rate, backs it. However, the bond would be matured in 5

years, where maturity premium needs to be added.

c) Providing the yield curve and indicating about the maturity premium to increase

sentiment might the force:

Particulars Value

Real risk free rate 2.00%

Compound annual rate 10.00%

Maturity premium 2.00%

Maturity premium in year 2 2.42%

Maturity premium in year 5 3.22%

Maturity premium in year 10 5.19%

Maturity premium in year 20 13.45%

Particulars Value

Real interest rate 2.00%

Inflation expected by investors 15.00%

Yrs 2 19.42%

Yrs 5 20.22%

Yrs 10 22.19%

Yrs 20 30.45%

Yrs 2 Yrs 5 Yrs 10 Yrs 20

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

19.42%

20.22%

22.19%

30.45%

Yield Curve

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MARKETS AND INSTITUTES

The above graph explains about the rising yield curve, which suggests that the new

government would raise the interest rate. This would increase concern for government ability

to secure the repayment of the debt, which in tur would raise the maturity premium, as market

participant will needs more protection.

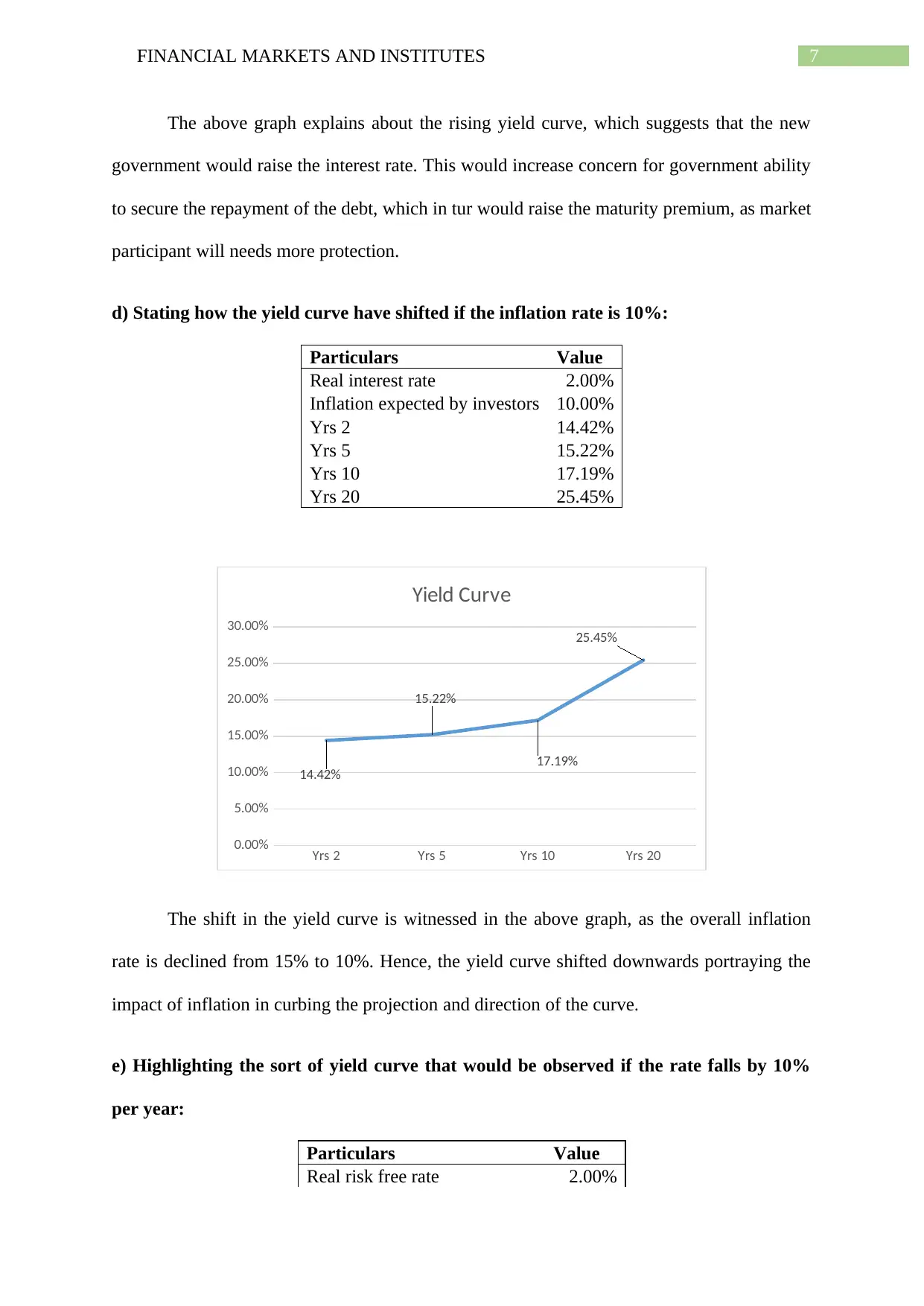

d) Stating how the yield curve have shifted if the inflation rate is 10%:

Particulars Value

Real interest rate 2.00%

Inflation expected by investors 10.00%

Yrs 2 14.42%

Yrs 5 15.22%

Yrs 10 17.19%

Yrs 20 25.45%

Yrs 2 Yrs 5 Yrs 10 Yrs 20

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

14.42%

15.22%

17.19%

25.45%

Yield Curve

The shift in the yield curve is witnessed in the above graph, as the overall inflation

rate is declined from 15% to 10%. Hence, the yield curve shifted downwards portraying the

impact of inflation in curbing the projection and direction of the curve.

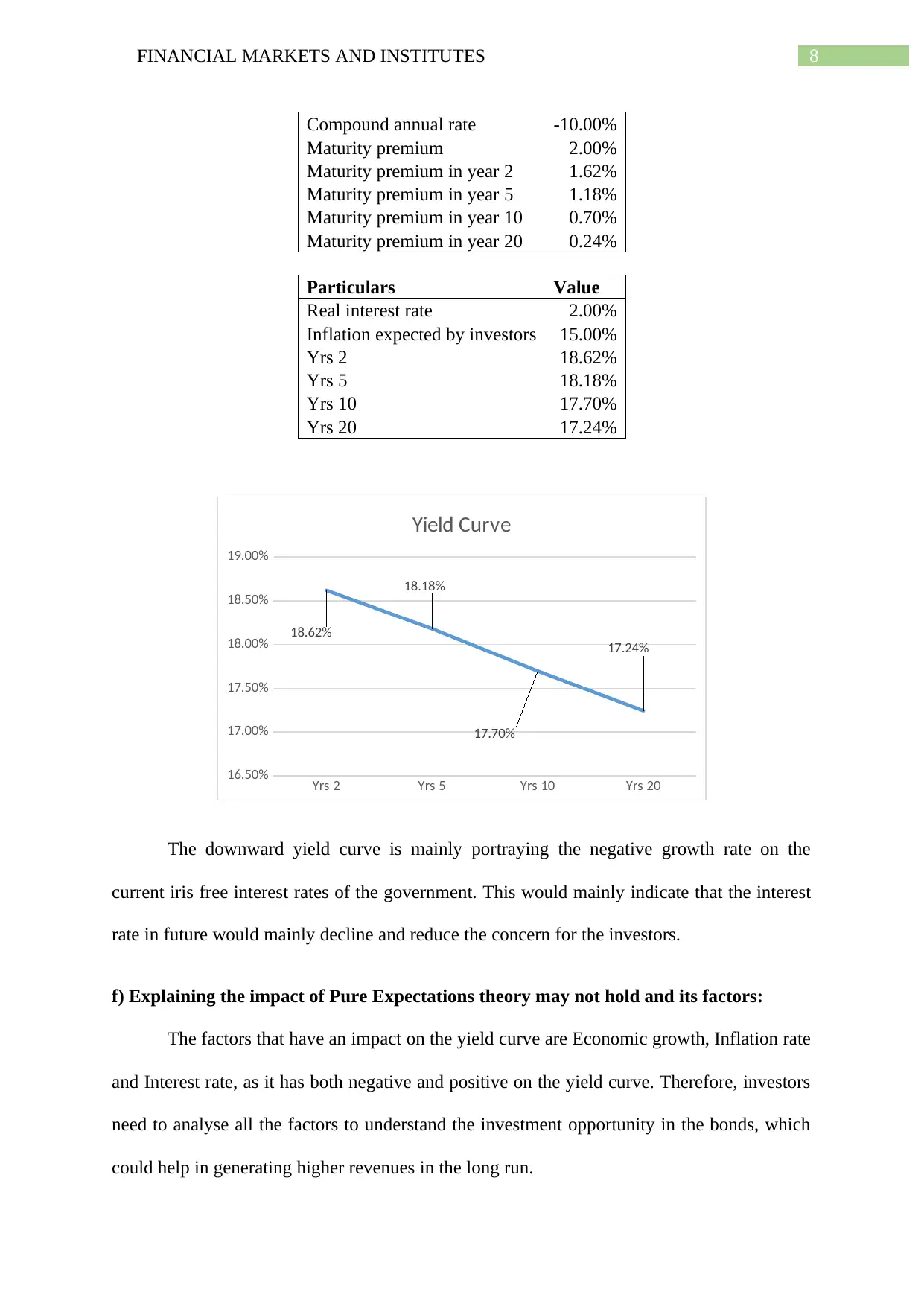

e) Highlighting the sort of yield curve that would be observed if the rate falls by 10%

per year:

Particulars Value

Real risk free rate 2.00%

The above graph explains about the rising yield curve, which suggests that the new

government would raise the interest rate. This would increase concern for government ability

to secure the repayment of the debt, which in tur would raise the maturity premium, as market

participant will needs more protection.

d) Stating how the yield curve have shifted if the inflation rate is 10%:

Particulars Value

Real interest rate 2.00%

Inflation expected by investors 10.00%

Yrs 2 14.42%

Yrs 5 15.22%

Yrs 10 17.19%

Yrs 20 25.45%

Yrs 2 Yrs 5 Yrs 10 Yrs 20

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

14.42%

15.22%

17.19%

25.45%

Yield Curve

The shift in the yield curve is witnessed in the above graph, as the overall inflation

rate is declined from 15% to 10%. Hence, the yield curve shifted downwards portraying the

impact of inflation in curbing the projection and direction of the curve.

e) Highlighting the sort of yield curve that would be observed if the rate falls by 10%

per year:

Particulars Value

Real risk free rate 2.00%

8FINANCIAL MARKETS AND INSTITUTES

Compound annual rate -10.00%

Maturity premium 2.00%

Maturity premium in year 2 1.62%

Maturity premium in year 5 1.18%

Maturity premium in year 10 0.70%

Maturity premium in year 20 0.24%

Particulars Value

Real interest rate 2.00%

Inflation expected by investors 15.00%

Yrs 2 18.62%

Yrs 5 18.18%

Yrs 10 17.70%

Yrs 20 17.24%

Yrs 2 Yrs 5 Yrs 10 Yrs 20

16.50%

17.00%

17.50%

18.00%

18.50%

19.00%

18.62%

18.18%

17.70%

17.24%

Yield Curve

The downward yield curve is mainly portraying the negative growth rate on the

current iris free interest rates of the government. This would mainly indicate that the interest

rate in future would mainly decline and reduce the concern for the investors.

f) Explaining the impact of Pure Expectations theory may not hold and its factors:

The factors that have an impact on the yield curve are Economic growth, Inflation rate

and Interest rate, as it has both negative and positive on the yield curve. Therefore, investors

need to analyse all the factors to understand the investment opportunity in the bonds, which

could help in generating higher revenues in the long run.

Compound annual rate -10.00%

Maturity premium 2.00%

Maturity premium in year 2 1.62%

Maturity premium in year 5 1.18%

Maturity premium in year 10 0.70%

Maturity premium in year 20 0.24%

Particulars Value

Real interest rate 2.00%

Inflation expected by investors 15.00%

Yrs 2 18.62%

Yrs 5 18.18%

Yrs 10 17.70%

Yrs 20 17.24%

Yrs 2 Yrs 5 Yrs 10 Yrs 20

16.50%

17.00%

17.50%

18.00%

18.50%

19.00%

18.62%

18.18%

17.70%

17.24%

Yield Curve

The downward yield curve is mainly portraying the negative growth rate on the

current iris free interest rates of the government. This would mainly indicate that the interest

rate in future would mainly decline and reduce the concern for the investors.

f) Explaining the impact of Pure Expectations theory may not hold and its factors:

The factors that have an impact on the yield curve are Economic growth, Inflation rate

and Interest rate, as it has both negative and positive on the yield curve. Therefore, investors

need to analyse all the factors to understand the investment opportunity in the bonds, which

could help in generating higher revenues in the long run.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL MARKETS AND INSTITUTES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL MARKETS AND INSTITUTES

Assignment Two:

Question 1:

a) Indicating why sensitivity analysis if assets and liabilities in a financial institutions:

The gap between its assets and liabilities are mainly high, as the assets have 30-year

mortgage, while liabilities are 5-year Certificate of deposits. Therefore, sensitivity analysis

can be used on the interest rates, as it would help in deducing that they do not face a crunch

making it difficult for the company to repay their liabilities.

b) Depicting the actions that would be taken when the time-weighted value of assets is

different from that of liabilities:

The overall time weighted value of assets and liabilities are relevantly not same, as its

assets are 30 year and liabilities are 5 years. In addition, the firm need to conduct a duration

matching system, where the interest rate sensitivity management would be required for

keeping track of the interest rate risk.

c) Stating the meaning of Liquidity Matching and the important to an institution:

The organisation needs to develop an appropriate liquidity matching system, where

the overall assets could be used for supporting its liabilities in time of cash crunch. The

current liabilities of the company will mainly mature in 5-yaer, whereas the overall assets

could only be used after 30-years mortgage payment. Thus, the organisation needs to

maintain sufficient funds for every 5-years, as repayments would be required for the

liabilities.

Assignment Two:

Question 1:

a) Indicating why sensitivity analysis if assets and liabilities in a financial institutions:

The gap between its assets and liabilities are mainly high, as the assets have 30-year

mortgage, while liabilities are 5-year Certificate of deposits. Therefore, sensitivity analysis

can be used on the interest rates, as it would help in deducing that they do not face a crunch

making it difficult for the company to repay their liabilities.

b) Depicting the actions that would be taken when the time-weighted value of assets is

different from that of liabilities:

The overall time weighted value of assets and liabilities are relevantly not same, as its

assets are 30 year and liabilities are 5 years. In addition, the firm need to conduct a duration

matching system, where the interest rate sensitivity management would be required for

keeping track of the interest rate risk.

c) Stating the meaning of Liquidity Matching and the important to an institution:

The organisation needs to develop an appropriate liquidity matching system, where

the overall assets could be used for supporting its liabilities in time of cash crunch. The

current liabilities of the company will mainly mature in 5-yaer, whereas the overall assets

could only be used after 30-years mortgage payment. Thus, the organisation needs to

maintain sufficient funds for every 5-years, as repayments would be required for the

liabilities.

11FINANCIAL MARKETS AND INSTITUTES

d) Stating whether financial futures as a method of hedging should be used by

Nationwide:

Derivative instrument such as future contract is mainly beneficial for fixing the losses

or fluctuations on exchange rate or purchase price. However, the overall hedging process on

the falling interest rate yield cannot be implemented, as it would not benefit the organisation.

Hence, not using the hedging process such as future contract would do better for the

organisation. Thus, for making the most out from the falling interest rate Nationwide

Building Society should not use any kind of derivative contracts.

Question 2:

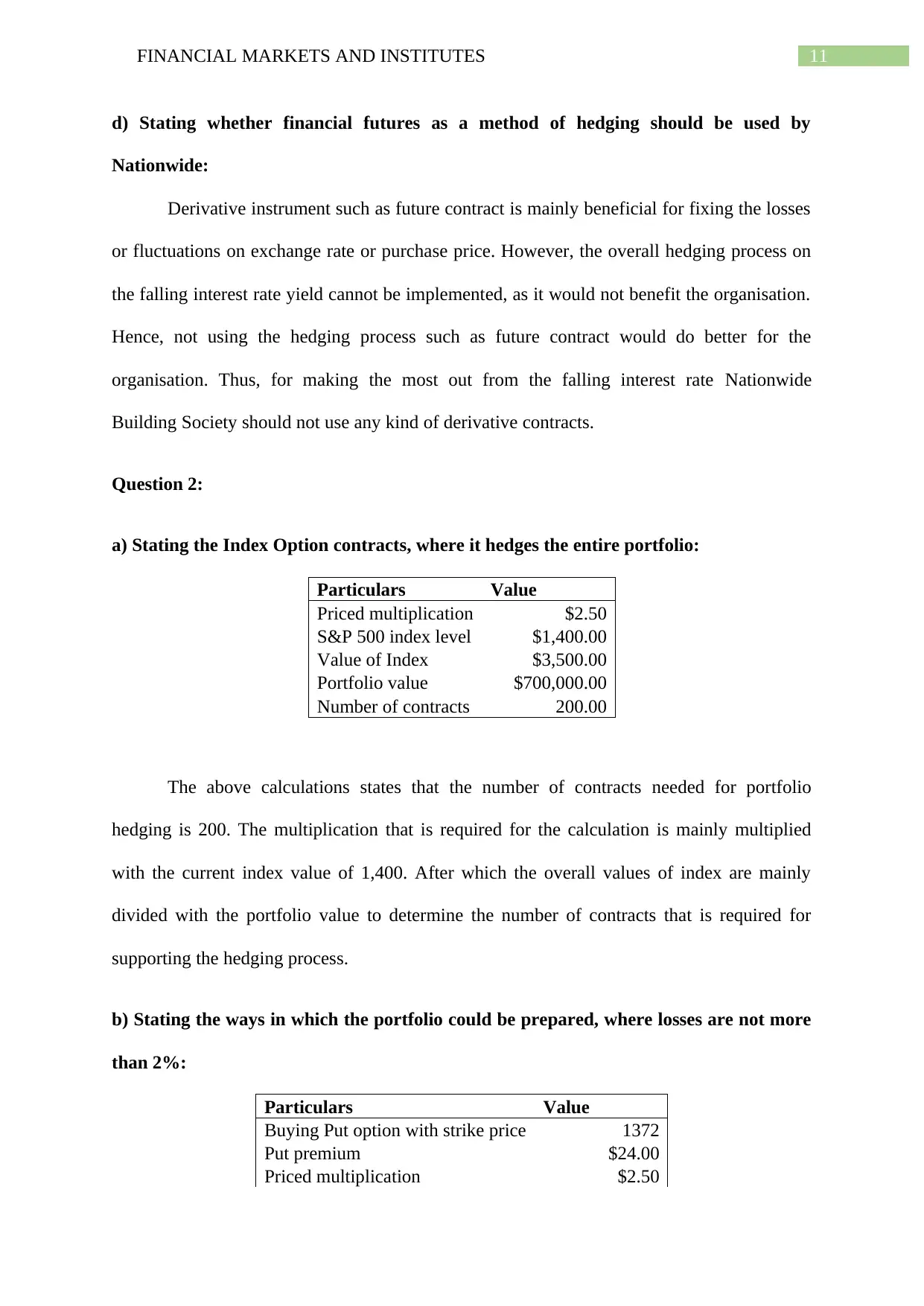

a) Stating the Index Option contracts, where it hedges the entire portfolio:

Particulars Value

Priced multiplication $2.50

S&P 500 index level $1,400.00

Value of Index $3,500.00

Portfolio value $700,000.00

Number of contracts 200.00

The above calculations states that the number of contracts needed for portfolio

hedging is 200. The multiplication that is required for the calculation is mainly multiplied

with the current index value of 1,400. After which the overall values of index are mainly

divided with the portfolio value to determine the number of contracts that is required for

supporting the hedging process.

b) Stating the ways in which the portfolio could be prepared, where losses are not more

than 2%:

Particulars Value

Buying Put option with strike price 1372

Put premium $24.00

Priced multiplication $2.50

d) Stating whether financial futures as a method of hedging should be used by

Nationwide:

Derivative instrument such as future contract is mainly beneficial for fixing the losses

or fluctuations on exchange rate or purchase price. However, the overall hedging process on

the falling interest rate yield cannot be implemented, as it would not benefit the organisation.

Hence, not using the hedging process such as future contract would do better for the

organisation. Thus, for making the most out from the falling interest rate Nationwide

Building Society should not use any kind of derivative contracts.

Question 2:

a) Stating the Index Option contracts, where it hedges the entire portfolio:

Particulars Value

Priced multiplication $2.50

S&P 500 index level $1,400.00

Value of Index $3,500.00

Portfolio value $700,000.00

Number of contracts 200.00

The above calculations states that the number of contracts needed for portfolio

hedging is 200. The multiplication that is required for the calculation is mainly multiplied

with the current index value of 1,400. After which the overall values of index are mainly

divided with the portfolio value to determine the number of contracts that is required for

supporting the hedging process.

b) Stating the ways in which the portfolio could be prepared, where losses are not more

than 2%:

Particulars Value

Buying Put option with strike price 1372

Put premium $24.00

Priced multiplication $2.50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.